|

|

市場調査レポート

商品コード

1077376

マスターデータ管理の世界市場:コンポーネント、組織規模(中小企業、大企業)、展開モード(クラウド、オンプレミス)、業界(BFSI、ヘルスケア)、地域別 - 2027年までの予測Master Data Management Market by Component, Organization Size (SMEs & Large Enterprises), Deployment Mode (Cloud & On-premises), Vertical (BFSI & Healthcare), and Region (North America, Europe, APAC, MEA, Latin America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| マスターデータ管理の世界市場:コンポーネント、組織規模(中小企業、大企業)、展開モード(クラウド、オンプレミス)、業界(BFSI、ヘルスケア)、地域別 - 2027年までの予測 |

|

出版日: 2022年05月18日

発行: MarketsandMarkets

ページ情報: 英文 279 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のマスターデータ管理の市場規模は、予測期間中に15.7%のCAGRで拡大する見通しで、2022年の167億米ドルから、2027年までに345億米ドルに達すると予測されています。

コンプライアンスに対するニーズの高まり、データ管理のためのデータ品質ツールの使用の増加、複数ドメインのマスターデータ管理に対する傾向の高まりなど、さまざまな要因がマスターデータ管理の技術やサービスの採用を促進すると予想されます。

当レポートでは、世界のマスターデータ管理市場について調査し、市場力学、テクノロジー分析、ケーススタディ、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- 累積成長分析

- マスターデータ管理:進化

- ケーススタディ

- テクノロジー分析

- ポーターのファイブフォース分析

- 供給/バリューチェーン分析

- 特許分析

- エコシステム

- 価格設定モデル分析

- 規制の影響

- COVID-19の影響

- 関税と規制状況

第6章 コンポーネント別:マスターデータ管理市場

- ソリューション

- サービス

- コンサルティングサービス

- 統合サービス

- トレーニング・サポートサービス

第7章 展開タイプ別:マスターデータ管理市場

- クラウド

- オンプレミス

第8章 組織規模別:マスターデータ管理市場

- 大企業

- 中小企業

第9章 業界別:マスターデータ管理市場

- 銀行・金融サービス・保険

- 政府

- 小売り

- IT・通信

- 製造

- エネルギー・公益事業

- ヘルスケア

- その他

第10章 地域別:マスターデータ管理市場

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋

- 中国

- インド

- シンガポール

- 日本

- その他

- 中東・アフリカ

- サウジアラビア王国

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

第11章 競合情勢

- 概要

- 主要企業戦略

- 収益分析

- 市場シェア分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- IBM

- ORACLE

- BROADCOM

- SAP

- SAS INSTITUTE

- TERADATA

- CLOUDERA

- TALEND

- RIVERSAND

- INFORMATICA

- STIBO SYSTEMS

- ATACCAMA

- TIBCO SOFTWARE

- その他の企業

- PROFISEE GROUP

- ACTIAN

- MINDTREE

- AWS

- CONTENTSERV

- WINSHUTTLE

- MICRO FOCUS

- VEEVA

- SALESFORCE

- HPE

- スタートアップ/中小企業

- RELTIO

- SEMARCHY

- MAGNITUDE SOFTWARE

- SYNCFORCE

- QLIK

- GOLDENSOURCE

- ZALONI

第13章 付録

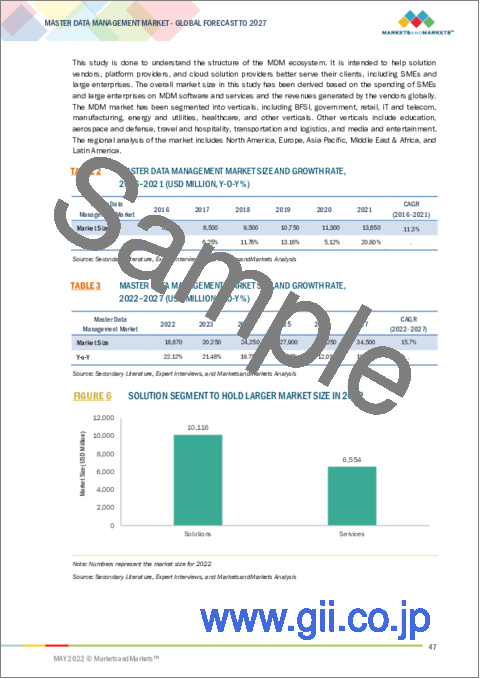

The master data management market size to grow from USD 16.7 billion in 2022 to USD 34.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 15.7% during the forecast period. Various factors such as rising need for compliance, increase in the use of data quality tools for data management, and rising trend towards multi-domain master data management are expected to drive the adoption of master data management technologies and services.

According to IBM, Master Data Management (MDM) is a comprehensive method to define and manage an organization's critical data. It provides a single, trusted view of data across enterprises, agile self-service access, analytical graph-based exploration, governance, and a user-friendly dashboard. Moreover, MDM provides a 360-degree view of data and enables users to deliver better business insights through self-service analytics.

The master data management market is expected to grow owing to several factors, such as rising need for compliance and rising trend towards multi-domain master data management. The increasing availability and accessibility to view master data records within and beyond organizations are leading to the need for authorized processes to maintain the authenticity and accuracy of this data. Therefore, organizations are implementing integrated data governance models with their MDM solutions. Presently, users prefer integrated multi-domain MDM solutions assist them in the observance of various kinds of information policies and help them resolve technical data management issues. Hence, data governance is widely being standardized to increase the adoption of MDM solutions in the market.

The COVID-19 pandemic has affected the master data management market. However, companies are still leveraging MDM software to analyze real-time demand, manage network traffic, and ensure a balanced approach in upstream, midstream, and downstream processes across verticals. Companies would look out for real-time MDM solutions with data visualization, simulation and scenario developments, capabilities to analyze data in different business processes, regression analysis, historical trend analysis and forecasting, clustering and segmentation, and standardized reporting. Most solution providers have realized this and started implementing their solutions with these features to help their clients.

The Services segment to grow at higher CAGR during the forecast period

Based on component, the MDM market is segmented into solutions and services. The CAGR of the Services segment is estimated to be the largest during the forecast period. Services play a very important part in the MDM market, and are considered as the core components for the effective functioning of any software. The growing demand for cloud-based services and the rising adoption of MDM solutions are driving the growth of the services segment. The efficient delivery of services helps in improving system reliability, operational efficiency, and cost management.

The On-Premises segment to have the largest market size during the forecast period

Based on deployment type, the MDM market is segmented into cloud and on-premises. In on-premises deployment, software is installed on the customers' server, whereas in cloud deployment, the software is hosted on dedicated equipment situated off-premises. On-premises deployment runs on customer data centers and allows them to control and manage all aspects of the MDM. On-premises deployment of MDM is a traditional deployment model and is presently the preferred method.

Asia Pacific to hold highest CAGR during the forecast period

The Asia Pacific MDM market is expected to grow at the highest CAGR of 24.0% from 2018 to 2023, due to growing industrialization in this region. This market is also expected to account for the significant adoption of MDM solutions. Initially, data management in this region followed an immature discipline. However, with the rising awareness about the increase in business productivity, supplemented with competently designed MDM solutions offered by vendors present in this region, is leading to Asia Pacific becoming a highly potential market.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the master data management market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, D-Level Executives: 25%, and Managers: 40%

- By Region: APAC: 25%, Europe: 30%, North America: 30%, MEA: 10%, Latin America: 5%

The report includes the study of key players offering master data management solutions and services. It profiles major vendors in the master data management market. The major players in the master data management market include IBM (US), Oracle (US), SAP (Germany), SAS (US), TIBCO Software (US), Informatica (US), Talend (US), Cloudera (US), Riversand (US), SyncForce (US), and Stibo Systems (Denmark).

Research Coverage

The market study covers the master data management market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as components, mapping type, application, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall master data management market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED FOR STUDY

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GLOBAL MASTER DATA MANAGEMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTION/SERVICES OF MASTER DATA MANAGEMENT MARKET

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY ̶ APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTION/SERVICES OF MASTER DATA MANAGEMENT MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY ̶ APPROACH 3 TOP-DOWN (DEMAND SIDE): SHARE OF MASTER DATA MANAGEMENT THROUGH OVERALL MASTER DATA MANAGEMENT SPENDING

- FIGURE 5 MASTER DATA MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- TABLE 1 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS FOR STUDY

- 2.6 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY

- TABLE 2 MASTER DATA MANAGEMENT MARKET SIZE AND GROWTH RATE, 2016-2021 (USD MILLION, Y-O-Y %)

- TABLE 3 MASTER DATA MANAGEMENT MARKET SIZE AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y %)

- FIGURE 6 SOLUTION SEGMENT TO HOLD LARGER MARKET SIZE IN 2022

- FIGURE 7 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE IN 2022

- FIGURE 8 ON-PREMISES DEPLOYMENT TYPE TO HOLD LARGER MARKET SIZE IN 2022

- FIGURE 9 HEALTHCARE VERTICAL TO HOLD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO HOLD LARGEST MARKET SHARE, AND ASIA PACIFIC TO HOLD HIGHEST CAGR IN MASTER DATA MANAGEMENT MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN MASTER DATA MANAGEMENT MARKET

- FIGURE 11 RISING NEED FOR COMPLIANCE TO DRIVE MASTER DATA MANAGEMENT MARKET GROWTH DURING FORECAST PERIOD

- 4.2 MASTER DATA MANAGEMENT MARKET, BY VERTICAL

- FIGURE 12 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO REGISTER LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 MASTER DATA MANAGEMENT MARKET, BY REGION

- FIGURE 13 NORTH AMERICA TO REGISTER LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 MASTER DATA MANAGEMENT MARKET: COMPONENTS AND TOP THREE VERTICALS

- FIGURE 14 SOLUTION SEGMENT AND BANKING, FINANCIAL SERVICES, & INSURANCE VERTICAL TO HOLD HIGHEST MARKET SHARES IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MASTER DATA MANAGEMENT MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in the use of data quality tools for data management

- 5.2.1.2 Rising need for compliance

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data security concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Incorporation of new technologies with master data management

- 5.2.3.2 Trend towards multi-domain master data management

- 5.2.4 CHALLENGES

- 5.2.4.1 Diversified data regulations and legislation across different verticals and regions

- 5.2.4.2 Network slowdown due to COVID-19 pandemic to impact the master data management market significantly

- 5.2.5 CUMULATIVE GROWTH ANALYSIS

- 5.3 MASTER DATA MANAGEMENT: EVOLUTION

- FIGURE 16 EVOLUTION OF MASTER DATA MANAGEMENT

- 5.4 CASE STUDIES

- 5.4.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 5.4.1.1 Use Case 1: Raiffeisen Bank used Ataccama ONE to power its operations, prevent fraud, and facilitate regulatory compliance

- 5.4.2 INFORMATION TECHNOLOGY AND TELECOMMUNICATION

- 5.4.2.1 Use Case 2: Avast used Ataccama ONE to improve its customer experience and ensure compliance with data privacy

- 5.4.3 RETAIL AND CONSUMER GOODS

- 5.4.3.1 Use Case 3: 1-800-Flowers.com used IBM InfoSphere Master Data Management to assist customers find right gifts

- 5.4.4 GOVERNMENT AND DEFENSE

- 5.4.4.1 Use Case 4: CAK used TIBCO MDM to better interact with citizens of Holland and other governmental agencies

- 5.4.5 MANUFACTURING

- 5.4.5.1 Use Case 5: Goya Foods used TIBCO MDM to enhance quality of data on its products

- 5.4.6 HEALTHCARE

- 5.4.6.1 Use Case 6: Hackensack Meridian used Informatica MDM to manage complex soils of data

- 5.4.7 ENERGY AND UTILITIES

- 5.4.7.1 Use Case 7: Fjordkraft used Informatica Master Data Management to consolidate, deduplicate, and master customer data

- 5.4.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 AI, ML, AND MASTER DATA MANAGEMENT

- 5.5.2 CLOUD COMPUTING AND MASTER DATA MANAGEMENT

- 5.5.3 BIG DATA & ANALYTICS AND MASTER DATA MANAGEMENT

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF EACH FORCE ON THE MASTER DATA MANAGEMENT MARKET

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS: MASTER DATA MANAGEMENT MARKET

- 5.6.1 THREAT FROM NEW ENTRANTS

- 5.6.2 THREAT FROM SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 SUPPLY/VALUE CHAIN ANALYSIS

- FIGURE 18 SUPPLY/VALUE CHAIN ANALYSIS

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.8.2 DOCUMENT TYPE

- TABLE 5 PATENTS FILED, 2020-2022

- 5.8.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 19 ANNUAL NUMBER OF PATENTS GRANTED, 2019-2022

- 5.8.3.1 Top applicants

- FIGURE 20 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020-2022

- 5.9 MDM ECOSYSTEM

- TABLE 6 MDM MARKET: ECOSYSTEM

- 5.10 PRICING MODEL ANALYSIS

- TABLE 7 PRICING MODEL

- 5.11 REGULATORY IMPLICATIONS

- 5.11.1 GENERAL DATA PROTECTION REGULATION

- 5.11.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.11.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.11.4 SARBANES-OXLEY ACT OF 2002

- 5.11.5 SOC 2 TYPE II COMPLIANCE

- 5.11.6 ISO/IEC 27001

- 5.11.7 THE GRAMM-LEACH-BLILEY ACT

- 5.12 MDM MARKET: COVID-19 IMPACT

- FIGURE 21 MASTER DATA MANAGEMENT MARKET TO DECLINE DURING 2022-2027

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 NORTH AMERICA: TARIFFS AND REGULATIONS

- 5.13.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.13.2.2 Gramm-Leach-Bliley (GLB) Act

- 5.13.2.3 HIPAA of 1996

- 5.13.2.4 Federal Information Security Management Act (FISMA)

- 5.13.2.5 Federal Information Processing Standards (FIPS)

- 5.13.2.6 California Consumer Privacy Act (CSPA)

- 5.13.3 EUROPE: TARIFFS AND REGULATIONS

- 5.13.3.1 GDPR 2016/679 is a regulation in the EU

- 5.13.3.2 General Data Protection Regulation

- 5.13.3.3 European Committee for Standardization (CEN)

- 5.13.3.4 European Technical Standards Institute (ETSI)

6 MASTER DATA MANAGEMENT MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: MASTER DATA MANAGEMENT MARKET DRIVERS

- 6.1.2 COMPONENTS: COVID-19 IMPACT

- FIGURE 22 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 13 MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 14 MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 SOLUTION

- TABLE 15 SOLUTION: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 16 SOLUTION: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 17 SOLUTION: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 18 SOLUTION: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 19 SOLUTION: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 20 SOLUTION: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 21 SOLUTION: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 22 SOLUTION: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 23 SOLUTION: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 24 SOLUTION: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 25 SOLUTION: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 26 SOLUTION: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 6.3 SERVICES

- TABLE 27 SERVICES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 28 SERVICES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 29 SERVICES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 30 SERVICES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 31 SERVICES: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 32 SERVICES: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 33 SERVICES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 34 SERVICES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 35 SERVICES: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 36 SERVICES: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 37 SERVICES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 38 SERVICES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 6.3.1 CONSULTING SERVICES

- 6.3.2 INTEGRATION SERVICES

- 6.3.3 TRAINING AND SUPPORT SERVICES

7 MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT TYPE: MASTER DATA MANAGEMENT MARKET DRIVERS

- 7.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

- FIGURE 23 CLOUD SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 39 MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 40 MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 7.2 CLOUD

- TABLE 41 CLOUD: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 42 CLOUD: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 43 CLOUD: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

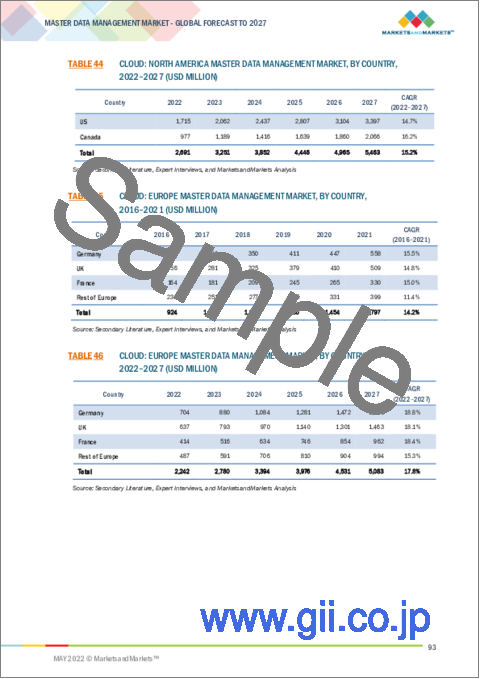

- TABLE 44 CLOUD: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 45 CLOUD: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 46 CLOUD: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 47 CLOUD: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 48 CLOUD: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 49 CLOUD: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 50 CLOUD: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 51 CLOUD: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 52 CLOUD: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 7.3 ON-PREMISES

- TABLE 53 ON-PREMISES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 54 ON-PREMISES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 55 ON-PREMISES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 56 ON-PREMISES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 57 ON-PREMISES: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 58 ON-PREMISES: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 59 ON-PREMISES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 60 ON-PREMISES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 61 ON-PREMISES: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 62 ON-PREMISES: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 63 ON-PREMISES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 64 ON-PREMISES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

8 MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: MASTER DATA MANAGEMENT MARKET DRIVERS

- 8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

- FIGURE 24 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 65 MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 66 MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- TABLE 67 LARGE ENTERPRISES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 68 LARGE ENTERPRISES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 69 LARGE ENTERPRISES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 70 LARGE ENTERPRISES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 71 LARGE ENTERPRISES: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 72 LARGE ENTERPRISES: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 73 LARGE ENTERPRISES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 74 LARGE ENTERPRISES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 75 LARGE ENTERPRISES: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 76 LARGE ENTERPRISES: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 77 LARGE ENTERPRISES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 78 LARGE ENTERPRISES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- TABLE 79 SMALL AND MEDIUM-SIZED ENTERPRISES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 80 SMALL AND MEDIUM-SIZED ENTERPRISES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 81 SMALL AND MEDIUM-SIZED ENTERPRISES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 82 SMALL AND MEDIUM-SIZED ENTERPRISES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 83 SMALL AND MEDIUM-SIZED ENTERPRISES: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 84 SMALL AND MEDIUM-SIZED ENTERPRISES: EUROPE MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 85 SMALL AND MEDIUM-SIZED ENTERPRISES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 86 SMALL AND MEDIUM-SIZED ENTERPRISES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 87 SMALL AND MEDIUM-SIZED ENTERPRISES: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 88 SMALL AND MEDIUM-SIZED ENTERPRISES: MIDDLE EAST & AFRICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 89 SMALL AND MEDIUM-SIZED ENTERPRISES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 90 SMALL AND MEDIUM-SIZED ENTERPRISES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

9 MASTER DATA MANAGEMENT MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: COVID-19 IMPACT

- 9.1.2 VERTICAL: MASTER DATA MANAGEMENT MARKET DRIVERS

- FIGURE 25 HEALTHCARE VERTICAL TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 91 MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 92 MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 9.2 BANKING, FINANCIAL SERVICES, & INSURANCE

- TABLE 93 BANKING, FINANCIAL SERVICES, & INSURANCE: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 94 BANKING, FINANCIAL SERVICES, & INSURANCE: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 GOVERNMENT

- TABLE 95 GOVERNMENT: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 96 GOVERNMENT: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 RETAIL

- TABLE 97 RETAIL: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 98 RETAIL: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 IT & TELECOM

- TABLE 99 IT & TELECOM: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 100 IT & TELECOM: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 MANUFACTURING

- TABLE 101 MANUFACTURING: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 102 MANUFACTURING: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 ENERGY & UTILITIES

- TABLE 103 ENERGY & UTILITIES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 104 ENERGY & UTILITIES: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.8 HEALTHCARE

- TABLE 105 HEALTHCARE: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 106 HEALTHCARE: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.9 OTHER VERTICALS

- TABLE 107 OTHER VERTICALS: MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 108 OTHER VERTICALS: MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

10 MASTER DATA MANAGEMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.1.1 REGION: COVID-19 EFFECT

- FIGURE 26 NORTH AMERICA TO LEAD MASTER DATA MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 27 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 109 MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 110 MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET DRIVERS

- FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 111 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 113 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 115 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 116 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 117 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 118 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 119 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 120 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.2 UNITED STATES

- TABLE 121 UNITED STATES: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 122 UNITED STATES: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 123 UNITED STATES: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 124 UNITED STATES: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 125 UNITED STATES: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 126 UNITED STATES: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.2.3 CANADA

- TABLE 127 CANADA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 128 CANADA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 129 CANADA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 130 CANADA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 131 CANADA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 132 CANADA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: MASTER DATA MANAGEMENT MARKET DRIVERS

- TABLE 133 EUROPE: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 134 EUROPE: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 135 EUROPE: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 136 EUROPE: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 137 EUROPE: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 138 EUROPE: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 139 EUROPE: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 140 EUROPE: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 141 EUROPE: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 142 EUROPE: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.2 UNITED KINGDOM

- TABLE 143 UNITED KINGDOM: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 144 UNITED KINGDOM: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 145 UNITED KINGDOM: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 146 UNITED KINGDOM: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 147 UNITED KINGDOM: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 148 UNITED KINGDOM: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.3.3 GERMANY

- TABLE 149 GERMANY: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 150 GERMANY: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 151 GERMANY: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 152 GERMANY: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 153 GERMANY: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 154 GERMANY: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.3.4 FRANCE

- TABLE 155 FRANCE: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 156 FRANCE: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 157 FRANCE: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 158 FRANCE: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 159 FRANCE: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 160 FRANCE: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.3.5 REST OF EUROPE

- TABLE 161 REST OF EUROPE: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 162 REST OF EUROPE: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 163 REST OF EUROPE: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 164 REST OF EUROPE: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 165 REST OF EUROPE: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 166 REST OF EUROPE: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET DRIVERS

- FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 167 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.2 CHINA

- TABLE 177 CHINA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 178 CHINA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 179 CHINA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 180 CHINA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 181 CHINA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 182 CHINA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.4.3 INDIA

- TABLE 183 INDIA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 184 INDIA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 185 INDIA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 186 INDIA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 187 INDIA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 188 INDIA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.4.4 SINGAPORE

- TABLE 189 SINGAPORE: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 190 SINGAPORE: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 191 SINGAPORE: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 192 SINGAPORE: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 193 SINGAPORE: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 194 SINGAPORE: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.4.5 JAPAN

- TABLE 195 JAPAN: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 196 JAPAN: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 197 JAPAN: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 198 JAPAN: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 199 JAPAN: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 200 JAPAN: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 201 REST OF ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET DRIVERS

- TABLE 207 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.5.2 KINGDOM OF SAUDI ARABIA

- TABLE 217 KINGDOM OF SAUDI ARABIA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 218 KINGDOM OF SAUDI ARABIA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 219 KINGDOM OF SAUDI ARABIA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 220 KINGDOM OF SAUDI ARABIA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 221 KINGDOM OF SAUDI ARABIA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 222 KINGDOM OF SAUDI ARABIA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.5.3 UNITED ARAB EMIRATES

- TABLE 223 UNITED ARAB EMIRATES: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 224 UNITED ARAB EMIRATES: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 225 UNITED ARAB EMIRATES: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 226 UNITED ARAB EMIRATES: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 227 UNITED ARAB EMIRATES: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 228 UNITED ARAB EMIRATES: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.5.4 QATAR

- TABLE 229 QATAR: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 230 QATAR: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 231 QATAR: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 232 QATAR: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 233 QATAR: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 234 QATAR: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.5.5 SOUTH AFRICA

- TABLE 235 SOUTH AFRICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 236 SOUTH AFRICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 237 SOUTH AFRICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 238 SOUTH AFRICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 239 SOUTH AFRICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 240 SOUTH AFRICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 241 REST OF MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 242 REST OF MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 243 REST OF MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET DRIVERS

- TABLE 247 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 248 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 249 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 250 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 251 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 252 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 253 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 254 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 255 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 256 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.6.2 BRAZIL

- TABLE 257 BRAZIL: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 258 BRAZIL: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 259 BRAZIL: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 260 BRAZIL: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 261 BRAZIL: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 262 BRAZIL: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.6.3 MEXICO

- TABLE 263 MEXICO: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 264 MEXICO: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 265 MEXICO: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 266 MEXICO: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 267 MEXICO: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 268 MEXICO: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 10.6.4 REST OF LATIN AMERICA

- TABLE 269 REST OF LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 270 REST OF LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2021 (USD MILLION)

- TABLE 272 REST OF LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 273 REST OF LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- TABLE 275 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MDM MARKET

- 11.3 REVENUE ANALYSIS

- FIGURE 30 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST FIVE YEARS

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 31 MDM MARKET SHARE ANALYSIS

- TABLE 276 MASTER DATA MANAGEMENT MARKET: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 32 KEY MASTER DATA MANAGEMENT MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

- TABLE 277 COMPANY COMPONENT FOOTPRINT

- TABLE 278 COMPANY REGION FOOTPRINT

- 11.6 STARTUP/SME EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 33 STARTUP/SMES: MASTER DATA MANAGEMENT MARKET EVALUATION MATRIX, 2022

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 279 PRODUCT LAUNCHES, SEPTEMBER 2019-MARCH 2022

- 11.7.2 DEALS

- TABLE 280 DEALS, APRIL 2020-APRIL 2022

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business overview, Products/solution/services offered, Recent Developments, COVID-19-related developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 12.2.1 IBM

- TABLE 281 IBM: BUSINESS OVERVIEW

- FIGURE 34 IBM: COMPANY SNAPSHOT

- TABLE 282 IBM: PRODUCTS OFFERED

- TABLE 283 IBM: SERVICES OFFERED

- TABLE 284 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 285 IBM: DEALS

- 12.2.2 ORACLE

- TABLE 286 ORACLE: BUSINESS OVERVIEW

- FIGURE 35 ORACLE: COMPANY SNAPSHOT

- TABLE 287 ORACLE: PRODUCTS OFFERED

- TABLE 288 ORACLE: SERVICES OFFERED

- TABLE 289 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 290 ORACLE: DEALS

- 12.2.3 BROADCOM

- TABLE 291 BROADCOM: BUSINESS OVERVIEW

- FIGURE 36 BROADCOM: COMPANY SNAPSHOT

- TABLE 292 BROADCOM: PRODUCTS OFFERED

- TABLE 293 BROADCOM: SERVICES OFFERED

- TABLE 294 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 295 BROADCOM: DEALS

- 12.2.4 SAP

- TABLE 296 SAP: BUSINESS OVERVIEW

- FIGURE 37 SAP: COMPANY SNAPSHOT

- TABLE 297 SAP: PRODUCTS OFFERED

- TABLE 298 SAP: SERVICES OFFERED

- TABLE 299 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 300 SAP: DEALS

- 12.2.5 SAS INSTITUTE

- TABLE 301 SAS INSTITUTE: BUSINESS OVERVIEW

- FIGURE 38 SAS INSTITUTE: FINANCIAL OVERVIEW

- TABLE 302 SAS INSTITUTE: PRODUCTS/SOLUTION/SERVICES OFFERED

- TABLE 303 SAS INSTITUTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 304 SAS INSTITUTE: DEALS

- 12.2.6 TERADATA

- TABLE 305 TERADATA: BUSINESS OVERVIEW

- FIGURE 39 TERADATA: COMPANY SNAPSHOT

- TABLE 306 TERADATA: PRODUCTS/SOLUTION/SERVICES OFFERED

- TABLE 307 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 308 TERADATA: DEALS

- 12.2.7 CLOUDERA

- TABLE 309 CLOUDERA: BUSINESS OVERVIEW

- FIGURE 40 CLOUDERA: COMPANY SNAPSHOT

- TABLE 310 CLOUDERA: PRODUCTS/SOLUTION/SERVICES OFFERED

- TABLE 311 CLOUDERA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 312 CLOUDERA: DEALS

- 12.2.8 TALEND

- TABLE 313 TALEND: BUSINESS OVERVIEW

- TABLE 314 TALEND: PRODUCTS/SOLUTION/SERVICES OFFERED

- TABLE 315 TALEND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 316 TALEND: DEALS

- 12.2.9 RIVERSAND

- TABLE 317 RIVERSAND: BUSINESS OVERVIEW

- TABLE 318 RIVERSAND: PRODUCTS/SOLUTION/SERVICES OFFERED

- TABLE 319 RIVERSAND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 320 RIVERSAND: DEALS

- 12.2.10 INFORMATICA

- TABLE 321 INFORMATICA: BUSINESS OVERVIEW

- TABLE 322 INFORMATICA: PRODUCTS OFFERED

- TABLE 323 INFORMATICA: SERVICES OFFERED

- TABLE 324 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 325 INFORMATICA: DEALS

- 12.2.11 STIBO SYSTEMS

- TABLE 326 STIBO SYSTEMS: BUSINESS OVERVIEW

- TABLE 327 STIBO SYSTEMS: PRODUCTS OFFERED

- TABLE 328 STIBO SYSTEMS: SERVICES OFFERED

- TABLE 329 STIBO SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 330 STIBO SYSTEMS: DEALS

- 12.2.12 ATACCAMA

- TABLE 331 ATACCAMA: BUSINESS OVERVIEW

- TABLE 332 ATACCAMA: PRODUCTS OFFERED

- TABLE 333 ATACCAMA: SERVICES OFFERED

- TABLE 334 ATACCAMA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 335 ATACCAMA: DEALS

- 12.2.13 TIBCO SOFTWARE

- TABLE 336 TIBCO SOFTWARE: BUSINESS OVERVIEW

- TABLE 337 TIBCO SOFTWARE: PRODUCTS OFFERED

- TABLE 338 TIBCO SOFTWARE: SERVICES OFFERED

- TABLE 339 TIBCO SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 340 TIBCO: DEALS

- 12.3 OTHER KEY PLAYERS

- 12.3.1 PROFISEE GROUP

- 12.3.2 ACTIAN

- 12.3.3 MINDTREE

- 12.3.4 AWS

- 12.3.5 CONTENTSERV

- 12.3.6 WINSHUTTLE

- 12.3.7 MICRO FOCUS

- 12.3.8 VEEVA

- 12.3.9 SALESFORCE

- 12.3.10 HPE

- 12.4 STARTUP/ SMES

- 12.4.1 RELTIO

- 12.4.2 SEMARCHY

- 12.4.3 MAGNITUDE SOFTWARE

- 12.4.4 SYNCFORCE

- 12.4.5 QLIK

- 12.4.6 GOLDENSOURCE

- 12.4.7 ZALONI

- *Details on Business overview, Products/solution/services offered, Recent Developments, COVID-19-related developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 ADJACENT AND RELATED MARKETS

- 13.1.1 ENTERPRISE CONTENT MANAGEMENT MARKET

- 13.1.1.1 Market definition

- 13.1.1.2 Market overview

- 13.1.1.3 Enterprise Content Management Market, by Business Function

- TABLE 341 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY BUSINESS FUNCTION, 2016-2020 (USD MILLION)

- TABLE 342 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY BUSINESS FUNCTION, 2021-2026 (USD MILLION)

- 13.1.1.4 Enterprise Content Management Market, by Component

- TABLE 343 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY COMPONENT, 2016-2020 (USD MILLION)

- TABLE 344 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY COMPONENT, 2021-2026 (USD MILLION)

- 13.1.1.5 Enterprise Content Management Market, by Organization Size

- TABLE 345 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 346 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 13.1.1.6 Enterprise Content Management Market, by Deployment Type

- TABLE 347 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2016-2020 (USD MILLION)

- TABLE 348 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2021-2026 (USD MILLION)

- 13.1.1.7 Enterprise Content Management Market, by Vertical

- TABLE 349 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 350 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY VERTICAL, 2021-2026 (USD MILLION)

- 13.1.1.8 Enterprise Content Management Market, by Region

- TABLE 351 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016-2020 (USD MILLION)

- TABLE 352 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- 13.1.2 METADATA MANAGEMENT TOOLS MARKET

- 13.1.2.1 Market definition

- 13.1.2.2 Market overview

- 13.1.2.3 Metadata Management Tools Market, by Application

- TABLE 353 METADATA MANAGEMENT TOOLS MARKET SIZE, BY APPLICATION, 2015-2020 (USD MILLION)

- TABLE 354 METADATA MANAGEMENT TOOLS MARKET SIZE, BY APPLICATION, 2021-2026 (USD MILLION)

- 13.1.2.4 Metadata Management Tools Market, by Business Function

- TABLE 355 METADATA MANAGEMENT TOOLS MARKET SIZE, BY BUSINESS FUNCTION, 2015-2020 (USD MILLION)

- TABLE 356 METADATA MANAGEMENT TOOLS MARKET SIZE, BY BUSINESS FUNCTION, 2021-2026 (USD MILLION)

- 13.1.2.5 Metadata Management Tools Market, by Organization Size

- TABLE 357 METADATA MANAGEMENT TOOLS MARKET SIZE, BY ORGANIZATION SIZE, 2015-2020 (USD MILLION)

- TABLE 358 METADATA MANAGEMENT TOOLS MARKET SIZE, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 13.1.2.6 Metadata Management Tools Market, by Vertical

- TABLE 359 METADATA MANAGEMENT TOOLS MARKET SIZE, BY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 360 METADATA MANAGEMENT TOOLS MARKET SIZE, BY VERTICAL, 2021-2026 (USD MILLION)

- 13.1.2.7 Metadata Management Tools Market, by Component

- TABLE 361 METADATA MANAGEMENT TOOLS MARKET SIZE, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 362 METADATA MANAGEMENT TOOLS MARKET SIZE, BY COMPONENT, 2021-2026 (USD MILLION)

- 13.1.2.8 Metadata Management Tools Market, by Metadata Type

- TABLE 363 METADATA MANAGEMENT TOOLS MARKET SIZE, BY METADATA TYPE, 2015-2020 (USD MILLION)

- TABLE 364 METADATA MANAGEMENT TOOLS MARKET SIZE, BY METADATA TYPE, 2021-2026 (USD MILLION)

- 13.1.2.9 Metadata Management Tools Market, by Deployment Mode

- TABLE 365 METADATA MANAGEMENT TOOLS MARKET SIZE, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 366 METADATA MANAGEMENT TOOLS MARKET SIZE, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 13.1.2.10 Metadata Management Tools Market, by Region

- TABLE 367 METADATA MANAGEMENT MARKET SIZE, BY REGION, 2015-2020 (USD MILLION)

- TABLE 368 METADATA MANAGEMENT MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- 13.1.1 ENTERPRISE CONTENT MANAGEMENT MARKET

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 AVAILABLE CUSTOMIZATIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS