|

|

市場調査レポート

商品コード

1614461

放射線治療の世界市場:システム別、ソフトウェアおよびサービス別、技術別、用途別、手技別、エンドユーザー別、地域別 - 2030年までの予測Radiotherapy Market by Technology, Procedure, Cancer, End User - Global Forecasts to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 放射線治療の世界市場:システム別、ソフトウェアおよびサービス別、技術別、用途別、手技別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2024年12月11日

発行: MarketsandMarkets

ページ情報: 英文 313 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の放射線治療の市場規模は、2024年の72億1,000万米ドルから2030年には96億2,000万米ドルに達し、予測期間中のCAGRは4.9%になると予測されています。

放射線治療技術とシステムの技術的進歩は、予測数年間の市場成長を促進すると予想される主要な要因の1つです。さらに、放射線治療製品の高コストは、放射線治療市場の成長に影響を与えます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(米ドル) |

| セグメント | システム別、ソフトウェアおよびサービス別、技術別、用途別、手技別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

技術別では、放射線治療は外部ビーム放射線治療、内部ビーム放射線治療/ブラキセラピーに区分されます。予測期間中、外部ビーム放射線治療分野が放射線治療市場を独占すると予測されています。外部ビーム放射線治療セグメントはさらに、リニアック、粒子線治療、従来型コバルト60遠隔療法に分けられます。がんの有病率の増加、システムおよびソフトウェアの強化、外部ビーム放射線治療装置の世界の普及が、この市場セグメントの成長をもたらしています。

手技別では、放射線治療市場は外部ビーム放射線治療(EBRT)手技と内部ビーム放射線治療(IBRT)/ブラキセラピー手技に区分されます。放射線治療市場は、予測期間中、外部ビーム放射線治療手技部門が支配的となる見込みです。外部ビーム放射線治療は、腫瘍ターゲティングの精度と正確性が向上するため、成長が見込まれています。

エンドユーザー別では、病院と独立放射線治療センターに区分されます。2023年の予測期間中、世界の放射線治療市場で最大のシェアを占めたのは病院でした。これは、病院部門が占める放射線治療の主な用途と大きな需要、新興国における病院数の増加に起因しています。

当レポートでは、世界の放射線治療市場について調査し、システム別、ソフトウェアおよびサービス別、技術別、用途別、手技別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 規制分析

- 償還シナリオ

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 貿易分析

- 特許分析

- 価格分析

- 技術分析

- ケーススタディ分析

- 2024年~2025年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- アンメットニーズ

- 生成AIが放射線治療市場に与える影響

第6章 放射線治療市場(システム別、ソフトウェアおよびサービス別)

- イントロダクション

- システム

- ソフトウェアおよびサービス

第7章 放射線治療市場(技術別)

- イントロダクション

- 外部照射放射線治療技術

- 内部照射放射線治療/近接放射線治療

第8章 放射線治療市場(用途別)

- イントロダクション

- 外部照射放射線治療

- 内部照射放射線治療/近接照射療法

第9章 放射線治療市場(手技別)

- イントロダクション

- 外部照射放射線治療

- 内部照射放射線治療/近接放射線治療

第10章 放射線治療市場(エンドユーザー別)

- イントロダクション

- 病院

- 独立系放射線治療センター

第11章 放射線治療市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- SIEMENS HEALTHINEERS AG(VARIAN MEDICAL SYSTEMS, INC.)

- ELEKTA

- ACCURAY INCORPORATED

- IBA WORLDWIDE

- VIEWRAY, INC.

- BRAINLAB AG

- PERSPECTIVE THERAPEUTICS

- HITACHI LTD.(HITACHI HIGH-TECH CORPORATION)

- SUMITOMO HEAVY INDUSTRIES, LTD.

- CARL ZEISS MEDITEC AG(WHOLLY OWNED SUBSIDIARY OF CARL ZEISS AG)

- MIM SOFTWARE INC.

- PANACEA MEDICAL TECHNOLOGIES PVT. LTD.

- PROVISION HEALTHCARE

- MEVION MEDICAL SYSTEMS

- RAYSEARCH LABORATORIES

- KONINKLIJKE PHILIPS N.V.

- その他の企業

- INTRAOP MEDICAL, INC.

- OPTIVUS PROTON THERAPY, INC.

- BEBIG MEDICAL

- P-CURE

- THERAGENICS CORPORATION

- PROTOM INTERNATIONAL

- DOS ISOFT SA

- ISOAID, LLC

- MAGNETTX ONCOLOGY SOLUTIONS LTD.

第14章 付録

List of Tables

- TABLE 1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 7 CLASS II PRESCRIBED EQUIPMENT CERTIFICATES

- TABLE 8 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 9 INDIA: MEDICAL DEVICE CLASSIFICATION UNDER CDSCO

- TABLE 10 CPT CODES FOR MAJOR RADIOTHERAPY TREATMENT MODALITIES

- TABLE 11 REIMBURSEMENT FOR RADIOTHERAPY PROCEDURES PER COURSE, 2021 VS. 2022

- TABLE 12 OPPS TECHNICAL PER PROCEDURE NATIONAL AVERAGE MEDICARE REIMBURSEMENT, 2021 VS. 2022

- TABLE 13 FREESTANDING PER COURSE NATIONAL AVERAGE MEDICARE REIMBURSEMENT, 2021 VS. 2022

- TABLE 14 RADIOTHERAPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF RADIOTHERAPY DEVICES

- TABLE 16 KEY BUYING CRITERIA FOR RADIOTHERAPY

- TABLE 17 IMPORT DATA FOR LINACS (HS CODE 902214), BY COUNTRY, 2019-2023 (USD)

- TABLE 18 EXPORT DATA FOR LINACS (HS CODE 902214), BY COUNTRY, 2019-2023 (USD)

- TABLE 19 AVERAGE SELLING PRICE RANGE OF KEY PLAYERS FOR TOP TWO PRODUCTS (USD)

- TABLE 20 AVERAGE SELLING PRICE TREND OF RADIOTHERAPY PRODUCTS, BY REGION, 2021-2023

- TABLE 21 CASE STUDY: ENHANCING PATIENT SAFETY-SBRT'S ROLE IN MINIMIZING RADIATION RISK IN AN ELDERLY PATIENT (90-YEAR-OLD FEMALE WITH A MEDICALLY INOPERABLE EARLY-STAGE NSCLC)

- TABLE 22 RADIOTHERAPY MARKET: DETAILED LIST OF MAJOR CONFERENCES & EVENTS

- TABLE 23 RADIOTHERAPY MARKET: CURRENT UNMET NEEDS

- TABLE 24 RADIOTHERAPY MARKET, BY SYSTEM AND SOFTWARE & SERVICE, 2022-2030 (USD MILLION)

- TABLE 25 RADIOTHERAPY SYSTEMS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 26 RADIOTHERAPY SOFTWARE & SERVICES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 27 RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 28 EXTERNAL BEAM RADIOTHERAPY TECHNOLOGIES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 29 EXTERNAL BEAM RADIOTHERAPY TECHNOLOGIES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 30 LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 31 LINACS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 32 CONVENTIONAL LINACS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 33 STEREOTACTIC ADVANCED ELECTRON/COBALT-60 LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 34 STEREOTACTIC ADVANCED ELECTRON/COBALT-60 LINACS MARKET, BY REGION, 2022-2030 (USD MILLION)

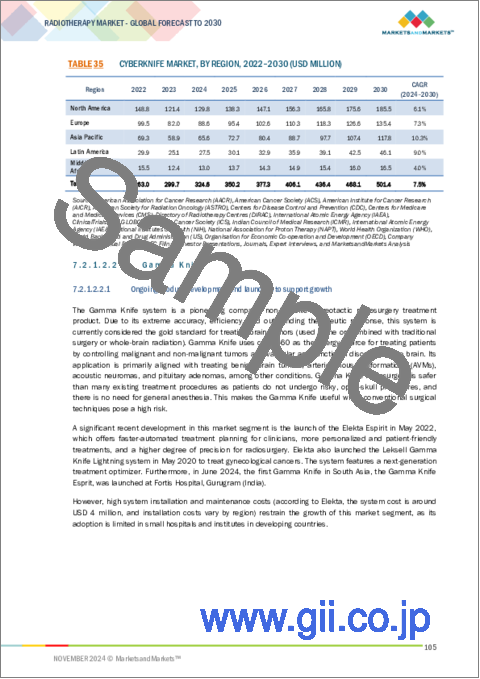

- TABLE 35 CYBERKNIFE MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 36 GAMMA KNIFE MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 37 TOMOTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 38 MRI LINACS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 39 PARTICLE THERAPY MARKET, BY SYSTEM TYPE, 2022-2030 (USD MILLION)

- TABLE 40 PARTICLE THERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 41 CYCLOTRONS THERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 42 SYNCHROTRONS THERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 43 SYNCHROCYCLOTRONS THERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 44 CONVENTIONAL COBALT-60 TELETHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 45 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY TECHNOLOGIES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 46 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY TECHNOLOGIES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 47 SEEDS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 48 AFTERLOADERS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 49 IORT SYSTEMS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 50 APPLICATORS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 51 RADIOTHERAPY MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 52 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 53 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 54 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET FOR PROSTATE CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 55 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET FOR BREAST CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 56 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET FOR LUNG CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 57 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET FOR HEAD & NECK CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 58 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET FOR COLORECTAL CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 59 OTHER EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 60 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 61 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 62 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET FOR PROSTATE CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 63 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET FOR GYNECOLOGICAL CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 64 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET FOR BREAST CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 65 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET FOR CERVICAL CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 66 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET FOR PENILE CANCER, BY REGION, 2022-2030 (USD MILLION)

- TABLE 67 OTHER INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 68 RADIOTHERAPY MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 69 EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 70 EXTERNAL BEAM RADIOTHERAPY PROCEDURES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 71 IMAGE-GUIDED RADIOTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 72 INTENSITY-MODULATED RADIOTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 73 3D CONFORMAL RADIOTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 74 STEREOTACTIC RADIOTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 75 PARTICLE THERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 76 OTHER EBRT PROCEDURES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 77 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 78 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 79 LDR BRACHYTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 80 HDR BRACHYTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 81 PDR BRACHYTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 82 RADIOTHERAPY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 83 RADIOTHERAPY MARKET FOR HOSPITALS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 84 RADIOTHERAPY MARKET FOR INDEPENDENT RADIOTHERAPY CENTERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 85 RADIOTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 86 RADIOTHERAPY MARKET: INSTALLED BASE, 2024 (UNITS)

- TABLE 87 NORTH AMERICA: RADIOTHERAPY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: STEREOTACTIC ADVANCED ELECTRON/COBALT-60 LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: PARTICLE THERAPY MARKET, BY SYSTEM TYPE, 2022-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: INTERNAL BEAM RADIOTHERAPY /BRACHYTHERAPY PROCEDURE MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: RADIOTHERAPY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 100 NORTH AMERICA: ESTIMATED NUMBER OF NEW CANCER CASES, 2022-2025

- TABLE 101 US: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 102 US: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 103 US: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 104 US: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 105 CANADA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 106 CANADA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 107 CANADA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 108 CANADA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 109 EUROPE: RADIOTHERAPY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 110 EUROPE: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 111 EUROPE: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 112 EUROPE: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 113 EUROPE: STEREOTACTIC ADVANCED ELECTRON/COBALT-60 LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 114 EUROPE: PARTICLE THERAPY MARKET, BY SYSTEM TYPE, 2022-2030 (USD MILLION)

- TABLE 115 EUROPE: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 116 EUROPE: EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 117 EUROPE: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 118 EUROPE: EXTERNAL BEAM RADIOTHERAPY MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 119 EUROPE: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY PROCEDURE MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 120 EUROPE: RADIOTHERAPY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 121 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 122 EUROPE: ESTIMATED NUMBER OF NEW CANCER CASES, 2022-2025

- TABLE 123 GERMANY: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 124 GERMANY: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 125 GERMANY: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 126 GERMANY: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 127 FRANCE: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 128 FRANCE: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 129 FRANCE: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 130 FRANCE: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 131 UK: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 132 UK: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 133 UK: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 134 UK: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 135 SPAIN: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 136 SPAIN: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 137 SPAIN: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 138 SPAIN: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 139 ITALY: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 140 ITALY: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 141 ITALY: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 142 ITALY: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 143 REST OF EUROPE: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 144 REST OF EUROPE: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: RADIOTHERAPY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: STEREOTACTIC ADVANCED ELECTRON/COBALT-60 LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PARTICLE THERAPY MARKET, BY SYSTEM TYPE, 2022-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: EXTERNAL BEAM RADIOTHERAPY MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY PROCEDURE MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: RADIOTHERAPY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 160 ASIA PACIFIC: ESTIMATED NUMBER OF NEW CANCER CASES, 2022-2025

- TABLE 161 JAPAN: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 162 JAPAN: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 163 JAPAN: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 164 JAPAN: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 165 CHINA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 166 CHINA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 167 CHINA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 168 CHINA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 169 INDIA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 170 INDIA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 171 INDIA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 172 INDIA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 173 SOUTH KOREA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 174 SOUTH KOREA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 175 SOUTH KOREA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 176 SOUTH KOREA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 177 AUSTRALIA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 178 AUSTRALIA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 179 AUSTRALIA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 180 AUSTRALIA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: RADIOTHERAPY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 186 LATIN AMERICA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: STEREOTACTIC ADVANCED ELECTRON/COBALT-60 LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 190 LATIN AMERICA: PARTICLE THERAPY MARKET, BY SYSTEM TYPE, 2022-2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 192 LATIN AMERICA: EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 193 LATIN AMERICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 195 LATIN AMERICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY PROCEDURE MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: RADIOTHERAPY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 197 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 198 LATIN AMERICA: ESTIMATED NUMBER OF NEW CANCER CASES, 2022-2025

- TABLE 199 BRAZIL: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 200 BRAZIL: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 201 BRAZIL: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 202 BRAZIL: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 203 MEXICO: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 204 MEXICO: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 205 MEXICO: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 206 MEXICO: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 207 REST OF LATIN AMERICA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 208 REST OF LATIN AMERICA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 209 REST OF LATIN AMERICA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 210 REST OF LATIN AMERICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: RADIOTHERAPY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: STEREOTACTIC ADVANCED ELECTRON/COBALT-60 LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: PARTICLE THERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY PROCEDURE MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: RADIOTHERAPY MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 224 MIDDLE EAST & AFRICA: ESTIMATED NUMBER OF NEW CANCER CASES, 2022-2025

- TABLE 225 GCC COUNTRIES: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 226 GCC COUNTRIES: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 227 GCC COUNTRIES: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 228 GCC COUNTRIES: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: RADIOTHERAPY MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: LINACS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 232 REST OF MIDDLE EAST & AFRICA: INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 233 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN RADIOTHERAPY MARKET

- TABLE 234 RADIOTHERAPY MARKET: DEGREE OF COMPETITION

- TABLE 235 RADIOTHERAPY MARKET: TECHNOLOGY FOOTPRINT

- TABLE 236 RADIOTHERAPY MARKET: APPLICATION FOOTPRINT

- TABLE 237 RADIOTHERAPY MARKET: END-USER FOOTPRINT

- TABLE 238 RADIOTHERAPY MARKET: REGION FOOTPRINT

- TABLE 239 RADIOTHERAPY MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 240 RADIOTHERAPY MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 241 RADIOTHERAPY MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 242 RADIOTHERAPY MARKET: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 243 RADIOTHERAPY MARKET: EXPANSIONS, JANUARY 2021-OCTOBER 2024

- TABLE 244 SIEMENS HEALTHINEERS AG (VARIAN MEDICAL SYSTEMS, INC.): COMPANY OVERVIEW

- TABLE 245 SIEMENS HEALTHINEERS AG (VARIAN MEDICAL SYSTEMS, INC.): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 246 SIEMENS HEALTHINEERS AG (VARIAN MEDICAL SYSTEMS, INC.): PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 247 SIEMENS HEALTHINEERS AG (VARIAN MEDICAL SYSTEMS, INC.): DEALS, JANUARY 2021- OCTOBER 2024

- TABLE 248 ELEKTA: COMPANY OVERVIEW

- TABLE 249 ELEKTA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 250 ELEKTA: PRODUCTS LAUNCHES AND APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 251 ELEKTA: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 252 ELEKTA: EXPANSIONS, JANUARY 2021- OCTOBER 2024

- TABLE 253 ACCURAY INCORPORATED: COMPANY OVERVIEW

- TABLE 254 ACCURAY INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 255 ACCURAY INCORPORATED: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 256 ACCURAY INCORPORATED: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 257 ACCURAY INCORPORATED: EXPANSIONS, JANUARY 2021- OCTOBER 2024

- TABLE 258 IBA WORLDWIDE: COMPANY OVERVIEW

- TABLE 259 IBA WORLDWIDE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 260 IBA WORLDWIDE: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 261 IBA WORLDWIDE: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 262 VIEWRAY, INC.: COMPANY OVERVIEW

- TABLE 263 VIEWRAY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 264 VIEWRAY, INC.: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 265 VIEWRAY, INC.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 266 BRAINLAB AG: COMPANY OVERVIEW

- TABLE 267 BRAINLAB AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 268 PERSPECTIVE THERAPEUTICS: COMPANY OVERVIEW

- TABLE 269 PERSPECTIVE THERAPEUTICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 270 PERSPECTIVE THERAPEUTICS: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 271 HITACHI LTD. (HITACHI HIGH-TECH CORPORATION): COMPANY OVERVIEW

- TABLE 272 HITACHI LTD. (HITACHI HIGH-TECH CORPORATION): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 273 HITACHI LTD. (HITACHI HIGH-TECH CORPORATION): DEALS, JANUARY 2021- OCTOBER 2024

- TABLE 274 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 275 SUMITOMO HEAVY INDUSTRIES, LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 276 SUMITOMO HEAVY INDUSTRIES LTD.: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 277 SUMITOMO HEAVY INDUSTRIES LTD.: OTHER DEVELOPMENTS, JANUARY 2021-OCTOBER 2024

- TABLE 278 CARL ZEISS MEDITEC AG (WHOLLY OWNED SUBSIDIARY OF CARL ZEISS AG): COMPANY OVERVIEW

- TABLE 279 CARL ZEISS MEDITEC AG (WHOLLY OWNED SUBSIDIARY OF CARL ZEISS AG): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 280 CARL ZEISS MEDITEC AG (WHOLLY OWNED SUBSIDIARY OF CARL ZEISS AG): PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 281 MIM SOFTWARE INC.: COMPANY OVERVIEW

- TABLE 282 MIM SOFTWARE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 283 MIM SOFTWARE INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 284 MIM SOFTWARE INC.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 285 PANACEA MEDICAL TECHNOLOGIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 286 PANACEA MEDICAL TECHNOLOGIES PVT. LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 287 PANACEA MEDICAL TECHNOLOGIES PVT. LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 288 PROVISION HEALTHCARE: COMPANY OVERVIEW

- TABLE 289 PROVISION HEALTHCARE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 290 MEVION MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 291 MEVION MEDICAL SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 292 MEVION MEDICAL SYSTEMS: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 293 MEVION MEDICAL SYSTEMS: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 294 RAYSEARCH LABORATORIES: COMPANY OVERVIEW

- TABLE 295 RAYSEARCH LABORATORIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 296 RAYSEARCH LABORATORIES: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 297 RAYSEARCH LABORATORIES: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 298 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 299 KONINKLIJKE PHILIPS N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 300 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 301 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 302 INTRAOP MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 303 OPTIVUS PROTON THERAPY, INC.: COMPANY OVERVIEW

- TABLE 304 BEBIG MEDICAL: COMPANY OVERVIEW

- TABLE 305 P-CURE: COMPANY OVERVIEW

- TABLE 306 THERAGENICS CORPORATION: COMPANY OVERVIEW

- TABLE 307 PROTOM INTERNATIONAL: COMPANY OVERVIEW

- TABLE 308 DOSISOFT SA: COMPANY OVERVIEW

- TABLE 309 ISOAID, LLC: COMPANY OVERVIEW

- TABLE 310 MAGNETTX ONCOLOGY SOLUTIONS LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2023)

- FIGURE 5 RADIOTHERAPY MARKET: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 RADIOTHERAPY MARKET, BY SYSTEM AND SOFTWARE & SERVICE, 2024 VS. 2030 (USD MILLION)

- FIGURE 8 RADIOTHERAPY MARKET, BY TECHNOLOGY, 2024 VS. 2030 (USD MILLION)

- FIGURE 9 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 10 RADIOTHERAPY MARKET SHARE, BY END USER, 2024 VS. 2030(%)

- FIGURE 11 RADIOTHERAPY MARKET: REGIONAL SNAPSHOT

- FIGURE 12 RISING CANCER PREVALENCE WORLDWIDE TO DRIVE MARKET GROWTH

- FIGURE 13 INTENSITY-MODULATED RADIATION THERAPY TO HOLD LARGEST SHARE OF MARKET IN 2024

- FIGURE 14 LINACS HELD LARGEST SHARE OF EUROPEAN MARKET IN 2O23

- FIGURE 15 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA WILL CONTINUE TO DOMINATE RADIOTHERAPY MARKET DURING FORECAST PERIOD

- FIGURE 17 RADIOTHERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 PROJECTED INCREASE IN CANCER CASES, 2020 VS. 2040

- FIGURE 19 RADIOTHERAPY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 RADIOTHERAPY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 RADIOTHERAPY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 RADIOTHERAPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF RADIOTHERAPY

- FIGURE 24 KEY BUYING CRITERIA FOR RADIOTHERAPY

- FIGURE 25 RADIOTHERAPY MARKET: TOP PATENT OWNERS/PATENTING TRENDS FOR PROTON BEAM THERAPY IN RECENT YEARS

- FIGURE 26 RADIOTHERAPY MARKET: TOP PATENT OWNERS/PATENTING TRENDS FOR MEDICAL LINEAR ACCELERATORS IN RECENT YEARS

- FIGURE 27 AVERAGE SELLING PRICE, BY PRODUCT, 2023 (USD)

- FIGURE 28 AVERAGE SELLING PRICE OF RADIOTHERAPY PRODUCTS, BY COUNTRY, 2023 (USD)

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 RADIOTHERAPY MARKET: NUMBER OF DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 31 RADIOTHERAPY MARKET: NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 32 VALUE OF INVESTOR DEALS IN RADIOTHERAPY MARKET, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 33 USE OF GEN AI IN RADIOTHERAPY MARKET

- FIGURE 34 NORTH AMERICA: RADIOTHERAPY MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: RADIOTHERAPY MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS IN RADIOTHERAPY MARKET (2019-2023)

- FIGURE 37 MARKET SHARE ANALYSIS OF KEY PLAYERS IN RADIOTHERAPY MARKET (2023)

- FIGURE 38 EXTERNAL BEAM RADIOTHERAPY MARKET RANKING, BY KEY PLAYER, 2023

- FIGURE 39 INTERNAL BEAM RADIOTHERAPY MARKET RANKING, BY KEY PLAYER, 2023

- FIGURE 40 RADIOTHERAPY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 41 RADIOTHERAPY MARKET: COMPANY FOOTPRINT

- FIGURE 42 RADIOTHERAPY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 43 EV/EBITDA OF KEY VENDORS

- FIGURE 44 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 45 RADIOTHERAPY MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 46 SIEMENS HEALTHINEERS AG (VARIAN MEDICAL SYSTEMS, INC.): COMPANY SNAPSHOT

- FIGURE 47 ELEKTA: COMPANY SNAPSHOT

- FIGURE 48 ACCURAY INCORPORATED: COMPANY SNAPSHOT

- FIGURE 49 IBA WORLDWIDE: COMPANY SNAPSHOT

- FIGURE 50 VIEWRAY, INC.: COMPANY SNAPSHOT

- FIGURE 51 PERSPECTIVE THERAPEUTICS: COMPANY SNAPSHOT

- FIGURE 52 HITACHI LTD. (HITACHI HIGH-TECH CORPORATION): COMPANY SNAPSHOT

- FIGURE 53 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 54 CARL ZEISS MEDITEC AG (WHOLLY OWNED SUBSIDIARY OF CARL ZEISS AG): COMPANY SNAPSHOT

- FIGURE 55 RAYSEARCH LABORATORIES: COMPANY SNAPSHOT

- FIGURE 56 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

The global radiotherapy market is projected to reach USD 9.62 billion by 2030 from USD 7.21 billion in 2024, growing at a CAGR of 4.9% during the forecast period. The technological advancements of radiotherapy technologies and systems is one of the major factors anticipated to boost market growth in the forecasting years. Additionally, the high cost of radiotherapy products affects the growth of the radiotherapy market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD) |

| Segments | System and software & service, Technology, Application, Procedure, End user, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

"The external beam radiotherapy segment to hold the largest share of the market in 2024."

Based on technology, radiotherapy is segmented into external beam radiotherapy, internal beam radiotherapy/ brachytherapy. The external beam radiotherapy segment is expected to dominate the radiotherapy market during the forecast period. The external beam radiotherapy segment is further divided into LINACs, Particle therapy and Conventional cobalt-60 teletherapy. With the growing prevalence of cancer, system and software enhancements, and the increasing adoption of external beam radiotherapy devices worldwide leads to the growth of this market segment.

"The external beam radiotherapy procedures segment to hold the largest share of the market in 2024."

Based on procedure, the Radiotherapy market is segmented into external beam radiotherapy (EBRT) procedures and internal beam radiotherapy (IBRT)/brachytherapy procedures. The radiotherapy market is expected to be dominated by external beam radiotherapy procedures segment during the forecast period. The external beam radiotherapy procedures are expected to grow due to increased precision & accuracy of tumor targeting in this therapy..

"The hospitals companies segment to hold the largest share of the market in 2024."

The end user market is segmented into hospitals and independent radiotherapy centres. Hospitals accounted for the largest share of the global radiotherapy market in 2023 during the forecasted years. This can be attributed to the major applications and large demand of radiotherapy accounted by hospital sector and the growing number of hospitals in emerging countries.

"The market in the APAC region is expected to register highest growth rate for Radiotherapy in 2024."

The radiotherapy market covers five key geographies-North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2023, a significant market share for radiotherapy was held by the market in the North American region, comprising the US and Canada. On the other hand, the Asia Pacific market is estimated to register the highest growth rate during the forecast period. The increasing market penetration opportunities in emerging APAC countries led to the growth of the radiotherapy market in this region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 48%, Tier 2- 36%, and Tier 3- 16%

- By Designation: Directors- 14%, C-level- 10%, and Others- 76%

- By Region: North America- 40%, Europe- 32%, Asia Pacific- 20%, Latin America- 5%, MEA- 3%

The prominent players in the Radiotherapy market are Siemens Healthineers GmbH (Germany), Elekta (Sweden), Accuray Incorporated (US), IBA WORLDWIDE (Belgium), ViewRay Technologies, Inc (US), Perspective Therapeutics, Inc. (US), Hitachi High Tech Corporation (Japan), Sumitomo Heavy Industries Ltd. (Japan), Carl Zeiss Meditec AG (Germany), Koninklijke Philips N.V. (Netherlands), among others.

Research Coverage

This report studies the radiotherapy market based on system, software & service, technology, application, procedure, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (Advancements in radiotherapy treatment technology, Growing patient population, Increasing initiatives to promote radiotherapy awareness, Growing use of particle therapy for cancer treatment), restraints (High cost of advanced lab consumables, Environmental sustainability concerns), opportunities (Lack of adequate healthcare infrastructure, High capital cost of radiotherapy, Complexity of radiotherapy), and challenges (Dearth of skilled personnel, Difficulties in visualizing tumors during radiotherapy, Risk of Radiation Exposure) influencing the growth of the radiotherapy market

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the radiotherapy market

- Service Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and service developments in the radiotherapy market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new services, growing geographies, and recent developments in the radiotherapy market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and services of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED AND REGIONS CONSIDERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 USAGE-BASED MARKET ESTIMATION

- 2.2.3 PRIMARY RESEARCH VALIDATION

- 2.3 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 STUDY ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 RADIOTHERAPY MARKET OVERVIEW

- 4.2 EXTERNAL BEAM RADIOTHERAPY MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- 4.3 EUROPE: EXTERNAL BEAM RADIOTHERAPY TECHNOLOGIES MARKET, BY TYPE AND REGION (2022)

- 4.4 RADIOTHERAPY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 RADIOTHERAPY MARKET: REGIONAL MIX, 2022-2030 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in radiotherapy treatment

- 5.2.1.2 Growing patient population

- 5.2.1.3 Increasing initiatives to promote radiotherapy awareness

- 5.2.1.4 Growing use of particle therapy for cancer treatment

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of adequate healthcare infrastructure

- 5.2.2.2 High capital cost of radiotherapy

- 5.2.2.3 Complexity of radiotherapy

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging economies

- 5.2.3.2 Favorable changes in US radiotherapy payment model

- 5.2.3.3 Government and private investments to meet rising demand for cancer treatment

- 5.2.4 CHALLENGES

- 5.2.4.1 Dearth of skilled personnel

- 5.2.4.2 Difficulties in visualizing tumors during radiotherapy

- 5.2.4.3 Risk of radiation exposure

- 5.2.1 DRIVERS

- 5.3 REGULATORY ANALYSIS

- 5.3.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- 5.3.2 REGULATORY LANDSCAPE

- 5.3.2.1 North America

- 5.3.2.1.1 US

- 5.3.2.1.2 Canada

- 5.3.2.2 Europe

- 5.3.2.3 Asia Pacific

- 5.3.2.3.1 China

- 5.3.2.3.2 Japan

- 5.3.2.3.3 India

- 5.3.2.1 North America

- 5.4 REIMBURSEMENT SCENARIO

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & DEVELOPMENT

- 5.5.2 PROCUREMENT & PRODUCT DEVELOPMENT

- 5.5.3 MARKETING, SALES, AND DISTRIBUTION

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 KEY BUYING CRITERIA

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 PATENT ANALYSIS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE, BY PRODUCT

- 5.12.2 AVERAGE SELLING PRICE, BY COUNTRY

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Linear accelerators (LINACs)

- 5.13.1.2 Image-guided radiotherapy (IGRT)

- 5.13.1.3 Intensity-modulated radiotherapy (IMRT)

- 5.13.1.4 Particle therapy

- 5.13.1.5 Surface-guided radiotherapy (SGRT)

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Chemotherapy

- 5.13.2.2 Immunotherapy

- 5.13.2.3 Hyperthermia therapy

- 5.13.3 ADJACENT TECHNOLOGIES

- 5.13.3.1 Medical imaging technologies

- 5.13.3.2 Radioisotope production technologies

- 5.13.3.3 Systematic radiotherapy

- 5.13.3.4 Theranostics

- 5.13.1 KEY TECHNOLOGIES

- 5.14 CASE STUDY ANALYSIS

- 5.15 KEY CONFERENCES & EVENTS, 2024-2025

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 INVESTMENT & FUNDING SCENARIO

- 5.18 UNMET NEEDS

- 5.19 IMPACT OF GENERATIVE AI ON RADIOTHERAPY MARKET

6 RADIOTHERAPY MARKET, BY SYSTEM AND SOFTWARE & SERVICE

- 6.1 INTRODUCTION

- 6.2 SYSTEMS

- 6.2.1 CONTINUOUS DEVELOPMENT OF ADVANCED TECHNOLOGIES TO BOOST MARKET

- 6.3 SOFTWARE & SERVICES

- 6.3.1 INCREASING DEMAND FOR PRECISE AND EFFECTIVE CANCER TREATMENT TO SUPPORT MARKET GROWTH

7 RADIOTHERAPY MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 EXTERNAL BEAM RADIOTHERAPY TECHNOLOGIES

- 7.2.1 LINACS

- 7.2.1.1 Conventional LINACs

- 7.2.1.1.1 Long treatment duration to limit adoption

- 7.2.1.2 Stereotactic advanced electron/cobalt-60 LINACs

- 7.2.1.2.1 CyberKnife

- 7.2.1.2.1.1 Precise radiation delivery with robotic correction capabilities to drive market

- 7.2.1.2.2 Gamma Knife

- 7.2.1.2.2.1 Ongoing product development and launches to support growth

- 7.2.1.2.3 TomoTherapy

- 7.2.1.2.3.1 High installation and maintenance costs to limit adoption

- 7.2.1.2.1 CyberKnife

- 7.2.1.3 MRI LINACs

- 7.2.1.3.1 Real-time imaging advantage to propel growth

- 7.2.1.1 Conventional LINACs

- 7.2.2 PARTICLE THERAPY

- 7.2.2.1 Cyclotrons

- 7.2.2.1.1 Enhanced outcomes and other advantages to boost adoption

- 7.2.2.2 Synchrotrons

- 7.2.2.2.1 Increasing investments in synchrotron facilities to drive market

- 7.2.2.3 Synchrocyclotrons

- 7.2.2.3.1 High space requirements to limit widespread adoption

- 7.2.2.1 Cyclotrons

- 7.2.3 CONVENTIONAL COBALT-60 TELETHERAPY

- 7.2.3.1 Complex dose delivery planning and radiation exposure to limit market adoption

- 7.2.1 LINACS

- 7.3 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY

- 7.3.1 SEEDS

- 7.3.1.1 Adverse side-effects associated with seeds to limit adoption

- 7.3.2 AFTERLOADERS

- 7.3.2.1 Proper positioning and better control of isotopes in modern afterloaders to drive demand

- 7.3.3 IORT SYSTEMS

- 7.3.3.1 Rising adoption of electronic brachytherapy procedures to support growth

- 7.3.4 APPLICATORS

- 7.3.4.1 High risk of radiation exposure in manual applicators to limit growth

- 7.3.1 SEEDS

8 RADIOTHERAPY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 EXTERNAL BEAM RADIOTHERAPY APPLICATIONS

- 8.2.1 PROSTATE CANCER

- 8.2.1.1 High incidence rate and efficiency of EBRT in prostate cancer treatment to support growth

- 8.2.2 BREAST CANCER

- 8.2.2.1 Therapeutic benefits of EBRT to drive market

- 8.2.3 LUNG CANCER

- 8.2.3.1 High prevalence of lung cancer and efficiency of EBRT to drive market

- 8.2.4 HEAD & NECK CANCER

- 8.2.4.1 Noninvasive treatment of head & neck cancers to drive market

- 8.2.5 COLORECTAL CANCER

- 8.2.5.1 High incidence of colorectal cancer to support market growth

- 8.2.6 OTHER EXTERNAL BEAM RADIOTHERAPY APPLICATIONS

- 8.2.1 PROSTATE CANCER

- 8.3 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS

- 8.3.1 PROSTATE CANCER

- 8.3.1.1 Precision of brachytherapy to drive market

- 8.3.2 GYNECOLOGICAL CANCER

- 8.3.2.1 Availability of alternatives to hinder adoption of brachytherapy

- 8.3.3 BREAST CANCER

- 8.3.3.1 Wide usage as replacement for traditional EBRT to drive market

- 8.3.4 CERVICAL CANCER

- 8.3.4.1 Effectiveness of combined brachytherapy-chemotherapy procedures to support adoption

- 8.3.5 PENILE CANCER

- 8.3.5.1 Rising awareness and effectiveness of brachytherapy to drive market

- 8.3.6 OTHER INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY APPLICATIONS

- 8.3.1 PROSTATE CANCER

9 RADIOTHERAPY MARKET, BY PROCEDURE

- 9.1 INTRODUCTION

- 9.2 EXTERNAL BEAM RADIOTHERAPY

- 9.2.1 IMAGE-GUIDED RADIOTHERAPY

- 9.2.1.1 Growing demand in treating deep-seated tumors to drive market

- 9.2.2 INTENSITY-MODULATED RADIOTHERAPY

- 9.2.2.1 Advantages over 2D and 3D-CRT to boost adoption

- 9.2.3 3D CONFORMAL RADIOTHERAPY

- 9.2.3.1 High precision and minimal damage to nearby tissues to boost adoption

- 9.2.4 STEREOTACTIC RADIOTHERAPY

- 9.2.4.1 Minimally invasive procedure to drive end-user preference

- 9.2.5 PARTICLE THERAPY

- 9.2.5.1 High usage as primary mode of cancer treatment to sustain market growth

- 9.2.6 OTHER EXTERNAL BEAM RADIOTHERAPY PROCEDURES

- 9.2.1 IMAGE-GUIDED RADIOTHERAPY

- 9.3 INTERNAL BEAM RADIOTHERAPY/BRACHYTHERAPY

- 9.3.1 LDR BRACHYTHERAPY

- 9.3.1.1 Low risk of radiation exposure to surrounding tissues to drive adoption

- 9.3.2 HDR BRACHYTHERAPY

- 9.3.2.1 Possibility of tissue injury to affect adoption

- 9.3.3 PDR BRACHYTHERAPY

- 9.3.3.1 Combination of advantages to boost growth

- 9.3.1 LDR BRACHYTHERAPY

10 RADIOTHERAPY MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS

- 10.2.1 HOSPITALS TO DOMINATE END-USER MARKET

- 10.3 INDEPENDENT RADIOTHERAPY CENTERS

- 10.3.1 LOWER OPERATING COSTS AND CONVENIENCE TO SUPPORT MARKET GROWTH

11 RADIOTHERAPY MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Changes in reimbursement scenario to drive growth

- 11.2.3 CANADA

- 11.2.3.1 Favorable initiatives from government and private organizations to boost market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Availability of novel radiotherapy products to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Presence of advanced healthcare system to augment growth

- 11.3.4 UK

- 11.3.4.1 High incidence of cancer to drive market

- 11.3.5 SPAIN

- 11.3.5.1 Growing research activities on cancer care to promote growth

- 11.3.6 ITALY

- 11.3.6.1 Rising clinical trials and research activities in hospitals and universities to support growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Rising geriatric population to encourage growth

- 11.4.3 CHINA

- 11.4.3.1 Growing partnerships among market players to support growth

- 11.4.4 INDIA

- 11.4.4.1 Increasing preference for minimally invasive treatment to propel market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Increasing incidence of cancer to support market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Growing cancer cases to fuel market

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Increasing prevalence of cancer to fuel market

- 11.5.3 MEXICO

- 11.5.3.1 Rising target population to boost market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Booming medical tourism to expedite growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN RADIOTHERAPY MARKET

- 12.3 REVENUE ANALYSIS, 2019-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.4.1 EXTERNAL BEAM RADIOTHERAPY MARKET RANKING

- 12.4.2 INTERNAL BEAM RADIOTHERAPY MARKET RANKING

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.5.5.1 Company footprint

- 12.5.5.2 Technology footprint

- 12.5.5.3 Application footprint

- 12.5.5.4 End-user footprint

- 12.5.5.5 Region footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SIEMENS HEALTHINEERS AG (VARIAN MEDICAL SYSTEMS, INC.)

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product approvals

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 ELEKTA

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches and approvals

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 ACCURAY INCORPORATED

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product approvals

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 IBA WORLDWIDE

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Products launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 VIEWRAY, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product approvals

- 13.1.5.3.2 Deals

- 13.1.6 BRAINLAB AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.7 PERSPECTIVE THERAPEUTICS

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 HITACHI LTD. (HITACHI HIGH-TECH CORPORATION)

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 SUMITOMO HEAVY INDUSTRIES, LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Other developments

- 13.1.10 CARL ZEISS MEDITEC AG (WHOLLY OWNED SUBSIDIARY OF CARL ZEISS AG)

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Products launches

- 13.1.11 MIM SOFTWARE INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services/Solutions offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches and approvals

- 13.1.11.3.2 Deals

- 13.1.12 PANACEA MEDICAL TECHNOLOGIES PVT. LTD.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services/Solutions offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches and approvals

- 13.1.13 PROVISION HEALTHCARE

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Services/Solutions offered

- 13.1.14 MEVION MEDICAL SYSTEMS

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Services/Solutions offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.14.3.2 Deals

- 13.1.15 RAYSEARCH LABORATORIES

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Services/Solutions offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Deals

- 13.1.16 KONINKLIJKE PHILIPS N.V.

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Services/Solutions offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches

- 13.1.16.3.2 Deals

- 13.1.1 SIEMENS HEALTHINEERS AG (VARIAN MEDICAL SYSTEMS, INC.)

- 13.2 OTHER PLAYERS

- 13.2.1 INTRAOP MEDICAL, INC.

- 13.2.2 OPTIVUS PROTON THERAPY, INC.

- 13.2.3 BEBIG MEDICAL

- 13.2.4 P-CURE

- 13.2.5 THERAGENICS CORPORATION

- 13.2.6 PROTOM INTERNATIONAL

- 13.2.7 DOS ISOFT SA

- 13.2.8 ISOAID, LLC

- 13.2.9 MAGNETTX ONCOLOGY SOLUTIONS LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS