|

|

市場調査レポート

商品コード

1829989

耐放射線性電子部品の世界市場:部品別、製造技術別、製品タイプ別、用途別、地域別 - 予測(~2030年)Radiation Hardened Electronics Market by Component (Mixed Signal ICs, Processors & Controllers, Memory, Power Management), Manufacturing Technique (RHBD, RHBP), Product Type (COTS, Custom), Application and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 耐放射線性電子部品の世界市場:部品別、製造技術別、製品タイプ別、用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年09月11日

発行: MarketsandMarkets

ページ情報: 英文 286 Pages

納期: 即納可能

|

概要

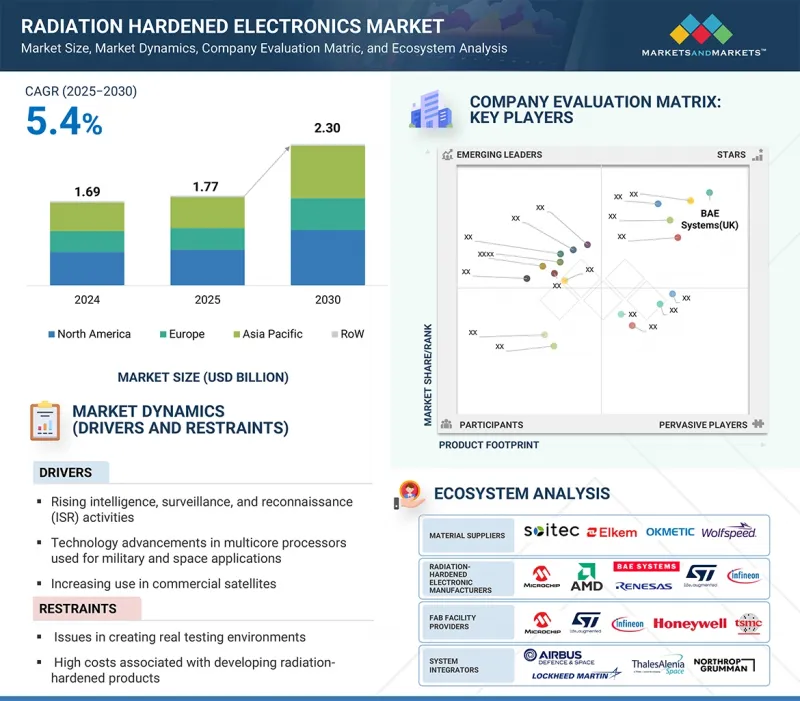

世界の耐放射線性電子部品の市場規模は、2025年の17億7,000万米ドルから2030年までに23億米ドルに達すると予測され、予測期間にCAGRで5.4%の成長が見込まれます。

人工衛星、無人機、防衛システムなどの情報収集・警戒監視・偵察(ISR)プラットフォームが、過酷な環境下でミッションクリティカルな性能を確保するために、耐放射線性のプロセッサー、コントローラー、メモリデバイス、ミックスドシグナルICへの依存度を高めていることから、市場は着実な成長を示しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 部品、製造技術、製品タイプ、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

防衛機関や宇宙機関は、状況認識やセキュアな通信を強化するためにISR機能に多額の投資を行っており、信頼性の高い耐放射線性部品の需要を高めています。しかし、高い開発コストと実際の試験環境の再現における課題が、依然として産業の主な抑制要因となっています。同時に、世界的な宇宙飛行の増加や、衛星における商用オフザシェルフ(COTS)部品の採用により、機会が生まれつつある一方で、ハイエンド顧客からのカスタマイズ要件などの課題が、競合情勢を形成し続けています。

「メモリセグメントが2025年~2030年に最高のCAGRで成長する見込みです。」

部品セグメントのメモリが予測期間にもっとも高いCAGRで成長する見込みです。メモリデバイスは、データを保持し、通信や機能を可能にするハードウェア部品です。宇宙船や核兵器などの重要な用途に使用されるメモリ製品は、半導体部品が受ける総電離線量(TID)を低減するために耐放射線強化が必要です。航空宇宙・宇宙部門における計算集約的な用途では、さまざまなプロセッサーノードやセンサーから得られる大量のデータを処理するために、高密度で高性能な耐放射線性メモリソリューションがますます求められるようになっています。

「宇宙用途が2025年に最大の市場シェアを記録する見込みです。」

耐放射線性電子部品は、多様な宇宙用途で困難を切り抜け、信頼性の高い動作を保証するために特別に設計されています。人工衛星を管理するオンボードコンピューターの心臓部からロケットを操縦する誘導システムまで、これらの堅牢な部品は驚くほど幅広いタスクに電力を供給します。通信、燃料効率、科学的データ収集、遠く離れた惑星表面での複雑なロボット操縦に対応しています。さらに、宇宙船のナビゲーションシステム、ペイロードのパフォーマンスモニタリング、宇宙放射線にさらされる中での飛行継続性の確保にも欠かせません。衛星コンステレーション、有人飛行、深宇宙探査プログラムの急速な増加に伴い、耐放射線性電子部品は、民間および政府の宇宙の取り組みに不可欠なものとなっています。

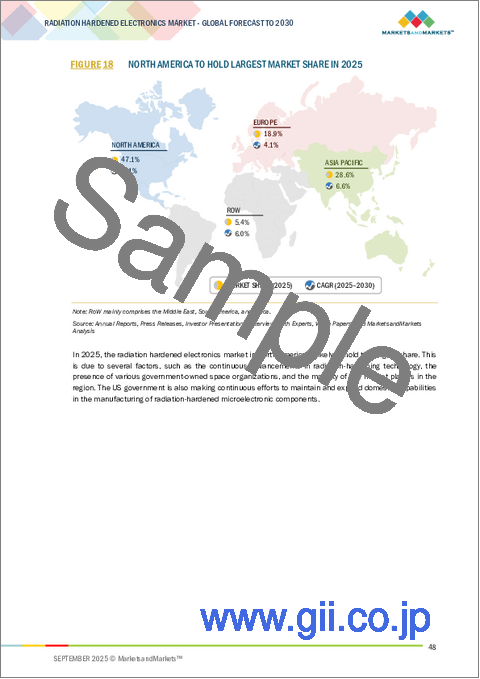

「北米が2030年に耐放射線性電子市場で最大のシェアを記録する可能性が高いです。」

北米が2030年に耐放射線性電子市場で最大のシェアを占めます。この分野における継続的な技術の進歩、さまざまな政府系宇宙機関のプレゼンス、この地域の主要市場企業の大半などの要因が、この地域における耐放射線性電子部品の成長可能性を後押ししています。米国政府は、耐放射線性電子部品の製造能力に継続的に取り組んでいます。加えて、旺盛な防衛予算、衛星コンステレーションへの投資の増加、NASAなどの政府機関とSpaceXやNorthrop Grummanなどの非公開航空宇宙企業との協力関係も採用を後押ししています。この地域はまた、確立された半導体エコシステム、広範な研究開発インフラ、次世代のISRとミサイル防衛システムに対する旺盛な需要からも恩恵を受けています。

当レポートでは、世界の耐放射線性電子部品市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 耐放射線性電子部品市場における魅力的な機会

- 耐放射線性電子部品市場:製品タイプ別

- 耐放射線性電子部品市場:製造技術別

- 耐放射線性電子部品市場:部品別

- 耐放射線性電子部品市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- 主要企業が提供するパワーマネジメント製品の平均販売価格:部品タイプ別(2024年)

- A/D・D/Aコンバーターの平均販売価格:主要メーカー別(2024年)

- プロセッサー・コントローラーの平均販売価格:主要企業別(2024年)

- メモリ製品の平均販売価格:主要企業別(2024年)

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 輸入シナリオ(HSコード8541)

- 輸出シナリオ(HSコード8541)

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 基準と規制

- 耐放射線性電子部品市場におけるAIの影響

- イントロダクション

- 主なユースケースと市場の将来性

- 耐放射線性電子部品市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 用途に対する影響

第6章 耐放射線性電子部品の材料とパッケージングタイプ

- イントロダクション

- 材料

- シリコン

- 炭化ケイ素(SiC)

- 窒化ガリウム(GaN)

- ヒ化ガリウム(GaAs)

- パッケージングタイプ

- フリップチップ

- セラミックパッケージ

第7章 耐放射線性電子部品市場:部品別

- イントロダクション

- ミックスドシグナルICS

- プロセッサー・コントローラー

- メモリ

- パワーマネジメント

- その他の部品(定性)

第8章 耐放射線性電子部品市場:製造技術別

- イントロダクション

- 設計による耐放射線強化(RHBD)

- プロセスによる耐放射線強化(RHBP)

- ソフトウェアによる耐放射線強化(RHBS)(定性的)

第9章 耐放射線性電子部品市場:製品タイプ別

- イントロダクション

- 商用オフザシェルフ

- カスタムメイド

第10章 耐放射線性電子部品市場:用途別

- イントロダクション

- 宇宙(衛星)

- 航空宇宙・防衛

- 原子力発電所

- 医療

- その他の用途

第11章 耐放射線性電子部品市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- 中東

- 南米

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2019年~2025年)

- 収益分析(2021年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- MICROCHIP TECHNOLOGY INC.

- BAE SYSTEMS

- RENESAS ELECTRONICS CORPORATION

- INFINEON TECHNOLOGIES AG

- STMICROELECTRONICS

- ADVANCED MICRO DEVICES, INC.

- TEXAS INSTRUMENTS INCORPORATED

- HONEYWELL INTERNATIONAL INC.

- TELEDYNE TECHNOLOGIES INCORPORATED

- TTM TECHNOLOGIES INC.

- その他の企業

- THALES

- ANALOG DEVICES, INC.

- DATA DEVICE CORPORATION

- 3D PLUS

- MERCURY SYSTEMS, INC.

- PCB PIEZOTRONICS, INC.

- VORAGO TECHNOLOGIES

- GSI TECHNOLOGY, INC.

- EVERSPIN TECHNOLOGIES INC

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- AITECH

- MICROELECTRONICS RESEARCH DEVELOPMENT CORPORATION

- TRIAD SEMICONDUCTOR

- ZERO ERROR SYSTEMS

- RESILIENT COMPUTING