|

|

市場調査レポート

商品コード

1397371

モーター監視の世界市場:提供区分別、展開別、監視プロセス別、最終用途別、地域別- 2028年までの予測Motor Monitoring Market by Offering, Deployment, Monitoring Process, End-use (Metals and Minings, Oil and Gas, Power Generation, Water and Wastewater, Food and Beverages, Chemicals, Automotive, Aerospace and Defense) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| モーター監視の世界市場:提供区分別、展開別、監視プロセス別、最終用途別、地域別- 2028年までの予測 |

|

出版日: 2023年12月11日

発行: MarketsandMarkets

ページ情報: 英文 341 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | 提供区分・展開・最終用途・監視プロセス・地域 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

モーター監視の市場規模は、2023年の23億米ドルから、予測期間中は8.7%のCAGRで推移し、2028年には35億米ドルの規模に成長すると予測されています。

モーター監視の市場は、産業オペレーションにおけるプロアクティブメンテナンスの価値が認識されるにつれて拡大しています。企業は、モーター監視システムから供給されるリアルタイムの洞察を活用することで、生産性を向上させ、ダウンタイムを削減しようとしています。センサー技術、データアナリティクス、IoTは予知保全を可能にし、さまざまな産業で重要なモーターの運転を最適化することによって、同市場の成長に貢献しています。

監視プロセス別では、オンラインの部門が市場を独占しています。これは、機械の振動、カップリングのズレやアンバランス、エアギャップの変動、ローターバーの破損、ベアリングのフルーティング、その他の関連する機械の状態パラメータを資産の寿命が尽きるまで追跡する監視システムをこれらが備えていることに起因しています。オンラインモータ監視システムは、モーターの動作と状態を監視する、モーターに恒久的に設置または取り付けられた一連のセンサーで構成されています。これらのセンサーは、モニター、アナライザー、中央サーバーなどの出力デバイスに接続され、無線ネットワークまたはケーブルネットワークを介してプラントオペレーターにデータを送信します。

最終用途別では、自動車部門がもっとも急成長している部門として浮上する見込みです。顧客の要求が変化する中で、自動車産業は、生産レベルを維持しながら効果的な品質管理を行うためのソリューションの導入に関して課題に直面しています。品質管理は、自動車の設計・製造に使用される機械のモーターが健全に機能しているかどうかに直接関係しています。モーター監視ソリューションは、組立ラインのボトルネックを減らし、生産レベルを維持するのに役立ちます。

北米地域は、急速な工業化、技術の改善、オートメーションの重視により、モーター監視市場で2番目に急成長している地域です。同地域の製造業、石油・ガス、エネルギー産業では、運転効率を高め、ダウンタイムを削減するために、モーター監視システムの利用が増加しています。さらに、スマートマニュファクチャリングとインダストリー4.0を奨励するイニシアティブ、重要な参入事業者の存在からも、高度なモーター監視技術への需要が高まり、北米はこの市場のダイナミックな成長ハブとなっています。

当レポートでは、世界のモーター監視の市場を調査し、市場概要、市場成長への各種影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- エコシステム/市場マップ

- バリューチェーン分析

- 原材料プロバイダー/サプライヤー/部品メーカー

- 技術分析

- 価格分析

- 関税、法規、規制

- 特許分析

- 貿易分析

- 主要な会議とイベント

- ケーススタディ分析

- ポーターのファイブフォース分析

第6章 モーター監視市場:最終用途産業別

- 石油・ガス

- 金属・鉱業

- 発電

- 自動車

- 化学品

- 水・廃水処理

- 食品・飲料

- 航空宇宙・防衛

- その他

第7章 モーター監視市場:製品別

- ハードウェア

- 振動センサー

- 赤外線センサー

- 腐食プローブ

- 超音波検出器

- スペクトラムアナライザー

- ソフトウェア

- 分析ソフトウェア

- 診断ソフトウェア

- サービス

- トレーニングサービス

- データ分析サービス

- テクニカルサポートおよびメンテナンスサービス

第8章 モーター監視市場:展開別

- オンプレミス

- クラウド

第9章 モーター監視市場:監視プロセス別

- オンライン

- オフライン/ポータブル

第10章 モーター監視市場:地域別

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

第11章 競合情勢

- 概要

- 市場シェア分析

- 収益分析

- 企業評価マトリックス

- 企業のフットプリント

- 新興企業/中小企業の評価マトリックス

- 競合シナリオ・動向

第12章 企業プロファイル

- 主要企業

- ABB

- GENERAL ELECTRIC

- SIEMENS

- HONEYWELL INTERNATIONAL INC.

- SCHNEIDER ELECTRIC

- BANNER ENGINEERING CORP.

- WILSON TRANSFORMERS

- SKF

- EMERSON ELECTRIC CO.

- ROCKWELL AUTOMATION

- QUALITROL COMPANY LLC

- WEG

- MITSUBISHI ELECTRIC CORPORATION

- EATON

- ADVANTECH CO., LTD.

- その他の企業

- DYNAPAR

- KCF TECHNOLOGIES

- PHOENIX CONTACT

- ALLIED RELIABILITY

- KONCAR-ELECTRICAL ENGINEERING INSTITUTE

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | Offering, Deployment, End User, Monitoring Process, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The Motor monitoring market is estimated to grow from USD 2.3 Billion in 2023 to USD 3.5 Billion by 2028; it is expected to record a CAGR of 8.7% during the forecast period. The motor monitoring market is expanding as people become more aware of the value of proactive maintenance in industrial operations. Businesses attempt to improve productivity and decrease downtime by utilizing real-time insights supplied by motor monitoring systems. Sensor technologies, data analytics, and the Internet of Things all contribute to market growth by enabling predictive maintenance and optimizing the operation of important motors in a variety of industries.

"Online is the largest segment of the Motor monitoring market, by monitoring process."

Based on the monitoring process, the Motor monitoring market has been split into two types: online and offline/portable. The online segment dominates the motor monitoring market as they have monitoring systems that track machine vibration, misaligned couplings and unbalance, air gap variation, broken rotor bars, bearing fluting, and other relevant machine condition parameters throughout the life of the asset. Online motor monitoring systems consist of a sequence of sensors permanently installed or mounted on motors that monitor their behavior and condition. These sensors are connected to output devices such as monitors, analyzers, and central servers and transmit data to plant operators either through a wireless network or cable network.

"Automotive segment is expected to emerge as the fastest-growing segment based on the end user."

Based on end user, the Motor monitoring market has been segmented into metals and minings, oil and gas, power generation, water and wastewater, food and beverages, chemicals, automotive, aerospace and defense and others. Automotive manufacturing refers to a wide range of companies involved in the design, development, manufacturing, and sale of motor vehicles. As customer requirements are changing, the automotive industry is facing challenges with respect to the implementation of solutions for effective quality management while keeping production levels up. Quality management is directly related to the health of functioning motors in the machines used to design and manufacture automobiles. Motor monitoring solutions help reduce the bottlenecks in the assembly line, keeping production levels up to the mark.

"Cloud is expected to be the fastest segment based on deployment."

The cloud deployment of motor monitoring solutions is a cost-efficient and effective way of managing large data issues in the power generation, oil & gas, and process industries. Cloud computing is a virtual storage architecture that allows businesses to house and access data, solutions, programs, and applications over the internet instead of a computer's hard drive or servers. Cloud-based motor monitoring solutions serve as a link between the physical and virtual worlds by obtaining real-time data from IoT sensors deployed on the motor and its components as well as the powertrain.

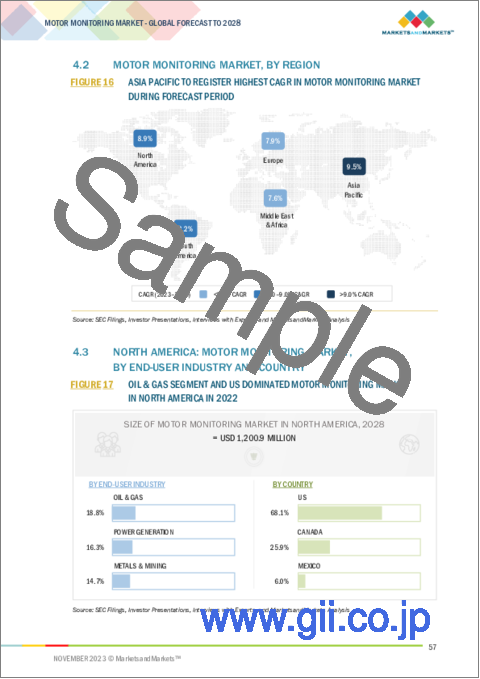

"North America is expected to emerge as the second-fastest region based on the Motor monitoring market."

By region, the Motor monitoring market has been segmented into Asia Pacific, North America, South America, Europe, and Middle East & Africa. North America is the second-fastest-growing region in the motor monitoring market, owing to rapid industrialization, technical improvements, and a strong emphasis on automation. Motor monitoring systems are increasingly being used in the region's manufacturing, oil & gas, and energy industries to increase operational efficiency and reduce downtime. Furthermore, the presence of significant market players, together with initiatives encouraging smart manufacturing and Industry 4.0, drives demand for advanced motor monitoring technology, establishing North America as a dynamic growth hub in this market.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 27%, Europe- 20%, Asia Pacific- 33%, South America- 8%, and the Middle East & Africa- 12%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The Motor monitoring market is dominated by a few major players that have a wide regional presence. The leading players in the Motor monitoring market are ABB (Switzerland), General Electric (US), Siemens (Germany), Honeywell (US), and Schneider Electric (France).

Research Coverage:

The report defines, describes, and forecasts the Motor monitoring market by component, offering, deployment, end user, monitoring process, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the Motor monitoring market.

Key Benefits of Buying the Report

- Increasing adoption of industry 4.0 principles in the manufacturing sector is likely to drive the demand. Factors such as hesitation to adopt monitoring solutions due to high initial investment, especially in developing countries are hindering the growth. Growing demand for aerospace and automotive industries is creating opportunities in this market. Long payback periods on investments are major challenges faced by countries in this market.

- Product Development/ Innovation: The trends such as launching of ABB Ability Smart Sensors, Integral Health Monitoring (IHM) and SKF Enlight Collect IMx-1.

- Market Development: The global scenario of motor monitoring systems is evolving rapidly, with trends in the motor monitoring market including a growing emphasis on predictive maintenance leveraging IoT and data analytics, increasing integration of advanced sensors and monitoring devices, a shift toward cloud-based solutions for remote monitoring, and the expansion of the market in emerging economies.

- Market Diversification: In March 2021, General Electric launched CONNECTIX, a software suite and expert service. It includes operations, maintenance, services tools, and solutions, which help to optimize operations and enable predictive maintenance and cyber-secure service solutions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), General Electric (US), Siemens (Germany), Honeywell (US), and Schneider Electric (France) among others in the Motor monitoring market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 MOTOR MONITORING MARKET, BY OFFERING

- TABLE 1 MOTOR MONITORING MARKET, BY OFFERING: INCLUSIONS & EXCLUSIONS

- 1.3.2 MOTOR MONITORING MARKET, BY MONITORING PROCESS

- TABLE 2 MOTOR MONITORING MARKET, BY MONITORING PROCESS: INCLUSIONS & EXCLUSIONS

- 1.3.3 MOTOR MONITORING MARKET, BY END-USER INDUSTRY

- TABLE 3 MOTOR MONITORING MARKET, BY END-USER INDUSTRIES: INCLUSIONS & EXCLUSIONS

- 1.3.4 MOTOR MONITORING MARKET, BY DEPLOYMENT

- TABLE 4 MOTOR MONITORING MARKET, BY DEPLOYMENT: INCLUSIONS & EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.5 YEARS CONSIDERED

- 1.5.1 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 MOTOR MONITORING MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 SCOPE

- FIGURE 5 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR MOTOR MONITORING MARKET

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand side

- 2.4.3.4 Calculation for demand side

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 8 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF MOTOR MONITORING

- FIGURE 9 MOTOR MONITORING MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Supply-side calculation

- 2.4.4.2 Assumptions for supply side

- 2.4.5 FORECAST

- 2.5 RISK ASSESSMENT

- 2.6 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 5 MOTOR MONITORING MARKET SNAPSHOT

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MOTOR MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 11 HARDWARE SEGMENT TO CAPTURE LARGEST SIZE OF MOTOR MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 12 ONLINE SEGMENT TO LEAD MOTOR MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 13 OIL & GAS SEGMENT TO ACQUIRE LARGEST SHARE OF MOTOR MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 14 ON-PREMISE SEGMENT TO COMMAND LARGER SHARE OF MOTOR MONITORING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MOTOR MONITORING MARKET

- FIGURE 15 RISING NEED FOR ENERGY EFFICIENCY TO DRIVE MARKET

- 4.2 MOTOR MONITORING MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MOTOR MONITORING MARKET DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY AND COUNTRY

- FIGURE 17 OIL & GAS SEGMENT AND US DOMINATED MOTOR MONITORING MARKET IN NORTH AMERICA IN 2022

- 4.4 MOTOR MONITORING MARKET, BY OFFERING

- FIGURE 18 HARDWARE SEGMENT TO COMMAND LARGEST SHARE OF MOTOR MONITORING MARKET IN 2028

- 4.5 MOTOR MONITORING MARKET, BY MONITORING PROCESS

- FIGURE 19 ONLINE SEGMENT TO ACCOUNT FOR LARGER SHARE OF MOTOR MONITORING MARKET IN 2028

- 4.6 MOTOR MONITORING MARKET, BY END-USER INDUSTRY

- FIGURE 20 OIL & GAS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- 4.7 MOTOR MONITORING MARKET, BY DEPLOYMENT

- FIGURE 21 ON-PREMISE SEGMENT TO HOLD LARGER MARKET SHARE IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 MOTOR MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of industry 4.0 principles in manufacturing sector

- FIGURE 23 INDUSTRIAL SENSORS MARKET, 2017-2020

- 5.2.1.2 Growing demand for predictive maintenance and analytics

- 5.2.1.3 Surging adoption of motor monitoring in transportation sector, especially in electric vehicles

- FIGURE 24 GLOBAL EV (CARS) SALES, 2016-2020 (UNITS)

- 5.2.1.4 Increasing adoption of wireless technology in motor monitoring

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited technical know-how to manage monitoring solutions

- 5.2.2.2 Hesitation to adopt monitoring solutions due to high initial investment, especially in developing countries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing focus on energy audits and regulations worldwide

- 5.2.3.2 Growing demand from aerospace and automotive industries

- 5.2.3.3 Advent of intelligent transportation systems (ITS)

- 5.2.4 CHALLENGES

- 5.2.4.1 Long payback period on investment

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM/MARKET MAP

- TABLE 6 MOTOR MONITORING MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- FIGURE 26 MARKET MAP/ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 27 MOTOR MONITORING MARKET: VALUE CHAIN ANALYSIS

- 5.6 RAW MATERIAL PROVIDERS/SUPPLIERS/COMPONENT MANUFACTURERS

- 5.6.1 MONITORING SOLUTION MANUFACTURERS/ASSEMBLERS

- 5.6.2 DISTRIBUTORS/RESELLERS

- 5.6.3 END USERS

- 5.6.4 MAINTENANCE AND SERVICE PROVIDERS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 CONDITION MONITORING

- 5.7.2 REMOTE VIBRATION MONITORING AND FAULT DIAGNOSIS SYSTEMS

- 5.8 PRICING ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE (ASP) OF MOTOR MONITORING SYSTEMS, BY MONITORING PROCESS, 2021-2023, (USD/UNIT)

- TABLE 7 ASP OF MOTOR MONITORING SYSTEMS, BY MONITORING PROCESS, 2021-2023 (USD/UNIT)

- TABLE 8 ASP TREND FOR MOTOR MONITORING SYSTEMS, BY REGION, 2021-2023 (USD/UNIT)

- FIGURE 29 ASP TREND FOR MOTOR MONITORING SYSTEMS, BY REGION, 2021-2023

- 5.9 TARIFFS, CODES, AND REGULATIONS

- 5.9.1 TARIFF ANALYSIS

- TABLE 9 TARIFF FOR HS CODE 9031

- 5.9.2 CODES AND REGULATIONS RELATED TO MOTOR MONITORING

- TABLE 10 MOTOR MONITORING: CODES AND REGULATIONS

- TABLE 11 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 PATENT ANALYSIS

- TABLE 12 MOTOR MONITORING MARKET: INNOVATIONS AND PATENT REGISTRATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 EXPORT SCENARIO FOR HS CODE 9031

- TABLE 13 EXPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.11.2 IMPORT SCENARIO FOR HS CODE 9031

- TABLE 14 IMPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 MOTOR MONITORING MARKET: LIST OF CONFERENCES AND EVENTS

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 EMERSON'S ONLINE MACHINERY HEALTH MONITORING HELPS PHOSPHATE MINE PROTECT CRITICAL ASSETS AND AVOID DOWNTIME

- 5.13.2 FAULT DETECTION IN COMPONENTS OF SYNCHRONOUS MOTORS WITH PARTIAL DISCHARGE MONITORING

- 5.13.3 SIEMENS PROVIDED HIGH-PRECISION MOTOR MONITORING FOR ENGINE TEST BENCHES

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 MOTOR MONITORING MARKET: IMPACT OF PORTER'S FIVE FORCES

- FIGURE 30 MOTOR MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF SUBSTITUTES

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF NEW ENTRANTS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

6 MOTOR MONITORING MARKET, BY END-USER INDUSTRY

- 6.1 INTRODUCTION

- FIGURE 31 MOTOR MONITORING MARKET SHARE, IN TERMS OF VALUE, BY END-USER INDUSTRY, 2022

- TABLE 17 MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 18 MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 6.2 OIL & GAS

- 6.2.1 REMOTE PLANT LOCATIONS AND HIGH SAFETY STANDARDS TO NECESSITATE DEPLOYMENT OF MOTOR MONITORING SOLUTIONS

- TABLE 19 OIL & GAS: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 20 OIL & GAS: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 METALS & MINING

- 6.3.1 CONCERNS OVER RELIABILITY AND SAFETY IN MINING OPERATIONS TO DRIVE DEMAND FOR MOTOR MONITORING

- TABLE 21 METALS & MINING: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 METALS & MINING: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 POWER GENERATION

- 6.4.1 INCREASING PENETRATION OF INFORMATION TECHNOLOGY IN POWER GENERATION TO DRIVE MARKET

- TABLE 23 POWER GENERATION: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 24 POWER GENERATION: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 AUTOMOTIVE

- 6.5.1 INCREASING DEMAND FOR EVS AND EFFICIENT MANUFACTURING PROCESS TO DRIVE MARKET FOR MOTOR MONITORING

- TABLE 25 AUTOMOTIVE: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 AUTOMOTIVE: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.6 CHEMICALS

- 6.6.1 NEED TO REDUCE EXPENSIVE DOWNTIME IN CHEMICAL PRODUCTION TO AUGMENT DEMAND FOR MOTOR MONITORING SYSTEMS

- TABLE 27 CHEMICALS: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 CHEMICALS: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.7 WATER & WASTEWATER TREATMENT

- 6.7.1 INTENSIFYING NEED TO OPTIMIZE WATER SUPPLY AND WASTEWATER TREATMENT PROCESSES TO FUEL DEMAND FOR MOTOR MONITORING

- TABLE 29 WATER & WASTEWATER TREATMENT: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 WATER & WASTEWATER TREATMENT: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.8 FOOD & BEVERAGES

- 6.8.1 NEED TO IMPROVE PERFORMANCE OF CRITICAL ASSETS TO DRIVE DEMAND FOR MOTOR MONITORING SOLUTIONS

- TABLE 31 FOOD & BEVERAGES: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 FOOD & BEVERAGES: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.9 AEROSPACE & DEFENSE

- 6.9.1 NEED TO PREVENT FAILURE OF CRITICAL ASSETS DUE TO MOTOR FAILURE TO FUEL DEMAND FOR MOTOR MONITORING SOLUTIONS

- TABLE 33 AEROSPACE & DEFENSE: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 AEROSPACE & DEFENSE: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.10 OTHER END-USER INDUSTRIES

- TABLE 35 OTHER END-USER INDUSTRIES: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 OTHER END-USER INDUSTRIES: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

7 MOTOR MONITORING MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 32 MOTOR MONITORING MARKET SHARE, IN TERMS OF VALUE, BY OFFERING, 2022

- TABLE 37 MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 38 MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 7.2 HARDWARE

- TABLE 39 HARDWARE: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 HARDWARE: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 HARDWARE: MOTOR MONITORING MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 42 HARDWARE: MOTOR MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.1 VIBRATION SENSORS

- 7.2.1.1 Need to detect mechanical issues in motors to prevent downtime to fuel adoption of vibration sensors

- 7.2.2 INFRARED SENSORS

- 7.2.2.1 Ability to identify anomalous patterns causing asset failure to induce demand for thermal monitoring of motors

- 7.2.3 CORROSION PROBES

- 7.2.3.1 Ever-present risk of corrosion in motors to increase demand for corrosion probes

- 7.2.4 ULTRASOUND DETECTORS

- 7.2.4.1 Rising need for non-invasive ways to detect problems in machinery to fuel demand for ultrasound detectors

- 7.2.5 SPECTRUM ANALYZERS

- 7.2.5.1 Increasing demand for wireless communication to boost need for spectrum analyzers

- 7.3 SOFTWARE

- 7.3.1 INCREASING FOCUS ON PREDICTIVE MAINTENANCE TO FUEL DEMAND FOR MOTOR MONITORING SOFTWARE

- TABLE 43 SOFTWARE: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 SOFTWARE: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 45 SOFTWARE: MOTOR MONITORING MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 46 SOFTWARE: MOTOR MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.3.2 ANALYTICS SOFTWARE

- 7.3.3 DIAGNOSTIC SOFTWARE

- 7.4 SERVICES

- TABLE 47 SERVICES: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 SERVICES: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 SERVICES: MOTOR MONITORING MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 50 SERVICES: MOTOR MONITORING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.4.1 TRAINING SERVICES

- 7.4.1.1 Growth in motor monitoring market to drive demand for training services

- 7.4.2 DATA ANALYSIS SERVICES

- 7.4.2.1 Advent of remote monitoring to boost demand for data analysis services

- 7.4.3 TECHNICAL SUPPORT & MAINTENANCE SERVICES

- 7.4.3.1 Increasing focus on extending life of motors to boost need for maintenance services

8 MOTOR MONITORING MARKET, BY DEPLOYMENT

- 8.1 INTRODUCTION

- FIGURE 33 MOTOR MONITORING MARKET SHARE, IN TERMS OF VALUE, BY DEPLOYMENT, 2022

- TABLE 51 MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 52 MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- 8.2 ON-PREMISE

- 8.2.1 NEED FOR FULL CONTROL OVER SENSITIVE DATA TO FUEL DEMAND FOR ON-PREMISE DEPLOYMENT OF MOTOR MONITORING SOLUTIONS

- TABLE 53 ON-PREMISE: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 ON-PREMISE: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 EASE OF DEPLOYMENT AND SCALABILITY TO DRIVE DEMAND FOR CLOUD-BASED MOTOR MONITORING SOLUTIONS

- TABLE 55 CLOUD: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 CLOUD: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

9 MOTOR MONITORING MARKET, BY MONITORING PROCESS

- 9.1 INTRODUCTION

- FIGURE 34 MOTOR MONITORING MARKET SHARE, IN TERMS OF VALUE, BY MONITORING PROCESS, 2022

- TABLE 57 MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 58 MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- 9.2 ONLINE

- 9.2.1 RISING EMPHASIS ON ELIMINATING IN-PERSON INSPECTIONS IN REMOTE LOCATIONS TO DRIVE DEMAND FOR ONLINE MONITORING

- TABLE 59 ONLINE: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 ONLINE: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

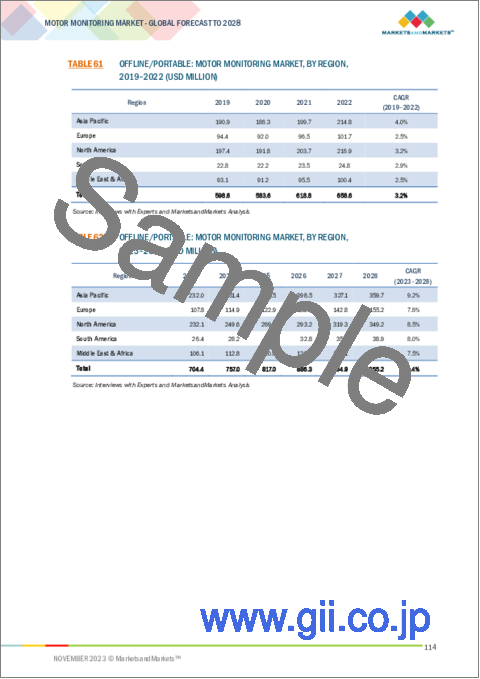

- 9.3 OFFLINE/PORTABLE 113 9.3.1 RISING DEMAND FOR COST-EFFICIENT MONITORING OF AGING MACHINES TO PROPEL SEGMENTAL GROWTH

- TABLE 61 OFFLINE/PORTABLE: MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 62 OFFLINE/PORTABLE: MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

10 MOTOR MONITORING MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 35 MOTOR MONITORING MARKET SHARE, IN TERMS OF VALUE, BY REGION, 2022

- FIGURE 36 ASIA PACIFIC MOTOR MONITORING MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- TABLE 63 MOTOR MONITORING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 MOTOR MONITORING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: MOTOR MONITORING MARKET SNAPSHOT

- TABLE 65 ASIA PACIFIC: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 66 ASIA PACIFIC: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 67 ASIA PACIFIC: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MOTOR MONITORING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MOTOR MONITORING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.1 CHINA

- 10.2.1.1 Rapid growth of manufacturing sector to drive market

- TABLE 81 CHINA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 82 CHINA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 83 CHINA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 84 CHINA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 85 CHINA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 86 CHINA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 87 CHINA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 88 CHINA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 89 CHINA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 90 CHINA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 91 CHINA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 92 CHINA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 93 CHINA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 94 CHINA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.2 JAPAN

- 10.2.2.1 Demand from automotive sector to boost market growth

- TABLE 95 JAPAN: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 96 JAPAN: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 97 JAPAN: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 98 JAPAN: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 99 JAPAN: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 100 JAPAN: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 JAPAN: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 102 JAPAN: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 103 JAPAN: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 104 JAPAN: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 105 JAPAN: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 106 JAPAN: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 107 JAPAN: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 108 JAPAN: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.3 SOUTH KOREA

- 10.2.3.1 Government policies aimed at boosting advanced manufacturing to support market growth

- TABLE 109 SOUTH KOREA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 110 SOUTH KOREA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 113 SOUTH KOREA: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 114 SOUTH KOREA: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 115 SOUTH KOREA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 116 SOUTH KOREA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 117 SOUTH KOREA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 118 SOUTH KOREA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 120 SOUTH KOREA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 121 SOUTH KOREA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 122 SOUTH KOREA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.4 INDIA

- 10.2.4.1 Government initiatives to boost manufacturing to increase demand for motor monitoring

- TABLE 123 INDIA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 124 INDIA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 125 INDIA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 126 INDIA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 127 INDIA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 128 INDIA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 129 INDIA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 130 INDIA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 131 INDIA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 132 INDIA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 133 INDIA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 134 INDIA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 135 INDIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 136 INDIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.5 AUSTRALIA

- 10.2.5.1 Increase in minerals and resource mining to induce demand for motor monitoring solutions

- TABLE 137 AUSTRALIA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 138 AUSTRALIA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 139 AUSTRALIA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 140 AUSTRALIA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 141 AUSTRALIA: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 142 AUSTRALIA: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 143 AUSTRALIA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 144 AUSTRALIA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 145 AUSTRALIA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 146 AUSTRALIA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 147 AUSTRALIA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 148 AUSTRALIA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 149 AUSTRALIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 150 AUSTRALIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.6 REST OF ASIA PACIFIC

- TABLE 151 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- TABLE 165 NORTH AMERICA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 166 NORTH AMERICA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 167 NORTH AMERICA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 168 NORTH AMERICA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 169 NORTH AMERICA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 170 NORTH AMERICA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 171 NORTH AMERICA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 172 NORTH AMERICA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 173 NORTH AMERICA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 174 NORTH AMERICA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 175 NORTH AMERICA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 176 NORTH AMERICA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 177 NORTH AMERICA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 178 NORTH AMERICA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 179 NORTH AMERICA: MOTOR MONITORING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 180 NORTH AMERICA: MOTOR MONITORING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.1 US

- 10.3.1.1 Initiatives to promote adoption of Industry 4.0 technologies to drive market

- TABLE 181 US: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 182 US: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 183 US: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 184 US: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 185 US: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 186 US: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 187 US: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 188 US: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 189 US: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 190 US: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 191 US: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 192 US: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 193 US: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 194 US: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.2 CANADA

- 10.3.2.1 Growing investments in mining and power generation industries to boost demand for motor monitoring solutions

- TABLE 195 CANADA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 196 CANADA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 197 CANADA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 198 CANADA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 199 CANADA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 200 CANADA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 201 CANADA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 202 CANADA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 203 CANADA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 204 CANADA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 205 CANADA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 206 CANADA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 207 CANADA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 208 CANADA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.3 MEXICO

- 10.3.3.1 Increasing investments in metals and mining vertical to fuel demand for motor monitoring solutions in Mexico

- TABLE 209 MEXICO: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 210 MEXICO: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 211 MEXICO: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 212 MEXICO: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 213 MEXICO: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 214 MEXICO: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 215 MEXICO: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 216 MEXICO: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 217 MEXICO: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 218 MEXICO: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 219 MEXICO: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 220 MEXICO: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 221 MEXICO: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 222 MEXICO: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- TABLE 223 EUROPE: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 224 EUROPE: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 225 EUROPE: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 226 EUROPE: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 227 EUROPE: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 228 EUROPE: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 229 EUROPE: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 230 EUROPE: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 231 EUROPE: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 232 EUROPE: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 233 EUROPE: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 234 EUROPE: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 235 EUROPE: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 236 EUROPE: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 237 EUROPE: MOTOR MONITORING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 238 EUROPE: MOTOR MONITORING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.1 GERMANY

- 10.4.1.1 Increasing penetration of industrial IoT to fuel demand for motor monitoring

- TABLE 239 GERMANY: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 240 GERMANY: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 241 GERMANY: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 242 GERMANY: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 243 GERMANY: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 244 GERMANY: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 245 GERMANY: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 246 GERMANY: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 247 GERMANY: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 248 GERMANY: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 249 GERMANY: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 250 GERMANY: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 251 GERMANY: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 252 GERMANY: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.2 UK

- 10.4.2.1 Push toward clean energy and innovations to drive market

- TABLE 253 UK: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 254 UK: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 255 UK: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 256 UK: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 257 UK: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 258 UK: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 259 UK: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 260 UK: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 261 UK: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 262 UK: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 263 UK: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 264 UK: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 265 UK: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 266 UK: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.3 FRANCE

- 10.4.3.1 Increasing investments in power generation industry to drive demand for motor monitoring solutions

- TABLE 267 FRANCE: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 268 FRANCE: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 269 FRANCE: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 270 FRANCE: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 271 FRANCE: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 272 FRANCE: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 273 FRANCE: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 274 FRANCE: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 275 FRANCE: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 276 FRANCE: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 277 FRANCE: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 278 FRANCE: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 279 FRANCE: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 280 FRANCE: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.4 RUSSIA

- 10.4.4.1 Government policies to boost EVs industry to support market growth

- TABLE 281 RUSSIA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 282 RUSSIA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 283 RUSSIA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 284 RUSSIA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 285 RUSSIA: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 286 RUSSIA: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 287 RUSSIA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 288 RUSSIA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 289 RUSSIA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 290 RUSSIA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 291 RUSSIA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 292 RUSSIA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 293 RUSSIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 294 RUSSIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.5 REST OF EUROPE

- TABLE 295 REST OF EUROPE: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 296 REST OF EUROPE: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 297 REST OF EUROPE: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 298 REST OF EUROPE: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 299 REST OF EUROPE: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 300 REST OF EUROPE: MOTOR MONITORING MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 301 REST OF EUROPE: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 302 REST OF EUROPE: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 303 REST OF EUROPE: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 304 REST OF EUROPE: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 305 REST OF EUROPE: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 306 REST OF EUROPE: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 307 REST OF EUROPE: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 308 REST OF EUROPE: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- TABLE 309 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 313 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 321 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 322 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 323 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 324 MIDDLE EAST & AFRICA: MOTOR MONITORING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.1 SAUDI ARABIA

- 10.5.1.1 Demand from oil & gas industry to drive market

- TABLE 325 SAUDI ARABIA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 326 SAUDI ARABIA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 327 SAUDI ARABIA: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 328 SAUDI ARABIA: MOTOR MONITORING MARKET FOR HARDWARE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 329 SAUDI ARABIA: MOTOR MONITORING MARKET FOR SOFTWARE, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 330 SAUDI ARABIA: MOTOR MONITORING MARKET FOR SOFTWARE, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 331 SAUDI ARABIA: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 332 SAUDI ARABIA: MOTOR MONITORING MARKET FOR SERVICES, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 333 SAUDI ARABIA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 334 SAUDI ARABIA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 335 SAUDI ARABIA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 336 SAUDI ARABIA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 337 SAUDI ARABIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 338 SAUDI ARABIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.2 UAE

- 10.5.2.1 Government focus on boosting manufacturing sector to contribute to market growth

- TABLE 339 UAE: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 340 UAE: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 341 UAE: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 342 UAE: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 343 UAE: MOTOR MONITORING MARKET FOR SOFTWARE, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 344 UAE: MOTOR MONITORING MARKET FOR SOFTWARE, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 345 UAE: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 346 UAE: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 347 UAE: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 348 UAE: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 349 UAE: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 350 UAE: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 351 UAE: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 352 UAE: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.3 TURKEY

- 10.5.3.1 Demand from agriculture industry to bring revenue opportunities for motor monitoring market players

- TABLE 353 TURKEY: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 354 TURKEY: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 355 TURKEY: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 356 TURKEY: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 357 TURKEY: MOTOR MONITORING MARKET FOR SOFTWARE, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 358 TURKEY: MOTOR MONITORING MARKET FOR SOFTWARE, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 359 TURKEY: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 360 TURKEY: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 361 TURKEY: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 362 TURKEY: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 363 TURKEY: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 364 TURKEY: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 365 TURKEY: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 366 TURKEY: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.4 QATAR

- 10.5.4.1 Rising industrial activities to offer growth opportunities for motor monitoring solution providers

- TABLE 367 QATAR: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 368 QATAR: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 369 QATAR: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 370 QATAR: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 371 QATAR: MOTOR MONITORING MARKE FOR SOFTWARE, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 372 QATAR: MOTOR MONITORING MARKE FOR SOFTWARE, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 373 QATAR: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 374 QATAR: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 375 QATAR: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 376 QATAR: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 377 QATAR: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 378 QATAR: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 379 QATAR: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 380 QATAR: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Increasing demand from mining industry to substantiate market growth

- TABLE 381 SOUTH AFRICA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 382 SOUTH AFRICA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 383 SOUTH AFRICA: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 384 SOUTH AFRICA: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 385 SOUTH AFRICA: MOTOR MONITORING MARKE FOR SOFTWARE, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 386 SOUTH AFRICA: MOTOR MONITORING MARKE FOR SOFTWARE, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 387 SOUTH AFRICA: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 388 SOUTH AFRICA: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 389 SOUTH AFRICA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 390 SOUTH AFRICA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 391 SOUTH AFRICA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 392 SOUTH AFRICA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 393 SOUTH AFRICA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 394 SOUTH AFRICA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.6 REST OF MEA

- TABLE 395 REST OF MEA: MOTOR MONITORING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 396 REST OF MEA: MOTOR MONITORING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 397 REST OF MEA: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 398 REST OF MEA: MOTOR MONITORING MARKET FOR HARDWARE, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 399 REST OF MEA: MOTOR MONITORING MARKET FOR SOFTWARE, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 400 REST OF MEA: MOTOR MONITORING MARKET FOR SOFTWARE, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 401 REST OF MEA: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 402 REST OF MEA: MOTOR MONITORING MARKET FOR SERVICES, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 403 REST OF MEA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2019-2022 (USD MILLION)

- TABLE 404 REST OF MEA: MOTOR MONITORING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 405 REST OF MEA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2019-2022 (USD MILLION)

- TABLE 406 REST OF MEA: MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2023-2028 (USD MILLION)

- TABLE 407 REST OF MEA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 408 REST OF MEA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 409 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019- 2022

- 11.2 MARKET SHARE ANALYSIS

- TABLE 410 MOTOR MONITORING MARKET: DEGREE OF COMPETITION, 2022

- FIGURE 38 MOTOR MONITORING MARKET SHARE ANALYSIS, 2022

- 11.3 REVENUE ANALYSIS

- FIGURE 39 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MOTOR MONITORING MARKET

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 STARS

- 11.4.2 PERVASIVE PLAYERS

- 11.4.3 EMERGING LEADERS

- 11.4.4 PARTICIPANTS

- FIGURE 40 MOTOR MONITORING MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.5 COMPANY FOOTPRINT

- TABLE 411 BY OFFERING: COMPANY FOOTPRINT

- TABLE 412 BY REGION: COMPANY FOOTPRINT

- TABLE 413 COMPANY FOOTPRINT

- 11.6 START-UP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 41 MOTOR MONITORING MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 414 MOTOR MONITORING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 415 MOTOR MONITORING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 416 MOTOR MONITORING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (END USERS)

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 417 MOTOR MONITORING MARKET: PRODUCT LAUNCHES, AUGUST 2017- OCTOBER 2020

- TABLE 418 MOTOR MONITORING MARKET: DEALS, OCTOBER 2020- SEPTEMBER 2021

- TABLE 419 MOTOR MONITORING MARKET: OTHERS, MARCH 2018 - AUGUST 2020

12 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 12.1 KEY PLAYERS

- 12.1.1 ABB

- TABLE 420 ABB: COMPANY OVERVIEW

- FIGURE 42 ABB: COMPANY SNAPSHOT

- TABLE 421 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 422 ABB: PRODUCT LAUNCHES

- TABLE 423 ABB: DEALS

- TABLE 424 ABB: OTHERS

- 12.1.2 GENERAL ELECTRIC

- TABLE 425 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 43 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 426 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 427 GENERAL ELECTRIC: PRODUCT LAUNCHES

- 12.1.3 SIEMENS

- TABLE 428 SIEMENS: COMPANY OVERVIEW

- FIGURE 44 SIEMENS: COMPANY SNAPSHOT

- TABLE 429 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 430 SIEMENS: PRODUCT LAUNCHES

- TABLE 431 SIEMENS: DEALS

- 12.1.4 HONEYWELL INTERNATIONAL INC.

- TABLE 432 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 45 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 433 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 434 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 435 HONEYWELL INTERNATIONAL INC.: OTHERS

- 12.1.5 SCHNEIDER ELECTRIC

- TABLE 436 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 46 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 437 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 438 SCHNEIDER ELECTRIC: DEALS

- 12.1.6 BANNER ENGINEERING CORP.

- TABLE 439 BANNER ENGINEERING CORP.: COMPANY OVERVIEW

- TABLE 440 BANNER ENGINEERING CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 441 BANNER ENGINEERING CORP.: PRODUCT LAUNCHES

- 12.1.7 WILSON TRANSFORMERS

- TABLE 442 WILSON TRANSFORMERS: COMPANY OVERVIEW

- TABLE 443 WILSON TRANSFORMERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.8 SKF

- TABLE 444 SKF: COMPANY OVERVIEW

- FIGURE 47 SKF: COMPANY SNAPSHOT

- TABLE 445 SKF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 446 SKF: PRODUCT LAUNCHES

- TABLE 447 SKF: DEALS

- TABLE 448 SKF: OTHERS

- 12.1.9 EMERSON ELECTRIC CO.

- TABLE 449 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 48 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 450 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 451 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 452 EMERSON ELECTRIC CO.: DEALS

- 12.1.10 ROCKWELL AUTOMATION

- TABLE 453 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- FIGURE 49 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 454 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 455 ROCKWELL AUTOMATION: DEALS

- 12.1.11 QUALITROL COMPANY LLC

- TABLE 456 QUALITROL COMPANY LLC: COMPANY OVERVIEW

- TABLE 457 QUALITROL COMPANY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.12 WEG

- TABLE 458 WEG: COMPANY OVERVIEW

- FIGURE 50 WEG: COMPANY SNAPSHOT

- TABLE 459 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 460 WEG: PRODUCT LAUNCHES

- TABLE 461 WEG: DEALS

- TABLE 462 WEG: OTHERS

- 12.1.13 MITSUBISHI ELECTRIC CORPORATION

- TABLE 463 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 51 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 464 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 465 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 466 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 467 MITSUBISHI ELECTRIC CORPORATION

- 12.1.14 EATON

- TABLE 468 EATON: COMPANY OVERVIEW

- FIGURE 52 EATON: COMPANY SNAPSHOT

- TABLE 469 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 470 EATON: PRODUCT LAUNCHES

- TABLE 471 EATON: OTHERS

- 12.1.15 ADVANTECH CO., LTD.

- TABLE 472 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- FIGURE 53 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

- TABLE 473 ADVANTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 474 ADVANTECH CO., LTD.: PRODUCT LAUNCHES

- TABLE 475 ADVANTECH CO., LTD.: DEALS

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 DYNAPAR

- 12.2.2 KCF TECHNOLOGIES

- 12.2.3 PHOENIX CONTACT

- 12.2.4 ALLIED RELIABILITY

- 12.2.5 KONCAR- ELECTRICAL ENGINEERING INSTITUTE

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS