|

|

市場調査レポート

商品コード

1923671

スマートビルディングにおけるスタートアップ(2026年):M&A・投資|AEC/Oライフサイクル全体のデジタルツイン・AIスタートアップStartUps in Smart Buildings 2026: M&A & Investments | Digital Twin & AI Startups across the AEC/O Lifecycle |

||||||

|

|||||||

| スマートビルディングにおけるスタートアップ(2026年):M&A・投資|AEC/Oライフサイクル全体のデジタルツイン・AIスタートアップ |

|

出版日: 2026年01月28日

発行: Memoori

ページ情報: 英文 1 Spreadsheet, 35 Charts, 113 Presentation Slides

納期: 即日から翌営業日

|

概要

スマートビルディングスタートアップのエコシステムは転換点に達しています。ベンチャーキャピタルによる資金調達は落ち着きを見せている一方、M&A活動は急拡大し、2025年だけで98件のスタートアップ買収が実施されました。これは2024年比75%増、過去10年間で最高の年間総数となります。この統合の動きは、定評あるビジネスモデルが戦略的買収企業の注目を集める成熟市場を示唆しています。

当レポートでは、スマートビルディング業界について調査分析し、2025年の全資金調達ラウンド、企業投資家、M&A活動、技術カテゴリ、AEC/Oライフサイクル全体にわたる84のデジタルツイン・AIスタートアップをリスト化したスプレッドシートに加え、高解像度チャートを含む2つのプレゼンテーションファイルを提供しています。当レポートは当社の2026 Enterprise Subscription Serviceに含まれています。

2026年にこの調査が重要となる理由

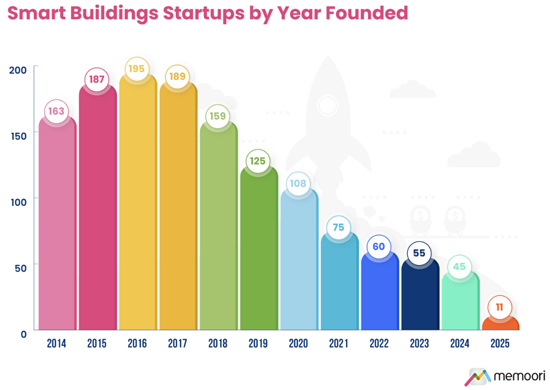

- エコシステムは成長段階から統合段階へと根本的に移行しました。2025年に設立された新規スタートアップはわずか11社しか確認できず、ピークである2016年の195社から着実に減少しています。

- しかしながら、スマートビルディングスタートアップへの資金調達活動はそれほど減少していません。2025年は281の資金調達ラウンドにわたり65億米ドルに達し、ラウンド数は5%減、総額は14%減となりました。

- また、シード/シリーズA投資の平均額は増加しています。投資家はより選択的な姿勢を示し、投資件数は減少する一方、1件あたりの投資額は拡大しています。

- 現在はスタートアップにとって厳しい環境です。投資獲得は困難であり、投資家は確固たる基盤と明確な収益源を持つ企業を優先しています。有力なPropTech VCであるFifth Wallは近年、高金利とトランプ政権の気候政策を理由に、人員を削減し、活発な資金調達を停止しました。

活発なM&A動向

2025年はM&A活動が活発化した年となり、2014年以降に設立されたスタートアップ98社が買収されました。これは2024年同期比で75%の増加となります。2014年以降、スマート商業ビル部門におけるスタートアップ買収件数は累計554件を記録しています。

2025年、VertivによるWaylay NVの買収を含む20件のIoTプラットフォーム買収が行われました。デジタルツイン関連の取引としては、Oakglen GroupによるPupil(英国)の買収、ZutecによるOperance(英国)の買収などが挙げられます。

2026年の見通し

スマートビルディング部門のスタートアップ情勢には、以下の大きな変化が予測されます

- 市場の成熟に伴い、取引数は減少する一方、資金調達ラウンドは大型化し、戦略的参画がより活発化すると予測されます。

- 既存企業が少数株主投資から買収プラットフォーム統合へ移行するにつれて、業界再編が加速します。

- 戦略的買収企業は、AIによって強化されたデジタルビル経営を中心にポートフォリオの再構築を継続します。