|

|

市場調査レポート

商品コード

1518401

自動車用サイバーセキュリティ市場:製品別、セキュリティタイプ別、展開形態別、用途別、地域別-2030年までの世界予測Automotive Cybersecurity Market by Offering (Hardware, Software, Services), Security Type (Network Security, Endpoint Security), Deployment Mode, Application (ADAS & Safety, Telematics, and Infotainment), and Geography - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用サイバーセキュリティ市場:製品別、セキュリティタイプ別、展開形態別、用途別、地域別-2030年までの世界予測 |

|

出版日: 2024年06月01日

発行: Meticulous Research

ページ情報: 英文 230 Pages

納期: 5~7営業日

|

全表示

- 概要

- 図表

- 目次

この調査レポートは、「自動車用サイバーセキュリティ市場:オファリング別、セキュリティタイプ別、展開モード別、用途別、地域別~2031年までの世界予測」と題し、主要5地域の自動車用サイバーセキュリティ市場を詳細に分析し、現在の市場動向、市場規模、市場シェア、最近の動向、2031年までの予測などをまとめています。

世界の自動車用サイバーセキュリティ市場は、2024~2031年のCAGRが19.9%で、2031年までに167億米ドルに達すると予測されます。

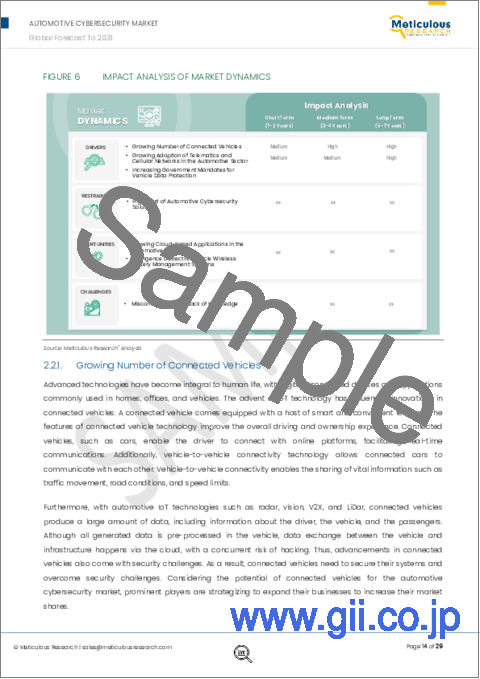

この市場の成長を牽引しているのは、コネクテッドカーの増加、自動車セグメントでのテレマティクス・セルラーネットワークの採用拡大、サイバー攻撃&データ漏洩事件の増加、車両データ保護に対する政府の義務付けの増加などです。このような主要要因が市場を形成しており、聴衆はこれらの要因を認識することが極めて重要です。しかし、自動車用サイバーセキュリティソリューションのコストが高いことが、自動車用サイバーセキュリティ市場の成長を抑制しています。

自動車産業におけるクラウドベースのアプリケーションの成長と電気自動車のワイヤレスバッテリー管理システムの出現は、市場の成長に大きな機会を提供すると期待されています。しかし、自動車用サイバーセキュリティソリューションに関する誤解や知識不足、車両電子システムの複雑化は、この市場で事業を展開する企業にとって大きな課題となっています。

目次

第1章 イントロダクション

第2章 調査手法

- 調査の前提条件

- 研究の限界

第3章 エグゼクティブ概要

- 市場分析:オファリング別

- 市場分析:セキュリティタイプ別

3.3展開モード別市場分析

- 市場用途別分析

- 市場分析:地域別

第4章 市場洞察

- イントロダクション

- 市場力学

- 促進要因

- コネクテッドカーの増加

- 自動車セグメントにおけるテレマティクスとセルラーネットワークの採用拡大

- 自動車データ保護に関する政府規制の強化

- 抑制要因

- 自動車用サイバーセキュリティソリューションのコスト高

- ビジネス機会

- 自動車業界におけるクラウドベースのアプリケーションの成長

- 電気自動車のワイヤレスバッテリー管理システムの登場

- 課題

- 自動車用サイバーセキュリティソリューションに関する誤解と知識不足

- 動向

- 技術動向

- 市場動向

- 促進要因

- 導入事例

第5章 自動車用サイバーセキュリティ市場:オファリング別

- イントロダクション

- ソフトウェア

- ハードウェア

- サービス

第6章 自動車用サイバーセキュリティ市場:セキュリティタイプ別

- イントロダクション

- アプリケーションセキュリティ

- エンドポイントセキュリティ

- ネットワークセキュリティ

第7章 自動車用サイバーセキュリティ市場:展開形態別

- イントロダクション

- 車載

- 外部クラウドサービス

第8章 自動車用サイバーセキュリティ市場:用途別

- イントロダクション

- ADASと安全性

- ボディコントロール・コンフォート

- インフォテインメント

- テレマティクス

- パワートレインシステム

- 通信システム

- その他

第9章 自動車用サイバーセキュリティ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- メキシコ

- ブラジル

- その他のラテンアメリカ

- 中東・アフリカ

第10章 自動車用サイバーセキュリティ市場:競合情勢

- イントロダクション

- 主要成長戦略

- 市場の差別化要因

- シナジー分析主要取引と戦略的提携

- 競合ダッシュボード

- 業界リーダー

- 市場の差別化要因

- 前衛企業

- 現代の有力企業

- ベンダーの市場ポジショニング

- 市場シェア分析

第11章 企業プロファイル(事業概要、財務概要、製品ポートフォリオ、戦略的展開)

- Thales Group(フランス)

- NXP Semiconductors N.V.(オランダ)

- HARMAN International(米国)

- Renesas Electronics Corporation(日本)

- STMicroelectronics N.V.(スイス)

- Garrett Motion Inc.(スイス)

- Argus Cyber Security Ltd(イスラエル)

- Vector Informatik GmbH(ドイツ)

- Karamba Security Ltd.(イスラエル)

- Synopsys, Inc.(米国)

- DENSO Corporation(日本)

- Guardknox Cyber-Technologies Ltd.(イスラエル)

- Infineon Technologies AG(ドイツ)

- UL LLC.(米国)

- Aptiv PLC(アイルランド)

第12章 付録

LIST OF TABLES

- Table 1 Global Automotive Cybersecurity Market Size, by Country/Region, 2021-2030 (USD Million)

- Table 2 Global Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 3 Global Automotive Cybersecurity Software Market Size, by Country/Region, 2021-2030 (USD Million)

- Table 4 Global Automotive Cybersecurity Hardware Market Size, by Country/Region, 2021-2030 (USD Million)

- Table 5 Global Automotive Cybersecurity Services Market Size, by Country/Region, 2021-2030 (USD Million)

- Table 6 Global Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 7 Global Automotive Cybersecurity Market Size for Application Security, by Country/Region, 2021-2030 (USD Million)

- Table 8 Global Automotive Cybersecurity Market Size for Endpoint Security, by Country/Region, 2021-2030 (USD Million)

- Table 9 Global Automotive Cybersecurity Market Size for Network Security, by Country/Region, 2021-2030 (USD Million)

- Table 10 Global Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 11 Global Automotive Cybersecurity Market Size for In-vehicle, by Country/Region, 2021-2030 (USD Million)

- Table 12 Global Automotive Cybersecurity Market Size for External Cloud Services, by Country/Region, 2021-2030 (USD Million)

- Table 13 Global Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 14 Global Automotive Cybersecurity Market Size for ADAS & Safety, by Country/Region, 2021-2030 (USD Million)

- Table 15 Global Automotive Cybersecurity Market Size for Body Control & Comfort, by Country/Region, 2021-2030 (USD Million)

- Table 16 Global Automotive Cybersecurity Market Size for Infotainment, by Country/Region, 2021-2030 (USD Million)

- Table 17 Global Automotive Cybersecurity Market Size for Telematics, by Country/Region, 2021-2030 (USD Million)

- Table 18 Global Automotive Cybersecurity Market Size for Powertrain Systems, by Country/Region, 2021-2030 (USD Million)

- Table 19 Global Automotive Cybersecurity Market Size for Communication Systems, by Country/Region, 2021-2030 (USD Million)

- Table 20 Global Automotive Cybersecurity Market Size for Other Applications, by Country/Region, 2021-2030 (USD Million)

- Table 21 Global Automotive Cybersecurity Market Size, by Country/Region, 2021-2030 (USD Million)

- Table 22 North America: Automotive Cybersecurity Market Size, by Country, 2021-2030 (USD Million)

- Table 23 North America: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 24 North America: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 25 North America: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 26 North America: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 27 U.S.: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 28 U.S.: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 29 U.S.: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 30 U.S.: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 31 Canada: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 32 Canada: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 33 Canada: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 34 Canada: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 35 Europe: Automotive Cybersecurity Market Size, by Country/Region, 2021-2030 (USD Million)

- Table 36 Europe: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 37 Europe: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 38 Europe: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 39 Europe: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 40 U.K.: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 41 U.K.: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 42 U.K.: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 43 U.K.: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 44 Germany: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 45 Germany: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 46 Germany: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 47 Germany: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 48 France: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 49 France: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 50 France: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 51 France: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 52 Italy: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 53 Italy: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 54 Italy: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 55 Italy: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 56 Spain: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 57 Spain: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 58 Spain: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 59 Spain: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 60 Rest of Europe: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 61 Rest of Europe: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 62 Rest of Europe: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 63 Rest of Europe: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 64 Asia-Pacific: Automotive Cybersecurity Market Size, by Country/Region, 2021-2030 (USD Million)

- Table 65 Asia-Pacific: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 66 Asia-Pacific: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 67 Asia-Pacific: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 68 Asia-Pacific: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 69 China: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 70 China: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 71 China: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 72 China: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 73 Japan: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 74 Japan: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 75 Japan: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 76 Japan: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 77 India: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 78 India: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 79 India: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 80 India: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 81 South Korea: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 82 South Korea: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 83 South Korea: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 84 South Korea: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 85 Rest of Asia-Pacific: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 86 Rest of Asia-Pacific: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 87 Rest of Asia-Pacific: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 88 Rest of Asia-Pacific: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 89 Latin America: Automotive Cybersecurity Market Size, by Country, 2021-2030 (USD Million)

- Table 90 Latin America: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 91 Latin America: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 92 Latin America: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 93 Latin America: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 94 Brazil: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 95 Brazil: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 96 Brazil: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 97 Brazil: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 98 Mexico: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 99 Mexico: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 100 Mexico: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 101 Mexico: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 102 Rest of Latin America: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 103 Rest of Latin America: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 104 Rest of Latin America: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 105 Rest of Latin America: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

- Table 106 Middle East & Africa: Automotive Cybersecurity Market Size, by Offering, 2021-2030 (USD Million)

- Table 107 Middle East & Africa: Automotive Cybersecurity Market Size, by Security Type, 2021-2030 (USD Million)

- Table 108 Middle East & Africa: Automotive Cybersecurity Market Size, by Deployment Mode, 2021-2030 (USD Million)

- Table 109 Middle East & Africa: Automotive Cybersecurity Market Size, by Application, 2021-2030 (USD Million)

LIST OF FIGURES

- Figure 1 Research Process

- Figure 2 Key Secondary Sources

- Figure 3 Primary Research Techniques

- Figure 4 Key Executives Interviewed

- Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

- Figure 6 Market Sizing & Growth Forecast Approach

- Figure 7 Key Insights

- Figure 8 Global Automotive Cybersecurity Market Size, by Offering, 2024 Vs. 2030 (USD Million)

- Figure 9 Global Automotive Cybersecurity Market Size, by Security Type, 2024 Vs. 2030 (USD Million)

- Figure 10 Global Automotive Cybersecurity Market Size, by Deployment Mode, 2024 Vs. 2030 (USD Million)

- Figure 11 Global Automotive Cybersecurity Market Size, by Application, 2024 Vs. 2030 (USD Million)

- Figure 12 Global Automotive Cybersecurity Market Size, by Geography, 2024 Vs. 2030 (USD Million)

- Figure 13 Automotive Cybersecurity Market, by Region

- Figure 14 Market Dynamics

- Figure 15 Global Automotive Cybersecurity Market Size, by Offering, 2024 Vs. 2030 (USD Million)

- Figure 16 Global Automotive Cybersecurity Market Size, by Security Type, 2024 Vs. 2030 (USD Million)

- Figure 17 Global Automotive Cybersecurity Market Size, by Deployment Mode, 2024 Vs. 2030 (USD Million)

- Figure 18 Global Automotive Cybersecurity Market Size, by Application, 2024 Vs. 2030 (USD Million

- Figure 19 Global Automotive Cybersecurity Market Size, by Geography, 2024 Vs. 2030 (USD Million)

- Figure 20 North America: Automotive Cybersecurity Market Snapshot

- Figure 21 Europe: Automotive Cybersecurity Market Snapshot

- Figure 22 Asia Pacific: Automotive Cybersecurity Market Snapshot

- Figure 23 Latin America: Automotive Cybersecurity Market Snapshot

- Figure 24 Key Growth Strategies Adopted by Key Players (2020-2022)

- Figure 25 Global Automotive Cybersecurity Market Share Analysis, by Key Player (2022)

- Figure 26 Thales Group: Financial Overview (2019-2021)

- Figure 27 NXP Semiconductors N.V.: Financial Overview (2019-2021)

- Figure 28 UL LLC.: Financial Overview (2019-2021)

- Figure 29 Renesas Electronics Corporation: Financial Overview (2019-2021)

- Figure 30 STMicroelectronics N.V.: Financial Overview (2019-2021)

- Figure 31 Garrett Motion Inc.: Financial Overview (2019-2021)

- Figure 32 Infineon Technologies AG: Financial Overview (2019-2021)

Automotive Cybersecurity Market by Offering (Hardware, Software, Services), Security Type (Network Security, Endpoint Security), Deployment Mode, Application (ADAS & Safety, Telematics, and Infotainment), and Geography-Global Forecast to 2031.

The research report titled 'Automotive Cybersecurity Market by Offering (Hardware, Software, Services), Security Type (Network Security, Endpoint Security), Deployment Mode, Application (ADAS & Safety, Telematics, and Infotainment), and Geography-Global Forecast to 2031', provides an in-depth analysis of the automotive cybersecurity market across five major geographies and emphasizes on the current market trends, market sizes, market shares, recent developments, and forecasts till 2031.

The global automotive cybersecurity market is projected to reach $16.7 billion by 2031, at a CAGR of 19.9% from 2024 to 2031.

This market's growth is driven by the increasing number of connected cars, the growing adoption of telematics & cellular networks in the automotive sector, rising incidents of cyberattacks & data breaches, and increasing government mandates for vehicle data protection. These key factors are shaping the market and it's crucial for the audience to be aware of them. However, the high cost of automotive cybersecurity solutions restrains the growth of the automotive cybersecurity market.

The growing cloud-based applications in the automotive industry and the emergence of electric vehicle wireless battery management systems are expected to offer significant opportunities for the market's growth. However, misconceptions & lack of knowledge regarding automotive cybersecurity solutions and the growing complexity of vehicle electronics systems are major challenges for players operating in this market.

The automotive cybersecurity market is segmented based on offering (hardware, software, and services), security type (application security, endpoint security, and network security), deployment mode (in-vehicle and external cloud services), and application (ADAS & safety, body control & comfort, infotainment, telematics, powertrain systems, communication systems, and other applications). This study also evaluates industry competitors and analyzes the market at the regional and country levels.

Based on offering, the automotive cybersecurity market is segmented into hardware, software, and services. In 2024, the software segment is expected to account for the largest share of the global automotive cybersecurity market. This segment's large market share is attributed to the increasing number of connected cars, the growing focus on software-centric security capabilities, and the rising vulnerabilities on IoT devices. In addition, the benefits offered by cybersecurity, such as reliability, comprehensive vulnerability coverage, efficiency, and security of real-time applications, further augment the growth of this segment. Moreover, the software segment is projected to register the highest CAGR during the forecast period.

Based on security type, the automotive cybersecurity market is segmented into network security, endpoint security, and application security. In 2024, the network security segment is expected to account for the largest share of the global automotive cybersecurity market. The large market share of this segment is attributed to the rising need to ensure network security via restricted device management in-vehicle terminals, the growing need to detect & prevent attacks on a vehicle, and the increasing need to protect connected network infrastructure. Moreover, the network security segment is projected to register the highest CAGR during the forecast period.

Based on deployment mode, the automotive cybersecurity market is segmented into in-vehicle and external cloud services. In 2024, the in-vehicle segment is expected to account for the largest share of the global automotive cybersecurity market. The large market share of this segment is attributed to the rising concerns about vehicle safety, increased installation of cutting-edge safety devices in automobiles, and the rising use of endpoint applications, such as radio, mobile, and smart antenna, in automobiles. However, the external cloud services segment is anticipated to register a higher CAGR during the forecast period. The growth of this segment is driven by the rise in data breaches and security concerns and the growing number of cloud-connected devices and vehicles.

Based on application, the automotive cybersecurity market is segmented into communication systems, ADAS & safety, body control & comfort, infotainment, telematics, powertrain systems, and other applications. In 2024, the communication systems segment is expected to account for the largest share of the global automotive cybersecurity market. The large market share of this segment is attributed to the rising cyber-attacks, the emergence of electric vehicle wireless battery management systems, and growing cloud-based applications in the automotive industry. Moreover, the communication systems segment is projected to register the highest CAGR during the forecast period.

Based on geography, the automotive cybersecurity market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of the global automotive cybersecurity market. Asia-Pacific's major market share is attributed to the presence of prominent automotive cybersecurity companies in the region, such as Renesas Electronics Corporation (Japan) and DENSO Corporation (Japan). In addition, the increasing penetration of connected cars, growing cyberattacks, and rising IoT deployment contribute to the growth of this regional market. For instance, according to data from the Ministry of Science and ICT, in 202, there were 10 million IoT device subscriptions in South Korea due to the growing use of connected cars and remote-control services.

Furthermore, Asia-Pacific is expected to register a rapid growth rate during the forecast period. The growth of this regional market is attributed to the economic growth in developing countries, growing cybercrimes, and rising demand for connected features in emerging economies.

Key Players:

The key players operating in the automotive cybersecurity market are Thales Group (France), NXP Semiconductors N.V. (Netherlands), UL LLC (U.S.), HARMAN International (U.S.), Renesas Electronics Corporation (Japan), STMicroelectronics N.V. (Switzerland), Garrett Motion Inc. (Switzerland), Argus Cyber Security Ltd (Israel), Vector Informatik GmbH (Germany), Karamba Security Ltd. (Israel), Synopsys, Inc. (U.S.), DENSO Corporation (Japan), Guardknox Cyber-Technologies Ltd. (Israel), and Infineon Technologies AG (Germany).

Key questions answered in the report-

- Which are the high-growth market segments in terms of offering, security type, deployment mode, and application?

- What was the historical market size for automotive cybersecurity across the globe?

- What are the market forecasts and estimates for 2024-2031?

- What are the major drivers, restraints, opportunities, challenges, and trends in the automotive cybersecurity market?

- Who are the major players in the automotive cybersecurity market, and what are their market shares?

- How is the competitive landscape?

- What are the recent developments in the automotive cybersecurity market?

- What are the different strategies adopted by the major players in the market?

- What are the geographic trends and high-growth countries?

- Who are the local emerging players in the automotive cybersecurity market, and how do they compete with other players?

Scope of the report:

Automotive Cybersecurity Market-by Offering

- Software

- Hardware

- Services

Automotive Cybersecurity Market-by Security Type

- Network Security

- Application Security

- Endpoint Security

Automotive Cybersecurity Market-by Deployment Mode

- In-vehicle

- External Cloud Services

Automotive Cybersecurity Market-by Application

- ADAS & safety

- Body Control & Comfort

- Infotainment

- Telematics

- Powertrain Systems

- Communication Systems

- Other Applications

Automotive Cybersecurity Market-by Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

TABLE OF CONTENTS

1. Introduction

- 1.1 Market Definition

- 1.2 Global Automotive Cybersecurity Market Ecosystem

- 1.3 Currency & Limitation

- 1.3.1 Currency

- 1.3.2 Limitations

- 1.4 Key Stakeholders

2. Research Methodology

- 2.1 Research Approach

- 2.2 Data Collection & Validation

- 2.2.1 Secondary Research

- 2.2.2 Primary Research

- 2.3 Market Assessment

- 2.3.1 Market Size Estimation

- 2.3.1.1 Bottom-up Approach

- 2.3.1.2 Top-down Approach

- 2.3.1.3 Growth Forecast

- 2.3.2 Market Share Analysis

- 2.3.1 Market Size Estimation

- 2.4 Assumptions for the Study

- 2.5 Limitation For Study

3. Executive Summary

- 3.1 Market Analysis, by Offering

- 3.2 Market Analysis, by Security Type

' 3.3 Market Analysis, by Deployment Mode

- 3.4 Market Analysis, by Application

- 3.5 Market Analysis, by Geography

4. Market Insights

- 4.1 Introduction

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Growing Number of Connected Cars

- 4.2.1.2 Growing Adoption of Telematics and Cellular Networks in the Automotive Sector

- 4.2.1.3 Increasing Government Mandates for Vehicle Data Protection

- 4.2.2 Restraints

- 4.2.2.1 High Costs of Automotive Cybersecurity Solutions

- 4.2.3 Opportunities

- 4.2.3.1 Growing Cloud-Based Applications in the Automotive Industry

- 4.2.3.2 Emergence of Electric Vehicle Wireless Battery Management Systems

- 4.2.4 Challenges

- 4.2.4.1 Misconceptions and Lack of Knowledge Regarding Automotive Cybersecurity Solutions

- 4.2.5 Trends

- 4.2.5.1 Technology Trend

- 4.2.5.2 Market Trend

- 4.2.1 Drivers

- 4.3 Case Studies

5. Automotive Cybersecurity Market, by Offering

- 5.1 Introduction

- 5.2 Software

- 5.3 Hardware

- 5.4 Services

6. Automotive Cybersecurity Market, by Security Type

- 6.1 Introduction

- 6.2 Application Security

- 6.3 Endpoint Security

- 6.4 Network Security

7. Automotive Cybersecurity Market, by Deployment Mode

- 7.1 Introduction

- 7.2 In-vehicle

- 7.3 External Cloud Services

8. Automotive Cybersecurity Market, by Application

- 8.1 Introduction

- 8.2 ADAS & Safety

- 8.3 Body Control & Comfort

- 8.4 Infotainment

- 8.5 Telematics

- 8.6 Powertrain Systems

- 8.7 Communication Systems

- 8.8 Other Applications

9. Automotive Cybersecurity Market, by Geography

- 9.1 Introduction

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 U.K.

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia-Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Rest of Asia-Pacific

- 9.5 Latin America

- 9.5.1 Mexico

- 9.5.2 Brazil

- 9.5.3 Rest of Latin America

- 9.6 Middle East & Africa

10. Automotive Cybersecurity Market-Competitive Landscape

- 10.1 Introduction

- 10.2 Key Growth Strategies

- 10.2.1 Market Differentiators

- 10.2.2 Synergy Analysis: Major Deals & Strategic Alliances

- 10.3 Competitive Dashboard

- 10.3.1 Industry Leader

- 10.3.2 Market Differentiators

- 10.3.3 Vanguards

- 10.3.4 Contemporary Stalwarts

- 10.4 Vendor Market Positioning

- 10.5 Market Share Analysis

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

- 11.1 Thales Group (France)

- 11.2 NXP Semiconductors N.V. (Netherlands)

- 11.3 HARMAN International (U.S.)

- 11.4 Renesas Electronics Corporation (Japan)

- 11.5 STMicroelectronics N.V. (Switzerland)

- 11.6 Garrett Motion Inc. (Switzerland)

- 11.7 Argus Cyber Security Ltd (Israel)

- 11.8 Vector Informatik GmbH (Germany)

- 11.9 Karamba Security Ltd. (Israel)

- 11.10 Synopsys, Inc. (U.S.)

- 11.11 DENSO Corporation (Japan)

- 11.12 Guardknox Cyber-Technologies Ltd. (Israel)

- 11.13 Infineon Technologies AG (Germany)

- 11.14 UL LLC. (U.S.)

- 11.15 Aptiv PLC (Ireland)

12. Appendix

- 12.1 Questionnaire

- 12.2 Available Customization