|

|

市場調査レポート

商品コード

1667630

質量分析の世界市場:製品別、サンプル別、用途別、エンドユーザー別 - 予測(~2030年)Mass Spectrometry Market by Product(Instrument (Triple Quadrupole, Q-TOF, FTMS, Quadrupole, TOF), Software & Services), Sample(LC-MS, GC-MS), Application (Omics, Drug Discovery, Food, Environmental), End User(Pharma, Biotech)-Global Forecasts to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 質量分析の世界市場:製品別、サンプル別、用途別、エンドユーザー別 - 予測(~2030年) |

|

出版日: 2025年02月04日

発行: MarketsandMarkets

ページ情報: 英文 365 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の質量分析の市場規模は、2024年の63億3,000万米ドルから2030年までに96億2,000万米ドルに達すると予測され、予測期間にCAGRで7.2%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 米ドル |

| セグメント | 製品、サンプル調製技法、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

市場の成長は、PFASやマイクロプラスチックのような分析物の環境サンプル検査における質量分析計の利用の増加が予測されることによるものと考えられます。製薬産業が研究開発により多くの予算を割り当て、医薬品の安全性に関する政府規制が質量分析計の需要を増加させます。エネルギー探査や気候研究への投資の増加は質量分析計の需要を刺激します。また、食品・飲料検査に高感度な定性・定量検査が義務付けられることで、質量分析市場の需要が増加すると予測されます。

「製品別では、器具セグメントが2023年に世界の質量分析市場で最大のシェアを占めました。」

ハイブリッド質量分析セグメントが質量分析市場で最大のシェアを占める。ハイブリッド質量分析は、迅速かつ高分解能の検査能力を発揮し、より正確で精密な結果を得ることができます。ハイブリッド質量分析計は、イオン源からイオン検出器まで、異なるタイプの質量分析計を少なくとも2つ、順に配置したものです。これにより、感度、精度、分解能、効率が大幅に向上し、その採用は単一の質量分析計と比較してかなりのレベルで進んでいます。さらに、ハイブリッド質量分析計で行われる分析では、大量の複雑なデータが高速かつ高分解能で得られ、正確で優れた分析が可能になるため、各社はこのようなデータセットを管理し分析するソフトウェアを提供する傾向にあります。

質量分析装置市場の成長は主に、分子量測定による未知の物質の分類、既知化合物の測定、分子の構造と化学的性質の決定などのさまざまな用途に使用できる質量分析計が提供する処理手順上の利点によって促進されています。

「サンプル調製技法別では、LC-MSセグメントが予測期間に最大のシェアを占めます。」

LC-MSは、さまざまな複雑なサンプルから得られた未知の化合物の定量および同定に、さまざまな部門でもっとも一般的に使用されている分析技術の1つです。LC-MSの使用は、分析における選択性と特異性の両方を提供するため、年々拡大しています。質量分析の進歩により、この技法の感度と精度はさらに向上し、複雑なサンプルマトリクス中の低レベルの分析物の検出と同定が可能になりました。液体クロマトグラフィ(LC)は、分析前にサンプルから化合物を分離するために広く使用されている技法であり、質量分析と頻繁に併用されます。

サードパーティ検査サービスプロバイダーやラボからの新たな汚染物質の検査に向けたLC-MSの新用途の登場は、過去3年間で増加しました。これらすべての条件が、LC-MSが質量分析市場で大きなシェアを獲得するのに役立っています。

「用途別では、オミクス研究セグメントが予測期間にもっとも速い成長を記録します。」

質量分析計は高感度で選択性が高いため、一塩基多型やショートタンデムリピートの特性解析を行うゲノミクス研究にも応用されています。メタボロミクスでは、健康な人と2型糖尿病患者から抽出した代謝物の血清プロファイルにおける特異的な変化を区別するのに役立つため、質量分析は糖尿病研究においても有望な結果を示しています。また、新生児スクリーニングにも有効で、先天性代謝異常の多重化アッセイのポートフォリオにつながっています。

オミクス研究セグメントは、予測期間に大きな成長が見込まれます。バイオ医薬品・バイオテクノロジー産業は、研究開発部門における診断バイオマーカー同定用途の進歩を促進しており、今後数年間におけるこの業界の大幅な成長と優位性につながります。

当レポートでは、世界の質量分析市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 質量分析市場の概要

- 質量分析の市場シェア:製品別(2024年・2030年)

- 質量分析市場:注入口タイプ別(2024年・2030年)

- 質量分析市場:エンドユーザー別(2024年・2030年)

- 質量分析市場:地域別(2023年)

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 平均販売価格の動向:主要企業別

- 平均販売価格の動向:地域別

- バリューチェーン分析

- 研究開発

- 原材料調達、製品開発

- マーケティング、販売、流通

- アフターサービス

- サプライチェーン分析

- 著名企業

- 中小企業

- エンドユーザー

- 販売と流通

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- HSコード9027の輸入シナリオ

- HSコード9027の輸出シナリオ

- 主な会議とイベント(2025年~2026年)

- ケーススタディ分析

- 規制情勢

- 規制分析

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- アンメットニーズ

- 質量分析市場に対するAI/生成AIの影響

- イントロダクション

- 質量分析の市場潜在力

- AIのユースケース

- AIを導入している主要企業

- 質量分析エコシステムにおけるAI/生成AIの未来

第6章 質量分析市場:注入口タイプ別

- イントロダクション

- LC-MS

- GC-MS

- ICP-MS

- その他の注入口タイプ

第7章 質量分析市場:製品別

- イントロダクション

- 器具

- ハイブリッド質量分析器具

- シングル質量分析器具

- その他の質量分析器具

- ソフトウェア・サービス

第8章 質量分析市場:用途別

- イントロダクション

- オミクス研究

- 創薬

- 環境試験

- 食品検査

- 医薬品/バイオ医薬品製造

- 臨床診断

- 応用科学

- その他の用途

第9章 質量分析市場:エンドユーザー別

- イントロダクション

- 製薬企業

- バイオテクノロジー企業

- 研究室・学術機関

- 環境試験所

- 食品・飲料産業

- 法医学研究所

- 石油化学産業

- その他のエンドユーザー

第10章 質量分析市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- 東南アジア

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 市場ランキング分析(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- AGILENT TECHNOLOGIES, INC.

- THERMO FISHER SCIENTIFIC INC.

- WATERS CORPORATION

- DANAHER

- BRUKER

- SHIMADZU CORPORATION

- MKS INSTRUMENTS

- PERKINELMER

- JEOL LTD.

- HITACHI HIGH-TECH CORPORATION

- TELEDYNE TECHNOLOGIES INCORPORATED

- AMETEK.INC.

- JASCO CORPORATION

- F. HOFFMANN-LA ROCHE LTD

- その他の企業

- ANALYTIK JENA GMBH+CO. KG

- HIDEN ANALYTICAL

- LECO CORPORATION

- RIGAKU HOLDINGS CORPORATION

- YOUNGIN CHROMASS

- SCION INSTRUMENTS

- KORE TECHNOLOGY

- PROCESS INSIGHTS, INC.

- MASSTECH

- ADVION, INC.

- SPACETEK TECHNOLOGY AG

- ELEMENTAR ANALYSENSYSTEME GMBH

- SKYRAY INSTRUMENTS USA, INC.

- MICROSAIC

- PFEIFFER VACUUM+FAB SOLUTIONS

第13章 付録

List of Tables

- TABLE 1 MASS SPECTROMETRY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MASS SPECTROMETRY MARKET: RISK ANALYSIS

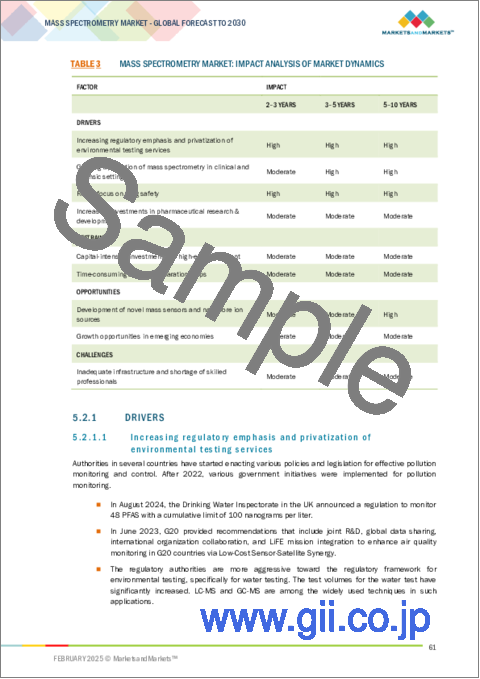

- TABLE 3 MASS SPECTROMETRY MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 4 DRUG WARNINGS/RECALLS IN INDIA, 2021-2024

- TABLE 5 AVERAGE SELLING PRICING TREND OF MASS SPECTROMETERS, BY KEY PLAYER, 2022-2024

- TABLE 6 AVERAGE SELLING PRICING TREND OF MASS SPECTROMETERS, BY REGION, 2022-2024

- TABLE 7 MASS SPECTROMETRY MARKET: ROLE OF COMPANIES/ORGANIZATIONS IN ECOSYSTEM

- TABLE 8 MASS SPECTROMETRY MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2024

- TABLE 9 IMPORT SCENARIO FOR HS CODE 9027, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 EXPORT SCENARIO FOR HS CODE 9027, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 MASS SPECTROMETRY MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 USE OF MASS SPECTROMETRY INSTRUMENTS FOR CLINICAL DIAGNOSTICS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MASS SPECTROMETRY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE OF PRODUCT

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 21 MASS SPECTROMETRY MARKET: LIST OF UNMET NEEDS

- TABLE 22 MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030(USD MILLION)

- TABLE 23 MASS SPECTROMETRY MARKET FOR LC-MS INLET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 24 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR LC-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 25 EUROPE: MASS SPECTROMETRY MARKET FOR LC-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 26 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR LC-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 27 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR LC-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 28 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR LC-MS INLET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 29 MASS SPECTROMETRY MARKET FOR GC-MS INLET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR GC-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 31 EUROPE: MASS SPECTROMETRY MARKET FOR GC-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR GC-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 33 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR GC-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 34 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR GC-MS INLET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 35 MASS SPECTROMETRY MARKET FOR ICP-MS INLET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR ICP-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 37 EUROPE: MASS SPECTROMETRY MARKET FOR ICP-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR ICP-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 39 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR ICP-MS INLET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 40 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR ICP-MS INLET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 41 MASS SPECTROMETRY MARKET FOR OTHER INLET TYPES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR OTHER INLET TYPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 43 EUROPE: MASS SPECTROMETRY MARKET FOR OTHER INLET TYPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR OTHER INLET TYPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 45 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR OTHER INLET TYPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 46 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR OTHER INLET TYPES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 47 MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 48 HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2023 VS. 2024 VS. 2030 (UNITS SOLD)

- TABLE 49 SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2023 VS 2024 VS 2030 (UNITS SOLD)

- TABLE 50 MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 51 MASS SPECTROMETRY INSTRUMENTS MARKET, BY INLET TYPE, 2022-2030(USD MILLION)

- TABLE 52 MASS SPECTROMETRY INSTRUMENTS MARKET, BY APPLICATION, 2022-2030(USD MILLION)

- TABLE 53 MASS SPECTROMETRY INSTRUMENTS MARKET, BY END USER, 2022-2030(USD MILLION)

- TABLE 54 MASS SPECTROMETRY INSTRUMENTS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 55 HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 56 HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 57 HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY INLET TYPE, 2022-2030(USD MILLION)

- TABLE 58 HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY APPLICATION, 2022-2030(USD MILLION)

- TABLE 59 HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 60 TRIPLE QUADRUPOLE MASS SPECTROMETRY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 61 Q-TOF MASS SPECTROMETRY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 62 FOURIER TRANSFORM MASS SPECTROMETRY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 63 SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 64 SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 65 SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 66 SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY END USER, 2022-2030 (USD MILLION)

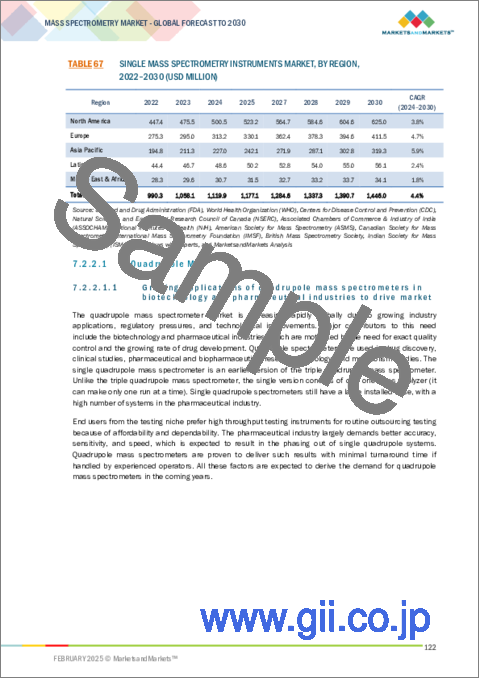

- TABLE 67 SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 68 QUADRUPOLE MASS SPECTROMETRY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 69 TIME-OF-FLIGHT MASS SPECTROMETRY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 70 ION TRAP MASS SPECTROMETRY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 71 OTHER MASS SPECTROMETRY INSTRUMENTS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 72 OTHER MASS SPECTROMETRY INSTRUMENTS MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 73 OTHER MASS SPECTROMETRY INSTRUMENTS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 74 OTHER MASS SPECTROMETRY INSTRUMENTS MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 75 MASS SPECTROMETRY MARKET FOR SOFTWARE & SERVICES, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 76 MASS SPECTROMETRY MARKET FOR SOFTWARE & SERVICES, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 77 MASS SPECTROMETRY MARKET FOR SOFTWARE & SERVICES, BY END USER, 2022-2030 (USD MILLION)

- TABLE 78 MASS SPECTROMETRY MARKET FOR SOFTWARE & SERVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 79 MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 80 MASS SPECTROMETRY MARKET FOR OMICS RESEARCH, BY REGION, 2022-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR OMICS RESEARCH, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 82 EUROPE: MASS SPECTROMETRY MARKET FOR OMICS RESEARCH, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC MASS SPECTROMETRY MARKET FOR OMICS RESEARCH, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 84 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR OMICS RESEARCH, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR OMICS RESEARCH, BY REGION, 2022-2030 (USD MILLION)

- TABLE 86 MASS SPECTROMETRY MARKET FOR DRUG DISCOVERY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 88 EUROPE: MASS SPECTROMETRY MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 90 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR DRUG DISCOVERY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 92 MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING, BY REGION, 2022-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 94 EUROPE: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 96 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING, BY REGION, 2022-2030 (USD MILLION)

- TABLE 98 MASS SPECTROMETRY MARKET FOR FOOD TESTING, BY REGION, 2022-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR FOOD TESTING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 100 EUROPE: MASS SPECTROMETRY MARKET FOR FOOD TESTING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR FOOD TESTING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 102 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR FOOD TESTING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR FOOD TESTING, BY REGION, 2022-2030 (USD MILLION)

- TABLE 104 MASS SPECTROMETRY MARKET FOR PHARMA/BIOPHARMA MANUFACTURING, BY REGION, 2022-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR PHARMA/BIOPHARMA MANUFACTURING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 106 EUROPE: MASS SPECTROMETRY MARKET FOR PHARMA/BIOPHARMA MANUFACTURING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR PHARMA/BIOPHARMA MANUFACTURING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR PHARMA/BIOPHARMA MANUFACTURING, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR PHARMA/BIOPHARMA MANUFACTURING, BY REGION, 2022-2030 (USD MILLION)

- TABLE 110 MASS SPECTROMETRY MARKET FOR CLINICAL DIAGNOSTICS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR CLINICAL DIAGNOSTICS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 112 EUROPE: MASS SPECTROMETRY MARKET FOR CLINICAL DIAGNOSTICS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR CLINICAL DIAGNOSTICS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 114 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR CLINICAL DIAGNOSTICS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR CLINICAL DIAGNOSTICS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 116 MASS SPECTROMETRY MARKET FOR APPLIED SCIENCES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR APPLIED SCIENCES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 118 EUROPE: MASS SPECTROMETRY MARKET FOR APPLIED SCIENCES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR APPLIED SCIENCES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 120 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR APPLIED SCIENCES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR APPLIED SCIENCES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 122 MASS SPECTROMETRY MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 124 EUROPE: MASS SPECTROMETRY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 126 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 128 MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 129 MASS SPECTROMETRY MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 131 EUROPE: MASS SPECTROMETRY MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 133 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 135 MASS SPECTROMETRY MARKET FOR BIOTECHNOLOGY COMPANIES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 137 EUROPE: MASS SPECTROMETRY MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 139 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA MASS SPECTROMETRY MARKET FOR BIOTECHNOLOGY COMPANIES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 141 MASS SPECTROMETRY MARKET FOR RESEARCH LABS & ACADEMIC INSTITUTES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR RESEARCH LABS & ACADEMIC INSTITUTES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 143 EUROPE: MASS SPECTROMETRY MARKET FOR RESEARCH LABS & ACADEMIC INSTITUTES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR RESEARCH LABS & ACADEMIC INSTITUTES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 145 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR RESEARCH LABS & ACADEMIC INSTITUTES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR RESEARCH LABS & ACADEMIC INSTITUTES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 147 MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING LABS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING LABS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 149 EUROPE: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING LABS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING LABS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING LABS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR ENVIRONMENTAL TESTING LABS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 153 MASS SPECTROMETRY MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 154 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 155 EUROPE: MASS SPECTROMETRY MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 157 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 159 MASS SPECTROMETRY MARKET FOR FORENSIC LABS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 160 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR FORENSIC LABS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 161 EUROPE: MASS SPECTROMETRY MARKET FOR FORENSIC LABS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR FORENSIC LABS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 163 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR FORENSIC LABS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR FORENSIC LABS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 165 MASS SPECTROMETRY MARKET FOR PETROCHEMICAL INDUSTRY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 166 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR PETROCHEMICAL INDUSTRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 167 EUROPE: MASS SPECTROMETRY MARKET FOR PETROCHEMICAL INDUSTRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR PETROCHEMICAL INDUSTRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR PETROCHEMICAL INDUSTRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR PETROCHEMICAL INDUSTRY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 171 MASS SPECTROMETRY MARKET FOR OTHER END USERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 172 NORTH AMERICA: MASS SPECTROMETRY MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 173 EUROPE: MASS SPECTROMETRY MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MASS SPECTROMETRY MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: MASS SPECTROMETRY MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET FOR OTHER END USERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 177 MASS SPECTROMETRY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 178 MASS SPECTROMETRY MARKET, BY REGION, 2023 VS. 2024 VS. 2030 (UNIT SALES)

- TABLE 179 NORTH AMERICA: MASS SPECTROMETRY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 180 NORTH AMERICA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 182 NORTH AMERICA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 184 NORTH AMERICA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 187 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- TABLE 188 US: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 189 US: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 190 US: HYBRID MASS SPECTROMETRY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 191 US: SINGLE MASS SPECTROMETRY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 192 US: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 193 US: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 194 US: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 195 CANADA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 196 CANADA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 197 CANADA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 198 CANADA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 199 CANADA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 200 CANADA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 201 CANADA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 202 EUROPE: MASS SPECTROMETRY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 203 EUROPE: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 204 EUROPE: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 205 EUROPE: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 206 EUROPE: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 207 EUROPE: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 208 EUROPE: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 209 EUROPE: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 210 MACROECONOMIC OUTLOOK FOR EUROPE

- TABLE 211 GERMANY: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 212 GERMANY: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 213 GERMANY: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 214 GERMANY: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 215 GERMANY: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 216 GERMANY: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 217 GERMANY: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 218 UK: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 219 UK: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 220 UK: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 221 UK: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 222 UK: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 223 UK: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 224 UK: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 225 FRANCE: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 226 FRANCE: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 227 FRANCE: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 228 FRANCE: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 229 FRANCE: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 230 FRANCE: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 231 FRANCE: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 232 ITALY: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 233 ITALY: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 234 ITALY: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 235 ITALY: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 236 ITALY: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 237 ITALY: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 238 ITALY: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 239 SPAIN: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 240 SPAIN: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 241 SPAIN: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 242 SPAIN: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 243 SPAIN: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 244 SPAIN: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 245 SPAIN: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 246 REST OF EUROPE: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 247 REST OF EUROPE: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 248 REST OF EUROPE: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 249 REST OF EUROPE: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 250 REST OF EUROPE: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 251 REST OF EUROPE: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 252 REST OF EUROPE: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 253 ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 254 ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 255 ASIA PACIFIC: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 256 ASIA PACIFIC: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 257 ASIA PACIFIC: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 258 ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 259 ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 260 ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 261 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- TABLE 262 JAPAN: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 263 JAPAN: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 264 JAPAN: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 265 JAPAN: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 266 JAPAN: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 267 JAPAN: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 268 JAPAN: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 269 CHINA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 270 CHINA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 271 CHINA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 272 CHINA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 273 CHINA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 274 CHINA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 275 CHINA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 276 INDIA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 277 INDIA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 278 INDIA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 279 INDIA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 280 INDIA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 281 INDIA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 282 INDIA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 283 SOUTH KOREA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 284 SOUTH KOREA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 285 SOUTH KOREA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 286 SOUTH KOREA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 287 SOUTH KOREA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 288 SOUTH KOREA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 289 SOUTH KOREA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 290 AUSTRALIA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 291 AUSTRALIA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 292 AUSTRALIA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 293 AUSTRALIA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 294 AUSTRALIA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 295 AUSTRALIA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 296 AUSTRALIA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 297 SOUTHEAST ASIA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 298 SOUTHEAST ASIA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 299 SOUTHEAST ASIA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 300 SOUTHEAST ASIA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 301 SOUTHEAST ASIA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 302 SOUTHEAST ASIA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 303 SOUTHEAST ASIA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 304 REST OF ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 305 REST OF ASIA PACIFIC: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 306 REST OF ASIA PACIFIC: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 307 REST OF ASIA PACIFIC: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 308 REST OF ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 309 REST OF ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 310 REST OF ASIA PACIFIC: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 311 LATIN AMERICA: MASS SPECTROMETRY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 312 LATIN AMERICA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 313 LATIN AMERICA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 314 LATIN AMERICA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 315 LATIN AMERICA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 316 LATIN AMERICA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 317 LATIN AMERICA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 318 LATIN AMERICA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 319 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- TABLE 320 BRAZIL: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 321 BRAZIL: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 322 BRAZIL: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 323 BRAZIL: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 324 BRAZIL: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 325 BRAZIL: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 326 BRAZIL: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 327 MEXICO: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 328 MEXICO: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 329 MEXICO: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 330 MEXICO: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 331 MEXICO: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 332 MEXICO: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 333 MEXICO: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 334 REST OF LATIN AMERICA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 335 REST OF LATIN AMERICA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 336 REST OF LATIN AMERICA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 337 REST OF LATIN AMERICA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 338 REST OF LATIN AMERICA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 339 REST OF LATIN AMERICA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 340 REST OF LATIN AMERICA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 341 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 342 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 343 MIDDLE EAST & AFRICA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 344 MIDDLE EAST & AFRICA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 345 MIDDLE EAST & AFRICA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 346 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 347 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 348 MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 349 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- TABLE 350 GCC COUNTRIES: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 351 GCC COUNTRIES: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 352 GCC COUNTRIES: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 353 GCC COUNTRIES: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 354 GCC COUNTRIES: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 355 GCC COUNTRIES: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 356 GCC COUNTRIES: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 357 REST OF MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 358 REST OF MIDDLE EAST & AFRICA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 359 REST OF MIDDLE EAST & AFRICA: HYBRID MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 360 REST OF MIDDLE EAST & AFRICA: SINGLE MASS SPECTROMETRY INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 361 REST OF MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY INLET TYPE, 2022-2030 (USD MILLION)

- TABLE 362 REST OF MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 363 REST OF MIDDLE EAST & AFRICA: MASS SPECTROMETRY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 364 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MASS SPECTROMETRY MARKET, 2021-2024

- TABLE 365 MASS SPECTROMETRY MARKET: DEGREE OF COMPETITION

- TABLE 366 MASS SPECTROMETRY MARKET: REGION FOOTPRINT

- TABLE 367 MASS SPECTROMETRY MARKET: PRODUCT FOOTPRINT

- TABLE 368 MASS SPECTROMETRY MARKET: APPLICATION FOOTPRINT

- TABLE 369 MASS SPECTROMETRY MARKET: END-USER FOOTPRINT

- TABLE 370 MASS SPECTROMETRY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 371 MASS SPECTROMETRY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 372 MASS SPECTROMETRY MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 373 MASS SPECTROMETRY MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 374 MASS SPECTROMETRY MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 375 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 376 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 377 AGILENT TECHNOLOGIES, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 378 AGILENT TECHNOLOGIES, INC.: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 379 AGILENT TECHNOLOGIES INC.: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 380 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 381 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 382 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 383 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 384 THERMO FISHER SCIENTIFIC INC.: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 385 WATERS CORPORATION: COMPANY OVERVIEW

- TABLE 386 WATERS CORPORATION: PRODUCTS OFFERED

- TABLE 387 WATERS CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 388 WATERS CORPORATION: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 389 WATERS CORPORATION: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 390 DANAHER: COMPANY OVERVIEW

- TABLE 391 DANAHER: PRODUCTS OFFERED

- TABLE 392 DANAHER: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 393 DANAHER: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 394 DANAHER: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 395 BRUKER: COMPANY OVERVIEW

- TABLE 396 BRUKER: PRODUCTS OFFERED

- TABLE 397 BRUKER: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 398 BRUKER: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 399 BRUKER: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 400 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 401 SHIMADZU CORPORATION: PRODUCTS OFFERED

- TABLE 402 SHIMADZU CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 403 SHIMADZU CORPORATION: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 404 SHIMADZU CORPORATION: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 405 MKS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 406 MKS INSTRUMENTS: PRODUCTS OFFERED

- TABLE 407 PERKINELMER: COMPANY OVERVIEW

- TABLE 408 PERKINELMER: PRODUCTS OFFERED

- TABLE 409 PERKINELMER: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 410 PERKINELMER: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 411 JEOL LTD.: COMPANY OVERVIEW

- TABLE 412 JEOL LTD.: PRODUCTS OFFERED

- TABLE 413 HITACHI HIGH-TECH CORPORATION: COMPANY OVERVIEW

- TABLE 414 HITACHI HIGH-TECH CORPORATION: PRODUCTS OFFERED

- TABLE 415 HITACHI HIGH-TECH CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-DECEMBER 2024

- TABLE 416 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 417 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 418 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 419 AMETEK.INC.: COMPANY OVERVIEW

- TABLE 420 AMETEK.INC.: PRODUCTS OFFERED

- TABLE 421 JASCO CORPORATION: COMPANY OVERVIEW

- TABLE 422 JASCO CORPORATION: PRODUCTS OFFERED

- TABLE 423 F. HOFFMANN-LA ROCHE LTD: COMPANY OVERVIEW

- TABLE 424 F. HOFFMANN-LA ROCHE LTD: PRODUCTS OFFERED

- TABLE 425 F. HOFFMANN-LA ROCHE LTD: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 426 ANALYTIK JENA GMBH+CO. KG: COMPANY OVERVIEW

- TABLE 427 HIDEN ANALYTICAL: COMPANY OVERVIEW

- TABLE 428 LECO CORPORATION: COMPANY OVERVIEW

- TABLE 429 RIGAKU HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 430 YOUNGIN CHROMASS: COMPANY OVERVIEW

- TABLE 431 SCION INSTRUMENTS: COMPANY OVERVIEW

- TABLE 432 KORE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 433 PROCESS INSIGHTS, INC.: COMPANY OVERVIEW

- TABLE 434 MASSTECH: COMPANY OVERVIEW

- TABLE 435 ADVION, INC.: COMPANY OVERVIEW

- TABLE 436 SPACETEK TECHNOLOGY AG: COMPANY OVERVIEW

- TABLE 437 ELEMENTAR ANALYSENSYSTEME GMBH: COMPANY OVERVIEW

- TABLE 438 SKYRAY INSTRUMENTS USA, INC.: COMPANY OVERVIEW

- TABLE 439 MICROSAIC: COMPANY OVERVIEW

- TABLE 440 PFEIFFER VACUUM+FAB SOLUTIONS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MASS SPECTROMETRY MARKET SEGMENTATION AND REGIONS COVERED

- FIGURE 2 MASS SPECTROMETRY MARKET: YEARS CONSIDERED

- FIGURE 3 MASS SPECTROMETRY MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2023

- FIGURE 7 MASS SPECTROMETRY MARKET: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 8 MASS SPECTROMETRY MARKET: GROWTH PROJECTIONS BASED ON REVENUE IMPACT OF KEY MACRO INDICATORS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 MASS SPECTROMETRY MARKET, BY PRODUCT, 2024 VS. 2030 (USD MILLION)

- FIGURE 11 MASS SPECTROMETRY MARKET SHARE, BY INLET TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 12 MASS SPECTROMETRY MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 13 MASS SPECTROMETRY MARKET, BY END USER, 2024 VS. 2030

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF MASS SPECTROMETRY MARKET, 2024-2030

- FIGURE 15 GROWING RESEARCH IN PROTEOMICS AND METABOLOMICS TO DRIVE MARKET

- FIGURE 16 SOFTWARE & SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 LC-MS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 PHARMACEUTICAL COMPANIES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 MASS SPECTROMETRY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF MASS SPECTROMETERS, BY KEY PLAYER, 2022-2024 (USD THOUSAND)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF MASS SPECTROMETERS, BY REGION, 2022-2024 (USD THOUSAND)

- FIGURE 24 MASS SPECTROMETRY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 MASS SPECTROMETRY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 MASS SPECTROMETRY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 MASS SPECTROMETRY MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 28 NUMBER OF DEALS IN MASS SPECTROMETRY MARKET, BY KEY PLAYER, 2020-2024

- FIGURE 29 VALUE OF DEALS IN MASS SPECTROMETRY MARKET, BY KEY PLAYER, 2020-2024 (USD THOUSAND)

- FIGURE 30 MASS SPECTROMETRY MARKET: PATENT ANALYSIS, JANUARY 2014-DECEMBER 2024

- FIGURE 31 MASS SPECTROMETRY MARKET: IMPORT SCENARIO FOR HS CODE 9027, 2019-2023

- FIGURE 32 MASS SPECTROMETRY MARKET: EXPORT SCENARIO FOR HS CODE 9027, 2019-2023

- FIGURE 33 US: PREMARKET NOTIFICATION: 510(K) APPROVALS FOR MEDICAL DEVICES

- FIGURE 34 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 35 MASS SPECTROMETRY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

- FIGURE 37 KEY BUYING CRITERIA, BY END USER

- FIGURE 38 NORTH AMERICA: MASS SPECTROMETRY MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MASS SPECTROMETRY MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MASS SPECTROMETRY MARKET, 2019-2023

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MASS SPECTROMETRY MARKET, 2023

- FIGURE 42 RANKING OF KEY PLAYERS IN MASS SPECTROMETRY INSTRUMENTS MARKET, 2023

- FIGURE 43 RANKING OF KEY PLAYERS IN MASS SPECTROMETRY SOFTWARE MARKET, 2023

- FIGURE 44 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 46 MASS SPECTROMETRY MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 MASS SPECTROMETRY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 48 MASS SPECTROMETRY MARKET: COMPANY FOOTPRINT

- FIGURE 49 MASS SPECTROMETRY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 50 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 51 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- FIGURE 52 WATERS CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 53 DANAHER: COMPANY SNAPSHOT (2023)

- FIGURE 54 BRUKER: COMPANY SNAPSHOT (2023)

- FIGURE 55 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 56 MKS INSTRUMENTS: COMPANY SNAPSHOT (2023)

- FIGURE 57 PERKINELMER: COMPANY SNAPSHOT (2023)

- FIGURE 58 JEOL LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 59 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 60 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT (2023)

- FIGURE 61 AMETEK.INC.: COMPANY SNAPSHOT (2023)

- FIGURE 62 F. HOFFMANN-LA ROCHE LTD: COMPANY SNAPSHOT (2023)

The global mass spectrometry market is estimated to reach USD 9.62 billion by 2030 from USD 6.33 billion in 2024, at a CAGR of 7.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD) |

| Segments | Product, Sample Preparation Technique, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

The market's growth can be attributed to mass spectrometers' applications in environmental sample testing of analytes like PFAS and microplastics in environmental testing which are expected to increase. The pharmaceutical industry's allocation of larger budgets for research and development and government regulation on drug safety will increase demand for mass spectrometers. Increasing investments in energy exploration and climate studies will stimulate demand for mass spectrometers. Also, the sensitive qualitative and quantitative mandates for food and beverage testing are expected to increase the demand in the mass spectrometry market.

"In terms of product, the instruments segment accounted the largest share in the global mass spectrometry market for the year 2023"

Based on the product, the mass spectrometry is segmented into instruments and software & services. The hybrid mass spectrometry segment accounts for the largest share of the mass spectrometry market. Hybrid mass spectrometers exhibit, rapid and high-resolution testing abilities with more accurate and precise results. Hybrid mass spectrometers incorporate at least two component mass analyzers of different types arranged in sequence from the ion source to the ion detector. This greatly increases their sensitivity, accuracy, resolution, and efficiency, which drives their adoption on a significant level when compared to single mass analyzers. Moreover, analyses performed with hybrid mass spectrometers yield large volumes of complex data at high speed and resolution and result in accurate and better analysis, companies tend to provide software to manage and analyze such data sets.

The growth of the mass spectrometry instruments market will primarily be driven by the procedural benefits offered by mass spectrometers as they can be used for different applications, such as classifying unknown substances by molecular weight measurement, measuring known compounds, and determining the structure and chemical properties of molecules.

"In terms of sample preparation technique, the LC-MS segment accounted for the largest share during the forecast period"

LC-MS is one of the most commonly used analytical techniques in various sectors for the quantitation and identification of unknowns from a variety of complex samples. The use of LC-MS has expanded over the years as it offers both selectivity and specificity in analysis. With advances in mass spectrometry, the sensitivity and accuracy of this technique have further increased, allowing for the detection and identification of low-level analytes in complex sample matrices. Liquid chromatography (LC) is a technique widely used to separate compounds from a sample before analysis and is frequently coupled to mass spectrometry.

The advent of new applications of LC-MS for testing emerging contaminants from third-party testing service providers and labs has increased in the last three years. All these conditions have helped LC-MS to acquire a major share in the mass spectrometry market.

"In terms of applications, the OMICS research segment registered the fastest growth during the forecast period"

Due to the high sensitivity and selection of mass spectrometry, it has also found applications in genomics research to characterize single nucleotide polymorphisms and short tandem repeats. In metabolomics, mass spectrometry has also shown promising results in diabetes studies, as it helps in distinguishing specific changes in the serum profile of metabolites extracted from healthy people and those with type 2 diabetes mellitus. It is also effective in newborn screening, leading to a portfolio of multiplexing assays for congenital metabolic errors.

The OMICS research segment is expected to witness significant growth during the forecast period. The biopharmaceutical and biotechnology industries have facilitated the advancement of diagnostics & biomarker identification applications in the R&D sector, leading to its significant growth and dominance in the industry in the upcoming years.

"In terms of end users, the pharmaceutical companies acquired the largest share of the global mass spectrometry market."

Several regulations for pharmaceutical manufacturing sites have been implemented that confines the metal residues and endotoxins in pharmaceutical products to certain limits, this is quantified on parameters for active pharmaceutical ingredients (API) in production volume. These constrictions have prompted pharmaceutical companies to procure and utilize mass spectrometers in their QC departments. Also, the anticipated revenue growth of this segment during the forecast period is attributed to the rapid expansion of the pharmaceutical industry worldwide and the technological advancements in the pharmaceutical sectors.

All these factors have favored the adoption mass spectrometry technique more to deliver quality end products.

"The market in the North America region is expected to hold significant market share for mass spectrometry in 2023."

The mass spectrometry market covers five key geographies-North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The market in the North America region is expected to hold significant market share for mass spectrometry in 2023. The growth of the mass spectrometry market in this region can be attributed to the increasing investments in pharmaceutical R&D and government funding for R&D activities.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 -35%, Tier 2- 45%, and Tier 3- 20%

- By Designation: C-level- 35%, Directors-25%, and Others-40%

- By Region: North America-40%, Europe-30%, Asia Pacific-20%, Latin America-5%, and the Middle East & Africa-3%

The key players profiled in the mass spectrometry market are Agilent Technologies, Inc. (US) Thermo Fisher Scientific, Inc. (US), Danaher Corporation (US), Waters Corporation (US), Bruker Corporation (US), Shimadzu Corporation (Japan), PerkinElmer, Inc. (US), Jeol Ltd (Japan), Jasco (Japan) Teledyne Technologies Incorporated (US), MKS Instruments (US), Ametek, Inc (US), Hitachi High-Tech Corporation (Japan)

Research Coverage

The research report examines the mass spectrometry market by product, sample preparation technique, application, end-users, and geography. This research covers factors that are driving market expansion, analyzes prospects and parameters faced by industries in the present time, and provides specifics on the competitive landscape considering market leaders and small and medium enterprises. This research also estimates the revenue of different market segments by considering five regions along with micro-market analysis.

Rationale to Buy the Report

The research report will help smaller and newer businesses as well as established ones understand the state of the market, which will help them increase their market share. Businesses that purchase the study may choose to employ one or more of the tactics listed below to increase their market presence.

This report provides insightful data on the following pointers:

- Market Penetration: In-depth coverage of product portfolios offered by the top players in the mass spectrometry market.

- Product Development/Innovation: In-depth coverage of product portfolios offered by the top players in the mass spectrometry market.

- Market Development: Insightful data on profitable developing areas.

- Market Diversification: Details about recent developments and advancements in the mass spectrometry market.

- Competitive Assessment: Extensive assessment of the products, growth tactics, revenue projections, and market categories of the top competitors.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1.1 RESEARCH DATA

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Indicative list of secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary sources

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 END USER-BASED MAPPING MARKET ESTIMATION

- 2.3 GROWTH FORECASTING MODEL

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MASS SPECTROSCOPY MARKET OVERVIEW

- 4.2 MASS SPECTROSCOPY MARKET SHARE, BY PRODUCT, 2024 VS. 2030 (USD MILLION)

- 4.3 MASS SPECTROSCOPY MARKET, BY INLET TYPE, 2024 VS. 2030 (USD MILLION)

- 4.4 MASS SPECTROSCOPY MARKET, BY END USER, 2024 VS. 2030 (USD MILLION)

- 4.5 MASS SPECTROSCOPY MARKET, BY REGION, 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing regulatory emphasis and privatization of environmental testing services

- 5.2.1.2 Growing application of mass spectrometry in clinical and forensic settings

- 5.2.1.3 Rising focus on drug safety

- 5.2.1.4 Increasing investments in pharmaceutical research & development

- 5.2.2 RESTRAINTS

- 5.2.2.1 Capital-intensive investments for high-end equipment

- 5.2.2.2 Time-consuming sample preparation steps

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of novel mass sensors and nanopore ion sources

- 5.2.3.2 Growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate infrastructure and shortage of skilled professionals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 R&D

- 5.5.2 RAW MATERIAL PROCUREMENT AND PRODUCT DEVELOPMENT

- 5.5.3 MARKETING, SALES, AND DISTRIBUTION

- 5.5.4 AFTERMARKET SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.6.4 SALES AND DISTRIBUTION

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Quadrupole mass analyzers

- 5.9.1.2 Time-of-flight mass analyzers

- 5.9.1.3 Ion trap mass analyzers

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 LC-MS

- 5.9.2.2 GC-MS

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Mass spectrometry imaging

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO FOR HS CODE 9027

- 5.11.2 EXPORT SCENARIO FOR HS CODE 9027

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 USE OF MASS SPECTROMETRY INSTRUMENTS FOR CLINICAL DIAGNOSTICS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY ANALYSIS

- 5.14.1.1 North America

- 5.14.1.2 Europe

- 5.14.1.3 Asia Pacific

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1 REGULATORY ANALYSIS

- 5.15 PORTER'S FIVE FORCE ANALYSIS

- 5.15.1 BARGAINING POWER OF SUPPLIERS

- 5.15.2 BARGAINING POWER OF BUYERS

- 5.15.3 THREAT OF NEW ENTRANTS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 KEY BUYING CRITERIA

- 5.17 UNMET NEEDS

- 5.18 IMPACT OF AI/GEN AI ON MASS SPECTROMETRY MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF MASS SPECTROMETRY

- 5.18.3 AI USE CASES

- 5.18.4 KEY COMPANIES IMPLEMENTING AI

- 5.18.5 FUTURE OF AI/GEN AI IN MASS SPECTROMETRY ECOSYSTEM

6 MASS SPECTROMETRY MARKET, BY INLET TYPE

- 6.1 INTRODUCTION

- 6.2 LC-MS

- 6.2.1 REGULATORY SHIFT TO BOOST MARKET

- 6.3 GC-MS

- 6.3.1 INCREASING FOCUS ON ANALYZING ENVIRONMENTAL CONTAMINANTS TO SUSTAIN GROWTH

- 6.4 ICP-MS

- 6.4.1 NEED FOR SIMPLE SAMPLE PREPARATION AND HIGH THROUGHPUT TO BOLSTER GROWTH

- 6.5 OTHER INLET TYPES

7 MASS SPECTROMETRY MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 INSTRUMENTS

- 7.2.1 HYBRID MASS SPECTROMETRY INSTRUMENTS

- 7.2.1.1 Triple quadrupole MS

- 7.2.1.1.1 Rising use of advanced analytical instruments to bolster growth

- 7.2.1.2 Quadrupole-time of flight MS

- 7.2.1.2.1 Increasing use of Q-TOF mass spectrometry for metabolomics research and food authenticity testing to facilitate growth

- 7.2.1.3 Fourier transform MS

- 7.2.1.3.1 Need for high resolution and mass measurement accuracy to increase growth

- 7.2.1.1 Triple quadrupole MS

- 7.2.2 SINGLE MASS SPECTROMETRY INSTRUMENTS

- 7.2.2.1 Quadrupole MS

- 7.2.2.1.1 Growing applications of quadrupole mass spectrometers in biotechnology and pharmaceutical industries to drive market

- 7.2.2.2 Time-of-flight MS

- 7.2.2.2.1 Increasing focus on biological analysis applications to expedite growth

- 7.2.2.3 Ion trap MS

- 7.2.2.3.1 Need for enhanced capabilities in research areas to contribute to growth

- 7.2.2.1 Quadrupole MS

- 7.2.3 OTHER MASS SPECTROMETRY INSTRUMENTS

- 7.2.1 HYBRID MASS SPECTROMETRY INSTRUMENTS

- 7.3 SOFTWARE & SERVICES

- 7.3.1 ONGOING AUTOMATION AND DIGITALIZATION OF LABORATORY PROCESSES TO AUGMENT GROWTH

8 MASS SPECTROMETRY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 OMICS RESEARCH

- 8.2.1 GROWING ADVANCEMENTS IN BIOLOGICAL RESEARCH IN PROTEOMICS AND GENOMICS TO PROPEL MARKET

- 8.3 DRUG DISCOVERY

- 8.3.1 NEED FOR HIGHER EFFICACY AND PRODUCT QUALITY TO ENCOURAGE GROWTH

- 8.4 ENVIRONMENTAL TESTING

- 8.4.1 GROWING WATER POLLUTION AND ENFORCEMENT OF ENVIRONMENTAL PROTECTION TO FUEL MARKET

- 8.5 FOOD TESTING

- 8.5.1 INCREASING IMPORTANCE OF SAFETY STANDARDS TO AMPLIFY GROWTH

- 8.6 PHARMA/BIOPHARMA MANUFACTURING

- 8.6.1 RISING USE OF MASS SPECTROMETRY IN PESTICIDE RESIDUE ANALYSIS, PROTEIN IDENTIFICATION, AND CARBON DATING TO AID GROWTH

- 8.7 CLINICAL DIAGNOSTICS

- 8.7.1 GROWING USE OF MASS SPECTROMETRY IN DRUG MONITORING, TOXICOLOGY, AND ENDOCRINOLOGY TO DRIVE MARKET

- 8.8 APPLIED SCIENCES

- 8.8.1 NEED FOR QUALITY CONTROL IN SEMICONDUCTOR INDUSTRY TO SUPPORT GROWTH

- 8.9 OTHER APPLICATIONS

9 MASS SPECTROMETRY MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 PHARMACEUTICAL COMPANIES

- 9.2.1 BOOMING CLINICAL TRIALS AND DRUG DISCOVERY TO STIMULATE GROWTH

- 9.3 BIOTECHNOLOGY COMPANIES

- 9.3.1 GROWING ADOPTION OF MASS SPECTROMETRY IN AGRICULTURE, PROTEOMICS, GENOMICS, AND FOOD TECHNOLOGY TO DRIVE MARKET

- 9.4 RESEARCH LABS & ACADEMIC INSTITUTES

- 9.4.1 INCREASING MASS SPECTROMETRY APPLICATIONS IN METABOLIC FINGERPRINTING ANALYSIS AND BIOMARKER DISCOVERY TO AID GROWTH

- 9.5 ENVIRONMENTAL TESTING LABS

- 9.5.1 INCREASING SOIL AND POLLUTION MONITORING TO SPEED UP GROWTH

- 9.6 FOOD & BEVERAGE INDUSTRY

- 9.6.1 GROWING DEMAND FOR HIGH-QUALITY, SAFE, AND NUTRITIOUS PRODUCTS TO FUEL MARKET

- 9.7 FORENSIC LABS

- 9.7.1 RISING TECHNOLOGICAL ADVANCEMENTS IN FORENSIC SCIENCE TO SUSTAIN GROWTH

- 9.8 PETROCHEMICAL INDUSTRY

- 9.8.1 GROWING OIL DEMAND TO DRIVE MARKET

- 9.9 OTHER END USERS

10 MASS SPECTROMETRY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Increasing availability of funding research to augment growth

- 10.2.3 CANADA

- 10.2.3.1 Growing focus on clean energy technology to propel market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Increasing adoption of advanced mass spectrometry in healthcare to expedite growth

- 10.3.3 UK

- 10.3.3.1 Rising focus on testing food products to sustain growth

- 10.3.4 FRANCE

- 10.3.4.1 Increasing emphasis on molecular-scale data storage to favor growth

- 10.3.5 ITALY

- 10.3.5.1 Growing utilization of mass spectrometry among pharmaceutical and biotechnology end-use industries to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Growing pharmaceutical exports to boost market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Progressive manufacturing landscape to augment growth

- 10.4.3 CHINA

- 10.4.3.1 Increasing investments in scientific R&D to advance growth

- 10.4.4 INDIA

- 10.4.4.1 Increasing focus on environmental technology market to boost market

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Rising focus on biotechnology to stimulate growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 Increasing focus on early disease diagnosis and development of RNA therapies to aid growth

- 10.4.7 SOUTHEAST ASIA

- 10.4.7.1 Growing focus on developing and commercializing innovative drugs to fuel market

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Booming biomanufacturing and life sciences industries to encourage growth

- 10.5.3 MEXICO

- 10.5.3.1 Expanding local manufacturing capabilities to accelerate growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Favorable government initiatives to contribute to growth

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MASS SPECTROMETRY MARKET

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 MARKET RANKING ANALYSIS, 2023

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Product footprint

- 11.8.5.4 Application footprint

- 11.8.5.5 End-user footprint

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2023

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of key startups/SMEs

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES AND APPROVALS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 AGILENT TECHNOLOGIES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and approvals

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 THERMO FISHER SCIENTIFIC INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and approvals

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 WATERS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches and approvals

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 DANAHER

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and approvals

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 BRUKER

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and approvals

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SHIMADZU CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches and approvals

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.7 MKS INSTRUMENTS

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 PERKINELMER

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches and approvals

- 12.1.8.3.2 Deals

- 12.1.9 JEOL LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 HITACHI HIGH-TECH CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Other developments

- 12.1.11 TELEDYNE TECHNOLOGIES INCORPORATED

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 AMETEK.INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 JASCO CORPORATION

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 F. HOFFMANN-LA ROCHE LTD

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches and approvals

- 12.1.1 AGILENT TECHNOLOGIES, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 ANALYTIK JENA GMBH+CO. KG

- 12.2.2 HIDEN ANALYTICAL

- 12.2.3 LECO CORPORATION

- 12.2.4 RIGAKU HOLDINGS CORPORATION

- 12.2.5 YOUNGIN CHROMASS

- 12.2.6 SCION INSTRUMENTS

- 12.2.7 KORE TECHNOLOGY

- 12.2.8 PROCESS INSIGHTS, INC.

- 12.2.9 MASSTECH

- 12.2.10 ADVION, INC.

- 12.2.11 SPACETEK TECHNOLOGY AG

- 12.2.12 ELEMENTAR ANALYSENSYSTEME GMBH

- 12.2.13 SKYRAY INSTRUMENTS USA, INC.

- 12.2.14 MICROSAIC

- 12.2.15 PFEIFFER VACUUM+FAB SOLUTIONS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS