|

|

市場調査レポート

商品コード

1295483

商業用セキュリティシステムの世界市場:ハードウェア別 (防火、ビデオ監視、アクセス制御、入退室管理)・ソフトウェア別 (火災分析、ビデオ監視、アクセス制御)・サービス別・業種別・地域別の将来予測 (2028年まで)Commercial Security System Market by Hardware (Fire Protection, Video Surveillance, Access Control, Entrance Control), Software (Fire Analysis, Video Surveillance, Access Control), Services, Vertical and Region- Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 商業用セキュリティシステムの世界市場:ハードウェア別 (防火、ビデオ監視、アクセス制御、入退室管理)・ソフトウェア別 (火災分析、ビデオ監視、アクセス制御)・サービス別・業種別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月15日

発行: MarketsandMarkets

ページ情報: 英文 284 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の商業用セキュリティシステムの市場規模は、2023年の2,363億米ドルから、2028年には3,437億米ドルに達し、2023年から2028年までの間に7.8%のCAGRで成長すると予測されています。

"防火システム市場の中で、スプリンクラーが最も高い成長率を達成する"

防火スプリンクラーシステムは、建物や施設における防火のための重要なコンポーネントです。スプリンクラーシステムは、パイプ・スプリンクラーヘッド・バルブ・給水源のネットワークで構成されています。スプリンクラーシステムの主な機能は、火災を検知し、影響を受ける領域に放水することで制御し、炎を抑制または消火することです。システムは、火災による熱の存在に自動的に反応するように設計されています。各スプリンクラーヘッドには、感熱素子(通常はガラス球または可溶性リンク)が装備されており、一定の温度に達するまで水が滞留します。火災によって周囲の温度が上昇すると、感熱素子が作動し、スプリンクラーヘッドを通って火災の下に水が流れます。スプリンクラーヘッドは、火災を包括的にカバーするため、建物全体に戦略的に配置されています。通常、スプリンクラーヘッドは天井や壁に設置され、特定の設計ガイドラインに従って間隔が決められています。スプリンクラーシステムには、市営水道や敷地内の貯水タンクなど、信頼できる水源に接続された配管網を通じて水が供給されます。

"ビデオ監視サービスが、予測期間中に最も高いCAGRで成長する"

設置・整備サービスは、ビデオ監視用ハードウェアの販売増加によって牽引されると予想されます。VSaaSはビデオ監視システムにこれまでにない柔軟性を加えます。監視カメラの映像は外部で保存されるため、事故や盗難、改ざんから保護されます。VSaaSシステムは、オンサイトのカメラのみを必要とし、エンドユーザーに最も費用対効果の高いソリューションを提供します。そのため、VSaaS市場は急成長が見込まれています。

VSaaSはクラウドで管理されるため、オペレーターはデスクトップ・ラップトップ・モバイル機器を通じて、いつでもどこからでも映像やカメラにアクセスできます。クラウドサービスは、活用領域やリソースへの拡張可能かつ容易なアクセスを提供するように設計されています。クラウドサービスには、ストレージバックアップ・ホステッドオフィススイート・データベース処理などがあります。VSaaSは、政府・都市監視・インフラ・銀行・小売・交通・教育・住宅などの分野で活用されており、ホスティングサービス・マネージドサービス・ハイブリッドサービスに区分されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 収益の変化と新たな収益源:商業セキュリティシステム市場の参入企業向け

- エコシステム分析

- テクノロジー分析

- 価格分析

- ケーススタディ分析

- 特許分析

- 貿易分析

- ポーターのファイブフォース分析

- 主要な会議とイベント (2023年~2024年)

- 規制状況

- 主要な利害関係者と購入基準

第6章 商業用セキュリティシステム市場:ハードウェア別

- イントロダクション

- 防火システム

- 火災検知器

- 消火装置

- 消火用スプリンクラーシステム

- 火災対応システム

- ビデオ監視システム

- カメラ

- モニター

- ストレージデバイス

- アクセサリー

- アクセス制御システム

- カードベースリーダー

- 生体認証リーダー

- マルチテクノロジーリーダー

- 電子ロック

- コントローラー

- その他

- 入退室管理システム

第7章 商業用セキュリティシステム市場:ソフトウェア別

- イントロダクション

- 火災分析ソフトウェア

- 火災マッピング・分析ソフトウェア

- 火災モデリング・シミュレーションソフトウェア

- ビデオ監視ソフトウェア

- ビデオ分析

- ビデオ管理ソフトウェア

- 導入モード別のソフトウェア

- アクセス制御ソフトウェア

- 来場者管理システム

- その他

第8章 商業用セキュリティシステム市場:サービス別

- イントロダクション

- セキュリティシステム統合サービス

- 遠隔監視サービス

- 防火サービス

- 整備サービス

- マネージドサービス

- エンジニアリングサービス

- 設置・設計サービス

- その他のサービス

- ビデオ監視サービス

- VSaaS (Video Surveillance as a service)

- 設置・整備サービス

- アクセス制御サービス

- 設置・インテグレーション

- サポート・整備

- ACaaS (Access Control as a Service)

第9章 商業用セキュリティシステム市場:業種別

- イントロダクション

- 商業

- 政府

- 交通機関

- 小売業

- 銀行・金融

- 教育

- 鉱業

- エネルギー・ユーティリティ

- スポーツ・レジャー

- 医療

- 軍事・防衛

第10章 商業用セキュリティシステム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋

- その他の地域 (ROW)

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 市場評価の枠組み

- 市場シェアとランキング分析

- 企業収益分析

- 企業評価クアドラント (2022年)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント (2022年)

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要企業

- JOHNSON CONTROLS

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- CARRIER

- HONEYWELL INTERNATIONAL INC.

- DAHUA TECHNOLOGY CO., LTD.

- DORMAKABA GROUP

- ROBERT BOSCH(BOSCH SICHERHEITSSYSTEME GMBH)

- AXIS COMMUNICATIONS AB

- SECOM CO., LTD.

- ASSA ABLOY

- その他の主な企業

- ADT

- SIEMENS

- HALMA PLC

- HOCHIKI CORPORATION

- TELEDYNE FLIR LLC

- ALLEGION PLC

- NICE S.P.A.

- ALARM.COM

- MOTOROLA SOLUTIONS, INC.(AVIGILON)

- DALLMEIER ELECTRONIC GMBH & CO. KG

- SECURITAS TECHNOLOGY

- GUNNEBO AB

- CONTROL4

- VIKING GROUP INC.

- NORDEN

- VIVINT, INC.

第13章 付録

The commercial security system market is projected to reach USD 343.7 billion by 2028 from USD 236.3 billion in 2023, at a CAGR of 7.8% from 2023 to 2028.

Fire sprinkler is expected to grow at the highest growth rate in fire protection system market during the forecast period

A fire sprinkler system is a crucial component of fire protection in buildings and facilities. It consists of a network of pipes, sprinkler heads, valves, and a water supply source. The primary function of a fire sprinkler system is to detect and control fires by discharging water onto the affected area, suppressing or extinguishing the flames. The system is designed to respond automatically to the presence of heat from a fire. Each sprinkler head is equipped with a heat-sensitive element, typically a glass bulb or a fusible link, that holds back the water until it reaches a certain temperature. When the ambient temperature rises due to a fire, the heat-sensitive element is activated, allowing the water to flow through the sprinkler head and onto the fire below. The sprinkler heads are strategically placed throughout the building to provide comprehensive coverage. They are typically positioned on the ceilings or walls, spaced according to specific design guidelines. The water is supplied to the sprinkler system through a network of pipes that are connected to a reliable water source, such as a municipal water supply or an on-site water storage tank.

Video Surveillance services are expected to grow at the highest CAGR during the forecast period

Installation and maintenance services are expected to be driven by the rise in sales of video surveillance hardware. VSaaS adds unprecedented flexibility to the video surveillance system. Since surveillance footage is stored off-site, it is better protected from accidents, theft, and tampering. VSaaS systems only require on-site cameras, offering the most cost-effective solutions to end users. Hence, the VSaaS market is expected to witness rapid growth.

As VSaaS is managed in the cloud, the operator can access the footage or cameras from anywhere, at any time through a desktop, laptop, or mobile device. Cloud services are designed to provide scalable and easy access to applications or resources. Cloud services include storage backup, hosted office suite, and database processing. VSaaS finds applications in government, city surveillance and infrastructure, banking, retail, transportation, education, and residential sectors. It is segmented into hosted, managed, and hybrid services.

The break-up of profile of primary participants in the Commercial security system market-

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, Tier 3 - 20%

- By Designation Type: C Level - 25%, Director Level - 35% , Others - 40%

- By Region Type: Asia Pacific - 25%, North America - 35%, Europe - 30%, Asia Pacific - 25%, and RoW - 10%

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 25% , Others - 40%

- By Region Type: North America - 40%, Europe - 20%, Asia Pacific - 30%, Middle East - 5%, and Latin America - 5%

The major players of Commercial security system market are Johnson Controls (US), Hangzhou Hikvision Digital Technology Co., Ltd (China), Carrier (US), Honeywell International Inc. (US), Robert Bosch GmbH (Bosch Sicherheitssysteme GmbH) (Germany), Dahua Technology Inc. (China), dormakaba Group s(Switzerland), ADT (US), Axis Communication AB. (Sweden), SECOM. CO. LTD, (Japan), ASSA ABLOY(Sweden), Siemens (Germany), Halma plc (US), Hochiki Corporation (Japan), Teledyne FLIR LLC(US), Allegion plc (Ireland), Nice S.p.A. (US), Alarm.com (Canada), Motorola Solutions, Inc. (Avigilon)(Canada), Dallmeier electronic (Germany), Securitas Technology (Canada), Gunnebo AB (Sweden), Control4 (US), Viking Group Inc. (US), Norden (UK), Vivint Inc (US).

Research Coverage

The report segments the commercial security system market and forecasts its size based on hardware, software, services, vertical, and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall commercial security system market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (the growing global rate of terrorism and organized crime), restraints (major privacy and security concerns), opportunities (rise in government and stakeholder funding for smart city development and city surveillance solutions), and challenges (cyber threats to commercial security systems poses significant risks) influencing the growth of the commercial security system market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the commercial security system market

- Market Development: Comprehensive information about lucrative markets - the report analyses the commercial security system market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Commercial security system market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Johnson Controls (US), Hangzhou Hikvision Digital Technology Co., Ltd (China), Carrier (US), Honeywell International Inc. (US), and Robert Bosch GmbH (Bosch Sicherheitssysteme GmbH) (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 COMMERCIAL SECURITY SYSTEM MARKET SEGMENTATION

- 1.3.2 REGIONS CONSIDERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 UNIT CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 COMMERCIAL SECURITY SYSTEM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key participants in primary interviews

- 2.1.3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.3.1 Key industry insights

- 2.1.4 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) -BOTTOM-UP ESTIMATION BASED ON REGION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RISK ASSESSMENT

- TABLE 1 RISK FACTOR ANALYSIS

- 2.5.1 RECESSION IMPACT

- 2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.6.1 ASSUMPTIONS

- 2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 COMMERCIAL SECURITY SYSTEM MARKET: RECESSION IMPACT

- FIGURE 9 COMMERCIAL SECURITY SYSTEM MARKET: IMPACT OF RECESSION

- FIGURE 10 VIDEO SURVEILLANCE TO ACCOUNT FOR HIGHEST MARKET SHARE IN COMMERCIAL SECURITY HARDWARE MARKET

- FIGURE 11 VIDEO SURVEILLANCE SOFTWARE TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

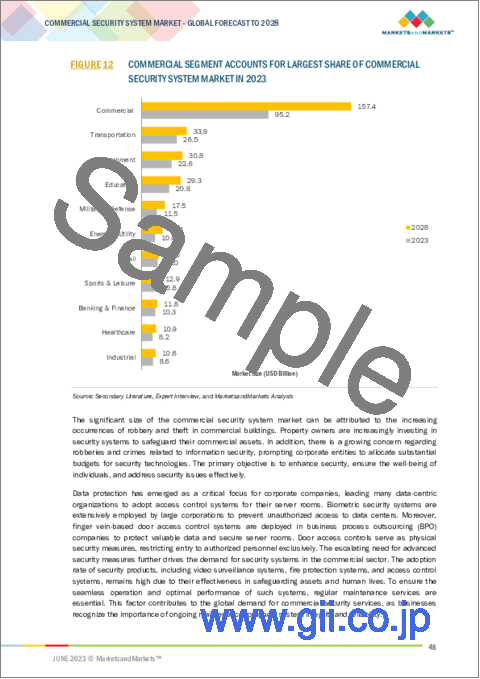

- FIGURE 12 COMMERCIAL SEGMENT ACCOUNTS FOR LARGEST SHARE OF COMMERCIAL SECURITY SYSTEM MARKET IN 2023

- FIGURE 13 COMMERCIAL SECURITY SYSTEM MARKET IN ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMMERCIAL SECURITY SYSTEM MARKET

- FIGURE 14 INCREASED DEMAND IN COMMERCIAL VERTICAL TO DRIVE COMMERCIAL SECURITY SYSTEM MARKET GROWTH

- 4.2 ASIA PACIFIC COMMERCIAL SECURITY SYSTEM MARKET, BY OFFERING AND COUNTRY

- FIGURE 15 SERVICES SEGMENT ACCOUNTS FOR LARGER SHARE OF ASIA PACIFIC COMMERCIAL SECURITY SYSTEM MARKET

- 4.3 COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE

- FIGURE 16 VIDEO SURVEILLANCE SOFTWARE SEGMENT TO DOMINATE OVERALL MARKET FROM 2023 TO 2028

- 4.4 COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE

- FIGURE 17 SECURITY SYSTEM INTEGRATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.5 COMMERCIAL SECURITY SYSTEM MARKET, BY VERTICAL

- FIGURE 18 COMMERCIAL SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.6 COMMERCIAL SECURITY SYSTEM MARKET, BY COUNTRY

- FIGURE 19 INDIA TO RECORD HIGHEST CAGR IN COMMERCIAL SECURITY SYSTEM MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 COMMERCIAL SECURITY SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing terrorism and organized crime

- 5.2.1.2 Expanding construction industry

- 5.2.1.3 Increasing use of IP cameras in security applications

- 5.2.1.4 Implementation of robust fire protection standards for effective fire security

- 5.2.1.5 Growing use of IoT-based security systems supported by cloud platforms

- 5.2.1.6 Reduction in insurance expenses by mitigating security risks

- 5.2.1.7 Enabling identification and preparation for potential environmental disasters

- FIGURE 21 COMMERCIAL SECURITY SYSTEM MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High setup, maintenance, and ownership costs of commercial security systems

- 5.2.2.2 Major privacy and security concerns due to potential data breaches and unauthorized access to sensitive information

- 5.2.2.3 Resistance to change impeding uptake and efficacy of commercial security systems

- FIGURE 22 COMMERCIAL SECURITY SYSTEM MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investments in smart city development and city surveillance solutions

- 5.2.3.2 Rising adoption of ACaaS and VSaaS

- 5.2.3.3 Need to upgrade fire protection-related regulatory compliances

- 5.2.3.4 Advancement and adoption of artificial intelligence (AI) and machine learning

- FIGURE 23 COMMERCIAL SECURITY SYSTEM MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.4 CHALLENGES

- 5.2.4.1 Cyber threats to commercial security systems

- 5.2.4.2 Complexity of integrating user interfaces with fire protection systems

- 5.2.4.3 Supply chain-related risks of commercial security systems

- 5.2.4.4 Rapid evolution of technology

- FIGURE 24 COMMERCIAL SECURITY SYSTEM MARKET CHALLENGES: IMPACT ANALYSIS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS: COMMERCIAL SECURITY SYSTEM MARKET

- 5.3.1 RESEARCH & DEVELOPMENT

- 5.3.2 SOLUTION MANUFACTURERS

- 5.3.3 SYSTEM INTEGRATORS

- 5.3.4 END USERS

- 5.3.5 MARKETING & SALES

- 5.4 REVENUE SHIFT AND NEW REVENUE POCKETS FOR COMMERCIAL SECURITY SYSTEM MARKET PLAYERS

- FIGURE 26 REVENUE SHIFT FOR PLAYERS IN COMMERCIAL SECURITY SYSTEM MARKET

- 5.5 ECOSYSTEM ANALYSIS

- TABLE 2 COMMERCIAL SECURITY SYSTEM MARKET: ECOSYSTEM

- FIGURE 27 KEY PLAYERS IN COMMERCIAL SECURITY SYSTEM MARKET

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 IOT-POWERED FIRE PROTECTION SYSTEM

- 5.6.2 CLOUD-BASED FIRE PROTECTION SYSTEM

- 5.6.3 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.6.4 VIDEO IMAGE SMOKE AND FLAME DETECTION SYSTEM

- 5.6.5 USE OF THERMAL CAMERAS IN ACCESS CONTROL

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND

- FIGURE 28 ASP TRENDS OF CARD-BASED READERS, BIOMETRIC READERS, MULTI-TECHNOLOGY READERS, AND ELECTRONIC LOCKS

- 5.7.2 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT TYPE

- FIGURE 29 ASP OF KEY PLAYERS, BY PRODUCT TYPE

- TABLE 3 AVERAGE SELLING PRICE FOR FOUR PRODUCTS, BY KEY PLAYERS (USD)

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 COMMERCIAL SECURITY SYSTEM FOR INCIDENT DETECTION

- TABLE 4 AXIS COMMUNICATIONS AB HELPS NEW ORLEANS OFFICE OF PUBLIC SAFETY AND HOMELAND SECURITY IN PUBLIC SAFETY, INCIDENT DETECTION

- 5.8.2 COMMERCIAL SECURITY SYSTEM FOR PUBLIC SAFETY

- TABLE 5 AXIS COMMUNICATIONS AB HELPS QUEENSLAND INVESTMENT CORPORATION TO TIGHTEN SECURITY FOR PUBLIC SAFETY AT SHOPPING CENTERS IN AUSTRALIA

- 5.8.3 COMMERCIAL SECURITY SYSTEM FOR IMPROVED IN-STORE SECURITY

- TABLE 6 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD. HELPS RETAILER MINISO TO IMPROVE LOSS PREVENTION

- 5.9 PATENT ANALYSIS

- 5.9.1 DOCUMENT TYPE

- TABLE 7 PATENTS FILED

- FIGURE 30 PATENTS FILED FROM 2013 TO 2022

- 5.9.2 PUBLICATION TREND

- FIGURE 31 NUMBER OF PATENTS PUBLISHED FROM 2013 TO 2022

- 5.9.3 JURISDICTION ANALYSIS

- FIGURE 32 TOP JURISDICTIONS

- 5.9.4 TOP PATENT OWNERS

- FIGURE 33 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS (2013-2022)

- TABLE 8 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- 5.10 TRADE ANALYSIS

- FIGURE 34 COUNTRY-WISE EXPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 853110 (2018-2022)

- TABLE 9 EXPORT SCENARIO FOR HS CODE: 853110-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 35 COUNTRY-WISE IMPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 853110 (2018-2022)

- TABLE 10 IMPORT SCENARIO FOR HS CODE: 853110-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS: COMMERCIAL SECURITY SYSTEM MARKET

- TABLE 11 COMMERCIAL SECURITY SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.11.2 THREAT OF NEW ENTRANTS

- 5.11.3 THREAT OF SUBSTITUTES

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 BARGAINING POWER OF SUPPLIERS

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 12 KEY CONFERENCES AND EVENTS, BY REGION, 2023-2023

- 5.13 REGULATORY LANDSCAPE

- TABLE 13 COMMERCIAL SECURITY SYSTEM MARKET: REGULATORY LANDSCAPE

- 5.13.1 REGIONAL REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS (%)

- 5.14.1 BUYING CRITERIA

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

6 COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE

- 6.1 INTRODUCTION

- FIGURE 38 VIDEO SURVEILLANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 20 COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2019-2022 (USD BILLION)

- TABLE 21 COMMERCIAL SECURITY SYSTEM MARKET, BY HARDWARE, 2023-2028 (USD BILLION)

- TABLE 22 COMMERCIAL SECURITY SYSTEM MARKET FOR HARDWARE, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 23 COMMERCIAL SECURITY SYSTEM MARKET FOR HARDWARE, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 24 COMMERCIAL SECURITY SYSTEM MARKET FOR HARDWARE, BY REGION, 2019-2022 (USD BILLION)

- TABLE 25 COMMERCIAL SECURITY SYSTEM MARKET FOR HARDWARE, BY REGION, 2023-2028 (USD BILLION)

- 6.2 FIRE PROTECTION SYSTEM

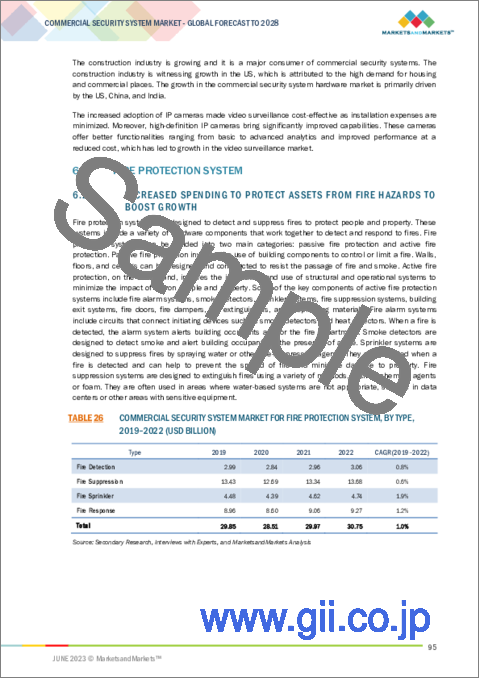

- 6.2.1 INCREASED SPENDING TO PROTECT ASSETS FROM FIRE HAZARDS TO BOOST GROWTH

- TABLE 26 COMMERCIAL SECURITY SYSTEM MARKET FOR FIRE PROTECTION SYSTEM, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 27 COMMERCIAL SECURITY SYSTEM MARKET FOR FIRE PROTECTION SYSTEM, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 28 COMMERCIAL SECURITY SYSTEM MARKET FOR FIRE PROTECTION SYSTEM, BY REGION, 2019-2022 (USD BILLION)

- TABLE 29 COMMERCIAL SECURITY SYSTEM MARKET FOR FIRE PROTECTION SYSTEM, BY REGION, 2023-2028 (USD BILLION)

- 6.2.2 FIRE DETECTION

- 6.2.2.1 Flame detectors

- 6.2.2.2 Smoke detectors

- 6.2.2.3 Heat detectors

- 6.2.3 FIRE SUPPRESSION

- 6.2.3.1 Fire detectors and control panels

- 6.2.3.2 Fire sprinklers, nozzles, caps, and control heads

- 6.2.3.3 Fire suppressor reagents

- 6.2.3.3.1 Chemical

- 6.2.3.3.2 Gaseous

- 6.2.3.3.3 Water

- 6.2.3.3.4 Foam

- 6.2.4 FIRE SPRINKLER SYSTEMS

- 6.2.4.1 Wet

- TABLE 30 ADVANTAGES AND DISADVANTAGES OF WET FIRE SPRINKLER SYSTEMS

- 6.2.4.2 Dry

- 6.2.4.3 Pre-action

- 6.2.4.4 Deluge

- 6.2.4.5 Other fire sprinkler systems

- 6.2.5 FIRE RESPONSE SYSTEMS

- 6.2.5.1 Emergency lighting systems

- 6.2.5.2 Voice evacuation and public alert systems

- 6.2.5.3 Secure communication systems

- 6.2.5.4 Fire alarm devices

- 6.3 VIDEO SURVEILLANCE SYSTEMS

- 6.3.1 TECHNOLOGICAL ADVANCEMENTS IN SURVEILLANCE CAMERAS TO INCREASE ADOPTION

- TABLE 31 COMMERCIAL SECURITY SYSTEM MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 32 COMMERCIAL SECURITY SYSTEM MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 33 COMMERCIAL SECURITY SYSTEM MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY REGION, 2019-2022 (USD BILLION)

- TABLE 34 COMMERCIAL SECURITY SYSTEM MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY REGION, 2023-2028 (USD BILLION)

- 6.3.2 CAMERA

- TABLE 35 IP CAMERA VS. ANALOG CAMERA

- 6.3.3 MONITOR

- 6.3.4 STORAGE DEVICE

- 6.3.4.1 Digital video recorders

- 6.3.4.1.1 Offer cost-effective data storage for cameras

- 6.3.4.2 Network video recorders

- 6.3.4.2.1 Easy to deploy and provide more flexibility

- 6.3.4.1 Digital video recorders

- 6.3.5 ACCESSORIES

- 6.3.5.1 Cables

- 6.3.5.2 Encoders

- 6.4 ACCESS CONTROL SYSTEMS

- 6.4.1 BIOMETRIC READERS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 BIOMETRIC READERS SEGMENT ACCOUNTS FOR LARGEST SHARE IN ACCESS CONTROL SYSTEM MARKET

- TABLE 36 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SYSTEM, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 37 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SYSTEM, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 38 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SYSTEM, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 39 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SYSTEM, BY TYPE, 2023-2028 (MILLION UNITS)

- TABLE 40 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SYSTEM, BY REGION, 2019-2022 (USD BILLION)

- TABLE 41 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SYSTEM, BY REGION, 2023-2028 (USD BILLION)

- 6.4.2 CARD-BASED READERS

- 6.4.2.1 Magnetic stripe cards and readers

- 6.4.2.2 Proximity cards and readers

- 6.4.2.3 Smart cards and readers

- 6.4.3 BIOMETRIC READERS

- 6.4.3.1 Fingerprint recognition

- 6.4.3.2 Palm recognition

- 6.4.3.3 Iris recognition

- 6.4.3.4 Facial recognition

- 6.4.3.5 Voice recognition

- 6.4.4 MULTI-TECHNOLOGY READERS

- 6.4.5 ELECTRONIC LOCKS

- 6.4.6 CONTROLLERS

- 6.4.7 OTHERS

- 6.5 ENTRANCE CONTROL SYSTEMS

- 6.5.1 ASIA PACIFIC TO WITNESS HIGH GROWTH FOR ENTRANCE CONTROL SYSTEMS

- TABLE 42 COMMERCIAL SECURITY SYSTEM MARKET FOR ENTRANCE CONTROL SYSTEM, BY REGION, 2019-2022 (USD BILLION)

- TABLE 43 COMMERCIAL SECURITY SYSTEM MARKET FOR ENTRANCE CONTROL SYSTEM, BY REGION, 2023-2028 (USD BILLION)

7 COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE

- 7.1 INTRODUCTION

- FIGURE 40 VIDEO SURVEILLANCE SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 44 COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2019-2022 (USD BILLION)

- TABLE 45 COMMERCIAL SECURITY SYSTEM MARKET, BY SOFTWARE, 2023-2028 (USD BILLION)

- TABLE 46 COMMERCIAL SECURITY SYSTEM MARKET FOR SOFTWARE, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 47 COMMERCIAL SECURITY SYSTEM MARKET FOR SOFTWARE, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 48 COMMERCIAL SECURITY SYSTEM MARKET FOR SOFTWARE, BY REGION, 2019-2022 (USD BILLION)

- TABLE 49 COMMERCIAL SECURITY SYSTEM MARKET FOR SOFTWARE, BY REGION, 2023-2028 (USD BILLION)

- 7.2 FIRE ANALYSIS SOFTWARE

- 7.2.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR FIRE ANALYSIS SOFTWARE

- 7.2.2 FIRE MAPPING AND ANALYSIS SOFTWARE

- 7.2.3 FIRE MODELING AND SIMULATION SOFTWARE

- TABLE 50 COMMERCIAL SECURITY SYSTEM MARKET FOR FIRE ANALYSIS SOFTWARE, BY REGION, 2019-2022 (USD BILLION)

- TABLE 51 COMMERCIAL SECURITY SYSTEM MARKET FOR FIRE ANALYSIS SOFTWARE, BY REGION, 2023-2028 (USD BILLION)

- 7.3 VIDEO SURVEILLANCE SOFTWARE

- 7.3.1 RISING TRENDS OF DEEP LEARNING AND AI TO DRIVE MARKET GROWTH

- 7.3.2 VIDEO ANALYTICS

- 7.3.3 VIDEO MANAGEMENT SOFTWARE

- 7.3.4 SOFTWARE BY DEPLOYMENT MODE

- 7.3.4.1 On-premises

- 7.3.4.2 Cloud

- TABLE 52 COMMERCIAL SECURITY SYSTEM MARKET FOR VIDEO SURVEILLANCE SOFTWARE, BY REGION, 2019-2022 (USD BILLION)

- TABLE 53 COMMERCIAL SECURITY SYSTEM MARKET FOR VIDEO SURVEILLANCE SOFTWARE, BY REGION, 2023-2028 (USD BILLION)

- 7.4 ACCESS CONTROL SOFTWARE

- 7.4.1 NORTH AMERICA TO BE LARGEST MARKET FOR ACCESS CONTROL SOFTWARE

- 7.4.2 VISITOR MANAGEMENT SYSTEM

- 7.4.3 OTHERS

- TABLE 54 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SOFTWARE, BY REGION, 2019-2022 (USD BILLION)

- TABLE 55 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SOFTWARE, BY REGION, 2023-2028 (USD BILLION)

8 COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICE

- 8.1 INTRODUCTION

- FIGURE 41 SECURITY SYSTEM INTEGRATION SERVICES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 56 COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICES, 2019-2022 (USD BILLION)

- TABLE 57 COMMERCIAL SECURITY SYSTEM MARKET, BY SERVICES, 2023-2028 (USD BILLION)

- TABLE 58 COMMERCIAL SECURITY SYSTEM MARKET FOR SERVICES, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 59 COMMERCIAL SECURITY SYSTEM MARKET FOR SERVICES, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 60 COMMERCIAL SECURITY SYSTEM MARKET FOR SERVICES, BY REGION, 2019-2022 (USD BILLION)

- TABLE 61 COMMERCIAL SECURITY SYSTEM MARKET FOR SERVICES, BY REGION, 2023-2028 (USD BILLION)

- 8.2 SECURITY SYSTEMS INTEGRATION SERVICES

- 8.2.1 SECURITY SYSTEMS INTEGRATION SERVICES TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 62 COMMERCIAL SECURITY SYSTEM MARKET FOR SECURITY SYSTEMS INTEGRATION SERVICES, BY REGION, 2019-2022 (USD BILLION)

- TABLE 63 COMMERCIAL SECURITY SYSTEM MARKET FOR SECURITY SYSTEMS INTEGRATION SERVICES, BY REGION, 2023-2028 (USD BILLION)

- 8.3 REMOTE MONITORING SERVICES

- 8.3.1 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF REMOTE MONITORING SERVICES MARKET DURING FORECAST PERIOD

- TABLE 64 COMMERCIAL SECURITY SYSTEM MARKET FOR REMOTE MONITORING SERVICES, BY REGION, 2019-2022 (USD BILLION)

- TABLE 65 COMMERCIAL SECURITY SYSTEM MARKET FOR REMOTE MONITORING SERVICES, BY REGION, 2023-2028 (USD BILLION)

- 8.4 FIRE PROTECTION SERVICES

- 8.4.1 EUROPE TO WITNESS HIGHEST GROWTH IN FIRE PROTECTION SERVICES SEGMENT DURING FORECAST PERIOD

- TABLE 66 COMMERCIAL SECURITY SYSTEM MARKET FOR FIRE PROTECTION SERVICES, BY REGION, 2019-2022 (USD BILLION)

- TABLE 67 COMMERCIAL SECURITY SYSTEM MARKET FOR FIRE PROTECTION SERVICES, BY REGION, 2023-2028 (USD BILLION)

- 8.4.2 MAINTENANCE SERVICES

- 8.4.3 MANAGED SERVICES

- 8.4.4 ENGINEERING SERVICES

- 8.4.5 INSTALLATION AND DESIGN SERVICES

- 8.4.6 OTHER SERVICES

- 8.5 VIDEO SURVEILLANCE SERVICES

- 8.5.1 INSTALLATION AND MAINTENANCE SERVICES FOR VIDEO SURVEILLANCE TO ACCOUNT FOR LARGEST SHARE

- TABLE 68 COMMERCIAL SECURITY SYSTEM MARKET FOR VIDEO SURVEILLANCE SERVICES, BY REGION, 2019-2022 (USD BILLION)

- TABLE 69 COMMERCIAL SECURITY SYSTEM MARKET FOR VIDEO SURVEILLANCE SERVICES, BY REGION, 2023-2028 (USD BILLION)

- 8.5.2 VSAAS

- 8.5.2.1 Hosted

- 8.5.2.1.1 Rising adoption of cloud services to drive growth

- 8.5.2.2 Managed

- 8.5.2.2.1 Reduced operational costs to provide opportunities for managed VSaaS

- 8.5.2.3 Hybrid

- 8.5.2.3.1 Data security, remote access, flexibility, and scalability features to drive adoption

- 8.5.2.1 Hosted

- 8.5.3 INSTALLATION AND MAINTENANCE SERVICES

- 8.5.3.1 Growing video surveillance market to drive demand

- 8.6 ACCESS CONTROL SERVICES

- 8.6.1 GROWING IMPLEMENTATION OF SECURITY SOLUTIONS TO BOOST DEMAND FOR INSTALLATION AND INTEGRATION SERVICES

- TABLE 70 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SERVICES, BY REGION, 2019-2022 (USD BILLION)

- TABLE 71 COMMERCIAL SECURITY SYSTEM MARKET FOR ACCESS CONTROL SERVICES, BY REGION, 2023-2028 (USD BILLION)

- 8.6.2 INSTALLATION AND INTEGRATION

- 8.6.3 SUPPORT AND MAINTENANCE

- 8.6.4 ACCESS CONTROL AS A SERVICE

- 8.6.4.1 Hosted ACaaS

- 8.6.4.2 Managed ACaaS

- 8.6.4.3 Hybrid ACaaS

9 COMMERCIAL SECURITY SYSTEM MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 42 COMMERCIAL VERTICAL ACCOUNTS FOR LARGEST SHARE IN OVERALL COMMERCIAL SECURITY SYSTEM MARKET

- TABLE 72 COMMERCIAL SECURITY SYSTEM MARKET, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 73 COMMERCIAL SECURITY SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD BILLION)

- 9.2 COMMERCIAL

- 9.2.1 COMMERCIAL SECURITY SYSTEMS WIDELY USED TO PREVENT SECURITY BREACH

- TABLE 74 COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 75 COMMERCIAL SECURITY SYSTEM MARKET FOR COMMERCIAL VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.3 GOVERNMENT

- 9.3.1 NEED TO RESTRICT UNAUTHORIZED ENTRY AND SAFEGUARD ASSETS TO DRIVE MARKET

- TABLE 76 COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 77 COMMERCIAL SECURITY SYSTEM MARKET FOR GOVERNMENT VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.4 TRANSPORTATION

- 9.4.1 RISE IN CRIMES AND VANDALISM-RELATED THREATS TO INCREASE NEED FOR SURVEILLANCE

- TABLE 78 COMMERCIAL SECURITY SYSTEM MARKET FOR TRANSPORTATION VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 79 COMMERCIAL SECURITY SYSTEM MARKET FOR TRANSPORTATION VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.5 RETAIL

- 9.5.1 INVESTMENTS IN VIDEO SURVEILLANCE CAMERAS PROVIDING LONG-TERM BENEFITS

- TABLE 80 COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 81 COMMERCIAL SECURITY SYSTEM MARKET FOR RETAIL VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.6 BANKING & FINANCE

- 9.6.1 STRINGENT GOVERNMENT POLICIES AND REGULATIONS TO DRIVE MARKET GROWTH

- TABLE 82 COMMERCIAL SECURITY SYSTEM MARKET FOR BANKING & FINANCE VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 83 COMMERCIAL SECURITY SYSTEM MARKET FOR BANKING & FINANCE VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.7 EDUCATION

- 9.7.1 FIRE PROTECTION SYSTEMS WITNESSING RISING ADOPTION IN EDUCATIONAL AND ACADEMIC BUILDINGS

- TABLE 84 COMMERCIAL SECURITY SYSTEM MARKET FOR EDUCATION VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 85 COMMERCIAL SECURITY SYSTEM MARKET FOR EDUCATION VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.8 INDUSTRIAL

- 9.8.1 INCREASE IN TERROR THREATS AND INCIDENTS OF THEFT TO DRIVE ADOPTION OF VIDEO SURVEILLANCE SYSTEMS

- TABLE 86 COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 87 COMMERCIAL SECURITY SYSTEM MARKET FOR INDUSTRIAL VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.9 ENERGY & UTILITY

- 9.9.1 REAL-TIME VIDEO SURVEILLANCE OF POWER SUBSTATIONS TO PROVIDE AUTOMATIC MONITORING AND CONTROL CAPABILITIES

- TABLE 88 COMMERCIAL SECURITY SYSTEM MARKET FOR ENERGY & UTILITY VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 89 COMMERCIAL SECURITY SYSTEM MARKET FOR ENERGY & UTILITY VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.10 SPORTS & LEISURE

- 9.10.1 VIDEO SURVEILLANCE USED TO ENSURE SAFETY OF PEOPLE AND FACILITIES

- TABLE 90 COMMERCIAL SECURITY SYSTEM MARKET FOR SPORTS & LEISURE VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 91 COMMERCIAL SECURITY SYSTEM MARKET FOR SPORTS & LEISURE VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.11 HEALTHCARE

- 9.11.1 HEALTHCARE SECTOR INCREASINGLY ADOPTING BIOMETRICS FOR PATIENT IDENTIFICATION AND STAFF ATTENDANCE TRACKING

- TABLE 92 COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 93 COMMERCIAL SECURITY SYSTEM MARKET FOR HEALTHCARE VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

- 9.12 MILITARY & DEFENSE

- 9.12.1 ACCESS CONTROL WIDELY USED IN MILITARY & DEFENSE SECTOR

- TABLE 94 COMMERCIAL SECURITY SYSTEM MARKET FOR MILITARY & DEFENSE VERTICAL, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 95 COMMERCIAL SECURITY SYSTEM MARKET FOR MILITARY & DEFENSE VERTICAL, BY OFFERING, 2023-2028 (USD BILLION)

10 COMMERCIAL SECURITY SYSTEM MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 43 COMMERCIAL SECURITY SYSTEM MARKET, BY REGION

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN COMMERCIAL SECURITY SYSTEM MARKET DURING FORECAST PERIOD

- TABLE 96 COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 97 COMMERCIAL SECURITY SYSTEM MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.2 NORTH AMERICA

- FIGURE 45 NORTH AMERICA: COMMERCIAL SECURITY SYSTEM MARKET SNAPSHOT

- TABLE 98 COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 99 COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 100 COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 101 COMMERCIAL SECURITY SYSTEM MARKET FOR NORTH AMERICA, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 102 COMMERCIAL SECURITY HARDWARE MARKET FOR NORTH AMERICA, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 103 COMMERCIAL SECURITY HARDWARE MARKET FOR NORTH AMERICA, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 104 COMMERCIAL SECURITY SOFTWARE MARKET FOR NORTH AMERICA, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 105 COMMERCIAL SECURITY SOFTWARE MARKET FOR NORTH AMERICA, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 106 COMMERCIAL SECURITY SERVICES MARKET FOR NORTH AMERICA, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 107 COMMERCIAL SECURITY SERVICES MARKET FOR NORTH AMERICA, BY VERTICAL, 2023-2028 (USD BILLION)

- 10.2.1 US

- 10.2.1.1 Rise in crime rate leading to increasing adoption of effective security solutions

- 10.2.2 CANADA

- 10.2.2.1 Adoption of access control systems driven by increasing demand from industrial and government verticals

- 10.2.3 MEXICO

- 10.2.3.1 Increasing focus on security to fuel demand for commercial security systems

- 10.2.4 NORTH AMERICA: RECESSION IMPACT

- 10.3 EUROPE

- FIGURE 46 EUROPE: COMMERCIAL SECURITY SYSTEM MARKET SNAPSHOT

- TABLE 108 COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 109 COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 110 COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 111 COMMERCIAL SECURITY SYSTEM MARKET FOR EUROPE, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 112 COMMERCIAL SECURITY HARDWARE MARKET FOR EUROPE, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 113 COMMERCIAL SECURITY HARDWARE MARKET FOR EUROPE, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 114 COMMERCIAL SECURITY SOFTWARE MARKET FOR EUROPE, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 115 COMMERCIAL SECURITY SOFTWARE MARKET FOR EUROPE, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 116 COMMERCIAL SECURITY SERVICES MARKET FOR EUROPE, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 117 COMMERCIAL SECURITY SERVICES MARKET FOR EUROPE, BY VERTICAL, 2023-2028 (USD BILLION)

- 10.3.1 UK

- 10.3.1.1 Market to witness significant growth due to government initiatives

- 10.3.2 GERMANY

- 10.3.2.1 Germany to account for largest share of market in Europe

- 10.3.3 FRANCE

- 10.3.3.1 Increased demand for video surveillance system to drive market

- 10.3.4 ITALY

- 10.3.4.1 Commercial security system market in Italy to register second-highest CAGR in Europe

- 10.3.5 RUSSIA

- 10.3.5.1 Demand for commercial security systems increasing due to crime and terrorism

- 10.3.6 REST OF EUROPE

- 10.3.7 EUROPE: RECESSION IMPACT

- 10.4 ASIA PACIFIC

- FIGURE 47 ASIA PACIFIC: COMMERCIAL SECURITY SYSTEM MARKET SNAPSHOT

- TABLE 118 COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 119 COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 120 COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 121 COMMERCIAL SECURITY SYSTEM MARKET FOR ASIA PACIFIC, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 122 COMMERCIAL SECURITY HARDWARE MARKET FOR ASIA PACIFIC, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 123 COMMERCIAL SECURITY HARDWARE MARKET FOR ASIA PACIFIC, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 124 COMMERCIAL SECURITY SOFTWARE MARKET FOR ASIA PACIFIC, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 125 COMMERCIAL SECURITY SOFTWARE MARKET FOR ASIA PACIFIC, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 126 COMMERCIAL SECURITY SERVICES MARKET FOR ASIA PACIFIC, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 127 COMMERCIAL SECURITY SERVICES MARKET FOR ASIA PACIFIC, BY VERTICAL, 2023-2028 (USD BILLION)

- 10.4.1 CHINA

- 10.4.1.1 China to be largest market for commercial security systems in Asia Pacific

- 10.4.2 JAPAN

- 10.4.2.1 Government initiatives to raise public awareness about fire safety precautions to drive market

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Presence of many cybersecurity companies to support market growth

- 10.4.4 INDIA

- 10.4.4.1 India projected to register highest CAGR during forecast period

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.6 ASIA PACIFIC: RECESSION IMPACT

- 10.5 ROW

- FIGURE 48 MIDDLE EAST & AFRICA TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- TABLE 128 COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2019-2022 (USD BILLION)

- TABLE 129 COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY REGION, 2023-2028 (USD BILLION)

- TABLE 130 COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY OFFERING, 2019-2022 (USD BILLION)

- TABLE 131 COMMERCIAL SECURITY SYSTEM MARKET FOR ROW, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 132 COMMERCIAL SECURITY HARDWARE MARKET FOR ROW, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 133 COMMERCIAL SECURITY HARDWARE MARKET FOR ROW, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 134 COMMERCIAL SECURITY SOFTWARE MARKET FOR ROW, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 135 COMMERCIAL SECURITY SOFTWARE MARKET FOR ROW, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 136 COMMERCIAL SECURITY SERVICES MARKET FOR ROW, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 137 COMMERCIAL SECURITY SERVICES MARKET FOR ROW, BY VERTICAL, 2023-2028 (USD BILLION)

- 10.5.1 MIDDLE EAST & AFRICA

- 10.5.1.1 High demand for access control systems to drive market

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Market in South America projected to register high growth during forecast period

- 10.5.3 ROW: RECESSION IMPACT

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET EVALUATION FRAMEWORK

- TABLE 138 KEY STRATEGIES UNDERTAKEN BY LEADING PLAYERS IN COMMERCIAL SECURITY SYSTEM MARKET FROM 2021 TO 2023

- 11.2.1 PRODUCT PORTFOLIO

- 11.2.2 REGIONAL FOCUS

- 11.2.3 MANUFACTURING FOOTPRINT

- 11.2.4 ORGANIC/INORGANIC STRATEGIES

- 11.3 MARKET SHARE AND RANKING ANALYSIS

- TABLE 139 COMMERCIAL SECURITY SYSTEM MARKET: DEGREE OF COMPETITION

- FIGURE 49 MARKET SHARE OF TOP FIVE PLAYERS OFFERING COMMERCIAL SECURITY SYSTEM

- 11.4 COMPANY REVENUE ANALYSIS

- FIGURE 50 REVENUE ANALYSIS OF KEY COMPANIES

- 11.5 COMPANY EVALUATION QUADRANT, 2022

- FIGURE 51 COMMERCIAL SECURITY SYSTEM MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 140 COMMERCIAL SECURITY SYSTEM MARKET: COMPANY FOOTPRINT

- TABLE 141 COMMERCIAL SECURITY SYSTEM MARKET: VERTICAL FOOTPRINT

- TABLE 142 COMMERCIAL SECURITY SYSTEM MARKET: REGION FOOTPRINT

- 11.7 STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 52 COMMERCIAL SECURITY SYSTEM MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- TABLE 143 COMMERCIAL SECURITY SYSTEM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 144 COMMERCIAL SECURITY SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- TABLE 145 PRODUCT LAUNCHES, 2021-MAY 2023

- 11.8.2 DEALS

- TABLE 146 DEALS, 2021-MAY 2023

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)**

- 12.2.1 JOHNSON CONTROLS

- TABLE 147 JOHNSON CONTROLS: COMPANY OVERVIEW

- FIGURE 53 JOHNSON CONTROLS: COMPANY SNAPSHOT

- 12.2.2 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- TABLE 148 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 54 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- 12.2.3 CARRIER

- TABLE 149 CARRIER: COMPANY OVERVIEW

- FIGURE 55 CARRIER: COMPANY SNAPSHOT

- 12.2.4 HONEYWELL INTERNATIONAL INC.

- TABLE 150 HONEYWELL INTERNATIONAL INC: COMPANY OVERVIEW

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- 12.2.5 DAHUA TECHNOLOGY CO., LTD.

- TABLE 151 DAHUA TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 57 DAHUA TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- 12.2.6 DORMAKABA GROUP

- TABLE 152 DORMAKABA GROUP: COMPANY OVERVIEW

- FIGURE 58 DORMAKABA GROUP: COMPANY SNAPSHOT

- 12.2.7 ROBERT BOSCH (BOSCH SICHERHEITSSYSTEME GMBH)

- TABLE 153 ROBERT BOSCH GMBH (BOSCH SICHERHEITSSYSTEME GMBH): COMPANY OVERVIEW

- FIGURE 59 ROBERT BOSCH GMBH (BOSCH SICHERHEITSSYSTEME GMBH): COMPANY SNAPSHOT

- 12.2.8 AXIS COMMUNICATIONS AB

- TABLE 154 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- FIGURE 60 AXIS COMMUNICATIONS AB: COMPANY SNAPSHOT

- 12.2.9 SECOM CO., LTD.

- TABLE 155 SECOM CO., LTD.: COMPANY OVERVIEW

- FIGURE 61 SECOM CO., LTD.: COMPANY SNAPSHOT

- 12.2.10 ASSA ABLOY

- TABLE 156 ASSA ABLOY: COMPANY OVERVIEW

- FIGURE 62 ASSA ABLOY: COMPANY SNAPSHOT

- * Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 12.3 OTHER KEY PLAYERS

- 12.3.1 ADT

- 12.3.2 SIEMENS

- 12.3.3 HALMA PLC

- 12.3.4 HOCHIKI CORPORATION

- 12.3.5 TELEDYNE FLIR LLC

- 12.3.6 ALLEGION PLC

- 12.3.7 NICE S.P.A.

- 12.3.8 ALARM.COM

- 12.3.9 MOTOROLA SOLUTIONS, INC. (AVIGILON)

- 12.3.10 DALLMEIER ELECTRONIC GMBH & CO. KG

- 12.3.11 SECURITAS TECHNOLOGY

- 12.3.12 GUNNEBO AB

- 12.3.13 CONTROL4

- 12.3.14 VIKING GROUP INC.

- 12.3.15 NORDEN

- 12.3.16 VIVINT, INC.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS