|

|

市場調査レポート

商品コード

1619715

米国のプリペイドワイヤレス市場:技術・用途・サービス別 (2024~2030年)United States Prepaid Wireless Market by Technology, Applications and Services 2024 - 2030 |

||||||

|

|||||||

| 米国のプリペイドワイヤレス市場:技術・用途・サービス別 (2024~2030年) |

|

出版日: 2024年12月23日

発行: Mind Commerce

ページ情報: 英文 152 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

米国のプリペイドワイヤレスサービスプロバイダーは近年、ポストペイドサービスの機能やプランと同等になるようサービスを進化させ、競争が激化しています。例えば、Verizon Wirelessは現在、プリペイドのファミリープラン、無制限プラン、BYODのサポートを提供しています。

プリペイドワイヤレスサービスは、ポストペイドとますます同等になるという支配的なトレンドの一部として、全般的な進化が続くと予想されています。これは、Verizonが最近TracFoneを買収したことからも明らかであり、同社は中核となるプリペイドワイヤレスサービスを差別化する一方で、エントリーレベルのプリペイドサービスも維持すると考えられています。

本レポートでは、米国のプリペイドワイヤレス市場を調査し、主要プロバイダーの分析、サービスの評価、プリペイドサービス提供に関わる技術、プリペイド通信、コンテンツ、商取引の将来性の評価などを行っています。レポートには5Gの影響分析も含まれています。

また、主要MVNO企業と提供サービスについても分析しています。さらに、プリペイドワイヤレスの将来像や、2030年までの加入者数と収益予測 (音声/データ/VAS別、接続タイプ別) も掲載しています。

掲載企業

|

|

目次

第1章 エグゼクティブサマリー

第2章 イントロダクション

第3章 米国の通信サービスプロバイダー

- ワイヤレスキャリアの提供

- プリペイドおよびポストペイドワイヤレス市場の概要

- プリペイドとポストペイドの市場戦略

- プリペイド技術のアプローチ

- プリペイドワイヤレス技術

- プリペイド市場の見通し

- 米国のプリペイドワイヤレス市場の端末プロバイダー

- 米国のワイヤレスプリペイドサービスの成長の原動力と課題

- その他の要因と見通し

第4章 米国のプリペイドワイヤレスサービスプロバイダーの分析

- AT&T

- T-Mobile

- US Cellular

- Verizon

- ワイヤレスプリペイドプランの比較分析

- プリペイドワイヤレス業界の統合

第5章 SprintとT-Mobileの合併がプリペイドワイヤレスに与える影響

- 米国の航空会社エコシステム全体への影響

- モバイル仮想ネットワーク事業者への影響

- プリペイド子会社への影響:Boost、Metro PCS、Virgin Mobile

第6章 モバイル仮想ネットワーク事業者

- 概要

- MVNO:MNOの資産を活用

- MVNO:MVNEのインフラとサービスを活用

- MVNOの戦略

- MVNOの差別化

- プリペイドとポストペイド

- 計画の概要と分析

- 主要MVNOのケーススタディ分析

- Airlink Mobile (DS Mobile)

- Airvoice Wireless

- JOLT Mobile

- Boost Mobile

- Consumer Cellular

- GreatCall

- kajeet

- Liberty Wireless

- H2O Wireless (Locus Telecommunications)

- Virgin Mobile USA

- Cricket (AT&T)

- Wal-Mart

- Page Plus

第7章 米国のプリペイドワイヤレスの予測

- ワイヤレスプリペイド加入者予測:接続タイプ別

- プリペイドワイヤレス収益予測・タイプ・接続タイプ別

- 月間ARPU予測

- プリペイドワイヤレスサービスプロバイダーの市場シェア

第8章 プリペイドワイヤレスの将来:付加価値サービス

- リアルタイム通信:RCSとWebRTC

- モバイルコマースにおけるプリペイドとストアドバリュー

- BYODとプリペイド

- プリペイドと決済

- プリペイドとウェアラブル

- プリペイドとスマートワークプレイス

- プリペイドとバーチャルリアリティ

- プリペイドと公共安全

- プリペイドとIoT

- 付加価値サービスの提供戦略

- サブスクリプション

- 従量制サービス

- データ

- メッセージング

- オンデマンドサービス

- オンデマンドからサブスクリプションへのアップセル

第9章 米国のプリペイドワイヤレス:ポーターのファイブフォース分析

第10章 米国のプリペイドワイヤレス:COVID-19の影響

- COVID-19は米国のプリペイド市場を活性化させたか?

- 主要企業による取り組みとステップ

- 米国のプリペイドワイヤレス市場への逆風

第11章 総論・提言

第12章 付録:MVNO戦略

- MVNOの種類

- フルMVNO

- サービスプロバイダー

- ESP:拡張サービスプロバイダー (ハイブリッドMVNO)

- ブランド再販業者

- MVNOモデル

- 格安MVNO

- ライフスタイル/ニッチMVNO

- メディア/エンターテイメントMVNO

- 民族系MVNO

- ビジネスMVNO

- ブランドMVNO

- データMVNO

- M2M/テレメトリMVNO

- クアッドプレイMVNO

- ローミングMVNO

- 米国MVNO企業の追加ケーススタディ分析

- CellNUVO

- Cellular Abroad

- AirVoice Wireless

- Airlink Mobile

- Jasper Wireless (Cisco)

- ZingPCs

- Boost Mobile

- Disney Mobile

- ZIP SIM

- Bratz Mobile

- Consumer Cellular

- CREDO Mobile

- DBS Communications

- Defense Mobile

- Freedom-Wireless

- GreatCall

- Kajeet

- KORE Wireless

- Liberty Wireless

- MetroPCS

- Lycamobile

- PixWireless

- National Geographic

- NET10

- Nextel Partners

- Page Plus

- Payless Cellular

- PlatinumTel Communications

- Google Fi

- Red Pocket Mobile

- Ting

- Total Call Mobile

- Tracfone Wireless

- Virgin Mobile USA

- Cricket Wireless

- H2O Wireless

- RingPlus

- PureTalk

第13章 付録:5G技術、インフラ、サービス

- 5G技術

- 5Gとコアネットワークインフラ

- 5Gと無線ネットワークインフラ

- 5Gの機能

- 5Gと超高精細音声サービス

- 5Gと非音声アプリケーションおよびサービス

- 5Gが公共安全サービスに与える影響

- 5GがIoTに与える影響

- 自動化、ロボット工学、産業分野への5Gの影響

- 5Gがビジネスサービスに与える影響

- 5Gと固定無線

- 5Gと屋内ワイヤレス

Overview:

This report evaluates the prepaid wireless market in the United States including major provider analysis and service assessment, technologies involved in prepaid service delivery, and assessment of the future of prepaid communications, content, and commerce. The report includes an analysis of the 5G impact.

The report also analyzes major MVNO companies and offerings. The report also provides a view into the future of prepaid wireless and market forecasts through 2030 including subscribers and Revenue by Voice vs. Data vs. VAS and by Connectivity Type.

Prepaid wireless service providers in the United States have become increasingly competitive in recent years as they evolve offerings to be more on par with post-paid service features and plans. For example, Verizon Wireless now offers prepaid family plans, unlimited plans, and support for BYOD whereas this was not the case just a few years ago.

We anticipate the continued evolution of prepaid wireless in general as part of a dominant trend towards prepaying mobile services becoming increasingly more comparable with post-paid wireless. This is evidenced by Verizon's recent acquisition of TracFone, which we believe it will maintain as an entry-level prepaid offering while the company differentiates its core prepaid wireless service.

The future of prepaid wireless communications will depend on more than just carrier-centric applications, communications, content, and commerce. For example, we see prepaid as an important aspect of many next-generation services that are provided by a variety of third-party service companies that do not wish to offer a postpaid option as it would typically rely upon wireless carrier billing via prepay.

Growth in prepaid wireless service will also depend on the extent to which next-generation services, such as virtual reality, are generally supported on a pre-pay basis. This is to say that prepaid customers must have access to wireless data plans that put them on par with postpaid in terms of both bandwidth and low latency required for acceptable end-user quality of experience.

While many emerging applications will be offered by Over-the-Top (OTT) service providers, we strongly recommend that MNOs offer their own branded/controlled Value-added Service (VAS) applications. The OTT application business model has caused data payload (e.g. apps that use data) to become increasingly more valuable to consumers than data itself, which is rapidly becoming a marginalized commodity. With this development, VAS applications have become much more important to network operators.

With the ever-increasing commoditization of carrier core services (mostly voice and messaging), there will be a growing dependence on VAS applications for initially top-line revenue growth (as data growth tapers off and margins are squeezed) and then for margin growth as bearer services become a cost-plus commodity. Prepaid wireless service providers must also provide their own VAS apps to remain competitive, even if it requires them to offer those apps on an OTT basis themselves.

Companies in Report:

|

|

Table of Contents

1. Executive Summary

2. Introduction

3. United States Communication Service Providers

- 3.1. Wireless Carrier Offerings

- 3.1.1. Prepaid and Postpaid Wireless Market Overview

- 3.1.2. Prepaid and Postpaid Market Strategy

- 3.1.3. Prepaid Technology Approaches

- 3.1.4. Prepaid Wireless Technology

- 3.1.5. Prepaid Market Outlook

- 3.2. USA Prepaid Wireless Market Handset Providers

- 3.3. Drivers and Challenges for Growth in the USA Wireless Prepaid Services

- 3.3.1. Prepaid Drivers

- 3.3.2. Prepaid Challenges

- 3.4. Other Factors and Outlook

4. United States Prepaid Wireless Service Provider Analysis

- 4.1. AT&T

- 4.1.1. Plans

- 4.1.2. Feature Analysis

- 4.1.3. SWOT Analysis

- 4.1.4. AT&T MVNO Companies

- 4.2. T-Mobile

- 4.2.1. Overview

- 4.2.2. Feature Analysis

- 4.2.3. SWOT Analysis

- 4.2.4. T-Mobile MVNO Companies

- 4.3. US Cellular

- 4.3.1. Overview

- 4.3.2. Plans

- 4.3.3. Feature Analysis

- 4.3.4. SWOT Analysis

- 4.4. Verizon

- 4.4.1. Overview

- 4.4.2. Plans

- 4.4.3. Feature Analysis

- 4.3.4. SWOT Analysis

- 4.4.5. Verizon MVNO Companies

- 4.5. Comparative Analysis of Wireless Prepaid Plans

- 4.6. Prepaid Wireless Industry Consolidation

5. Sprint and T-Mobile Merger Impact on Prepaid Wireless

- 5.1.1. Impact on the USA Carrier Ecosystem as a Whole

- 5.1.2. Impact on Mobile Virtual Network Operators

- 5.1.3. Impact on Prepaid Subsidiaries: Boost, Metro PCS, and Virgin Mobile

6. Mobile Virtual Network Operators

- 6.1. Overview

- 6.2. MVNOs Leverage MNO Assets

- 6.3. MVNOs Leverage MVNE Infrastructure and Services

- 6.4. MVNO Strategies

- 6.5. MVNO Differentiation

- 6.6. Prepaid vs. Postpaid Offerings

- 6.7. Plan Overview and Analysis

- 6.8. Select MVNO Case Study Analysis

- 6.8.1. Airlink Mobile (DS Mobile)

- 6.8.2. Airvoice Wireless

- 6.8.3. JOLT Mobile

- 6.8.4. Boost Mobile

- 6.8.5. Consumer Cellular

- 6.8.6. GreatCall

- 6.8.7. kajeet

- 6.8.8. Liberty Wireless

- 6.8.9. H2O Wireless (Locus Telecommunications)

- 6.8.10. Virgin Mobile USA

- 6.8.11. Cricket (AT&T)

- 6.8.12. Wal-Mart

- 6.8.13. Page Plus

7. USA Prepaid Wireless Forecasts 2024 - 2030

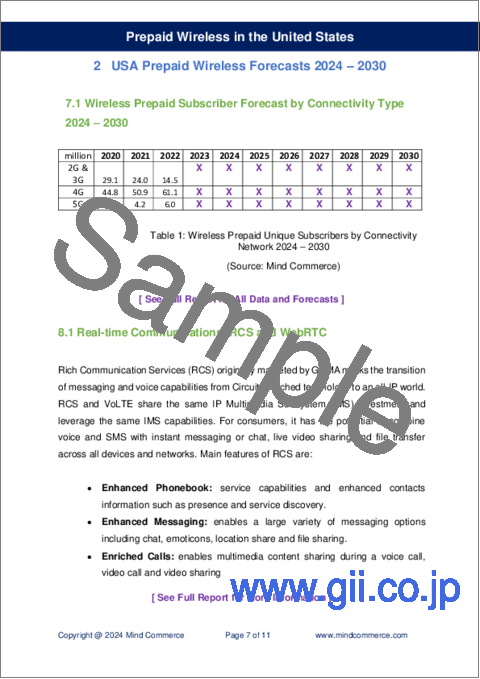

- 7.1. Wireless Prepaid Subscriber Forecast by Connectivity Type 2024 - 2030

- 7.2. Prepaid Wireless Revenue Forecast by Type, and Connectivity 2024 - 2030

- 7.3. Monthly ARPU Forecast 2024 - 2030

- 7.4. Prepaid Wireless Service Provider Market Share 2024 - 2030

8. Future of Prepaid Wireless: Value-added Services

- 8.1. Real-time Communications: RCS and WebRTC

- 8.2. Prepaid and Stored Value in Mobile Commerce

- 8.3. BYOD and Prepaid

- 8.4. Prepaid and Payments

- 8.5. Prepaid and Wearables

- 8.6. Prepaid and the Smart Workplace

- 8.7. Prepaid and Virtual Reality

- 8.8. Prepaid and Public Safety

- 8.9. Prepaid and Internet of Things (IoT)

- 8.10. Offer Strategies for Value Added Services

- 8.10.1. Subscription

- 8.10.2. Per-use Services

- 8.10.3. Data

- 8.10.4. Messaging

- 8.10.5. On-demand Service

- 8.10.6. Up-selling from On-demand to Subscription

9. Porter's Five Forces of Prepaid Wireless in the United States

10. COVID-19 Impact on Prepaid Wireless in the United States

- 10.1. Did Covid-19 lift the Prepaid Market in the United States?

- 10.2. Initiatives and Steps taken by Key Players

- 10.2.1. Verizon

- 10.2.2. T-Mobile (now including Sprint)

- 10.2.3. AT&T

- 10.3. Headwinds for the US Prepaid Wireless Market

11. Conclusions and Recommendations

12. Appendix: MVNO Strategies

- 12.1. MVNO Types

- 12.1.1. Full MVNO

- 12.1.2. Service Provider

- 12.1.3. ESP: Enhanced Service Provider (Hybrid MVNO)

- 12.1.4. Branded Reseller

- 12.2. MVNO Models

- 12.2.1. Discount MVNOs

- 12.2.2. Lifestyle/Niche MVNOs

- 12.2.3. Media/Entertainment MVNOs

- 12.2.4. Ethnic MVNOs

- 12.2.5. Business MVNOs

- 12.2.6. Brand MVNOs

- 12.2.7. Data MVNOs

- 12.2.8. M2M/Telemetry MVNOs

- 12.2.9. Quad Play MVNOs

- 12.2.10. Roaming MVNOs

- 12.3. Additional Case Study Analysis of USA MVNO Companies

- 12.3.1. CellNUVO

- 12.3.2. Cellular Abroad

- 12.3.3. AirVoice Wireless

- 12.3.4. Airlink Mobile

- 12.3.5. Jasper Wireless (Cisco)

- 12.3.6. ZingPCs

- 12.3.7. Boost Mobile

- 12.3.8. Disney Mobile

- 12.3.9. ZIP SIM

- 12.3.10. Bratz Mobile

- 12.3.11. Consumer Cellular

- 12.3.12. CREDO Mobile

- 12.3.13. DBS Communications

- 12.3.14. Defense Mobile

- 12.3.15. Freedom-Wireless

- 12.3.16. GreatCall

- 12.3.17. Kajeet

- 12.3.18. KORE Wireless

- 12.3.19. Liberty Wireless

- 12.3.20. MetroPCS

- 12.3.21. Lycamobile

- 12.3.22. PixWireless

- 12.3.23. National Geographic

- 12.3.24. NET10

- 12.3.25. Nextel Partners

- 12.3.26. Page Plus

- 12.3.27. Payless Cellular

- 12.3.28. PlatinumTel Communications

- 12.3.29. Google Fi

- 12.3.30. Red Pocket Mobile

- 12.3.31Ting

- 12.3.32. Total Call Mobile

- 12.3.33. Tracfone Wireless

- 12.3.34. Virgin Mobile USA

- 12.3.35. Cricket Wireless

- 12.3.36. H2O Wireless

- 12.3.37. RingPlus

- 12.3.38. PureTalk

13.0. Appendix: 5G Technology, Infrastructure, and Services

- 13.1. 5G Technology

- 13.2. 5G and Core Network Infrastructure

- 13.2.1. 5G and Edge Computing

- 13.2.2. 5G and Network Slicing

- 13.3. 5G and Radio Network Infrastructure

- 13.4. 5G Capabilities

- 13.5. 5G and Ultra-High-Definition Voice Service

- 13.6. 5G and Non-voice Applications and Services

- 13.7. 5G Impact on Public Safety Services

- 13.8. 5G Impact on the Internet of Things

- 13.9. 5G Impact on Automation, Robotics, and the Industrial Sector

- 13.10. 5G Impact on Business Services

- 13.11. 5G and Fixed Wireless

- 13.12. 5G and Indoor Wireless

Figures:

- Figure 1: Prepaid Phone Options

- Figure 2: Roaming in Cellular Networks

- Figure 3: Drivers and Challenges of the USA Wireless Prepaid Services

- Figure 4: AT&T Prepaid Pricing

- Figure 5: T-Mobile Prepaid Pricing

- Figure 6: US Cellular Prepaid Pricing

- Figure 7: Verizon Prepaid Pricing

- Figure 8: USA MVNOs

- Figure 9: Airvoice Wireless Pricing

- Figure 10: Jolt Mobile Pricing

- Figure 11: Consumer Cellular Pricing

- Figure 12: Competitive Rivalry Among Prepaid Providers

- Figure 13: The 5G Network Slicing Infrastructure and Solution Ecosystem

- Figure 14: 5G Network Slicing Support of Different Application Types

Tables:

- Table 1: Wireless Prepaid Unique Subscribers by Connectivity Network 2024 - 2030

- Table 2: Wireless Prepaid Subscribers 2024 - 2030

- Table 3: Wireless Prepaid Revenue by Voice vs. Data vs. VAS 2024 - 2030

- Table 4: Wireless Prepaid Revenue by Connectivity 2024 - 2030

- Table 5: Wireless Prepaid Revenue 2024 - 2030

- Table 6: Wireless Prepaid Average Monthly ARPU 2024 - 2030

- Table 7: Wireless Prepaid Vendor Market Share by Subscription 2024 - 2030