|

|

市場調査レポート

商品コード

1720953

ライフサイエンスアナリティクスの世界市場:タイプ別、コンポーネント別、用途別、エンドユーザー別、地域別 - 2030年までの予測Life Science Analytics Market by Type, by Service, Application, End User & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ライフサイエンスアナリティクスの世界市場:タイプ別、コンポーネント別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月02日

発行: MarketsandMarkets

ページ情報: 英文 405 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のライフサイエンスアナリティクスの市場規模は、予測期間中のCAGRが11.4%と見込まれ、2025年の400億3,000万米ドルから2030年には688億1,000万米ドルに達すると予測されています。

同市場は、ライフサイエンス分野におけるビッグデータの複雑性と多様性により成長が見込まれています。研究開発、商業化(市場参入、価格設定、販売・マーケティングなど)、安全性など、業界全体のさまざまな用途で高度な分析ソリューションの需要が高まっています。さらに、ライフサイエンスやヘルスケア業界では、より良いデータの標準化が求められているため、市場も拡大しています。しかし、新興国ではITインフラが不十分であることや、アナリティクスソリューションの導入に消極的であることなどが、市場成長の課題となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | タイプ別、コンポーネント別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

ライフサイエンスアナリティクスソフトウェアセグメントはさらに、オンプレミス、クラウドベース、SaaSに区分されます。SaaS(Software-as-a-Service)セグメントは予測期間中に最も高い成長を記録すると予測されています。SaaSセグメントの成長は、様々なクラウドサイロからのデータのシームレスな統合、遠隔地からの無制限のユーザーアクセス、低メンテナンスコスト、高セキュリティ、プライバシー、容易なアクセス性、ハードウェアへの先行投資が不要、容量の柔軟性とリソース利用の最適化など、このモデルが提供する多くの利点に起因しています。さらに、SaaSモデルによって提供される複数の用途は、会計、パフォーマンス監視、ウェブメールやインスタントメッセンジャーを通じたコミュニケーションなどの分野にまたがり、このセグメントの成長にさらに貢献しています。

製薬・バイオテクノロジー企業、医療機器企業、研究機関、アウトソーシングされたライフサイエンス機関が、ライフサイエンスアナリティクス市場のエンドユーザー分野を構成しています。2024年のエンドユーザー別ライフサイエンスアナリティクス市場では、製薬・バイオテクノロジー企業が大きなシェアを占めています。また、このセグメントは予測期間中に最も高い成長を記録する見込みです。このセグメントが突出した地位を占め、高成長を遂げている背景には、製薬・バイオテクノロジー企業の研究開発費の増加、研究開発プロセスにおけるアナリティクスの利用の増加、ファーマコビジランスにおけるアナリティクスの重要性の高まり、創薬の迅速化と臨床試験の最適化の必要性、データ主導の洞察による規制コンプライアンスの強化の必要性などがあります。さらに、個別化医療と精密治療の推進、AIと機械学習の統合は、製薬・バイオテクノロジー業界におけるアナリティクスの価値をさらに高めています。

ライフサイエンスアナリティクス市場は、北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカに二分されます。アジア太平洋は予測期間中に最も高い成長を記録すると予想されています。同地域の高成長は、同地域における大規模かつ増加する患者人口の存在、革新的な治療に対するニーズの高まり、ヘルスケアにおけるビッグデータの出現、HCITインフラへの支出の増加、および同地域の新興国に対する様々な市場プレイヤーの焦点のシフトに起因すると考えられます。また、ライフサイエンス業界全体でデジタル&テクノロジーを駆使したソリューションの採用を促進する政府の取り組みや、ワークフロー全体にわたる高度なテクノロジーの統合に大きな注目が集まっていることも、市場の成長に寄与しています。

当レポートでは、世界のライフサイエンスアナリティクス市場について調査し、タイプ別、コンポーネント別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- エコシステム分析

- バリューチェーン分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 規制状況

- 価格分析

- 2025年~2026年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- エンドユーザー分析

- ライフサイエンスアナリティクスビジネスモデル

- 投資と資金調達のシナリオ

- AI/生成AIがライフサイエンスアナリティクス市場に与える影響

第6章 2025年の米国関税の影響- 概要

- イントロダクション

- 主要関税率

- 価格影響分析

- 国/地域への影響

- 米国

- 欧州

- アジア太平洋

- 最終用途産業への影響

第7章 ライフサイエンスアナリティクス市場(タイプ別)

- イントロダクション

- 記述的分析

- 予測分析

- 処方分析

第8章 ライフサイエンスアナリティクス市場(コンポーネント別)

- イントロダクション

- サービス

- ソフトウェア

第9章 ライフサイエンスアナリティクス市場(用途別)

- イントロダクション

- 研究開発

- 商業分析

- 規制遵守

- 製造およびサプライチェーンの最適化

- 安全性

第10章 ライフサイエンスアナリティクス市場(エンドユーザー別)

- イントロダクション

- 製薬・バイオテクノロジー企業

- 医療機器企業

- 研究センター

- アウトソーシングライフサイエンス組織

第11章 ライフサイエンスアナリティクス市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- GCC諸国

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/ソフトウェア比較分析

- 企業評価と財務指標

- ライフサイエンスアナリティクスベンダーの年初来(YTD)株価最終収益と5年間の株価ベータ

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ORACLE

- MERATIVE

- SAS INSTITUTE INC.

- ACCENTURE

- IQVIA INC.

- COGNIZANT

- WIPRO

- VERADIGM LLC

- OPTUM, INC.

- MICROSOFT

- MAXISIT

- EXLSERVICE HOLDINGS, INC.

- INOVALON

- CITIUSTECH INC.

- SAAMA

- AXTRIA

- CLARIVATE

- THOUGHTSPHERE

- THOUGHTSPOT INC.

- SALESFORCE, INC.

- その他の企業

- GOOGLE LLC

- AMAZON WEB SERVICES, INC.

- VEEVA SYSTEMS

- ELSEVIER

- KOMODO HEALTH, INC.

第14章 付録

List of Tables

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 LIFE SCIENCE ANALYTICS MARKET: RISK ASSESSMENT

- TABLE 3 MARKET DYNAMICS: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AI IN TELEHEALTH & TELEMEDICINE MARKET

- TABLE 4 PHARMACEUTICAL COMPANIES IMPACTED BY CYBER INCIDENTS, 2024

- TABLE 5 LIFE SCIENCE ANALYTICS MARKET: ROLE IN ECOSYSTEM

- TABLE 6 LIFE SCIENCE ANALYTICS MARKET: PORTER'S FIVE FORCES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 8 KEY BUYING CRITERIA FOR END USERS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 AVERAGE SELLING PRICE OF LIFE SCIENCE ANALYTICS SOLUTIONS, BY APPLICATION

- TABLE 15 AVERAGE SELLING PRICE OF ANALYTICS SOLUTIONS, BY REGION

- TABLE 16 LIFE SCIENCE ANALYTICS MARKET: LIST OF KEY CONFERENCES AND EVENTS

- TABLE 17 LIST OF PATENTS/PATENT APPLICATIONS

- TABLE 18 UNMET NEEDS IN LIFE SCIENCE ANALYTICS MARKET

- TABLE 19 END-USER EXPECTATIONS IN LIFE SCIENCE ANALYTICS MARKET

- TABLE 20 MAJOR INVESTMENTS IN AI IN LIFE SCIENCE ANALYTICS MARKET

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 23 DESCRIPTIVE ANALYTICS: LIFE SCIENCE ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 PREDICTIVE ANALYTICS: LIFE SCIENCE ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 PRESCRIPTIVE ANALYTICS: LIFE SCIENCE ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 27 LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 28 LIFE SCIENCE ANALYTICS MARKET FOR SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 30 LIFE SCIENCE ANALYTICS MARKET FOR MANAGED SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 LIFE SCIENCE ANALYTICS MARKET FOR ANALYTICAL SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

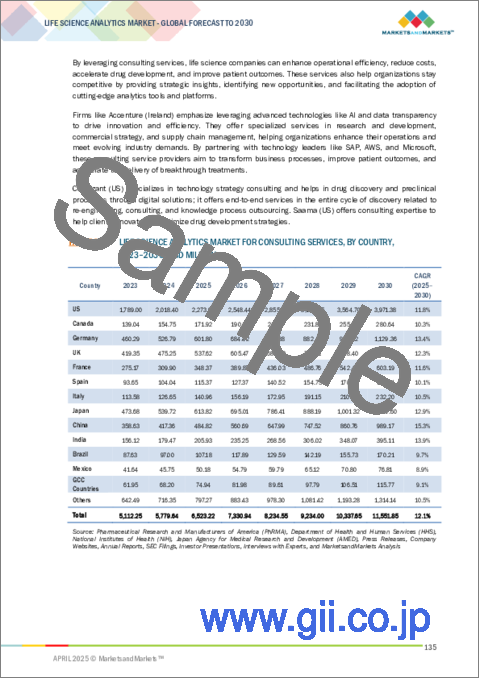

- TABLE 32 LIFE SCIENCE ANALYTICS MARKET FOR CONSULTING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 34 LIFE SCIENCE ANALYTICS MARKET FOR PROFESSIONAL SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 LIFE SCIENCE ANALYTICS MARKET FOR TRAINING & IMPLEMENTATION SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 LIFE SCIENCE ANALYTICS MARKET FOR MAINTENANCE & SUPPORT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 LIFE SCIENCE ANALYTICS MARKET FOR OTHER PROFESSIONAL SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 39 LIFE SCIENCE ANALYTICS MARKET FOR SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 LIFE SCIENCE ANALYTICS MARKET FOR ON-PREMISES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 LIFE SCIENCE ANALYTICS MARKET FOR CLOUD-BASED, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 LIFE SCIENCE ANALYTICS MARKET FOR SAAS-BASED, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 44 LIFE SCIENCE ANALYTICS MARKET: COMMERCIALLY AVAILABLE R&D SOLUTIONS

- TABLE 45 LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 46 LIFE SCIENCE ANALYTICS MARKET FOR RESEARCH & DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 LIFE SCIENCE ANALYTICS MARKET: COMMERCIALLY AVAILABLE CLINICAL TRIAL SOLUTIONS

- TABLE 48 LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 50 LIFE SCIENCE ANALYTICS MARKET FOR LABORATORY SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 LIFE SCIENCE ANALYTICS MARKET FOR PATIENT RECRUITMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 LIFE SCIENCE ANALYTICS MARKET FOR SITE IDENTIFICATION SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 LIFE SCIENCE ANALYTICS MARKET FOR OTHER CLINICAL TRIAL SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 55 LIFE SCIENCE ANALYTICS MARKET FOR PHASE I CLINICAL TRIALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 LIFE SCIENCE ANALYTICS MARKET FOR PHASE II CLINICAL TRIALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 LIFE SCIENCE ANALYTICS MARKET FOR PHASE III CLINICAL TRIALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 LIFE SCIENCE ANALYTICS MARKET: COMMERCIALLY AVAILABLE PRECLINICAL & DRUG DISCOVERY SOLUTIONS

- TABLE 59 LIFE SCIENCE ANALYTICS MARKET FOR PRECLINICAL & DRUG DISCOVERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 61 LIFE SCIENCE ANALYTICS MARKET FOR COMMERCIAL ANALYTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 LIFE SCIENCE ANALYTICS MARKET: COMMERCIALLY AVAILABLE SALES & MARKETING SOLUTIONS

- TABLE 63 LIFE SCIENCE ANALYTICS MARKET FOR SALES & MARKETING SUPPORT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 LIFE SCIENCE ANALYTICS MARKET FOR MARKET ACCESS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 LIFE SCIENCE ANALYTICS MARKET FOR RWE & VALUE EVIDENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 LIFE SCIENCE ANALYTICS MARKET FOR ENGAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 LIFE SCIENCE ANALYTICS MARKET: COMMERCIALLY AVAILABLE REGULATORY COMPLIANCE SOLUTIONS

- TABLE 68 LIFE SCIENCE ANALYTICS MARKET FOR REGULATORY COMPLIANCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 LIFE SCIENCE ANALYTICS MARKET: COMMERCIALLY AVAILABLE MANUFACTURING & SUPPLY CHAIN OPTIMIZATION SOLUTIONS

- TABLE 70 LIFE SCIENCE ANALYTICS MARKET FOR MANUFACTURING & SUPPLY CHAIN OPTIMIZATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 72 LIFE SCIENCE ANALYTICS MARKET FOR SAFETY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 LIFE SCIENCE ANALYTICS MARKET: COMMERCIALLY AVAILABLE PHARMACOVIGILANCE SOLUTIONS

- TABLE 74 LIFE SCIENCE ANALYTICS MARKET FOR PHARMACOVIGILANCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 LIFE SCIENCE ANALYTICS MARKET FOR MEDICAL DEVICE SAFETY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 LIFE SCIENCE ANALYTICS MARKET FOR DIAGNOSTIC VIGILANCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 78 LIFE SCIENCE ANALYTICS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 LIFE SCIENCE ANALYTICS MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 LIFE SCIENCE ANALYTICS MARKET FOR RESEARCH CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 LIFE SCIENCE ANALYTICS MARKET FOR OUTSOURCED LIFE SCIENCE ORGANIZATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 LIFE SCIENCE ANALYTICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: LIFE SCIENCE ANALYTICS SERVICES MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: MANAGED SERVICES MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: PROFESSIONAL SERVICES MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 97 US: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 US: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 99 US: LIFE SCIENCE ANALYTICS SERVICES MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 100 US: MANAGED SERVICES MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 101 US: PROFESSIONAL SERVICES MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 102 US: LIFE SCIENCE ANALYTICS SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 103 US: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 104 US: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 105 US: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 106 US: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 107 US: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 108 US: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 109 US: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 110 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 112 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY SERVICES TYPE, 2023-2030 (USD MILLION)

- TABLE 113 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 114 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 115 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 116 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 117 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 118 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 119 CANADA: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 120 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 121 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 122 CANADA: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 126 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 127 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 128 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 129 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 130 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 131 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 132 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 133 EUROPE: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 134 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 135 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 136 EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 139 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 140 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 141 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 142 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 143 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 144 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 145 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 146 GERMANY: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 147 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 148 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 149 GERMANY: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 150 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 152 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 153 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 154 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 155 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 156 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 157 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 158 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 159 FRANCE: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 160 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 161 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 162 FRANCE: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 163 UK: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 UK: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 165 UK: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 166 UK: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 167 UK: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 168 UK: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 169 UK: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 170 UK: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 171 UK: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 172 UK: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 173 UK: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 174 UK: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 175 UK: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 176 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 178 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 179 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 180 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 181 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 182 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 183 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 184 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 185 ITALY: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 186 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 187 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 188 ITALY: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 189 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 191 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 192 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 193 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 194 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 195 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 196 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 197 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 198 SPAIN: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 199 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 200 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 201 SPAIN: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 202 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 204 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 205 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 206 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 208 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 210 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 211 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 212 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 213 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 214 REST OF EUROPE: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 216 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 219 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 220 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 221 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 222 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 226 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 227 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 228 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 229 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 231 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 232 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 233 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 234 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 235 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 236 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 237 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 238 JAPAN: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 239 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 240 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 241 JAPAN: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 242 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 244 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 245 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 246 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 247 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 248 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 249 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 250 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 251 CHINA: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 252 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 253 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 254 CHINA: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 255 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 257 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 258 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 259 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 260 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 261 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 262 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 263 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 264 INDIA: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 265 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 266 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 267 INDIA: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 268 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 270 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 271 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 272 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 273 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 274 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 275 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 278 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 281 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 282 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 284 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 285 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 286 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 287 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 288 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 289 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 290 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 291 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 292 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 293 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 294 LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 295 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 297 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 298 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 299 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 300 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 301 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 302 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 303 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 304 BRAZIL: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 305 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 306 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 307 BRAZIL: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 308 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 310 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 311 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 312 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 313 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 314 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 315 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 316 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 317 MEXICO: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 318 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 319 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 320 MEXICO: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 321 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 323 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 324 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 325 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 326 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)SOFTWARE

- TABLE 327 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 328 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 329 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 330 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 331 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 332 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 333 REST OF LATIN AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 334 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 335 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 336 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 337 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 338 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 339 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 340 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 341 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 342 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 343 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 344 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 345 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 346 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 347 MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 348 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 349 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 350 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 351 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 352 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 353 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 354 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 355 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 356 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 357 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 358 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 359 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 360 GCC COUNTRIES: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 361 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 362 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 363 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 364 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY MANAGED SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 365 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2023-2030 (USD MILLION)

- TABLE 366 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY SOFTWARE TYPE, 2023-2030 (USD MILLION)

- TABLE 367 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 368 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY RESEARCH & DEVELOPMENT APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 369 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY CLINICAL TRIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 370 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET FOR CLINICAL TRIALS, BY PHASE, 2023-2030 (USD MILLION)

- TABLE 371 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY COMMERCIAL ANALYTICS APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 372 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY SAFETY APPLICATION TYPE, 2023-2030 (USD MILLION)

- TABLE 373 REST OF MIDDLE EAST & AFRICA: LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 374 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN LIFE SCIENCE ANALYTICS MARKET

- TABLE 375 LIFE SCIENCE ANALYTICS MARKET: DEGREE OF COMPETITION

- TABLE 376 LIFE SCIENCE ANALYTICS MARKET: REGION FOOTPRINT (25 COMPANIES)

- TABLE 377 LIFE SCIENCE ANALYTICS MARKET: TYPE FOOTPRINT (25 COMPANIES)

- TABLE 378 LIFE SCIENCE ANALYTICS MARKET: APPLICATION FOOTPRINT (25 COMPANIES)

- TABLE 379 LIFE SCIENCE ANALYTICS MARKET: COMPONENT FOOTPRINT (25 COMPANIES)

- TABLE 380 LIFE SCIENCE ANALYTICS MARKET: END USER FOOTPRINT (25 COMPANIES)

- TABLE 381 LIFE SCIENCE ANALYTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 382 LIFE SCIENCE ANALYTICS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- TABLE 383 LIFE SCIENCE ANALYTICS MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 384 LIFE SCIENCE ANALYTICS MARKET: DEALS, JANUARY 2022-MARCH 2025

- TABLE 385 ORACLE: COMPANY OVERVIEW

- TABLE 386 ORACLE: PRODUCTS & SERVICES OFFERED

- TABLE 387 ORACLE: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 388 ORACLE: DEALS, JANUARY 2022-MARCH 2025

- TABLE 389 MERATIVE: COMPANY OVERVIEW

- TABLE 390 MERATIVE: PRODUCTS & SERVICES OFFERED

- TABLE 391 MERATIVE: DEALS, JANUARY 2022-MARCH 2025

- TABLE 392 MERATIVE: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 393 SAS INSTITUTE: COMPANY OVERVIEW

- TABLE 394 SAS INSTITUTE: PRODUCTS & SERVICES OFFERED

- TABLE 395 SAS INSTITUTE: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 396 SAS INSTITUTE: DEALS, JANUARY 2022-MARCH 2025

- TABLE 397 ACCENTURE: COMPANY OVERVIEW

- TABLE 398 ACCENTURE: PRODUCTS OFFERED

- TABLE 399 ACCENTURE: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 400 ACCENTURE: DEALS, JANUARY 2022-MARCH 2025

- TABLE 401 ACCENTURE: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 402 IQVIA: COMPANY OVERVIEW

- TABLE 403 IQVIA: PRODUCTS & SERVICES OFFERED

- TABLE 404 IQVIA: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 405 IQVIA: DEALS, JANUARY 2022-MARCH 2025

- TABLE 406 IQVIA: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 407 COGNIZANT: COMPANY OVERVIEW

- TABLE 408 COGNIZANT: PRODUCTS & SERVICES OFFERED

- TABLE 409 COGNIZANT: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 410 COGNIZANT: DEALS, JANUARY 2022-MARCH 2025

- TABLE 411 WIPRO: COMPANY OVERVIEW

- TABLE 412 WIPRO: PRODUCTS & SERVICES OFFERED

- TABLE 413 WIPRO: DEALS, JANUARY 2022-MARCH 2025

- TABLE 414 VERADIGM: COMPANY OVERVIEW

- TABLE 415 VERADIGM: PRODUCTS & SERVICES OFFERED

- TABLE 416 VERADIGM: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 417 VERADIGM: DEALS, JANUARY 2022-MARCH 2025

- TABLE 418 OPTUM: COMPANY OVERVIEW

- TABLE 419 OPTUM: PRODUCTS & SERVICES OFFERED

- TABLE 420 MICROSOFT: COMPANY OVERVIEW

- TABLE 421 MICROSOFT: PRODUCTS & SERVICES OFFERED

- TABLE 422 MICROSOFT: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 423 MICROSOFT: DEALS, JANUARY 2022-MARCH 2025

- TABLE 424 MAXISIT: COMPANY OVERVIEW

- TABLE 425 MAXISIT: PRODUCTS & SERVICES OFFERED

- TABLE 426 MAXISIT: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 427 EXLSERVICE HOLDINGS: COMPANY OVERVIEW

- TABLE 428 EXLSERVICE HOLDINGS: PRODUCTS & SERVICES OFFERED

- TABLE 429 EXLSERVICE HOLDINGS: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 430 EXLSERVICE HOLDINGS: DEALS, JANUARY 2022-MARCH 2025

- TABLE 431 INOVALON: COMPANY OVERVIEW

- TABLE 432 INOVALON: PRODUCTS & SERVICES OFFERED

- TABLE 433 INOVALON: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 434 INOVALON: DEALS, JANUARY 2022-MARCH 2025

- TABLE 435 CITIUSTECH: COMPANY OVERVIEW

- TABLE 436 CITIUSTECH: PRODUCTS & SERVICES OFFERED

- TABLE 437 CITIUSTECH: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 438 CITIUSTECH: DEALS, JANUARY 2022-MARCH 2025

- TABLE 439 CITIUSTECH: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 440 SAAMA: COMPANY OVERVIEW

- TABLE 441 SAAMA: PRODUCTS & SERVICES OFFERED

- TABLE 442 SAAMA: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 443 SAAMA: DEALS, JANUARY 2022-MARCH 2025

- TABLE 444 SAAMA: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 445 AXTRIA: COMPANY OVERVIEW

- TABLE 446 AXTRIA: PRODUCTS & SERVICES OFFERED

- TABLE 447 AXTRIA: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 448 AXTRIA: DEALS, JANUARY 2022-MARCH 2025

- TABLE 449 AXTRIA: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 450 CLARIVATE: COMPANY OVERVIEW

- TABLE 451 CLARIVATE: PRODUCTS & SERVICES OFFERED

- TABLE 452 CLARIVATE: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 453 CLARIVATE: DEALS, JANUARY 2022-MARCH 2025

- TABLE 454 THOUGHTSPHERE: COMPANY OVERVIEW

- TABLE 455 THOUGHTSPHERE: PRODUCTS & SERVICES OFFERED

- TABLE 456 THOUGHTSPOT: COMPANY OVERVIEW

- TABLE 457 THOUGHTSPOT: PRODUCTS & SERVICES OFFERED

- TABLE 458 THOUGHTSPOT: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 459 THOUGHTSPOT: DEALS, JANUARY 2022-MARCH 2025

- TABLE 460 SALESFORCE: COMPANY OVERVIEW

- TABLE 461 SALESFORCE: PRODUCTS & SERVICES OFFERED

- TABLE 462 SALESFORCE: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 463 SALESFORCE: DEALS, JANUARY 2022-MARCH 2025

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 LIFE SCIENCE ANALYTICS MARKET: REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 6 BOTTOM-UP APPROACH: END-USER SPENDING ON LIFE SCIENCE ANALYTICS

- FIGURE 7 LIFE SCIENCE ANALYTICS MARKET: CAGR PROJECTION FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 8 CAGR PROJECTION: SUPPLY-SIDE ANALYSIS

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 LIFE SCIENCE ANALYTICS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 LIFE SCIENCE ANALYTICS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 LIFE SCIENCE ANALYTICS MARKET: REGIONAL SNAPSHOT

- FIGURE 16 RISING TECHNOLOGICAL ADVANCEMENTS AND GROWING ADOPTION OF ANALYTICS SOLUTIONS FOR CLINICAL TRIALS TO DRIVE MARKET

- FIGURE 17 NORTH AMERICA TO DOMINATE LIFE SCIENCE ANALYTICS MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 18 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND US HELD LARGEST MARKET SHARE IN NORTH AMERICA IN 2024

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 20 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 21 LIFE SCIENCE ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 HEALTH EXPENDITURE AS SHARE OF GDP, 2022 (OR NEAREST YEAR)

- FIGURE 23 LIFE SCIENCE ANALYTICS MARKET ECOSYSTEM

- FIGURE 24 LIFE SCIENCE ANALYTICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 LIFE SCIENCE ANALYTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR END USERS

- FIGURE 28 REVENUE SHIFT IN LIFE SCIENCE ANALYTICS MARKET

- FIGURE 29 JURISDICTION ANALYSIS: TOP APPLICANTS FOR LIFE SCIENCE ANALYTICS PATENTS, JANUARY 2011-MARCH 2025

- FIGURE 30 MAJOR PATENTS FOR LIFE SCIENCE ANALYTICS, JANUARY 2011- MARCH 2025

- FIGURE 31 FUNDING OF PLAYERS IN LIFE SCIENCE ANALYTICS MARKET

- FIGURE 32 MARKET POTENTIAL OF AI/GENERATIVE AI, BY INDUSTRY

- FIGURE 33 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 34 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: LIFE SCIENCE ANALYTICS MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS IN LIFE SCIENCE ANALYTICS MARKET, 2020-2024

- FIGURE 37 LIFE SCIENCE ANALYTICS MARKET: MARKET SHARE ANALYSIS (2024)

- FIGURE 38 LIFE SCIENCE ANALYTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 39 LIFE SCIENCE ANALYTICS MARKET: COMPANY FOOTPRINT (25 COMPANIES)

- FIGURE 40 LIFE SCIENCE ANALYTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 41 EV/EBITDA OF KEY VENDORS

- FIGURE 42 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF LIFE SCIENCE ANALYTICS VENDORS

- FIGURE 43 ORACLE: COMPANY SNAPSHOT

- FIGURE 44 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 45 IQVIA: COMPANY SNAPSHOT

- FIGURE 46 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 47 WIPRO: COMPANY SNAPSHOT

- FIGURE 48 VERADIGM: COMPANY SNAPSHOT

- FIGURE 49 UNITED HEALTH GROUP: COMPANY SNAPSHOT

- FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 51 EXLSERVICE HOLDINGS: COMPANY SNAPSHOT

- FIGURE 52 CLARIVATE: COMPANY SNAPSHOT

- FIGURE 53 SALESFORCE: COMPANY SNAPSHOT

The global life science analytics market is projected to reach USD 68.81 billion by 2030 from USD 40.03 billion in 2025, at a CAGR of 11.4% during the forecast period. The market is anticipated to grow due to the complexity and diversity of big data in the life sciences sector. There is an increasing demand for advanced analytical solutions for various applications across the industry, including research and development, commercialization (such as market access, pricing, and sales and marketing), and safety. Additionally, the market has grown because of the need for better data standardization in the life sciences and healthcare industries. However, challenges to market growth include inadequate IT infrastructure and a reluctance to adopt analytics solutions in emerging economies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Component, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

"The software-as-a-service (SaaS) subsegment is expected to register the highest growth during the forecast period."

The life science analytics software segment is further segmented into on-premise, cloud-based, and software-as-a-service. The software-as-a-service (SaaS) segment is expected to register the highest growth during the forecast period. The growth of the SaaS segment can be attributed to the ample number of advantages offered by this model, such as the seamless integration of data from various cloud silos, unlimited user access from remote locations, low maintenance costs, high security, privacy, easy accessibility, no upfront capital investment for hardware, and extreme capacity flexibility and optimized resource utilization. Moreover, several applications offered by the SaaS model, spanning areas such as accounting, performance monitoring, and communication through webmail and instant messengers, further contribute to the segment's growth.

"Pharmaceutical & biotechnology companies are expected to dominate the life science analytics market during the forecast period."

Pharmaceutical & biotechnology companies, medical device companies, research institutes, and outsourced life science organizations make up the end-user segments of the life science analytics market. In 2024, pharmaceutical & biotechnology companies accounted for a significant share of the life science analytics market, by end user. This segment is also expected to register the highest growth during the forecast period. The prominent position & high growth of this segment are due to the increasing R&D expenditure of pharma & biotech companies, the increasing use of analytics for research & development processes, the growing importance of analytics in pharmacovigilance, the need to accelerate drug discovery and optimize clinical trials, and the need to enhance regulatory compliance through data-driven insights. Moreover, the push for personalized medicine and precision therapeutics and the integration of AI and machine learning further strengthen the value of analytics in the pharma & biotech industry.

"Asia Pacific is expected to register the highest market growth during the forecast period."

The life science analytics market is bifurcated into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is expected to register the highest growth during the forecast period. The high growth of this region can be attributed to the presence of a large and growing patient population in the region, the increasing need for innovative therapies, the emergence of big data in healthcare, increasing spending on HCIT infrastructure, and the shifting focus of various market players on emerging countries in the region. Government initiatives to promote the adoption of digital & technologically enabled solutions across the life science industry and the significant focus on integrating sophisticated technologies across workflows also contribute to market growth.

The breakdown of primary participants is as mentioned below:

- By Company Type: Tier 1 (32%), Tier 2 (44%), and Tier 3 (24%)

- By Designation: Directors (30%), Managers (34%), and Others (36%)

- By Region: North America (40%), Europe (28%), Asia Pacific (20%), Latin America (7%), and the Middle East & Africa (5%)

List of Companies Profiled in the Report

- Oracle (US)

- Merative (formerly IBM) (US)

- SAS Institute (US)

- Accenture (Ireland)

- IQVIA (US)

- Cognizant (US)

- Wipro (India)

- Veradigm (US)

- Optum (US)

- Microsoft (US)

- MaxisIT (US)

- ExlService Holdings (US)

- Inovalon (US)

- CitiusTech (US)

- Saama (US)

- Axtria (US)

- Clarivate (UK)

- ThoughtSphere (US)

- ThoughtSpot (US)

- Salesforce (US)

- Google LLC (US)

- Amazon Web Services, Inc. (US)

- Veeva Systems (US)

- Elsevier (Netherlands)

- Komodo Health, Inc. (US)

Research Coverage:

The report provides an analysis of the life science analytics market and aims to estimate the market size and future growth potential of various segments based on type, component, application, end user, and region. It also examines factors affecting market growth, including drivers, opportunities, and challenges. The report evaluates the opportunities and challenges for stakeholders and explores micromarkets in terms of their growth trends, prospects, and contributions to the overall life science analytics market. Additionally, the report forecasts the revenue of market segments across five major regions. It includes a competitive analysis of the key players in the market, accompanied by their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers (rising pressure to curb healthcare spending, need for improved data standardization, technological advancements in analytical solutions, heterogeneity and complexity of big data in life sciences, growing adoption of analytical solutions in clinical trials, and increasing R&D expenditure in pharmaceutical & biotechnology companies), restraints (high implementation costs of advanced analytical solutions and data privacy concerns), opportunities (growing focus on value-based care, use of analytics in precision & personalized medicine, big data analytics for R&D productivity, and growing adoption of cloud-based analytics), and challenges (issues associated with data integration, shortage of skilled personnel, and reluctance to adopt life science analytics solutions in emerging countries) are factors contributing the growth of the life science analytics market.

- Product Development/Innovation: Detailed insights on upcoming trends, research & development activities, and new software launches in the life science analytics market.

- Market Development: Comprehensive information on the lucrative emerging markets, type of solution, component, deployment model, industry, and region.

- Market Diversification: Exhaustive information about the software portfolios, growing geographies, recent developments, and investments in the life science analytics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, company evaluation quadrant, and capabilities of leading players in the global life science analytics market such as Oracle (US), Merative (formerly IBM) (US), SAS Institute (US), Accenture (Ireland), IQVIA (US), Cognizant (US), Wipro (India), Veradigm (US), and Optum (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 LIFE SCIENCE ANALYTICS MARKET OVERVIEW

- 4.2 LIFE SCIENCE ANALYTICS MARKET, BY REGION

- 4.3 NORTH AMERICA: LIFE SCIENCE ANALYTICS MARKET, BY END USER AND COUNTRY

- 4.4 LIFE SCIENCE ANALYTICS MARKET: GEOGRAPHIC SNAPSHOT

- 4.5 LIFE SCIENCE ANALYTICS MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising pressure to curb healthcare spending

- 5.2.1.2 Need for improved data standardization

- 5.2.1.3 Technological advancements in analytical solutions

- 5.2.1.4 Heterogeneity and complexity of big data in life sciences

- 5.2.1.5 Growing adoption of analytical solutions in clinical trials

- 5.2.1.6 Increasing R&D expenditure in pharmaceutical & biotechnology companies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs of advanced analytical solutions

- 5.2.2.2 Data privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing focus on value-based care

- 5.2.3.2 Use of analytics in precision & personalized medicine

- 5.2.3.3 Big data analytics for R&D productivity

- 5.2.3.4 Growing adoption of cloud-based analytics

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues associated with data integration

- 5.2.4.2 Shortage of skilled personnel

- 5.2.4.3 Reluctance to adopt life science analytics solutions in emerging countries

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 GROWING ADOPTION OF ANALYTICS IN COMMERCIAL OPERATIONS

- 5.3.2 LEVERAGING DATA & ANALYTICS TO ACCELERATE DRUG DISCOVERY & DEVELOPMENT

- 5.3.3 FOCUS ON REAL-TIME DATA ANALYTICS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Artificial intelligence and machine learning

- 5.4.1.2 Big data analytics

- 5.4.1.3 Quantum computing

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Bioinformatics tools

- 5.4.2.2 Internet of Things

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Blockchain

- 5.4.1 KEY TECHNOLOGIES

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 NOVARTIS USES MULTI-CLOUD DATA ANALYTICS PLATFORM TO OPTIMIZE OPERATIONS AND ACCELERATE INNOVATION

- 5.9.2 SAS VISUAL ANALYTICS HELPS MAXIMIZE PROFITABILITY THROUGH PRESCRIPTIVE ANALYTICS & DATA VISUALIZATION

- 5.9.3 STREAMLINING REGULATORY MONITORING AND IMPACT ASSESSMENTS: GEDEON RICHTER'S PARTNERSHIP WITH CLARIVATE

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 NORTH AMERICA

- 5.10.3 EUROPE

- 5.10.4 ASIA PACIFIC

- 5.10.5 MIDDLE EAST & AFRICA

- 5.10.6 LATIN AMERICA

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

- 5.11.2 AVERAGE SELLING PRICE, BY REGION

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 PATENT ANALYSIS

- 5.14.1 PATENT PUBLICATION TRENDS

- 5.14.2 JURISDICTION ANALYSIS: TOP APPLICANT

- 5.14.3 MAJOR PATENTS

- 5.15 END USER ANALYSIS

- 5.15.1 UNMET NEEDS

- 5.15.2 END-USER EXPECTATIONS

- 5.16 LIFE SCIENCE ANALYTICS BUSINESS MODELS

- 5.16.1 SUBSCRIPTION-BASED MODEL

- 5.16.2 SAAS MODEL

- 5.16.3 PAY-PER-USE/USAGE-BASED MODEL

- 5.16.4 ENTERPRISE LICENSING

- 5.16.5 FREEMIUM MODEL

- 5.16.6 ENTERPRISE LICENSING

- 5.16.7 CONCURRENT LICENSING

- 5.16.8 CONSULTING SERVICES MODEL

- 5.16.9 PARTNERSHIP/REVENUE-SHARING MODEL

- 5.16.10 HYBRID MODELS

- 5.17 INVESTMENT & FUNDING SCENARIO

- 5.18 IMPACT OF AI/GENERATIVE AI ON LIFE SCIENCE ANALYTICS MARKET

- 5.18.1 TOP USE CASES & MARKET POTENTIAL

- 5.18.1.1 Key use cases

- 5.18.2 CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION

- 5.18.2.1 Case study 1: Knowledge mining for a global biopharmaceutical company

- 5.18.2.2 Healthcare analytics market

- 5.18.3 USER READINESS AND IMPACT ASSESSMENT

- 5.18.3.1 User readiness

- 5.18.3.1.1 Pharmaceutical & biotechnology companies

- 5.18.3.1.2 Medical device companies

- 5.18.3.1.3 Research centers

- 5.18.3.1.4 Outsourced life science organizations

- 5.18.3.2 Impact assessment

- 5.18.3.2.1 User A: Pharmaceutical & biotechnology companies

- 5.18.3.2.1.1 Implementation

- 5.18.3.2.1.2 Impact

- 5.18.3.2.2 User B: Medical device companies

- 5.18.3.2.2.1 Implementation

- 5.18.3.2.2.2 Impact

- 5.18.3.2.3 User C: Research institutes

- 5.18.3.2.3.1 Implementation

- 5.18.3.2.3.2 Impact

- 5.18.3.2.4 User D: Outsourced life science organizations

- 5.18.3.2.4.1 Implementation

- 5.18.3.2.4.2 Impact

- 5.18.3.2.1 User A: Pharmaceutical & biotechnology companies

- 5.18.3.1 User readiness

- 5.18.1 TOP USE CASES & MARKET POTENTIAL

6 IMPACT OF 2025 US TARIFF-OVERVIEW

- 6.1 INTRODUCTION

- 6.2 KEY TARIFF RATES

- 6.3 PRICE IMPACT ANALYSIS

- 6.4 IMPACT ON COUNTRY/REGION

- 6.4.1 US

- 6.4.2 EUROPE

- 6.4.3 ASIA PACIFIC

- 6.5 IMPACT ON END-USE INDUSTRIES

7 LIFE SCIENCE ANALYTICS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DESCRIPTIVE ANALYTICS

- 7.2.1 ADVANCED VISUAL DATA EXPLORATION AND SUPPORT FOR INNOVATION TO DRIVE DEMAND

- 7.3 PREDICTIVE ANALYTICS

- 7.3.1 SIMULATION DEVELOPMENT FOR PREDICTING FUTURE TRENDS TO PROPEL MARKET GROWTH

- 7.4 PRESCRIPTIVE ANALYTICS

- 7.4.1 REAL-TIME ANALYSIS FOR IMPROVED DECISION-MAKING TO SUPPORT MARKET GROWTH

8 LIFE SCIENCE ANALYTICS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 SERVICES

- 8.2.1 MANAGED SERVICES

- 8.2.1.1 Analytical services

- 8.2.1.1.1 Focus on expediting approvals and product launches to drive growth

- 8.2.1.2 Consulting services

- 8.2.1.2.1 Support for R&D, process development, and other workflow processes to drive market

- 8.2.1.1 Analytical services

- 8.2.2 PROFESSIONAL SERVICES

- 8.2.2.1 Training & implementation services

- 8.2.2.1.1 Stringent regulations, increasing competition, and need for skill development to propel demand

- 8.2.2.2 Maintenance & support services

- 8.2.2.2.1 Rising complexity of analytical technologies and expanding research needs to support market growth

- 8.2.2.3 Other professional services

- 8.2.2.1 Training & implementation services

- 8.2.1 MANAGED SERVICES

- 8.3 SOFTWARE

- 8.3.1 ON-PREMISES

- 8.3.1.1 Provision of multivendor architecture and security benefits to drive market

- 8.3.2 CLOUD-BASED

- 8.3.2.1 Real-time analysis and elimination of purchasing costs for software & hardware to drive adoption

- 8.3.3 SAAS-BASED

- 8.3.3.1 Increasing adoption of digital solutions and advantages of cloud-based models to drive growth

- 8.3.1 ON-PREMISES

9 LIFE SCIENCE ANALYTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 RESEARCH & DEVELOPMENT

- 9.2.1 CLINICAL TRIALS

- 9.2.1.1 Laboratory services

- 9.2.1.1.1 Better accuracy, efficiency, and data interpretation to support demand for lab services

- 9.2.1.2 Patient recruitment services

- 9.2.1.2.1 Need for better candidate identification and enrollment forecasting to propel market growth

- 9.2.1.3 Site identification services

- 9.2.1.3.1 Benefits in locating ideal trial sites and interpreting data to support adoption

- 9.2.1.4 Other clinical trial services

- 9.2.1.5 Life science analytics market for clinical trials, by phase

- 9.2.1.6 PHASE I

- 9.2.1.6.1 Strong pipeline of pharmaceutical companies to propel market growth

- 9.2.1.7 PHASE II

- 9.2.1.7.1 Extended duration of phase II studies to create growth opportunities for CROs

- 9.2.1.8 PHASE III

- 9.2.1.8.1 Rising trial expenditure to drive demand for cost-effective clinical research services

- 9.2.1.1 Laboratory services

- 9.2.2 PRECLINICAL & DRUG DISCOVERY

- 9.2.2.1 Ability to assist researchers in process innovation and decision support to drive adoption

- 9.2.1 CLINICAL TRIALS

- 9.3 COMMERCIAL ANALYTICS

- 9.3.1 SALES & MARKETING SUPPORT

- 9.3.1.1 Rising analysis of digital marketing effectiveness to drive adoption

- 9.3.2 MARKET ACCESS

- 9.3.2.1 Focus on strategic pricing, reimbursement, and policy changes to support market growth

- 9.3.3 RWE & VALUE EVIDENCE

- 9.3.3.1 Increased data integration, partnerships, and technological to propel use of RWE

- 9.3.4 ENGAGEMENT SERVICES

- 9.3.4.1 Need for better patient engagement, digital advancements, and AI integration to propel market

- 9.3.1 SALES & MARKETING SUPPORT

- 9.4 REGULATORY COMPLIANCE

- 9.4.1 STRINGENT REQUIREMENTS FOR COMPLIANCE ADHERENCE TO DRIVE ADOPTION

- 9.5 MANUFACTURING & SUPPLY CHAIN OPTIMIZATION

- 9.5.1 RISING NEED FOR REDUCING LOGISTICS COSTS TO SUPPORT MARKET GROWTH

- 9.6 SAFETY

- 9.6.1 PHARMACOVIGILANCE

- 9.6.1.1 Monitoring of drug trials and medication programs to fuel market uptake

- 9.6.2 MEDICAL DEVICE SAFETY

- 9.6.2.1 Stringent safety standards, rigorous risk assessments, and robust quality control to drive demand

- 9.6.3 DIAGNOSTIC VIGILANCE

- 9.6.3.1 Continuous monitoring, integration of diverse data sources, and ongoing education to enhance accuracy and thoroughness

- 9.6.1 PHARMACOVIGILANCE

10 LIFE SCIENCE ANALYTICS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.2.1 RISING NEED FOR INNOVATIVE THERAPIES TO DRIVE ANALYTICS USAGE IN PRODUCT DEVELOPMENT

- 10.3 MEDICAL DEVICE COMPANIES

- 10.3.1 ADOPTION OF DATA ANALYTICS FOR DEVICE COMMERCIALIZATION TO DRIVE MARKET

- 10.4 RESEARCH CENTERS

- 10.4.1 NEED FOR ANALYZING LARGE VOLUMES OF DATA TO SUPPORT MARKET GROWTH

- 10.5 OUTSOURCED LIFE SCIENCE ORGANIZATIONS

- 10.5.1 RISING R&D OUTSOURCING BY LIFE SCIENCE COMPANIES TO DRIVE MARKET

11 LIFE SCIENCE ANALYTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 Established economy and increasing R&D expenditure to drive adoption of analytical solutions

- 11.2.3 CANADA

- 11.2.3.1 Rising need for data standardization in life sciences to fuel uptake

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Growing R&D investments by pharmaceutical & biotechnology companies to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Growing government support for adoption of AI & big data analytics to drive market

- 11.3.4 UK

- 11.3.4.1 Rising clinical trial activity to drive uptake of life science analytics solutions

- 11.3.5 ITALY

- 11.3.5.1 Growing number of drug approvals to drive uptake of analytics solutions

- 11.3.6 SPAIN

- 11.3.6.1 Surging government investments focusing on personalized medicine to drive growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 JAPAN

- 11.4.2.1 Growing government support for clinical R&D activities to drive adoption

- 11.4.3 CHINA

- 11.4.3.1 Growth in life science industry to support adoption of solutions

- 11.4.4 INDIA

- 11.4.4.1 Rising R&D expenditure and drug development to support market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.5.2 BRAZIL

- 11.5.2.1 Brazil to dominate life science analytics market in Latin America

- 11.5.3 MEXICO

- 11.5.3.1 Growing prominence of startups and rising R&D activity to propel market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Rising investments, advancements, and developing healthcare infrastructure to drive market

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN LIFE SCIENCE ANALYTICS MARKET

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Type footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 Component footprint

- 12.5.5.6 End user footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.7 BRAND/SOFTWARE COMPARATIVE ANALYSIS

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF LIFE SCIENCE ANALYTICAL VENDORS

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 12.10.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ORACLE

- 13.1.1.1 Business overview

- 13.1.1.2 Products & services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches & enhancements

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 MERATIVE

- 13.1.2.1 Business overview

- 13.1.2.2 Products & services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 SAS INSTITUTE INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products & services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches & enhancements

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 ACCENTURE

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches & enhancements

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 IQVIA INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products & services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches & enhancements

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 COGNIZANT

- 13.1.6.1 Business overview

- 13.1.6.2 Products & services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches & enhancements

- 13.1.6.3.2 Deals

- 13.1.7 WIPRO

- 13.1.7.1 Business overview

- 13.1.7.2 Products & services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 VERADIGM LLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products & services offered

- 13.1.8.3 Recent developments