|

|

市場調査レポート

商品コード

1267442

マルチプレックスアッセイの世界市場:製品・サービス別 (消耗品、装置、ソフトウェア・サービス)・種類別 (核酸、タンパク質)・技術別 (フローサイトメトリー、発光)・用途別 (研究開発、臨床診断)・エンドユーザー別 (製薬企業、病院) の将来予測 (2027年まで)Multiplex Assays Market by Product & Service (Consumables, Instruments, Software & Services), Type (Nucleic Acid, Protein), Technology (Flow Cytometry, Luminescence), Application (R&D, Diagnosis), End User (Pharma, Hospitals) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| マルチプレックスアッセイの世界市場:製品・サービス別 (消耗品、装置、ソフトウェア・サービス)・種類別 (核酸、タンパク質)・技術別 (フローサイトメトリー、発光)・用途別 (研究開発、臨床診断)・エンドユーザー別 (製薬企業、病院) の将来予測 (2027年まで) |

|

出版日: 2023年05月01日

発行: MarketsandMarkets

ページ情報: 英文 200 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のマルチプレックスアッセイの市場規模は、2022年に35億米ドル、2027年には53億米ドルに達すると予測され、予測期間中のCAGRは8.8%となる見通しです。

慢性疾患の負担により、その抑制と管理のためのマルチプレックスアッセイの使用が必要となっています。多くのバイオマーカーが探索・検証されているため、新しい診断テストが開発される可能性が高くなっています。現在のところ、特定の疾患群を対象としたマルチプレックスアッセイは数種類に限られています。新しいバイオマーカーが開発されれば、新しいマルチプレックスアッセイを開発することができます。このため、バイオマーカーの検証により、マルチプレックスアッセイ市場の発展機会を創出できます。しかし、装置のコストが高いことが、マルチプレックスアッセイの普及を制限する大きな要因となっています。

"消耗品のセグメントが、マルチプレックスアッセイ市場において予測期間中に、製品・サービス別で最も成長率が高くなる"

2022年に、消耗品セグメントは最大の市場シェアを占めています。また、このセグメントは最も高いCAGRで成長すると予想されています。装置セグメントは、マルチプレックスアッセイ市場で2番目に大きなシェアを占めています。感染症やがんの発生率の増加、ハイスループット能力を備えた自動化・高度装置の需要増大、最小限の人的介入による迅速・正確な検査結果に対するニーズの高まりが、装置のセグメントを牽引しています。

"研究開発のセグメントが、マルチプレックスアッセイ市場において予測期間中に、用途別で最も成長率が高くなる"

2022年のマルチプレックスアッセイ市場では、研究開発用途のセグメントが最大のシェアを占めています。その中でも、創薬・開発のセグメントが最大のシェアを占めました。創薬・開発向けマルチプレックスアッセイの需要は、その利点から増加しています。これらのアッセイは、医薬品開発の臨床段階における薬物反応バイオマーカー、免疫療法の成功、毒性の評価に有効である傾向があります。

"アジア太平洋:マルチプレックスアッセイ市場で最も急速に成長している地域"

アジア太平洋は、予測期間中に最も高いCAGRで成長すると予測されています。アジア太平洋は、病気の早期発見や定期的な健康診断への認識向上に向けた政府の取り組み強化や、医療費の増加、インドと中国における病院や臨床検査室の増加、インド・中国・日本における診断処置向け研究基盤の強化といった要因によって、予測期間中に最も高い成長率を示すと予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタム化データ

第6章 マルチプレックスアッセイ市場:製品・サービス別

- イントロダクション

- 消耗品

- 装置

- ソフトウェア・サービス

第7章 マルチプレックスアッセイ市場:種類別

- イントロダクション

- タンパク質マルチプレックスアッセイ

- 平面タンパク質アッセイ

- ビーズベースタンパク質アッセイ

- その他のタンパク質アッセイ

- 核酸マルチプレックスアッセイ

- 平面核酸アッセイ

- ビーズベース核酸アッセイ

- その他の核酸アッセイ

- 細胞ベースマルチプレックスアッセイ

第8章 マルチプレックスアッセイ市場:技術別

- イントロダクション

- フローサイトメトリー

- 蛍光検出

- 発光

- マルチプレックスリアルタイムPCR

- その他の技術

第9章 マルチプレックスアッセイ市場:用途別

- イントロダクション

- 研究開発

- 創薬・開発

- バイオマーカー探索・検証

- 臨床診断

- 感染症

- がん

- 心血管疾患

- 自己免疫疾患

- 神経系疾患

- 代謝・内分泌疾患

- その他の疾患

第10章 マルチプレックスアッセイ市場:エンドユーザー別

- イントロダクション

- 製薬・バイオテクノロジー企業

- 病院・研究機関

- リファレンスラボラトリー

- その他のエンドユーザー

第11章 マルチプレックスアッセイ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の収益シェア分析

- 市場シェア分析

- 企業評価クアドラント

- スタートアップ/中小企業の競合リーダーシップマッピング (2021年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ILLUMINA, INC.

- BIO-RAD LABORATORIES, INC.

- THERMO FISHER SCIENTIFIC, INC.

- BECTON, DICKINSON AND COMPANY

- DIASORIN S.P.A.

- QIAGEN N.V.

- ABCAM PLC

- MERCK KGAA

- AGILENT TECHNOLOGIES, INC.

- QUANTERIX

- BIO-TECHNE

- MESO SCALE DIAGNOSTICS, LLC

- RANDOX LABORATORIES LTD.

- その他の企業

- OLINK

- SEEGENE INC.

- SIEMENS HEALTHINEERS AG

- PERKINELMER INC.

- SHIMADZU CORPORATION

- PROMEGA CORPORATION

- ENZO BIOCHEM INC.

- CAYMAN CHEMICAL

- BOSTER BIOLOGICAL TECHNOLOGY

- ANTIGENIX AMERICA, INC.

- QUANSYS BIOSCIENCES INC.

- RAYBIOTECH LIFE, INC.

第14章 付録

The multiplex assays market is valued at an estimated USD 3.5 billion in 2022 and is projected to reach USD 5.3 billion by 2027, at a CAGR of 8.8% during the forecast period. The burden of chronic diseases has necessitated the use of multiplex assays for containment and management. As many biomarkers are being discovered and validated, there is a higher probability of the development of new diagnostic tests. At present, there are only a few multiplex assays targeting specific disease classes. With the development of new biomarkers, new multiplex assays can be developed. Owing to this, biomarker validation can create opportunities for the development of the multiplex assays market. However, high instrument cost is a major factor limiting the wider adoption of multiplex assays.

"The consumables segment accounted for the highest growth rate in the multiplex assays market, by product & service, during the forecast period"

Based on product & service, the multiplex assays market is segmented into three broad categories, namely, consumables, instruments, and software & services. In 2022, the consumables segment accounted for the largest share of the market. This segment is also expected to grow at the highest CAGR. The instruments segment accounted for the second largest share of the multiplex assays market. The increasing incidence of infectious diseases & cancer, growing demand for automated and advanced instruments with high-throughput capacities and increasing need for faster and more accurate test results with minimal human intervention are driving the instruments market segment.

"The research & development segment accounted for the highest growth rate in the multiplex assays market, by application, during the forecast period"

Based on applications, the multiplex assays market is segmented into research & development (drug discovery & development and biomarker discovery & validation) and clinical diagnostics (infectious diseases, cancer, cardiovascular diseases, autoimmune diseases, nervous system disorders, metabolism & endocrinology disorders, and other diseases). The research & development application segment accounted the largest share of the multiplex assays market in 2022. The drug discovery & development segment accounted for the largest share of the multiplex assays market for research & development in 2022. The demand for multiplex assays in drug discovery & development has increased due to their benefits. These assays tend to be effective in evaluating drug response biomarkers, immunotherapy success, and toxicity during the clinical stages of drug development.

"Asia Pacific: The fastest-growing region multiplex assays market"

The global multiplex assays market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. The Asia Pacific region is projected to register the highest CAGR during the forecast period. The Asia Pacific market is expected to witness the highest growth during the forecast period due to factors such as growing government efforts to increase awareness about the early detection of diseases and the increasing number of regular health check-ups; rising healthcare expenditure; the increasing number of hospitals and clinical diagnostic laboratories in India and China; and growing strength in the research base for diagnostic procedures across India, China, and Japan.

The break-up of the profile of primary participants in the multiplex assays market:

- By Company Type: Tier 1 - 42%, Tier 2 - 37%, and Tier 3 - 21%

- By Designation: C-level - 34%, D-level - 42%, and Others - 24%

- By Region: North America - 32%, Europe - 30%, Asia Pacific - 24%, and the Rest of the World - 14%

The key players in this market are Illumina, Inc. (US), Thermo Fisher Scientific, Inc. (US), Bio-Rad Laboratories, Inc. (US), Becton, Dickinson and Company (US), DiaSorin S.p.A. (Italy), QIAGEN N.V. (Netherlands), Abcam plc (UK), Merck KGaA (Germany), Agilent Technologies, Inc. (US), Quanterix (US), Bio-Techne (US), MESO SCALE DIAGNOSTICS, LLC (US), Randox Laboratories Ltd. (UK), Olink (Sweden), Seegene Inc. (South Korea), Siemens Healthcare AG (Germany), PerkinElmer Inc. (US), Shimadzu Corporation (Japan), Promega Corporation (US), Enzo Biochem Inc. (US), Cayman Chemical (US), Boster Biological Technology (US), Antigenix America, Inc. (US), Quansys Biosciences Inc. (US), and RayBiotech Life, Inc. (US).

Research Coverage:

This research report categorizes the multiplex assays market by product & service (consumables, instruments, and software & services), type (protein multiplex assays [planar protein assays, bead-based protein assays, and other protein assays], nucleic acid multiplex assays [planar nucleic acid assays, bead-based nucleic acid assays, and other nucleic acid assays], and cell-based Multiplex Assays), technology (flow cytometry, fluorescence detection, luminescence, multiplex real-time PCR, and other technologies), application (research & development [drug discovery & development and biomarker discovery & validation] and clinical diagnostics [infectious diseases, cancer, cardiovascular diseases, autoimmune diseases, nervous system disorders, and metabolism & endocrinology disorders, and other diseases]), end user (pharmaceutical & biotechnology companies, hospitals & research institutes, reference laboratories, and other end users), and region (North America, Europe, Asia Pacific, and the Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the multiplex assays market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; acquisitions, agreements. new product & service launches, and recent developments associated with the multiplex assays market. Competitive analysis of upcoming startups in the multiplex assays market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall multiplex assays market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing use of multiplex assays in companion diagnostics, increasing advantages over singleplex and traditional assays, and increasing incidence of chronic and infectious diseases and growing awareness about early disease diagnosis), restraints (rising costs of equipment and growing number of stringent regulations and standards), opportunities (increasing validation of biomarkers in molecular and protein diagnostics and rising need for high-throughput and automated systems), and challenges (increasing dearth of skilled professionals) influencing the growth of the multiplex assays market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the multiplex assays market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the multiplex assays market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the multiplex assays market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Illumina, Inc. (US), Thermo Fisher Scientific, Inc. (US), Bio-Rad Laboratories, Inc. (US), Becton, Dickinson and Company (US), DiaSorin S.p.A. (Italy), and Merck KGaA (Germany) among others in the multiplex assays market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- FIGURE 1 MULTIPLEX ASSAYS MARKET: RESEARCH DESIGN METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MULTIPLEX ASSAYS MARKET: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS

- 2.9 RISK ASSESSMENT

- 2.9.1 RISK ASSESSMENT: MULTIPLEX ASSAYS MARKET

- 2.10 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 8 MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 MULTIPLEX ASSAYS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 MULTIPLEX ASSAYS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 MULTIPLEX ASSAYS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 MULTIPLEX ASSAYS MARKET OVERVIEW

- FIGURE 14 INCREASING ADOPTION OF MULTIPLEX ASSAYS IN COMPANION DIAGNOSTICS TO DRIVE MARKET GROWTH

- 4.2 MULTIPLEX ASSAYS MARKET SHARE, BY PRODUCT & SERVICE, 2022 VS. 2027

- FIGURE 15 CONSUMABLES PRODUCT & SERVICE SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2027

- 4.3 MULTIPLEX ASSAYS MARKET SHARE, BY TYPE, 2022 VS. 2027

- FIGURE 16 PROTEIN MULTIPLEX ASSAYS TYPE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.4 MULTIPLEX ASSAYS MARKET SHARE, BY TECHNOLOGY, 2022 VS. 2027

- FIGURE 17 FLOW CYTOMETRY TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.5 MULTIPLEX ASSAYS MARKET SHARE, BY APPLICATION, 2022 VS. 2027

- FIGURE 18 RESEARCH & DEVELOPMENT APPLICATION TO ACCOUNT FOR LARGER MARKET SHARE

- 4.6 MULTIPLEX ASSAYS MARKET SHARE, BY END USER, 2022 VS. 2027

- FIGURE 19 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES END USER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.7 MULTIPLEX ASSAYS MARKET: REGIONAL GROWTH OPPORTUNITIES

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 MULTIPLEX ASSAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of multiplex assays in companion diagnostics

- 5.2.1.2 Increasing advantages over singleplex and traditional assays

- 5.2.1.3 Increasing incidence of chronic and infectious diseases and growing awareness about early disease diagnosis

- FIGURE 22 INCIDENCE OF DIABETES, BY REGION, IN 2021, 2030, AND 2045

- TABLE 1 TOTAL HEALTH EXPENDITURE DUE TO DIABETES (20-79 YEARS) IN 2021, BY COUNTRY

- TABLE 2 GLOBAL INCIDENCE OF INFECTIOUS DISEASES

- TABLE 3 APPROVED AND LAUNCHED MULTIPLEX ASSAYS FOR DIAGNOSIS OF SARS-COV-2

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising costs of equipment

- 5.2.2.2 Growing number of stringent regulations and standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing validation of biomarkers in molecular and protein diagnostics

- 5.2.3.2 Rising need for high-throughput and automated systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing dearth of skilled professionals

- TABLE 4 NUMBER OF LAB TECHNOLOGISTS AND TECHNICIANS IN US, 2020

- 5.3 CUSTOMIZATION DATA

- TABLE 5 MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

6 MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- TABLE 6 MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- 6.2 PRIMARY NOTES

- 6.2.1 KEY INDUSTRY INSIGHTS

- 6.3 CONSUMABLES

- 6.3.1 RECURRENT REQUIREMENTS AND PURCHASES OF CONSUMABLES TO DRIVE MARKET

- TABLE 7 MULTIPLEX ASSAY CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 8 NORTH AMERICA: MULTIPLEX ASSAY CONSUMABLES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4 INSTRUMENTS

- 6.4.1 LAUNCH OF TECHNOLOGICALLY ADVANCED INSTRUMENTS TO SUPPORT MARKET GROWTH

- TABLE 9 MULTIPLEX ASSAY INSTRUMENT MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 10 NORTH AMERICA: MULTIPLEX ASSAY INSTRUMENTS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.5 SOFTWARE & SERVICES

- 6.5.1 INCREASING NEED FOR EFFECTIVE DATA MANAGEMENT WITHIN LABORATORIES TO FUEL UPTAKE OF ADVANCED SOFTWARE

- TABLE 11 MULTIPLEX ASSAY SOFTWARE & SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 12 NORTH AMERICA: MULTIPLEX ASSAY SOFTWARE & SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 MULTIPLEX ASSAYS MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 13 MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 7.2 PROTEIN MULTIPLEX ASSAYS

- TABLE 14 PROTEIN MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 15 PROTEIN MULTIPLEX ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 16 NORTH AMERICA: PROTEIN MULTIPLEX ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1 PLANAR PROTEIN ASSAYS

- 7.2.1.1 Pivotal role in drug discovery to support uptake

- TABLE 17 PLANAR PROTEIN ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 18 NORTH AMERICA: PLANAR PROTEIN ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2 BEAD-BASED PROTEIN ASSAYS

- 7.2.2.1 Best suited to study protein-protein interactions

- TABLE 19 BEAD-BASED PROTEIN ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 20 NORTH AMERICA: BEAD-BASED PROTEIN ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

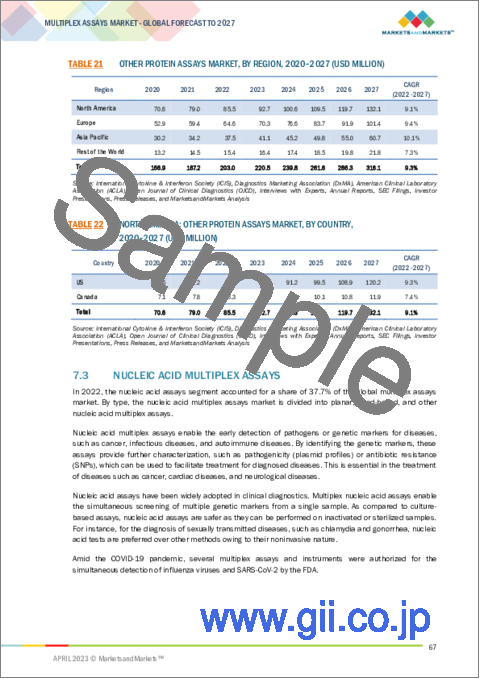

- 7.2.3 OTHER PROTEIN ASSAYS

- TABLE 21 OTHER PROTEIN ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 22 NORTH AMERICA: OTHER PROTEIN ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 NUCLEIC ACID MULTIPLEX ASSAYS

- TABLE 23 SOME FDA-AUTHORIZED MULTIPLEX ASSAYS AND INSTRUMENTS FOR SIMULTANEOUS DETECTION OF INFLUENZA AND SARS-COV-2

- TABLE 24 NUCLEIC ACID MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 25 NUCLEIC ACID MULTIPLEX ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 26 NORTH AMERICA: NUCLEIC ACID MULTIPLEX ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3.1 PLANAR NUCLEIC ACID ASSAYS

- 7.3.1.1 Planar multiplex assays preferred in gene expression analysis, SNP genotyping, and transcriptome analysis

- TABLE 27 PLANAR NUCLEIC ACID ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 28 NORTH AMERICA: PLANAR NUCLEIC ACID ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3.2 BEAD-BASED NUCLEIC ACID ASSAYS

- 7.3.2.1 Increasing infectious diseases and genetic screening tests to drive market

- TABLE 29 BEAD-BASED NUCLEIC ACID ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 30 NORTH AMERICA: BEAD-BASED NUCLEIC ACID ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3.3 OTHER NUCLEIC ACID ASSAYS

- TABLE 31 OTHER NUCLEIC ACID ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: OTHER NUCLEIC ACID ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 CELL-BASED MULTIPLEX ASSAYS

- 7.4.1 BETTER VARIABILITY THAN BIOCHEMICAL-BASED ASSAYS TO DRIVE MARKET

- TABLE 33 CELL-BASED MULTIPLEX ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: CELL-BASED MULTIPLEX ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

8 MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- TABLE 35 MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 8.2 FLOW CYTOMETRY

- 8.2.1 WIDE APPLICATIONS IN PROTEIN EXPRESSION, RNA, AND CELL HEALTH STATUS TO MAKE THIS MARKET SEGMENT LARGEST

- TABLE 36 MULTIPLEX ASSAYS MARKET FOR FLOW CYTOMETRY, BY REGION, 2020-2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 FLUORESCENCE DETECTION

- 8.3.1 INCREASING USE OF MICROARRAY SCANNERS AND FLUORESCENCE MICROSCOPES TO FUEL GROWTH

- TABLE 38 MULTIPLEX ASSAYS MARKET FOR FLUORESCENCE DETECTION, BY REGION, 2020-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR FLUORESCENCE DETECTION, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 LUMINESCENCE

- 8.4.1 RAPID AND EASY-TO-USE BENEFITS OF LUMINESCENCE TECHNOLOGY TO DRIVE MARKET

- TABLE 40 MULTIPLEX ASSAYS MARKET FOR LUMINESCENCE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR LUMINESCENCE, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.5 MULTIPLEX REAL-TIME PCR

- 8.5.1 HIGH SPECIFICITY AND SENSITIVITY OF MULTIPLEX REAL-TIME PCR TO DRIVE ADOPTION OF MULTIPLEX ASSAYS

- TABLE 42 MULTIPLEX ASSAYS MARKET FOR MULTIPLEX REAL-TIME PCR, BY REGION, 2020-2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR MULTIPLEX REAL-TIME PCR, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.6 OTHER TECHNOLOGIES

- TABLE 44 MULTIPLEX ASSAYS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2020-2027 (USD MILLION)

9 MULTIPLEX ASSAYS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 46 MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2 RESEARCH & DEVELOPMENT

- TABLE 47 MULTIPLEX ASSAYS MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 48 MULTIPLEX ASSAYS MARKET FOR RESEARCH & DEVELOPMENT, BY REGION, 2020-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR RESEARCH & DEVELOPMENT, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.2.1 DRUG DISCOVERY & DEVELOPMENT

- 9.2.1.1 Multiplex assays massively employed in preclinical and clinical phases

- TABLE 50 MULTIPLEX ASSAYS MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY REGION, 2020-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.2.2 BIOMARKER DISCOVERY & VALIDATION

- 9.2.2.1 Multiplex assays aid in quantitative measurement of protein biomarkers in large samples

- TABLE 52 MULTIPLEX ASSAYS MARKET FOR BIOMARKER DISCOVERY & VALIDATION, BY REGION, 2020-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR BIOMARKER DISCOVERY & VALIDATION, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3 CLINICAL DIAGNOSTICS

- TABLE 54 MULTIPLEX ASSAYS MARKET FOR CLINICAL DIAGNOSTICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 55 MULTIPLEX ASSAYS MARKET FOR CLINICAL DIAGNOSTICS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR CLINICAL DIAGNOSTICS, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3.1 INFECTIOUS DISEASES

- 9.3.1.1 Growing prevalence of infectious diseases to drive uptake of multiplex assays

- TABLE 57 MULTIPLEX ASSAYS MARKET FOR INFECTIOUS DISEASE DIAGNOSTICS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR INFECTIOUS DISEASE DIAGNOSTICS, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3.2 CANCER

- 9.3.2.1 Rising burden of cancer to drive market

- TABLE 59 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

- TABLE 60 NUMBER OF PREVALENT CANCER CASES WORLDWIDE IN 2020, BY TYPE OF CANCER

- TABLE 61 MULTIPLEX ASSAYS MARKET FOR CANCER DIAGNOSTICS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR CANCER DIAGNOSTICS, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3.3 CARDIOVASCULAR DISEASES

- 9.3.3.1 High burden of cardiovascular diseases to support market growth

- TABLE 63 MULTIPLEX ASSAYS MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3.4 AUTOIMMUNE DISEASES

- 9.3.4.1 High incidence and prevalence of autoimmune diseases to drive demand for measures promoting early diagnosis

- TABLE 65 PREVALENCE OF SOME AUTOIMMUNE DISEASES

- TABLE 66 MULTIPLEX ASSAYS MARKET FOR AUTOIMMUNE DISEASES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR AUTOIMMUNE DISEASES, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3.5 NERVOUS SYSTEM DISORDERS

- 9.3.5.1 Growing prevalence of nervous system disorders to fuel uptake of multiplex assays for early diagnosis and treatment

- TABLE 68 MULTIPLEX ASSAYS MARKET FOR NERVOUS SYSTEM DISORDERS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR NERVOUS SYSTEM DISORDERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3.6 METABOLISM & ENDOCRINOLOGY DISORDERS

- 9.3.6.1 Multiplex assays used to measure endocrine and metabolic biomarkers that help in timely diagnosis of such conditions

- TABLE 70 MULTIPLEX ASSAYS MARKET FOR METABOLISM & ENDOCRINOLOGY DISORDERS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR METABOLISM & ENDOCRINOLOGY DISORDERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3.7 OTHER DISEASES

- TABLE 72 MULTIPLEX ASSAYS MARKET FOR OTHER DISEASES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR OTHER DISEASES, BY COUNTRY, 2020-2027 (USD MILLION)

10 MULTIPLEX ASSAYS MARKET, BY END USER

- 10.1 INTRODUCTION

- TABLE 74 MULTIPLEX ASSAYS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.2.1 GROWING DEMAND FOR MULTIPLEX ASSAYS IN DRUG DISCOVERY & CLINICAL STUDIES TO DRIVE ITS UPTAKE

- TABLE 75 MULTIPLEX ASSAYS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.3 HOSPITALS & RESEARCH INSTITUTES

- 10.3.1 INCREASING NUMBER OF HOSPITALS TO DRIVE MARKET

- TABLE 77 MULTIPLEX ASSAYS MARKET FOR HOSPITALS & RESEARCH INSTITUTES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR HOSPITALS & RESEARCH INSTITUTES, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.4 REFERENCE LABORATORIES

- 10.4.1 GROWING NUMBER OF CLINICAL TESTS PERFORMED IN REFERENCE LABORATORIES AND INCREASING NUMBER OF ACCREDITED LABORATORIES TO SUPPORT MARKET GROWTH

- TABLE 79 MULTIPLEX ASSAYS MARKET FOR REFERENCE LABORATORIES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.5 OTHER END USERS

- TABLE 81 MULTIPLEX ASSAYS MARKET FOR OTHER END USERS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: MULTIPLEX ASSAYS MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

11 MULTIPLEX ASSAYS MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 83 MULTIPLEX ASSAYS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- TABLE 84 NORTH AMERICA: MULTIPLEX ASSAYS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: MULTIPLEX ASSAYS MARKET, BY END USER, 2020-2027 (USD MILLION)

- FIGURE 23 NORTH AMERICA: MULTIPLEX ASSAYS MARKET SNAPSHOT

- 11.2.1 RECESSION IMPACT ON NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing prevalence of infectious diseases and cancer to drive market

- TABLE 90 US: MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 91 US: MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 US: MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 93 US: MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 94 US: MULTIPLEX ASSAYS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Increased funding activities by government in life sciences research & drug development to support market growth

- TABLE 95 CANADA: MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 96 CANADA: MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 97 CANADA: MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 98 CANADA: MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 99 CANADA: MULTIPLEX ASSAYS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.3 EUROPE

- TABLE 100 EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY (% OF GDP)

- TABLE 101 EUROPE: MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 102 EUROPE: MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 EUROPE: MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 104 EUROPE: MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 105 EUROPE: MULTIPLEX ASSAYS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.3.1 RECESSION IMPACT ON EUROPE

- 11.4 ASIA PACIFIC

- FIGURE 24 ASIA PACIFIC: MULTIPLEX ASSAYS MARKET SNAPSHOT

- TABLE 106 ASIA PACIFIC: MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MULTIPLEX ASSAYS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4.1 RECESSION IMPACT ON ASIA PACIFIC

- 11.5 REST OF THE WORLD

- TABLE 111 REST OF THE WORLD: MULTIPLEX ASSAYS MARKET, BY PRODUCT & SERVICE, 2020-2027 (USD MILLION)

- TABLE 112 REST OF THE WORLD: MULTIPLEX ASSAYS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 113 REST OF THE WORLD: MULTIPLEX ASSAYS MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 114 REST OF THE WORLD: MULTIPLEX ASSAYS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 115 REST OF THE WORLD: MULTIPLEX ASSAYS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.5.1 RECESSION IMPACT ON REST OF THE WORLD

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS

- TABLE 116 OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPANIES

- 12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 25 REVENUE SHARE ANALYSIS OF TOP PLAYERS (2017-2021)

- 12.4 MARKET SHARE ANALYSIS

- 12.4.1 MULTIPLEX ASSAYS MARKET

- FIGURE 26 MULTIPLEX ASSAYS MARKET SHARE, BY KEY PLAYER, 2021

- TABLE 117 MULTIPLEX ASSAYS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 12.5 COMPANY EVALUATION QUADRANT

- 12.5.1 LIST OF EVALUATED VENDORS

- 12.5.2 STARS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PERVASIVE PLAYERS

- 12.5.5 PARTICIPANTS

- FIGURE 27 MULTIPLEX ASSAYS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 12.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 28 MULTIPLEX ASSAYS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES & REGULATORY APPROVALS

- TABLE 118 KEY PRODUCT LAUNCHES & REGULATORY APPROVALS (2020- 2023)

- 12.7.2 DEALS

- TABLE 119 KEY DEALS (2020-2023)

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View)**

- 13.1.1 ILLUMINA, INC.

- TABLE 120 ILLUMINA, INC.: BUSINESS OVERVIEW

- FIGURE 29 COMPANY SNAPSHOT: ILLUMINA, INC. (2022)

- 13.1.2 BIO-RAD LABORATORIES, INC.

- TABLE 121 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 30 COMPANY SNAPSHOT: BIO-RAD LABORATORIES, INC. (2022)

- 13.1.3 THERMO FISHER SCIENTIFIC, INC.

- TABLE 122 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- FIGURE 31 COMPANY SNAPSHOT: THERMO FISHER SCIENTIFIC, INC. (2021)

- 13.1.4 BECTON, DICKINSON AND COMPANY

- TABLE 123 BECTON, DICKINSON AND COMPANY.: BUSINESS OVERVIEW

- FIGURE 32 COMPANY SNAPSHOT: BECTON, DICKINSON AND COMPANY (2022)

- 13.1.5 DIASORIN S.P.A.

- TABLE 124 DIASORIN S.P.A.: BUSINESS OVERVIEW

- FIGURE 33 COMPANY SNAPSHOT: DIASORIN S.P.A. (2021)

- 13.1.6 QIAGEN N.V.

- TABLE 125 QIAGEN N.V.: BUSINESS OVERVIEW

- FIGURE 34 COMPANY SNAPSHOT: QIAGEN N.V. (2021)

- 13.1.7 ABCAM PLC

- TABLE 126 ABCAM PLC.: BUSINESS OVERVIEW

- FIGURE 35 COMPANY SNAPSHOT: ABCAM PLC (2021)

- 13.1.8 MERCK KGAA

- TABLE 127 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 36 COMPANY SNAPSHOT: MERCK KGAA (2022)

- 13.1.9 AGILENT TECHNOLOGIES, INC.

- TABLE 128 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 37 COMPANY SNAPSHOT: AGILENT TECHNOLOGIES, INC. (2022)

- 13.1.10 QUANTERIX

- TABLE 129 QUANTERIX: BUSINESS OVERVIEW

- FIGURE 38 COMPANY SNAPSHOT: QUANTERIX (2022)

- 13.1.11 BIO-TECHNE

- TABLE 130 BIO-TECHNE: BUSINESS OVERVIEW

- FIGURE 39 COMPANY SNAPSHOT: BIO-TECHNE (2021)

- 13.1.12 MESO SCALE DIAGNOSTICS, LLC

- TABLE 131 MESO SCALE DIAGNOSTICS, LLC: BUSINESS OVERVIEW

- 13.1.13 RANDOX LABORATORIES LTD.

- TABLE 132 RANDOX LABORATORIES LTD.: BUSINESS OVERVIEW

- * Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 OLINK

- TABLE 133 OLINK: COMPANY OVERVIEW

- 13.2.2 SEEGENE INC.

- TABLE 134 SEEGENE INC.: COMPANY OVERVIEW

- 13.2.3 SIEMENS HEALTHINEERS AG

- TABLE 135 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- 13.2.4 PERKINELMER INC.

- TABLE 136 PERKINELMER INC.: COMPANY OVERVIEW

- 13.2.5 SHIMADZU CORPORATION

- TABLE 137 SHIMADZU CORPORATION: COMPANY OVERVIEW

- 13.2.6 PROMEGA CORPORATION

- TABLE 138 PROMEGA CORPORATION: COMPANY OVERVIEW

- 13.2.7 ENZO BIOCHEM INC.

- TABLE 139 ENZO BIOCHEM INC.: COMPANY OVERVIEW

- 13.2.8 CAYMAN CHEMICAL

- TABLE 140 CAYMAN CHEMICAL: COMPANY OVERVIEW

- 13.2.9 BOSTER BIOLOGICAL TECHNOLOGY

- TABLE 141 BOSTER BIOLOGICAL TECHNOLOGY: COMPANY OVERVIEW

- 13.2.10 ANTIGENIX AMERICA, INC.

- TABLE 142 ANTIGENIX AMERICA, INC.: COMPANY OVERVIEW

- 13.2.11 QUANSYS BIOSCIENCES INC.

- TABLE 143 QUANSYS BIOSCIENCES INC.: COMPANY OVERVIEW

- 13.2.12 RAYBIOTECH LIFE, INC.

- TABLE 144 RAYBIOTECH LIFE, INC.: COMPANY OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS