|

|

市場調査レポート

商品コード

1614460

エッジAIソフトウェアの世界市場:オファリング別、データモダリティ別、技術別、最終用途別、地域別 - 2030年までの予測Edge AI Software Market by Technology (Generative AI, Machine Learning (ML) (Supervised Learning, Reinforcement Learning), Natural Language Processing (NLP), Computer Vision), Data Modality (Spatial Data, Temporal Data) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| エッジAIソフトウェアの世界市場:オファリング別、データモダリティ別、技術別、最終用途別、地域別 - 2030年までの予測 |

|

出版日: 2024年12月10日

発行: MarketsandMarkets

ページ情報: 英文 345 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

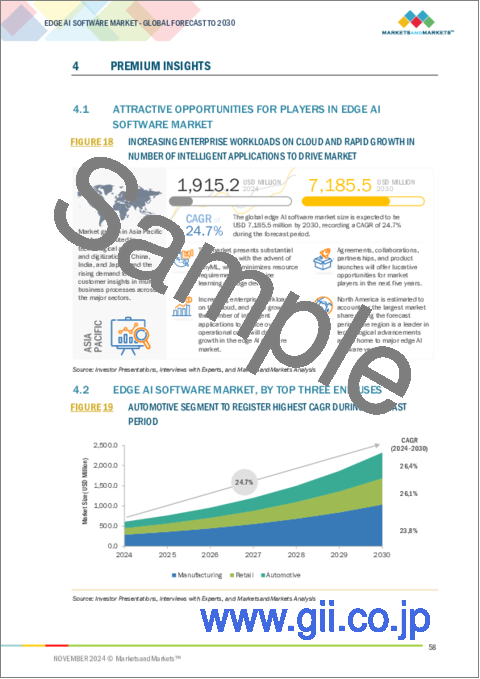

エッジAIソフトウェアの市場規模は、2024年の19億2,000万米ドルから2030年には71億9,000万米ドルに成長し、予測期間中のCAGRは24.7%になると予測されています。

同市場は、エッジAIを活用した予知保全により、機器の故障を事前にリアルタイムで監視・予測できるようになり、産業オペレーションが変革されつつあること、エッジAIにより、スマートフォン、ウェアラブル、スマートホームシステムなどのデバイスでローカルにデータを処理することで、消費者に高度にパーソナライズされた体験を提供できるようになりつつあること、スマートグリッドやエネルギー管理システムが、エッジAIの分散型インテリジェンスを提供する能力から大きな恩恵を受けていることなどから、成長が見込まれています。しかし、エッジでの機械学習モデルの展開と管理の複雑さ、標準プロトコルの不在、異なるエッジAIプラットフォーム、デバイス、エコシステム間の相互運用性により成長が抑制される可能性があり、エッジAIインフラストラクチャの構築と拡張に必要な高額な初期投資は、一部の組織にとって法外な負担となる可能性があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | オファリング別、データモダリティ別、技術別、最終用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

プラットフォームソリューションは、多様なAI機能を統合し、展開を合理化し、業界を横断して拡張可能な用途をサポートする能力により、エッジAIソフトウェア市場で最も高いCAGR成長を記録すると予想されます。これらのプラットフォームは、エッジデバイス上でのAIモデルのシームレスな開発、テスト、展開を可能にし、複雑さを軽減して市場投入までの時間を短縮します。将来のビジネスチャンスは、自律システム、高度なロボット工学、分散型IoTエコシステムにこれらのソリューションを活用することにあります。カスタマイズ可能なプラットフォームは、リアルタイム分析、データセキュリティ、相互運用性などの特定の要件に対応でき、ヘルスケア、自動車、産業オートメーションなどの分野での採用を促進します。

予測期間中、リアルタイムの品質管理、予知保全、ロボティクス自動化への採用により、製造業がエッジAIソフトウェア市場を独占すると予測されます。エッジAIは、製造業者が膨大な量のマシンデータをローカルで処理することを可能にし、待ち時間を短縮して業務効率を高める。将来的な可能性としては、スマート工場ソリューションへのエッジAIの活用、エネルギー消費の最適化、自律的な生産ラインの実現などが挙げられます。製造業がインダストリー4.0への取り組みを優先し、重要な業務にローカライズされたインテリジェンスを求める中、この分野でのエッジAIソフトウェアの導入は今後も急速に拡大していくでしょう。

当レポートでは、世界のエッジAIソフトウェア市場について調査し、オファリング別、データモダリティ別、技術別、最終用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- エッジAIソフトウェア市場におけるジェネレーティブAIの影響

- エッジAIソフトウェア市場:進化

- エコシステム分析

- サプライチェーン分析

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 2024年~2025年の主な会議とイベント

- ポーターのファイブフォース分析

- 顧客ビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

第6章 エッジAIソフトウェア市場、オファリング別

- イントロダクション

- ソフトウェア

- サービス

第7章 エッジAIソフトウェア市場、データモダリティ別

- イントロダクション

- 視覚データ

- 聴覚データ

- テキストデータ

- 空間データ

- 時間データ

- マルチモーダルデータ

第8章 エッジAIソフトウェア市場、技術別

- イントロダクション

- 生成AI

- その他

第9章 エッジAIソフトウェア市場、最終用途別

- イントロダクション

- 製造

- ヘルスケア・ライフサイエンス

- エネルギー・ユーティリティ

- 通信

- 小売

- 自動車

- 輸送・物流

- スマートシティ

- BFSI

- 消費者向け電子機器およびデバイス

- その他

第10章 エッジAIソフトウェア市場、地域別

- イントロダクション

- 北米

- 促進要因:北米のエッジAIソフトウェア市場

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 促進要因:欧州のエッジAIソフトウェア市場

- 欧州:マクロ経済見通し

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- その他

- アジア太平洋

- 促進要因:アジア太平洋のエッジAIソフトウェア市場

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- オーストラリアとニュージーランド

- ASEAN諸国

- その他

- 中東・アフリカ

- 促進要因:中東・アフリカのエッジAIソフトウェア市場

- 中東・アフリカ:マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- 促進要因:ラテンアメリカのエッジAIソフトウェア市場

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/有力企業、2023年~2024年

- 収益分析

- 市場シェア分析、2023年

- ブランド/製品比較

- 企業価値評価と財務指標

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第12章 企業プロファイル

- イントロダクション

- MICROSOFT

- IBM

- AWS

- NUTANIX

- SYNAPTICS

- GORILLA TECHNOLOGIES

- INFINEON TECHNOLOGIES

- INTEL

- VEEA

- その他の企業

- INTENT HQ

- BAIDU

- NVIDIA

- ALIBABA CLOUD

- BOSCH GLOBAL SOFTWARE TECHNOLOGIES

- AZION

- BLAIZE

- CLEARBLADE

- JOHNSON CONTROLS

- MIDOKURA

- スタートアップ/中小企業のプロファイル

- AXELERA AI

- EDGE IMPULSE

- LATENT AI

- TERAKI

- EKKONO

- SPECTRO CLOUD

- BARBARA

- INVISION AI

- HORIZON ROBOTICS

- KNERON

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATE, 2019-2023

- TABLE 2 KEY PARTICIPANTS IN PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 EDGE AI SOFTWARE MARKET SIZE AND GROWTH RATE, 2019-2023 (USD MILLION, Y-O-Y)

- TABLE 5 EDGE AI SOFTWARE MARKET SIZE AND GROWTH RATE, 2024-2030 (USD MILLION, Y-O-Y)

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EDGE AI SOFTWARE MARKET: PATENTS FILED, 2015-2024

- TABLE 12 EDGE AI SOFTWARE-RELATED PATENTS, 2023-2024

- TABLE 13 INDICATIVE PRICING ANALYSIS OF EDGE AI SOFTWARE, BY DATA MODALITY

- TABLE 14 INDICATIVE PRICING ANALYSIS OF EDGE AI SOFTWARE, BY OFFERING

- TABLE 15 EDGE AI SOFTWARE MARKET: KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 16 EDGE AI SOFTWARE MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 19 EDGE AI SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 20 EDGE AI SOFTWARE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 21 SOFTWARE: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 22 SOFTWARE: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 23 SOFTWARE: EDGE AI SOFTWARE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 24 SOFTWARE: EDGE AI SOFTWARE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 25 PLATFORMS: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 PLATFORMS: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 27 SOFTWARE DEVELOPMENT KITS: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 28 SOFTWARE DEVELOPMENT KITS: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 FRAMEWORKS & TOOLKITS: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 FRAMEWORKS & TOOLKITS: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 31 SOFTWARE: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 32 SOFTWARE: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 33 CLOUD: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 CLOUD: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

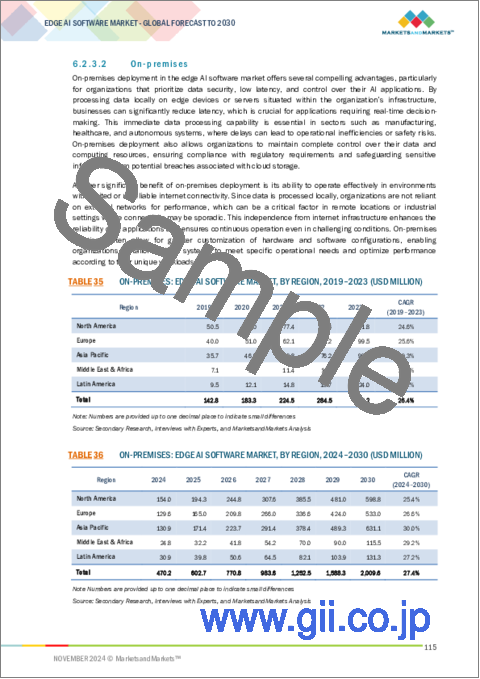

- TABLE 35 ON-PREMISES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 36 ON-PREMISES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 37 EDGE AI SOFTWARE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 38 EDGE AI SOFTWARE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 39 SERVICES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 SERVICES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 41 PROFESSIONAL SERVICES: EDGE AI SOFTWARE MARKET, 2019-2023 (USD MILLION)

- TABLE 42 PROFESSIONAL SERVICES: EDGE AI SOFTWARE MARKET, 2024-2030 (USD MILLION)

- TABLE 43 PROFESSIONAL SERVICES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 44 PROFESSIONAL SERVICES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 45 TRAINING & CONSULTING: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 TRAINING & CONSULTING: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 SYSTEM INTEGRATION & TESTING: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 SYSTEM INTEGRATION & TESTING: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 49 SUPPORT & MAINTENANCE: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 SUPPORT & MAINTENANCE: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 51 MANAGED SERVICES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 52 MANAGED SERVICES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 53 EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2019-2023 (USD MILLION)

- TABLE 54 EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2024-2030 (USD MILLION)

- TABLE 55 VISUAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 VISUAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 AUDITORY DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 AUDITORY DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 59 TEXTUAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 TEXTUAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 61 SPATIAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 62 SPATIAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 63 TEMPORAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 64 TEMPORAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 MULTIMODAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 MULTIMODAL DATA: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 67 EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 68 EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 69 GENERATIVE AI: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 GENERATIVE AI: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 71 OTHER AI: EDGE AI SOFTWARE MARKET, 2019-2023 (USD MILLION)

- TABLE 72 OTHER AI: EDGE AI SOFTWARE MARKET, 2024-2030 (USD MILLION)

- TABLE 73 OTHER AI: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 OTHER AI: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 MACHINE LEARNING: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 76 MACHINE LEARNING: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 77 NATURAL LANGUAGE PROCESSING: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 NATURAL LANGUAGE PROCESSING: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 79 COMPUTER VISION: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 80 COMPUTER VISION: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 81 OTHER TECHNOLOGIES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 OTHER TECHNOLOGIES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 83 EDGE AI SOFTWARE MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 84 EDGE AI SOFTWARE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 85 MANUFACTURING: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 MANUFACTURING: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 87 HEALTHCARE & LIFE SCIENCES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 88 HEALTHCARE & LIFE SCIENCES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 89 ENERGY & UTILITIES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 ENERGY & UTILITIES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 91 TELECOMMUNICATION: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 92 TELECOMMUNICATION: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 93 RETAIL: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 94 RETAIL: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 95 AUTOMOTIVE: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 96 AUTOMOTIVE: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 97 TRANSPORTATION & LOGISTICS: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 98 TRANSPORTATION & LOGISTICS: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 99 SMART CITIES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 100 SMART CITIES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 101 BFSI: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 102 BFSI: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 103 CONSUMER ELECTRONICS & DEVICES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 104 CONSUMER ELECTRONICS & DEVICES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 105 OTHER END USES: EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 106 OTHER END USES: EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 107 EDGE AI SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 108 EDGE AI SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 110 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 112 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 114 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 116 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 118 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2024-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2019-2023 (USD MILLION)

- TABLE 120 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2024-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2019-2023 (USD MILLION)

- TABLE 124 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2024-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 126 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 128 NORTH AMERICA: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 129 EUROPE: EDGE AI SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 130 EUROPE: EDGE AI SOFTWARE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 131 EUROPE: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 132 EUROPE: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 133 EUROPE: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 134 EUROPE: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 135 EUROPE: EDGE AI SOFTWARE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 136 EUROPE: EDGE AI SOFTWARE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 137 EUROPE: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 138 EUROPE: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2024-2030 (USD MILLION)

- TABLE 139 EUROPE: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2019-2023 (USD MILLION)

- TABLE 140 EUROPE: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2024-2030 (USD MILLION)

- TABLE 141 EUROPE: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 142 EUROPE: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 143 EUROPE: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2019-2023 (USD MILLION)

- TABLE 144 EUROPE: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2024-2030 (USD MILLION)

- TABLE 145 EUROPE: EDGE AI SOFTWARE MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 146 EUROPE: EDGE AI SOFTWARE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 147 EUROPE: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 148 EUROPE: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 150 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 152 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 154 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 156 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 158 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2024-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2019-2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2024-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 163 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2019-2023 (USD MILLION)

- TABLE 164 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2024-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 168 ASIA PACIFIC: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2024-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2019-2023 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2024-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2019-2023 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2024-2030 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY SUB-REGION, 2019-2023 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY SUB-REGION, 2024-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 192 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 193 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 194 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 195 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 196 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 197 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 198 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 199 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 200 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY PROFESSIONAL SERVICE, 2024-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2019-2023 (USD MILLION)

- TABLE 202 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY DATA MODALITY, 2024-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 204 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 205 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2019-2023 (USD MILLION)

- TABLE 206 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY OTHER AI TECHNOLOGIES, 2024-2030 (USD MILLION)

- TABLE 207 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 208 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 209 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 210 LATIN AMERICA: EDGE AI SOFTWARE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 211 OVERVIEW OF STRATEGIES ADOPTED BY KEY EDGE AI SOFTWARE VENDORS, 2023-2024

- TABLE 212 EDGE AI SOFTWARE MARKET: DEGREE OF COMPETITION

- TABLE 213 EDGE AI SOFTWARE MARKET: REGION FOOTPRINT

- TABLE 214 EDGE AI SOFTWARE MARKET: OFFERING FOOTPRINT

- TABLE 215 EDGE AI SOFTWARE MARKET: TECHNOLOGY FOOTPRINT

- TABLE 216 EDGE AI SOFTWARE MARKET: END USE FOOTPRINT

- TABLE 217 EDGE AI SOFTWARE MARKET: KEY STARTUPS/SMES

- TABLE 218 EDGE AI SOFTWARE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 219 EDGE AI SOFTWARE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2022- NOVEMBER 2024

- TABLE 220 EDGE AI SOFTWARE MARKET: DEALS, JANUARY 2022-NOVEMBER 2024

- TABLE 221 MICROSOFT: COMPANY OVERVIEW

- TABLE 222 MICROSOFT: PRODUCTS OFFERED

- TABLE 223 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 224 MICROSOFT: DEALS

- TABLE 225 IBM: COMPANY OVERVIEW

- TABLE 226 IBM: PRODUCTS OFFERED

- TABLE 227 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 228 IBM: DEALS

- TABLE 229 GOOGLE: COMPANY OVERVIEW

- TABLE 230 GOOGLE: PRODUCTS OFFERED

- TABLE 231 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 232 GOOGLE: DEALS

- TABLE 233 AWS: COMPANY OVERVIEW

- TABLE 234 AWS: PRODUCTS OFFERED

- TABLE 235 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 236 AWS: DEALS

- TABLE 237 NUTANIX: COMPANY OVERVIEW

- TABLE 238 NUTANIX: PRODUCTS OFFERED

- TABLE 239 NUTANIX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 240 NUTANIX: DEALS

- TABLE 241 SYNAPTICS: COMPANY OVERVIEW

- TABLE 242 SYNAPTICS: PRODUCTS OFFERED

- TABLE 243 SYNAPTICS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 244 SYNAPTICS: DEALS

- TABLE 245 GORILLA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 246 GORILLA TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 247 GORILLA TECHNOLOGIES: DEALS

- TABLE 248 INFINEON TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 249 INFINEON TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 250 INFINEON TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 251 INFINEON TECHNOLOGIES: DEALS

- TABLE 252 INTEL: COMPANY OVERVIEW

- TABLE 253 INTEL: PRODUCTS

- TABLE 254 INTEL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 255 INTEL: DEALS

- TABLE 256 VEEA: COMPANY OVERVIEW

- TABLE 257 VEEA: PRODUCTS OFFERED

- TABLE 258 VEEA: DEALS

- TABLE 259 AXELERA AI: COMPANY OVERVIEW

- TABLE 260 AXELERA AI: PRODUCTS OFFERED

- TABLE 261 AXELERA AI: DEALS

- TABLE 262 EDGE IMPULSE: COMPANY OVERVIEW

- TABLE 263 EDGE IMPULSE: PRODUCTS OFFERED

- TABLE 264 EDGE IMPULSE: DEALS

- TABLE 265 EDGE COMPUTING MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 266 EDGE COMPUTING MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 267 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 268 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 269 EDGE COMPUTING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 270 EDGE COMPUTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 271 EDGE COMPUTING MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 272 EDGE COMPUTING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 273 EDGE COMPUTING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 274 EDGE COMPUTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 275 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 276 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2024-2030 (USD BILLION)

- TABLE 277 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2019-2023 (USD BILLION)

- TABLE 278 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2024-2030 (USD BILLION)

- TABLE 279 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD BILLION)

- TABLE 280 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2024-2030 (USD BILLION)

- TABLE 281 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2019-2023 (USD BILLION)

- TABLE 282 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2024-2030 (USD BILLION)

- TABLE 283 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2019-2023 (USD BILLION)

- TABLE 284 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2024-2030 (USD BILLION)

List of Figures

- FIGURE 1 EDGE AI SOFTWARE MARKET: RESEARCH DESIGN

- FIGURE 2 EDGE AI SOFTWARE MARKET: DATA TRIANGULATION

- FIGURE 3 TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM EDGE AI SOFTWARE PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL EDGE AI SOFTWARE PRODUCTS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL EDGE AI SOFTWARE PRODUCTS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF EDGE AI SOFTWARE MARKET THROUGH OVERALL EDGE AI SOFTWARE SPENDING

- FIGURE 8 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2024

- FIGURE 9 PLATFORMS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 10 CLOUD SEGMENT TO LEAD MARKET IN 2024

- FIGURE 11 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2024

- FIGURE 12 TRAINING & CONSULTING SEGMENT TO LEAD PROFESSIONAL SERVICES MARKET IN 2024

- FIGURE 13 VISUAL DATA SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2024

- FIGURE 14 OTHER AI SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 15 MACHINE LEARNING SEGMENT TO LEAD MARKET IN 2024

- FIGURE 16 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 EDGE AI SOFTWARE MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 INCREASING ENTERPRISE WORKLOADS ON CLOUD AND RAPID GROWTH IN NUMBER OF INTELLIGENT APPLICATIONS TO DRIVE MARKET

- FIGURE 19 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 VISUAL DATA AND MANUFACTURING SEGMENTS TO ACCOUNT FOR LARGEST MARKET SHARES IN 2024

- FIGURE 21 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 22 EDGE AI SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 POTENTIAL OF GENERATIVE AI USE IN EDGE AI SOFTWARE

- FIGURE 24 EVOLUTION OF EDGE AI SOFTWARE MARKET

- FIGURE 25 EDGE AI SOFTWARE MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 26 EDGE AI SOFTWARE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 LEADING EDGE AI SOFTWARE VENDORS, BY FUNDING VALUE (MILLION) AND FUNDING ROUND, 2024

- FIGURE 28 EDGE AI SOFTWARE MARKET: NUMBER OF PATENTS GRANTED, 2015-2024

- FIGURE 29 REGIONAL ANALYSIS OF EDGE AI SOFTWARE-RELATED PATENTS GRANTED, 2015-2024

- FIGURE 30 EDGE AI SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 EDGE AI SOFTWARE MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE END USES

- FIGURE 34 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 PLATFORMS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST

- FIGURE 36 ON-PREMISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 MANAGED SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 SUPPORT & MAINTENANCE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 AUDITORY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 MACHINE LEARNING SEGMENT TO LEAD DURING FORECAST PERIOD

- FIGURE 42 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 EDGE AI SOFTWARE MARKET IN INDIA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: EDGE AI SOFTWARE MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: EDGE AI SOFTWARE MARKET SNAPSHOT

- FIGURE 47 TOP FIVE PLAYERS DOMINATED MARKET OVER LAST FIVE YEARS

- FIGURE 48 SHARE OF LEADING COMPANIES IN EDGE AI SOFTWARE MARKET, 2023

- FIGURE 49 EDGE AI SOFTWARE MARKET: BRAND/PRODUCT COMPARISON, BY OFFERING

- FIGURE 50 EDGE AI SOFTWARE MARKET: BRAND/PRODUCT COMPARISON, BY DATA MODALITY

- FIGURE 51 EDGE AI SOFTWARE MARKET: COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 52 EDGE AI SOFTWARE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 53 EDGE AI SOFTWARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 54 EDGE AI SOFTWARE MARKET: COMPANY FOOTPRINT

- FIGURE 55 EDGE AI SOFTWARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 56 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 57 IBM: COMPANY SNAPSHOT

- FIGURE 58 GOOGLE: COMPANY SNAPSHOT

- FIGURE 59 AWS: COMPANY SNAPSHOT

- FIGURE 60 NUTANIX: COMPANY SNAPSHOT

- FIGURE 61 SYNAPTICS: COMPANY SNAPSHOT

- FIGURE 62 GORILLA TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 63 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 64 INTEL: COMPANY SNAPSHOT

The Edge AI software market is projected to grow from USD 1.92 billion in 2024 to USD 7.19 billion by 2030, at a compound annual growth rate (CAGR) of 24.7% during the forecast period. The market is anticipated to grow due to Predictive maintenance powered by Edge AI is transforming industrial operations by enabling real-time monitoring and forecasting of equipment failures before they happen, Edge AI is enabling highly personalized experiences for consumers by processing data locally on devices like smartphones, wearables, and smart home systems and Smart grids and energy management systems are benefiting greatly from Edge AI's ability to provide distributed intelligence. However, growth may be restrained by the complexity of deploying and managing machine learning models at the edge, the absence of standard protocols and interoperability between different Edge AI platforms, devices, and ecosystems can slow down adoption and the high initial investment required to build and scale Edge AI infrastructure can be prohibitive for some organizations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | USD (Billion) |

| Segments | By Offering, By Data Modality, By Technology, By End Uses. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"Edge AI Platform Solutions Leading the Market with Highest CAGR Growth"

Platform solutions are expected to register the highest CAGR growth in the Edge AI software market due to their ability to integrate diverse AI capabilities, streamline deployment, and support scalable applications across industries. These platforms enable seamless development, testing, and deployment of AI models on edge devices, reducing complexity and accelerating time-to-market. Future opportunities lie in leveraging these solutions for autonomous systems, advanced robotics, and distributed IoT ecosystems, where customizable platforms can address specific requirements for real-time analytics, data security, and interoperability, driving adoption across sectors like healthcare, automotive, and industrial automation.

"Predictive Maintenance and Robotics Automation Transforming Manufacturing with Edge AI"

During the forecast period, the manufacturing sector is anticipated to dominate the Edge AI software market, driven by its adoption for real-time quality control, predictive maintenance, and robotics automation. Edge AI enables manufacturers to process vast amounts of machine data locally, reducing latency and enhancing operational efficiency. Future opportunities include leveraging Edge AI for smart factory solutions, optimizing energy consumption, and enabling autonomous production lines. As manufacturers prioritize Industry 4.0 initiatives and demand localized intelligence for critical operations, the deployment of Edge AI software in this sector will continue to expand rapidly.

"Asia Pacific's rapid edge AI software market growth fueled by innovation and emerging technologies, while North America leads in market size"

Asia Pacific is projected to be the fastest-growing market for Edge AI software during the forecast period, driven by rapid industrialization, increasing adoption of IoT devices, and significant investments in smart city initiatives. The region's growing demand for localized data processing in sectors like manufacturing, retail, and telecommunications further boosts this trend. Meanwhile, North America holds the largest market share due to its early adoption of advanced technologies, strong presence of key players, and robust infrastructure supporting AI deployment. Future opportunities include expanding Edge AI applications in Asia Pacific's emerging markets for autonomous systems and real-time analytics, while North America continues to innovate in areas like healthcare and defense with cutting-edge edge computing solutions.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the Edge AI software market.

- By Company: Tier I - 30%, Tier II - 40%, and Tier III - 30%

- By Designation: C-Level Executives - 35%, D-Level Executives - 25%, and others - 40%

- By Region: North America - 30%, Europe - 35%, Asia Pacific - 25%, Middle East & Africa - 5%, and Latin America - 5%

The report includes the study of key players offering edge AI software market. It profiles major vendors in the Edge AI software market. The major players in the Edge AI software market include Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), Gorilla Technologies (UK), Intel (US), VEEA (US), Infineon Technologies (German), Intent HQ (UK), Baidu (China), NVIDIA (US), Alibaba Group (Singapore), Bosch Global Software Technologies (India), Azion (US), Blaize (US), ClearBlade (US), Johnson Controls (US), Midokura (Japan), Latent AI (US), Axelera AI (Netherlands), Teraki (Germany), Ekkono (Sweden), Edge Impulse (US), Spectro Cloud (US), Barbara (Spain), Invision AI (US), Horizon Robotics (China), and Kneron (US).

Research coverage

This research report categorizes the Edge AI software Market By offering (Software [By Type and By Deployment mode] and Services [Professional services and Managed services]), By data Modality (Visual data, Auditory data, Textual data, Spatial data, Temporal data and Multi-modal data), By Technology (Generative AI and Other AI [Machine learning, Natural language processing, Computer vision and Others]), By End Uses (Manufacturing, Smart cities, BFSI, Healthcare & life sciences, Energy & utilities, Telecommunication, Retail, Automotive, Transportation & logistics, Consumer electronics & devices and Other end uses [IT & ITeS, Education and Agriculture]), and By Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Edge AI software market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the Edge AI software market. Competitive analysis of upcoming startups in the Edge AI software market ecosystem is covered in this report.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Edge AI software market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing number of intelligent applications, rising use of IoT applications, increasing adoption of 5G network technology, exponential growth of data volume and network traffic), restraints (Bandwidth limitations resulting from the need for continuous data transfer and limited availability of AI experts), opportunities (growing deployment of TinyML, rising demand of autonomous and connected vehicles, emergence of transformative applications in various fields), and challenges (Need for optimization of edge AI standards, complexity of integrating diverse systems and lack of hardware standards).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Edge AI software market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Edge AI software market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Edge AI software market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), Gorilla Technologies (UK), Intel (US), VEEA (US), Infineon Technologies (Germany), Intent HQ (UK), Baidu (China), NVIDIA (US), Alibaba Group (Singapore), Bosch Global Software Technologies (India), Azion (US), Blaize (US), ClearBlade (US), Johnson Controls (US), Midokura (Japan), Latent AI (US), Axelera AI (Netherlands), Teraki (Germany), Ekkono (Sweden), Edge Impulse (US), Spectro Cloud (US), Barbara (Spain), Invision AI (US), Horizon Robotics (China), and Kneron (US), among others in the Edge AI software market. The report also helps stakeholders understand the pulse of the Edge AI software market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EDGE AI SOFTWARE MARKET

- 4.2 EDGE AI SOFTWARE MARKET, BY TOP THREE END USES

- 4.3 EDGE AI SOFTWARE MARKET IN NORTH AMERICA, BY TOP THREE DATA MODALITY TYPES AND END USES

- 4.4 EDGE AI SOFTWARE MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of intelligent applications

- 5.2.1.2 Exponential growth of data volume and network traffic

- 5.2.1.3 Rising use of IoT applications

- 5.2.1.4 Increasing adoption of 5G network technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 Bandwidth limitations resulting from need for continuous data transfer

- 5.2.2.2 Limited availability of AI experts

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing deployment of TinyML

- 5.2.3.2 Rising demand for autonomous and connected vehicles

- 5.2.3.3 Emergence of transformative applications in various fields

- 5.2.4 CHALLENGES

- 5.2.4.1 Need for optimization of edge AI standards

- 5.2.4.2 Complexity of integrating diverse systems

- 5.2.4.3 Lack of hardware standards

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON EDGE AI SOFTWARE MARKET

- 5.3.1 TOP USE CASES AND MARKET POTENTIAL

- 5.3.1.1 Key use cases

- 5.3.1.1.1 Real-time Data Processing and Analysis

- 5.3.1.1.2 Predictive Maintenance

- 5.3.1.1.3 Anomaly Detection

- 5.3.1.1.4 Personalized User Experience

- 5.3.1.1.5 Enhanced Security & Fraud Detection

- 5.3.1.1.6 Scalable AI Models

- 5.3.1.1 Key use cases

- 5.3.1 TOP USE CASES AND MARKET POTENTIAL

- 5.4 EDGE AI SOFTWARE MARKET: EVOLUTION

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PLATFORM PROVIDERS

- 5.5.2 SDK PROVIDERS

- 5.5.3 FRAMEWORK & TOOLKIT PROVIDERS

- 5.5.4 SERVICE PROVIDERS

- 5.5.5 TECHNOLOGY PARTNERS/INTEGRATORS

- 5.5.6 END USERS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: LEVERAGING EDGE AI AND GEOSPATIAL ANALYTICS FOR ENHANCED RESPONSE AND RECOVERY

- 5.8.2 CASE STUDY 2: FACILITATING PREDICTIVE MAINTENANCE AND COST SAVINGS FOR PRINT SHOP

- 5.8.3 CASE STUDY 3: TRANSFORMING POWER DISTRIBUTION BY LEVERAGING EDGE AI IN VIRTUALIZED SUBSTATIONS

- 5.8.4 CASE STUDY 4: REVOLUTIONIZING INDUSTRIAL MONITORING WITH EKKONO'S EDGE AI VIRTUAL SENSORS

- 5.8.5 CASE STUDY 5: TRANSFORMING WAREHOUSE EFFICIENCY WITH AUTONOMOUS AI-DRIVEN INVENTORY MONITORING SOLUTIONS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Edge computing

- 5.9.1.2 Machine Learning (ML)

- 5.9.1.3 Computer vision

- 5.9.1.4 Natural Language Processing (NLP)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Federated technologies

- 5.9.2.2 Cloud computing

- 5.9.2.3 Internet of Things (IoT)

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Big data analytics

- 5.9.3.2 Digital twins

- 5.9.3.3 Blockchain

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGIONAL REGULATIONS

- 5.10.2.1 North America

- 5.10.2.1.1 SCR 17: Artificial Intelligence Bill - California, US

- 5.10.2.1.2 S1103: Artificial Intelligence Automated Decision Bill - Connecticut, US

- 5.10.2.1.3 National Artificial Intelligence Initiative Act (NAIIA)

- 5.10.2.1.4 Artificial Intelligence and Data Act (AIDA) - Canada

- 5.10.2.2 Europe

- 5.10.2.2.1 Artificial Intelligence Act (AIA) - European Union

- 5.10.2.2.2 General Data Protection Regulation - European Union

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services - China

- 5.10.2.3.2 National AI Strategy - Singapore

- 5.10.2.3.3 Hiroshima AI Process Comprehensive Policy Framework - Japan

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 National Strategy for Artificial Intelligence - UAE

- 5.10.2.4.2 National Artificial Intelligence Strategy - Qatar

- 5.10.2.4.3 AI Ethics Principles and Guidelines - Dubai, UAE

- 5.10.2.5 Latin America

- 5.10.2.5.1 Declaration of Santiago - Chile

- 5.10.2.5.2 Brazilian Artificial Intelligence Strategy - Brazil

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- 5.12 PRICING ANALYSIS

- 5.12.1 INDICATIVE PRICING ANALYSIS OF EDGE AI SOFTWARE, BY DATA MODALITY

- 5.12.2 INDICATIVE PRICING ANALYSIS OF EDGE AI SOFTWARE, BY OFFERING

- 5.13 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15.1 KEY TRENDS/DISRUPTIONS IMPACTING BUSINESS MODELS

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

6 EDGE AI SOFTWARE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: EDGE AI SOFTWARE MARKET, BY OFFERING

- 6.2 SOFTWARE

- 6.2.1 RISING DEMAND ACROSS DIVERSE INDUSTRIES TO BOOST MARKET

- 6.2.2 BY TYPE

- 6.2.2.1 Platforms

- 6.2.2.2 Software development kits (SDKs)

- 6.2.2.3 Frameworks & toolkits

- 6.2.3 BY DEPLOYMENT MODE

- 6.2.3.1 Cloud

- 6.2.3.2 On-premises

- 6.3 SERVICES

- 6.3.1 RISING DEMAND FOR IMPLEMENTATION AND MAINTENANCE SUPPORT TO DRIVE MARKET

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Training & consulting

- 6.3.2.2 System integration & testing

- 6.3.2.3 Support & maintenance

- 6.3.3 MANAGED SERVICES

7 EDGE AI SOFTWARE MARKET, BY DATA MODALITY

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: EDGE AI SOFTWARE MARKET, BY DATA MODALITY

- 7.2 VISUAL DATA

- 7.2.1 NEED FOR QUICK DECISION-MAKING TO DRIVE DEMAND

- 7.2.2 IMAGE DATA

- 7.2.3 VIDEO DATA

- 7.3 AUDITORY DATA

- 7.3.1 INCREASING REQUIREMENT FOR SPEEDY RECOGNITION OF AUDITORY SIGNALS TO BOOST MARKET

- 7.3.2 AUDIO DATA

- 7.3.3 AUDIO SENSOR DATA

- 7.4 TEXTUAL DATA

- 7.4.1 NEED FOR QUICK RESPONSE TO TEXT DATA TO DRIVE MARKET

- 7.4.2 STRUCTURED TEXT DATA

- 7.4.3 UNSTRUCTURED TEXT DATA

- 7.4.4 SEMI-STRUCTURED TEXT DATA

- 7.5 SPATIAL DATA

- 7.5.1 GROWING ADOPTION OF LOCATION-BASED APPLICATIONS TO PROPEL MARKET

- 7.5.2 GEOSPATIAL DATA

- 7.5.3 LOCATION SENSON DATA

- 7.6 TEMPORAL DATA

- 7.6.1 RISING REQUIREMENT FOR PREDICTIVE MAINTENANCE TO BOOST MARKET

- 7.6.2 TIME-SERIES DATA

- 7.6.3 ENVIRONMENTAL SENSOR DATA

- 7.7 MULTIMODAL DATA

- 7.7.1 INCREASING NEED TO COMBINE INFORMATION FROM VARIOUS SOURCES TO DRIVE DEMAND

- 7.7.2 MULTIMODAL FUSION

- 7.7.3 CROSS-MODAL FUSION

8 EDGE AI SOFTWARE MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: EDGE AI SOFTWARE MARKET, BY TECHNOLOGY

- 8.2 GENERATIVE AI

- 8.2.1 INCREASING NEED FOR CONTENT CREATION AT LOCAL LEVEL TO DRIVE MARKET

- 8.3 OTHER AI

- 8.3.1 ABILITY TO FACILITATE QUICK DECISION-MAKING TO DRIVE DEMAND

- 8.3.2 MACHINE LEARNING

- 8.3.2.1 Supervised learning

- 8.3.2.2 Unsupervised learning

- 8.3.2.3 Reinforcement learning

- 8.3.3 NATURAL LANGUAGE PROCESSING

- 8.3.4 COMPUTER VISION

- 8.3.5 OTHER TECHNOLOGIES

9 EDGE AI SOFTWARE MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: EDGE AI SOFTWARE MARKET, BY END USE

- 9.2 MANUFACTURING

- 9.2.1 ABILITY TO ENHANCE OVERALL PRODUCTIVITY TO DRIVE MARKET

- 9.2.2 INDUSTRIAL AUTOMATION

- 9.2.3 PREDICTIVE MAINTENANCE

- 9.2.4 QUALITY CONTROL

- 9.2.5 YIELD OPTIMIZATION

- 9.2.6 CONDITION & PRECISION MONITORING

- 9.3 HEALTHCARE & LIFE SCIENCES

- 9.3.1 NEED FOR QUICK DATA ANALYSIS TO BOOST DEMAND

- 9.3.2 REMOTE PATIENT MONITORING

- 9.3.3 MEDICAL IMAGING

- 9.3.4 HOSPITAL MANAGEMENT SYSTEMS

- 9.3.5 REAL-TIME HEALTH DATA ANALYTICS

- 9.3.6 PERSONALIZED MEDICINE

- 9.4 ENERGY & UTILITIES

- 9.4.1 GROWING ADOPTION TO IMPROVE OPERATIONAL EFFICIENCY TO FUEL MARKET

- 9.4.2 SMART GRIDS

- 9.4.3 RENEWABLE ENERGY MANAGEMENT

- 9.4.4 ASSET MONITORING & OPTIMIZATION

- 9.4.5 ENERGY DISTRIBUTION AUTOMATION

- 9.4.6 PREDICTIVE ENERGY DEMAND FORECASTING

- 9.5 TELECOMMUNICATION

- 9.5.1 NEED TO OPTIMIZE NETWORK PERFORMANCE TO DRIVE DEMAND

- 9.5.2 5G INFRASTRUCTURE

- 9.5.3 REAL-TIME NETWORK MONITORING

- 9.5.4 SUBSCRIBER DATA ANALYTICS

- 9.5.5 AUTOMATED CALL ROUTING

- 9.6 RETAIL

- 9.6.1 INCREASING DEMAND FOR PERSONALIZED SHOPPING EXPERIENCES TO DRIVE MARKET

- 9.6.2 IN-STORE ANALYTICS

- 9.6.3 SMART CHECKOUTS

- 9.6.4 CUSTOMER BEHAVIOR ANALYSIS

- 9.6.5 INVENTORY MANAGEMENT

- 9.6.6 PERSONALIZED PROMOTIONS & OFFERS

- 9.7 AUTOMOTIVE

- 9.7.1 INCREASING DEMAND FOR CONNECTED VEHICLES TO DRIVE MARKET

- 9.7.2 AUTONOMOUS AND SEMI-AUTONOMOUS VEHICLES

- 9.7.3 ADVANCED DRIVER-ASSISTANCE SYSTEMS (ADAS)

- 9.7.4 DRIVER MONITORING SYSTEMS

- 9.7.5 IN-VEHICLE INFOTAINMENT SYSTEMS

- 9.8 TRANSPORTATION & LOGISTICS

- 9.8.1 ABILITY TO STREAMLINE OPERATIONS TO FUEL DEMAND

- 9.8.2 FLEET MANAGEMENT

- 9.8.3 ROUTE OPTIMIZATION

- 9.8.4 LOGISTICS AUTOMATION

- 9.8.5 TRAFFIC PATTERN ANALYSIS

- 9.8.6 SUPPLY CHAIN OPTIMIZATION

- 9.9 SMART CITIES

- 9.9.1 GROWING PRESSURE ON INFRASTRUCTURE AND PUBLIC SERVICES TO DRIVE DEMAND

- 9.9.2 TRAFFIC MANAGEMENT

- 9.9.3 WASTE MANAGEMENT

- 9.9.4 ENVIRONMENTAL MONITORING

- 9.9.5 SURVEILLANCE & SECURITY

- 9.9.6 EMERGENCY RESPONSE SYSTEMS

- 9.10 BFSI

- 9.10.1 RISING REQUIREMENT FOR FRAUD DETECTION AND PREVENTION TO PROPEL MARKET

- 9.10.2 FRAUD DETECTION & PREVENTION

- 9.10.3 AUTOMATED TRADING SYSTEMS

- 9.10.4 CUSTOMER SENTIMENT ANALYSIS

- 9.10.5 COMPLIANCE & REGULATORY REPORTING

- 9.11 CONSUMER ELECTRONICS & DEVICES

- 9.11.1 INCREASING DEMAND FOR FASTER RESPONSE TIMES TO FUEL MARKET

- 9.11.2 SMARTPHONES & TABLETS

- 9.11.3 WEARABLE DEVICES

- 9.11.4 SMART CAMERAS & SECURITY DEVICES

- 9.11.5 AUGMENTED & VIRTUAL REALITY (AR/VR) HEADSETS

- 9.11.6 CONSUMER DRONES

- 9.11.7 HOME APPLIANCES

- 9.11.8 OTHER DEVICES

- 9.12 OTHER END USES

10 EDGE AI SOFTWARE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 DRIVERS: EDGE AI SOFTWARE MARKET IN NORTH AMERICA

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.3.1 Increasing government initiatives to propel market

- 10.2.4 CANADA

- 10.2.4.1 Collaborative efforts by government and private sector to drive market

- 10.3 EUROPE

- 10.3.1 DRIVERS: EDGE AI SOFTWARE MARKET IN EUROPE

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.3.1 Government support for research and development to fuel market

- 10.3.4 FRANCE

- 10.3.4.1 Increasing focus on real-time data processing to drive demand

- 10.3.5 GERMANY

- 10.3.5.1 Introduction of innovation hubs and collaborative platforms to boost market

- 10.3.6 ITALY

- 10.3.6.1 Rising focus on research activities to drive market

- 10.3.7 SPAIN

- 10.3.7.1 Government initiatives and private sector investments to drive market

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 DRIVERS: EDGE AI SOFTWARE MARKET IN ASIA PACIFIC

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.3.1 Government support for AI-related research to drive market

- 10.4.4 JAPAN

- 10.4.4.1 Focus on infrastructure enhancement to boost demand

- 10.4.5 INDIA

- 10.4.5.1 Government focus on innovation to drive market

- 10.4.6 AUSTRALIA & NEW ZEALAND

- 10.4.6.1 Partnerships to leverage edge computing capabilities to boost demand

- 10.4.7 ASEAN COUNTRIES

- 10.4.7.1 Increasing government focus on responsible AI adoption to fuel market

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 DRIVERS: EDGE AI SOFTWARE MARKET IN MIDDLE EAST & AFRICA

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Saudi Arabia

- 10.5.3.1.1 Growing demand for real-time data processing to fuel market

- 10.5.3.2 UAE

- 10.5.3.2.1 Focus on digital transformation to drive demand

- 10.5.3.3 Turkey

- 10.5.3.3.1 Industry-academic research partnerships to boost market

- 10.5.3.4 Qatar

- 10.5.3.4.1 Increasing adoption of IoT devices to drive demand

- 10.5.3.5 Rest of Middle East

- 10.5.3.1 Saudi Arabia

- 10.5.4 AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 DRIVERS: EDGE AI SOFTWARE MARKET IN LATIN AMERICA

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.3.1 Rising adoption of edge computing across sectors to drive market

- 10.6.4 MEXICO

- 10.6.4.1 Government support for digital transformation to fuel market

- 10.6.5 ARGENTINA

- 10.6.5.1 Increasing investment in digital infrastructure to drive demand

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN, 2023-2024

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.4.1 MARKET RANKING ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.5.1 BRAND/PRODUCT COMPARISON, BY OFFERING

- 11.5.2 BRAND/PRODUCT COMPARISON, BY DATA MODALITY

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Technology footprint

- 11.7.5.5 End use footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.1.1 MICROSOFT

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and enhancements

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 IBM

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and enhancements

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 GOOGLE

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches and enhancements

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 AWS

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and enhancements

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 NUTANIX

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and enhancements

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SYNAPTICS

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches and enhancements

- 12.1.6.3.2 Deals

- 12.1.7 GORILLA TECHNOLOGIES

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 INFINEON TECHNOLOGIES

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches and enhancements

- 12.1.8.3.2 Deals

- 12.1.9 INTEL

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches and enhancements

- 12.1.9.3.2 Deals

- 12.1.10 VEEA

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.1 MICROSOFT

- 12.2 OTHER PLAYERS

- 12.2.1 INTENT HQ

- 12.2.2 BAIDU

- 12.2.3 NVIDIA

- 12.2.4 ALIBABA CLOUD

- 12.2.5 BOSCH GLOBAL SOFTWARE TECHNOLOGIES

- 12.2.6 AZION

- 12.2.7 BLAIZE

- 12.2.8 CLEARBLADE

- 12.2.9 JOHNSON CONTROLS

- 12.2.10 MIDOKURA

- 12.3 STARTUP/SME PROFILES

- 12.3.1 AXELERA AI

- 12.3.1.1 Business overview

- 12.3.1.2 Products offered

- 12.3.1.3 Recent developments

- 12.3.1.3.1 Deals

- 12.3.2 EDGE IMPULSE

- 12.3.2.1 Business overview

- 12.3.2.2 Products offered

- 12.3.2.3 Recent developments

- 12.3.2.3.1 Deals

- 12.3.3 LATENT AI

- 12.3.4 TERAKI

- 12.3.5 EKKONO

- 12.3.6 SPECTRO CLOUD

- 12.3.7 BARBARA

- 12.3.8 INVISION AI

- 12.3.9 HORIZON ROBOTICS

- 12.3.10 KNERON

- 12.3.1 AXELERA AI

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 EDGE COMPUTING MARKET - GLOBAL FORECAST TO 2029

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Edge computing market, by component

- 13.2.2.2 Edge computing market, by organization size

- 13.2.2.3 Edge computing market, by application

- 13.2.2.4 Edge computing market, by vertical

- 13.2.2.5 Edge computing market, by region

- 13.3 ARTIFICIAL INTELLIGENCE (AI) MARKET - GLOBAL FORECAST TO 2030

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 Artificial intelligence market, by offering

- 13.3.2.2 Artificial intelligence market, by technology

- 13.3.2.3 Artificial intelligence market, by business function

- 13.3.2.4 Artificial intelligence market, by vertical

- 13.3.2.5 Artificial intelligence market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS