|

|

市場調査レポート

商品コード

1106659

ポリウレアコーティングの世界市場:原料の種類別・ポリウレアの種類別 (純粋、ハイブリッド)・技術別 (吹付、注入、ハンドミキシング)・最終用途別 (建築・建設、輸送、工業、修景) の将来予測 (2027年まで)Polyurea Coatings Market by Raw Material Type, Polyurea Type (Pure and Hybrid), Technology (Spraying, Pouring, Hand Mixing) and End-Use (Building & Construction, Transportation, Industrial, Landscape) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ポリウレアコーティングの世界市場:原料の種類別・ポリウレアの種類別 (純粋、ハイブリッド)・技術別 (吹付、注入、ハンドミキシング)・最終用途別 (建築・建設、輸送、工業、修景) の将来予測 (2027年まで) |

|

出版日: 2022年07月21日

発行: MarketsandMarkets

ページ情報: 英文 262 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

ポリウレアコーティングの世界市場規模は2021年に12億米ドルで、予測期間中にCAGR10.3%で成長し、2027年には20億米ドルに達すると予測されています。

ポリウレアコーティングは、VOCを含まず、ポットライフが長く、硬化速度が速いです。また、過酷な条件下 (高湿度下および/または低温下) でも使用することができます。

"純粋タイプのセグメントは、予測期間中、ポリウレアコーティング市場全体の中で、量的に最も高いCAGRを記録する"

純粋ポリウレアコーティングは、鉱業、パイプライン、車両、屋根、鉄骨構造、コンクリート構造、床、プールなどで使用されています。中国は長年にわたり、化石燃料、宝石、金属の採掘でトップの座を占めてきました。この鉱業におけるトップの座を背景に、アジア太平洋は世界の鉱業およびポリウレアコーティング市場で大きなシェアを獲得しています。インド、中国、ベトナム、マレーシア、インドネシア、オーストラリア、ニュージーランド、スリランカといった鉱物が豊富な国も積極的に採掘活動を行っており、ポリウレアコーティングの需要を押し上げています。このシナリオは予測期間中も続くと予想されます。

"予測期間中、技術別では吹き付けセグメントが最も高いCAGRを記録する"

このセグメントの市場促進要因は、各国のインフラ成長、床面用コーティング、屋根用コーティング、ベッドライニング、二次封じ込め、廃水処理などの活用領域の成長です。アジア太平洋、特に中国、インド、タイ、インドネシア、マレーシアなどの発展途上国から、これらの用途に対する強い需要があります。世界のポリウレアコーティングメーカーは、これらの新興地域に製造施設や販売事務所を設立して、需要の増加に対応しています。

"アジア太平洋のポリウレアコーティング市場は、予測期間中に最大の市場シェアを記録する"

アジア太平洋は、急速に発展している国々が数多く存在する新興経済圏です。各種業界・企業がこの地域への投資に意欲的です。北米と欧州の大手企業の多くは、安価な原材料、低い生産コスト、現地の新興市場により良いサービスを提供できることから、製造拠点をアジア太平洋に移すことを計画しています。アジア太平洋では、中産階級の可処分所得の増加により、プレミアム製品や高品質な製品に対する需要が高まっています。このため、アジア太平洋の市場では、ポリウレアコーティングの需要が増加しています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 原材料分析

- イソシアネート

- レジンブレンド

- バリューチェーンの概要

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 世界の建設動向と予測

- 技術の概要

- ケーススタディ

- 平均価格分析

- ポリウレアコーティングの主要な輸出国・輸入国

- COVID-19以後のサプライチェーンの危機

- 世界市場のシナリオ

- エコシステムマップ

- 顧客のビジネスに影響を与える傾向/混乱

- 世界の規制状況

- 特許分析

- COVID-19の影響分析

- COVID-19の経済的評価

- COVID-19の影響:シナリオ評価

- 2022年から2023年の主要な会議とイベント

第6章 ポリウレアコーティング市場:原材料別

- イントロダクション

- 芳香族イソシアナート

- 脂肪族イソシアネート

第7章 ポリウレアコーティング市場:ポリウレアの種類別

- イントロダクション

- 純粋ポリウレア

- ハイブリッドポリウレア

第8章 ポリウレアコーティング市場:技術別

- イントロダクション

- 吹付

- 注入

- ハンドミキシング

第9章 ポリウレアコーティング市場:最終用途産業別

- イントロダクション

- 建物・建設

- 輸送

- 工業

- 修景

第10章 ポリウレアコーティング市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- インドネシア

- 台湾

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- ベネルクス諸国

- 英国

- フランス

- スペイン

- イタリア

- ロシア

- 他の欧州諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- 他の中東・アフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- 他の南米諸国

第11章 競合情勢

- 概要

- 市場シェア分析

- ポリウレアの競合市場:競争の程度

- 市場ランキング分析

- 主要企業の戦略/有力企業

- 企業収益の分析

- 競合リーダーシップマッピング (2021年)

- 中小企業のマトリックス (2021)

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合ベンチマーキング

- 競合シナリオ

- 戦略の動向

- 取引

第12章 企業プロファイル

- PPG INDUSTRIES INC.

- SHERWIN-WILLIAMS COMPANY

- NUKOTE COATING SYSTEMS

- ARMORTHANE INC.

- WASSER CORPORATION

- RHINO LININGS CORPORATION

- KUKDO CHEMICAL CO., LTD.

- VOELKEL INDUSTRIAL PRODUCTS GMBH(VIP)

- TEKNOS

- その他の企業

- POLYCOAT PRODUCTS LLC

- TECHNOPOL

- SATYEN POLYMERS PVT. LTD

- PROKOL PROTECTIVE COATINGS

- CIPY POLYURETHANES PVT. LTD.

- ULTIMATE LININGS

- ZHUHAI FEIYANG NOVEL MATERIALS CO. LTD.

- CHEMLINE INC.

- DURAAMEN ENGINEERED PRODUCTS INC.

- KRYPTON CHEMICAL

- ELASTOTHANE LTD

- ISOMAT S.A.

第13章 隣接/関連市場

- イントロダクション

- 制限

- 塗料・コーティングのエコシステムと相互接続された市場

- コーティング用樹脂

- アクリル

- アルキド

- ビニル

- ポリウレタン

- エポキシ

- ポリエステル

- 不飽和ポリエステル

- 飽和ポリエステル

- アミノ

- その他

第14章 付録

The global polyurea coatings market size was USD 1.2 billion in 2021 and is projected to grow at a CAGR of 10.3% during the forecast period to reach USD 2.0 billion by 2027. Polyurea coatings have no VOC content, a longer pot life, and faster curing ability. They can be used in extreme conditions (under high humidity and/or at low temperatures).

"The pure type segment is expected is expected to register the highest CAGR of the overall polyurea coatings market during the forecast period, in terms of volume."

Pure polyurea coatings are used in the mining industry, pipelines, vehicles, roofs, steel structures, concrete structures, floors, and pools. For many years China has been the top miner for fossil fuels, gemstones, and metals. The country's top position in the mining industry has helped Asia Pacific gain a significant share in the global mining industry as well as in the pure polyurea coatings market. Economies rich in minerals, such as India, China, Vietnam, Malaysia, Indonesia, Australia & New Zealand, and Sri Lanka, are also actively engaged in mining activities that have helped boost the demand for polyurea coatings. This scenario is expected to continue during the forecast period.

"The spraying segment of the technology is projected to register the highest CAGR during the forecast period."

Market drivers in this segment are infrastructural growth in various countries, and growth in applications, including floor coatings, roof coatings, bed-linings, secondary containment, and wastewater treatments. There is strong demand for these applications from the Asia Pacific region, especially from developing countries such as China, India, Thailand, Indonesia, and Malaysia. Global polyurea coating manufacturers are establishing their manufacturing facilities or sales offices in these emerging regions to cater to the increasing demand.

Asia - Pacific polyurea coatings market is projected to register the largest market share during the forecast period.

Asia Pacific is an emerging economy with many rapidly developing countries. Various industry players are willing to invest in this region. Most of the leading players in North America and Europe are planning to shift their manufacturing base to Asia Pacific as it offers inexpensive raw materials, low cost of production, and the ability to serve the local emerging market in a better way. The Asia Pacific region is experiencing increased demand for premium and high-quality products due to the increasing disposable income of the middle-class population. This has led to an increased demand for polyurea coatings in the Asia Pacific market.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the waterborne coatings market, and information was gathered from secondary research to determine and verify the market size of several segments and subsegments.

- By Company Type: Tier 1 - 46%, Tier 2 - 34%, and Tier 3 - 20%

- By Designation: C Level - 30%, D Level - 60%, and Others - 10%

- By Region: Europe - 20%, North America - 35%, APAC - 30%, South America- 5%, and the Middle East & Africa - 10%

The key companies profiled in this report are PPG Industries Inc. (US), and Sherwin-Williams Company (US).

Research Coverage:

This report provides detailed segmentation of the polyurea coatings market based on raw material type polyurea type, technology, end - use industry, and region. Based on raw material type, polyurea coatings industry has been segmented into aliphatic and aromatic. Based on polyurea type, the market has been segmented into pure and hybrid. Based on technology, the market has been segmented into spraying, pouring and hand mixing. Based on end - use industry market has been segmented into building & construction, transportation, industrial and landscape. Based on region, the market has been segmented into Asia Pacific, Europe, North America, South America, and the Middle East & Africa.

Key Benefits of Buying the Report

From an insights perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market share analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET SCOPE

- FIGURE 1 POLYUREA COATINGS MARKET SEGMENTATION

- 1.2.2 REGIONS COVERED

- 1.3 MARKET INCLUSIONS AND EXCLUSIONS

- 1.3.1 MARKET INCLUSIONS

- 1.3.2 MARKET EXCLUSIONS

- 1.4 YEARS CONSIDERED FOR THE STUDY

- 1.5 CURRENCY

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 POLYUREA COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Critical secondary inputs

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Critical primary inputs

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key primary data sources

- 2.1.2.4 Key industry insights

- 2.1.2.5 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 POLYUREA COATINGS MARKET, BY VALUE

- FIGURE 5 POLYUREA COATINGS MARKET, BY REGION

- FIGURE 6 POLYUREA COATINGS MARKET, BY END-USE INDUSTRY

- FIGURE 7 POLYUREA COATINGS MARKET, BY RAW MATERIAL TYPE

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, BY END-USE INDUSTRY

- FIGURE 9 POLYUREA COATINGS MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

- 2.3 MARKET FORECAST APPROACH

- 2.3.1 SUPPLY-SIDE FORECAST

- FIGURE 10 POLYUREA COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 11 METHODOLOGY FOR SUPPLY-SIDE SIZING OF POLYUREA COATINGS MARKET

- 2.3.2 DEMAND-SIDE FORECAST

- FIGURE 12 POLYUREA COATINGS MARKET: DEMAND-SIDE FORECAST

- 2.4 FACTOR ANALYSIS

- FIGURE 13 FACTOR ANALYSIS OF POLYUREA COATINGS MARKET

- 2.5 DATA TRIANGULATION

- FIGURE 14 POLYUREA COATINGS MARKET: DATA TRIANGULATION

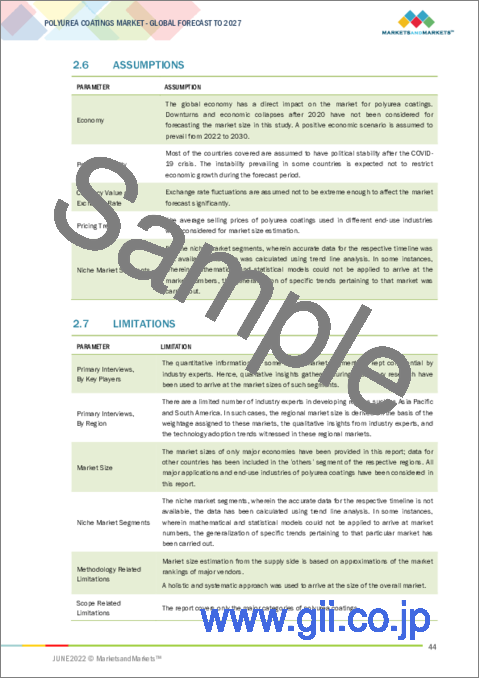

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 POLYUREA COATINGS MARKET SNAPSHOT, 2022 VS. 2027 VS. 2030

- FIGURE 15 AROMATIC ISOCYANATE TO BE LARGER SEGMENT DURING FORECAST YEAR

- FIGURE 16 PURE POLYUREA TO BE FASTER-GROWING SEGMENT

- FIGURE 17 BUILDING & CONSTRUCTION END-USE INDUSTRY TO DOMINATE MARKET

- FIGURE 18 SPRAYING TECHNOLOGY TO DOMINATE MARKET

- FIGURE 19 ASIA PACIFIC TO BE FASTEST-GROWING POLYUREA COATINGS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN POLYUREA COATINGS MARKET

- FIGURE 20 POLYUREA COATINGS MARKET TO REGISTER ROBUST GROWTH BETWEEN 2022 AND 2030

- 4.2 POLYUREA COATINGS MARKET, BY RAW MATERIAL

- FIGURE 21 ALIPHATIC ISOCYANATE SEGMENT TO SHOW FASTER GROWTH

- 4.3 POLYUREA COATINGS MARKET, DEVELOPED VS. EMERGING COUNTRIES

- FIGURE 22 EMERGING COUNTRIES TO GROW FASTER THAN DEVELOPED COUNTRIES

- 4.4 ASIA PACIFIC POLYUREA COATINGS MARKET, BY POLYUREA TYPE AND END-USE INDUSTRY

- FIGURE 23 PURE POLYUREA AND BUILDING & CONSTRUCTION SEGMENTS ACCOUNT FOR LARGEST SHARES

- 4.5 POLYUREA COATINGS MARKET, BY KEY COUNTRIES

- FIGURE 24 INDIA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 RAW MATERIAL ANALYSIS

- FIGURE 25 FORMATION OF POLYUREA COATINGS

- 5.2.1 ISOCYANATES

- 5.2.2 RESIN BLEND

- 5.3 VALUE CHAIN OVERVIEW

- 5.3.1 VALUE CHAIN ANALYSIS

- FIGURE 26 POLYUREA COATINGS - VALUE CHAIN ANALYSIS

- TABLE 2 POLYUREA COATINGS MARKET: SUPPLY CHAIN ECOSYSTEM

- 5.3.2 DISRUPTION IN VALUE CHAIN DUE TO COVID-19

- 5.3.2.1 Action plan against such vulnerability

- 5.4 MARKET DYNAMICS

- FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYUREA COATINGS MARKET

- 5.4.1 DRIVERS

- 5.4.1.1 Polyurea coatings replacing other competitive coating systems

- 5.4.1.2 Technological advancements in manufacturing processes and techniques

- 5.4.1.3 Growing use in various end-use industries

- 5.4.2 RESTRAINTS

- 5.4.2.1 Costlier than competitive coating technologies

- 5.4.3 OPPORTUNITIES

- 5.4.3.1 Advancements in coating technologies and emerging applications

- 5.4.3.2 Growing opportunities in Asia Pacific

- 5.4.4 CHALLENGES

- 5.4.4.1 Skilled manpower required to handle toxic raw materials

- 5.4.4.2 Popularity of existing coating technologies

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS OF POLYUREA COATINGS MARKET

- TABLE 3 POLYUREA COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.2 BARGAINING POWER OF BUYERS

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 THREAT OF NEW ENTRANTS

- 5.6 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- 5.6.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR POLYUREA COATINGS

- TABLE 5 KEY BUYING CRITERIA FOR POLYUREA COATINGS

- 5.7 MACROECONOMIC INDICATORS

- 5.7.1 INTRODUCTION

- 5.7.2 GDP TRENDS AND FORECAST

- TABLE 6 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE

- 5.7.2.1 COVID-19 impact on the global economy

- 5.7.3 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- FIGURE 31 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014-2035

- 5.7.3.1 COVID-19 impact on construction industry

- 5.8 TECHNOLOGY OVERVIEW

- 5.9 CASE STUDY

- 5.10 AVERAGE PRICING ANALYSIS

- FIGURE 32 PRICING ANALYSIS OF POLYUREA COATINGS MARKET, BY REGION, 2021

- 5.10.1 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- FIGURE 33 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- 5.11 KEY COUNTRIES EXPORTING AND IMPORTING POLYUREA COATINGS

- TABLE 7 INTENSITY OF TRADE, BY KEY COUNTRIES

- 5.11.1 EXPORT-IMPORT TRADE STATISTICS

- TABLE 8 EXPORT DATA FOR NON-REFRACTORY SURFACING PREPARATIONS FOR FACADES, INSIDE WALLS, FLOORS, CEILINGS (USD THOUSAND)

- TABLE 9 IMPORT DATA OF NON-REFRACTORY SURFACING PREPARATIONS FOR FACADES, INSIDE WALLS, FLOORS, CEILINGS (USD THOUSAND)

- 5.12 SUPPLY CHAIN CRISES SINCE COVID-19

- 5.13 GLOBAL SCENARIOS

- 5.13.1 CHINA

- 5.13.1.1 China's debt problem

- 5.13.1.2 Australia-China trade war

- 5.13.1.3 Environmental commitments

- 5.13.2 EUROPE

- 5.13.2.1 Political instability in Germany

- 5.13.2.2 Energy crisis in Europe

- 5.13.1 CHINA

- 5.14 ECOSYSTEM MAP

- FIGURE 34 PAINTS & COATINGS ECOSYSTEM

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 35 TRENDS IN END-USE INDUSTRIES IMPACTING STRATEGIES OF COATINGS MANUFACTURERS

- 5.16 GLOBAL REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17 PATENT ANALYSIS

- 5.17.1 METHODOLOGY

- 5.17.2 PUBLICATION TRENDS

- FIGURE 36 PUBLICATION TRENDS, 2018-2022

- 5.17.3 INSIGHTS

- 5.17.4 JURISDICTION ANALYSIS

- FIGURE 37 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2018-2022

- 5.17.5 TOP APPLICANTS

- FIGURE 38 NUMBER OF PATENTS, BY COMPANY, 2018-2022

- 5.18 COVID-19 IMPACT ANALYSIS

- 5.18.1 COVID-19 ECONOMIC ASSESSMENT

- FIGURE 39 LATEST WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

- 5.18.2 ECONOMIC IMPACT OF COVID-19 - SCENARIO ASSESSMENT

- FIGURE 40 FACTORS IMPACTING ECONOMIES OF SELECT G20 COUNTRIES IN 2020

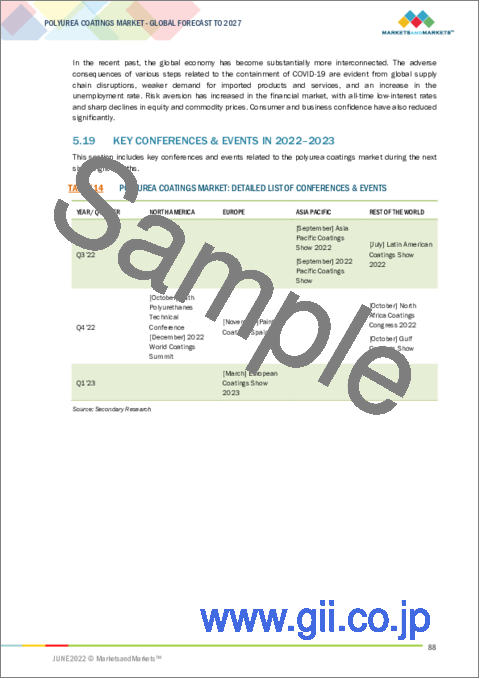

- 5.19 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 14 POLYUREA COATINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 POLYUREA COATINGS MARKET, BY RAW MATERIAL

- 6.1 INTRODUCTION

- FIGURE 41 AROMATIC ISOCYANATE SEGMENT TO HOLD LARGER MARKET SHARE

- TABLE 15 POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (THOUSAND LITERS)

- TABLE 16 POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (THOUSAND LITERS)

- TABLE 17 POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (THOUSAND LITERS)

- TABLE 18 POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (USD MILLION)

- TABLE 19 POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (USD MILLION)

- TABLE 20 POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (USD MILLION)

- 6.2 AROMATIC ISOCYANATE

- 6.2.1 GROWTH OF END USE SECTORS TO INFLUENCE MARKET

- TABLE 21 AROMATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 22 AROMATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 23 AROMATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 24 AROMATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 25 AROMATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 26 AROMATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (USD MILLION)

- 6.3 ALIPHATIC ISOCYANATE

- 6.3.1 DEMAND FROM BUILDING & CONSTRUCTION AND TRANSPORTATION INDUSTRIES EXPECTED TO DRIVE MARKET

- TABLE 27 ALIPHATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 28 ALIPHATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 29 ALIPHATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 30 ALIPHATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 ALIPHATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 32 ALIPHATIC ISOCYANATE-BASED POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (USD MILLION)

7 POLYUREA COATINGS MARKET, BY POLYUREA TYPE

- 7.1 INTRODUCTION

- FIGURE 42 PURE POLYUREA TO BE LARGER SEGMENT

- TABLE 33 POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (THOUSAND LITERS)

- TABLE 34 POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (THOUSAND LITERS)

- TABLE 35 POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (THOUSAND LITERS)

- TABLE 36 POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (USD MILLION)

- TABLE 37 POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (USD MILLION)

- TABLE 38 POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (USD MILLION)

- 7.2 PURE POLYUREA

- 7.2.1 NEW PRODUCT DEVELOPMENT TO BOOST DEMAND

- TABLE 39 PURE POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 40 PURE POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 41 PURE POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 42 PURE POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 PURE POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 44 PURE POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (USD MILLION)

- 7.3 HYBRID POLYUREA

- 7.3.1 GROWTH OF INFRASTRUCTURE SECTOR IN ASIA PACIFIC TO PROPEL MARKET

- TABLE 45 HYBRID POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 46 HYBRID POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 47 HYBRID POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 48 HYBRID POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 HYBRID POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 50 HYBRID POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (USD MILLION)

8 POLYUREA COATINGS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 43 SPRAYING TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE

- TABLE 51 POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (THOUSAND LITERS)

- TABLE 52 POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (THOUSAND LITERS)

- TABLE 53 POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (THOUSAND LITERS)

- TABLE 54 POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 55 POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 56 POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (USD MILLION)

- 8.2 SPRAYING

- 8.2.1 MOST WIDELY USED POLYUREA COATING TECHNOLOGY DUE TO GROWING APPLICATIONS

- TABLE 57 REGIONAL POLYUREA COATINGS MARKET, BY SPRAYING TECHNOLOGY, 2018-2021 (THOUSAND LITERS)

- TABLE 58 REGIONAL POLYUREA COATINGS MARKET, BY SPRAYING TECHNOLOGY 2022-2027 (THOUSAND LITERS)

- TABLE 59 REGIONAL POLYUREA COATINGS MARKET, BY SPRAYING TECHNOLOGY 2028-2030 (THOUSAND LITERS)

- TABLE 60 REGIONAL POLYUREA COATINGS MARKET, BY SPRAYING TECHNOLOGY 2018-2021 (USD MILLION)

- TABLE 61 REGIONAL POLYUREA COATINGS MARKET, BY SPRAYING TECHNOLOGY 2022-2027 (USD MILLION)

- TABLE 62 REGIONAL POLYUREA COATINGS MARKET, BY SPRAYING TECHNOLOGY 2028-2030 (USD MILLION)

- 8.3 POURING

- 8.3.1 STRINGENT ENVIRONMENTAL REGULATIONS REQUIRING ZERO OR NON-VOC COATINGS TO BOOST DEMAND

- TABLE 63 REGIONAL POLYUREA COATINGS MARKET, BY POURING TECHNOLOGY 2018-2021 (THOUSAND LITERS)

- TABLE 64 REGIONAL POLYUREA COATINGS MARKET, BY POURING TECHNOLOGY, 2022-2027 (THOUSAND LITERS)

- TABLE 65 REGIONAL POLYUREA COATINGS MARKET, BY POURING TECHNOLOGY, 2028-2030 (THOUSAND LITERS)

- TABLE 66 REGIONAL POLYUREA COATINGS MARKET, BY POURING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 67 REGIONAL POLYUREA COATINGS MARKET, BY POURING TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 68 REGIONAL POLYUREA COATINGS MARKET, BY POURING TECHNOLOGY, 2028-2030 (USD MILLION)

- 8.4 HAND MIXING

- 8.4.1 HIGH DEMAND FOR DECORATIVE FLOORING AND INDUSTRIAL FLOORING APPLICATIONS

- TABLE 69 REGIONAL POLYUREA COATINGS MARKET, BY HAND MIXING TECHNOLOGY, 2018-2021 (THOUSAND LITERS)

- TABLE 70 REGIONAL POLYUREA COATINGS MARKET, BY HAND MIXING TECHNOLOGY 2022-2027 (THOUSAND LITERS)

- TABLE 71 REGIONAL POLYUREA COATINGS MARKET, BY HAND MIXING TECHNOLOGY, 2028-2030 (THOUSAND LITERS)

- TABLE 72 REGIONAL POLYUREA COATINGS MARKET, BY HAND MIXING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 73 REGIONAL POLYUREA COATINGS MARKET, BY HAND MIXING TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 74 REGIONAL POLYUREA COATINGS MARKET, BY HAND MIXING TECHNOLOGY, 2028-2030 (USD MILLION)

9 POLYUREA COATINGS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 44 BUILDING & CONSTRUCTION TO BE LARGEST END-USE INDUSTRY OF POLYUREA COATINGS DURING FORECAST YEAR

- TABLE 75 POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 76 POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 77 POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 78 POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 79 POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 80 POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (USD MILLION)

- 9.2 BUILDING & CONSTRUCTION

- 9.2.1 INCREASED PER CAPITA INCOME IN EMERGING ECONOMIES TO DRIVE MARKET

- TABLE 81 POLYUREA COATINGS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 82 POLYUREA COATINGS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 83 POLYUREA COATINGS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 84 POLYUREA COATINGS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 85 POLYUREA COATINGS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 86 POLYUREA COATINGS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2028-2030 (USD MILLION)

- 9.3 TRANSPORTATION

- 9.3.1 INCREASING DEMAND FOR REFRIGERATED FOOD TRUCKS TO BOOST MARKET

- TABLE 87 POLYUREA COATINGS MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 88 POLYUREA COATINGS MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 89 POLYUREA COATINGS MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 90 POLYUREA COATINGS MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 91 POLYUREA COATINGS MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 92 POLYUREA COATINGS MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2028-2030 (USD MILLION)

- 9.4 INDUSTRIAL

- 9.4.1 POPULATION GROWTH AND IMPROVED STANDARD OF LIVING TO DRIVE MARKET

- TABLE 93 POLYUREA COATINGS MARKET SIZE IN INDUSTRIAL SEGMENT, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 94 POLYUREA COATINGS MARKET SIZE IN INDUSTRIAL SEGMENT, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 95 POLYUREA COATINGS MARKET SIZE IN INDUSTRIAL SEGMENT, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 96 POLYUREA COATINGS MARKET SIZE IN INDUSTRIAL SEGMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 97 POLYUREA COATINGS MARKET SIZE IN INDUSTRIAL SEGMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 98 POLYUREA COATINGS MARKET SIZE IN INDUSTRIAL SEGMENT, BY REGION, 2028-2030 (USD MILLION)

- 9.5 LANDSCAPE

- 9.5.1 RISING LANDSCAPE-RELATED CONSTRUCTION TO INCREASE DEMAND FOR POLYUREA COATINGS

- TABLE 99 POLYUREA COATINGS MARKET SIZE IN LANDSCAPE END-USE INDUSTRY, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 100 POLYUREA COATINGS MARKET SIZE IN LANDSCAPE END-USE INDUSTRY, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 101 POLYUREA COATINGS MARKET SIZE IN LANDSCAPE END-USE INDUSTRY, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 102 POLYUREA COATINGS MARKET SIZE IN LANDSCAPE END-USE INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 103 POLYUREA COATINGS MARKET SIZE IN LANDSCAPE END-USE INDUSTRY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 104 POLYUREA COATINGS MARKET SIZE IN LANDSCAPE END-USE INDUSTRY, BY REGION, 2028-2030 (USD MILLION)

10 POLYUREA COATINGS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 45 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING REGION IN POLYUREA COATINGS MARKET

- TABLE 105 POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (THOUSAND LITERS)

- TABLE 106 POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (THOUSAND LITERS)

- TABLE 107 POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (THOUSAND LITERS)

- TABLE 108 POLYUREA COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 109 POLYUREA COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 110 POLYUREA COATINGS MARKET SIZE, BY REGION, 2028-2030 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: POLYUREA COATINGS MARKET SNAPSHOT

- TABLE 111 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (THOUSAND LITERS)

- TABLE 112 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (THOUSAND LITERS)

- TABLE 113 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (THOUSAND LITERS)

- TABLE 114 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (USD MILLION)

- TABLE 115 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (USD MILLION)

- TABLE 116 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (THOUSAND LITERS)

- TABLE 118 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (THOUSAND LITERS)

- TABLE 119 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (THOUSAND LITERS)

- TABLE 120 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (USD MILLION)

- TABLE 121 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (USD MILLION)

- TABLE 122 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (THOUSAND LITERS)

- TABLE 124 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (THOUSAND LITERS)

- TABLE 125 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (THOUSAND LITERS)

- TABLE 126 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 127 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 128 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 130 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 131 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 132 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 133 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 134 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 136 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 137 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 138 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 139 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 140 NORTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Increase in housing investments and growing exports to emerging countries to drive market

- 10.2.2 CANADA

- 10.2.2.1 Growing construction activities and boost to transportation sector to fuel market

- 10.2.3 MEXICO

- 10.2.3.1 Changing monetary and fiscal policies to support market growth

- 10.3 ASIA PACIFIC

- FIGURE 47 ASIA PACIFIC: POLYUREA COATINGS MARKET SNAPSHOT

- TABLE 141 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (THOUSAND LITERS)

- TABLE 142 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (THOUSAND LITERS)

- TABLE 143 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (THOUSAND LITERS)

- TABLE 144 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (USD MILLION)

- TABLE 145 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (USD MILLION)

- TABLE 146 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (THOUSAND LITERS)

- TABLE 148 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (THOUSAND LITERS)

- TABLE 149 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (THOUSAND LITERS)

- TABLE 150 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (USD MILLION)

- TABLE 151 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (USD MILLION)

- TABLE 152 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (THOUSAND LITERS)

- TABLE 154 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (THOUSAND LITERS)

- TABLE 155 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (THOUSAND LITERS)

- TABLE 156 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 158 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 160 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 161 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 162 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 163 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 164 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 166 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 167 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 168 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 169 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 170 ASIA PACIFIC: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (USD MILLION)

- 10.3.1 CHINA

- 10.3.1.1 Increasing foreign investments to propel market

- 10.3.2 INDIA

- 10.3.2.1 Rising disposable income and urbanization contribute to demand for polyurea coatings

- 10.3.3 JAPAN

- 10.3.3.1 Well-established building & construction industry to boost market

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Government initiatives to promote advanced technologies and manufacturing activities support market growth

- 10.3.5 MALAYSIA

- 10.3.5.1 Increasing construction activities to boost demand

- 10.3.6 INDONESIA

- 10.3.6.1 Rising domestic consumption and FDIs to push market growth

- 10.3.7 TAIWAN

- 10.3.7.1 Growing demand for polyurea coatings in construction & infrastructure industry to propel market

- 10.3.8 REST OF ASIA PACIFIC

- 10.4 EUROPE

- FIGURE 48 EUROPE: POLYUREA COATINGS MARKET SNAPSHOT

- TABLE 171 EUROPE: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (THOUSAND LITERS)

- TABLE 172 EUROPE: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (THOUSAND LITERS)

- TABLE 173 EUROPE: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (THOUSAND LITERS)

- TABLE 174 EUROPE: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (USD MILLION)

- TABLE 175 EUROPE: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (USD MILLION)

- TABLE 176 EUROPE: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (USD MILLION)

- TABLE 177 EUROPE: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (THOUSAND LITERS)

- TABLE 178 EUROPE: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (THOUSAND LITERS)

- TABLE 179 EUROPE: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (THOUSAND LITERS)

- TABLE 180 EUROPE: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (USD MILLION)

- TABLE 181 EUROPE: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (USD MILLION)

- TABLE 182 EUROPE: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (USD MILLION)

- TABLE 183 EUROPE: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (THOUSAND LITERS)

- TABLE 184 EUROPE: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (THOUSAND LITERS)

- TABLE 185 EUROPE: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (THOUSAND LITERS)

- TABLE 186 EUROPE: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 187 EUROPE: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 188 EUROPE: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (USD MILLION)

- TABLE 189 EUROPE: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 190 EUROPE: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (THOUSAND LITER)

- TABLE 191 EUROPE: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 192 EUROPE: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 193 EUROPE: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 194 EUROPE: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (USD MILLION)

- TABLE 195 EUROPE: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 196 EUROPE: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 197 EUROPE: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 198 EUROPE: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 199 EUROPE: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 200 EUROPE: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (USD MILLION)

- 10.4.1 GERMANY

- 10.4.1.1 Presence of large number of polyurea coating manufacturers promotes market growth

- 10.4.2 BENELUX

- 10.4.2.1 Rising exports and increasing investments in energy and transport infrastructure to fuel market

- 10.4.3 UK

- 10.4.3.1 Expanding construction industry to drive market

- 10.4.4 FRANCE

- 10.4.4.1 Government construction policies to be growth drivers

- 10.4.5 SPAIN

- 10.4.5.1 Increasing construction activities and automotive production to propel market

- 10.4.6 ITALY

- 10.4.6.1 Rapidly expanding construction industry to boost market

- 10.4.7 RUSSIA

- 10.4.7.1 Government initiatives to expand infrastructure to boost market

- 10.4.8 REST OF EUROPE

- 10.5 MIDDLE EAST & AFRICA

- FIGURE 49 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SNAPSHOT

- TABLE 201 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (THOUSAND LITERS)

- TABLE 202 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (THOUSAND LITERS)

- TABLE 203 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (THOUSAND LITERS)

- TABLE 204 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (THOUSAND LITERS)

- TABLE 208 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (THOUSAND LITERS)

- TABLE 209 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (THOUSAND LITERS)

- TABLE 210 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (THOUSAND LITERS)

- TABLE 214 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (THOUSAND LITERS)

- TABLE 215 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (THOUSAND LITERS)

- TABLE 216 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 220 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2027 (THOUSAND LITER)

- TABLE 221 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 222 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 226 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 227 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 228 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (USD MILLION)

- 10.5.1 SAUDI ARABIA

- 10.5.1.1 Positive performance of construction industry to impact market

- 10.5.2 UAE

- 10.5.2.1 Ongoing infrastructure projects contribute to demand

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Rising construction of stadiums and roads adds to market growth

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.6 SOUTH AMERICA

- FIGURE 50 SOUTH AMERICA: POLYUREA COATINGS MARKET SNAPSHOT

- TABLE 231 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (THOUSAND LITERS)

- TABLE 232 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (THOUSAND LITERS)

- TABLE 233 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (THOUSAND LITERS)

- TABLE 234 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2018-2021 (USD MILLION)

- TABLE 235 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2022-2027 (USD MILLION)

- TABLE 236 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY RAW MATERIAL, 2028-2030 (USD MILLION)

- TABLE 237 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (THOUSAND LITERS)

- TABLE 238 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (THOUSAND LITERS)

- TABLE 239 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (THOUSAND LITERS)

- TABLE 240 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2018-2021 (USD MILLION)

- TABLE 241 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2022-2027 (USD MILLION)

- TABLE 242 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY POLYUREA TYPE, 2028-2030 (USD MILLION)

- TABLE 243 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (THOUSAND LITERS)

- TABLE 244 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (THOUSAND LITERS)

- TABLE 245 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (THOUSAND LITERS)

- TABLE 246 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 247 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 248 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY TECHNOLOGY, 2028-2030 (USD MILLION)

- TABLE 249 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 250 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 251 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 252 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 253 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 254 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2028-2030 (USD MILLION)

- TABLE 255 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (THOUSAND LITERS)

- TABLE 256 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (THOUSAND LITERS)

- TABLE 257 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (THOUSAND LITERS)

- TABLE 258 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 259 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 260 SOUTH AMERICA: POLYUREA COATINGS MARKET SIZE, BY COUNTRY, 2028-2030 (USD MILLION)

- 10.6.1 BRAZIL

- 10.6.1.1 Growth in energy and oil & gas industries promoting demand for polyurea coatings

- 10.6.2 ARGENTINA

- 10.6.2.1 High demand for polyurea coatings in construction and automotive industries

- 10.6.3 COLOMBIA

- 10.6.3.1 Increasing demand for automobiles positively impacts polyurea coatings market

- 10.6.4 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 261 STRATEGIES ADOPTED BY KEY MANUFACTURERS OF POLYUREA COATINGS

- 11.2 MARKET SHARE ANALYSIS

- FIGURE 51 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- 11.2.1 POLYUREA COATINGS MARKET: DEGREE OF COMPETITION

- 11.2.2 MARKET RANKING ANALYSIS

- FIGURE 52 RANKING OF KEY PLAYERS

- 11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 262 STRATEGIC POSITIONING OF KEY PLAYERS

- 11.4 COMPANY REVENUE ANALYSIS

- FIGURE 53 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FIVE YEARS

- 11.5 COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 54 POLYUREA COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.6 SME MATRIX, 2021

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 STARTING BLOCKS

- 11.6.4 RESPONSIVE COMPANIES

- FIGURE 55 POLYUREA COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING OF EMERGING COMPANIES, 2021

- 11.7 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 56 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN POLYUREA COATINGS MARKET

- 11.8 BUSINESS STRATEGY EXCELLENCE

- FIGURE 57 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN POLYUREA COATINGS MARKET

- 11.9 COMPETITIVE BENCHMARKING

- TABLE 263 POLYUREA COATINGS MARKET: DETAILED LIST OF KEY PLAYERS

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 MARKET EVALUATION FRAMEWORK

- TABLE 264 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 265 HIGHEST ADOPTED STRATEGIES

- TABLE 266 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 11.10.2 MARKET EVALUATION MATRIX

- TABLE 267 COMPANY INDUSTRY FOOTPRINT

- TABLE 268 COMPANY REGION FOOTPRINT

- TABLE 269 COMPANY FOOTPRINT

- 11.11 STRATEGIC DEVELOPMENTS

- 11.11.1 DEALS

- TABLE 270 DEALS, 2018-2022

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 PPG INDUSTRIES INC.

- TABLE 271 PPG INDUSTRIES INC.: COMPANY OVERVIEW

- FIGURE 58 PPG INDUSTRIES INC.: COMPANY SNAPSHOT

- TABLE 272 PPG INDUSTRIES INC.: DEALS

- 12.2 SHERWIN-WILLIAMS COMPANY

- TABLE 273 SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- FIGURE 59 SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- TABLE 274 SHERWIN-WILLIAMS COMPANY: DEALS

- 12.3 NUKOTE COATING SYSTEMS

- TABLE 275 NUKOTE COATING SYSTEMS: COMPANY OVERVIEW

- 12.4 ARMORTHANE INC.

- TABLE 276 ARMORTHANE INC.: COMPANY OVERVIEW

- 12.5 WASSER CORPORATION

- TABLE 277 WASSER CORPORATION: COMPANY OVERVIEW

- 12.6 RHINO LININGS CORPORATION

- TABLE 278 RHINO LININGS CORPORATION: COMPANY OVERVIEW

- 12.7 KUKDO CHEMICAL CO., LTD.

- TABLE 279 KUKDO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 12.8 VOELKEL INDUSTRIAL PRODUCTS GMBH (VIP)

- TABLE 280 VOELKEL INDUSTRIAL PRODUCTS GMBH (VIP): COMPANY OVERVIEW

- 12.9 TEKNOS

- TABLE 281 TEKNOS: COMPANY OVERVIEW

- FIGURE 60 TEKNOS: COMPANY SNAPSHOT

- 12.10 OTHER COMPANIES

- 12.10.1 POLYCOAT PRODUCTS LLC

- TABLE 282 POLYCOAT PRODUCTS LLC: COMPANY OVERVIEW

- 12.10.2 TECHNOPOL

- TABLE 283 TECHNOPOL: COMPANY OVERVIEW

- 12.10.3 SATYEN POLYMERS PVT. LTD

- TABLE 284 SATYEN POLYMERS PVT. LTD.: COMPANY OVERVIEW

- 12.10.4 PROKOL PROTECTIVE COATINGS

- TABLE 285 PROKOL PROTECTIVE COATINGS: COMPANY OVERVIEW

- 12.10.5 CIPY POLYURETHANES PVT. LTD.

- TABLE 286 CIPY POLYURETHANES PVT. LTD: COMPANY OVERVIEW

- 12.10.6 ULTIMATE LININGS

- TABLE 287 ULTIMATE LININGS: COMPANY OVERVIEW

- 12.10.7 ZHUHAI FEIYANG NOVEL MATERIALS CO. LTD.

- TABLE 288 ZHUHAI FEIYANG NOVEL MATERIALS CO. LTD: COMPANY OVERVIEW

- 12.10.8 CHEMLINE INC.

- TABLE 289 CHEMLINE INC.: COMPANY OVERVIEW

- 12.10.9 DURAAMEN ENGINEERED PRODUCTS INC.

- TABLE 290 DURAAMEN ENGINEERED PRODUCTS INC.: COMPANY OVERVIEW

- 12.10.10 KRYPTON CHEMICAL

- TABLE 291 KRYPTON CHEMICAL: COMPANY OVERVIEW

- 12.10.11 ELASTOTHANE LTD

- TABLE 292 ELASTOTHANE LTD: COMPANY OVERVIEW

- 12.10.12 ISOMAT S.A.

- TABLE 293 ISOMAT S.A.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 PAINTS & COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

- FIGURE 61 PAINTS & COATINGS: ECOSYSTEM

- 13.4 COATING RESINS

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 COATING RESINS MARKET, BY RESIN TYPE

- TABLE 294 COATING RESINS MARKET SIZE, BY RESIN TYPE, 2017-2020 (USD MILLION)

- TABLE 295 COATING RESINS MARKET SIZE, BY RESIN TYPE, 2021-2026 (USD MILLION)

- TABLE 296 COATING RESINS MARKET SIZE, BY RESIN TYPE, 2017-2020 (KILOTONS)

- TABLE 297 COATING RESINS MARKET SIZE, BY RESIN TYPE, 2021-2026 (KILOTONS)

- 13.5 ACRYLIC

- 13.5.1 LARGEST CATEGORY OF BINDER RESINS USED FOR COATING APPLICATIONS

- 13.6 ALKYD

- 13.6.1 HIGHER RESISTANCE PROPERTY OF ALKYD RESINS TO DRIVE GROWTH

- 13.7 VINYL

- 13.7.1 DEVELOPMENT OF DISPERSION TYPE OF VINYL RESINS TO BOOST THIS SEGMENT

- 13.8 POLYURETHANE

- 13.8.1 HIGH-PERFORMANCE CHARACTERISTICS OF POLYURETHANE TO BOOST MARKET GROWTH

- 13.9 EPOXY

- 13.9.1 USE OF EPOXY RESINS IN DIVERSE APPLICATIONS TO DRIVE GROWTH

- 13.10 POLYESTER

- 13.10.1 UNSATURATED POLYESTER

- 13.10.1.1 Ease of manufacturing and its cost-effectiveness to propel demand for unsaturated polyesters

- 13.10.2 SATURATED POLYESTER

- 13.10.2.1 Increasing use of saturated polyester resins to drive market

- 13.10.1 UNSATURATED POLYESTER

- 13.11 AMINO

- 13.11.1 EXCELLENT TENSILE STRENGTH, HARDNESS, AND IMPACT RESISTANCE TO BOOST DEMAND FOR AMINO RESINS

- 13.12 OTHERS

- 13.12.1 COATING RESINS MARKET, BY TECHNOLOGY

- TABLE 298 COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 299 COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2021-2026 (USD MILLION)

- TABLE 300 COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2017-2020 (KILOTONS)

- TABLE 301 COATING RESINS MARKET SIZE, BY TECHNOLOGY, 2021-2026 (KILOTONS)

- 13.12.1.1 Waterborne coatings

- FIGURE 62 TYPES OF WATERBORNE COATINGS

- 13.12.1.2 Solvent-borne coatings

- TABLE 302 TRADITIONAL FORMULATION SOLVENT USED FOR EACH RESIN TYPE

- 13.12.1.3 Powder coatings

- FIGURE 63 TYPES OF POWDER COATINGS

- 13.12.1.4 Others

- 13.12.1.4.1 High solids coatings

- 13.12.1.4 Others

- FIGURE 64 TYPES OF HIGH SOLIDS COATINGS

- 13.12.1.4.2 Radiation curable coatings

- FIGURE 65 TYPES OF RADIATION CURABLE COATINGS

- 13.12.2 COATING RESINS MARKET, BY APPLICATION

- TABLE 303 COATING RESINS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 304 COATING RESINS MARKET SIZE, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 305 COATING RESINS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTONS)

- TABLE 306 COATING RESINS MARKET SIZE, BY APPLICATION, 2021-2026 (KILOTONS)

- TABLE 307 ARCHITECTURAL COATING RESINS MARKET SIZE, BY SUB-APPLICATION, 2017-2020 (USD MILLION)

- TABLE 308 ARCHITECTURAL COATING RESINS MARKET SIZE, BY SUB-APPLICATION, 2021-2026 (USD MILLION)

- TABLE 309 ARCHITECTURAL COATING RESINS MARKET SIZE, BY SUB-APPLICATION, 2017-2020 (KILOTONS)

- TABLE 310 ARCHITECTURAL COATING RESINS MARKET SIZE, BY SUB-APPLICATION, 2021-2026 (KILOTONS)

- TABLE 311 INDUSTRIAL COATING RESINS MARKET SIZE, BY SUB-APPLICATION, 2017-2020 (USD MILLION)

- TABLE 312 INDUSTRIAL COATING RESINS MARKET SIZE, BY SUB-APPLICATION, 2021-2026 (USD MILLION)

- TABLE 313 INDUSTRIAL COATING RESINS MARKET SIZE, BY SUB-APPLICATION, 2017-2020 (KILOTONS)

- TABLE 314 INDUSTRIAL COATING RESINS MARKET SIZE, BY SUB-APPLICATION, 2021-2026 (KILOTONS)

- 13.12.2.1 Architectural coatings

- 13.12.2.2 Marine & protective coatings

- 13.12.2.3 General industrial coatings

- 13.12.2.4 Automotive coatings

- 13.12.2.5 Wood coatings

- 13.12.2.6 Packaging coatings

- 13.12.2.7 Others

- 13.12.2.7.1 Coil

- 13.12.2.7.2 Aerospace

- 13.12.2.7.3 Graphic arts

- 13.12.3 COATING RESINS MARKET, BY REGION

- TABLE 315 COATING RESINS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 316 COATING RESINS MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- TABLE 317 COATING RESINS MARKET SIZE, BY REGION, 2017-2020 (KILOTONS)

- TABLE 318 COATING RESINS MARKET SIZE, BY REGION, 2021-2026 (KILOTONS)

- 13.12.3.1 Asia Pacific

- 13.12.3.2 Europe

- 13.12.3.3 North America

- 13.12.3.4 Middle East & Africa

- 13.12.3.5 South America

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATION

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS