|

|

市場調査レポート

商品コード

1881286

獣医学参照試験所の世界市場:サービス別、用途別、動物タイプ別、エンドユーザー別、地域別 - 2030年までの予測Veterinary Reference Laboratory Market by Service (Microbiology, Immunodiagnostics, Molecular Diagnostics, PCR, ELISA, Hematology, Urinalysis), Animal (Companion, Livestock), Application (Clinical Pathology, Toxicology), Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 獣医学参照試験所の世界市場:サービス別、用途別、動物タイプ別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年11月25日

発行: MarketsandMarkets

ページ情報: 英文 606 Pages

納期: 即納可能

|

概要

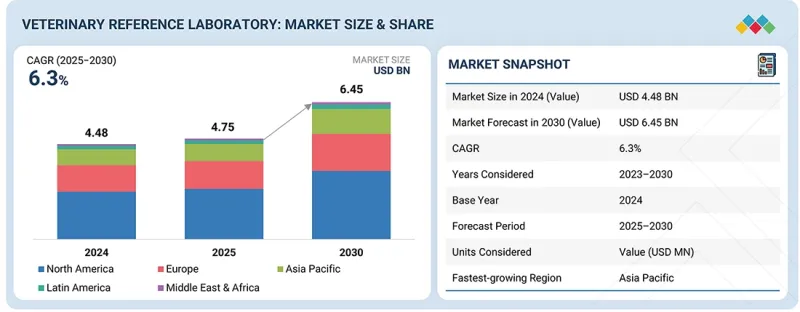

獣医学参照試験所の市場規模は、2025年の475万米ドルから2030年までに646万米ドルへ成長し、CAGR 6.3%を記録すると予測されています。

人獣共通感染症や慢性動物疾患の増加、コンパニオンアニマルの飼育率の上昇、予防医療への重視の高まりが、主に市場の拡大を牽引しています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 金額(10億米ドル) |

| セグメント | サービス別、用途別、動物タイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

分子診断、免疫診断、臨床化学検査などの高度な診断検査に対する需要の高まりにより、先進国および新興地域双方において、高スループットの基準検査機関の設立が加速しています。さらに、自動化、AIベースの画像解析、分子検査における技術的進歩により、検査結果の迅速な提供と診断精度の向上が可能となり、獣医師とペットオーナーの間の信頼関係がさらに深まっています。

同時に、診断サービスとデジタルプラットフォームや検査室情報管理システム(LIMS)の統合が進むことで、ワークフローの効率化、検体のトレーサビリティ向上、検査結果への遠隔アクセスが可能となっています。疾病の早期発見やコンパニオンアニマルの健康管理プログラムへの関心の高まりが検査導入をさらに後押しする一方、獣医療の企業化や診療所と基準検査機関との提携拡大が、安定した検体流入を促進しています。しかしながら、市場は高い運営コストや検査費用、熟練した検査技師の不足、獣医学診断を規制する厳格な基準といった課題に直面しています。さらに、多様な地域における品質保証の維持、バイオセキュリティ対策や検体輸送の課題への対応は、正確性・信頼性・成長の持続を目指す検査機関にとって重要な優先事項であり続けています。

用途別に見ると、獣医学参照試験所市場は臨床病理学、細菌学、ウイルス学、寄生虫学、その他の用途に分類されます。2024年には臨床病理学が市場で最大のシェアを占めました。この優位性は、血液学、細胞学、臨床化学検査を通じて詳細な診断知見を提供する同セグメントの重要な役割に起因します。これらの分析により、獣医師は全身性疾患の正確な診断、治療経過の追跡、複雑な病態の効果的な管理が可能となります。コンパニオンアニマルの増加と獣医診療の頻度上昇が、日常的な病理検査サービスの需要を後押ししています。さらに、自動分析装置やデジタル病理システムにおける技術進歩により、診断精度、効率性、結果報告までの時間が大幅に改善され、この分野の市場成長をさらに促進しています。

エンドユーザー別では、獣医学参照試験所市場は動物病院・診療所、研究機関・大学、ポイントオブケア/院内検査室、その他のエンドユーザーに分類されます。2024年時点で、獣医クリニック・病院セグメントが世界市場で最大のシェアを占めました。この優位性は主に、診断精度と効率向上のため、分子診断、免疫診断、臨床化学検査などの高度かつ専門的な検査を外部委託するクリニックが増加し、集中型検査機関との提携による診断検査量が増加していることに起因します。

コンパニオンアニマルの増加、ペット医療費の拡大、小規模・大規模動物病院ネットワークの拡充も、診療所・病院からの検体流入増加に寄与しています。これらの施設では、院内では効率的に実施できない確定診断や複雑な検査を参考検査機関に依存することで、治療成果と業務フローの改善を図っています。さらに、診療所と参考検査機関間のデジタル検体管理システムや自動結果報告システムの統合により、検査結果の返却時間が短縮され、エビデンスに基づく獣医療が支援されています。

獣医学参照試験所市場は、北米、欧州、アジア太平洋、中東・アフリカに区分されます。2024年時点で、北米が世界市場で最大のシェアを占めました。この優位性は、ペット飼育率の高さ、予防獣医療に対する強い意識、地域全体でのペット向け医療費支出の多さなど、いくつかの主要な要因に起因しています。IDEXX Laboratories、Zoetis Services LLC、Mars, Incorporatedといった主要企業の存在に加え、確立された動物病院・診断センターのネットワークが、同地域の主導的地位をさらに強化しています。北米地域内では、米国が最大の市場シェアを占めています。これは、同国の先進的な獣医療インフラ、専門的・分子診断検査への需要拡大、自動化およびデジタル病理ソリューションの急速な導入に支えられています。さらに、米国市場は、ペット保険の普及率の高さ、獣医療サービス提供者の強固なエコシステム、コンパニオンアニマルおよび家畜診断技術革新に向けた研究開発への積極的な投資といった利点も享受しています。

当レポートでは、世界の獣医学参照試験所市場について調査し、サービス別、用途別、動物タイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 業界動向

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 規制分析

- 特許分析

- 価格分析

- 償還分析

- ペットの親の行動

- 2025年~2026年の主な会議とイベント

- エンドユーザーの視点と満たされていないニーズ

- AI/GEN AIが獣医学参照試験所市場に与える影響

- エコシステムマップ

- 生態系における役割

- バリューチェーン分析

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- 2025年の米国関税が獣医学検査市場に与える影響

第6章 獣医学参照試験所市場(サービス別)

- イントロダクション

- 臨床化学

- 免疫診断

- 分子診断

- 血液学

- 尿検査

- 組織病理学および細胞学

- 微生物学

- その他

第7章 獣医学参照試験所市場(用途別)

- イントロダクション

- 臨床病理学

- 細菌学

- ウイルス学

- 寄生虫学

- 生産性テスト

- 妊娠検査

- 毒性試験

- その他

第8章 獣医学参照試験所市場(動物タイプ別)

- イントロダクション

- コンパニオンアニマル

- 家畜

第9章 獣医学参照試験所市場(エンドユーザー別)

- イントロダクション

- 動物病院・クリニック

- ポイントオブケア/社内検査

- 獣医学調査機関および大学

- その他

第10章 獣医学参照試験所市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- タイ

- ニュージーランド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較

- 主要企業の研究開発費

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- IDEXX LABORATORIES, INC.

- MARS, INCORPORATED

- ZOETIS SERVICES LLC

- GD(ROYAL GD ANIMAL HEALTH)

- LABOKLIN GMBH & CO. KG

- CVS(UK)LIMITED

- NATIONAL VETERINARY SERVICES LABORATORY USDA-APHIS

- ANIMAL AND PLANT HEALTH AGENCY

- ICAR-NIVEDI(NATIONAL INSTITUTE OF VETERINARY EPIDEMIOLOGY AND DISEASE INFORMATICS)

- NATIONAL VETERINARY SERVICES

- TEXAS A&M VETERINARY MEDICAL DIAGNOSTIC LABORATORY(TVMDL)

- ANIMAL HEALTH DIAGNOSTIC CENTER, CORNELL UNIVERSITY

- COLORADO STATE UNIVERSITY(VETERINARY DIAGNOSTIC LABORATORY)

- BIOBEST LABORATORIES LTD.

- PRIVATE VETERINARY CLINIC SAN MARCO SRL UNIPERSONALE

- その他の企業

- ROYAL VETERINARY COLLEGE, UNIVERSITY OF LONDON

- UNIVERSITY OF GUELPH, ANIMAL HEALTH LABORATORY

- VAXXINOVA

- MIRA VISTA LABS

- ELLIE DIAGNOSTICS

- PROTATEK INTERNATIONAL, INC.

- THE PIRBRIGHT INSTITUTE

- CVR LABORATORY(CVRL)

- VETERINARY PATHOLOGY GROUP

- FRIEDRICH-LOEFFLER-INSTITUT(FLI)