|

|

市場調査レポート

商品コード

1342758

園芸用照明の世界市場:設置タイプ別、照明タイプ別、提供別、栽培タイプ別、技術別、用途別、地域別 - 予測(~2028年)Horticulture Lighting Market by Installation type, Lighting Type, Offering, Cultivation Type, Technology, Application, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 園芸用照明の世界市場:設置タイプ別、照明タイプ別、提供別、栽培タイプ別、技術別、用途別、地域別 - 予測(~2028年) |

|

出版日: 2023年08月29日

発行: MarketsandMarkets

ページ情報: 英文 257 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の園芸用照明の市場規模は、2023年に37億米ドル、2028年までに104億米ドルに達し、2023年~2028年にCAGRで22.4%の成長が予測されています。

予測期間中、LEDがもっとも高いCAGRで成長する見込みです。

エコフレンドリー目標に後押しされ、世界中の政府が屋内植物栽培にLEDを推奨し、固体照明(SSL)技術を推進しています。これにより、CEA施設におけるLEDの採用が促進され、園芸用照明におけるLEDの潜在性が高まっています。現在進行中の研究開発では、SSLシステムがより手頃な価格になるよう努力しています。

園芸用照明の用途セグメントにおいて、温室が予測期間にもっとも高い市場シェアを持つと予測されます。

予測期間中、アジア太平洋がもっとも高いCAGRで成長する見込みです。

2022年、アジア太平洋は市場で26%のシェアを占めました。アジア太平洋市場は、2023年~2028年にCAGRで26.4%の成長が見込まれています。この成長は、人口の急増、食料需要の増加、年間を通じた新鮮な農産物の生産に向けたCEA(Controlled Environment Agriculture)のような先進の農法の採用によって牽引されています。限られた資源で農業生産高を向上させ、予測不可能な気候変動から作物を守らなければならないというプレッシャーも、アジア太平洋において園芸用照明の採用を後押ししています。

当レポートでは、世界の園芸用照明市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 園芸用照明市場の企業にとっての魅力的な機会

- 園芸用照明市場:提供別

- 園芸用照明市場:設置タイプ別

- 園芸用照明市場:照明タイプ別

- 園芸用照明市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 研究開発

- 製品メーカー

- システムインテグレーター

- マーケティング、販売

- 最終用途産業

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- ポーターのファイブフォース分析

- 特許分析

- 貿易分析

- 価格分析

- ケーススタディ分析

- 規制情勢

- 主な会議とイベント(2023年~2024年)

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 主な購入基準

第6章 園芸用照明市場:設置タイプ別

- イントロダクション

- 新規設置

- 後付け設置

第7章 園芸用照明市場:照明タイプ別

- イントロダクション

- トップライティング

- インターライティング

第8章 園芸用照明市場:提供別

- イントロダクション

- ハードウェア

- 照明器具

- 照明制御

- ソフトウェア、サービス

第9章 園芸用照明市場:栽培タイプ別

- イントロダクション

- 果物、野菜

- 花卉栽培

- 大麻

第10章 園芸用照明市場:技術別

- イントロダクション

- 蛍光灯

- T5蛍光灯

- コンパクト蛍光ランプ(CFL)

- 高輝度放電(HID)

- 高圧ナトリウム(HPS)ランプ

- メタルハライド(MH)ランプ

- HPSとMH園芸用ランプの比較

- 発光ダイオード(LED)

- その他

第11章 園芸用照明市場:用途別

- イントロダクション

- 温室

- 垂直農場

- 屋内農場

- その他

第12章 園芸用照明市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 北米の園芸用照明市場に対する景気後退の影響

- 欧州

- 英国

- ドイツ

- オランダ

- スカンジナビア

- その他の欧州

- 欧州の園芸用照明市場に対する不況の影響

- アジア太平洋

- 中国

- 日本

- 東南アジア

- オーストラリア

- その他のアジア太平洋

- アジア太平洋の園芸用照明市場に対する不況の影響

- その他の地域

- 南米

- 中東・アフリカ

- その他の地域の園芸用照明市場に対する不況の影響

第13章 競合情勢

- 概要

- 主要企業が採用した主要戦略

- 市場シェアとランキング分析(2022年)

- 企業の収益分析(2018年~2022年)

- 企業の評価マトリクス(2022年)

- 競合ベンチマーキング

- スタートアップ/中小企業(SME)の評価マトリクス(2022年)

- 主なスタートアップ/中小企業のリスト

- 競合ベンチマーキング

- 競合シナリオと動向

第14章 企業プロファイル

- イントロダクション

- 主要企業

- SIGNIFY HOLDING (PHILIPS LIGHTING)

- GAVITA INTERNATIONAL B.V.

- HELIOSPECTRA

- AMS-OSRAM INTERNATIONAL GMBH

- CALIFORNIA LIGHTWORKS

- VALOYA

- HORTILUX SCHREDER

- ILUMINAR LIGHTING

- CURRENT LIGHTING SOLUTIONS, LLC.

- GE LIGHTING (SAVANT TECHNOLOGIES LLC.)

- その他の企業

- ACUITY BRANDS, INC.

- LUMILEDS HOLDING B.V.

- CREE LED, AN SGH COMPANY

- TCP LIGHTING

- PARSOURCE

- ECONOLUX INDUSTRIES LTD.

- OREON

- GLACIALLIGHT-DIVISION OF GLACIALTECH INC.

- BLACK DOG HORTICULTURE TECHNOLOGIES & CONSULTING

- VIPARSPECTRA

- ACTIVE GROW

- AGNETIX

- THRIVE AGRITECH

- BRIDGELUX, INC.

- KROPTEK

第15章 付録

The horticulture lighting market is expected to reach USD 10.4 billion by 2028 from USD 3.7 billion in 2023, at a CAGR of 22.4% during the 2023-2028 period. Horticulture lighting technology has the ability to offer customizable light spectra, tailored to meet the specific requirements of diverse plant species and various growth stages. This level of precision and customization has transformed the way plants are cultivated, as it allows growers to create an ideal light environment for each crop, leading to optimized plant growth and faster maturation processes. In traditional farming methods, plants rely solely on natural sunlight, which may not always provide the ideal spectrum of light for optimal growth. Horticulture lighting addresses this limitation by utilizing light-emitting diodes (LEDs) that can produce light across a wide range of wavelengths. This flexibility allows growers to select and fine-tune the light spectrum best suited to the specific needs of their crops.

Different plant species have varying light requirements, and even within a single plant's life cycle, their lighting needs can change. For instance, young seedlings may require more blue light to promote strong root and shoot development, while mature plants may benefit from an increased amount of red light to support flowering and fruiting. With customizable light spectra, horticulture lighting systems can be adjusted to provide the appropriate light ratios for each growth stage, ensuring plants receive the exact wavelengths they need at each developmental phase.

By fine-tuning the light spectra, horticulture lighting promotes photosynthesis, the process by which plants convert light into energy for growth. Providing the right combination of colors ensures that photosynthesis occurs at its maximum efficiency, leading to improved biomass production and healthier, more vigorous plants. Moreover, with the ability to manipulate light spectra, growers can influence various plant characteristics, such as flavor, color, and nutritional content. For example, specific light spectra can enhance the production of certain compounds, like antioxidants or essential oils, which contribute to the taste and nutritional value of fruits, vegetables, and herbs.

The application of customizable light spectra is particularly valuable in indoor farming and controlled environment agriculture settings, where natural sunlight may be limited or inconsistent. By precisely tailoring the light conditions to match the exact requirements of the crops being cultivated, horticulture lighting ensures a consistent and predictable growth environment, resulting in better yields and crop quality.

LED is expected to grow at the highest CAGR during the forecast period

Solid-state light sources like LEDs and OLEDs are modern lighting solutions, with LEDs often referred to as the fourth generation of artificial lighting. LEDs are semiconductors converting electricity to light through electron movement. Equipped with heat sinks and fans, LED grow lights emit minimal heat, allowing close placement to plants. They provide optimal light for plant growth, aiding photosynthesis and offering control over plant morphology through spectrum adjustments.

Advanced LED grow lights offer adjustable spectra, suited to plant growth stages. They surpass traditional lighting in efficiency, with up to 60% electro-optical conversion efficiency, outperforming HPS and fluorescent lamps. LED longevity is nearly 50,000 hours, consuming 50% less energy than fluorescent and 85% less than incandescent lights. Resistant to shocks and moisture, LEDs suit controlled environment agriculture (CEA) settings. Their efficiency, durability, and environmental compatibility make them a key choice in greenhouses and indoor farms.

Driven by eco-friendly goals, governments worldwide endorse LEDs for indoor plant growth, promoting solid-state lighting (SSL) technology. This boosts LED adoption in CEA facilities and enhances their potential in horticultural lighting. Ongoing research and development strive to make SSL systems more affordable.

Many companies have introduced LED, horticulture lighting products such as in December 2022, Signify Holding (Phillips Lighting) introduces 1,040-watt Philips HPS light fixture for a low-maintenance, hybrid light installation in combination with Philips GreenPower LED toplighting. And in March 2022, Signify Holding (Phillips Lighting) introduces Philips GreenPower LED gridlighting to steer uniform bud development and increase yield of top-shelf flowers. It provides optimal light intensity during each growth phase with rotary dimming.

Greenhouses in horticulture lighting application segment is expected to have the heightest market share in the forecast period.

Greenhouses serve as sheltered environments to optimize crop growth and yield. They transcend geographic and climatic constraints, ensuring consistent conditions year-round. These structures harness natural sunlight and humidity to nurture a variety of plants, either soil-based or through hydroponics. Greenhouses offer water efficiency, uniform light distribution via LED grow lights, and controlled temperature and humidity. Smart greenhouses, enabled by sensors and automation, revolutionize agriculture. They tailor microclimates for plants. Hydroponic and non-hydroponic setups define greenhouse categories. Smart greenhouses, including LED technology, enhance crop production efficiency. Europe's shift away from older technologies boosts LED horticulture lighting.

Supplemental horticulture lights address limited daylight, propelling yield growth. LED lights outshine metal halide and high-pressure sodium lamps. Gotham Greens and OSRAM exemplify innovative greenhouse solutions. Automation reduces labor dependency and drives production efficiency.

Almeria, Spain, underscores greenhouse economic significance. The province dominates Spain's horticultural greenhouse landscape. Notably, AppHarvest secured $91 million to support its Kentucky facility, emphasizing sustainability. Agroinvest in Russia, with a vast greenhouse complex, contributes to local vegetable self-sufficiency. In 2021, AppHarvest secured USD 91 million from Equlibrium Capital for its Kentucky facility. Agroinvest in Russia operates a substantial greenhouse complex, aiding regional vegetable self-sufficiency.

During the forecast period, the Asia Pacific region is expected to grow at the highest CAGR.

In 2022, Asia Pacific held a ~ 26% share of the horticulture lighting market. This market segment includes China, Japan, Southeast Asia, Australia, and the Rest of Asia Pacific. Anticipated growth for Asia Pacific's horticulture lighting market is marked by a 26.4% CAGR from 2023 to 2028. This trajectory is driven by the region's burgeoning population, escalating food demand, and the adoption of advanced farming methods like Controlled Environment Agriculture (CEA) for year-round fresh produce. The pressure to enhance agricultural yields with limited resources and safeguard crops against unpredictable climate changes also bolsters horticulture lighting adoption in Asia Pacific.

In July 2021, Heliospectra AB, a world leader in intelligent lighting technology for vertical farming, announced a new seller partnership with MineARC Systems, a global leader in manufacturing and supplying controlled environments. The company will represent Heliospectra's market-leading LED lighting and lighting control solutions in the Australian market.

The break-up of the profile of primary participants in the horticulture lighting market-

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation Type: C Level - 40%, Director Level - 35%, Others - 25%

- By Region Type: North America- 40%, Asia Pacific - 30%, Europe - 20%, RoW - 10%,

The major players in the horticulture lighting market with a significant global presence include Signify Holding (Phillips Lighting) (Netherlands), Gavita International B.V.(Netherlands), Heliospectra(Sweden), ams-OSRAM International GmbH(Austria), California LightWorks(US), Valoya (Finland), Hortilux Schreder(Netherlands), ILUMINAR Lighting(US), Current Lighting Solutions, LLC.(US), GE Lighting (SAVANT TECHNOLOGIES LLC.)(US), ACUITY BRANDS, INC.(US), Lumileds Holding B.V.(Netherlands), Cree LED an SGH company(US), TCP Lighting(US), PARsource(US), EconoLux Industries Ltd.(China), Oreon (Netherlands), GlacialLight - Division of GlacialTech Inc.(Taiwan), Black Dog Horticulture Technologies & Consulting(US), ViparSpectra(US), Active Grow(US), Agnetix(US), Thrive Agritech(US), Bridgelux, Inc.(US), and Kroptek(UK).

Research Coverage

The report segments the horticulture lighting market and forecasts its size based and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall horticulture lighting market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Controlled environment agriculture (CEA) practices and the adoption of SSL technology receive robust backing from governments), restraints (High installation and setup cost), opportunities (Integration with sustainable architecture), and challenges (Limited regulations and standards) influencing the growth of the horticulture lighting market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the horticulture lighting market

- Market Development: Comprehensive information about lucrative markets - the report analyses the horticulture lighting market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the horticulture lighting market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Signify Holding (Phillips Lighting) (Netherlands), Gavita International B.V.(Netherlands), Heliospectra(Sweden), ams-OSRAM International GmbH(Austria), and California LightWorks(US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 HORTICULTURE LIGHTING MARKET SEGMENTATION

- 1.3.2 GEOGRAPHICAL SCOPE

- FIGURE 2 HORTICULTURE LIGHTING MARKET: GEOGRAPHICAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 HORTICULTURE LIGHTING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary research

- 2.1.1.2 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key participants for primary interviews

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE GENERATED BY KEY HORTICULTURE LIGHTING PROVIDERS (SUPPLY SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF REVENUE ESTIMATION OF KEY MARKET PLAYER (SUPPLY SIDE)

- 2.2.1 MARKET SIZE ESTIMATION APPROACH: IDENTIFICATION OF COMPANIES OFFERING HORTICULTURE LIGHTING EQUIPMENT

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP ESTIMATION, BY REGION (DEMAND SIDE)

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to derive market size using bottom-up analysis

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- 2.2.3.1 Approach to derive market size using top-down analysis

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 RISK ASSESSMENT

- TABLE 1 RISK FACTOR ANALYSIS

- 2.6 APPROACH TO ANALYZE IMPACT OF RECESSION ON HORTICULTURE LIGHTING MARKET

- 2.7 RESEARCH ASSUMPTIONS

- FIGURE 10 ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- FIGURE 11 LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 IMPACT OF RECESSION

- FIGURE 12 HORTICULTURE LIGHTING MARKET: IMPACT OF RECESSION

- FIGURE 13 LED SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- FIGURE 14 GREENHOUSES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- FIGURE 15 FRUITS AND VEGETABLES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- FIGURE 16 HORTICULTURE LIGHTING MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HORTICULTURE LIGHTING MARKET

- FIGURE 17 GROWING ADOPTION OF CONTROLLED ENVIRONMENT AGRICULTURAL PRACTICES IN URBAN AREAS

- 4.2 HORTICULTURE LIGHTING MARKET, BY OFFERING

- FIGURE 18 HARDWARE SEGMENT TO ACCOUNT FOR LARGER SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- 4.3 HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE

- FIGURE 19 RETROFIT INSTALLATIONS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- 4.4 HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE

- FIGURE 20 TOPLIGHTING SEGMENT TO ACCOUNT FOR LARGER SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- 4.5 HORTICULTURE LIGHTING MARKET, BY COUNTRY

- FIGURE 21 SOUTHEAST ASIA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 HORTICULTURE LIGHTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of sustainable year-round crop production practices

- 5.2.1.2 Optimization of plant growth using customizable light spectra

- 5.2.1.3 Government-led initiatives to promote controlled environment agriculture (CEA) practices

- 5.2.1.4 Optimization of space for agricultural practices amidst arable land scarcity

- 5.2.1.5 Rising investments in modern agricultural techniques

- 5.2.1.6 Widespread adoption of LED fixtures as reliable lighting source

- 5.2.1.7 Adoption of artificial lighting to enhance energy efficiency

- FIGURE 23 HORTICULTURE LIGHTING MARKET: DRIVERS AND THEIR IMPACT

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and setup costs

- 5.2.2.2 Navigation of complex light spectrum for crop cultivation

- 5.2.2.3 High energy consumption

- FIGURE 24 HORTICULTURE LIGHTING MARKET: RESTRAINTS AND THEIR IMPACT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging trend of farm-to-table concept

- 5.2.3.2 Growing prospects for vertical farming in Asian and Middle Eastern markets

- 5.2.3.3 Availability of weather-resilient solutions for crop production

- 5.2.3.4 Prominence of horticulture lighting software and calculators

- 5.2.3.5 Expansion of home gardening market

- 5.2.3.6 Integration of sustainable architecture

- FIGURE 25 HORTICULTURE LIGHTING MARKET: OPPORTUNITIES AND THEIR IMPACT

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited regulations and standards

- 5.2.4.2 Shortage of large-scale technical expertise

- 5.2.4.3 Need for standardized testing for product quality assessment

- 5.2.4.4 Complexities associated with integration of components and technologies into advanced agriculture facilities

- FIGURE 26 HORTICULTURE LIGHTING MARKET: CHALLENGES AND THEIR IMPACT

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 27 HORTICULTURE LIGHTING MARKET: VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH AND DEVELOPMENT

- 5.3.2 PRODUCT MANUFACTURERS

- 5.3.3 SYSTEM INTEGRATORS

- 5.3.4 MARKETING AND SALES

- 5.3.5 END-USER INDUSTRIES

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN HORTICULTURE LIGHTING MARKET

- 5.5 ECOSYSTEM ANALYSIS

- TABLE 2 COMPANIES AND THEIR ROLE IN HORTICULTURE LIGHTING ECOSYSTEM

- FIGURE 29 HORTICULTURE LIGHTING MARKET: ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 SOLID-STATE LIGHTING TECHNOLOGY

- 5.6.2 FULL-SPECTRUM LED GROW LIGHTING SYSTEM

- 5.6.3 CENTRALIZED POWER SUPPLY

- 5.6.4 ADVANCED UV-LED TECHNOLOGY

- 5.6.5 SMART LIGHTING SOLUTIONS

- 5.6.6 LIGHTING SYSTEMS WITH INTERNET OF THINGS (IOT)

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 IMPACT ANALYSIS OF PORTER'S FIVE FORCES

- TABLE 3 HORTICULTURE LIGHTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.7.2 THREAT OF NEW ENTRANTS

- 5.7.3 THREAT OF SUBSTITUTES

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 BARGAINING POWER OF SUPPLIERS

- 5.8 PATENT ANALYSIS

- 5.8.1 DOCUMENT TYPE

- TABLE 4 PATENTS FILED

- FIGURE 31 PATENTS FILED, 2013-2022

- 5.8.2 PUBLICATION TREND

- FIGURE 32 NUMBER OF PATENTS PUBLISHED, 2013-2022

- 5.8.3 JURISDICTION ANALYSIS

- FIGURE 33 JURISDICTION ANALYSIS

- 5.8.4 TOP PATENT OWNERS

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PUBLISHED PATENT APPLICATIONS, 2013-2022

- TABLE 5 TOP 20 PUBLISHED PATENT OWNERS IN LAST 10 YEARS

- 5.9 TRADE ANALYSIS

- FIGURE 35 COUNTRY-WISE EXPORT DATA FOR PRODUCTS UNDER HS CODE 9405, 2018-2022 (USD THOUSAND)

- TABLE 6 EXPORT SCENARIO FOR HS CODE: 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 36 COUNTRY-WISE IMPORT DATA FOR PRODUCTS UNDER HS CODE 9405, 2018-2022 (USD THOUSAND)

- TABLE 7 IMPORT SCENARIO FOR HS CODE: 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE (ASP) OF PRODUCTS OFFERED BY TWO KEY PLAYERS, BY TECHNOLOGY

- TABLE 8 AVERAGE SELLING PRICE (ASP) OF PRODUCTS OFFERED BY TOP TWO PLAYERS, BY TECHNOLOGY (USD)

- 5.10.2 AVERAGE SELLING PRICE (ASP) TREND FOR FLUORESCENT, HIGH-INTENSITY DISCHARGE (HID), AND LIGHT-EMITTING DIODE (LED), 2019-2028

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 TOPLINE GERBERA ACHIEVED REMARKABLE ENERGY SAVINGS AND ENHANCED FLOWER QUALITY USING PHILIPS HORTICULTURE LED SOLUTIONS

- 5.11.2 SIGNIFY HOLDING WITH BAIYI YINONG INTERNATIONAL FLOWER PORT HELPED CHINA REVOLUTIONIZE ROSE PRODUCTION

- 5.11.3 HELIOSPECTRA PROVIDED CUTTING-EDGE SMART LED LIGHT SOLUTIONS TO NORTH AMERICAN AGTECH TO TRANSFORM AGRICULTURAL LANDSCAPE

- 5.11.4 SIGNIFY HOLDING HELPED GOODLEAF COMMUNITY FARMS ENHANCE FOOD PRODUCTION CAPABILITIES

- 5.12 REGULATORY LANDSCAPE

- TABLE 9 HORTICULTURE LIGHTING MARKET: REGULATORY FRAMEWORK

- 5.12.1 REGIONAL REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

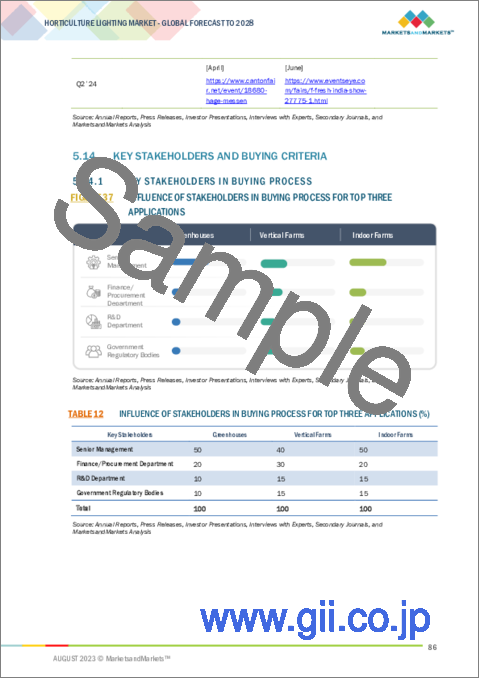

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.14.2 KEY BUYING CRITERIA

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE

- 6.1 INTRODUCTION

- FIGURE 38 RETROFIT INSTALLATIONS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 14 HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019-2022 (USD MILLION)

- TABLE 15 HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023-2028 (USD MILLION)

- 6.2 NEW INSTALLATIONS

- 6.2.1 RISING ADOPTION OF VERTICAL FARMING TO FUEL SEGMENTAL GROWTH

- TABLE 16 NEW INSTALLATIONS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 17 NEW INSTALLATIONS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 RETROFIT INSTALLATIONS

- 6.3.1 INCREASED INSTALLATION OF RETROFITTING LIGHT FIXTURES TO BOOST MARKET GROWTH

- TABLE 18 RETROFIT INSTALLATIONS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 19 RETROFIT INSTALLATIONS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

7 HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE

- 7.1 INTRODUCTION

- FIGURE 39 INTERLIGHTING SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 20 HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019-2022 (USD MILLION)

- TABLE 21 HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023-2028 (USD MILLION)

- 7.2 TOPLIGHTING

- 7.2.1 ADOPTION OF TOPLIGHTING IN CONTROLLED ENVIRONMENT AGRICULTURE (CEA) FACILITIES TO BOOST SEGMENTAL GROWTH

- TABLE 22 TOPLIGHTING: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 TOPLIGHTING: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 INTERLIGHTING

- 7.3.1 GROWING DEMAND FOR INTERLIGHTING IN COMMERCIAL GREENHOUSES TO DRIVE MARKET

- TABLE 24 INTERLIGHTING: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 INTERLIGHTING: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

8 HORTICULTURE LIGHTING MARKET, BY OFFERING

- 8.1 INTRODUCTION

- FIGURE 40 SOFTWARE & SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 26 HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 27 HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 8.2 HARDWARE

- 8.2.1 LIGHTING FIXTURES

- 8.2.1.1 Growing need for effective commercial operations to boost adoption

- 8.2.2 LIGHTING CONTROLS

- 8.2.2.1 Adoption of lighting controls to regulate light levels in CEA facilities to drive market

- TABLE 28 HARDWARE: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 HARDWARE: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 HORTICULTURE LIGHTING MARKET, BY HARDWARE TYPE, 2019-2022 (USD MILLION)

- TABLE 31 HORTICULTURE LIGHTING MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- 8.2.1 LIGHTING FIXTURES

- 8.3 SOFTWARE AND SERVICES

- 8.3.1 ADOPTION OF HORTICULTURE LIGHTING SOFTWARE AND SERVICES TO DRIVE SEGMENTAL GROWTH

- TABLE 32 SOFTWARE & SERVICES: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 SOFTWARE & SERVICES: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

9 HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE

- 9.1 INTRODUCTION

- FIGURE 41 FRUITS AND VEGETABLES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- TABLE 34 HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019-2022 (USD MILLION)

- TABLE 35 HORTICULTURE LIGHTING MARKE, BY CULTIVATION TYPE, 2023-2028 (USD MILLION)

- 9.2 FRUITS AND VEGETABLES

- 9.2.1 INCREASING DEMAND FOR ORGANIC FRUITS AND VEGETABLES TO BOOST ADOPTION OF HORTICULTURE LIGHTING IN VERTICAL FARMS AND GREENHOUSES

- TABLE 36 FRUITS AND VEGETABLES: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 FRUITS AND VEGETABLES: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 FLORICULTURE

- 9.3.1 NEED TO FACILITATE CORRECT LIGHT RATIO TO REDUCE FLOWERING TIME AND INCREASE FLOWER PRODUCTION TO DRIVE DEMAND

- TABLE 38 FLORICULTURE: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 FLORICULTURE: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 CANNABIS

- 9.4.1 ADOPTION OF BLUE LIGHTS TO ENSURE EFFECTIVE CANNABIS PLANT GROWTH TO DRIVE MARKET

- TABLE 40 CANNABIS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 CANNABIS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

10 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- FIGURE 42 LED SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- TABLE 42 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 43 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 44 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019-2022 (THOUSAND UNITS)

- TABLE 45 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023-2028 (THOUSAND UNITS)

- 10.2 FLUORESCENT

- 10.2.1 T5 FLUORESCENT LIGHTS

- 10.2.1.1 Rising need for efficiency in indoor cultivation to drive demand for T5 fluorescent lights

- 10.2.2 COMPACT FLUORESCENT LAMP (CFL)

- 10.2.2.1 Increasing adoption of compact fluorescent lamps attributed to adaptability and cost-effectiveness to drive market

- TABLE 46 FLUORESCENT: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 47 FLUORESCENT: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.1 T5 FLUORESCENT LIGHTS

- 10.3 HIGH-INTENSITY DISCHARGE (HID)

- 10.3.1 HIGH-PRESSURE SODIUM (HPS) LAMPS

- 10.3.1.1 Rising adoption of high-pressure sodium lamps in greenhouse settings to support market growth

- 10.3.2 METAL-HALIDE (MH) LAMPS

- 10.3.2.1 Adoption of metal-halide lamps to boost initial vegetative stage of plant growth to drive market

- 10.3.3 COMPARISON BETWEEN HPS AND MH HORTICULTURE LAMPS

- TABLE 48 HID: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 49 HID: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.1 HIGH-PRESSURE SODIUM (HPS) LAMPS

- 10.4 LIGHT-EMITTING DIODE (LED)

- 10.4.1 DEMAND FOR LED LIGHTS IN INDOOR FARMING TO DRIVE SEGMENTAL GROWTH

- TABLE 50 LED: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 51 LED: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5 OTHERS

- TABLE 52 OTHERS: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 53 OTHERS: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

11 HORTICULTURE LIGHTING MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 43 VERTICAL FARMS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- TABLE 54 HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 55 HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2 GREENHOUSES

- 11.2.1 UTILIZATION OF HORTICULTURE LIGHTS IN GREENHOUSES TO INCREASE CROP YIELD TO DRIVE MARKET

- TABLE 56 GREENHOUSES: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 57 GREENHOUSES: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY 2023-2028 (USD MILLION)

- TABLE 58 GREENHOUSES: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 GREENHOUSES: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 VERTICAL FARMS

- 11.3.1 INCREASED DEMAND FOR HORTICULTURE LIGHTING IN VERTICAL FARMS TO DRIVE SEGMENTAL GROWTH

- TABLE 60 VERTICAL FARMS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 61 VERTICAL FARMS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 62 VERTICAL FARMS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 VERTICAL FARMS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.2 RECENT DEVELOPMENTS IN VERTICAL FARMING MARKET, BY REGION

- TABLE 64 DEVELOPMENTS IN NORTH AMERICAN VERTICAL FARMING MARKET

- TABLE 65 DEVELOPMENTS IN EUROPEAN VERTICAL FARMING MARKET

- TABLE 66 DEVELOPMENTS IN ASIA PACIFIC VERTICAL FARMING MARKET

- TABLE 67 DEVELOPMENTS IN ROW VERTICAL FARMING MARKET

- 11.4 INDOOR FARMS

- 11.4.1 INCREASING FOCUS ON INFRASTRUCTURE DEVELOPMENT TO SUPPORT MARKET GROWTH

- TABLE 68 INDOOR FARMS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 69 INDOOR FARMS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 70 INDOOR FARMS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 INDOOR FARMS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 OTHERS

- TABLE 72 OTHERS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 73 OTHERS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 74 OTHERS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 OTHERS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

12 HORTICULTURE LIGHTING MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 44 HORTICULTURE LIGHTING, BY REGION

- FIGURE 45 ASIA PACIFIC TO RECORD HIGHEST CAGR IN HORTICULTURE LIGHTING MARKET DURING FORECAST PERIOD

- TABLE 76 HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: HORTICULTURE LIGHTING MARKET SNAPSHOT

- TABLE 78 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Increased adoption of vertical farms and greenhouses to support market growth

- 12.2.2 CANADA

- 12.2.2.1 Presence of challenging climatic conditions to increase adoption of horticulture lighting

- 12.2.3 MEXICO

- 12.2.3.1 Increasing adoption of controlled agricultural practices to drive market

- 12.2.4 RECESSION IMPACT ON HORTICULTURE LIGHTING MARKET IN NORTH AMERICA

- 12.3 EUROPE

- FIGURE 47 EUROPE: HORTICULTURE LIGHTING MARKET SNAPSHOT

- TABLE 90 EUROPE: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 91 EUROPE: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 92 EUROPE: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 93 EUROPE: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019-2022 (USD MILLION)

- TABLE 95 EUROPE: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023-2028 (USD MILLION)

- TABLE 96 EUROPE: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019-2022 (USD MILLION)

- TABLE 99 EUROPE: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023-2028 (USD MILLION)

- TABLE 100 EUROPE: HORTICULTURE LIGHTING MARKET, BY COUNTRY 2019-2022 (USD MILLION)

- TABLE 101 EUROPE: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.1 UK

- 12.3.1.1 Emerging vertical farms and greenhouses to stimulate market growth

- 12.3.2 GERMANY

- 12.3.2.1 Adoption of advanced farming techniques to fuel demand

- 12.3.3 NETHERLANDS

- 12.3.3.1 Presence of leading horticulture lighting providers to drive market

- 12.3.4 SCANDINAVIA

- 12.3.4.1 Rising focus on minimizing fresh fruit and vegetable imports to increase demand

- 12.3.5 REST OF EUROPE

- 12.3.6 RECESSION IMPACT ON HORTICULTURE LIGHTING MARKET IN EUROPE

- 12.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET SNAPSHOT

- TABLE 102 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019-2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023-2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019-2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2023-2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.1 CHINA

- 12.4.1.1 Increasing adoption of Controlled Environment Agriculture (CEA) practices to drive market

- 12.4.2 JAPAN

- 12.4.2.1 Growing adaption of urban agriculture to support market growth

- 12.4.3 SOUTHEAST ASIA

- 12.4.3.1 Government-led initiatives and scarcity of natural resources to drive demand

- 12.4.4 AUSTRALIA

- 12.4.4.1 Legalization of cannabis cultivation to drive demand

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.6 RECESSION IMPACT ON HORTICULTURE LIGHTING MARKET IN ASIA PACIFIC

- 12.5 ROW

- FIGURE 49 ROW HORTICULTURE LIGHTING MARKET, BY REGION

- TABLE 114 ROW: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 115 ROW: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 116 ROW: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 117 ROW: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 118 ROW: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019-2022 (USD MILLION)

- TABLE 119 ROW: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023-2028 (USD MILLION)

- TABLE 120 ROW: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019-2022 (USD MILLION)

- TABLE 121 ROW: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2023-2028 (USD MILLION)

- TABLE 122 ROW: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019-2022 (USD MILLION)

- TABLE 123 ROW: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023-2028 (USD MILLION)

- TABLE 124 ROW: HORTICULTURE LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 125 ROW: HORTICULTURE LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.5.1 SOUTH AMERICA

- 12.5.1.1 Growing installation of vertical farms by startups to support market growth

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Rising focus on sustainable food production to boost market growth

- 12.5.3 RECESSION IMPACT ON HORTICULTURE LIGHTING MARKET IN ROW

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- FIGURE 50 HORTICULTURE LIGHTING MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2021-2023

- 13.3 MARKET SHARE AND RANKING ANALYSIS, 2022

- TABLE 126 HORTICULTURE LIGHTING MARKET: DEGREE OF COMPETITION

- FIGURE 51 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2022

- 13.4 COMPANY REVENUE ANALYSIS, 2018-2022

- FIGURE 52 REVENUE ANALYSIS OF THREE KEY COMPANIES, 2018-2022

- 13.5 COMPANY EVALUATION MATRIX, 2022

- FIGURE 53 HORTICULTURE LIGHTING MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.6 COMPETITIVE BENCHMARKING

- TABLE 127 COMPANY FOOTPRINT

- TABLE 128 APPLICATION: COMPANY FOOTPRINT

- TABLE 129 REGION: COMPANY FOOTPRINT

- 13.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- FIGURE 54 HORTICULTURE LIGHTING (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.8 LIST OF KEY STARTUPS/SMES

- TABLE 130 HORTICULTURE LIGHTING MARKET: LIST OF KEY STARTUPS/SMES

- 13.9 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 131 HORTICULTURE LIGHTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.10 COMPETITIVE SCENARIOS AND TRENDS

- 13.10.1 PRODUCT LAUNCHES

- TABLE 132 HORTICULTURE LIGHTING MARKET: PRODUCT LAUNCHES, 2020-2023

- 13.10.2 DEALS

- TABLE 133 HORTICULTURE LIGHTING MARKET: DEALS, 2020-2023

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 14.2.1 SIGNIFY HOLDING (PHILIPS LIGHTING)

- TABLE 134 SIGNIFY HOLDING (PHILLIPS LIGHTING): COMPANY OVERVIEW

- FIGURE 55 SIGNIFY HOLDING (PHILLIPS LIGHTING): COMPANY SNAPSHOT

- TABLE 135 SIGNIFY HOLDING (PHILLIPS LIGHTING): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 SIGNIFY HOLDING (PHILLIPS LIGHTING): PRODUCT LAUNCHES

- TABLE 137 SIGNIFY HOLDING (PHILLIPS LIGHTING): DEALS

- TABLE 138 SIGNIFY HOLDING (PHILLIPS LIGHTING): OTHERS

- 14.2.2 GAVITA INTERNATIONAL B.V.

- TABLE 139 GAVITA INTERNATIONAL B.V.: COMPANY OVERVIEW

- TABLE 140 GAVITA INTERNATIONAL B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 GAVITA INTERNATIONAL B.V.: OTHERS

- 14.2.3 HELIOSPECTRA

- TABLE 142 HELIOSPECTRA: COMPANY OVERVIEW

- FIGURE 56 HELIOSPECTRA: COMPANY SNAPSHOT

- TABLE 143 HELIOSPECTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 HELIOSPECTRA: PRODUCT LAUNCHES

- TABLE 145 HELIOSPECTRA: DEALS

- TABLE 146 HELIOSPECTRA: OTHERS

- 14.2.4 AMS-OSRAM INTERNATIONAL GMBH

- TABLE 147 AMS-OSRAM INTERNATIONAL GMBH: COMPANY OVERVIEW

- FIGURE 57 AMS-OSRAM INTERNATIONAL GMBH: COMPANY SNAPSHOT

- TABLE 148 AMS-OSRAM INTERNATIONAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 AMS-OSRAM INTERNATIONAL GMBH: PRODUCT LAUNCHES

- TABLE 150 AMS-OSRAM INTERNATIONAL GMBH: DEALS

- TABLE 151 AMS-OSRAM INTERNATIONAL GMBH: OTHERS

- 14.2.5 CALIFORNIA LIGHTWORKS

- TABLE 152 CALIFORNIA LIGHTWORKS: COMPANY OVERVIEW

- TABLE 153 CALIFORNIA LIGHTWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 CALIFORNIA LIGHTWORKS: PRODUCT LAUNCHES

- 14.2.6 VALOYA

- TABLE 155 VALOYA: COMPANY OVERVIEW

- TABLE 156 VALOYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 VALOYA: PRODUCT LAUNCHES

- TABLE 158 VALOYA: DEALS

- 14.2.7 HORTILUX SCHREDER

- TABLE 159 HORTILUX SCHREDER: COMPANY OVERVIEW

- TABLE 160 HORTILUX SCHREDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 HORTILUX SCHREDER: PRODUCT LAUNCHES

- TABLE 162 HORTILUX SCHREDER: DEALS

- 14.2.8 ILUMINAR LIGHTING

- TABLE 163 ILUMINAR LIGHTING: COMPANY OVERVIEW

- TABLE 164 ILUMINAR LIGHTING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 ILUMINAR LIGHTING: PRODUCT LAUNCHES

- 14.2.9 CURRENT LIGHTING SOLUTIONS, LLC.

- TABLE 166 CURRENT LIGHTING SOLUTIONS, LLC: COMPANY OVERVIEW

- TABLE 167 CURRENT LIGHTING SOLUTIONS, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 CURRENT LIGHTING SOLUTIONS, LLC: PRODUCT LAUNCHES

- TABLE 169 CURRENT LIGHTING SOLUTIONS, LLC: DEALS

- 14.2.10 GE LIGHTING (SAVANT TECHNOLOGIES LLC.)

- TABLE 170 GE LIGHTING (SAVANT TECHNOLOGIES LLC.): COMPANY OVERVIEW

- TABLE 171 GE LIGHTING (SAVANT TECHNOLOGIES LLC.): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 14.3 OTHER PLAYERS

- 14.3.1 ACUITY BRANDS, INC.

- 14.3.2 LUMILEDS HOLDING B.V.

- 14.3.3 CREE LED, AN SGH COMPANY

- 14.3.4 TCP LIGHTING

- 14.3.5 PARSOURCE

- 14.3.6 ECONOLUX INDUSTRIES LTD.

- 14.3.7 OREON

- 14.3.8 GLACIALLIGHT - DIVISION OF GLACIALTECH INC.

- 14.3.9 BLACK DOG HORTICULTURE TECHNOLOGIES & CONSULTING

- 14.3.10 VIPARSPECTRA

- 14.3.11 ACTIVE GROW

- 14.3.12 AGNETIX

- 14.3.13 THRIVE AGRITECH

- 14.3.14 BRIDGELUX, INC.

- 14.3.15 KROPTEK

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS