|

|

市場調査レポート

商品コード

1816000

HVACシステムの世界市場:冷房別、暖房別、換気別、技術別、サービス別 - 予測(~2030年)HVAC System Market by Cooling, Heating, Ventilation, Technology, Service - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| HVACシステムの世界市場:冷房別、暖房別、換気別、技術別、サービス別 - 予測(~2030年) |

|

出版日: 2025年08月28日

発行: MarketsandMarkets

ページ情報: 英文 335 Pages

納期: 即納可能

|

概要

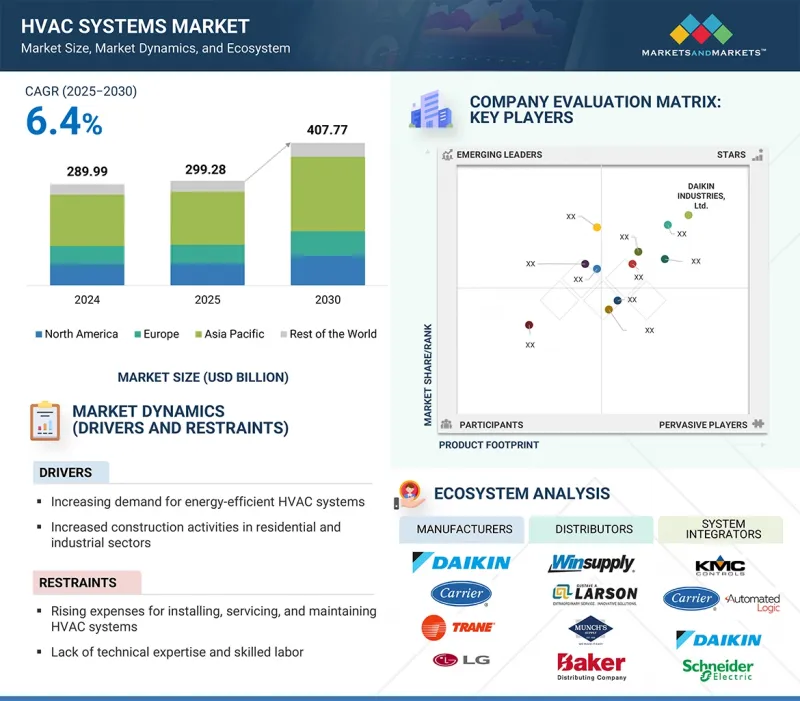

世界のHVACシステムの市場規模は、2025年の2,992億8,000万米ドルから2030年までに4,077億7,000万米ドルに達すると予測され、2025年~2030年にCAGRで6.4%の成長が見込まれます。

HVAC産業は近年著しい進歩を示しており、革新的なHVACシステムの需要が急増しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 暖房機器、冷房機器、換気機器、技術、導入タイプ、サービスタイプ、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

エネルギー効率に対するニーズの高まり、室内空気質の向上、よりスマートで接続性の高いシステムへの要望など、複数の要因がこうした進歩を後押ししています。スマートHVACシステムは、センサーと先進のアルゴリズムを使用して、屋内と屋外の状態をモニターし、リアルタイムでシステム設定を調整し、エネルギー使用とシステム性能に関する詳細なアナリティクスをユーザーに提供します。

「新築建物セグメントが予測期間に最大の市場シェアを占めます。」

政府の関与はHVAC市場において極めて重要です。政府の関与は規制遵守を実施する一方で、都市化を支援するためにHVACシステムの採用を奨励しているからです。高効率HVAC機器の展開、VRFシステムの採用、スマートサーモスタットとビルディングオートメーション制御の統合、先進の空気ろ過の使用、再生可能エネルギーを動力とする冷暖房の導入など、エネルギー効率と環境に配慮した建築法が重視されるようになった結果、米国の建物に対するエネルギー効率要件を定めたASHRAE Standard 90.1などの基準が厳しくなっています。

「エアハンドリングユニットセグメントが予測期間にもっとも高いCAGRを記録する見込みです。」

エアハンドリングユニット(AHU)セグメントは、室内空気質の改良、エネルギー効率の高い換気、より厳しい空気品質基準への準拠に対する需要の高まりにより、HVACシステム市場全体でもっとも高いCAGRを記録すると予測されています。商業スペースや医療施設の建設の増加は、効果的な空気の分配とろ過に用いるAHUの採用をさらに促進します。

「中国が2025年にアジア太平洋のHVACシステム市場で最大のシェアを占めると推定されます。」

中国はアジア太平洋最大のHVACシステム市場です。この市場は、急速な都市化、大規模なインフラと住宅建設プロジェクト、近代的な快適ソリューションを求める中間層の人口増加によって牽引されています。エネルギー効率の高い技術を推進する政府の支援政策が、気温の上昇や空調システムの採用の増加もあり、中国のHVAC市場の力強い成長をさらに促進しています。

当レポートでは、世界のHVACシステム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- HVACシステム(機器+サービス)市場における魅力的な機会

- 北米のHVACシステム市場:国別、機器タイプ別

- 商業エンドユーザー向けHVACシステム市場:タイプ別

- HVACシステム市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- HVACシステム機器の平均販売価格:主要エンドユーザー別

- HVACシステム機器の平均販売価格の動向:地域別

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- ERIKS、LG ELECTRONICSのAIドリブンVRFソリューションでエネルギー効率を向上

- MITSUBISHI ELECTRIC CORPORATION、都市型マルチVRFゾーニングシステム、ヒートポンプ給湯システム「HEAT2O」、統合制御システムを開発

- TOWNSEND ENERGYによるACコンデンサーの交換

- NETRによる補助冷暖房向けダクトレスミニスプリットシステムの設置

- DAIKINの鉄道制御システム向け温度制御ソリューション

- 複数のLGの高静圧ダクト式シングルゾーンユニットが、南ジョージア州の大型オープン倉庫で年間を通して均一な温度を提供

- 投資と資金調達のシナリオ

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 特許分析

- 主な会議とイベント

- 規制情勢

- 規制機関、政府機関、その他の組織

- 基準と規制

- HVACシステム市場に対する生成AIの影響

- HVACシステム市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第6章 HVACシステム市場:冷房機器別

- イントロダクション

- ユニタリーエアコン

- VRFシステム

- チラー

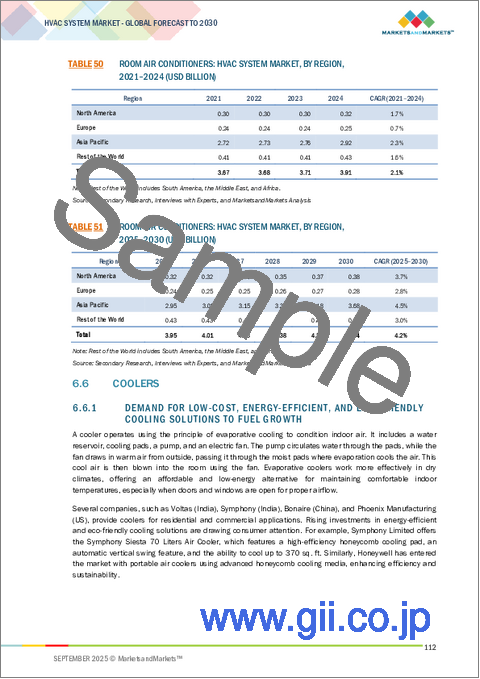

- ルームエアコン

- クーラー

- 冷却塔

第7章 HVACシステム市場:暖房機器別

- イントロダクション

- ヒートポンプ

- 炉

- ユニタリーヒーター

- ボイラー

第8章 HVACシステム市場:換気機器別

- イントロダクション

- エアハンドリングユニット

- エアフィルター

- 除湿機

- 換気扇

- 加湿器

- 空気清浄機

第9章 HVACシステム市場:技術別

- イントロダクション

- 従来式HVACシステム

- スマートHVACシステム

- サステナブル/グリーンHVACシステム

第10章 HVACシステム市場:導入タイプ別

- イントロダクション

- 新築建物

- 改修建物

第11章 HVACシステム市場:サービスタイプ別

- イントロダクション

- 設置サービス

- メンテナンス・修理サービス

- アップグレード/交換サービス

- コンサルティングサービス

第12章 HVACシステム市場:エンドユーザー別

- イントロダクション

- 商業

- 住宅

- 工業

第13章 HVACシステム市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- ポーランド

- 北欧

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 南米

- 中東

- アフリカ

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年6月~2025年7月

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標(2024年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- CARRIER

- DAIKIN INDUSTRIES, LTD.

- LG ELECTRONICS

- MIDEA

- TRANE TECHNOLOGIES PLC

- LENNOX INTERNATIONAL INC.

- JOHNSON CONTROLS

- HONEYWELL INTERNATIONAL INC.

- MITSUBISHI ELECTRIC CORPORATION

- SAMSUNG

- GREE ELECTRIC APPLIANCES, INC. OF ZHUHAI

- FUJITSU GENERAL

- PANASONIC HOLDINGS CORPORATION

- ROBERT BOSCH GMBH

- MODINE

- その他の企業

- HAIER GROUP

- SYSTEMAIR AB

- AAON

- WHIRLPOOL CORPORATION

- ELECTROLUX

- FERROLI

- VAILLANT GROUP

- RHEEM MANUFACTURING COMPANY

- AMERICAN STANDARD HEATING AND AIR CONDITIONING

- WM TECHNOLOGIES LLC