|

|

市場調査レポート

商品コード

1503248

点滴灌漑の世界市場:コンポーネント別、作物タイプ別、用途別、エミッター/ドリッパータイプ別、地域別 - 予測(~2029年)Drip Irrigation Market Report by Component, Crop Type, Application, Emitter/Dripper Type, & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 点滴灌漑の世界市場:コンポーネント別、作物タイプ別、用途別、エミッター/ドリッパータイプ別、地域別 - 予測(~2029年) |

|

出版日: 2024年06月24日

発行: MarketsandMarkets

ページ情報: 英文 312 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の点滴灌漑の市場規模は、2024年の56億米ドルから、予測期間中はCAGR 9.0%で推移し、2029年には86億米ドルの規模に成長すると予測されています。

点滴灌漑の利点には、節水効果の向上、作物の収量の増加、雑草の繁殖の抑制、養分の損失の最小化などがあります。点滴灌漑は、制御された安定した水の供給により、植物の健全な成長と生産性の向上を促進し、現代農業の持続可能な選択肢となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額(米ドル) |

| セグメント | コンポーネント・作物タイプ・用途・エミッター/ドリッパータイプ・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・南米・その他の地域 |

作物収量の増加に対する需要の高まりが世界の点滴灌漑市場を牽引:

点滴灌漑システムは、農家が正確な量の水と栄養素を植物の根域に直接供給することを可能にし、より健全な成長を促進し、収量を最大化します。灌漑効率を最適化し、作物へのストレスを軽減することで、点滴灌漑は作物の品質向上と農場全体の収益性向上に貢献します。このような生産性向上へのニーズは、水不足や気候条件の変動といった課題に直面している地域では特に重要であり、安定した作物の成長を維持する点滴灌漑の能力は特に貴重なものとなります。

作物タイプ別では、畑作物および果実・ナッツの部門が2023年に主要部門に:

点滴灌漑は、水利用を最適化し、作物の品質を向上させる能力により、畑作物と果実・ナッツの部門で広く採用されています。トウモロコシ、大豆、綿花などの畑作物では、点滴システムは水と栄養分を根域に直接供給し、水の無駄を減らして収量を増加させます。この精密な灌漑方法により、最適な成長と発育に不可欠な水分レベルが一定に保たれます。同様に、ブドウ、アーモンド、柑橘類などの果物やナッツ類においても、点滴灌漑は果実の品質、大きさ、味に不可欠な均一な水分分配を促進します。これらの分野での点滴灌漑の採用は、持続可能な水管理の必要性と、多様な農業環境において生産性を最大化したいという願望によって推進されています。

適用法別では、表面灌漑の成長率がもっとも高い:

表面点滴灌漑が地下点滴灌漑よりも好まれる理由はいくつかあります。第一に、部品が地上にあり、アクセスしやすいため、漏水や詰まりを素早く特定し修理できます。また、視界がよく、配水をコントロールしやすいため、作物や土壌の状態に合わせて調整しやすいです。さらに、地下システムで問題となる根の侵入や土壌の移動による障害も起こりにくいです。表面点滴灌漑は、特に凹凸のある地形で均一な配水を確保する上でより効果的であり、エミッターの点検や清掃が容易です。埋設されたエミッターの周囲で土壌が圧縮され、システムの効率が低下するという潜在的な問題も回避できます。また、表面システムは、灌漑ニーズや輪作方法の変化への適応性が高く、農家にとって柔軟性が高いという利点もあります。

当レポートでは、世界の点滴灌漑の市場を調査し、市場概要、市場影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済指標

- 人口密度の増加

- 気候変動

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- 顧客の事業に影響を与える動向/ディスラプション

- バリューチェーン分析

- エコシステム分析/市場マップ

- 技術分析

- 価格分析

- 特許分析

- ケーススタディ分析

- 貿易分析

- 主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

第7章 点滴灌漑市場:コンポーネント別

- エミッター/ドリッパー

- 圧力ポンプ

- 点滴メインライン/点滴チューブ

- バルブ

- フィルター・肥料注入器

- 肥料注入器

- フィルター

- 付属品・アクセサリー

- 水道メーター

- 圧力計

- 灌漑コントローラー

- ジョイナー

- グロメット

- エンドキャップ

- その他の付属品

第8章 点滴灌漑市場:エミッター/ドリッパータイプ別

- インラインエミッター

- オンラインエミッター

第9章 点滴灌漑市場:作物別

- 畑作物

- トウモロコシ

- コットン

- サトウキビ

- 米

- その他

- 果物・ナッツ

- ブドウ

- りんご

- 洋ナシ

- クルミ

- その他

- 野菜

- トマト

- トウガラシ属

- チリ

- キャベツ

- その他

- その他

第10章 点滴灌漑市場:適用法別

- 表面点滴灌漑

- 地下点滴灌漑

第11章 点滴灌漑市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- セグメント収益分析

- 市場シェア分析、2023年

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業価値評価と財務指標

- ブランド/製品/サービス分析

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- NETAFIM

- RIVULIS

- THE TORO COMPANY

- JAIN IRRIGATION SYSTEMS LTD.

- HUNTER INDUSTRIES INC.

- MAHINDRA EPC IRRIGATION LIMITED

- RAIN BIRD CORPORATION

- CHINADRIP IRRIGATION EQUIPMENT(XIAMEN)CO., LTD

- ELGO IRRIGATION LTD.

- SHANGHAI IRRIST CORP., LTD.

- ANTELCO

- MICROJET IRRIGATION SYSTEMS

- METZER

- GRUPO CHAMARTIN S.A.

- AZUD

- その他の企業

- DRIPWORKS

- IRRITEC S.P.A

- GOLDENKEY

- KSNM DRIP

- NATIONAL DIVERSIFIED SALES, INC.

- AGRODRIP

- IRRIGATION DIRECT CANADA

- SUJAY IRRIGATIONS PVT LTD.

- BHARAT DRIP IRRIGATION AND AGRO

- GLOBAL IRRIGATION, INC.

第14章 隣接市場と関連市場

第15章 付録

The global drip irrigation market is estimated at USD 5.6 billion in 2024 and is projected to reach USD 8.6 billion by 2029, at a CAGR of 9.0% during the forecast period. Drip irrigation is a precise and efficient watering method that delivers water directly to the root zone of plants through a network of tubes, valves, and emitters. This system minimizes water wastage by reducing evaporation and runoff, ensuring that water is used effectively. The benefits of drip irrigation include improved water conservation, enhanced crop yields, reduced weed growth, and minimized nutrient loss. By providing consistent and controlled water supply, drip irrigation promotes healthier plant growth and increased productivity, making it a sustainable choice for modern agriculture.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Component, Crop Type, Application, Emitter/Dripper Type, & Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

"Rising demand for higher crop yields to drive the drip irrigation market globally"

Drip irrigation systems enable farmers to provide precise amounts of water and nutrients directly to the root zone of plants, promoting healthier growth and maximizing yields. By optimizing irrigation efficiency and reducing stress on crops, drip irrigation contributes to increased crop quality and overall farm profitability. This demand for enhanced productivity is particularly crucial in regions facing challenges such as water scarcity or variable climatic conditions, where drip irrigation's ability to sustain consistent crop growth becomes particularly valuable.

"In 2023, field crops and fruits & nuts stood as the major segment within the crop type segment of the drip irrigation market. "

Drip irrigation has seen widespread adoption in both field crops and fruits & nuts due to its ability to optimize water use and enhance crop quality. In field crops such as maize, soybeans, and cotton, drip systems deliver water and nutrients directly to the root zone, reducing water waste and increasing yields. This precise irrigation method ensures consistent moisture levels critical for optimal growth and development. Similarly, in fruits & nuts such as grapes, almonds, and citrus, drip irrigation promotes uniform water distribution, which is essential for fruit quality, size, and taste. The adoption of drip irrigation in these sectors has been driven by the need for sustainable water management practices and the desire to maximize productivity in diverse agricultural settings.

"Within the application segment,surface application will grow at highest rate."

Surface drip irrigation is preferred over subsurface drip irrigation for several reasons. First, it is generally easier and less costly to install and maintain since the components are accessible above ground, allowing for quicker identification and repair of leaks or blockages. Additionally, surface systems provide better visibility and control over water distribution, making it easier to adjust for different crops and soil conditions. They are also less likely to be disrupted by root intrusion or soil movement, which can be problematic in subsurface systems. Surface drip irrigation can be more effective in ensuring uniform water distribution, especially on uneven terrain, and allows for easier inspection and cleaning of emitters. Furthermore, it avoids potential issues with soil compaction around buried emitters, which can reduce system efficiency. Lastly, surface systems are more adaptable to changing irrigation needs and crop rotation practices, providing greater flexibility for farmers.

"The drip irrigation market in Rest of the World is projected to grow at highest rate during the forecast period."

Drip irrigation is poised to grow at the highest rate in ROW region due to several compelling reasons. Firstly, these regions face significant water scarcity challenges exacerbated by climate change and rapid population growth. Drip irrigation's ability to maximize water efficiency by delivering water directly to plant roots minimizes wastage from evaporation and runoff, making it an ideal solution in water-stressed environments. Secondly, there is increasing governmental and international support for sustainable agriculture practices and food security initiatives, driving investments in modern irrigation technologies like drip systems. Thirdly, the expansion of commercial agriculture and horticultural sectors in these regions, coupled with the demand for high-value crops, further fuels the adoption of drip irrigation to ensure reliable and efficient water supply.

The Break-up of Primaries:

By Company Type: Tire 1- 35%, Tire 2- 40%, Tire 3- 25%

By Designation: CXOs - 30%, Managers - 50%, Executives - 20%

By Region: North America - 25%, Europe - 25%, Asia Pacific - 30%, South America - 10%, RoW - 10%

Key players in this market include Rivulis (Isarel), The Toro Company (US), Jain Irrigation Systems Ltd. (India), HUNTERS INDUSTRIES INC. (US), NETAFIM (Isarel), Mahindra EPC Irrigation Limited (India), Rain Bird Corporation (US), Chinadrip Irrigation Equipment (Xiamen) Co., Ltd. (China), Elgo Irrigation Ltd. (Isarel), Shanghai Irrist Corp., Ltd. (China), Antelco (Australia), Microjet Irrigation Systems (South Africa), metzer (Isarel), Grupo Chamartin S.A. (Spain), and Azud (Spain).

Research Coverage:

The report segments the drip irrigation market based on component type, crop type, application, emitter/dripper type, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the drip irrigation market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services, key strategies, Contracts, partnerships, and agreements. New product launches, mergers and acquisitions, and recent developments associated with the drip irrigation market. Competitive analysis of upcoming startups in the drip irrigation market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall drip irrigation market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights on the following pointers:

- Analysis of key drivers (government programs and subsidies driving acceptance of drip irrigation systems, cost efficiency in agricultural productions, and enhanced crop yields) restraints (high initial cost of large-scale drip irrigation systems and high cost of system maintenance) opportunities (increase adoption of precision agriculture and advancements in technological capabilities of drip irrigation systems) and challenges (environmental degradation of drip irrigation equipment and bioclogging in drip irrigation systems).

- Product Development/Innovation: Detailed insights on research & development activities and new product launches in the drip irrigation market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the drip irrigation market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the drip irrigation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Rivulis (Isarel), The Toro Company (US), Jain Irrigation Systems Ltd. (India), HUNTERS INDUSTRIES INC. (US), NETAFIM (Isarel), Mahindra EPC Irrigation Limited (India), Rain Bird Corporation (US), Chinadrip Irrigation Equipment (Xiamen) Co., Ltd. (China), Elgo Irrigation Ltd. (Isarel), Shanghai Irrist Corp., Ltd. (China), Antelco (Australia), Microjet Irrigation Systems (South Africa), metzer (Isarel), Grupo Chamartin S.A. (Spain), and Azud (Spain) in the drip irrigation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 DRIP IRRIGATION MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- TABLE 1 DRIP IRRIGATION MARKET: INCLUSIONS & EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.3.4 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019-2023

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DRIP IRRIGATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 3 KEY DATA FROM PRIMARY SOURCES

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 DRIP IRRIGATION MARKET: DEMAND-SIDE CALCULATION

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- FIGURE 5 DRIP IRRIGATION MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: SUPPLY SIDE

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 RECESSION IMPACT ON DRIP IRRIGATION MARKET

- 2.6.1 RECESSION MACRO INDICATORS

- FIGURE 7 INDICATORS OF RECESSION

- FIGURE 8 GLOBAL INFLATION RATE, 2011-2022

- FIGURE 9 GLOBAL GDP, 2011-2022 (USD TRILLION)

- FIGURE 10 RECESSION INDICATORS AND THEIR IMPACT ON DRIP IRRIGATION MARKET

- FIGURE 11 DRIP IRRIGATION MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 3 DRIP IRRIGATION MARKET SNAPSHOT, 2024 VS. 2029

- FIGURE 12 DRIP IRRIGATION MARKET, BY COMPONENT, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 DRIP IRRIGATION MARKET, BY CROP TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 DRIP IRRIGATION MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 DRIP IRRIGATION MARKET SHARE (2023) AND CAGR (2024-2029), BY REGION

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES IN DRIP IRRIGATION MARKET

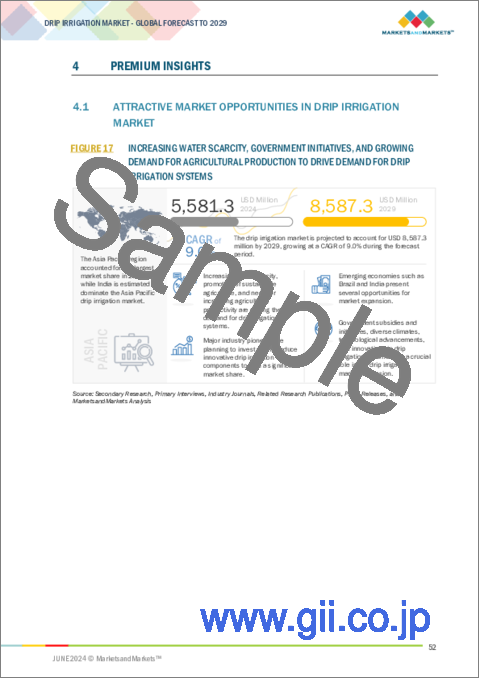

- FIGURE 17 INCREASING WATER SCARCITY, GOVERNMENT INITIATIVES, AND GROWING DEMAND FOR AGRICULTURAL PRODUCTION TO DRIVE DEMAND FOR DRIP IRRIGATION SYSTEMS

- 4.2 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY COMPONENT AND COUNTRY

- FIGURE 18 DRIP MAINLINES/DRIP TUBES SEGMENT AND INDIA TO ACCOUNT FOR LARGEST SHARES IN ASIA PACIFIC DRIP IRRIGATION MARKET IN 2024

- 4.3 DRIP IRRIGATION MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 19 INDIA TO ACCOUNT FOR LARGEST SHARE (BY VALUE) IN 2024

- 4.4 DRIP IRRIGATION MARKET, BY COMPONENT AND REGION

- FIGURE 20 DRIP MAINLINES/DRIP TUBES SEGMENT TO OCCUPY LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 DRIP IRRIGATION MARKET, BY CROP TYPE AND REGION

- FIGURE 21 FIELD CROPS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE AND REGION

- FIGURE 22 INLINE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.7 DRIP IRRIGATION MARKET, BY APPLICATION AND REGION

- FIGURE 23 SURFACE APPLICATION TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 24 GLOBAL FRESHWATER WITHDRAWALS, 2020

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASING POPULATION DENSITY

- TABLE 4 POPULATION DENSITY, BY COUNTRY, 2019-2027 (PEOPLE PER SQUARE KILOMETER)

- FIGURE 25 POPULATION PROJECTION: TOP 10 POPULOUS COUNTRIES, 2050 VS. 2075 (THOUSANDS)

- 5.2.2 CLIMATE CHANGE

- 5.3 MARKET DYNAMICS

- FIGURE 26 MARKET DYNAMICS: DRIP IRRIGATION MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Government programs and subsidies driving acceptance of drip irrigation systems

- 5.3.1.2 Efficiency in water use in drought-prone areas

- TABLE 5 WATER REQUIREMENT, BY CROP: DRIP IRRIGATION VS. CONVENTIONAL IRRIGATION

- 5.3.1.3 Cost efficiency in agricultural production

- 5.3.1.4 Enhanced crop yields

- TABLE 6 INCREASE IN YIELD: DRIP IRRIGATION VS. SURFACE IRRIGATION

- 5.3.2 RESTRAINTS

- 5.3.2.1 High initial cost of large-scale drip irrigation systems

- 5.3.2.2 High cost of system maintenance

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increasing adoption of precision agriculture and sustainable practices

- 5.3.3.2 Advancements in technological capabilities of drip irrigation systems

- 5.3.4 CHALLENGES

- 5.3.4.1 Environmental degradation of equipment resulting in additional costs for clean-up and disposal

- 5.3.4.2 Soil salinity hazards and bioclogging in drip irrigation systems

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 DRIP IRRIGATION MARKET: TRENDS/DISRUPTING IMPACTING CUSTOMERS' BUSINESSES

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 28 DRIP IRRIGATION MARKET: VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 RAW MATERIALS & MANUFACTURING

- 6.3.3 MARKETING & SALES

- 6.3.4 ASSEMBLY & INSTALLATION

- 6.3.5 FEEDBACK

- 6.4 ECOSYSTEM ANALYSIS/MARKET MAP

- 6.4.1 DEMAND SIDE

- 6.4.2 SUPPLY SIDE

- FIGURE 29 KEY STAKEHOLDERS IN DRIP IRRIGATION MARKET ECOSYSTEM

- TABLE 7 DRIP IRRIGATION MARKET: ECOSYSTEM

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 AUTOMATED IRRIGATION SYSTEMS

- 6.5.1.2 PRESSURE-COMPENSATING EMITTERS

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 SOIL MOISTURE SENSORS

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 FERTIGATION SYSTEMS

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY CROP TYPE

- FIGURE 30 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY CROP TYPE, 2023

- TABLE 8 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY CROP TYPE, 2023 (USD/HECTARE)

- FIGURE 31 AVERAGE SELLING PRICE TREND, BY CROP TYPE, 2019-2023 (USD/HECTARE)

- TABLE 9 AVERAGE SELLING PRICE (ASP) TREND OF DRIP IRRIGATION SYSTEMS, BY CROP TYPE, 2019-2023 (USD/HECTARE)

- FIGURE 32 FIELD CROPS: AVERAGE SELLING PRICE TREND, BY REGION

- 6.6.2 AVERAGE SELLING PRICE TREND OF CROP TYPE, BY REGION

- TABLE 10 FIELD CROPS: AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2019-2023 (USD/HECTARE)

- FIGURE 33 FRUITS & NUTS: AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 11 FRUITS & NUTS: AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2019-2023 (USD/HECTARE)

- FIGURE 34 VEGETABLE CROPS: AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 12 VEGETABLE CROPS: AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2019-2023 (USD/HECTARE)

- FIGURE 35 OTHER CROPS: AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 13 OTHER CROPS: AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2019-2023 (USD/HECTARE)

- 6.7 PATENT ANALYSIS

- FIGURE 36 PATENTS GRANTED FOR DRIP IRRIGATION MARKET, 2014-2024

- FIGURE 37 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DRIP IRRIGATION MARKET, 2014-2024

- TABLE 14 KEY PATENTS PERTAINING TO DRIP IRRIGATION, 2014-2024

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 INNOVATIVE IRRIGATION REFORM IN YUANMOU COUNTY

- 6.8.2 OPTIMIZING DRIP IRRIGATION FOR ROCK MELON IN TROPICAL RAIN HOUSE SHELTERS

- 6.8.3 ENHANCING RED RASPBERRY YIELDS WITH PULSE DRIP IRRIGATION

- 6.9 TRADE ANALYSIS

- 6.9.1 EXPORT SCENARIO OF HS CODE 842482

- FIGURE 38 EXPORT VALUE OF HS CODE 842482: KEY COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 15 EXPORT VALUE OF HS CODE 842482, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- 6.9.2 IMPORT SCENARIO OF HS CODE 842482

- FIGURE 39 IMPORT VALUE OF HS CODE 842482: KEY COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 16 IMPORT VALUE OF HS CODE 842482, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- 6.10 KEY CONFERENCES & EVENTS

- TABLE 17 DRIP IRRIGATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024-2025

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 NORTH AMERICA

- 6.11.2.1 US

- 6.11.2.2 Canada

- 6.11.2.3 Mexico

- 6.11.3 EUROPE

- 6.11.3.1 Spain

- 6.11.3.2 France

- 6.11.3.3 Germany

- 6.11.4 ASIA PACIFIC

- 6.11.4.1 India

- 6.11.4.2 China

- 6.11.4.3 Australia

- TABLE 23 STANDARDS CODES & PRACTICES FOR RURAL IRRIGATION SYSTEM DESIGN BY QUEENSLAND STATE GOVERNMENT

- 6.11.4.4 Bangladesh

- 6.11.5 MIDDLE EAST

- 6.11.5.1 UAE

- 6.11.6 AFRICA

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 24 PORTER'S FIVE FORCES IMPACT ON DRIP IRRIGATION MARKET

- FIGURE 40 DRIP IRRIGATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR EMITTER/DRIPPER TYPES

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR EMITTER/DRIPPER TYPES

- 6.13.2 BUYING CRITERIA

- FIGURE 42 KEY BUYING CRITERIA FOR EMITTER/DRIPPER TYPES

- TABLE 26 KEY BUYING CRITERIA FOR EMITTER/DRIPPER TYPES

- 6.14 INVESTMENT AND FUNDING SCENARIO

- FIGURE 43 INVESTMENT & FUNDING SCENARIO OF FEW MAJOR PLAYERS

7 DRIP IRRIGATION MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 44 DRIP MAINLINES/DRIP TUBES TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

- TABLE 27 DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 28 DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 7.2 EMITTERS/DRIPPERS

- 7.2.1 INCREASED EFFICIENCY DUE TO EMITTERS/DRIPPERS TO DRIVE DEMAND

- TABLE 29 EMITTERS/DRIPPERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 EMITTERS/DRIPPERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 PRESSURE PUMPS

- 7.3.1 SOLAR PUMP TO SAVE ELECTRICITY AND INCREASE EFFICIENCY IN DRIP IRRIGATION

- TABLE 31 PRESSURE PUMPS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 PRESSURE PUMPS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4 DRIP MAINLINES/DRIP TUBES

- 7.4.1 AVAILABILITY OF INNOVATIVE MATERIALS AND EASY INSTALLATION TO AID GROWTH OF DRIP TUBES/DRIP LINES

- TABLE 33 DRIP MAINLINES/DRIP TUBES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 DRIP MAINLINES/DRIP TUBES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.5 VALVES

- 7.5.1 AUTOMATION OF VALVES TO DRIVE GROWTH OF DRIP IRRIGATION MARKET

- TABLE 35 VALVES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 36 VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.6 FILTERS & FERTILIZER INJECTORS

- 7.6.1 FERTILIZER INJECTORS TO OFFER FAST AND ACCURATE WAY TO FEED PLANTS

- 7.6.2 FERTILIZER INJECTORS

- 7.6.3 FILTERS

- 7.6.3.1 Primary filters

- 7.6.3.1.1 Sand separators

- 7.6.3.1.2 Hydrocyclone filters

- 7.6.3.2 Secondary filters

- 7.6.3.2.1 Disc filters

- 7.6.3.2.2 Screen filters

- 7.6.3.1 Primary filters

- TABLE 37 FILTERS & FERTILIZER INJECTORS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 FILTERS & FERTILIZER INJECTORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.7 FITTINGS & ACCESSORIES

- 7.7.1 COST-EFFECTIVENESS AND HIGHER IRRIGATION SYSTEM CONTROL TO BOLSTER DEMAND IN ASIA PACIFIC

- 7.7.2 WATER METERS

- 7.7.3 PRESSURE GAUGES

- 7.7.4 IRRIGATION CONTROLLERS

- 7.7.5 JOINERS

- 7.7.6 GROMMETS

- 7.7.7 END CAPS

- 7.7.8 OTHER FITTINGS & ACCESSORIES

- TABLE 39 FITTINGS & ACCESSORIES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 FITTINGS & ACCESSORIES MARKET, BY REGION, 2024-2029 (USD MILLION)

8 DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE

- 8.1 INTRODUCTION

- FIGURE 45 INLINE SEGMENT TO DOMINATE DRIP IRRIGATION MARKET DURING FORECAST PERIOD

- TABLE 41 DRIP IRRIGATION MARKET, BY EMITTER TYPE, 2019-2023 (USD MILLION)

- TABLE 42 DRIP IRRIGATION MARKET, BY EMITTER TYPE, 2024-2029 (USD MILLION)

- 8.2 INLINE EMITTERS

- 8.2.1 IMPROVED EFFICIENCY AND FERTIGATION COMPATIBILITY TO DRIVE DEMAND FOR INLINE EMITTERS

- TABLE 43 INLINE EMITTERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 44 INLINE EMITTERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 ONLINE EMITTERS

- 8.3.1 INNOVATION IN ONLINE EMITTERS IN REDUCING COSTS TO DRIVE DEMAND FOR DRIP IRRIGATION

- TABLE 45 ONLINE EMITTERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 ONLINE EMITTERS MARKET, BY REGION, 2024-2029 (USD MILLION)

9 DRIP IRRIGATION MARKET, BY CROP TYPE

- 9.1 INTRODUCTION

- FIGURE 46 FIELD CROPS TO DOMINATE DRIP IRRIGATION MARKET DURING FORECAST PERIOD

- TABLE 47 DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 48 DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 49 DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 50 DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- 9.2 FIELD CROPS

- 9.2.1 INCREASING CONCERNS OVER WATER SCARCITY TO FUEL DEMAND FOR DRIP IRRIGATION SYSTEMS

- 9.2.2 CORN

- 9.2.3 COTTON

- 9.2.4 SUGARCANE

- 9.2.5 RICE

- 9.2.6 OTHER FIELD CROPS

- TABLE 51 DRIP IRRIGATION MARKET FOR FIELD CROPS, BY REGION, 2019-2023 ('000 HA)

- TABLE 52 DRIP IRRIGATION MARKET FOR FIELD CROPS, BY REGION, 2024-2029 ('000 HA)

- TABLE 53 DRIP IRRIGATION MARKET FOR FIELD CROPS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 DRIP IRRIGATION MARKET FOR FIELD CROPS, BY REGION, 2024-2029 (USD MILLION)

- 9.3 FRUITS & NUTS

- 9.3.1 HIGH-PROFIT MARGINS AND REDUCTION OF CROP STRESS FOR OPTIMUM GROWTH TO DRIVE ADOPTION OF DRIP IRRIGATION

- 9.3.2 GRAPES

- 9.3.3 APPLES

- 9.3.4 PEARS

- 9.3.5 WALNUTS

- 9.3.6 OTHER FRUITS & NUTS

- TABLE 55 DRIP IRRIGATION MARKET FOR FRUITS & NUTS, BY REGION, 2019-2023 ('000 HA)

- TABLE 56 DRIP IRRIGATION MARKET FOR FRUITS & NUTS, BY REGION, 2024-2029 ('000 HA)

- TABLE 57 DRIP IRRIGATION MARKET FOR FRUITS & NUTS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 DRIP IRRIGATION MARKET FOR FRUITS & NUTS, BY REGION, 2024-2029 (USD MILLION)

- 9.4 VEGETABLE CROPS

- 9.4.1 IMPROVED YIELDS AND HIGH EFFICIENCY TO DRIVE DEMAND FOR DRIP IRRIGATION OF VEGETABLE CROPS

- 9.4.2 TOMATOES

- 9.4.3 CAPSICUM

- 9.4.4 CHILLI

- 9.4.5 CABBAGE

- 9.4.6 OTHER VEGETABLE CROPS

- TABLE 59 DRIP IRRIGATION MARKET FOR VEGETABLE CROPS, BY REGION, 2019-2023 ('000 HA)

- TABLE 60 DRIP IRRIGATION MARKET FOR VEGETABLE CROPS, BY REGION, 2024-2029 ('000 HA)

- TABLE 61 DRIP IRRIGATION MARKET FOR VEGETABLE CROPS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 62 DRIP IRRIGATION MARKET FOR VEGETABLE CROPS, BY REGION, 2024-2029 (USD MILLION)

- 9.5 OTHER CROPS

- TABLE 63 DRIP IRRIGATION MARKET FOR OTHER CROPS, BY REGION, 2019-2023 ('000 HA)

- TABLE 64 DRIP IRRIGATION MARKET FOR OTHER CROPS, BY REGION, 2024-2029 ('000 HA)

- TABLE 65 DRIP IRRIGATION MARKET FOR OTHER CROPS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 DRIP IRRIGATION MARKET FOR OTHER CROPS, BY REGION, 2024-2029 (USD MILLION)

10 DRIP IRRIGATION MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 47 SURFACE APPLICATION TO DOMINATE DRIP IRRIGATION MARKET DURING FORECAST PERIOD

- TABLE 67 DRIP IRRIGATION MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 68 DRIP IRRIGATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2 SURFACE APPLICATION

- 10.2.1 LOW COST OF INSTALLATION AND MAINTENANCE LEADING TO INCREASING DEMAND

- TABLE 69 SURFACE DRIP IRRIGATION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 SURFACE DRIP IRRIGATION MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 SUBSURFACE APPLICATION

- 10.3.1 ADVANCEMENTS IN FERTIGATION AND INLINE EMITTER TECHNOLOGIES TO DRIVE GROWTH

- TABLE 71 SUBSURFACE DRIP IRRIGATION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 SUBSURFACE DRIP IRRIGATION MARKET, BY REGION, 2024-2029 (USD MILLION)

11 DRIP IRRIGATION MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 73 DRIP IRRIGATION MARKET SIZE, BY REGION, 2019-2023 ('000 HA)

- TABLE 74 DRIP IRRIGATION MARKET SIZE, BY REGION, 2024-2029 ('000 HA)

- TABLE 75 DRIP IRRIGATION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 76 DRIP IRRIGATION MARKET, BY REGION, 2024-2029 (USD MILLION)

- FIGURE 48 MIDDLE EAST PROJECTED TO BE FASTEST-GROWING IN DRIP IRRIGATION MARKET DURING FORECAST PERIOD

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT

- FIGURE 49 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2024

- TABLE 77 NORTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 78 NORTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 79 NORTH AMERICA: DRIP IRRIGATION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: DRIP IRRIGATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: DRIP IRRIGATION MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: DRIP IRRIGATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2019-2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2024-2029 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Increasing adoption of drip irrigation systems on farmlands and advancement in technologies to drive adoption of drip irrigation equipment

- TABLE 89 US: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 90 US: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 91 US: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 92 US: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 93 US: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 94 US: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Increasing investments in developing irrigation infrastructure to drive demand for drip irrigation systems

- TABLE 95 CANADA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD THOUSAND)

- TABLE 96 CANADA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD THOUSAND)

- TABLE 97 CANADA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 98 CANADA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 99 CANADA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD THOUSAND)

- TABLE 100 CANADA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD THOUSAND)

- 11.2.4 MEXICO

- 11.2.4.1 Government policies and high-water tariffs encourage farmers to adopt drip irrigation systems

- TABLE 101 MEXICO: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 102 MEXICO: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 103 MEXICO: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 104 MEXICO: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 105 MEXICO: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 106 MEXICO: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: RECESSION IMPACT

- FIGURE 50 EUROPEAN DRIP IRRIGATION MARKET: RECESSION IMPACT ANALYSIS, 2024

- TABLE 107 EUROPE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 108 EUROPE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 109 EUROPE: DRIP IRRIGATION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 110 EUROPE: DRIP IRRIGATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 EUROPE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 112 EUROPE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 113 EUROPE: DRIP IRRIGATION MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 114 EUROPE: DRIP IRRIGATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 115 EUROPE: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 116 EUROPE: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 117 EUROPE: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2019-2023 (USD MILLION)

- TABLE 118 EUROPE: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2024-2029 (USD MILLION)

- 11.3.2 SPAIN

- 11.3.2.1 Use of drip irrigation system in production of high-value crops to drive market in Spain

- TABLE 119 SPAIN: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 120 SPAIN: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 121 SPAIN: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 122 SPAIN: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 123 SPAIN: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 124 SPAIN: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.3.3 ITALY

- 11.3.3.1 Vineyards to contribute significantly to demand for drip irrigation systems in Italy

- TABLE 125 ITALY: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD THOUSAND)

- TABLE 126 ITALY: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD THOUSAND)

- TABLE 127 ITALY: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 128 ITALY: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 129 ITALY: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD THOUSAND)

- TABLE 130 ITALY: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD THOUSAND)

- 11.3.4 FRANCE

- 11.3.4.1 Increasing need for modernization of irrigation system to supplement drip irrigation deployment

- TABLE 131 FRANCE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 132 FRANCE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 133 FRANCE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 134 FRANCE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 135 FRANCE: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 136 FRANCE: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.3.5 GREECE

- 11.3.5.1 Consistent efforts by Greek government to fuel deployment of microirrigation systems

- TABLE 137 GREECE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 138 GREECE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 139 GREECE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 140 GREECE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 141 GREECE: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 142 GREECE: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.3.6 TURKEY

- 11.3.6.1 Consistent efforts by Turkish government to boost modern irrigation methods, including drip irrigation

- TABLE 143 TURKEY: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 144 TURKEY: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 145 TURKEY: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 146 TURKEY: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 147 TURKEY: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 148 TURKEY: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 149 REST OF EUROPE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 150 REST OF EUROPE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 151 REST OF EUROPE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 152 REST OF EUROPE: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 153 REST OF EUROPE: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 154 REST OF EUROPE: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 51 ASIA PACIFIC: DRIP IRRIGATION MARKET SNAPSHOT

- 11.4.1 RECESSION IMPACT

- FIGURE 52 ASIA PACIFIC RECESSION IMPACT ANALYSIS, 2024

- TABLE 155 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 156 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 157 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 158 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 159 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 161 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 163 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 164 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 165 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2019-2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2024-2029 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Growing concerns about water usage and initiatives by Chinese government to drive drip irrigation market

- TABLE 167 CHINA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 168 CHINA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 169 CHINA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 170 CHINA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 171 CHINA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 172 CHINA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Rising concerns over water scarcity and favorable agricultural environment to fuel drip irrigation market growth in India

- TABLE 173 INDIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 174 INDIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 175 INDIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 176 INDIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 177 INDIA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 178 INDIA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.4.4 AUSTRALIA

- 11.4.4.1 Technological advancements and presence of key players in Australia to support drip irrigation

- TABLE 179 AUSTRALIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 180 AUSTRALIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 181 AUSTRALIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 182 AUSTRALIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 183 AUSTRALIA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 184 AUSTRALIA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.4.5 JAPAN

- 11.4.5.1 Increase in scope of protected agriculture to attract investments in drip irrigation

- TABLE 185 JAPAN: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD THOUSAND)

- TABLE 186 JAPAN: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD THOUSAND)

- TABLE 187 JAPAN: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 188 JAPAN: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 189 JAPAN: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD THOUSAND)

- TABLE 190 JAPAN: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD THOUSAND)

- 11.4.6 INDONESIA

- 11.4.6.1 Minimal land for agriculture and short rainfall periods driving demand for drip irrigation systems

- TABLE 191 INDONESIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 192 INDONESIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 193 INDONESIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 194 INDONESIA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 195 INDONESIA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD THOUSAND)

- TABLE 196 INDONESIA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD THOUSAND)

- 11.4.7 THAILAND

- 11.4.7.1 Government initiatives expected to encourage drip irrigation for fruit cultivation

- TABLE 197 THAILAND: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD THOUSAND)

- TABLE 198 THAILAND: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD THOUSAND)

- TABLE 199 THAILAND: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 200 THAILAND: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 201 THAILAND: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD THOUSAND)

- TABLE 202 THAILAND: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD THOUSAND)

- 11.4.8 REST OF ASIA PACIFIC

- TABLE 203 REST OF ASIA PACIFIC: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 206 REST OF ASIA PACIFIC: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 207 REST OF ASIA PACIFIC: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 RECESSION IMPACT

- FIGURE 53 SOUTH AMERICAN RECESSION IMPACT ANALYSIS, 2024

- TABLE 209 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 210 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 211 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 212 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 213 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 214 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 215 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 216 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 217 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 218 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 219 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2019-2023 (USD MILLION)

- TABLE 220 SOUTH AMERICA: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2024-2029 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Adoption of drip irrigation through drip protection to drive market

- TABLE 221 BRAZIL: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 222 BRAZIL: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 223 BRAZIL: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 224 BRAZIL: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 225 BRAZIL: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 226 BRAZIL: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Growing potential for agriculture to boost demand for drip irrigation

- TABLE 227 ARGENTINA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 228 ARGENTINA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 229 ARGENTINA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 230 ARGENTINA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 231 ARGENTINA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 232 ARGENTINA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 233 REST OF SOUTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 234 REST OF SOUTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 235 REST OF SOUTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 236 REST OF SOUTH AMERICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 237 REST OF SOUTH AMERICA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 238 REST OF SOUTH AMERICA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.6 REST OF THE WORLD (ROW)

- FIGURE 54 ROW: DRIP IRRIGATION MARKET SNAPSHOT

- 11.6.1 RECESSION IMPACT

- FIGURE 55 ROW RECESSION IMPACT ANALYSIS, 2024

- TABLE 239 ROW: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 240 ROW: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 241 ROW: DRIP IRRIGATION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 242 ROW: DRIP IRRIGATION MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 243 ROW: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 244 ROW: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 245 ROW: DRIP IRRIGATION MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 246 ROW: DRIP IRRIGATION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 247 ROW: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 248 ROW: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 249 ROW: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2019-2023 (USD MILLION)

- TABLE 250 ROW: DRIP IRRIGATION MARKET, BY EMITTER/DRIPPER TYPE, 2024-2029 (USD MILLION)

- 11.6.2 AFRICA

- 11.6.2.1 Investments by governments and collaboration of companies to support drip irrigation to fuel demand

- TABLE 251 AFRICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 252 AFRICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 253 AFRICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 254 AFRICA: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 255 AFRICA: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 256 AFRICA: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 11.6.3 MIDDLE EAST

- 11.6.3.1 Investments by governments and partnerships between key players to drive market growth

- TABLE 257 MIDDLE EAST: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 258 MIDDLE EAST: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 259 MIDDLE EAST: DRIP IRRIGATION MARKET, BY CROP TYPE, 2019-2023 ('000 HA)

- TABLE 260 MIDDLE EAST: DRIP IRRIGATION MARKET, BY CROP TYPE, 2024-2029 ('000 HA)

- TABLE 261 MIDDLE EAST: DRIP IRRIGATION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 262 MIDDLE EAST: DRIP IRRIGATION MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 263 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DRIP IRRIGATION MARKET, 2020-2024

- 12.3 SEGMENTAL REVENUE ANALYSIS

- FIGURE 56 ANNUAL SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- 12.4 MARKET SHARE ANALYSIS, 2023

- FIGURE 57 DRIP IRRIGATION MARKET: MARKET SHARE ANALYSIS

- TABLE 264 DRIP IRRIGATION MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 58 DRIP IRRIGATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.5.5.1 Company footprint

- FIGURE 59 COMPANY FOOTPRINT

- 12.5.5.2 Component footprint

- TABLE 265 DRIP IRRIGATION MARKET: COMPONENT FOOTPRINT

- 12.5.5.3 Emitter/Dripper type footprint

- TABLE 266 DRIP IRRIGATION MARKET: EMITTER/DRIPPER TYPE FOOTPRINT

- 12.5.5.4 Crop type footprint

- TABLE 267 DRIP IRRIGATION MARKET: CROP TYPE FOOTPRINT

- 12.5.5.5 Application footprint

- TABLE 268 DRIP IRRIGATION MARKET: APPLICATION FOOTPRINT

- 12.5.5.6 Region footprint

- TABLE 269 DRIP IRRIGATION MARKET: REGION FOOTPRINT

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 60 DRIP IRRIGATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.6.5.1 Detailed list of key startups/SMEs

- TABLE 270 DRIP IRRIGATION MARKET: LIST OF KEY STARTUPS/SMES

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 271 DRIP IRRIGATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023 (1/3)

- TABLE 272 DRIP IRRIGATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023 (2/3)

- TABLE 273 DRIP IRRIGATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023 (3/3)

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 61 COMPANY VALUATION OF FEW MAJOR PLAYERS

- FIGURE 62 EV/EBITDA OF KEY COMPANIES

- 12.8 BRAND/PRODUCT/SERVICE ANALYSIS

- FIGURE 63 BRAND/PRODUCT/SERVICE ANALYSIS, BY KEY BRANDS OF DRIP IRRIGATION KEY

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- TABLE 274 DRIP IRRIGATION MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020-MAY 2024

- 12.9.2 DEALS

- TABLE 275 DRIP IRRIGATION MARKET: DEALS, JANUARY 2020-MAY 2024

- 12.9.3 EXPANSIONS

- TABLE 276 DRIP IRRIGATION MARKET: EXPANSIONS, JANUARY 2020-MAY 2024

13 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 13.1 KEY PLAYERS

- 13.1.1 NETAFIM

- TABLE 277 NETAFIM: COMPANY OVERVIEW

- FIGURE 64 NETAFIM: COMPANY SNAPSHOT

- TABLE 278 NETAFIM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 NETAFIM: PRODUCT LAUNCHES

- TABLE 280 NETAFIM: DEALS

- 13.1.2 RIVULIS

- TABLE 281 RIVULIS: COMPANY OVERVIEW

- TABLE 282 RIVULIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 RIVULIS: PRODUCT LAUNCHES

- TABLE 284 RIVULIS: DEALS

- 13.1.3 THE TORO COMPANY

- TABLE 285 THE TORO COMPANY: COMPANY OVERVIEW

- FIGURE 65 THE TORO COMPANY: COMPANY SNAPSHOT

- TABLE 286 THE TORO COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 THE TORO COMPANY: PRODUCT LAUNCHES

- 13.1.4 JAIN IRRIGATION SYSTEMS LTD.

- TABLE 288 JAIN IRRIGATION SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 66 JAIN IRRIGATION SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 289 JAIN IRRIGATION SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 JAIN IRRIGATION SYSTEMS LTD.: DEALS

- 13.1.5 HUNTER INDUSTRIES INC.

- TABLE 291 HUNTER INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 292 HUNTER INDUSTRIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 HUNTER INDUSTRIES INC.: DEALS

- 13.1.6 MAHINDRA EPC IRRIGATION LIMITED

- TABLE 294 MAHINDRA EPC IRRIGATION LIMITED: COMPANY OVERVIEW

- FIGURE 67 MAHINDRA EPC IRRIGATION LIMITED.: COMPANY SNAPSHOT

- TABLE 295 MAHINDRA EPC IRRIGATION LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 RAIN BIRD CORPORATION

- TABLE 296 RAIN BIRD CORPORATION: COMPANY OVERVIEW

- TABLE 297 RAIN BIRD CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 RAIN BIRD CORPORATION: PRODUCT LAUNCHES

- 13.1.8 CHINADRIP IRRIGATION EQUIPMENT (XIAMEN) CO., LTD

- TABLE 299 CHINADRIP IRRIGATION EQUIPMENT (XIAMEN) CO., LTD.: COMPANY OVERVIEW

- TABLE 300 CHINADRIP IRRIGATION EQUIPMENT CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 CHINADRIP IRRIGATION EQUIPMENT (XIAMEN) CO., LTD.: PRODUCT LAUNCHES

- 13.1.9 ELGO IRRIGATION LTD.

- TABLE 302 ELGO IRRIGATION LTD.: COMPANY OVERVIEW

- TABLE 303 ELGO IRRIGATION LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.10 SHANGHAI IRRIST CORP., LTD.

- TABLE 304 SHANGHAI IRRIST CORP., LTD.: COMPANY OVERVIEW

- TABLE 305 SHANGHAI IRRIST CORP., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 ANTELCO

- TABLE 306 ANTELCO: COMPANY OVERVIEW

- TABLE 307 ANTELCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 ANTELCO: DEALS

- 13.1.12 MICROJET IRRIGATION SYSTEMS

- TABLE 309 MICROJET IRRIGATION SYSTEMS: COMPANY OVERVIEW

- TABLE 310 MICROJET IRRIGATION SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 METZER

- TABLE 311 METZER: COMPANY OVERVIEW

- TABLE 312 METZER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 METZER: EXPANSIONS

- 13.1.14 GRUPO CHAMARTIN S.A.

- TABLE 314 GRUPO CHAMARTIN S.A.: COMPANY OVERVIEW

- TABLE 315 GRUPO CHAMARTIN S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.15 AZUD

- TABLE 316 AZUD: COMPANY OVERVIEW

- TABLE 317 AZUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 DRIPWORKS

- TABLE 318 DRIPWORKS: COMPANY OVERVIEW

- TABLE 319 DRIPWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.2 IRRITEC S.P.A

- TABLE 320 IRRITEC S.P.A: COMPANY OVERVIEW

- TABLE 321 IRRITEC S.P.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 IRRITEC S.P.A: DEALS

- TABLE 323 IRRITEC S.P.A: EXPANSIONS

- 13.2.3 GOLDENKEY

- TABLE 324 GOLDENKEY: COMPANY OVERVIEW

- TABLE 325 GOLDENKEY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.4 KSNM DRIP

- TABLE 326 KSNM DRIP: COMPANY OVERVIEW

- TABLE 327 KSNM DRIP PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.5 NATIONAL DIVERSIFIED SALES, INC.

- TABLE 328 NATIONAL DIVERSIFIED SALES, INC.: COMPANY OVERVIEW

- TABLE 329 NATIONAL DIVERSIFIED SALES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.6 AGRODRIP

- 13.2.7 IRRIGATION DIRECT CANADA

- 13.2.8 SUJAY IRRIGATIONS PVT LTD.

- 13.2.9 BHARAT DRIP IRRIGATION AND AGRO

- 13.2.10 GLOBAL IRRIGATION, INC.

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 330 ADJACENT MARKETS TO DRIP IRRIGATION MARKET

- 14.2 LIMITATIONS

- 14.3 DRIPPERS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 331 DRIPPERS MARKET, BY DRIPPER TYPE, 2019-2021 (USD MILLION)

- TABLE 332 DRIPPERS MARKET, BY DRIPPER TYPE, 2022-2027 (USD MILLION)

- 14.4 IRRIGATION AUTOMATION MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 333 IRRIGATION AUTOMATION MARKET, BY COMPONENT, 2019-2021 (USD MILLION)

- TABLE 334 IRRIGATION AUTOMATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS