|

|

市場調査レポート

商品コード

1881238

CIAMの世界市場:ソリューション別、サービス別、認証タイプ別、業界別 - 予測(~2030年)Consumer Identity and Access Management (CIAM) Market by Solutions (Identity Administration, PII Management & Analytics, Access Management, Fraud Detection), Services, Authentication Type, and Vertical - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| CIAMの世界市場:ソリューション別、サービス別、認証タイプ別、業界別 - 予測(~2030年) |

|

出版日: 2025年10月30日

発行: MarketsandMarkets

ページ情報: 英文 412 Pages

納期: 即納可能

|

概要

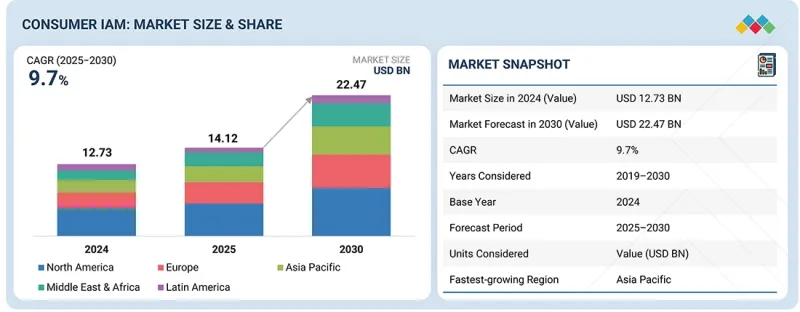

世界のCIAMの市場規模は、2025年の141億2,000万米ドルから2030年までに224億7,000万米ドルに達すると予測され、予測期間にCAGRで9.7%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万/10億米ドル |

| セグメント | 提供、組織規模、業界、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

CIAMの採用は、保険とリスク管理の要件によってますます推進されています。組織は、進化するサイバー規制への準拠、耐量子補償基準への対応、潜在的な責任の軽減、機密性が高く重要なデータの長期的な保護を確保し、将来の量子技術を活用したサイバー攻撃や侵害への曝露を低減することを目指しています。

業界別では、BFSIセグメントが最大の市場シェアを占めています。

BFSI部門は、デジタルバンキングやモバイル決済の台頭、顧客データの安全な取り扱いに関する規制要件により、消費者向けID・アクセス管理(CIAM)市場において最大の業界となっています。金融機関は、GDPR、PSD2、KYC/AML要件などの枠組みへの準拠を確保しつつ、ID盗難、不正行為、不正アクセスに対抗するため、CIAMプラットフォームへの依存度を高めています。2024年のIBM Securityレポートによると、金融サービス部門は全世界のデータ侵害の18%を占めており、その脆弱性の高さが浮き彫りとなっています。銀行やフィンテック企業は、アダプティブ認証、AIに基づく行動分析、生体認証を統合し、シームレスでありながら安全なユーザーエクスペリエンスを提供しています。例えば、HSBCはPing IdentityのCIAMソリューションを採用し、顧客ID管理を一元化するとともに、デジタルチャネル全体での多要素認証を強化し、コンプライアンスと顧客の信頼の両方を向上させました。BFSI部門におけるオープンバンキングとデジタルトランスフォーメーションへの継続的な取り組みは、CIAMを世界の金融ネットワーク全体で摩擦のないコンプライアンスに準拠したスケーラブルなIDエコシステムを実現するために不可欠なものとしています。

サービスセグメントが予測期間にもっとも高い成長率を示す見込みです。

サービスセグメントはCIAM市場でもっとも成長が速いカテゴリであり、専門家主導の導入と継続的なプラットフォーム最適化に対する企業からの需要の高まりがそれを促進しています。これには統合・展開、サポート・保守、コンサルティングサービスが含まれ、円滑な採用、システムの相互運用性、規制順守を保証します。組織がレガシーIDシステムを近代化するにつれて、クラウドとハイブリッドインフラとの専門的な統合へのニーズが大幅に増加しています。継続的な保守サービスは、進化するセキュリティ上の脅威への対応や大規模顧客データベースの効率的な管理に不可欠です。例えば、CIAMプラットフォームを採用する企業は、認証フレームワークのカスタマイズや脅威のリアルタイムモニタリングをマネージドサービスプロバイダーに委託することが多くみられます。BFSI、小売、医療部門における急速なデジタルトランスフォーメーションは、スケーラブルで安全かつ継続的に管理されるCIAMサービスの需要をさらに加速させています。

「地域別では、北米が最大の市場規模を占めると推定されます。」

北米は、急速なデジタルトランスフォーメーション、強力な規制執行、そしてセキュアでシームレスな顧客ID体験への需要の高まりにより、CIAMソリューションの最大の市場であり続けています。同地域ではID詐欺問題が深刻化しており、米国連邦取引委員会(FTC)のレポートによると、2024年には110万件を超えるID盗難事件が発生しており、これは金融、小売、医療部門における持続的な脅威を反映しています。組織は、これらのリスクを軽減しつつ顧客の利便性を高めるため、アダプティブ認証、生体認証、行動分析を特徴とする、AIによって強化されたCIAMソリューションの採用を加速しています。

当レポートでは、世界のCIAM市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要な知見

- CIAM市場の企業にとって魅力的な機会

- CIAM市場:提供別

- CIAM市場:ソリューション別

- CIAM市場:サービス別

- CIAM市場:展開方式別

- CIAM市場:認証タイプ別

- CIAM市場:組織規模別

- CIAM市場:業界別

- CIAM市場:地域別

第4章 市場の概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 相互接続された市場と部門横断的な機会

- BFSI

- ホスピタリティ

- 医療

- 小売・eコマース

- 通信

- Tier 1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 世界のICT業界の動向

- 世界のサイバーセキュリティ業界の動向

- バリューチェーン分析

- エコシステム分析

- 価格設定の分析

- 主要企業の平均販売価格の動向:認証タイプ別

- 参考価格分析:ベンダー別

- 貿易分析

- 輸入シナリオ(HSコード8471)

- 輸出シナリオ(HSコード8471)

- カスタマービジネスに影響を与える動向と混乱

- 主な会議とイベント(2025年~2026年)

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響 - CIAM市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 業界

第6章 戦略的破壊:特許、デジタル、AIの採用

- 主な新技術

- AI/機械学習

- 生体認証

- ブロックチェーン

- 補完技術

- クラウドコンピューティング

- アプリケーションプログラミングインターフェース(API)

- 認証

- 技術/製品ロードマップ

- 特許分析

- 将来の用途

- AIによる本人確認と行動認証

- パスワードレス認証エコシステム

- 分散型IDと検証可能な資格情報

- プライバシー保護の同意とデータガバナンス

- IoT・エッジベース環境向けCIAM

- 生成AI

- CIAM市場における主なユースケースと市場の将来性

- 主なユースケース

- CIAM市場におけるベストプラクティス

- CIAMにおけるAI導入のケーススタディ

- 相互接続された隣接エコシステムと市場企業への影響

- CIAMソリューション市場における生成AIの採用に対する顧客の準備状況

第7章 規制情勢

第8章 消費者情勢と購買行動

- 意思決定プロセス

- 主なステークホルダーと購入基準

- 採用障壁と内部課題

- さまざまな最終用途産業からのアンメットニーズ

第9章 CIAM市場:提供別

- イントロダクション

- ソリューション

- サービス

第10章 CIAM市場:認証タイプ別

- イントロダクション

- MFA

- SSO

- パスワードレス認証

第11章 CIAM市場:展開方式別

- イントロダクション

- クラウド

- オンプレミス

- ハイブリッド

第12章 CIAM市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第13章 CIAM市場:業界別

- イントロダクション

- BFSI

- ホスピタリティ

- 医療

- 小売・eコマース

- 通信

- 教育

- 政府

- エネルギー・公益事業

- 製造

- iゲーミング

- その他の業界

第14章 CIAM市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- シンガポール

- その他のアジア太平洋

- 中東・アフリカ

- GCC

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランドの比較

- IBM

- OKTA

- SAP

- MICROSOFT

- PING IDENTITY

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

第16章 企業プロファイル

- 主要企業

- IBM

- OKTA

- SAP

- MICROSOFT

- PING IDENTITY

- THALES

- BROADCOM

- AWS

- SALESFORCE

- OPENTEXT

- AKAMAI TECHNOLOGIES

- DELOITTE

- HID GLOBAL

- CYBERARK

- NEVIS SECURITY

- その他の主要企業

- SIMEIO SOLUTIONS

- UBISECURE

- ONELOGIN

- SECUREAUTH

- LOGINRADIUS

- OMADA IDENTITY

- WSO2

- WIDASCONCEPTS

- FUSIONAUTH

- TRANSMIT SECURITY

- IDNOW

- MINIORANGE

- STRIVACITY