|

|

市場調査レポート

商品コード

1829984

ワクチンの世界市場:適応疾患別、技術別、タイプ別、投与経路別、エンドユーザー別、地域別 - 2030年までの予測Vaccines Market by Technology (Conjugate, Recombinant, Inactivated, Live Attenuated, Viral Vector, mRNA), Type (Monovalent, Multivalent), Disease (Pneumococcal, Flu, Hepatitis, MMR, RSV), Route of Administration (IM, SC, Oral)-Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ワクチンの世界市場:適応疾患別、技術別、タイプ別、投与経路別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月02日

発行: MarketsandMarkets

ページ情報: 英文 450 Pages

納期: 即納可能

|

概要

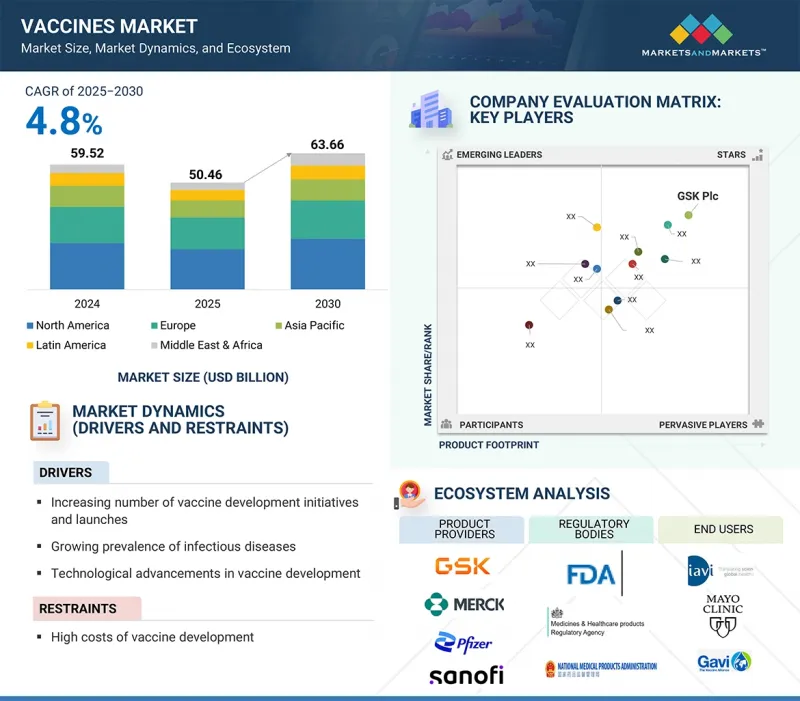

ワクチンの市場規模は、2025年の504億6,000万米ドルから2030年には636億6,000万米ドルに達し、予測期間中のCAGRは4.8%になると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 適応疾患別、技術別、タイプ別、投与経路別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

伝染性疾患の高い発生率、ワクチン技術の革新、ワクチン開発に対する政府の支援と多額の資金援助、ワクチン接種イニシアチブの増加、革新的製品への投資と上市への強い注力といった要因が、この成長ワクチンの原動力となっています。

2024年、適応疾患別では、肺炎球菌セグメントがワクチン市場で最大のシェアを占めています。

適応疾患別では、混合ワクチン、HPV、髄膜炎菌性疾患、帯状疱疹、ロタウイルス、MMR、肺炎球菌性疾患、インフルエンザ、水痘、肝炎、DTP、ポリオ、その他の適応疾患に区分されます。2022年には、肺炎球菌セグメントがワクチン市場で最大のシェアを占めました。この背景には、世界的な肺炎球菌感染症の罹患率の上昇、ワクチン接種プログラムに対する政府資金の増加、肺炎、髄膜炎、血流感染などの肺炎球菌関連合併症に伴う深刻な健康リスクに対する一般市民の意識の高まりなど、いくつかの重要な要因があります。さらに、最近承認された20価や21価の結合型ワクチンなど、次世代肺炎球菌ワクチンの開発や技術革新が進んでいるため、予防接種の選択肢が拡大し、市場成長と公衆衛生上の成果がさらに高まっています。

2024年、ワクチンの種類別では、多価ワクチン分野が最大シェアを占めています。

ワクチン市場は、タイプ別に一価ワクチンと多価ワクチンに分けられます。2024年には、多価ワクチンセグメントがワクチン市場の最大部分を占めました。この優位性は、多価ワクチンが1回の投与で複数の疾患に対する予防効果を発揮することに起因しています。このため、必要な注射の回数が減り、予防接種が簡素化されるため、患者のコンプライアンスが向上し、物流上の課題も減少します。さらに、呼吸器感染症や特定のがんなど、広範囲な免疫を必要とする疾患の流行が拡大していることも、こうしたワクチンへの需要を高めています。この動向をさらに後押ししているのは、多価ワクチンの効率的な製造に向けた技術の進歩や投資の増加であり、これによって大規模かつ迅速な製造が可能となっています。ワクチン接種スケジュールが簡素化されることで接種率が向上し、公衆衛生上の成果が高まるため、医療アクセスが限られている地域の政府やヘルスケアプロバイダーは、特に多価ワクチンを好んで使用しています。

2024年には、アジア太平洋がワクチン市場で最も急成長する地域となります。

ワクチン市場の地域は、北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカに分けられます。アジア太平洋は、予測期間中に著しいCAGRで成長すると予想されています。この成長の背景には、公衆衛生に対する意識の高まり、国家的予防接種プログラムの拡大、ヘルスケア・インフラへの政府投資の増加があります。こうした取り組みを支えているのは、官民パートナーシップ、ワクチンの公平性向上を目指した国際協力、高度なワクチン開発とより安価な生産を可能にする技術進歩です。さらに、この地域、特に中国やインドなどの国々では人口が増加傾向にあり、既存ワクチンと新規ワクチンの両方にとって大きなターゲット市場となっています。これらの要因が、ワクチン産業市場におけるアジア太平洋のリーダーシップを際立たせています。

当レポートでは、世界のワクチン市場について調査し、適応疾患別、技術別、タイプ別、投与経路別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界動向

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- バリューチェーン分析

- パイプライン分析

- エコシステム分析

- 規制分析

- 貿易分析

- ポーターのファイブフォース分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- AI/生成AIがワクチン市場に与える影響

- 2025年の米国関税がワクチン市場に与える影響

- ワクチン調達データ

- ワクチン製造プロセス

第7章 ワクチン市場(適応疾患別)

- イントロダクション

- 肺炎球菌感染症

- インフルエンザ

- 混合ワクチン

- HPV

- 髄膜炎菌感染症

- 帯状疱疹

- ロタウイルス

- MMR

- 水痘

- 肝炎

- DTP

- ポリオ

- RSV

- COVID-19

- その他

第8章 ワクチン市場(技術別)

- イントロダクション

- ワクチン市場(COVID-19ワクチンを除く)、技術別

- COVID-19ワクチン市場(技術別)

第9章 ワクチン市場(COVID-19ワクチンを除く)、タイプ別

- イントロダクション

- 多価ワクチン

- 一価ワクチン

第10章 ワクチン市場(COVID-19ワクチンを除く)、投与経路別

- イントロダクション

- 筋肉内および皮下投与

- 経口投与

- その他

第11章 ワクチン市場(COVID-19ワクチンを除く)、エンドユーザー別

- イントロダクション

- 成人用ワクチン

- 小児用ワクチン

第12章 ワクチン市場(COVID-19ワクチンを除く)、地域別

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東

- 感染症の蔓延が市場を牽引

- 中東のマクロ経済見通し

- アフリカ

- 市場を活性化させるための先進国からの資金と補助金の入手可能性

- アフリカのマクロ経済見通し

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- GSK PLC

- MERCK & CO., INC.

- PFIZER INC.

- SANOFI

- CSL

- EMERGENT

- JOHNSON & JOHNSON SERVICES, INC.

- ASTRAZENECA

- SERUM INSTITUTE OF INDIA PVT., LTD.

- BAVARIAN NORDIC

- MITSUBISHI TANABE PHARMA CORPORATION

- DAIICHI SANKYO COMPANY, LIMITED

- PANACEA BIOTEC

- BIOLOGICAL E LIMITED

- BHARAT BIOTECH

- NOVAVAX

- INOVIO PHARMACEUTICALS

- その他の企業

- SINOVAC

- INCEPTA PHARMACEUTICALS LTD.

- VALNEVA SE

- VBI VACCINE INC.

- BIO FARMA

- MICROGEN

- ZHI FEI BIOLOGICAL

- INDIAN IMMUNOLOGICALS LIMITED