|

|

市場調査レポート

商品コード

1358280

スマート水管理の世界市場:水道メーター別、ソリューション別、サービス別、エンドユーザー別、地域別 - 予測(~2028年)Smart Water Management Market by Water Meter (AMR, AMI), Solution (Enterprise Asset Management, Network Management, Smart Irrigation), Service (Professional, Managed), End User (Residential, Commercial, Industrial) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| スマート水管理の世界市場:水道メーター別、ソリューション別、サービス別、エンドユーザー別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月02日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のスマート水管理の市場規模は、2023年に166億米ドル、2028年までに282億米ドルに達し、予測期間中にCAGRで11.3%の成長が予測されています。

消費者は、安全な飲料水、信頼性の高い廃水処理、効率的な雨水管理など、品質の高い水サービスをますます求めるようになっています。

水道メーターの中では、AMIメーターが予測期間中にもっとも高い市場シェアを占めます。

規制の義務化、環境意識、コスト削減の追求などが、AMI水道メーターの採用拡大に寄与しています。

ソリューションの中では、企業資産管理が予測期間中にもっとも高い市場シェアを占めます。

市場では、企業資産管理(EAM)ソリューションの重要性が高まっています。水インフラはますます複雑化し、IoTセンサーやAIなどの新技術が統合されています。EAMソリューションは、公共事業者が資産と運用を一元的に把握することで、この複雑性を管理するのに役立ちます。

地域の中では、アジア太平洋が予測期間中に高いCAGRを維持します。

アジア太平洋は世界でもっとも都市化が進んでいる地域で、人口の半数以上が都市に住んでいます。急速な都市化と人口の増加が、水資源とインフラへの圧力を高めています。スマート水管理ソリューションは、水資源の節約、水効率の改善、水損失の削減に役立ちます。

当レポートでは、世界のスマート水管理市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- スマート水管理市場の企業にとっての機会

- スマート水管理市場に対する不況の影響

- 北米のスマート水管理市場:提供別、エンドユーザー別

- 欧州のスマート水管理市場:提供別、エンドユーザー別

- アジア太平洋のスマート水管理市場:提供別、エンドユーザー別

第5章 市場の概要と産業動向

- 市場の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- スマート水管理サービスの進化

- バリューチェーン分析

- エコシステム分析

- 特許分析

- 貿易分析

- 水道メーターの輸出シナリオ

- 水道メーターの輸入シナリオ

- ケーススタディ

- 価格分析

- 技術分析

- 主な技術

- 関連技術

- 主な会議とイベント(2023年~2024年)

- ポーターのファイブフォース分析

- 規制情勢

- 購買者に影響を与える動向/混乱

- 主なステークホルダーと購入基準

- スマート水管理市場のベストプラクティス

- 包括的なデータ収集

- 先進データアナリティクス

- 漏れの検出と防止

- リアルタイムモニタリング

- 需要予測

- リモートコントロールとオートメーション

- スマートな計測と請求

- スマート水管理市場の技術ロードマップ

- スマート水管理市場のビジネスモデル

第6章 スマート水管理市場:提供別

- イントロダクション

- 水道メーター

- AMRメーター

- AMIメーター

- ソリューション

- 企業資産管理

- 分析とデータ管理

- セキュリティ

- スマート灌漑管理

- 先進圧力管理

- モバイル労働力管理

- ネットワーク管理

- 顧客情報システム・請求

- 漏れの検出

- その他のソリューション

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 スマート水管理市場:エンドユーザー別

- イントロダクション

- 住宅

- 商業

- 工業

第8章 スマート水管理市場:技術別

- イントロダクション

- IoT

- AI

- ビッグデータ・アナリティクス

- クラウドコンピューティング

- その他の技術

第9章 スマート水管理市場:地域別

- イントロダクション

- 北米

- 北米のスマート水管理市場の促進要因

- 北米の不況の影響

- 北米の規制情勢

- 米国

- カナダ

- 欧州

- 欧州のスマート水管理市場の促進要因

- 欧州の不況の影響

- 欧州の規制情勢

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋のスマート水管理市場の促進要因

- アジア太平洋の不況の影響

- アジア太平洋の規制情勢

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのスマート水管理市場の促進要因

- 中東・アフリカの不況の影響

- 中東・アフリカの規制情勢

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカのスマート水管理市場の促進要因

- ラテンアメリカの不況の影響

- ラテンアメリカの規制情勢

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の収益実績の分析

- 主要企業の市場シェアの分析

- 主要企業のランキング

- 競合ベンチマーキング

- 主要企業の評価マトリクス

- スタートアップ/中小企業向けの企業の評価マトリクス

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- SIEMENS

- IBM

- ABB

- HONEYWELL ELSTER

- SCHNEIDER ELECTRIC

- ITRON

- SUEZ

- ORACLE

- LANDIS+GYR

- TRIMBLE WATER

- XYLEM

- KAMSTRUP

- その他の企業

- HYDROPOINT

- I20

- XENIUS

- NEPTUNE TECHNOLOGY

- TAKADU

- BADGER METER

- AQUAMATIX

- LISHTOT

- CITYTAPS

- FREDSENSE

- FRACTA

- SMART ENERGY WATER

- AYYEKA

- KETOS

第12章 隣接市場と関連市場

- イントロダクション

- スマートシティ向けIoT市場

- 市場の定義

- 市場の概要

- スマートビルディング市場

- 市場の定義

- 市場の概要

第13章 付録

The Smart water management market size is expected to grow from USD 16.6 billion in 2023 to USD 28.2 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 11.3% during the forecast period. Consumers increasingly demand high-quality water services, including safe drinking water, reliable wastewater treatment, and efficient stormwater management. Smart water management solutions can help utilities meet these demands by providing real-time data and insights that can be used to improve water quality, reduce water loss, and optimize operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Offering, End user, Technology, End Use |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

Among water meters, AMI Meters to hold the highest market share during the forecast period

AMI water meters are a component of this infrastructure used to measure and monitor water consumption in a more advanced and intelligent manner compared to traditional water meters. hese meters are equipped with technology that allows them to collect and transmit data about water usage remotely and in real-time The growing concern over water scarcity and the need for sustainable water practices is driving the market . Additionally, regulatory mandates, environmental consciousness, and the quest for cost savings have all contributed to the increasing adoption of AMI water meters.

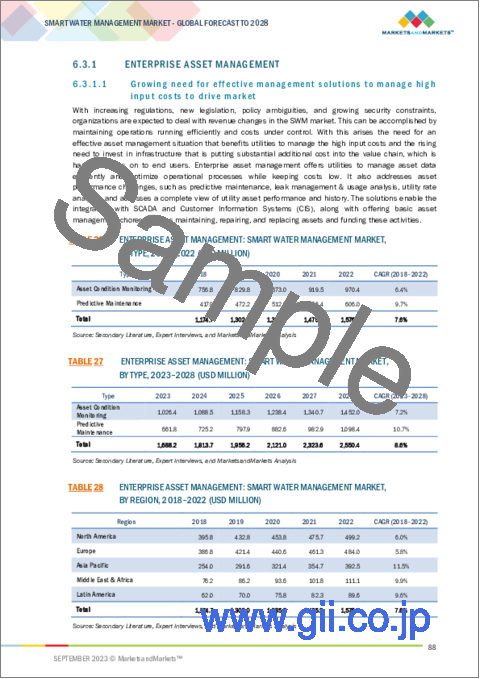

Among solutions, Enterprise Asset Management to hold the highest market share during the forecast period

Enterprise asset management (EAM) solutions are increasingly important in the smart water management market. EAM solutions help utilities to track, manage, and maintain their physical assets throughout their entire lifecycle, from procurement to disposal. Water infrastructure is becoming increasingly complex, integrating new technologies such as IoT sensors and artificial intelligence (AI). EAM solutions can help utilities manage this complexity by providing a unified view of their assets and operations.

Among regions, Asia Pacific is to hold a higher CAGR during the forecast period.

Asia Pacific is the most urbanized region in the world, with over half of the population living in cities. Rapid urbanization and population growth are increasing pressure on water resources and infrastructure. Smart water management solutions can help to conserve water resources, improve water efficiency, and reduce water loss.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the smart water management market.

- By Company: Tier I: 35%, Tier II: 39%, and Tier III: 26%

- By Designation: C-Level Executives: 55%, Directors: 40%, and others: 5%

- By Region: North America: 30%, Europe: 35%, Asia Pacific: 25%, RoW-10%

The report includes studying key players offering Smart water management solutions and services. It profiles major vendors in the global Smart water management market. The major vendors in the global Smart water management market include Siemens (Germany), IBM (US), ABB (Switzerland), Honeywell Elster (US), Schneider Electric (France), Itron (US), SUEZ ( France), Oracle (US), Landis+Gyr (Switzerland), Trimble Water (US), Xylem (US), Kamstrup (Denmark), HydroPoint (US), i2O (UK), Xenius (India), Neptune Technology (US), TaKaDu (Israel), Badger Meter (US), AquamatiX (UK), Lishtot (Israel), CityTaps ( France), FREDsense (Canada), Fracta (US), Smart Energy Water (US), Ayyeka ((US), Ketos (US).

Research Coverage

The market study covers the Smart water management market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as offering, end-users, technology, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report would help the market leaders and new entrants in the following ways:

- It comprehensively segments the smart water management market and provides the closest approximations of the revenue numbers for the overall market and its subsegments across different regions.

- It would help stakeholders understand the market's pulse and provide information on the key market drivers, restraints, challenges, and opportunities.

- It would help stakeholders understand their competitors better and gain more insights to enhance their positions in the market. The competitive landscape includes a competitor ecosystem, new service developments, partnerships, and mergers and acquisitions.

The report provides insights on the following pointers:

Analysis of key drivers (growing rapid urbanization, rising complexities of managing water usage, need for regulatory and sustainability mandates concerning environment, rising need to replace aging water infrastructure) restraints (integration of water systems with modern smart solutions, reduced shelf-life of smart meters) opportunities (increasing role of smart water management in smart city revolution, Strong government initiatives and regulatory implementations to promote SWM solutions) challenges (difficulty in technology implementation over legacy infrastructure, high initial investments and lower return) influencing the growth of the smart water management market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in smart water management market. Market Development: Comprehensive information about lucrative markets - the report analyses the Smart water management market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the smart water management market. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Siemens (Germany), IBM (US), ABB (Switzerland), Honeywell Elster (US), Schneider Electric (France), Itron (US), SUEZ ( France), Oracle (US), Landis+Gyr (Switzerland), Trimble Water (US), Xylem (US), Kamstrup (Denmark), HydroPoint (US), i2O (UK), Xenius (India), Neptune Technology (US), TaKaDu (Israel), Badger Meter (US), AquamatiX (UK), Lishtot (Israel), CityTaps ( France), FREDsense (Canada), Fracta (US), Smart Energy Water (US), Ayyeka ((US), Ketos (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- TABLE 2 SMART WATER MANAGEMENT MARKET: PRIMARY RESPONDENTS

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 SMART WATER MANAGEMENT MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE OF SMART WATER MANAGEMENT SERVICES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF FOCUS AREAS OF SMART WATER MANAGEMENT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (TOP-DOWN): SHARE OF SMART WATER MANAGEMENT MARKET THROUGH SMART CITIES

- 2.4 MARKET FORECAST

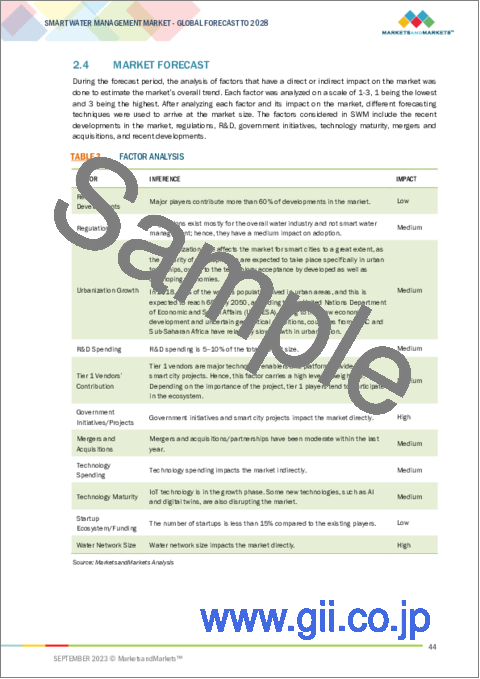

- TABLE 3 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 IMPLICATIONS OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 6 SMART WATER MANAGEMENT MARKET, 2021-2028 (USD MILLION)

- FIGURE 7 SMART WATER MANAGEMENT MARKET: HOLISTIC VIEW

- FIGURE 8 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN SMART WATER MANAGEMENT MARKET

- FIGURE 9 REPLACEMENT OF AGING INFRASTRUCTURE TO DRIVE SMART WATER MANAGEMENT MARKET GROWTH

- 4.2 IMPACT OF RECESSION IN SMART WATER MANAGEMENT MARKET

- FIGURE 10 SMART WATER MANAGEMENT MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- 4.3 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY OFFERING AND END USER

- FIGURE 11 NORTH AMERICA: SOLUTIONS AND INDUSTRIAL SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.4 EUROPE: SMART WATER MANAGEMENT MARKET, BY OFFERING AND END USER

- FIGURE 12 EUROPE: SOLUTIONS AND INDUSTRIAL SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.5 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY OFFERING AND END USER

- FIGURE 13 ASIA PACIFIC: SOLUTIONS AND INDUSTRIAL SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 14 SMART WATER MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid urbanization

- 5.2.1.2 Rising complexities of managing water usage

- 5.2.1.3 Need for regulatory and sustainability mandates concerning environment

- 5.2.1.4 Rising need to replace aging water infrastructure

- 5.2.2 RESTRAINTS

- 5.2.2.1 Integration of water systems with modern smart solutions

- 5.2.2.2 Reduced shelf-life of smart meters

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing role of smart water management in smart city revolution

- 5.2.3.2 Strong government initiatives and regulatory implementations to promote smart water management solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulty in technology implementation over legacy infrastructure

- 5.2.4.2 High initial investments and low returns

- 5.3 EVOLUTION OF SMART WATER MANAGEMENT SERVICES

- FIGURE 15 EVOLUTION OF SMART WATER MANAGEMENT SERVICES

- FIGURE 16 ECOSYSTEM MAP

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 17 SMART WATER MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- TABLE 4 ECOSYSTEM ANALYSIS

- 5.6 PATENT ANALYSIS

- FIGURE 18 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- TABLE 5 TOP 20 PATENT OWNERS (US)

- FIGURE 19 NUMBER OF PATENTS GRANTED, 2013-2023

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT SCENARIO OF WATER METERS

- FIGURE 20 EXPORT OF WATER METERS, BY KEY COUNTRY, 2015-2022 (USD MILLION)

- 5.7.2 IMPORT SCENARIO OF WATER METERS

- FIGURE 21 IMPORT OF WATER METERS, BY KEY COUNTRY, 2015-2022 (USD MILLION)

- 5.8 CASE STUDIES

- 5.8.1 CASE STUDY 1: SOUTHERN WATER INSTALLED NEW METERS TO HELP CUSTOMERS TAKE CONTROL OF THEIR WATER BILLS

- 5.8.2 CASE STUDY 2: LOS ANGELES DEPARTMENT OF WATER AND POWER INSTALLED TRIMBLE ERESPOND INCIDENT MANAGEMENT SOLUTION TO IMPROVE OVERALL INCIDENT MANAGEMENT AND CUSTOMER RELATIONS

- 5.8.3 USE CASE 3: LAS VEGAS VALLEY WATER DISTRICT INSTALLED MUELLER WATER PRODUCTS' ECHOSHORE®-TX PERMANENT LEAK DETECTION PLATFORM TO REDUCE WATER LOSS DUE TO LEAKAGE

- 5.8.4 USE CASES 4: ILLINOIS WATER DEPARTMENT INSTALLED NEPTUNE MOBILE AMR TO FACILITATE FAST DATA COLLECTION

- 5.8.5 CASE STUDY 5: K-WATER INTRODUCED SMART WATER MANAGEMENT SOLUTIONS TO ENSURE SUSTAINABLE WATER SUPPLY TO EVERY CITIZEN

- 5.9 PRICING ANALYSIS

- 5.9.1 INDICATIVE PRICING ANALYSIS, BY KEY OFFERING

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY KEY OFFERING

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Artificial Intelligence (AI)

- 5.10.1.2 Internet of Things (IoT)

- 5.10.1.3 Big Data Analytics

- 5.10.1.4 5G Network

- 5.10.2 ADJACENT TECHNOLOGIES

- 5.10.2.1 Edge Computing

- 5.10.2.2 Digital Twin

- 5.10.1 KEY TECHNOLOGIES

- 5.11 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 7 SMART WATER MANAGEMENT MARKET: LIST OF KEY CONFERENCES & EVENTS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 SMART WATER MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 BARGAINING POWER OF SUPPLIERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 REGULATORY LANDSCAPE

- 5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 22 SMART WATER MANAGEMENT MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS ON BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- 5.15.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- 5.16 BEST PRACTICES IN SMART WATER MANAGEMENT MARKET

- 5.16.1 COMPREHENSIVE DATA COLLECTION

- 5.16.2 ADVANCED DATA ANALYTICS

- 5.16.3 LEAK DETECTION AND PREVENTION

- 5.16.4 REAL-TIME MONITORING

- 5.16.5 DEMAND FORECASTING

- 5.16.6 REMOTE CONTROL AND AUTOMATION

- 5.16.7 SMART METERING AND BILLING

- 5.17 TECHNOLOGY ROADMAP FOR SMART WATER MANAGEMENT MARKET

- TABLE 11 TECHNOLOGY ROADMAP FOR SMART WATER MANAGEMENT MARKET, 2023-2030

- 5.18 BUSINESS MODELS OF SMART WATER MANAGEMENT MARKET

6 SMART WATER MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 25 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 6.1.1 OFFERINGS: SMART WATER MANAGEMENT MARKET DRIVERS

- TABLE 12 SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 13 SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 WATER METERS

- FIGURE 26 AMR METERS SEGMENT TO GROW AT HIGHER CAGR BY 2028

- TABLE 14 WATER METERS: SMART WATER MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 15 WATER METERS: SMART WATER MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 16 WATER METERS: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 17 WATER METERS: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1 AMR METERS

- 6.2.1.1 Need to eliminate issues, such as inaccurate invoicing and poor customer service, to drive popularity of AMR meters

- TABLE 18 AMR METERS: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 AMR METERS: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 AMI METERS

- 6.2.2.1 Demand to replace legacy systems in residential, commercial, and industrial setups to propel market

- TABLE 20 AMI METERS: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 AMI METERS: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SOLUTIONS

- FIGURE 27 ENTERPRISE ASSET MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE

- TABLE 22 SOLUTIONS: SMART WATER MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 23 SOLUTIONS: SMART WATER MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 24 SOLUTIONS: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 SOLUTIONS: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 ENTERPRISE ASSET MANAGEMENT

- 6.3.1.1 Growing need for effective management solutions to manage high input costs to drive market

- TABLE 26 ENTERPRISE ASSET MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 27 ENTERPRISE ASSET MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 28 ENTERPRISE ASSET MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 ENTERPRISE ASSET MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.2 Asset condition monitoring

- TABLE 30 ASSET CONDITION MONITORING: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 ASSET CONDITION MONITORING: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.3 Predictive maintenance

- TABLE 32 PREDICTIVE MAINTENANCE: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 PREDICTIVE MAINTENANCE: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 ANALYTICS & DATA MANAGEMENT

- 6.3.2.1 Need for processing huge amounts of data into actionable insights to propel market

- TABLE 34 ANALYTICS & DATA MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 35 ANALYTICS & DATA MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 36 ANALYTICS & DATA MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 ANALYTICS & DATA MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.2 Meter data management

- TABLE 38 METER DATA MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 METER DATA MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.3 Supervisory control & data acquisition

- TABLE 40 SUPERVISORY CONTROL & DATA ACQUISITION: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 SUPERVISORY CONTROL & DATA ACQUISITION: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 SECURITY

- 6.3.3.1 Demand to manage water supply networks to boost growth

- TABLE 42 SECURITY: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 SECURITY: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.4 SMART IRRIGATION MANAGEMENT

- 6.3.4.1 Rising need for sustainable and responsible irrigation solutions to encourage market expansion

- TABLE 44 SMART IRRIGATION MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 SMART IRRIGATION MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.5 ADVANCED PRESSURE MANAGEMENT

- 6.3.5.1 Increasing water loss due to leakage and rising incidental expenses to drive growth

- TABLE 46 ADVANCED PRESSURE MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 ADVANCED PRESSURE MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.6 MOBILE WORKFORCE MANAGEMENT

- 6.3.6.1 Aging infrastructure and workforce transitions to encourage adoption of MWM solutions among leading players

- TABLE 48 MOBILE WORKFORCE MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 MOBILE WORKFORCE MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.7 NETWORK MANAGEMENT

- 6.3.7.1 Rising need for smarter infrastructure to drive market

- TABLE 50 NETWORK MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 NETWORK MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.8 CUSTOMER INFORMATION SYSTEM & BILLING

- 6.3.8.1 Growing demand to streamline utility operations and provide quality services to boost growth

- TABLE 52 CIS AND BILLING: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 CIS AND BILLING: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.9 LEAK DETECTION

- 6.3.9.1 Growing need to detect leaks in pipelines and other water network assets to drive market

- TABLE 54 LEAK DETECTION: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 LEAK DETECTION: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.10 OTHER SOLUTIONS

- TABLE 56 OTHER SOLUTIONS: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 OTHER SOLUTIONS: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 SERVICES

- FIGURE 28 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 58 SERVICES: SMART WATER MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 59 SERVICES: SMART WATER MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 60 SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1 PROFESSIONAL SERVICES

- 6.4.1.1 Increasing complexity of operations to drive demand for professional services

- TABLE 62 PROFESSIONAL SERVICES: SMART WATER MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 63 PROFESSIONAL SERVICES: SMART WATER MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 64 PROFESSIONAL SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 PROFESSIONAL SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1.2 Consulting services

- TABLE 66 CONSULTING SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 CONSULTING SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1.3 System integration & deployment services

- TABLE 68 SYSTEM INTEGRATION & DEPLOYMENT SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 69 SYSTEM INTEGRATION & DEPLOYMENT SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1.4 Support & maintenance services

- TABLE 70 SUPPORT & MAINTENANCE SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 71 SUPPORT & MAINTENANCE SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.2 MANAGED SERVICES

- 6.4.2.1 Rising need to improve operations and cut down expenses to spur growth

- TABLE 72 MANAGED SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 73 MANAGED SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

7 SMART WATER MANAGEMENT MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 29 RESIDENTIAL SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 7.1.1 END USERS: SMART WATER MANAGEMENT MARKET DRIVERS

- TABLE 74 SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 75 SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 7.2 RESIDENTIAL

- 7.2.1 DEMAND FOR FRESHWATER IN RESIDENTIAL AREAS TO DRIVE ADOPTION OF SMART WATER SOLUTIONS

- 7.2.2 RESIDENTIAL: SMART WATER MANAGEMENT USE CASES

- 7.2.2.1 Leak detection

- 7.2.2.2 Irrigation control

- 7.2.2.3 Appliances efficiency

- 7.2.2.4 Remote monitoring

- TABLE 76 RESIDENTIAL: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 77 RESIDENTIAL: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 COMMERCIAL

- 7.3.1 NEED TO COMBAT WATER CHALLENGES TO MAINTAIN GOOD WATER QUALITY TO PROPEL MARKET

- 7.3.2 COMMERCIAL: SMART WATER MANAGEMENT USE CASES

- 7.3.2.1 Facility management

- 7.3.2.2 Tenant billing

- 7.3.2.3 Sustainable practices

- 7.3.2.4 Predictive maintenance

- 7.3.2.5 Regulatory compliance

- TABLE 78 COMMERCIAL: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 79 COMMERCIAL: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 INDUSTRIAL

- 7.4.1 GROWING AWARENESS AMONG INDUSTRIES REGARDING IMPACT OF WATER WASTAGE TO DRIVE POPULARITY OF SMART WATER MANAGEMENT SOLUTIONS

- 7.4.2 MANUFACTURING

- 7.4.3 ENERGY & UTILITIES

- 7.4.4 AGRICULTURE

- 7.4.5 MINING

- 7.4.6 OTHERS

- 7.4.7 INDUSTRIAL: SMART WATER MANAGEMENT USE CASES

- 7.4.7.1 Process optimization

- 7.4.7.2 Water quality monitoring

- 7.4.7.3 Energy efficiency

- 7.4.7.4 Remote operation

- TABLE 80 INDUSTRIAL: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 81 INDUSTRIAL: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 82 INDUSTRIAL: SMART WATER MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 83 INDUSTRIAL: SMART WATER MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

8 SMART WATER MANAGEMENT MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.1.1 TECHNOLOGIES: SMART WATER MANAGEMENT MARKET DRIVERS

- 8.2 IOT

- 8.2.1 NEED TO COLLECT REAL-TIME DATA ON WATER QUALITY TO BOOST ADOPTION OF IOT SOLUTIONS IN SMART WATER MANAGEMENT

- 8.3 ARTIFICIAL INTELLIGENCE

- 8.3.1 ADOPTION OF AI SOLUTIONS TO ANALYZE VAST AMOUNTS OF DATA GENERATED BY IOT SENSORS TO BOOST MARKET

- 8.4 BIG DATA & ANALYTICS

- 8.4.1 USE OF BIG DATA & ANALYTICS TO ANALYZE HISTORICAL DATA AND IDENTIFY CONSUMPTION PATTERNS TO SPUR GROWTH

- 8.5 CLOUD COMPUTING

- 8.5.1 RISING DEMAND FOR SCALABLE AND FLEXIBLE PLATFORMS TO STORE AND PROCESS WATER-RELATED DATA TO ENCOURAGE GROWTH

- 8.6 OTHER TECHNOLOGIES

9 SMART WATER MANAGEMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 30 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 84 SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 85 SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: SMART WATER MANAGEMENT MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- 9.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 86 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2018-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023-2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2018-2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.4 US

- 9.2.4.1 Dire need to replace aging infrastructure to foster growth

- TABLE 106 US: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 107 US: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 108 US: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2018-2022 (USD MILLION)

- TABLE 109 US: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023-2028 (USD MILLION)

- TABLE 110 US: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 111 US: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 112 US: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 113 US: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 114 US: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 115 US: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 116 US: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 117 US: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 118 US: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 119 US: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 120 US: SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 121 US: SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 122 US: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2018-2022 (USD MILLION)

- TABLE 123 US: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2023-2028 (USD MILLION)

- 9.2.5 CANADA

- 9.2.5.1 Increasing investments in industrial development to boost growth

- 9.3 EUROPE

- 9.3.1 EUROPE: SMART WATER MANAGEMENT MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- 9.3.3 EUROPE: REGULATORY LANDSCAPE

- TABLE 124 EUROPE: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 125 EUROPE: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2018-2022 (USD MILLION)

- TABLE 127 EUROPE: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 129 EUROPE: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 131 EUROPE: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 133 EUROPE: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 134 EUROPE: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 135 EUROPE: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 136 EUROPE: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 137 EUROPE: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 138 EUROPE: SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 139 EUROPE: SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 140 EUROPE: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2018-2022 (USD MILLION)

- TABLE 141 EUROPE: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 142 EUROPE: SMART WATER MANAGEMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 143 EUROPE: SMART WATER MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.4 UK

- 9.3.4.1 Adoption of smart solutions by water agencies to cut down water leakage incidents to drive growth

- TABLE 144 UK: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 145 UK: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 146 UK: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2018-2022 (USD MILLION)

- TABLE 147 UK: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023-2028 (USD MILLION)

- TABLE 148 UK: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 149 UK: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 150 UK: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 151 UK: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 152 UK: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 153 UK: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 154 UK: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 155 UK: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 156 UK: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 157 UK: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 158 UK: SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 159 UK: SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 160 UK: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2018-2022 (USD MILLION)

- TABLE 161 UK: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2023-2028 (USD MILLION)

- 9.3.5 GERMANY

- 9.3.5.1 Need to improve water quality and clean up rivers to drive market

- 9.3.6 FRANCE

- 9.3.6.1 High usability of smart water management technologies to drive growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- 9.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 162 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2018-2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023-2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2018-2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.4 CHINA

- 9.4.4.1 Government efforts to develop sustainable water supply strategies to encourage market expansion

- TABLE 182 CHINA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 183 CHINA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 184 CHINA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2018-2022 (USD MILLION)

- TABLE 185 CHINA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023-2028 (USD MILLION)

- TABLE 186 CHINA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 187 CHINA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 188 CHINA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 189 CHINA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 190 CHINA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 191 CHINA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 192 CHINA: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 193 CHINA: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 194 CHINA: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 195 CHINA: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 196 CHINA: SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 197 CHINA: SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 198 CHINA: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2018-2022 (USD MILLION)

- TABLE 199 CHINA: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2023-2028 (USD MILLION)

- 9.4.5 JAPAN

- 9.4.5.1 Strong investments by leading players in new technologies to drive growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Rising government initiatives to improve water management to boost growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 9.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 200 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2018-2022 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023-2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2018-2022 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.4 MIDDLE EAST

- 9.5.4.1 Active participation of governments in developing and upgrading infrastructure to drive market

- 9.5.5 AFRICA

- 9.5.5.1 Awareness about benefits of optimum consumption of water to propel market

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: SMART WATER MANAGEMENT MARKET DRIVERS

- 9.6.2 LATIN AMERICA: RECESSION IMPACT

- 9.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 220 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2018-2022 (USD MILLION)

- TABLE 223 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023-2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 225 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 227 LATIN AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 228 LATIN AMERICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 229 LATIN AMERICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 230 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 231 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 232 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 233 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 234 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 235 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 236 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2018-2022 (USD MILLION)

- TABLE 237 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY INDUSTRIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 238 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 239 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.6.4 BRAZIL

- 9.6.4.1 Rapid population growth to drive demand for smart water management

- 9.6.5 MEXICO

- 9.6.5.1 Rising government incentives to support use of water-efficient technologies to drive demand

- 9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 240 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 33 HISTORICAL REVENUE ANALYSIS, 2020-2022

- 10.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- TABLE 241 SMART WATER MANAGEMENT MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.5 RANKING OF KEY PLAYERS

- FIGURE 34 RANKING OF KEY PLAYERS, 2023

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 242 DETAILED LIST OF STARTUPS/SMES

- TABLE 243 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 244 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 10.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- FIGURE 35 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 36 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 10.8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- FIGURE 37 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 38 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- TABLE 245 SMART WATER MANAGEMENT MARKET: PRODUCT LAUNCHES, 2021-2023

- 10.9.2 DEALS

- TABLE 246 SMART WATER MANAGEMENT MARKET: DEALS, 2021-2023

- 10.9.3 OTHERS

- TABLE 247 SMART WATER MANAGEMENT MARKET: OTHERS, 2020-2021

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices made, and Weaknesses and Competitive threats)**

- 11.1.1 SIEMENS

- TABLE 248 SIEMENS: BUSINESS OVERVIEW

- FIGURE 39 SIEMENS: COMPANY SNAPSHOT

- TABLE 249 SIEMENS: PRODUCTS OFFERED

- TABLE 250 SIEMENS: DEALS

- 11.1.2 IBM

- TABLE 251 IBM: BUSINESS OVERVIEW

- FIGURE 40 IBM: COMPANY SNAPSHOT

- TABLE 252 IBM: PRODUCTS OFFERED

- TABLE 253 IBM: DEALS

- 11.1.3 ABB

- TABLE 254 ABB: BUSINESS OVERVIEW

- FIGURE 41 ABB: COMPANY SNAPSHOT

- TABLE 255 ABB: PRODUCTS OFFERED

- TABLE 256 ABB: PRODUCT LAUNCHES

- TABLE 257 ABB: DEALS

- 11.1.4 HONEYWELL ELSTER

- TABLE 258 HONEYWELL ELSTER: BUSINESS OVERVIEW

- FIGURE 42 HONEYWELL ELSTER: COMPANY SNAPSHOT

- TABLE 259 HONEYWELL ELSTER: PRODUCTS OFFERED

- TABLE 260 HONEYWELL ELSTER: DEALS

- 11.1.5 SCHNEIDER ELECTRIC

- TABLE 261 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 43 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 262 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- TABLE 263 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 264 SCHNEIDER ELECTRIC: DEALS

- 11.1.6 ITRON

- TABLE 265 ITRON: BUSINESS OVERVIEW

- FIGURE 44 ITRON: COMPANY SNAPSHOT

- TABLE 266 ITRON: PRODUCTS OFFERED

- TABLE 267 ITRON: DEALS

- 11.1.7 SUEZ

- TABLE 268 SUEZ: BUSINESS OVERVIEW

- FIGURE 45 SUEZ: COMPANY SNAPSHOT

- TABLE 269 SUEZ: PRODUCTS OFFERED

- TABLE 270 SUEZ: PRODUCT LAUNCHES

- TABLE 271 SUEZ: DEALS

- 11.1.8 ORACLE

- TABLE 272 ORACLE: BUSINESS OVERVIEW

- FIGURE 46 ORACLE: COMPANY SNAPSHOT

- TABLE 273 ORACLE: PRODUCTS OFFERED

- TABLE 274 ORACLE: PRODUCT LAUNCHES

- TABLE 275 ORACLE: DEALS

- TABLE 276 ORACLE: OTHERS

- 11.1.9 LANDIS+GYR

- TABLE 277 LANDIS+GYR: BUSINESS OVERVIEW

- FIGURE 47 LANDIS+GYR: COMPANY SNAPSHOT

- TABLE 278 LANDIS+GYR: PRODUCTS OFFERED

- TABLE 279 LANDIS+GYR: PRODUCT LAUNCHES

- TABLE 280 LANDIS+GYR: DEALS

- 11.1.10 TRIMBLE WATER

- TABLE 281 TRIMBLE WATER: BUSINESS OVERVIEW

- FIGURE 48 TRIMBLE WATER: COMPANY SNAPSHOT

- TABLE 282 TRIMBLE WATER: PRODUCTS OFFERED

- TABLE 283 TRIMBLE WATER: PRODUCT LAUNCHES

- TABLE 284 TRIMBLE WATER: DEALS

- TABLE 285 TRIMBLE WATER: OTHERS

- 11.1.11 XYLEM

- 11.1.12 KAMSTRUP

- 11.2 OTHER PLAYERS

- 11.2.1 HYDROPOINT

- 11.2.2 I20

- 11.2.3 XENIUS

- 11.2.4 NEPTUNE TECHNOLOGY

- 11.2.5 TAKADU

- 11.2.6 BADGER METER

- 11.2.7 AQUAMATIX

- 11.2.8 LISHTOT

- 11.2.9 CITYTAPS

- 11.2.10 FREDSENSE

- 11.2.11 FRACTA

- 11.2.12 SMART ENERGY WATER

- 11.2.13 AYYEKA

- 11.2.14 KETOS

- *Details on Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices made, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 IOT IN SMART CITIES MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.2.1 IoT in smart cities market, by offering

- TABLE 286 IOT IN SMART CITIES MARKET, BY OFFERING, 2016-2019 (USD BILLION)

- TABLE 287 IOT IN SMART CITIES MARKET, BY OFFERING, 2019-2025 (USD BILLION)

- 12.2.2.2 IoT in smart cities market, by solution

- TABLE 288 IOT IN SMART CITIES MARKET, BY SOLUTION, 2016-2019 (USD BILLION)

- TABLE 289 IOT IN SMART CITIES MARKET, BY SOLUTION, 2019-2025 (USD BILLION)

- 12.2.2.3 IoT in smart cities market, by service

- TABLE 290 SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2016-2019 (USD BILLION)

- TABLE 291 SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2019-2025 (USD BILLION)

- TABLE 292 PROFESSIONAL SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2016-2019 (USD BILLION)

- TABLE 293 PROFESSIONAL SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2019-2025 (USD BILLION)

- 12.2.2.4 IoT in smart cities market, by application

- TABLE 294 IOT IN SMART CITIES MARKET, BY APPLICATION, 2016-2019 (USD BILLION)

- TABLE 295 IOT IN SMART CITIES MARKET, BY APPLICATION, 2019-2025 (USD BILLION)

- 12.2.2.5 IoT in smart cities market, by region

- TABLE 296 IOT IN SMART CITIES MARKET, BY REGION, 2016-2019 (USD BILLION)

- TABLE 297 IOT IN SMART CITIES MARKET, BY REGION, 2019-2025 (USD BILLION)

- 12.3 SMART BUILDINGS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.2.1 Smart buildings market, by component

- TABLE 298 SMART BUILDINGS MARKET, BY COMPONENT, 2017-2019 (USD MILLION)

- TABLE 299 SMART BUILDINGS MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- 12.3.2.2 Smart buildings market, by solution

- TABLE 300 SOLUTIONS: SMART BUILDINGS MARKET, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 301 SOLUTIONS: SMART BUILDINGS MARKET, BY TYPE, 2019-2025 (USD MILLION)

- 12.3.2.3 Smart buildings market, by service

- TABLE 302 SERVICES: SMART BUILDINGS MARKET, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 303 SERVICES: SMART BUILDINGS MARKET, BY TYPE, 2019-2025 (USD MILLION)

- 12.3.2.4 Smart buildings market, by building type

- TABLE 304 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2017-2019 (USD MILLION)

- TABLE 305 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2019-2025 (USD MILLION)

- 12.3.2.5 Smart buildings market, by region

- TABLE 306 SMART BUILDINGS MARKET, BY REGION, 2017-2019 (USD MILLION)

- TABLE 307 SMART BUILDINGS MARKET, BY REGION, 2019-2025 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS