|

市場調査レポート

商品コード

1445973

内分泌検査: 市場シェア分析、業界動向と統計、成長予測(2024~2029年)Global Endocrine Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 内分泌検査: 市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 132 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

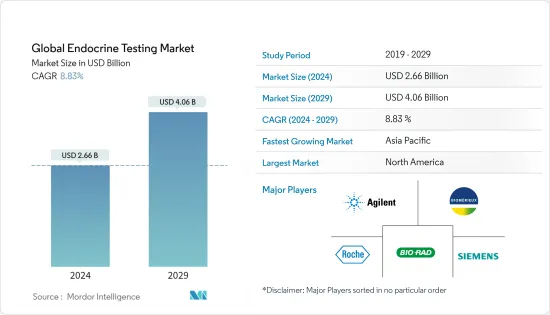

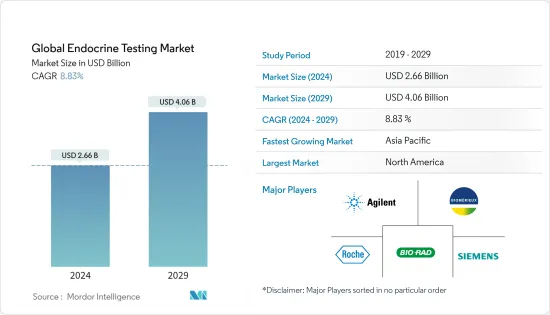

世界の内分泌検査市場規模は2024年に26億6,000万米ドルと推定され、2029年までに40億6,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に8.83%のCAGRで成長します。

パンデミック中、甲状腺疾患のある人は新型コロナウイルス感染症にかかりやすいことが多くの調査で実証されており、甲状腺ホルモンレベルをチェックして管理するためのさまざまな内分泌検査が世界中で大きな需要を生み出しています。 2021年1月の「新型COVID-1950人の患者における甲状腺機能分析:レトロスペクティブ研究」と題された調査研究によると、COVID-19が重症化するほど、TSHとTT3のレベルが低くなり、統計的に有意となった。 TSHおよびTT3レベルの低下の程度は、病気の重症度と正の相関がありました。したがって、血清TSHおよびTT3レベルの変化は、COVID-19症の経過の重要な兆候です。これにより、パンデミック中に甲状腺ホルモン検査の内分泌検査が増加し、市場の成長を促進した可能性があります。

内分泌疾患の有病率の増加と診断技術の進歩が主に市場の成長を推進しています。さらに、世界中で高齢者人口の増加と早期診断と治療に対する意識の高まりが市場の成長を促進すると予想されています。内分泌検査とは、内分泌腺から分泌されるホルモンのレベルを測定し、肥満、糖尿病、甲状腺疾患などのさまざまな疾患を診断することを指します。国際連盟によると、2021年には約5億3,700万人の成人が糖尿病を抱えており、2045年までにこの数は7億8,300万人に増加すると予想されています。世界中で糖尿病が増加していることにより、インスリンホルモン検査の採用が増加し、それによって市場の成長を促進すると予想されます。

2022年3月の世界保健機関(WHO)によると、世界中で成人6億5,000万人、青少年3億4,000万人、子供3,900万人が肥満であり、その数は今も増加し続けています。 WHOは、2025年までに1億6,700万人の大人と子供が過体重または肥満により健康の一部を失うと予測しています。これは、甲状腺機能の内分泌検査のさらなる採用につながり、市場の成長を促進します。

さらに、アルコール摂取は、さまざまな内分泌疾患や障害の最大の危険因子の1つです。世界的に見て、先進地域の高所得国は最もアルコール消費量が多いです。この大量のアルコール摂取も、病気の負担の主な要因の1つとなっています。内分泌検査ツールの需要により、市場関係者は製品開発や新製品の発売にも注力しています。たとえば、2021年 11月、スイスの医療技術会社ブルームダイアグノスティックスは、甲状腺機能低下症の特定を支援するブルーム甲状腺検査を導入しました。この検査では、成人は使い捨てキットを使用して甲状腺刺激ホルモン(TSH)を検査し、甲状腺機能障害を特定できます。

世界中の多くの国で糖尿病、甲状腺疾患の有病率が高まっており、市場の成長をさらに促進すると予想されています。ただし、検査技術の開発コストが高いことと、後進国および新興諸国における認識の欠如により、予測期間中の市場の成長が妨げられると予想されます。

内分泌検査市場の動向

甲状腺刺激ホルモン検査(TSH)は利益をもたらす成長が期待される

この部門の成長を牽引する要因には、甲状腺疾患の有病率の増加、甲状腺ケアへの取り組み、タバコとアルコールの消費量の増加、革新的な製品の発売に向けた主要企業による技術進歩などが含まれます。

甲状腺刺激ホルモン(TSH)は下垂体で生成され、甲状腺を刺激して代謝を助けるチロキシンとトリヨードチロニンを生成します。 TSH検査は甲状腺レベルを測定するために使用されます。甲状腺疾患の負担は世界中で増加しています。たとえば、2021年6月に「Frontiers in Endocrinology」に掲載された「The Burden of Hormonal Disorders: A Worldwide Overview With a Particular Look in Italy(ホルモン障害の負担:イタリアを中心とした世界の概観)」と題された研究によると、最も典型的な甲状腺の状態である甲状腺結節は、次のようなものであることが判明しました。世界の一般人口の19~68%であり、女性と高齢者の頻度が高くなります。したがって、甲状腺疾患の罹患率がこのように高いことが、このセグメントの成長を促進すると予想されます。

さらに、2022年 5月に、Thyrocare Technologies Limitedはインドのナーグプールに初の地域処理ラボ(RPL)を立ち上げ、迅速かつ正確な甲状腺機能検査を手頃な価格で提供しました。インドなどの人口密度の高い国でのこのような取り組みは、このセグメントの成長をさらに促進するでしょう。

TSH測定は、主に費用対効果の高い病気のスクリーニングを容易にするこれらの検査の技術開発により、最近甲状腺機能検査において重要性を増しています。 TSHはまた、生化学的治療目標を提供するとともに、潜在性甲状腺機能低下症または甲状腺機能亢進症の新しい定義を導入しました。さらに、製品技術の進歩とヘルスケアの手頃な価格の増加が市場の成長を促進しています。現在、正確な結果を得るために質量分析法が液体クロマトグラフィーとともに使用されており、予測期間中の市場の成長を促進します。

北米が大きなシェアを占めると予想される

北米は、確立されたヘルスケアインフラ、肥満の高い有病率、診断技術の進歩、新製品の発売などの要因により、大きなシェアを占めると予想されています。身体活動の減少と甲状腺疾患の有病率の増加が市場の成長を促進すると予想されます。

米国がん協会によると、2022年に米国で新たに約43,800人の甲状腺がん患者(男性11,860人、女性31,940人)と約2,230人(男性1,070人、女性1,160人)の死亡が報告されると予想されています。したがって、米国における甲状腺がんの罹患率と死亡率の高さは、甲状腺ケアの増加につながり、それによってこの地域の内分泌検査市場の成長を促進すると考えられます。

北米は、先天性甲状腺機能低下症の新生児への強制スクリーニング、甲状腺ホルモン機能に関する革新的な調査活動、甲状腺がんを検出するための費用対効果の高い方法、バセドウ病に関する有望な調査など、いくつかの取り組みにより、今後数年間で大きな成長を遂げる可能性があります。この病気はさらに予後の改善につながる可能性が高く、甲状腺疾患の新しい予防治療にもつながります。

さらに、2021年 8月に、Initoは家庭用不妊検査をアメリカ市場に導入しました。 Initoデバイスはスマートフォンアプリと組み合わせて使用され、プロゲステロン、黄体形成ホルモン、エストロゲンの実際のレベルを測定する家庭用検査です。この情報は、構想プロセスに関する意思決定を支援するためにユーザーに提供されます。したがって、米国市場へのこのような新製品の発売は、この地域の市場の成長を促進すると予想されます

したがって、上記の要因により、調査対象の市場は、この地域で予測期間中に成長すると予想されます。

内分泌検査業界の概要

世界の内分泌検査市場は適度な競争があり、この市場には国内および国際的な企業がいくつかあります。市場関係者は、新製品の発売、製品革新、地理的拡大に焦点を当てています。市場で活動している主要な市場企業には、Bio-Rad Laboratories Inc.、Agilent Technologies Inc.、bioMerieux SA、F. Hoffmann-La Roche Ltd、およびSiemens AGが含まれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 内分泌疾患の有病率の増加と高齢者人口の増加

- 製品技術の進歩

- 市場抑制要因

- 高度な内分泌検査装置の高コスト

- 低開発新興諸国における認識の欠如

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- テスト

- 甲状腺検査

- インスリン検査

- ヒト絨毛性ゴナドトロピン検査

- プロラクチン検査

- 黄体形成ホルモン検査

- プロゲステロン検査

- その他のテスト

- テクノロジー別

- 免疫測定法

- タンデム質量分析

- センサー技術

- その他の技術

- エンドユーザー別

- 病院

- 臨床検査室

- その他のエンドユーザー

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東とアフリカ

- GCC

- 南アフリカ

- その他中東およびアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- AB Sciex

- Abbott Laboratories

- Agilent Technologies Inc.

- bioMerieux SA

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- DiaSorin SpA

- F. Hoffmann-La Roche Ltd

- Hologic Inc.

- Ortho Clinical Diagnostics

- Quest Diagnostics

- Siemens Healthineers AG

- Thermo Fisher Scientific

第7章 市場機会と将来の動向

The Global Endocrine Testing Market size is estimated at USD 2.66 billion in 2024, and is expected to reach USD 4.06 billion by 2029, growing at a CAGR of 8.83% during the forecast period (2024-2029).

During the pandemic, many research studies have demonstrated that people with thyroid disorders are more prone to the COVID 19 infection, creating a significant demand for various endocrine tests globally to check and manage thyroid hormone levels. As per the January 2021 research study titled 'Thyroid Function Analysis in 50 Patients with COVID-19: A Retrospective Study', the more severe the COVID-19, the lower the TSH and TT3 levels were, with statistical significance. The degree of the decreases in TSH and TT3 levels was positively correlated with the severity of the disease. Hence, the changes in serum TSH and TT3 levels are the important manifestations of the courses of COVID-19. This might have increased the endocrine testing during the pandemic for the testing of thyroid hormone, driving the market growth.

The growing prevalence of endocrine disorders and advancements in diagnostic technologies are primarily driving the market growth. Furthermore, the growing older population, coupled with rising awareness about early diagnosis and treatment worldwide, is anticipated to boost the market growth. Endocrine testing refers to the measuring of levels of hormones secreted by the endocrine glands and the diagnosis of various disorders such as obesity, diabetes, and thyroid disease. According to the International Federation, in 2021, approximately 537 million adults were living with diabetes, and by 2045, this number will rise to 783 million. The rising diabetes across the globe will lead to increase adoption of insulin hormone testing, thereby expected to drive the market growth.

According to the World Health Organization (WHO) in March 2022, 650 million adults, 340 million teenagers, and 39 million children are obese around the world and the number is still rising. By 2025, the WHO predicts that 167 million adults and children will lose some of their health due to being overweight or obese. This will lead to further adoption of endocrine testing for thyroid function, driving the market growth.

In addition, alcohol consumption is one of the largest risk factors for various endocrine diseases and disabilities. Globally, high-income countries of the developed region have the highest alcohol consumption. This high consumption of alcohol is also serving as one of the major factors for the burden of the disease. Due to the demand for endocrine testing tools, market players are also focusing on product development and novel launches. For instance, in November 2021, Bloom Diagnostics, a Swiss medical technology company has introduced the Bloom Thyroid Test to assist identify hypothyroidism. With this test, adults can test for thyroid-stimulating hormone (TSH) using the single-use kit to identify thyroid dysfunction.

The growing prevalence of diabetes, thyroid disorders in many of the countries around the world are anticipated to further fuel the market growth. However, the high cost for the development of testing technologies and lack of awareness in underdeveloped and developing countries is expected to impede market growth over the forecast period.

Endocrine Testing Market Trends

Thyroid Stimulating Hormone Testing (TSH) Anticipated to have Lucrative Growth

The factors driving the segment growth include the rise in the prevalence of thyroid conditions, initiatives for thyrocare, the rise in consumption of tobacco and alcohol, and technological advancements by the key players for the launch of innovative products, among others.

Thyroid-stimulating hormone (TSH) is produced by the pituitary gland and stimulates the thyroid gland to produce thyroxine and triiodothyronine, which helps in metabolism. TSH testing is used to measure thyroid levels. The burden of thyroid disorders is increasing across the globe. For instance, according to the study published in 'Frontiers in Endocrinology', titled ' The Burden of Hormonal Disorders: A Worldwide Overview With a Particular Look in Italy' in June 2021, The thyroid nodule, the most typical thyroid condition was found to be 19-68% of the general population globally, with women and the elderly having a higher frequency. Such a high prevalence of thyroid conditions is therefore expected to drive this segment growth.

In addition, in May 2022, Thyrocare Technologies Limited has launched its first Regional Processing Lab (RPL) in Nagpur, India to provide thyroid function test with speed and accuracy at affordable prices. Such initiatives in highly populated countries such as India will further drive the growth of this segment.

TSH measurement has recently gained importance in thyroid function testing mainly due to the technological developments in these tests facilitating cost-effective disease screening. TSH also introduced new definitions of subclinical hypothyroidism or hyperthyroidism, along with delivering biochemical treatment targets. Furthermore, advancements in product technologies, coupled with the growing affordability for healthcare, are fueling the market growth. Mass spectroscopy is now used along with liquid chromatography for accurate results, which will fuel the market growth over the forecast period.

North America is Anticipated to have Significant Share

North America is anticipated to have a significant share, owing to the factors such as well-established healthcare infrastructure, high prevalence of obesity, advancements in diagnostic technologies, and new product launches. The less physical activity and growing prevalence of thyroid disorders are anticipated to fuel the market growth.

According to the American Cancer Society in 2022, about 43,800 new cases of thyroid cancer (11,860 in men and 31,940 in women) and about 2,230 deaths from thyroid cancer (1,070 men and 1,160 women) will be reported in the United States. The high prevalence and deaths of thyroid cancer in the United States will therefore lead to increased thyroid care, thereby driving the market growth for endocrine testing in this region.

North America is likely to witness major growth in the coming years, owing to several initiatives, such as compulsory screening of newborns for congenital hypothyroidism, revolutionary research work on thyroid hormone function, cost-effective methods to detect thyroid cancer, promising research on Graves' disease, which is likely to further lead to improved prognosis, and new preventive treatments of thyroid diseases.

Moreover, in August 2021, Inito has introduced the home fertility test to the American market. The Inito device, used in conjunction with a smartphone app, is a home test that determines the actual levels of progesterone, luteinizing hormone, and oestrogen. This information is provided to users to help them make decisions regarding the conception process. Such launch of new products to the market in the United States is therefore expected to drive the market growth in this region.

Hence, owing to the above-mentioned factors, the market studied is expected to grow over the forecast period in the region.

Endocrine Testing Industry Overview

The global endocrine testing market is moderately competitive, and there are several local and international companies in this market. Market players are focusing on new product launches, product innovations, and geographical expansions. The key market players operating in the market include Bio-Rad Laboratories Inc., Agilent Technologies Inc., bioMerieux SA, F. Hoffmann-La Roche Ltd, and Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Endocrine Disorders and Increasing Geriatric Population

- 4.2.2 Advancements in Product Technologies

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Endocrine Testing Devices

- 4.3.2 Lack of Awareness in Underdeveloped and Developing Countries

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Test

- 5.1.1 Thyroid Test

- 5.1.2 Insulin Test

- 5.1.3 Human Chorionic Gonadotropin Test

- 5.1.4 Prolactin Test

- 5.1.5 Luteinizing Hormone Test

- 5.1.6 Progesterone Test

- 5.1.7 Other Tests

- 5.2 By Technology

- 5.2.1 Immunoassay

- 5.2.2 Tandem Mass Spectroscopy

- 5.2.3 Sensor Technology

- 5.2.4 Other Technologies

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clincal Laboratories

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AB Sciex

- 6.1.2 Abbott Laboratories

- 6.1.3 Agilent Technologies Inc.

- 6.1.4 bioMerieux SA

- 6.1.5 Bio-Rad Laboratories Inc.

- 6.1.6 Danaher Corporation

- 6.1.7 DiaSorin SpA

- 6.1.8 F. Hoffmann-La Roche Ltd

- 6.1.9 Hologic Inc.

- 6.1.10 Ortho Clinical Diagnostics

- 6.1.11 Quest Diagnostics

- 6.1.12 Siemens Healthineers AG

- 6.1.13 Thermo Fisher Scientific