|

|

市場調査レポート

商品コード

1493849

植物育成ライトの世界市場:提供別、ワット数別、スペクトル別、栽培植物別、設置タイプ別、照明タイプ別、販売チャネル別、用途別、地域別 - 予測(~2029年)Grow Lights Market by Offering (Hardware, Software & Services), Wattage (<300, >=300), Spectrum (Full Spectrum, Limited Spectrum), Cultivated Plant, Installation Type, Lighting Type, Sales Channel, Application and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 植物育成ライトの世界市場:提供別、ワット数別、スペクトル別、栽培植物別、設置タイプ別、照明タイプ別、販売チャネル別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2024年05月30日

発行: MarketsandMarkets

ページ情報: 英文 231 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の植物育成ライトの市場規模は、2024年の20億米ドルから2029年までに64億米ドルに達し、2024年~2029年にCAGRで26.5%の成長が予測されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(10億米ドル) |

| セグメント | 提供別、ワット数別、スペクトル別、栽培植物別、設置タイプ別、照明タイプ別、販売チャネル別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

LED植物育成ライトは、エネルギー効率、寿命、汎用性、色彩品質において従来の照明技術を凌駕しています。価格競争力の向上により、垂直農場、屋内農場、温室などの用途に広く採用され、さまざまなタイプ、形状、サイズ、価格、色の植物のニーズに応えています。LED植物育成ライトはエネルギー効率と寿命で伝統的な高輝度放電(HID)ランプを上回り、5万時間近くの長い動作寿命を提供し、50%~85%少ない電力を消費します。植物の要求に合わせて特定のスペクトルを照射できるため、エネルギーコストを削減しながら、成長可能性と栄養価を最大限に高めることができます。さらに、LEDは軽量で設置が容易であり、熱放射が少ないため、植物が近くに置かれても傷むことがありません。振動や熱衝撃、水や湿気にも強いため、温室環境にも最適です。これらの属性は、スペクトルの調整と配光の制御の進歩とともに、伝統的な農法の天候に依存した制限を緩和し、年間を通じた作物生産に向けた好ましい選択肢としてLED植物育成ライトを位置づけます。

LED植物育成ライトは、農家が天候に左右されることなく、年間を通じて高品質な作物を生産できるようにする上で、極めて重要な役割を果たしています。光合成に必要な光合成有効放射(PAR)を供給するその能力は、特に日照時間の限られた地域において、植物の品質と生産性を高めます。特定の作物向けに光のスペクトルを最適化し、照明制御を強化することで、LED植物育成ライトはエネルギーコストを最小限に抑えながら、収穫高と栄養価を最大化します。LED照明によって促進される環境制御型農業(CEA)は、屋内の1エーカーが屋外の数エーカーに相当するため、年間複数回の収穫が可能です。管理された環境は、害虫の駆除、収穫後の腐敗、悪天候の影響を最小限に抑え、高品質で安定した収穫を保証します。気候変動が従来の農業に課題を突きつける中、LED植物育成ライトを利用したCEAの採用が急増し、効率的な屋内園芸ソリューションの需要がさらに高まると予測されます。

「植物育成ライト市場における需要を増加させる各国の薬用植物合法化」

マリファナなどの薬用植物が合法化されたことで、特にこれらの植物が認可されている地域では、植物育成ライトの需要が急増しました。2024年4月のNational Conference of State Legislaturesのレポートによると、24の州と2つの準州、コロンビア特別区が、成人の娯楽用として少量の大麻(マリファナ)を合法化しています。近年では、デラウェア州、メリーランド州、ミネソタ州、ミズーリ州、オハイオ州、ロードアイランド州で、21歳以上の個人が特定量の大麻を所持することを認める法律が成立しました。デラウェア州を除くこれらの新法では、個人が自宅で大麻を栽培することも認められていますが、許可される植物の数は州によって異なります。注目すべきは、これら6つの地域すべてで、医療目的の大麻が娯楽目的の成人使用より先に合法化されていることです。

当レポートでは、世界の植物育成ライト市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 植物育成ライト市場の企業にとって魅力的な機会

- 植物育成ライト市場:設置タイプ別

- 植物育成ライト市場:栽培植物別

- 植物育成ライト市場:地域別

第5章 市場の概要

- イントロダクション

- 植物育成ライトの市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格の動向:ワット数別

- LED植物育成ライトの参考価格:地域別

- サプライチェーン分析

- 研究開発エンジニア

- コンポーネントプロバイダー/インプットサプライヤー

- OEM

- システムインテグレーター/技術サービスプロバイダー

- 販売業者・販売パートナー

- 用途

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード9405)

- 輸出シナリオ(HSコード9405)

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 植物育成ライト市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア・サービス

第7章 植物育成ライト市場:ワット数別

- イントロダクション

- 300ワット未満

- 300ワット以上

第8章 植物育成ライト市場:スペクトル別

- イントロダクション

- フルスペクトル

- 限定スペクトル

第9章 植物育成ライト市場:栽培植物別

- イントロダクション

- 果物・野菜

- 花

- 大麻

第10章 植物育成ライト市場:設置タイプ別

- イントロダクション

- 新規設置

- 改修設置

第11章 植物育成ライト市場:照明タイプ別

- イントロダクション

- トップライティング

- インターライティング

第12章 植物育成ライト市場:販売チャネル別

- イントロダクション

- 流通チャネル

- eコマースチャネル

- 直接販売チャネル

第13章 植物育成ライト市場:用途別

- イントロダクション

- 温室

- 垂直農業

- 屋内農業

- その他の用途

第14章 植物育成ライト市場:地域別

- イントロダクション

- 北米

- 不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 不況の影響

- 英国

- ドイツ

- オランダ

- スカンジナビア

- その他の欧州

- アジア太平洋

- 不況の影響

- 中国

- 日本

- 東南アジア

- オーストラリア

- その他のアジア太平洋

- その他の地域

- 不況の影響

- 中東

- 南米

- アフリカ

第15章 競合情勢

- 概要

- 主要企業戦略/有力企業(2023年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業評価と財務指標

- ブランド/製品の比較

- 企業評価マトリクス:主要企業(2023年)

- 企業評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第16章 企業プロファイル

- イントロダクション

- 主要企業

- SIGNIFY HOLDING

- GAVITA INTERNATIONAL B.V.

- HELIOSPECTRA

- AMS-OSRAM AG

- CALIFORNIA LIGHTWORKS

- LEDVANCE GMBH

- HORTILUX SCHREDER

- VALOYA

- ILUMINAR LIGHTING LLC.

- SAVANT TECHNOLOGIES LLC

- その他の企業

- ECONOLUX INDUSTRIES LTD.

- LEMNIS OREON B.V.

- HYPERION GROW LIGHTS

- SANANBIO

- DONGGUAN LEDESTAR OPTO-ELECTRONICS TECH. CO., LTD.

- VIPARSPECTRA

- KIND LED GROW LIGHTS

- BLACK DOG HORTICULTURE TECHNOLOGIES & CONSULTING

- AGROLUX B.V.

- SOLLUM TECHNOLOGIES

- MARS HYDRO

- BIOLOGICAL INNOVATION AND OPTIMIZATION SYSTEMS, LLC

- EVERLIGHT ELECTRONICS CO., LTD.

- NICHIA CORPORATION

- THRIVE AGRITECH

第17章 付録

The grow lights market is expected to reach USD 6.4 billion by 2029 from USD 2.0 billion in 2024, at a CAGR of 26.5% during the 2024-2029 period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Wattage, Spectrum, Cultivated Plant, Installation Type, Lighting Type, Sales Channel, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

LED grow lights have surpassed conventional lighting technologies in energy efficiency, lifespan, versatility, and color quality. With their increasing cost competitiveness, they're widely adopted in applications like vertical farms, indoor farms, and greenhouses, catering to various plant needs with different types, shapes, sizes, prices, and colors. LED grow lights outshine traditional high-intensity discharge (HID) lamps in energy efficiency and lifespan, offering a longer operating life of nearly 50,000 hours and consuming 50% to 85% less electricity. Their ability to emit specific spectrums tailored to plant requirements maximizes growth potential and nutritional value while reducing energy costs. Additionally, LEDs are lighter, easier to install, and less heat-emitting, ensuring plants remain unharmed even when placed in proximity. Their resistance to vibrations, thermal shocks, water, and moisture makes them ideal for greenhouse environments. These attributes, coupled with advancements in spectral tailoring and light distribution control, position LED grow lights as the preferred choice for year-round crop production, mitigating weather-dependent limitations of traditional farming methods.

LED grow lights play a pivotal role in enabling farmers to produce high-quality crops throughout the year, irrespective of weather conditions. Their ability to provide photosynthetically active radiation (PAR) for photosynthesis enhances plant quality and productivity, particularly in regions with limited sunlight. By optimizing light spectra for specific crops and offering greater lighting control, LED grow lights maximize yields and nutritional values while minimizing energy costs. Controlled environment agriculture (CEA), facilitated by LED lighting, allows for multiple harvests per year, with one indoor acre equivalent to several outdoor acres. The controlled environment minimizes pest infestation, post-harvest spoilage, and the impact of adverse weather conditions, ensuring high-quality, consistent yields. As climate change poses challenges to traditional farming, the adoption of CEA practices, powered by LED grow lights, is expected to surge, driving further demand for efficient indoor horticulture solutions.

"Legalization of medicinal plants in different countries to increase in the demand of grow lights marker."

The legalization of medicinal plants, such as marijuana, has sparked a surge in the demand for grow lights, especially in areas where these plants are sanctioned. According to the report by National Conference of State Legislatures in April 2024, 24 states along with two territories and the District of Columbia, have legalized small amounts of cannabis (marijuana) for adult recreational use. Recently, legislation in Delaware, Maryland, Minnesota, Missouri, Ohio, and Rhode Island has been passed, permitting individuals aged 21 or older to possess specific quantities of cannabis. These new laws, except in Delaware, also allow individuals to cultivate marijuana at home, although the permitted number of plants varies by state. It's noteworthy that in all six of these areas, cannabis for medical purposes was legalized before recreational adult use.

In June 2022, Thailand marked a significant milestone by becoming the inaugural Asian nation to legalize cannabis. With this legislative change, cultivating and trading marijuana and hemp products, as well as utilizing plant parts for medicinal purposes, ceased to be criminal offenses. Consequently, methods such as grow tents, greenhouses, and vertical farms have become prevalent for indoor cannabis cultivation. However, all these methods necessitate the incorporation of artificial grow lights, thereby paving the way for promising market expansion opportunities.

With marijuana legalization, there's a noticeable trend among cannabis companies diversifying their product offerings. The increased legalization of cannabis cultivation has driven a higher demand for vertical farms and greenhouses, consequently boosting the need for LED-based grow lights. Cannabis grown without sunlight requires careful consideration of various factors. For instance, the heat emitted from HPS lights can damage the product, while LEDs, operating at lower temperatures, offer a solution to excessive heat emissions.

The advantages of LED lighting for cannabis growth are widely recognized: increased yields, shortened crop cycles, and consistent quality. Utilizing the appropriate blend of white, red, and blue LEDs promotes shorter, more compact cannabis plants with enhanced branching and improved THC/CBD potency.

"Fruits & Vegetables segment of grow lights market projected to record the highest market share during the forecast period."

Grow lights ensure optimal plant growth and survival by providing tailored light spectra tailored to the specific requirements of different plants. The appropriate combination of light spectrum, intensity, and duration collectively stimulates plant growth, flowering, and reproduction. Fruits and vegetables such as cucumbers, tomatoes, lettuce, mint, basil, and strawberries are predominantly cultivated in Controlled Environment Agriculture (CEA) facilities.

Outdoor cultivation of these fruits and vegetables necessitates suitable soil, favorable climatic conditions, sunlight, adequate water supply, and high-quality seeds or plant materials, typically yielding only two harvests per season. Failure to meet these conditions can result in poor-quality or inedible produce. However, in vertical farms and greenhouses, these fruits and vegetables thrive in a controlled environment with optimized water and light conditions, often without soil. Harvests in these environments are unaffected by seasonal changes, climatic fluctuations, excessive water usage, or soil variations.

During the vegetative stage, young plants require blue light for growth, while plants in the flowering stage benefit from red spectrum wavelengths, which accelerate stem growth, promote flowering, and enhance fruit and chlorophyll production. Plants respond to light shortly after germination, even before the appearance of the first leaf. Insufficient light exposure during this critical stage can lead to elongated stems and weak plant growth. Adequate spacing between plants is essential to ensure each receives sufficient light for proper growth. Red and blue wavelengths are the most utilized by plants for photosynthesis.

Strawberries are one of the most cultivated fruits in vertical farms, with the trend of vertical farming for strawberries on the rise. A single square foot of a strawberry tower foundation can accommodate around 100 strawberry plants, a significant increase compared to traditional land cultivation, with potential for further growth by increasing the height of the vertical tower.

In May 2024, Heliospectra launched 1500W MITRA X LED light featuring an increased output of 5700µmol, wide beam optics, and 3.7 efficacy. With only 2 LED lights needed to cover a standard 8m trellis, the new MITRA X reduces investment costs for vegetable growers while ensuring high output and uniformity to optimize taste and yield. The expanded MITRA X platform emphasizes modularity and versatility, catering to various environments and crops to address the diverse requirements of contemporary growers.

"New installations arse expected to have the largest market share of grow lights in the forecast period."

The demand for fresh horticultural produce is increasing due to the rapidly growing global population. This is expected to encourage growers to set up new greenhouses and expand their existing production facilities to cultivate higher yields each year. The emergence of vertical farms, particularly in urban settings, contributes to the overall increase in horticultural output. Plants grown in vertical farms depend entirely on artificial lighting for photosynthesis; this factor drives the market for new installations.

LED grow lights are preferred over traditional ones in vertical farms for increased productivity and reduced power consumption. These lights have a lower weight and are easier to configure. They emit less heat than high-intensity discharge (HID) bulbs, so the risk of plants getting burned even if LEDs are placed close to them is relatively low. Additionally, LEDs have a long operating life of nearly 50,000 hours, enabling them to be used for more than five years with 14-18 hours of daily operations.

The break-up of the profile of primary participants in the grow lights market-

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: North America - 20%, Europe -40 %, Asia Pacific - 30%, RoW - 10%,

The major players in the grow lights market are Signify Holding (Netherlands), Gavita International B.V. (Netherlands), Heliospectra (Sweden), ams-OSRAM AG (Austria), California LightWorks (US), Hortilux Schreder (Netherlands), Valoya (Finland), ILUMINAR Lighting LLC. (US), SAVANT TECHNOLOGIES LLC. (US), Ushio Inc. (Japan), EconoLux Industries Ltd. (China), LEDVANCE GmbH (Germany), Lemnis Oreon B.V. (Netherlands), Hyperion Grow Lights (England), Sananbio (China), Dongguan LEDESTAR Opto-electronics Tech. Co., Ltd. (China), ViparSpectra (US), Kind LED Grow Lights (US), Black Dog Horticulture Technologies & Consulting (US), Agrolux B.V. (Netherlands), Sollum Technologies (Canada), Mars Hydro (China), Biological Innovation and Optimization Systems, LLC. (US), EVERLIGHT ELECTRONICS CO., LTD. (Taiwan), and NICHIA CORPORATION (Japan).

Research Coverage

The report segments the grow lights market and forecasts its size based and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall grow lights market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising investments in the establishment of vertical farms, greenhouses, and advanced technologies), restraints (human health risk associated with LED grow lights), opportunities (legalization of medicinal plants in different countries), and challenges (Complexities in implementing controlled environment agriculture (CEA) technology and the demand for technical expertise)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the grow lights market

- Market Development: Comprehensive information about lucrative markets - the report analyses the grow lights market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the grow lights market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like ams-OSRAM AG (Austria), Signify Holding (Netherlands), SAVANT TECHNOLOGIES LLC. (US), ILUMINAR Lighting LLC. (US), and Gavita International B.V. (Netherlands).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 GROW LIGHTS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- FIGURE 2 GROW LIGHTS MARKET: REGIONS COVERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.3.5 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 GROWTH FORECAST ASSUMPTIONS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- FIGURE 3 GROW LIGHTS MARKET: RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.1.2 Key secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Interviews with experts

- 2.2.2.3 Breakdown of interviews with experts

- 2.2.2.4 Insights of industry experts

- 2.2.3 SECONDARY AND PRIMARY RESEARCH

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - REVENUE GENERATED BY KEY PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE) - REVENUE ESTIMATION OF KEY PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) -BOTTOM-UP ESTIMATION BASED ON REGION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to derive market size using top-down analysis

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

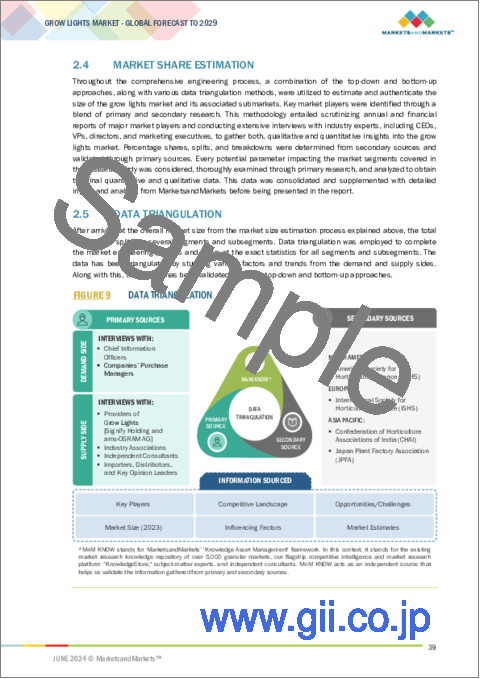

- 2.4 MARKET SHARE ESTIMATION

- 2.5 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.6 RISK ASSESSMENT

- TABLE 2 RISK FACTOR ANALYSIS

- 2.7 RECESSION-RELATED ASSUMPTIONS

- 2.8 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.8.1 RESEARCH ASSUMPTIONS

- 2.8.2 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 VERTICAL FARMING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 >=300 WATTS TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 EUROPE HELD LARGEST SHARE OF GROW LIGHTS MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GROW LIGHTS MARKET

- FIGURE 13 RISING DEMAND FOR GROW LIGHTS IN INDOOR SETTINGS TO FUEL MARKET GROWTH

- 4.2 GROW LIGHTS MARKET, BY INSTALLATION TYPE

- FIGURE 14 NEW INSTALLATIONS SEGMENT TO HOLD LARGER MARKET SHARE BETWEEN 2024 AND 2029

- 4.3 GROW LIGHTS MARKET, BY CULTIVATED PLANT

- FIGURE 15 FRUITS & VEGETABLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 GROW LIGHTS MARKET, BY REGION

- FIGURE 16 SOUTHEAST ASIA GROW LIGHTS MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 GROW LIGHTS MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GROW LIGHTS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for fresh food amid declining arable land

- FIGURE 18 ARABLE LAND (% OF LAND AREA), 2000-2020

- 5.2.1.2 Robust government support for implementation of solid-state lighting technology and controlled-environment agriculture methodologies

- 5.2.1.3 Rising investments in establishment of vertical farms, greenhouses, and advanced technologies

- 5.2.1.4 Maximizing horticulture efficiency and unlocking year-round crop production

- FIGURE 19 GROW LIGHTS MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High investments in establishment and installation

- 5.2.2.2 Optimizing plant growth through varied light spectrums

- 5.2.2.3 Risk to human health due to LED grow lights

- 5.2.2.4 Constraints in optimal grow light placement for plant growth

- FIGURE 20 GROW LIGHTS MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Legalization of cannabis for medicinal purposes

- 5.2.3.2 Technological advancements in LED grow lights and automation in lighting systems

- 5.2.3.3 Prospective markets for vertical farming in Asia and Middle East

- 5.2.3.4 Integrated hardware, software, and data analytics platforms for horticultural yield estimation and energy conservation

- FIGURE 21 GROW LIGHTS MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in implementing controlled environment agriculture technology and lack of technical expertise

- 5.2.4.2 Lack of standardized testing protocols for evaluating horticulture lighting product quality

- FIGURE 22 GROW LIGHTS MARKET CHALLENGES: IMPACT ANALYSIS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY WATTAGE

- FIGURE 24 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY WATTAGE, 2024

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY WATTAGE, 2020-2024 (USD)

- 5.4.2 INDICATIVE PRICING OF LED GROW LIGHTS, BY REGION

- TABLE 4 INDICATIVE PRICING OF LED GROW LIGHTS, BY REGION, 2020-2024 (USD)

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS: GROW LIGHTS MARKET

- 5.5.1 RESEARCH & DEVELOPMENT ENGINEERS

- 5.5.2 COMPONENT PROVIDERS/INPUT SUPPLIERS

- 5.5.3 ORIGINAL EQUIPMENT MANUFACTURERS

- 5.5.4 SYSTEM INTEGRATORS/TECHNOLOGY & SERVICE PROVIDERS

- 5.5.5 DISTRIBUTORS & SALES PARTNERS

- 5.5.6 APPLICATIONS

- 5.6 ECOSYSTEM ANALYSIS

- TABLE 5 GROW LIGHTS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 KEY PLAYERS IN GROW LIGHTS MARKET

- 5.7 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO FOR STARTUPS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 LED grow lights

- 5.8.1.2 UV and far-red light integration

- 5.8.1.3 Smart lighting

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Climate control systems

- 5.8.2.2 Hydroponic and aeroponic systems

- 5.8.3 ADJACENT TECHNOLOGY

- 5.8.3.1 Spectrum control technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- FIGURE 28 PATENTS APPLIED AND GRANTED, 2014-2023

- TABLE 6 GROW LIGHTS MARKET: MAJOR PATENTS, 2023-2024

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 9405)

- FIGURE 29 IMPORT DATA FOR HS CODE 9405, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 7 IMPORT SCENARIO FOR HS CODE 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.10.2 EXPORT SCENARIO (HS CODE 9405)

- FIGURE 30 EXPORT DATA FOR HS CODE 9405, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 8 EXPORT SCENARIO FOR HS CODE 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 SIGNIFY HOLDING HELPS TOPLINE GERBERA NURSERY TRANSITION TO FULL LED LIGHTING

- TABLE 10 PHILIPS GREENPOWER LED TOP LIGHTING INCREASES EFFICIENCY AND QUALITY FOR GROWER RINO MANS

- 5.12.2 MAXIMIZING BERRY PRODUCTION AT NOURSE FARMS WITH CALIFORNIA LIGHTWORKS MEGADRIVE LIGHTING SYSTEM

- TABLE 11 INNOVATING BERRY CULTIVATION WITH STATE-OF-ART LIGHTING SOLUTIONS

- 5.12.3 NIPOMO AG HARNESSES CALIFORNIA LIGHTWORKS MEGADRIVE LED SYSTEM TO THRIVE IN COMPETITIVE CANNABIS MARKET

- TABLE 12 PATENTED TECHNOLOGY DRIVES HIGHER YIELDS AND LOWER COSTS FOR SAN LUIS OBISPO GREENHOUSE

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- TABLE 13 MFN TARIFF FOR HS CODE 9405-RELATED PRODUCTS EXPORTED BY CHINA (2023)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 GROW LIGHTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 IMPACT ANALYSIS OF PORTER'S FIVE FORCES

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF NEW ENTRANTS

- 5.14.3 THREAT OF SUBSTITUTES

- 5.14.4 BARGAINING POWER OF BUYERS

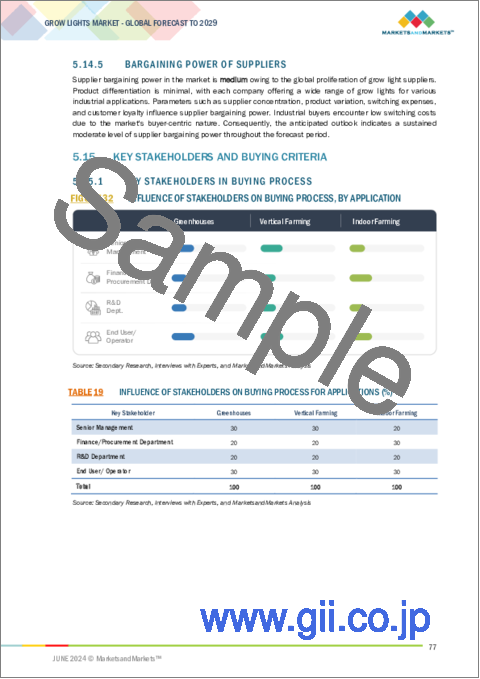

- 5.14.5 BARGAINING POWER OF SUPPLIERS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 20 KEY BUYING CRITERIA, BY APPLICATION

6 GROW LIGHTS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 34 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 21 GROW LIGHTS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 22 GROW LIGHTS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 INCREASING DEMAND FOR HARDWARE COMPONENTS TO DRIVE MARKET

- TABLE 23 HARDWARE: GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 24 HARDWARE: GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 6.3 SOFTWARE & SERVICES

- 6.3.1 BALANCE BETWEEN LIGHTING AND ENERGY COSTS TO DRIVE MARKET

- TABLE 25 SOFTWARE & SERVICES: GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 26 SOFTWARE & SERVICES: GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

7 GROW LIGHTS MARKET, BY WATTAGE

- 7.1 INTRODUCTION

- FIGURE 35 GROW LIGHTS MARKET, BY WATTAGE

- FIGURE 36 >=300 WATTS GROW LIGHTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 27 GROW LIGHTS MARKET, BY WATTAGE, 2020-2023 (USD MILLION)

- TABLE 28 GROW LIGHTS MARKET, BY WATTAGE, 2024-2029 (USD MILLION)

- TABLE 29 GROW LIGHTS MARKET, BY WATTAGE, 2020-2023 (THOUSAND UNITS)

- TABLE 30 GROW LIGHTS MARKET, BY WATTAGE, 2024-2029 (THOUSAND UNITS)

- 7.2 <300 WATTS

- 7.2.1 APPLICATIONS IN HYDROPONIC GREENHOUSES AND CANNABIS CULTIVATION TO DRIVE MARKET

- TABLE 31 <300 WATTS: GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 32 <300 WATTS: GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 7.3 >=300 WATTS

- 7.3.1 CONSISTENT PHOTOSYNTHESIS STIMULATION PROMOTING RAPID PLANT GROWTH TO DRIVE MARKET

- TABLE 33 >=300 WATTS: GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 34 >=300 WATTS: GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

8 GROW LIGHTS MARKET, BY SPECTRUM

- 8.1 INTRODUCTION

- FIGURE 37 LIMITED SPECTRUM GROW LIGHTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 35 GROW LIGHTS MARKET, BY SPECTRUM, 2020-2023 (USD MILLION)

- TABLE 36 GROW LIGHTS MARKET, BY SPECTRUM, 2024-2029 (USD MILLION)

- 8.2 FULL SPECTRUM

- 8.2.1 MIMICKING SUNLIGHT, ENHANCING PLANT GROWTH, ROOT DEVELOPMENT, AND HEALTH DRIVING MARKET

- 8.3 LIMITED SPECTRUM

- 8.3.1 RED AND BLUE SPECTRUMS OPTIMIZING PLANT GROWTH TO DRIVE MARKET

9 GROW LIGHTS MARKET, BY CULTIVATED PLANT

- 9.1 INTRODUCTION

- FIGURE 38 FRUITS & VEGETABLES SEGMENT TO DOMINATE GROW LIGHTS MARKET DURING FORECAST PERIOD

- TABLE 37 GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2020-2023 (USD MILLION)

- TABLE 38 GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2024-2029 (USD MILLION)

- 9.2 FRUITS & VEGETABLES

- 9.2.1 RISING DEMAND FOR HIGH-QUALITY ORGANIC FRUITS & VEGETABLES TO DRIVE MARKET

- TABLE 39 FRUITS & VEGETABLES: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 FRUITS & VEGETABLES: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 FLOWERS

- 9.3.1 ADVANTAGES OVER TRADITIONAL FARMING METHODS TO DRIVE MARKET

- TABLE 41 FLOWERS: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 FLOWERS: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 CANNABIS

- 9.4.1 LEGALIZATION, HIGHER RETURNS ON INVESTMENT, AND AUGMENTED FUNDING TO PROPEL MARKET

- TABLE 43 CANNABIS: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 CANNABIS: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

10 GROW LIGHTS MARKET, BY INSTALLATION TYPE

- 10.1 INTRODUCTION

- FIGURE 39 RETROFIT INSTALLATIONS SEGMENT TO REGISTER HIGH GROWTH RATE DURING FORECAST PERIOD

- TABLE 45 GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 46 GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- 10.2 NEW INSTALLATIONS

- 10.2.1 RISING DEMAND FOR VERTICAL AND INDOOR FARMING TO DRIVE MARKET

- TABLE 47 NEW INSTALLATIONS: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 NEW INSTALLATIONS: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 RETROFIT INSTALLATIONS

- 10.3.1 ENERGY CONSERVATION AND REDUCED OPERATIONAL COSTS TO DRIVE MARKET

- TABLE 49 RETROFIT INSTALLATIONS: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 RETROFIT INSTALLATIONS: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

11 GROW LIGHTS MARKET, BY LIGHTING TYPE

- 11.1 INTRODUCTION

- FIGURE 40 TOP LIGHTING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 51 GROW LIGHTS MARKET, BY LIGHTING TYPE, 2020-2023 (USD MILLION)

- TABLE 52 GROW LIGHTS MARKET, BY LIGHTING TYPE, 2024-2029 (USD MILLION)

- 11.2 TOP LIGHTING

- 11.2.1 LIGHTING IN INDOOR CULTIVATION MIMICKING SUNLIGHT TO DRIVE MARKET

- TABLE 53 TOP LIGHTING: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 TOP LIGHTING: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.3 INTERLIGHTING

- 11.3.1 BIDIRECTIONAL LIGHTS ENABLING HIGHER YIELDS TO DRIVE MARKET

- TABLE 55 INTERLIGHTING: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 INTERLIGHTING: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

12 GROW LIGHTS MARKET, BY SALES CHANNEL

- 12.1 INTRODUCTION

- FIGURE 41 DISTRIBUTION CHANNELS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 57 GROW LIGHTS MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 58 GROW LIGHTS MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- 12.2 DISTRIBUTION CHANNELS

- 12.2.1 SUPERIOR AFTER-SALES SUPPORT TO DRIVE MARKET

- 12.3 E-COMMERCE CHANNELS

- 12.3.1 RISING PREFERENCE BY SMALL GROWERS/HOME-BASED GROWERS TO BOOST MARKET

- 12.4 DIRECT SALES CHANNELS

- 12.4.1 INCREASING APPREHENSIONS REGARDING COUNTERFEIT PRODUCTS TO DRIVE MARKET

13 GROW LIGHTS MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- FIGURE 42 GROW LIGHTS MARKET, BY APPLICATION

- FIGURE 43 VERTICAL FARMING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 59 GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 60 GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 13.2 GREENHOUSES

- 13.2.1 PROTECTED ENVIRONMENTS ENSURING OPTIMAL YIELDS TO DRIVE MARKET

- TABLE 61 GREENHOUSES: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 GREENHOUSES: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 GREENHOUSES: GROW LIGHTS MARKET, BY WATTAGE, 2020-2023 (USD MILLION)

- TABLE 64 GREENHOUSES: GROW LIGHTS MARKET, BY WATTAGE, 2024-2029 (USD MILLION)

- TABLE 65 GREENHOUSES: GROW LIGHTS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 66 GREENHOUSES: GROW LIGHTS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 13.3 VERTICAL FARMING

- 13.3.1 MAXIMIZING SPACE AND ENERGY EFFICIENCY TO DRIVE MARKET

- TABLE 67 VERTICAL FARMING: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 VERTICAL FARMING: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 VERTICAL FARMING: GROW LIGHTS MARKET, BY WATTAGE, 2020-2023 (USD MILLION)

- TABLE 70 VERTICAL FARMING: GROW LIGHTS MARKET, BY WATTAGE, 2024-2029 (USD MILLION)

- TABLE 71 VERTICAL FARMING: GROW LIGHTS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 72 VERTICAL FARMING: GROW LIGHTS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 13.4 INDOOR FARMING

- 13.4.1 AUGMENTING LIGHT, NUTRITION FOR HOUSEPLANTS, HASTENING GROWTH AND FLOWERING TO DRIVE MARKET

- TABLE 73 INDOOR FARMING: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 INDOOR FARMING: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 INDOOR FARMING: GROW LIGHTS MARKET, BY WATTAGE, 2020-2023 (USD MILLION)

- TABLE 76 INDOOR FARMING: GROW LIGHTS MARKET, BY WATTAGE, 2024-2029 (USD MILLION)

- TABLE 77 INDOOR FARMING: GROW LIGHTS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 78 INDOOR FARMING: GROW LIGHTS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 13.5 OTHER APPLICATIONS

- TABLE 79 OTHER APPLICATIONS: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 OTHER APPLICATIONS: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 OTHER APPLICATIONS: GROW LIGHTS MARKET, BY WATTAGE, 2020-2023 (USD MILLION)

- TABLE 82 OTHER APPLICATIONS: GROW LIGHTS MARKET, BY WATTAGE, 2024-2029 (USD MILLION)

- TABLE 83 OTHER APPLICATIONS: GROW LIGHTS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 84 OTHER APPLICATIONS: GROW LIGHTS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

14 GROW LIGHTS MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 44 MARKET SEGMENTATION, BY REGION

- FIGURE 45 ASIA PACIFIC GROW LIGHTS MARKET TO RECORD HIGHEST CAGR BETWEEN 2024 AND 2029

- TABLE 85 GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 86 GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 14.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: GROW LIGHTS MARKET SNAPSHOT

- TABLE 87 NORTH AMERICA: GROW LIGHTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: GROW LIGHTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2020-2023 (USD MILLION)

- TABLE 92 NORTH AMERICA: GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2024-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: GROW LIGHTS MARKET, BY LIGHTING TYPE, 2020-2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: GROW LIGHTS MARKET, BY LIGHTING TYPE, 2024-2029 (USD MILLION)

- 14.2.1 IMPACT OF RECESSION

- 14.2.2 US

- 14.2.2.1 Presence of major manufacturers to drive market

- 14.2.3 CANADA

- 14.2.3.1 Scarcity of natural light, unfavorable weather conditions, and relatively stable economy to drive market

- 14.2.4 MEXICO

- 14.2.4.1 Growth in protected agricultural activities in greenhouses to boost market

- 14.3 EUROPE

- FIGURE 47 EUROPE: GROW LIGHTS MARKET SNAPSHOT

- TABLE 97 EUROPE: GROW LIGHTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 98 EUROPE: GROW LIGHTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 EUROPE: GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 100 EUROPE: GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 101 EUROPE: GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2020-2023 (USD MILLION)

- TABLE 102 EUROPE: GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2024-2029 (USD MILLION)

- TABLE 103 EUROPE: GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 104 EUROPE: GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 105 EUROPE: GROW LIGHTS MARKET, BY LIGHTING TYPE, 2020-2023 (USD MILLION)

- TABLE 106 EUROPE: GROW LIGHTS MARKET, BY LIGHTING TYPE, 2024-2029 (USD MILLION)

- 14.3.1 IMPACT OF RECESSION

- 14.3.2 UK

- 14.3.2.1 Adoption of technological advancements in indoor farming to drive market

- 14.3.3 GERMANY

- 14.3.3.1 Increasing demand for fresh food products to drive market

- 14.3.4 NETHERLANDS

- 14.3.4.1 Strong agricultural sector and highly advanced greenhouse industry to boost market

- 14.3.5 SCANDINAVIA

- 14.3.5.1 Need to reduce dependence on imports to drive market

- 14.3.6 REST OF EUROPE

- 14.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: GROW LIGHTS MARKET SNAPSHOT

- TABLE 107 ASIA PACIFIC: GROW LIGHTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: GROW LIGHTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 111 ASIA PACIFIC: GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2020-2023 (USD MILLION)

- TABLE 112 ASIA PACIFIC: GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2024-2029 (USD MILLION)

- TABLE 113 ASIA PACIFIC: GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 114 ASIA PACIFIC: GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 115 ASIA PACIFIC: GROW LIGHTS MARKET, BY LIGHTING TYPE, 2020-2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: GROW LIGHTS MARKET, BY LIGHTING TYPE, 2024-2029 (USD MILLION)

- 14.4.1 IMPACT OF RECESSION

- 14.4.2 CHINA

- 14.4.2.1 Development of vertical farming infrastructure to propel market

- 14.4.3 JAPAN

- 14.4.3.1 Substantial shortage of arable land to drive market

- 14.4.4 SOUTHEAST ASIA

- 14.4.4.1 Challenges in conventional farming to drive market

- 14.4.5 AUSTRALIA

- 14.4.5.1 Growing awareness of advantages of artificial lighting to drive market

- 14.4.6 REST OF ASIA PACIFIC

- 14.5 ROW

- FIGURE 49 MIDDLE EAST TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- TABLE 117 ROW: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 118 ROW: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 119 ROW: GROW LIGHTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 120 ROW: GROW LIGHTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 121 ROW: GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2020-2023 (USD MILLION)

- TABLE 122 ROW: GROW LIGHTS MARKET, BY CULTIVATED PLANT, 2024-2029 (USD MILLION)

- TABLE 123 ROW: GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 124 ROW: GROW LIGHTS MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 125 ROW: GROW LIGHTS MARKET, BY LIGHTING TYPE, 2020-2023 (USD MILLION)

- TABLE 126 ROW: GROW LIGHTS MARKET, BY LIGHTING TYPE,2024-2029 (USD MILLION)

- 14.5.1 IMPACT OF RECESSION

- 14.5.2 MIDDLE EAST

- 14.5.2.1 Optimizing crop production while minimizing water and land use to drive market

- 14.5.2.2 GCC Countries

- 14.5.2.2.1 Focus on reducing carbon emissions and improving energy efficiency to drive market

- 14.5.2.3 Rest of Middle East

- TABLE 127 MIDDLE EAST: GROW LIGHTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 128 MIDDLE EAST: GROW LIGHTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 14.5.3 SOUTH AMERICA

- 14.5.3.1 Mitigating effects of extreme weather, deforestation, water pollution, and soil degradation to drive market

- 14.5.4 AFRICA

- 14.5.4.1 Enhancing productivity and plant development amid unfavorable weather conditions to drive market

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2024

- TABLE 129 GROW LIGHTS MARKET: KEY STRATEGIES ADOPTED BY LEADING PLAYERS, JUNE 2023-MAY 2024

- 15.3 REVENUE ANALYSIS, 2019-2023

- FIGURE 50 GROW LIGHTS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2023

- 15.4 MARKET SHARE ANALYSIS, 2023

- TABLE 130 GROW LIGHTS MARKET: DEGREE OF COMPETITION

- FIGURE 51 GROW LIGHTS MARKET SHARE ANALYSIS, 2023

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.5.1 COMPANY VALUATION

- FIGURE 52 GROW LIGHTS MARKET: COMPANY VALUATION, 2024

- 15.5.2 FINANCIAL METRICS

- FIGURE 53 GROW LIGHTS MARKET: FINANCIAL METRICS, 2023

- 15.6 BRAND/PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- FIGURE 54 GROW LIGHTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 15.7.5.1 Company footprint

- FIGURE 55 GROW LIGHTS MARKET: COMPANY FOOTPRINT

- 15.7.5.2 Region footprint

- TABLE 131 REGION: COMPANY FOOTPRINT (12 COMPANIES)

- 15.7.5.3 Offering footprint

- TABLE 132 OFFERING: COMPANY FOOTPRINT (12 COMPANIES)

- 15.7.5.4 Wattage footprint

- TABLE 133 WATTAGE: COMPANY FOOTPRINT (12 COMPANIES)

- 15.7.5.5 Spectrum footprint

- TABLE 134 SPECTRUM: COMPANY FOOTPRINT (12 COMPANIES)

- 15.7.5.6 Cultivated plant footprint

- TABLE 135 CULTIVATED PLANT: COMPANY FOOTPRINT (12 COMPANIES)

- 15.7.5.7 Installation type footprint

- TABLE 136 INSTALLATION TYPE: COMPANY FOOTPRINT (12 COMPANIES)

- 15.7.5.8 Lighting type footprint

- TABLE 137 LIGHTING TYPE: COMPANY FOOTPRINT (12 COMPANIES)

- 15.7.5.9 Sales channel footprint

- TABLE 138 SALES CHANNEL: COMPANY FOOTPRINT (12 COMPANIES)

- 15.7.5.10 Application footprint

- TABLE 139 APPLICATION: COMPANY FOOTPRINT (12 COMPANIES)

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- FIGURE 56 GROW LIGHTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 15.8.5.1 Detailed list of startups/SMEs

- TABLE 140 GROW LIGHTS MARKET: KEY STARTUPS/SMES

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 141 GROW LIGHTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 15.9 COMPETITIVE SCENARIO AND TRENDS

- 15.9.1 PRODUCT LAUNCHES

- TABLE 142 GROW LIGHTS MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2024

- 15.9.2 DEALS

- TABLE 143 GROW LIGHTS MARKET: DEALS, JANUARY 2020-MAY 2024

16 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 16.1 INTRODUCTION

- 16.2 KEY PLAYERS

- 16.2.1 SIGNIFY HOLDING

- TABLE 144 SIGNIFY HOLDING: COMPANY OVERVIEW

- FIGURE 57 SIGNIFY HOLDING: COMPANY SNAPSHOT

- TABLE 145 SIGNIFY HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 SIGNIFY HOLDING: PRODUCT LAUNCHES, JANUARY 2020-MAY 2024

- TABLE 147 SIGNIFY HOLDING: DEALS, JANUARY 2020-MAY 2024

- 16.2.2 GAVITA INTERNATIONAL B.V.

- TABLE 148 GAVITA INTERNATIONAL B.V.: COMPANY OVERVIEW

- TABLE 149 GAVITA INTERNATIONAL B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.2.3 HELIOSPECTRA

- TABLE 150 HELIOSPECTRA: COMPANY OVERVIEW

- FIGURE 58 HELIOSPECTRA: COMPANY SNAPSHOT

- TABLE 151 HELIOSPECTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 HELIOSPECTRA: PRODUCT LAUNCHES, JANUARY 2020-MAY 2024

- TABLE 153 HELIOSPECTRA: DEALS, JANUARY 2020-MAY 2024

- 16.2.4 AMS-OSRAM AG

- TABLE 154 AMS-OSRAM AG: COMPANY OVERVIEW

- FIGURE 59 AMS-OSRAM AG: COMPANY SNAPSHOT

- TABLE 155 AMS-OSRAM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 AMS-OSRAM AG: PRODUCT LAUNCHES, JANUARY 2020-MAY 2024

- TABLE 157 AMS-OSRAM AG: DEALS, JANUARY 2020-MAY 2024

- 16.2.5 CALIFORNIA LIGHTWORKS

- TABLE 158 CALIFORNIA LIGHTWORKS: COMPANY OVERVIEW

- TABLE 159 CALIFORNIA LIGHTWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 CALIFORNIA LIGHTWORKS: PRODUCT LAUNCHES, JANUARY 2020-MAY 2024

- TABLE 161 CALIFORNIA LIGHTWORKS: DEALS, JANUARY 2020-MAY 2024

- 16.2.6 LEDVANCE GMBH

- TABLE 162 LEDVANCE GMBH: COMPANY OVERVIEW

- TABLE 163 LEDVANCE GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.2.7 HORTILUX SCHREDER

- TABLE 164 HORTILUX SCHREDER: COMPANY OVERVIEW

- TABLE 165 HORTILUX SCHREDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 HORTILUX SCHREDER: PRODUCT LAUNCHES, JANUARY 2020-MAY 2024

- TABLE 167 HORTILUX SCHREDER: DEALS, JANUARY 2020-MAY 2024

- 16.2.8 VALOYA

- TABLE 168 VALOYA: COMPANY OVERVIEW

- TABLE 169 VALOYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 VALOYA: PRODUCT LAUNCHES, JANUARY 2020-MAY 2024

- TABLE 171 VALOYA: DEALS, JANUARY 2020-MAY 2024

- 16.2.9 ILUMINAR LIGHTING LLC.

- TABLE 172 ILUMINAR LIGHTING LLC.: COMPANY OVERVIEW

- TABLE 173 ILUMINAR LIGHTING LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.2.10 SAVANT TECHNOLOGIES LLC

- TABLE 174 SAVANT TECHNOLOGIES LLC: COMPANY OVERVIEW

- TABLE 175 SAVANT TECHNOLOGIES LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 SAVANT TECHNOLOGIES LLC.: DEALS, JANUARY 2020-MAY 2024

- 16.3 OTHER PLAYERS

- 16.3.1 ECONOLUX INDUSTRIES LTD.

- 16.3.2 LEMNIS OREON B.V.

- 16.3.3 HYPERION GROW LIGHTS

- 16.3.4 SANANBIO

- 16.3.5 DONGGUAN LEDESTAR OPTO-ELECTRONICS TECH. CO., LTD.

- 16.3.6 VIPARSPECTRA

- 16.3.7 KIND LED GROW LIGHTS

- 16.3.8 BLACK DOG HORTICULTURE TECHNOLOGIES & CONSULTING

- 16.3.9 AGROLUX B.V.

- 16.3.10 SOLLUM TECHNOLOGIES

- 16.3.11 MARS HYDRO

- 16.3.12 BIOLOGICAL INNOVATION AND OPTIMIZATION SYSTEMS, LLC

- 16.3.13 EVERLIGHT ELECTRONICS CO., LTD.

- 16.3.14 NICHIA CORPORATION

- 16.3.15 THRIVE AGRITECH

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

17 APPENDIX

- 17.1 INSIGHTS OF INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS