|

|

市場調査レポート

商品コード

1459460

予知保全の世界市場:コンポーネント・技術・技法・組織規模・産業・地域別 - 予測(~2029年)Predictive Maintenance Market by Component (Hardware, Solution (Deployment Mode), & Services), Technology, Technique (Vibration Analysis, Infrared Thermography, Motor Circuit Analysis), Organization Size, Vertical, & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 予知保全の世界市場:コンポーネント・技術・技法・組織規模・産業・地域別 - 予測(~2029年) |

|

出版日: 2024年03月29日

発行: MarketsandMarkets

ページ情報: 英文 377 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の予知保全の市場規模は、予測期間中に35.1%のCAGRで推移し、2024年の106億米ドルから、2029年には478億米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | コンポーネント・技術・技法・組織規模・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

コンポーネント別では、ソリューションの部門が予測期間中に最大の規模を維持すると予測されています。予知保全ソリューションは、従来の保全手法による資産状態の監視に課題があることから、企業にとって不可欠なコンポーネントとして浮上しています。また、これらのソリューションはリアルタイムの資産監視を提供し、ルールベースのメンテナンスアプローチよりも大幅に進歩しているため、企業はコストを削減し、ダウンタイムを最小限に抑え、運用メンテナンスプロセスを最適化するプロアクティブメンテナンス戦略を採用することができます。ソリューション部門は、スタンドアロン型と統合型に分類され、統合型ソリューションは、その包括的な機能性と多様な部門や地域で広く採用されていることから、大きな需要があります。単機能と多機能の両方を提供できる統合型ソフトウェアは、スタンドアロン型ソフトウェアよりも人気を得ています。スタンドアロン型ソフトウェアはカスタマイズ機能に欠けますが、手頃な価格であるため、中小企業では依然として普及しています。

技術別では、AIの部門が予測期間中にもっとも高いCAGRで成長すると予測されています。AI技術は、高度なアルゴリズムと機械学習モデルを活用してデータを分析し、潜在的な機器の故障を事前に予測することで、予知保全において重要な役割を果たしています。この技術により、企業は事後保全から事前保全、さらには予知保全戦略へと移行し、最終的には資産の信頼性を向上させ、ダウンタイムを削減し、保全コストを最適化することができます。

地域別では、アジア太平洋地域が予測期間中にもっとも高いCAGRを示す見通しです。IoT技術の商業化と、技術を最大限に活用するためのさらなる進歩の必要性が、この地域における予知保全ソリューションの採用を促進すると予想されています。この地域には、中国や日本などの主要経済国が含まれており、予知保全市場で高い成長を記録することが期待されています。また、同地域では、エネルギー・ユーティリティ、輸送・物流、ヘルスケア・ライフサイエンスなどの産業で予測保全ソリューションとサービスがもっとも高い割合で採用される見通しです。

当レポートでは、世界の予知保全の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ビジネスモデル、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 予知保全市場:進化

- サプライチェーン分析

- エコシステム/市場マップ

- ケーススタディ分析

- 貿易分析

- 規制状況

- 特許分析

- 技術分析

- 価格分析

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- 主な会議とイベント

- 主なステークホルダーと購入基準

- 技術ロードマップ

- ビジネスモデル

第6章 予知保全市場:コンポーネント別

- ハードウェア

- ソリューション

- 統合型

- スタンドアロン型

- ソリューション:導入モード別

- クラウド

- オンプレミス

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 予知保全市場:技術別

- アナリティクス・データ管理

- AI

- IoTプラットフォーム

- センサー・その他のデバイス

第8章 予知保全市場:技法別

- 振動解析

- テストコンポーネント配置

- 不均衡検出

- 共鳴識別

- ギア故障検出

- その他

- 赤外線サーモグラフィ

- 電気接続・システム検査

- 暖房システム評価

- 流体分析

- 放電パターン分析

- 屋根メンテナンス

- その他

- 音響モニタリング

- パイプライン監視

- コンデンサー評価

- 真空システム監視

- ファン健康診断

- エアコンプレッサー監視

- その他

- オイル分析

- タービンメンテナンス

- 油圧システムメンテナンス

- エンジン評価

- 伝達評価

- ギア潤滑油レベル監視

- その他

- モーター回路解析

- エンジン劣化評価

- シャフト&ローターアライメント

- 断熱評価

- ギア評価

- 短絡スキャン

- その他

- その他

第9章 予知保全市場:組織規模別

- 大企業

- 中小企業

第10章 予知保全市場:産業別

- エネルギー・ユーティリティ

- 製造

- 自動車・輸送

- 航空宇宙・防衛

- 建設・鉱業

- ヘルスケア

- 電気通信

- その他

第11章 予知保全市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

- 主要ベンダーの企業評価と財務指標

第13章 企業プロファイル

- 主要企業

- IBM

- ABB

- SCHNEIDER ELECTRIC

- AWS

- MICROSOFT

- HITACHI

- SAP

- SAS INSTITUTE

- SOFTWARE AG

- TIBCO SOFTWARE

- ALTAIR

- ORACLE

- SPLUNK

- C3.AI

- EMERSON

- GE

- HONEYWELL

- SIEMENS

- PTC

- スタートアップ/SME

- DINGO

- UPTAKE

- SAMOTICS

- WAVESCAN

- QUADRICAL AI

- UPKEEP

- LIMBLE

- SENSEGROW

- PRESAGE INSIGHTS

- FACLON LABS

第14章 隣接市場と関連市場

第15章 付録

The global predictive maintenance market is valued at USD 10.6 billion in 2024 and is estimated to reach USD 47.8 billion in 2029, registering a CAGR of 35.1% during the forecast period. The continuous advancements in big data, Machine-to-Machine (M2M) communication, and cloud technology have opened up new possibilities for analyzing information derived from industrial assets. IoT devices generate vast amounts of data from diverse sources like sensors, cameras, and interconnected devices. However, this data alone lacks value until it is transformed into actionable, context-rich information. Big data analytics and data visualization techniques empower users to uncover fresh insights through batch processing and offline analysis. While real-time data analysis and decision-making are often manual, automating these processes is preferred for scalability. AI technology plays a crucial role in analyzing the extensive data volumes generated by various components of the IoT ecosystem and converting them into meaningful insights. Enterprises are integrating AI into their established analytical frameworks to automate data interpretation and gain real-time insights from IoT-generated data. AI equips enterprises with frameworks and tools to analyze real-time data and discover multiple use cases for IoT applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | By Component, Technology, Technique, Organization size, Vertical and Region. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"By component, the solution segment is projected to hold the largest market size during the forecast period."

Predictive maintenance solutions have emerged as indispensable components for numerous successful and large enterprises, given the challenges they face in monitoring asset conditions using traditional maintenance methods. Moreover, these solutions offer real-time asset monitoring, a significant advancement over rule-based maintenance approaches, allowing organizations to adopt proactive maintenance strategies that reduce costs, minimize downtime, and optimize operational maintenance processes. The solutions market is categorized into standalone and integrated offerings, with integrated solutions experiencing substantial demand due to their comprehensive functionality and widespread adoption across diverse sectors and regions. Integrated software, offering both single and multi-functional capabilities, has gained popularity over standalone software, which lacks customization capabilities but remains prevalent in small and mid-sized enterprises due to its affordability.

"By Technology, Artificial Intelligence is registered to grow at the highest CAGR during the forecast period."

AI technology plays a significant role in predictive maintenance by leveraging advanced algorithms and machine learning models to analyze data and predict potential equipment failures before they occur. This technology enables organizations to move from reactive maintenance to proactive and even predictive maintenance strategies, ultimately improving asset reliability, reducing downtime, and optimizing maintenance costs. Examples of AI technology in predictive maintenance include the use of predictive modeling techniques such as regression analysis, decision trees, and neural networks to forecast equipment failures based on historical data patterns. AI-powered anomaly detection algorithms can also identify abnormal behavior in real-time sensor data, allowing for timely intervention and preventive maintenance actions. Additionally, AI-driven condition monitoring systems utilizing IoT sensors can continuously monitor equipment health and performance metrics, providing early warnings of potential issues and enabling predictive maintenance scheduling. These AI technologies empower organizations to transform their maintenance practices, enhance operational efficiency, and drive better business outcomes.

"Asia Pacific is projected to witness the highest CAGR during the forecast period."

Asia Pacific has witnessed advanced and dynamic adoption of new technologies and is expected to record the highest CAGR during the forecast period. The commercialization of IoT technology and the need for further advancements to leverage the technology to the best are expected to drive the adoption of predictive maintenance solutions in the region. The region includes major economies, such as China and Japan, which are expected to register high growth in the predictive maintenance market. Verticals, such as energy and utilities, transportation and logistics, and healthcare and life sciences, are expected to adopt predictive maintenance solutions and services at the highest rate in the region. Companies operating in Asia Pacific would benefit from the flexible economic conditions, industrialization- and globalization-motivated policies of the governments, as well as from the growing digitalization, which is expected to have a huge impact on the business community. Other countries in the region, such as South Korea, Singapore, Hong Kong, and Malaysia, are exploring ways to integrate predictive maintenance solutions and services. The countries considered for the analysis of the Asian predictive maintenance market are China, Japan, India, Bangladesh, and the rest of Asia Pacific.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the predictive maintenance market.

- By Company: Tier I: 34%, Tier II: 43%, and Tier III: 23%

- By Designation: C-Level Executives: 50%, Directors: 30%, and Others: 20%

- By Region: North America: 25%, Europe: 30%, Asia Pacific: 30%, Middle East & Africa: 10%, Latin America: 5%

Major vendors offering predictive maintenance hardware, solution and services across the globe are IBM (US), ABB (Switzerland), Schneider Electric (France), AWS (US), Google (US), Microsoft (US), Hitachi (Japan), SAP (Germany), SAS Institute (US), Software AG (Germany), TIBCO Software (US), Altair (US), Oracle (US), Splunk (US), C3.ai (US), Emerson (US), GE (US), Honeywell (US), Siemens (Germany), PTC (US), Dingo (Australia), Uptake (US), Samotics (Netherlands), WaveScan (Singapore), Quadrical Ai (Canada), UpKeep (US), Limble (US), SenseGrow (US), Presage Insights (India), Falcon Labs (India).

Research Coverage

The market study covers predictive maintenance across segments. It aims at estimating the market size and the growth potential across different segments, such as component (hardware, solution [by deployment mode] & services), technology, technique, organization size, vertical and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for predictive maintenance and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing use of emerging technologies to gain valuable insights, Advent of ML and AI, Growing need to reduce maintenance cost, equipment failure, and downtime), restraints (Lack of skilled workforce, Data security concerns), opportunities (Rising internet proliferation and growing usage of connected and integrated technologies, Real-time condition monitoring to assist in taking prompt actions), and challenges (Frequent maintenance and upgradation requirement to keep the systems updated, Ownership and privacy of collected data) influencing the growth of the predictive maintenance market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the predictive maintenance market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the predictive maintenance market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in predictive maintenance market strategies; the report also helps stakeholders understand the pulse of the predictive maintenance market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), ABB (Switzerland), Schneider Electric (France), AWS (US), Google (US) among others in the predictive maintenance market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2019-2023

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PREDICTIVE MAINTENANCE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 2 LIST OF PRIMARY INTERVIEWS

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 2 PREDICTIVE MAINTENANCE MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 APPROACH 1 (SUPPLY SIDE): REVENUE OF HARDWARE/SOLUTIONS/SERVICES OF PREDICTIVE MAINTENANCE MARKET

- FIGURE 5 APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PREDICTIVE MAINTENANCE MARKET HARDWARE/SOLUTIONS/SERVICES

- FIGURE 6 APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL PREDICTIVE MAINTENANCE MARKET HARDWARE/SOLUTIONS/SERVICES

- FIGURE 7 APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF PREDICTIVE MAINTENANCE MARKET THROUGH OVERALL PREDICTIVE MAINTENANCE MARKET SPENDING

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPACT OF RECESSION ON GLOBAL PREDICTIVE MAINTENANCE MARKET

- TABLE 4 RECESSION IMPACT ON PREDICTIVE MAINTENANCE MARKET

3 EXECUTIVE SUMMARY

- TABLE 5 PREDICTIVE MAINTENANCE MARKET SIZE AND GROWTH RATE, 2019-2023 (USD MILLION, Y-O-Y)

- TABLE 6 PREDICTIVE MAINTENANCE MARKET SIZE AND GROWTH RATE, 2024-2029 (USD MILLION, Y-O-Y)

- FIGURE 8 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2024

- FIGURE 9 INTEGRATED SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 10 ON-PREMISES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 11 PUBLIC SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2024

- FIGURE 12 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER SHARE IN 2024

- FIGURE 13 SYSTEM INTEGRATION TO ACCOUNT FOR LARGEST MARKET SIZE IN 2024

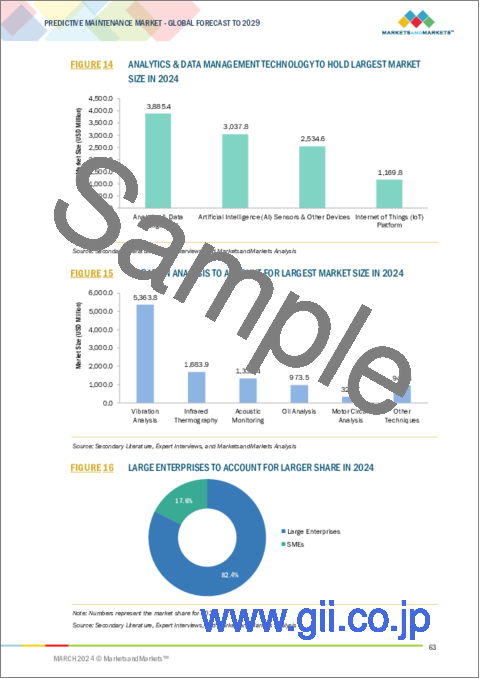

- FIGURE 14 ANALYTICS & DATA MANAGEMENT TECHNOLOGY TO HOLD LARGEST MARKET SIZE IN 2024

- FIGURE 15 VIBRATION ANALYSIS TO ACCOUNT FOR LARGEST MARKET SIZE IN 2024

- FIGURE 16 LARGE ENTERPRISES TO ACCOUNT FOR LARGER SHARE IN 2024

- FIGURE 17 ENERGY & UTILITIES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO GROW AT HIGHEST CAGR IN PREDICTIVE MAINTENANCE MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN PREDICTIVE MAINTENANCE MARKET

- FIGURE 19 ADOPTION OF INDUSTRY 4.0 AND DIGITAL TRANSFORMATION INITIATIVES ACROSS INDUSTRIES TO DRIVE MARKET

- 4.2 PREDICTIVE MAINTENANCE MARKET, BY COMPONENT

- FIGURE 20 SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 PREDICTIVE MAINTENANCE MARKET, BY COMPONENT & KEY VERTICALS

- FIGURE 21 SOLUTIONS AND ENERGY & UTILITIES TO ACCOUNT FOR LARGEST SHARES OF NORTH AMERICAN MARKET IN 2024

- 4.4 PREDICTIVE MAINTENANCE MARKET, BY REGION

- FIGURE 22 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2024

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 PREDICTIVE MAINTENANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of emerging technologies to gain valuable insights

- 5.2.1.2 Advent of ML and AI

- 5.2.1.3 Rising internet proliferation and growing use of connected and integrated technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of skilled workforce

- 5.2.2.2 Data security concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Real-time condition monitoring to assist in taking prompt actions

- 5.2.3.2 Growing need to reduce maintenance cost, equipment failure, and downtime

- 5.2.4 CHALLENGES

- 5.2.4.1 Frequent maintenance and upgradation requirements

- 5.2.4.2 Ownership and privacy of collected data

- 5.3 PREDICTIVE MAINTENANCE MARKET: EVOLUTION

- FIGURE 24 PREDICTIVE MAINTENANCE MARKET EVOLUTION

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 25 PREDICTIVE MAINTENANCE MARKET: SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM/MARKET MAP

- FIGURE 26 KEY PLAYERS IN PREDICTIVE MAINTENANCE MARKET ECOSYSTEM

- TABLE 7 PREDICTIVE MAINTENANCE MARKET: ECOSYSTEM

- 5.5.1 HARDWARE PROVIDERS

- 5.5.2 SOLUTION PROVIDERS

- 5.5.3 SERVICE PROVIDERS

- 5.5.4 DATA MANAGEMENT & ANALYTICS PROVIDERS

- 5.5.5 REGULATORY BODIES

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 RIYADH AIRPORT MODERNIZED MAINTENANCE BY IMPLEMENTING MAXIMO AND IBM COGNOS ANALYTICS

- 5.6.2 VPI ENHANCED EFFICIENCY OF ITS COMBINED CYCLE GAS TURBINE PLANT WITH IBM MAXIMO APPLICATION SUITE

- 5.6.3 WESTERN DIGITAL BOOSTED MANUFACTURING EXCELLENCE WITH SAS ASSET PERFORMANCE ANALYTICS

- 5.6.4 VANTAGE POWER ACCELERATED PREDICTIVE MAINTENANCE FOR CONNECTED VEHICLES WITH VPVISION

- 5.6.5 SAM4 HEALTH PREVENTED COSTLY DOWNTIME WITH PREDICTIVE MAINTENANCE ALERTS

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO OF SPECTROMETERS

- FIGURE 27 IMPORT DATA OF SPECTROMETERS, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.7.2 EXPORT SCENARIO OF SPECTROMETERS

- FIGURE 28 EXPORT DATA OF SPECTROMETERS, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.1.1 North America

- 5.8.1.1.1 US

- 5.8.1.1.2 Canada

- 5.8.1.2 Europe

- 5.8.1.3 Asia Pacific

- 5.8.1.3.1 South Korea

- 5.8.1.3.2 China

- 5.8.1.3.3 India

- 5.8.1.4 Middle East & Africa

- 5.8.1.4.1 UAE

- 5.8.1.4.2 KSA

- 5.8.1.4.3 Bahrain

- 5.8.1.5 Latin America

- 5.8.1.5.1 Brazil

- 5.8.1.5.2 Mexico

- 5.8.1.1 North America

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.1.1 Patents filed, by document type

- TABLE 13 PATENTS FILED, 2013-2023

- 5.9.1.2 Innovation and patent applications

- FIGURE 29 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2013-2023

- 5.9.1.2.1 Top 10 applicants in predictive maintenance market

- FIGURE 30 TOP 10 APPLICANTS IN PREDICTIVE MAINTENANCE MARKET, 2013-2023

- FIGURE 31 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PREDICTIVE MAINTENANCE MARKET, 2013-2023

- TABLE 14 TOP 20 PATENT OWNERS IN PREDICTIVE MAINTENANCE MARKET, 2013-2023

- TABLE 15 LIST OF FEW PATENTS IN PREDICTIVE MAINTENANCE MARKET, 2021-2023

- 5.9.1 METHODOLOGY

- 5.10 TECHNOLOGY ANALYSIS

- FIGURE 32 PREDICTIVE MAINTENANCE MARKET: TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 ML

- 5.10.1.2 Big data

- 5.10.2 ADJACENT TECHNOLOGIES

- 5.10.2.1 Edge computing

- 5.10.2.2 Digital twin

- 5.10.2.3 Cloud computing

- 5.10.3 COMPLEMENTARY TECHNOLOGIES

- 5.10.3.1 AR & VR

- 5.10.3.2 Blockchain

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY TECHNOLOGY

- FIGURE 33 AVERAGE SELLING PRICE TREND OF KEY PLAYERS: TOP THREE TECHNOLOGIES

- TABLE 16 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, TOP THREE TECHNOLOGIES

- 5.11.2 INDICATIVE PRICING ANALYSIS OF PREDICTIVE MAINTENANCE, BY COMPONENT

- TABLE 17 PREDICTIVE MAINTENANCE: INDICATIVE PRICING LEVELS OF PREDICTIVE MAINTENANCE, BY COMPONENT

- 5.12 INVESTMENT AND FUNDING SCENARIO

- FIGURE 34 PREDICTIVE MAINTENANCE MARKET: INVESTMENT LANDSCAPE

- 5.13 PORTER'S FIVE FORCES' ANALYSIS

- FIGURE 35 PORTER'S FIVE FORCES' ANALYSIS: PREDICTIVE MAINTENANCE MARKET

- TABLE 18 PORTER'S FIVE FORCES IMPACT ON PREDICTIVE MAINTENANCE MARKET

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 36 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 19 PREDICTIVE MAINTENANCE MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.16.2 BUYING CRITERIA

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.17 TECHNOLOGY ROADMAP OF PREDICTIVE MAINTENANCE MARKET

- TABLE 22 SHORT-TERM ROADMAP (FOR NEXT 5 YEARS)

- TABLE 23 LONG-TERM ROADMAP (BEYOND NEXT 5 YEARS)

- 5.18 BUSINESS MODELS OF PREDICTIVE MAINTENANCE MARKET

- 5.18.1 EQUIPMENT HEALTH MONITORING AND MAINTENANCE RECOMMENDATIONS AS A SERVICE

- 5.18.2 OVERALL EQUIPMENT EFFICIENCY (OEE) RISK AS A SERVICE

- 5.18.3 UPTIME AS A SERVICE

- 5.18.4 WARRANTY AS A SERVICE

- 5.18.5 SUPPLY CHAIN MANAGEMENT INFORMATION AS A SERVICE

6 PREDICTIVE MAINTENANCE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: PREDICTIVE MAINTENANCE MARKET DRIVERS

- FIGURE 39 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 25 PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 6.2 HARDWARE

- TABLE 26 HARDWARE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 27 HARDWARE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 SOLUTIONS

- FIGURE 40 STANDALONE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 28 PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 29 PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 30 SOLUTION: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 31 SOLUTION: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.1 INTEGRATED

- TABLE 32 INTEGRATED: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 33 INTEGRATED: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2 STANDALONE

- TABLE 34 STANDALONE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 35 STANDALONE: PREDICTIVE MAINTENANCE MARKET, BY REGION 2024-2029 (USD MILLION)

- 6.4 SOLUTIONS BY DEPLOYMENT MODE

- FIGURE 41 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 36 PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 37 PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 6.4.1 CLOUD

- 6.4.1.1 Reduced operational cost and higher scalability to enable growth in cloud-based deployments

- FIGURE 42 HYBRID CLOUD TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 38 PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2019-2023 (USD MILLION)

- TABLE 39 PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2024-2029 (USD MILLION)

- TABLE 40 CLOUD: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 41 CLOUD: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.1.2 Public

- TABLE 42 PUBLIC: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 43 PUBLIC: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.1.3 Private

- TABLE 44 PRIVATE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 45 PRIVATE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.1.4 Hybrid

- TABLE 46 HYBRID: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 HYBRID: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.2 ON-PREMISES

- 6.4.2.1 Rising cost of support and maintenance impacting growth of on-premises solutions

- TABLE 48 ON-PREMISES: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 49 ON-PREMISES: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.5 SERVICES

- FIGURE 43 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 50 PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 51 PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 52 SERVICES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 53 SERVICES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.5.1 PROFESSIONAL SERVICES

- 6.5.1.1 Demand for expert guidance and seamless integration to drive professional services

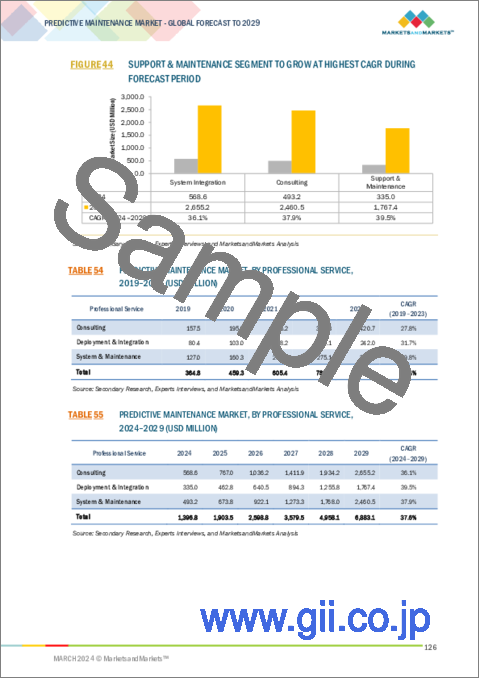

- FIGURE 44 SUPPORT & MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 54 PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 55 PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 56 PROFESSIONAL SERVICES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 57 PROFESSIONAL SERVICES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.5.1.2 System Integration

- TABLE 58 SYSTEM INTEGRATION: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 59 SYSTEM INTEGRATION: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.5.1.3 Support & Maintenance

- TABLE 60 SUPPORT & MAINTENANCE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 SUPPORT & MAINTENANCE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.5.1.4 Consulting

- TABLE 62 CONSULTING: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 63 CONSULTING: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.5.2 MANAGED SERVICES

- 6.5.2.1 Increasing need of IT Infrastructure support to drive growth of managed services

- TABLE 64 MANAGED SERVICES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 65 MANAGED SERVICES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

7 PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.1.1 TECHNOLOGY: PREDICTIVE MAINTENANCE MARKET DRIVERS

- FIGURE 45 ARTIFICIAL INTELLIGENCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 66 PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 67 PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 7.2 ANALYTICS & DATA MANAGEMENT

- 7.2.1 INCREASED DEMAND FOR REAL-TIME INSIGHTS AND PROACTIVE MAINTENANCE STRATEGIES

- TABLE 68 ANALYTICS & DATA MANAGEMENT: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 69 ANALYTICS & DATA MANAGEMENT: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 ARTIFICIAL INTELLIGENCE

- 7.3.1 GROWING DEMAND FOR AI-DRIVEN PREDICTIVE MAINTENANCE FOR ENHANCED ASSET RELIABILITY

- TABLE 70 ARTIFICIAL INTELLIGENCE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 71 ARTIFICIAL INTELLIGENCE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4 IOT PLATFORM

- 7.4.1 RAPID ADOPTION OF IOT PLATFORMS FOR REAL-TIME ASSET MONITORING TO DRIVE MARKET GROWTH

- TABLE 72 IOT PLATFORM: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 73 IOT PLATFORM: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.5 SENSORS & OTHER DEVICES

- 7.5.1 RISING DEMAND FOR CUSTOMER EXPERIENCE TO FUEL CLOUD ADOPTION IN PREDICTIVE MAINTENANCE

- TABLE 74 SENSORS & OTHER DEVICES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 75 SENSORS & OTHER DEVICES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

8 PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE

- 8.1 INTRODUCTION

- 8.1.1 TECHNIQUE: PREDICTIVE MAINTENANCE MARKET DRIVERS

- FIGURE 46 MOTOR CIRCUIT ANALYSIS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 76 PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2019-2023 (USD MILLION)

- TABLE 77 PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2024-2029 (USD MILLION)

- 8.2 VIBRATION ANALYSIS

- 8.2.1 GROWING DEMAND FOR EFFICIENT MACHINERY HEALTH MONITORING TO DRIVE VIBRATION ANALYSIS

- TABLE 78 VIBRATION ANALYSIS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 79 VIBRATION ANALYSIS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.2.2 TEST COMPONENT ALIGNMENT

- 8.2.3 DETECT IMBALANCES

- 8.2.4 RESONANCE IDENTIFICATION

- 8.2.5 GEAR FAILURE DETECTION

- 8.2.6 OTHERS

- 8.3 INFRARED THERMOGRAPHY

- 8.3.1 RISING DEMAND FOR NON-INTRUSIVE PREDICTIVE MAINTENANCE TO DRIVE INFRARED THERMOGRAPHY

- TABLE 80 INFRARED THERMOGRAPHY: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 81 INFRARED THERMOGRAPHY: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3.2 INSPECT ELECTRICAL CONNECTIONS AND SYSTEMS

- 8.3.3 ASSESS HEATING SYSTEMS

- 8.3.4 FLUID ANALYSIS

- 8.3.5 ANALYZE DISCHARGE PATTERNS

- 8.3.6 ROOF MAINTENANCE

- 8.3.7 OTHERS

- 8.4 ACOUSTIC MONITORING

- 8.4.1 ADOPTION OF ULTRASONIC ACOUSTIC ANALYSIS TO DRIVE PREDICTIVE MAINTENANCE EFFICIENCY

- TABLE 82 ACOUSTIC MONITORING: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 ACOUSTIC MONITORING: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4.2 PIPELINE MONITORING

- 8.4.3 CONDENSER EVALUATION

- 8.4.4 VACUUM SYSTEM MONITORING

- 8.4.5 FAN HEALTH ASSESSMENT

- 8.4.6 AIR COMPRESSOR MONITORING

- 8.4.7 OTHERS

- 8.5 OIL ANALYSIS

- 8.5.1 OPTIMIZING EQUIPMENT LIFESPAN THROUGH PROACTIVE LUBRICATION MANAGEMENT STRATEGIES

- TABLE 84 OIL ANALYSIS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 85 OIL ANALYSIS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.5.2 TURBINE MAINTENANCE

- 8.5.3 HYDRAULIC SYSTEM MAINTENANCE

- 8.5.4 ENGINE EVALUATION

- 8.5.5 TRANSMISSION ASSESSMENT

- 8.5.6 GEAR LUBRICANT LEVEL MONITORING

- 8.5.7 OTHERS

- 8.6 MOTOR CIRCUIT ANALYSIS

- 8.6.1 NEED FOR EFFICIENT PREDICTIVE MAINTENANCE IN PUMPING SYSTEMS

- TABLE 86 MOTOR CIRCUIT ANALYSIS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 87 MOTOR CIRCUIT ANALYSIS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.6.2 ASSESS ENGINE DEGRADATION

- 8.6.3 SHAFT AND ROTOR ALIGNMENT

- 8.6.4 INSULATION EVALUATION

- 8.6.5 GEAR ASSESSMENT

- 8.6.6 SCAN FOR SHORT CIRCUITS

- 8.6.7 OTHERS

- 8.7 OTHER TECHNIQUES

- TABLE 88 OTHER TECHNIQUES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 89 OTHER TECHNIQUES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

9 PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZE: PREDICTIVE MAINTENANCE MARKET DRIVERS

- FIGURE 47 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 90 PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 91 PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 9.2 LARGE ENTERPRISES

- 9.2.1 INTEGRATION OF AI AND IOT TECHNOLOGIES TO DRIVE ADOPTION OF PREDICTIVE MAINTENANCE AMONG LARGE ENTERPRISES

- TABLE 92 LARGE ENTERPRISES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 93 LARGE ENTERPRISES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.3.1 AFFORDABLE IOT AND CLOUD SOLUTIONS TO DRIVE SMES TO ADOPT PREDICTIVE MAINTENANCE

- TABLE 94 SMES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 95 SMES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

10 PREDICTIVE MAINTENANCE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: PREDICTIVE MAINTENANCE MARKET DRIVERS

- FIGURE 48 ENERGY & UTILITIES TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 96 PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 97 PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 10.2 ENERGY & UTILITIES

- 10.2.1 IOT DEVICES ENABLE REAL-TIME MONITORING, ENHANCING PREDICTIVE MAINTENANCE ACCURACY

- TABLE 98 ENERGY & UTILITIES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 99 ENERGY & UTILITIES: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 MANUFACTURING

- 10.3.1 INDUSTRY 4.0 INTEGRATION TO DRIVE REAL-TIME MONITORING AND PREDICTIVE MAINTENANCE

- TABLE 100 MANUFACTURING: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 101 MANUFACTURING: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 AUTOMOTIVE & TRANSPORTATION

- 10.4.1 SHIFT TOWARD INDIVIDUAL MOBILITY TO BOOST PREDICTIVE MAINTENANCE INVESTMENTS IN AUTOMOTIVE

- TABLE 102 AUTOMOTIVE & TRANSPORTATION: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 103 AUTOMOTIVE & TRANSPORTATION: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5 AEROSPACE & DEFENSE

- 10.5.1 MODERNIZATION INITIATIVES IN AIRPORTS AND DEFENSE SECTOR TO PROPEL MARKET GROWTH

- TABLE 104 AEROSPACE & DEFENSE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 105 AEROSPACE & DEFENSE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6 CONSTRUCTION & MINING

- 10.6.1 SAFETY CONCERNS AND ASSET OPTIMIZATION TO FUEL GROWTH IN PREDICTIVE MAINTENANCE

- TABLE 106 CONSTRUCTION & MINING: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 107 CONSTRUCTION & MINING: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7 HEALTHCARE

- 10.7.1 RISING DEMAND FOR UNINTERRUPTED HEALTHCARE SERVICES TO FUEL PREDICTIVE MAINTENANCE ADOPTION

- TABLE 108 HEALTHCARE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 109 HEALTHCARE: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8 TELECOMMUNICATIONS

- 10.8.1 COSTLY DOWNTIME RISKS TO FUEL ADOPTION OF IOT-DRIVEN PREDICTIVE MAINTENANCE

- TABLE 110 TELECOMMUNICATIONS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 111 TELECOMMUNICATIONS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.9 OTHER VERTICALS

- TABLE 112 OTHER VERTICALS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 113 OTHER VERTICALS: PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

11 PREDICTIVE MAINTENANCE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 49 INDIA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 114 PREDICTIVE MAINTENANCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 115 PREDICTIVE MAINTENANCE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 51 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 116 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 117 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 118 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 119 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 120 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 121 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 122 NORTH AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 123 NORTH AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 124 NORTH AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2019-2023 (USD MILLION)

- TABLE 125 NORTH AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2024-2029 (USD MILLION)

- TABLE 126 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 127 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 128 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 129 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 130 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 131 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 132 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2019-2023 (USD MILLION)

- TABLE 133 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 134 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 135 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 136 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 137 NORTH AMERICA: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Strong government support and availability of funds to fuel demand for predictive maintenance solutions

- TABLE 138 US: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 139 US: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 140 US: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 141 US: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 142 US: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 143 US: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Adoption of advanced CMMS technologies and focus on advanced technologies to boost demand for predictive maintenance solutions

- TABLE 144 CANADA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 145 CANADA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 146 CANADA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 147 CANADA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 148 CANADA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 149 CANADA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: PREDICTIVE MAINTENANCE MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 150 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 151 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 152 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 153 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 154 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 155 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 156 EUROPE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 157 EUROPE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 158 EUROPE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2019-2023 (USD MILLION)

- TABLE 159 EUROPE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2024-2029 (USD MILLION)

- TABLE 160 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 161 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 162 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 163 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 164 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 165 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 166 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2019-2023 (USD MILLION)

- TABLE 167 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 168 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 169 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 170 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 171 EUROPE: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Strong AI strategy, government funding, and stringent regulatory compliances to spur market growth

- TABLE 172 UK: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 173 UK: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 174 UK: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 175 UK: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 176 UK: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 177 UK: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Focus on AI research and development and implementation of Industry 4.0 to drive market

- TABLE 178 GERMANY: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 179 GERMANY: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 180 GERMANY: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 181 GERMANY: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 182 GERMANY: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 183 GERMANY: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.5.1 France's AI research centers and industry investments to foster market growth

- TABLE 184 FRANCE: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 185 FRANCE: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 186 FRANCE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 187 FRANCE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 188 FRANCE: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 189 FRANCE: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.3.6 SPAIN

- 11.3.6.1 Implementation of AESIA and rapid growth in AI technologies to propel market

- TABLE 190 SPAIN: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 191 SPAIN: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 192 SPAIN: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 193 SPAIN: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 194 SPAIN: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 195 SPAIN: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.3.7 ITALY

- 11.3.7.1 Strategic programs and initiatives for implementing AI to drive demand for predictive maintenance solutions

- TABLE 196 ITALY: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 197 ITALY: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 198 ITALY: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 199 ITALY: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 200 ITALY: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 201 ITALY: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.3.8 REST OF EUROPE

- TABLE 202 REST OF EUROPE: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 203 REST OF EUROPE: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 204 REST OF EUROPE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 205 REST OF EUROPE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 206 REST OF EUROPE: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 207 REST OF EUROPE: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 52 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 208 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 209 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 210 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 211 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 212 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 213 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 214 ASIA PACIFIC: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 215 ASIA PACIFIC: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 216 ASIA PACIFIC: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2019-2023 (USD MILLION)

- TABLE 217 ASIA PACIFIC: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2024-2029 (USD MILLION)

- TABLE 218 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 219 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 220 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 221 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 222 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 223 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 224 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2019-2023 (USD MILLION)

- TABLE 225 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 226 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 227 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 228 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 229 ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Government's heavy financial and strategic support in research and development and investments from global players to accelerate market growth

- TABLE 230 CHINA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 231 CHINA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 232 CHINA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 233 CHINA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 234 CHINA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 235 CHINA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Adoption of maintenance performance monitoring solutions by Japan Airlines to foster market growth

- TABLE 236 JAPAN: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 237 JAPAN: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 238 JAPAN: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 239 JAPAN: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 240 JAPAN: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 241 JAPAN: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.4.5 INDIA

- 11.4.5.1 Need to forecast, track in real time, and manage networks to enhance better customer experience in automotive sector to drive market

- TABLE 242 INDIA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 243 INDIA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 244 INDIA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 245 INDIA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 246 INDIA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 247 INDIA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Integration of IoT sensors and AI enhancing maintenance efficiency to boost demand for predictive maintenance

- TABLE 248 SOUTH KOREA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 249 SOUTH KOREA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 250 SOUTH KOREA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 251 SOUTH KOREA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 252 SOUTH KOREA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 253 SOUTH KOREA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Need to optimize asset performance, reduce downtime, and lower maintenance costs to propel market

- TABLE 254 AUSTRALIA & NEW ZEALAND: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 255 AUSTRALIA & NEW ZEALAND: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 256 AUSTRALIA & NEW ZEALAND: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 257 AUSTRALIA & NEW ZEALAND: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 258 AUSTRALIA & NEW ZEALAND: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 259 AUSTRALIA & NEW ZEALAND: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.4.8 REST OF ASIA PACIFIC

- TABLE 260 REST OF ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 261 REST OF ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 262 REST OF ASIA PACIFIC: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 263 REST OF ASIA PACIFIC: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 264 REST OF ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 265 REST OF ASIA PACIFIC: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 266 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2019-2023 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2024-2029 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2019-2023 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 286 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Government initiatives to achieve Smart Dubai program and active integration of AI to propel market

- TABLE 288 UAE: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 289 UAE: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 290 UAE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 291 UAE: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 292 UAE: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 293 UAE: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.5.4 SAUDI ARABIA

- 11.5.4.1 Need for advancing technology sector as part of Vision 2030 initiative and smart city programs to bolster market growth

- TABLE 294 SAUDI ARABIA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 295 SAUDI ARABIA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 296 SAUDI ARABIA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 297 SAUDI ARABIA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 298 SAUDI ARABIA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 299 SAUDI ARABIA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.5.5 QATAR

- 11.5.5.1 Collaboration with tech giants to accelerate IoT-driven predictive maintenance solutions in Qatar

- TABLE 300 QATAR: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 301 QATAR: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 302 QATAR: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 303 QATAR: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 304 QATAR: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 305 QATAR: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.5.6 TURKEY

- 11.5.6.1 Emphasis on defense strategies to leverage AI technologies to drive growth of AI-powered predictive maintenance solutions

- TABLE 306 TURKEY: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 307 TURKEY: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 308 TURKEY: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 309 TURKEY: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 310 TURKEY: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 311 TURKEY: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.5.7 SOUTH AFRICA

- 11.5.7.1 Presence of major tech companies and concerns regarding impact of AI on economic growth to drive market

- TABLE 312 SOUTH AFRICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 313 SOUTH AFRICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 314 SOUTH AFRICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 315 SOUTH AFRICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 316 SOUTH AFRICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 317 SOUTH AFRICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.5.8 REST OF MIDDLE EAST & AFRICA

- TABLE 318 REST OF MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 320 REST OF MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 321 REST OF MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 322 REST OF MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 323 REST OF MIDDLE EAST & AFRICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 324 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 325 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 326 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 327 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 328 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 329 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 330 LATIN AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 331 LATIN AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 332 LATIN AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2019-2023 (USD MILLION)

- TABLE 333 LATIN AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY CLOUD, 2024-2029 (USD MILLION)

- TABLE 334 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 335 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 336 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 337 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 338 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 339 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 340 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2019-2023 (USD MILLION)

- TABLE 341 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 342 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 343 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 344 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 345 LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Rapid adoption of Industry 4.0 technologies to bolster market growth

- TABLE 346 BRAZIL: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 347 BRAZIL: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 348 BRAZIL: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 349 BRAZIL: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 350 BRAZIL: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 351 BRAZIL: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.6.4 MEXICO

- 11.6.4.1 Growing need for enhanced connectivity in business processes to drive adoption of predictive maintenance solutions

- TABLE 352 MEXICO: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 353 MEXICO: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 354 MEXICO: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 355 MEXICO: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 356 MEXICO: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 357 MEXICO: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.6.5 ARGENTINA

- 11.6.5.1 Thriving tech ecosystem and government support to fuel market

- TABLE 358 ARGENTINA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 359 ARGENTINA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 360 ARGENTINA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 361 ARGENTINA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 362 ARGENTINA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 363 ARGENTINA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 11.6.6 REST OF LATIN AMERICA

- TABLE 364 REST OF LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 365 REST OF LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 366 REST OF LATIN AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 367 REST OF LATIN AMERICA: PREDICTIVE MAINTENANCE SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 368 REST OF LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 369 REST OF LATIN AMERICA: PREDICTIVE MAINTENANCE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- TABLE 370 OVERVIEW OF STRATEGIES ADOPTED BY KEY PREDICTIVE MAINTENANCE VENDORS

- 12.3 REVENUE ANALYSIS

- FIGURE 53 REVENUE ANALYSIS OF KEY PLAYERS (2019-2023)

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 54 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2023

- 12.4.1 MARKET RANKING ANALYSIS

- TABLE 371 PREDICTIVE MAINTENANCE MARKET: DEGREE OF COMPETITION

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 55 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 56 PREDICTIVE MAINTENANCE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company Footprint

- FIGURE 57 PREDICTIVE MAINTENANCE MARKET: COMPANY FOOTPRINT (20 COMPANIES)

- 12.6.5.2 Region Footprint

- TABLE 372 COMPANY REGION FOOTPRINT

- 12.6.5.3 Component Footprint

- TABLE 373 COMPANY COMPONENT FOOTPRINT

- 12.6.5.4 Technology Footprint

- TABLE 374 COMPANY TECHNOLOGY FOOTPRINT

- 12.6.5.5 Vertical Footprint

- TABLE 375 COMPANY VERTICAL FOOTPRINT

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 58 PREDICTIVE MAINTENANCE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.7.5.1 Detailed List of Key Startups/SMEs

- TABLE 376 PREDICTIVE MAINTENANCE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 12.7.5.2 Competitive Benchmarking of Key Startups/SMEs

- TABLE 377 PREDICTIVE MAINTENANCE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.8 COMPETITIVE SCENARIO AND TRENDS

- 12.8.1 PRODUCT LAUNCHES

- TABLE 378 PREDICTIVE MAINTENANCE MARKET: PRODUCT LAUNCHES, JANUARY 2021-FEBRUARY 2024

- 12.8.2 DEALS

- TABLE 379 PREDICTIVE MAINTENANCE MARKET: DEALS, JANUARY 2021-FEBRUARY 2024

- 12.9 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 59 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 60 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 IBM

- TABLE 380 IBM: BUSINESS OVERVIEW

- FIGURE 61 IBM: COMPANY SNAPSHOT

- TABLE 381 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 382 IBM: DEALS

- 13.2.2 ABB

- TABLE 383 ABB: BUSINESS OVERVIEW

- FIGURE 62 ABB: COMPANY SNAPSHOT

- TABLE 384 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 ABB: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 386 ABB: DEALS

- 13.2.3 SCHNEIDER ELECTRIC

- TABLE 387 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 63 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 388 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 390 SCHNEIDER ELECTRIC: DEALS

- 13.2.4 AWS

- TABLE 391 AWS: BUSINESS OVERVIEW

- FIGURE 64 AWS: COMPANY SNAPSHOT

- TABLE 392 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 393 AWS: PRODUCT LAUNCHES

- TABLE 394 AWS: DEALS

- 13.2.5 GOOGLE

- TABLE 395 GOOGLE: BUSINESS OVERVIEW

- FIGURE 65 GOOGLE: COMPANY SNAPSHOT

- TABLE 396 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 397 GOOGLE: PRODUCT LAUNCHES

- TABLE 398 GOOGLE: DEALS

- 13.2.6 MICROSOFT

- TABLE 399 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 66 MICROSOFT: COMPANY SNAPSHOT

- TABLE 400 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 401 MICROSOFT: DEALS

- 13.2.7 HITACHI

- TABLE 402 HITACHI: BUSINESS OVERVIEW

- FIGURE 67 HITACHI: COMPANY SNAPSHOT

- TABLE 403 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 404 HITACHI: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 405 HITACHI: DEALS

- 13.2.8 SAP

- TABLE 406 SAP: BUSINESS OVERVIEW

- FIGURE 68 SAP: COMPANY SNAPSHOT

- TABLE 407 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 SAP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 409 SAP: DEALS

- 13.2.9 SAS INSTITUTE

- TABLE 410 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 411 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 SAS INSTITUTE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 413 SAS INSTITUTE: DEALS

- 13.2.10 SOFTWARE AG

- TABLE 414 SOFTWARE AG: BUSINESS OVERVIEW

- FIGURE 69 SOFTWARE AG: COMPANY SNAPSHOT

- TABLE 415 SOFTWARE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 416 SOFTWARE AG: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 417 SOFTWARE AG: DEALS

- 13.2.11 TIBCO SOFTWARE

- TABLE 418 TIBCO SOFTWARE: BUSINESS OVERVIEW

- TABLE 419 TIBCO SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 420 TIBCO SOFTWARE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 421 TIBCO SOFTWARE: DEALS

- 13.2.12 ALTAIR

- TABLE 422 ALTAIR: BUSINESS OVERVIEW

- FIGURE 70 ALTAIR: COMPANY SNAPSHOT

- TABLE 423 ALTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 424 ALTAIR: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 425 ALTAIR: DEALS

- 13.2.13 ORACLE

- TABLE 426 ORACLE: BUSINESS OVERVIEW

- FIGURE 71 ORACLE: COMPANY SNAPSHOT

- TABLE 427 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 428 ORACLE: DEALS

- 13.2.14 SPLUNK

- TABLE 429 SPLUNK: BUSINESS OVERVIEW

- TABLE 430 SPLUNK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 431 SPLUNK: DEALS

- 13.2.15 C3.AI

- 13.2.16 EMERSON

- 13.2.17 GE

- 13.2.18 HONEYWELL

- 13.2.19 SIEMENS

- 13.2.20 PTC

- 13.3 STARTUPS/SMES

- 13.3.1 DINGO

- 13.3.2 UPTAKE

- 13.3.3 SAMOTICS

- 13.3.4 WAVESCAN

- 13.3.5 QUADRICAL AI

- 13.3.6 UPKEEP

- 13.3.7 LIMBLE

- 13.3.8 SENSEGROW

- 13.3.9 PRESAGE INSIGHTS

- 13.3.10 FACLON LABS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 ADJACENT AND RELATED MARKETS

- 14.1.1 INTRODUCTION

- 14.1.2 ENTERPRISE ASSET MANAGEMENT MARKET- GLOBAL FORECAST TO 2028

- 14.1.2.1 Market definition

- 14.1.2.2 Market overview

- TABLE 432 ENTERPRISE ASSET MANAGEMENT MARKET SIZE AND GROWTH, 2018-2022 (USD MILLION, Y-O-Y%)

- TABLE 433 ENTERPRISE ASSET MANAGEMENT MARKET SIZE AND GROWTH, 2023-2028 (USD MILLION, Y-O-Y%)

- 14.1.2.2.1 Enterprise Asset Management Market, By Offering

- TABLE 434 ENTERPRISE ASSET MANAGEMENT MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 435 ENTERPRISE ASSET MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 14.1.2.2.2 Enterprise Asset Management Market, By Application

- TABLE 436 ENTERPRISE ASSET MANAGEMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 437 ENTERPRISE ASSET MANAGEMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 14.1.2.2.3 Enterprise Asset Management Market, By Deployment Model

- TABLE 438 ENTERPRISE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 439 ENTERPRISE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 14.1.2.2.4 Enterprise Asset Management Market, By Organization Size

- TABLE 440 ENTERPRISE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 441 ENTERPRISE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 14.1.2.2.5 Enterprise Asset Management Market, By Vertical

- TABLE 442 ENTERPRISE ASSET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 443 ENTERPRISE ASSET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 14.1.2.2.6 Enterprise Asset Management Market, By Region

- TABLE 444 ENTERPRISE ASSET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 445 ENTERPRISE ASSET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.1.3 BIG DATA MARKET-GLOBAL FORECAST TO 2028

- 14.1.3.1 Market definition

- 14.1.3.2 Market overview

- TABLE 446 GLOBAL BIG DATA MARKET SIZE AND GROWTH RATE, 2018-2022 (USD MILLION, Y-O-Y)

- TABLE 447 GLOBAL BIG DATA MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y)

- 14.1.3.2.1 Big Data Market, By Offering

- TABLE 448 BIG DATA MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 449 BIG DATA MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 14.1.3.2.2 Big Data Market, By Business Function

- TABLE 450 BIG DATA MARKET, BY BUSINESS FUNCTION, 2018-2022 (USD MILLION)

- TABLE 451 BIG DATA MARKET, BY BUSINESS FUNCTION, 2023-2028 (USD MILLION)

- 14.1.3.2.3 Big Data Market, By Data Type

- TABLE 452 BIG DATA MARKET, BY DATA TYPE, 2018-2022 (USD MILLION)

- TABLE 453 BIG DATA MARKET, BY DATA TYPE, 2023-2028 (USD MILLION)

- 14.1.3.2.4 Big Data Market, By Vertical

- TABLE 454 BIG DATA MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 455 BIG DATA MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 14.1.3.2.5 Big Data Market, By Region

- TABLE 456 BIG DATA MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 457 BIG DATA MARKET, BY REGION, 2023-2028 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS