|

|

市場調査レポート

商品コード

1239424

タンパク質成分の世界市場:原料別 (動物、植物、昆虫、微生物)・形状別 (乾燥、液体)・用途別 (食品・飲料、飼料、化粧品・パーソナルケア用品、医薬品)・地域別の将来予測 (2028年まで)Protein Ingredients Market by Source (Animal, Plant, Insect, and Microbial), Form (Dry and Liquid), Application (Food & Beverages, Feed, Cosmetics & Personal Care Products, and Pharmaceuticals), and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| タンパク質成分の世界市場:原料別 (動物、植物、昆虫、微生物)・形状別 (乾燥、液体)・用途別 (食品・飲料、飼料、化粧品・パーソナルケア用品、医薬品)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月09日

発行: MarketsandMarkets

ページ情報: 英文 251 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のタンパク質成分の市場規模は、2023年に610億米ドル、2028年には856億米ドルに達すると予測され、予測期間中に7.0%のCAGRで成長する見込みです。

各種業界でのタンパク質の用途の広さや、健康食品やダイエットに対する消費者の意識と嗜好の高まりが、タンパク質成分の需要を後押ししています。

地域別に見ると、アジア太平洋が予測期間中に8.1%と大幅な成長を遂げると予測されています。市場の主な促進要因として、人口増加や経済成長、ベジタリアン・ビーガン食品の人気拡大などが挙げられ、特に植物由来のカテゴリーでは、域内市場の今後の発展が期待されています。さらに、大手企業は同地域で販売拠点や製造工場を拡大しており、急成長地域の一つである同地域のタンパク質原料市場のエコシステムを後押ししています。

用途別では、医薬品分野が最も速い成長率を示しています。タンパク質は製薬・医療産業において重要な役割を担っています。さらに、都市化の進展やペースの速いライフスタイルに伴い、欠乏症の治療や予防のためにサプリメントや代用品が今後高い人気を集めると考えられ、今後数年間で業界をさらに牽引していくでしょう。

原料別に見ると、今後は微生物由来タンパク質が、持続可能で効率的な生産工程を武器に、市場を牽引していくと考えられています。

当レポートでは、世界のタンパク質成分の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、原料別・形状別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン

- 技術分析

- 価格分析

- 市場マッピングとエコシステム

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

- 貿易分析

- 主な会議とイベント (2023年~2024年)

- 関税と規制の状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ

第7章 タンパク質成分市場:原料別

- イントロダクション

- 動物由来

- 乳タンパク質成分

- 卵タンパク質

- コラーゲン

- 植物由来

- 大豆

- 小麦

- エンドウ

- その他の原料

- 昆虫由来

- 微生物由来

第8章 タンパク質成分市場:形状別

- イントロダクション

- 乾燥

- 液体

第9章 タンパク質成分市場:用途別

- イントロダクション

- 食品・飲料

- 食肉・代替肉

- 乳製品・乳製品代替品

- ベーカリー製品

- パフォーマンス栄養素

- インスタント食品

- その他の食品用途

- 飼料

- 化粧品・パーソナルケア用品

- 医薬品

第10章 タンパク質成分市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々 (RoW)

- アフリカ

- 中東

第11章 競合情勢

- 概要

- 市場シェア分析 (2021年)

- 主要企業の収益分析:セグメント別

- 主要企業の戦略

- 企業評価クアドラント(主要企業)

- 製品フットプリント

- 世界のタンパク質原料市場:スタートアップ/中小企業の評価クアドラント (2021年)

- 競合シナリオ

- 新製品の発売

- 資本取引

- その他

第12章 企業プロファイル

- 主要企業

- DUPONT

- ADM

- CARGILL, INCORPORATED

- KERRY GROUP PLC

- ARLA FOODS AMBA

- BRF GLOBAL

- THE SCOULAR COMPANY

- ROQUETTE FRERES

- AMCO PROTEINS

- A&B INGREDIENTS

- PURIS

- COSUCRA

- BURCON

- SOTEXPRO

- AGT FOOD AND INGREDIENTS

- その他の企業

- NOW FOODS

- SHANDONG SINOGLORY HEALTH FOOD CO., LTD

- PROCESS AGROCHEM INDUSTRIES PVT LTD.

- CJ SELECTA

- AMINOLA BV

- THE GREEN LABS LLC.

- ETCHEM

- BREMIL GROUP

- CHAITANYA GROUP OF INDUSTRIES

- NORDIC SOYA OY

- JR UNIQUE FOODS

- HIPROMINE S.A.

- BIOFLYTECH

- TEBRIO

第13章 隣接・関連市場

- イントロダクション

- 分析の限界

- 乳製品原料市場

- 植物性タンパク質市場

第14章 付録

The global protein ingredients market is estimated to be valued at USD 61.0 Billion in 2023. It is projected to reach USD 85.6 Billion by 2028, recording a CAGR of 7.0% during the forecast period. Protein is essential for important body functions. Animal sources such as collagen, dairy, and egg; plant sources such as soy, pea, and wheat; and insect sources are rich in protein content. Their demand is on a spike with their rise in the usage of various industry applications. The demand is also aided by growing consumer awareness and preference for health products and diets.

"Asia Pacific is projected to witness a significant growth of 8.1% during the forecast period"

The protein ingredients market in Asia Pacific is growing at a CAGR of 8.1%. The Asia-Pacific region consists of a rising population, some of the world's fastest-growing economies, and a growing preference for vegetarian and vegan foods, which is expected to thrive the protein ingredients market in the region, especially in the plant sources category. Moreover, major players are expanding their sales presence and manufacturing plants in the region, pumping the protein ingredients market's ecosystem in one of the fastest growing regions.

"The pharmaceuticals segment by application has the fastest growth rate in the protein ingredients market."

According to WHO, 1 in 6 people in the world will age above 60 years by 2030. Thus, growth in the global healthcare industry can be attributed to the increase in the aging population, the need for improved metabolism and health, and reduced susceptibility to diseases. Proteins are essential amino acids that help the human body boost its immunity and help build and repair tissues. They are the building blocks for bones, muscles, cartilage, skin, and blood. Proteins thus form an important component in the pharmaceutical and healthcare industries. Moreover, with rising urbanization, and fast-paced lifestyles supplements and substitute are believed to become highly popular in the coming times to treat and prevent deficiencies, further driving the industry in the coming years.

"Sustainable and efficient production process to drive the protein ingredients market for microbial source in the coming times"

The process of producing protein ingredients from animal and plant sources is very resource intensive. It is very time-consuming and requires a large amount of land, energy, and water. Microbial sources of protein offer various benefits to the manufacturers with respect to savings in terms of land and water use (up to 98% water savings). Thus, the process also helps with the reduction of carbon footprint. Therefore, though the microbial source of proteins may appear as a niche market today, it is expected to grow at a very fast pace in the coming times to emerge as one of the most significant alternative sources of protein.

Break-up of Primaries:

- By Company Type: Tier 1 - 30%, Tier 2- 45%, Tier 3 - 25%

- By Designation: Managers - 50%, CXOs - 25%, and Executives- 25%

- By Region: Asia Pacific - 40%, Europe - 25%, North America - 25%, RoW - 10%

Leading players profiled in this report:

- DuPont (US)

- ADM (US)

- Cargill, Incorporated (US)

- Kerry Group plc (Ireland)

- Arla Foods amba (Denmark)

- BRF Global (Brazil)

- The Scoular Company (US)

- Roquette Freres (France)

- AMCO Proteins (US)

- A&B Ingredients (US)

- Puris (US)

- Cosucra (Belgium)

- Burcon (Canada)

- Sotexpro (France)

- AGT Food & Ingredients (Canada)

Research Coverage:

The report segments the protein ingredients market on the basis of source, form, application, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges of the global protein ingredients market.

Reasons to buy this report:

- To get a comprehensive overview of the protein ingredients market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the protein ingredients market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.6.1 CURRENCY UNIT

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.6.2 VOLUME UNIT

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PROTEIN INGREDIENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM-UP (BASED ON SOURCES, BY REGION)

- 2.2.2 APPROACH TWO: TOP-DOWN (BASED ON GLOBAL MARKET)

- 2.3 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.4 RECESSION IMPACT ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 STUDY LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 PROTEIN INGREDIENTS MARKET SNAPSHOT, 2022 VS. 2028

- FIGURE 4 PROTEIN INGREDIENTS MARKET SIZE, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 5 PROTEIN INGREDIENTS MARKET SIZE, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 PROTEIN INGREDIENTS MARKET SIZE, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 PROTEIN INGREDIENTS MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN PROTEIN INGREDIENTS MARKET

- FIGURE 8 RISING CONSUMER HEALTH AWARENESS AND DEMAND FOR MEAT AND MEAT ALTERNATIVES TO DRIVE MARKET

- 4.2 EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE AND COUNTRY (2022)

- FIGURE 9 ANIMAL SOURCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN EUROPE AMONG PROTEIN INGREDIENTS SOURCES

- 4.3 PROTEIN INGREDIENTS MARKET, BY SOURCE

- FIGURE 10 ANIMAL SOURCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 PROTEIN INGREDIENTS MARKET, BY APPLICATION

- FIGURE 11 FOOD & BEVERAGES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 PROTEIN INGREDIENTS MARKET, BY FORM

- FIGURE 12 DRY FORM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN RETAIL SALES

- FIGURE 13 RETAIL AND FOOD SERVICE SALES IN US (BILLION USD)

- 5.2.2 GROWTH OPPORTUNITIES IN DEVELOPING REGIONS

- FIGURE 14 GDP GROWTH RATE IN ASIAN COUNTRIES, 2020-2021

- 5.3 MARKET DYNAMICS

- FIGURE 15 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increasing demand for proteins as nutritional and functional ingredients post COVID-19

- 5.3.1.2 Rising demand for livestock products

- 5.3.1.3 Growing demand for personal and healthcare products

- 5.3.2 RESTRAINTS

- 5.3.2.1 Ban on plant proteins of GM origin

- 5.3.2.2 Cultural restriction on gelatin consumption

- 5.3.2.3 Allergies associated with plant-based protein sources

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growing potential of dairy and plant proteins

- 5.3.3.2 Demand for plant-based protein from growing vegan population

- 5.3.4 CHALLENGES

- 5.3.4.1 Concerns over quality of food & beverages due to adulteration of GM ingredients

- 5.3.4.2 Economic constraints related to processing capacity of pea protein

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 PRODUCTION AND PROCESSING

- 6.2.4 DISTRIBUTION

- 6.2.5 MARKETING & SALES

- FIGURE 16 VALUE CHAIN ANALYSIS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 CARBON DIOXIDE-BASED PROTEIN INGREDIENTS

- 6.3.2 RECOMBINANT TECHNOLOGY FOR COLLAGEN PRODUCTION

- 6.3.3 EXTRUSION

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE, BY SOURCE

- FIGURE 17 GLOBAL: AVERAGE SELLING PRICE, BY SOURCE

- TABLE 3 SOY: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TONS)

- TABLE 4 WHEAT: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TONS)

- TABLE 5 PEA: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TONS)

- 6.5 MARKET MAPPING AND ECOSYSTEM

- 6.5.1 MARKET MAPPING OF ECOSYSTEM

- 6.5.1.1 Demand side

- 6.5.1.2 Supply side

- FIGURE 18 PROTEIN INGREDIENTS: MARKET MAP

- TABLE 6 PROTEIN INGREDIENTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- FIGURE 19 PROTEIN INGREDIENTS: ECOSYSTEM MAPPING

- 6.5.1 MARKET MAPPING OF ECOSYSTEM

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 20 REVENUE SHIFT FOR PROTEIN INGREDIENTS MARKET

- 6.7 PATENT ANALYSIS

- FIGURE 21 NUMBER OF PATENTS GRANTED BETWEEN 2013 TO 2022

- FIGURE 22 TOP TEN INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 23 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- TABLE 7 PATENTS PERTAINING TO PROTEIN INGREDIENTS, 2021-2023

- 6.8 TRADE ANALYSIS

- 6.8.1 PEPTONES AND THEIR DERIVATIVES (2021)

- TABLE 8 TOP TEN IMPORTERS AND EXPORTERS OF PEPTONES AND THEIR DERIVATIVES, 2021 (KG)

- 6.8.2 GELATIN (2021)

- TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF GELATIN, 2021 (KG)

- 6.8.3 SOYBEAN (2021)

- TABLE 10 TOP TEN IMPORTERS AND EXPORTERS OF SOYBEAN, 2021 (KG)

- 6.8.4 PEA (2021)

- TABLE 11 TOP TEN IMPORTERS AND EXPORTERS OF PEA, 2021 (KG)

- 6.8.5 WHEAT AND MESLIN (2021)

- TABLE 12 TOP TEN IMPORTERS AND EXPORTERS OF WHEAT AND MESLIN, 2021 (USD THOUSAND)

- 6.9 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 13 KEY CONFERENCES AND EVENTS IN PROTEIN INGREDIENTS MARKET, 2023-2024

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 PROTEIN INGREDIENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 BARGAINING POWER OF SUPPLIERS

- 6.11.3 BARGAINING POWER OF BUYERS

- 6.11.4 THREAT OF SUBSTITUTES

- 6.11.5 THREAT OF NEW ENTRANTS

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOURCES (%)

- 6.12.2 BUYING CRITERIA

- TABLE 19 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 25 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- 6.13 CASE STUDIES

- TABLE 20 GELITA AG: COLLAGEN FOR LEAN MUSCLE

- TABLE 21 ADM: SPICED APPLE DRINKABLE YOGURT

7 PROTEIN INGREDIENTS MARKET, BY SOURCE

- 7.1 INTRODUCTION

- FIGURE 26 ANIMAL SOURCE TO DOMINATE MARKET FROM 2023 TO 2028 (USD MILLION)

- TABLE 22 PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 23 PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 7.2 ANIMAL SOURCE

- 7.2.1 DIVERSE FLAVOR AND NUTRITION-RICH PROFILE TO DRIVE DEMAND FOR PROTEIN INGREDIENTS

- TABLE 24 ANIMAL SOURCE: PROTEIN INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 25 ANIMAL SOURCE: PROTEIN INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 26 ANIMAL SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 ANIMAL SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 DAIRY PROTEIN INGREDIENTS

- TABLE 28 DAIRY PROTEIN: PROTEIN INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 29 DAIRY PROTEIN: PROTEIN INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.2.1 Milk Protein

- 7.2.2.1.1 MPC

- 7.2.2.1.2 Milk protein isolates

- 7.2.2.1.3 Milk protein hydrolysates

- 7.2.2.1 Milk Protein

- TABLE 30 MILK PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 MILK PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2.2 Whey Protein

- 7.2.2.2.1 Whey protein concentrate

- 7.2.2.2.2 Whey protein isolates

- 7.2.2.2 Whey Protein

- TABLE 32 WHEY PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 WHEY PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2.3 Casein & caseinates

- TABLE 34 CASEIN & CASEINATES PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 35 CASEIN & CASEINATES PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.3 EGG PROTEIN

- TABLE 36 EGG PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 EGG PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.4 COLLAGEN

- TABLE 38 COLLAGEN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 COLLAGEN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PLANT SOURCE

- 7.3.1 CONSUMER INCLINATION TOWARD FOOD SUSTAINABILITY AND CONCERN ABOUT ANIMAL CRUELTY TO DRIVE DEMAND

- TABLE 40 PLANT SOURCE: PROTEIN INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 41 PLANT SOURCE: PROTEIN INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 42 PLANT SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

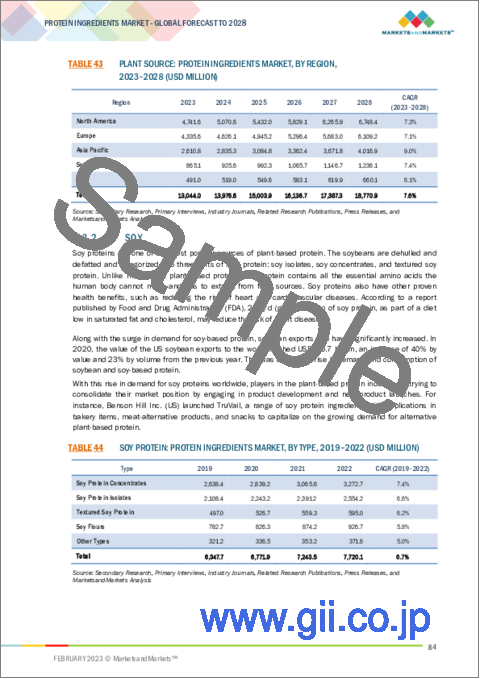

- TABLE 43 PLANT SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.2 SOY

- TABLE 44 SOY PROTEIN: PROTEIN INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 45 SOY PROTEIN: PROTEIN INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 46 SOY PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 SOY PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.3 WHEAT

- TABLE 48 WHEAT PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 WHEAT PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.4 PEA

- TABLE 50 PEA PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 PEA PROTEIN: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.5 OTHER SOURCES

- TABLE 52 OTHER SOURCES: OTHER PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 OTHER SOURCES: OTHER PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 INSECT SOURCE

- 7.4.1 RISING DEMAND FOR ALTERNATIVE PROTEIN TO DRIVE MARKET

- TABLE 54 INSECT SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 INSECT SOURCE: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 MICROBIAL SOURCE

- 7.5.1 SUSTAINABLE AND EFFICIENT PRODUCTION PROCESS TO DRIVE DEMAND

8 PROTEIN INGREDIENTS MARKET, BY FORM

- 8.1 INTRODUCTION

- FIGURE 27 DRY INGREDIENTS SUB-SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- TABLE 56 PROTEIN INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 57 PROTEIN INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 8.2 DRY

- 8.2.1 LONGER SHELF LIFE, CONSISTENT MOUTH FEEL AND TEXTURE, AND EASE OF USE IN RECIPES TO DRIVE DEMAND

- TABLE 58 DRY FORM: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 DRY FORM: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 LIQUID

- 8.3.1 EASY BLEND-ABILITY AND GROWING DEMAND FOR RTD BEVERAGES AND INFANT NUTRITION TO INCREASE DEMAND

- TABLE 60 LIQUID FORM: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 LIQUID FORM: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 PROTEIN INGREDIENTS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 28 PROTEIN INGREDIENTS MARKET SIZE, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 62 PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 63 PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 FOOD & BEVERAGES

- 9.2.1 CONSUMER SHIFT TOWARD HEALTHY AND NUTRITIVE LIFESTYLES TO DRIVE MARKET

- TABLE 64 FOOD & BEVERAGES APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 FOOD & BEVERAGES APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 66 FOOD & BEVERAGES APPLICATION: PROTEIN INGREDIENTS MARKET, BY SUB-APPLICATION, 2019-2022 (USD MILLION)

- TABLE 67 FOOD & BEVERAGES APPLICATION: PROTEIN INGREDIENTS MARKET, BY SUB-APPLICATION, 2023-2028 (USD MILLION)

- 9.2.2 MEAT & MEAT ALTERNATIVES

- TABLE 68 MEAT & MEAT ALTERNATIVES: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 MEAT & MEAT ALTERNATIVES: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.3 DAIRY & DAIRY ALTERNATIVES

- TABLE 70 DAIRY & DAIRY ALTERNATIVES: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 DAIRY & DAIRY ALTERNATIVES: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.4 BAKERY PRODUCTS

- TABLE 72 BAKERY PRODUCTS: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 BAKERY PRODUCTS: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.5 PERFORMANCE NUTRITION

- TABLE 74 PERFORMANCE NUTRITION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 PERFORMANCE NUTRITION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.6 CONVENIENCE FOODS

- TABLE 76 CONVENIENCE FOODS: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 CONVENIENCE FOODS: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.7 OTHER FOOD APPLICATIONS

- TABLE 78 OTHER FOOD APPLICATIONS: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 OTHER FOOD APPLICATIONS: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 FEED

- 9.3.1 RISING DEMAND FOR LIVESTOCK PRODUCTS TO FUEL DEMAND FOR PROTEIN INGREDIENTS IN FEED INDUSTRY

- TABLE 80 FEED APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 FEED APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 82 PET FOOD APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 83 PET FOOD APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 COSMETICS & PERSONAL CARE PRODUCTS

- 9.4.1 FUELING DEMAND FOR COSMETIC PRODUCTS DUE TO HIGH STRESS ON PERSONAL GROOMING TO DRIVE MARKET

- FIGURE 29 BIFURCATION OF COSMETICS AND PERSONAL CARE PRODUCT SEGMENTS, MARKET SHARE (%)

- TABLE 84 COSMETICS & PERSONAL CARE PRODUCTS APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 COSMETICS & PERSONAL CARE PRODUCTS APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 PHARMACEUTICALS

- 9.5.1 INCREASING NUMBER OF AGED POPULATION WORLDWIDE TO BOOST MARKET GROWTH

- TABLE 86 PHARMACEUTICALS APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 PHARMACEUTICALS APPLICATION: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 PROTEIN INGREDIENTS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 30 PROTEIN INGREDIENTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 88 PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 MACRO INDICATORS OF RECESSION

- FIGURE 31 INDICATORS OF RECESSION

- FIGURE 32 WORLD INFLATION RATE: 2011-2021

- FIGURE 33 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 34 GLOBAL FOOD INGREDIENTS MARKET: EARLIER FORECAST VS RECESSION FORECAST

- FIGURE 35 RECESSION INDICATORS AND THEIR IMPACT ON PROTEIN INGREDIENTS MARKET

- FIGURE 36 GLOBAL PROTEIN INGREDIENTS MARKET: EARLIER FORECAST VS RECESSION FORECAST

- 10.3 NORTH AMERICA

- 10.3.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 37 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 38 NORTH AMERICA PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 90 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: PROTEIN INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.3.2 US

- 10.3.2.1 Consumer inclination toward protein-rich products due to rising prevalence of chronic diseases to propel market growth

- TABLE 98 US: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 99 US: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.3.3 CANADA

- 10.3.3.1 Booming food and beverage industry and strengthening insect protein sector to boost market

- TABLE 100 CANADA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 101 CANADA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.3.4 MEXICO

- 10.3.4.1 Strong food industry and surging meat exports to boost market

- TABLE 102 MEXICO: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 103 MEXICO: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 39 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 40 EUROPE PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 41 EUROPE: PROTEIN INGREDIENTS MARKET SNAPSHOT

- TABLE 104 EUROPE: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 105 EUROPE: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 106 EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 107 EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 108 EUROPE: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 109 EUROPE: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 110 EUROPE: PROTEIN INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 111 EUROPE: PROTEIN INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.4.2 GERMANY

- 10.4.2.1 Rise in penetration of collagen and increasing consumption of plant-based food to drive market

- TABLE 112 GERMANY: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 113 GERMANY: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.4.3 FRANCE

- 10.4.3.1 Government initiatives for producing insect and plant-based protein and growing cosmetic industry to boost market

- TABLE 114 FRANCE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 115 FRANCE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.4.4 UK

- 10.4.4.1 Increased health awareness and high dairy products consumption to drive market

- TABLE 116 UK: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 117 UK: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.4.5 ITALY

- 10.4.5.1 Dominant position in pharmaceutical sector and rising consumer preference for plant-based proteins to boost market

- TABLE 118 ITALY: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 119 ITALY: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.4.6 SPAIN

- 10.4.6.1 High sales of collagen-based food supplements and meat alternatives to propel market

- TABLE 120 SPAIN: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 121 SPAIN: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.4.7 REST OF EUROPE

- TABLE 122 REST OF EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 123 REST OF EUROPE: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.5 ASIA PACIFIC

- 10.5.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 42 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 43 ASIA PACIFIC PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 124 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.5.2 CHINA

- 10.5.2.1 Increasing application in infant nutrition to drive market

- TABLE 132 CHINA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 133 CHINA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.5.3 INDIA

- 10.5.3.1 Well-established dairy protein industry to support market growth

- TABLE 134 INDIA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 135 INDIA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.5.4 JAPAN

- 10.5.4.1 Global partnerships and agreements to influence protein ingredients market

- TABLE 136 JAPAN: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 137 JAPAN: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.5.5 AUSTRALIA & NEW ZEALAND

- 10.5.5.1 Investment activities in protein ingredients to drive market

- TABLE 138 AUSTRALIA & NEW ZEALAND: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 139 AUSTRALIA & NEW ZEALAND: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.5.6 REST OF ASIA PACIFIC

- TABLE 140 REST OF ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 44 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 45 SOUTH AMERICA PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 46 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET SNAPSHOT

- TABLE 142 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 143 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 144 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 147 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 148 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 149 SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.6.2 BRAZIL

- 10.6.2.1 Growing soybean production, animal meat exports, and popularity of insect protein to boost market

- TABLE 150 BRAZIL: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 151 BRAZIL: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.6.3 ARGENTINA

- 10.6.3.1 Increasing demand for bovine-sourced collagen to drive market

- TABLE 152 ARGENTINA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 153 ARGENTINA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.6.4 REST OF SOUTH AMERICA

- TABLE 154 REST OF SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 155 REST OF SOUTH AMERICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.7 ROW

- 10.7.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 47 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 48 ROW PROTEIN INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 156 ROW: PROTEIN INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 157 ROW: PROTEIN INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 158 ROW: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 159 ROW: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 160 ROW: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 161 ROW: PROTEIN INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 162 ROW: PROTEIN INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 163 ROW: PROTEIN INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.7.2 AFRICA

- 10.7.2.1 Surge in cases of malnutrition to drive demand for protein ingredients

- TABLE 164 AFRICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 165 AFRICA: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.7.3 MIDDLE EAST

- 10.7.3.1 Rising incidences of obesity and diabetes to fuel demand for protein-rich food

- TABLE 166 MIDDLE EAST: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 167 MIDDLE EAST: PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2021

- TABLE 168 GLOBAL PROTEIN INGREDIENTS MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 49 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD MILLION)

- 11.4 KEY PLAYER STRATEGIES

- TABLE 169 STRATEGIES ADOPTED BY KEY PROTEIN INGREDIENTS MANUFACTURERS

- 11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 50 GLOBAL PROTEIN INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 11.6 PRODUCT FOOTPRINT

- TABLE 170 COMPANY SOURCE FOOTPRINT

- TABLE 171 COMPANY APPLICATION FOOTPRINT

- TABLE 172 COMPANY REGIONAL FOOTPRINT

- TABLE 173 OVERALL COMPANY FOOTPRINT

- 11.7 GLOBAL PROTEIN INGREDIENTS MARKET: EVALUATION QUADRANT FOR STARTUPS/SMES, 2021

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 STARTING BLOCKS

- 11.7.3 RESPONSIVE COMPANIES

- 11.7.4 DYNAMIC COMPANIES

- FIGURE 51 GLOBAL PROTEIN INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- 11.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 174 GLOBAL PROTEIN INGREDIENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 175 GLOBAL PROTEIN INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 NEW PRODUCT LAUNCHES

- TABLE 176 PROTEIN INGREDIENTS: NEW PRODUCT LAUNCHES, 2019-2020

- 11.8.2 DEALS

- TABLE 177 PROTEIN INGREDIENTS: DEALS, 2020-2022

- 11.8.3 OTHERS

- TABLE 178 PROTEIN INGREDIENTS: OTHERS, 2019-2022

12 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

- 12.1 KEY PLAYERS

- 12.1.1 DUPONT

- TABLE 179 DUPONT: BUSINESS OVERVIEW

- FIGURE 52 DUPONT: COMPANY SNAPSHOT

- TABLE 180 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 DUPONT: NEW PRODUCT LAUNCHES

- TABLE 182 DUPONT: DEALS

- TABLE 183 DUPONT: OTHERS

- 12.1.2 ADM

- TABLE 184 ADM: BUSINESS OVERVIEW

- FIGURE 53 ADM: COMPANY SNAPSHOT

- TABLE 185 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ADM: DEALS

- TABLE 187 ADM: OTHERS

- 12.1.3 CARGILL, INCORPORATED

- TABLE 188 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 54 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 189 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 CARGILL, INCORPORATED: NEW PRODUCT LAUNCHES

- TABLE 191 CARGILL, INCORPORATED: DEALS

- TABLE 192 CARGILL, INCORPORATED: OTHERS

- 12.1.4 KERRY GROUP PLC

- FIGURE 55 KERRY GROUP PLC: COMPANY SNAPSHOT

- TABLE 193 KERRY GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 KERRY GROUP PLC: DEALS

- 12.1.5 ARLA FOODS AMBA

- TABLE 195 ARLA FOODS AMBA: BUSINESS OVERVIEW

- FIGURE 56 ARLA FOODS AMBA: COMPANY SNAPSHOT

- TABLE 196 ARLA FOODS AMBA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 ARLA FOODS AMBA: NEW PRODUCT LAUNCHES

- TABLE 198 ARLA FOODS AMBA: OTHERS

- 12.1.6 BRF GLOBAL

- TABLE 199 BRF GLOBAL: BUSINESS OVERVIEW

- FIGURE 57 BRF GLOBAL: COMPANY SNAPSHOT

- TABLE 200 BRF GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 THE SCOULAR COMPANY

- TABLE 201 THE SCOULAR COMPANY: BUSINESS OVERVIEW

- FIGURE 58 THE SCOULAR COMPANY: COMPANY SNAPSHOT

- TABLE 202 THE SCOULAR COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 THE SCOULAR COMPANY: OTHERS

- 12.1.8 ROQUETTE FRERES

- TABLE 204 ROQUETTE FRERES: BUSINESS OVERVIEW

- TABLE 205 ROQUETTE FRERES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 ROQUETTE FRERES: NEW PRODUCT LAUNCHES

- TABLE 207 ROQUETTE FRERES: OTHERS

- 12.1.9 AMCO PROTEINS

- TABLE 208 AMCO PROTEINS: BUSINESS OVERVIEW

- TABLE 209 AMCO PROTEINS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 AMCO PROTEINS: NEW PRODUCT LAUNCHES

- 12.1.10 A&B INGREDIENTS

- TABLE 211 A&B INGREDIENTS: BUSINESS OVERVIEW

- TABLE 212 A&B INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 A&B INGREDIENTS: DEALS

- 12.1.11 PURIS

- TABLE 214 PURIS: BUSINESS OVERVIEW

- TABLE 215 PURIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 PURIS: OTHERS

- 12.1.12 COSUCRA

- TABLE 217 COSUCRA: BUSINESS OVERVIEW

- TABLE 218 COSUCRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 COSUCRA: OTHERS

- 12.1.13 BURCON

- TABLE 220 BURCON: BUSINESS OVERVIEW

- TABLE 221 BURCON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 BURCON: DEALS

- TABLE 223 BURCON: OTHERS

- 12.1.14 SOTEXPRO

- TABLE 224 SOTEXPRO: BUSINESS OVERVIEW

- TABLE 225 SOTEXPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.15 AGT FOOD AND INGREDIENTS

- TABLE 226 AGT FOOD AND INGREDIENTS: BUSINESS OVERVIEW

- TABLE 227 AGT FOOD AND INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 AGT FOOD AND INGREDIENTS: DEALS

- 12.2 OTHER PLAYERS

- 12.2.1 NOW FOODS

- TABLE 229 NOW FOODS: COMPANY OVERVIEW

- 12.2.2 SHANDONG SINOGLORY HEALTH FOOD CO., LTD

- TABLE 230 SHANDONG SINOGLORY HEALTH FOOD CO., LTD: COMPANY OVERVIEW

- 12.2.3 PROCESS AGROCHEM INDUSTRIES PVT LTD.

- TABLE 231 PROCESS AGROCHEM INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- 12.2.4 CJ SELECTA

- TABLE 232 CJ SELECTA: COMPANY OVERVIEW

- 12.2.5 AMINOLA BV

- TABLE 233 AMINOLA BV: COMPANY OVERVIEW

- 12.2.6 THE GREEN LABS LLC.

- TABLE 234 THE GREEN LABS: COMPANY OVERVIEW

- 12.2.7 ETCHEM

- TABLE 235 ETCHEM: COMPANY OVERVIEW

- 12.2.8 BREMIL GROUP

- TABLE 236 BREMIL GROUP: COMPANY OVERVIEW

- 12.2.9 CHAITANYA GROUP OF INDUSTRIES

- TABLE 237 CHAITANYA GROUP OF INDUSTRIES: COMPANY OVERVIEW

- 12.2.10 NORDIC SOYA OY

- TABLE 238 NORDIC SOYA OY: COMPANY OVERVIEW

- 12.2.11 JR UNIQUE FOODS

- TABLE 239 JR UNIQUE FOODS: BUSINESS OVERVIEW

- TABLE 240 PROTENGA: BUSINESS OVERVIEW

- 12.2.12 HIPROMINE S.A.

- TABLE 241 HIPROMINE S.A.: BUSINESS OVERVIEW

- 12.2.13 BIOFLYTECH

- TABLE 242 BIOFLYTECH: BUSINESS OVERVIEW

- 12.2.14 TEBRIO

- TABLE 243 TEBRIO: BUSINESS OVERVIEW

- Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 244 ADJACENT MARKETS

- 13.2 RESEARCH LIMITATIONS

- 13.3 DAIRY INGREDIENTS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 245 DAIRY INGREDIENTS MARKET, BY SOURCE, 2021-2026 (USD MILLION)

- 13.4 PLANT-BASED PROTEIN MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- TABLE 246 PLANT-BASED PROTEIN MARKET, BY TYPE, 2019-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS