|

|

市場調査レポート

商品コード

1667629

ケイ酸ナトリウムの世界市場:形状別、用途別、地域別 - 予測(~2029年)Sodium Silicate Market by Form, Application, & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ケイ酸ナトリウムの世界市場:形状別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2025年02月26日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のケイ酸ナトリウムの市場規模は、2024年に推定55億米ドルであり、2029年までに68億3,000万米ドルに達すると予測され、CAGRで4.4%の成長が見込まれます。

ケイ酸ナトリウムの需要が伸びているのは、洗浄・乳化作用があるため、基本成分として洗剤製造に応用されているためです。建設活動の成長も、強力な結合を形成して表面を強化する能力から、セメントや接着剤への応用を後押ししています。ケイ酸ナトリウムは、パルプ・紙産業でも漂白、脱墨、サイジングに使用されています。厳しい環境法も、廃水処理と浄化における使用の増加を後押ししています。これらすべての組み合わせが、さまざまな産業におけるケイ酸ナトリウムの需要の増加を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 100万米ドル |

| セグメント | 形状、用途、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、南米 |

形状別では、液体ケイ酸ナトリウムが予測期間にもっとも高いCAGRとなります。

液体ケイ酸ナトリウムセグメントは、その高い溶解性、適用の容易さ、プロセス効率により、予測期間のCAGRがもっとも高いです。洗剤、接着剤、水処理薬品における使用の増加は、特に急速に工業化が進んでいる地域における大きな促進要因となっています。建設産業では、液体ケイ酸ナトリウムは耐久性や耐性を高める性質があるため、コンクリートの緻密化や表面処理に使用されています。また、パルプ・紙産業では脱墨やコーティングへの利用が拡大しており、需要をさらに押し上げています。このセグメントの成長は、さまざまな産業で性能向上を可能にする配合技術の開発によっても促進されています。

用途別では、沈降シリカが予測期間にもっとも高いCAGRとなります。

沈降シリカセグメントは、ゴム、食品・パーソナルケア部門での利用の拡大により、予測期間にもっとも高いCAGRを記録しました。低燃費で高性能なタイヤへの需要の高まりにより、タイヤ補強剤としての利用が拡大していることが、市場成長に大きく寄与しています。沈降シリカは、粉末や顆粒状の固化防止剤として食品産業で幅広く利用されています。さらに、化粧品やパーソナルケア製品の増粘剤や調整剤としての使用も需要を高めています。シリカの生産プロセスの改良や特殊グレード沈降シリカへの投資の増加も、このセグメントの急成長を後押ししています。

アジア太平洋が予測期間にケイ酸ナトリウム市場でもっとも高いCAGRとなる見込みです。

アジア太平洋は、製造業の強固な基盤、国外投資の拡大、生産技術の開発により、予測期間にケイ酸ナトリウム市場でもっとも高いCAGRを持つ見込みです。中国、インド、日本などの経済圏では、化学処理施設が拡大しており、結果としてケイ酸ナトリウムの消費が増加しています。有利な政府政策、生産コストの低下、原材料の入手のしやすさなどが市場成長をさらに後押ししています。

当レポートでは、世界のケイ酸ナトリウム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ケイ酸ナトリウム市場の企業にとって魅力的な機会

- ケイ酸ナトリウム市場:形状別

- ケイ酸ナトリウム市場:用途別

- アジア太平洋のケイ酸ナトリウム市場:用途別、国別

- ケイ酸ナトリウム市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場動向

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業の動向

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格の動向:形状別

- 平均販売価格の動向:地域別

- バリューチェーン分析

- エコシステム分析

- ケイ酸ナトリウム市場に対する生成AIの影響

- 技術分析

- 主要技術

- 補完技術

- 特許分析

- 貿易分析

- HSコード283919に関連する輸出データ

- HSコード283919に関連する輸入データ

- 主な会議とイベント(2024年~2025年)

- 関税と規制情勢

- 関税データ(HSコード:283919)商業用ケイ酸塩を含むケイ酸ナトリウム(メタケイ酸ナトリウムを除く)

- 規制機関、政府機関、その他の組織

- 規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- マクロ経済分析

- イントロダクション

- GDPの動向と予測

- 投資と資金調達のシナリオ

第7章 ケイ酸ナトリウム市場:形状別

- イントロダクション

- 液体

- 固体

第8章 ケイ酸ナトリウム市場:用途別

- イントロダクション

- 洗剤

- 接着剤

- 水処理

- パルプ・紙

- 沈降シリカ

- その他の用途

第9章 ケイ酸ナトリウム市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ポーランド

- イタリア

- スペイン

- オランダ

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- PQ CORPORATION

- QEMETICA

- NIPPON CHEMICAL INDUSTRIAL CO., LTD.

- OCCIDENTAL PETROLEUM CORPORATION

- TOKUYAMA CORPORATION

- FUJI CHEMICAL CO., LTD.

- IQE GROUP

- ORIENTAL SILICAS CORPORATION

- EVONIK INDUSTRIES AG

- METRO CHEM INDUSTRIES

- その他の企業

- STPP GROUP

- SINCHEM SILICA GEL CO., LTD.

- SILMACO NV

- LYNN MANUFACTURING

- JAM GROUP COMPANY

- MERCK KGAA

- ANKIT SILICATE

- SUN SILICATES (PTY) LTD.

- HINDCON CHEMICALS LTD.

- IXOM

- CHEMSUPPLY AUSTRALIA

- HAWKINS

- DUBI CHEM MARINE INTERNATIONAL

- SAHAJANAND INDUSTRIES LIMITED

- ADWAN CHEMICAL INDUSTRIES CO., LTD.

第12章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 水処理薬品市場

- 市場の定義

- 市場の概要

- 水処理薬品市場:タイプ別

- 水処理薬品市場:原料別

- 水処理薬品市場:用途別

- 水処理薬品市場:エンドユーザー別

- 水処理薬品市場:地域別

- フュームドシリカ市場

- 市場の定義

- 市場の概要

- フュームドシリカ市場:タイプ別

- フュームドシリカ市場:用途別

- フュームドシリカ市場:地域別

第13章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF SODIUM SILICATE OFFERED BY KEY PLAYERS, BY FORM, 2023 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE TREND OF SODIUM SILICATE, BY REGION, 2023-2029 (USD/KG)

- TABLE 3 ROLE OF COMPANIES IN SODIUM SILICATE MARKET ECOSYSTEM

- TABLE 4 LIST OF PATENTS FOR SODIUM SILICATE

- TABLE 5 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 6 TARIFF RELATED TO SILICATES OF SODIUM, INCLUDING COMMERCIAL SILICATES (EXCLUDING SODIUM METASILICATES)

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 15 GLOBAL GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 16 SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 17 SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 18 SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 19 SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 20 SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

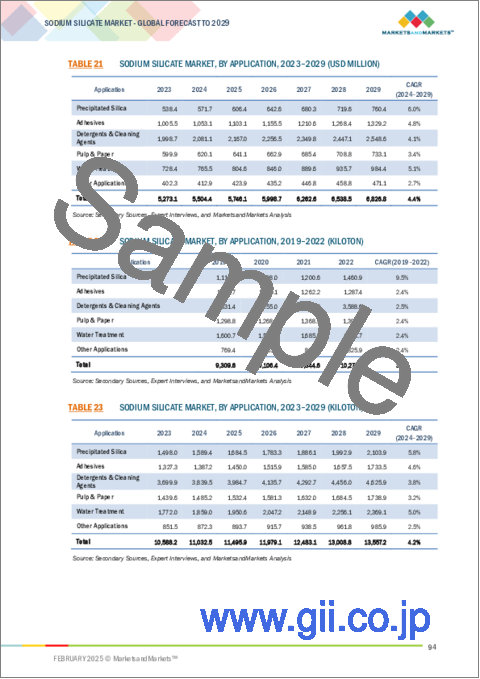

- TABLE 21 SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 22 SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 23 SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 24 SODIUM SILICATE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 SODIUM SILICATE MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 26 SODIUM SILICATE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 27 SODIUM SILICATE MARKET, BY REGION, 2023-2029 (KILOTON)

- TABLE 28 ASIA PACIFIC: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 29 ASIA PACIFIC: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 30 ASIA PACIFIC: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 31 ASIA PACIFIC: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- TABLE 32 ASIA PACIFIC: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 34 ASIA PACIFIC: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 35 ASIA PACIFIC: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 36 ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 38 ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 39 ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 40 CHINA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 41 CHINA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 42 CHINA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 43 CHINA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 44 CHINA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 45 CHINA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 46 CHINA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 47 CHINA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 48 INDIA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 49 INDIA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 50 INDIA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 51 INDIA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 52 INDIA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 53 INDIA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 54 INDIA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 55 INDIA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 56 JAPAN: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 57 JAPAN: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 58 JAPAN: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 59 JAPAN: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 60 JAPAN: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 61 JAPAN: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 62 JAPAN: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 63 JAPAN: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 64 SOUTH KOREA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 65 SOUTH KOREA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 66 SOUTH KOREA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 67 SOUTH KOREA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 68 SOUTH KOREA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 69 SOUTH KOREA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 70 SOUTH KOREA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 71 SOUTH KOREA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 72 INDONESIA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 73 INDONESIA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 74 INDONESIA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 75 INDONESIA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 76 INDONESIA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 77 INDONESIA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 78 INDONESIA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 79 INDONESIA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 80 REST OF ASIA PACIFIC: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 83 REST OF ASIA PACIFIC: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 84 REST OF ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 85 REST OF ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 86 REST OF ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 87 REST OF ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 88 NORTH AMERICA: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 91 NORTH AMERICA: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- TABLE 92 NORTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 95 NORTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 96 NORTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 99 NORTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 100 US: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 101 US: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 102 US: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 103 US: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 104 US: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 105 US: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 106 US: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 107 US: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 108 CANADA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 109 CANADA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 110 CANADA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 111 CANADA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 112 CANADA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 113 CANADA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 114 CANADA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 115 CANADA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 116 MEXICO: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 117 MEXICO: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 118 MEXICO: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 119 MEXICO: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 120 MEXICO: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 MEXICO: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 122 MEXICO: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 123 MEXICO: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 124 EUROPE: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 125 EUROPE: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 126 EUROPE: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 127 EUROPE: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- TABLE 128 EUROPE: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 129 EUROPE: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 130 EUROPE: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 131 EUROPE: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 132 EUROPE: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 133 EUROPE: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 134 EUROPE: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 135 EUROPE: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 136 GERMANY: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 137 GERMANY: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 138 GERMANY: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 139 GERMANY: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 140 GERMANY: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 141 GERMANY: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 142 GERMANY: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 143 GERMANY: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 144 UK: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 145 UK: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 146 UK: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 147 UK: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 148 UK: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 149 UK: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 150 UK: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 151 UK: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 152 FRANCE: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 153 FRANCE: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 154 FRANCE: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 155 FRANCE: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 156 FRANCE: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 157 FRANCE: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 158 FRANCE: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 159 FRANCE: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 160 POLAND: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 161 POLAND: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 162 POLAND: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 163 POLAND: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 164 POLAND: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 165 POLAND: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 166 POLAND: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 167 POLAND: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 168 ITALY: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 169 ITALY: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 170 ITALY: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 171 ITALY: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 172 ITALY: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 173 ITALY: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 174 ITALY: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 175 ITALY: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 176 SPAIN: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 177 SPAIN: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 178 SPAIN: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 179 SPAIN: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 180 SPAIN: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 181 SPAIN: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 182 SPAIN: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 183 SPAIN: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 184 NETHERLANDS: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 185 NETHERLANDS: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 186 NETHERLANDS: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 187 NETHERLANDS: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 188 NETHERLANDS: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 189 NETHERLANDS: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 190 NETHERLANDS: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 191 NETHERLANDS: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 192 REST OF EUROPE: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 193 REST OF EUROPE: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 194 REST OF EUROPE: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 195 REST OF EUROPE: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 196 REST OF EUROPE: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 197 REST OF EUROPE: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 198 REST OF EUROPE: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 199 REST OF EUROPE: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 200 SOUTH AMERICA: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 201 SOUTH AMERICA: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 202 SOUTH AMERICA: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 203 SOUTH AMERICA: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- TABLE 204 SOUTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 205 SOUTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 206 SOUTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 207 SOUTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 208 SOUTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 209 SOUTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 210 SOUTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 211 SOUTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 212 BRAZIL: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 213 BRAZIL: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 214 BRAZIL: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 215 BRAZIL: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 216 BRAZIL: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 217 BRAZIL: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 218 BRAZIL: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 219 BRAZIL: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 220 ARGENTINA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 221 ARGENTINA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 222 ARGENTINA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 223 ARGENTINA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 224 ARGENTINA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 225 ARGENTINA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 226 ARGENTINA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 227 ARGENTINA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 228 REST OF SOUTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 229 REST OF SOUTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 230 REST OF SOUTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 231 REST OF SOUTH AMERICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 232 REST OF SOUTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 233 REST OF SOUTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 234 REST OF SOUTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 235 REST OF SOUTH AMERICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 236 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 239 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY COUNTRY, 2023-2029 (KILOTON)

- TABLE 240 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 243 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 244 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 247 MIDDLE EAST & AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 248 GCC COUNTRIES: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 249 GCC COUNTRIES: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 250 GCC COUNTRIES: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 251 GCC COUNTRIES: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 252 GCC COUNTRIES: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 253 GCC COUNTRIES: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 254 GCC COUNTRIES: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 255 GCC COUNTRIES: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 256 SAUDI ARABIA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 257 SAUDI ARABIA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 258 SAUDI ARABIA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 259 SAUDI ARABIA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 260 SAUDI ARABIA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 261 SAUDI ARABIA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 262 SAUDI ARABIA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 263 SAUDI ARABIA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 264 UAE: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 265 UAE: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 266 UAE: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 267 UAE: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 268 UAE: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 269 UAE: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 270 UAE: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 271 UAE: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 272 REST OF GCC COUNTRIES: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 273 REST OF GCC COUNTRIES: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 274 REST OF GCC COUNTRIES: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 275 REST OF GCC COUNTRIES: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 276 REST OF GCC COUNTRIES: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 277 REST OF GCC COUNTRIES: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 278 REST OF GCC COUNTRIES: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 279 REST OF GCC COUNTRIES: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 280 SOUTH AFRICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 281 SOUTH AFRICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 282 SOUTH AFRICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 283 SOUTH AFRICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 284 SOUTH AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 285 SOUTH AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 286 SOUTH AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 287 SOUTH AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 288 REST OF MIDDLE EAST & SOUTH AFRICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 289 REST OF MIDDLE EAST & SOUTH AFRICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (USD MILLION)

- TABLE 290 REST OF MIDDLE EAST & SOUTH AFRICA: SODIUM SILICATE MARKET, BY FORM, 2019-2022 (KILOTON)

- TABLE 291 REST OF MIDDLE EAST & SOUTH AFRICA: SODIUM SILICATE MARKET, BY FORM, 2023-2029 (KILOTON)

- TABLE 292 REST OF MIDDLE EAST & SOUTH AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 293 REST OF MIDDLE EAST & SOUTH AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 294 REST OF MIDDLE EAST & SOUTH AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 295 REST OF MIDDLE EAST & SOUTH AFRICA: SODIUM SILICATE MARKET, BY APPLICATION, 2023-2029 (KILOTON)

- TABLE 296 SODIUM SILICATE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN JANUARY 2020 & JANUARY 2025

- TABLE 297 SODIUM SILICATE MARKET: DEGREE OF COMPETITION

- TABLE 298 SODIUM SILICATE MARKET: FORM FOOTPRINT

- TABLE 299 SODIUM SILICATE MARKET: APPLICATION FOOTPRINT

- TABLE 300 SODIUM SILICATE MARKET: REGION FOOTPRINT

- TABLE 301 SODIUM SILICATE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 302 SODIUM SILICATE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 303 SODIUM SILICATE MARKET: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 304 SODIUM SILICATE MARKET: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 305 SODIUM SILICATE MARKET: OTHER DEVELOPMENTS, JANUARY 202O-JANUARY 2025

- TABLE 306 PQ CORPORATION: COMPANY OVERVIEW

- TABLE 307 PQ CORPORATION: PRODUCTS OFFERED

- TABLE 308 PQ CORPORATION: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 309 PQ CORPORATION: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 310 QEMETICA: COMPANY OVERVIEW

- TABLE 311 QEMETICA: PRODUCTS OFFERED

- TABLE 312 QEMETICA: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 313 QEMETICA: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 314 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 315 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 316 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 317 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 318 OCCIDENTAL PETROLEUM CORPORATION: COMPANY OVERVIEW

- TABLE 319 OCCIDENTAL PETROLEUM CORPORATION: PRODUCTS OFFERED

- TABLE 320 OCCIDENTAL PETROLEUM CORPORATION: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 321 TOKUYAMA CORPORATION: COMPANY OVERVIEW

- TABLE 322 TOKUYAMA CORPORATION: PRODUCTS OFFERED

- TABLE 323 TOKUYAMA CORPORATION: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 324 TOKUYAMA CORPORATION: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 325 FUJI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 326 FUJI CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 327 IQE GROUP: COMPANY OVERVIEW

- TABLE 328 IQE GROUP: PRODUCTS OFFERED

- TABLE 329 IQE GROUP: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 330 ORIENTAL SILICAS CORPORATION: COMPANY OVERVIEW

- TABLE 331 ORIENTAL SILICAS CORPORATION: PRODUCTS OFFERED

- TABLE 332 ORIENTAL SILICAS CORPORATION: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 333 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 334 EVONIK INDUSTRIES AG: PRODUCTS OFFERED

- TABLE 335 EVONIK INDUSTRIES AG: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 336 EVONIK INDUSTRIES AG: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 337 METRO CHEM INDUSTRIES: COMPANY OVERVIEW

- TABLE 338 METRO CHEM INDUSTRIES: PRODUCTS OFFERED

- TABLE 339 STPP GROUP: COMPANY OVERVIEW

- TABLE 340 SINCHEM SILICA GEL CO., LTD.: COMPANY OVERVIEW

- TABLE 341 SILMACO NV: COMPANY OVERVIEW

- TABLE 342 LYNN MANUFACTURING: COMPANY OVERVIEW

- TABLE 343 JAM GROUP COMPANY: COMPANY OVERVIEW

- TABLE 344 MERCK KGAA: COMPANY OVERVIEW

- TABLE 345 ANKIT SILICATE: COMPANY OVERVIEW

- TABLE 346 SUN SILICATES (PTY) LTD.: COMPANY OVERVIEW

- TABLE 347 HINDCON CHEMICALS LTD.: COMPANY OVERVIEW

- TABLE 348 IXOM: COMPANY OVERVIEW

- TABLE 349 CHEMSUPPLY AUSTRALIA: COMPANY OVERVIEW

- TABLE 350 HAWKINS: COMPANY OVERVIEW

- TABLE 351 DUBI CHEM MARINE INTERNATIONAL: COMPANY OVERVIEW

- TABLE 352 SAHAJANAND INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 353 ADWAN CHEMICAL INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 354 WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 355 WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 356 WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 357 WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 358 WATER TREATMENT CHEMICALS MARKET, BY SOURCE, 2020-2022 (USD MILLION)

- TABLE 359 WATER TREATMENT CHEMICALS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 360 WATER TREATMENT CHEMICALS MARKET, BY SOURCE, 2020-2022 (KILOTON)

- TABLE 361 WATER TREATMENT CHEMICALS MARKET, BY SOURCE, 2023-2028 (KILOTON)

- TABLE 362 WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 363 WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 364 WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 365 WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 366 WATER TREATMENT CHEMICALS MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 367 WATER TREATMENT CHEMICALS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 368 WATER TREATMENT CHEMICALS MARKET, BY END USER, 2020-2022 (KILOTON)

- TABLE 369 WATER TREATMENT CHEMICALS MARKET, BY END USER, 2023-2028 (KILOTON)

- TABLE 370 WATER TREATMENT CHEMICALS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 371 WATER TREATMENT CHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 372 WATER TREATMENT CHEMICALS MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 373 WATER TREATMENT CHEMICALS MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 374 FUMED SILICA MARKET, BY TYPE, 2019-2026 (USD MILLION)

- TABLE 375 FUMED SILICA MARKET, BY TYPE, 2019-2026 (KILOTON)

- TABLE 376 FUMED SILICA MARKET, BY APPLICATION, 2019-2026 (USD MILLION)

- TABLE 377 FUMED SILICA MARKET, BY APPLICATION, 2019-2026 (KILOTON)

- TABLE 378 FUMED SILICA MARKET, BY REGION, 2019-2026 (USD MILLION)

- TABLE 379 FUMED SILICA MARKET, BY REGION, 2019-2026 (KILOTON)

List of Figures

- FIGURE 1 SODIUM SILICATE MARKET: RESEARCH DESIGN

- FIGURE 2 SODIUM SILICATE MARKET: BOTTOM-UP APPROACH

- FIGURE 3 SODIUM SILICATE MARKET: TOP-DOWN APPROACH

- FIGURE 4 APPROACH 1

- FIGURE 5 APPROACH 2

- FIGURE 6 SODIUM SILICATE MARKET: DATA TRIANGULATION

- FIGURE 7 LIQUID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 DETERGENT & CLEANING AGENTS SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF SODIUM SILICATE MARKET IN 2023

- FIGURE 10 INCREASING INFRASTRUCTURE DEVELOPMENT AND RISING ENVIRONMENTAL CONCERNS TO DRIVE MARKET

- FIGURE 11 LIQUID FORM TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 PRECIPITATED SILICA SEGMENT TO REGISTER FASTEST GROWTH BETWEEN 2024 & 2029

- FIGURE 13 DETERGENTS & CLEANING AGENTS SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2023

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 SODIUM SILICATE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

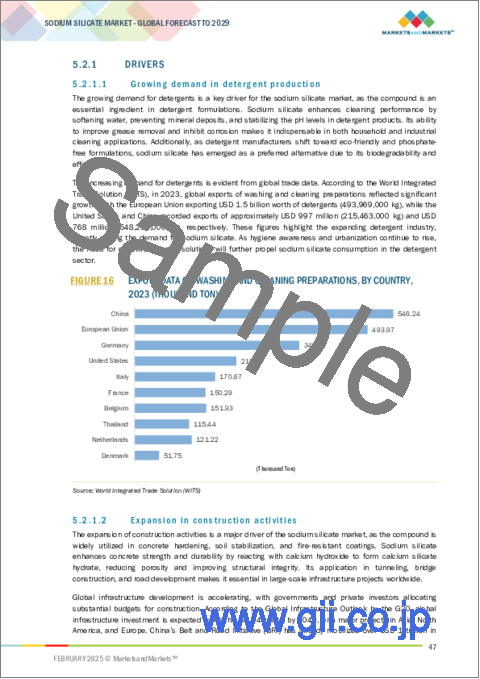

- FIGURE 16 EXPORT DATA ON WASHING AND CLEANING PREPARATIONS, BY COUNTRY, 2023 (THOUSAND TON)

- FIGURE 17 TRENDS AND PATTERNS OF URBANIZATION IN ASIA AND AFRICA

- FIGURE 18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 19 AVERAGE SELLING PRICE TREND OF SODIUM SILICATE OFFERED BY KEY PLAYERS, BY APPLICATION, 2023 (USD/KILOTON)

- FIGURE 20 AVERAGE SELLING PRICE TREND OF SODIUM SILICATE, BY REGION, 2023-2029 (USD/KG)

- FIGURE 21 SODIUM SILICATE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 SODIUM SILICATE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 LIST OF MAJOR PATENTS FOR SODIUM SILICATE MARKET, 2013-2024

- FIGURE 24 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SODIUM SILICATE MARKET, 2013-2024

- FIGURE 25 EXPORT DATA RELATED TO HS CODE 283919, BY COUNTRY, 2018-2023 (USD MILLION)

- FIGURE 26 IMPORT DATA RELATED TO HS CODE 283919, BY COUNTRY, 2018-2023 (USD MILLION)

- FIGURE 27 SODIUM SILICATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 30 INVESTOR DEAL AND FUNDING TREND, 2018-2024 (USD MILLION)

- FIGURE 31 SODIUM SILICATE MARKET, BY FORM, 2024 VS. 2029 (USD MILLION)

- FIGURE 32 SODIUM SILICATE MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 33 CHINA TO REGISTER FASTEST GROWTH FROM 2024 TO 2029

- FIGURE 34 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: SODIUM SILICATE MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: SODIUM SILICATE MARKET SNAPSHOT

- FIGURE 37 GERMANY: VEHICLES ON ROAD, 2019-2023 (MILLION UNITS)

- FIGURE 38 SPAIN: NEW CAR REGISTRATIONS, 2023 VS. 2024 (MILLION UNITS)

- FIGURE 39 SODIUM SILICATE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2018-2023 (USD BILLION)

- FIGURE 40 SODIUM SILICATE MARKET SHARE ANALYSIS, 2023

- FIGURE 41 COMPANY VALUATION OF KEY PLAYERS IN SODIUM SILICATE MARKET (USD BILLION)

- FIGURE 42 EV/EBITDA RATIO OF KEY PLAYERS IN SODIUM SILICATE MARKET

- FIGURE 43 SODIUM SILICATE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 44 SODIUM SILICATE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 45 SODIUM SILICATE MARKET: COMPANY FOOTPRINT

- FIGURE 46 SODIUM SILICATE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 47 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 48 OCCIDENTAL PETROLEUM CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 TOKUYAMA CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

The market for sodium silicate is approximated to be USD 5.50 billion in 2024, and it is projected to reach USD 6.83 billion by 2029 at a CAGR of 4.4%. The growing demand for sodium silicate is driven by its application in detergent manufacturing, as a fundamental ingredient because of its cleaning and emulsifying nature. The growth of construction activities also propel its application in cement and adhesives from its ability to form a strong bind and strengthen surfaces. Sodium silicate is also used by the pulp and paper industry for bleaching, de-inking, and sizing. Tough environmental laws also favor its increasing use in wastewater treatment and purification. All these combined are driving the increasing demand for sodium silicate in various industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | Form, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

By Form, Liquid sodium silicate accounted for the highest CAGR during the forecast period

The liquid sodium silicate segment has the highest CAGR in the forecast period due to its higher solubility, application ease, and process efficiency. Its growing use in detergents, adhesives, and water treatment chemicals has been a significant driver, particularly in rapidly industrializing regions. In the construction industry, liquid sodium silicate is used for densification of concrete and surface treatment because it has the property to increase durability as well as resistance. Its growing application in the pulp and paper industry for de-inking and coatings has also driven demand further. Growth in the segment is also being facilitated through developments in formulation technologies, which allow for improved performance in a range of industries.

By Application, Precipitated silica accounted for the highest CAGR during the forecast period

The precipitated silica segment registered the highest CAGR in the forecast period due to its expanding applications in the rubber, food, and personal care sectors. Its growing applications as a tire reinforcing agent on account of growing demand for fuel-efficient and high-performance tires has been a strong market growth contributor. Precipitated silica finds extensive application in the food industry as an anti-caking agent in powdered and granulated form. Furthermore, its use as a thickener and conditioner in cosmetics and personal care products has increased demand. Improved production processes for silica and increased investments in specialty-grade precipitated silica also favor the growth of the segment at a fast pace.

APAC is projected to account for the highest CAGR in the sodium silicate market during the forecast period

The Asia Pacific region is expected to have the highest CAGR within the sodium silicate market over the forecast period because of the region's robust base of manufacturing, growing foreign investments, and developments in production technologies. Economies such as China, India, and Japan are experiencing chemical processing facilities expanding, thereby resulting in increased sodium silicate consumption. Favorable government policies, lower production costs, and easy availability of raw materials further support market growth.

- By Company Type: Tier 1: 55%, Tier 2: 25%, Tier 3: 20%

- By Designation: Directors: 50%, Managers: 30%, Others: 20%

- By Region: North America: 20%, Europe: 25%, Asia Pacific: 45%, ROW-10%

Companies Covered:

Companies Covered: PQ Corporation (US), Qemetica (Poland), Nippon Chemical Industrial Co., Ltd. (Japan), Occidental Petroleum Corporation (US), Tokuyama Corporation (Japan), FUJI CHEMICAL Co., Ltd. (Japan), IQE Group (Spain), Oriental Silicas Corporation (Taiwan), Evonik Industries AG (Germany), and Metro Chem Industries (Ahmedabad) are some key players in sodium silicate Market.

Research Coverage

The market study covers the sodium silicate market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on form, application, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the sodium silicate market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall sodium silicate market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand in detergent production, expansion in construction activities, rising demand from the pulp and paper industry, environmental regulations favoring water treatment), restraints (fluctuating raw material prices, and health and environmental concerns ), opportunities (applications in green tire manufacturing, rapid urbanization in africa and asia, use in lithium-ion battery recycling, development of advanced oil recovery techniques), and challenges (environmental and regulatory compliance and competition from alternative materials) influencing the growth of the sodium silicate market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the sodium silicate market

- Market Development: Comprehensive information about profitable markets - the report analyses the sodium silicate market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the sodium silicate market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as PQ Corporation (US), Qemetica (Poland), Nippon Chemical Industrial Co., Ltd. (Japan), Occidental Petroleum Corporation (US), Tokuyama Corporation (Japan), FUJI CHEMICAL Co., Ltd. (Japan), IQE Group (Spain), Oriental Silicas Corporation (Taiwan), Evonik Industries AG (Germany), Metro Chem Industries (Ahmedabad) and others in the sodium silicate market. The report also helps stakeholders understand the pulse of the sodium silicate market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews: Demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS ASSOCIATED WITH SODIUM SILICATE MARKET

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SODIUM SILICATE MARKET

- 4.2 SODIUM SILICATE MARKET, BY FORM

- 4.3 SODIUM SILICATE MARKET, BY APPLICATION

- 4.4 ASIA PACIFIC: SODIUM SILICATE MARKET, BY APPLICATION AND COUNTRY

- 4.5 SODIUM SILICATE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMIC

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand in detergent production

- 5.2.1.2 Expansion in construction activities

- 5.2.1.3 Rising demand from pulp & paper industry

- 5.2.1.4 Environmental regulations favoring water treatment

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating raw material prices

- 5.2.2.2 Health and environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Application in green tire manufacturing

- 5.2.3.2 Rapid urbanization in Africa and Asia

- 5.2.3.3 Use in lithium-ion battery recycling

- 5.2.3.4 Development of advanced oil recovery techniques

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental and regulatory compliance

- 5.2.4.2 Competition from alternative materials

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY FORM

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 IMPACT OF GEN AI ON SODIUM SILICATE MARKET

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Hydrothermal synthesis optimization

- 6.6.1.2 Fluidized bed reactor technology

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Waste-based raw material utilization

- 6.6.2.2 Low-carbon furnace technology

- 6.6.1 KEY TECHNOLOGIES

- 6.7 PATENT ANALYSIS

- 6.8 TRADE ANALYSIS

- 6.8.1 EXPORT DATA RELATED TO HS CODE 283919, BY COUNTRY, 2018-2023 (USD MILLION)

- 6.8.2 IMPORT DATA RELATED TO HS CODE 283919, BY COUNTRY, 2018-2023 (USD MILLION)

- 6.9 KEY CONFERENCES AND EVENTS IN 2024-2025

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 TARIFF DATA (HS CODE: 283919) FOR SILICATES OF SODIUM, INCLUDING COMMERCIAL SILICATES (EXCLUDING SODIUM METASILICATES)

- 6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.3 REGULATORY FRAMEWORK

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 ENHANCEMENT OF SOIL QUALITY WITH SODIUM SILICATE

- 6.13.2 IMPROVED DRILLING EFFICIENCY IN WELLS

- 6.13.3 ENHANCING OIL, GAS, AND GEOTHERMAL WELL OPERATIONS

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECASTS

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 SODIUM SILICATE MARKET, BY FORM

- 7.1 INTRODUCTION

- 7.2 LIQUID

- 7.2.1 VERSATILE APPLICATIONS AND CUSTOMIZABLE PROPERTIES TO DRIVE DEMAND

- 7.2.2 ALKALINE

- 7.2.3 NEUTRAL

- 7.3 SOLID

- 7.3.1 STABILITY, EASE OF STORAGE, AND ROLE IN ENHANCING EFFICIENCY TO DRIVE ADOPTION

- 7.3.2 ALKALINE

- 7.3.3 NEUTRAL

8 SODIUM SILICATE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 DETERGENTS & CLEANING AGENTS

- 8.2.1 REGULATIONS AND CONSUMER TRENDS TO SUPPORT MARKET GROWTH

- 8.3 ADHESIVES

- 8.3.1 GROWTH IN PACKAGING, CONSTRUCTION, AUTOMOTIVE, AND WOODWORKING INDUSTRIES TO DRIVE MARKET

- 8.4 WATER TREATMENT

- 8.4.1 RISING INVESTMENTS IN WATER TREATMENT TO DRIVE MARKET

- 8.5 PULP & PAPER

- 8.5.1 INCREASING USE IN PAPER RECYCLING, RETENTION, AND COATING APPLICATIONS TO DRIVE MARKET

- 8.6 PRECIPITATED SILICA

- 8.6.1 GROWTH IN AUTOMOTIVE, RUBBER, AND FOOTWEAR INDUSTRIES TO PROPEL MARKET

- 8.7 OTHER APPLICATIONS

9 SODIUM SILICATE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Increasing infrastructure investments to drive demand

- 9.2.2 INDIA

- 9.2.2.1 Rapid economic growth, industrial expansion, and large-scale infrastructure investments to drive market

- 9.2.3 JAPAN

- 9.2.3.1 Booming construction sector to drive demand

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Increasing wastewater treatment initiatives to drive market

- 9.2.5 INDONESIA

- 9.2.5.1 Rising urbanization and expanding exports of sodium silicate and paper products to drive market growth

- 9.2.6 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Increasing wastewater treatment requirements and infrastructure investments to drive demand

- 9.3.2 CANADA

- 9.3.2.1 Recycling initiatives to propel demand

- 9.3.3 MEXICO

- 9.3.3.1 Rising investments in water infrastructure to support market growth

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Increase in commercial vehicle sales and green tire manufacturing to boost growth

- 9.4.2 UK

- 9.4.2.1 Growing detergents industry to propel market

- 9.4.3 FRANCE

- 9.4.3.1 Growth in EV production and turnkey projects to boost demand

- 9.4.4 POLAND

- 9.4.4.1 Increase in wastewater treatment initiatives to drive market

- 9.4.5 ITALY

- 9.4.5.1 Growth in automotive sector to drive growth

- 9.4.6 SPAIN

- 9.4.6.1 Increase in exports and consumer spending to drive market

- 9.4.7 NETHERLANDS

- 9.4.7.1 Well-established chemical industry to support market growth

- 9.4.8 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Industrial expansion to propel demand

- 9.5.2 ARGENTINA

- 9.5.2.1 Advancements in wastewater treatment to drive demand

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Growth in EV production and construction industry to drive market

- 9.6.1.2 UAE

- 9.6.1.2.1 Increased investments in manufacturing and construction industry to boost demand

- 9.6.1.3 Rest of GCC Countries

- 9.6.1.1 Saudi Arabia

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Increased imports and growth in pulp & paper industry to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYERS STRATEGIES/ RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.5.1 COMPANY VALUATION

- 10.5.2 FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Form footprint

- 10.7.5.3 Application footprint

- 10.7.5.4 Region footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

- 10.9.2 EXPANSIONS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 PQ CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 QEMETICA

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 OCCIDENTAL PETROLEUM CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 TOKUYAMA CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Expansions

- 11.1.5.3.2 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 FUJI CHEMICAL CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 MnM view

- 11.1.7 IQE GROUP

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Other developments

- 11.1.7.4 MnM view

- 11.1.8 ORIENTAL SILICAS CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.4 MnM view

- 11.1.9 EVONIK INDUSTRIES AG

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansions

- 11.1.9.4 MnM view

- 11.1.10 METRO CHEM INDUSTRIES

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 MnM view

- 11.1.1 PQ CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 STPP GROUP

- 11.2.2 SINCHEM SILICA GEL CO., LTD.

- 11.2.3 SILMACO NV

- 11.2.4 LYNN MANUFACTURING

- 11.2.5 JAM GROUP COMPANY

- 11.2.6 MERCK KGAA

- 11.2.7 ANKIT SILICATE

- 11.2.8 SUN SILICATES (PTY) LTD.

- 11.2.9 HINDCON CHEMICALS LTD.

- 11.2.10 IXOM

- 11.2.11 CHEMSUPPLY AUSTRALIA

- 11.2.12 HAWKINS

- 11.2.13 DUBI CHEM MARINE INTERNATIONAL

- 11.2.14 SAHAJANAND INDUSTRIES LIMITED

- 11.2.15 ADWAN CHEMICAL INDUSTRIES CO., LTD.

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 WATER TREATMENT CHEMICALS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 WATER TREATMENT CHEMICALS MARKET, BY TYPE

- 12.3.4 WATER TREATMENT CHEMICALS MARKET, BY SOURCE

- 12.3.5 WATER TREATMENT CHEMICALS MARKET, BY APPLICATION

- 12.3.6 WATER TREATMENT CHEMICALS MARKET, BY END USER

- 12.3.7 WATER TREATMENT CHEMICALS MARKET, BY REGION

- 12.4 FUMED SILICA MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- 12.4.3 FUMED SILICA MARKET, BY TYPE

- 12.4.4 FUMED SILICA MARKET, BY APPLICATION

- 12.4.5 FUMED SILICA MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS