|

|

市場調査レポート

商品コード

1423877

無線充電の世界市場:実装別、技術別、用途別、地域別 - 予測(~2029年)Wireless Charging Market by Implementation (Transmitters, Receivers), Technology (Magnetic Resonance, Inductive, Radio Frequency), Application (Automotive, Consumer Electronics, Healthcare) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 無線充電の世界市場:実装別、技術別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2024年02月07日

発行: MarketsandMarkets

ページ情報: 英文 242 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の無線充電の市場規模は、2024年の64億米ドルから2029年までに160億米ドルに達し、2024年~2029年にCAGRで20.3%の成長が予測されています。

スマートデバイスやポータブルデバイスの普及、電気自動車における無線充電需要の増加、マルチデバイス充電ステーションに対する要求の高まり、家具、インフラ、スマートホーム、IoTデバイスへの充電機能の統合動向の高まり。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 実装別、技術別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「誘導技術セグメントが2023年に無線充電市場で最大の市場シェアを占めます。」

誘導技術は、その有効性、利便性、広く受け入れられていることから、無線充電に広く利用されています。特にQi無線充電規格に採用されている誘導システムは、トランスミッターとレシーバーのコイル間に密接な結合を確立し、充電プロセス中のエネルギー損失を最小限に抑えます。電力伝送の有効性とエネルギー損失の最小化で知られる誘導技術は、スマートフォンやウェアラブルなどのコンシューマーエレクトロニクスに広く受け入れられています。誘導技術は、携帯電話、携帯情報端末(PDA)、MP3、医療機器、電動歯ブラシ、電動工具などの中型電子機器の無線充電に使用されています。

「コンシューマーエレクトロニクス用途が2023年に無線充電市場で最大の市場シェアを占めます。」

コンシューマーエレクトロニクスが無線充電市場を独占し、最大の市場シェアを占めています。これは主に無線充電技術が日常的な機器に広く統合されているためです。スマートフォンの普及、ユーザーの利便性向上への注力、シームレスな体験の追求が、スマートフォン、タブレット、スマートウォッチ、その他のガジェットなどのデバイスにおける無線充電の広範な受け入れに拍車をかけています。無線充電の需要は、ウェアラブル技術、特にスマートウォッチの人気によって高まっており、ケーブルのない便利な充電体験への欲求が強まっています。製品の差別化は大きな要因であり、無線充電機能は競争の激しいコンシューマーエレクトロニクス市場において独自のセールスポイントとなっています。業界の世界への影響力、トレンドセッターとしての性質、革新性が、無線充電市場でのリーダーシップに寄与しており、さまざまなデバイスにわたる望ましい機能に対する消費者の選好の高まりと可処分所得の上昇によって支えられています。

「米国が2023年に無線充電市場で最大のシェアを保持します。」

電気自動車、スマートデバイス、家具、インフラ、医療における無線充電の需要の高まりが、北米の市場成長を支援すると予測されています。米国では、技術の急速な採用と製品開発が市場成長に大きな役割を果たすと推定されます。米国の製造業は北米最大級の規模を誇ります。製造施設の増加により、米国では無線充電器の需要が高まっています。米国市場の成長は、Energizer(米国)、Plugless Power Inc.(米国)、Ossia Inc.(米国)、Qualcomm Technologies, Inc.(米国)、Leggett & Platt, Incorporated(米国)、Texas Instruments Incorporated(米国)、WiTricity Corporation(米国)といった著名な市場企業のプレゼンスも要因となっています。

当レポートでは、世界の無線充電市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 無線充電市場の企業にとって魅力的な機会

- 無線充電市場:技術別

- 無線充電市場:用途別

- 無線充電市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 平均販売価格(ASP)の動向:電力定格別

- 平均販売価格(ASP)の動向:地域別

- サプライチェーン分析

- エコシステムマッピング

- 技術分析

- IoT

- AI

- 予知保全

- インダストリー4.0

- 特許分析

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 標準と規制情勢

- 規制機関、政府機関、その他の組織

- 規格

- ポーターのファイブフォース分析

- 主なステークホルダーと購入標準

- 購入プロセスにおける主なステークホルダー

- 購入標準

第6章 無線充電製品の種類と市場の近年の動向

- イントロダクション

- 無線充電製品の種類

- 無線充電パッド

- 無線充電スタンド

- 無線充電パワーバンク

- 無線充電マット

- 自動車用無線充電器

- 無線充電家具

- 無線充電ドック

- 無線充電スリーブ/ケース

- マルチデバイス充電ステーション

- 無線充電マウスパッド

- 無線充電機能付きデスクランプ

- 高速無線充電器

- 無線充電市場の近年の動向

- 電気自動車(EVS)への統合

- 家具やインフラへの統合

- 長距離無線充電

- 先進の充電技術

- 標準化と相互運用性

- スマートフォンやウェアラブルへの統合

- 双方向無線充電

- 公共空間への設置

第7章 無線充電市場:実装別

- イントロダクション

- 送電機

- 受電機

第8章 無線充電市場:技術別

- イントロダクション

- 磁気共鳴

- 誘導

- RF

第9章 無線充電市場:用途別

- イントロダクション

- 自動車

- コンシューマーエレクトロニクス

- 医療

- その他

第10章 無線充電市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州の不況の影響

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋の不況の影響

- 中国

- 日本

- インド

- その他のアジア太平洋

- その他の地域

- 南米

- GCC諸国

- アフリカとその他中東

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益分析(2018年~2022年)

- 市場シェア分析(2023年)

- 企業の評価マトリクス(2023年)

- スタートアップ/中小企業(SME)の評価マトリクス(2023年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- ENERGIZER

- SAMSUNG

- PLUGLESS POWER INC.

- OSSIA INC.

- QUALCOMM TECHNOLOGIES, INC.

- LEGGETT & PLATT, INCORPORATED

- INFINEON TECHNOLOGIES AG

- RENESAS ELECTRONICS CORPORATION

- TEXAS INSTRUMENTS INCORPORATED

- WITRICITY CORPORATION

- その他の企業

- ANKER INNOVATIONS

- CONVENIENTPOWER

- ENERGOUS CORPORATION

- INDUCTEV INC.

- MOJO MOBILITY INC.

- NUCURRENT

- PORTRONICS

- POWERCAST CORPORATION

- POWERMAT

- POWERSPHYR INC.

- PULS GMBH

- WIBOTIC

- WI-CHARGE

- WIRELESS ADVANCED VEHICLE ELECTRIFICATION, LLC.

- ZENS

第13章 隣接市場と関連市場

- リチウムイオン電池市場

- イントロダクション

- コンシューマーエレクトロニクス

- 自動車

- 航空宇宙

- 船舶

- 医療

- 工業

- 電力

- 通信

第14章 付録

The wireless charging market is expected to reach USD 16.0 billion by 2029 from USD 6.4 billion in 2024, at a CAGR of 20.3% from 2024-2029. Rising adoption of smart and portable devices, increasing demand for wireless charging in electric vehicles, rising requirement for multi-device charging stations, increasing trend of integrating charging capabilities into furniture, infrastructures, smart homes, and IoT devices.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Implementation, Technology, Application and Region |

| Regions covered | North America, Europe, Asia Pacific, RoW |

"Inductive technology segment is to hold the largest market share of wireless charging market in 2023."

Inductive technology is widely utilized in wireless charging due to its effectiveness, convenience, and widespread acceptance. Specifically employed in the Qi wireless charging standard, inductive systems establish a close coupling between the coils of the transmitter and receiver, minimizing energy loss during the charging process. Known for its effectiveness in power transfer and minimized energy loss, inductive technology is widely accepted in consumer electronics like smartphones and wearables. Inductive technology is used to wirelessly charge mid-sized electronic devices, such as mobile phones, personal digital assistants (PDA), MP3, medical devices, electric toothbrushes, and power tools.

"Consumer electronics application is to hold the largest market share of wireless charging market in 2023."

Consumer electronics dominate the wireless charging market, commanding the largest market share, primarily due to the widespread integration of wireless charging technology into everyday devices. The widespread presence of smartphones, a focus on enhancing user convenience, and the pursuit of seamless experiences have fueled the extensive acceptance of wireless charging in devices like smartphones, tablets, smartwatches, and other gadgets. The demand for wireless charging is heightened by the popularity of wearable technology, particularly smartwatches, which intensifies the desire for cable-free and convenient charging experiences. Product differentiation is a key factor, with wireless charging capabilities serving as a unique selling point in the competitive consumer electronics market. The industry's global influence, trendsetting nature, and innovation contribute to its leadership in the wireless charging market, supported by the growing consumer preference for the desirable feature across various devices and rising disposable incomes.

"The US in holds the largest market share of wireless charging market in 2023."

North America comprises the US, Canada, and Mexico. The rising demand for wireless charging in electric vehicles, smart devices, furniture and infrastructure, and healthcare expected to support the market growth in North America. In the US, rapid adoption of technologies and product development are estimated to play a significant role in market growth. The US manufacturing industry is one of the largest in North America. The growth of manufacturing facilities has increased the demand for wireless chargers in the US. The growth of the market in US is also attributed to presence of prominent market players such as Energizer (US), Plugless Power Inc. (US), Ossia Inc. (US), Qualcomm Technologies, Inc. (US), Leggett & Platt, Incorporated (US), Texas Instruments Incorporated (US), WiTricity Corporation (US).

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation - C-level Executives - 40%, Directors - 35%, and Others - 25%

- By Region - North America - 30%, Europe - 20%, Asia Pacific - 35%, and Rest of the World - 15%

Major players in the wireless charging market include Energizer (US), SAMSUNG (South Korea), Plugless Power Inc. (US), Ossia Inc. (US), and Qualcomm Technologies, Inc. (US) and others.

Research Coverage

The report segments the wireless charging market by Implementation, Technology, Application, and Region. The report also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall wireless charging market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of critical drivers (Rising adoption of smart and portable devices, increasing demand for wireless charging in electric vehicles, rising requirement for multi-device charging stations, increasing trend of integrating charging capabilities into furniture, infrastructures, smart homes, and IoT devices.), restraints (Compatibility issue associated with wireless charging devices), opportunities (use of wireless technology to charge warehouse trucks, development of faster and more efficient wireless technology), challenges (high investment in implementing iarge-scale wireless charging infrastructure for electric vehicles, preference for traditional charging technology) influencing the growth of the wireless charging market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the wireless charging market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the wireless charging market across various regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the wireless charging market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Energizer (US), SAMSUNG (South Korea), Plugless Power Inc. (US), Ossia Inc. (US), and Qualcomm Technologies, Inc. (US), WiTricity Corporation (US) and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 WIRELESS CHARGING MARKET: RESEARCH DESIGN

- 2.2 SECONDARY AND PRIMARY RESEARCH

- FIGURE 2 WIRELESS CHARGING MARKET: SECONDARY AND PRIMARY RESEARCH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary interviews with experts

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primaries

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to derive market size using bottom-up analysis (demand side)

- FIGURE 3 WIRELESS CHARGING MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to derive market size using top-down analysis (supply side)

- FIGURE 4 WIRELESS CHARGING MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON WIRELESS CHARGING MARKET

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 WIRELESS CHARGING MARKET, 2020-2029 (USD MILLION)

- FIGURE 8 INDUCTIVE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 9 RECEIVERS SEGMENT HELD LARGER MARKET SHARE IN 2023

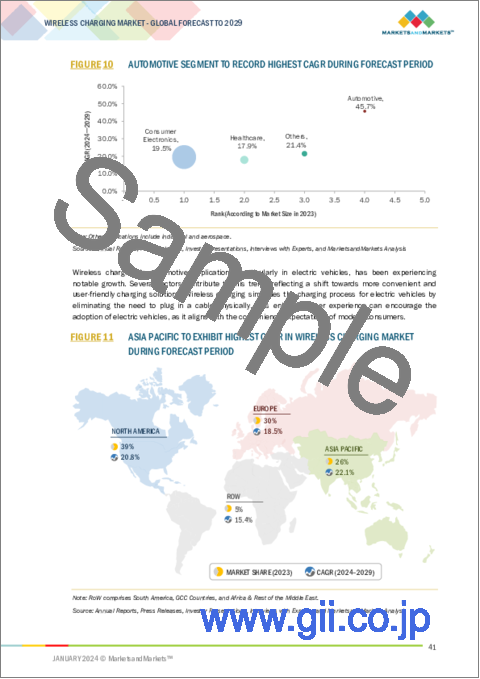

- FIGURE 10 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN WIRELESS CHARGING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WIRELESS CHARGING MARKET

- FIGURE 12 GROWING ADOPTION OF INTERNET OF THINGS (IOT) AND OTHER ELECTRONIC DEVICES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 WIRELESS CHARGING MARKET, BY TECHNOLOGY

- FIGURE 13 INDUCTIVE SEGMENT ACCOUNTED FOR LARGEST SHARE OF WIRELESS CHARGING MARKET IN 2023

- 4.3 WIRELESS CHARGING MARKET, BY APPLICATION

- FIGURE 14 CONSUMER ELECTRONICS SEGMENT TO LEAD WIRELESS CHARGING MARKET DURING FORECAST PERIOD

- 4.4 WIRELESS CHARGING MARKET, BY REGION

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR IN WIRELESS CHARGING MARKET BETWEEN 2024 AND 2029

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 WIRELESS CHARGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of smart and portable devices

- 5.2.1.2 Increasing sales of electric vehicles and demand for wireless charging

- TABLE 1 GLOBAL SALES OF ELECTRIC VEHICLES, REGION/COUNTRY, 2023

- 5.2.1.3 Rising requirement for multi-device charging stations

- 5.2.1.4 Increasing trend of integrating wireless charging capabilities into furniture, infrastructures, smart homes, and IoT devices

- FIGURE 17 WIRELESS CHARGING MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Compatibility issues associated with wireless charging devices

- FIGURE 18 WIRELESS CHARGING MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of wireless technology to charge warehouse trucks

- 5.2.3.2 Development of faster and more efficient wireless charging technology

- FIGURE 19 WIRELESS CHARGING MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 High investments in implementing large-scale wireless charging infrastructure for electric vehicles

- 5.2.4.2 Preference for traditional charging technology

- 5.2.4.3 Limited range of wireless chargers

- FIGURE 20 WIRELESS CHARGING MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- TABLE 2 AVERAGE SELLING (ASP) PRICE OF WIRELESS CHARGERS, 2023

- TABLE 3 AVERAGE SELLING PRICE (ASP) OF WIRELESS CHARGING COMPONENTS, 2023

- FIGURE 22 AVERAGE SELLING PRICE (ASP) OF WIRELESS TRANSMITTERS, 2020-2029 (USD)

- 5.4.1 AVERAGE SELLING PRICE (ASP) TREND, BY POWER RATING

- 5.4.1.1 Average selling price (ASP) of wireless chargers offered by three key players, by power rating (USD)

- FIGURE 23 AVERAGE SELLING PRICE (ASP) OF WIRELESS CHARGERS OFFERED BY THREE KEY PLAYERS, BY POWER RATING (USD)

- TABLE 4 AVERAGE SELLING PRICE (ASP) OF WIRELESS CHARGERS OFFERED BY THREE KEY PLAYERS, BY POWER RATING (USD)

- 5.4.2 AVERAGE SELLING PRICE (ASP) TREND, BY REGION

- TABLE 5 AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2023 (USD)

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 24 WIRELESS CHARGING MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM MAPPING

- FIGURE 25 WIRELESS CHARGING MARKET: ECOSYSTEM MAPPING

- TABLE 6 COMPANIES AND THEIR ROLES IN WIRELESS CHARGING ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 INTERNET OF THINGS (IOT)

- 5.7.2 ARTIFICIAL INTELLIGENCE (AI)

- 5.7.3 PREDICTIVE MAINTENANCE

- 5.7.4 INDUSTRY 4.0

- 5.8 PATENT ANALYSIS

- FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 7 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR, 2014-2023

- TABLE 8 PATENTS RELATED TO WIRELESS CHARGING, 2019-2023

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- FIGURE 28 IMPORT DATA FOR HS CODE 850440-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.9.2 EXPORT SCENARIO

- FIGURE 29 EXPORT DATA FOR HS CODE 850440-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 WIRELESS CHARGING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 CASE STUDY ANALYSIS

- TABLE 10 ELECTRIFIED TRANSPORTATION COMPANY DEPLOYED WIRELESS CHARGING SYSTEMS FOR ELECTRIC VEHICLES

- TABLE 11 MOMENTUM DYNAMICS DEPLOYED WIRELESS CHARGING SYSTEM AT COLUMBIA STATION IN WENATCHEE, WA, US, TO CHARGE LINK TRANSIT BUSES WITH MOMENTUM DYNAMICS CHARGING

- TABLE 12 DAIHEN CORPORATION INCORPORATED WIRELESS CHARGING TECHNOLOGY FOR INDUSTRIAL APPLICATIONS UNDER WITRICITY LICENSE

- TABLE 13 DELTA ELECTRONICS DEPLOYED WIRELESS CHARGING TECHNOLOGY PROVIDED BY WITRICITY CORPORATION TO REVOLUTIONIZE WAREHOUSE MANAGEMENT

- 5.12 STANDARDS AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 STANDARDS

- 5.12.2.1 QI standard

- 5.12.2.2 AirFuel Alliance

- 5.12.2.2.1 Power Matters Alliance (PMA)

- TABLE 18 FREQUENCY RANGE OF STANDARDS

- 5.12.2.3 ISO 15118-20

- 5.12.2.4 China GB standards for wireless charging of electric vehicles

- 5.12.2.5 Radio Equipment Directive

- 5.12.2.5.1 EN 301 489-1 & -3 (EMC)

- 5.12.2.5.2 ETSI EN 303 417 (Radio)

- 5.12.2.6 Standards for wireless charging

- TABLE 19 STANDARDS RELATED TO WIRELESS CHARGING

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 WIRELESS CHARGING MARKET: PORTER'S FIVE FORCES ANALYSIS, 2023

- TABLE 20 WIRELESS CHARGING MARKET: PORTER'S FIVE FORCES ANALYSIS, 2023

- 5.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 THREAT OF NEW ENTRANTS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 WIRELESS CHARGING PRODUCT TYPES AND RECENT TRENDS IN MARKET

- 6.1 INTRODUCTION

- 6.2 WIRELESS CHARGING PRODUCT TYPES

- 6.2.1 WIRELESS CHARGING PADS

- 6.2.2 WIRELESS CHARGING STANDS

- 6.2.3 WIRELESS CHARGING POWER BANKS

- 6.2.4 WIRELESS CHARGING MATS

- 6.2.5 CAR WIRELESS CHARGERS

- 6.2.6 WIRELESS CHARGING FURNITURE

- 6.2.7 WIRELESS CHARGING DOCKS

- 6.2.8 WIRELESS CHARGING SLEEVES/CASES

- 6.2.9 MULTI-DEVICE CHARGING STATIONS

- 6.2.10 WIRELESS CHARGING MOUSE PADS

- 6.2.11 DESK LAMPS WITH WIRELESS CHARGING

- 6.2.12 FAST WIRELESS CHARGERS

- 6.3 RECENT TRENDS IN WIRELESS CHARGING MARKET

- 6.3.1 INTEGRATION INTO ELECTRIC VEHICLES (EVS)

- 6.3.2 INTEGRATION INTO FURNITURE AND INFRASTRUCTURE

- 6.3.3 LONG-RANGE WIRELESS CHARGING

- 6.3.4 ADVANCED CHARGING TECHNOLOGIES

- 6.3.5 STANDARDIZATION AND INTEROPERABILITY

- 6.3.6 INTEGRATION INTO SMARTPHONES AND WEARABLES

- 6.3.7 BI-DIRECTIONAL WIRELESS CHARGING

- 6.3.8 INSTALLATION IN PUBLIC SPACES

7 WIRELESS CHARGING MARKET, BY IMPLEMENTATION

- 7.1 INTRODUCTION

- FIGURE 33 WIRELESS CHARGING MARKET, BY IMPLEMENTATION

- FIGURE 34 RECEIVERS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 23 WIRELESS CHARGING MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 24 WIRELESS CHARGING MARKET, BY IMPLEMENTATION, 2024-2029 (USD MILLION)

- 7.2 TRANSMITTERS

- 7.2.1 GROWING DEMAND FOR FAST CHARGING SOLUTIONS TO INCREASE DEVELOPMENT OF TRANSMITTERS AND DRIVE MARKET

- TABLE 25 TRANSMITTERS: WIRELESS CHARGING MARKET, 2020-2023 (MILLION UNITS)

- TABLE 26 TRANSMITTERS: WIRELESS CHARGING MARKET, 2024-2029 (MILLION UNITS)

- TABLE 27 TRANSMITTERS: WIRELESS CHARGING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 28 TRANSMITTERS: WIRELESS CHARGING SYSTEMS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 7.3 RECEIVERS

- 7.3.1 DEVELOPMENT OF INTEGRATED WIRELESS RECEIVERS FOR CONSUMER ELECTRONICS TO DRIVE MARKET

- 7.3.2 AFTERMARKET

- 7.3.3 INTEGRATED

- TABLE 29 RECEIVERS: WIRELESS CHARGING SYSTEMS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 30 RECEIVERS: WIRELESS CHARGING SYSTEMS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

8 WIRELESS CHARGING MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 35 WIRELESS CHARGING MARKET, BY TECHNOLOGY

- FIGURE 36 MAGNETIC RESONANCE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 31 WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 32 WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 8.2 MAGNETIC RESONANCE

- 8.2.1 RISING USE TO SIMULTANEOUSLY CHARGE MULTIPLE DEVICES WITH LARGE POWER REQUIREMENTS TO DRIVE MARKET

- TABLE 33 MAGNETIC RESONANCE: WIRELESS CHARGING MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 34 MAGNETIC RESONANCE: WIRELESS CHARGING MARKET, BY IMPLEMENTATION, 2024-2029 (USD MILLION)

- TABLE 35 MAGNETIC RESONANCE: WIRELESS CHARGING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 36 MAGNETIC RESONANCE: WIRELESS CHARGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 8.3 INDUCTIVE

- 8.3.1 GROWING DEMAND FOR QI WIRELESS CHARGING BASED ON INDUCTIVE TECHNOLOGY FROM MANY SMARTPHONE, SMARTWATCH, AND EARBUD MANUFACTURERS TO DRIVE MARKET

- TABLE 37 INDUCTIVE: WIRELESS CHARGING MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 38 INDUCTIVE: WIRELESS CHARGING MARKET, BY IMPLEMENTATION, 2024-2029 (USD MILLION)

- TABLE 39 INDUCTIVE: WIRELESS CHARGING MARKET FOR INDUCTIVE, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 40 INDUCTIVE: WIRELESS CHARGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 8.4 RADIO FREQUENCY

- 8.4.1 INCREASING USE TO CHARGE MULTIPLE DEVICES SIMULTANEOUSLY WITHIN OPERATIONAL RANGE TO DRIVE MARKET

- TABLE 41 RADIO FREQUENCY: WIRELESS CHARGING MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 42 RADIO FREQUENCY: WIRELESS CHARGING MARKET, BY IMPLEMENTATION, 2024-2029 (USD MILLION)

- TABLE 43 RADIO FREQUENCY: WIRELESS CHARGING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 44 RADIO FREQUENCY: WIRELESS CHARGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

9 WIRELESS CHARGING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 WIRELESS CHARGING MARKET, BY APPLICATION

- FIGURE 38 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 45 WIRELESS CHARGING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 46 WIRELESS CHARGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 9.2 AUTOMOTIVE

- 9.2.1 INCREASING DEMAND FOR WIRELESS CHARGING OF ELECTRIC VEHICLES TO DRIVE MARKET

- 9.2.2 ELECTRIC VEHICLES

- TABLE 47 AUTOMOTIVE: WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 48 AUTOMOTIVE: WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 49 AUTOMOTIVE: WIRELESS CHARGING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 AUTOMOTIVE: WIRELESS CHARGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 AUTOMOTIVE: NORTH AMERICA WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 52 AUTOMOTIVE: NORTH AMERICA WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 53 AUTOMOTIVE: EUROPE WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 54 AUTOMOTIVE: EUROPE WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 55 AUTOMOTIVE: ASIA PACIFIC WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 56 AUTOMOTIVE: ASIA PACIFIC WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 57 AUTOMOTIVE: ROW WIRELESS CHARGING MARKET, BY COUNTRY/REGION, 2020-2023 (USD MILLION)

- TABLE 58 AUTOMOTIVE: ROW WIRELESS CHARGING MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- 9.3 CONSUMER ELECTRONICS

- 9.3.1 GROWING DEMAND FOR PORTABLE AND COMPACT ELECTRONIC DEVICES TO DRIVE MARKET

- 9.3.2 SMARTPHONES AND TABLETS

- 9.3.3 LAPTOPS AND NOTEBOOKS

- 9.3.4 WEARABLES

- 9.3.5 OTHER CONSUMER ELECTRONICS

- TABLE 59 CONSUMER ELECTRONICS: WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 60 CONSUMER ELECTRONICS: WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 61 CONSUMER ELECTRONICS: WIRELESS CHARGING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 CONSUMER ELECTRONICS: WIRELESS CHARGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 CONSUMER ELECTRONICS: NORTH AMERICA WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 64 CONSUMER ELECTRONICS: NORTH AMERICA WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 65 CONSUMER ELECTRONICS: EUROPE WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 66 CONSUMER ELECTRONICS: EUROPE WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: ASIA PACIFIC WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: ASIA PACIFIC WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: ROW WIRELESS CHARGING MARKET, BY REGION/COUNTRY, 2020-2023 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: ROW WIRELESS CHARGING MARKET, BY REGION/COUNTRY, 2024-2029 (USD MILLION)

- 9.4 HEALTHCARE

- 9.4.1 INCREASING ADOPTION OF INTERNET OF THINGS (IOT) DEVICES IN HEALTHCARE SECTOR TO DRIVE MARKET

- 9.4.2 HEARING AIDS

- 9.4.3 GLUCOSE MONITORS

- 9.4.4 SMART GLASSES

- TABLE 71 HEALTHCARE: WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 72 HEALTHCARE: WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 73 HEALTHCARE: WIRELESS CHARGING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 HEALTHCARE: WIRELESS CHARGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 HEALTHCARE: NORTH AMERICA WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 76 HEALTHCARE: NORTH AMERICA WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 77 HEALTHCARE: EUROPE WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 HEALTHCARE: EUROPE WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 79 HEALTHCARE: ASIA PACIFIC WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 80 HEALTHCARE: ASIA PACIFIC WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 81 HEALTHCARE: ROW WIRELESS CHARGING MARKET, BY REGION/COUNTRY, 2020-2023 (USD MILLION)

- TABLE 82 HEALTHCARE: ROW WIRELESS CHARGING MARKET, BY REGION/COUNTRY, 2024-2029 (USD MILLION)

- 9.5 OTHERS

- TABLE 83 OTHERS: WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 84 OTHERS: WIRELESS CHARGING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 85 OTHERS: WIRELESS CHARGING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 86 OTHERS: WIRELESS CHARGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 87 OTHERS: NORTH AMERICA WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 88 OTHERS: NORTH AMERICA WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 89 OTHERS: EUROPE WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 OTHERS: EUROPE WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 91 OTHERS: ASIA PACIFIC WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 92 OTHERS: ASIA PACIFIC WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 93 OTHERS: ROW WIRELESS CHARGING MARKET, BY REGION/COUNTRY, 2020-2023 (USD MILLION)

- TABLE 94 OTHERS: ROW WIRELESS CHARGING MARKET, BY REGION/COUNTRY, 2024-2029 (USD MILLION)

10 WIRELESS CHARGING MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 INDIA TO DEPICT HIGHEST CAGR IN WIRELESS CHARGING MARKET DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA TO DOMINATE WIRELESS CHARGING MARKET FROM 2024 TO 2029

- TABLE 95 WIRELESS CHARGING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 96 WIRELESS CHARGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 41 NORTH AMERICA: WIRELESS CHARGING MARKET SNAPSHOT

- TABLE 97 NORTH AMERICA: WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 98 NORTH AMERICA: WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 NORTH AMERICA: WIRELESS CHARGING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 100 NORTH AMERICA: WIRELESS CHARGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Rapid adoption of advanced technologies and smart product development to drive market

- 10.2.3 CANADA

- 10.2.3.1 Government-led initiatives and increasing use of wireless charging for consumer electronic devices to drive market

- 10.2.4 MEXICO

- 10.2.4.1 Growing adoption of electric vehicles to fuel market growth

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- FIGURE 42 EUROPE: WIRELESS CHARGING MARKET SNAPSHOT

- TABLE 101 EUROPE: WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 102 EUROPE: WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 103 EUROPE: WIRELESS CHARGING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 104 EUROPE: WIRELESS CHARGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Government initiatives and support for electric vehicle charging infrastructure development to boost market growth

- 10.3.3 GERMANY

- 10.3.3.1 Government subsidies for electric vehicle purchases and tax benefits to drive demand

- 10.3.4 FRANCE

- 10.3.4.1 Rising global trend of sustainable and eco-friendly technologies in wireless charging to drive market

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 43 ASIA PACIFIC: WIRELESS CHARGING MARKET SNAPSHOT

- TABLE 105 ASIA PACIFIC: WIRELESS CHARGING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: WIRELESS CHARGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 107 ASIA PACIFIC: WIRELESS CHARGING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: WIRELESS CHARGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Massive consumer market and high adoption of new technologies to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Presence of automobile giants to drive market

- 10.4.4 INDIA

- 10.4.4.1 Ongoing advancements in wireless charging technologies to fuel demand

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- TABLE 109 ROW: WIRELESS CHARGING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 110 ROW: WIRELESS CHARGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 111 ROW: WIRELESS CHARGING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 112 ROW: WIRELESS CHARGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Booming automotive industry to drive market

- 10.5.2 GCC COUNTRIES

- 10.5.2.1 Adoption of global technology trends to drive demand

- 10.5.3 AFRICA & REST OF MIDDLE EAST

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 113 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN WIRELESS CHARGING MARKET

- 11.3 REVENUE ANALYSIS, 2018-2022

- FIGURE 44 WIRELESS CHARGING MARKET: REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2018-2022

- 11.4 MARKET SHARE ANALYSIS, 2023

- TABLE 114 WIRELESS CHARGING MARKET: DEGREE OF COMPETITION, 2023

- FIGURE 45 WIRELESS CHARGING MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY EVALUATION MATRIX, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 46 WIRELESS CHARGING MARKET: COMPANY EVALUATION MATRIX, 2023

- 11.5.5 COMPANY FOOTPRINT

- TABLE 115 COMPANY OVERALL FOOTPRINT

- TABLE 116 COMPANY APPLICATION FOOTPRINT

- TABLE 117 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 118 COMPANY REGION FOOTPRINT

- 11.6 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION MATRIX, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 47 WIRELESS CHARGING MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 119 WIRELESS CHARGING MARKET: LIST OF KEYS STARTUPS/SMES

- TABLE 120 WIRELESS CHARGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

- 11.7.1 PRODUCT LAUNCHES

- TABLE 121 WIRELESS CHARGING MARKET: PRODUCT LAUNCHES, DECEMBER 2021-OCTOBER 2023

- 11.7.2 DEALS

- TABLE 122 WIRELESS CHARGING MARKET: DEALS, APRIL 2021-JUNE 2023

- 11.7.3 OTHERS

- TABLE 123 WIRELESS CHARGING MARKET: OTHERS, FEBRUARY 2021-JULY 2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1.1 ENERGIZER

- TABLE 124 ENERGIZER: COMPANY OVERVIEW

- FIGURE 48 ENERGIZER: COMPANY SNAPSHOT

- TABLE 125 ENERGIZER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.2 SAMSUNG

- TABLE 126 SAMSUNG: COMPANY OVERVIEW

- FIGURE 49 SAMSUNG: COMPANY SNAPSHOT

- TABLE 127 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 SAMSUNG: PRODUCT LAUNCHES

- 12.1.3 PLUGLESS POWER INC.

- TABLE 129 PLUGLESS POWER INC.: COMPANY OVERVIEW

- TABLE 130 PLUGLESS POWER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 PLUGLESS POWER INC.: PRODUCT LAUNCHES

- TABLE 132 PLUGLESS POWER INC.: DEALS

- 12.1.4 OSSIA INC.

- TABLE 133 OSSIA INC.: COMPANY OVERVIEW

- TABLE 134 OSSIA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 OSSIA INC.: PRODUCT LAUNCHES

- TABLE 136 OSSIA INC.: DEALS

- 12.1.5 QUALCOMM TECHNOLOGIES, INC.

- TABLE 137 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 50 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 138 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 140 QUALCOMM TECHNOLOGIES, INC.: DEALS

- 12.1.6 LEGGETT & PLATT, INCORPORATED

- TABLE 141 LEGGETT & PLATT, INCORPORATED: COMPANY OVERVIEW

- FIGURE 51 LEGGETT & PLATT, INCORPORATED: COMPANY SNAPSHOT

- TABLE 142 LEGGETT & PLATT, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 INFINEON TECHNOLOGIES AG

- TABLE 143 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 52 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 144 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- 12.1.8 RENESAS ELECTRONICS CORPORATION

- TABLE 146 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 53 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 147 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- 12.1.9 TEXAS INSTRUMENTS INCORPORATED

- TABLE 149 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- FIGURE 54 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- TABLE 150 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- 12.1.10 WITRICITY CORPORATION

- TABLE 152 WITRICITY CORPORATION: COMPANY OVERVIEW

- TABLE 153 WITRICITY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 WITRICITY CORPORATION: PRODUCT LAUNCHES

- TABLE 155 WITRICITY CORPORATION: DEALS

- TABLE 156 WITRICITY CORPORATION: OTHERS

- 12.2 OTHER PLAYERS

- 12.2.1 ANKER INNOVATIONS

- TABLE 157 ANKER INNOVATIONS: COMPANY OVERVIEW

- 12.2.2 CONVENIENTPOWER

- TABLE 158 CONVENIENTPOWER: COMPANY OVERVIEW

- 12.2.3 ENERGOUS CORPORATION

- TABLE 159 ENERGOUS CORPORATION: COMPANY OVERVIEW

- 12.2.4 INDUCTEV INC.

- TABLE 160 INDUCTEV INC.: COMPANY OVERVIEW

- 12.2.5 MOJO MOBILITY INC.

- TABLE 161 MOJO MOBILITY INC.: COMPANY OVERVIEW

- 12.2.6 NUCURRENT

- TABLE 162 NUCURRENT: COMPANY OVERVIEW

- 12.2.7 PORTRONICS

- TABLE 163 PORTRONICS: COMPANY OVERVIEW

- 12.2.8 POWERCAST CORPORATION

- TABLE 164 POWERCAST CORPORATION: COMPANY OVERVIEW

- 12.2.9 POWERMAT

- TABLE 165 POWERMAT: COMPANY OVERVIEW

- 12.2.10 POWERSPHYR INC.

- TABLE 166 POWERSPHYR INC.: COMPANY OVERVIEW

- 12.2.11 PULS GMBH

- TABLE 167 PULS GMBH: COMPANY OVERVIEW

- 12.2.12 WIBOTIC

- TABLE 168 WIBOTIC: COMPANY OVERVIEW

- 12.2.13 WI-CHARGE

- TABLE 169 WI-CHARGE: COMPANY OVERVIEW

- 12.2.14 WIRELESS ADVANCED VEHICLE ELECTRIFICATION, LLC.

- TABLE 170 WIRELESS ADVANCED VEHICLE ELECTRIFICATION, LLC.: COMPANY OVERVIEW

- 12.2.15 ZENS

- TABLE 171 ZENS: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 LITHIUM-ION BATTERY MARKET

- 13.2 INTRODUCTION

- FIGURE 55 LITHIUM-ION BATTERY MARKET, BY APPLICATION

- FIGURE 56 AUTOMOTIVE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 172 LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2019-2022 (USD BILLION)

- TABLE 173 LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

- 13.3 CONSUMER ELECTRONICS

- 13.3.1 GROWING POPULARITY OF ELECTRONIC DEVICES TO BOOST SEGMENTAL GROWTH

- 13.3.2 SMARTPHONES

- 13.3.2.1 Rising power demands of modern-day smartphones to drive market

- 13.3.3 LAPTOPS

- 13.3.3.1 Increasing demand for slim and small-sized laptops equipped with li-ion batteries to drive market

- 13.3.4 OTHERS

- TABLE 174 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 175 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 176 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 177 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2023-2032 (USD MILLION)

- TABLE 178 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 179 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD MILLION)

- TABLE 180 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 181 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY REGION, 2023-2032 (USD MILLION)

- 13.4 AUTOMOTIVE

- 13.4.1 GROWING ADOPTION OF HEVS AND PHEVS TO DRIVE DEMAND FOR LI-ION BATTERIES

- 13.4.2 PLUG-IN HYBRID ELECTRIC VEHICLES

- 13.4.2.1 Stringent government guidelines pertaining to carbon emissions to drive market

- TABLE 182 AUTOMOTIVE: LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 183 AUTOMOTIVE: LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 184 AUTOMOTIVE: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 185 AUTOMOTIVE: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2023-2032 (USD MILLION)

- TABLE 186 AUTOMOTIVE: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 187 AUTOMOTIVE: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD MILLION)

- TABLE 188 AUTOMOTIVE: LITHIUM-ION BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 189 AUTOMOTIVE: LITHIUM-ION BATTERY MARKET, BY REGION, 2023-2032 (USD MILLION)

- 13.5 AEROSPACE

- 13.5.1 NEED FOR SAFE AND COST-EFFECTIVE POWER SOURCES IN AEROSPACE APPLICATIONS TO DRIVE DEMAND

- 13.5.2 COMMERCIAL AIRCRAFT

- 13.5.2.1 Enhanced performance and safety in aircraft systems with li-ion batteries to boost segmental growth

- TABLE 190 AEROSPACE: LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 191 AEROSPACE: LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 192 AEROSPACE: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 193 AEROSPACE: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2023-2032 (USD MILLION)

- TABLE 194 AEROSPACE: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 195 AEROSPACE: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD MILLION)

- TABLE 196 AEROSPACE: LITHIUM-ION BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 197 AEROSPACE: LITHIUM-ION BATTERY MARKET, BY REGION, 2023-2032 (USD MILLION)

- 13.6 MARINE

- 13.6.1 INCREASING PREFERENCE FOR LFP BATTERIES IN MARINE APPLICATIONS TO SUPPORT GROWTH

- 13.6.2 COMMERCIAL

- 13.6.2.1 Need to reduce carbon emissions in commercial shipping to boost demand

- 13.6.3 TOURISM

- 13.6.3.1 Sustainable tourism through electric boats to drive demand

- TABLE 198 MARINE: LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 199 MARINE: LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 200 MARINE: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 201 MARINE: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2023-2032 (USD MILLION)

- TABLE 202 MARINE: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 203 MARINE: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD MILLION)

- TABLE 204 MARINE: LITHIUM-ION BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 205 MARINE: LITHIUM-ION BATTERY MARKET, BY REGION, 2023-2032 (USD MILLION)

- 13.7 MEDICAL

- 13.7.1 NEED FOR RELIABLE POWER IN BATTERY-BASED MEDICAL DEVICES TO DRIVE MARKET

- TABLE 206 MEDICAL: LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 207 MEDICAL: LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 208 MEDICAL: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 209 MEDICAL: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2023-2032 (USD MILLION)

- TABLE 210 MEDICAL: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 211 MEDICAL: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD MILLION)

- TABLE 212 MEDICAL: LITHIUM-ION BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 213 MEDICAL: LITHIUM-ION BATTERY MARKET, BY REGION, 2023-2032 (USD MILLION)

- 13.8 INDUSTRIAL

- 13.8.1 INCREASING EMPHASIS ON ENVIRONMENT SAFETY AND ENHANCING DURABILITY OF MINING AND CONSTRUCTION EQUIPMENT TO DRIVE MARKET

- 13.8.2 MINING EQUIPMENT

- 13.8.2.1 Need to reduce carbon footprint in mining industry to boost demand

- 13.8.3 CONSTRUCTION EQUIPMENT

- 13.8.3.1 Implementation of lithium-ion battery-powered machinery in construction operations to foster segmental growth

- 13.8.4 FORKLIFTS, AUTOMATED GUIDED VEHICLES, AND AUTOMATED MOBILE ROBOTS

- 13.8.4.1 Focus on reducing labor costs and increasing productivity through multi-shift applications to fuel demand

- TABLE 214 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 215 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 216 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 217 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2023-2032 (USD MILLION)

- TABLE 218 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 219 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD MILLION)

- TABLE 220 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 221 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY REGION, 2023-2032 (USD MILLION)

- 13.9 POWER

- 13.9.1 ADVANTAGES OF LITHIUM-ION BATTERIES IN GRID APPLICATIONS TO BOOST MARKET GROWTH

- TABLE 222 POWER: LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 223 POWER: LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 224 POWER: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 225 POWER: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2023-2032 (USD MILLION)

- TABLE 226 POWER: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 227 POWER: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD MILLION)

- TABLE 228 POWER: LITHIUM-ION BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 229 POWER: LITHIUM-ION BATTERY MARKET, BY REGION, 2023-2032 (USD MILLION)

- 13.10 TELECOMMUNICATIONS

- 13.10.1 ENHANCED COMMUNICATION BASE STATION STABILITY WITH LITHIUM-ION BATTERIES TO STRENGTHEN MARKET

- TABLE 230 TELECOMMUNICATIONS: LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 231 TELECOMMUNICATIONS: LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 232 TELECOMMUNICATIONS: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 233 TELECOMMUNICATIONS: LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2023-2032 (USD MILLION)

- TABLE 234 TELECOMMUNICATIONS: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 235 TELECOMMUNICATIONS: LITHIUM-ION BATTERY MARKET, BY VOLTAGE, 2023-2032 (USD MILLION)

- TABLE 236 TELECOMMUNICATIONS: LITHIUM-ION BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 237 TELECOMMUNICATIONS: LITHIUM-ION BATTERY MARKET, BY REGION, 2023-2032 (USD MILLION)

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS