|

|

市場調査レポート

商品コード

1923690

RFIDの世界市場:提供別、フォームファクター別、用途別、最終用途別 - 予測(~2034年)RFID Market by Offering, Form Factor, Application, End Use - Global Forecast to 2034 |

||||||

カスタマイズ可能

|

|||||||

| RFIDの世界市場:提供別、フォームファクター別、用途別、最終用途別 - 予測(~2034年) |

|

出版日: 2026年01月23日

発行: MarketsandMarkets

ページ情報: 英文 332 Pages

納期: 即納可能

|

概要

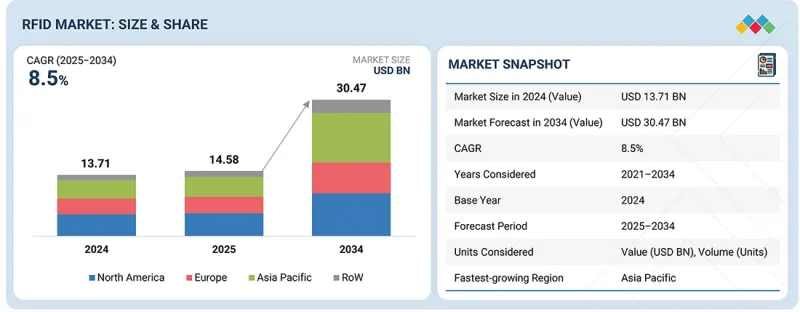

世界のRFIDの市場規模は、2025年に145億8,000万米ドル、2034年までに304億7,000万米ドルに達すると予測され、2025年~2034年にCAGRで8.5%の成長が見込まれます。

複数の業界におけるリアルタイム追跡、業務可視性、データ精度の需要の増加により、市場は予測期間に安定した成長を示す見込みです。企業は在庫精度、資産活用率、サプライチェーンの透明性の向上を目的としてRFIDを採用しています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2034年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2034年 |

| 単位 | 10億米ドル |

| セグメント | 提供、周波数帯域、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

UHF RFIDタグ、固定式/携帯式リーダー、アンテナ、RFIDソフトウェアプラットフォームの展開の拡大は、小売、ロジスティクス、製造、医療環境における自動化を支えています。商品レベルでのタグ付けと倉庫自動化により、手作業とサイクルタイムが削減されています。RFIDとIoTプラットフォーム、クラウドアナリティクス、企業システムの統合により、データ主導の意思決定と予測的考察が可能となっています。オムニチャネル小売、コールドチェーンロジスティクス、産業オートメーションの拡大が採用をさらに促進しています。トレーサビリティ、食品安全、医療コンプライアンスに関する政府の取り組みも市場成長を支えています。しかしながら、初期導入コスト、システム統合の複雑性、データ管理要件といった課題が、コスト重視の環境における採用を制限する可能性があります。タグ設計、リーダー性能、ソフトウェアの相互運用性における継続的な革新と、スケーラブルな展開モデルが、RFID市場の長期的な拡大を持続させる上で重要となります。

「用途別では、非接触型決済セグメントが2025年~2034年にもっとも高いCAGRを記録すると予測されます。」

非接触型決済セグメントが予測期間にRFID市場においてもっとも高いCAGRを記録すると見込まれています。これは、迅速・安全・便利な決済方法への需要の増加によるものです。NFC/HFベースのRFID技術の採用の拡大により、小売、公共交通、ホスピタリティ、銀行用途などで広く展開されています。消費者は、取引時間の短縮、衛生面の向上、ユーザーエクスペリエンスの向上を理由に非接触型決済を好みます。政府や金融機関はキャッシュレス決済エコシステムの推進を継続し、インフラのアップグレードや端末の設置を加速させています。都市交通システムの成長とスマートモビリティ構想は、RFID対応運賃収受システムの採用をさらに促進します。セキュアエレメント、暗号化、トークン化の進歩は、取引の安全性と規制遵守を強化します。非接触型決済システムとモバイルウォレット、ウェアラブルデバイス、スマートカードの統合は、対応可能な使用法を拡大します。新興市場ではデジタル決済の普及率向上に伴い急速な成長がみられます。初期インフラコストや相互運用性の課題は残る一方、標準化の進行と技術改良により、非接触型決済はRFID市場でもっとも成長が速い用途セグメントとなっています。

「フォームファクター別では、ラベルセグメントが2034年に最大の市場シェアを占めると予測されています。」

RFIDラベルセグメントは、数量の多いコスト重視の用途で広く採用されていることから、最大の市場シェアを維持すると予測されています。RFIDラベルはRFIDインレイと印刷ラベルを組み合わせることで、製品・包装・資産の効率的な識別と追跡を可能にします。小売はその第一の促進要因であり、在庫精度向上、損失削減、オムニチャネル対応を支援するため、商品単位でのラベリングが大規模に展開されています。ロジスティクス・倉庫業務では、出荷追跡、パレット管理、プロセス自動化にRFIDラベルが活用されています。このセグメントは、低い単価、統合の容易さ、既存のラベリング作業フローとの互換性から恩恵を受けています。アンテナ設計、チップ感度、印刷技術の進歩により、読み取り性能と耐久性が向上しています。RFIDラベルは、トレーサビリティと規制遵守を支援するために、医療、医薬品、食品サプライチェーンでも採用されつつあります。UHFプロトコルの標準化と世界的な調達能力が、さらなる拡張性を支えています。企業がパイロットプロジェクトを超えてRFID導入を拡大する中、RFIDラベルはRFID市場全体において、数量と応用範囲で引き続き主導的な地位を維持しています。

当レポートでは、世界のRFID市場について調査分析し、主な促進要因と抑制要因、製品開発とイノベーション、競合情勢に関する知見を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要な知見

- RFID市場の企業にとって魅力的な機会

- RFID市場:提供別

- RFID市場:フォームファクター別

- RFID市場:材料別

- RFID市場:周波数帯域別

- RFID市場:最終用途別

- RFID市場:用途別

- RFID市場:地域別

- RFID市場:地域別

第4章 市場の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 相互接続された市場と部門横断的な機会

- 相互接続された市場

- 部門横断的な機会

- Tier 1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済の見通し

- GDPの動向と予測

- 世界のRFID業界の動向

- 世界のIoT業界の動向

- バリューチェーン分析

- エコシステム分析

- 価格設定の分析

- RFID製品の平均販売価格の動向:主要企業別(2021年~2024年)

- RFID製品の平均販売価格の動向:地域別(2021年~2024年)

- 貿易分析

- 輸入シナリオ(HSコード8523)

- 輸出シナリオ(HSコード8523)

- 主な会議とイベント(2026年~2027年)

- カスタマービジネスに影響を与える動向/ディスラプション

- 投資と資金調達シナリオ(2021年~2025年)

- ケーススタディ分析

- 2025年の米国関税の影響-RFID市場

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 最終用途への影響

第6章 技術の進歩、AIによる影響、特許、イノベーション

- 主な新技術

- コンピュータービジョン

- リアルタイム位置情報システム

- RFID対応センサー・ロボット

- 補完技術

- クラウドベースRFID

- IoT向けRFID

- RFIDとブロックチェーンの統合

- 隣接技術

- NFC・RFIDハイブリッドソリューション

- フレキシブルRFIDタグ

- テクノロジーロードマップ

- 短期:インフラの近代化とインテリジェントトラッキング(2025年~2027年)

- 中期:インテリジェントオートメーションとエコシステム統合(2027年~2030年)

- 長期:自律型、信頼性、データドリブンRFIDエコシステム(2030年~2035年以降)

- 特許分析

- RFID市場に対するAIの影響

- 主なユースケースと市場の将来性

- RFID市場における企業のベストプラクティス

- RFID市場におけるAI導入に関するケーススタディ

- 相互接続された/隣接するエコシステムと市場企業への影響

- RFID市場におけるAI採用に対する顧客の準備状況

第7章 規制情勢と持続可能性に関する取り組み

- 地域の規制とコンプライアンス

- 規制機関、政府機関、その他の組織

- 業界標準

- 持続可能性への取り組み

- 環境への影響を軽減するためのRFIDの使用

- 持続可能なRFID製品の設計と材料の活用

- エネルギー効率の高い低消費電力RFIDシステムの展開

- RFIDを活用した循環型経済・再使用可能モデルの採用

- 環境とトレーサビリティに関する規制に対応するためのRFIDの導入

- 持続可能な製造とサプライチェーンの透明性の受け入れ

- 包装と文書の廃棄物を削減するためのRFIDの採用

- 持続可能性構想に対する規制政策の影響

- RFID製品設計に対する環境規制の影響

- RFIDベンダーとエンドユーザーに対する廃棄物管理政策の影響

- 国内・国際サプライチェーンにおける貿易規制の影響

- データの収集と管理に対するESG開示規制の影響

- 地域によって異なる規制の影響

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 購買プロセスに関与する主なステークホルダーとその評価基準

- 購買プロセスにおける主なステークホルダー

- 購入基準

- 採用障壁と内部課題

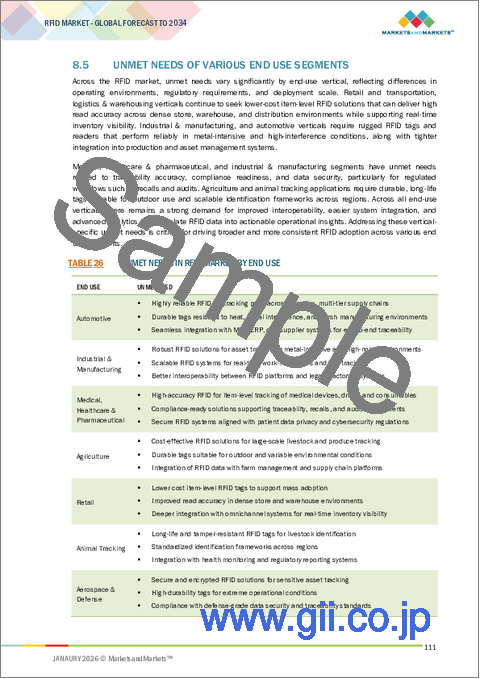

- さまざまな最終用途部門のアンメットニーズ

第9章 RFIDチップ製造に使用されるウエハーの寸法

- 8インチ

- 12インチ

- その他

第10章 RFID市場:提供別

- タグ

- リーダー

- ソフトウェア・サービス

第11章 RFID市場:材料別

- プラスチック

- ガラス

- 紙

- その他の材料

第12章 RFID市場:周波数帯域別

- 低

- 高

- 超高

第13章 RFID市場:フォームファクター別

- カード

- ラベル

- キーフォブ・トークン

- バンド

- 紙・インレイ

- インプラント

- センサーベースタグ

- その他のフォームファクター

第14章 RFID市場:用途別

- 在庫・資産管理

- セキュリティ・アクセス制御

- 発券業務

- 非接触型決済

第15章 RFID市場:最終用途別

- 自動車

- 医療・医薬品

- 農業

- 小売

- 輸送・ロジスティクス・倉庫

- 動物追跡

- 航空宇宙・防衛

- スポーツ・イベント・人物追跡

- データセンター

- 工業・製造

第16章 RFID市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- ポーランド

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア・ニュージーランド

- ASEAN

- その他のアジア太平洋

- その他の地域

- 中東

- アフリカ

- 南米

第17章 競合情勢

- 概要

- 主要企業の競争戦略/強み(2021年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- ブランド/製品の比較

- 競合シナリオ

第18章 企業プロファイル

- 主要企業

- ZEBRA TECHNOLOGIES CORP.

- HONEYWELL INTERNATIONAL INC.

- AVERY DENNISON CORPORATION

- HID GLOBAL CORPORATION

- DATALOGIC S.P.A.

- IMPINJ, INC.

- ALIEN TECHNOLOGY, LLC

- CAEN RFID S.R.L.

- GAO RFID INC.

- XEMELGO, INC.

- その他の企業

- INVENGO INFORMATION TECHNOLOGY CO., LTD.

- MOJIX

- SAG SECURITAG ASSEMBLY GROUP CO., LTD.

- LINXENS

- CHECKPOINT SYSTEMS, INC.

- IDENTIV, INC.

- NEDAP N.V.

- JADAK

- UNITECH ELECTRONICS CO., LTD.

- INFOTEK SOFTWARE & SYSTEMS(P)LTD.

- BARTRONICS INDIA LIMITED

- BARTECH DATA SYSTEMS PVT. LTD.

- GLOBERANGER

- ORBCOMM INC.

- BEONTAG

- CORERFID

- TAGMASTER NORTH AMERICA

- RFID, INC.

- OMNITAAS

- CONTROLTEK