|

|

市場調査レポート

商品コード

1359928

持続的腎代替療法 (CRRT) の世界市場 (~2028年):製品 ・モダリティ ・年齢・エンドユーザー・地域別Continuous Renal Replacement Therapy Market by Product (Hemofilter, Bloodline, Machines, Dialysates), Modality (SCUF, CVVH, CVVHD, CVVHDF), Age (Adult, Pediatric), Enduser (Hospitals, Ambulatory), and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 持続的腎代替療法 (CRRT) の世界市場 (~2028年):製品 ・モダリティ ・年齢・エンドユーザー・地域別 |

|

出版日: 2023年10月06日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の持続的腎代替療法 (CRRT) の市場規模は、2023年の14億米ドルから、予測期間中は8.1%のCAGRで推移し、2028年には21億米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 米ドル |

| セグメント | 製品・モダリティ・年齢層・エンドユーザー・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

急性腎不全 (AKI) の増加、ICUや重症患者における効果的な腎代替療法への注目の高まりなど、さまざまな要因がCRRTシステムとディスポーザブルの需要増加の主な要因となっています。さらに、技術的に進歩したCRRTシステム、高血圧の有病率の上昇、急性腎障害の症例の増加なども予測期間中のCRRT需要を促進すると予測されています。

製品別では、予測期間中、透析液・補液の部門が最大のシェアを示し、予測期間中は高い成長率を示すと予測されています。高成長の背景には、血行動態が不安定な患者の治療におけるCRRT需要の大幅な増加、腎代替療法用の透析液および補液を提供するメーカーの増加、さらに市場における参入企業の存在感の強さなどがあります。

モダリティ別では、CVVHDFの部門が予測期間中、もっとも高い成長率を示すと予想されています。腎臓専門医や重症治療医の間でCVVHDFが選ばれる傾向にあること、また血液透析と比較して中サイズの溶質のクリアランスが良好であること (介入なしで正確な酸塩基平衡が得られること、CRRTに関連するリン酸欠乏領域が大幅に減少すること) などの利点が、今後数年間の同分野の成長を支える要因の一部となっています。

地域別では、アジア太平洋地域が予測期間中に最大のCAGRで成長する見通しです。CRRTに対する認知度の向上、医療費の増加、可処分所得の増加、敗血症の発生率の上昇、AKIの主な原因である高血圧と糖尿病の有病率の増加、オーストラリアと日本におけるCRRTの高い使用率、AKI治療のためのCRRTへのアクセスの増加などが同地域におけるCRRTシステムの導入の増加に大きな役割を果たしています。

当レポートでは、世界の持続的腎代替療法 (CRRT) の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制分析

- 償還シナリオ

- 主要な会議とイベント

- 特許分析

- 貿易分析

- 技術分析

- エコシステム分析

- バリューチェーン分析

- 価格傾向分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- CRRTシステムにおけるAIの統合

- CRRTシステムによるアンメットニーズとエンドユーザーの期待

第6章 持続的腎代替療法 (CRRT) 市場:製品別

- 透析液・補液

- 使い捨て用品

- 血液フィルター

- 血液回路セット・チューブ

- その他

- CRRTシステム

第7章 持続的腎代替療法 (CRRT) 市場:モダリティ別

- CVVH

- CVVHDF

- CVVHD

- SCUF

第8章 持続的腎代替療法 (CRRT) 市場:年齢層別

- 成人

- 小児・新生児

第9章 持続的腎代替療法 (CRRT) 市場:エンドユーザー別

- 病院

- 外来診療

- 在宅医療

- その他

第10章 持続的腎代替療法 (CRRT) 市場:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 市場参入企業の収益シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の企業評価マトリックス

- CRRT市場における企業フットプリント分析

- CRRT市場:製品の発売と規制当局の承認

- CRRT市場:取引

- CRRT市場:その他の展開

第12章 企業プロファイル

- 主要企業

- BAXTER INTERNATIONAL, INC.

- FRESENIUS MEDICAL CARE AG & CO. KGAA

- NIKKISO CO., LTD.

- B. BRAUN MELSUNGEN AG

- MEDTRONIC PLC

- ASAHI KASEI CORPORATION

- TORAY MEDICAL CO., LTD.

- NIPRO CORPORATION

- INFOMED SA

- MEDICA SPA

- MEDITES PHARMA SPOL. S.R.O.

- MEDICAL COMPONENTS, INC.

- SWS HEMODIALYSIS CARE CO., LTD.

- NINGBO TIANYI MEDICAL DEVICES CO., LTD.

- ANJUE MEDICAL EQUIPMENT CO., LTD.

- KIMAL

- JIANGXI SANXIN MEDTEC CO., LTD.

- その他の企業

- ALLMED MEDICAL PRODUCTS CO., LTD.

- DIALCO MEDICAL INC.

- BROWNDOVE HEALTHCARE PVT. LTD.

- STERIS PLC

- KURARAY MEDICAL PLC

- LIVANOVA PLC

- DIAVERUM DEUTSCHLAND GMBH

- SEMBCORP INDUSTRIES

第13章 付録

The global Continuous renal replacement therapy therapy market size is projected to reach USD 2.1 billion by 2028 from USD 1.4 billion in 2023, at a CAGR of 8.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | (USD) billion |

| Segments | Product, modality, age group, End user and region |

| Regions covered | North America, EuropeAPAC, LATAM , MEA. |

Various factors such as increasing incidences of Acute kidney injyury (AKI) and rising prominence on effective renal replacement therapy among patients in ICU and critically ill patients are majorly attributing to the rise in the demand for CRRT system and disposables. Moreover, the technologically advanced CRRT system in the market and rising prevalence of hypertension and rising cases of Acute kidney injury, are some of the factors which are anticipated to drive the demand for Continuous renal replacement therapy therapy during the forecast period.

"The dialysate and replacement fluid segment to capture the largest share in Continuous renal replacement therapy therapy market, by product, during the forecast period."

The dialysate and replacement fluid segment is expected to witness the high growth rate during the forecast period. The high growth owes to the significant increase in the demand for CRRT in the treatment for the patients who are unstablehemodynamically , the increase in the number of manufacturers who are offering dialysate and replacement fluids for renal replacement therapy, and also the strong presence of players in the market.

"The continuous venovenous hemodiafiltration segment to witness highest growth rate in Continuous renal replacement therapy therapy market, by modality in 2022."

The continuous venovenous hemodiafiltration modality segment is expected to witness the highest growth rate in the CRRT market during the forecast period. The rising preference of continuous venovenous hemodiafiltrationmodality among nephrologists and critical care physicians, and also the advantages which includes better clearance of medium-sized solutes in comparison to hemodialysis (accurate acid-base balance without intervention, and a significant reduction in CRRT-related phosphate depletion area are some of the factors which supports the growth of the segment in the coming years.

"The Hospital segment accounted for the largest share of the Continuous renal replacement therapy therapy, by age group, in 2022"

The CRRT process mainly adopted in hospitals due to its technological advancements and cost of investment. The economical stability of hospitals among other end users has led to its larger market share. The continuous renal replacement therapy (CRRT) is mostly used treatment in hospitals, especially in the intensive care unit (ICU) or the patients who are critically ill. It can help to stabilize hemodynamic parameters and improve clinical symptoms and organ function in patients, which can help to reduce complications

"The Asia Pacific market to grow at the highest CAGR during the forecast period."

The Continuous renal replacementtherapy market is segmented into five major regions, , North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The increase in the awareness of Continuous renal replacement therapy therapy, increasing healthcare expenditures, rising of the disposable incomes , rising incidences of sepsis, increasing prevalence of hypertension & diabetes (major causes of AKI), the high use of CRRT in Australia and Japan, , and increasing accessibility to CRRT for AKI treatment are some of the key factors that are playing major role in increase of adoption of the CRRT systems in Asia Pacific region

Breakdown of supply-side primary interviews:

- By Company Type: Tier 1: 25%, Tier 2: 30%, and Tier 3: 45%

- By Designation: C-level: 26%, D-level: 30%, and Others: 44%

- By Region: North America: 40%, Europe: 31%, APAC: 20%, Latin America: 6%, and the Middle East & Africa: 3%

The major players operating in the Continuous renal replacement therapy therapy market are Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International Inc. (US), and B. Braun Melsungen AG (Germany),

Research Coverage

This report studies the Continuous renal replacement therapy therapy market based on the product, modality, age group, end users and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Key Benefits of Buying the Report

The report can help established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one, or a combination of the below-mentioned five strategies.

This report provides insights into the following pointers:

- Market Driver: The growth of the market attributes to increase of advanced technology and benefits of using CRRT systems.

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Continuous renal replacement therapy market. The report analyzes the market based on the product, modality, age group, end users and region.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the Continuous renal replacement therapy market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for Continuous renal replacement therapy across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the Continuous renal replacement therapy market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the Continuous renal replacement therapy market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: REGIONAL SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 MAJOR MARKET STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from industry experts

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARIES: CONTINUOUS RENAL REPLACEMENT THERAPY (CRRT) MARKET

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 7 SUPPLY-SIDE MARKET ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: BAXTER INTERNATIONAL INC.

- FIGURE 9 REVENUE SHARE ANALYSIS FOR TOP PLAYERS

- FIGURE 10 DEMAND-SIDE MARKET ESTIMATION: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- FIGURE 11 DEMAND-SIDE MARKET ESTIMATION: CONTINUOUS RENAL REPLACEMENT THERAPY CONSUMABLES

- FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET (2023-2028)

- FIGURE 13 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 14 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 15 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- 2.6 LIMITATIONS

- 2.7 METHODOLOGY-RELATED LIMITATIONS

- 2.8 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 16 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 GEOGRAPHICAL SNAPSHOT OF CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

4 PREMIUM INSIGHTS

- 4.1 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET OVERVIEW

- FIGURE 21 RISING PREVALENCE OF ACUTE KIDNEY INJURY AND GROWING AWARENESS OF CRRT TO DRIVE MARKET

- 4.2 NORTH AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT AND COUNTRY (2022)

- FIGURE 22 DIALYSATE & REPLACEMENT FLUIDS SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- 4.3 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 23 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 REGIONAL MIX: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET (2021-2028)

- FIGURE 24 NORTH AMERICA WILL CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: EMERGING VS. DEVELOPED MARKETS

- FIGURE 25 EMERGING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 26 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing incidence of acute kidney injury (AKI)

- FIGURE 27 GLOBAL INCIDENCE OF ACUTE KIDNEY INJURY, 2010 VS. 2015 VS. 2020

- TABLE 2 NUMBER OF PEOPLE AGED 65 OR OVER, BY REGION, 2019 VS. 2050

- 5.2.1.2 Growing number of ICU patients with AKI and increasing incidence of sepsis

- FIGURE 28 IMPACT OF ICU-ACQUIRED AKI IN US

- 5.2.1.3 Increasing clinical advantage of CRRT over intermittent blood purification

- 5.2.1.4 Technological advancements and new product launches

- 5.2.1.5 Growing prevalence of diabetes and hypertension

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory guidelines in North America

- 5.2.2.2 High procedural cost of CRRT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets in Asia Pacific and RoW

- 5.2.3.2 Increasing applications of CRRT

- 5.2.3.2.1 Evolution of CRRT from simple renal replacement treatment to multi-organ support therapy

- 5.2.3.2.2 Progression of CRRT from adaptive renal devices to multipurpose treatment machines

- 5.2.3.3 Ongoing research to establish safety and efficacy profile of CRRT

- 5.2.3.4 Development of CRRT systems for pediatric patients

- 5.2.3.4.1 The CARPEDIEM Project

- 5.2.3.5 Untapped growth opportunities in North America

- 5.2.4 CHALLENGES

- 5.2.4.1 High complexity of CRRT

- 5.2.4.2 Lack of standard treatment guidelines in developing nations

- 5.2.4.3 Shortage of trained ICU professionals in developing nations

- 5.2.4.4 Poor reimbursement scenario in developing countries

- 5.2.4.5 Lack of awareness about benefits of CRRT

- 5.3 REGULATORY ANALYSIS

- 5.3.1 NORTH AMERICA

- 5.3.2 EUROPE

- 5.3.3 ASIA PACIFIC

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.4 REST OF THE WORLD (ROW)

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.4 REIMBURSEMENT SCENARIO

- 5.4.1 NORTH AMERICA

- 5.4.2 EUROPE

- 5.4.3 ASIA PACIFIC

- 5.4.3.1 Japan

- 5.4.4 REST OF THE WORLD (ROW)

- 5.4.4.1 Brazil

- 5.4.4.2 Central America and the Caribbean

- 5.5 KEY CONFERENCES & EVENTS

- TABLE 3 KEY CONFERENCES & EVENTS, 2023

- 5.6 PATENT ANALYSIS

- 5.6.1 PATENT PUBLICATION TRENDS FOR CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- FIGURE 29 PATENT PUBLICATION TRENDS (JANUARY 2013-AUGUST 2023)

- 5.6.2 INSIGHTS ON JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 30 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR CONTINUOUS RENAL REPLACEMENT PATENTS, 2013-2023

- FIGURE 31 TOP 10 APPLICANT COUNTRIES/REGIONS FOR CONTINUOUS RENAL REPLACEMENT PATENTS, 2013-2023

- TABLE 4 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: LIST OF MAJOR PATENTS

- 5.7 TRADE ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 MINIMALLY INVASIVE CRRT

- 5.8.2 CRRT IN COMBINATION WITH OTHER THERAPIES

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 VALUE CHAIN ANALYSIS

- FIGURE 32 VALUE CHAIN OF CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- 5.11 PRICING TREND ANALYSIS

- TABLE 5 AVERAGE PRICE OF CRRT SYSTEMS AND CONSUMABLES, BY COUNTRY, 2020 (USD)

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- 5.13.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- TABLE 8 KEY BUYING CRITERIA FOR CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

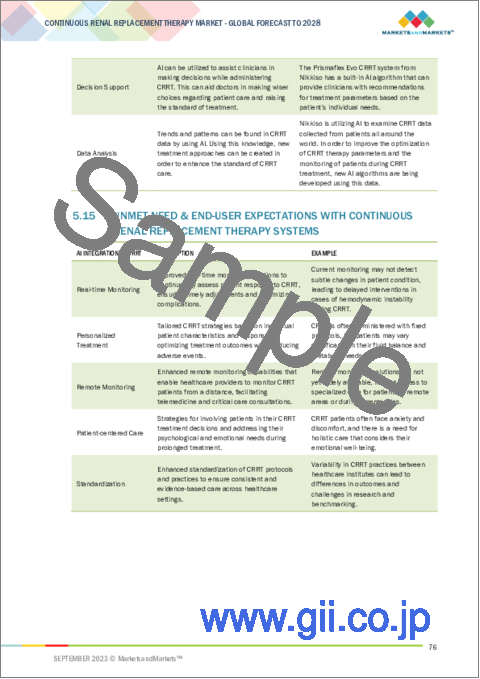

- 5.14 ARTIFICIAL INTELLIGENCE INTEGRATION IN CONTINUOUS RENAL REPLACEMENT THERAPY SYSTEMS

- 5.15 UNMET NEED & END-USER EXPECTATIONS WITH CONTINUOUS RENAL REPLACEMENT THERAPY SYSTEMS

6 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 9 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 DIALYSATE & REPLACEMENT FLUIDS

- 6.2.1 RISING DEMAND FOR DIALYSATE TO DRIVE MARKET

- TABLE 10 DIALYSATE & REPLACEMENT FLUIDS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 DISPOSABLES

- TABLE 11 DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 12 DISPOSABLES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 HEMOFILTERS

- 6.3.1.1 Widely adopted during CRRT procedures for treatment of AKI

- TABLE 13 HEMOFILTERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2 BLOODLINE SETS & TUBES

- 6.3.2.1 Development of blood tubing with special coding to prevent clotting to offer growth opportunities

- TABLE 14 BLOODLINE SETS & TUBES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.3 OTHER DISPOSABLES

- TABLE 15 OTHER DISPOSABLES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 CRRT SYSTEMS

- 6.4.1 AVAILABILITY OF TECHNOLOGICALLY ADVANCED, EASY-TO-USE SYSTEMS TO BOOST MARKET GROWTH

- TABLE 16 CRRT SYSTEMS MARKET BY COUNTRY, 2021-2028 (USD MILLION)

7 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY

- 7.1 INTRODUCTION

- TABLE 17 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- 7.2 CONTINUOUS VENOVENOUS HEMOFILTRATION

- 7.2.1 WIDESPREAD ADOPTION IN TREATMENT OF ACUTE KIDNEY INJURY TO DRIVE MARKET

- TABLE 18 CONTINUOUS VENOVENOUS HEMOFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 CONTINUOUS VENOVENOUS HEMODIAFILTRATION

- 7.3.1 USED IN PATIENTS WITH CONGESTIVE HEART FAILURE

- TABLE 19 CONTINUOUS VENOVENOUS HEMODIAFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 CONTINUOUS VENOVENOUS HEMODIALYSIS

- 7.4.1 MORE EFFECTIVE IN REMOVING SMALL TO MEDIUM-SIZED MOLECULES COMPARED TO OTHER CRRT MODALITIES

- TABLE 20 CONTINUOUS VENOVENOUS HEMODIALYSIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 SLOW CONTINUOUS ULTRAFILTRATION

- 7.5.1 DOES NOT USE DIALYSATE OR REPLACEMENT FLUIDS FOR REMOVAL OF EXCESS FLUID FROM BLOODSTREAM

- TABLE 21 SLOW CONTINUOUS ULTRAFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP

- 8.1 INTRODUCTION

- TABLE 22 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- 8.2 ADULTS

- 8.2.1 LARGEST AND FASTEST-GROWING SEGMENT OF MARKET

- TABLE 23 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET FOR ADULTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 PEDIATRICS & NEONATES

- 8.3.1 HIGH PREVALENCE OF AKI IN NEONATES TO SUPPORT MARKET GROWTH

- TABLE 24 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET FOR PEDIATRICS & NEONATES, BY COUNTRY, 2021-2028 (USD MILLION)

9 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 25 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 HOSPITALS

- 9.2.1 FASTEST-GROWING END-USER SEGMENT

- TABLE 26 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET FOR HOSPITALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 AMBULATORY CARE

- 9.3.1 REDUCED INPATIENT STAY TO SUPPORT MARKET GROWTH

- TABLE 27 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET FOR AMBULATORY CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 HOME CARE

- 9.4.1 RISING ADOPTION OF PORTABLE AND HOME-BASED DEVICES TO AID MARKET GROWTH

- TABLE 28 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET FOR HOME CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.5 OTHER END USERS

- TABLE 29 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

10 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 30 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICAN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: RECESSION IMPACT

- FIGURE 35 NORTH AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET SNAPSHOT

- TABLE 31 NORTH AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Large number of AKI patients to drive market

- TABLE 37 US: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 38 US: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 39 US: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 40 US: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 41 US: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 High cost of CRRT to negatively impact market growth

- TABLE 42 CANADA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 43 CANADA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 44 CANADA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 45 CANADA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 46 CANADA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPEAN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: RECESSION IMPACT

- TABLE 47 EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 48 EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 49 EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 50 EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 51 EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 52 EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Largest market for continuous renal replacement therapy in Europe

- TABLE 53 GERMANY: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 54 GERMANY: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 GERMANY: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 56 GERMANY: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 57 GERMANY: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Rising number of sepsis cases to support market growth

- TABLE 58 UK: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 59 UK: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 UK: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 61 UK: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 62 UK: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Growing AKI patient population to propel market growth

- TABLE 63 FRANCE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 64 FRANCE: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 FRANCE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 66 FRANCE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 67 FRANCE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Government initiatives to promote awareness of renal care to drive market

- TABLE 68 ITALY: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 69 ITALY: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 ITALY: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 71 ITALY: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 72 ITALY: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Favorable reimbursement scenario to favor market growth

- TABLE 73 SPAIN: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 74 SPAIN: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 75 SPAIN: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 76 SPAIN: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 77 SPAIN: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 78 REST OF EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 79 REST OF EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 REST OF EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 81 REST OF EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 82 REST OF EUROPE: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: RECESSION IMPACT

- FIGURE 36 ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET SNAPSHOT

- TABLE 83 ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Well-established medical infrastructure to support market growth

- TABLE 89 JAPAN: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 90 JAPAN: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 JAPAN: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 92 JAPAN: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 93 JAPAN: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Increasing prevalence of ESRD and AKI to boost demand for CRRT

- TABLE 94 CHINA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 95 CHINA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 CHINA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 97 CHINA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 98 CHINA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Large patient population to support market growth

- TABLE 99 INDIA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 100 INDIA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 INDIA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 102 INDIA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 103 INDIA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Government initiatives to increase adoption of CRRT

- TABLE 104 AUSTRALIA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 105 AUSTRALIA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 AUSTRALIA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 107 AUSTRALIA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 108 AUSTRALIA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing awareness through online education programs and events to aid market growth

- TABLE 109 SOUTH KOREA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 110 SOUTH KOREA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 112 SOUTH KOREA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 113 SOUTH KOREA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 114 REST OF ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICAN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: RECESSION IMPACT

- TABLE 119 LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 120 LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 121 LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 123 LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Rising incidence of AKI to drive market

- TABLE 125 BRAZIL: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 126 BRAZIL: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 127 BRAZIL: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 128 BRAZIL: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 129 BRAZIL: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.3 MEXICO

- 10.5.3.1 Large patient population to drive market

- TABLE 130 MEXICO: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 131 MEXICO: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 MEXICO: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 133 MEXICO: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 134 MEXICO: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.4 REST OF LATIN AMERICA

- TABLE 135 REST OF LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 136 REST OF LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 REST OF LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 138 REST OF LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 139 REST OF LATIN AMERICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 LACK OF AWARENESS REGARDING CRRT TO RESTRAIN MARKET GROWTH

- 10.6.2 MIDDLE EAST AND AFRICAN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: RECESSION IMPACT

- TABLE 140 MIDDLE EAST & AFRICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: CONTINUOUS RENAL REPLACEMENT THERAPY DISPOSABLES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY MODALITY, 2021-2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY AGE GROUP, 2021-2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: CONTINUOUS RENAL REPLACEMENT THERAPY MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- FIGURE 37 GROWTH STRATEGIES ADOPTED BY KEY PLAYERS IN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- 11.2 REVENUE SHARE ANALYSIS OF MARKET PLAYERS, 2018-2022 (USD MILLION)

- FIGURE 38 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- FIGURE 39 MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- TABLE 145 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: DEGREE OF COMPETITION

- 11.3 COMPANY EVALUATION MATRIX

- 11.3.1 STARS

- 11.3.2 EMERGING LEADERS

- 11.3.3 PERVASIVE PLAYERS

- 11.3.4 PARTICIPANTS

- FIGURE 40 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.4 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 11.4.1 PROGRESSIVE COMPANIES

- 11.4.2 STARTING BLOCKS

- 11.4.3 RESPONSIVE COMPANIES

- 11.4.4 DYNAMIC COMPANIES

- FIGURE 41 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 11.5 FOOTPRINT ANALYSIS OF PLAYERS IN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- TABLE 146 PRODUCT, REGIONAL, AND END-USER FOOTPRINT ANALYSIS OF PLAYERS IN CONTINUOUS RENAL REPLACEMENT THERAPY MARKET

- TABLE 147 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 148 END-USER FOOTPRINT OF COMPANIES

- TABLE 149 REGIONAL FOOTPRINT OF COMPANIES

- 11.6 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: PRODUCT LAUNCHES AND REGULATORY APPROVALS (JANUARY 2019 TO AUGUST 2023)

- TABLE 150 KEY PRODUCT LAUNCHES AND REGULATORY APPROVALS

- 11.7 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: DEALS (JANUARY 2019 TO AUGUST 2023)

- TABLE 151 KEY DEALS

- 11.8 CONTINUOUS RENAL REPLACEMENT THERAPY MARKET: OTHER DEVELOPMENTS (JANUARY 2019 TO AUGUST 2023)

- TABLE 152 OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 MAJOR PLAYERS

- 12.1.1 BAXTER INTERNATIONAL, INC.

- TABLE 153 BAXTER INTERNATIONAL, INC.: BUSINESS OVERVIEW

- FIGURE 42 BAXTER INTERNATIONAL, INC.: COMPANY SNAPSHOT (2022)

- TABLE 154 BAXTER INTERNATIONAL, INC.: PRODUCT OFFERINGS

- 12.1.2 FRESENIUS MEDICAL CARE AG & CO. KGAA

- TABLE 155 FRESENIUS MEDICAL CARE AG & CO. KGAA: BUSINESS OVERVIEW

- FIGURE 43 FRESENIUS MEDICAL CARE AG & CO. KGAA: COMPANY SNAPSHOT (2022)

- TABLE 156 FRESENIUS MEDICAL CARE AG & CO. KGAA: PRODUCT OFFERINGS

- 12.1.3 NIKKISO CO., LTD.

- TABLE 157 NIKKISO CO., LTD.: BUSINESS OVERVIEW

- FIGURE 44 NIKKISO CO., LTD.: COMPANY SNAPSHOT (2022)

- TABLE 158 NIKKISO CO., LTD.: PRODUCT OFFERINGS

- 12.1.4 B. BRAUN MELSUNGEN AG

- TABLE 159 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

- FIGURE 45 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2022)

- TABLE 160 B. BRAUN MELSUNGEN AG: PRODUCT OFFERINGS

- 12.1.5 MEDTRONIC PLC

- TABLE 161 MEDTRONIC PLC: BUSINESS OVERVIEW

- FIGURE 46 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- TABLE 162 MEDTRONIC PLC: PRODUCT OFFERINGS

- 12.1.6 ASAHI KASEI CORPORATION

- TABLE 163 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- FIGURE 47 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 164 ASAHI KASEI CORPORATION: PRODUCT OFFERINGS

- 12.1.7 TORAY MEDICAL CO., LTD.

- TABLE 165 TORAY MEDICAL CO., LTD.: BUSINESS OVERVIEW

- FIGURE 48 TORAY MEDICAL CO., LTD.: COMPANY SNAPSHOT (2022)

- TABLE 166 TORAY MEDICAL CO., LTD.: PRODUCT OFFERINGS

- 12.1.8 NIPRO CORPORATION

- TABLE 167 NIPRO CORPORATION: BUSINESS OVERVIEW

- FIGURE 49 NIPRO CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 168 NIPRO CORPORATION: PRODUCT OFFERINGS

- 12.1.9 INFOMED SA

- TABLE 169 INFOMED SA: BUSINESS OVERVIEW

- TABLE 170 INFOMED SA: PRODUCT OFFERINGS

- 12.1.10 MEDICA SPA

- TABLE 171 MEDICA SPA: BUSINESS OVERVIEW

- TABLE 172 MEDICA SPA: PRODUCT OFFERINGS

- 12.1.11 MEDITES PHARMA SPOL. S.R.O.

- TABLE 173 MEDITES PHARMA SPOL. S.R.O.: BUSINESS OVERVIEW

- TABLE 174 MEDITES PHARMA SPOL. S.R.O.: PRODUCT OFFERINGS

- 12.1.12 MEDICAL COMPONENTS, INC.

- TABLE 175 MEDICAL COMPONENTS, INC.: BUSINESS OVERVIEW

- TABLE 176 MEDICAL COMPONENTS, INC.: PRODUCT OFFERINGS

- 12.1.13 SWS HEMODIALYSIS CARE CO., LTD.

- TABLE 177 SWS HEMODIALYSIS CARE CO., LTD.: BUSINESS OVERVIEW

- TABLE 178 SWS HEMODIALYSIS CARE CO., LTD.: PRODUCT OFFERINGS

- 12.1.14 NINGBO TIANYI MEDICAL DEVICES CO., LTD.

- TABLE 179 NINGBO TIANYI MEDICAL DEVICES CO., LTD.: BUSINESS OVERVIEW

- TABLE 180 NINGBO TIANYI MEDICAL DEVICES CO., LTD.: PRODUCT OFFERINGS

- 12.1.15 ANJUE MEDICAL EQUIPMENT CO., LTD.

- TABLE 181 ANJUE MEDICAL EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

- TABLE 182 ANJUE MEDICAL EQUIPMENT CO., LTD.: PRODUCT OFFERINGS

- 12.1.16 KIMAL

- TABLE 183 KIMAL: BUSINESS OVERVIEW

- TABLE 184 KIMAL.: PRODUCT OFFERINGS

- 12.1.17 JIANGXI SANXIN MEDTEC CO., LTD.

- TABLE 185 JIANGXI SANXIAN MEDTECH CO., LTD.: BUSINESS OVERVIEW

- TABLE 186 JIANGXI SANXIAN MEDTECH CO., LTD.: PRODUCT OFFERINGS

- 12.2 OTHER PLAYERS

- 12.2.1 ALLMED MEDICAL PRODUCTS CO., LTD.

- 12.2.2 DIALCO MEDICAL INC.

- 12.2.3 BROWNDOVE HEALTHCARE PVT. LTD.

- 12.2.4 STERIS PLC

- 12.2.5 KURARAY MEDICAL PLC

- 12.2.6 LIVANOVA PLC

- 12.2.7 DIAVERUM DEUTSCHLAND GMBH

- 12.2.8 SEMBCORP INDUSTRIES

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS