|

|

市場調査レポート

商品コード

1241249

産業用ボイラーの世界市場:燃料別 (天然ガス、石炭、石油)・ボイラー別 (煙管式、水管式)・機能別 (温水、蒸気)・ボイラー馬力別 (10~150BHP、151~300BHP、301~600BHP)・エンドユース産業別・地域別の将来予測 (2030年まで)Industrial Boilers Market by Fuel (Natural Gas, Coal, Oil), Boiler (Fire-Tube, Water Tube), Function (Hot Water, Steam), Boiler Horsepower (10-150 BHP, 151-300 BHP, 301-600 BHP), End-Use Industry, And Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 産業用ボイラーの世界市場:燃料別 (天然ガス、石炭、石油)・ボイラー別 (煙管式、水管式)・機能別 (温水、蒸気)・ボイラー馬力別 (10~150BHP、151~300BHP、301~600BHP)・エンドユース産業別・地域別の将来予測 (2030年まで) |

|

出版日: 2023年03月10日

発行: MarketsandMarkets

ページ情報: 英文 229 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の産業用ボイラーの市場規模は、2022年の153億米ドルから2030年には198億米ドルへと、予測期間中に3.3%のCAGRで成長すると予測されています。

二酸化炭素の排出を最小限に抑え、再生可能エネルギーを最大限に利用することを目的とした政府の厳しい規制が、電力・食品・化学産業におけるクリーン技術の利用などの需要増加を後押ししています。この市場は、今後数年間にわたり急速に成長すると予測されています。

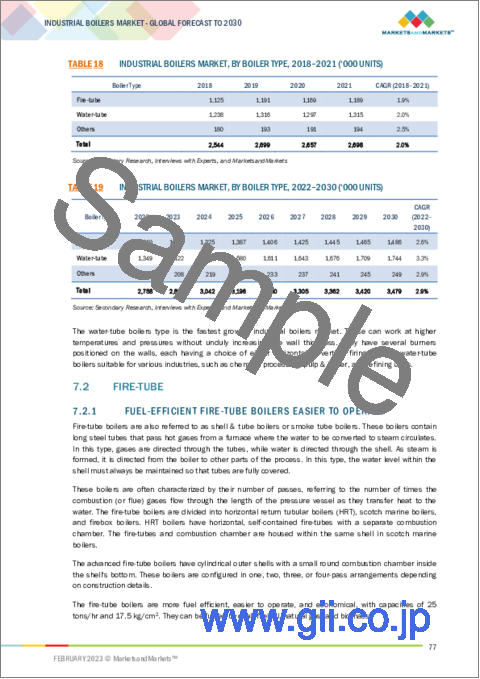

"ボイラーの種類別では、水管式が予測期間中、最も急速に成長する"

種類別に見ると、水管式ボイラーのセグメントが最も急成長しており、金額ベースでは、2022年から2030年の間に3.7%のCAGRを達成すると予測されています。水管式ボイラーは蒸気タービン発電など、乾燥した高圧・高エネルギーの蒸気を必要とする用途で特に魅力的です。そのため、化学処理、製紙/パルプ、精製装置など、さまざまな産業用途で好まれています。また、交換や修理が容易であることも特徴です。

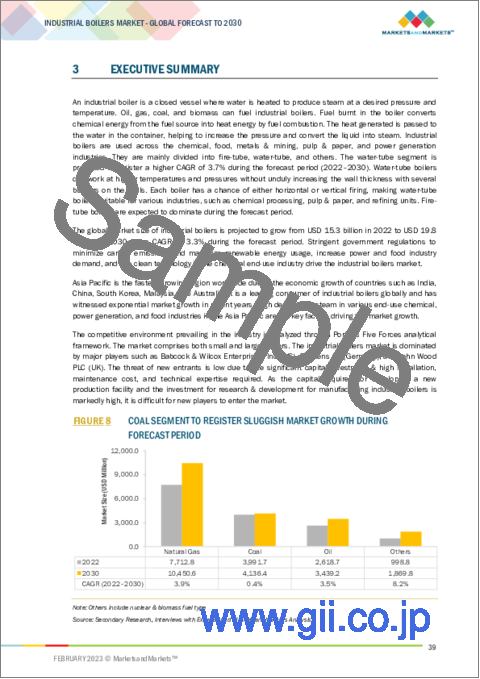

"燃料の種類別では、石炭は予測期間中は (金額ベースで) 伸び悩む見通し"

石炭は今後 (2022年~2030年) の伸び悩みが見込まれています。これは、再生可能エネルギーへの需要が増加していることに起因しています。しかし、石炭は産業用ボイラーに広く利用されており、原子力やバイオマスなど他の燃料タイプよりも経済的です。

ボイラー馬力別では、10~150BHPのセグメントが予測期間中に (金額ベースで) 3番目に急成長する"

ボイラー馬力 (BHP) 別に見ると、10~150BHPのセグメントが3番目に急成長しているセグメントであり、2022年から2030年の間に2.9%のCAGR (金額ベース) で成長すると予測されています。小型の産業用ボイラー (容量10~150BHP) は、食品加工や製紙・パルプなどの産業分野で、蒸気・温水目的で活用されています。小型ボイラーは設置が簡単で、世界で最も多く製造されています。また、工場・学校・病院といった効率的な暖房を必要とする大規模な建物でも使用されています。

"機能別では、温水ボイラーが予測期間中、(金額ベースで) 最も急速に成長する"

温水ボイラーは、機能別では最も急成長しているセグメントで、2022年から2030年の間に3.8%のCAGR (金額ベース) で成長すると予測されています。温水ボイラーは、住宅・商業施設・公共施設で使用され、重油・軽油・ガス・デュアル燃料・石炭、もみ殻、その他の農業廃棄物燃料など、さまざまな種類の燃料で動作するように設計されています。また、高効率、低メンテナンス、高耐久性を実現しています。

"エンドユース産業別では、製紙・パルプが予測期間中に (金額ベースで) 3番目に急成長する"

エンドユース産業別に見ると、製紙・パルプが予測期間中 (2022年~2030年) に3番目に急成長するセグメントとなっています。産業用ボイラーは、製紙産業の電力・処理システム用の蒸気を生成します。高圧の蒸気は蒸気タービンで使用され、製紙工場での発電に使用されます。同時に、パルプ・製紙業界では、木材パルプを作るための木材チップの加熱や調理など、さまざまなプロセス用途に中低圧の蒸気が必要です。さらに製紙工場では、化学薬品の加熱やドライヤーのドラムなど、その他の用途でも蒸気が使用されます。

"地域別では、北米地域が (金額ベースで) 3番目に急速に成長する"

北米は、2022年の産業用ボイラー市場において、金額ベースで3番目に大きな市場です。この地域の国々は、再生可能燃料ベースのボイラーの幅広い使用を促進する新しい規制の実施をすでに開始しています。北米には多くの産業用ボイラーメーカーが存在します。この地域は、発電を石炭とガスに大きく依存しています。しかし、米国環境保護庁の水銀・大気有害物質基準に準拠した新規制により、石炭純生産能力は60ギガワット (GW) 近く減少しました。さらに、2017年から2030年の間に、競合価格の天然ガスや再生可能エネルギーによる発電量の増加により、さらに65GWの石炭火力発電容量が停止すると推定されています。

当レポートでは、世界の産業用ボイラーの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、燃料の種類別・ボイラーの種類別・機能別・ボイラー馬力 (BHP) 別・エンドユース産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 特許分析

- エコシステムマッピング

- バリューチェーン分析

- 技術分析

- 価格分析

- ポーターのファイブフォース分析

- 貿易分析

- マクロ経済指標

- 顧客のビジネスに影響を与える動向と混乱

- 主な会議とイベント (2023年~2024年)

- 不況の影響

- 関税と規制

- ケーススタディ分析

第6章 産業用ボイラー市場:燃料の種類別

- イントロダクション

- 天然ガス

- 石炭

- 石油

- その他

第7章 産業用ボイラー市場:ボイラーの種類別

- イントロダクション

- 煙管式

- 水管式

- その他

第8章 産業用ボイラー市場:機能別

- イントロダクション

- 温水

- 蒸気

第9章 産業用ボイラー市場:ボイラー馬力 (BHP) 別

- イントロダクション

- 10~150 BHP

- 151~300 BHP

- 301~600 BHP

第10章 産業用ボイラー市場:エンドユース産業別

- イントロダクション

- 化学・石油化学

- 食品

- パルプ・製紙

- 金属・鉱業

- 発電

- その他

第11章 地域分析

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- オーストラリア

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- トルコ

- 東欧

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

- 他の中東・アフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第12章 競合情勢

- 概要

- 主要企業のランキング分析 (2022年)

- 市場シェア分析

- 上位企業の収益分析

- 市場評価マトリックス

- 企業評価マトリックス (ティア1、2022年)

- スタートアップと中小企業の評価マトリックス

- 企業フットプリント:エンドユース産業

- 企業フットプリント:地域

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合シナリオ

- 製品の発売

- 資本取引

- その他の動向

第13章 企業プロファイル

- 主要企業

- BABCOCK & WILCOX ENTERPRISES, INC.

- SIEMENS AG

- JOHN WOOD PLC

- DONGFANG ELECTRIC CORPORATION LIMITED

- ROBERT BOSCH GMBH

- MITSUBISHI POWER

- THERMAX LIMITED

- SOFINTER GROUP

- BHARAT HEAVY ELECTRICALS LIMITED

- CLEAVER-BROOKS, INC.

- BYWORTH BOILERS LTD.

- ANDRITZ AG

- HARBIN ELECTRIC COMPANY LIMITED

- ALFA LAVAL AB

- IHI CORPORATION

- その他の企業

- BRYAN STEAM, LLC

- COCHRAN LTD.

- FORBES MARSHALL PRIVATE LIMITED

- THE FULTON COMPANIES

- VAPOR POWER INTERNATIONAL, LLC

- SUPERIOR BOILER WORKS, INC.

- HURST BOILER & WELDING COMPANY, INC.

- JOHNSTON BOILER COMPANY

- PARKER BOILER COMPANY

- RENTECH BOILER SYSTEMS, INC.

第14章 付録

The global market size of industrial boilers is projected to grow from USD 15.3 billion in 2022 to USD 19.8 billion by 2030, at a CAGR of 3.3% during the forecast period. The stringent government regulations designed to minimize carbon emissions and maximize the use of renewable energy drives increased demand for power and food industries, as well as the use of clean technology in the chemical industry. This market is predicted to grow rapidly in the coming years.

In terms of value,water-tube accounts for the fastest-growing segment in industrial boilers market, by boiler type, during the forecast period.

The water-tube boiler segment is the fastest-growing application type of industrial boiler. In terms of value, it is projected to register a CAGR of 3.7% between 2022 and 2030. Water-tube boilers are particularly attractive in applications that require dry, high-pressure, high-energy steam, including steam turbine power generation. Water-tube industrial boilers are preferred in various industrial applications, such as chemical processing, pulp & paper, and refining units. They can be easily replaced or repaired.

In terms of value, coal is estimated to be account for sluggish growing segment in industrial boilers market, by fuel type, during the forecast period.

Coal is estimated to witness sluggish growth in the market during 2022-2030. This is attributed to the increasing demand for renewables. However, coal is widely available for industrial boilers and is more economical than other fuel types, such as nuclear energy and biomass.

In terms of value, 10-150 BHP is estimated to be third fastest-growing segment in industrial boilers market, by boiler horsepower type, during the forecast period.

The 10-150 BHP boilers segment is the third fastest-growing boiler horsepower type of industrial boiler. In terms of value, it is projected to register a CAGR of 2.9% between 2022 and 2030. Small-sized industrial boilers range from 10-150 BHP in terms of capacity and are used for steam and hot water applications in various industries like food processing & paper & pulp. They are available in standard designs based on their sizes with low customizations. These boilers are easy to install and are the highest manufactured industrial boilers worldwide. They are used in factories, schools, hospitals, and other large buildings requiring efficient heating.

In terms of value, hot-water is estimated to fastest growing segment in industrial boilers market, by function type, during the forecast period.

The hot water boilers segment is the fastest-growing function type of industrial boiler. In terms of value, it is projected to register a CAGR of 3.8% between 2022 and 2030. Hot water boilers are used in residential, commercial, and institutional buildings. These boilers are designed to operate on various fuel types such as heavy oil, light oil, gas, dual fuel, coal, husk, and other agro-waste fuels. They offer high efficiency, low maintenance, and good durability.

In terms of value, paper & pulp is estimated to be third fastest-growing segment in industrial boilers market, by end use, during the forecast period.

Paper & pulp is the third fastest growing segment by end-use during the forecast period 2022-2030. Industrial boilers generate steam for power and process systems in the paper industry. The high-pressure steam is used in steam turbines to generate electricity for the paper mill. The pulp & paper industry requires medium and low-pressure steam for various process applications, such as heating and cooking the wood chips to make wood pulp. In paper mills, steam is used in other applications such as heating chemicals, dryer drums, and other processes.

North America region accounted for the third-fastest growing segment in the industrial boilers market by value.

North America is the third-largest industrial boilers market in terms of value, in 2022. The countries in the region have already started implementing new regulations that promote the wide use of renewable fuels based boilers. North America houses many industrial boilers manufacturers. The region relies heavily on coal and gas for electricity generation. However, with the new regulations in compliance with the US Environmental Protection Agency's Mercury and Air Toxics Standards, net coal production capacity decreased by nearly 60 gigawatts (GW). It is further estimated that between 2017 and 2030, an additional 65 GW of coal-fired generating capacity would shut down due to competitively priced natural gas and increasing energy generation from renewable sources.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the industrial boilers market, and information was gathered from secondary research to determine and verify the market size of several segments. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 30%, Tier 2 - 35%, and Tier 3 - 35%

- By Designation: C Level Executives- 20%, Directors - 40%, and Others - 40%

- By Region: Asia Pacific - 50%, Europe - 20%, North America - 10%, the Middle East & Africa - 10%, and South America- 10%

Babcock & Wilcox Enterprises INC (US), Siemens AG (Germany), John Wood Group PLC (UK), Dongfang Electric Corporation Limited (DEC LTD) (China), Mitsubishi Power (Japan), Thermax Limited (India), Sofinter Group (Italy), Bharat Heavy Electricals Limited (BHEL) (India), Harbin Electric Company Limited (China), IHI Corporation (Japan), Alfa Laval AB (Sweden), Andritz AG (Austria), Robert Bosch GMBH (Germany), Cleaver Brooks Inc. (US), and Byworth Boilers Limited (UK) are the key players in the industrial boilers market

Research Coverage:

This research report categorizes the industrial boilers market based on fuel type, boiler type, function type, boiler horse type, end use, and region. Based on fuel type, the market has been segmented into coal, natural gas, oil & others. Based on boiler type, the market has been segmented into fire-tube boilers & water-tube boilers. Based on the function type, industrial boilers have been segmented into steam & hot-water boilers. Based on the boiler horsepower type, industrial boilers are segmented into 10-150 BHP, 151-300 BHP, 301-600 BHP & Above 600 BHP. Based on end-use industry, the market has been segmented into chemicals & petrochemicals, food, metals &mining, power generation and others. Based on region, the industrial boilers market has been segmented into Asia Pacific, North America, Europe, the Middle East & Africa, and South America. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; new product launches, investment & expansions, mergers & collaborations; and recent developments associated with the industrial boilers market.

Key Benefits of Buying the Report:

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the industrial boilers Insulation market; high growth regions; and market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 INDUSTRIAL BOILERS: DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 INDUSTRIAL BOILERS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 INDUSTRIAL BOILERS: MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INDUSTRIAL BOILERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.3 PRIMARY INTERVIEWS

- 2.1.3.1 Primary interviews-demand and supply sides

- 2.1.3.2 Key industry insights

- 2.1.3.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH

- 2.2.1.1 Arriving at market size using bottom-up approach

- FIGURE 4 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Arriving at market size using top-down approach

- FIGURE 5 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 INDUSTRIAL BOILERS MARKET: DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- FIGURE 7 INDUSTRIAL BOILERS MARKET: FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

- FIGURE 8 COAL SEGMENT TO REGISTER SLUGGISH MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 9 FIRE-TUBE TO DOMINATE BOILER TYPE DURING FORECAST PERIOD

- FIGURE 10 STEAM BOILERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 10-150 BHP SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 12 CHEMICALS & PETROCHEMICALS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE

4 PREMIUM INSIGHTS

- 4.1 EMERGING ECONOMIES TO WITNESS HIGH GROWTH IN INDUSTRIAL BOILERS MARKET

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.2 INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE

- FIGURE 15 STEAM BOILERS TO BE FASTEST GROWING FUNCTION TYPE DURING FORECAST PERIOD

- 4.3 INDUSTRIAL BOILERS MARKET, BY BOILER TYPE

- FIGURE 16 WATER-TUBE BOILERS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.4 INDUSTRIAL BOILERS MARKET, BY FUEL TYPE

- FIGURE 17 COAL-FUELED BOILERS TO REGISTER SLUGGISH GROWTH DURING FORECAST PERIOD

- 4.5 INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER

- FIGURE 18 ABOVE 600 BHP TO BE FASTEST GROWING BOILER HORSEPOWER TYPE DURING FORECAST PERIOD

- 4.6 INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY

- FIGURE 19 POWER GENERATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.7 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 20 CHEMICALS & PETROCHEMICALS INDUSTRY AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INDUSTRIAL BOILERS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Government policies to increase requirements for industrial boilers

- 5.2.1.2 Increasing demand from power and food & beverage industries

- 5.2.1.3 High demand for clean technology from chemical industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Significant capital investment and high installation and

maintenance cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of biomass boilers to achieve low carbon emission targets

- FIGURE 22 ENERGY PRODUCED FROM BIOMASS (2005-2019) (TWH)

- 5.2.3.2 Replacement of aging boilers and adoption of supercritical and

ultra-supercritical boilers

- 5.2.3.3 Increasing demand for compact designs and lean operations

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulations and emission control

- 5.2.4.2 Increasing energy prices

- 5.3 PATENT ANALYSIS

- 5.3.1 METHODOLOGY

- 5.3.2 GLOBAL PATENT ANALYSIS

- TABLE 3 PATENT COUNT

- FIGURE 23 TOTAL NUMBER OF PATENTS

- 5.3.3 PUBLICATION TRENDS

- FIGURE 24 TOTAL NUMBER OF PATENTS IN LAST 10 YEARS

- 5.3.4 INSIGHTS

- 5.3.5 LEGAL STATUS

- FIGURE 25 PATENT ANALYSIS, BY LEGAL STATUS

- 5.3.6 JURISDICTION-WISE PATENT ANALYSIS

- FIGURE 26 TOP JURISDICTIONS FOR INDUSTRIAL BOILER PATENTS

- 5.3.7 TOP COMPANIES/APPLICANTS

- FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- 5.3.8 LEADING PATENT OWNERS (US)

- TABLE 4 TOP 10 PATENT OWNERS, 2012-2022

- 5.4 ECOSYSTEM MAPPING

- FIGURE 28 INDUSTRIAL BOILERS ECOSYSTEM

- TABLE 5 INDUSTRIAL BOILERS: ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 MANUFACTURERS

- 5.5.3 DISTRIBUTORS

- 5.5.4 END USERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 LOW NOX BOILERS

- 5.6.2 INDUSTRIAL INTERNET OF THINGS

- 5.6.3 REMOTE MONITORING

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE BY REGION

- FIGURE 30 INDUSTRIAL BOILERS PRICES IN DIFFERENT REGIONS, 2021

- FIGURE 31 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE

END-USE SEGMENTS

- 5.7.2 AVERAGE SELLING PRICE BY KEY PLAYERS

- TABLE 6 KEY PLAYERS: AVERAGE SELLING PRICE (USD '000/UNITS)

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INDUSTRIAL BOILERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF SUBSTITUTES

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 THREAT OF NEW ENTRANTS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 7 INDUSTRIAL BOILERS: PORTER'S FIVE FORCES ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT-EXPORT SCENARIO OF INDUSTRIAL BOILERS MARKET

- TABLE 8 IMPORT TRADE DATA FOR INDUSTRIAL BOILERS

- TABLE 9 EXPORT TRADE DATA FOR INDUSTRIAL BOILERS

- 5.10 MACROECONOMIC INDICATORS

- 5.10.1 GDP TRENDS AND FORECASTS

- TABLE 10 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018-2025

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 IMPACT OF TRENDS AND DISRUPTIONS ON CUSTOMERS' BUSINESSES

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 11 INDUSTRIAL BOILERS MARKET: CONFERENCES AND EVENTS

- 5.13 RECESSION IMPACT

- 5.14 TARIFF AND REGULATIONS

- 5.14.1 NORTH AMERICA

- 5.14.2 EUROPE

- 5.14.3 ASIA

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 BYWORTH'S FELLSMAN HOT WATER BOILER FOR SHEFFIELD WEDNESDAY FOOTBALL CLUB

- 5.15.2 THERMAX'S CPFD FOR GOVIND DAIRY PHALTAN

6 INDUSTRIAL BOILERS MARKET, BY FUEL TYPE

- 6.1 INTRODUCTION

- FIGURE 34 NATURAL GAS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 12 INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2021 (USD MILLION)

- TABLE 13 INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2022-2030 (USD MILLION)

- TABLE 14 INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2021 ('000 UNITS)

- TABLE 15 INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2022-2030 ('000 UNITS)

- 6.2 NATURAL GAS

- 6.2.1 REGULATORY GUIDELINES CONCERNING CO2 EMISSIONS TO DRIVE MARKET

- 6.3 COAL

- 6.3.1 ASIA PACIFIC TO DOMINATE COAL-FIRED INDUSTRIAL BOILERS MARKET

- 6.4 OIL

- 6.4.1 HIGH AVAILABILITY OF CRUDE OIL EXPECTED TO FUEL MARKET GROWTH

- 6.5 OTHERS

7 INDUSTRIAL BOILERS MARKET, BY BOILER TYPE

- 7.1 INTRODUCTION

- FIGURE 35 FIRE-TUBE BOILERS SEGMENT PROJECTED TO DOMINATE DURING FORECAST PERIOD

- TABLE 16 INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2018-2021 (USD MILLION)

- TABLE 17 INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2022-2030 (USD MILLION)

- TABLE 18 INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2018-2021 ('000 UNITS)

- TABLE 19 INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2022-2030 ('000 UNITS)

- 7.2 FIRE-TUBE

- 7.2.1 FUEL-EFFICIENT FIRE-TUBE BOILERS EASIER TO OPERATE

- 7.3 WATER-TUBE

- 7.3.1 WATER-TUBE BOILERS TO BE HIGHLY EFFICACIOUS

- 7.4 OTHERS

8 INDUSTRIAL BOILERS MARKET, BY FUNCTION

- 8.1 INTRODUCTION

- FIGURE 36 STEAM BOILERS TO DOMINATE DURING FORECAST PERIOD

- TABLE 20 INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 21 INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 22 INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 ('000 UNITS)

- TABLE 23 INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 ('000 UNITS)

- 8.2 HOT WATER

- 8.2.1 HIGH-TEMPERATURE HOT WATER BOILERS IDEAL FOR LARGER SYSTEMS

- 8.3 STEAM

- 8.3.1 STEAM BOILERS PREFERRED IN TURBINE AND POWER INDUSTRIES

9 INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER

- 9.1 INTRODUCTION

- FIGURE 37 10-150 BHP SEGMENT PROJECTED TO DOMINATE DURING FORECAST PERIOD

- TABLE 24 INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2021 (USD MILLION)

- TABLE 25 INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2022-2030 (USD MILLION)

- TABLE 26 INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2021 ('000 UNITS)

- TABLE 27 INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2022-2030 ('000 UNITS)

- 9.2 10-150 BHP

- 9.2.1 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE FOR 10-150 BHP INDUSTRIAL BOILERS

- 9.3 151-300 BHP

- 9.3.1 PRECISE PRESSURE AND TEMPERATURE REQUIREMENT ACROSS END-USE INDUSTRIES TO FUEL MARKET GROWTH

- 9.4 301-600 BHP

- 9.4.1 INCREASING DEMAND FOR HIGH-PRESSURE STEAM OUTPUT TO PROPEL SEGMENT GROWTH

10 INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 38 CHEMICALS & PETROCHEMICALS SEGMENT PROJECTED TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 28 INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 29 INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- TABLE 30 INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 ('000 UNITS)

- TABLE 31 INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 ('000 UNITS)

- 10.2 CHEMICALS & PETROCHEMICALS

- 10.2.1 HIGH DEMAND FOR BULK CHEMICALS IN EMERGING ECONOMIES TO PROPEL SEGMENT GROWTH

- 10.3 FOOD

- 10.3.1 INCREASING DEMAND FOR PACKAGED FOODS TO FUEL SEGMENT GROWTH

- 10.4 PULP & PAPER

- 10.4.1 HIGH DEMAND FOR PAPER IN ASIA PACIFIC TO BOOST INDUSTRIAL GROWTH

- 10.5 METALS & MINING

- 10.5.1 INCREASING DEMAND FOR STEEL AND MINING INDUSTRIES TO DRIVE MARKET

- 10.6 POWER GENERATION

- 10.6.1 POWER GENERATION SEGMENT TO ENCOUNTER RAPID GROWTH DURING FORECAST PERIOD

- 10.7 OTHERS

11 REGIONAL ANALYSIS

- 11.1 INTRODUCTION

- FIGURE 39 INDUSTRIAL BOILERS MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 32 INDUSTRIAL BOILERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 33 INDUSTRIAL BOILERS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 34 INDUSTRIAL BOILERS MARKET, BY REGION, 2018-2021 ('000 UNITS)

- TABLE 35 INDUSTRIAL BOILERS MARKET, BY REGION, 2022-2030 ('000 UNITS)

- 11.2 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC INDUSTRIAL BOILERS MARKET SNAPSHOT

- TABLE 36 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 37 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 39 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 ('000 UNITS)

- TABLE 40 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2018-2021 (USD MILLION)

- TABLE 41 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2022-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2021 (USD MILLION)

- TABLE 43 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2022-2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 45 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2021 (USD MILLION)

- TABLE 47 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2022-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 49 ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.2.1 CHINA

- 11.2.1.1 Replacing coal-fired boilers by gas-fired boilers to fuel segment growth

- TABLE 50 CHINA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 51 CHINA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 52 CHINA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 53 CHINA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.2.2 INDIA

- 11.2.2.1 Increased demand from chemical industry to drive market

- TABLE 54 INDIA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 55 INDIA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 56 INDIA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 57 INDIA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.2.3 JAPAN

- 11.2.3.1 Increasing use of boilers in food & chemical end-use industry to propel market

- TABLE 58 JAPAN: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 59 JAPAN: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 60 JAPAN: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 61 JAPAN: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Replacing coal-fired plants with LNG-based plants to achieve carbon neutrality

- TABLE 62 SOUTH KOREA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 63 SOUTH KOREA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 64 SOUTH KOREA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 65 SOUTH KOREA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.2.5 MALAYSIA

- 11.2.5.1 Rising demand for food products to propel market

- TABLE 66 MALAYSIA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 67 MALAYSIA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 68 MALAYSIA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 69 MALAYSIA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.2.6 AUSTRALIA

- 11.2.6.1 Adoption of renewable resources to meet electricity requirement

- TABLE 70 AUSTRALIA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 71 AUSTRALIA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 72 AUSTRALIA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 73 AUSTRALIA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.2.7 REST OF ASIA PACIFIC

- 11.2.7.1 Growth in chemical industries to drive market

- TABLE 74 REST OF ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.3 EUROPE

- FIGURE 41 EUROPE INDUSTRIAL BOILERS MARKET SNAPSHOT

- TABLE 78 EUROPE: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 79 EUROPE: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 80 EUROPE: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 81 EUROPE: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 ('000 UNITS)

- TABLE 82 EUROPE: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2018-2021 (USD MILLION)

- TABLE 83 EUROPE: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2022-2030 (USD MILLION)

- TABLE 84 EUROPE: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2021 (USD MILLION)

- TABLE 85 EUROPE: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2022-2030 (USD MILLION)

- TABLE 86 EUROPE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 87 EUROPE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 88 EUROPE: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2021 (USD MILLION)

- TABLE 89 EUROPE: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2022-2030 (USD MILLION)

- TABLE 90 EUROPE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 91 EUROPE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Advancements in high-value fine chemicals to propel market

- TABLE 92 GERMANY: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 93 GERMANY: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 94 GERMANY: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 95 GERMANY: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Reducing carbon emissions to boost demand for hydrogen-fired industrial boilers

- TABLE 96 UK: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 97 UK: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 98 UK: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 99 UK: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Rising demand from chemical industry to drive market

- TABLE 100 FRANCE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 101 FRANCE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 102 FRANCE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 103 FRANCE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Growth of food industries to increase demand for industrial boilers

- TABLE 104 ITALY: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 105 ITALY: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 106 ITALY: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 107 ITALY: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.3.5 TURKEY

- 11.3.5.1 Demand for processed food products to drive market

- TABLE 108 TURKEY: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 109 TURKEY: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 110 TURKEY: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 111 TURKEY: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.3.6 EASTERN EUROPE

- 11.3.6.1 Growing demand for industrial boilers in food end-use industry to fuel market growth

- TABLE 112 EASTERN EUROPE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 113 EASTERN EUROPE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 114 EASTERN EUROPE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 115 EASTERN EUROPE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.3.7 REST OF EUROPE

- 11.3.7.1 Increasing demand for chemicals and food products to propel market

- TABLE 116 REST OF EUROPE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 117 REST OF EUROPE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 118 REST OF EUROPE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 119 REST OF EUROPE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.4 NORTH AMERICA

- TABLE 120 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 121 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 123 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 ('000 UNITS)

- TABLE 124 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2018-2021 (USD MILLION)

- TABLE 125 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2022-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2021 (USD MILLION)

- TABLE 127 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2022-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 129 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2021 (USD MILLION)

- TABLE 131 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2022-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 133 NORTH AMERICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.4.1 US

- 11.4.1.1 Adoption of natural gas-fired boilers to meet clean energy requirement

- TABLE 134 US: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 135 US: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 136 US: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 137 US: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.4.2 CANADA

- 11.4.2.1 Significant presence of food processing companies to drive market

- TABLE 138 CANADA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 139 CANADA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 140 CANADA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 141 CANADA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.4.3 MEXICO

- 11.4.3.1 Rising demand from chemical segment to propel market

- TABLE 142 MEXICO: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 143 MEXICO: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 144 MEXICO: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 145 MEXICO: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- TABLE 146 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 149 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 ('000 UNITS)

- TABLE 150 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2018-2021 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2022-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2021 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2022-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2021 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2022-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.5.1 SAUDI ARABIA

- 11.5.1.1 Thermal energy consumption in chemical industries to fuel market growth

- TABLE 160 SAUDI ARABIA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 161 SAUDI ARABIA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 162 SAUDI ARABIA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 163 SAUDI ARABIA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.5.2 UAE

- 11.5.2.1 Increasing demand for basic chemicals, polymers, and fertilizers to fuel segment growth

- TABLE 164 UAE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 165 UAE: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 166 UAE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 167 UAE: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.5.3 EGYPT

- 11.5.3.1 Production of domestic fossil gas to reduce carbon consumption

- TABLE 168 EGYPT: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 169 EGYPT: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 170 EGYPT: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 171 EGYPT: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.4.1 Increasing demand for industrial chemicals and fertilizers to fuel market growth

- TABLE 172 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.6 SOUTH AMERICA

- TABLE 176 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 177 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 178 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2018-2021 ('000 UNITS)

- TABLE 179 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY COUNTRY, 2022-2030 ('000 UNITS)

- TABLE 180 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2018-2021 (USD MILLION)

- TABLE 181 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY BOILER TYPE, 2022-2030 (USD MILLION)

- TABLE 182 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2021 (USD MILLION)

- TABLE 183 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2022-2030 (USD MILLION)

- TABLE 184 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 185 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 186 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2021 (USD MILLION)

- TABLE 187 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2022-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 189 SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.6.1 BRAZIL

- 11.6.1.1 Extensive use of natural gas and biomass to drive market

- TABLE 190 BRAZIL: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 191 BRAZIL: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 192 BRAZIL: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 193 BRAZIL: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.6.2 ARGENTINA

- 11.6.2.1 Adoption of renewable energy to boost market

- TABLE 194 ARGENTINA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 195 ARGENTINA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 196 ARGENTINA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 197 ARGENTINA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.3.1 Expansion of food end-use industries to fuel market growth

- TABLE 198 REST OF SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2018-2021 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY FUNCTION TYPE, 2022-2030 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: INDUSTRIAL BOILERS MARKET, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- FIGURE 42 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

- 12.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 43 RANKING OF TOP FIVE PLAYERS IN INDUSTRIAL BOILERS MARKET, 2022

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 44 INDUSTRIAL BOILERS MARKET SHARE, BY COMPANY, 2021

- TABLE 202 INDUSTRIAL BOILERS MARKET: DEGREE OF COMPETITION

- 12.4 REVENUE ANALYSIS OF TOP PLAYERS

- TABLE 203 INDUSTRIAL BOILERS MARKET: REVENUE ANALYSIS (USD)

- 12.5 MARKET EVALUATION MATRIX

- TABLE 204 MARKET EVALUATION MATRIX

- 12.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 45 INDUSTRIAL BOILERS MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.7 STARTUP AND SME EVALUATION MATRIX

- 12.7.1 RESPONSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- 12.7.3 PROGRESSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 46 INDUSTRIAL BOILERS MARKET: STARTUPS AND SMES MATRIX, 2022

- 12.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 12.9 COMPANY REGION FOOTPRINT

- 12.10 STRENGTH OF PRODUCT PORTFOLIO

- 12.11 BUSINESS STRATEGY EXCELLENCE

- 12.12 COMPETITIVE SCENARIO

- 12.12.1 PRODUCT LAUNCHES

- TABLE 205 PRODUCT LAUNCHES, 2018-2022

- 12.12.2 DEALS

- TABLE 206 DEALS, 2018-2022

- 12.12.3 OTHER DEVELOPMENTS

- TABLE 207 OTHER DEVELOPMENTS, 2018-2021

13 COMPANY PROFILES

(Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices, Weakness and competitive threats)*

- 13.1 MAJOR PLAYERS

- 13.1.1 BABCOCK & WILCOX ENTERPRISES, INC.

- TABLE 208 BABCOCK & WILCOX ENTERPRISES, INC.: COMPANY OVERVIEW

- FIGURE 47 BABCOCK & WILCOX ENTERPRISES, INC.: COMPANY SNAPSHOT

- TABLE 209 BABCOCK & WILCOX ENTERPRISES, INC.: DEALS

- 13.1.2 SIEMENS AG

- TABLE 210 SIEMENS AG: COMPANY OVERVIEW

- FIGURE 48 SIEMENS AG: COMPANY SNAPSHOT

- TABLE 211 SIEMENS AG: PRODUCT OFFERINGS

- TABLE 212 SIEMENS AG: DEALS

- 13.1.3 JOHN WOOD PLC

- TABLE 213 JOHN WOOD GROUP PLC: COMPANY OVERVIEW

- FIGURE 49 JOHN WOOD GROUP PLC: COMPANY SNAPSHOT

- TABLE 214 JOHN WOOD GROUP PLC: PRODUCT OFFERINGS

- TABLE 215 JOHN WOOD GROUP PLC: DEALS

- 13.1.4 DONGFANG ELECTRIC CORPORATION LIMITED

- TABLE 216 DONGFANG ELECTRIC CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 217 DONGFANG ELECTRIC CORPORATION LIMITED: PRODUCT OFFERINGS

- TABLE 218 DONGFANG ELECTRIC CORPORATION LIMITED: DEALS

- 13.1.5 ROBERT BOSCH GMBH

- TABLE 219 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- FIGURE 50 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 220 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 221 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- 13.1.6 MITSUBISHI POWER

- TABLE 222 MITSUBISHI POWER: COMPANY OVERVIEW

- TABLE 223 MITSUBISHI POWER: PRODUCT OFFERINGS

- TABLE 224 MITSUBISHI POWER: PRODUCT LAUNCHES

- TABLE 225 MITSUBISHI POWER: DEALS

- 13.1.7 THERMAX LIMITED

- TABLE 226 THERMAX LIMITED: COMPANY OVERVIEW

- FIGURE 51 THERMAX LIMITED: COMPANY SNAPSHOT

- TABLE 227 THERMAX LIMITED: PRODUCT OFFERINGS

- TABLE 228 THERMAX LIMITED: DEALS

- 13.1.8 SOFINTER GROUP

- TABLE 229 SOFINTER GROUP: COMPANY OVERVIEW

- TABLE 230 SOFINTER GROUP: PRODUCT OFFERINGS

- 13.1.9 BHARAT HEAVY ELECTRICALS LIMITED

- TABLE 231 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY OVERVIEW

- FIGURE 52 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT

- TABLE 232 BHARAT HEAVY ELECTRICALS LIMITED: PRODUCT OFFERINGS

- TABLE 233 BHARAT HEAVY ELECTRICALS LIMITED: DEALS

- 13.1.10 CLEAVER-BROOKS, INC.

- TABLE 234 CLEAVER-BROOKS, INC.: COMPANY OVERVIEW

- TABLE 235 CLEAVER-BROOKS, INC.: PRODUCTS OFFERED

- TABLE 236 CLEAVER-BROOKS, INC.: PRODUCT LAUNCHES

- 13.1.11 BYWORTH BOILERS LTD.

- TABLE 237 BYWORTH BOILERS LTD.: COMPANY OVERVIEW

- TABLE 238 BYWORTH BOILERS LTD.: PRODUCTS OFFERED

- 13.1.12 ANDRITZ AG

- TABLE 239 ANDRITZ AG: COMPANY OVERVIEW

- FIGURE 53 ANDRITZ AG: COMPANY SNAPSHOT

- TABLE 240 ANDRITZ AG: PRODUCT OFFERINGS

- 13.1.13 HARBIN ELECTRIC COMPANY LIMITED

- TABLE 242 HARBIN ELECTRIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 243 HARBIN ELECTRIC COMPANY LIMITED: PRODUCT OFFERINGS

- 13.1.14 ALFA LAVAL AB

- TABLE 244 ALFA LAVAL AB: COMPANY OVERVIEW

- FIGURE 54 ALFA LAVAL AB: COMPANY SNAPSHOT

- TABLE 245 ALFA LAVAL AB: PRODUCT OFFERINGS

- 13.1.15 IHI CORPORATION

- TABLE 246 IHI CORPORATION: COMPANY OVERVIEW

- FIGURE 55 IHI CORPORATION: COMPANY SNAPSHOT

- TABLE 247 IHI CORPORATION: PRODUCT OFFERINGS

- TABLE 249 IHI CORPORATION: OTHER DEVELOPMENTS

- Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 BRYAN STEAM, LLC

- 13.2.2 COCHRAN LTD.

- 13.2.3 FORBES MARSHALL PRIVATE LIMITED

- 13.2.4 THE FULTON COMPANIES

- 13.2.5 VAPOR POWER INTERNATIONAL, LLC

- 13.2.6 SUPERIOR BOILER WORKS, INC.

- 13.2.7 HURST BOILER & WELDING COMPANY, INC.

- 13.2.8 JOHNSTON BOILER COMPANY

- 13.2.9 PARKER BOILER COMPANY

- 13.2.10 RENTECH BOILER SYSTEMS, INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS