|

|

市場調査レポート

商品コード

1622838

船舶用バッテリーの世界市場:タイプ別、船舶タイプ別、機能別、容量別、推進力別、出力別、設計別、形状別、販売別、地域別、予測(~2030年)Marine Battery Market by Type (Lithium, Sodium-ion, Nickel Cadmium, Lead-acid, Fuel-cell), Vessel Type (Commercial, Defense, Unmanned Maritime Vehicles) Function, Capacity, Propulsion, Power, Design, Form, Sales, Regions, Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 船舶用バッテリーの世界市場:タイプ別、船舶タイプ別、機能別、容量別、推進力別、出力別、設計別、形状別、販売別、地域別、予測(~2030年) |

|

出版日: 2024年12月17日

発行: MarketsandMarkets

ページ情報: 英文 293 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の船舶用バッテリーの市場規模は、8億8,230万米ドルから15億600万米ドルに達すると予測され、2024年~2030年の予測期間にCAGRで9.3%の成長が見込まれます。

市場は、技術の進歩や厳しい環境規制などの要因により成長しています。Siemens Energy(ドイツ)、Leclanche SA(スイス)、Corvus Energy(カナダ)、Toshiba Corporation(日本)、EnerSys(米国)などが、船舶用バッテリー市場で活動する主要企業です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 船舶タイプ、機能、容量、推進力、出力、設計、タイプ、販売、形状 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「商業セグメントが予測期間に船舶用バッテリー市場でもっとも高い市場シェアを占めます。」

貨物船、タンカー、旅客船における持続可能な推進システムの採用が急速に増加しています。この成長は、IMO 2020のような厳しい環境規制によるもので、より少ない排出と燃料消費の要件を設定しています。商業船舶は排出規制区域を頻繁に航行するため、これらの規制への適合を維持するためにハイブリッドまたは完全な電気ソリューションを求めています。さらに、運航効率の向上と運航コストの削減に向けた、フェリー、クルーズ船、オフショア支援船の電化への投資の増加が、このセグメントの船舶用バッテリーの需要をさらに後押ししています。

「デュアルパーパスバッテリーセグメントが予測期間に船舶用バッテリー市場でもっとも高いCAGRを占めます。」

デュアルパーパスセグメントは、始動力とディープサイクル機能の両方を提供する汎用性により、2024年~2030年にもっとも高いCAGRを維持すると予測され、無数の海上用途に適しています。信頼性の高いエンジン始動と、航海、照明、補機などの船上システム用の安定した電力に対する需要が強いため、デュアルパーパスバッテリーはこうした船舶に最適です。さらに、デュアルパーパスバッテリーは、個別のバッテリーシステムの必要性を減らすため、スペースとコストを最適化します。ハイブリッド推進システムや先進の船舶技術の需要が高まる中、効率性、耐久性、さまざまな機能要件を満たす柔軟性から、海洋産業ではデュアルパーパスバッテリーの使用が人気を集めています。

「欧州市場がもっとも高い市場シェアを占めると推定されます。」

欧州市場は、一連の厳しい環境規制、政府のインセンティブ、海洋部門における多くの厳しい持続可能性への取り組みにより、船舶用バッテリー市場の成長を促進しています。欧州は、European Green Dealのような取り組みや、船舶からの温室効果ガス排出の大幅な削減を強制するIMO 2020の厳しい法律を通じて、ゼロエミッション輸送を率先して実施しています。例えば、ノルウェー、オランダ、スウェーデンといった国々は、船隊を電化するための新技術を導入しており、特にフェリーや短距離船ではバッテリーシステムがもっとも効率的です。充電ステーションや持続可能なエネルギー源を持つ港湾の広大なネットワークなど、強力なインフラが存在します。

当レポートでは、世界の船舶用バッテリー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 船舶用バッテリー市場の企業にとって魅力的な機会

- 船舶用バッテリー市場:船舶タイプ別

- 船舶用バッテリー市場:タイプ別

- 船舶用バッテリー市場:機能別

- 船舶用バッテリー市場:売上別

- 船舶用バッテリー市場:推進力別

- 船舶用バッテリー市場:容量別

- 船舶用バッテリー市場:形状別

- 船舶用バッテリー市場:設計別

- 船舶用バッテリー市場:出力別

- 船舶用バッテリー市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向と混乱

- バリューチェーン分析

- エコシステム分析

- 著名企業

- 民間企業と中小企業

- エンドユーザー

- 価格分析

- 主要企業の平均販売価格の動向:バッテリータイプ別(2024年)

- 平均販売価格の動向:地域別(2024年)

- 世界のバッテリーの平均価格と船舶用途向けバッテリーの平均価格

- 投資と資金調達のシナリオ

- 数量データ

- 運用データ

- 規制情勢

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 主なステークホルダーと購入基準

- ユースケース分析

- 主な会議とイベント(2025年)

- マクロ経済の見通し

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

- 船舶産業におけるAIの影響:ユースケース

- 総所有コスト(TCO)

- イントロダクション

- バッテリーの使用目的

- コスト要因

- 技術とバッテリーのタイプ

- メンテナンスとアフターマーケットのコスト

- ビジネスモデル

- 資本支出(CAPEX)モデル

- パワーアズアサービス(PAAS)モデル

- バッテリー交換モデル

- BOMの分析

- 船舶用バッテリーに使用される材料

- リチウムイオンバッテリー(電動船、ハイブリッド船)

- 鉛蓄電池(従来式船舶)

- 構造、サポート材料

- 安全、保護材料

- 技術ロードマップ

- バッテリーパック形状の進化

- 既存のバッテリーパック形状

- バッテリーパック形状の将来

- バッテリーパック形状に関する考察

第6章 産業動向

- イントロダクション

- 技術動向

- 次世代固体電池技術

- ハイブリッド、統合エネルギーシステム

- 先進のバッテリー管理システム

- リサイクル可能で環境にやさしいバッテリー

- メガトレンドの影響

- 先進の材料と製造

- ビッグデータアナリティクス

- 持続可能性への取り組み

- AI

- サプライチェーン分析

- 特許分析

- 船舶用バッテリーエコシステムに関する考察

- イントロダクション

- バッテリー技術に関するエンドユーザーの選好

- 各種船舶の電力消費仕様

- 容量とバッテリー出力の採用動向

- バッテリー設計の長所と短所

- 船舶タイプに対する主なバッテリーの機能要件

- 推進ニーズに基づくバッテリータイプの需要

第7章 船舶用バッテリー市場:機能別

- イントロダクション

- 始動用バッテリー

- ディープサイクルバッテリー

- デュアルパーパスバッテリー

第8章 船舶用バッテリー市場:出力別

- イントロダクション

- 75kW未満

- 75~150kW

- 151~745kW

- 746~7,560kW

- 7,560kW超

第9章 船舶用バッテリー市場:容量別

- イントロダクション

- 100AH未満

- 100~250AH

- 250AH超

第10章 船舶用バッテリー市場:設計別

- イントロダクション

- 固体

- 液体/ゲルベース

第11章 船舶用バッテリー市場:形状別

- イントロダクション

- 角形

- 円筒形

- パウチ形

第12章 船舶用バッテリー市場:推進力別

- イントロダクション

- 完全電動

- ハイブリッド

- 従来式

第13章 船舶用バッテリー市場:販売別

- イントロダクション

- OEM

- アフターマーケット

第14章 船舶用バッテリー市場:タイプ別

- イントロダクション

- リチウム

- ナトリウムイオン

- ニッケルカドミウム

- 鉛蓄電池

- 燃料電池

第15章 船舶用バッテリー市場:船舶タイプ別

- イントロダクション

- 商業

- 旅客船

- 貨物船

- その他の船舶

- 防衛

- 駆逐艦

- フリゲート艦

- コルベット

- 揚陸艦

- 航空母艦

- 巡視船

- 無人海洋車両

- 無人水中車両

- 無人水上車両

第16章 船舶用バッテリー市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- スウェーデン

- オランダ

- ノルウェー

- デンマーク

- その他の欧州

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- PESTLE分析

- GCC諸国

- トルコ

- その他の中東

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

第17章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年~2024年)

- 収益分析

- 市場シェア分析

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 競合シナリオ

第18章 企業プロファイル

- 主要企業

- SIEMENS ENERGY

- LECLANCHE SA

- CORVUS ENERGY

- TOSHIBA CORPORATION

- ENERSYS

- SHIFT

- SAFT

- SENSATA TECHNOLOGIES, INC.

- POWERTECH SYSTEMS

- THE FURUKAWA BATTERY CO., LTD.

- EAST PENN MANUFACTURING COMPANY

- KOREA SPECIAL BATTERY CO., LTD.(KSB)

- CLARIOS

- EXIDE TECHNOLOGIES

- SHENZHEN MANLY BATTERY CO., LTD.

- その他の企業

- ECHANDIA AB

- FORSEE POWER

- EST-FLOATTECH

- LITHIUMWERKS

- LIFELINE

- EVEREXCEED INDUSTRIAL CO., LTD.

- US BATTERY

- SOLAREDGE

- FREUDENBERG E-POWER SYSTEMS

- SONNENSCHEIN

第19章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 MARINE BATTERY MARKET

- TABLE 3 CURRENT BATTERY CAPACITY AND POWER REQUIREMENTS FOR SHIPS

- TABLE 4 FEASIBILITY OF DECARBONIZATION SCENARIOS

- TABLE 5 IMPLEMENTATION MILESTONES FOR ELECTRIFICATION IN MARINE TRANSPORT (2025 VS. 2035 VS. 2050)

- TABLE 6 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 7 AVERAGE SELLING PRICES OF KEY PLAYERS, BY BATTERY TYPE, 2024

- TABLE 8 AVERAGE SELLING PRICES OF KEY BATTERY TYPES, BY REGION, 2024

- TABLE 9 GLOBAL AVERAGE BATTERY PRICING AND AVERAGE BATTERY PRICING FOR MARINE APPLICATIONS, 2020-2023 (USD)

- TABLE 10 GLOBAL AVERAGE BATTERY PRICING FORECAST AND AVERAGE BATTERY PRICING FORECAST FOR MARINE APPLICATIONS, 2024-2030 (USD)

- TABLE 11 LITHIUM-ION PRICING FOR NMC AND PHOSPHATE TYPES, 2020-2023 (USD)

- TABLE 12 LITHIUM-ION PRICING FORECAST FOR NMC AND PHOSPHATE TYPES, 2024-2030 (USD)

- TABLE 13 MARINE BATTERY MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 14 MARINE BATTERY MARKET, BY REGION-WISE OEM VESSEL COUNT, 2024-2030 (UNITS)

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LATIN AMERICA AND AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 IMPORT DATA FOR HS CODE 8901 VESSELS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 21 EXPORT DATA FOR HS CODE 8901-COMPLIANT VESSELS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY VESSEL TYPE (%)

- TABLE 23 BUYING CRITERIA, BY KEY VESSEL TYPE

- TABLE 24 KEY CONFERENCES AND EVENTS, 2025

- TABLE 25 IMPACT OF AI ON MARINE VESSEL APPLICATIONS

- TABLE 26 LIST OF MAJOR PATENTS GRANTED IN MARINE BATTERY MARKET, 2023-2024

- TABLE 27 KEY INSIGHTS DRIVING END USER PREFERENCES

- TABLE 28 CAPACITY VS. POWER DEPENDENCE ON VESSEL TYPES

- TABLE 29 PROS AND CONS OF BATTERY DESIGNS

- TABLE 30 KEY BATTERY FUNCTION REQUIREMENTS FOR VESSEL TYPES

- TABLE 31 DEMAND FOR BATTERY TYPES BASED ON PROPULSION NEEDS

- TABLE 32 MARINE BATTERY MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 33 MARINE BATTERY MARKET, BY FUNCTION, 2024-2030 (USD MILLION)

- TABLE 34 MARINE BATTERY MARKET, BY POWER, 2020-2023 (USD MILLION)

- TABLE 35 MARINE BATTERY MARKET, BY POWER, 2024-2030 (USD MILLION)

- TABLE 36 MARINE BATTERY MARKET, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 37 MARINE BATTERY MARKET, BY CAPACITY, 2024-2030 (USD MILLION)

- TABLE 38 MARINE BATTERY MARKET, BY DESIGN, 2020-2023 (USD MILLION)

- TABLE 39 MARINE BATTERY MARKET, BY DESIGN, 2024-2030 (USD MILLION)

- TABLE 40 MARINE BATTERY MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 41 MARINE BATTERY MARKET, BY FORM, 2024-2030 (USD MILLION)

- TABLE 42 MARINE BATTERY MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 43 MARINE BATTERY MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 44 ALL-ELECTRIC SHIP PROJECTS (GLOBAL)

- TABLE 45 MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 46 MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 47 MARINE BATTERY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 48 MARINE BATTERY MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 49 MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 50 MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 51 MARINE BATTERY MARKET, BY COMMERCIAL VESSEL, 2020-2023 (USD MILLION)

- TABLE 52 MARINE BATTERY MARKET, BY COMMERCIAL VESSEL, 2024-2030 (USD MILLION)

- TABLE 53 MARINE BATTERY MARKET, BY PASSENGER VESSEL, 2020-2023 (USD MILLION)

- TABLE 54 MARINE BATTERY MARKET, BY PASSENGER VESSEL, 2024-2030 (USD MILLION)

- TABLE 55 MARINE BATTERY MARKET, BY CARGO VESSEL, 2020-2023 (USD MILLION)

- TABLE 56 MARINE BATTERY MARKET, BY CARGO VESSEL, 2024-2030 (USD MILLION)

- TABLE 57 OTHER VESSELS: MARINE BATTERY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 58 OTHER VESSELS: MARINE BATTERY MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 59 MARINE BATTERY MARKET, BY DEFENSE VESSEL, 2020-2023 (USD MILLION)

- TABLE 60 MARINE BATTERY MARKET, BY DEFENSE VESSEL, 2024-2030 (USD MILLION)

- TABLE 61 MARINE BATTERY MARKET, BY UNMANNED MARITIME VEHICLE, 2020-2023 (USD MILLION)

- TABLE 62 MARINE BATTERY MARKET, BY UNMANNED MARITIME VEHICLE, 2024-2030 (USD MILLION)

- TABLE 63 MARINE BATTERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 MARINE BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARINE BATTERY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARINE BATTERY MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARINE BATTERY MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARINE BATTERY MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 73 US: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 74 US: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 75 US: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 76 US: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 77 CANADA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 78 CANADA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 79 CANADA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 80 CANADA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 81 EUROPE: MARINE BATTERY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 82 EUROPE: MARINE BATTERY MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 83 EUROPE: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 84 EUROPE: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 85 EUROPE: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 86 EUROPE: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 87 EUROPE: MARINE BATTERY MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: MARINE BATTERY MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 89 UK: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 90 UK: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 91 UK: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 92 UK: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 93 SWEDEN: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 94 SWEDEN: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 95 SWEDEN: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 96 SWEDEN: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 97 NETHERLANDS: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 98 NETHERLANDS: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 99 NETHERLANDS: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 100 NETHERLANDS: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 101 NORWAY: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 102 NORWAY: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 103 NORWAY: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 104 NORWAY: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 105 DENMARK: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 106 DENMARK: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 107 DENMARK: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 108 DENMARK: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 110 REST OF EUROPE: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 112 REST OF EUROPE: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARINE BATTERY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARINE BATTERY MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARINE BATTERY MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARINE BATTERY MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 121 CHINA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 122 CHINA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 123 CHINA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 124 CHINA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 125 INDIA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 126 INDIA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 127 INDIA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 128 INDIA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 129 JAPAN: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 130 JAPAN: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 131 JAPAN: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 132 JAPAN: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 133 SOUTH KOREA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 134 SOUTH KOREA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 135 SOUTH KOREA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 136 SOUTH KOREA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET, BY COUNTRY AND REGION, 2020-2023 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET, BY COUNTRY AND REGION, 2024-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 149 UAE: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 150 UAE: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 151 UAE: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 152 UAE: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 153 SAUDI ARABIA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 154 SAUDI ARABIA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 155 SAUDI ARABIA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 156 SAUDI ARABIA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 157 TURKEY: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 158 TURKEY: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 159 TURKEY: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 160 TURKEY: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 161 REST OF MIDDLE EAST: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 162 REST OF MIDDLE EAST: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 165 AFRICA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 166 AFRICA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 167 AFRICA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 168 AFRICA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: MARINE BATTERY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 170 LATIN AMERICA: MARINE BATTERY MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 172 LATIN AMERICA: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 174 LATIN AMERICA: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: MARINE BATTERY MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 176 LATIN AMERICA: MARINE BATTERY MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 177 BRAZIL: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 178 BRAZIL: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 179 BRAZIL: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 180 BRAZIL: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 181 MEXICO: MARINE BATTERY MARKET, BY VESSEL TYPE, 2020-2023 (USD MILLION)

- TABLE 182 MEXICO: MARINE BATTERY MARKET, BY VESSEL TYPE, 2024-2030 (USD MILLION)

- TABLE 183 MEXICO: MARINE BATTERY MARKET, BY SALES, 2020-2023 (USD MILLION)

- TABLE 184 MEXICO: MARINE BATTERY MARKET, BY SALES, 2024-2030 (USD MILLION)

- TABLE 185 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 186 MARINE BATTERY MARKET: DEGREE OF COMPETITION

- TABLE 187 MARINE BATTERY MARKET: COMPANY PROPULSION FOOTPRINT

- TABLE 188 MARINE BATTERY MARKET: COMPANY VESSEL TYPE FOOTPRINT

- TABLE 189 MARINE BATTERY MARKET: COMPANY FORM FOOTPRINT

- TABLE 190 MARINE BATTERY MARKET: COMPANY REGION FOOTPRINT

- TABLE 191 MARINE BATTERY MARKET: LIST OF STARTUPS/SMES

- TABLE 192 MARINE BATTERY MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 193 MARINE BATTERY MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020-NOVEMBER 2024

- TABLE 194 MARINE BATTERY MARKET: DEALS, JANUARY 2020-NOVEMBER 2024

- TABLE 195 MARINE BATTERY MARKET: OTHER DEVELOPMENTS, JANUARY 2020-NOVEMBER 2024

- TABLE 196 SIEMENS ENERGY: COMPANY OVERVIEW

- TABLE 197 SIEMENS ENERGY: PRODUCTS OFFERED

- TABLE 198 SIEMENS ENERGY: DEALS

- TABLE 199 SIEMENS ENERGY: OTHER DEVELOPMENTS

- TABLE 200 LECLANCHE SA: COMPANY OVERVIEW

- TABLE 201 LECLANCHE SA: PRODUCTS OFFERED

- TABLE 202 LECLANCHE SA: PRODUCT LAUNCHES

- TABLE 203 LECLANCHE SA: DEALS

- TABLE 204 LECLANCHE SA: OTHER DEVELOPMENTS

- TABLE 205 CORVUS ENERGY: COMPANY OVERVIEW

- TABLE 206 CORVUS ENERGY: PRODUCTS OFFERED

- TABLE 207 CORVUS ENERGY: DEALS

- TABLE 208 CORVUS ENERGY: OTHER DEVELOPMENTS

- TABLE 209 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 210 TOSHIBA CORPORATION: PRODUCTS OFFERED

- TABLE 211 TOSHIBA CORPORATION: DEALS

- TABLE 212 ENERSYS: COMPANY OVERVIEW

- TABLE 213 ENERSYS: PRODUCTS OFFERED

- TABLE 214 ENERSYS: DEALS

- TABLE 215 ENERSYS: OTHER DEVELOPMENTS

- TABLE 216 SHIFT: COMPANY OVERVIEW

- TABLE 217 SHIFT: PRODUCTS OFFERED

- TABLE 218 SHIFT: DEALS

- TABLE 219 SAFT: COMPANY OVERVIEW

- TABLE 220 SAFT: PRODUCTS OFFERED

- TABLE 221 SAFT: PRODUCT LAUNCHES

- TABLE 222 SENSATA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 223 SENSATA TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 224 SENSATA TECHNOLOGIES, INC.: DEALS

- TABLE 225 POWERTECH SYSTEMS: COMPANY OVERVIEW

- TABLE 226 POWERTECH SYSTEMS: PRODUCTS OFFERED

- TABLE 227 THE FURUKAWA BATTERY CO., LTD.: COMPANY OVERVIEW

- TABLE 228 THE FURUKAWA BATTERY CO., LTD.: PRODUCTS OFFERED

- TABLE 229 THE FURUKAWA BATTERY CO., LTD.: DEALS

- TABLE 230 EAST PENN MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 231 EAST PENN MANUFACTURING COMPANY: PRODUCTS OFFERED

- TABLE 232 EAST PENN MANUFACTURING COMPANY: PRODUCT LAUNCHES

- TABLE 233 EAST PENN MANUFACTURING COMPANY: DEALS

- TABLE 234 KOREA SPECIAL BATTERY CO., LTD. (KSB): COMPANY OVERVIEW

- TABLE 235 KOREA SPECIAL BATTERY CO., LTD. (KSB): PRODUCTS OFFERED

- TABLE 236 CLARIOS: COMPANY OVERVIEW

- TABLE 237 CLARIOS: PRODUCTS OFFERED

- TABLE 238 CLARIOS: PRODUCT LAUNCHES

- TABLE 239 EXIDE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 240 EXIDE TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 241 EXIDE TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 242 SHENZHEN MANLY BATTERY CO., LTD.: COMPANY OVERVIEW

- TABLE 243 SHENZHEN MANLY BATTERY CO., LTD.: PRODUCTS OFFERED

- TABLE 244 ECHANDIA AB: COMPANY OVERVIEW

- TABLE 245 FORSEE POWER: COMPANY OVERVIEW

- TABLE 246 EST-FLOATTECH: COMPANY OVERVIEW

- TABLE 247 LITHIUMWERKS: COMPANY OVERVIEW

- TABLE 248 LIFELINE: COMPANY OVERVIEW

- TABLE 249 EVEREXCEED INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 250 US BATTERY: COMPANY OVERVIEW

- TABLE 251 SOLAREDGE: COMPANY OVERVIEW

- TABLE 252 FREUDENBERG E-POWER SYSTEMS: COMPANY OVERVIEW

- TABLE 253 SONNENSCHEIN: COMPANY OVERVIEW

- TABLE 254 MARINE BATTERY MARKET: LAUNDRY LIST OF MAPPED COMPANIES

List of Figures

- FIGURE 1 REPORT PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 COMMERCIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 LITHIUM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 PRISMATIC SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 10 151-745 KW SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 LIQUID/GEL-BASED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 INCREASING TECHNOLOGICAL ADVANCEMENTS TO DRIVE DEMAND FOR MARINE BATTERIES

- FIGURE 14 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 15 LITHIUM SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 STARTING BATTERIES SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

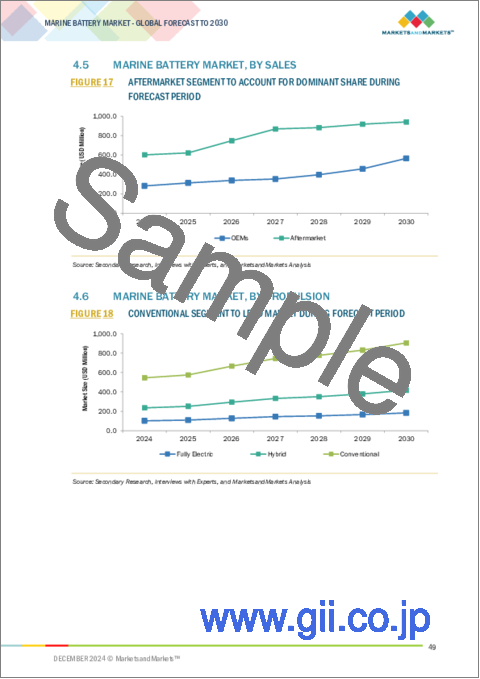

- FIGURE 17 AFTERMARKET SEGMENT TO ACCOUNT FOR DOMINANT SHARE DURING FORECAST PERIOD

- FIGURE 18 CONVENTIONAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 > 250 AH SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 PRISMATIC SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 21 LIQUID/GEL-BASED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 151-745 KW SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 23 SAUDI ARABIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 24 MARINE BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 DEVELOPMENT STAGES OF PORT AND BUNKER PROJECTS, BY FUEL TYPE, 2023

- FIGURE 26 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 GLOBAL AVERAGE BATTERY PRICING AND AVERAGE BATTERY PRICING FOR MARINE APPLICATIONS, 2020-2023 (USD)

- FIGURE 30 GLOBAL AVERAGE BATTERY PRICING FORECAST AND AVERAGE BATTERY PRICING FORECAST FOR MARINE APPLICATIONS, 2024-2030 (USD)

- FIGURE 31 LITHIUM-ION PRICING FOR NMC AND PHOSPHATE TYPES, 2020-2023 (USD MILLION)

- FIGURE 32 LITHIUM-ION PRICING FORECAST FOR NMC AND PHOSPHATE TYPES, 2024-2030 (USD MILLION)

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 34 IMPORT DATA FOR HS CODE 8901 VESSELS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 35 EXPORT DATA FOR HS CODE 8901 VESSELS, 2019-2023 (USD THOUSAND)

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY VESSEL TYPES

- FIGURE 37 KEY BUYING CRITERIA, BY VESSEL TYPE

- FIGURE 38 IMPACT OF AI ON MARINE VESSEL FUNCTIONING

- FIGURE 39 TCO OF MARINE BATTERIES THROUGHOUT THEIR LIFECYCLE

- FIGURE 40 TCO COMPARISON OF MARINE BATTERIES, BY VESSEL TYPE

- FIGURE 41 MARINE BATTERY MARKET: BUSINESS MODELS

- FIGURE 42 BILL OF MATERIALS ANALYSIS FOR MARINE BATTERY COMPONENTS

- FIGURE 43 BILL OF MATERIALS ANALYSIS FOR LITHIUM-ION MARINE BATTERIES

- FIGURE 44 BILL OF MATERIALS ANALYSIS FOR LEAD-ACID BATTERIES

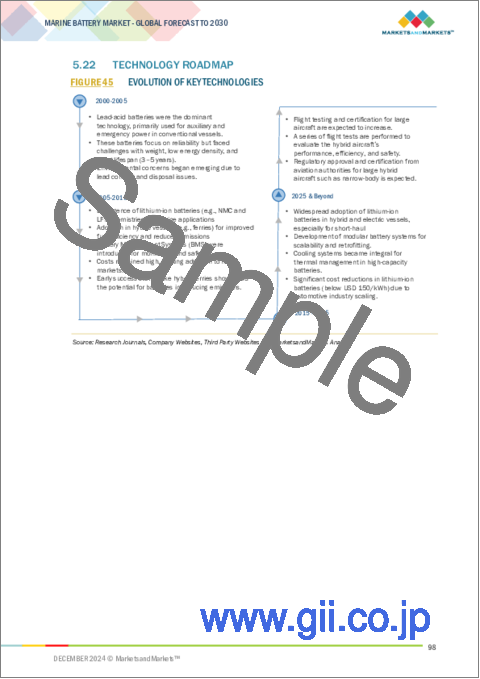

- FIGURE 45 EVOLUTION OF KEY TECHNOLOGIES

- FIGURE 46 TECHNOLOGY ROADMAP FOR MARINE BATTERY MARKET

- FIGURE 47 BATTERY PACKING FORM

- FIGURE 48 SOLID-STATE BATTERY PACKING

- FIGURE 49 SUPPLY CHAIN ANALYSIS

- FIGURE 50 LIST OF MAJOR PATENTS GRANTED IN MARINE BATTERY MARKET, 2013-2023

- FIGURE 51 POWER CONSUMPTION FOR PASSENGER VESSELS

- FIGURE 52 POWER CONSUMPTION FOR CARGO AND OTHER COMMERCIAL VESSELS

- FIGURE 53 CAPACITY VS. POWER FOR DIFFERENT VESSEL TYPES

- FIGURE 54 STARTING BATTERIES SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 55 151-745 KW SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 56 > 250 AH SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 57 SOLID-STATE SEGMENT TO HAVE HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 58 PRISMATIC SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 59 FULLY ELECTRIC SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 60 OEMS SEGMENT TO REGISTER HIGHER CAGR THAN AFTERMARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 61 LITHIUM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 62 UNMANNED MARITIME VEHICLES SEGMENT TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 63 MARINE BATTERY MARKET: REGIONAL SNAPSHOT

- FIGURE 64 NORTH AMERICA: MARINE BATTERY MARKET SNAPSHOT

- FIGURE 65 EUROPE: MARINE BATTERY MARKET SNAPSHOT

- FIGURE 66 ASIA PACIFIC: MARINE BATTERY MARKET SNAPSHOT

- FIGURE 67 MIDDLE EAST & AFRICA: MARINE BATTERY MARKET SNAPSHOT

- FIGURE 68 LATIN AMERICA: MARINE BATTERY MARKET SNAPSHOT

- FIGURE 69 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 70 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 71 MARINE BATTERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 72 MARINE BATTERY MARKET: COMPANY FOOTPRINT

- FIGURE 73 MARINE BATTERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 74 EV/EBIDTA OF PROMINENT MARKET PLAYERS

- FIGURE 75 COMPANY VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 76 BRAND/PRODUCT COMPARISON

- FIGURE 77 SIEMENS ENERGY: COMPANY SNAPSHOT

- FIGURE 78 LECLANCHE SA: COMPANY SNAPSHOT

- FIGURE 79 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 80 ENERSYS: COMPANY SNAPSHOT

- FIGURE 81 THE FURUKAWA BATTERY CO., LTD.: COMPANY SNAPSHOT

The marine battery market is projected to grow from USD 882.3 million to USD 1,506.0 million, at a CAGR of 9.3% during the forecast period from 2024 to 2030. The marine battery market is experiencing growth due to factors such as technological advancements, and stringent environmental regulations. Siemens Energy (Germany), Leclanche SA (Switzerland), Corvus Energy (Canada), Toshiba Corporation (Japan) and EnerSys (US) are some of the leading players operating in the marine battery market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By vessel type, function, capacity, propulsion, power, design, type, sales, form |

| Regions covered | North America, Europe, APAC, RoW |

"The Commercial segment to account for highest market share in the marine battery market during the forecast period."

The marine battery market has been segmented into commercial, defense, Unmanned Underwater Vehicles and Unmanned Surface Vehicles based on ship type. The commercial segment is projected to grow at highest market share during the forecast period 2024 to 2030. The adoption of sustainable propulsion systems in cargo ships, tankers, and passenger vessels is rising fast. The growth here is due to strict environmental regulations such as IMO 2020, which sets up the requirement for lesser emissions and fuel consumption. Commercial ships frequently sails in the Emission Controlled Zones and seek hybrid or fully electric solutions to maintain compliance with these regulations. Additionally, increasing investments in electrifying ferries, cruise ships, and offshore support vessels to enhance operational efficiency and reduce operating costs further support the demand for marine batteries in this segment.

"The Dual-Purpose batteries segment to account for highest CAGR in the marine battery market during the forecast period."

The marine battery has been segmented into Starting Batteries, Deep-cycle Batteries, and Dual-Purpose Batteries based on function . The dual-purpose segment is expected to hold the highest CAGR from 2024 to 2030 based on their versatility in providing both starting power and deep-cycle capabilities, making it suitable for a myriad of maritime applications. Due to strong demand for reliable engine starting and consistent power for onboard systems such as navigation, lighting, and auxiliary equipment, dual purpose batteries are best suited for such vessels. In addition, dual-purpose batteries reduce the requirement for separate battery systems, thereby optimizing space and cost for operators. With the increasing demand in hybrid propulsion systems and advanced marine technologies, the use of dual-purpose batteries is gaining popularity within the maritime industry due to their efficiency, durability, and flexibility to meet varied functional requirements.

"The European market is estimated to hold the highest market share."

European market due to a series of severe environmental regulations, government incentives, and many more stringent sustainability initiatives in the maritime sector have driven the growth of marine battery market. Europe has been on the lead to enforce zero-emission transportation through initiatives like the European Green Deal and strict IMO 2020 laws enforcing a great deal of reduction in greenhouse gas emissions from ships. Countries such as Norway, the Netherlands, and Sweden, for instance, are embracing new technologies to make their fleet electrified, and more specifically in ferries and short-range vessels, as battery systems would be most efficient there. Strong infrastructure exists, including charging stations and a widespread network of ports with sustainable energy sources.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-20%; Europe-40%; Asia Pacific-20%; Rest of the Worlds- 20%

Siemens Energy (Germany), Leclanche SA (Switzerland), Corvus Energy (Canada), Toshiba Corporation (Japan) and EnerSys (US) are some of the leading players operating in the marine battery market .

Research Coverage

The study covers the marine battery market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on propulsion, capacity, operation and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall marine battery market and its subsegments. The report covers the entire ecosystem of the marine battery market . It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and factors, such as increasing consumer preference for high-quality marine battery services, rising global traffic need that could contribute to an increase in marine battery market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the aircraft cabin interiors market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in aircraft cabin interiors market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Siemens Energy (Germany), Leclanche SA (Switzerland), Corvus Energy (Canada), Toshiba Corporation (Japan) and EnerSys (US) among others in the marine battery market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY & PRICING

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARINE BATTERY MARKET

- 4.2 MARINE BATTERY MARKET, BY VESSEL TYPE

- 4.3 MARINE BATTERY MARKET, BY TYPE

- 4.4 MARINE BATTERY MARKET, BY FUNCTION

- 4.5 MARINE BATTERY MARKET, BY SALES

- 4.6 MARINE BATTERY MARKET, BY PROPULSION

- 4.7 MARINE BATTERY MARKET, BY CAPACITY

- 4.8 MARINE BATTERY MARKET, BY FORM

- 4.9 MARINE BATTERY MARKET, BY DESIGN

- 4.10 MARINE BATTERY MARKET, BY POWER

- 4.11 MARINE BATTERY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising fuel costs and need for operational efficiency

- 5.2.1.2 Growth in demand for electric and hybrid marine vessels

- 5.2.1.3 Advances in battery technology

- 5.2.1.4 Stringent environmental regulations

- 5.2.1.5 Increasing trend toward decarbonization and renewable energy integration

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital requirements

- 5.2.2.2 Inadequate charging infrastructure

- 5.2.2.3 Limited recycling and disposal solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Hybrid propulsion systems

- 5.2.3.2 Electrification of short-range vessels

- 5.2.3.3 Rapid innovations and technological advancements

- 5.2.4 CHALLENGES

- 5.2.4.1 Energy density limitations

- 5.2.4.2 Supply chain constraints and raw material shortage

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY BATTERY TYPE, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND, BY REGION, 2024

- 5.6.2.1 Factors affecting pricing, by region

- 5.6.2.1.1 North America

- 5.6.2.1.2 Europe

- 5.6.2.1.3 Asia Pacific

- 5.6.2.1 Factors affecting pricing, by region

- 5.6.3 AVERAGE GLOBAL BATTERY PRICING AND AVERAGE BATTERY PRICING FOR MARINE APPLICATIONS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 VOLUME DATA

- 5.9 OPERATIONAL DATA

- 5.10 REGULATORY LANDSCAPE

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- 5.11.2 EXPORT SCENARIO

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Lithium-ion batteries

- 5.12.1.2 Solid-state batteries

- 5.12.2 ADJACENT TECHNOLOGIES

- 5.12.2.1 Power-to-X (P2X) technology

- 5.12.2.2 Battery thermal management systems

- 5.12.3 COMPLEMENTARY TECHNOLOGIES

- 5.12.3.1 Battery management system

- 5.12.3.2 Energy management system

- 5.12.1 KEY TECHNOLOGIES

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 USE CASE ANALYSIS

- 5.14.1 NISHISHIBA ELECTRIC DEVELOPED JAPAN'S FIRST HYBRID FREIGHT COASTER, UTASHIMA, UTILIZING LITHIUM-ION BATTERIES FOR PROPULSION

- 5.14.2 LECLANCHE PROVIDED HYBRID ENERGY STORAGE SYSTEM FEATURING LITHIUM-ION BATTERIES FOR PROPULSION

- 5.14.3 DAMEN SHIPYARDS GROUP INTEGRATED SCIB AS POWER SOURCE FOR ITS ELECTRIC FERRY, DAMEN FERRY 2306E3

- 5.15 KEY CONFERENCES AND EVENTS, 2025

- 5.16 MACROECONOMIC OUTLOOK

- 5.16.1 INTRODUCTION

- 5.16.2 NORTH AMERICA

- 5.16.3 EUROPE

- 5.16.4 ASIA PACIFIC

- 5.16.5 MIDDLE EAST & AFRICA

- 5.16.6 LATIN AMERICA

- 5.17 IMPACT OF AI ON MARINE INDUSTRY: USE CASES

- 5.17.1 IMPACT OF AI ON MARINE BATTERY MARKET

- 5.18 TOTAL COST OF OWNERSHIP (TCO)

- 5.18.1 INTRODUCTION

- 5.18.2 PURPOSE OF BATTERY USAGE

- 5.18.2.1 Electric vessels

- 5.18.2.2 Conventional vessels

- 5.18.3 COST DRIVERS

- 5.18.3.1 Electric vessels

- 5.18.3.2 Conventional vessels

- 5.18.4 TECHNOLOGY AND BATTERY TYPE

- 5.18.4.1 Electric vessels

- 5.18.4.2 Conventional vessels

- 5.18.5 MAINTENANCE AND AFTERMARKET COSTS

- 5.18.5.1 Electric vessels

- 5.18.5.2 Conventional vessels

- 5.19 BUSINESS MODELS

- 5.19.1 CAPITAL EXPENDITURE (CAPEX) MODEL

- 5.19.2 POWER-AS-A-SERVICE (PAAS) MODEL

- 5.19.3 BATTERY SWAPPING MODEL

- 5.20 BILL OF MATERIALS ANALYSIS

- 5.20.1 BILL OF MATERIALS ANALYSIS FOR MARINE BATTERY COMPONENTS

- 5.21 MATERIALS USED IN MARINE BATTERIES

- 5.21.1 LITHIUM-ION BATTERIES (ELECTRIC AND HYBRID VESSELS)

- 5.21.2 LEAD-ACID BATTERIES (CONVENTIONAL VESSELS)

- 5.21.3 STRUCTURAL AND SUPPORT MATERIALS

- 5.21.4 SAFETY AND PROTECTIVE MATERIALS

- 5.22 TECHNOLOGY ROADMAP

- 5.23 EVOLUTION OF BATTERY PACKING FORM

- 5.23.1 EXISTING BATTERY PACKING FORM

- 5.23.2 FUTURE OF BATTERY PACKING FORM

- 5.23.3 INSIGHTS ON BATTERY PACKING FORM

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 NEXT-GENERATION SOLID-STATE BATTERY TECHNOLOGY

- 6.2.2 HYBRID AND INTEGRATED ENERGY SYSTEMS

- 6.2.3 ADVANCED BATTERY MANAGEMENT SYSTEMS

- 6.2.4 RECYCLABLE AND ECO-FRIENDLY BATTERIES

- 6.3 IMPACT OF MEGA TRENDS

- 6.3.1 ADVANCED MATERIALS AND MANUFACTURING

- 6.3.2 BIG DATA ANALYTICS

- 6.3.3 SUSTAINABILITY INITIATIVES

- 6.3.4 ARTIFICIAL INTELLIGENCE

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

- 6.6 INSIGHTS ON MARINE BATTERY ECOSYSTEM

- 6.6.1 INTRODUCTION

- 6.6.2 END USER PREFERENCES ON BATTERY TECHNOLOGIES

- 6.6.2.1 Dual-purpose innovations to enhance market penetration

- 6.6.2.2 Transitioning from lithium to next-generation batteries

- 6.6.2.3 Collaboration as a catalyst for growth

- 6.6.2.4 Lifecycle integration to maximize ROI

- 6.6.2.5 Region-wise adoption strategies

- 6.6.3 POWER CONSUMPTION SPECIFICATIONS FOR DIFFERENT VESSEL TYPES

- 6.6.4 CAPACITY VS. BATTERY POWER ADOPTION TRENDS

- 6.6.4.1 Positive correlation in sustained energy delivery

- 6.6.4.2 Inverse correlation in high-power systems

- 6.6.4.3 Capacity supporting power efficiency

- 6.6.4.4 Trade-off correlation in hybrid systems

- 6.6.4.5 Application-dependent correlation

- 6.6.5 PROS AND CONS OF BATTERY DESIGNS

- 6.6.6 KEY BATTERY FUNCTION REQUIREMENTS FOR VESSEL TYPES

- 6.6.7 DEMAND FOR BATTERY TYPES BASED ON PROPULSION NEEDS

7 MARINE BATTERY MARKET, BY FUNCTION

- 7.1 INTRODUCTION

- 7.2 STARTING BATTERIES

- 7.2.1 STARTING BATTERIES DELIVER QUICK BURSTS OF HIGH POWER

- 7.3 DEEP-CYCLE BATTERIES

- 7.3.1 NEED FOR STEADY AMOUNT OF POWER OVER EXTENDED PERIOD TO BOOST GROWTH

- 7.4 DUAL-PURPOSE BATTERIES

- 7.4.1 MULTIPURPOSE ENERGY NEEDS IN SMALL VESSELS TO DRIVE DEMAND FOR DUAL-PURPOSE BATTERIES

8 MARINE BATTERY MARKET, BY POWER

- 8.1 INTRODUCTION

- 8.2 < 75 KW

- 8.2.1 ADOPTION OF < 75 KW BATTERIES IN SMALL AND MEDIUM-SIZED VESSELS TO DRIVE MARKET

- 8.3 75-150 KW

- 8.3.1 INCREASING ADOPTION OF HYBRID PROPULSION SYSTEMS TO DRIVE MARKET FOR 75-150 KW BATTERIES

- 8.4 151-745 KW

- 8.4.1 DEMAND FOR BATTERIES WITH HIGH POWER OUTPUT TO DRIVE MARKET

- 8.5 746-7,560 KW

- 8.5.1 HIGH ENERGY DENSITY, SCALABILITY, AND ABILITY OF 746-7,560 KW BATTERIES TO HANDLE HEAVY LOADS TO DRIVE DEMAND

- 8.6 > 7,560 KW

- 8.6.1 MARINE BATTERIES WITH POWER RATINGS ABOVE 7,560 KW USED FOR LONG-HAUL OPERATIONS

9 MARINE BATTERY MARKET, BY CAPACITY

- 9.1 INTRODUCTION

- 9.2 < 100 AH

- 9.2.1 MARINE BATTERIES WITH LESS THAN 100 AH USED FOR SMALL VESSELS WITH MODERN POWER REQUIREMENTS

- 9.3 100-250 AH

- 9.3.1 USE OF 100-250 AH MARINE BATTERIES IN RECREATIONAL AND COMMERCIAL VESSELS TO DRIVE MARKET

- 9.4 > 250 AH

- 9.4.1 NEED FOR LARGE VESSELS REQUIRING POWER FOR EXTENDED PERIOD TO DRIVE MARKET

10 MARINE BATTERY MARKET, BY DESIGN

- 10.1 INTRODUCTION

- 10.2 SOLID-STATE

- 10.2.1 INCREASING NEED FOR HIGH ENERGY DENSITY TO DRIVE MARKET

- 10.3 LIQUID/GEL-BASED

- 10.3.1 COST-EFFECTIVENESS, RELIABILITY, AND SUITABILITY OF LIQUID/GEL-BASED BATTERIES TO DRIVE THEIR DEMAND

11 MARINE BATTERY MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 PRISMATIC

- 11.2.1 NEED FOR BATTERIES WITH COMPACT DESIGN AND DURABILITY TO DRIVE GROWTH

- 11.3 CYLINDRICAL

- 11.3.1 HIGH DEMAND FOR THERMALLY STABLE BATTERIES TO PROPEL DEMAND

- 11.4 POUCH

- 11.4.1 NEED FOR BATTERIES WITH LIGHT WEIGHT AND COMPACT DESIGN TO DRIVE MARKET

12 MARINE BATTERY MARKET, BY PROPULSION

- 12.1 INTRODUCTION

- 12.2 FULLY ELECTRIC

- 12.2.1 INCREASING FOCUS ON DECARBONIZATION TO DRIVE MARKET

- 12.3 HYBRID

- 12.3.1 REDUCES FUEL USAGE AND VESSEL'S CARBON FOOTPRINT

- 12.4 CONVENTIONAL

- 12.4.1 NEED TO SUPPLEMENT TRADITIONAL PROPULSION SYSTEMS TO DRIVE MARKET

13 MARINE BATTERY MARKET, BY SALES

- 13.1 INTRODUCTION

- 13.2 OEMS

- 13.2.1 INCREASING EMPHASIS ON SUSTAINABILITY TO DRIVE MARKET

- 13.3 AFTERMARKET

- 13.3.1 ADVANCEMENTS IN BATTERY TECHNOLOGIES TO DRIVE MARKET

14 MARINE BATTERY MARKET, BY TYPE

- 14.1 INTRODUCTION

- 14.2 LITHIUM

- 14.2.1 NEED FOR HIGH-PERFORMANCE BATTERIES TO DRIVE MARKET

- 14.3 SODIUM-ION

- 14.3.1 NEED FOR SUSTAINABLE, COST-EFFECTIVE, AND ABUNDANT SOLUTIONS FOR ENERGY STORAGE TO DRIVE MARKET

- 14.4 NICKEL CADMIUM

- 14.4.1 HARSH MARITIME ENVIRONMENTS TO DRIVE DEMAND FOR NICKEL-CADMIUM BATTERIES

- 14.5 LEAD-ACID

- 14.5.1 LOW MANUFACTURING AND REPLACEMENT COSTS TO DRIVE MARKET

- 14.6 FUEL CELL

- 14.6.1 NEED FOR VESSEL ELECTRIFICATION TO DRIVE GROWTH

15 MARINE BATTERY MARKET, BY VESSEL TYPE

- 15.1 INTRODUCTION

- 15.2 COMMERCIAL

- 15.2.1 PASSENGER VESSELS

- 15.2.1.1 Yachts

- 15.2.1.1.1 Increasing adoption of green technologies to drive market

- 15.2.1.2 Ferries

- 15.2.1.2.1 Increasing use of electric ferries to drive demand

- 15.2.1.3 Cruise ships

- 15.2.1.3.1 Demand for operational efficiency of vessels to drive market

- 15.2.1.1 Yachts

- 15.2.2 CARGO VESSELS

- 15.2.2.1 Container vessels

- 15.2.2.1.1 Shift toward hybrid, zero-emission port operations to drive demand

- 15.2.2.2 Bulk carriers

- 15.2.2.2.1 Increasing adoption of hybrid-electric propulsion systems to drive market

- 15.2.2.3 Tankers

- 15.2.2.3.1 Increasing need for enhanced energy storage for emergency systems to drive market

- 15.2.2.4 Gas tankers

- 15.2.2.4.1 Conversion of traditional gas tankers to sustainable mode of propulsion

- 15.2.2.5 Dry cargo ships

- 15.2.2.5.1 Increasing cargo volume to boost growth

- 15.2.2.6 Barges

- 15.2.2.6.1 Increase in small inland waterways to drive market

- 15.2.2.1 Container vessels

- 15.2.3 OTHER VESSELS

- 15.2.3.1 Fishing vessels

- 15.2.3.1.1 Low fuel consumption of fully electric fishing vessels to drive demand

- 15.2.3.2 Tugs and workboats

- 15.2.3.2.1 Increasing support of ports for electrification of vessels to drive market

- 15.2.3.3 Research vessels

- 15.2.3.3.1 Technological advancements in battery technology to propel growth

- 15.2.3.4 Dredgers

- 15.2.3.4.1 Adoption of hybrid systems to boost demand

- 15.2.3.1 Fishing vessels

- 15.2.1 PASSENGER VESSELS

- 15.3 DEFENSE

- 15.3.1 DESTROYERS

- 15.3.1.1 Increasing use of electric propulsive destroyers to boost growth

- 15.3.2 FRIGATES

- 15.3.2.1 Plans by naval forces to install hybrid propulsion systems for frigates to boost market

- 15.3.3 CORVETTES

- 15.3.3.1 Enhanced operational flexibility requirements by corvettes to drive growth

- 15.3.4 AMPHIBIOUS SHIPS

- 15.3.4.1 Increasing use of amphibious ships with hybrid propulsion by naval forces to drive market

- 15.3.5 AIRCRAFT CARRIERS

- 15.3.5.1 Adoption of hybrid and electric propulsion systems to boost growth

- 15.3.6 PATROL VESSELS

- 15.3.6.1 Increasing need for surveillance and protection missions to drive growth

- 15.3.1 DESTROYERS

- 15.4 UNMANNED MARITIME VEHICLES

- 15.4.1 UNMANNED UNDERWATER VEHICLES

- 15.4.1.1 Growth in underwater defense operations to drive market

- 15.4.2 UNMANNED SURFACE VEHICLES

- 15.4.2.1 Need for increasing surveillance and reconnaissance to drive demand

- 15.4.1 UNMANNED UNDERWATER VEHICLES

16 MARINE BATTERY MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 PESTLE ANALYSIS

- 16.2.2 US

- 16.2.2.1 Increasing adoption of electric boats to drive market

- 16.2.3 CANADA

- 16.2.3.1 Increasing emphasis on cleaner boating to drive market

- 16.3 EUROPE

- 16.3.1 PESTLE ANALYSIS

- 16.3.2 UK

- 16.3.2.1 Increasing investment in electric marine ecosystems for passenger vessels to drive market

- 16.3.3 SWEDEN

- 16.3.3.1 Government incentives and subsidy plans to drive market

- 16.3.4 NETHERLANDS

- 16.3.4.1 Increasing adoption of zero-emission ships to drive market

- 16.3.5 NORWAY

- 16.3.5.1 Replacement of traditional vessels with electric vessels to drive market

- 16.3.6 DENMARK

- 16.3.6.1 Favorable environmental regulations to drive market

- 16.3.7 REST OF EUROPE

- 16.4 ASIA PACIFIC

- 16.4.1 PESTLE ANALYSIS

- 16.4.2 CHINA

- 16.4.2.1 Strategic development of marine transportation and presence of shipbuilding companies to drive market

- 16.4.3 INDIA

- 16.4.3.1 Growth of maritime industry with focus on carbon emission reduction to drive market

- 16.4.4 JAPAN

- 16.4.4.1 Increasing electric shipbuilding industry to drive market

- 16.4.5 SOUTH KOREA

- 16.4.5.1 Advancements in battery technology to drive market

- 16.4.6 REST OF ASIA PACIFIC

- 16.5 MIDDLE EAST & AFRICA

- 16.5.1 PESTLE ANALYSIS

- 16.5.2 GCC COUNTRIES

- 16.5.2.1 UAE

- 16.5.2.1.1 Government initiatives to build electric and hybrid vessels to drive market

- 16.5.2.2 Saudi Arabia

- 16.5.2.2.1 Increase in cruise ships, ferries, and tourist yachts to drive market

- 16.5.2.1 UAE

- 16.5.3 TURKEY

- 16.5.3.1 Government incentives for sustainable shipping solutions to drive market

- 16.5.4 REST OF MIDDLE EAST

- 16.5.4.1 AFRICA

- 16.5.4.1.1 Increasing investments in research & development to drive market

- 16.5.4.1 AFRICA

- 16.6 LATIN AMERICA

- 16.6.1 PESTLE ANALYSIS

- 16.6.2 BRAZIL

- 16.6.2.1 Adoption of hybrid propulsion in large vessels to drive market

- 16.6.3 MEXICO

- 16.6.3.1 Growth in demand for marine travel to drive market

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 17.3 REVENUE ANALYSIS

- 17.4 MARKET SHARE ANALYSIS

- 17.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 17.5.1 STARS

- 17.5.2 EMERGING LEADERS

- 17.5.3 PERVASIVE PLAYERS

- 17.5.4 PARTICIPANTS

- 17.5.5 COMPANY FOOTPRINT: KEY PLAYERS

- 17.5.5.1 Company footprint

- 17.5.5.2 Company propulsion footprint

- 17.5.5.3 Company vessel type footprint

- 17.5.5.4 Company form footprint

- 17.5.5.5 Company region footprint

- 17.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 17.6.1 PROGRESSIVE COMPANIES

- 17.6.2 RESPONSIVE COMPANIES

- 17.6.3 DYNAMIC COMPANIES

- 17.6.4 STARTING BLOCKS

- 17.6.5 COMPETITIVE BENCHMARKING

- 17.7 COMPANY VALUATION AND FINANCIAL METRICS

- 17.8 BRAND/PRODUCT COMPARISON

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 17.9.2 DEALS

- 17.9.3 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 SIEMENS ENERGY

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Deals

- 18.1.1.3.2 Other developments

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 LECLANCHE SA

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches

- 18.1.2.3.2 Deals

- 18.1.2.3.3 Other developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 CORVUS ENERGY

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Deals

- 18.1.3.3.2 Other developments

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 TOSHIBA CORPORATION

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Deals

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 ENERSYS

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Deals

- 18.1.5.3.2 Other developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 SHIFT

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Deals

- 18.1.7 SAFT

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Product launches

- 18.1.8 SENSATA TECHNOLOGIES, INC.

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Deals

- 18.1.9 POWERTECH SYSTEMS

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.10 THE FURUKAWA BATTERY CO., LTD.

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Deals

- 18.1.11 EAST PENN MANUFACTURING COMPANY

- 18.1.11.1 Business overview

- 18.1.11.2 Products offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Product launches

- 18.1.11.3.2 Deals

- 18.1.12 KOREA SPECIAL BATTERY CO., LTD. (KSB)

- 18.1.12.1 Business overview

- 18.1.12.2 Products offered

- 18.1.13 CLARIOS

- 18.1.13.1 Business overview

- 18.1.13.2 Products offered

- 18.1.13.3 Recent developments

- 18.1.13.3.1 Product launches

- 18.1.14 EXIDE TECHNOLOGIES

- 18.1.14.1 Business overview

- 18.1.14.2 Products offered

- 18.1.14.3 Recent developments

- 18.1.14.3.1 Product launches

- 18.1.15 SHENZHEN MANLY BATTERY CO., LTD.

- 18.1.15.1 Business overview

- 18.1.15.2 Products offered

- 18.1.1 SIEMENS ENERGY

- 18.2 OTHER PLAYERS

- 18.2.1 ECHANDIA AB

- 18.2.2 FORSEE POWER

- 18.2.3 EST-FLOATTECH

- 18.2.4 LITHIUMWERKS

- 18.2.5 LIFELINE

- 18.2.6 EVEREXCEED INDUSTRIAL CO., LTD.

- 18.2.7 US BATTERY

- 18.2.8 SOLAREDGE

- 18.2.9 FREUDENBERG E-POWER SYSTEMS

- 18.2.10 SONNENSCHEIN

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 ANNEXURE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS