|

|

市場調査レポート

商品コード

1555574

自動車用インバーターの世界市場:インバータータイプ・推進タイプ・材料・電力出力・技術・車両タイプ・出力電圧・地域別の予測 (~2033年)Global Automotive Inverter Market Research Report Information by Inverter Type, By Propulsion Type By Material By Power Output By Technology By Vehicle Type By Voltage Output and By Region -Forecast Till 2033 |

||||||

|

|||||||

| 自動車用インバーターの世界市場:インバータータイプ・推進タイプ・材料・電力出力・技術・車両タイプ・出力電圧・地域別の予測 (~2033年) |

|

出版日: 2024年08月28日

発行: Market Research Future

ページ情報: 英文 205 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

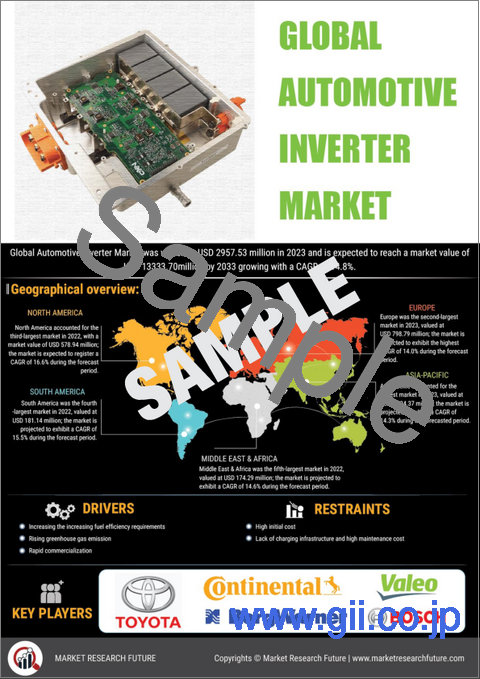

自動車用インバーターの市場規模は、2023年の29億5,753万米ドルから、予測期間中はCAGR 14.8%で推移し、2033年には133億3,370万米ドルの規模に成長すると予測されています。

地域別インサイト

アジア太平洋地域の自動車用インバーター市場は2023年にはおよそ41.40%のシェアを示すと推計されています。同地域市場は、自動車用インバーターに対する継続的な需要と自動車生産の増加によって牽引されています。さらに、自動車の安全性向上への政府による要請も同地域の自動車用インバーターの需要を大きく押し上げています。

北米は自動車用インバーターの長期的な成長市場であり、特に米国ではトラックとバスの生産台数の増加が予想され、自動車の安全性と効率性システムの採用が増加しています。北米市場を牽引する要因としては、多くの小型保有車の老朽化、小型自動車1台当たりの平均走行距離の増加などが挙げられます。

欧州も2023年に大きな市場ポテンシャルを示しています。欧州の自動車用インバーター市場は、産業の発展、政府の交通安全への取り組み支援などの結果、大きく成長すると予測されています。

当レポートでは、世界の自動車用インバーターの市場を調査し、市場の定義と概要、市場成長への各種影響因子の分析、市場規模の推移・予測、各種区分・地域別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

第3章 調査手法

第4章 市場力学

- 促進要因

- 燃費効率要件の強化

- 温室効果ガス排出量の増加

- 急速な商業化

- 抑制要因

- 充電インフラの不足と高い維持費

- 初期費用の高さ

- 機会

- インバーター業界における急速な革新とR&Dの強化

- 太陽光自動車の需要の増加

- 動向

- インバーター技術の進歩

- 電気自動車とハイブリッド車の急増

- サプライチェーンの最適化

- COVID-19の影響分析

第5章 市場要因分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- SWOT分析

- PESTEL分析

- 規制の見通し

第6章 世界の自動車用インバーター市場:インバータータイプ別

- 概要

- トラクションインバーター

- ソフトスイッチングインバーター

第7章 世界の自動車用インバーター市場:推進タイプ別

- バッテリー電気自動車

- プラグインハイブリッド車

- ハイブリッド車

第8章 世界の自動車用インバーター市場:材料別

- 窒化ガリウム

- シリコン

- シリコンカーバイド

- その他

第9章 世界の自動車用インバーター市場:電力出力別

- 200KW未満

- 200-300KW

- 400KW超

第10章 世界の自動車用インバーター市場:技術別

- IGBT

- MOSFET

第11章 世界の自動車用インバーター市場:車両タイプ別

- 乗用車

- 商用車

第12章 世界の自動車用インバーター市場:地域別

- 概要

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第13章 競合情勢

- 市場シェア分析

- 競合ダッシュボード

- 主な展開と成長戦略

第14章 企業プロファイル

- BORGWARNER INC.

- ROBERT BOSCH

- GKN AUTOMOTIVE

- TOYOTA INDUSTRIES CORPORATION

- LEAR CORPORATION

- SENSATATECHNOLOGIES, INC.

- MITSUBISHI ELECTRIC CORPORATION

- VALEO

- INFINEON

- NXP SEMICONDUCTORS

- STMICROELECTRONICS

- MARELLI

- NISSAN MOTOR CORPORATION

- DANFOSS

- CONTINENTAL AG

- DENSO CORPORATION

LIST OF TABLES

- TABLE 1 QFD MODELING FOR MARKET SHARE ASSESSMENT

- TABLE 2 GLOBAL AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 3 GLOBAL AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 4 GLOBAL AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 5 GLOBAL AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 6 GLOBAL AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY, 2019-2033 (USD MILLION)

- TABLE 7 GLOBAL AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 8 GLOBAL AUTOMOTIVE INVERTER MARKET, BY REGION, 2019-2033 (USD MILLION)

- TABLE 9 NORTH AMERICA: AUTOMOTIVE INVERTER MARKET, BY COUNTRY, 2019-2033 (USD MILLION)

- TABLE 10 NORTH AMERICA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 11 NORTH AMERICA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 12 NORTH AMERICA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 13 NORTH AMERICA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 14 NORTH AMERICA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 15 NORTH AMERICA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 16 US AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 17 US AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 18 US AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 19 US AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 20 US AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 21 US AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 22 CANADA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 23 CANADA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 24 CANADA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 25 CANADA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 26 CANADA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 27 CANADA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 28 MEXICO AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 29 MEXICO AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 30 MEXICO AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 31 MEXICO AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 32 MEXICO AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 33 MEXICO AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 34 EUROPE: AUTOMOTIVE INVERTER MARKET, BY COUNTRY, 2019-2033 (USD MILLION)

- TABLE 35 EUROPE AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 36 EUROPE AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 37 EUROPE AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 38 EUROPE AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 39 EUROPE AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 40 EUROPE AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 41 GERMANY AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 42 GERMANY AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 43 GERMANY AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 44 GERMANY AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 45 GERMANY AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 46 GERMANY AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 47 FRANCE AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 48 FRANCE AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 49 FRANCE AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 50 FRANCE AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 51 FRANCE AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 52 FRANCE AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 53 UK AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 54 UK AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 55 UK AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 56 UK AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 57 UK AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 58 UK AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 59 ITALY AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 60 ITALY AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 61 ITALY AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 62 ITALY AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 63 ITALY AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 64 ITALY AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 65 SPAIN AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 66 SPAIN AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 67 SPAIN AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 68 SPAIN AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 69 SPAIN AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 70 SPAIN AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 71 TURKEY AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 72 TURKEY AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 73 TURKEY AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 74 TURKEY AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 75 TURKEY AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 76 TURKEY AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 77 REST OF EUROPE AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 78 REST OF EUROPE AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 79 REST OF EUROPE AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 80 REST OF EUROPE AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 81 REST OF EUROPE AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 82 REST OF EUROPE AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 83 ASIA-PACIFIC: AUTOMOTIVE INVERTER MARKET, BY COUNTRY, 2019-2033 (USD MILLION)

- TABLE 84 ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 85 ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 86 ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 87 ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 88 ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 89 ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 90 CHINA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 91 CHINA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 92 CHINA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 93 CHINA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 94 CHINA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 95 CHINA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 96 INDIA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 97 INDIA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 98 INDIA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 99 INDIA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 100 INDIA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 101 INDIA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 102 JAPAN AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 103 JAPAN AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 104 JAPAN AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 105 JAPAN AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 106 JAPAN AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 107 JAPAN AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 108 SOUTH KOREA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 109 SOUTH KOREA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 110 SOUTH KOREA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 111 SOUTH KOREA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 112 SOUTH KOREA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 113 SOUTH KOREA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 114 INDONESIA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 115 INDONESIA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 116 INDONESIA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 117 INDONESIA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 118 INDONESIA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 119 INDONESIA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 120 REST OF ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 121 REST OF ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 122 REST OF ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 123 REST OF ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 124 REST OF ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 125 REST OF ASIA-PACIFIC AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: AUTOMOTIVE INVERTER MARKET, BY COUNTRY, 2019-2033 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 133 SAUDI ARABIA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 134 SAUDI ARABIA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 135 SAUDI ARABIA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 136 SAUDI ARABIA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 137 SAUDI ARABIA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 138 SAUDI ARABIA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 139 UAE AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 140 UAE AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 141 UAE AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 142 UAE AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 143 UAE AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 144 UAE AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 145 SOUTH AFRICA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 146 SOUTH AFRICA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 147 SOUTH AFRICA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 148 SOUTH AFRICA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 149 SOUTH AFRICA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 150 SOUTH AFRICA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 151 REST OF MEA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 152 REST OF MEA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 153 REST OF MEA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 154 REST OF MEA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 155 REST OF MEA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 156 REST OF MEA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 157 SOUTH AMERICA: AUTOMOTIVE INVERTER MARKET, BY COUNTRY, 2019-2033 (USD MILLION)

- TABLE 158 SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 159 SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 160 SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 161 SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 162 SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 163 SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 164 BRAZIL AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 165 BRAZIL AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 166 BRAZIL AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 167 BRAZIL AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 168 BRAZIL AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 169 BRAZIL AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 170 ARGENTINA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 171 ARGENTINA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 172 ARGENTINA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 173 ARGENTINA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 174 ARGENTINA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 175 ARGENTINA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2019-2033 (USD MILLION)

- TABLE 177 REST OF SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2019-2033 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2019-2033 (USD MILLION)

- TABLE 179 REST OF SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2019-2033 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY 2019-2033 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2019-2033 (USD MILLION)

- TABLE 182 PRODUCT LAUNCH/PRODUCT APPROVAL /ACCQUISITION

- TABLE 183 PARTNERSHIP/INVESTMENT

- TABLE 184 BORGWARNER INC.: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 185 BORGWARNER INC.: KEY DEVELOPMENTS

- TABLE 186 ROBERT BOSCH: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 187 ROBERT BOSCH: KEY DEVELOPMENTS

- TABLE 188 GKN AUTOMOTIVE: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 189 GKN AUTOMOTIVE: KEY DEVELOPMENTS

- TABLE 190 TOYOTA INDUSTRIES CORPORATION: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 191 TOYOTA INDUSTRIES CORPORATION: KEY DEVELOPMENTS

- TABLE 192 LEAR CORPORATION.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 LEAR CORPORATION.: KEY DEVELOPMENTS

- TABLE 194 SENSATA TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 SENSATA TECHNOLOGIES, INC.: KEY DEVELOPMENTS

- TABLE 196 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 MITSUBISHI ELECTRIC CORPORATION: KEY DEVELOPMENTS

- TABLE 198 VALEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 VALEO: KEY DEVELOPMENTS

- TABLE 200 INFINEON: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 201 INFINEON: KEY DEVELOPMENTS

- TABLE 202 NXP SEMICONDUCTORS: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 203 NXP SEMICONDUCTORS: KEY DEVELOPMENTS

- TABLE 204 STMICROELECTRONICS: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 205 STMICROELECTRONICS:KEY DEVELOPMENTS

- TABLE 206 MARELLI: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 207 MARELLI: KEY DEVELOPMENTS

- TABLE 208 NISSAN MOTOR CORPORATION: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 209 NISSAN MOTOR CORPORATION: : KEY DEVELOPMENTS

- TABLE 210 DANFOSS: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 211 DANFOSS: KEY DEVELOPMENTS

- TABLE 212 CONTINENTAL AG: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 213 CONTITNENTAL AG: KEY DEVELOPMENTS

- TABLE 214 DENSO CORPORATION: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 215 DENSO CORPORATION: KEY DEVELOPMENTS

LIST OF FIGURES

- FIGURE 1 GLOBAL AUTOMOTIVE INVERTER MARKET: STRUCTURE

- FIGURE 2 GLOBAL AUTOMOTIVE INVERTER MARKET: MARKET GROWTH FACTOR ANALYSIS (2023-2033)

- FIGURE 3 DRIVER IMPACT ANALYSIS (2024-2033)

- FIGURE 4 RESTRAINT IMPACT ANALYSIS (2024-2033)

- FIGURE 5 OPPORTUNITY IMPACT FORECAST

- FIGURE 6 VALUE CHAIN: GLOBAL AUTOMOTIVE INVERTER MARKET

- FIGURE 7 PORTER'S FIVE FORCES ANALYSIS OF THE GLOBAL AUTOMOTIVE INVERTER MARKET

- FIGURE 8 SWOT ANALYSIS OF THE GLOBAL AUTOMOTIVE INVERTER MARKET

- FIGURE 9 PESTEL ANALYSIS OF THE GLOBAL AUTOMOTIVE INVERTER MARKET

- FIGURE 10 GLOBAL AUTOMOTIVE INVERTER MARKET; INVERTER SEGMENT ATTRACTIVENESS, (USD MILLION)

- FIGURE 11 GLOBAL AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2023 & 2033(USD MILLION)

- FIGURE 12 GLOBAL AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE, 2023 (% SHARE)

- FIGURE 13 GLOBAL AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, SEGMENT ATTARCTIVENESS ANALYSIS

- FIGURE 14 GLOBAL AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2023 & 2033(USD MILLION)

- FIGURE 15 GLOBAL AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE, 2023 (% SHARE)

- FIGURE 16 GLOBAL AUTOMOTIVE INVERTER MARKET, BY MATERIAL, SEGMENT ATTARCTIVENESS ANALYSIS

- FIGURE 17 GLOBAL AUTOMOTIVE INVERTER MARKET, BY MATERIAL, 2023 & 2033(USD MILLION)

- FIGURE 18 GLOBAL AUTOMOTIVE INVERTER MARKET, BY MATERIAL 2023 (% SHARE)

- FIGURE 19 GLOBAL AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, SEGMENT ATTARCTIVENESS ANALYSIS

- FIGURE 20 GLOBAL AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2023 & 2033(USD MILLION)

- FIGURE 21 GLOBAL AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT, 2023 (% SHARE)

- FIGURE 22 GLOBAL AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY, SEGMENT ATTARCTIVENESS ANALYSIS

- FIGURE 23 GLOBAL AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY, 2023 & 2033(USD MILLION)

- FIGURE 24 GLOBAL AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY, 2023 (% SHARE)

- FIGURE 25 GLOBAL AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, SEGMENT ATTARCTIVENESS ANALYSIS

- FIGURE 26 GLOBAL AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2023 & 2033(USD MILLION)

- FIGURE 27 GLOBAL AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE, 2023 (% SHARE)

- FIGURE 28 GLOBAL AUTOMOTIVE INVERTER MARKET, BY REGION, 2023 (% SHARE)

- FIGURE 29 GLOBAL AUTOMOTIVE INVERTER MARKET, BY REGION, 2022 VS 2033 (USD MILLION)

- FIGURE 30 NORTH AMERICA MARKET ANALYSIS: AUTOMOTIVE INVERTER MARKET, 2019-2033(USD MILLION)

- FIGURE 31 NORTH AMERICA: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

- FIGURE 32 NORTH AMERICA: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 & 2033(USD MILLION)

- FIGURE 33 EUROPE MARKET ANALYSIS: AUTOMOTIVE INVERTER MARKET, 2019-2033(USD MILLION)

- FIGURE 34 EUROPE: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

- FIGURE 35 EUROPE: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 & 2033(USD MILLION)

- FIGURE 36 ASIA-PACIFIC MARKET ANALYSIS: AUTOMOTIVE INVERTER MARKET, 2019-2033(USD MILLION)

- FIGURE 37 ASIA-PACIFIC: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

- FIGURE 38 ASIA-PACIFIC: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 & 2033(USD MILLION)

- FIGURE 39 MIDDLE EAST & AFRICA MARKET ANALYSIS: AUTOMOTIVE INVERTER MARKET, 2019-2033(USD MILLION)

- FIGURE 40 MIDDLE EAST & AFRICA: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

- FIGURE 41 MIDDLE EAST & AFRICA: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 & 2033(USD MILLION)

- FIGURE 42 SOUTH AMERICA MARKET ANALYSIS: AUTOMOTIVE INVERTER MARKET, 2019-2033(USD MILLION)

- FIGURE 43 SOUTH AMERICA: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

- FIGURE 44 SOUTH AMERICA: AUTOMOTIVE INVERTER MARKET SHARE, BY COUNTRY, 2023 & 2033(USD MILLION)

- FIGURE 45 GLOBAL AUTOMOTIVE INVERTER MARKET PLAYERS: COMPETITIVE ANALSIS, 2022

- FIGURE 46 COMPETITOR DASHBOARD: GLOBAL AUTOMOTIVE INVERTER MARKET

- FIGURE 47 BORGWARNER INC.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 48 BORGWARNER INC.: SWOT ANALYSIS

- FIGURE 49 ROBERT BOSCH: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 50 ROBERT BOSCH: SWOT ANALYSIS

- FIGURE 51 GKN AUTOMOTIVE: SWOT ANALYSIS

- FIGURE 52 TOYOTA INDUSTRIES CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 53 TOYOTA INDUSTRIES CORPORATION: SWOT ANALYSIS

- FIGURE 54 LEAR CORPORATION.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 55 LEAR CORPORATION: SWOT ANALYSIS

- FIGURE 56 SENSATA TECHNOLOGIES, INC.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 57 SENSATA TECHNOLOGIES, INC.: SWOT ANALYSIS

- FIGURE 58 MITSUBISHI ELECTRIC CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 59 MITSUBISHI ELECTRIC CORPORATION: SWOT ANALYSIS

- FIGURE 60 VALEO: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 61 VALEO: SWOT ANALYSIS

- FIGURE 62 INFINEON: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 63 INFINEON: SWOT ANALYSIS

- FIGURE 64 NXP SEMICONDUCTORS: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 65 NXP SEMICONDUCTORS: SWOT ANALYSIS

- FIGURE 66 STMICROELECTRONICS: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 67 STMICROELECTRONICS: SWOT ANALYSIS

- FIGURE 68 MARELLI: SWOT ANALYSIS

- FIGURE 69 NISSAN MOTOR CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 70 NISSAN MOTOR CORPORATION: SWOT ANALYSIS

- FIGURE 71 DANFOSS: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 72 DANFOSS: SWOT ANALYSIS

- FIGURE 73 CONTINENTAL AG FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 74 CONTINENTAL AG: SWOT ANALYSIS

- FIGURE 75 DENSO CORPORATION :FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 76 DENSO CORPORATION: SWOT ANALYSIS

Global Automotive Inverter Market Research Report Information by Inverter Type (Traction Inverter, and Soft Switching Inverter), By Propulsion Type (Battery Electric Vehicle, Plug in Hybrid Vehicle, and Hybrid Vehicle) By Material (Gallium Nitride, Silicon, Silicon Carbide, and Others) By Power Output (upto 200, 200kW-300kW, Above 400kW) By Technology (IGBT, mosfet) By Vehicle Type (Passenger Car, and Commercial Vehicles) By Voltage Output (Below 400 V, and Above 400 V) and By Region (North America, Europe, Asia-Pacific, Middle East and Africa, South America) -Forecast Till 2033

Market Overview

The Automotive Inverter market is expected to increase from USD 2,957.53 million in 2023 to USD 13,333.7 million by 2033, with a compound yearly growth rate (CAGR) of 14.8% over the forecast period (2024-2033). Global Automotive inverters convert the DC power output stored in the battery to AC power, which is needed to operate the motor. The motor torque and speed can be adjusted, as well as the vehicle speed, by utilizing the inverter to regulate the quantity and frequency of the Power Output delivered to the motor. High output density is an essential factor for automotive inverters, which have tighter space limits than other applications.

One of the most well-known techniques for storing solar energy is Tesla Power output, which is sold as a complement to a photovoltaic solar panel system. The Tesla Power Wall is a large lithium solar battery that stores the energy generated by a home's solar panels throughout the day. This zero-carbon method to power generation and consumption is a great example of reducing the environmental impact of mass transportation. There are currently start-ups focusing on materials innovation and sustainable mobility. They are also using solar technologies to develop solar-electric vehicles. Tesla is the only automaker to offer a complete end-to-end solution for the generation, storage, and use of solar energy at the home.

Market Segmentation

The Automotive Inverter Market is segmented by propulsion type, including battery electric, plug-in hybrid, and hybrid vehicles.

The market is segmented by material, including gallium nitride, silicon, silicon carbide, and others.

The market is segmented based on power output: up to 200 kW, 200 kW to 400 kW, and more than 400 kW.

Regional insights

The study covers North America, Europe, Asia-Pacific, the Middle East and Africa, and South America. By 2023, the Asia-Pacific Automotive Inverter market will account for roughly 41.40% of the global market. The automotive inverter market in Asia Pacific is driven by ongoing demand for automotive inverters and increased vehicle production. Furthermore, rising government demands for boosting vehicle safety have significantly boosted demand for the Asia-Pacific automotive engine automotive inverter.

North America represents a long-term growth market for automotive inverters, particularly in the United States, because to the anticipated volume of truck and bus manufacturing and the increasing adoption of vehicle safety and efficiency systems. Factors driving the North American market include a big and aging light vehicle park, as well as a greater average number of miles traveled per light vehicle.

Meanwhile, Europe appears as a major rival, with significant market potential in 2023. The European automotive inverter market is predicted to grow significantly as a result of increased industrial development, rising demand for automotive inverters, and supportive government road safety efforts.

Major Players

Some of the major players in the global market include Robert Bosch, BorgWarner Inc., Toyota Industries Corporation, Infineon, NXP Semiconductors, STMicroelectronics, Marelli, Lear Corporation, SensataTechnologies, Inc., Mitsubishi Electric Corporation, Nissan Motor Corporation, Danfoss, Continental AG, Denso Corporation, Continental AG, Valeo, and others.

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

2 MARKET INTRODUCTION

- 2.1 DEFINITION

- 2.2 SCOPE OF THE STUDY

- 2.3 RESEARCH OBJECTIVE

- 2.4 MARKET STRUCTURE

3 RESEARCH METHODOLOGY

- 3.1 OVERVIEW

- 3.2 DATA FLOW

- 3.2.1 DATA MINING PROCESS

- 3.3 PURCHASED DATABASE:

- 3.4 SECONDARY SOURCES:

- 3.4.1 SECONDARY RESEARCH DATA FLOW:

- 3.5 PRIMARY RESEARCH:

- 3.5.1 PRIMARY RESEARCH DATA FLOW:

- 3.5.2 PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED

- 3.5.3 PRIMARY RESEARCH: REGIONAL COVERAGE

- 3.6 APPROACHES FOR MARKET SIZE ESTIMATION:

- 3.6.1 REVENUE ANALYSIS APPROACH

- 3.7 DATA FORECASTING

- 3.7.1 DATA FORECASTING TECHNIQUE

- 3.8 DATA MODELING

- 3.8.1 MICROECONOMIC FACTOR ANALYSIS:

- 3.8.2 DATA MODELING:

- 3.9 TEAMS AND ANALYST CONTRIBUTION

4 MARKET DYNAMICS

- 4.1 INTRODUCTION

- 4.2 DRIVERS

- 4.2.1 INCREASING FUEL EFFICIENCY REQUIREMENTS

- 4.2.2 RISING GREENHOUSE GAS EMISSION

- 4.2.3 RAPID COMMERCIALIZATION

- 4.3 RESTRAINTS

- 4.3.1 LACK OF CHARGING INFRASTRUCTURE AND HIGH MAINTENANCE COST

- 4.3.2 HIGH INITIAL COSTS

- 4.4 OPPORTUNITY

- 4.4.1 RAPID INNOVATION AND INCREASED R&D IN THE INVERTERS INDUSTRY

- 4.4.2 RISE IN DEMAND FOR SOLAR-POWER OUTPUTED ELECTRIC VEHICLES

- 4.5 TRENDS

- 4.5.1 ADVANCEMENTS IN INVERTER TECHNOLOGY

- 4.5.2 SURGE IN ELECTRIC VEHICLES (EVS) AND HYBRIDS

- 4.5.3 SUPPLY CHAIN OPTIMIZATION

- 4.6 COVID-19 IMPACT ANALYSIS

- 4.6.1 IMPACT ON OVERALL AUTOMOTIVE INDUSTRY

- 4.6.1.1 ECONOMIC IMPACT

- 4.6.2 IMPACT ON AUTOMOTIVE INVERTER MARKET

- 4.6.3 IMPACT ON SUPPLY CHAIN OF AUTOMOTIVE INVERTER

- 4.6.3.1 PRICE VARIATION OF KEY RAW MATERIAL

- 4.6.3.2 PRODUCTION SHUTDOWN

- 4.6.3.3 CASH FLOW CONSTRAINTS

- 4.6.3.4 IMPACT ON IMPORT/EXPORT

- 4.6.4 IMPACT ON MARKET DEMAND OF AUTOMOTIVE INVERTER

- 4.6.4.1 IMPACT DUE TO RESTRICTIONS/LOCKDOWN

- 4.6.4.2 CONSUMER SENTIMENTS

- 4.6.5 IMPACT ON PRICING OF AUTOMOTIVE INVERTER

- 4.6.1 IMPACT ON OVERALL AUTOMOTIVE INDUSTRY

5 MARKET FACTOR ANALYSIS

- 5.1 SUPPLY CHAIN ANALYSIS

- 5.1.1 R&D

- 5.1.2 COMPONENT SUPPLY

- 5.1.3 MANUFACTURE & ASSEMBLY

- 5.1.4 SALES & DISTRIBUTION

- 5.1.5 END USERS

- 5.2 PORTER'S FIVE FORCES MODEL

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 BARGAINING POWER OUTPUT OF SUPPLIERS

- 5.2.3 THREAT OF SUBSTITUTES

- 5.2.4 BARGAINING POWER OUTPUT OF BUYERS

- 5.2.5 INTENSITY OF RIVALRY

- 5.3 MARKET SWOT ANALYSIS

- 5.4 MARKET PESTEL ANALYSIS

- 5.5 REGULATORY OUTLOOK

6 GLOBAL AUTOMOTIVE INVERTER MARKET, BY INVERTER TYPE

- 6.1 OVERVIEW

- 6.2 TRACTION INVERTER

- 6.3 SOFT SWITCHING INVERTER

7 GLOBAL AUTOMOTIVE INVERTER MARKET, BY PROPULSION TYPE

- 7.1 INTRODUCTION

- 7.2 BATTERY ELECTRIC VEHICLE

- 7.3 PLUG IN HYBRID VEHICLE

- 7.4 HYBRID VEHICLE

8 GLOBAL AUTOMOTIVE INVERTER MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 GALLIUM NITRIDE

- 8.3 SILICON

- 8.4 SILICON CARBIDE

- 8.5 OTHERS

9 GLOBAL AUTOMOTIVE INVERTER MARKET, BY POWER OUTPUT

- 9.1 INTRODUCTION

- 9.2 UPTO 200 KW

- 9.3 200KW-300 KW

- 9.4 ABOVE 400 KW

10 GLOBAL AUTOMOTIVE INVERTER MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 IGBT

- 10.3 MOSFET

11 GLOBAL AUTOMOTIVE INVERTER MARKET, BY VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 PASSENGER CAR

- 11.3 COMMERCIAL VEHICLES

12 GLOBAL AUTOMOTIVE INVERTER MARKET, BY REGION

- 12.1 OVERVIEW

- 12.1.1 GLOBAL AUTOMOTIVE INVERTER MARKET, BY REGION, 2022 VS 2033 (USD MILLION)

- 12.1.2 GLOBAL AUTOMOTIVE INVERTER MARKET, BY REGION, 2019-2033 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.2 CANADA

- 12.2.3 MEXICO

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.2 FRANCE

- 12.3.3 UK

- 12.3.4 ITALY

- 12.3.5 SPAIN

- 12.3.6 TURKEY

- 12.3.7 REST OF EUROPE

- 12.4 ASIA-PACIFIC

- 12.4.1 CHINA

- 12.4.2 INDIA

- 12.4.3 JAPAN

- 12.4.4 SOUTH KOREA

- 12.4.5 INDONESIA

- 12.4.6 REST OF ASIA-PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 SAUDI ARABIA

- 12.5.2 UAE

- 12.5.3 SOUTH AFRICA

- 12.5.4 REST OF MEA

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.2 ARGENTINA

- 12.6.3 REST OF SOUTH AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS, 2022

- 13.3 COMPETITOR DASHBOARD

- 13.4 KEY DEVELOPMENTS & GROWTH STRATEGIES

- 13.4.1 PRODUCT LAUNCH/PRODUCT APPROVAL/PRODUCT DEVELOPMET/ ACCQUISITION

- 13.4.2 PARTNERSHIP/INVESTMENT

14 COMPANY PROFILE

- 14.1 BORGWARNER INC.

- 14.1.1 COMPANY OVERVIEW

- 14.1.2 FINANCIAL OVERVIEW

- 14.1.3 PRODUCTS OFFERED

- 14.1.4 KEY DEVELOPMENTS

- 14.1.5 SWOT ANALYSIS

- 14.1.6 KEY STRATEGIES

- 14.2 ROBERT BOSCH

- 14.2.1 COMPANY OVERVIEW

- 14.2.2 FINANCIAL OVERVIEW

- 14.2.3 PRODUCTS OFFERED

- 14.2.4 KEY DEVELOPMENTS

- 14.2.5 SWOT ANALYSIS

- 14.2.6 KEY STRATEGIES

- 14.3 GKN AUTOMOTIVE

- 14.3.1 COMPANY OVERVIEW

- 14.3.2 FINANCIAL OVERVIEW

- 14.3.3 PRODUCTS OFFERED

- 14.3.4 KEY DEVELOPMENTS

- 14.3.5 SWOT ANALYSIS

- 14.3.6 KEY STRATEGIES

- 14.4 TOYOTA INDUSTRIES CORPORATION

- 14.4.1 COMPANY OVERVIEW

- 14.4.2 FINANCIAL OVERVIEW

- 14.4.3 PRODUCTS OFFERED

- 14.4.4 KEY DEVELOPMENTS

- 14.4.5 SWOT ANALYSIS

- 14.4.6 KEY STRATEGIES

- 14.5 LEAR CORPORATION

- 14.5.1 COMPANY OVERVIEW

- 14.5.2 FINANCIAL OVERVIEW

- 14.5.3 PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.5.4 KEY DEVELOPMENTS

- 14.5.5 SWOT ANALYSIS

- 14.5.6 KEY STRATEGIES

- 14.6 SENSATATECHNOLOGIES, INC.

- 14.6.1 COMPANY OVERVIEW

- 14.6.2 FINANCIAL OVERVIEW

- 14.6.3 PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.6.4 KEY DEVELOPMENTS

- 14.6.5 SWOT ANALYSIS

- 14.6.6 KEY STRATEGIES

- 14.7 MITSUBISHI ELECTRIC CORPORATION

- 14.7.1 COMPANY OVERVIEW

- 14.7.2 FINANCIAL OVERVIEW

- 14.7.3 PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.7.4 KEY DEVELOPMENTS

- 14.7.5 SWOT ANALYSIS

- 14.7.6 KEY STRATEGIES

- 14.8 VALEO

- 14.8.1 COMPANY OVERVIEW

- 14.8.2 FINANCIAL OVERVIEW

- 14.8.3 PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.8.4 KEY DEVELOPMENTS

- 14.8.5 SWOT ANALYSIS

- 14.8.6 KEY STRATEGIES

- 14.9 INFINEON

- 14.9.1 COMPANY OVERVIEW

- 14.9.2 FINANCIAL OVERVIEW

- 14.9.3 PRODUCTS OFFERED

- 14.9.4 KEY DEVELOPMENTS

- 14.9.5 SWOT ANALYSIS

- 14.9.6 KEY STRATEGIES

- 14.10 NXP SEMICONDUCTORS

- 14.10.1 COMPANY OVERVIEW

- 14.10.2 FINANCIAL OVERVIEW

- 14.10.3 PRODUCTS OFFERED

- 14.10.4 KEY DEVELOPMENTS

- 14.10.5 SWOT ANALYSIS

- 14.10.6 KEY STRATEGIES

- 14.11 STMICROELECTRONICS

- 14.11.1 COMPANY OVERVIEW

- 14.11.2 FINANCIAL OVERVIEW

- 14.11.3 PRODUCTS OFFERED

- 14.11.4 KEY DEVELOPMENTS

- 14.11.5 SWOT ANALYSIS

- 14.11.6 KEY STRATEGIES

- 14.12 MARELLI

- 14.12.1 COMPANY OVERVIEW

- 14.12.2 FINANCIAL OVERVIEW

- 14.12.3 PRODUCTS OFFERED

- 14.12.4 KEY DEVELOPMENTS

- 14.12.5 SWOT ANALYSIS

- 14.12.6 KEY STRATEGIES

- 14.13 NISSAN MOTOR CORPORATION

- 14.13.1 COMPANY OVERVIEW

- 14.13.2 FINANCIAL OVERVIEW

- 14.13.3 PRODUCTS OFFERED

- 14.13.4 KEY DEVELOPMENTS

- 14.13.5 SWOT ANALYSIS

- 14.13.6 KEY STRATEGIES

- 14.14 DANFOSS

- 14.14.1 COMPANY OVERVIEW

- 14.14.2 FINANCIAL OVERVIEW

- 14.14.3 PRODUCTS OFFERED

- 14.14.4 KEY DEVELOPMENTS

- 14.14.5 SWOT ANALYSIS

- 14.14.6 KEY STRATEGIES

- 14.15 CONTINENTAL AG

- 14.15.1 COMPANY OVERVIEW

- 14.15.2 FINANCIAL OVERVIEW

- 14.15.3 PRODUCTS OFFERED

- 14.15.4 KEY DEVELOPMENTS

- 14.15.5 SWOT ANALYSIS

- 14.15.6 KEY STRATEGIES

- 14.16 DENSO CORPORATION

- 14.16.1 COMPANY OVERVIEW

- 14.16.2 FINANCIAL OVERVIEW

- 14.16.3 PRODUCTS OFFERED

- 14.16.4 KEY DEVELOPMENTS

- 14.16.5 SWOT ANALYSIS

- 14.16.6 KEY STRATEGIES