|

|

市場調査レポート

商品コード

1368148

研究用抗体および試薬の世界市場:製品別、技術別、用途別、エンドユーザー別、地域別-2028年までの予測Research Antibodies & Reagents Market by Product (Antibodies, Reagents), Technology, Application, End User & Region - Global forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 研究用抗体および試薬の世界市場:製品別、技術別、用途別、エンドユーザー別、地域別-2028年までの予測 |

|

出版日: 2023年10月16日

発行: MarketsandMarkets

ページ情報: 英文 385 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の研究用抗体および試薬の市場規模は、2023年の118億米ドルから2028年には162億米ドルに達し、2023年から2028年の予測期間中に6.5%のCAGRで成長すると予測されています。

同市場の成長は、大学の研究プロジェクトを商業化するために技術的・財政的支援を提供することで大学の研究者を支援しているライフサイエンス企業に起因しています。また、抗体は、従来の免疫測定法に基づくELISA、電気泳動、蛍光アッセイなどの技術を用いて、さまざまな抗原、酵素、DNA、mRNAを検出するために使用されるため、バイオマーカーの同定と検証において重要な役割を果たしています。さらに、様々な分離技術、高度なタンパク質同定技術、構造決定技術の開発により、複雑な混合物から何千ものタンパク質を同定できるようになっています。このため、バイオマーカー同定やバリデーション用途の研究用抗体に対する大きな需要が生まれています。

| レポート範囲 | |

|---|---|

| 対象期間 | 2021-2028 |

| 基準年 | 2022 |

| 予測期間 | 2023-2028 |

| 単位 | 金額 (USD) Billion |

| セグメント | 製品別(抗体、試薬)、技術別、用途別、エンドユーザー別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中近東アフリカ |

2022年の世界の研究用抗体市場では、マウスが由来別で最大のシェアを占めています。マウスは伝統的にモノクローナル抗体を作製する宿主として、またウサギの一次抗体に対する第二の宿主として選択されてきました。これらの動物は、動物の使用と経済性を考慮した場合に比べ、生産が容易であるという利点があります。抗体の一次供給源としてのマウスのこのような費用対効果により、このセグメントは高いシェアを占めています。

技術別では、予測期間中、フローサイトメトリー分野は最も高い成長が見込まれています。フローサイトメトリー技術の主な利点の1つは、不均一な混合物内の単一細胞に対してマルチパラメータ分析を同時に実行できることです。フローサイトメトリーは、高いスループットと細胞の特徴の自動定量化を提供します。これらの要因は、フローサイトメトリーにおける技術革新と癌研究における用途拡大とともに、このセグメントの成長を促進しています。

用途別では、2022年には、プロテオミクスが世界の研究用抗体および試薬市場で最大のシェアを占めました。様々な分野(癌生物学、発生・幹細胞生物学、医学など)におけるプロテオミクス研究の重要性の高まりや、生命を脅かす疾患(呼吸器感染症、神経疾患、結核など)の改善治療の必要性から、多くの政府機関がプロテオミクス研究を積極的に推進しており、市場の成長を促進しています。

エンドユーザー別では、2022年には、製薬会社およびバイオテクノロジー企業が、予後予測、診断同定、創薬研究開発におけるバイオマーカーの定量化のために抗体を必要としているため、研究用抗体および試薬のエンドユーザー市場において、世界第2位のシェアを占めています。

予測期間中(2023年~2028年)、アジア太平洋の研究用抗体および試薬市場は最も高いCAGRで成長すると予測されています。高い成長可能性を背景に、多くのメーカーが世界の製造拠点をアジア太平洋に拡大しています。低コスト製造の優位性から、メーカーは中国とインドを最も収益性の高い製造・研究開発拠点と考えています。これがアジア太平洋の高成長に寄与しています。

当レポートでは、世界の研究用抗体および試薬市場について調査し、製品別、技術別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 研究手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界の動向

- サプライチェーン分析

- 製品ポートフォリオ分析

- 技術分析

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 貿易分析(HSコード)

- エコシステム分析

- 特許分析

- 主要な会議とイベント

- 規制分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 研究用抗体および試薬市場、製品別

- イントロダクション

- 試薬

- 抗体

第7章 研究用抗体および試薬市場、技術別

- イントロダクション

- 酵素結合免疫吸着アッセイ(ELISA)

- フローサイトメトリー

- ウェスタンブロッティング

- 免疫蛍光

- 免疫組織化学

- 免疫沈降

- その他

第8章 研究用抗体および試薬市場、用途別

- イントロダクション

- プロテオミクス

- 創薬開発

- ゲノミクス

第9章 研究用抗体および試薬市場、エンドユーザー別

- イントロダクション

- 研究所

- 製薬会社およびバイオテクノロジー企業

- CRO

第10章 研究用抗体および試薬市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 市場シェア分析

- 主要企業の収益シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競争の動向

第12章 企業プロファイル

- 主要参入企業

- ABCAM PLC

- CELL SIGNALING TECHNOLOGY, INC.

- THERMO FISHER SCIENTIFIC INC.

- MERCK KGAA

- BECTON, DICKINSON AND COMPANY

- BIO-RAD LABORATORIES, INC.

- F. HOFFMANN-LA ROCHE LTD.

- AGILENT TECHNOLOGIES, INC.

- DANAHER

- LONZA GROUP

- GENSCRIPT

- REVVITY

- ILLUMINA, INC.

- その他の企業

- IMMUNOPRECISE ANTIBODIES LTD.

- FUJIREBIO

- ANALYTIK JENA GMBH+CO. KG

- OMEGA BIO-TEK, INC.

- DOVETAIL GENOMICS

- ATLAS ANTIBODIES AB

- ROCKLAND IMMUNOCHEMICALS, INC.

- SANTA CRUZ BIOTECHNOLOGY, INC.

- JACKSON IMMUNORESEARCH INC.

- PROTEINTECH GROUP, INC.

- ICL, INC.

- SOUTHERNBIOTECH

第13章 付録

The global research antibodies and reagents market is projected to reach USD 16.2 billion by 2028 from USD 11.8 billion in 2023, at a CAGR of 6.5% during the forecast period of 2023 to 2028. The growth of this market can be attributed life science companies that are helping university researchers by providing technical and financial assistance to commercialize university research projects. Also, Antibodies play a significant role in biomarker identification and validation as they are used to detect various antigens, enzymes, DNA, and mRNAs using technologies such as ELISA, electrophoresis, and fluorescence assays that are based on conventional immunoassays. Moreover, developing various separation techniques, advanced protein identification, and structure determination technologies has enabled thousands of proteins to be identified from complex mixtures. This has created significant demand for research antibodies for biomarker identification and validation applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | Product, Technology, Application, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa |

On the basis of source, the mice segment holds the highest market share during the forecast period.

Based on the source, the research antibodies market has been categorized into rabbits, mice, and others. Mice accounted for the largest share of the global research antibodies market, by source, in 2022. Mice have traditionally been the host of choice to produce monoclonal antibodies and as a second host against primary rabbit antibodies. These animals offer the advantage of easy production compared to animal use and economic considerations. Such cost-effectiveness of mice as a primary source of antibodies makes this segment the higher share holder.

On the basis of technology, the flow cytometry segment is expected to register the highest CAGR during the forecast period.

On the basis of technology, the research antibodies and reagents market is segmented into western blotting, flow cytometry, ELISA, Immunohistochemistry, Immunofluorescence, Immunoprecipitation, and other technologies. During the forecast period the flow cytometry segment is expected to witness the highest growth. One of the major advantages of flow cytometry technique is its ability to perform simultaneous multi-parameter analysis on single cells within a heterogeneous mixture. It offers a high throughput and the automated quantification of cell features. These factors, along with technological innovations in flow cytometry and its growing applications in cancer research, are driving the growth of this segment.

On the basis of application, the proteomics holds the highest market share during the forecast period.

On the basis of application, the research antibodies and reagents market is segmented into proteomics, drug development and Genomics. In 2022, Proteomics held the largest share of the global research antibodies and reagents market. The increasing importance of proteomic studies in various fields (such as cancer biology, developmental and stem cell biology, and medicine) and the need for the remedial treatment of life-threatening diseases (such as respiratory infections, neurological conditions, and tuberculosis) have led many government agencies to promote proteomics research actively, thus promoting market growth.

On the basis of end user, the pharmaceutical & biotechnology holds the second highest market share during the forecast period.

The research antibodies and reagents market is divided into the pharmaceutical & biotechnology companies, research laboratories and Contract Research Organizations. In 2022 the pharmaceutical & biotechnology companies held the second largest share of the global research antibodies and reagents end-user market as pharmaceutical & biotechnology companies require antibodies for prognostic, predictive, or diagnostic identification and the quantification of biomarkers in drug discovery and development.

By Region, The Asia Pacific region is expected to register the highest CAGR during the forecast period.

During the forecast period (2023 to 2028), the Asia Pacific research antibodies and reagents market is expected to grow at the highest CAGR. Owning to high growth potential, many manufacturers are extending their global manufacturing bases to the APAC. With their low-cost manufacturing advantage, manufacturers consider China and India the most profitable manufacturing and R&D locations. This is contributing to high growth rate in the Asia Pacific region.

Break of primary participants was as mentioned below:

- By Respondant - Supply Side-70%, Demand Side-30%

- By Designation - Manger-45%, CXOs and Directors-30%, Executives-25%

- By Region - North America-30%, Europe-25%, Asia Pacific-30%, Latin America- 10%, Middle East and Africa-5%

Key players in the research antibodies and reagents market

Some prominent players in the global research antibodies and reagents market are Abcam plc (UK), Cell Signaling Technology, Inc. (US), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), BD (US), Bio-Rad Laboratories, Inc. (US), F. Hoffmann-La Roche Ltd (Switzerland), Agilent Technologies, Inc. (US), Danaher (US), Lonza (Switzerland), GenScript (China), Revvity (US), SouthernBiotech (US), Illumina, Inc. (US), ImmunoPrecise Antibodies Ltd (US), Fujirebio (Sweden), Analytik Jena GmbH+Co. KG (Germany), Omega Bio-tek, Inc. (US), Dovetail Genomics (US), Atlas Antibodies (Sweden), Rockland Immunochemicals, Inc. (US), Santa Cruz Biotechnology, Inc.(US), Jackson ImmunoResearch Inc. (US), Proteintech Group, Inc. (US), and ICL, Inc. (US).

Research Coverage:

The report analyzes the research antibodies and reagent market and aims at estimating the market size and future growth potential of this market based on various segments such as product, distribution channel, and region. The report also includes a product portfolio matrix of various research antibodies and reagents products available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Key Benefits of buying the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them, garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Analysis of key drivers (Rising funding for life sciences research, Increasing industry-academia collaborations, Growing applications of biomarker identification & validation), restraint (Quality concerns and inadequacy of reproducible results, Ethical concerns for animal welfare in antibody production), opportunities (High-growth potential of emerging economies, Rising demand for personalized medicine and protein therapeutics, Growth in stem cell and neurobiology research, Outsourcing of services to CROs), challenges (Complexities associated with antibody development, Increasing pricing pressure).

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global research antibodies and reagent market. The report analyzes this market by product and distribution channel.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global research antibodies and reagent market.

- Market Development: Comprehensive information on the lucrative emerging markets by product and distribution channel

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global research antibodies and reagent market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the global research antibodies and reagent market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- FIGURE 1 RESEARCH ANTIBODIES AND REAGENTS MARKET

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 LIMITATIONS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- FIGURE 3 BREAKDOWN OF PRIMARIES

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS) FOR 2022

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS METHODOLOGY

- FIGURE 6 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE SHARE ANALYSIS), 2022

- FIGURE 7 ILLUSTRATIVE EXAMPLE OF THERMO FISHER SCIENTIFIC INC.: REVENUE SHARE ANALYSIS (2022)

- 2.2.1 INSIGHTS FROM PRIMARY EXPERTS

- FIGURE 8 MARKET VALIDATION FROM PRIMARY SOURCES

- FIGURE 9 TOP-DOWN APPROACH

- 2.3 MARKET GROWTH RATE PROJECTIONS

- FIGURE 10 CAGR PROJECTIONS

- FIGURE 11 RESEARCH ANTIBODIES AND REAGENTS MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES

- 2.4 DATA TRIANGULATION AND METHODOLOGY APPROACH

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RECESSION IMPACT ANALYSIS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021-2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019-2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023-2028 (USD MILLION)

3 EXECUTIVE SUMMARY

- FIGURE 13 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 RESEARCH ANTIBODIES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 RESEARCH REAGENTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 GEOGRAPHIC SNAPSHOT OF RESEARCH ANTIBODIES AND REAGENTS MARKET

4 PREMIUM INSIGHTS

- 4.1 RESEARCH ANTIBODIES AND REAGENTS MARKET OVERVIEW

- FIGURE 20 RISING FUNDING INVESTMENTS IN LIFE SCIENCES RESEARCH TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- 4.2 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION

- FIGURE 21 PROTEOMICS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.3 GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 22 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY REGION

- FIGURE 23 ASIA PACIFIC SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 RESEARCH ANTIBODIES AND REAGENTS MARKET: DEVELOPED VS. EMERGING MARKETS

- FIGURE 24 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 RESEARCH ANTIBODIES AND REAGENTS MARKET: DRIVERS, OPPORTUNITIES, RESTRAINTS, AND CHALLENGES

- TABLE 4 RESEARCH ANTIBODIES AND REAGENTS MARKET: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising funding for life sciences research

- 5.2.1.2 Increasing industry-academia collaborations

- 5.2.1.3 Growing applications of biomarker identification & validation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Quality concerns and inadequacy of reproducible results

- 5.2.2.2 Ethical concerns for animal welfare in antibody production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High-growth potential of emerging economies

- 5.2.3.2 Personalized medicine and protein therapeutics

- 5.2.3.3 Growth in stem cell and neurobiology research

- 5.2.3.4 Outsourcing services to CROs

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with antibody development

- 5.2.4.2 Increasing pricing pressure

- 5.3 INDUSTRY TRENDS

- 5.3.1 GROWING R&D ON THERAPEUTIC ANTIBODIES

- 5.3.2 OPTIMAL USAGE OF RECOMBINANT ANTIBODIES

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 26 RESEARCH ANTIBODIES AND REAGENTS MARKETS: SUPPLY SIDE ANALYSIS

- 5.5 PRODUCT PORTFOLIO ANALYSIS

- TABLE 5 RESEARCH ANTIBODIES AND REAGENTS MARKET: PRODUCT PORTFOLIO ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 REVENUE SHIFT AND REVENUE GROWTH

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING ANALYSIS, BY ANTIBODIES

- TABLE 6 INDICATIVE PRICING OF ANTIBODIES, BY KEY PLAYERS (2022)

- 5.8.2 INDICATIVE PRICING ANALYSIS OF OVERALL MARKET (QUALITATIVE ANALYSIS)

- 5.9 TRADE ANALYSIS (HS CODES)

- TABLE 7 EXPORT DATA FOR DIAGNOSTIC OR LABORATORY REAGENTS (HS CODE 3822), 2018-2022 (USD THOUSAND)

- TABLE 8 IMPORT DATA FOR DIAGNOSTIC OR LABORATORY REAGENTS (HS CODE 3822), 2018-2022 (USD THOUSAND)

- 5.10 ECOSYSTEM ANALYSIS

- 5.10.1 ROLE IN ECOSYSTEM

- 5.11 PATENT ANALYSIS

- FIGURE 28 RESEARCH ANTIBODIES AND REAGENT MARKET: PATENT ANALYSIS

- TABLE 9 INDICATIVE LIST OF PATENTS IN RESEARCH ANTIBODIES AND REAGENTS MARKET

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 10 RESEARCH ANTIBODIES AND REAGENTS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS (2023-2024)

- 5.13 REGULATORY ANALYSIS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 RESEARCH ANTIBODIES AND REAGENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR RESEARCH ANTIBODY & REAGENT PRODUCTS

- FIGURE 30 BUYING CRITERIA FOR PRODUCTS, BY END USER

6 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 13 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 REAGENTS

- TABLE 14 REAGENTS, BY TYPE AND APPLICATION

- TABLE 15 RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 16 RESEARCH REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 17 NORTH AMERICA: RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 18 EUROPE: RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 19 ASIA PACIFIC: RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 LATIN AMERICA: RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 21 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1 MEDIA & SERA

- 6.2.1.1 Critical component in cell culture to boost demand

- TABLE 22 RESEARCH REAGENTS MARKET FOR MEDIA & SERA, BY REGION, 2021-2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: RESEARCH REAGENTS MARKET FOR MEDIA & SERA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 EUROPE: RESEARCH REAGENTS MARKET FOR MEDIA & SERA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: RESEARCH REAGENTS MARKET FOR MEDIA & SERA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 26 LATIN AMERICA: RESEARCH REAGENTS MARKET FOR MEDIA & SERA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 27 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET FOR MEDIA & SERA, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.2 STAINS & DYES

- 6.2.2.1 Growing applications in cell biology and molecular studies to fuel uptake

- TABLE 28 RESEARCH REAGENTS MARKET FOR STAINS & DYES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: RESEARCH REAGENTS MARKET FOR STAINS & DYES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 30 EUROPE: RESEARCH REAGENTS MARKET FOR STAINS & DYES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: RESEARCH REAGENTS MARKET FOR STAINS & DYES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 32 LATIN AMERICA: RESEARCH REAGENTS MARKET FOR STAINS & DYES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 33 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET FOR STAINS & DYES, BY REGION, 2021-2028 (USD MILLION)

- 6.2.3 FIXATIVES

- 6.2.3.1 High utilization in immunohistochemistry and western blotting to propel market

- TABLE 34 RESEARCH REAGENTS MARKET FOR FIXATIVES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: RESEARCH REAGENTS MARKET FOR FIXATIVES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 36 EUROPE: RESEARCH REAGENTS MARKET FOR FIXATIVES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: RESEARCH REAGENTS MARKET FOR FIXATIVES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 38 LATIN AMERICA: RESEARCH REAGENTS MARKET FOR FIXATIVES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET FOR FIXATIVES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.4 BUFFERS

- 6.2.4.1 High utilization in drug development to drive market

- TABLE 40 RESEARCH REAGENTS MARKET FOR BUFFERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: RESEARCH REAGENTS MARKET FOR BUFFERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 42 EUROPE: RESEARCH REAGENTS MARKET FOR BUFFERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: RESEARCH REAGENTS MARKET FOR BUFFERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 LATIN AMERICA: RESEARCH REAGENTS MARKET FOR BUFFERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 45 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET FOR BUFFERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.5 SOLVENTS

- 6.2.5.1 Broad applications in pharmaceutical processes and IHC assays to propel market

- TABLE 46 RESEARCH REAGENTS MARKET FOR SOLVENTS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: RESEARCH REAGENTS MARKET FOR SOLVENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 48 EUROPE: RESEARCH REAGENTS MARKET FOR SOLVENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: RESEARCH REAGENTS MARKET FOR SOLVENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 LATIN AMERICA: RESEARCH REAGENTS MARKET FOR SOLVENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 51 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET FOR SOLVENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.6 ENZYMES

- 6.2.6.1 Rising proteomic & genomic research studies to fuel uptake

- TABLE 52 RESEARCH REAGENTS MARKET FOR ENZYMES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: RESEARCH REAGENTS MARKET FOR ENZYMES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 EUROPE: RESEARCH REAGENTS MARKET FOR ENZYMES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: RESEARCH REAGENTS MARKET FOR ENZYMES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 56 LATIN AMERICA: RESEARCH REAGENTS MARKET FOR ENZYMES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET FOR ENZYMES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.7 PROBES

- 6.2.7.1 Quantitative and versatile capabilities to propel market

- TABLE 58 RESEARCH REAGENTS MARKET FOR PROBES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: RESEARCH REAGENTS MARKET FOR PROBES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 60 EUROPE: RESEARCH REAGENTS MARKET FOR PROBES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: RESEARCH REAGENTS MARKET FOR PROBES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 LATIN AMERICA: RESEARCH REAGENTS MARKET FOR PROBES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 63 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET FOR FIXATIVES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.8 OTHER REAGENTS

- TABLE 64 OTHER RESEARCH REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: OTHER RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 66 EUROPE: OTHER RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 ASIA PACIFIC: OTHER RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 68 LATIN AMERICA: OTHER RESEARCH REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET FOR OTHER RESEARCH REAGENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 ANTIBODIES

- TABLE 70 RESEARCH ANTIBODIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 75 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 ANTIBODIES, BY TYPE

- TABLE 76 ANTIBODIES, BY TYPE AND APPLICATION

- TABLE 77 RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.3.1.1 Primary antibodies

- 6.3.1.1.1 Rising demand for personalized therapeutics to drive market

- 6.3.1.1 Primary antibodies

- TABLE 78 PRIMARY RESEARCH ANTIBODIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: PRIMARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: PRIMARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: PRIMARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 82 LATIN AMERICA: PRIMARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 83 MIDDLE EAST & AFRICA: PRIMARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1.2 Secondary antibodies

- 6.3.1.2.1 Low production costs to support market growth

- 6.3.1.2 Secondary antibodies

- TABLE 84 SECONDARY RESEARCH ANTIBODIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: SECONDARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 86 EUROPE: SECONDARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: SECONDARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 88 LATIN AMERICA: SECONDARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: SECONDARY RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2 ANTIBODIES, BY FORM

- TABLE 90 ANTIBODIES, BY FORM AND APPLICATION

- TABLE 91 RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- 6.3.2.1 Monoclonal antibodies

- 6.3.2.1.1 High usage in biomedical science to boost demand

- 6.3.2.1 Monoclonal antibodies

- TABLE 92 MONOCLONAL RESEARCH ANTIBODIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MONOCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 94 EUROPE: MONOCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MONOCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 96 LATIN AMERICA: MONOCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: MONOCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2.2 Polyclonal antibodies

- 6.3.2.2.1 Ability to target specific assays to fuel uptake

- 6.3.2.2 Polyclonal antibodies

- TABLE 98 POLYCLONAL RESEARCH ANTIBODIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: POLYCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 100 EUROPE: POLYCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: POLYCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 102 LATIN AMERICA: POLYCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: POLYCLONAL RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

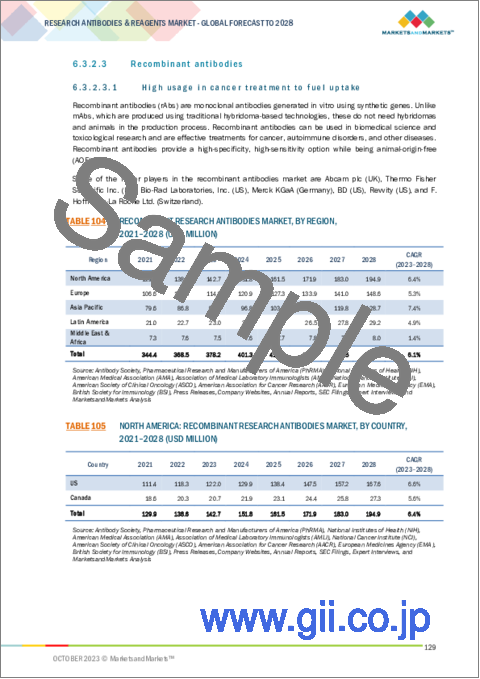

- 6.3.2.3 Recombinant antibodies

- 6.3.2.3.1 High usage in cancer treatment to fuel uptake

- 6.3.2.3 Recombinant antibodies

- TABLE 104 RECOMBINANT RESEARCH ANTIBODIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: RECOMBINANT RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 106 EUROPE: RECOMBINANT RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: RECOMBINANT RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 108 LATIN AMERICA: RECOMBINANT RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: RECOMBINANT RESEARCH ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.3 ANTIBODIES, BY SOURCE

- TABLE 110 ANTIBODIES, BY SOURCE AND APPLICATION

- TABLE 111 RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- 6.3.3.1 Mice

- 6.3.3.1.1 Preferred hosts for antibody production to propel market

- 6.3.3.1 Mice

- TABLE 112 MICE ANTIBODIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: MICE ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 114 EUROPE: MICE ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MICE ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 116 LATIN AMERICA: MICE ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: MICE ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.3.2 Rabbits

- 6.3.3.2.1 Cost-effective benefits to drive demand

- 6.3.3.2 Rabbits

- TABLE 118 RABBIT ANTIBODIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: RABBIT ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 120 EUROPE: RABBIT ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: RABBIT ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 122 LATIN AMERICA: RABBIT ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: RABBIT ANTIBODIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.3.3 Other sources

- TABLE 124 OTHER ANTIBODY SOURCES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: OTHER ANTIBODY SOURCES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 126 EUROPE: OTHER ANTIBODY SOURCES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: OTHER ANTIBODY SOURCES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: OTHER ANTIBODY SOURCES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: OTHER ANTIBODY SOURCES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4 ANTIBODIES, BY RESEARCH AREA

- TABLE 130 ANTIBODIES, BY RESEARCH AREA AND APPLICATION

- TABLE 131 RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- 6.3.4.1 Oncology

- 6.3.4.1.1 Rising incidence of cancer and associated oncology diagnostics to drive market

- 6.3.4.1 Oncology

- TABLE 132 RESEARCH ANTIBODIES MARKET FOR ONCOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: RESEARCH ANTIBODIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 134 EUROPE: RESEARCH ANTIBODIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 136 LATIN AMERICA: RESEARCH ANTIBODIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET FOR ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4.2 Infectious diseases

- 6.3.4.2.1 Increasing incidence of viral infections to drive market

- 6.3.4.2 Infectious diseases

- TABLE 138 RESEARCH ANTIBODIES MARKET FOR INFECTIOUS DISEASES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: RESEARCH ANTIBODIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 140 EUROPE: RESEARCH ANTIBODIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: RESEARCH ANTIBODIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4.3 Immunology

- 6.3.4.3.1 Growing awareness of autoimmune diseases to support market growth

- 6.3.4.3 Immunology

- TABLE 144 RESEARCH ANTIBODIES MARKET FOR IMMUNOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: RESEARCH ANTIBODIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 146 EUROPE: RESEARCH ANTIBODIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 148 LATIN AMERICA: RESEARCH ANTIBODIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4.4 Neurobiology

- 6.3.4.4.1 Wide applications in molecular & cellular neuroscience to drive market

- 6.3.4.4 Neurobiology

- TABLE 150 RESEARCH ANTIBODIES MARKET FOR NEUROBIOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: RESEARCH ANTIBODIES MARKET FOR NEUROBIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 152 EUROPE: RESEARCH ANTIBODIES MARKET FOR NEUROBIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET FOR NEUROBIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 154 LATIN AMERICA: RESEARCH ANTIBODIES MARKET FOR NEUROBIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET FOR NEUROBIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4.5 Stem cells

- 6.3.4.5.1 Growing importance of transplantations to propel market

- 6.3.4.5 Stem cells

- TABLE 156 RESEARCH ANTIBODIES MARKET FOR STEM CELLS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 157 NORTH AMERICA: RESEARCH ANTIBODIES MARKET FOR STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 158 EUROPE: RESEARCH ANTIBODIES MARKET FOR STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET FOR STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: RESEARCH ANTIBODIES MARKET FOR STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET FOR STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4.6 Other research areas

- TABLE 162 RESEARCH ANTIBODIES MARKET FOR OTHER RESEARCH AREAS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 163 NORTH AMERICA: RESEARCH ANTIBODIES MARKET FOR OTHER RESEARCH AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 164 EUROPE: RESEARCH ANTIBODIES MARKET FOR OTHER RESEARCH AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 165 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET FOR OTHER RESEARCH AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: RESEARCH ANTIBODIES MARKET FOR OTHER RESEARCH AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET FOR OTHER RESEARCH AREAS, BY COUNTRY, 2021-2028 (USD MILLION)

7 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 168 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

- 7.2.1 ABILITY TO DETECT ONCOLOGY AND INFECTIOUS DISEASE SAMPLES TO PROPEL MARKET

- TABLE 169 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR ELISA, BY REGION, 2021-2028 (USD MILLION)

- TABLE 170 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR ELISA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 171 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR ELISA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR ELISA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 173 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR ELISA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR ELISA, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 FLOW CYTOMETRY

- 7.3.1 GROWING APPLICATIONS IN CANCER RESEARCH TO DRIVE MARKET

- TABLE 175 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR FLOW CYTOMETRY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 176 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 177 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 179 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 WESTERN BLOTTING

- 7.4.1 HIGH ACCURACY AND SIMPLIFIED ASSESSMENT TO DRIVE MARKET

- TABLE 181 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR WESTERN BLOTTING, BY REGION, 2021-2028 (USD MILLION)

- TABLE 182 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR WESTERN BLOTTING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 183 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR WESTERN BLOTTING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR WESTERN BLOTTING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR WESTERN BLOTTING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR WESTERN BLOTTING, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 IMMUNOFLUORESCENCE

- 7.5.1 ABILITY TO DETERMINE SPECIFIC GENE EXPRESSIONS TO SUPPORT MARKET

- TABLE 187 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOFLUORESCENCE, BY REGION, 2021-2028 (USD MILLION)

- TABLE 188 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOFLUORESCENCE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 189 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOFLUORESCENCE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOFLUORESCENCE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOFLUORESCENCE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOFLUORESCENCE, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.6 IMMUNOHISTOCHEMISTRY

- 7.6.1 GROWING APPLICATIONS IN DRUG EFFICACY TESTING TO SUPPORT MARKET GROWTH

- TABLE 193 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOHISTOCHEMISTRY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 194 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOHISTOCHEMISTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 195 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOHISTOCHEMISTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 196 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOHISTOCHEMISTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 197 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOHISTOCHEMISTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOHISTOCHEMISTRY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.7 IMMUNOPRECIPITATION

- 7.7.1 HIGH-SPECIFICITY RESULTS TO CONTRIBUTE TO MARKET GROWTH

- TABLE 199 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOPRECIPITATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 200 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOPRECIPITATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 201 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOPRECIPITATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 202 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOPRECIPITATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 203 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOPRECIPITATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR IMMUNOPRECIPITATION, BY REGION, 2021-2028 (USD MILLION)

- 7.8 OTHER TECHNOLOGIES

- TABLE 205 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 206 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 207 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 209 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

8 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 211 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2 PROTEOMICS

- 8.2.1 RISING GOVERNMENT INVESTMENTS IN RESEARCH PROJECTS TO DRIVE MARKET

- TABLE 212 TECHNOLOGICAL APPLICATIONS OF ANTIBODIES IN PROTEOMICS

- TABLE 213 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PROTEOMICS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 214 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PROTEOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 215 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PROTEOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PROTEOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 217 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PROTEOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PROTEOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 DRUG DEVELOPMENT

- 8.3.1 RISING PHARMA R&D EXPENDITURE TO PROPEL MARKET

- FIGURE 31 APPLICATION OF ANTIBODIES IN DRUG DEVELOPMENT PROCESS

- TABLE 219 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR DRUG DEVELOPMENT, BY REGION, 2021-2028 (USD MILLION)

- TABLE 220 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR DRUG DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 221 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR DRUG DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR DRUG DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR DRUG DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR DRUG DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 GENOMICS

- 8.4.1 INCREASING INVESTMENTS IN GENOMICS MEDICINE TO SUPPORT MARKET GROWTH

- TABLE 225 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR GENOMICS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 226 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR GENOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 227 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR GENOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 228 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR GENOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 229 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR GENOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR GENOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

9 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 231 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 RESEARCH LABORATORIES

- 9.2.1 INCREASING STUDIES IN BIOMEDICAL AND LIFE SCIENCE RESEARCH TO PROPEL MARKET

- TABLE 232 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR RESEARCH LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 233 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 234 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 235 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 236 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 9.3.1 RISING FOCUS ON DRUG DEVELOPMENT TO DRIVE MARKET

- TABLE 238 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 239 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 240 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 241 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 242 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 CONTRACT RESEARCH ORGANIZATIONS

- 9.4.1 ASSISTED SERVICES FOR MAB DEVELOPMENT TO SUPPORT MARKET GROWTH

- TABLE 244 RESEARCH ANTIBODIES AND REAGENTS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 245 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 246 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 247 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 248 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

10 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 250 RESEARCH ANTIBODIES AND REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET SNAPSHOT

- TABLE 251 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 252 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 253 NORTH AMERICA: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 254 NORTH AMERICA: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 255 NORTH AMERICA: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 256 NORTH AMERICA: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 257 NORTH AMERICA: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 258 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 259 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 260 NORTH AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Increasing funding for oncology therapeutics to drive market

- TABLE 261 US NIH BUDGET FOR DISCIPLINES, FY 2019 TO FY 2022 (USD BILLION)

- TABLE 262 US: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 263 US: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 264 US: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 265 US: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 266 US: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 267 US: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 268 US: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 269 US: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 270 US: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Rising funding for biomedical research projects to drive market

- TABLE 271 CANADA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 272 CANADA: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 273 CANADA: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 274 CANADA: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 275 CANADA: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 276 CANADA: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 277 CANADA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 278 CANADA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 279 CANADA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 NORTH AMERICA: RECESSION IMPACT

- 10.3 EUROPE

- TABLE 280 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 281 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 282 EUROPE: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 283 EUROPE: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 284 EUROPE: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 285 EUROPE: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 286 EUROPE: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 287 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 288 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 289 EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Growing industry-academia collaborations for life science research to drive market

- TABLE 290 GERMANY: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 291 GERMANY: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 292 GERMANY: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 293 GERMANY: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 294 GERMANY: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 295 GERMANY: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 296 GERMANY: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 297 GERMANY: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 298 GERMANY: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Rising incidence of cancer to support market growth

- TABLE 299 UK: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 300 UK: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 301 UK: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 302 UK: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 303 UK: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 304 UK: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 305 UK: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 306 UK: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 307 UK: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Rising demand for personalized therapeutics to support market growth

- TABLE 308 FRANCE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 309 FRANCE: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 310 FRANCE: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 311 FRANCE: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 312 FRANCE: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 313 FRANCE: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 314 FRANCE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 315 FRANCE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 316 FRANCE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Federal funding for targeted research projects to support market growth

- TABLE 317 ITALY: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 318 ITALY: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 319 ITALY: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 320 ITALY: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 321 ITALY: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 322 ITALY: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 323 ITALY: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 324 ITALY: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 325 ITALY: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Favorable funding initiatives for novel therapeutic development to propel market

- TABLE 326 SPAIN: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 327 SPAIN: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 328 SPAIN: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 329 SPAIN: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 330 SPAIN: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 331 SPAIN: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 332 SPAIN: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 333 SPAIN: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 334 SPAIN: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 335 REST OF EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 336 REST OF EUROPE: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 337 REST OF EUROPE: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 338 REST OF EUROPE: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 339 REST OF EUROPE: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 340 REST OF EUROPE: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 341 REST OF EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 342 REST OF EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 343 REST OF EUROPE: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.7 EUROPE: RECESSION IMPACT

- 10.4 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET SNAPSHOT

- TABLE 344 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 345 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 346 ASIA PACIFIC: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 347 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 348 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 349 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 350 ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 351 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 352 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 353 ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Rising establishment of R&D facilities to propel market

- TABLE 354 CHINA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 355 CHINA: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 356 CHINA: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 357 CHINA: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 358 CHINA: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 359 CHINA: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 360 CHINA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 361 CHINA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 362 CHINA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Rising growth in biotechnology industry to propel market

- TABLE 363 JAPAN: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 364 JAPAN: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 365 JAPAN: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 366 JAPAN: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 367 JAPAN: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 368 JAPAN: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 369 JAPAN: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 370 JAPAN: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 371 JAPAN: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Rising growth in pharmaceutical industry to drive market

- TABLE 372 INDIA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 373 INDIA: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 374 INDIA: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 375 INDIA: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 376 INDIA: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 377 INDIA: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 378 INDIA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 379 INDIA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 380 INDIA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 REST OF ASIA PACIFIC

- TABLE 381 REST OF ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 382 REST OF ASIA PACIFIC: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 383 REST OF ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 384 REST OF ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 385 REST OF ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 386 REST OF ASIA PACIFIC: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 387 REST OF ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 388 REST OF ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 389 REST OF ASIA PACIFIC: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 ASIA PACIFIC: RECESSION IMPACT

- 10.5 LATIN AMERICA

- TABLE 390 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 391 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 392 LATIN AMERICA: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 393 LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 394 LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 395 LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 396 LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 397 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 398 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 399 LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.1 BRAZIL

- 10.5.1.1 Growing hub for pharma R&D to support market growth

- TABLE 400 BRAZIL: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 401 BRAZIL: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 402 BRAZIL: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 403 BRAZIL: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 404 BRAZIL: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 405 BRAZIL: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 406 BRAZIL: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 407 BRAZIL: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 408 BRAZIL: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.2 REST OF LATIN AMERICA

- TABLE 409 REST OF LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 410 REST OF LATIN AMERICA: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 411 REST OF LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 412 REST OF LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 413 REST OF LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 414 REST OF LATIN AMERICA: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 415 REST OF LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 416 REST OF LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 417 REST OF LATIN AMERICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.3 LATIN AMERICA: RECESSION IMPACT

- 10.6 MIDDLE EAST & AFRICA

- TABLE 418 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 419 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 420 MIDDLE EAST & AFRICA: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 421 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 422 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 423 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 424 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 425 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 426 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 427 MIDDLE EAST & AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.1 MIDDLE EAST

- 10.6.1.1 Rising research collaborations to drive market

- TABLE 428 MIDDLE EAST: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 429 MIDDLE EAST: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 430 MIDDLE EAST: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 431 MIDDLE EAST: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 432 MIDDLE EAST: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 433 MIDDLE EAST: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 434 MIDDLE EAST: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 435 MIDDLE EAST: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 436 MIDDLE EAST: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.2 AFRICA

- 10.6.2.1 Growing genomic studies to support market growth

- TABLE 437 AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 438 AFRICA: RESEARCH REAGENTS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 439 AFRICA: RESEARCH ANTIBODIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 440 AFRICA: RESEARCH ANTIBODIES MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 441 AFRICA: RESEARCH ANTIBODIES MARKET, BY SOURCE, 2021-2028 (USD MILLION)

- TABLE 442 AFRICA: RESEARCH ANTIBODIES MARKET, BY RESEARCH AREA, 2021-2028 (USD MILLION)

- TABLE 443 AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 444 AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 445 AFRICA: RESEARCH ANTIBODIES AND REAGENTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.3 MIDDLE EAST & AFRICA: RECESSION IMPACT

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 34 KEY DEVELOPMENTS IN RESEARCH ANTIBODIES AND REAGENTS MARKET

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 RESEARCH ANTIBODIES AND REAGENTS MARKET: MARKET SHARE ANALYSIS

- FIGURE 35 MARKET SHARE ANALYSIS FOR OVERALL MARKET, BY KEY PLAYER (2022)

- TABLE 446 RESEARCH ANTIBODIES AND REAGENTS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 11.3.2 RESEARCH ANTIBODIES MARKET: MARKET SHARE ANALYSIS (2022)

- FIGURE 36 RESEARCH ANTIBODIES MARKET: MARKET SHARE ANALYSIS, BY KEY PLAYER (2022)

- 11.4 REVENUE SHARE ANALYSIS OF TOP PLAYERS

- FIGURE 37 REVENUE SHARE ANALYSIS OF TOP PLAYERS (2020-2022)

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 38 RESEARCH ANTIBODIES AND REAGENTS MARKET: COMPANY EVALUATION MATRIX (2022)

- 11.5.5 COMPANY FOOTPRINT

- 11.5.5.1 Company footprint (25 Companies)

- TABLE 447 COMPANY FOOTPRINT ANALYSIS

- 11.5.5.2 Company product footprint (25 Companies)

- TABLE 448 PRODUCT FOOTPRINT ANALYSIS

- 11.5.5.3 Company regional footprint (25 Companies)

- TABLE 449 REGIONAL FOOTPRINT ANALYSIS

- 11.6 START-UP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 39 RESEARCH ANTIBODIES AND REAGENTS MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES (2022)

- TABLE 450 RESEARCH ANTIBODIES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 451 RESEARCH ANTIBODIES AND REAGENTS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 11.7 COMPETITIVE TRENDS

- TABLE 452 RESEARCH ANTIBODIES AND REAGENTS MARKET: PRODUCT LAUNCHES (2020-2023)

- TABLE 453 RESEARCH ANTIBODIES AND REAGENTS MARKET: DEALS (2020-2023)

- TABLE 454 RESEARCH ANTIBODIES AND REAGENTS MARKET: OTHER DEVELOPMENTS (2020-2023)

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 12.1.1 ABCAM PLC

- TABLE 455 ABCAM PLC: BUSINESS OVERVIEW

- FIGURE 40 ABCAM PLC: COMPANY SNAPSHOT (2022)

- 12.1.2 CELL SIGNALING TECHNOLOGY, INC.

- TABLE 456 CELL SIGNALING TECHNOLOGY, INC.: BUSINESS OVERVIEW

- 12.1.3 THERMO FISHER SCIENTIFIC INC.

- TABLE 457 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- FIGURE 41 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- 12.1.4 MERCK KGAA

- TABLE 458 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 42 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 12.1.5 BECTON, DICKINSON AND COMPANY

- TABLE 459 BD: BUSINESS OVERVIEW

- FIGURE 43 BD: COMPANY SNAPSHOT (2022)

- 12.1.6 BIO-RAD LABORATORIES, INC.

- TABLE 460 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 44 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- 12.1.7 F. HOFFMANN-LA ROCHE LTD.

- TABLE 461 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- FIGURE 45 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- 12.1.8 AGILENT TECHNOLOGIES, INC.

- TABLE 462 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 46 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2022)

- 12.1.9 DANAHER

- TABLE 463 DANAHER: BUSINESS OVERVIEW

- FIGURE 47 DANAHER: COMPANY SNAPSHOT (2022)

- 12.1.10 LONZA GROUP

- TABLE 464 LONZA GROUP: BUSINESS OVERVIEW

- FIGURE 48 LONZA GROUP: COMPANY SNAPSHOT (2022)

- 12.1.11 GENSCRIPT

- TABLE 465 GENSCRIPT: BUSINESS OVERVIEW

- FIGURE 49 GENSCRIPT: COMPANY SNAPSHOT (2022)

- 12.1.12 REVVITY

- TABLE 466 REVVITY: BUSINESS OVERVIEW

- FIGURE 50 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

- 12.1.13 ILLUMINA, INC.

- TABLE 467 ILLUMINA, INC.: BUSINESS OVERVIEW

- FIGURE 51 ILLUMINA, INC.: COMPANY SNAPSHOT (2022)

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 IMMUNOPRECISE ANTIBODIES LTD.

- TABLE 468 IMMUNOPRECISE ANTIBODIES LTD.: COMPANY OVERVIEW

- 12.2.2 FUJIREBIO

- TABLE 469 FUJIREBIO: COMPANY OVERVIEW

- 12.2.3 ANALYTIK JENA GMBH+CO. KG

- TABLE 470 ANALYTIK JENA GMBH+CO. KG: COMPANY OVERVIEW

- 12.2.4 OMEGA BIO-TEK, INC.

- TABLE 471 OMEGA BIO-TEK, INC.: COMPANY OVERVIEW

- 12.2.5 DOVETAIL GENOMICS

- TABLE 472 DOVETAIL GENOMICS: COMPANY OVERVIEW

- 12.2.6 ATLAS ANTIBODIES AB

- TABLE 473 ATLAS ANTIBODIES AB: COMPANY OVERVIEW

- 12.2.7 ROCKLAND IMMUNOCHEMICALS, INC.

- TABLE 474 ROCKLAND IMMUNOCHEMICALS, INC.: BUSINESS OVERVIEW

- 12.2.8 SANTA CRUZ BIOTECHNOLOGY, INC.

- TABLE 475 SANTA CRUZ BIOTECHNOLOGY, INC.: COMPANY OVERVIEW

- 12.2.9 JACKSON IMMUNORESEARCH INC.

- TABLE 476 JACKSON IMMUNORESEARCH INC.: COMPANY OVERVIEW

- 12.2.10 PROTEINTECH GROUP, INC.

- TABLE 477 PROTEINTECH GROUP, INC.: COMPANY OVERVIEW

- 12.2.11 ICL, INC.

- TABLE 478 ICL, INC.: COMPANY OVERVIEW

- 12.2.12 SOUTHERNBIOTECH

- TABLE 479 SOUTHERNBIOTECH: COMPANY OVERVIEW

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS