|

|

市場調査レポート

商品コード

1543641

垂直農法の世界市場:成長メカニズム別、構造別、作物タイプ別、提供区分別、地域別 - 予測(~2029年)Vertical Farming Market by Growth Mechanism (Hydroponics, Aeroponics, Aquaponics), Structure (Building-based and Shipping container-based), Crop Type, Offering (Hardware, Software, Services) & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 垂直農法の世界市場:成長メカニズム別、構造別、作物タイプ別、提供区分別、地域別 - 予測(~2029年) |

|

出版日: 2024年07月31日

発行: MarketsandMarkets

ページ情報: 英文 251 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の垂直農法の市場規模は、2024年の56億米ドルから、予測期間中は19.7%のCAGRで推移し、2029年には137億米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額(米ドル) |

| セグメント | 提供区分・成長メカニズム・構造・作物タイプ・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

"予測期間中、照明ハードウェアタイプが最大のシェアを占める"

照明は屋内垂直農法の要件に合わせて大きく改良されており、LED照明の使用は大きな人気を得ています。LED照明は、農家による光の組成と明るさの両方の制御が可能なため、植物のニーズに合わせて光を調整することができ、その結果、植物の成長が早まり、生産量が増加します。また、LED照明は省エネルギーであり、また、他のランプに比べて寿命が長いため、メンテナンス費用も削減できます。さらに、LED照明は熱の発生が比較的少ないため、植物が熱害を受ける可能性が低く、農家の労働条件が大幅に改善されます。

"予測期間中、エアロポニックス成長メカニズムの部門が最大の市場シェアを記録する"

エアロポニックス成長メカニズムは、水耕栽培とは対照的に生産性が高く、水の使用量が大幅に少ないため、垂直農法市場でもっとも高い成長率を示すと予想されています。エアロポニックスは、植物が成長に必要な最適条件をすべて得ることができ、豊富な養液を植物の根に直接供給できるため、より資源を有効活用できます。水耕栽培に比べ、エアロポニックスの固定費は高いですが、収穫量がはるかに多いことを考えれば、投資回収率ははるかに高いです。天然資源と水の保全に対する世界の意識の高まりに伴い、特に市街地では限られたスペースと水を利用して生産量を増やす必要性が高まっているため、エアロポニックシステムの導入は進む見通しです。

"輸送コンテナベースの垂直農園が予測期間中にもっとも高いCAGRで成長する見通し"

垂直農法は輸送用コンテナを使用し、海や鉄道で輸送できるように設計されているため、ある場所から別の場所へ簡単に移動することができます。輸送用コンテナを利用した垂直農法は価格的にも手頃です。また、輸送用コンテナ農場は気候が制御されているため、生産工程で使用する水の量が少なくて済みます。

当レポートでは、世界の垂直農法の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/ディスラプション

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- ケーススタディ分析

- 関税および規制の枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- AI/生成AIが垂直農法市場:市場に与える影響

第6章 垂直農法市場:提供区分別

- ハードウェア

- 照明

- 水耕栽培用コンポーネント

- 気候制御

- センサー

- ソフトウェア

- 農場管理ソフトウェア

- サービス

- マネージド&プロフェッショナルサービス

- メンテナンス&サポートサービス

第7章 垂直農法市場:成長メカニズム別

- 水耕栽培

- エアロポニックス

- アクアポニックス

第8章 垂直農法市場:構造別

- 建物ベースの垂直農法

- 輸送コンテナベースの垂直農法

第9章 垂直農法市場:作物別

- 野菜

- 果物

第10章 垂直農法市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- SIGNIFY HOLDING

- AMS-OSRAM AG

- FREIGHT FARMS, INC.

- AEROFARMS

- HELIOSPECTRA

- PLENTY UNLIMITED INC.

- VALOYA

- EVERLIGHT ELECTRONICS CO., LTD

- SPREAD CO., LTD.

- SKY GREENS

- その他の主要企業

- AMHYDRO

- URBAN CROP SOLUTIONS

- VERTICAL FARM SYSTEMS

- BOWERY FARMING INC.

- AGRICOOL

- SANANBIO

- INFARM

- INTELLIGENT GROWTH SOLUTIONS LIMITED

- 4D BIOS INC

- BRIGHTFARMS

- VERTICAL FUTURE

- CUBICFARM SYSTEMS CORP.

- VERTICAL HARVEST

- HYDROFARM

- GENERAL HYDROPONICS

第13章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 KEY SECONDARY SOURCES

- TABLE 3 PRIMARY PARTICIPANTS CROSS VALUE CHAIN

- TABLE 4 RISK FACTOR ANALYSIS

- TABLE 5 BENEFITS OF VERTICAL FARMS VERSUS OTHER METHODS

- TABLE 6 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY KEY PLAYER, 2019-2023 (USD)

- TABLE 7 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY REGION, 2019-2023 (USD)

- TABLE 8 VERTICAL FARMING MARKET: ECOSYSTEM

- TABLE 9 LIST OF GRANTED PATENTS RELATED TO VERTICAL FARMING MARKET, 2021-2023

- TABLE 10 EXPORT DATA FOR HS CODE 8539 - LIGHTING PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 11 IMPORT DATA FOR HS CODE 8539 - LIGHTING PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 13 IMPORT DATA FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 8415 - HVAC CONTROL SYSTEM, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 15 IMPORT DATA FOR HS CODE 8415 - HVAC CONTROL SYSTEM, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 16 VERTICAL FARMING MARKET: DETAILED LIST OF RELATED CONFERENCES AND EVENTS, 2024-2025

- TABLE 17 NETHERLANDS: MFN TARIFF FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT EXPORTED, 2023

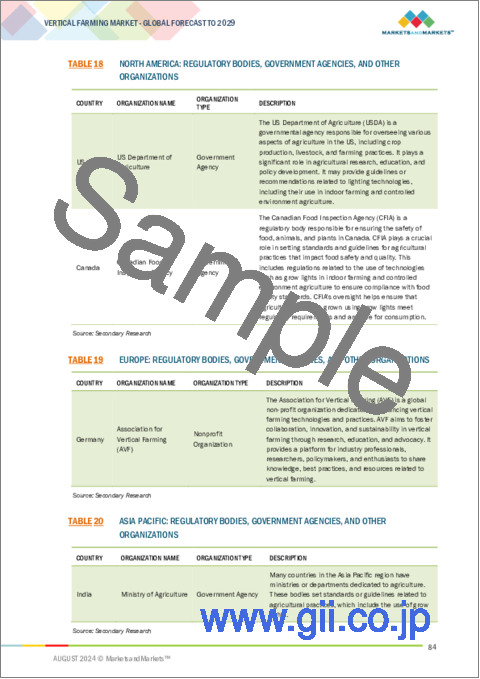

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 VERTICAL FARMING MARKET: REGULATIONS

- TABLE 23 VERTICAL FARMING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 24 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY OFFERING

- TABLE 25 KEY BUYING CRITERIA FOR TOP THREE OFFERINGS

- TABLE 26 VERTICAL FARMING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 27 VERTICAL FARMING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 28 VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 29 VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 30 VERTICAL FARMING HARDWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 VERTICAL FARMING HARDWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 VERTICAL FARMING LIGHTING HARDWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 VERTICAL FARMING LIGHTING HARDWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 VERTICAL FARMING HYDROPONIC COMPONENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 VERTICAL FARMING HYDROPONIC COMPONENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 VERTICAL FARMING CLIMATE CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 VERTICAL FARMING CLIMATE CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 VERTICAL FARMING SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 VERTICAL FARMING SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 VERTICAL FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 VERTICAL FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 VERTICAL FARMING SERVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 VERTICAL FARMING SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 45 VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 46 HYDROPONIC VERTICAL FARMING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 HYDROPONIC VERTICAL FARMING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 AEROPONIC VERTICAL FARMING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 AEROPONIC VERTICAL FARMING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 AQUAPONIC VERTICAL FARMING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 AQUAPONIC VERTICAL FARMING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 53 VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 54 BUILDING-BASED VERTICAL FARMING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 BUILDING-BASED VERTICAL FARMING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 SHIPPING CONTAINER-BASED VERTICAL FARMING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 SHIPPING CONTAINER-BASED VERTICAL FARMING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 VERTICAL FARMING MARKET, BY CROP TYPE, 2020-2023 (THOUSAND TONS)

- TABLE 59 VERTICAL FARMING MARKET, BY CROP TYPE, 2024-2029 (THOUSAND TONS)

- TABLE 60 VERTICAL FARMING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 VERTICAL FARMING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: VERTICAL FARMING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 63 NORTH AMERICA: VERTICAL FARMING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 64 NORTH AMERICA: VERTICAL FARMING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 65 NORTH AMERICA: VERTICAL FARMING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 70 NORTH AMERICA: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 71 NORTH AMERICA: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 72 US: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 73 US: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 74 US: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 75 US: VERTICAL FARMING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 76 CANADA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 77 CANADA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 78 CANADA: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 79 CANADA: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 80 EUROPE: VERTICAL FARMING MARKET, BY COUNTRY/REGION, 2020-2023 (USD MILLION)

- TABLE 81 EUROPE: VERTICAL FARMING MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- TABLE 82 EUROPE: VERTICAL FARMING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 83 EUROPE: VERTICAL FARMING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 84 EUROPE: VERTICAL FARMING MARKET FOR HARDWARE, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 85 EUROPE: VERTICAL FARMING MARKET FOR HARDWARE, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 86 EUROPE: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 87 EUROPE: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 88 EUROPE: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 89 EUROPE: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 90 EU4: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 91 EU4: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 92 EU4: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 93 EU4: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 94 UK: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 95 UK: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 96 UK: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 97 UK: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 98 ASIA PACIFIC: VERTICAL FARMING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 99 ASIA PACIFIC: VERTICAL FARMING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: VERTICAL FARMING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 101 ASIA PACIFIC: VERTICAL FARMING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 102 ASIA PACIFIC: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 103 ASIA PACIFIC: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 104 ASIA PACIFIC: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 105 ASIA PACIFIC: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 106 ASIA PACIFIC: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 107 ASIA PACIFIC: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 108 CHINA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 109 CHINA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 110 CHINA: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 111 CHINA: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 112 JAPAN: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 113 JAPAN: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 114 JAPAN: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 115 JAPAN: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 116 ROW: VERTICAL FARMING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 117 ROW: VERTICAL FARMING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 118 ROW: VERTICAL FARMING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 119 ROW: VERTICAL FARMING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 120 ROW: VERTICAL FARMING HARDWARE MARKET, BY HARDWARE TYPE, 2020-2023 (USD MILLION)

- TABLE 121 ROW: VERTICAL FARMING MARKET HARDWARE, BY HARDWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 122 ROW: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 123 ROW: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 124 ROW: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 125 ROW: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 126 SOUTH AMERICA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 127 SOUTH AMERICA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 128 SOUTH AMERICA: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 129 SOUTH AMERICA: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: VERTICAL FARMING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: VERTICAL FARMING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2020-2023 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2024-2029 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: VERTICAL FARMING MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: VERTICAL FARMING MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 136 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 137 VERTICAL FARMING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 138 VERTICAL FARMING MARKET: OFFERING FOOTPRINT, 2023

- TABLE 139 VERTICAL FARMING MARKET: GROWTH MECHANISM FOOTPRINT, 2023

- TABLE 140 VERTICAL FARMING MARKET: STRUCTURE FOOTPRINT, 2023

- TABLE 141 VERTICAL FARMING MARKET: CROP TYPE FOOTPRINT, 2023

- TABLE 142 VERTICAL FARMING MARKET: REGIONAL FOOTPRINT, 2023

- TABLE 143 VERTICAL FARMING MARKET: LIST OF KEY STARTUPS/SMES, 2023

- TABLE 144 VERTICAL FARMING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES, 2023

- TABLE 145 VERTICAL FARMING MARKET: PRODUCT LAUNCHES, JANUARY 2020-APRIL 2024

- TABLE 146 VERTICAL FARMING MARKET: DEALS, JANUARY 2020-APRIL 2024

- TABLE 147 VERTICAL FARMING MARKET: EXPANSIONS, JANUARY 2020-APRIL 2024

- TABLE 148 VERTICAL FARMING MARKET: OTHER DEVELOPMENTS, JANUARY 2020-APRIL 2024

- TABLE 149 SIGNIFY HOLDING: BUSINESS OVERVIEW

- TABLE 150 SIGNIFY HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 SIGNIFY HOLDING: DEALS

- TABLE 152 AMS-OSRAM AG: BUSINESS OVERVIEW

- TABLE 153 AMS-OSRAM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 AMS-OSRAM AG: PRODUCT LAUNCHES

- TABLE 155 AMS-OSRAM AG: DEALS

- TABLE 156 FREIGHT FARMS, INC. BUSINESS OVERVIEW

- TABLE 157 FREIGHT FARMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 FREIGHT FARMS, INC: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 159 FREIGHT FARMS, INC: DEALS

- TABLE 160 AEROFARMS: BUSINESS OVERVIEW

- TABLE 161 AEROFARMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 AEROFARMS: DEALS

- TABLE 163 HELIOSPECTRA: BUSINESS OVERVIEW

- TABLE 164 HELIOSPECTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 HELIOSPECTRA: PRODUCT LAUNCHES

- TABLE 166 HELIOSPECTRA: DEALS

- TABLE 167 HELIOSPECTRA: OTHER DEVELOPMENTS

- TABLE 168 PLENTY UNLIMITED INC.: BUSINESS OVERVIEW

- TABLE 169 PLENTY UNLIMITED INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 PLENTY UNLIMITED INC.: DEALS

- TABLE 171 PLENTY UNLIMITED INC.: EXPANSIONS

- TABLE 172 VALOYA: BUSINESS OVERVIEW

- TABLE 173 VALOYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 VALOYA: DEALS

- TABLE 175 EVERLIGHT ELECTRONICS CO., LTD: BUSINESS OVERVIEW

- TABLE 176 EVERLIGHT ELECTRONICS CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 SPREAD CO., LTD.: BUSINESS OVERVIEW

- TABLE 178 SPREAD CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 SPREAD CO., LTD.: DEALS

- TABLE 180 SKY GREENS: BUSINESS OVERVIEW

- TABLE 181 SKY GREENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 VERTICAL FARMING MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 VERTICAL FARMING MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 SECONDARY AND PRIMARY RESEARCH APPROACHES

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - REVENUE GENERATED BY KEY PLAYERS

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE) - BOTTOM-UP ESTIMATION BASED ON REGION

- FIGURE 11 VERTICAL FARMING MARKET: BOTTOM-UP APPROACH

- FIGURE 12 VERTICAL FARMING MARKET: TOP-DOWN APPROACH

- FIGURE 13 DATA TRIANGULATION

- FIGURE 14 RESEARCH ASSUMPTIONS

- FIGURE 15 VERTICAL FARMING MARKET GROWTH TREND, 2020-2029 (USD MILLION)

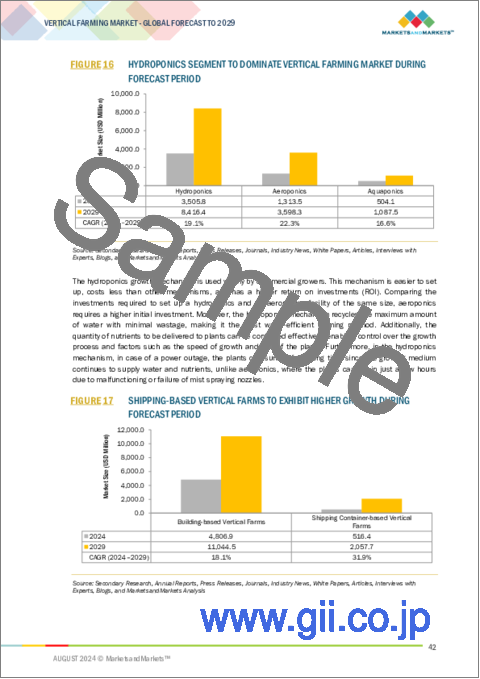

- FIGURE 16 HYDROPONICS SEGMENT TO DOMINATE VERTICAL FARMING MARKET DURING FORECAST PERIOD

- FIGURE 17 SHIPPING-BASED VERTICAL FARMS TO EXHIBIT HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 18 LETTUCE LIKELY TO BE MOST COMMONLY GROWN CROP ACROSS DIFFERENT VERTICAL FARMS

- FIGURE 19 SERVICES TO BE FASTEST-GROWING SEGMENT IN VERTICAL FARMING MARKET DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN VERTICAL FARMING MARKET FROM 2024 TO 2029

- FIGURE 21 INCREASE IN INVESTMENTS AND PARTNERSHIPS BETWEEN FARMS AND TECHNOLOGY PROVIDERS TO BOOST VERTICAL FARMING MARKET GROWTH

- FIGURE 22 HARDWARE TO BE MOST ADOPTED AMONG VERTICAL FARMING OFFERINGS IN 2024 AND 2029

- FIGURE 23 LIGHTING SEGMENT TO GAIN MORE MARKET SHARE BETWEEN 2024 AND 2029

- FIGURE 24 HYDROPONIC GROWTH MECHANISM TO DOMINATE MARKET FROM 2024 TO 2029

- FIGURE 25 BUILDING-BASED VERTICAL FARMS TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 26 ASIA PACIFIC TO DOMINATE VERTICAL FARMING MARKET DURING FORECAST PERIOD

- FIGURE 27 VERTICAL FARMING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 GLOBAL POPULATION, 2015-2050 (BILLION)

- FIGURE 29 VERTICAL FARMING MARKET DRIVERS AND THEIR IMPACT

- FIGURE 30 VERTICAL FARMING MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 31 VERTICAL FARMING MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 32 VERTICAL FARMING MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 33 REVENUE SHIFT AND NEW REVENUE POCKETS FOR VERTICAL FARMING MARKET PLAYERS

- FIGURE 34 AVERAGE SELLING PRICE OF LIGHTING COMPONENT OFFERED BY KEY PLAYERS, 2023 (USD)

- FIGURE 35 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY KEY PLAYER, 2019-2023 (USD)

- FIGURE 36 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY REGION, 2019-2023 (USD)

- FIGURE 37 SUPPLY CHAIN ANALYSIS: VERTICAL FARMING MARKET

- FIGURE 38 VERTICAL FARMING MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO

- FIGURE 40 NUMBER OF PATENTS GRANTED WORLDWIDE FROM 2014 TO 2023

- FIGURE 41 REGIONAL ANALYSIS OF PATENTS GRANTED FOR VERTICAL FARMING MARKET, 2014-2023

- FIGURE 42 EXPORT DATA FOR HS CODE 8539 - LIGHTING PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 43 IMPORT DATA FOR HS CODE 8539 - LIGHTING PRODUCTS, BY REGION, 2020-2022 (USD THOUSAND)

- FIGURE 44 EXPORT DATA FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 45 IMPORT DATA FOR HS CODE 8436 - AGRICULTURAL EQUIPMENT, BY REGION, 2020-2022 (USD THOUSAND)

- FIGURE 46 EXPORT DATA FOR HS CODE 8415 - HVAC CONTROL SYSTEM, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 47 IMPORT DATA FOR HS CODE 8415 - HVAC CONTROL SYSTEM, BY REGION, 2020-2022 (USD THOUSAND)

- FIGURE 48 VERTICAL FARMING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 49 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY OFFERING

- FIGURE 50 KEY BUYING CRITERIA FOR TOP THREE OFFERINGS

- FIGURE 51 ADOPTION OF GEN AI IN VERTICAL FARMING

- FIGURE 52 VERTICAL FARMING MARKET, BY OFFERING

- FIGURE 53 VERTICAL FARMING MARKET BY HARDWARE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 54 LIGHTING HARDWARE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 55 VERTICAL FARMING MARKET, BY GROWTH MECHANISM

- FIGURE 56 HYDROPONICS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024 AND 2029

- FIGURE 57 VERTICAL FARMING MARKET, BY STRUCTURE

- FIGURE 58 BUILDING-BASED VERTICAL FARMS TO HOLD LARGEST MARKET SHARE IN 2024 AND 2029

- FIGURE 59 LETTUCE CROP TYPE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 60 VERTICAL FARMING MARKET, BY REGION

- FIGURE 61 SINGAPORE TO RECORD HIGHEST CAGR IN VERTICAL FARMING MARKET DURING FORECAST PERIOD

- FIGURE 62 ASIA PACIFIC TO RECORD HIGHEST GROWTH RATE IN VERTICAL FARMING MARKET DURING FORECAST PERIOD

- FIGURE 63 NORTH AMERICA: VERTICAL FARMING MARKET SNAPSHOT

- FIGURE 64 EUROPE: VERTICAL FARMING MARKET SNAPSHOT

- FIGURE 65 ASIA PACIFIC: VERTICAL FARMING MARKET SNAPSHOT

- FIGURE 66 ROW: VERTICAL FARMING MARKET SNAPSHOT

- FIGURE 67 VERTICAL FARMING MARKET: REVENUE ANALYSIS OF THREE KEY PLAYERS, 2019-2023

- FIGURE 68 VERTICAL FARMING MARKET SHARE ANALYSIS, 2023

- FIGURE 69 COMPANY VALUATION OF KEY VERTICAL FARMING MARKET VENDORS, 2023 (USD BILLION)

- FIGURE 70 FINANCIAL METRICS (EV/EBITDA) OF KEY VERTICAL FARMING MARKET VENDORS, 2023

- FIGURE 71 BRAND/PRODUCT COMPARISON

- FIGURE 72 VERTICAL FARMING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 73 VERTICAL FARMING MARKET: COMPANY FOOTPRINT, 2023

- FIGURE 74 VERTICAL FARMING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 75 SIGNIFY HOLDING: COMPANY SNAPSHOT

- FIGURE 76 AMS-OSRAM AG: COMPANY SNAPSHOT

- FIGURE 77 HELIOSPECTRA: COMPANY SNAPSHOT

- FIGURE 78 EVERLIGHT ELECTRONICS CO., LTD: COMPANY SNAPSHOT

The global vertical farming market was valued at USD 5.6 billion in 2024 and is projected to reach USD 13.7 billion by 2029; it is expected to register a CAGR of 19.7% during the forecast period. The market of vertical farming is progressing through several aspects:This is a human centred approach and is adopted to facilitate efficient use of available resources, water and land through influencing climate change. Altruistic demands are also driven by food security issues like population growth, urbanization and safe food. Some of the examples of benefits that could be attributed to the economic aspect includes; transportation cost, year round production and production of high valued crops. The use of IoT, Hyper intelligent transport system (HITS), AI, LED lighting, and hydroponics increases effectiveness in the organization. All of them provide the needful argument for vertical farming, which indeed can be viewed as one of the most promising models of contemporary agriculture.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By offering, growth mechanism, structure, crop type, and region |

| Regions covered | North America, Europe, APAC, RoW |

"The lighting hardware type to hold the largest share during the forecast period."

Lighting has tremendously improved owing to its pros specific to indoor vertical farms' requirements, and the use of LED lighting has gained huge popularity. LED lights give the farmers the control of both the light composition and the brightness, so that the former are able to adjust the light to the needs of the plants, thus helping them grow faster and produce more. In addition, LED lights are energy saving, that is, they use way much power than most conventional sources of lighting. It also cuts on costs of maintenance due to their longer lasting as compared to other lamp types. Thirdly, LED lights produce comparatively little heat that reduces the possibilities of heat injury of plants and making the working condition of farmers much better. This has made the LED lighting to be popular among the vertical farm operators since it add more value to the vertical farming technique by averting the key reason behind the failure of the farming methodology in the past.

"The aeroponics growth mechanism segment to record highest market share during the forecast period."

The aeroponic growth mechanism is anticipated to exhibit the highest growth rate in the vertical farming market due to its higher productivity in contrast to hydroponics as well as the substantially lesser utilization of water. Aeroponics occupies a lesser amount of space let plants get all optimal conditions necessary for their growth and provide rich nutrient solution directly to roots of the plant, thus it is more resourceful. The fixed cost of aeroponics, compared to hydroponics are higher, but the payback is much higher given that the yields are much higher. With the increasing global awareness towards conservation of natural resources and water the need to increase production using limited space and water especially in built-up areas is likely to boost the uptake of aeroponic systems and therefore fuel the growth of this segment in the vertical farming market.

"The shipping container-based vertical farms is likely to grow at the highest CAGR during the forecast period."

Vertical farms use shipping containers, that is sustainable, space optimal and can easily be moved from one location to another since they are designed to be transported via sea and rail hence the name 'shipping' containers. Shipping container-based vertical farms are comapritively more affordable. This is due to the ability of the farms to be built in different regions fully equipped without large capital investments in infrastructure. Also, shipping container farms are climate controlled meaning less water is used during the production processes and also there is production all year round which plays a pivotal role especially in the aspects of food insecurity. Knowing this, the market for vertical farming utilizing shipping containers will inevitably grow as technology progresses in an attempt to enhance the efficiency of these systems and provide entrepreneurs and investors with a competent solution in the agriculture industry.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 45%, Tier 3 - 15%

- By Designation- C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region-North America - 20%, Europe - 30%, Asia Pacific - 35%, RoW - 15%

The vertical farming market is dominated by a few globally established players such as Signify (Netherlands), Freight Farms (US), AeroFarms (US), Sky Greens (Singapore), Spread (Japan), Plenty (US), Valoya (Finland), Osram (Germany), Everlight Electronics (Taiwan), and Heliospectra AB (Sweden). The study includes an in-depth competitive analysis of these key players in the vertical farming market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the vertical farming market and forecasts its size by offering, growth mechanism, structure, crop type, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the vertical farming ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (high yield and numerous other benefits associated with vertical farming over conventional farming, advancements in light-emitting diode (led) technology, year-round crop production irrespective of weather conditions, and requirement of minimum resources). Restraint (lack of technically skilled workforce and limited crop types, and high start-up costs). Opportunity (reduced environmental impact from agriculture by adoption of vertical farming, and cannabis cultivation through vertical farming). Challenges (maintenance of temperature, humidity, and air circulation in a vertical farm, and vertical farming on a large scale)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and services launches in the vertical farming market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the vertical farming market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the vertical farming market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Signify (Netherlands), Freight Farms (US), AeroFarms (US), Sky Greens (Singapore), Spread (Japan), Plenty (US), Valoya (Finland), Osram (Germany), Everlight Electronics (Taiwan), and Heliospectra AB (Sweden) among others in the vertical farming market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants and key opinion leaders in primary interviews

- 2.1.2.2 Key insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VERTICAL FARMING MARKET

- 4.2 VERTICAL FARMING MARKET, BY OFFERING

- 4.3 VERTICAL FARMING MARKET, BY HARDWARE TYPE

- 4.4 VERTICAL FARMING MARKET, BY GROWTH MECHANISM

- 4.5 VERTICAL FARMING MARKET, BY STRUCTURE

- 4.6 VERTICAL FARMING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 High yield associated with vertical farming over conventional farming

- 5.1.1.2 Advancements in light-emitting diode (LED) technology

- 5.1.1.3 Year-round crop production irrespective of weather conditions

- 5.1.1.4 Decrease in arable land and water scarcity amid growing urban population

- 5.1.2 RESTRAINTS

- 5.1.2.1 Lack of technically skilled workforce and limited crop types

- 5.1.2.2 High startup costs

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Reduced environmental impact from vertical agriculture

- 5.1.3.2 Potential market opportunities in Asia Pacific and Middle East

- 5.1.3.3 Growth of cannabis cultivation through vertical farming

- 5.1.4 CHALLENGES

- 5.1.4.1 Maintenance of temperature, humidity, and air circulation in vertical farm

- 5.1.4.2 Higher energy consumption leading to high operational costs

- 5.1.4.3 Large-scale cost-intensiveness

- 5.1.1 DRIVERS

- 5.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY LIGHTING COMPONENTS

- 5.3.2 AVERAGE SELLING PRICE OF LIGHTING COMPONENTS, BY KEY PLAYER

- 5.3.3 AVERAGE SELLING PRICE TREND OF LIGHTING COMPONENTS, BY REGION

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Climate control systems

- 5.7.1.2 Hydroponic and aeroponic systems

- 5.7.1.3 UV and far-red light integration

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Smart lighting

- 5.7.2.2 LED grow lights

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Spectrum control technology

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 HS CODE 8539 - LIGHTING PRODUCTS

- 5.9.1.1 Export data

- 5.9.1.2 Import data

- 5.9.2 HS CODE 8436 - AGRICULTURAL EQUIPMENT

- 5.9.2.1 Export data

- 5.9.2.2 Import data

- 5.9.3 HS CODE 8415 - HVAC CONTROL SYSTEM

- 5.9.3.1 Export data

- 5.9.3.2 Import data

- 5.9.1 HS CODE 8539 - LIGHTING PRODUCTS

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 LJUSGARDA: SCALING UP INDOOR GROWTH WITH HELIOSPECTRA

- 5.11.2 HORTIPOLARIS: PERENNIAL SUPPORT FOR LED LIGHTING IN CULTIVATION AND RESEARCH FACILITIES BY FLUENCE BY OSRAM

- 5.11.3 AEROFARMS: IMPROVING AEROPONIC PRECISION FARMING USING AI

- 5.11.4 AEROFARMS: IOT DEPLOYMENT FOR DATA-DRIVEN INSIGHTS IN COLLABORATION WITH DELL EMC

- 5.11.5 RIAT: SIGNIFY'S LED LIGHTING SOLUTION USED FOR VERTICAL FARMING TOMATOES AND CUCUMBERS

- 5.11.6 KARMA FARM: FREIGHT FARMS ADDED HYDROPONIC SOLUTIONS TO ACHIEVE SUSTAINABILITY

- 5.12 TARIFF AND REGULATORY FRAMEWORK

- 5.12.1 TARIFFS ANALYSIS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 REGULATIONS

- 5.12.4 STANDARDS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 BARGAINING POWER OF SUPPLIERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF AI/GEN AI ON VERTICAL FARMING MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 USE OF GEN AI IN VERTICAL FARMING

- 5.15.3 CASE STUDY ANALYSIS

- 5.15.3.1 John Deere: Modernizing agriculture through AI and automation

- 5.15.3.2 CropIn: Leveraging AI and data analytics to provide farmers with real-time insights

- 5.15.3.3 California's Central Valley: AI-controlled Irrigation to be game changer for water management in agriculture

- 5.15.3.4 CropIn and AWS: Collaborating to tackle global hunger with AI

- 5.15.4 IMPACT ON VERTICAL FARMING MARKET

- 5.15.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 VERTICAL FARMING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 LIGHTING

- 6.2.1.1 Lighting fixtures

- 6.2.1.1.1 High efficiency of LEDs and innovative lighting solutions for better yield

- 6.2.1.2 Lighting control

- 6.2.1.2.1 Connected energy-saving lighting systems proven to be optimal for vertical farming

- 6.2.1.1 Lighting fixtures

- 6.2.2 HYDROPONIC COMPONENTS

- 6.2.2.1 Appropriate utilization of nutrient-laden water to ensure high crop growth

- 6.2.3 CLIMATE CONTROL

- 6.2.3.1 Effective HVAC systems critical to ensure high productivity through precise temperature control

- 6.2.4 SENSORS

- 6.2.4.1 Sensors to provide necessary data points for accurate monitoring to ensure high productivity and farm efficiency

- 6.2.1 LIGHTING

- 6.3 SOFTWARE

- 6.3.1 FARM MANAGEMENT SOFTWARE

- 6.3.1.1 Real-time monitoring and analytics help optimize crop growth and respond quickly to any issues

- 6.3.1 FARM MANAGEMENT SOFTWARE

- 6.4 SERVICES

- 6.4.1 MANAGED & PROFESSIONAL SERVICES

- 6.4.1.1 Consulting services offer customized strategies for vertical farms, addressing specific challenges and goals

- 6.4.2 MAINTENANCE & SUPPORT SERVICES

- 6.4.2.1 Regular maintenance required by advanced technology in vertical farming to ensure optimal performance and prevent costly breakdowns

- 6.4.1 MANAGED & PROFESSIONAL SERVICES

7 VERTICAL FARMING MARKET, BY GROWTH MECHANISM

- 7.1 INTRODUCTION

- 7.2 HYDROPONICS

- 7.2.1 SIMPLE AND COST-EFFECTIVE INSTALLATION AND EFFICIENT GROWTH OPTION FOR CULTIVATION WITH LIMITED ARABLE LAND

- 7.3 AEROPONICS

- 7.3.1 HIGH PRODUCTIVITY AND LOW TIMEFRAME ACHIEVED USING IMPROVED MINIMAL LAND AND WATER RESOURCES

- 7.4 AQUAPONICS

- 7.4.1 MINIMAL WATER AND PESTICIDE USAGE

8 VERTICAL FARMING MARKET, BY STRUCTURE

- 8.1 INTRODUCTION

- 8.2 BUILDING-BASED VERTICAL FARMS

- 8.2.1 COUNTRIES WITH UNSUPPORTED CROP ENVIRONMENTS TO BE EARLY ADOPTERS OF BUILDING-BASED VERTICAL FARMS

- 8.3 SHIPPING CONTAINER-BASED VERTICAL FARMS

- 8.3.1 EMERGING VERTICAL FARMING SOLUTIONS FOR SMALL FARMERS

9 VERTICAL FARMING MARKET, BY CROP TYPE

- 9.1 INTRODUCTION

- 9.2 VEGETABLES

- 9.2.1 LETTUCE MAINLY CULTIVATED IN CONTROLLED ENVIRONMENTS IN VERTICAL FARMS

- 9.3 FRUITS

- 9.3.1 INCREASE IN DEMAND FOR ORGANIC FRUITS

10 VERTICAL FARMING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Increase in number of vertical farms and partnerships among companies in US

- 10.2.3 CANADA

- 10.2.3.1 Presence of technologically advanced vertical farming companies in Canada

- 10.2.4 MEXICO

- 10.2.4.1 Increase in population, deteriorating cultivation zones, and scarcity of water drive adoption of vertical farming in Mexico

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 EU4

- 10.3.2.1 Focus on advanced technologies helps create high growth opportunities for vertical farming market in EU4

- 10.3.3 UK

- 10.3.3.1 Introduction of robotic arms for automating several vertical farming processes, such as harvesting, to reduce labor costs

- 10.3.4 SCANDINAVIA

- 10.3.4.1 Deployment of vertical farms in restaurants, retail, and grocery stores eliminates food wastage during transportation in Scandinavia

- 10.3.5 NETHERLANDS

- 10.3.5.1 Partnerships and collaborations between leading vertical farming companies are driving market's growth in Netherlands

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Increase in investment in vertical farming due to growth in urban population and declining agricultural land in China

- 10.4.3 JAPAN

- 10.4.3.1 High involvement in R&D for vertical farming producing growth opportunities in Japan

- 10.4.4 SINGAPORE

- 10.4.4.1 Government support and achieving food security help Singapore become global leader in vertical farming

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Unavailability of land for traditional farming due to high population density

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 ROW: MACROECONOMIC OUTLOOK

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Emergence of startups involved in vertical farming

- 10.5.3 MIDDLE EAST & AFRICA

- 10.5.3.1 GCC

- 10.5.3.1.1 Scarcity of freshwater and arable land to be driver

- 10.5.3.2 Rest of the Middle East & Africa

- 10.5.3.1 GCC

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 EV/EBIDTA

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Offering footprint

- 11.7.5.3 Growth mechanism footprint

- 11.7.5.4 Structure footprint

- 11.7.5.5 Crop type footprint

- 11.7.5.6 Regional footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SIGNIFY HOLDING

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent Developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices made

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 AMS-OSRAM AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Products/solutions/services launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices made

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 FREIGHT FARMS, INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Products/solutions/services launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM views

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices made

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 AEROFARMS

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices made

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 HELIOSPECTRA

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Products/solutions/services launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 PLENTY UNLIMITED INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Expansions

- 12.1.7 VALOYA

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 EVERLIGHT ELECTRONICS CO., LTD

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 SPREAD CO., LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent Developments

- 12.1.9.3.1 Deals

- 12.1.10 SKY GREENS

- 12.1.10.1 Business overview

- 12.1.10.2 Products/solutions/services offered

- 12.1.1 SIGNIFY HOLDING

- 12.2 OTHER KEY PLAYERS

- 12.2.1 AMHYDRO

- 12.2.2 URBAN CROP SOLUTIONS

- 12.2.3 VERTICAL FARM SYSTEMS

- 12.2.4 BOWERY FARMING INC.

- 12.2.5 AGRICOOL

- 12.2.6 SANANBIO

- 12.2.7 INFARM

- 12.2.8 INTELLIGENT GROWTH SOLUTIONS LIMITED

- 12.2.9 4D BIOS INC

- 12.2.10 BRIGHTFARMS

- 12.2.11 VERTICAL FUTURE

- 12.2.12 CUBICFARM SYSTEMS CORP.

- 12.2.13 VERTICAL HARVEST

- 12.2.14 HYDROFARM

- 12.2.15 GENERAL HYDROPONICS

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS