|

|

市場調査レポート

商品コード

1881235

半導体製造装置の世界市場:リソグラフィ、ウエハー表面処理、ウエハー洗浄、成膜、組立・パッケージング、ダイシング、計測、ボンディング、ウエハー検査/IC検査、メモリ、論理、ディスクリート、アナログ - 予測(~2032年)Semiconductor Manufacturing Equipment Market by Lithography, Wafer Surface Conditioning, Wafer Cleaning, Deposition, Assembly & Packaging, Dicing, Metrology, Bonding, Wafer Testing/IC Testing, Memory, Logic, Discrete, Analog - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 半導体製造装置の世界市場:リソグラフィ、ウエハー表面処理、ウエハー洗浄、成膜、組立・パッケージング、ダイシング、計測、ボンディング、ウエハー検査/IC検査、メモリ、論理、ディスクリート、アナログ - 予測(~2032年) |

|

出版日: 2025年11月21日

発行: MarketsandMarkets

ページ情報: 英文 316 Pages

納期: 即納可能

|

概要

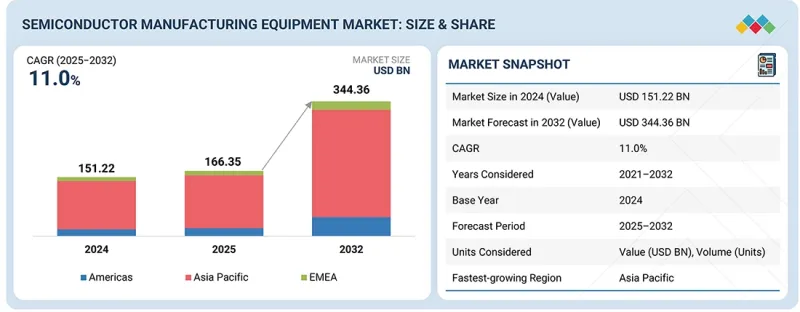

世界の半導体製造装置の市場規模は、2025年の1,663億5,000万米ドルから2032年までに3,443億6,000万米ドルに達すると予測され、CAGRで11.0%の成長が見込まれます。

自動車用半導体部門の急速な成長が、2025年の半導体製造装置市場の大きな促進要因として台頭しています。自動車業界が電化、自動運転、先進の接続性、ソフトウェア定義アーキテクチャへと移行する中、マイクロコントローラー、PMIC、センサー、ADASプロセッサーを含む高信頼性半導体コンポーネントへの需要は引き続き急激に増加しています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 10億米ドル |

| セグメント | 製造工程、エンドユーザー、前工程装置、後工程装置、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

電気自動車(EV)への急速な移行と、1台あたりの半導体搭載量の増加により、トラクションインバーター、バッテリーマネジメントシステム、パワーエレクトロニクス、センシングモジュール、ADASプラットフォームなどに使用される先進のチップの需要が大幅に増加しています。自動車メーカーとTier 1サプライヤーは、自動車グレードの半導体の生産に向け、ファブの生産能力の拡大と既存ラインのアップグレードを進めており、リソグラフィ、成膜、エッチング、計測、検査ツールなどの重要な装置への投資を直接的に促進しています。自動車用途における厳しい性能、信頼性、トレーサビリティの要件を踏まえ、このセグメントは精密製造と堅牢な品質管理を重視しており、自動車認定ツールセットを有する半導体製造装置サプライヤーに恩恵をもたらしています。

「OSAT企業が予測期間に最高のCAGRを記録する見込みです。」

OSAT企業は、業界が先進のパッケージングと高密度検査要件へ急速に移行する中核にあるため、予測期間にもっとも高いCAGRを記録すると見込まれます。チップ設計がAI/ML、HPC、5G、自動運転、ヘテロジニアス統合をサポートする方向へ進化するにつれて、2.5D/3Dパッケージング、ファンアウトウエハーレベルパッケージング、システムインパッケージング(SiP)、高性能自動検査装置(ATE)といった先進の後工程への需要は引き続き急増しています。

ファブレス企業はコスト削減と市場投入の加速を目的に、組立・検査工程のアウトソーシングを増加させており、これによりOSAT企業は生産能力の拡大と先進の装置の採用を迫られています。さらに、微細化の進行、チップレットベースアーキテクチャの採用、パッケージング主導の性能向上への移行が、OSAT投資を大きく押し上げています。これらの要因により、エンドユーザー別ではOSAT企業が半導体製造装置市場においてもっとも成長が速いセグメントとなっています。

「検査装置が2024年に半導体製造後工程装置市場を牽引しました。」

検査装置は、半導体製造後工程装置市場において最大のシェアを占めています。これは、あらゆる半導体デバイスが出荷前に機能精度、性能信頼性、欠陥のない動作を保証するために、複数の検査段階を経る必要があるためです。I/O数の増加、微細化、チップレットアーキテクチャ、先進のパッケージング形式などによってチップの複雑化が進むにつれて、包括的な電気的検査、機能検査、バーンイン検査、システムレベル検査へのニーズが大幅に高まっています。

さらに、AIアクセラレーター、カーエレクトロニクス、産業オートメーション、5Gなどの用途の台頭により、極めて高い信頼性と安全基準が要求され、検査の強度と範囲の要件がさらに高まっています。デバイスの故障にかかるコストが急激に上昇したため、厳重な検査は半導体メーカーにとって必須の工程となっています。結果として、OSAT、IDM、ファブレス企業は、先進の自動検査装置(ATE)、プロービングシステム、検査技術への投資を継続的に行っており、これにより半導体製造後工程装置市場における検査装置の主導的地位が確固たるものとなっています。

当レポートでは、世界の半導体製造装置市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要な知見

- 半導体製造装置市場の企業にとって魅力的な機会

- 半導体製造装置市場:エンドユーザー別

- 半導体製造装置市場:前工程装置別

- 半導体製造装置市場:地域別

第4章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アンメットニーズとホワイトスペース

- 相互接続された市場と部門横断的な機会

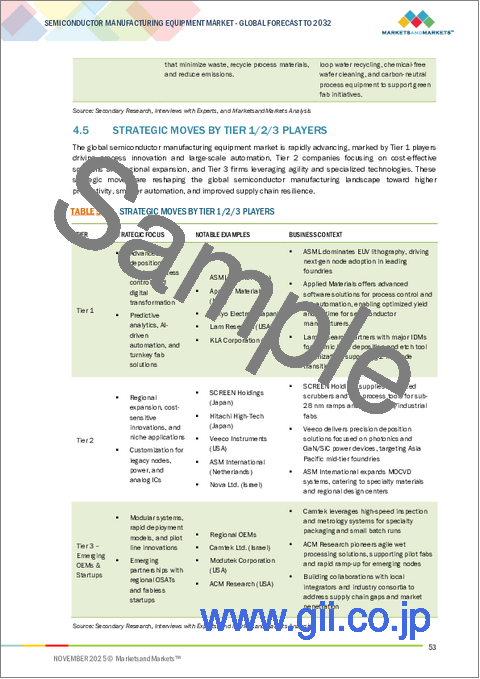

- Tier 1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 世界のファウンドリ業界の動向

- 世界のIDM業界の動向

- 世界のOSAT業界の動向

- バリューチェーン分析

- エコシステム分析

- 価格設定の分析

- 主要企業が提供する前工程リソグラフィ装置の平均販売価格の動向:タイプ別(2021年~2024年)

- 標準リソグラフィ装置の平均販売価格の動向:地域別(2021年~2024年)

- 貿易分析

- 輸入シナリオ(HSコード848620)

- 輸出シナリオ(HSコード848620)

- 主な会議とイベント(2025年~2026年)

- カスタマービジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 半導体製造装置市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- エンドユーザーへの影響

第6章 技術の進歩、AIによる影響、特許、イノベーション、そして将来の用途

- 主な新技術

- 極端紫外線(EUV)リソグラフィ

- ウエハーボンディング

- 補完技術

- 技術/製品ロードマップ

- 特許分析

- 半導体製造装置市場に対するAI/生成AIの影響

- 主なユースケースと市場の将来性

- 半導体製造装置市場におけるOEMのベストプラクティス

- 半導体製造装置市場におけるAI導入に関する事例研究

- 相互接続されたエコシステムと市場企業への影響

- AI/生成AI統合半導体製造装置の採用に対する顧客の準備状況

第7章 地域の情勢、持続可能性に関する取り組み

- 地域の規制とコンプライアンス

- 規制機関、政府機関、その他の組織

- 業界標準

- 持続可能性への取り組み

- 持続可能性取り組みに対する規制政策の影響

- 認証、ラベル、環境基準

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 購買プロセスに関与する主なステークホルダーとその評価基準

- 購買プロセスにおける主なステークホルダー

- 購入基準

- 採用障壁と内部課題

- さまざまなエンドユーザーのアンメットニーズ

- 市場の収益性

第9章 半導体製造装置におけるウエハーのタイプの概観

- イントロダクション

- シリコン(SI)

- シリコンカーバイド(SIC)

- 窒化ガリウム(GAN)

- ガリウムヒ素(GAAS)

- その他のウエハータイプ

第10章 半導体製造装置の最終製品

- イントロダクション

- メモリ

- 論理デバイス

- MPU

- CPU

- GPU

- DSP

- その他

- ディスクリートデバイス

- アナログIC

- その他の最終製品

第11章 半導体製造装置におけるさまざまなICの次元

- イントロダクション

- 2D IC

- 2.5D IC

- 3D IC

第12章 半導体製造装置で処理されるウエハーのサイズ

- イントロダクション

- 150ミリメートル以下

- 200ミリメートル

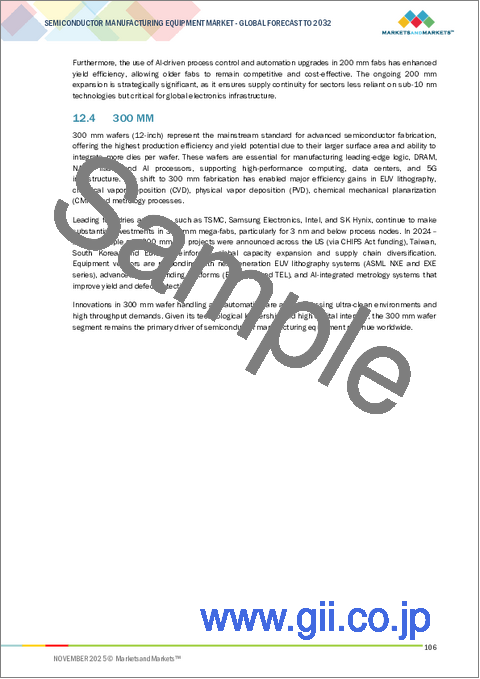

- 300ミリメートル

第13章 半導体製造装置市場:製造工程別

- イントロダクション

- 前工程

- 後工程

- その他の工程

第14章 半導体製造装置市場:前工程装置別

- イントロダクション

- リソグラフィ装置

- 成膜装置

- ウエハー表面処理装置

- ウエハー洗浄装置

- 計測・検査装置

- その他の前工程装置

第15章 半導体製造装置市場:後工程装置別

- イントロダクション

- パッケージング

- ダイシング

- ボンディング

- ウエハー検査/IC検査

第16章 半導体製造装置市場:エンドユーザー別

- イントロダクション

- ファウンドリ

- IDMS

- OSAT企業

- その他のエンドユーザー

第17章 半導体製造装置市場:地域別

- イントロダクション

- 南北アメリカ

- 米国

- その他の南北アメリカ

- アジア太平洋

- 中国

- 日本

- 韓国

- 台湾

- インド

- その他のアジア太平洋

- 欧州・中東・アフリカ

- 欧州

- 中東・アフリカ

第18章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2024年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- 製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第19章 企業プロファイル

- イントロダクション

- 主要企業

- APPLIED MATERIALS, INC.

- ASML

- TOKYO ELECTRON LIMITED

- LAM RESEARCH CORPORATION

- KLA CORPORATION

- SCREEN HOLDINGS CO., LTD.

- TERADYNE INC.

- ZEISS GROUP

- ADVANTEST CORPORATION

- HITACHI HIGH-TECH CORPORATION

- PLASMA-THERM

- その他の企業

- ASM INTERNATIONAL

- EV GROUP(EVG)

- ONTO INNOVATION

- NORDSON CORPORATION

- ADT-ADVANCED DICING TECHNOLOGIES

- BENEQ

- CVD EQUIPMENT CORPORATION

- EUGENE TECHNOLOGY CO. LTD.

- NIKON CORPORATION

- SEMICONDUCTOR EQUIPMENT CORP.

- SENTECH INSTRUMENTS GMBH

- CANON INC.

- KOKUSAI ELECTRIC CORPORATION

- SEMES

- FORMFACTOR

- エンドユーザー

- FOUNDRIES

- IDM FIRMS

- OSAT COMPANIES