|

|

市場調査レポート

商品コード

1244931

IO-Linkの世界市場:種類別 (IO-Link Wired、IO-Link Wireless)・コンポーネント別 (IO-Linkマスター、IO-Linkデバイス)・業種別 (プロセス産業、ハイブリッド産業)・用途別 (工作機械、イントラロジスティクス・ソリューション)・地域別の将来予測 (2028年まで)IO-Link Market by Type (IO-Link Wired, IO-Link Wireless), Component (IO-Link Masters, IO-Link Devices), Industry (Process Industries, Hybrid Industries), Application (Machine Tools, Intralogistics Solutions) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| IO-Linkの世界市場:種類別 (IO-Link Wired、IO-Link Wireless)・コンポーネント別 (IO-Linkマスター、IO-Linkデバイス)・業種別 (プロセス産業、ハイブリッド産業)・用途別 (工作機械、イントラロジスティクス・ソリューション)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月15日

発行: MarketsandMarkets

ページ情報: 英文 224 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

IO-Link市場は、2023年の136億米ドルから、2028年には339億米ドルに達すると予測され、2023年から2028年までのCAGRは20.0%と見込まれています。

すべてのフィールドバス・プロトコルをサポートできることが、IO-Link市場の成長を促進する一方、コンパクトな機械の使用と基本的なセンサーの使用が、IO-Link市場の成長を抑制しています。

"IO-Link Wireless部門が、予測期間中に高いCAGRで成長する"

予測期間中は、IO-Link Wireless部門がより高いCAGRを記録すると予測されています。IO-Link Wirelessの性能・機能・能力はIO-Link Wiredと同等ですが、ケーブルがないため、より柔軟で堅牢性・拡張性に優れています。無線IO-Linプロトコルの需要増大や、産業界におけるスマート製造の普及浸透が、IO-Link Wirelessソリューションのメーカーに有利な機会を生み出し、ひいてはこのセグメントの成長を促進すると期待されています。

"IO-Linkデバイス部門が、より高いCAGRで成長する"

IO-Linkデバイスは、あらゆるフィールドバスやオートメーションシステムに統合することができ、デバイスの自動交換機能を備えています。また、従来のディスクリートI/Oと同じ費用対効果の高い標準型・非シールド3線ケーブルを使って接続できるため、複雑な配線を減らすことができます。製造業では、オペレーションの卓越性に対するニーズが高まっています。このため、予知保全・状態監視・トレーサビリティなど、各種産業向けサービスの需要が高まっており、IO-Linkデバイスの需要に拍車がかかると予想されます。これらすべての要因が、予測期間中のIO-Linkデバイスセグメントの成長を促進すると予想されます。

"ディスクリート産業部門が、最も高いCAGRで成長する"

予測期間中、ディスクリート産業分野は最も高いCAGRで成長すると思われます。ディスクリート産業は、製造業務において厳格なプロトコルを守り、運用コストの削減に継続的に注力しています。そのため、事業運営に産業用オートメーションやIoT技術を導入しています。また、これらの産業は、増大する顧客の要求に応えるため、機械の運用効率を向上させることに主眼を置いています。IO-Linkは、製造コストの削減、試運転時間の短縮、ネットワークノードの数の削減、機械やシステムのダウンタイムの低減に貢献することができます。ディスクリート製造には、ナットやボルト、ブラケット、ワイヤー、アセンブリ、個々の製品などの部品やシステムが含まれます。ライフサイクルが終了したディスクリート製品は、部品に分解され、リサイクルすることが可能です。

"パッケージング自動化ソリューション部門が、予測期間中に大きな成長率を達成する"

IO-Link市場のパッケージング自動化ソリューション部門は、予測期間中に最も高いCAGRを記録すると予想されています。この成長は、最小限の人的介入で効果的かつスピーディーなパッケージングプロセスへの需要が高まっていることに起因していると考えられます。さらに、パッケージング自動化ソリューションは、製品の選別・ハンドリング・保管・出荷など、さまざまなパッケージングプロセスで使用されています。IO-Linkソリューションは、センサーと自動化システム間の双方向通信を確立することで、パッケージングプロセスを最適化するのに役立ちます。また、IO-Linkソリューションは、迅速かつ安全な試運転、信頼性の高い高品質のパッケージングプロセス、最終的なパッケージング機械の稼働率の向上、迅速な投資回収、リモート診断の実行といった特長も備えています。したがって、パッケージング自動化の継続的な進化とIO-Linkベースのセンサーの高い採用が、近い将来、パッケージング自動化ソリューションの需要を押し上げると予想されます。

"アジア太平洋地域が最も高いCAGRで成長する"

アジア太平洋は、技術革新が進み、各種産業でオートメーション技術の導入が進んでいることから、IO-Link市場が最も成長している地域です。アジア太平洋地域では、IO-Link技術は自動車や電子機器などの産業で使用されています。特に、日本と中国がIO-Link市場に大きく貢献しています。アジア太平洋地域は、世界の自動車製造の中心地として浮上しています。そのため、多数の大手自動車メーカーが自動車生産拠点の自動化に投資しています。このため、予測期間中、アジア太平洋地域は最も高いCAGRで成長すると思われます。

当レポートでは、世界のIO-Linkの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・コンポーネント別・業種別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- IO-Linkのエコシステム

- ポーターのファイブフォース分析

- ケーススタディ分析

- 技術分析

- IO-Linkソリューションの平均販売価格

- 貿易分析

- 特許分析 (2020年~2022年)

- 関税と規制

第6章 IO-Link市場:種類別

- イントロダクション

- IO-Link Wired (有線IO-Link)

- IO-Link Wireless (無線IO-Link)

第7章 IO-Link市場:コンポーネント別

- イントロダクション

- IO-Linkマスター

- PROFINET

- Ethernet/IP

- Modbus TCP/IP

- EtherCAT

- マルチプロトコル

- その他

- IO-Linkデバイス

- センサーノード

- モジュール

- アクチュエーター

- RFID読み取りヘッド、ほか

第8章 IO-Link市場:業種別

- イントロダクション

- ディスクリート産業

- 自動車

- 航空宇宙・防衛

- 半導体・エレクトロニクス

- 機械製造

- 包装

- ハイブリッド産業

- 医薬品

- 金属・鉱業

- 食品・飲料

- セメント・ガラス

- プロセス産業

- 石油・ガス

- 化学薬品

- エネルギー・電力

第9章 IO-Link市場:用途別

- イントロダクション

- 工作機械

- ハンドリング・組立自動化

- パッケージング自動化ソリューション

- イントラロジスティクス・ソリューション

第10章 IO-Link市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東・アフリカ (MEA)

- 南米

第11章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 製品ポートフォリオ

- 重要地域

- 製造フットプリント

- 有機・無機成長戦略

- 上位5社の5年間の収益分析 (2017年~2021年)

- 市場シェア分析:IO-Link市場 (2022年)

- 市場評価クアドラント (2022年)

- 企業のフットプリント

- スタートアップ/中小企業 (SME) の評価クアドラント (2022年)

- 競合状況・動向

- 製品の発売

- 資本取引

第12章 企業プロファイル

- 主要企業

- SIEMENS AG

- HANS TURCK GMBH & CO. KG

- BALLUFF GMBH

- IFM ELECTRONIC GMBH

- SICK AG

- ROCKWELL AUTOMATION, INC.

- OMRON CORPORATION

- PEPPERL+FUCHS

- FESTO SE & CO. KG

- SMC CORPORATION

- その他の企業

- BOSCH REXROTH AG

- BAUMER

- BELDEN INC.

- BECKHOFF AUTOMATION GMBH & CO. KG

- BANNER ENGINEERING CORP.

- WEIDMULLER INTERFACE GMBH & CO. KG

- PHOENIX CONTACT GMBH & CO. KG

- WENGLOR SENSORIC GMBH

- CARLO GAVAZZI HOLDING AG

- DATALOGIC S.P.A.

- BIHL+WIEDEMANN GMBH

- MURRELEKTRONIK GMBH

- JUMO GMBH & CO. KG

- CORETIGO

第13章 付録

The IO-Link market is projected to reach USD 33.9 billion by 2028 from an estimated USD 13.6 billion in 2023, at a CAGR of 20.0% from 2023 to 2028. Ability to support all fieldbus protocols is driving the growth of the IO-Link market, whereas use of compact machines and use of basic sensors are restraining the growth of IO-Link market

IO-Link wireless segment is expected to grow at higher CAGR during forecast period

The IO-Link wireless segment is projected to register a higher CAGR during the forecast period. The performance, functionality, and capability of IO-Link wireless are comparable to wired IO-Link; however, the elimination of cables ensures more flexibility, greater robustness, and better scalability. The rising demand for the IO-Link wireless protocol and increasing adoption of smart manufacturing across industries are expected to create lucrative opportunities for the manufacturers of the IO-Link wireless solutions, which in turns, driving the growth of the segment in future.

IO-Link devices segment to register growth at higher CAGR

IO-Link devices can be integrated into any fieldbus or automation system and have auto-device replacement functionality. They can be connected using the same cost-effective standard unshielded 3-wire cables as conventional discrete I/O, which helps reduce complex wiring. In the manufacturing industry, there is a growing need for operational excellence. This leads to the demand for various industrial services, such as predictive maintenance, condition monitoring, and traceability, which are expected to spur the demand for IO-Link devices. All these factors are expected to drive the growth of the IO-Link devices segment during the forecast period.

Discrete industries segment is likely to grow at highest CAGR

The discrete industries segment is likely to grow at the highest CAGR during the forecast period. Discrete industries follow stringent protocols for their manufacturing operations and continuously focus on reducing operational costs. This leads them to adopt industrial automation and IoT technologies for their business operations. These industries also majorly focus on improving the operational efficiency of machines to meet the growing customer demands. IO-Link can help reduce manufacturing costs, speed up commissioning times, reduce the number of network nodes, and lower the downtime of machines or systems. Discrete manufacturing involves parts and systems such as nuts and bolts, brackets, wires, assemblies, and individual products. A discrete product at the end of its life cycle can be broken down into its components, which can be recycled.

Packaging automation solutions segment to register significant growth during forecast period

The packaging automation solutions segment of the IO-Link market is expected to record the highest CAGR during the forecast period. The growth can be attributed to the increasing demand for effective and speedy packaging processes with minimal human interventions. Moreover, packaging automation solutions are used in various packaging processes, including product sorting, product handling, product storage, and product shipment. IO-Link solutions help optimize the packaging process by establishing bidirectional communication between sensors and automation systems. IO-Link solutions also offer features such as rapid and safe commissioning, reliable and high-quality packaging processes, improved availability of the final packaging machines, rapid returns on investment, and the ability to carry out remote diagnosis. Hence, the continuous evolution of packaging automation and the high adoption of IO-Link-based sensors are expected to boost the demand for packaging automation solutions in the near future.

Asia pacific to register growth at highest CAGR

Asia Pacific is the fastest-growing IO-Link market owing to the ongoing technological innovations and increasing adoption of automation technologies in various industries. In Asia Pacific, IO-Link technology is used in industries such as automotive and electronics. Japan and China are the major contributors to the IO-Link market in the region. Asia Pacific has emerged as an automobile manufacturing hub in the world. Hence, companies such as Volkswagen, Toyota Motor Corporation, Renault-Nissan- Mitsubishi Alliance, Daimler, Tata Motors, and Mahindra & Mahindra have made investments in automating their automobile production sites. Owing to this, Asia Pacific is likely to register growth at the highest CAGR during the forecast period.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 10%, Tier 2 - 20%, Tier 3 - 70%

- By Designation- C-level Executives - 35%, Managers - 25%, Others - 40%

- By Region-North America - 25%, Europe - 42%, Asia Pacific - 21%, RoW - 12%

The IO-Link market is dominated by a few globally established players such as Siemens AG (Germany), Rockwell Automation, Inc. (US); OMRON Corporation (Japan); Hans Turck GmbH & Co. KG (Germany); Balluff GmbH (Germany); ifm electronic GmbH (Germany); Pepperl+Fuchs (Germany); SICK AG (Germany); Festo SE & Co. KG (Germany); and SMC Corporation (Japan). The study includes an in-depth competitive analysis of these key players in the IO-Link market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the IO-Link market and forecasts its size, by type, industry, component, application, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the smart agriculture ecosystem

Key Benefits to Buy the Report:

- Analysis Of: Rising demand for industry 4.0, ability to support all fieldbus protocols, and growing demand for remote configuration, monitoring, and maintenance are the driving factors of the io-link market. Whereas, the restraining factors are use of compact machines and use of basic sensors. Limitations of ethernet and increasing adoption of io-link in automotive industry are the opportunities, while cyber risks associated with automation systems is the challenged faced by the io-link market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the IO-Link market

- Market Development: Comprehensive information about lucrative markets - the report analyses the IO-Link market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the IO-Link market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Siemens AG (Germany), Rockwell Automation, Inc. (US); OMRON Corporation (Japan); Hans Turck GmbH & Co. KG (Germany); Balluff GmbH (Germany) among others in the IO-Link market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 IO-LINK MARKET SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 IO-LINK MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)-REVENUE GENERATED BY COMPANIES FROM SALES OF IO-LINK SOLUTIONS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)-ILLUSTRATIVE EXAMPLE OF COMPANY OPERATING IN IO-LINK MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE)-DEMAND FOR IO-LINK FOR MACHINE TOOLS APPLICATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Estimating market size using bottom-up analysis (demand side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Estimating market size using top-down analysis (supply side)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.5.1 RESEARCH ASSUMPTIONS

- TABLE 1 KEY ASSUMPTIONS: MACRO AND MICRO-ECONOMIC ENVIRONMENT

- 2.5.2 LIMITATIONS

- FIGURE 9 LIMITATIONS: IO-LINK MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 IO-LINK WIRELESS SEGMENT TO REGISTER HIGHER CAGR THAN IO-LINK WIRED SEGMENT DURING FORECAST PERIOD

- FIGURE 11 PACKAGING AUTOMATION SOLUTIONS SEGMENT TO WITNESS HIGHEST GROWTH FROM 2023 TO 2028

- FIGURE 12 DISCRETE INDUSTRIES SEGMENT TO WITNESS HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 13 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 3.1 IMPACT OF RECESSION ON IO-LINK MARKET

- FIGURE 14 PRE- AND POST-RECESSION IMPACT ON IO-LINK MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN IO-LINK MARKET

- FIGURE 15 RISING NEED FOR INDUSTRY 4.0 TO FUEL DEMAND FOR IO-LINK SOLUTIONS IN COMING YEARS

- 4.2 IO-LINK MARKET, BY TYPE

- FIGURE 16 IO-LINK WIRED SEGMENT TO CAPTURE LARGER MARKET SHARE BY 2028

- 4.3 IO-LINK MARKET, BY COMPONENT

- FIGURE 17 IO-LINK DEVICES SEGMENT TO CAPTURE LARGER MARKET SHARE BY 2028

- 4.4 IO-LINK MARKET, BY APPLICATION

- FIGURE 18 PACKAGING AUTOMATION SOLUTIONS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.5 IO-LINK MARKET, BY APPLICATION AND REGION

- FIGURE 19 HANDLING AND ASSEMBLY AUTOMATION, AND EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 IO-LINK MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for Industry 4.0

- FIGURE 21 INDUSTRY 4.0 TRANSFORMING FACTORIES INTO SMART FACTORIES

- 5.2.1.2 Ability to support all fieldbus protocols

- 5.2.1.3 Growing demand for remote configuration, monitoring, and maintenance

- FIGURE 22 IO-LINK MARKET: DRIVERS AND THEIR IMPACT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Use of compact machines

- 5.2.2.2 Use of basic sensors

- FIGURE 23 IO-LINK MARKET: RESTRAINTS AND THEIR IMPACT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Limitations of Ethernet

- 5.2.3.2 Increasing adoption of IO-Link in automotive industry

- FIGURE 24 IO-LINK MARKET: OPPORTUNITIES AND THEIR IMPACT

- 5.2.4 CHALLENGES

- 5.2.4.1 Cyber risks associated with automation systems

- FIGURE 25 IO-LINK MARKET: CHALLENGES AND THEIR IMPACT

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 26 IO-LINK MARKET: SUPPLY CHAIN

- TABLE 2 IO-LINK MARKET: COMPANIES AND THEIR ROLE IN SUPPLY CHAIN

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR IO-LINK MARKET

- FIGURE 27 REVENUE SHIFT IN IO-LINK MARKET

- 5.5 IO-LINK ECOSYSTEM

- FIGURE 28 IO-LINK ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 IO-LINK MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 BALLUFF REDUCED CHANGEOVER TIME BY 65% WITH GUIDED FORMAT CHANGE

- 5.7.2 HARPAK-ULMA IMPROVES CUSTOMER AGILITY WITH SMART PACKAGING MACHINES FROM ROCKWELL AUTOMATION

- 5.7.3 PROCECO INTEGRATED CLEANING SYSTEMS WITH CUBE67 AND IO-LINK SOLUTIONS

- 5.7.4 MARSTON'S BREWERY USES IFM IO-LINK DEVICES TO UPDATE TANK-LEVEL CONTROL

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 COMPLEMENTARY TECHNOLOGIES

- 5.8.1.1 Fieldbus technology

- 5.8.1.2 Interface technology

- 5.8.1 COMPLEMENTARY TECHNOLOGIES

- 5.9 AVERAGE SELLING PRICE OF IO-LINK SOLUTIONS

- TABLE 4 AVERAGE SELLING PRICE OF IO-LINK SOLUTIONS, BY COMPONENT

- 5.10 TRADE ANALYSIS

- TABLE 5 IMPORTS DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 6 EXPORTS DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.11 PATENT ANALYSIS, 2020-2022

- TABLE 7 TOP 20 PATENT OWNERS DURING 2013-2022

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS FROM 2012 TO 2021

- FIGURE 31 PATENTS GRANTED WORLDWIDE, 2012-2021

- 5.12 TARIFFS AND REGULATIONS

- 5.12.1 TARIFFS

- TABLE 8 TARIFF FOR HS CODE 853890 EXPORTED BY US (2021)

- TABLE 9 TARIFF FOR HS CODE 853890 EXPORTED BY INDIA (2021)

- 5.12.2 REGULATORY COMPLIANCES

- 5.12.3 STANDARDS

6 IO-LINK MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 32 IO-LINK MARKET, BY TYPE

- FIGURE 33 IO-LINK WIRED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 10 IO-LINK MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 11 IO-LINK MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 12 IO-LINK MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 13 IO-LINK MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- 6.2 IO-LINK WIRED

- FIGURE 34 IO-LINK WIRED

- 6.3 IO-LINK WIRELESS

- FIGURE 35 IO-LINK WIRELESS

7 IO-LINK MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 36 IO-LINK DEVICES SEGMENT TO REGISTER HIGHER CAGR FROM 2023 TO 2028

- TABLE 14 IO-LINK MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 15 IO-LINK MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

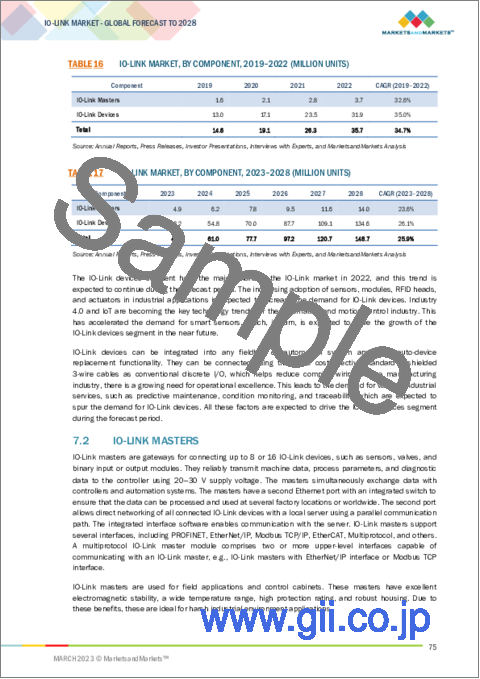

- TABLE 16 IO-LINK MARKET, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 17 IO-LINK MARKET, BY COMPONENT, 2023-2028 (MILLION UNITS)

- 7.2 IO-LINK MASTERS

- TABLE 18 IO-LINK MASTERS MARKET, BY INTERFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 19 IO-LINK MASTERS MARKET, BY INTERFACE TYPE, 2023-2028 (USD MILLION)

- TABLE 20 IO-LINK MARKET, BY INTERFACE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 21 IO-LINK MARKET, BY INTERFACE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 22 IO-LINK MASTERS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 23 IO-LINK MASTERS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 24 IO-LINK MASTERS MARKET, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 25 IO-LINK MASTERS MARKET, BY APPLICATION, 2023-2028 (MILLION UNITS)

- FIGURE 37 IO-LINK MASTERS MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 26 IO-LINK MASTERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 IO-LINK MASTERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 28 IO-LINK MASTERS MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 29 IO-LINK MASTERS MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 7.2.1 PROFINET

- 7.2.1.1 PROFINET protocol led IO-Link market in 2022

- 7.2.2 ETHERNET/IP

- 7.2.2.1 EtherNet/IP ideal for control applications and Industrial Internet of Things (IIoT)

- 7.2.3 MODBUS TCP/IP

- 7.2.3.1 Modbus TCP/IP protocol widely used in process industries for factory automation

- 7.2.4 ETHERCAT

- 7.2.4.1 EtherCAT makes machines and systems faster, simpler, and more cost-effective

- 7.2.5 MULTIPROTOCOL

- 7.2.5.1 Multiprotocol solutions offer better user experience and support for field upgrades

- 7.2.6 OTHERS

- 7.3 IO-LINK DEVICES

- TABLE 30 IO-LINK DEVICES MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 31 IO-LINK DEVICES MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 32 IO-LINK DEVICES MARKET, BY DEVICE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 33 IO-LINK DEVICES MARKET, BY DEVICE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 34 IO-LINK DEVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 35 IO-LINK DEVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 36 IO-LINK DEVICES MARKET, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 37 IO-LINK DEVICES MARKET, BY APPLICATION, 2023-2028 (MILLION UNITS)

- FIGURE 38 EUROPE TO LEAD IO-LINK DEVICES MARKET FROM 2023 TO 2028

- TABLE 38 IO-LINK DEVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 IO-LINK DEVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 40 IO-LINK DEVICES MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 41 IO-LINK DEVICES MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 7.3.1 SENSOR NODES

- 7.3.1.1 Sensor nodes are small and inexpensive devices with limited battery and computation power

- TABLE 42 IO-LINK SENSOR NODES MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 43 IO-LINK SENSOR NODES MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 44 IO-LINK SENSOR NODES MARKET, BY SUBTYPE, 2019-2022 (MILLION UNITS)

- TABLE 45 IO-LINK SENSOR NODES MARKET, BY SUBTYPE, 2023-2028 (MILLION UNITS)

- 7.3.1.2 Position sensors

- 7.3.1.2.1 Position sensors enable presence and absence detection of objects

- 7.3.1.3 Temperature sensors

- 7.3.1.3.1 Temperature sensors can detect differences in temperature of objects and their surroundings

- 7.3.1.4 Pressure sensors

- 7.3.1.4.1 Pressure sensors determine pressure applied to sensors and convert this information into output signal

- 7.3.1.5 Vibration sensors

- 7.3.1.5.1 Vibration sensors help measure acceleration, speed, and normal vibration in various applications

- 7.3.1.6 Others

- 7.3.1.2 Position sensors

- 7.3.2 MODULES

- 7.3.2.1 IO-Link modules enable connection of standard sensors and actuators

- 7.3.3 ACTUATORS

- 7.3.3.1 Actuators help machines achieve physical movement

- 7.3.4 RFID READ HEADS AND OTHERS

8 IO-LINK MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 39 DISCRETE INDUSTRIES TO DOMINATE IO-LINK MARKET DURING FORECAST PERIOD

- TABLE 46 IO-LINK MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 47 IO-LINK MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 48 IO-LINK MARKET, BY INDUSTRY, 2019-2022 (MILLION UNITS)

- TABLE 49 IO-LINK MARKET, BY INDUSTRY, 2023-2028 (MILLION UNITS)

- 8.2 DISCRETE INDUSTRIES

- FIGURE 40 EUROPE TO LEAD IO-LINK MARKET FOR DISCRETE INDUSTRIES FROM 2023 TO 2028

- TABLE 50 IO-LINK MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 IO-LINK MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 52 IO-LINK MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 53 IO-LINK MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2023-2028 (MILLION UNITS)

- 8.2.1 AUTOMOTIVE

- 8.2.1.1 IO-Link solutions help streamline manufacturing processes

- 8.2.2 AEROSPACE & DEFENSE

- 8.2.2.1 Increased automation in aerospace & defense industry to boost demand for IO-Link solutions

- 8.2.3 SEMICONDUCTOR & ELECTRONICS

- 8.2.3.1 Decentralization in semiconductor & electronics industry to propel IO-Link market growth

- 8.2.4 MACHINE MANUFACTURING

- 8.2.4.1 IO-Link facilitates control architecture modernization to support IIoT and Industry 4.0

- 8.2.5 PACKAGING

- 8.2.5.1 Need for high-quality packaging processes to boost demand for IO-Link solutions

- 8.3 HYBRID INDUSTRIES

- TABLE 54 IO-LINK MARKET FOR HYBRID INDUSTRIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 IO-LINK MARKET FOR HYBRID INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 IO-LINK MARKET FOR HYBRID INDUSTRIES, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 57 IO-LINK MARKET FOR HYBRID INDUSTRIES, BY REGION, 2023-2028 (MILLION UNITS)

- 8.3.1 PHARMACEUTICALS

- 8.3.1.1 Adoption of IO-Link solutions to make manufacturing operations faster and more cost-effective

- 8.3.2 METALS & MINING

- 8.3.2.1 IO-Link solutions to help manage processes better and increase productivity

- 8.3.3 FOOD & BEVERAGES

- 8.3.3.1 Need for process reliability and constant product quality to drive demand for IO-Link solutions

- 8.3.4 CEMENT AND GLASS

- 8.3.4.1 Emphasis of manufacturers on conserving natural resources and protecting climate to offer lucrative opportunities for IO-Link solution providers

- 8.4 PROCESS INDUSTRIES

- FIGURE 41 EUROPE TO LEAD IO-LINK MARKET FOR PROCESS INDUSTRIES DURING FORECAST PERIOD

- TABLE 58 IO-LINK MARKET FOR PROCESS INDUSTRIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 IO-LINK MARKET FOR PROCESS INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 IO-LINK MARKET FOR PROCESS INDUSTRIES, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 61 IO-LINK MARKET FOR PROCESS INDUSTRIES, BY REGION, 2023-2028 (MILLION UNITS)

- 8.4.1 OIL & GAS

- 8.4.1.1 Rising focus on lowering operational costs in oil & gas industry to increase adoption of IO-Link solutions

- 8.4.2 CHEMICALS

- 8.4.2.1 IO-Link solutions to increase efficiency, sustainability, and safety of chemicals manufacturing and processing plants

- 8.4.3 ENERGY & POWER

- 8.4.3.1 IO-Link solutions to help increase flexibility and efficiency of energy & power industry

9 IO-LINK MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 42 HANDLING AND ASSEMBLY AUTOMATION SEGMENT ESTIMATED TO LEAD IO-LINK MARKET IN 2023

- TABLE 62 IO-LINK MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 63 IO-LINK MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 64 IO-LINK MARKET, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 65 IO-LINK MARKET, BY APPLICATION, 2023-2028 (MILLION UNITS)

- 9.2 MACHINE TOOLS

- 9.2.1 RISING NEED FOR AUTOMATIC SETTING OF SENSOR PARAMETERS TO FUEL DEMAND FOR IO-LINK SOLUTIONS IN MACHINE TOOLS

- TABLE 66 IO-LINK MARKET FOR MACHINE TOOLS, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 67 IO-LINK MARKET FOR MACHINE TOOLS, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 68 IO-LINK MARKET FOR MACHINE TOOLS, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 69 IO-LINK MARKET FOR MACHINE TOOLS, BY COMPONENT, 2023-2028 (MILLION UNITS)

- FIGURE 43 EUROPE TO LEAD IO-LINK MARKET FOR MACHINE TOOLS DURING FORECAST PERIOD

- TABLE 70 IO-LINK MARKET FOR MACHINE TOOLS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 IO-LINK MARKET FOR MACHINE TOOLS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 72 IO-LINK MARKET FOR MACHINE TOOLS, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 73 IO-LINK MARKET FOR MACHINE TOOLS, BY REGION, 2023-2028 (MILLION UNITS)

- 9.3 HANDLING AND ASSEMBLY AUTOMATION

- 9.3.1 INCREASING DEMAND FOR INDUSTRIAL AUTOMATION TO ACCELERATE GROWTH OF HANDLING AND ASSEMBLY AUTOMATION APPLICATION

- TABLE 74 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 75 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 76 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 77 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 78 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 80 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 81 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY REGION, 2023-2028 (MILLION UNITS)

- 9.4 PACKAGING AUTOMATION SOLUTIONS

- 9.4.1 NEED TO INCREASE PRODUCTIVITY AND REDUCE MANUFACTURING COSTS TO DRIVE DEMAND FOR PACKAGING AUTOMATION SOLUTIONS

- FIGURE 44 IO-LINK DEVICES TO LEAD IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS DURING FORECAST PERIOD

- TABLE 82 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 83 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 84 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 85 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 86 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 88 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 89 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY REGION, 2023-2028 (MILLION UNITS)

- 9.5 INTRALOGISTICS SOLUTIONS

- 9.5.1 USE OF IO-LINK SOLUTIONS TO INCREASE OVERALL EFFICACY OF CONVEYOR BELTS

- TABLE 90 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 91 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 92 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 93 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 94 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 95 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 96 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 97 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY REGION, 2023-2028 (MILLION UNITS)

10 IO-LINK MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 45 EUROPE TO HOLD LARGEST SHARE OF IO-LINK MARKET FROM 2023 TO 2028

- TABLE 98 IO-LINK MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 99 IO-LINK MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 100 IO-LINK MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 101 IO-LINK MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 10.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: IO-LINK MARKET SNAPSHOT

- TABLE 102 IO-LINK MARKET IN NORTH AMERICA, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 103 IO-LINK MARKET IN NORTH AMERICA, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 104 IO-LINK MARKET IN NORTH AMERICA, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 105 IO-LINK MARKET IN NORTH AMERICA, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 106 IO-LINK MARKET IN NORTH AMERICA, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 107 IO-LINK MARKET IN NORTH AMERICA, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 108 IO-LINK MARKET IN NORTH AMERICA, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 109 IO-LINK MARKET IN NORTH AMERICA, BY APPLICATION, 2023-2028 (MILLION UNITS)

- TABLE 110 IO-LINK MARKET IN NORTH AMERICA, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 111 IO-LINK MARKET IN NORTH AMERICA, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 112 IO-LINK MARKET IN NORTH AMERICA, BY INDUSTRY, 2019-2022 (MILLION UNITS)

- TABLE 113 IO-LINK MARKET IN NORTH AMERICA, BY INDUSTRY, 2023-2028 (MILLION UNITS)

- TABLE 114 IO-LINK MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 115 IO-LINK MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 116 IO-LINK MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 117 IO-LINK MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (MILLION UNITS)

- 10.2.1 US

- 10.2.1.1 Rising petroleum industry to offer lucrative growth opportunities for IO-Link market

- 10.2.2 CANADA

- 10.2.2.1 Growth in manufacturing sector to drive adoption of IO-Link solutions

- 10.2.3 MEXICO

- 10.2.3.1 Continuous developments in manufacturing industry to boost demand for IO-Link solutions

- 10.3 EUROPE

- FIGURE 47 EUROPE: IO-LINK MARKET SNAPSHOT

- TABLE 118 IO-LINK MARKET IN EUROPE, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 119 IO-LINK MARKET IN EUROPE, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 120 IO-LINK MARKET IN EUROPE, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 121 IO-LINK MARKET IN EUROPE, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 122 IO-LINK MARKET IN EUROPE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 IO-LINK MARKET IN EUROPE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 124 IO-LINK MARKET IN EUROPE, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 125 IO-LINK MARKET IN EUROPE, BY APPLICATION, 2023-2028 (MILLION UNITS)

- TABLE 126 IO-LINK MARKET IN EUROPE, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 127 IO-LINK MARKET IN EUROPE, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 128 IO-LINK MARKET IN EUROPE, BY INDUSTRY, 2019-2022 (MILLION UNITS)

- TABLE 129 IO-LINK MARKET IN EUROPE, BY INDUSTRY, 2023-2028 (MILLION UNITS)

- TABLE 130 IO-LINK MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 131 IO-LINK MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 132 IO-LINK MARKET IN EUROPE, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 133 IO-LINK MARKET IN EUROPE, BY COUNTRY, 2023-2028 (MILLION UNITS)

- 10.3.1 GERMANY

- 10.3.1.1 Growing adoption of robotics and automation products to boost demand for IO-Link solutions

- 10.3.2 UK

- 10.3.2.1 Increased adoption of IO-Link solutions by aerospace sector to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Vibrant automotive industry to drive IO-Link market

- 10.3.4 ITALY

- 10.3.4.1 IO-Link used to facilitate communication between connected devices in robots industry

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: IO-LINK MARKET SNAPSHOT

- TABLE 134 IO-LINK MARKET IN ASIA PACIFIC, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 135 IO-LINK MARKET IN ASIA PACIFIC, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 136 IO-LINK MARKET IN ASIA PACIFIC, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 137 IO-LINK MARKET IN ASIA PACIFIC, BY COMPONENT, 2023-2028 (MILLION UNITS)

- FIGURE 49 HANDLING AND ASSEMBLY AUTOMATION SEGMENT TO LEAD MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- TABLE 138 IO-LINK MARKET IN ASIA PACIFIC, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 139 IO-LINK MARKET IN ASIA PACIFIC, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 IO-LINK MARKET IN ASIA PACIFIC, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 141 IO-LINK MARKET IN ASIA PACIFIC, BY APPLICATION, 2023-2028 (MILLION UNITS)

- TABLE 142 IO-LINK MARKET IN ASIA PACIFIC, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 143 IO-LINK MARKET IN ASIA PACIFIC, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 144 IO-LINK MARKET IN ASIA PACIFIC, BY INDUSTRY, 2019-2022 (MILLION UNITS)

- TABLE 145 IO-LINK MARKET IN ASIA PACIFIC, BY INDUSTRY, 2023-2028 (MILLION UNITS)

- FIGURE 50 CHINA TO DOMINATE ASIA PACIFIC IO-LINK MARKET DURING FORECAST PERIOD

- TABLE 146 IO-LINK MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 147 IO-LINK MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 148 IO-LINK MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 149 IO-LINK MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (MILLION UNITS)

- 10.4.1 CHINA

- 10.4.1.1 Growing automation in manufacturing industry to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Rising automotive industry to propel IO-Link market growth

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Growing electronics industry to boost market growth

- 10.4.4 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- TABLE 150 IO-LINK MARKET IN REST OF THE WORLD, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 151 IO-LINK MARKET IN REST OF THE WORLD, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 152 IO-LINK MARKET IN REST OF THE WORLD, BY COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 153 IO-LINK MARKET IN REST OF THE WORLD, BY COMPONENT, 2023-2028 (MILLION UNITS)

- TABLE 154 IO-LINK MARKET IN REST OF THE WORLD, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 155 IO-LINK MARKET IN REST OF THE WORLD, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 156 IO-LINK MARKET IN REST OF THE WORLD, BY APPLICATION, 2019-2022 (MILLION UNITS)

- TABLE 157 IO-LINK MARKET IN REST OF THE WORLD, BY APPLICATION, 2023-2028 (MILLION UNITS)

- TABLE 158 IO-LINK MARKET IN REST OF THE WORLD, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 159 IO-LINK MARKET IN REST OF THE WORLD, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 160 IO-LINK MARKET IN REST OF THE WORLD, BY INDUSTRY, 2019-2022 (MILLION UNITS)

- TABLE 161 IO-LINK MARKET IN REST OF THE WORLD, BY INDUSTRY, 2023-2028 (MILLION UNITS)

- TABLE 162 IO-LINK MARKET IN REST OF THE WORLD, BY REGION, 2019-2022 (USD MILLION)

- TABLE 163 IO-LINK MARKET IN REST OF THE WORLD, BY REGION, 2023-2028 (USD MILLION)

- TABLE 164 IO-LINK MARKET IN REST OF THE WORLD, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 165 IO-LINK MARKET IN REST OF THE WORLD, BY REGION, 2023-2028 (MILLION UNITS)

- 10.5.1 MIDDLE EAST AND AFRICA (MEA)

- 10.5.1.1 Growing automation in oil & gas industry to propel demand for IO-Link

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Growing mining industry to drive IO-Link market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 166 OVERVIEW OF STRATEGIES DEPLOYED BY KEY IO-LINK COMPANIES

- 11.2.1 PRODUCT PORTFOLIO

- 11.2.2 REGIONAL FOCUS

- 11.2.3 MANUFACTURING FOOTPRINT

- 11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE COMPANIES, 2017-2021

- FIGURE 51 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN IO-LINK MARKET

- 11.4 MARKET SHARE ANALYSIS: IO-LINK MARKET, 2022

- TABLE 167 IO-LINK MARKET: MARKET SHARE ANALYSIS (2022)

- 11.5 MARKET EVALUATION QUADRANT, 2022

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 52 COMPANY EVALUATION QUADRANT, 2022

- 11.6 COMPANY FOOTPRINT

- TABLE 168 COMPANY FOOTPRINT

- TABLE 169 INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 170 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 171 REGIONAL FOOTPRINT OF COMPANIES

- 11.7 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2022

- TABLE 172 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN IO-LINK MARKET

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 53 STARTUP/SME EVALUATION QUADRANT, 2022

- 11.8 COMPETITIVE SITUATIONS AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- TABLE 173 PRODUCT LAUNCHES (2019-2022)

- 11.8.2 DEALS

- TABLE 174 DEALS (2019-2022)

12 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

- 12.1 KEY PLAYERS

- 12.1.1 SIEMENS AG

- TABLE 175 SIEMENS AG: BUSINESS OVERVIEW

- FIGURE 54 SIEMENS AG: COMPANY SNAPSHOT

- TABLE 176 SIEMENS AG: PRODUCTS OFFERED

- TABLE 177 SIEMENS AG: PRODUCT LAUNCHES

- TABLE 178 SIEMENS AG: DEALS

- 12.1.2 HANS TURCK GMBH & CO. KG

- TABLE 179 HANS TURCK GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 180 HANS TURCK GMBH & CO. KG: PRODUCT OFFERED

- TABLE 181 HANS TURCK GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 182 HANS TURCK GMBH & CO. KG: DEALS

- 12.1.3 BALLUFF GMBH

- TABLE 183 BALLUFF: BUSINESS OVERVIEW

- TABLE 184 BALLUFF GMBH: PRODUCTS OFFERED

- TABLE 185 BALLUFF GMBH: PRODUCTS LAUNCHES

- 12.1.4 IFM ELECTRONIC GMBH

- TABLE 186 IFM ELECTRONIC GMBH: BUSINESS OVERVIEW

- TABLE 187 IFM ELECTRONIC GMBH: PRODUCTS OFFERED

- TABLE 188 IFM ELECTRONIC GMBH: DEALS

- 12.1.5 SICK AG

- TABLE 189 SICK AG: BUSINESS OVERVIEW

- FIGURE 55 SICK AG: COMPANY SNAPSHOT

- TABLE 190 SICK AG: PRODUCTS OFFERED

- TABLE 191 SICK AG: PRODUCTS LAUNCHES

- TABLE 192 SICK AG: DEALS

- 12.1.6 ROCKWELL AUTOMATION, INC.

- TABLE 193 ROCKWELL AUTOMATION, INC.: BUSINESS OVERVIEW

- FIGURE 56 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

- TABLE 194 ROCKWELL AUTOMATION, INC.: PRODUCTS OFFERED

- TABLE 195 ROCKWELL AUTOMATION, INC.: PRODUCT LAUNCHES

- 12.1.7 OMRON CORPORATION

- TABLE 196 OMRON CORPORATION: BUSINESS OVERVIEW

- FIGURE 57 OMRON CORPORATION: COMPANY SNAPSHOT

- TABLE 197 OMRON CORPORATION: PRODUCTS OFFERED

- TABLE 198 OMRON CORPORATION: PRODUCT LAUNCHES

- 12.1.8 PEPPERL+FUCHS

- TABLE 199 PEPPERL+FUCHS: BUSINESS OVERVIEW

- TABLE 200 PEPPERL+FUCHS: PRODUCTS OFFERED

- TABLE 201 PEPPERL+FUCHS: PRODUCT LAUNCHES

- TABLE 202 PEPPERL+FUCHS: DEALS

- 12.1.9 FESTO SE & CO. KG

- TABLE 203 FESTO SE & CO. KG COMPANY: BUSINESS OVERVIEW

- TABLE 204 FESTO SE & CO. KG: PRODUCTS OFFERED

- TABLE 205 FESTO SE & CO. KG: DEALS

- 12.1.10 SMC CORPORATION

- TABLE 206 SMC CORPORATION: BUSINESS OVERVIEW

- FIGURE 58 SMC CORPORATION: COMPANY SNAPSHOT

- TABLE 207 SMC CORPORATION: PRODUCTS OFFERED

- Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 BOSCH REXROTH AG

- 12.2.2 BAUMER

- 12.2.3 BELDEN INC.

- 12.2.4 BECKHOFF AUTOMATION GMBH & CO. KG

- 12.2.5 BANNER ENGINEERING CORP.

- 12.2.6 WEIDMULLER INTERFACE GMBH & CO. KG

- 12.2.7 PHOENIX CONTACT GMBH & CO. KG

- 12.2.8 WENGLOR SENSORIC GMBH

- 12.2.9 CARLO GAVAZZI HOLDING AG

- 12.2.10 DATALOGIC S.P.A.

- 12.2.11 BIHL+WIEDEMANN GMBH

- 12.2.12 MURRELEKTRONIK GMBH

- 12.2.13 JUMO GMBH & CO. KG

- 12.2.14 CORETIGO

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS