|

|

市場調査レポート

商品コード

1543643

床暖房の世界市場:タイプ別、用途別、提供区分別、設置タイプ別、地域別 - 予測(~2029年)Underfloor Heating Market by Type (Manifolds & Valves, Zone Valves, Heating Pipes, Wiring Centers, Zone Valves, Thermal Actuators, Heating Cales, Mats, Thermostats & Sensors), Offering, Installation Type (New, Retrofit), Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 床暖房の世界市場:タイプ別、用途別、提供区分別、設置タイプ別、地域別 - 予測(~2029年) |

|

出版日: 2024年08月12日

発行: MarketsandMarkets

ページ情報: 英文 213 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の床暖房の市場規模は、2024年の53億米ドルから、予測期間中は7.3%のCAGRで推移し、2029年には76億米ドルの規模に成長すると予測されています。

都市化の進展、持続可能な建設活動に対する規制要件、集合住宅や商業施設内の空気の質の向上、ゾーニング機能、その他の戦略が床暖房市場の成長を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額(米ドル) |

| セグメント | タイプ・提供区分・設置タイプ・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

"床暖房市場は電気式が大きく成長する"

電気で作動する床暖房システムは、電気毛布と同様の機能を持っており、床下に設置されたケーブルに電気を通すことで発熱します。この暖房タイプは広い面積には不向きで費用対効果に悪いですが、小さなスペースには理想的です。電気式床暖房システムは、非腐食性で柔軟な発熱体を利用するため、設置が簡単です。温水式に比べ、部品も少なくて済みます。これらのシステムは、カーペット、ラグ、ラミネート、タイル、木製の床を暖め、床暖房を提供するために一般的に使用されています。

"新規設置が床暖房市場で大きなシェアを占める"

新規設置の部門は2023年により大きな市場シェアを示し、新築の住宅や商業ビルで新規設置が増加傾向にあるため、予測期間中も同様の傾向が見られると考えられています。また、米国、英国、ドイツなど多くの先進国では、建物に対する厳しいエネルギー効率規制が実施されています。

"北米地域は床暖房市場の成長に大きく貢献する"

北米は、いくつかの説得力のある理由から、床暖房市場で大きなシェアを得る態勢を整えています。同地域は、複雑な暖房プロセスを管理し、規制遵守を確保し、効率を向上させるために不可欠な強固な産業・商業・住宅基盤を形成しています。先進的な暖房技術は、リアルタイムのモニタリング、予知保全、データ分析を可能にし、機敏な意思決定と継続的な改善イニシアチブをサポートします。

当レポートでは、世界の床暖房の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 床暖房市場へのAIの影響

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 顧客ビジネスに影響を与える動向/ディスラプション

- 技術分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント

- 規制状況

第6章 床暖房用床材の種類

- タイル・石

- 木製床材

- 積層床材

- ビニル・リノリウム床材

- ゴム・カーペット床材

第7章 床暖房システムの接続タイプ

- 接続

- 非接続

第8章 床暖房システムと統合されたサブシステム

- 暖房システム

- パイプ・ケーブル

- 配電ユニット

- 制御システム

- センサー

- 制御インターフェース

第9章 床暖房市場:設置タイプ別

- 新規設置

- 改修設置

第10章 床暖房市場:提供区分別

- ハードウェア

- サービス

第11章 床暖房市場:製品タイプ・部品タイプ別

- 温水式床暖房

- 加熱パイプ

- サーモスタット・センサー

- サーマルアクチュエーター

- ゾーンバルブ

- 配線センター

- マニホールド・バルブ

- 電気式床暖房

- 加熱ケーブル

- ヒートマット

- サーモスタット・センサー

第12章 床暖房市場:用途別

- 住宅

- 戸建

- 集合住宅

- 商用

- 小売

- 運輸・物流

- ホスピタリティ

- ヘルスケア

- スポーツ&エンターテイメント

- 工業用

- その他

第13章 床暖房市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第14章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- RESIDEO TECHNOLOGIES INC.

- NVENT

- WARMUP PLC

- REHAU LTD

- MAGNUM HEATING GROUP B.V.

- UPONOR CORPORATION

- EMERSON ELECTRIC CO.

- ROBERT BOSCH GMBH

- DANFOSS

- MITSUBISHI ELECTRIC CORPORATION

- SIEMENS AG

- SCHNEIDER ELECTRIC

- INCOGNITO HEAT CO.

- その他の企業

- MYSON

- THERMOSOFT INTERNATIONAL CORPORATION

- FLEXEL INTERNATIONAL

- NEXANS

- AMUHEAT

- ESI HEATING AND COOLING

- JANES RADIANT HEATING

- WARMAFLOOR

- RAYOTEC LTD

- RBT UNDERFLOOR LTD

- UHEAT

- SCHLUTER-SYSTEMS

第16章 付録

List of Tables

- TABLE 1 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE TREND OF UNDERFLOOR HEATING SYSTEM COMPONENTS PROVIDED BY MAJOR PLAYERS (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF UNDERFLOOR HEATING SYSTEM COMPONENTS, 2020-2023 (USD)

- TABLE 4 INDICATIVE PRICING TREND OF MANIFOLDS, BY REGION (USD)

- TABLE 5 UNDERFLOOR HEATING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 UNDERFLOOR HEATING MARKET: MAJOR PATENTS

- TABLE 9 UNDERFLOOR HEATING MARKET: CONFERENCES AND EVENTS, 2024-2025

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

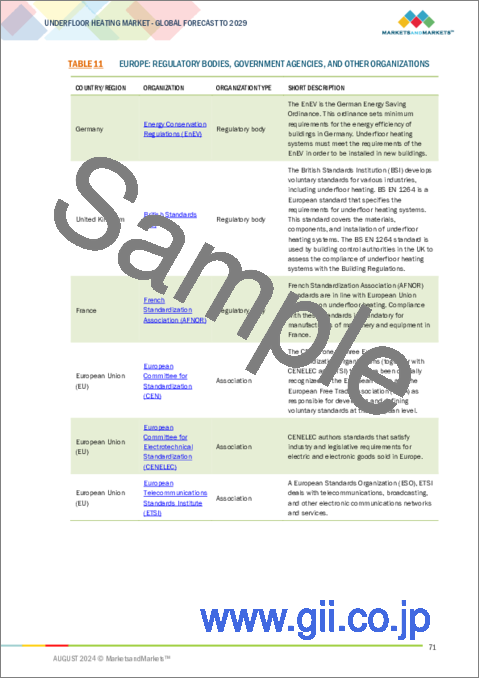

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 UNDERFLOOR HEATING MARKET: KEY STANDARDS

- TABLE 15 COMPARISON OF FLOOR COVERING TYPES

- TABLE 16 ADVANTAGES OF VARIOUS FLOOR COVERING TYPES

- TABLE 17 ADVANTAGES OF WOODEN FLOOR COVERINGS

- TABLE 18 UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 19 UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 20 NEW INSTALLATIONS: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 21 NEW INSTALLATIONS: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 22 RETROFIT INSTALLATIONS: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 23 RETROFIT INSTALLATIONS: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 24 UNDERFLOOR HEATING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 25 UNDERFLOOR HEATING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 26 HARDWARE: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 27 HARDWARE: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 28 SERVICES: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 29 SERVICES: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 30 UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 31 UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 32 HYDRONIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY COMPONENT TYPE, 2020-2023 (MILLION UNITS/MILLION FEET)

- TABLE 33 HYDRONIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY COMPONENT TYPE, 2024-2029 (MILLION UNITS/MILLION FEET)

- TABLE 34 ELECTRIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY COMPONENT TYPE, 2020-2023 (MILLION UNITS/MILLION FEET/MILLION SQUARE FEET)

- TABLE 35 ELECTRIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY COMPONENT TYPE, 2024-2029 (MILLION UNITS/MILLION FEET/MILLION SQUARE FEET)

- TABLE 36 HYDRONIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 37 HYDRONIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 38 HYDRONIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 39 HYDRONIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 40 HYDRONIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY COMPONENT TYPE, 2020-2023 (USD MILLION)

- TABLE 41 HYDRONIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY COMPONENT TYPE, 2024-2029 (USD MILLION)

- TABLE 42 ELECTRIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 43 ELECTRIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 44 ELECTRIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 45 ELECTRIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 46 ELECTRIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY COMPONENT TYPE, 2020-2023 (USD MILLION)

- TABLE 47 ELECTRIC UNDERFLOOR HEATING: UNDERFLOOR HEATING MARKET, BY COMPONENT TYPE, 2024-2029 (USD MILLION)

- TABLE 48 UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 49 UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 50 RESIDENTIAL: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 51 RESIDENTIAL: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 52 RESIDENTIAL: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 53 RESIDENTIAL: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 54 RESIDENTIAL: UNDERFLOOR HEATING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 RESIDENTIAL: UNDERFLOOR HEATING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 COMMERCIAL: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 57 COMMERCIAL: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 58 COMMERCIAL: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 59 COMMERCIAL: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 60 COMMERCIAL: UNDERFLOOR HEATING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 COMMERCIAL: UNDERFLOOR HEATING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 HEALTHCARE: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 63 HEALTHCARE: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 64 HEALTHCARE: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 65 HEALTHCARE: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 66 HEALTHCARE: UNDERFLOOR HEATING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 HEALTHCARE: UNDERFLOOR HEATING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 SPORTS & ENTERTAINMENT: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 69 SPORTS & ENTERTAINMENT: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 70 SPORTS & ENTERTAINMENT: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 71 SPORTS & ENTERTAINMENT: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 72 SPORTS & ENTERTAINMENT: UNDERFLOOR HEATING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 SPORTS & ENTERTAINMENT: UNDERFLOOR HEATING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 74 INDUSTRIAL: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 75 INDUSTRIAL: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 76 INDUSTRIAL: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 77 INDUSTRIAL: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 78 INDUSTRIAL: UNDERFLOOR HEATING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 79 INDUSTRIAL: UNDERFLOOR HEATING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 OTHERS: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 81 OTHERS: UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 82 OTHERS: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 83 OTHERS: UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 84 OTHERS: UNDERFLOOR HEATING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 85 OTHERS: UNDERFLOOR HEATING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 86 UNDERFLOOR HEATING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 87 UNDERFLOOR HEATING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: UNDERFLOOR HEATING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: UNDERFLOOR HEATING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 91 NORTH AMERICA: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 92 EUROPE: UNDERFLOOR HEATING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 93 EUROPE: UNDERFLOOR HEATING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 94 EUROPE: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 95 EUROPE: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 96 ASIA PACIFIC: UNDERFLOOR HEATING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 97 ASIA PACIFIC: UNDERFLOOR HEATING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 98 ASIA PACIFIC: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 99 ASIA PACIFIC: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 100 ROW: UNDERFLOOR HEATING MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 101 ROW: UNDERFLOOR HEATING MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 102 ROW: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 103 ROW: UNDERFLOOR HEATING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 104 KEY PLAYER STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 105 UNDERFLOOR HEATING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 106 UNDERFLOOR HEATING MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 107 UNDERFLOOR HEATING MARKET: INSTALLATION TYPE FOOTPRINT

- TABLE 108 UNDERFLOOR HEATING MARKET: APPLICATION FOOTPRINT

- TABLE 109 UNDERFLOOR HEATING MARKET: REGION FOOTPRINT

- TABLE 110 UNDERFLOOR HEATING MARKET: KEY STARTUPS/SMES

- TABLE 111 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 112 UNDERFLOOR HEATING MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 113 UNDERFLOOR HEATING MARKET: DEALS, JANUARY 2021-JUNE 2024

- TABLE 114 RESIDEO TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 115 RESIDEO TECHNOLOGIES INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 116 RESIDEO TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 117 RESIDEO TECHNOLOGIES INC.: DEALS

- TABLE 118 NVENT: COMPANY OVERVIEW

- TABLE 119 NVENT: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 120 NVENT: PRODUCT LAUNCHES

- TABLE 121 NVENT: DEALS

- TABLE 122 WARMUP PLC: COMPANY OVERVIEW

- TABLE 123 WARMUP PLC: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 124 WARMUP PLC: DEALS

- TABLE 125 REHAU LTD: COMPANY OVERVIEW

- TABLE 126 REHAU LTD: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 127 REHAU LTD: PRODUCT LAUNCHES

- TABLE 128 MAGNUM HEATING GROUP B.V.: COMPANY OVERVIEW

- TABLE 129 MAGNUM HEATING GROUP B.V.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 130 UPONOR CORPORATION: COMPANY OVERVIEW

- TABLE 131 UPONOR CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 132 UPONOR CORPORATION: DEALS

- TABLE 133 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 134 EMERSON ELECTRIC CO.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 135 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 136 ROBERT BOSCH GMBH: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 137 DANFOSS: COMPANY OVERVIEW

- TABLE 138 DANFOSS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 139 DANFOSS: PRODUCT LAUNCHES

- TABLE 140 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 141 MITSUBISHI ELECTRIC CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 142 SIEMENS AG: COMPANY OVERVIEW

- TABLE 143 SIEMENS AG: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 144 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 145 SCHNEIDER ELECTRIC: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 146 INCOGNITO HEAT CO.: COMPANY OVERVIEW

- TABLE 147 INCOGNITO HEAT CO.: PRODUCT/SOLUTION/SERVICE OFFERINGS

List of Figures

- FIGURE 1 UNDERFLOOR HEATING MARKET SEGMENTATION

- FIGURE 2 UNDERFLOOR HEATING MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 3 UNDERFLOOR HEATING MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS FROM UNDERFLOOR HEATING SYSTEMS

- FIGURE 7 DATA TRIANGULATION

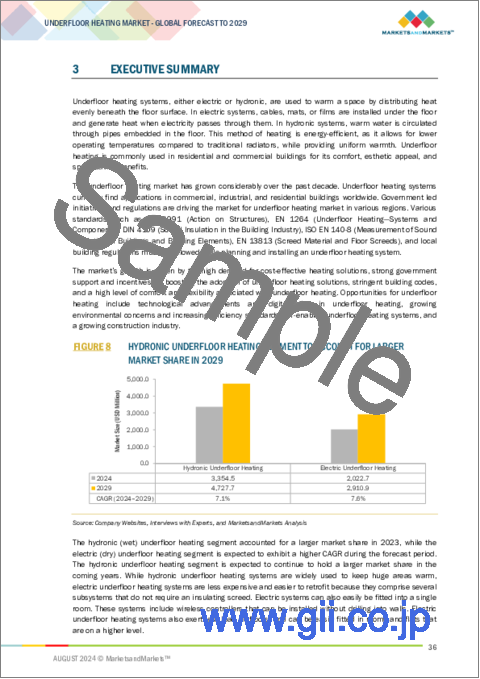

- FIGURE 8 HYDRONIC UNDERFLOOR HEATING SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 9 NEW INSTALLATIONS SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 10 RESIDENTIAL SEGMENT TO LEAD MARKET IN 2029

- FIGURE 11 EUROPEAN UNDERFLOOR HEATING MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 INCREASING AWARENESS OF BENEFITS OF UNDERFLOOR HEATING SYSTEMS TO DRIVE MARKET

- FIGURE 13 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 14 HYDRONIC UNDERFLOOR HEATING SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 15 RESIDENTIAL SEGMENT TO COMMAND UNDERFLOOR HEATING MARKET IN 2029

- FIGURE 16 UK TO REGISTER HIGHEST CAGR IN GLOBAL UNDERFLOOR HEATING MARKET DURING FORECAST PERIOD

- FIGURE 17 UNDERFLOOR HEATING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 UNDERFLOOR HEATING MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 19 UNDERFLOOR HEATING MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 20 UNDERFLOOR HEATING MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 21 UNDERFLOOR HEATING MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 22 UNDERFLOOR HEATING MARKET: AI IMPACT ANALYSIS

- FIGURE 23 UNDERFLOOR HEATING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 UNDERFLOOR HEATING SYSTEMS: ECOSYSTEM ANALYSIS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO

- FIGURE 26 AVERAGE SELLING PRICE TREND OF UNDERFLOOR HEATING SYSTEM COMPONENTS OFFERED BY MAJOR PLAYERS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF MANIFOLDS, BY REGION, 2020-2023

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 UNDERFLOOR HEATING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 32 IMPORT DATA FOR HS CODE 841861-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 33 EXPORT DATA FOR HS CODE 841861-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 34 TOP PATENT APPLICANTS AND OWNERS, 2014-2023

- FIGURE 35 UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE

- FIGURE 36 NEW INSTALLATIONS SEGMENT TO LEAD MARKET IN 2024

- FIGURE 37 RESIDENTIAL SEGMENT TO DOMINATE UNDERFLOOR HEATING MARKET FOR NEW INSTALLATIONS IN 2024

- FIGURE 38 UNDERFLOOR HEATING MARKET, BY OFFERING

- FIGURE 39 HARDWARE SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 40 HYDRONIC UNDERFLOOR HEATING SEGMENT TO HOLD LARGER SHARE OF UNDERFLOOR HEATING MARKET FOR HARDWARE IN 2024

- FIGURE 41 UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE AND COMPONENT TYPE

- FIGURE 42 HYDRONIC UNDERFLOOR HEATING SEGMENT TO LEAD MARKET FROM 2024 TO 2029

- FIGURE 43 RESIDENTIAL SEGMENT TO HOLD LARGEST SHARE OF HYDRONIC UNDERFLOOR HEATING MARKET IN 2029

- FIGURE 44 HARDWARE SEGMENT TO HOLD LARGER SHARE OF ELECTRIC UNDERFLOOR HEATING MARKET IN 2029

- FIGURE 45 UNDERFLOOR HEATING MARKET, BY APPLICATION

- FIGURE 46 RESIDENTIAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 47 UNDERFLOOR HEATING MARKET, BY REGION

- FIGURE 48 UK TO BE FASTEST-GROWING UNDERFLOOR HEATING MARKET GLOBALLY DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: SNAPSHOT OF UNDERFLOOR HEATING MARKET

- FIGURE 50 EUROPE: SNAPSHOT OF UNDERFLOOR HEATING MARKET

- FIGURE 51 ASIA PACIFIC: SNAPSHOT OF UNDERFLOOR HEATING MARKET

- FIGURE 52 UNDERFLOOR HEATING MARKET: REVENUE ANALYSIS, 2020-2023

- FIGURE 53 UNDERFLOOR HEATING MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 54 COMPANY VALUATION, 2023

- FIGURE 55 FINANCIAL METRICS (EV/EBITDA), 2023

- FIGURE 56 BRAND/PRODUCT COMPARISON

- FIGURE 57 UNDERFLOOR HEATING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 58 UNDERFLOOR HEATING MARKET: COMPANY FOOTPRINT

- FIGURE 59 UNDERFLOOR HEATING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 60 RESIDEO TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 61 NVENT: COMPANY SNAPSHOT

- FIGURE 62 REHAU LTD: COMPANY SNAPSHOT

- FIGURE 63 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 64 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 65 DANFOSS: COMPANY SNAPSHOT

- FIGURE 66 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 68 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

The global underfloor heating market was valued at USD 5.3 billion in 2024 and is estimated to reach USD 7.6 billion by 2029, registering a CAGR of 7.3% during the forecast period. The rising urbanization, regulatory requirements for sustainable construction activities, enhanced air quality inside the residential as well as commercial complexes, zoning capabilities as well as other strategies foster a reasonable setting for underfloor heating market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Offering, Installation Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Electric to grow significantly in underfloor heating market."

Underfloor heating systems that run on electricity function similarly to electric blankets. The system generates heat by passing electricity through the cable installed beneath the floor as heating pads. While this heating type is unsuitable for large areas or cost-effective, it is ideal for smaller spaces. Electric underfloor heating systems utilize non-corrosive and flexible heating elements, making them easy to install. They require fewer components compared to hydronic underfloor heating systems. These systems are commonly used to heat carpets, rugs, laminates, tiles, and wood floors and provide floor warming.

"New installation contributes significant share in the underfloor heating market."

In 2023, the new installation segment accounted for a larger market share, and a similar trend is likely to be observed during the forecast period, as the use of underfloor heating systems is on the rise in newly constructed residential and commercial buildings. Additionally, many developed nations, such as the US, the UK, and Germany, have implemented strict energy efficiency regulations for buildings.

Underfloor heating systems can help developers reduce installation costs in new buildings by utilizing on-site laborers for basic system installation and specialist contractors for electric system and boiler commissioning and connection. Although the installation cost of water-based underfloor heating systems is initially higher than standard radiator systems, they are more energy-efficient (>30%) than traditional central heating systems. Additionally, underfloor heating systems are now being offered as a value-added feature by builders to attract home buyers. All these trends indicate that newly installed underfloor heating systems are expected to dominate the market in the near future.

"North America will contribute significantly to the growth rate in underfloor heating market."

North America is poised to contribute a significant share to the underfloor heating market for several compelling reasons. The region boasts a robust industrial, commercial as well as residential base across that forms an integral to managing complex heating processes, ensuring regulatory compliance, and improving efficiency. Advanced heating technologies enable real-time monitoring, predictive maintenance, and data analytics, thereby supporting agile decision-making and continuous improvement initiatives.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the underfloor heating market place.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 48%, Directors - 33%, and Others - 37%

- By Region: North America- 35%, Europe - 18%, Asia Pacific- 40% and RoW- 5%

The study includes an in-depth competitive analysis of these key players in the underfloor heating market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the underfloor heating market by type, end-use, and region (North America, Europe, Asia Pacific). The report scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the underfloor heating market. A detailed analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, Contracts, partnerships, and agreements. New product and service launches, acquisitions, and recent developments associated with the underfloor heating market. This report covers competitive analysis of upcoming startups in the underfloor heating market ecosystem.

Reasons to buy this report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the underfloor heating market, and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for cost-effective and advanced heating solutions, Government-led support and incentives for boosting adoption of underfloor heating solutions, Presence of Stringent building codes, High comfort and flexibility associated with underfloor heating systems), restraints (Longer response time than other heating systems, High Installation cost), opportunities (Technological advancements and digitalization in underfloor heating solution, Emergence of Internet of Things (IoT) based underfloor heating systems, Expanding construction industry), and challenges (Setup issues associated with underfloor heating systems) influencing the growth of the underfloor heating market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the underfloor heating market

- Market Development: Comprehensive information about lucrative markets - the report analyses the underfloor heating market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the underfloor heating market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as Resideo Technologies Inc (US), nVent Electric Plc (UK), Warmup (UK) Siemens (Germany), Emerson Electric Co. (US), Mitsubishi Electric Corporation (Japan) and Schneider Electric (US), among others in the underfloor heating market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS.

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants in primary interviews

- 2.1.2.2 Key participants in primary interviews

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.2.5 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Bottom-up approach for estimating market size

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Top-down approach for estimating market size

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UNDERFLOOR HEATING MARKET

- 4.2 UNDERFLOOR HEATING MARKET, BY OFFERING

- 4.3 UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE

- 4.4 UNDERFLOOR HEATING MARKET, BY APPLICATION

- 4.5 UNDERFLOOR HEATING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for cost-effective and advanced heating solutions

- 5.2.1.2 Rising adoption due to government support and incentives

- 5.2.1.3 Implementation of stringent building codes

- 5.2.1.4 Integration of renewable energy sources

- 5.2.2 RESTRAINTS

- 5.2.2.1 Longer response time than for other heating systems

- 5.2.2.2 High installation costs

- 5.2.2.3 Time-consuming and complex regulatory approval process

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements and digitalization trends

- 5.2.3.2 Emergence of IoT-based underfloor heating systems

- 5.2.3.3 Expanding construction industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Setup issues associated with underfloor heating systems

- 5.2.1 DRIVERS

- 5.3 AI IMPACT ON UNDERFLOOR HEATING MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY COMPONENT TYPE

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Internet of Things (IoT)

- 5.9.1.2 Predictive maintenance

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Artificial intelligence (AI)

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Graphene heating films

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 NVENT RAYCHEM INSTALLS RESPONSIVE UNDERFLOOR HEATING SYSTEM AT LUXURY DEVELOPMENT

- 5.12.2 CONTINENTAL'S ONEBOARD SYSTEM SOLVES STRUCTURAL CHALLENGES AT NEWBUILD PROPERTY

- 5.12.3 DEVEX SYSTEMS PROVIDES HYDRONIC UNDERFLOOR HEATING AT AUSTRALIAN CHURCH

- 5.12.4 WARMUP PROVIDES HYDRONIC UNDERFLOOR HEATING SYSTEM FOR UPMARKET APARTMENT COMPLEX

- 5.12.5 WARMUP SUCCESSFULLY INSTALLS ZONE-BASED UNDERFLOOR HEATING SYSTEM AT HOUSING DEVELOPMENT

- 5.12.6 THERMO FLOOR UK DESIGNS MODERN UNDERFLOOR HEATING SYSTEM FOR TRINITY COLLEGE CHAPEL

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 841861)

- 5.13.2 EXPORT SCENARIO (HS CODE 841861)

- 5.14 PATENT ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

6 TYPES OF FLOOR COVERINGS FOR UNDERFLOOR HEATING

- 6.1 INTRODUCTION

- 6.2 TILE AND STONE

- 6.2.1 PROVIDE LONG-LASTING WARMTH DUE TO HIGH THERMAL CONDUCTIVITY

- 6.3 WOOD FLOORING

- 6.3.1 OFFERS VARYING DEGREES OF WARMTH BASED ON DENSITY

- 6.4 LAMINATE FLOORING

- 6.4.1 MOST APPROPRIATE CHOICE FOR RESIDENTIAL APPLICATIONS

- 6.5 VINYL AND LINOLEUM FLOORING

- 6.5.1 PROVIDES QUICK HEATING AND COOLING IN HOMES

- 6.6 RUBBER AND CARPET FLOORING

- 6.6.1 HIGHLY CONDUCTIVE RUBBER PREFERRED IN INDUSTRIAL AREAS

7 CONNECTION TYPES OF UNDERFLOOR HEATING SYSTEMS

- 7.1 INTRODUCTION

- 7.2 CONNECTED

- 7.2.1 IMPROVED FUNCTIONALITY DUE TO INTEGRATION OF NEW TECHNOLOGIES

- 7.3 NON-CONNECTED

- 7.3.1 COST-EFFECTIVE AND EASY TO INSTALL

8 SUBSYSTEMS INTEGRATED WITH UNDERFLOOR HEATING SYSTEMS

- 8.1 INTRODUCTION

- 8.2 HEATING SYSTEMS

- 8.2.1 PIPES AND CABLES

- 8.2.1.1 Facilitate heat transfer to floor

- 8.2.2 DISTRIBUTION UNITS

- 8.2.2.1 Transport hot water from heating systems to heat exchangers

- 8.2.1 PIPES AND CABLES

- 8.3 CONTROL SYSTEMS

- 8.3.1 SENSORS

- 8.3.1.1 Used to measure floor temperature

- 8.3.2 CONTROL INTERFACES

- 8.3.2.1 Help control thermostats in heating systems

- 8.3.1 SENSORS

9 UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE

- 9.1 INTRODUCTION

- 9.2 NEW INSTALLATIONS

- 9.2.1 STRICT ENERGY EFFICIENCY STANDARDS AND CODES TO DRIVE DEMAND

- 9.3 RETROFIT INSTALLATIONS

- 9.3.1 WIDER ADOPTION OF ELECTRIC SYSTEMS FOR RENOVATIONS TO BOOST MARKET

10 UNDERFLOOR HEATING MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 ADVANCEMENTS RELATED TO HARDWARE INTEGRATION TO DRIVE DEMAND

- 10.3 SERVICES

- 10.3.1 INCREASED DEMAND IN RESIDENTIAL AND COMMERCIAL SECTORS TO BOOST MARKET

11 UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE AND COMPONENT TYPE

- 11.1 INTRODUCTION

- 11.2 HYDRONIC UNDERFLOOR HEATING

- 11.2.1 HEATING PIPES

- 11.2.1.1 Designed to disperse heat evenly

- 11.2.2 THERMOSTATS AND SENSORS

- 11.2.2.1 Used to regulate temperature

- 11.2.3 THERMAL ACTUATORS

- 11.2.3.1 Designed to control hot water flow in underfloor heating zones

- 11.2.4 ZONE VALVES

- 11.2.4.1 Used to control heating operations of different building zones

- 11.2.5 WIRING CENTERS

- 11.2.5.1 Regulate heating operations from centralized location

- 11.2.6 MANIFOLDS AND VALVES

- 11.2.6.1 Used to control room temperature

- 11.2.1 HEATING PIPES

- 11.3 ELECTRIC UNDERFLOOR HEATING

- 11.3.1 HEATING CABLES

- 11.3.1.1 Used to facilitate underfloor heating

- 11.3.2 HEATING MATS

- 11.3.2.1 Critical part of DIY-based underfloor heating systems

- 11.3.3 THERMOSTATS AND SENSORS

- 11.3.3.1 Monitor and maintain floor temperature

- 11.3.1 HEATING CABLES

12 UNDERFLOOR HEATING MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 RESIDENTIAL

- 12.2.1 SINGLE-FAMILY HOMES

- 12.2.1.1 Need for energy efficiency and design flexibility to drive demand

- 12.2.2 APARTMENTS

- 12.2.2.1 Reduced energy consumption to boost market

- 12.2.1 SINGLE-FAMILY HOMES

- 12.3 COMMERCIAL

- 12.3.1 RETAIL

- 12.3.1.1 Growing adoption of humidity control systems to drive market

- 12.3.2 TRANSPORTATION AND LOGISTICS

- 12.3.2.1 Need for efficient heating systems to fuel adoption

- 12.3.3 HOSPITALITY

- 12.3.3.1 High energy efficiency and esthetic advantages to drive demand

- 12.3.1 RETAIL

- 12.4 HEALTHCARE

- 12.4.1 GROWING DEPLOYMENT IN MEDICAL FACILITIES TO PROPEL MARKET

- 12.5 SPORTS & ENTERTAINMENT

- 12.5.1 RISING USE TO CREATE COMFORTABLE ENVIRONMENTS TO DRIVE MARKET

- 12.6 INDUSTRIAL

- 12.6.1 INCREASING DEPLOYMENT IN VARIOUS SETTINGS TO DRIVE DEMAND

- 12.7 OTHERS

13 UNDERFLOOR HEATING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Strict government regulations to drive demand

- 13.2.3 CANADA

- 13.2.3.1 Increasing public awareness to boost market

- 13.2.4 MEXICO

- 13.2.4.1 Government efforts to increase adoption to bolster market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Government initiatives and regulations to boost market

- 13.3.3 GERMANY

- 13.3.3.1 Mandatory construction standards and directives to drive demand

- 13.3.4 FRANCE

- 13.3.4.1 Focus on sustainability to fuel market

- 13.3.5 BELGIUM

- 13.3.5.1 Increasing renovation and retrofit projects to boost market

- 13.3.6 NETHERLANDS

- 13.3.6.1 Focus on reducing energy consumption to drive market

- 13.3.7 POLAND

- 13.3.7.1 Commitment to thermal modernization to boost demand

- 13.3.8 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Need to reduce greenhouse gas emissions to drive market

- 13.4.3 JAPAN

- 13.4.3.1 Increasing demand for modern heating solutions to fuel market

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Rising requirement for efficient heating systems to propel demand

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Rising construction of premium properties to drive demand

- 13.5.3 AFRICA

- 13.5.3.1 Increased demand for residential and commercial properties to boost market

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Growing demand for sustainable solutions to bolster market

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 14.3 REVENUE ANALYSIS, 2020-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint

- 14.7.5.2 Product type footprint

- 14.7.5.3 Installation type footprint

- 14.7.5.4 Application footprint

- 14.7.5.5 Region footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 RESIDEO TECHNOLOGIES INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 NVENT

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 WARMUP PLC

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 REHAU LTD

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 MAGNUM HEATING GROUP B.V.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.6 UPONOR CORPORATION

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.4 MnM view

- 15.1.6.4.1 Key strengths/Right to win

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses/Competitive threats

- 15.1.7 EMERSON ELECTRIC CO.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 ROBERT BOSCH GMBH

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 DANFOSS

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.10 MITSUBISHI ELECTRIC CORPORATION

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 SIEMENS AG

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 SCHNEIDER ELECTRIC

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 INCOGNITO HEAT CO.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.1 RESIDEO TECHNOLOGIES INC.

- 15.2 OTHER PLAYERS

- 15.2.1 MYSON

- 15.2.2 THERMOSOFT INTERNATIONAL CORPORATION

- 15.2.3 FLEXEL INTERNATIONAL

- 15.2.4 NEXANS

- 15.2.5 AMUHEAT

- 15.2.6 ESI HEATING AND COOLING

- 15.2.7 JANES RADIANT HEATING

- 15.2.8 WARMAFLOOR

- 15.2.9 RAYOTEC LTD

- 15.2.10 RBT UNDERFLOOR LTD

- 15.2.11 UHEAT

- 15.2.12 SCHLUTER-SYSTEMS

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS