|

|

市場調査レポート

商品コード

1359921

自動車用センサーの世界市場:販売チャネル別、センサータイプ別、車両タイプ別、用途別、地域別-2028年までの予測Automotive Sensors Market by Sales Channel (OEM, Aftermarket), Type (Temperature, Pressure, Oxygen, Position, Speed, Inertial, Image, Level, Chemical Sensors), Vehicle Type (Passenger Car, LCV, HCV), Application, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用センサーの世界市場:販売チャネル別、センサータイプ別、車両タイプ別、用途別、地域別-2028年までの予測 |

|

出版日: 2023年10月05日

発行: MarketsandMarkets

ページ情報: 英文 342 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

自動車用センサーの市場規模は、2023年に308億米ドルと評価され、2023年から2028年にかけてCAGR 15.0%で拡大し、2028年には622億米ドルになると予測されています。

顧客の要求を満たすためのセンサー技術の進歩や、GHG排出量を削減するための代替燃料車に対する消費者の傾斜の高まりなどの要因が、予測期間中の市場成長を促進するとみられています。車両認証は、ADAS周辺機器の偽造を防止し、クラウドとの安全なデータ通信を確保するために実装しなければならない自動車セキュリティの重要な側面です。

電子機器やソフトウェア部品の搭載が増加し、自動車は複雑化しています。テクノロジーがモビリティに与える影響の拡大に伴い、自動車の安全性、セキュリティ、快適性に関する懸念が生じています。自動車産業は独立した車両の意思決定とクラウド接続に依存しているため、自動車のセキュリティは不可欠です。車両認証は、ADAS周辺機器の偽造を防止し、クラウドとの安全なデータ通信を確保するために実装されなければならない自動車セキュリティの重要な側面です。英国、ドイツ、米国、中国を含む複数の政府、および自動車OEMのコンソーシアムは、インフォテインメント・システム/室内エレクトロニクス・アーキテクチャの安全性向上について懸念を表明しました。消費者の需要も、照明ソリューション、緊急システム、車両表示システムの開発に拍車をかけています。

ABSやエアバッグを含む必要不可欠な安全装備の搭載は、中国やインドなどアジア太平洋の発展途上国の政府によって義務付けられています。同時に、欧州や北米の自動車市場は、商用車への運転支援システムの導入拡大に注力しています。フォルクスワーゲン・グループやフォードといった自動車大手は、エアバッグを全車種に標準装備することで安全性に積極的に取り組んでいます。競争の激しい市場で優位に立つため、各メーカーは先進的な安全性と豪華な機能に投資しており、自動車用センサーの需要が顕著に増加しています。

自動車用センサーの需要が増加している主な要因は、ADAS(先進運転支援システム)やAD(自律走行)システムが自律走行技術の促進要因として台頭し、自律走行技術の採用が増加していることです。これらのシステムは、画像センサー、温度センサー、位置センサー、速度センサーなど、さまざまな種類のセンサに広く依存しています。これらのセンサーは、自動車の安全性と自動化の両方を推進する上で重要な役割を果たしています。

アジア太平洋の自動車用センサー市場は、予測期間中に最も高いCAGRで拡大すると予想されています。この成長は、同地域の厳しい政府規制により、自動車の安全性を高め、環境汚染を低減するための先進技術の統合が必要とされていることに起因しています。さらに、同地域ではADAS(先進運転支援システム)や自律走行車の大幅な採用とともに、電気自動車やハイブリッド車への嗜好が高まっています。さらに、消費者の可処分所得の増加、自動車インフラ開拓への投資の増加、より効率的で安全な自動車への需要の高まりなどが、アジア太平洋における自動車センサー市場の急速な拡大に寄与しています。

当レポートでは、世界の自動車用センサー市場について調査し、販売チャネル別、センサータイプ別、車両タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 生態系マッピング

- ポーターのファイブフォース分析

- ケーススタディ分析

- 技術分析

- 価格分析

- 貿易分析

- 特許分析、2019~2023年

- 関税と規制状況

- 2023年~2024年の主要な会議とイベント

- 主要な利害関係者と購入基準

第6章 自動車用センサー市場、販売チャネル別

- イントロダクション

- OEM

- アフターマーケット

第7章 自動車用センサー市場、センサータイプ別

- イントロダクション

- 温度センサー

- 圧力センサー

- 酸素センサー

- 窒素酸化物(NOX)センサー

- 位置センサー

- スピードセンサー

- 慣性センサー

- イメージセンサー

- レベルセンサー

- 化学センサー

- レーダーセンサー

- 超音波センサー

- LiDARセンサー

- 電流センサー

- その他

第8章 自動車用センサー市場、車両タイプ別

- イントロダクション

- 乗用車

- LCV

- HCV

第9章 自動車用センサー市場、用途別

- イントロダクション

- パワートレインシステム

- シャーシ

- 排気システム

- 安全性と制御システム

- 車体電装品

- テレマティクスシステム

- ドライバー支援と自動化

- その他

第10章 自動車用センサー市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス、2022年

- スタートアップ/中小企業(SMES)の評価マトリックス、2022年

- 競争シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- ROBERT BOSCH GMBH

- ON SEMICONDUCTOR

- OMNIVISION

- TE CONNECTIVITY

- CONTINENTAL AG

- DENSO CORPORATION

- INFINEON TECHNOLOGIES AG

- NXP SEMICONDUCTORS

- PANASONIC

- ALLEGRO MICROSYSTEMS, INC.

- その他の企業

- SENSATA TECHNOLOGIES, INC.

- BORGWARNER INC.

- ANALOG DEVICES, INC.

- ELMOS SEMICONDUCTOR SE

- APTIV.

- CTS CORPORATION

- AUTOLIV, INC.

- STMICROELECTRONICS

- ZF FRIEDRICHSHAFEN AG

- QUANERGY SOLUTIONS, INC.

- INNOVIZ TECHNOLOGIES LTD.

- VALEO S.A.

- MAGNA INTERNATIONAL INC.

- MELEXIS

- AMPHENOL ADVANCED SENSORS

第13章 付録

The automotive sensor market is valued at USD 30.8 billion in 2023 and is anticipated to be USD 62.2 billion by 2028, growing at a CAGR of 15.0% from 2023 to 2028. Factors such as advancements in sensor technologies to meet customer requirements, and growing inclination of consumers toward alternative fuel vehicles to reduce GHG emissions are likely to drive market growth during the forecast period. Vehicle authentication is a critical aspect of automotive security that must be implemented to prevent the counterfeiting of ADAS peripherals and ensure secure data communication with the cloud.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | (USD Million/Billion), Volume (Million Units) |

| Segments | By Sales Channel, By Sensor Types, By Vehicle Types, By Application, and By Region |

| Regions covered | North America, Europe, Asia Pacific, and RoW |

Growing focus on implementing vehicle authentication to ensure driver safety and comfort

Vehicles have become more complex due to the increased installation of electronics and software components. Concerns about vehicle safety, security, and comfort will arise with the growth of technology's influence on mobility. Automobile security is essential as the automotive industry relies on independent vehicle decision-making and cloud connectivity. Vehicle authentication is a critical aspect of automotive security that must be implemented to prevent the counterfeiting of ADAS peripherals and ensure secure data communication with the cloud. Several governments, including the UK, Germany, the US, and China, and a consortium of automotive OEMs expressed their concerns about improving the safety of the infotainment system/interior electronics architecture. Consumer demand has also fueled developments in lighting solutions, emergency systems, and vehicle display systems.

Moreover, electrical system controls are increasingly being adopted to ensure passenger safety, intimate drivers about the condition of the vehicle component, and warn them about high-risk scenarios. Automotive semiconductor vendors will likely benefit from a surge in demand for various car semiconductor devices, including microcontrollers (MCUs), sensors, and memory modules. The strong focus of OEMs on vehicle automation, electrification, digital connectivity, and security leads to adding more semiconductors to automotive electronics and subsystems, including automotive sensors. Thus, the consumer demand for safety, security, and comfort in automobiles will propel the growth of the automotive sensors market.

The installation of essential safety features, including ABS and airbags, is a mandate enforced by governments in developing countries in the Asia Pacific, such as China and India. At the same time, the established automotive market in Europe and North America is focused on the greater deployment of driver assistance systems in commercial vehicles. Automotive giants, such as Volkswagen Group and Ford, have proactively approached safety by making airbags a standard feature across their range. To stay ahead in a competitive market, manufacturers have been investing in advanced safety and luxury features, leading to a notable increase in the demand for automotive sensors.

Minimizing driver stress through adoption of advanced driver-assistance systems

The growing demand for automotive sensors is primarily attributed to the increasing adoption of autonomous driving technology with advanced driver-assistance systems (ADAS) and autonomous driving (AD) systems emerging as the growth drivers of autonomous driving technology. These systems rely extensively on various sensor types including image sensors, temperature sensors, position sensors, and speed sensors. These sensors play a crucial role in advancing both vehicle safety and automation.

Additionally, there are other sensor categories, such as powertrain sensors, chassis sensors, and body sensors, that also play significant roles in driving the automotive sensor market. Powertrain sensors are essential for ensuring the efficient operation of vital engine and transmission components, while chassis sensors monitor critical functions like braking and steering. In vehicles operating at SAE AV Level 3 and beyond, a combination of sensors is employed across ADAS/AD systems, braking systems, and power steering systems, with body sensors assessing vehicle performance and condition across multiple parameters. Body sensors can capture and transmit data related to door and roof closure, seat occupancy, and environmental conditions, such as sunlight and rainfall. These sensors can trigger alerts and perform basic functions, which can reduce driver stress and increase their productivity. Therefore, the increasing use of autonomous vehicles equipped with a wide range of sensors is driving the growth of the automotive sensors market.

"Asia Pacific is the fastest-growing region in the automotive sensor market."

The Asia Pacific automotive sensor market is expected to witness highest CAGR during the forecast period. This growth can be attributed to the region's stringent government regulations necessitating the integration of advanced technologies to enhance vehicle safety and reduce environmental pollution. Additionally, there is a growing preference for electric and hybrid vehicles, alongside a substantial adoption of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles in the region. Furthermore, the increasing disposable income of consumers, increasing investments in automotive infrastructure development, and a rising demand for more efficient and safer vehicles are all contributing to the rapid expansion of the automotive sensor market in the Asia Pacific region.

The breakup of primaries conducted during the study is depicted below:

- By Company Type: Tier 1 - 20 %, Tier 2 - 45%, and Tier 3 -35%

- By Designation: C-Level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America- 45%, Europe - 20%, Asia Pacific - 30%, Rest of world- 5%

Research Coverage

The report segments the automotive sensor market and forecasts its size, by value and volume, based on region (North America, Europe, Asia Pacific, and RoW), Sensor Types (temperature sensors, pressure sensors, position sensors, oxygen sensors, NOx sensors, speed sensors, inertial sensors, image sensors, level sensors, chemical sensors, radar sensors, ultrasonic sensors, LiDAR sensors, current sensors, and other sensor types [rain sensors, relative humidity sensors, proximity sensors, particulate matter sensors]), Sales Channel (original equipment manufacturers (OEMs) and aftermarkets), Vehicle Types (passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs)) and Application (powertrain systems, chassis, exhaust systems, safety and control systems, vehicle body electronics, telematics systems, driver assistance and automation, and other applications [vehicle monitoring systems, vehicle tracking systems, and vehicle security systems]). The report also comprehensively reviews market drivers, restraints, opportunities, and challenges in the automotive sensor market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reason to Buy Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall automotive sensor market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

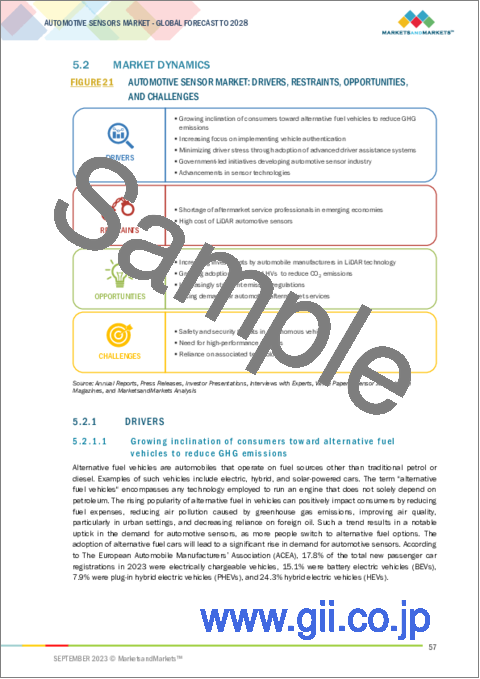

- Analysis of key drivers (government incentives and grants to support R&D in automotive sensor technology, and minimizing driver stress through adoption of advanced driver-assistance systems), restraints (High cost of LiDAR automotive sensors, and shortage of aftermarket service professionals in emerging economies), opportunities (growing adoption of EVs and HVs to reduce CO2 emissions, and Increasing investments by automobile manufacturers in LiDAR technology), and challenges (safety and security threats in autonomous vehicles, and need for high-performance sensors)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive sensor market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive sensor market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive sensor market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Robert Bosch GmbH (Germany), ON Semiconductor (US), OMNIVISION (US), TE Connectivity (Germany), and Continental AG (Germany), among others in the automotive sensor market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AUTOMOTIVE SENSOR MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 REGIONAL SCOPE

- 1.4 CURRENCY CONSIDERED

- TABLE 1 CURRENCY CONVERSION RATES

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE SENSOR MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of key primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 AUTOMOTIVE SENSOR MARKET: RESEARCH FLOW

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUES GENERATED BY COMPANIES FROM SALES OF AUTOMOTIVE SENSORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (DEMAND SIDE): DEMAND FOR AUTOMOTIVE SENSORS IN DIFFERENT APPLICATIONS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size through bottom-up analysis (demand side)

- FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size through top-down analysis (supply side)

- FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 AUTOMOTIVE SENSOR MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 9 AUTOMOTIVE SENSOR MARKET: RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

- FIGURE 10 AUTOMOTIVE SENSOR MARKET: RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 11 OEM SEGMENT TO LEAD AUTOMOTIVE SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 12 POSITION SENSORS TO HOLD LARGEST SHARE OF AUTOMOTIVE SENSOR MARKET IN 2023

- FIGURE 13 PASSENGER CAR SEGMENT TO DOMINATE AUTOMOTIVE SENSOR MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 14 SAFETY & CONTROL SYSTEMS TO EXHIBIT HIGHEST CAGR IN AUTOMOTIVE SENSOR MARKET, BY APPLICATION, FROM 2023 TO 2028

- FIGURE 15 ASIA PACIFIC TO RECORD HIGHEST CAGR IN AUTOMOTIVE SENSOR MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 MAJOR GROWTH OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE SENSOR MARKET

- FIGURE 16 GROWING USE OF AUTOMOTIVE SENSORS IN POWERTRAIN SYSTEMS TO DRIVE MARKET

- 4.2 AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE

- FIGURE 17 LIDAR SENSORS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 AUTOMOTIVE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY AND VEHICLE TYPE

- FIGURE 18 CHINA AND PASSENGER CAR SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- 4.4 AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL

- FIGURE 19 ORIGINAL EQUIPMENT MANUFACTURER (OEM) TO HOLD LARGER SHARE OF AUTOMOTIVE SENSOR MARKET IN 2023 AND 2028

- 4.5 AUTOMOTIVE SENSOR MARKET, BY COUNTRY

- FIGURE 20 SPAIN TO RECORD HIGHEST CAGR IN GLOBAL AUTOMOTIVE SENSOR MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 AUTOMOTIVE SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing inclination of consumers toward alternative fuel vehicles to reduce GHG emissions

- 5.2.1.2 Increasing focus on vehicle authentication to ensure driver safety and comfort

- 5.2.1.3 Minimizing driver stress through adoption of advanced driver-assistance systems

- 5.2.1.4 Government incentives and grants to support R&D in automotive sensor technology

- 5.2.1.5 Advancements in sensor technologies to meet customer requirements

- FIGURE 22 AUTOMOTIVE SENSOR MARKET: IMPACT OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of aftermarket service professionals in emerging economies

- 5.2.2.2 High cost of LiDAR automotive sensors

- FIGURE 23 AUTOMOTIVE SENSOR MARKET: IMPACT OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investments by automobile manufacturers in LiDAR technology

- 5.2.3.2 Growing adoption of EVs and HEVs to reduce CO2 emissions

- 5.2.3.3 Increasingly stringent emission regulations

- 5.2.3.4 Rising demand for automotive aftermarket services

- FIGURE 24 AUTOMOTIVE SENSOR MARKET: IMPACT OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Safety and security threats in autonomous vehicles

- 5.2.4.2 Need for high-performance sensors

- 5.2.4.3 Reliance on associated technologies to ensure functional accuracy

- FIGURE 25 AUTOMOTIVE SENSOR MARKET: IMPACT OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 26 AUTOMOTIVE SENSOR MARKET: VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN AUTOMOTIVE SENSOR MARKET

- 5.5 ECOSYSTEM MAPPING

- FIGURE 28 AUTOMOTIVE SENSOR ECOSYSTEM MAPPING

- FIGURE 29 KEY PLAYERS IN AUTOMOTIVE SENSOR ECOSYSTEM

- TABLE 2 LIST OF AUTOMOTIVE SENSOR MANUFACTURERS AND SUPPLIERS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 AUTOMOTIVE SENSOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 DEVELOPMENT OF AUTOMOTIVE SENSOR CHIP FOR ELECTRIC VEHICLES TO RELAY INFORMATION

- 5.7.2 INTEGRATION OF SENSORS IN PRINTED CIRCUIT BOARDS TO WITHSTAND EXTREME TEMPERATURES AND SENSE ROAD CONDITIONS

- 5.7.3 INTRODUCTION OF PRESSURE SENSOR FOR HIGH-PERFORMANCE APPLICATIONS

- 5.7.4 IMPLEMENTATION OF RAIN SENSORS TO ADJUST WIPER SPEED BASED ON RAINFALL INTENSITY

- 5.7.5 ADOPTION OF IMAGE SENSORS TO ENHANCE STORAGE EFFICIENCY AND TRACEABILITY

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 TIME-OF-FLIGHT (TOF) SENSORS

- 5.8.2 MAGNETIC SENSORS

- 5.8.3 ADVANCED DRIVER-ASSISTANCE SYSTEMS (ADAS)

- 5.8.4 ELECTRONIC STABILITY CONTROL (ESC) SYSTEMS

- 5.8.5 AUTONOMOUS VEHICLES

- 5.8.6 AIRBAG SYSTEMS

- 5.9 PRICING ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE SENSORS, BY SENSOR TYPE

- 5.9.1 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 31 AVERAGE SELLING PRICE TREND OF SPEED SENSORS, BY REGION

- FIGURE 32 AVERAGE SELLING PRICE TREND OF TEMPERATURE SENSORS, BY REGION

- FIGURE 33 AVERAGE SELLING PRICE TREND OF PRESSURE SENSORS, BY REGION

- 5.9.2 AVERAGE SELLING PRICE TREND OF SENSOR TYPES PROVIDED BY KEY PLAYERS

- FIGURE 34 AVERAGE SELLING PRICE TREND OF DIFFERENT SENSORS OFFERED BY KEY PLAYERS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- FIGURE 35 IMPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.10.2 EXPORT SCENARIO

- FIGURE 36 EXPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11 PATENT ANALYSIS, 2019-2023

- FIGURE 37 PATENTS GRANTED WORLDWIDE FROM 2013 TO 2023

- TABLE 5 TOP 20 PATENT OWNERS FROM 2013 TO 2023

- FIGURE 38 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2013 TO 2023

- 5.12 TARIFFS AND REGULATORY LANDSCAPE

- 5.12.1 TARIFFS

- TABLE 6 MFN TARIFFS FOR PRODUCTS COVERED UNDER HS CODE 903290 EXPORTED BY US

- TABLE 7 MFN TARIFFS FOR PRODUCTS COVERED UNDER HS CODE 903290 EXPORTED BY CHINA

- 5.12.2 REGULATORY COMPLIANCE

- 5.12.2.1 Regulations

- 5.12.2.2 Standards

- 5.12.2.3 Regulatory bodies, government agencies, and other organizations

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 12 AUTOMOTIVE SENSOR MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 40 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6 AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL

- 6.1 INTRODUCTION

- FIGURE 41 AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL

- FIGURE 42 OEM SEGMENT TO DOMINATE AUTOMOTIVE SENSOR MARKET THROUGHOUT FORECAST PERIOD

- TABLE 15 AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 16 AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 17 AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 18 AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 6.2 OEM

- 6.2.1 GOVERNMENT MANDATES REGARDING VEHICLE AND ROAD SAFETY TO LEAD TO HIGH ADOPTION OF ADVANCED SENSOR TECHNOLOGIES BY OEMS

- TABLE 19 OEM: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (USD MILLION)

- TABLE 20 OEM: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (USD MILLION)

- TABLE 21 OEM: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (MILLION UNITS)

- TABLE 22 OEM: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (MILLION UNITS)

- 6.3 AFTERMARKET

- 6.3.1 RISING USE OF AUTOMOTIVE SENSORS BY DIY ENTHUSIASTS TO DRIVE SEGMENTAL GROWTH

- TABLE 23 AFTERMARKET: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (USD MILLION)

- TABLE 24 AFTERMARKET: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (USD MILLION)

- TABLE 25 AFTERMARKET: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (MILLION UNITS)

- TABLE 26 AFTERMARKET: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (MILLION UNITS)

7 AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE

- 7.1 INTRODUCTION

- FIGURE 43 AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE

- FIGURE 44 LIDAR SENSORS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 27 AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (USD MILLION)

- TABLE 28 AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (USD MILLION)

- TABLE 29 AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (MILLION UNITS)

- TABLE 30 AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (MILLION UNITS)

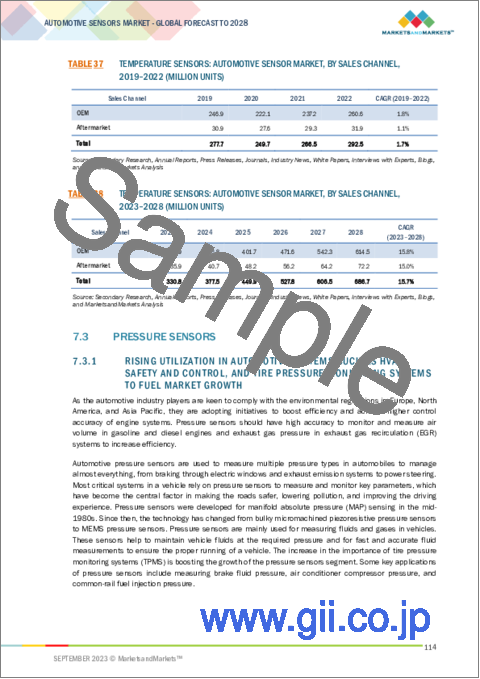

- 7.2 TEMPERATURE SENSORS

- 7.2.1 GROWING USE IN ENGINE/POWERTRAIN MANAGEMENT AND HVAC SYSTEMS OF AUTOMOBILES TO DRIVE MARKET

- TABLE 31 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 33 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 34 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 35 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 36 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 37 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 38 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.3 PRESSURE SENSORS

- 7.3.1 RISING UTILIZATION IN AUTOMOTIVE SYSTEMS SUCH AS HVAC, SAFETY AND CONTROL, AND TIRE PRESSURE MONITORING SYSTEMS TO FUEL MARKET GROWTH

- TABLE 39 PRESSURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 PRESSURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 PRESSURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 42 PRESSURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 43 PRESSURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 44 PRESSURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 45 PRESSURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 46 PRESSURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.4 OXYGEN SENSORS

- 7.4.1 INCREASING IMPLEMENTATION OF O2 SENSORS TO MEASURE PROPORTION OF OXYGEN IN AIR-FUEL MIXTURES TO CONTRIBUTE TO MARKET GROWTH

- TABLE 47 OXYGEN SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 OXYGEN SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 OXYGEN SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 50 OXYGEN SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 51 OXYGEN SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 52 OXYGEN SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 53 OXYGEN SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 54 OXYGEN SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.5 NITROGEN OXIDE (NOX) SENSORS

- 7.5.1 GROWING DEPLOYMENT OF NOX SENSORS TO DETECT NITROGEN OXIDE LEVELS IN AUTOMOBILE EMISSIONS TO SUPPORT MARKET GROWTH

- TABLE 55 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 58 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 59 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 60 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 61 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 62 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.6 POSITION SENSORS

- 7.6.1 INCREASING FOCUS OF AUTOMAKERS ON DEVELOPING VEHICLES WITH ENHANCED COMFORT AND IMPROVED FUEL EFFICIENCY TO DRIVE MARKET

- FIGURE 45 ASIA PACIFIC TO LEAD AUTOMOTIVE SENSOR MARKET FOR POSITION SENSORS DURING FORECAST PERIOD

- TABLE 63 POSITION SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 POSITION SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 65 POSITION SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 66 POSITION SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 67 POSITION SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 68 POSITION SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 69 POSITION SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 70 POSITION SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.7 SPEED SENSORS

- 7.7.1 ELEVATING ADOPTION OF SPEED SENSORS TO MEASURE ENGINE CAMSHAFT AND VEHICLE SPEED TO DRIVE MARKET

- TABLE 71 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 73 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 74 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 75 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 76 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 77 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 78 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.8 INERTIAL SENSORS

- 7.8.1 INTEGRATION OF INERTIAL SENSORS IN ACCELEROMETERS AND GYROSCOPES TO SUPPORT MARKET GROWTH

- 7.8.1.1 Accelerometers

- 7.8.1.2 Gyroscopes

- TABLE 79 INERTIAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 INERTIAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 81 INERTIAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 82 INERTIAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 83 INERTIAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 84 INERTIAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 85 INERTIAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 86 INERTIAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.8.1 INTEGRATION OF INERTIAL SENSORS IN ACCELEROMETERS AND GYROSCOPES TO SUPPORT MARKET GROWTH

- 7.9 IMAGE SENSORS

- 7.9.1 EXTENSIVE USE OF IMAGE SENSORS IN ADVANCED DRIVER-ASSISTANCE SYSTEMS TO BOOST DEMAND

- 7.9.1.1 Complementary metal-oxide-semiconductor (CMOS)

- 7.9.1.2 Charge-coupled device (CCD)

- TABLE 87 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 89 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 90 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 91 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 92 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 93 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 94 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.9.1 EXTENSIVE USE OF IMAGE SENSORS IN ADVANCED DRIVER-ASSISTANCE SYSTEMS TO BOOST DEMAND

- 7.10 LEVEL SENSORS

- 7.10.1 RISING DEPLOYMENT OF LEVEL SENSORS TO MONITOR AND MANAGE FUEL, ENGINE OIL, AND COOLANT LEVELS TO SUPPORT MARKET GROWTH

- TABLE 95 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 96 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 98 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 99 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 100 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 101 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 102 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.11 CHEMICAL SENSORS

- 7.11.1 INCREASING ADOPTION OF CHEMICAL SENSORS TO ADHERE TO STRINGENT EMISSION STANDARDS TO SUPPORT SEGMENTAL GROWTH

- TABLE 103 CHEMICAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 104 CHEMICAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 105 CHEMICAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 106 CHEMICAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 107 CHEMICAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 108 CHEMICAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 109 CHEMICAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 110 CHEMICAL SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.12 RADAR SENSORS

- 7.12.1 INSTALLATION OF RADAR SENSORS IN AUTONOMOUS VEHICLES TO RECOGNIZE SURROUNDINGS TO CONTRIBUTE TO MARKET GROWTH

- TABLE 111 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 112 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 113 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 114 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 115 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 116 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 117 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 118 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.13 ULTRASONIC SENSORS

- 7.13.1 INCREASING IMPORTANCE OF PARKING ASSISTANCE, BLIND-SPOT DETECTION, AND COLLISION AVOIDANCE SYSTEMS TO BOOST DEMAND FOR ULTRASONIC SENSORS

- TABLE 119 ULTRASONIC SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 120 ULTRASONIC SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 121 ULTRASONIC SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 122 ULTRASONIC SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 123 ULTRASONIC SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 124 ULTRASONIC SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 125 ULTRASONIC SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 126 ULTRASONIC SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.14 LIDAR SENSORS

- 7.14.1 RISING UTILIZATION OF LIDAR SENSORS TO DETECT OBSTACLES TO ENSURE SMOOTH AND SAFE RIDE TO DRIVE MARKET

- TABLE 127 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 128 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 129 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 130 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 131 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 132 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 133 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 134 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.15 CURRENT SENSORS

- 7.15.1 INTEGRATION OF CURRENT SENSORS INTO BATTERY MANAGEMENT SYSTEMS TO FUEL MARKET GROWTH

- TABLE 135 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 136 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 137 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 138 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 139 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 140 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 141 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 142 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

- 7.16 OTHER SENSOR TYPES

- 7.16.1 RAIN SENSORS

- 7.16.2 RELATIVE HUMIDITY SENSORS

- 7.16.3 PROXIMITY SENSORS

- 7.16.4 PARTICULATE MATTER SENSORS

- TABLE 143 OTHER SENSOR TYPES: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 144 OTHER SENSOR TYPES: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 145 OTHER SENSOR TYPES: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 146 OTHER SENSOR TYPES: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 147 OTHER SENSOR TYPES: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (USD MILLION)

- TABLE 148 OTHER SENSOR TYPES: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 149 OTHER SENSOR TYPES: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 150 OTHER SENSOR TYPES: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023-2028 (MILLION UNITS)

8 AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- FIGURE 46 AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE

- FIGURE 47 PASSENGER CAR SEGMENT TO RECORD HIGHEST CAGR IN AUTOMOTIVE SENSOR MARKET DURING FORECAST PERIOD

- TABLE 151 AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 152 AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 153 AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 154 AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 8.2 PASSENGER CAR

- 8.2.1 INSTALLATION OF GPS, CAMERAS, AND INFOTAINMENT SYSTEMS IN PASSENGER CARS TO DRIVE SEGMENTAL GROWTH

- TABLE 155 PASSENGER CAR: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 156 PASSENGER CAR: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 157 PASSENGER CAR: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 158 PASSENGER CAR: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2023-2028 (MILLION UNITS)

- FIGURE 48 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN AUTOMOTIVE SENSOR MARKET FOR PASSENGER CARS DURING FORECAST PERIOD

- TABLE 159 PASSENGER CAR: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 160 PASSENGER CAR: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 161 PASSENGER CAR: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 162 PASSENGER CAR: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 8.3 LCV

- 8.3.1 SURGING DEMAND FOR LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET GROWTH

- TABLE 163 LCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 164 LCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 165 LCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 166 LCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2023-2028 (MILLION UNITS)

- TABLE 167 LCV: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 168 LCV: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 169 LCV: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 170 LCV: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 8.4 HCV

- 8.4.1 RISING DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE SEGMENTAL GROWTH

- TABLE 171 HCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 172 HCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 173 HCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 174 HCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2023-2028 (MILLION UNITS)

- TABLE 175 HCV: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 176 HCV: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 177 HCV: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 178 HCV: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

9 AUTOMOTIVE SENSOR MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 49 AUTOMOTIVE SENSOR MARKET, BY APPLICATION

- FIGURE 50 SAFETY & CONTROL SYSTEMS TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- TABLE 179 AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 180 AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 181 AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 182 AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2023-2028 (MILLION UNITS)

- 9.2 POWERTRAIN SYSTEMS

- 9.2.1 NEED TO IMPROVE FUEL EFFICIENCY TO DRIVE INNOVATIONS IN POWERTRAIN SYSTEMS

- FIGURE 51 PASSENGER CAR SEGMENT TO LEAD AUTOMOTIVE SENSOR MARKET FOR POWERTRAIN SYSTEMS DURING FORECAST PERIOD

- TABLE 183 POWERTRAIN SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 184 POWERTRAIN SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 185 POWERTRAIN SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 186 POWERTRAIN SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 9.3 CHASSIS

- 9.3.1 DEPLOYMENT OF AUTOMOTIVE SENSORS IN CHASSIS TO IMPROVE VEHICLE SAFETY AND STABILITY

- TABLE 187 CHASSIS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 188 CHASSIS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 189 CHASSIS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 190 CHASSIS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 9.4 EXHAUST SYSTEMS

- 9.4.1 STRINGENT EMISSION STANDARDS TO DRIVE DEMAND FOR EXHAUST SYSTEMS

- TABLE 191 EXHAUST SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 192 EXHAUST SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 193 EXHAUST SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 194 EXHAUST SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 9.5 SAFETY & CONTROL SYSTEMS

- 9.5.1 INCREASED FOCUS ON VEHICLE AND PASSENGER SAFETY TO DRIVE MARKET

- FIGURE 52 PASSENGER CAR SEGMENT TO DOMINATE AUTOMOTIVE SENSOR MARKET FOR SAFETY & CONTROL SYSTEMS DURING FORECAST PERIOD

- TABLE 195 SAFETY & CONTROL SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 196 SAFETY & CONTROL SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 197 SAFETY & CONTROL SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 198 SAFETY & CONTROL SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 9.6 VEHICLE BODY ELECTRONICS

- 9.6.1 INTEGRATION OF ADVANCED ELECTRONIC COMPONENTS IN VEHICLES TO SUPPORT SEGMENTAL GROWTH

- TABLE 199 VEHICLE BODY ELECTRONICS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 200 VEHICLE BODY ELECTRONICS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 201 VEHICLE BODY ELECTRONICS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 202 VEHICLE BODY ELECTRONICS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 9.7 TELEMATICS SYSTEMS

- 9.7.1 STRINGENT GOVERNMENT NORMS REGARDING PASSENGER SAFETY AND SECURITY TO PROMOTE ADOPTION OF TELEMATICS SYSTEMS

- TABLE 203 TELEMATICS SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 204 TELEMATICS SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 205 TELEMATICS SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 206 TELEMATICS SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 9.8 DRIVER ASSISTANCE & AUTOMATION

- 9.8.1 INCREASED ADOPTION OF ADVANCED TECHNOLOGIES TO IMPROVE PASSENGER AND ROAD SAFETY TO SUPPORT MARKET GROWTH

- TABLE 207 DRIVER ASSISTANCE & AUTOMATION: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 208 DRIVER ASSISTANCE & AUTOMATION: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 209 DRIVER ASSISTANCE & AUTOMATION: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 210 DRIVER ASSISTANCE & AUTOMATION: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 9.9 OTHER APPLICATIONS

- TABLE 211 OTHER APPLICATIONS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 212 OTHER APPLICATIONS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 213 OTHER APPLICATIONS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 214 OTHER APPLICATIONS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

10 AUTOMOTIVE SENSOR MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 53 AUTOMOTIVE SENSOR MARKET, BY REGION

- FIGURE 54 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMOTIVE SENSOR MARKET DURING FORECAST PERIOD

- TABLE 215 AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 216 AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 217 AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 218 AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 55 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET SNAPSHOT

- TABLE 219 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (USD MILLION)

- TABLE 220 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (USD MILLION)

- TABLE 221 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (MILLION UNITS)

- TABLE 222 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (MILLION UNITS)

- FIGURE 56 US TO LEAD NORTH AMERICAN AUTOMOTIVE SENSOR MARKET DURING FORECAST PERIOD

- TABLE 223 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 224 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 225 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 226 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 227 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 228 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 229 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 230 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 10.2.2 US

- 10.2.2.1 Increased demand for autonomous and electric vehicles to drive market

- 10.2.3 CANADA

- 10.2.3.1 Government-led initiatives to reduce vehicular emissions to boost demand for automotive sensors

- 10.2.4 MEXICO

- 10.2.4.1 Rising number of free-trade agreements with other countries to create opportunities for market players

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- FIGURE 57 EUROPE: AUTOMOTIVE SENSOR MARKET SNAPSHOT

- TABLE 231 EUROPE: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (USD MILLION)

- TABLE 232 EUROPE: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (USD MILLION)

- TABLE 233 EUROPE: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (MILLION UNITS)

- TABLE 234 EUROPE: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (MILLION UNITS)

- FIGURE 58 GERMANY TO COMMAND EUROPEAN AUTOMOTIVE SENSOR MARKET THROUGHOUT FORECAST PERIOD

- TABLE 235 EUROPE: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 236 EUROPE: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 237 EUROPE: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 238 EUROPE: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 239 EUROPE: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 240 EUROPE: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 241 EUROPE: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 242 EUROPE: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 10.3.2 GERMANY

- 10.3.2.1 Large presence of major automobile OEMs to drive market

- 10.3.3 UK

- 10.3.3.1 Rising implementation of automotive sensors in luxury cars to fuel market growth

- 10.3.4 FRANCE

- 10.3.4.1 Promotion of electric and hybrid vehicles to boost demand for automotive sensors

- 10.3.5 SPAIN

- 10.3.5.1 Presence of stringent vehicular emission norms to boost demand for advanced automotive sensors

- 10.3.6 ITALY

- 10.3.6.1 High demand for small city cars, sports cars, and supercars to contribute to market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 59 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET SNAPSHOT

- TABLE 243 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (USD MILLION)

- TABLE 244 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (USD MILLION)

- TABLE 245 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (MILLION UNITS)

- TABLE 246 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (MILLION UNITS)

- FIGURE 60 CHINA TO LEAD ASIA PACIFIC AUTOMOTIVE SENSOR MARKET DURING FORECAST PERIOD

- TABLE 247 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 248 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 249 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 250 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 251 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 252 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 253 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 254 ASIA PACIFIC: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 10.4.2 CHINA

- 10.4.2.1 Growing use of LiDAR sensors in modern-day vehicles to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Rising focus on manufacturing technologically advanced vehicles to boost demand for automotive sensors

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Increasing demand for vehicle safety and comfort to fuel market growth

- 10.4.5 INDIA

- 10.4.5.1 Growing interest of foreign direct investors in automotive sector to create lucrative opportunities

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 ROW: RECESSION IMPACT

- TABLE 255 ROW: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (USD MILLION)

- TABLE 256 ROW: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (USD MILLION)

- TABLE 257 ROW: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019-2022 (MILLION UNITS)

- TABLE 258 ROW: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2023-2028 (MILLION UNITS)

- FIGURE 61 SOUTH AMERICA TO DOMINATE AUTOMOTIVE SENSOR MARKET IN ROW DURING FORECAST PERIOD

- TABLE 259 ROW: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 260 ROW: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 261 ROW: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 262 ROW: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 263 ROW: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 264 ROW: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 265 ROW: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 266 ROW: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Rising demand for safe and fuel-efficient cars to foster market growth

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Expansion of automobile OEMs into new untapped markets to boost demand

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 267 OVERVIEW OF STRATEGIES DEPLOYED BY KEY AUTOMOTIVE SENSOR PROVIDERS

- 11.3 REVENUE ANALYSIS

- FIGURE 62 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN AUTOMOTIVE SENSOR MARKET, 2018-2022

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 63 AUTOMOTIVE SENSOR MARKET SHARE ANALYSIS, 2022

- TABLE 268 AUTOMOTIVE SENSOR MARKET: MARKET SHARE ANALYSIS, 2022

- 11.5 COMPANY EVALUATION MATRIX, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 64 AUTOMOTIVE SENSOR MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.5.5 COMPANY FOOTPRINT

- TABLE 269 COMPANY FOOTPRINT: APPLICATION

- TABLE 270 COMPANY FOOTPRINT: REGION

- TABLE 271 OVERALL COMPANY FOOTPRINT

- 11.6 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 65 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 11.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 272 AUTOMOTIVE SENSOR MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 273 AUTOMOTIVE SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

- 11.7.1 PRODUCT LAUNCHES

- TABLE 274 PRODUCT LAUNCHES, JANUARY 2019-JUNE 2023

- 11.7.2 DEALS

- TABLE 275 DEALS, JANUARY 2019-AUGUST 2023

- 11.7.3 OTHERS

- TABLE 276 EXPANSIONS AND INVESTMENTS, JULY 2019-AUGUST 2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1 KEY PLAYERS

- 12.1.1 ROBERT BOSCH GMBH

- TABLE 277 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- FIGURE 66 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- 12.1.2 ON SEMICONDUCTOR

- TABLE 278 ON SEMICONDUCTOR: COMPANY OVERVIEW

- FIGURE 67 ON SEMICONDUCTOR: COMPANY SNAPSHOT

- 12.1.3 OMNIVISION

- TABLE 279 OMNIVISION: COMPANY OVERVIEW

- 12.1.4 TE CONNECTIVITY

- TABLE 280 TE CONNECTIVITY: COMPANY OVERVIEW

- FIGURE 68 TE CONNECTIVITY: COMPANY SNAPSHOT

- 12.1.5 CONTINENTAL AG

- TABLE 281 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 69 CONTINENTAL AG: COMPANY SNAPSHOT

- 12.1.6 DENSO CORPORATION

- TABLE 282 DENSO CORPORATION: COMPANY OVERVIEW

- FIGURE 70 DENSO CORPORATION: COMPANY SNAPSHOT

- 12.1.7 INFINEON TECHNOLOGIES AG

- TABLE 283 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 71 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- 12.1.8 NXP SEMICONDUCTORS

- TABLE 284 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- FIGURE 72 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- 12.1.9 PANASONIC

- TABLE 285 PANASONIC: COMPANY OVERVIEW

- FIGURE 73 PANASONIC: COMPANY SNAPSHOT

- 12.1.10 ALLEGRO MICROSYSTEMS, INC.

- TABLE 286 ALLEGRO MICROSYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 74 ALLEGRO MICROSYSTEMS, INC.: COMPANY SNAPSHOT

- 12.2 OTHER KEY PLAYERS

- 12.2.1 SENSATA TECHNOLOGIES, INC.

- 12.2.2 BORGWARNER INC.

- 12.2.3 ANALOG DEVICES, INC.

- 12.2.4 ELMOS SEMICONDUCTOR SE

- 12.2.5 APTIV.

- 12.2.6 CTS CORPORATION

- 12.2.7 AUTOLIV, INC.

- 12.2.8 STMICROELECTRONICS

- 12.2.9 ZF FRIEDRICHSHAFEN AG

- 12.2.10 QUANERGY SOLUTIONS, INC.

- 12.2.11 INNOVIZ TECHNOLOGIES LTD.

- 12.2.12 VALEO S.A.

- 12.2.13 MAGNA INTERNATIONAL INC.

- 12.2.14 MELEXIS

- 12.2.15 AMPHENOL ADVANCED SENSORS

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS