|

|

市場調査レポート

商品コード

1336040

化粧品用酸化防止剤の世界市場:由来別(天然、合成)、タイプ別(ビタミン、酵素、ポリフェノール)、機能別(アンチエイジング、ヘアコンディショニング、UVカット)、用途別(スキンケア、ヘアケア、メイクアップ)-2028年までの予測Cosmetic Antioxidants Market by Source (Natural, Synthetic), Type (Vitamins, Enzymes, Polyphenols), Function (Anti-aging, Hair Conditioning, UV Protection), and Application (Skin Care, Hair Care, Make-up)- Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 化粧品用酸化防止剤の世界市場:由来別(天然、合成)、タイプ別(ビタミン、酵素、ポリフェノール)、機能別(アンチエイジング、ヘアコンディショニング、UVカット)、用途別(スキンケア、ヘアケア、メイクアップ)-2028年までの予測 |

|

出版日: 2023年08月11日

発行: MarketsandMarkets

ページ情報: 英文 274 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

化粧品用酸化防止剤の市場規模は、2023年の1億3,200万米ドルから2028年には1億7,800万米ドルに成長し、CAGRは6.2%と推定されています。

先進諸国では、化粧品に使用される成分に対する消費者の意識が高く、合成酸化防止剤よりも天然酸化防止剤を好む傾向があります。例えば、米国や欧州諸国の消費者は、その健康上の利点と副作用の少なさから、スキンケア、ヘアケア、メイクアップ製品に天然の抗酸化物質を求めています。合成の化粧品用酸化防止剤は安価で、発展途上国では需要が高いです。この動向は、化粧品への合成酸化防止剤の使用に関する規制が、先進経済諸国の規制に比べ、特に新興諸国ではそれほど厳しくないことにも起因しています。

太陽や人工的な紫外線源からの紫外線(UV)に長時間さらされると、光老化として知られる皮膚の早期老化を引き起こします。光老化は主に活性酸素種(ROS)によって引き起こされ、皮膚に生物学的損傷を与え、日焼けや日焼けの原因となります。したがって、日焼け止めローションやクリームなどの化粧品は、光老化の影響を克服するために使用されます。

化学由来の酸化防止剤は、様々な化学プロセスを通じて得られます。費用対効果が高く、入手しやすいことから化粧品に使用されています。しかしながら、化粧品への使用を制限する様々な規制の厳しい実施や製剤化のために、化学的に誘導された酸化防止剤の需要は天然の酸化防止剤に比べて減少しています。ブチル化ヒドロキシアニソール(BHA)、ブチル化ヒドロキシトルエン(BHT)、tert-ブチルヒドロキノン(TBHQ)は、化粧品に使用される主な化学由来酸化防止剤です。

ポリフェノールには、エピガロカテキンガレート、シリマリン、ゲニステイン、ローズマリーエキスなどの植物化学物質が含まれます。ポリフェノールには抗炎症作用や抗菌作用があります。エピガロカテキンガレートは、緑茶の有効成分である抗酸化剤と抗菌剤です。エピガロカテキンガレートは、緑茶の有効成分である抗酸化剤および抗菌剤です。レスベラトロールは非フラバノイド系の強力な抗酸化物質。あらゆる環境ダメージから肌の表面を保護する働きがあります。また、肌を落ち着かせる効果もあり、肌の赤みを最小限に抑えます。

ヘアケアとは、毛髪に関連する衛生学や美容学に用いられる用語です。髪の乾燥、くせ毛、切れ毛など、さまざまなタイプの髪の問題に対処するために、さまざまなタイプのヘアケア製品が製造されています。これらの製品は、毛髪の挙動や性質を調整し、その質感や外観を維持・改善するのに役立ちます。化粧品用酸化防止剤は、毛髪に関する特定の問題に対処するために、様々な組み合わせで使用され、所望の製剤を形成します。これらの抗酸化剤は、太陽、煙、汚染によって引き起こされるフリーラジカルや酸化の影響を抑えるのに役立ちます。緑茶やビタミンなどの抗酸化剤は、毛包の縮小を防ぎ、新しく健康な髪の成長を促すため、抜け毛予防に広く使われています。

中東・アフリカにおける化粧品用酸化防止剤の需要は、同地域の化粧品とパーソナルケア産業の成長によって牽引されています。トルコ、サウジアラビア、アラブ首長国連邦などの中東・アフリカ諸国は高級観光地として浮上しており、輸入された高級化粧品やパーソナルケア製品は大きな需要があります。中東・アフリカは、化粧品原料の製造・販売企業にとって成長機会の増大をもたらします。さらに、中東諸国の統治機関の現在の戦略は、経済を多様化し、石油への依存をなくすことです。これらの国々は製造業とサービス業に注力しています。

当レポートでは、世界の化粧品用酸化防止剤市場について調査し、由来別、タイプ別、機能別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界の動向

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- 生態系マッピング

- 技術分析

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 価格分析

- 貿易分析

- 規制状況

- 2023~2024年の主要な会議とイベント

- 特許分析

第7章 化粧品用酸化防止剤市場、由来別

- イントロダクション

- 天然

- 化学由来

第8章 化粧品用酸化防止剤市場、タイプ別

- イントロダクション

- ビタミン

- カロテノイド

- ポリフェノール

- 酵素

- その他

第9章 化粧品用酸化防止剤市場、機能別

- イントロダクション

- ヘアコンディショニング

- アンチエイジング

- 保湿

- UVカット

- 抗炎症

- ヘアクレンジング

- その他

第10章 化粧品用酸化防止剤市場、用途別

- イントロダクション

- スキンケア

- ヘアケア

- メイクアップ

第11章 化粧品用酸化防止剤市場、地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 主要市場プレーヤーのランキング、2022年

- 市場シェア分析

- 主要企業の収益分析

- 企業の製品フットプリント分析

- 企業評価マトリックス

- 競合ベンチマーキング

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- BASF SE

- EVONIK INDUSTRIES AG

- CRODA INTERNATIONAL PLC

- WACKER CHEMIE AG

- EASTMAN CHEMICAL COMPANY

- ASHLAND INC.

- CLARIANT AG

- SEPPIC

- KONINKLIJKE DSM N.V.(ROYAL DSM)

- BTSA BIOTECNOLOGIAS APLICADAS S.L.

- その他の企業

- THE LUBRIZOL CORPORATION

- MERCK & CO., INC.

- ADM

- JAN DEKKER

- PROVITAL S.A.

- YASHO INDUSTRIES LIMITED

- NEXIRA

- ASH INGREDIENTS, INC.

- BLUE CALIFORNIA

- SYMRISE AG

- VANTAGE SPECIALTY CHEMICALS

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- INNOVACOS

- CIREBELLE

- SALVONA

第14章 隣接市場および関連市場

第15章 付録

In terms of value, the cosmetic antioxidants market is estimated to grow from USD 132 million in 2023 to USD 178 million by 2028, at a CAGR of 6.2%. In developed countries, consumer awareness about ingredients used in cosmetic products is high, and there is a preference for natural antioxidants over synthetic. For example, consumers in the US and European countries seek natural antioxidants in skincare, haircare, and makeup products due to their health benefits and fewer side effects. Synthetic cosmetic antioxidants are inexpensive and in high demand in developing countries. This trend can also be attributed to less stringent regulations regarding the use of synthetic antioxidants in cosmetic products, especially in developing countries as compared to regulations in developed economies.

"UV protection is expected to be the fastest-growing function of the cosmetic antioxidants market, in terms of value, during the forecast period."

Long exposure to ultraviolet (UV) radiation from the sun or artificial UV sources causes premature aging of the skin, which is known as photoaging. Photoaging is primarily triggered by reactive oxygen species (ROS), which causes biological damage to the skin and leads to sunburn and tanning; it might also cause skin cancer. Therefore, cosmetic products such as sunscreen lotions and creams are used to overcome the effects of photoaging.

"Synthetic source accounted for the second largest share of the cosmetic antioxidants market, in terms of value, in 2022."

Chemically derived antioxidants are derived through various chemical processes. They are used in cosmetics due to their cost-effectiveness and easy availability. However, the demand for chemically derived antioxidants is decreasing as compared to natural antioxidants, owing to the formulation and stringent implementation of various regulations that restrict their use in cosmetics. Butylated hydroxy anisole (BHA), butylated hydroxytoluene (BHT), and tert-Butylhydroquinone (TBHQ) are the major chemically derived antioxidants used in cosmetics.

"Polyphenols is expected to be the second fastest-growing type of the cosmetic antioxidants market, in terms of value, during the forecast period."

Polyphenols include phytochemicals, such as epigallocatechin gallate, silymarin, genistein, and rosemary extract. Polyphenols have anti-inflammatory and anti-microbial properties. Epigallocatechin gallate is an antioxidant and anti-microbial agent, which is an active constituent of green tea. Epigallocatechin gallate is an antioxidant and anti-microbial agent, which is an active constituent of green tea. Resveratrol is a non-flavanoid type of powerful antioxidant. It helps to protect the surface of the skin against any kind of environmental damage. It also has significant skin-calming properties, which help to minimize the redness of the skin.

"Hair care application accounted for the second largest share of the cosmetic antioxidants market, in terms of value, in 2022."

Hair care is a term used for hair-related hygiene and cosmetology. Different types of hair care products are manufactured to address different types of hair problems, such as dry hair, frizzy hair, and breaking hair. These products help to regulate the behavior and properties of hair to maintain and improve its texture and appearance. Cosmetic antioxidants are used in various combinations to form the desired formulation to address specific hair-related problems. These antioxidants help to limit the effect of free radicals and oxidation caused by the sun, smoke, and pollution. Antioxidants such as green tea and vitamins are widely used to prevent hair loss, as they prevent the follicle from shrinking and stimulate the growth of new and healthy hair.

"Middle East & Africa is projected to be the second fastest growing region, in terms of value, during the forecast period in the Cosmetic antioxidants market."

The demand for cosmetic antioxidants in the Middle East & Africa is driven by the growth of cosmetics and personal care industries in the region. Some countries of the Middle East & Africa, such as Turkey, Saudi Arabia, and the UAE, have emerged as premium tourism destinations, wherein imported luxury cosmetics and personal care products are in huge demand. The Middle East & Africa provides increased growth opportunities for cosmetic ingredient manufacturing and distribution companies. Furthermore, the current strategy of the governing bodies in the countries of the Middle East is to diversify their economy and eliminate their dependence on oil. These countries are focusing on their manufacturing and services sectors.

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: C-Level - 23%, Director Level - 37%, and Others - 40%

- By Region: North America - 32%, Europe - 21%, Asia Pacific - 28%, Middle East & Africa - 12%, South America - 7%

The key players profiled in the report include are Evonik Industries AG (Germany), Croda International Plc (UK), BASF SE (Germany), Eastman Chemical Company (US), and Wacker Chemie AG (Germany) among others.

Research Coverage

This report segments the market for cosmetic antioxidants based on source, type, function, application and region and provides estimations of value (USD million) and volume (Ton) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, key strategies, associated with the market for cosmetic antioxidants.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the cosmetic antioxidants market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on cosmetic antioxidants offered by top players in the global market

- Analysis of key drives: (growth in automotive sector, demand from medical application, and growing healthcare expenditure and favorable reimbursement scenario), restraints (high initial and maintenance cost of machine), opportunities (rising trend of electric vehicles), and challenges (skilled personnel for operations) influencing the growth of cosmetic antioxidants market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cosmetic antioxidants market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for cosmetic antioxidants across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global cosmetic antioxidants market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the cosmetic antioxidants market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 COSMETIC ANTIOXIDANTS: MARKET DEFINITION AND INCLUSIONS, BY SOURCE

- 1.2.3 COSMETIC ANTIOXIDANTS: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.2.4 COSMETIC ANTIOXIDANTS: MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.5 COSMETIC ANTIOXIDANTS: MARKET DEFINITION AND INCLUSIONS, BY FUNCTION

- 1.3 STUDY SCOPE

- FIGURE 1 COSMETIC ANTIOXIDANTS MARKET SEGMENTATION

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 UNITS CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 COSMETIC ANTIOXIDANTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION - APPROACH 1 (SUPPLY-SIDE): COMBINED MARKET SHARE OF MAJOR PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION - APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL TYPES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 BOTTOM-UP (DEMAND-SIDE): PRODUCTS SOLD AND THEIR AVERAGE SELLING PRICE

- 2.3 DATA TRIANGULATION

- FIGURE 6 COSMETIC ANTIOXIDANTS MARKET: DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 7 SUPPLY-SIDE MARKET CAGR PROJECTIONS

- 2.4.2 DEMAND SIDE

- FIGURE 8 DEMAND-SIDE MARKET GROWTH PROJECTIONS

- 2.5 FACTOR ANALYSIS

- 2.6 RECESSION IMPACT ANALYSIS

- 2.7 ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISKS

- TABLE 1 COSMETIC ANTIOXIDANTS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

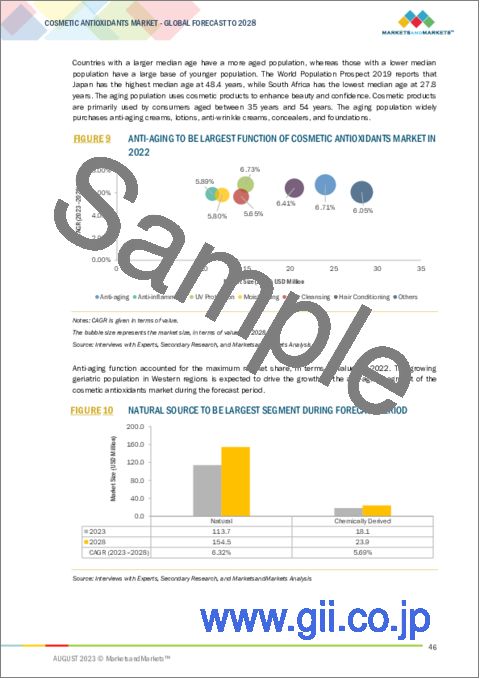

- FIGURE 9 ANTI-AGING TO BE LARGEST FUNCTION OF COSMETIC ANTIOXIDANTS MARKET IN 2022

- FIGURE 10 NATURAL SOURCE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 11 VITAMINS SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 SKIN CARE TO BE LARGEST APPLICATION OF COSMETIC ANTIOXIDANTS DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COSMETIC ANTIOXIDANTS MARKET

- FIGURE 14 INCREASING APPLICATION AREAS OFFER GROWTH OPPORTUNITIES FOR COSMETIC ANTIOXIDANTS MARKET

- 4.2 COSMETIC ANTIOXIDANTS MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY AND APPLICATION

- FIGURE 16 SKIN CARE AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.4 COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION AND REGION

- FIGURE 17 ANTI-AGING LED COSMETIC ANTIOXIDANTS MARKET IN MOST REGIONS

- 4.5 COSMETIC ANTIOXIDANTS MARKET, BY KEY COUNTRY

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in aging population

- TABLE 2 WORLD POPULATION INDEX (MEDIAN AGE), BY COUNTRY, 2022

- 5.2.1.2 Rise in online purchase of cosmetics

- 5.2.1.3 High demand for customized cosmetic products

- 5.2.1.4 Rising disposable income and improving living standards

- TABLE 3 GROSS ADJUSTED HOUSEHOLD DISPOSABLE PER CAPITA INCOME, 2019 AND 2022 (USD)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of advanced medical treatments in developed countries

- 5.2.2.2 High cost of natural antioxidants

- 5.2.2.3 Safety concerns about chemically derived antioxidants

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for male cosmetics

- 5.2.3.2 Potential use of microbiome in cosmetics

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulations reshaping cosmetic antioxidants market

- 5.2.4.2 Increase in counterfeit cosmetic products

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS: COSMETIC ANTIOXIDANTS MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 4 COSMETIC ANTIOXIDANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST

- TABLE 5 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020-2028 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 21 COSMETIC ANTIOXIDANTS MARKET: SUPPLY CHAIN

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END USERS

- 6.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR COSMETIC ANTIOXIDANTS MARKET

- FIGURE 22 COSMETIC ANTIOXIDANTS MARKET: FUTURE REVENUE MIX

- 6.3 ECOSYSTEM MAPPING

- FIGURE 23 COSMETIC ANTIOXIDANTS MARKET: ECOSYSTEM MAP

- TABLE 6 COSMETIC ANTIOXIDANTS MARKET: ECOSYSTEM

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 TECHNOLOGICAL ADVANCEMENTS IN COSMETIC ANTIOXIDANTS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 MAJESTEM DRYPURE BY CRODA TO PROVIDE ANTI-AGING BENEFITS

- 6.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 6.6.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE, BY APPLICATION

- FIGURE 26 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 9 AVERAGE SELLING PRICE BY KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- 6.7.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 27 AVERAGE SELLING PRICE OF COSMETIC ANTIOXIDANTS, BY REGION, 2021-2028

- TABLE 10 AVERAGE SELLING PRICE OF COSMETIC ANTIOXIDANTS, BY REGION, 2021-2028 (USD/KG)

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO

- FIGURE 28 COSMETIC ANTIOXIDANTS IMPORT, BY KEY COUNTRY (2013-2022)

- TABLE 11 IMPORT OF COSMETIC ANTIOXIDANTS, BY REGION, 2017-2021 (USD MILLION)

- 6.8.2 EXPORT SCENARIO

- FIGURE 29 COSMETIC ANTIOXIDANTS EXPORT, BY KEY COUNTRY (2017-2021)

- TABLE 12 EXPORT OF COSMETIC ANTIOXIDANTS, BY REGION, 2017-2021 (USD MILLION)

- 6.9 REGULATORY LANDSCAPE

- 6.9.1 REGULATIONS RELATED TO COSMETIC ANTIOXIDANTS

- 6.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 13 COSMETIC ANTIOXIDANTS MARKET: KEY CONFERENCES AND EVENTS

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- TABLE 14 PATENT COUNT

- FIGURE 30 PATENTS REGISTERED IN COSMETIC ANTIOXIDANTS MARKET, 2012-2022

- FIGURE 31 PATENT PUBLICATION TRENDS, 2012-2022

- FIGURE 32 LEGAL STATUS OF PATENTS FILED IN COSMETIC ANTIOXIDANTS MARKET

- 6.11.3 JURISDICTION ANALYSIS

- FIGURE 33 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- 6.11.4 TOP APPLICANTS

- FIGURE 34 L'OREAL GROUP REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- TABLE 15 PATENTS BY L'OREAL GROUP

- TABLE 16 PATENTS BY PROCTER & GAMBLE

- TABLE 17 TOP 10 PATENT OWNERS IN US, 2012-2022

7 COSMETIC ANTIOXIDANTS MARKET, BY SOURCE

- 7.1 INTRODUCTION

- FIGURE 35 NATURAL SOURCE TO LEAD COSMETIC ANTIOXIDANTS MARKET DURING FORECAST PERIOD

- TABLE 18 COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (USD MILLION)

- TABLE 19 COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (USD MILLION)

- TABLE 20 COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (TON)

- TABLE 21 COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (TON)

- 7.2 NATURAL

- 7.2.1 INCREASING AWARENESS ON USE OF GREEN PRODUCTS TO DRIVE MARKET

- TABLE 22 NATURAL: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 23 NATURAL: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 24 NATURAL: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 25 NATURAL: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 7.3 CHEMICALLY DERIVED

- 7.3.1 COST-EFFECTIVENESS AND EASY AVAILABILITY OF CHEMICAL ANTIOXIDANTS TO DRIVE MARKET

- TABLE 26 CHEMICALLY DERIVED: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 27 CHEMICALLY DERIVED: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 28 CHEMICALLY DERIVED: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 29 CHEMICALLY DERIVED: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

8 COSMETIC ANTIOXIDANTS MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 36 VITAMINS TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 30 COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

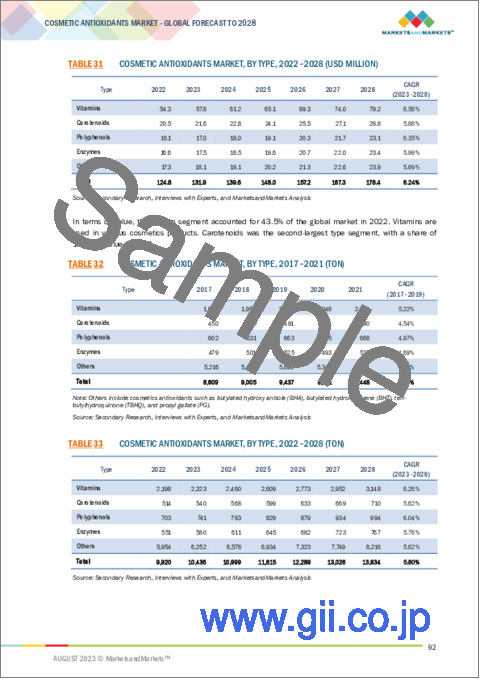

- TABLE 31 COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 32 COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 33 COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (TON)

- 8.2 VITAMINS

- 8.2.1 HEALTH BENEFITS OF VITAMINS TO DRIVE MARKET

- 8.2.2 VITAMIN E

- 8.2.3 VITAMIN C

- 8.2.4 VITAMIN A

- TABLE 34 VITAMINS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 35 VITAMINS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 36 VITAMINS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 37 VITAMINS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 8.3 CAROTENOIDS

- 8.3.1 USE OF CAROTENOIDS IN SUNSCREEN LOTIONS AND CONDITIONERS TO FUEL MARKET

- TABLE 38 CAROTENOIDS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 39 CAROTENOIDS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 40 CAROTENOIDS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 41 CAROTENOIDS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 8.4 POLYPHENOLS

- 8.4.1 SKIN CALMING PROPERTIES OF POLYPHENOLS TO DRIVE MARKET

- TABLE 42 POLYPHENOLS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 43 POLYPHENOLS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 44 POLYPHENOLS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2017-2021 (TON)

- TABLE 45 POLYPHENOLS: COSMETIC ANTIOXIDANT MARKET, BY REGION, 2022-2028 (TON)

- 8.5 ENZYMES

- 8.5.1 DEMAND FOR ANTI-INFLAMMATORY AND ANTI-AGING SKIN CREAMS TO DRIVE MARKET

- TABLE 46 ENZYMES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 47 ENZYMES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 48 ENZYMES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 49 ENZYMES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 8.6 OTHER TYPES

- 8.6.1 BUTYLATED HYDROXY ANISOLE

- 8.6.2 BUTYLATED HYDROXYTOLUENE

- 8.6.3 TERT-BUTYLHYDROQUINONE

- 8.6.4 PROPYL GALLATE

- TABLE 50 OTHER TYPES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 51 OTHER TYPES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 52 OTHER TYPES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 53 OTHER TYPES: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

9 COSMETIC ANTIOXIDANT MARKET, BY FUNCTION

- 9.1 INTRODUCTION

- FIGURE 37 ANTI-AGING FUNCTION TO DOMINATE COSMETIC ANTIOXIDANTS MARKET DURING FORECAST PERIOD

- TABLE 54 COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 55 COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (USD MILLION)

- TABLE 56 COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (TON)

- TABLE 57 COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (TON)

- 9.2 HAIR CONDITIONING

- 9.2.1 GROWING DEMAND FOR HAIR CONDITIONERS AND SERUMS TO DRIVE MARKET

- TABLE 58 HAIR CONDITIONING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 59 HAIR CONDITIONING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 60 HAIR CONDITIONING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 61 HAIR CONDITIONING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 9.3 ANTI-AGING

- 9.3.1 PREMATURE SKIN AGING TO FUEL DEMAND FOR ANTIOXIDANTS

- TABLE 62 ANTI-AGING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 63 ANTI-AGING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 64 ANTI-AGING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 65 ANTI-AGING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 9.4 MOISTURIZING

- 9.4.1 MOISTURIZING PROPERTIES OF VITAMINS TO FUEL DEMAND FOR SKIN AND HAIR CARE PRODUCTS

- TABLE 66 MOISTURIZING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 67 MOISTURIZING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 68 MOISTURIZING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 69 MOISTURIZING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 9.5 UV PROTECTION

- 9.5.1 DEMAND FOR SUNSCREEN LOTIONS TO FUEL MARKET

- TABLE 70 UV PROTECTION: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 71 UV PROTECTION: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 72 UV PROTECTION: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 73 UV PROTECTION: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 9.6 ANTI-INFLAMMATORY

- 9.6.1 ANTI-INFLAMMATORY PROPERTIES OF POMEGRANATE EXTRACTS TO BOOST MARKET

- TABLE 74 ANTI-INFLAMMATORY: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 75 ANTI-INFLAMMATORY: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 76 ANTI-INFLAMMATORY: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 77 ANTI-INFLAMMATORY: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 9.7 HAIR CLEANSING

- 9.7.1 INCREASING ENVIRONMENTAL POLLUTION TO FUEL DEMAND FOR CLEANSERS

- TABLE 78 HAIR CLEANSING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 79 HAIR CLEANSING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 80 HAIR CLEANSING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 81 HAIR CLEANSING: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 9.8 OTHER FUNCTIONS

- TABLE 82 OTHER FUNCTIONS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 83 OTHER FUNCTIONS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 84 OTHER FUNCTIONS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 85 OTHER FUNCTIONS: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

10 COSMETIC ANTIOXIDANT MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 38 SKIN CARE APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 86 COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 87 COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 88 COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 89 COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 10.2 SKIN CARE

- 10.2.1 RISING DEMAND FOR GROOMING & COSMETIC PRODUCTS TO DRIVE MARKET

- TABLE 90 SKIN CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 91 SKIN CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 92 SKIN CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 93 SKIN CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 10.3 HAIR CARE

- 10.3.1 HIGH DEMAND FOR GREEN TEA AND VITAMIN SUPPLEMENTS TO FUEL MARKET

- TABLE 94 HAIR CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 95 HAIR CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 96 HAIR CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 97 HAIR CARE: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 10.4 MAKE-UP

- 10.4.1 INCREASED DEMAND FOR COLOR COSMETICS AND MINERAL POWDERS TO DRIVE MARKET

- TABLE 98 MAKE-UP: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 99 MAKE-UP: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 100 MAKE-UP: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 101 MAKE-UP: COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

11 COSMETIC ANTIOXIDANTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING COSMETIC ANTIOXIDANTS MARKET DURING FORECAST PERIOD

- TABLE 102 COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 103 COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 104 COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2017-2021 (TON)

- TABLE 105 COSMETIC ANTIOXIDANTS MARKET, BY REGION, 2022-2028 (TON)

- 11.2 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET SNAPSHOT

- 11.2.1 RECESSION IMPACT ON ASIA PACIFIC

- 11.2.2 ASIA PACIFIC COSMETIC ANTIOXIDANTS MARKET, BY SOURCE

- TABLE 106 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (TON)

- TABLE 109 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (TON)

- 11.2.3 ASIA PACIFIC COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION

- TABLE 110 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 111 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 113 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.2.4 ASIA PACIFIC COSMETIC ANTIOXIDANTS MARKET, BY TYPE

- TABLE 114 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 115 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 117 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (TON)

- 11.2.5 ASIA PACIFIC COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION

- TABLE 118 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 119 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (TON)

- TABLE 121 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (TON)

- 11.2.6 ASIA PACIFIC COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY

- TABLE 122 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (TON)

- TABLE 125 ASIA PACIFIC: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (TON)

- 11.2.6.1 China

- 11.2.6.1.1 Strong economic growth to drive market

- 11.2.6.1 China

- TABLE 126 CHINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 127 CHINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 128 CHINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 129 CHINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.2.6.2 Japan

- 11.2.6.2.1 Strong foothold of leading manufacturers to drive market

- 11.2.6.2 Japan

- TABLE 130 JAPAN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 131 JAPAN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 132 JAPAN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 133 JAPAN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.2.6.3 India

- 11.2.6.3.1 Rising income levels and minimal regulatory intervention to propel market

- 11.2.6.3 India

- TABLE 134 INDIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 135 INDIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 136 INDIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 137 INDIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.2.6.4 South Korea

- 11.2.6.4.1 Presence of leading functional cosmetics manufacturers to drive market

- 11.2.6.4 South Korea

- TABLE 138 SOUTH KOREA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 139 SOUTH KOREA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 140 SOUTH KOREA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 141 SOUTH KOREA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.3 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET SNAPSHOT

- 11.3.1 RECESSION IMPACT ON NORTH AMERICA

- 11.3.2 NORTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY SOURCE

- TABLE 142 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (USD MILLION)

- TABLE 143 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (TON)

- TABLE 145 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (TON)

- 11.3.3 NORTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION

- TABLE 146 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 147 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 149 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.3.4 NORTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY TYPE

- TABLE 150 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 151 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 152 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 153 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (TON)

- 11.3.5 NORTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION

- TABLE 154 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 155 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (USD MILLION)

- TABLE 156 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (TON)

- TABLE 157 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (TON)

- 11.3.6 NORTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY

- TABLE 158 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 159 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 160 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (TON)

- TABLE 161 NORTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (TON)

- 11.3.6.1 US

- 11.3.6.1.1 Demand for natural and herbal cosmetic products to drive market

- 11.3.6.1 US

- TABLE 162 US: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 163 US: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 164 US: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 165 US: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.3.6.2 Canada

- 11.3.6.2.1 Increasing demand for premium cosmetic products to fuel market

- 11.3.6.2 Canada

- TABLE 166 CANADA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 167 CANADA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 168 CANADA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 169 CANADA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.3.6.3 Mexico

- 11.3.6.3.1 Increased purchasing power to boost market

- 11.3.6.3 Mexico

- TABLE 170 MEXICO: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 171 MEXICO: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 172 MEXICO: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 173 MEXICO: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.4 EUROPE

- FIGURE 42 EUROPE: COSMETIC ANTIOXIDANTS MARKET SNAPSHOT

- 11.4.1 RECESSION IMPACT ON EUROPE

- 11.4.2 EUROPE COSMETIC ANTIOXIDANTS MARKET, BY SOURCE

- TABLE 174 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (USD MILLION)

- TABLE 175 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (USD MILLION)

- TABLE 176 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (TON)

- TABLE 177 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (TON)

- 11.4.3 EUROPE COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION

- TABLE 178 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 179 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 180 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 181 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.4.4 EUROPE COSMETIC ANTIOXIDANTS MARKET, BY TYPE

- TABLE 182 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 183 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 184 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 185 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (TON)

- 11.4.5 EUROPE COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION

- TABLE 186 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 187 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (USD MILLION)

- TABLE 188 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (TON)

- TABLE 189 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (TON)

- 11.4.6 EUROPE COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY

- TABLE 190 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 191 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 192 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (TON)

- TABLE 193 EUROPE: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (TON)

- 11.4.6.1 Germany

- 11.4.6.1.1 Stable per capita spending of consumers to drive market

- 11.4.6.1 Germany

- TABLE 194 GERMANY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 195 GERMANY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 196 GERMANY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 197 GERMANY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.4.6.2 UK

- 11.4.6.2.1 Increased consumer spending on cosmetic products to drive market

- 11.4.6.2 UK

- TABLE 198 UK: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 199 UK: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 200 UK: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 201 UK: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.4.6.3 France

- 11.4.6.3.1 Strong foothold of cosmetic manufacturers to drive market

- 11.4.6.3 France

- TABLE 202 FRANCE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 203 FRANCE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 204 FRANCE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 205 FRANCE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.4.6.4 Italy

- 11.4.6.4.1 Rapid population aging to fuel demand for antioxidants

- 11.4.6.4 Italy

- TABLE 206 ITALY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 207 ITALY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 208 ITALY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 209 ITALY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.4.6.5 Russia

- 11.4.6.5.1 Increasing aging population to boost demand for cosmetic antioxidants

- 11.4.6.5 Russia

- TABLE 210 RUSSIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 211 RUSSIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 212 RUSSIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 213 RUSSIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.4.6.6 Spain

- 11.4.6.6.1 Use of high-quality cosmetic ingredients in skin care products to drive market

- 11.4.6.6 Spain

- TABLE 214 SPAIN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 215 SPAIN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 216 SPAIN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 217 SPAIN: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- 11.5.2 MIDDLE EAST & AFRICA COSMETIC ANTIOXIDANTS MARKET, BY SOURCE

- TABLE 218 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (TON)

- TABLE 221 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (TON)

- 11.5.3 MIDDLE EAST & AFRICA COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION

- TABLE 222 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 225 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.5.4 MIDDLE EAST & AFRICA COSMETIC ANTIOXIDANTS MARKET, BY TYPE

- TABLE 226 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 229 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (TON)

- 11.5.5 MIDDLE EAST & AFRICA COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION

- TABLE 230 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (TON)

- TABLE 233 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (TON)

- 11.5.6 MIDDLE EAST & AFRICA COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY

- TABLE 234 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (TON)

- TABLE 237 MIDDLE EAST & AFRICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (TON)

- 11.5.6.1 Turkey

- 11.5.6.1.1 Growing disposable income to drive market

- 11.5.6.1 Turkey

- TABLE 238 TURKEY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 239 TURKEY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 240 TURKEY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 241 TURKEY: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.5.6.2 Saudi Arabia

- 11.5.6.2.1 Wide use of premium cosmetic products to spur market

- 11.5.6.2 Saudi Arabia

- TABLE 242 SAUDI ARABIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 243 SAUDI ARABIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 244 SAUDI ARABIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 245 SAUDI ARABIA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.5.6.3 UAE

- 11.5.6.3.1 Wide presence of local cosmetics manufacturers to drive market

- 11.5.6.3 UAE

- TABLE 246 UAE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 247 UAE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 248 UAE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 249 UAE: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.6 SOUTH AMERICA

- 11.6.1 RECESSION IMPACT ON SOUTH AMERICA

- 11.6.2 SOUTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY SOURCE

- TABLE 250 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (USD MILLION)

- TABLE 251 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (USD MILLION)

- TABLE 252 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2017-2021 (TON)

- TABLE 253 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY SOURCE, 2022-2028 (TON)

- 11.6.3 SOUTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION

- TABLE 254 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 255 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 256 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 257 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.6.4 SOUTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY TYPE

- TABLE 258 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 259 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 260 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2017-2021 (TON)

- TABLE 261 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY TYPE, 2022-2028 (TON)

- 11.6.5 SOUTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION

- TABLE 262 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 263 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (USD MILLION)

- TABLE 264 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2017-2021 (TON)

- TABLE 265 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY FUNCTION, 2022-2028 (TON)

- 11.6.6 SOUTH AMERICA COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY

- TABLE 266 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 267 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 268 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2017-2021 (TON)

- TABLE 269 SOUTH AMERICA: COSMETIC ANTIOXIDANTS MARKET, BY COUNTRY, 2022-2028 (TON)

- 11.6.6.1 Brazil

- 11.6.6.1.1 Rising per capita spending on cosmetic products to drive market

- 11.6.6.1 Brazil

- TABLE 270 BRAZIL: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 271 BRAZIL: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 272 BRAZIL: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 273 BRAZIL: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

- 11.6.6.2 Argentina

- 11.6.6.2.1 Strong sales network of local capitalized stores to fuel market

- 11.6.6.2 Argentina

- TABLE 274 ARGENTINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 275 ARGENTINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 276 ARGENTINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2017-2021 (TON)

- TABLE 277 ARGENTINA: COSMETIC ANTIOXIDANTS MARKET, BY APPLICATION, 2022-2028 (TON)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 278 STRATEGIES ADOPTED BY KEY COSMETIC ANTIOXIDANTS MANUFACTURERS

- 12.3 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 43 RANKING OF TOP FIVE PLAYERS IN COSMETIC ANTIOXIDANTS MARKET, 2022

- 12.4 MARKET SHARE ANALYSIS

- TABLE 279 COSMETIC ANTIOXIDANTS MARKET: DEGREE OF COMPETITION

- FIGURE 44 EVONIK INDUSTRIES AG ACCOUNTED FOR LARGEST SHARE OF COSMETIC ANTIOXIDANTS MARKET IN 2022

- 12.5 REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

- 12.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 46 COSMETIC ANTIOXIDANTS MARKET: COMPANY FOOTPRINT

- TABLE 280 COSMETIC ANTIOXIDANTS MARKET: SOURCE FOOTPRINT

- TABLE 281 COSMETIC ANTIOXIDANTS MARKET: APPLICATION FOOTPRINT

- TABLE 282 COSMETIC ANTIOXIDANTS MARKET: REGION FOOTPRINT

- 12.7 COMPANY EVALUATION MATRIX

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 47 COMPANY EVALUATION MATRIX: COSMETIC ANTIOXIDANTS MARKET

- 12.8 COMPETITIVE BENCHMARKING

- TABLE 283 COSMETIC ANTIOXIDANTS MARKET: KEY STARTUPS/SMES

- TABLE 284 COSMETIC ANTIOXIDANTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.9 STARTUP/SME EVALUATION MATRIX

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- FIGURE 48 STARTUP/SME EVALUATION QUADRANT: COSMETIC ANTIOXIDANTS MARKET

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- TABLE 285 COSMETIC ANTIOXIDANTS MARKET: PRODUCT LAUNCHES (2020-2023)

- 12.10.2 DEALS

- TABLE 286 COSMETIC ANTIOXIDANTS MARKET: DEALS (2020-2023)

- 12.10.3 OTHER DEVELOPMENTS

- TABLE 287 COSMETIC ANTIOXIDANTS MARKET: OTHER DEVELOPMENTS (2020-2023)

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1 KEY PLAYERS

- 13.1.1 BASF SE

- TABLE 288 BASF SE: COMPANY OVERVIEW

- FIGURE 49 BASF SE: COMPANY SNAPSHOT

- TABLE 289 BASF SE: DEALS

- 13.1.2 EVONIK INDUSTRIES AG

- TABLE 290 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 50 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 291 EVONIK INDUSTRIES AG: DEALS

- TABLE 292 EVONIK INDUSTRIES AG: OTHER DEVELOPMENTS

- 13.1.3 CRODA INTERNATIONAL PLC

- TABLE 293 CRODA INTERNATIONAL PLC: COMPANY OVERVIEW

- FIGURE 51 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

- TABLE 294 CRODA INTERNATIONAL PLC: DEALS

- TABLE 295 CRODA INTERNATIONAL PLC: OTHER DEVELOPMENTS

- 13.1.4 WACKER CHEMIE AG

- TABLE 296 WACKER CHEMIE AG: COMPANY OVERVIEW

- FIGURE 52 WACKER CHEMIE AG: COMPANY SNAPSHOT

- 13.1.5 EASTMAN CHEMICAL COMPANY

- TABLE 297 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 53 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 298 EASTMAN CHEMICAL COMPANY: DEALS

- 13.1.6 ASHLAND INC.

- TABLE 299 ASHLAND INC.: COMPANY OVERVIEW

- FIGURE 54 ASHLAND INC.: COMPANY SNAPSHOT

- TABLE 300 ASHLAND INC.: PRODUCT LAUNCHES

- TABLE 301 ASHLAND INC.: DEALS

- 13.1.7 CLARIANT AG

- TABLE 302 CLARIANT AG: COMPANY OVERVIEW

- FIGURE 55 CLARIANT AG: COMPANY SNAPSHOT

- TABLE 303 CLARIANT AG: DEALS

- 13.1.8 SEPPIC

- TABLE 304 SEPPIC: COMPANY OVERVIEW

- 13.1.9 KONINKLIJKE DSM N.V. (ROYAL DSM)

- TABLE 305 KONINKLIJKE DSM N.V. (ROYAL DSM): COMPANY OVERVIEW

- FIGURE 56 KONINKLIJKE DSM N.V. (ROYAL DSM): COMPANY SNAPSHOT

- TABLE 306 KONINKLIJKE DSM N.V. (ROYAL DSM): DEALS

- 13.1.10 BTSA BIOTECNOLOGIAS APLICADAS S.L.

- TABLE 307 BTSA BIOTECNOLOGIAS APLICADAS S.L.: COMPANY OVERVIEW

- 13.2 OTHER PLAYERS

- 13.2.1 THE LUBRIZOL CORPORATION

- TABLE 308 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- 13.2.2 MERCK & CO., INC.

- TABLE 309 MERCK & CO., INC.: COMPANY OVERVIEW

- 13.2.3 ADM

- TABLE 310 ADM: COMPANY OVERVIEW

- 13.2.4 JAN DEKKER

- TABLE 311 JAN DEKKER: COMPANY OVERVIEW

- 13.2.5 PROVITAL S.A.

- TABLE 312 PROVITAL S.A.: COMPANY OVERVIEW

- 13.2.6 YASHO INDUSTRIES LIMITED

- TABLE 313 YASHO INDUSTRIES LIMITED: COMPANY OVERVIEW

- 13.2.7 NEXIRA

- TABLE 314 NEXIRA: COMPANY OVERVIEW

- 13.2.8 ASH INGREDIENTS, INC.

- TABLE 315 ASH INGREDIENTS, INC.: COMPANY OVERVIEW

- 13.2.9 BLUE CALIFORNIA

- TABLE 316 BLUE CALIFORNIA: COMPANY OVERVIEW

- 13.2.10 SYMRISE AG

- TABLE 317 SYMRISE AG: COMPANY OVERVIEW

- 13.2.11 VANTAGE SPECIALTY CHEMICALS

- TABLE 318 VANTAGE SPECIALTY CHEMICALS: COMPANY OVERVIEW

- 13.2.12 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 319 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY OVERVIEW

- 13.2.13 INNOVACOS

- TABLE 320 INNOVACOS: COMPANY OVERVIEW

- 13.2.14 CIREBELLE

- TABLE 321 CIREBELLE: COMPANY OVERVIEW

- 13.2.15 SALVONA

- TABLE 322 SALVONA: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 PERSONAL CARE INGREDIENTS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 PERSONAL CARE INGREDIENTS MARKET, BY REGION

- TABLE 323 PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 324 PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 325 PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 326 PERSONAL CARE INGREDIENTS MARKET, BY REGION, 2022-2027 (KILOTON)

- 14.3.3.1 Europe

- 14.3.3.1.1 Europe: Personal care ingredients market, by country

- 14.3.3.1 Europe

- TABLE 327 EUROPE: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 328 EUROPE: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 329 EUROPE: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 330 EUROPE: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- 14.3.3.2 Asia Pacific

- 14.3.3.2.1 Asia Pacific: Personal care ingredients market, by country

- 14.3.3.2 Asia Pacific

- TABLE 331 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 332 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 333 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 334 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- 14.3.3.3 North America

- 14.3.3.3.1 North America: Personal care ingredients market, by country

- 14.3.3.3 North America

- TABLE 335 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 336 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 337 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 338 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- 14.3.3.4 Middle East & Africa

- 14.3.3.4.1 Middle East & Africa: Personal care ingredients market, by country

- 14.3.3.4 Middle East & Africa

- TABLE 339 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 340 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 341 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 342 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- 14.3.3.5 South America

- 14.3.3.5.1 South America: Personal care ingredients market, by country

- 14.3.3.5 South America

- TABLE 343 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 344 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 345 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 346 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.1 AUTHOR DETAILS