|

|

市場調査レポート

商品コード

1538582

自律型無人潜水機(AUV)の世界市場:形状別、タイプ別、技術別、ペイロード別 - 予測(~2029年)Autonomous Underwater Vehicle (AUV) Market by Shape (Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-hull Vehicle), Type (Shallow, Medium, & Large AUVs), Technology (Imaging, Navigation, Propulsion), Payload - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 自律型無人潜水機(AUV)の世界市場:形状別、タイプ別、技術別、ペイロード別 - 予測(~2029年) |

|

出版日: 2024年08月19日

発行: MarketsandMarkets

ページ情報: 英文 275 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自律型無人潜水機(AUV)の市場規模は、2024年に20億米ドルであり、2029年までに43億米ドルに達すると予測され、2024年~2029年にCAGRで15.9%の成長が見込まれます。

海底ケーブルや海底環境を保護するための自律型無人潜水機(AUV)の使用の増加や、高速自律型無人潜水機へのニッケル水素電池の統合、オフショアエネルギー探査におけるAUVの需要の増加が、自律型無人潜水機(AUV)市場に有利な機会を提供しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 100万米ドル |

| セグメント | 形状別、タイプ別、技術別、ペイロード別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

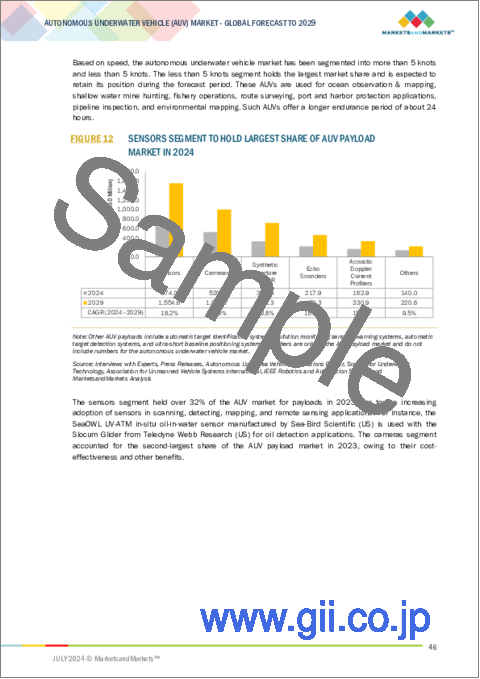

「AUVペイロード市場のセンサーセグメントが予測期間にもっとも高い成長率で成長する見込みです。」

AUVペイロード市場のセンサーセグメントは、地雷探知やパイプライン敷設計画、石油・ガス探査におけるスキャン、探知、マッピング、リモートセンシング用途でのセンサーの使用の増加により、予測期間に高いCAGRで成長する見込みです。自律型無人潜水機(AUV)は、対潜戦(ASW)任務やパイプライン検査に対し、センサーを使用して環境をマッピングし、対象物を検出します。これらのセンサーは、海底の鉄の位置を特定したり、海底ケーブルを調査したり、海水中のさまざまな化学品を検出し分類したりするためにも使用されます。

「メキシコの軍事・防衛用途セグメントが予測期間にもっとも高い成長率を記録する見込みです。」

メキシコの軍事・防衛用途向け自律型無人潜水機(AUV)市場は、予測期間にもっとも高いCAGRで成長する見込みです。国境警備に向けメキシコ湾や北太平洋でAUVの展開が増加していることが、同国の市場成長の促進要因の1つです。自律型無人潜水機(AUV)は、沿岸地域のモニター、不審な活動の検知、情報収集にますます使用されるようになっています。また、海軍作戦における詳細な海底マッピングにも採用されています。

「中国が予測期間に最大の市場シェアを占める見込みです。」

中国は、中国海軍によるAUVの採用の増加により、2023年、アジア太平洋で最大の市場シェアを占めました。中国はAUVに利用する費用対効果の高い革新的な技術ソリューションの開発に注力しています。90年代半ば以来、中国は地域紛争に勝利し、世界的な利益を拡大する目的で軍事近代化プログラムに関与しています。

当レポートでは、世界の自律型無人潜水機(AUV)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 自律型無人潜水機(AUV)市場の企業にとっての大きな機会

- 自律型無人潜水機(AUV)市場:タイプ別

- アジア太平洋の自律型無人潜水機(AUV)市場:用途別、国別

- 自律型無人潜水機(AUV)市場:用途別

- 自律型無人潜水機(AUV)市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 平均販売価格の動向

- さまざまなAUVコンポーネントの平均コストの分割

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術動向

- IoT

- ロボットの標準オペレーティングシステムに関する研究

- AIチップ

- デジタル海洋自動化システム

- 改良されたバッテリー技術

- ケーススタディ分析

- 特許分析

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 関税と規制情勢

- 関税分析

- 規制情勢

- 主な会議とイベント

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 自律型無人潜水機(AUV)市場:技術別

- イントロダクション

- 衝突回避

- 通信

- ナビゲーション

- 推進

- イメージング

第7章 自律型無人潜水機(AUV)市場:タイプ別

- イントロダクション

- 浅水AUVS

- 中型AUVS

- 大型AUV

第8章 自律型無人潜水機(AUV)市場:速度別

- イントロダクション

- 5ノット未満

- 5ノット超

第9章 自律型無人潜水機(AUV)市場:形状別

- イントロダクション

- 魚雷

- 層流ボディ

- 流線形長方形スタイル

- 多胴

第10章 自律型無人潜水機(AUV)市場:ペイロードタイプ別

- イントロダクション

- カメラ

- センサー

- 合成開口ソナー

- エコーサウンダー

- 超音波ドップラー流速プロファイラー

- その他

第11章 自律型無人潜水機(AUV)市場:用途別

- イントロダクション

- 軍事・防衛

- 石油・ガス

- 環境保護・モニタリング

- 海洋学

- 考古学・探査

- 捜索・救助活動

第12章 地域の分析

- イントロダクション

- 北米

- 北米に対する不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州に対する不況の影響

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋に対する不況の影響

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他のアジア太平洋

- その他の地域

- その他の地域に対する不況の影響

- 南米

- GCC諸国

- アフリカとその他中東

第13章 競合情勢

- 主要企業が採用した戦略

- 上位5社の収益分析

- 市場シェア分析

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス(2023年)(主要企業)

- 企業の評価マトリクス(2023年)(スタートアップ/中小企業)

- 競合シナリオ

第14章 企業プロファイル

- イントロダクション

- 主要企業

- KONGSBERG

- TELEDYNE TECHNOLOGIES INCORPORATED

- FUGRO

- GENERAL DYNAMICS CORPORATION

- SAAB

- EXAIL TECHNOLOGIES

- LOCKHEED MARTIN CORPORATION

- ATLAS ELEKTRONIK

- L3HARRIS TECHNOLOGIES, INC.

- BOSTON ENGINEERING

- その他の企業

- INTERNATIONAL SUBMARINE ENGINEERING LIMITED

- MSUBS

- FALMOUTH SCIENTIFIC, INC.

- TERRADEPTH

- ECOSUB ROBOTICS LIMITED

- EELUME AS

- HYDROMEA

- BOEING

- GRAAL TECH S.R.L.

- RIPTIDE AUTONOMOUS SOLUTIONS LLC

- BALTROBOTICS

- SONARDYNE

- OCEANSCAN-MST

- XYLEM

- RTSYS

第15章 付録

List of Tables

- TABLE 1 PRICING ANALYSIS FOR AUTONOMOUS UNDERWATER VEHICLES

- TABLE 2 AVERAGE COST SPLIT OF COMPONENTS WITH RESPECT TO OVERALL AUV COSTS

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 TOP 20 PATENT OWNERS IN LAST 10 YEARS (US)

- TABLE 5 MAJOR PATENTS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- TABLE 6 TARIFFS IMPOSED BY US ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 7 TARIFFS IMPOSED BY SOUTH AFRICA ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 8 TARIFFS IMPOSED BY CANADA ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 9 TARIFFS IMPOSED BY UK ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 10 TARIFFS IMPOSED BY FRANCE ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 AUTONOMOUS UNDERWATER VEHICLE MARKET: CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 IMPACT OF PORTER'S FIVE FORCES ON AUTONOMOUS UNDERWATER VEHICLES MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 19 AUV MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 20 AUV MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 21 COLLISION AVOIDANCE: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 22 COLLISON AVOIDANCE: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 23 COMMUNICATION OPTIONS FOR SEARAPTOR AUVS BY TELEDYNE MARINE (US)

- TABLE 24 COMMUNICATION: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 25 COMMUNICATION: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

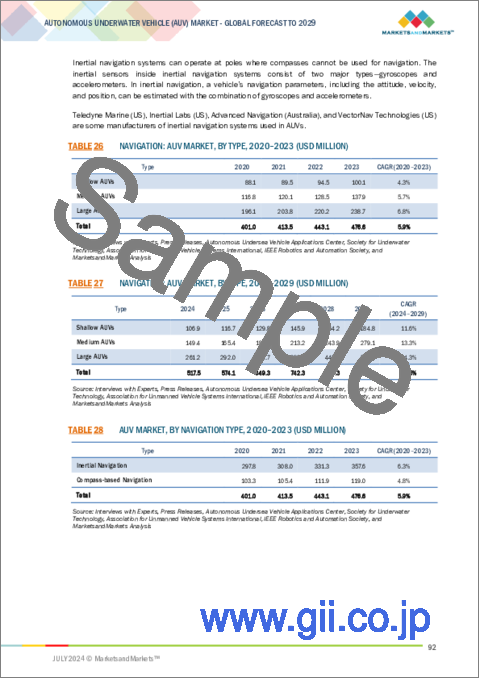

- TABLE 26 NAVIGATION: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 27 NAVIGATION: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 28 AUV MARKET, BY NAVIGATION TYPE, 2020-2023 (USD MILLION)

- TABLE 29 AUV MARKET, BY NAVIGATION TYPE, 2024-2029 (USD MILLION)

- TABLE 30 TYPES OF BATTERIES

- TABLE 31 AUVS AND THEIR RESPECTIVE BATTERIES

- TABLE 32 PROPULSION: AUV MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 33 PROPULSION: AUV MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 34 PROPULSION: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 35 PROPULSION: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 36 IMAGING: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 37 IMAGING: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 38 IMAGING: AUV MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 39 IMAGING: AUV MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 40 FEATURES OF DIFFERENT AUV TYPES

- TABLE 41 AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 42 AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 43 AUV MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 44 AUV MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 45 SHALLOW AUVS: APPLICATIONS AND OEMS

- TABLE 46 SHALLOW AUV MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 47 SHALLOW AUV MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 48 SHALLOW AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 49 SHALLOW AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 50 SHALLOW AUV MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 51 SHALLOW AUV MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 52 SHALLOW AUV MARKET, BY SHAPE, 2020-2023 (USD MILLION)

- TABLE 53 SHALLOW AUV MARKET, BY SHAPE, 2024-2029 (USD MILLION)

- TABLE 54 MEDIUM AUVS: APPLICATIONS AND OEMS

- TABLE 55 MEDIUM AUV MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 56 MEDIUM AUV MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 57 MEDIUM AUV MARKET, BY SHAPE, 2020-2023 (USD MILLION)

- TABLE 58 MEDIUM AUV MARKET, BY SHAPE, 2024-2029 (USD MILLION)

- TABLE 59 MEDIUM AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 60 MEDIUM AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 61 LARGE AUVS: APPLICATIONS AND OEMS

- TABLE 62 LARGE AUV MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 63 LARGE AUV MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 64 LARGE AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 65 LARGE AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 66 LARGE AUV MARKET, BY SHAPE, 2020-2023 (USD MILLION)

- TABLE 67 LARGE AUV MARKET, BY SHAPE, 2024-2029 (USD MILLION)

- TABLE 68 AUV MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 69 AUV MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 70 AUV MARKET, BY SHAPE, 2020-2023 (USD MILLION)

- TABLE 71 AUV MARKET, BY SHAPE, 2024-2029 (USD MILLION)

- TABLE 72 TORPEDO: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 73 TORPEDO: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 74 LAMINAR FLOW BODY: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 75 LAMINAR FLOW BODY: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 76 STREAMLINED RECTANGULAR STYLE: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 77 STREAMLINED RECTANGULAR STYLE: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 78 MULTI-HULL AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 79 MULTI-HULL AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 80 AUV MARKET, BY PAYLOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 81 AUV MARKET, BY PAYLOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 82 CAMERAS: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 83 CAMERAS: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 84 CAMERAS: AUV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 85 CAMERAS: AUV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 86 SENSORS: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 87 SENSORS: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 88 SYNTHETIC APERTURE SONAR: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 89 SYNTHETIC APERTURE SONAR: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 90 ECHO SOUNDERS: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 91 ECHO SOUNDERS: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 92 ACOUSTIC DOPPLER CURRENT PROFILERS: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 93 ACOUSTIC DOPPLER CURRENT PROFILERS: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 94 OTHER PAYLOADS: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 95 OTHER PAYLOADS: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 96 AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 97 AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 98 MILITARY & DEFENSE: AUV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 99 MILITARY & DEFENSE: AUV MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 102 EUROPE: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 103 EUROPE: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 104 ASIA PACIFIC: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 105 ASIA PACIFIC: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 106 ROW: AUV MARKET FOR MILITARY & DEFENSE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 107 ROW: AUV MARKET FOR MILITARY & DEFENSE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 108 OIL & GAS: AUV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 109 OIL & GAS: AUV MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 112 EUROPE: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 113 EUROPE: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 116 ROW: AUV MARKET FOR OIL & GAS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 117 ROW: AUV MARKET FOR OIL & GAS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 118 ENVIRONMENT PROTECTION & MONITORING: AUV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 119 ENVIRONMENT PROTECTION & MONITORING: AUV MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 120 NORTH AMERICA: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 121 NORTH AMERICA: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 122 EUROPE: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 123 EUROPE: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 125 ASIA PACIFIC: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 126 ROW: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY REGION, 2020-2023 (USD MILLION)

- TABLE 127 ROW: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY REGION, 2024-2029 (USD MILLION)

- TABLE 128 OCEANOGRAPHY: AUV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 129 OCEANOGRAPHY: AUV MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 130 NORTH AMERICA: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 131 NORTH AMERICA: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 132 EUROPE: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 133 EUROPE: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 136 ROW: AUV MARKET FOR OCEANOGRAPHY, BY REGION, 2020-2023 (USD MILLION)

- TABLE 137 ROW: AUV MARKET FOR OCEANOGRAPHY, BY REGION, 2024-2029 (USD MILLION)

- TABLE 138 ARCHEOLOGY & EXPLORATION: AUV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 139 ARCHEOLOGY & EXPLORATION: AUV MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 140 NORTH AMERICA: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 141 NORTH AMERICA: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 142 EUROPE: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 143 EUROPE: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 146 ROW: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY REGION, 2020-2023 (USD MILLION)

- TABLE 147 ROW: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY REGION, 2024-2029 (USD MILLION)

- TABLE 148 SEARCH & SALVAGE OPERATIONS: AUV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 149 SEARCH & SALVAGE OPERATIONS: AUV MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 150 NORTH AMERICA: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 151 NORTH AMERICA: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 152 EUROPE: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 153 EUROPE: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 154 ASIA PACIFIC: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 156 ROW: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 157 ROW: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 158 AUV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 159 AUV MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 160 NORTH AMERICA: AUV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 161 NORTH AMERICA: AUV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 162 NORTH AMERICA: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 163 NORTH AMERICA: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 164 EUROPE: AUV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 165 EUROPE: AUV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 166 EUROPE: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 167 EUROPE: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 168 ASIA PACIFIC: AUV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 169 ASIA PACIFIC: AUV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 171 ASIA PACIFIC: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 172 ROW: AUV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 173 ROW: AUV MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 174 ROW: AUV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 175 ROW: AUV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 176 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- TABLE 177 AUTONOMOUS UNDERWATER VEHICLE MARKET: DEGREE OF COMPETITION

- TABLE 178 AUTONOMOUS UNDERWATER VEHICLE MARKET: RANKING ANALYSIS

- TABLE 179 AUTONOMOUS UNDERWATER VEHICLE MARKET: TYPE FOOTPRINT

- TABLE 180 AUTONOMOUS UNDERWATER VEHICLE MARKET: SHAPE FOOTPRINT

- TABLE 181 AUTONOMOUS UNDERWATER VEHICLE MARKET: PAYLOAD TYPE FOOTPRINT

- TABLE 182 AUTONOMOUS UNDERWATER VEHICLE MARKET: APPLICATION FOOTPRINT

- TABLE 183 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY REGION FOOTPRINT

- TABLE 184 AUTONOMOUS UNDERWATER VEHICLE MARKET: KEY STARTUPS/SMES

- TABLE 185 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 AUTONOMOUS UNDERWATER VEHICLE MARKET: PRODUCT LAUNCHES, 2021-2024

- TABLE 187 AUTONOMOUS UNDERWATER VEHICLE MARKET: DEALS, 2021-2024

- TABLE 188 AUTONOMOUS UNDERWATER VEHICLE MARKET: OTHER DEVELOPMENTS, 2021-2024

- TABLE 189 KONGSBERG: COMPANY OVERVIEW

- TABLE 190 KONGSBERG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 KONGSBERG: RECENT DEVELOPMENTS, 2021-2024

- TABLE 192 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 193 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES, 2021-2024

- TABLE 195 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS, 2021-2024

- TABLE 196 FUGRO: COMPANY OVERVIEW

- TABLE 197 FUGRO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 198 FUGRO: RECENT DEVELOPMENTS, 2021-2024

- TABLE 199 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 200 GENERAL DYNAMICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 GENERAL DYNAMICS CORPORATION: RECENT DEVELOPMENTS, 2021-2024

- TABLE 202 SAAB: COMPANY OVERVIEW

- TABLE 203 SAAB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 SAAB: RECENT DEVELOPMENTS, 2021-2024

- TABLE 205 EXAIL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 206 EXAIL TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 207 EXAIL TECHNOLOGIES: PRODUCT LAUNCHES, 2021-2024

- TABLE 208 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 209 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES, 2021-2024

- TABLE 211 LOCKHEED MARTIN CORPORATION: DEALS, 2021-2024

- TABLE 212 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS, 2021-2024

- TABLE 213 ATLAS ELECTRONIK: COMPANY OVERVIEW

- TABLE 214 ATLAS ELECTRONIK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 215 ATLAS ELECTRONIK: DEALS, 2021-2024

- TABLE 216 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 217 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 218 BOSTON ENGINEERING: COMPANY OVERVIEW

- TABLE 219 BOSTON ENGINEERING: PRODUCTS/SERVICES/SOLUTIONS OFFERED

List of Figures

- FIGURE 1 AUTONOMOUS UNDERWATER VEHICLE MARKET SEGMENTATION

- FIGURE 2 AUTONOMOUS UNDERWATER VEHICLE MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF AUV PRODUCTS AND SOLUTIONS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION: AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 8 IMAGING SEGMENT TO COMMAND AUV MARKET DURING FORECAST PERIOD

- FIGURE 9 LARGE AUVS SEGMENT TO HOLD LARGEST SHARE BETWEEN 2024 AND 2029

- FIGURE 10 TORPEDO SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 11 LESS THAN 5 KNOTS SEGMENT TO COMMAND LARGER SHARE DURING FORECAST PERIOD

- FIGURE 12 SENSORS SEGMENT TO HOLD LARGEST SHARE OF AUV PAYLOAD MARKET IN 2024

- FIGURE 13 ARCHEOLOGY & EXPLORATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO WITNESS HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 15 INCREASING CAPITAL EXPENDITURE IN OFFSHORE INDUSTRY TO FUEL DEMAND FOR AUV DURING FORECAST PERIOD

- FIGURE 16 LARGE AUV SEGMENT TO DOMINATE IN TERMS OF VALUE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC AUV MARKET: MILITARY & DEFENSE SEGMENT AND CHINA -LARGEST SHAREHOLDERS IN 2024

- FIGURE 18 MILITARY & DEFENSE TO HOLD LARGEST SHARE OF AUV MARKET BY 2029

- FIGURE 19 AUV MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 AUTONOMOUS UNDERWATER VEHICLE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT OF DRIVERS ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 22 IMPACT OF RESTRAINTS ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 23 UNDERWATER CONNECTORS MARKET REVENUE FROM 2022 TO 2027

- FIGURE 24 IMPACT OF OPPORTUNITIES ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 25 IMPACT OF CHALLENGES ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 26 TRENDS INFLUENCING AUTONOMOUS UNDERWATER VEHICLE BUSINESS OWNERS

- FIGURE 27 AUVS: AVERAGE SELLING PRICE

- FIGURE 28 AUTONOMOUS UNDERWATER VEHICLE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 AUTONOMOUS UNDERWATER VEHICLE MARKET ECOSYSTEM

- FIGURE 30 FUNDS ACQUIRED BY COMPANIES IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 31 PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED, 2013-2023

- FIGURE 33 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 900630, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 34 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 900630, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS: AUTONOMOUS UNDERWATER VEHICLES MARKET

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 38 FUNDAMENTAL CHARACTERISTICS OF AUVS

- FIGURE 39 IMAGING SEGMENT TO GROW AT HIGHEST CAGR DURING 2024-2029

- FIGURE 40 CLASSIFICATION OF AUVS BY DEPTH

- FIGURE 41 LARGE AUVS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 42 MORE THAN 5 KNOTS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 TORPEDO SEGMENT TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 44 ILLUSTRATION: TORPEDO AUV

- FIGURE 45 ILLUSTRATION: LAMINAR FLOW BODY AUV

- FIGURE 46 ILLUSTRATION: MULTI-HULL VEHICLES

- FIGURE 47 SENSORS SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ARCHEOLOGY & EXPLORATION SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 50 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

- FIGURE 51 PRE- AND POST-RECESSION ANALYSIS: NORTH AMERICAN AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 52 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

- FIGURE 53 PRE- AND POST-RECESSION ANALYSIS: EUROPEAN AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 54 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

- FIGURE 55 PRE- AND POST-RECESSION ANALYSIS: ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 56 PRE- AND POST-RECESSION ANALYSIS: ROW AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 57 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2021-2023

- FIGURE 58 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 59 VALUATION AND FINANCIAL MATRIX OF KEY PLAYERS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 60 ENTERPRISE VALUE/EBITDA OF KEY PLAYERS

- FIGURE 61 AUTONOMOUS UNDERWATER VEHICLE MARKET: TOP TRENDING BRANDS/PRODUCTS

- FIGURE 62 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 63 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY FOOTPRINT

- FIGURE 64 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 65 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 66 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 67 FUGRO: COMPANY SNAPSHOT

- FIGURE 68 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 SAAB: COMPANY SNAPSHOT

- FIGURE 70 EXAIL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 71 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

The autonomous underwater vehicle (AUV) market is valued at USD 2.0 billion in 2024 and is projected to reach USD 4.3 billion by 2029; it is expected to grow at a CAGR of 15.9% from 2024 to 2029. Rising use of autonomous underwater vehicles to protect subsea cables and seabed environment, integration of NiMH batteries into high-speed autonomous underwater vehicles, and growing demand for AUVs in offshore energy exploration provide lucrative opportunities to the autonomous underwater vehicle (AUV) market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Shape, Type, Technology, Payload and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Sensors segment of the AUV payload market is expected to grow with the highest growth rate during the forecast period."

The sensors segment of the AUV payload market is projected to grow at a higher CAGR during the forecast period owing to the increasing use of sensors for scanning, detection, mapping, and remote sensing applications in mine detection, pipeline layout planning, and oil & gas exploration. Autonomous underwater vehicles use sensors to map their environments and detect objects of interest for anti-submarine warfare (ASW) missions and pipeline inspections. These sensors are also used to identify the location of ferrous objects in the seabed, examine undersea cables, and detect and classify a wide variety of chemicals in seawater.

"Military & defense application segment in Mexico is expected to register highest growth rate during the forecast period."

The Mexican autonomous underwater vehicle market for military & defense applications is expected to grow at the highest CAGR during the forecast period. The rising deployment of AUVs in the Gulf of Mexico and the North Pacific Ocean to secure the borders is one factor propelling the country's market growth. The autonomous underwater vehicles are being increasingly used to monitor coastal areas, detect suspicious activities, and gather intelligence. They are also employed for detailed seabed mapping in naval operations.

"China is expected to hold the largest market share during the forecast period."

China held the largest market share of the autonomous underwater vehicle (AUV) market in Asia Pacific, in 2023, due to the increasing adoption of AUVs by the Chinese navy. China focuses on the development of cost-effective and innovative technological solutions for AUVs. Since mid-90s, China has been involved in a military modernization program with an aim to win regional conflicts as well as its expanding global interests. Following is the breakup of the profiles of the primary participants for the report.

- By Company Type: Tier 1 - 40 %, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: C-Level Executives -40%, Directors- 40%, and Others - 20%

- By Region: North America- 40%, Europe- 20%, Asia Pacific - 30%, and RoW - 10%

The report profiles key autonomous underwater vehicle (AUV) market players and analyzes their market shares. Players profiled in this report are KONGSBERG (Norway), Teledyne Technologies Incorporated (US), General Dynamics Corporation (US), Saab (Sweden), Exail Technologies (France), Lockheed Martin Corporation (US), Fugro (Netherlands), ATLAS ELEKTRONIK (Germany), etc.

Research Coverage

The report defines, describes, and forecasts the autonomous underwater vehicle (AUV) market based on Technology, Type, Shape, Speed, Payload Type, Application, and Region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the autonomous underwater vehicle (AUV) market. It also analyses competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions conducted by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall autonomous underwater vehicle (AUV) market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing investments in oil and gas drilling activities, rising deployment of advanced technologies to ensure border and maritime security, shifting preference toward renewable energy sources, and technological advancements in AUVs), restraints (High development, operational, and maintenance costs, and limited endurance and range hindering broader deployment of AUVs), opportunities (Integration of NiMH batteries into high-speed AUVs, rising use of AUVs to protect subsea cables and seabed environment, and growing demand for AUVs in offshore energy exploration), and challenges (Low speed, signal processing, and environmental issues witnessed by AUVs during underwater surveys, risk of data loss and increase in research timelines due to challenging marine environment, and robust legal and ethical frameworks for AUV adoption) influencing the growth of the autonomous underwater vehicle (AUV) market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the autonomous underwater vehicle (AUV) market

- Market Development: Comprehensive information about lucrative markets - the report analyses the autonomous underwater vehicle (AUV) market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the autonomous underwater vehicle (AUV) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like KONGSBERG (Norway), Teledyne Technologies Incorporated (US), General Dynamics Corporation (US), Saab (Sweden), Exail Technologies (France), Lockheed Martin Corporation (US), Fugro (Netherlands), ATLAS ELEKTRONIK (Germany), Boston Engineering Corporation (US), L3Harris Technologies, Inc. (US), Graal Tech S.r.l. (Italy), International Submarine Engineering Limited (Canada), Boeing (US), Riptide Autonomous Solutions (US), MSubs (China), BaltRobotics (Poland), and Hydromea (Switzerland), among others in the autonomous underwater vehicle (AUV) market strategies. The report also helps stakeholders understand the pulse of the autonomous underwater vehicle (AUV) market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market share by top-down analysis (demand side)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MAJOR OPPORTUNITIES FOR PLAYERS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- 4.2 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE

- 4.3 AUTONOMOUS UNDERWATER VEHICLE MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 4.4 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION

- 4.5 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments in offshore oil & gas drilling

- 5.2.1.2 Deployment of advanced technologies to ensure border and maritime security

- 5.2.1.3 Shifting preference toward renewable energy sources

- 5.2.1.4 Technological advancements in AUVs

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development, operational, and maintenance costs

- 5.2.2.2 Limited endurance and range

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of NiMH batteries into high-speed AUVs

- 5.2.3.2 Rising use of AUVs to protect subsea cables and seabed environment

- 5.2.3.3 Growing demand in offshore energy exploration

- 5.2.4 CHALLENGES

- 5.2.4.1 Low speed, signal processing, and environmental issues during underwater surveys

- 5.2.4.2 Risk of data loss and prolonged research timelines due to challenging marine environment

- 5.2.4.3 Legal and ethical concerns

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND

- 5.4.2 AVERAGE COST SPLIT OF VARIOUS AUV COMPONENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY TRENDS

- 5.8.1 INTERNET OF THINGS

- 5.8.2 RESEARCH ON STANDARD OPERATING SYSTEMS IN ROBOTS

- 5.8.3 ARTIFICIAL INTELLIGENCE CHIPS

- 5.8.4 DIGITAL MARINE AUTOMATION SYSTEMS

- 5.8.5 IMPROVED BATTERY TECHNOLOGY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 TERRADEPTH OFFERS OCEAN DATA AS A SERVICE USING AUVS

- 5.9.2 TERRADEPTH'S ABSOLUTE OCEAN INCREASES OPERATIONAL EFFICIENCY FOR S. T. HUDSON

- 5.9.3 LONG-ENDURANCE AUV DEVELOPMENT WITH SHALLOW WATER SIMPLICITY

- 5.10 PATENT ANALYSIS

- 5.10.1 KEY PATENTS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- 5.11.2 EXPORT SCENARIO

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- 5.12.2 REGULATORY LANDSCAPE

- 5.12.2.1 Regulatory bodies, government agencies, and other organizations

- 5.13 KEY CONFERENCES AND EVENTS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

6 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 COLLISION AVOIDANCE

- 6.2.1 SONAR

- 6.2.1.1 Deployment of SONAR technology in AUVs to detect underwater obstacles

- 6.2.1 SONAR

- 6.3 COMMUNICATION

- 6.3.1 ACOUSTIC COMMUNICATION

- 6.3.1.1 Reliance on acoustic sound waves for underwater communication

- 6.3.2 SATELLITE COMMUNICATION

- 6.3.2.1 Adoption of satellite communication to enable real-time data transfer between AUVs and operators

- 6.3.1 ACOUSTIC COMMUNICATION

- 6.4 NAVIGATION

- 6.4.1 COMPASS-BASED NAVIGATION

- 6.4.1.1 Use of compass-based systems to increase navigation accuracy

- 6.4.2 INERTIAL NAVIGATION

- 6.4.2.1 Typically adopted in deepwater applications

- 6.4.1 COMPASS-BASED NAVIGATION

- 6.5 PROPULSION

- 6.5.1 FIN CONTROL ACTUATORS

- 6.5.1.1 Utilization in AUVs to provide roll, pitch, and yaw control

- 6.5.2 PROPULSION MOTORS

- 6.5.2.1 Adoption in AUVs to enable forward and reverse motions

- 6.5.3 PUMP MOTORS

- 6.5.3.1 Use of DC brushless pump motors to offer variable speed control

- 6.5.4 LINEAR ELECTROMECHANICAL ACTUATORS

- 6.5.4.1 Adoption as low-cost alternative to hydraulic actuators

- 6.5.5 BATTERY MODULES

- 6.5.5.1 Deployment of battery modules in AUVs for energy storage

- 6.5.5.2 Applied battery technologies and alternatives

- 6.5.6 TYPES OF PROPULSION SYSTEMS

- 6.5.6.1 Electric system

- 6.5.6.2 Mechanical system

- 6.5.6.3 Hybrid system

- 6.5.1 FIN CONTROL ACTUATORS

- 6.6 IMAGING

- 6.6.1 SIDE-SCAN SONAR IMAGERS

- 6.6.1.1 Adoption in shallow water surveys

- 6.6.2 MULTIBEAM ECHO SOUNDERS

- 6.6.2.1 Use for seabed mapping

- 6.6.3 SUB-BOTTOM PROFILERS

- 6.6.3.1 Used to detect layers within sediments

- 6.6.4 LED LIGHTING

- 6.6.4.1 Deployed to provide higher light output

- 6.6.1 SIDE-SCAN SONAR IMAGERS

7 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SHALLOW AUVS

- 7.2.1 ADOPTION IN OCEAN OBSERVATION, ROUTE MAPPING, AND MINE-HUNTING APPLICATIONS

- 7.3 MEDIUM AUVS

- 7.3.1 WIDE-SCALE UTILIZATION IN MILITARY APPLICATIONS - KEY DRIVER

- 7.4 LARGE AUVS

- 7.4.1 USE IN DEEPWATER MAPPING AND SURVEY APPLICATIONS TO DRIVE MARKET

8 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED

- 8.1 INTRODUCTION

- 8.2 LESS THAN 5 KNOTS

- 8.2.1 NEED FOR LONGER ENDURANCE TO DRIVE DEMAND

- 8.3 MORE THAN 5 KNOTS

- 8.3.1 INCREASING USE IN DEFENSE AND SURVEILLANCE APPLICATIONS TO DRIVE DEMAND

9 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE

- 9.1 INTRODUCTION

- 9.2 TORPEDO

- 9.2.1 WIDELY USED IN MARINE ENGINEERING APPLICATIONS

- 9.3 LAMINAR FLOW BODY

- 9.3.1 INCREASING ADOPTION TO ENSURE BORDER SECURITY TO PROPEL GROWTH

- 9.4 STREAMLINED RECTANGULAR STYLE

- 9.4.1 USE TO COLLECT UNDERWATER INFORMATION TO DRIVE SEGMENT

- 9.5 MULTI-HULL VEHICLE

- 9.5.1 USE TO SURVEY SEAFLOORS AND STUDY MAGNETIC PROPERTIES TO BOOST MARKET

10 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PAYLOAD TYPE

- 10.1 INTRODUCTION

- 10.2 CAMERAS

- 10.2.1 HIGH-RESOLUTION DIGITAL STILL CAMERAS

- 10.2.1.1 Used to monitor fixed underwater assets

- 10.2.2 DUAL-EYE CAMERAS

- 10.2.2.1 Adoption of dual-eye cameras to form 3D images

- 10.2.1 HIGH-RESOLUTION DIGITAL STILL CAMERAS

- 10.3 SENSORS

- 10.3.1 CONDUCTIVITY, TEMPERATURE, AND DEPTH SENSORS

- 10.3.1.1 Deployment in AUVs to evaluate water composition

- 10.3.2 BIOGEOCHEMICAL SENSORS

- 10.3.2.1 Turbulence probes

- 10.3.2.1.1 Used to understand marine life and environmental changes

- 10.3.2.2 Oxygen, nitrate, chlorophyll, and photosynthetically active radiation sensors

- 10.3.2.2.1 Used to measure oxygen, nitrate, chlorophyll, and PAR in water

- 10.3.2.1 Turbulence probes

- 10.3.1 CONDUCTIVITY, TEMPERATURE, AND DEPTH SENSORS

- 10.4 SYNTHETIC APERTURE SONAR

- 10.4.1 WIDELY USED FOR UNDERWATER ACOUSTIC IMAGING

- 10.5 ECHO SOUNDERS

- 10.5.1 INTEGRATION OF ECHO SOUNDERS IN AUVS TO ENABLE OPERATORS TO VIEW SEABED

- 10.6 ACOUSTIC DOPPLER CURRENT PROFILERS

- 10.6.1 USED TO MEASURE CURRENT VELOCITIES AND WATER DEPTH

- 10.7 OTHERS

11 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 MILITARY & DEFENSE

- 11.2.1 BORDER SECURITY & SURVEILLANCE

- 11.2.1.1 Use of SONAR-enabled AUVs for border security and surveillance

- 11.2.2 ANTISUBMARINE WARFARE

- 11.2.2.1 Adopted to address antisubmarine warfare challenges in ocean and littoral zones

- 11.2.3 ANTI-TRAFFICKING & CONTRABAND MONITORING

- 11.2.3.1 Implementation of communication technology-powered AUVs to track illegal activities

- 11.2.4 ENVIRONMENTAL ASSESSMENT

- 11.2.4.1 Used to collect current and tidal data

- 11.2.5 MINE COUNTERMEASURE IDENTIFICATION

- 11.2.5.1 Deployment for detection and clearance of mines

- 11.2.1 BORDER SECURITY & SURVEILLANCE

- 11.3 OIL & GAS

- 11.3.1 PIPELINE SURVEYS

- 11.3.1.1 Use of side-scan SONAR to detect and track pipelines in real time

- 11.3.2 GEOPHYSICAL SURVEYS

- 11.3.2.1 Adoption of AUVs to inspect traditional sites and survey routes

- 11.3.3 DEBRIS/CLEARANCE SURVEYS

- 11.3.3.1 Deployment of time-efficient AUVs in debris assessment

- 11.3.4 BASELINE ENVIRONMENTAL ASSESSMENT

- 11.3.4.1 Use of AUVs to classify seabed types

- 11.3.1 PIPELINE SURVEYS

- 11.4 ENVIRONMENT PROTECTION & MONITORING

- 11.4.1 HABITAT RESEARCH

- 11.4.1.1 Use of AUVs to examine marine habitat

- 11.4.2 WATER SAMPLING

- 11.4.2.1 Adoption of AUVs to measure salinity and other physical characteristics of water

- 11.4.3 FISHERY STUDY

- 11.4.3.1 Adoption of AUVs to measure overfishing impact

- 11.4.4 EMERGENCY RESPONSE

- 11.4.4.1 Use of AUVs in post-hurricane assessment of subsea infrastructure

- 11.4.1 HABITAT RESEARCH

- 11.5 OCEANOGRAPHY

- 11.5.1 USED TO OBTAIN PREVIOUSLY INACCESSIBLE DATA ON TIME AND SPATIAL SCALES

- 11.6 ARCHEOLOGY & EXPLORATION

- 11.6.1 USE OF AUVS IN LOCATION OF UNDERWATER ARCHEOLOGICAL SITES

- 11.7 SEARCH & SALVAGE OPERATIONS

- 11.7.1 ADOPTION OF AUVS TO DETECT SHIPWRECKS

12 REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: IMPACT OF RECESSION

- 12.2.2 US

- 12.2.2.1 Reliance on AUVs for subsea inspection and mapping

- 12.2.2.2 US: Rules and regulations for AUVs

- 12.2.2.2.1 Introduction of regulations for AUV operators and manufacturers

- 12.2.3 CANADA

- 12.2.3.1 Adoption of AUVs for surveys under thick ice layers to drive market

- 12.2.4 MEXICO

- 12.2.4.1 Utilization of AUVs in underwater habitat research to boost market

- 12.3 EUROPE

- 12.3.1 EUROPE: IMPACT OF RECESSION

- 12.3.2 UK

- 12.3.2.1 Government contracts to drive market

- 12.3.2.2 UK: Rules and regulations for AUVs

- 12.3.2.2.1 Development of regulatory frameworks for MAS

- 12.3.3 GERMANY

- 12.3.3.1 Introduction of innovative AUVs for oceanography applications - key driver

- 12.3.4 FRANCE

- 12.3.4.1 Reliance on AUVs and other robotic systems for minehunting to fuel growth

- 12.3.5 ITALY

- 12.3.5.1 Wide adoption of AUVs to explore underwater archeological sites to boost market

- 12.3.6 SPAIN

- 12.3.6.1 Ban on oil & gas exploration to limit growth

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- 12.4.2 CHINA

- 12.4.2.1 Deployment of AI-powered AUVs for smart underwater navigation to boost market

- 12.4.3 INDIA

- 12.4.3.1 Adoption of AUVs for offshore crude pipeline inspection to fuel growth

- 12.4.4 JAPAN

- 12.4.4.1 Use of AUVs to safeguard coastal areas - key driver

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Growing number of AUV manufacturers to drive market

- 12.4.6 AUSTRALIA

- 12.4.6.1 Increasing use of AUVs for various commercial applications to drive market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 ROW: IMPACT OF RECESSION

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Use of AUVs for offshore oil & gas drilling

- 12.5.3 GCC COUNTRIES

- 12.5.3.1 Increasing oil & gas exploration activities to drive market

- 12.5.4 AFRICA & REST OF MIDDLE EAST

- 12.5.4.1 Employment of AUVs for seabed mapping and oil & gas explorations

13 COMPETITIVE LANDSCAPE

- 13.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.2 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- 13.3 MARKET SHARE ANALYSIS

- 13.4 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX, 2023 (KEY PLAYERS)

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT

- 13.6.5.1 Company footprint

- 13.6.5.2 Type footprint

- 13.6.5.3 Shape footprint

- 13.6.5.4 Payload type footprint

- 13.6.5.5 Application footprint

- 13.6.5.6 Region footprint

- 13.7 COMPANY EVALUATION MATRIX, 2023 (STARTUPS/SMES)

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- 13.8.2 DEALS

- 13.8.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 KONGSBERG

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Services/Solutions offered

- 14.2.1.3 Recent developments

- 14.2.1.4 MnM view

- 14.2.1.4.1 Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses & competitive threats

- 14.2.2 TELEDYNE TECHNOLOGIES INCORPORATED

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Services/Solutions offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.3.2 Deals

- 14.2.2.4 MnM view

- 14.2.2.4.1 Right to win

- 14.2.2.4.2 Strategic choices made

- 14.2.2.4.3 Weaknesses & competitive threats

- 14.2.3 FUGRO

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Services/Solutions offered

- 14.2.3.3 Recent developments

- 14.2.3.4 MnM view

- 14.2.3.4.1 Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses & competitive threats

- 14.2.4 GENERAL DYNAMICS CORPORATION

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Services/Solutions offered

- 14.2.4.3 Recent developments

- 14.2.4.4 MnM view

- 14.2.4.4.1 Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses & competitive threats

- 14.2.5 SAAB

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Services/Solutions offered

- 14.2.5.3 Recent developments

- 14.2.5.4 MnM view

- 14.2.5.4.1 Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses & competitive threats

- 14.2.6 EXAIL TECHNOLOGIES

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Services/Solutions offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches

- 14.2.7 LOCKHEED MARTIN CORPORATION

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Services/Solutions offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Product launches

- 14.2.7.3.2 Deals

- 14.2.7.3.3 Other developments

- 14.2.8 ATLAS ELEKTRONIK

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Services/Solutions offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Deals

- 14.2.9 L3HARRIS TECHNOLOGIES, INC.

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Services/Solutions offered

- 14.2.10 BOSTON ENGINEERING

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Services/Solutions offered

- 14.2.1 KONGSBERG

- 14.3 OTHER PLAYERS

- 14.3.1 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

- 14.3.2 MSUBS

- 14.3.3 FALMOUTH SCIENTIFIC, INC.

- 14.3.4 TERRADEPTH

- 14.3.5 ECOSUB ROBOTICS LIMITED

- 14.3.6 EELUME AS

- 14.3.7 HYDROMEA

- 14.3.8 BOEING

- 14.3.9 GRAAL TECH S.R.L.

- 14.3.10 RIPTIDE AUTONOMOUS SOLUTIONS LLC

- 14.3.11 BALTROBOTICS

- 14.3.12 SONARDYNE

- 14.3.13 OCEANSCAN-MST

- 14.3.14 XYLEM

- 14.3.15 RTSYS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS