|

|

市場調査レポート

商品コード

1468737

船舶用エンジンの世界市場:エンジン別、タイプ別、出力範囲別、燃料別、船舶別、地域別 - 予測(~2029年)Marine Engines Market by Engine (Propulsion and Auxiliary), Type (Two Stroke and Four Stroke), Power Range (Up to 1,000 hp, 1,001-5,000 hp, 5,001-10,000 hp, 10,001-20,000 hp, and Above 20,000 hp), Fuel, Vessel and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 船舶用エンジンの世界市場:エンジン別、タイプ別、出力範囲別、燃料別、船舶別、地域別 - 予測(~2029年) |

|

出版日: 2024年04月03日

発行: MarketsandMarkets

ページ情報: 英文 323 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の船舶用エンジンの市場規模は、2024年の推定131億米ドルから大きく増加し、2029年までに152億米ドルに達し、2024年~2029年にCAGRで3.0%の安定した成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 米ドル |

| セグメント | エンジン別、タイプ別、出力範囲別、燃料別、船舶別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

船舶用エンジン市場の未来は、環境問題への関心、技術の進歩、持続可能性への関心の高まりの合流によって、大きく変化しようとしています。環境規制の強化や、世界中でのクリーンな海運の推進により、重油(HFO)の使用は減少の一途をたどる見込みです。液化天然ガス(LNG)のようなクリーンな代替燃料は、特に新造船で大きな市場シェアを獲得すると予測されます。バイオ燃料や再生可能資源由来の合成燃料も有望な選択肢として浮上していますが、インフラ開発と価格競争力が極めて重大な要因となります。メーカーは、燃料効率の改善、低排出ガス、複数の燃料を使用できるエンジンの開発に注力します。MGOのような従来の燃料と、LNGやバイオ燃料のようなよりクリーンな代替燃料とをシームレスに切り替えられるように設計されたエンジンは、船舶運航者に、進化する規制や燃料の利用可能性に対するより大きな柔軟性と適応性を提供します。エンジン運転による廃熱を回収し、追加発電や他の船内プロセスに利用する技術は、全体的なエネルギー効率を向上させます。センサー、先進の制御、遠隔モニタリングシステムの統合は、エンジン性能を最適化し、予知保全を可能にし、運航効率を向上させます。エンジンメーカー、造船業者、燃料サプライヤーを含む船舶産業全体が、持続可能性目標の達成に向けて協力することになります。これには、カーボンニュートラル燃料の開発、港湾の陸上電力インフラへの投資、よりクリーンな技術の採用にインセンティブを与える規制の策定などが含まれる可能性があります。船舶用エンジン市場の将来見通しは、技術革新により前向きです。産業は、よりクリーンで、より効率的で、持続可能な運航に向けて軌道に乗っています。技術が進歩し、規制が進化し、環境責任への関心が高まるにつれ、海洋を航行する船舶の動力源となるエンジンの種類にも大きな変化が現れることが予測されます。

「オイルタンカーセグメントが2024年~2029年に第2位の市場シェアを占めます。」

オイルタンカーは、大量の原油と石油精製品を輸送するために設計されています。これらの巨大船、特にULCCやVLCCは、抵抗に打ち勝ち、大洋を長距離効率的に航行するために、非常に強力なエンジンを必要とします。石油タンカーは、石油を生産地から精製所や貯蔵施設に輸送するために、しばしば数週間にわたる長旅を行います。そのため、連続運転と卓越した信頼性を備えたエンジンが必要となります。推進力よりも燃料効率を優先する他の船種とは異なり、オイルタンカーは、長距離にわたって大量の積荷を効率的に推進する能力を優先します。このため、高馬力の2ストロークエンジンが依然として主流となっています。結論として、巨大なサイズ、貨物積載量、長距離運航、高出力エンジンへの依存により、石油タンカーは船舶用エンジン市場の主な促進要因となっており、この部門で2番目に大きな市場シェアを占める可能性が高いです。

当レポートでは、世界の船舶用エンジン市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 船舶用エンジン市場の企業にとって魅力的な機会

- 船舶用エンジン市場:地域別

- アジア太平洋の船舶用エンジン市場:船舶と国別(2023年)

- 船舶用エンジン市場:エンジン別(2029年)

- 船舶用エンジン市場:タイプ別(2029年)

- 船舶用エンジン市場:出力範囲別(2029年)

- 船舶用エンジン市場:燃料別(2029年)

- 船舶用エンジン市場:船舶別(2029年)

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 投資と資金調達のシナリオ

- サプライチェーン分析

- 原材料供給者/サプライヤー

- コンポーネントメーカー

- 船舶用エンジンメーカー/組立業者

- 販売業者

- エンドユーザー

- アフターサービス

- 技術分析

- 価格分析

- 参考価格分析:出力範囲別

- 平均販売価格の動向:地域別(2020年~2024年)

- 主な会議とイベント(2024年~2025年)

- 関税、規制、規制

- 船舶用エンジンに関する関税

- 規制機関、政府機関、その他の組織

- 船舶用エンジンに関する規制

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

第6章 船舶用エンジン市場:タイプ別

- イントロダクション

- 2ストローク

- 4ストローク

第7章 船舶用エンジン市場:エンジン別

- イントロダクション

- 推進エンジン

- 補機エンジン

第8章 船舶用エンジン市場:出力範囲別

- イントロダクション

- 1,000HP以下

- 1,001~5,000HP

- 5,001~10,000HP

- 10,001~20,000HP

- 20,000HP超

第9章 船舶用エンジン市場:燃料別

- イントロダクション

- 重油

- 船舶用ディーゼル油

- 船舶用ガスオイル

- その他の燃料

第10章 船舶用エンジン市場:船舶別

- イントロダクション

- オフショア支援船

- オイルタンカー

- バルクキャリアー

- 一般貨物

- コンテナー船

- プロダクトタンカー

- 曳船

- その他の船舶

第11章 船舶用エンジン市場:地域別

- イントロダクション

- アジア太平洋

- アジア太平洋の市場に対する不況の影響

- 中国

- 日本

- 韓国

- フィリピン

- ベトナム

- その他のアジア太平洋

- 欧州

- 欧州市場に対する不況の影響

- ドイツ

- イタリア

- ロシア

- フィンランド

- フランス

- その他の欧州

- 北米

- 北米市場に対する不況の影響

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- 中東・アフリカ市場に対する不況の影響

- GCC諸国

- アラブ首長国連邦

- その他のGCC諸国

- トルコ

- 南アフリカ

- エジプト

- その他の中東・アフリカ

- 南米

- 南米市場に対する不況の影響

- ブラジル

- アルゼンチン

- その他の南米

第12章 競合情勢

- 主要企業戦略

- 上位5社の市場シェア分析

- 収益分析

- 企業の評価マトリクス

- 企業の評価と財務指標

- 船舶用エンジン市場:ブランド/製品の比較

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- CATERPILLAR

- WARTSILA

- MAN ENERGY SOLUTIONS

- AB VOLVO PENTA

- ROLLS-ROYCE PLC

- HD HYUNDAI HEAVY INDUSTRIES CO., LTD.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- CUMMINS INC.

- DAIHATSU DIESEL MFG. CO., LTD.

- DEUTZ AG

- WINGD

- FAIRBANKS MORSE DEFENSE

- WABTEC CORPORATION

- YANMAR MARINE INTERNATIONAL

- ISOTTA FRASCHINI MOTORI S.P.A.

- その他の企業

- CNPC JICHAI POWER COMPANY LIMITED

- BERGEN ENGINES

- MAHINDRA POWEROL

- IHI POWER SYSTEMS CO., LTD.

- WEICHAI HOLDING GROUP CO., LTD.

- AGCO POWER

- PERKINS ENGINES COMPANY LIMITED

- KAWASAKI HEAVY INDUSTRIES, LTD.

- SCANIA

- COOPER CORP.

第14章 付録

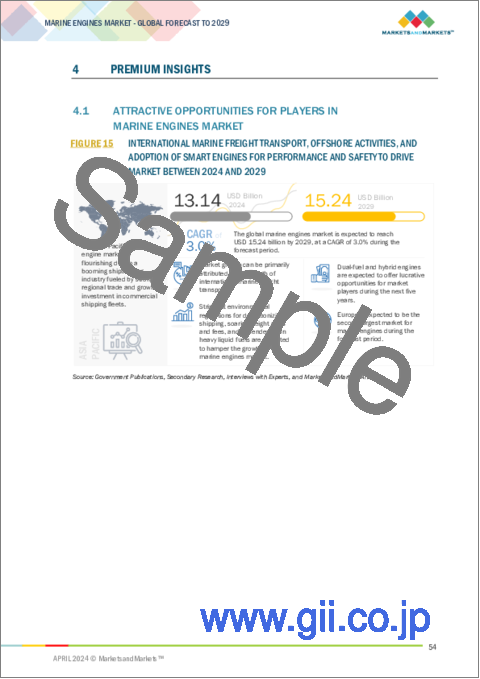

The global marine engines market is on a trajectory to reach USD 15.2 billion by 2029, a notable increase from the estimated USD 13.1 billion in 2024, with a steady CAGR of 3.0% spanning the period from 2024 to 2029.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Engine, By Type, By Power Range, By Fuel, By Vessel |

| Regions covered | Asia Pacific, North America, Europe, Middle East and Africa, and South America |

The future of the marine engine market is poised for significant change, driven by a confluence of environmental concerns, technological advancements, and a growing focus on sustainability. Stricter environmental regulations and a global push for cleaner shipping will lead to a continued decline in the use of Heavy Fuel Oil (HFO). Cleaner alternatives like Liquefied Natural Gas (LNG) are expected to gain significant market share, particularly for new vessels. Biofuels and synthetic fuels derived from renewable sources are also emerging as promising options, although infrastructure development and cost competitiveness will be crucial factors. Manufacturers will focus on developing engines with improved fuel efficiency, lower emissions, and the capability to operate on multiple fuel types. Engines designed to seamlessly switch between traditional fuels like MGO and cleaner alternatives like LNG or biofuels will offer ship operators greater flexibility and adaptability to evolving regulations and fuel availability. Technologies that capture and utilize waste heat from engine operation for additional power generation or other onboard processes will improve overall energy efficiency. Integration of sensors, advanced controls, and remote monitoring systems will optimize engine performance, enable predictive maintenance, and improve operational efficiency. The entire maritime industry, including engine manufacturers, shipbuilders, and fuel suppliers, will collaborate towards achieving sustainability goals. This could involve the development of carbon-neutral fuels, investment in shore-side power infrastructure for ports, and the creation of regulations that incentivize the adoption of cleaner technologies. The future of the marine engine market is bright with innovation. The industry is on a trajectory towards cleaner, more efficient, and sustainable operations. As technology advances, regulations evolve, and the focus on environmental responsibility intensifies, we can expect to see significant changes in the types of engines powering the vessels that traverse our oceans.

"Oil tankers segment, by Vessel, to hold second-largest market share from 2024 to 2029."

Oil tankers are designed to transport vast quantities of crude oil and refined petroleum products. These behemoths, particularly Ultra Large Crude Carriers (ULCCs) and Very Large Crude Carriers (VLCCs), require immensely powerful engines to overcome drag and efficiently navigate long distances across oceans. Oil tankers undertake long journeys, often spanning weeks, to transport oil from production sites to refineries or storage facilities. This necessitates engines built for continuous operation and exceptional reliability. Unlike some other vessel types that might prioritize fuel efficiency over raw power, oil tankers prioritize the ability to efficiently propel massive loads over long distances. This translates to a significant demand for high-horsepower, two-stroke engines that remain the dominant choice for these vessels. In conclusion, the immense size, cargo capacity, long-distance operation, and reliance on high-power engines make oil tankers the primary driver of the marine engine market, likely holding the second-largest market share in this sector.

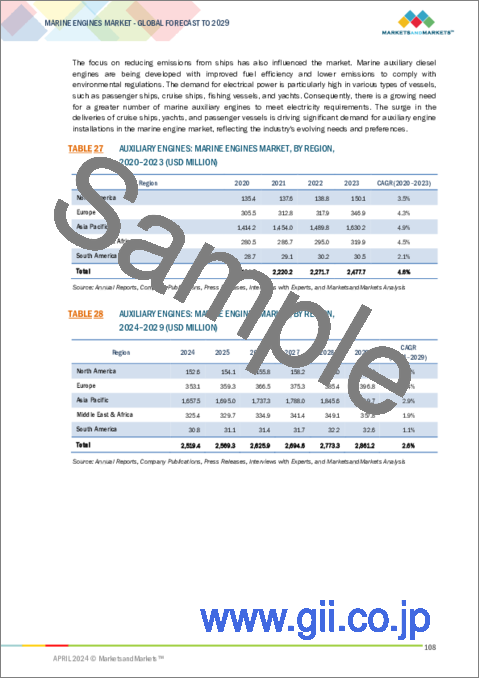

"Auxiliary segment, by engine, to be the second-largest market from 2024 to 2029."

Auxiliary engines hold the second-largest market share in the marine engine market. Auxiliary engines come in a range of power outputs, catering to the specific needs of different onboard systems. From smaller engines powering lighting systems to larger ones driving powerful pumps or winches, the versatility in auxiliary engine power contributes to their widespread use. Auxiliary engines play a critical role in ensuring the overall reliability of a vessel. They often operate in a redundant configuration, meaning there might be multiple auxiliary engines on board. This redundancy ensures that a malfunction in one engine doesn't cripple vital onboard systems. Their reliable operation is essential for uninterrupted power supply and safe vessel operations. The increasing automation of onboard systems and the growing demand for amenities on passenger vessels necessitates a reliable source of power. This translates to a continued demand for auxiliary engines to support these evolving needs. Manufacturers are constantly developing auxiliary engines with improved fuel efficiency, lower emissions, and better noise reduction capabilities. These advancements make auxiliary engines a more environmentally friendly and cost-effective solution for onboard power generation. The extensive application across various vessel types, diverse power requirements, focus on redundancy and reliability, advancements in technology, and the growing complexity of onboard systems all contribute to auxiliary engines holding the second-largest market share in the marine engine sector. They are the workhorses behind the scenes, ensuring the smooth and efficient operation of a vessel, even if they aren't directly responsible for propulsion.

"Europe to be second-largest region in marine engines market."

Europe's position as the second-largest market share holder in the marine engine market can be attributed to a confluence of factors that make it a hub for shipbuilding, technological innovation, and stringent environmental regulations. Europe boasts a long and rich history in shipbuilding, with renowned shipyards at the forefront of technological innovation. These shipyards often collaborate with engine manufacturers to develop and integrate cutting-edge engines into their vessels. This focus on advanced technology positions Europe as a leader in the high-power engine segment, particularly for large container ships and cruise liners. Europe enforces some of the world's strictest environmental regulations for maritime emissions. This focus on clean air and water quality incentivizes the development and adoption of cleaner burning engines that comply with regulations in Emission Control Areas (ECAs), designated areas with stricter emission controls. European manufacturers are at the forefront of developing engines that utilize cleaner fuels like LNG and exploring alternative options like biofuels. European ship owners and maritime companies are increasingly prioritizing sustainability in their operations. This translates to a demand for cleaner and more efficient engines that meet not only current but also anticipated future environmental regulations. Engine manufacturers in Europe are actively developing future-proof technologies like dual-fuel engines capable of operating on cleaner alternatives alongside traditional fuels. Europe has a vast and diverse maritime fleet encompassing large container ships, cruise liners, ferries, offshore service vessels, and specialized research vessels. This diversity necessitates a wide range of engine types and powers, contributing to the overall market share held by European manufacturers catering to these varied needs. Europe's strong shipbuilding tradition, focus on technological innovation, stringent environmental regulations, diverse maritime fleet, and robust after-sales infrastructure all contribute to its position as the second-largest market share holder in the marine engine market. However, competition from Asia and the high initial investment costs of cleaner technologies are challenges that European manufacturers need to navigate to maintain their leadership position.

Breakdown of Primaries:

In-depth interviews with key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, were conducted to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The primary interviews were distributed as follows:

By Company Type: Tier 1-30%, Tier 2-55%, and Tier 3-15%

By Designation: C-Level-30%, D-Level-20%, and Others-50%

By Region: North America-18%, Europe-8%, Asia Pacific-60%, South America-4% and

Middle East & Africa-10%.

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2021: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

The marine engines market is predominantly governed by well-established global leaders. Notable players in the marine engines market include Caterpillar (US), Wartsila (Finland), AB Volvo Penta (Sweden), Man Energy Solutions (Germany), Rolls-Royce Plc (UK), Mitsubishi Heavy Industries, Ltd. (Japan), HDHyundai Heavy Industries Co., Ltd. (South Korea), Cummins Inc. (US), Daihatsu Diesel Mfg. Co., Ltd. (Japan), Deutz AG (Germany), and several others.

Research Coverage:

The report provides a comprehensive definition, description, and forecast of the marine engines market based on various parameters, including engine (Propulsion and Auxiliary), type (Four Stroke and Two Stroke), Power Range (Up to 1,000 hp, 1,001-5,000 hp, 5,001-10,000 hp, 10,001-20,000 hp, Above 20,000 hp), Fuel (Marine Diesel Oil, Others, Heavy Fuel Oil, and Marine Gas Oil), Vessel (Bulk Carrier, Oil Tankers, Offshore Support Vessels, General Cargo, Others, Container Ships, Tugs, and Product Tankers), and region (Asia Pacific, North America, Europe, Middle East and Africa, South America). The report also offers a thorough qualitative and quantitative analysis of the marine engines market, encompassing a comprehensive examination of the key market drivers, limitations, opportunities, and challenges. Additionally, it covers critical facets of the market, such as an assessment of the competitive landscape, an analysis of market dynamics, value-based market estimates, and future trends in the marine engines market. The report provides investment and funding information of key players in the marine engines market.

Key Benefits of Buying the Report

The report is thoughtfully designed to benefit both established industry leaders and newcomers in the marine engines market. It provides reliable revenue forecasts for the entire market as well as its individual sub-segments. This data is a valuable resource for stakeholders, enabling them to gain a comprehensive understanding of the competitive landscape and formulate effective market strategies for their businesses. Furthermore, the report serves as a channel for stakeholders to grasp the current state of the market, providing essential insights into market drivers, limitations, challenges, and growth opportunities. By incorporating these insights, stakeholders can make well-informed decisions and stay informed about the constantly evolving dynamics of the marine engines industry.

- Analysis of key drivers: (Growth in international marine freight transport, Aging fleet, Adoption of smart engines for performance and safety), restraints (Stringent environmental regulations, Soaring freight rates and fees, Dependce on heavy liquid fluids), opportunities (Rise of e-commerce and online trade, Rising demand for duel fuel and hybrid engines), and challenges (Structural factors increasing maritime transport costs, Volatile oil & gas prices) influencing the growth of the marine engines market.

- Product Development/ Innovation: The marine engines market is in a constant state of evolution, with a primary focus on product development and innovation. Leading industry players like Caterpillar, Wartsila, Man Energy Solutions, and AB Volvo Penta are at the forefront of advancing their product offerings to address shifting demands and environmental considerations. There is a notable shift towards enhancing the intelligence of recloser.

- Market Development: The marine engine market is on an exciting trajectory, driven by a confluence of environmental concerns, technological advancements, and a growing emphasis on sustainability. Stricter environmental regulations and a global push for cleaner shipping are leading to a decline in the use of Heavy Fuel Oil (HFO). Liquefied Natural Gas (LNG) is emerging as a significant contender, particularly for new vessels. Biofuels and synthetic fuels derived from renewable sources are also gaining traction, although infrastructure development and cost competitiveness will be crucial factors in their wider adoption. Manufacturers are constantly innovating to develop engines with improved fuel efficiency, lower emissions, and the capability to operate on multiple fuel types. Dual-Fuel and Multi-Fuel Engines can seamlessly switch between traditional fuels like MGO and cleaner alternatives like LNG or biofuels, offering ship owners greater flexibility and adaptability to evolving regulations and fuel availability. Waste Heat Recovery Systems Technologies capture waste heat from engine operation for additional power generation or other onboard processes will improve overall energy efficiency. While internal combustion engines will likely remain dominant in the near future, alternative propulsion technologies like electric and hybrid systems are gaining traction, particularly for smaller vessels and harbor operations. Advancements in battery technology and efficient charging infrastructure will be crucial for wider adoption of electric propulsion in larger vessels. The entire maritime industry, including engine manufacturers, shipbuilders, fuel suppliers, and regulatory bodies, are increasingly collaborating towards achieving sustainability goals. This could involve the development of carbon-neutral fuels, investment in shore-side power infrastructure for ports, and the creation of regulations that incentivize the adoption of cleaner technologies. The development of the marine engine market is exciting and dynamic. As technology advances, regulations evolve, and the focus on environmental responsibility intensifies, we can expect to see a continued shift towards cleaner, more efficient, and sustainable marine propulsion solutions.

- Market Diversification: The marine engine market is undergoing significant diversification driven by a confluence of factors, including stricter environmental regulations, technological advancements, and the pursuit of sustainable practices. This diversification manifests in several key areas. Traditionally, the marine engine market relied heavily on Heavy Fuel Oil (HFO) due to its cost-effectiveness. However, stricter regulations aimed at reducing air and water pollution are driving a shift towards cleaner burning fuels. LNG is emerging as a significant alternative, particularly for new vessels. It offers lower emissions of sulfur oxides (SOx) and nitrogen oxides (NOx) compared to HFO. However, infrastructure development for LNG bunkering facilities is crucial for wider adoption. Derived from renewable sources like biomass or waste products, these fuels offer a carbon-neutral alternative. While still in their early stages of development, advancements in production methods and cost reduction could make them more viable options in the future. New engine technologies aim to reduce fuel consumption and operating costs while maintaining power output. This can involve advancements in combustion processes, waste heat recovery systems, and engine optimization software. Cleaner burning technologies like exhaust gas aftertreatment systems and selective catalytic reduction (SCR) are being developed to comply with stricter emission regulations. The marine engine market is no longer a one-size-fits-all solution. Market diversification is fostering innovation across fuel options, engine technologies, and after-sales services. This caters to the diverse needs of different vessel types and operational requirements. As environmental concerns intensify and the focus on sustainability grows, we can expect further diversification in the marine engine market with the development of even cleaner, more efficient, and future-proof propulsion solutions for the global maritime industry.

- Competitive Assessment: A comprehensive evaluation has been conducted to scrutinize the market presence, growth strategies, and service offerings of key players in the marine engines market. These prominent companies include Caterpillar (US), Wartsila (Finland), Man Energy Solutions (Germany), AB Volvo Penta (Sweden), Rolls-Royce Plc (UK), HDHyundai Heavy Industries Co., Ltd. (South Korea), Mitsubishi Heavy Industries, Ltd. (Japan), Cummins Inc. (US), Daihatsu Diesel Mfg. Co., Ltd. (Japan), Deutz AG (Germany), and others. This analysis provides in-depth insights into the competitive positions of these major players, their approaches to driving market growth, and the range of services they offer within the marine engines segment.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 INCLUSIONS AND EXCLUSIONS, BY ENGINE

- 1.3.2 INCLUSIONS AND EXCLUSIONS, BY TYPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS, BY POWER RANGE

- 1.3.4 INCLUSIONS AND EXCLUSIONS, BY FUEL

- 1.3.5 INCLUSIONS AND EXCLUSIONS, BY VESSEL

- 1.3.6 INCLUSIONS AND EXCLUSIONS, BY REGION

- 1.4 MARKET SCOPE

- 1.4.1 MARINE ENGINES MARKET SEGMENTATION

- 1.5 REGIONS COVERED

- 1.6 YEARS CONSIDERED

- 1.7 CURRENCY CONSIDERED

- 1.8 LIMITATIONS

- 1.9 STAKEHOLDERS

- 1.10 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MARINE ENGINES MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.1.2 List of major secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Breakdown of primaries

- 2.2.2.2 Key data from primary sources

- FIGURE 3 BREAKDOWN OF INTERVIEWS WITH EXPERTS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR MARINE ENGINES

- 2.2.2.3 Participant companies for primary research

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Regional analysis

- 2.3.3.2 Country analysis

- 2.3.3.3 Demand-side assumptions

- 2.3.3.4 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF MARINE ENGINES

- FIGURE 8 MARINE ENGINES MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions

- 2.3.4.2 Supply-side calculations

- 2.3.5 FORECAST

- 2.3.5.1 Impact of recession

- 2.3.5.2 Research assumptions

3 EXECUTIVE SUMMARY

- TABLE 1 MARINE ENGINES MARKET SNAPSHOT

- FIGURE 9 ASIA PACIFIC DOMINATED MARINE ENGINES MARKET IN 2023

- FIGURE 10 PROPULSION ENGINES SEGMENT TO ACCOUNT FOR LARGER SHARE BETWEEN 2024 AND 2029

- FIGURE 11 ABOVE 20,000 HP POWER RANGE SEGMENT TO LEAD MARINE ENGINES MARKET BETWEEN 2024 AND 2029

- FIGURE 12 TWO-STROKE ENGINES SEGMENT TO DOMINATE MARINE ENGINES MARKET BETWEEN 2024 AND 2029

- FIGURE 13 MARINE DIESEL OIL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARINE ENGINES MARKET BETWEEN 2024 AND 2029

- FIGURE 14 BULK CARRIERS TO LEAD MARINE ENGINES MARKET BETWEEN 2024 AND 2029

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARINE ENGINES MARKET

- FIGURE 15 INTERNATIONAL MARINE FREIGHT TRANSPORT, OFFSHORE ACTIVITIES, AND ADOPTION OF SMART ENGINES FOR PERFORMANCE AND SAFETY TO DRIVE MARKET BETWEEN 2024 AND 2029

- 4.2 MARINE ENGINES MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: MARINE ENGINES MARKET, BY VESSEL AND COUNTRY, 2023

- FIGURE 17 OIL TANKERS SEGMENT AND CHINA HELD LARGEST SHARES IN 2023

- 4.4 MARINE ENGINES MARKET, BY ENGINE, 2029

- FIGURE 18 PROPULSION ENGINES SEGMENT TO ACCOUNT FOR LARGER SHARE

- 4.5 MARINE ENGINES MARKET, BY TYPE, 2029

- FIGURE 19 TWO-STROKE SEGMENT TO DOMINATE MARINE ENGINES MARKET

- 4.6 MARINE ENGINES MARKET, BY POWER RANGE, 2029

- FIGURE 20 ABOVE 20,000 HP SEGMENT TO HOLD LARGEST SHARE OF MARINE ENGINES MARKET

- 4.7 MARINE ENGINES MARKET, BY FUEL, 2029

- FIGURE 21 MARINE DIESEL OIL SEGMENT TO DOMINATE MARINE ENGINES MARKET

- 4.8 MARINE ENGINES MARKET, BY VESSEL, 2029

- FIGURE 22 BULK CARRIERS SEGMENT TO LEAD MARINE ENGINES MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 MARINE ENGINES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for marine freight transportation

- FIGURE 24 WORLD SEABORNE TRADE, 2023

- 5.2.1.2 Flourishing cruise industry

- FIGURE 25 GLOBAL CRUISE CAPACITY PROJECTIONS, 2016-2028

- 5.2.1.3 Growth in offshore activities

- FIGURE 26 OFFSHORE OIL AND GAS PRODUCTION SCENARIO, 2016-2040

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental regulations to decarbonize shipping

- FIGURE 27 CARBON DIOXIDE EMISSIONS BY MAIN VESSEL TYPE, 2012-2023 (TON)

- 5.2.2.2 Geopolitical uncertainties and potential disruptions to trade routes

- FIGURE 28 AVERAGE DISTANCE TRAVELLED, 1999-2024 (NAUTICAL MILE)

- 5.2.2.3 Technological hurdles in use of alternative fuels for marine engines

- FIGURE 29 NUMBER OF SHIPS OPERATING ON ALTERNATIVE MARINE FUELS, 2023

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Enhancements in fuel efficiency offers significant opportunities

- 5.2.3.2 Rising demand for dual-fuel and hybrid engines

- 5.2.3.3 Digitalization and automation in marine industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Structural factors increasing maritime transport costs

- 5.2.4.2 uel price volatility

- FIGURE 30 AVERAGE CRUDE OIL PRICES, 2015-2024

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARINE ENGINE PROVIDERS

- FIGURE 31 REVENUE SHIFT FOR MARINE ENGINE PROVIDERS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 32 MARINE ENGINES MARKET: KEY PLAYERS IN ECOSYSTEM

- TABLE 2 MARINE ENGINES MARKET: ROLE IN ECOSYSTEM

- 5.5 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 FUNDING RAISED BY TOP PLAYERS IN MARINE ENGINES MARKET, 2020-2024

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 34 SUPPLY CHAIN ANALYSIS: MARINE ENGINES MARKET

- 5.6.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.6.2 COMPONENT MANUFACTURERS

- 5.6.3 MARINE ENGINE MANUFACTURERS/ASSEMBLERS

- 5.6.4 DISTRIBUTORS

- 5.6.5 END USERS

- 5.6.6 POST-SALES SERVICES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Liquefied Natural Gas (LNG) engines

- 5.7.1.2 Hybrid and electric marine propulsion

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING ANALYSIS, BY POWER RANGE

- TABLE 3 INDICATIVE PRICING ANALYSIS OF MARINE ENGINES, 2023

- 5.8.2 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024

- 5.9 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 4 MARINE ENGINES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- 5.10 TARIFFS, CODES, AND REGULATIONS

- 5.10.1 TARIFFS RELATED TO MARINE ENGINES

- TABLE 5 IMPORT TARIFFS IN TERMS OF % OF IMPORTED VALUE FOR HS 840810 MARINE PROPULSION ENGINES IN 2022

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.3 CODES AND REGULATIONS RELATED TO MARINE ENGINES

- TABLE 10 MARINE ENGINES: CODES AND REGULATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 TRADE ANALYSIS FOR COMPRESSION-IGNITION INTERNAL COMBUSTION PISTON ENGINE"DIESEL OR SEMI-DIESEL ENGINE, " FOR MARINE PROPULSION

- 5.11.2 IMPORT DATA

- TABLE 11 IMPORT SCENARIO FOR HS CODE 840810 - COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 35 IMPORT DATA FOR HS CODE 840810-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023 (USD THOUSAND)

- 5.11.3 EXPORT DATA

- TABLE 12 EXPORT SCENARIO FOR HS CODE 840810-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- FIGURE 36 EXPORT DATA FOR HS CODE 840810-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023 (USD THOUSAND)

- 5.12 PATENT ANALYSIS

- FIGURE 37 MARINE ENGINES MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2013-2023

- TABLE 13 MARINE ENGINES MARKET: INNOVATIONS AND PATENT REGISTRATIONS, DECEMBER 2020-DECEMBER 2023

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 PORTER'S FIVE FORCES ANALYSIS FOR MARINE ENGINES MARKET

- TABLE 14 MARINE ENGINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 39 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VESSEL TYPES

- TABLE 15 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VESSEL TYPES

- 5.14.2 BUYING CRITERIA

- FIGURE 40 KEY BUYING CRITERIA FOR TOP 3 VESSEL TYPES

- TABLE 16 KEY BUYING CRITERIA FOR TOP 3 VESSEL TYPES

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 MAINTAINING MANEUVERABILITY AND MEETING REGULATIONS: BISSO TOWBOAT UPGRADES FLEET WITH MODERN ASD TRACTOR TUG

- 5.15.1.1 Problem statement

- 5.15.1.2 Solution

- 5.15.2 POWERING GREEN GROWTH: EDDA WIND EQUIPS FLEET FOR SUSTAINABLE OFFSHORE WIND OPERATIONS

- 5.15.2.1 Problem statement

- 5.15.2.2 Solution

- 5.15.3 POWERING SUSTAINABLE BALTIC SEA TRAVEL: FINNLINES INTEGRATES HYBRID TECHNOLOGY FOR ECO-FRIENDLY FERRY OPERATIONS

- 5.15.3.1 Problem statement

- 5.15.3.2 Solution

- 5.15.4 SEASPAN FERRIES CHARTS COURSE FOR SUSTAINABLE SHIPPING WITH HYBRID TECHNOLOGY AND OPERATIONAL OPTIMIZATION

- 5.15.4.1 Problem statement

- 5.15.4.2 Solution

- 5.15.1 MAINTAINING MANEUVERABILITY AND MEETING REGULATIONS: BISSO TOWBOAT UPGRADES FLEET WITH MODERN ASD TRACTOR TUG

6 MARINE ENGINES MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 41 MARINE ENGINES MARKET SHARE, BY TYPE, 2023

- TABLE 17 MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 18 MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 6.2 TWO-STROKE

- 6.2.1 COST REDUCTION DUE TO LOW-GRADE FUEL TO DRIVE MARKET

- TABLE 19 TWO-STROKE MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 20 TWO-STROKE MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 FOUR-STROKE

- 6.3.1 DEMAND FOR PASSENGER BOATS AND FERRIES TO DRIVE MARKET

- TABLE 21 FOUR-STROKE MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 22 FOUR-STROKE MARINE ENGINES MARKET SIZE, BY REGION, 2024-2029 (USD MILLION)

7 MARINE ENGINES MARKET, BY ENGINE

- 7.1 INTRODUCTION

- FIGURE 42 MARINE ENGINES MARKET SHARE, BY ENGINE, 2023

- TABLE 23 MARINE ENGINES MARKET, BY ENGINE, 2020-2023 (USD MILLION)

- TABLE 24 MARINE ENGINES MARKET, BY ENGINE, 2024-2029 (USD MILLION)

- 7.2 PROPULSION ENGINES

- 7.2.1 PRIME MOVERS OF SHIPS TO DRIVE MARKET

- TABLE 25 PROPULSION ENGINES: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 PROPULSION ENGINES: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 AUXILIARY ENGINES

- 7.3.1 SMOOTH OPERATION OF VESSEL'S PRIMARY ENGINES, PIPING SYSTEMS, AND EQUIPMENT TO DRIVE MARKET

- TABLE 27 AUXILIARY ENGINES: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 AUXILIARY ENGINES: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

8 MARINE ENGINES MARKET, BY POWER RANGE

- 8.1 INTRODUCTION

- FIGURE 43 MARINE ENGINES MARKET SHARE, BY POWER RANGE, 2023

- TABLE 29 MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (USD MILLION)

- TABLE 30 MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (USD MILLION)

- 8.2 UP TO 1,000 HP

- 8.2.1 APPLICATIONS IN SMALLER VESSELS TO DRIVE MARKET

- TABLE 31 UP TO 1,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 32 UP TO 1,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 UP TO 1,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (UNIT)

- TABLE 34 UP TO 1,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (UNIT)

- 8.3 1,001-5,000 HP

- 8.3.1 EFFICIENT OPERATION AND FUEL ECONOMY TO DRIVE MARKET

- TABLE 35 1,001-5,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 1,001-5,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 1,001-5,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (UNIT)

- TABLE 38 1,001-5,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (UNIT)

- 8.4 5,001-10,000 HP

- 8.4.1 LARGER CARGO LOADS AND MAINTENANCE OF EFFICIENT OPERATIONS OVER EXTENDED DISTANCES TO DRIVE MARKET

- TABLE 39 5,001-10,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 5,001-10,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 5,001-10,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (UNIT)

- TABLE 42 5,001-10,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (UNIT)

- 8.5 10,001-20,000 HP

- 8.5.1 EXCEPTIONAL POWER DELIVERY CAPABILITIES FOR LARGE CARRIERS TO DRIVE MARKET

- TABLE 43 10,001-20,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 10,001-20,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 10,001-20,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (UNIT)

- TABLE 46 10,001-20,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (UNIT)

- 8.6 ABOVE 20,000 HP

- 8.6.1 POWER FOR CONTAINER GIANTS AND SUPERTANKERS TO DRIVE MARKET

- TABLE 47 ABOVE 20,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 ABOVE 20,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 ABOVE 20,000 HP MARINE ENGINES MARKET, BY REGION, 2020-2023 (UNIT)

- TABLE 50 ABOVE 20,000 HP MARINE ENGINES MARKET, BY REGION, 2024-2029 (UNIT)

9 MARINE ENGINES MARKET, BY FUEL

- 9.1 INTRODUCTION

- FIGURE 44 MARINE ENGINES MARKET SHARE, BY FUEL, 2023

- TABLE 51 MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 52 MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 9.2 HEAVY FUEL OIL

- 9.2.1 HIGH SULFUR CONTENT TO CAUSE DECLINE IN MARKET SHARE

- TABLE 53 HEAVY FUEL OIL: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 HEAVY FUEL OIL: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 MARINE DIESEL OIL

- 9.3.1 EFFICIENT AND RELIABLE PERFORMANCE ACROSS VARIOUS VESSELS AND MARINE OPERATIONS TO DRIVE MARKET

- TABLE 55 MARINE DIESEL OIL: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 MARINE DIESEL OIL: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 MARINE GAS OIL

- 9.4.1 HIGHEST-GRADE MARINE OIL FOR FASTER MOVING ENGINES TO DRIVE MARKET

- TABLE 57 MARINE GAS OIL: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 MARINE GAS OIL: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5 OTHER FUELS

- TABLE 59 OTHER FUELS: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 OTHER FUELS: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

10 MARINE ENGINES MARKET, BY VESSEL

- 10.1 INTRODUCTION

- FIGURE 45 MARINE ENGINES MARKET SHARE, BY VESSEL, 2023

- TABLE 61 MARINE ENGINES MARKET, BY VESSEL, 2020-2023 (USD MILLION)

- TABLE 62 MARINE ENGINES MARKET, BY VESSEL, 2024-2029 (USD MILLION)

- 10.2 OFFSHORE SUPPORT VESSELS

- 10.2.1 DIVERSE SUPPORT OPERATIONS TO DRIVE MARKET

- TABLE 63 OFFSHORE SUPPORT VESSELS: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 OFFSHORE SUPPORT VESSELS: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 OIL TANKERS

- 10.3.1 VITAL ROLE IN GLOBAL OIL TRANSPORTATION TO DRIVE MARKET

- TABLE 65 OIL TANKERS: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 OIL TANKERS: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 BULK CARRIERS

- 10.4.1 ENVIRONMENTALLY EFFICIENT AND WIDE RANGE OF SIZES TO DRIVE MARKET

- TABLE 67 BULK CARRIERS: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 BULK CARRIERS: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5 GENERAL CARGO

- 10.5.1 GREATER EFFICIENCY AND PROTECTION PROVIDED BY CONTAINER SHIPS TO REDUCE DEMAND

- TABLE 69 GENERAL CARGO: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 GENERAL CARGO: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6 CONTAINER SHIPS

- 10.6.1 EFFICIENCY PROVIDED BY STANDARDIZED SHIPPING CONTAINERS TO DRIVE MARKET

- TABLE 71 CONTAINER SHIPS: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 CONTAINER SHIPS: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7 PRODUCT TANKERS

- 10.7.1 TRANSPORT OF REFINED PETROLEUM PRODUCTS TO DRIVE MARKET

- TABLE 73 PRODUCT TANKERS: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 PRODUCT TANKERS: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8 TUGS

- 10.8.1 WORKHORSES OF MARITIME INDUSTRY TO DRIVE MARKET

- TABLE 75 TUGS: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 TUGS: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.9 OTHER VESSELS

- TABLE 77 OTHERS: MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 78 OTHERS: MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

11 MARINE ENGINES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 46 MARINE ENGINES MARKET SHARE, BY REGION, 2023

- FIGURE 47 MARINE ENGINES MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- TABLE 79 MARINE ENGINES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 MARINE ENGINES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 ASIA PACIFIC

- 11.2.1 IMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: MARINE ENGINES MARKET SNAPSHOT

- TABLE 81 ASIA PACIFIC: MARINE ENGINES MARKET, BY ENGINE, 2020-2023 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARINE ENGINES MARKET, BY ENGINE, 2024-2029 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (UNIT)

- TABLE 88 ASIA PACIFIC: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (UNIT)

- TABLE 89 ASIA PACIFIC: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARINE ENGINES MARKET, BY VESSEL, 2020-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARINE ENGINES MARKET, BY VESSEL, 2024-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARINE ENGINES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARINE ENGINES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.2.2 CHINA

- 11.2.2.1 Robust shipbuilding industry and economic growth to drive market

- TABLE 95 CHINA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 96 CHINA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 97 CHINA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 98 CHINA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.2.3 JAPAN

- 11.2.3.1 Ongoing recession expected to have adverse effects on market growth

- TABLE 99 JAPAN: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 100 JAPAN: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 101 JAPAN: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 102 JAPAN: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Surge in shipbuilding activity to boost market

- TABLE 103 SOUTH KOREA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 104 SOUTH KOREA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 105 SOUTH KOREA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 106 SOUTH KOREA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.2.5 PHILIPPINES

- 11.2.5.1 Focus on producing bulk carriers, container ships, and tankers to drive market

- TABLE 107 PHILIPPINES: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 108 PHILIPPINES: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 109 PHILIPPINES: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 110 PHILIPPINES: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.2.6 VIETNAM

- 11.2.6.1 Government initiatives aimed at developing and enhancing shipbuilding industry to drive market

- TABLE 111 VIETNAM: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 112 VIETNAM: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 113 VIETNAM: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 114 VIETNAM: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.2.7 REST OF ASIA PACIFIC

- TABLE 115 REST OF ASIA PACIFIC: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 IMPACT OF RECESSION ON MARKET IN EUROPE

- FIGURE 49 EUROPE: MARINE ENGINES MARKET SNAPSHOT

- TABLE 119 EUROPE: MARINE ENGINES MARKET, BY ENGINE, 2020-2023 (USD MILLION)

- TABLE 120 EUROPE: MARINE ENGINES MARKET, BY ENGINE, 2024-2029 (USD MILLION)

- TABLE 121 EUROPE: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 122 EUROPE: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 123 EUROPE: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (USD MILLION)

- TABLE 124 EUROPE: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (USD MILLION)

- TABLE 125 EUROPE: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (UNIT)

- TABLE 126 EUROPE: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (UNIT)

- TABLE 127 EUROPE: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 128 EUROPE: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- TABLE 129 EUROPE: MARINE ENGINES MARKET, BY VESSEL, 2020-2023 (USD MILLION)

- TABLE 130 EUROPE: MARINE ENGINES MARKET, BY VESSEL, 2024-2029 (USD MILLION)

- TABLE 131 EUROPE: MARINE ENGINES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 132 EUROPE: MARINE ENGINES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Development of climate-friendly maritime technologies to drive market

- TABLE 133 GERMANY: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 134 GERMANY: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 135 GERMANY: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 136 GERMANY: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.3.3 ITALY

- 11.3.3.1 Ro-Ro, passenger cabotage routes, and investments in LNG and hydrogen to drive market

- TABLE 137 ITALY: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 138 ITALY: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 139 ITALY: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 140 ITALY: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.3.4 RUSSIA

- 11.3.4.1 Upgrading and strengthening local shipbuilding industry to drive market

- TABLE 141 RUSSIA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 142 RUSSIA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 143 RUSSIA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 144 RUSSIA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.3.5 FINLAND

- 11.3.5.1 Promotion of green shipping corridors and eco-friendly transport to drive market

- TABLE 145 FINLAND: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 146 FINLAND: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 147 FINLAND: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 148 FINLAND: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.3.6 FRANCE

- 11.3.6.1 Zero-emission aim by mid-century to drive market

- TABLE 149 FRANCE: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 150 FRANCE: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 151 FRANCE: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 152 FRANCE: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 153 REST OF EUROPE: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 154 REST OF EUROPE: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 155 REST OF EUROPE: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 156 REST OF EUROPE: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.4 NORTH AMERICA

- 11.4.1 IMPACT OF RECESSION ON MARKET IN NORTH AMERICA

- TABLE 157 NORTH AMERICA: MARINE ENGINES MARKET, BY ENGINE, 2020-2023 (USD MILLION)

- TABLE 158 NORTH AMERICA: MARINE ENGINES MARKET, BY ENGINE, 2024-2029 (USD MILLION)

- TABLE 159 NORTH AMERICA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 160 NORTH AMERICA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 161 NORTH AMERICA: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (USD MILLION)

- TABLE 162 NORTH AMERICA: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (USD MILLION)

- TABLE 163 NORTH AMERICA: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (UNIT)

- TABLE 164 NORTH AMERICA: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (UNIT)

- TABLE 165 NORTH AMERICA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 166 NORTH AMERICA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- TABLE 167 NORTH AMERICA: MARINE ENGINES MARKET, BY VESSEL, 2020-2023 (USD MILLION)

- TABLE 168 NORTH AMERICA: MARINE ENGINES MARKET, BY VESSEL, 2024-2029 (USD MILLION)

- TABLE 169 NORTH AMERICA: MARINE ENGINES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 170 NORTH AMERICA: MARINE ENGINES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.4.2 US

- 11.4.2.1 Investments in shipyards and growth in international trade to drive market

- TABLE 171 US: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 172 US: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 173 US: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 174 US: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.4.3 CANADA

- 11.4.3.1 National Shipbuilding Strategy to drive market

- TABLE 175 CANADA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 176 CANADA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 177 CANADA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 178 CANADA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.4.4 MEXICO

- 11.4.4.1 Investments in port infrastructure projects for economic development to drive market

- TABLE 179 MEXICO: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 180 MEXICO: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 181 MEXICO: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 182 MEXICO: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 IMPACT OF RECESSION ON MARKET IN MIDDLE EAST & AFRICA

- TABLE 183 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY ENGINE, 2020-2023 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY ENGINE, 2024-2029 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (UNIT)

- TABLE 190 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (UNIT)

- TABLE 191 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY VESSEL, 2020-2023 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY VESSEL, 2024-2029 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.2 GCC COUNTRIES

- 11.5.2.1 Heavy investments in expanding and modernizing port infrastructure to drive market

- TABLE 197 GCC COUNTRIES: MARINE ENGINES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 198 GCC COUNTRIES: MARINE ENGINES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Trade hub connecting major regions to drive market

- TABLE 199 UAE: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 200 UAE: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 201 UAE: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 202 UAE: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.5.4 REST OF GCC COUNTRIES

- TABLE 203 REST OF GCC COUNTRIES: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 204 REST OF GCC COUNTRIES: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 205 REST OF GCC COUNTRIES: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 206 REST OF GCC COUNTRIES: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.5.5 TURKEY

- 11.5.5.1 Demand for eco-friendly vessels and integration of green technologies to drive market

- TABLE 207 TURKEY: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 208 TURKEY: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 209 TURKEY: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 210 TURKEY: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.5.6 SOUTH AFRICA

- 11.5.6.1 Shipbreaking and ship repair industry to drive market

- TABLE 211 SOUTH AFRICA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 212 SOUTH AFRICA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 213 SOUTH AFRICA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 214 SOUTH AFRICA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.5.7 EGYPT

- 11.5.7.1 Freight transport through Suez Canal to drive market

- TABLE 215 EGYPT: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 216 EGYPT: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 217 EGYPT: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 218 EGYPT: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.5.8 REST OF MIDDLE EAST & AFRICA

- TABLE 219 REST OF MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 220 REST OF MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 221 REST OF MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 222 REST OF MIDDLE EAST & AFRICA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.6 SOUTH AMERICA

- 11.6.1 IMPACT OF RECESSION ON MARKET IN SOUTH AMERICA

- TABLE 223 SOUTH AMERICA: MARINE ENGINES MARKET, BY ENGINE, 2020-2023 (USD MILLION)

- TABLE 224 SOUTH AMERICA: MARINE ENGINES MARKET, BY ENGINE, 2024-2029 (USD MILLION)

- TABLE 225 SOUTH AMERICA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 226 SOUTH AMERICA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 227 SOUTH AMERICA: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (USD MILLION)

- TABLE 228 SOUTH AMERICA: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (USD MILLION)

- TABLE 229 SOUTH AMERICA: MARINE ENGINES MARKET, BY POWER RANGE, 2020-2023 (UNIT)

- TABLE 230 SOUTH AMERICA: MARINE ENGINES MARKET, BY POWER RANGE, 2024-2029 (UNIT)

- TABLE 231 SOUTH AMERICA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 232 SOUTH AMERICA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- TABLE 233 SOUTH AMERICA: MARINE ENGINES MARKET, BY VESSEL, 2020-2023 (USD MILLION)

- TABLE 234 SOUTH AMERICA: MARINE ENGINES MARKET, BY VESSEL, 2024-2029 (USD MILLION)

- TABLE 235 SOUTH AMERICA: MARINE ENGINES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 236 SOUTH AMERICA: MARINE ENGINES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.6.2 BRAZIL

- 11.6.2.1 Growing offshore oil exploration to drive market

- TABLE 237 BRAZIL: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 238 BRAZIL: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 239 BRAZIL: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 240 BRAZIL: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.6.3 ARGENTINA

- 11.6.3.1 Rising shipbuilding sector to drive market

- TABLE 241 ARGENTINA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 242 ARGENTINA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 243 ARGENTINA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 244 ARGENTINA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

- 11.6.4 REST OF SOUTH AMERICA

- TABLE 245 REST OF SOUTH AMERICA: MARINE ENGINES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 246 REST OF SOUTH AMERICA: MARINE ENGINES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 247 REST OF SOUTH AMERICA: MARINE ENGINES MARKET, BY FUEL, 2020-2023 (USD MILLION)

- TABLE 248 REST OF SOUTH AMERICA: MARINE ENGINES MARKET, BY FUEL, 2024-2029 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- TABLE 249 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, APRIL 2020-FEBRUARY 2024

- 12.1 KEY PLAYER STRATEGIES

- 12.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 250 MARINE ENGINES MARKET: DEGREE OF COMPETITION

- FIGURE 50 MARINE ENGINES MARKET SHARE ANALYSIS, 2023

- 12.3 REVENUE ANALYSIS

- FIGURE 51 TOP PLAYERS IN MARINE ENGINES MARKET FROM 2018 TO 2022

- 12.4 COMPANY EVALUATION MATRIX

- 12.4.1 STARS

- 12.4.2 PERVASIVE PLAYERS

- 12.4.3 EMERGING LEADERS

- 12.4.4 PARTICIPANTS

- FIGURE 52 MARINE ENGINES MARKET: COMPANY EVALUATION MATRIX, 2023

- 12.4.5 OVERALL COMPANY FOOTPRINT (20 COMPANIES)

- FIGURE 53 OVERALL COMPANY FOOTPRINT (20 COMPANIES)

- 12.4.6 FUEL: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 251 FUEL: COMPANY FOOTPRINT (25 COMPANIES)

- 12.4.7 POWER RANGE: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 252 POWER RANGE: COMPANY FOOTPRINT (25 COMPANIES)

- 12.4.8 ENGINE: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 253 ENGINE: COMPANY FOOTPRINT (25 COMPANIES)

- 12.4.9 TYPE: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 254 TYPE: COMPANY FOOTPRINT (25 COMPANIES)

- 12.4.10 REGION: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 255 REGION: COMPANY FOOTPRINT (25 COMPANIES)

- 12.4.11 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.4.12 PROGRESSIVE COMPANIES

- 12.4.13 RESPONSIVE COMPANIES

- 12.4.14 DYNAMIC COMPANIES

- 12.4.15 STARTING BLOCKS

- FIGURE 54 MARINE ENGINES MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 12.4.16 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- TABLE 256 MARINE ENGINES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 257 MARINE ENGINES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 55 EV/EBITDA OF KEY VENDORS

- FIGURE 56 COMPANY VALUATION OF KEY VENDORS

- 12.6 MARINE ENGINES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 57 BRAND/PRODUCT COMPARISON OF KEY VENDORS

- 12.7 COMPETITIVE SCENARIO AND TRENDS

- 12.7.1 PRODUCT LAUNCHES

- TABLE 258 MARINE ENGINES MARKET: PRODUCT LAUNCHES, APRIL 2020 - FEBRUARY 2024

- 12.7.2 DEALS

- TABLE 259 MARINE ENGINES MARKET: DEALS, MAY 2020 - FEBRUARY 2024

- 12.7.3 OTHERS

- TABLE 260 MARINE ENGINES MARKET: OTHERS, DECEMBER 2020 - FEBRUARY 2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1.1 CATERPILLAR

- TABLE 261 CATERPILLAR: COMPANY OVERVIEW

- FIGURE 58 CATERPILLAR: COMPANY SNAPSHOT (2023)

- TABLE 262 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 CATERPILLAR: PRODUCT LAUNCHES

- TABLE 264 CATERPILLAR: DEALS

- TABLE 265 CATERPILLAR: OTHERS

- 13.1.2 WARTSILA

- TABLE 266 WARTSILA: COMPANY OVERVIEW

- FIGURE 59 WARTSILA: COMPANY SNAPSHOT (2023)

- TABLE 267 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 WARTSILA: PRODUCT LAUNCHES

- TABLE 269 WARTSILA: DEALS

- TABLE 270 WARTSILA: CONTRACTS

- 13.1.3 MAN ENERGY SOLUTIONS

- TABLE 271 MAN ENERGY SOLUTIONS: COMPANY OVERVIEW

- FIGURE 60 MAN ENERGY SOLUTIONS: COMPANY SNAPSHOT (2022)

- TABLE 272 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS): PRODUCT LAUNCHES

- TABLE 274 MAN ENERGY SOLUTIONS: DEALS

- TABLE 275 MAN ENERGY SOLUTIONS: OTHERS

- 13.1.4 AB VOLVO PENTA

- TABLE 276 AB VOLVO PENTA: COMPANY OVERVIEW

- FIGURE 61 AB VOLVO PENTA: COMPANY SNAPSHOT (2023)

- TABLE 277 AB VOLVO PENTA: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 278 AB VOLVO PENTA: PRODUCT LAUNCHES

- TABLE 279 AB VOLVO PENTA: DEALS

- TABLE 280 AB VOLVO PENTA: OTHERS

- 13.1.5 ROLLS-ROYCE PLC

- TABLE 281 ROLLS-ROYCE PLC: COMPANY OVERVIEW

- FIGURE 62 ROLLS-ROYCE PLC: COMPANY SNAPSHOT (2023)

- TABLE 282 ROLLS-ROYCE PLC: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 283 ROLLS-ROYCE HOLDINGS: DEALS

- TABLE 284 ROLLS- ROYCE PLC: CONTRACTS

- 13.1.6 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.

- TABLE 285 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- FIGURE 63 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: COMPANY SNAPSHOT (2022)

- TABLE 286 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 287 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: DEALS

- TABLE 288 HD HYUNDAI HEAVY INDUSTRIES CO., LTD.: CONTRACTS

- 13.1.7 MITSUBISHI HEAVY INDUSTRIES, LTD.

- TABLE 289 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- FIGURE 64 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT (2023)

- TABLE 290 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 292 MITSUBISHI HEAVY INDUSTRIES, LTD.: OTHERS

- 13.1.8 CUMMINS INC.

- TABLE 293 CUMMINS INC.: COMPANY OVERVIEW

- FIGURE 65 CUMMINS INC.: COMPANY SNAPSHOT (2023)

- TABLE 294 CUMMINS INC.: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 295 CUMMINS INC.: PRODUCT LAUNCHES

- TABLE 296 CUMMINS INC.: DEALS

- 13.1.9 DAIHATSU DIESEL MFG. CO., LTD.

- TABLE 297 DAIHATSU DIESEL MFG., CO. LTD.: COMPANY OVERVIEW

- FIGURE 66 DAIHATSU DIESEL MFG. CO. LTD: COMPANY SNAPSHOT (2023)

- TABLE 298 DAIHATSU DIESEL MFG. CO., LTD.: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 299 DAIHATSU DIESEL MFG. CO LTD.: PRODUCT LAUNCHES

- TABLE 300 DAIHATSU: DEALS

- TABLE 301 DAIHATSU DIESEL MFG. CO., LTD.: OTHERS

- 13.1.10 DEUTZ AG

- TABLE 302 DEUTZ AG: COMPANY OVERVIEW

- FIGURE 67 DEUTZ AG: COMPANY SNAPSHOT (2023)

- TABLE 303 DEUTZ AG: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 304 DEUTZ AG: DEALS

- TABLE 305 DEUTZ AG: OTHERS

- 13.1.11 WINGD

- TABLE 306 WINGD: COMPANY OVERVIEW

- TABLE 307 WINGD: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 308 WINGD: PRODUCT LAUNCHES

- TABLE 309 WINGD: DEALS

- TABLE 310 WINGD: OTHERS

- 13.1.12 FAIRBANKS MORSE DEFENSE

- TABLE 311 FAIRBANKS MORSE DEFENSE: COMPANY OVERVIEW

- TABLE 312 FAIRBANKS MORSE: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 313 FAIRBANKS MORSE DEFENSE: PRODUCT LAUNCHES

- TABLE 314 FAIRBANKS MORSE DEFENSE: DEALS

- TABLE 315 FAIRBANKS MORSE DEFENSE: OTHERS

- 13.1.13 WABTEC CORPORATION

- TABLE 316 WABTEC CORPORATION: COMPANY OVERVIEW

- FIGURE 68 WABTEC CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 317 WABTEC CORPORATION: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 318 WABTEC CORPORATION: OTHERS

- 13.1.14 YANMAR MARINE INTERNATIONAL

- TABLE 319 YANMAR MARINE INTERNATIONAL: COMPANY OVERVIEW

- TABLE 320 YANMAR MARINE INTERNATIONAL: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 321 YANMAR MARINE INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 322 YANMAR MARINE INTERNATIONAL: DEALS

- 13.1.15 ISOTTA FRASCHINI MOTORI S.P.A.

- TABLE 323 ISOTTA FRASCHINI MOTORI S.P.A.: COMPANY OVERVIEW

- TABLE 324 ISOTTA FRASCHINI MOTORI S.P.A.: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 CNPC JICHAI POWER COMPANY LIMITED

- 13.2.2 BERGEN ENGINES

- 13.2.3 MAHINDRA POWEROL

- 13.2.4 IHI POWER SYSTEMS CO., LTD.

- 13.2.5 WEICHAI HOLDING GROUP CO., LTD.

- 13.2.6 AGCO POWER

- 13.2.7 PERKINS ENGINES COMPANY LIMITED

- 13.2.8 KAWASAKI HEAVY INDUSTRIES, LTD.

- 13.2.9 SCANIA

- 13.2.10 COOPER CORP.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS