|

|

市場調査レポート

商品コード

1538578

静水圧プレス成形市場:材料別、用途別、オファリング別、タイプ別、容量別、プロセスタイプ別、最終用途産業別、地域別 - 2029年までの予測Isostatic Pressing Market by Offering (System, Services), Type (Hot and Cold), HIP Capacity (Small, Medium, & Large), CIP Process (Wet & Dry), Industry (Automotive, Aerospace, Medical, Precision Machine Manufacturing) & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 静水圧プレス成形市場:材料別、用途別、オファリング別、タイプ別、容量別、プロセスタイプ別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月15日

発行: MarketsandMarkets

ページ情報: 英文 257 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

静水圧プレス成形の市場規模は、2024年の76億米ドルから2029年には99億米ドルに増加し、2024年から2029年のCAGRは5.4%になると予測されています。

静水圧プレス成形市場を牽引している主な理由はいくつかありますが、効率を高める技術の進歩や、さまざまな産業における高性能材料へのニーズの高まり、人工股関節や人工膝関節などの生体適合性や高密度インプラントに対する医療分野のニーズ、自動化やリアルタイムプロセス監視の進歩による静水圧プレスの効率と一貫性の向上などが挙げられます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2029年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 材料別、用途別、オファリング別、タイプ別、容量別、プロセスタイプ別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

熱間静水圧プレス(HIP)サービス分野は、高性能で信頼性の高い部品を必要とする航空宇宙、防衛、医療、自動車などの産業における多様な用途のため、静水圧プレス成形市場をリードする可能性が高いとみられています。HIPは、多孔性を排除しながら3Dプリント品の特性を改善する能力があるため、積層造形に不可欠です。技術の向上、厳しい品質要求、経済成長、環境的利益、政府支援、競争上の優位性など、すべてがHIPサービスの必要性に寄与しています。

粉末冶金カテゴリーは、航空宇宙、防衛、自動車、医療産業で使用される先端材料への需要が高まっているため、CIP 促進要因ッグプレスにおいて最も速いCAGRで発展すると予測されています。これは、CIP装置の新技術と、信頼性と一貫した生産量を必要とする高度なプロセスによって促進され、その結果、均一な密度と欠陥の少ない高性能部品への需要が高まっています。さらに、新興国における経済と産業の拡大、持続可能性の目標、奨励金と研究開発費による政府の支援が、CIP 促進要因ッグプレス技術の受け入れと普及を促進しています。

北米は米国、カナダ、メキシコで構成されています。このうち、米国が北米の最大市場シェアを占めています。米国は、技術導入と製品開拓の強化により、市場成長に大きく貢献すると予想されます。技術革新、特に精密工学と製造における世界的リーダーである米国の静水圧プレス成形市場は急成長しています。米国における静水圧プレス成形の用途は、タービンブレードから構造部品やその他の重要なハードウェアに至るまで、様々な高性能部品やコンポーネントの生産のための航空宇宙産業や防衛産業においてもかなり広範囲に及んでいます。さらに、米国の最先端医療分野では、医療用インプラントや医療機器に使用される材料の品質に対する要求が高く、欠陥のない高品質の部品を確実に製造するために、静水圧プレス加工の需要が高まっています。

当レポートでは、世界の静水圧プレス成形市場について調査し、材料別、用途別、オファリング別、タイプ別、容量別、プロセスタイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- AI/生成AIが静水圧プレス成形市場に与える影響

第6章 静水圧プレス成形市場、材料別

- イントロダクション

- 金属

- セラミック

- 複合

- プラスチック

- 炭素

第7章 静水圧プレス成形市場、用途別

- イントロダクション

- 加圧鋳造

- HIPクラッディング

- HIPろう付け

- 付加製造(AM)

- 金属射出成形(MIM)

- 粉末冶金(PM)

第8章 静水圧プレス成形市場、オファリング別

- イントロダクション

- システム

- サービス

第9章 静水圧プレス成形市場、タイプ別

- イントロダクション

- 熱間静水圧プレス成形(ヒップ)

- 冷間静水圧プレス成形(CIP)

第10章 静水圧プレス成形市場、容量別

- イントロダクション

- 小型熱間静水圧プレス

- 中型熱間静水圧プレス

- 大型熱間静水圧プレス

第11章 静水圧プレス成形市場、プロセスタイプ別

- イントロダクション

- ウェットバッグプレス

- ドライバッグプレス

第12章 静水圧プレス成形市場、最終用途産業別

- イントロダクション

- 自動車

- 航空宇宙

- 医療

- エネルギー・電力

- エレクトロニクス・半導体

- 精密機械製造

- 研究開発

- その他

第13章 静水圧プレス成形市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 主要企業の収益分析、2020~2023年

- 市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第15章 企業プロファイル

- 主要参入企業

- KOBE STEEL, LTD.

- BODYCOTE

- KENNAMETAL INC.

- NIKKISO CO., LTD.

- DORST TECHNOLOGIES GMBH & CO. KG

- AMERICAN ISOSTATIC PRESSES, INC.

- EPSI

- PRESSURE TECHNOLOGY, INC.

- SHANXI GOLDEN KAIYUAN CO., LTD.

- FLUITRON

- その他の企業

- AEGIS TECHNOLOGY

- AUBERT & DUVAL

- FREY & CO. GMBH

- HIPERBARIC

- HOGANAS

- ILSHINAUTOCLAVE CO., LTD.

- INSMART SYSTEMS

- ISOSTATIC PRESSING SERVICES

- KITTYHAWK

- MTC POWDER SOLUTIONS

- MTI CORPORATION

- PTC INDUSTRIES LIMITED

- QUAD CITY MANUFACTURING LAB(QCML)

- TECHFORM ADVANCED CASTING TECHNOLOGY LLC

- TIANJIN PACIFIC ULTRA HIGH VOLTAGE EQUIPMENT CO., LTD.

第16章 隣接市場

第17章 付録

List of Tables

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP TWO TYPES (USD)

- TABLE 3 INDICATIVE PRICING TREND OF ISOSTATIC PRESSING SYSTEMS, BY REGION, 2021-2023 (USD)

- TABLE 4 ISOSTATIC PRESSING MARKET: ECOSYSTEM

- TABLE 5 LIST OF PATENTS, 2021-2024

- TABLE 6 ISOSTATIC PRESSING MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2024-2026

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 STANDARDS

- TABLE 12 PORTER'S FIVE FORCES IMPACT ON ISOSTATIC PRESSING MARKET

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 15 NUCLEAR DECOMMISSIONING AUTHORITY (NDA) USED ISOSTATIC PRESSING SYSTEMS TO ADDRESS ISSUES RELATED TO MATERIALS BLENDED WITH PLUTONIUM

- TABLE 16 LUCIDEON HELPED MEDICAL IMPLANT COMPANY TACKLE ADDITIVE MANUFACTURING HIP ISSUES

- TABLE 17 BODYCOTE PROVIDED ROLLS-ROYCE HOT ISOSTATIC PRESSING SERVICES TO IMPROVE MATERIAL PROPERTIES

- TABLE 18 STRYKER CORPORATION USED QUINTUS' HIP SYSTEM TO PRODUCE TITANIUM MEDICAL IMPLANTS WITH COMPLEX SHAPES

- TABLE 19 ISOSTATIC PRESSING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

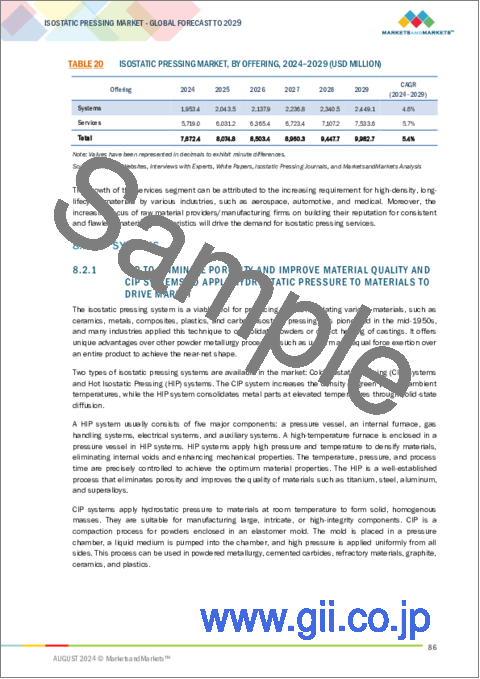

- TABLE 20 ISOSTATIC PRESSING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 21 SYSTEMS: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 22 SYSTEMS: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 23 SERVICES: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 24 SERVICES: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 25 ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 26 ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 27 ISOSTATIC PRESSING SYSTEM SHIPMENT, BY TYPE, 2023 (THOUSAND UNITS)

- TABLE 28 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 29 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 30 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 31 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 32 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 33 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 34 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 35 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 36 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SERVICES, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 37 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SERVICES, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 38 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SERVICES, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 HOT ISOSTATIC PRESSING (HIP): ISOSTATIC PRESSING MARKET FOR SERVICES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 45 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 46 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY PROCESS TYPE, 2020-2023 (USD MILLION)

- TABLE 47 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY PROCESS TYPE, 2024-2029 (USD MILLION)

- TABLE 48 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 49 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 50 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 51 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 52 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SERVICES, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 53 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SERVICES, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 54 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SYSTEMS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SERVICES, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 COLD ISOSTATIC PRESSING (CIP): ISOSTATIC PRESSING MARKET FOR SERVICES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 HOT ISOSTATIC PRESSING MARKET, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 61 HOT ISOSTATIC PRESSING MARKET, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 62 COLD ISOSTATIC PRESSING MARKET, BY PROCESS TYPE, 2020-2023 (USD MILLION)

- TABLE 63 COLD ISOSTATIC PRESSING MARKET, BY PROCESS TYPE, 2024-2029 (USD MILLION)

- TABLE 64 ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 65 ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 66 AUTOMOTIVE: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 67 AUTOMOTIVE: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 68 AUTOMOTIVE: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 69 AUTOMOTIVE: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 70 AEROSPACE: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 71 AEROSPACE: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 72 AEROSPACE: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 AEROSPACE: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 74 MEDICAL: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 75 MEDICAL: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 76 MEDICAL: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 77 MEDICAL: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 78 ENERGY & POWER: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 79 ENERGY & POWER: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 80 ENERGY & POWER: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 ENERGY & POWER: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 82 ELECTRONICS & SEMICONDUCTOR: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 83 ELECTRONICS & SEMICONDUCTOR: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 84 ELECTRONICS & SEMICONDUCTOR: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 85 ELECTRONICS & SEMICONDUCTOR: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 86 PRECISION MACHINE MANUFACTURING: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 87 PRECISION MACHINE MANUFACTURING: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 88 PRECISION MACHINE MANUFACTURING: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 89 PRECISION MACHINE MANUFACTURING: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 90 RESEARCH & DEVELOPMENT: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 91 RESEARCH & DEVELOPMENT: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 92 RESEARCH & DEVELOPMENT: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 RESEARCH & DEVELOPMENT: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 94 OTHER END-USE INDUSTRIES: ISOSTATIC PRESSING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 95 OTHER END-USE INDUSTRIES: ISOSTATIC PRESSING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 96 OTHER END-USE INDUSTRIES: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 97 OTHER END-USE INDUSTRIES: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 98 ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 99 ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 100 HOT ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 101 HOT ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 102 COLD ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 103 COLD ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 104 NORTH AMERICA: ISOSTATIC PRESSING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 105 NORTH AMERICA: ISOSTATIC PRESSING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 106 NORTH AMERICA: ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 108 EUROPE: ISOSTATIC PRESSING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 109 EUROPE: ISOSTATIC PRESSING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 110 EUROPE: ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 111 EUROPE: ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ISOSTATIC PRESSING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ISOSTATIC PRESSING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 116 REST OF THE WORLD: ISOSTATIC PRESSING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 117 REST OF THE WORLD: ISOSTATIC PRESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 118 REST OF THE WORLD: ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 119 REST OF THE WORLD: ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 120 MIDDLE EAST: ISOSTATIC PRESSING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 121 MIDDLE EAST: ISOSTATIC PRESSING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 122 ISOSTATIC PRESSING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 123 ISOSTATIC PRESSING SYSTEM MARKET: MARKET SHARE ANALYSIS, 2023

- TABLE 124 ISOSTATIC PRESSING MARKET: TYPE FOOTPRINT

- TABLE 125 ISOSTATIC PRESSING MARKET: OFFERING FOOTPRINT

- TABLE 126 ISOSTATIC PRESSING MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 127 ISOSTATIC PRESSING MARKET: REGION FOOTPRINT

- TABLE 128 ISOSTATIC PRESSING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 129 ISOSTATIC PRESSING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY TYPE

- TABLE 130 ISOSTATIC PRESSING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY END-USER INDUSTRY

- TABLE 131 ISOSTATIC PRESSING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 132 ISOSTATIC PRESSING MARKET: PRODUCT LAUNCHES, MARCH 2020-MAY 2024

- TABLE 133 ISOSTATIC PRESSING MARKET: DEALS, MARCH 2020-MAY 2024

- TABLE 134 ISOSTATIC PRESSING MARKET: EXPANSIONS, MARCH 2020-MAY 2024

- TABLE 135 ISOSTATIC PRESSING MARKET: OTHER DEVELOPMENTS, MARCH 2020-MAY 2024

- TABLE 136 KOBE STEEL, LTD.: COMPANY OVERVIEW

- TABLE 137 KOBE STEEL, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 KOBE STEEL, LTD.: DEALS

- TABLE 139 BODYCOTE: COMPANY OVERVIEW

- TABLE 140 BODYCOTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 BODYCOTE: DEALS

- TABLE 142 BODYCOTE: EXPANSIONS

- TABLE 143 KENNAMETAL INC.: COMPANY OVERVIEW

- TABLE 144 KENNAMETAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 KENNAMETAL INC.: DEALS

- TABLE 146 NIKKISO CO., LTD.: COMPANY OVERVIEW

- TABLE 147 NIKKISO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 DORST TECHNOLOGIES GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 149 DORST TECHNOLOGIES GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 DORST TECHNOLOGIES GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 151 AMERICAN ISOSTATIC PRESSES, INC.: COMPANY OVERVIEW

- TABLE 152 AMERICAN ISOSTATIC PRESSES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 AMERICAN ISOSTATIC PRESSES, INC.: OTHER DEVELOPMENTS

- TABLE 154 EPSI: COMPANY OVERVIEW

- TABLE 155 EPSI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 PRESSURE TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 157 PRESSURE TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 SHANXI GOLDEN KAIYUAN CO., LTD.: COMPANY OVERVIEW

- TABLE 159 SHANXI GOLDEN KAIYUAN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 FLUITRON: COMPANY OVERVIEW

- TABLE 161 FLUITRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 AEGIS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 163 AUBERT & DUVAL: COMPANY OVERVIEW

- TABLE 164 FREY & CO. GMBH: COMPANY OVERVIEW

- TABLE 165 HIPERBARIC: COMPANY OVERVIEW

- TABLE 166 HOGANAS: COMPANY OVERVIEW

- TABLE 167 ILSHINAUTOCLAVE CO., LTD.: COMPANY OVERVIEW

- TABLE 168 INSMART SYSTEMS: COMPANY OVERVIEW

- TABLE 169 ISOSTATIC PRESSING SERVICES: COMPANY OVERVIEW

- TABLE 170 KITTYHAWK: COMPANY OVERVIEW

- TABLE 171 MTC POWDER SOLUTIONS: COMPANY OVERVIEW

- TABLE 172 MTI CORPORATION: COMPANY OVERVIEW

- TABLE 173 PTC INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 174 QUAD CITY MANUFACTURING LAB (QCML): COMPANY OVERVIEW

- TABLE 175 TECHFORM ADVANCED CASTING TECHNOLOGY LLC: COMPANY OVERVIEW

- TABLE 176 TIANJIN PACIFIC ULTRA HIGH VOLTAGE EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 177 3D PRINTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 178 3D PRINTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 179 PRINTERS: 3D PRINTING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 180 PRINTERS: 3D PRINTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 181 PRINTERS: 3D PRINTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 182 PRINTERS: 3D PRINTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 183 PRINTERS: 3D PRINTING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 184 PRINTERS: 3D PRINTING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 185 PRINTERS: 3D PRINTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 186 PRINTERS: 3D PRINTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 187 MATERIALS: 3D PRINTING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 188 MATERIALS: 3D PRINTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 189 MATERIALS: 3D PRINTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 190 MATERIALS: 3D PRINTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 191 MATERIALS: 3D PRINTING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 192 MATERIALS: 3D PRINTING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 193 MATERIALS: 3D PRINTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 194 MATERIALS: 3D PRINTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 195 PLASTICS: 3D PRINTING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 196 PLASTICS: 3D PRINTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 197 THERMOPLASTICS: 3D PRINTING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 198 THERMOPLASTICS: 3D PRINTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 199 TECHNICAL SPECIFICATIONS OF ACRYLONITRILE BUTADIENE STYRENE (ABS)

- TABLE 200 TECHNICAL SPECIFICATIONS OF POLYLACTIC ACID (PLA)

- TABLE 201 TECHNICAL SPECIFICATIONS OF NYLON

- TABLE 202 TECHNICAL SPECIFICATIONS OF POLYPROPYLENE

- TABLE 203 TECHNICAL SPECIFICATIONS OF POLYCARBONATE

- TABLE 204 TECHNICAL SPECIFICATIONS OF POLYVINYL ALCOHOL (PVA)

- TABLE 205 METALS: 3D PRINTING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 206 METALS: 3D PRINTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 207 SOFTWARE: 3D PRINTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 208 SOFTWARE: 3D PRINTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 209 SOFTWARE: 3D PRINTING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 210 SOFTWARE: 3D PRINTING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 211 SOFTWARE: 3D PRINTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 212 SOFTWARE: 3D PRINTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 213 SERVICES: 3D PRINTING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 214 SERVICES: 3D PRINTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 215 SERVICES: 3D PRINTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 216 SERVICES: 3D PRINTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 217 SERVICES: 3D PRINTING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 218 SERVICES: 3D PRINTING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 219 SERVICES: 3D PRINTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 220 SERVICES: 3D PRINTING MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 ISOSTATIC PRESSING MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM ISOSTATIC PRESSING SYSTEM TYPES

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 SERVICES SEGMENT TO DOMINATE MARKET FROM 2024 TO 2029

- FIGURE 7 HOT ISOSTATIC PRESSING (HIP) SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 LARGE-SIZED HIP SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

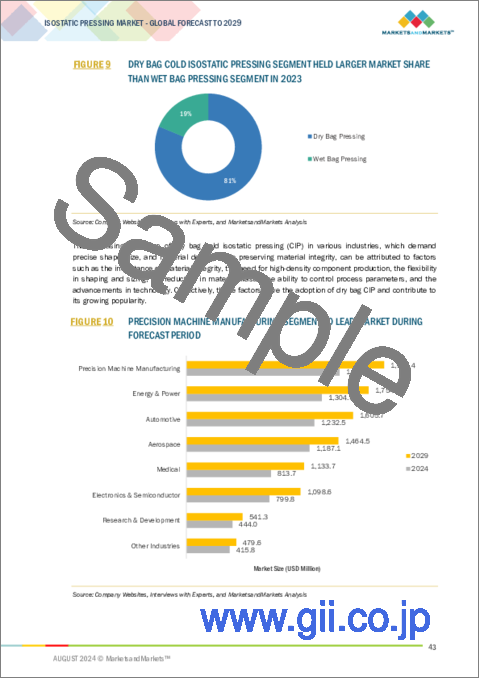

- FIGURE 9 DRY BAG COLD ISOSTATIC PRESSING SEGMENT HELD LARGER MARKET SHARE THAN WET BAG PRESSING SEGMENT IN 2023

- FIGURE 10 PRECISION MACHINE MANUFACTURING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 EXPANSION OF MEDICAL INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR ASIA PACIFIC ISOSTATIC PRESSING MARKET

- FIGURE 13 SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN SYSTEMS SEGMENT DURING FORECAST PERIOD

- FIGURE 14 HOT ISOSTATIC PRESSING (HIP) SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 LARGE-SIZED HIP SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 DRY BAG PRESSING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 MEDICAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 NORTH AMERICA TO LEAD MARKET IN 2024

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 ISOSTATIC PRESSING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 ISOSTATIC PRESSING MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 ISOSTATIC PRESSING MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 ISOSTATIC PRESSING MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 ISOSTATIC PRESSING MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP TWO TYPES (USD)

- FIGURE 27 INDICATIVE PRICING TREND OF ISOSTATIC PRESSING SYSTEMS, BY REGION, 2021-2023 (USD)

- FIGURE 28 ISOSTATIC PRESSING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 ISOSTATIC PRESSING ECOSYSTEM

- FIGURE 30 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 31 IMPORT DATA FOR HS CODE 8462-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR HS CODE 8462-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 33 ISOSTATIC PRESSING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 36 USE CASES OF GENERATIVE AI/AI

- FIGURE 37 IMPACT OF AI ON ISOSTATIC PRESSING MARKET

- FIGURE 38 ISOSTATIC PRESSING MARKET, BY OFFERING

- FIGURE 39 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 ISOSTATIC PRESSING MARKET, BY TYPE

- FIGURE 41 HOT ISOSTATIC PRESSING SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 HOT ISOSTATIC PRESSING MARKET, BY CAPACITY

- FIGURE 43 LARGE-SIZED HOT ISOSTATIC PRESSING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 COLD ISOSTATIC PRESSING MARKET, BY PROCESS TYPE

- FIGURE 45 DRY BAG PRESSING SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 46 ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY

- FIGURE 47 MEDICAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ISOSTATIC PRESSING MARKET, BY REGION

- FIGURE 49 CHINA TO REGISTER HIGHEST CAGR IN ISOSTATIC PRESSING MARKET DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN ISOSTATIC PRESSING MARKET DURING FORECAST PERIOD

- FIGURE 51 NORTH AMERICA: ISOSTATIC PRESSING MARKET SNAPSHOT

- FIGURE 52 EUROPE: ISOSTATIC PRESSING MARKET SNAPSHOT

- FIGURE 53 ASIA PACIFIC: ISOSTATIC PRESSING MARKET SNAPSHOT

- FIGURE 54 ISOSTATIC PRESSING MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2023

- FIGURE 55 ISOSTATIC PRESSING SYSTEM MARKET SHARE ANALYSIS, 2023

- FIGURE 56 ISOSTATIC PRESSING MARKET: COMPANY VALUATION

- FIGURE 57 ISOSTATIC PRESSING MARKET: FINANCIAL METRICS

- FIGURE 58 ISOSTATIC PRESSING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 59 ISOSTATIC PRESSING MARKET: COMPANY FOOTPRINT

- FIGURE 60 ISOSTATIC PRESSING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 61 KOBE STEEL, LTD.: COMPANY SNAPSHOT

- FIGURE 62 BODYCOTE: COMPANY SNAPSHOT

- FIGURE 63 KENNAMETAL INC.: COMPANY SNAPSHOT

- FIGURE 64 NIKKISO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 65 SERVICES SEGMENT TO RECORD HIGHEST CAGR IN 3D PRINTING MARKET DURING FORECAST PERIOD

- FIGURE 66 INDUSTRIAL PRINTERS SEGMENT TO DOMINATE 3D PRINTING MARKET DURING FORECAST PERIOD

- FIGURE 67 PLASTICS SEGMENT TO DOMINATE 3D PRINTING MARKET DURING FORECAST PERIOD

The isostatic pressing market is expected to increase from USD 7.6 billion in 2024 to USD 9.9 billion by 2029, at a 5.4% CAGR between 2024 and 2029. Several major reasons drive the isostatic pressing market, including technological advancements that boost efficiency and the growing need for high-performance materials in various industries, The medical sector's need for biocompatible and high-density implants, such as hip and knee replacements, Advances in automation and real-time process monitoring improve the efficiency and consistency of isostatic pressing.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2029-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD billion) |

| Segments | Offering, Type, Capacity, Process Type, End-use Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"HIP services segment is expected to dominate the isostatic pressing market throughout the forecast period"

The Hot Isostatic Pressing (HIP) services segment is likely to lead the isostatic pressing market due to its diverse applications in industries such as aerospace, defense, medical, and automotive, which require high-performance, dependable components. HIP's ability to improve the characteristics of 3D-printed items while eliminating porosity makes it essential for additive manufacturing. Technological improvements, demanding quality requirements, economic growth, environmental benefits, government assistance, and competitive advantages all contribute to the need for HIP services.

"CIP Dry bag pressing segment is expected to grow with significant CAGR during forecast period"

The powder metallurgy category is predicted to develop at the fastest CAGR in CIP dry bag pressing because to rising demand for advanced materials used in aerospace, defence, automotive, and medical industries. This has been fuelled by new technologies in CIP equipment and advanced processes that require reliability and consistent output, resulting in a greater demand for high-performance components with uniform density and fewer faults. Furthermore, economic and industrial expansion in emerging nations, sustainability goals, and government support through incentives and R&D expenditures facilitate the acceptance and spread of CIP dry bag pressing technology.

"The US in holds the largest market share of isostatic market in 2023."

North America comprises the US, Canada, and Mexico. Of these, the US captures the maximum market share of North America. The US is expected to contribute significantly to market growth due to the enhanced adoption of technology and product development. Being a global leader in innovation, particularly in precision engineering and manufacturing, the isostatic pressing market of the United States is on a surge.This then becomes a package including precision, efficiency, and integration capabilities. The application of isostatic pressing in the United States is also quite extensive in the aerospace and defense industries for the production of various high-performance parts and components, from turbine blades to structural parts and other important hardware. Moreover, the state-of-the-art health sector in the US places great demands on the quality of materials to be used for medical implants and devices, hence increasing the demand for isostatic pressing services in ensuring that defect-free, quality components are produced..

The growth of the market in US is also attributed to presence of prominent market players such as Kennametal, Inc. (US), American Isostatic Presses, Inc (US), EPSI (US), Pressure Technology, Inc. (US).

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation - C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region - North America - 35%, Europe - 18%, Asia Pacific - 40%, and Rest of the World - 7%

Major players in the isostatic pressing market include KOBE STEEL, LTD. (Japan), Bodycote (UK), Kennametal, Inc. (US), Nikkiso., Ltd. (Japan), DORST Technologies GmbH & Co. KG (Germany), American Isostatic Presses, Inc (US), EPSI (US), and others.

Research Coverage

The report segments the isostatic pressing l market by Offering, Type, capacity, process type, End-use Industry and Region. The report also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall isostatic pressing market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of critical drivers (Increased deployment of HIP systems to densify 3D-printed parts, Capability of HIP systems to reduce product maintenance costs and cycle time, Increasing emphasis on integrating HIP with other heat-treatment processes, Increased technological advancement in Cold Isostatic Pressing (CIP).), restraints (High initial investment), opportunities (Growing adoption of HIP by aerospace industry, Increasing demand for low-cost titanium and alloys from automakers), challenges (Complex Setup and Operation in Isostatic Pressing, Limitations associated with isostatic pressing tools) influencing the growth of the isostatic pressing market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the isostatic pressing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the isostatic pressing market across various regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the isostatic pressing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like include KOBE STEEL, LTD. (Japan), Bodycote (UK), Kennametal, Inc. (US), Nikkiso., Ltd. (Japan), DORST Technologies GmbH & Co. KG (Germany), American Isostatic Presses, Inc (US), EPSI (US), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary profiles

- 2.1.2.2 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size using bottom-up approach

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for arriving at market size using top-down approach

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN ISOSTATIC PRESSING MARKET

- 4.2 ISOSTATIC PRESSING MARKET, BY OFFERING

- 4.3 ISOSTATIC PRESSING MARKET, BY TYPE

- 4.4 HOT ISOSTATIC PRESSING MARKET, BY CAPACITY

- 4.5 COLD ISOSTATIC PRESSING MARKET, BY PROCESS TYPE

- 4.6 ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY

- 4.7 ISOSTATIC PRESSING MARKET, BY REGION

- 4.8 ISOSTATIC PRESSING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased deployment of HIP systems to densify 3D-printed parts

- 5.2.1.2 Rising demand for HIP systems to reduce product maintenance costs and cycle time

- 5.2.1.3 Increasing emphasis on integrating HIP with other heat-treatment processes

- 5.2.1.4 Growing technological advancement in Cold Isostatic Pressing (CIP)

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of HIP in aerospace industry

- 5.2.3.2 Rising demand for low-cost titanium and alloys from automakers

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex setup and operation in isostatic pressing

- 5.2.4.2 Limitations associated with isostatic pressing tools

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 5.4.2 INDICATIVE PRICING ANALYSIS OF ISOSTATIC PRESSING SYSTEMS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Material handling technology

- 5.7.1.2 High-pressure torsion (HPT)

- 5.7.1.3 Hydrostatic isostatic pressing

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Pneumatic isostatic pressing (PIP)

- 5.7.2.2 Pressure control system

- 5.7.2.3 Electro-hydraulic isostatic pressing (EHIP)

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Additive manufacturing (AM)

- 5.7.3.2 Robotic automation

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8462)

- 5.9.2 EXPORT SCENARIO (HS CODE 8462)

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2026

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 STANDARDS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF SUBSTITUTES

- 5.12.5 THREAT OF NEW ENTRANTS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 CASE STUDY ANALYSIS

- 5.15 IMPACT OF AI/GENERATIVE AI ON ISOSTATIC PRESSING MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 AI-SPECIFIC USE CASES

6 ISOSTATIC PRESSING MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- 6.2 METAL

- 6.3 CERAMIC

- 6.4 COMPOSITE

- 6.5 PLASTIC

- 6.6 CARBON

7 ISOSTATIC PRESSING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 CASTING DENSIFICATION

- 7.3 HIP CLADDING

- 7.4 HIP BRAZING

- 7.5 ADDITIVE MANUFACTURING (AM)

- 7.6 METAL INJECTION MOLDING (MIM)

- 7.7 POWDER METALLURGY (PM)

8 ISOSTATIC PRESSING MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 SYSTEMS

- 8.2.1 HIP TO ELIMINATE POROSITY AND IMPROVE MATERIAL QUALITY AND CIP SYSTEMS TO APPLY HYDROSTATIC PRESSURE TO MATERIALS TO DRIVE MARKET

- 8.3 SERVICES

- 8.3.1 ISOSTATIC PRESSING SERVICES TO OFFER COMPLETE MANUFACTURING SOLUTIONS FROM MATERIAL SOURCING TO FINAL PRODUCT FINISHING

9 ISOSTATIC PRESSING MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 HOT ISOSTATIC PRESSING (HIP)

- 9.2.1 HOT ISOSTATIC PRESSING TO REDUCE SCRAP, IMPROVE YIELD, AND MAXIMIZE MATERIAL UTILIZATION

- 9.3 COLD ISOSTATIC PRESSING (CIP)

- 9.3.1 COLD ISOSTATIC PRESSING ENABLES FORMATION OF LARGE, COMPLICATED, AND NEAR-NET SHAPES AND SAVES TIME AND COST

10 ISOSTATIC PRESSING MARKET, BY CAPACITY

- 10.1 INTRODUCTION

- 10.2 SMALL-SIZED HOT ISOSTATIC PRESSING

- 10.2.1 SMALL-SIZED HOT ISOSTATIC PRESSING TO OFFER HIGH PRECISION AND FINE-TUNE PROCESS PARAMETERS IN EARLY-STAGE DEVELOPMENT

- 10.3 MEDIUM-SIZED HOT ISOSTATIC PRESSING

- 10.3.1 MEDIUM-SIZED HOT ISOSTATIC PRESSING TO EXHIBIT BALANCE BETWEEN VOLUME AND CAPABILITY

- 10.4 LARGE-SIZED HOT ISOSTATIC PRESSING

- 10.4.1 LARGE-SIZED HOT ISOSTATIC PRESSING TO DENSIFY LARGE PRODUCTS, REDUCE PER-UNIT PROCESSING COSTS, AND HELP CUSTOMERS GAIN COMPETITIVE ADVANTAGE

11 ISOSTATIC PRESSING MARKET, BY PROCESS TYPE

- 11.1 INTRODUCTION

- 11.2 WET BAG PRESSING

- 11.2.1 NEED FOR HIGH PRODUCTION RATES TO FUEL DEMAND FOR WET BAG AND DRY BAG PRESSING

- 11.3 DRY BAG PRESSING

- 11.3.1 GROWING NEED FOR LIGHTWEIGHT AND STRONG COMPONENTS TO PROPEL MARKET

12 ISOSTATIC PRESSING MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 AUTOMOTIVE

- 12.2.1 HOT ISOSTATIC PRESSING TO HELP CREATE LIGHTWEIGHT AUTOMOBILE PRODUCTS AND DESIGNS

- 12.3 AEROSPACE

- 12.3.1 DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS IN COMMERCIAL AEROSPACE INDUSTRY SUPPORTS EXTENSIVE USE OF HIP

- 12.4 MEDICAL

- 12.4.1 ISOSTATIC PRESSING TO HELP MANUFACTURE HIGH-QUALITY, BIOCOMPATIBLE CERAMIC COMPONENTS

- 12.5 ENERGY & POWER

- 12.5.1 GROWING DEMAND FOR ENERGY, NEED FOR RELIABLE POWER PLANTS, AND DEVELOPMENT OF EFFICIENT MATERIALS TO DRIVE MARKET

- 12.6 ELECTRONICS & SEMICONDUCTOR

- 12.6.1 HOT ISOSTATIC PRESSING-DENSIFIED CASTING TO INCREASE ELECTRONIC EQUIPMENT STRENGTH, FLEXIBILITY, AND FATIGUE LIFE

- 12.7 PRECISION MACHINE MANUFACTURING

- 12.7.1 HOT ISOSTATIC PRESSING TO OFFER CONSISTENCY AND REPEATABILITY AND IMPROVE QUALITY AND PERFORMANCE OF PRECISION MACHINE TOOLS

- 12.8 RESEARCH & DEVELOPMENT

- 12.8.1 RESEARCH & DEVELOPMENT TO GAIN COMPETITIVE ADVANTAGE OVER RIVALS

- 12.9 OTHER END-USE INDUSTRIES

13 ISOSTATIC PRESSING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Growing innovation in isostatic pressing techniques and systems to drive demand

- 13.2.3 CANADA

- 13.2.3.1 Need to reduce manufacturing cost and cycle time in automotive, medical, and energy & power industries to drive market

- 13.2.4 MEXICO

- 13.2.4.1 Rising demand for high-performance materials in aerospace, medical, and other industries to drive market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Increasing investments in advanced material research, including composites and high-tech ceramics, to drive market

- 13.3.3 GERMANY

- 13.3.3.1 Growing adoption of new technologies in automotive industry to drive market

- 13.3.4 FRANCE

- 13.3.4.1 Rising demand for high-performance components in aerospace & defense industry to drive market

- 13.3.5 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Increasing demand for medical implants and devices to drive market

- 13.4.3 JAPAN

- 13.4.3.1 High investments in additive manufacturing and other innovative technologies to drive market

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Government-led R&D investments to boost innovation in isostatic pressing support among local firms to drive market

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 REST OF THE WORLD

- 13.5.1 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

- 13.5.2 SOUTH AMERICA

- 13.5.2.1 Expansion of steel-production facilities to fuel market growth

- 13.5.3 MIDDLE EAST

- 13.5.3.1 GCC countries

- 13.5.3.1.1 Increasing industrialization and need for advanced manufacturing technologies to drive market

- 13.5.3.2 Rest of Middle East

- 13.5.3.2.1 Burgeoning investment in automotive component manufacturing to drive market

- 13.5.3.1 GCC countries

- 13.5.4 AFRICA

- 13.5.4.1 Rising partnerships and collaborations among aircraft and automobile manufacturers to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.3 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint

- 14.7.5.2 Type footprint

- 14.7.5.3 Offering footprint

- 14.7.5.4 End-use industry footprint

- 14.7.5.5 Region footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 14.8.5.1 List of key startups/SMEs

- 14.8.5.2 Type: Startup/SME footprint

- 14.8.5.3 End-use industry: Startup/SME footprint

- 14.8.5.4 Region: Startup/SME footprint

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 KOBE STEEL, LTD.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 BODYCOTE

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.3.2 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 KENNAMETAL INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 NIKKISO CO., LTD.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses and competitive threats

- 15.1.5 DORST TECHNOLOGIES GMBH & CO. KG

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 AMERICAN ISOSTATIC PRESSES, INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Other developments

- 15.1.7 EPSI

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 PRESSURE TECHNOLOGY, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 SHANXI GOLDEN KAIYUAN CO., LTD.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 FLUITRON

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.1 KOBE STEEL, LTD.

- 15.2 OTHER PLAYERS

- 15.2.1 AEGIS TECHNOLOGY

- 15.2.2 AUBERT & DUVAL

- 15.2.3 FREY & CO. GMBH

- 15.2.4 HIPERBARIC

- 15.2.5 HOGANAS

- 15.2.6 ILSHINAUTOCLAVE CO., LTD.

- 15.2.7 INSMART SYSTEMS

- 15.2.8 ISOSTATIC PRESSING SERVICES

- 15.2.9 KITTYHAWK

- 15.2.10 MTC POWDER SOLUTIONS

- 15.2.11 MTI CORPORATION

- 15.2.12 PTC INDUSTRIES LIMITED

- 15.2.13 QUAD CITY MANUFACTURING LAB (QCML)

- 15.2.14 TECHFORM ADVANCED CASTING TECHNOLOGY LLC

- 15.2.15 TIANJIN PACIFIC ULTRA HIGH VOLTAGE EQUIPMENT CO., LTD.

16 ADJACENT MARKET

- 16.1 3D PRINTING MARKET

- 16.2 PRINTERS

- 16.2.1 DESKTOP PRINTERS

- 16.2.1.1 Growing use of desktop printers in schools and universities to drive market

- 16.2.2 INDUSTRIAL PRINTERS

- 16.2.2.1 Rising adoption of industrial printers to generate concept models, precision and functional prototypes, and master patterns and molds to drive market

- 16.2.1 DESKTOP PRINTERS

- 16.3 MATERIALS

- 16.3.1 PLASTICS

- 16.3.1.1 Growing use to create functional prototypes and end-use parts in various verticals to drive demand

- 16.3.1.2 Thermoplastics

- 16.3.1.2.1 Versatility of thermoplastics in 3D printing to fuel demand

- 16.3.1.2.2 Acrylonitrile butadiene styrene (ABS)

- 16.3.1.2.3 Polylactic acid (PLA)

- 16.3.1.2.4 Nylon

- 16.3.1.2.5 Other thermoplastics

- 16.3.1.2.5.1 Polypropylene

- 16.3.1.2.5.2 Polycarbonate

- 16.3.1.2.5.3 Polyvinyl alcohol (PVA)

- 16.3.1.3 Photopolymers

- 16.3.1.3.1 Rising use of photopolymers in electronics, healthcare, packaging, sports and leisure, automotive, military, and consumer goods verticals to drive market

- 16.3.2 METALS

- 16.3.2.1 Steel

- 16.3.2.1.1 Capability of stainless steel to strengthen 3D-printed models to drive demand

- 16.3.2.2 Aluminum

- 16.3.2.2.1 Rising adoption of alumide to build complex models, small series of models, and functional models to drive market

- 16.3.2.3 Titanium

- 16.3.2.3.1 Growing use of titanium powder to make models strong and precise to drive market

- 16.3.2.4 Nickel

- 16.3.2.4.1 Increasing demand for metal alloys in aerospace & defense vertical to manufacture rocket parts, gas turbine blades, filtration and separation units, and heat exchangers to drive market

- 16.3.2.5 Other metals

- 16.3.2.1 Steel

- 16.3.3 CERAMICS

- 16.3.3.1 Growing adoption of ceramics in printing home decor and tableware products to drive demand

- 16.3.4 OTHER MATERIALS

- 16.3.4.1 Wax

- 16.3.4.2 Laywood

- 16.3.4.3 Paper

- 16.3.4.4 Biocompatible materials

- 16.3.5 3D PRINTING MARKET FOR MATERIALS, BY FORM

- 16.3.5.1 Filament

- 16.3.5.1.1 Availability of general plastics in filament form for 3D printing applications to drive demand

- 16.3.5.2 Powder

- 16.3.5.2.1 Use of metal powers in aerospace & defense, jewelry, and fashion design verticals to drive market

- 16.3.5.3 Liquid

- 16.3.5.3.1 Diversity of liquid materials in 3D printing technology used in various verticals to drive market

- 16.3.5.1 Filament

- 16.3.1 PLASTICS

- 16.4 SOFTWARE

- 16.4.1 ABILITY TO MANIPULATE 3D MODELS ACCORDING TO REAL-WORLD ENVIRONMENTS BEFORE PRINTING TO DRIVE DEMAND

- 16.4.2 DESIGN

- 16.4.2.1 Increasing installation of design software to create drawings of parts and assemblies to drive market

- 16.4.3 INSPECTION

- 16.4.3.1 Development of inspection software to ensure compliance of prototypes with required specifications to fuel market growth

- 16.4.4 PRINTING

- 16.4.4.1 Use of printing software to analyze precision in printer functioning to drive market

- 16.4.5 SCANNING

- 16.4.5.1 Implementation of scanning software to create digital models and improve designs of physical objects to fuel market growth

- 16.5 SERVICES

- 16.5.1 CUSTOMIZATION AND ON-DEMAND MANUFACTURING IN 3D PRINTING TO DRIVE DEMAND

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS