|

|

市場調査レポート

商品コード

1170843

食品用ガスの世界市場:種類別 (窒素、酸素、二酸化炭素)・用途別 (冷凍・冷蔵、包装、炭酸化)・産業別 (乳製品・冷凍食品、食品・飲料、食肉・鶏肉・海産物)・地域別の将来予測 (2027年まで)Food Grade Gases Market by Type (Nitrogen, Oxygen, Carbon Dioxide), Application (Freezing & Chilling, Packaging, Carbonation), Industry (Dairy & Frozen Products, Beverages, Meat, Poultry & Seafood) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 食品用ガスの世界市場:種類別 (窒素、酸素、二酸化炭素)・用途別 (冷凍・冷蔵、包装、炭酸化)・産業別 (乳製品・冷凍食品、食品・飲料、食肉・鶏肉・海産物)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年12月07日

発行: MarketsandMarkets

ページ情報: 英文 225 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の食品用ガスの市場規模は、2022年に76億米ドル、2027年には106億米ドルに達し、予測期間中に6.9%のCAGRで成長する見通しです。

先進国における食品消費パターンの変化や、加工食品・飲料製品の消費増加、加工食品生産国からインド・中国・南米諸国などの新興市場への貿易増加により、食品・飲料製品の冷却、冷凍、包装、炭酸化の需要が増加しています。そのため、食品用ガスの消費量も増加しています。

地域別に見ると、アジア太平洋が予測期間中に7.5%のCAGRで成長すると推定されています。アジア太平洋は人口が多く、大量の食品・飲料を必要とするため、これらの製品の冷却・冷凍・包装・炭酸化のニーズが高く、最も成長率の高い市場となっています。

種類別では、二酸化炭素のセグメントが予測期間中に7.1%という最高のCAGRで成長すると予測されています。需要の大きさの主な要因として、用途の幅広さ (冷蔵・冷却、改質空気包装、極低温冷却など) が挙げられます。特に、二酸化炭素は-78.5℃という非常に低い温度で気体に昇華するため、固体 (ドライアイス) や液体の状態で冷蔵や冷却に利用されています。また、ワインやぶどうジュースなどの保存料としても利用されています。

供給モード別では、バルク方式のセグメントが予測期間中に7.2%という高いCAGRで成長すると予測されています。また、2021年には最大の市場シェアを占めています。バルク方式は、食品用ガスの保管を容易にし、ひいては輸送の利便性を高めます。

当レポートでは、世界の食品用ガスの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・供給モード別・産業別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 腐りやすい商品に対する消費者の需要の高まり

- 貿易自由化による国際食品貿易の成長

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- イントロダクション

- 規制の枠組み

- 特許分析

- バリューチェーン分析

- 投入物

- 製造

- 貯蔵

- 流通

- マーケティング・販売

- 食品用ガス市場のバイヤーに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- ポーターのファイブフォース分析

第7章 食品用ガス市場:種類別

- イントロダクション

- 二酸化炭素

- 窒素

- 空気

- その他のガス

第8章 食品用ガス市場:供給モード別

- イントロダクション

- バルク

- シリンダー

第9章 食品用ガス市場:産業別

- イントロダクション

- 飲料産業

- 食肉・鶏肉・魚介類産業

- 乳製品・冷凍食品産業

- 果物・野菜産業

- インスタント食品産業

- 製パン・製菓産業

- その他の産業

第10章 食品用ガス市場:用途別

- イントロダクション

- 冷凍・冷蔵

- 包装

- 炭酸化

- その他の用途

第11章 食品用ガス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- オランダ

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- ニュージーランド

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の中東・アフリカ諸国

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 主要企業の収益分析:セグメント別

- 市場シェア分析

- 主要企業の戦略

- 競合リーダーシップマッピング (主要企業)

- 競合リーダーシップマッピング (スタートアップ/中小企業)

- 企業のフットプリント

- 競合情勢

- 資本取引

- その他の動向

第13章 企業プロファイル

- 主要企業

- LINDE PLC

- AIR PRODUCTS & CHEMICALS, INC.

- AIR LIQUIDE

- THE MESSER GROUP GMBH

- TAIYO NIPPON SANSO CORPORATION

- WESFARMERS LIMITED

- PT ANEKA GAS INDUSTRI TBK

- MASSY GROUP, INC.

- AIR WATER, INC.

- LES GAZ INDUSTRIELS LTD.

- SOL GROUP

- GULF CRYO

- NATIONAL GASES LTD.

- GRUPPO SIAD

- CRYOGENIC GASES

- その他の企業

- ADITYA AIR PRODUCTS

- SIDEWINDER DRY ICE & GAS

- AXCEL GASES

- CHENGDU TAIYU INDUSTRIAL GASES CO., LTD.

- YINGDE GAS GROUP SHANGHAI

- SIDDHI VINAYAKA INDUSTRIAL GASES PVT. LTD.

- AMERICAN WELDING & GAS

- IJSFABRIEK STROMBEEK N.V.

- AIR SOURCE INDUSTRIES

- PURITY CYLINDRICAL GASES

第14章 隣接・関連市場

- イントロダクション

- 食品包装技術・機器市場

- コールドチェーン市場

第15章 付録

The global food grade gases market is estimated to be valued at USD 7.6 billion in 2022. It is projected to reach USD 10.6 billion by 2027, recording a CAGR of 6.9% during the forecast period. The changing food consumption patterns in developed markets, rising consumption of processed food & beverage products, and increased trade from processed food-producing countries to emerging markets such as India, China, and countries in South America have led to an increase in the demand for chilling, freezing, packaging, and carbonation of food & beverage products. This has led to an increase in the consumption of food-grade gases.

Food-grade gases need to conform to "food-grade" regulations, that is, the EC directive 96/77/EC on food additives within EU countries and the FDA (Food and Drug Administration) guidelines in the US. Also, equipment such as cylinder regulators used with food packaging gases and with the FDA's GRAS-approved food additive gases should be generally recognized as safe and comply with the European Commission Regulation No. 1935/2004. The FDA's Food Safety Modernization Act (FSMA) is poised to impact the control for perishable foods significantly. The Act of 2010 (FSMA) was signed by President Obama on January 4, 2011. As a result of its implementation, there is increased control over milk products, meat, fish, baked goods, and any perishable food to prevent health hazards.

"The Asia-pacific region is estimated to record a CAGR of 7.5% during the forecast period."

The Asia Pacific region is the fastest-growing market as the large population here demands a large number of food & beverage products, due to which the need for chilling, freezing, packaging, and carbonating these products is higher. Liquefied food-grade carbon dioxide is used in the beverage industry for carbonation. It is also used to manufacture dry ice, which has a large market in the Asia Pacific region.

According to the Population Reference Bureau, the fastest-growing consumer markets of China, India, and a few other Asia Pacific countries had a combined population exceeding 4.46 billion people (as of 2020), which is projected to become an increasingly important driver for the global food-grade gases market over the next two decades. Other drivers that would have a positive impact on this market are the rising household incomes and the growing middle-class population.

Key factors such as industrialization, growing middle-class population, rising disposable income, changing lifestyles, and the rising consumption of packed products are expected to drive the demand for food-grade gases during the forecast period.

Key players in the food grade gases market are Taiyo Nippon Sanso Corporation (Japan), Air Water Inc. (Japan), Wesfarmers Limited (Australia), PT Aneka Gas Industri Tbk (Indonesia).

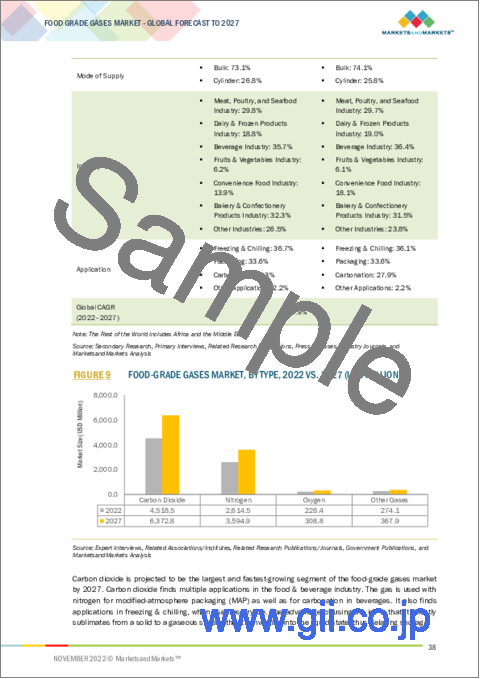

"The carbon dioxide segment of the food-grade gases market is projected to grow at the highest CAGR of 7.1% during the forecast period. The high demand for carbon dioxide can mainly be attributed to its wide applications in refrigeration, cooling, modified-air packaging, and cryogenic cooling."

Carbon dioxide is a colorless, odorless, and non-toxic gas and can be produced in an air separation unit. Carbon dioxide is used for refrigeration and cooling in the solid (dry ice) and liquid form because it sublimates to gas at a very low temperature of -78.5°C (-109.3°F). It is widely used for carbonation in soft drinks, beers, and other alcoholic drinks. The gas also has applications in conserving wine, grape juices, and other juices. Beverage-grade carbon dioxide, which is considered an ingredient in the beverage industry, should be compliant with the strongest regulations of the EC (E290) and International Society of Beverages Technologists (ISBT). Carbon dioxide is also used for MAP; it is injected and frequently removed to eliminate oxygen from the package. This is known as modified-atmospheric packaging.

Carbon dioxide helps to extend the shelf-life of food products by preventing molecular breakdown. It also helps prevent discoloration and preserves flavor. It can prevent the spoilage of many foods, including fruits, raw meats, and packaged baked snacks.

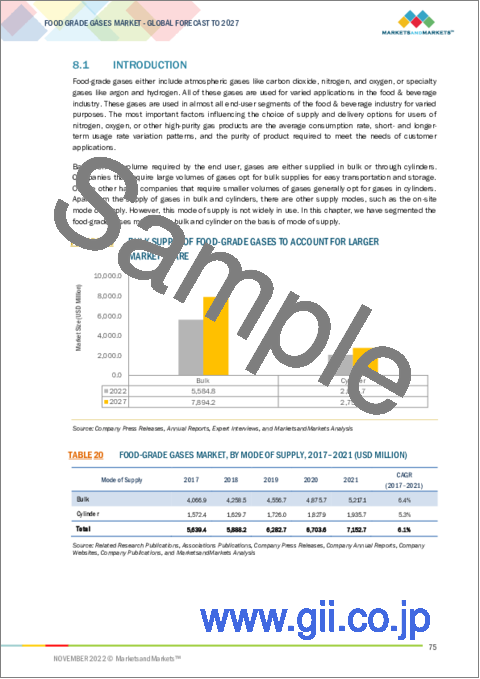

"The bulk segment in the food-grade gases market is projected to grow at a higher CAGR of 7.2% during the forecast period. This segment also accounted for the larger share of the market in 2021. Bulk storage makes it easy to store food-grade gases, which, in turn, makes it convenient for transportation."

Bulk gases are generally supplied in large volumes either as a cryogenic liquid or in a high-pressure gas form. The liquefied gas is often stored in the air separation unit so as to be transported in bulk. During transportation by rail/road, the temperature of the tank must be well maintained. Bulk gas plants are mostly designed to produce liquid products that can be economically transported. Bulk gases are transported in large quantities to the customer through tanks, trucks, or rail. These gases, when supplied in bulk, are easier to transport and store. The bulk form also requires a much smaller storage space than the normal gaseous form; hence, the bulk mode of supply of these gases is usually preferred.

Food-grade gases, which include carbon dioxide, oxygen, nitrogen, hydrogen, and argon, are supplied in tankers or tube trailers. Large food & beverage manufacturers generally prefer the bulk form of these gases. Carbon dioxide and nitrogen are the most commonly supplied bulk gases because of their use in high volumes in soft drinks and food packaging. If an end user requires a gas for various processes, the liquid is first vaporized and then delivered as a gas through a supply pipe. If the processes require liquids, it is delivered directly from the storage vessel through a cryogenic vacuum-insulated pipeline. Almost all the key players offer bulk gases.

Break-up of Primaries:

By Value Chain: Demand side - 41%, Supply side - 59%

By Designation: Managers - 24%, CXOs - 31%, and Executives- 45.0%

By Region: Europe - 29%, Asia Pacific - 32%, North America - 24%, RoW - 15%

Leading players profiled in this report:

- Linde PLC. (Ireland)

- Air Products & Chemicals, Inc. (US)

- Air Liquide (France)

- The Messer Group GmbH (Germany)

- Taiyo Nippon Sanso Corporation (Japan)

- Wesfarmers Limited (Australia)

- PT Aneka Gas Industri Tbk (Indonesia)

- Massy Group, Inc. (Caribbean)

- Air Water Inc. (Japan)

- Sol Group (Italy)

- Gulf Cryo (UAE)

- National Gases Ltd (Pakistan)

- Gruppo SIAD (Italy)

- Cryogenic Gases (US)

- Lez Gas Industriels Ltd. (Mauritius)

- Aditya Air Products (India)

- Sidewinder Dry Ice & Gas (South Africa)

- Axcel Gases (India)

- Chengdu Taiya Industrial Gases Co. (China)

- Yingde Gas Group Shanghai (China)

- Siddhi Vinayak Industries Gases Pvt. LTD. (India)

- American Welding & Gas (US)

- Ijsfabriek Strombeek N.V (Belgium)

- Air Source Industries (US)

- Purity Cylindrical Gases (US)

Research Coverage:

The report segments the food grade gases market on the basis of type, application, mode of supply, industry, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the food grade gases market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the food grade gases market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the food grade gases market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.1.1 MARKET DEFINITION

- 1.2 MARKET SCOPE

- 1.2.1 MARKETS COVERED

- FIGURE 1 FOOD-GRADE GASES MARKET SEGMENTATION

- 1.2.2 REGIONAL SEGMENTATION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.3.1 PERIODIZATION CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2017-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 FOOD-GRADE GASES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 FOOD-GRADE GASES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 FOOD-GRADE GASES MARKET SIZE ESTIMATION (DEMAND SIDE)

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 FOOD-GRADE GASES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 FOOD-GRADE GASES MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- 2.3 GROWTH RATE FORECAST ASSUMPTION

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- TABLE 2 ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS & ASSOCIATED RISKS

- TABLE 3 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 4 FOOD-GRADE GASES MARKET SHARE, 2022 VS. 2027

- FIGURE 9 FOOD-GRADE GASES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 FOOD-GRADE GASES MARKET, BY INDUSTRY, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 FOOD-GRADE GASES MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 FOOD-GRADE GASES MARKET OVERVIEW

- FIGURE 13 HIGH DEMAND FOR CARBONATED BEVERAGES TO DRIVE MARKET GROWTH

- 4.2 FOOD-GRADE GASES MARKET, BY APPLICATION & REGION (2022 VS. 2027)

- FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF FOOD-GRADE GASES MARKET

- 4.3 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY KEY COUNTRY & TYPE (2021)

- FIGURE 15 CHINA TO DOMINATE FOOD-GRADE GASES MARKET IN ASIA PACIFIC

- 4.4 FOOD-GRADE GASES MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 16 ASIAN COUNTRIES TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISING CONSUMER DEMAND FOR PERISHABLE GOODS

- FIGURE 17 GROWING SALES OF CONVENIENCE FOODS, 2020 (% CHANGE IN SALES)

- 5.2.2 GROWTH IN INTERNATIONAL FOOD TRADE DUE TO TRADE LIBERALIZATION

- FIGURE 18 FOOD & BEVERAGE TRADE VALUE IN 2020 (USD MILLION)

- 5.3 MARKET DYNAMICS

- FIGURE 19 FOOD-GRADE GASES MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Shift toward convenient packaged foods

- 5.3.1.2 Growing number of microbreweries across all regions

- 5.3.2 RESTRAINTS

- 5.3.2.1 Strict government regulations to meet quality standards

- TABLE 5 LIST OF FOOD-GRADE GASES AND APPLICATIONS

- TABLE 6 REGULATIONS ON TRANSPORTATION AND STORAGE OF GAS CYLINDERS

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increasing consumer preference for frozen and chilled food products

- 5.3.3.2 Recent advances in target chemi-resistive gas sensors

- 5.3.4 CHALLENGES

- 5.3.4.1 Safe & proper handling of food-grade gases

- 5.3.4.2 Need to provide right mixture of gases in controlled-environment packaging

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 REGULATORY FRAMEWORK

- 6.2.1 NORTH AMERICA

- 6.2.1.1 US

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 EUROPE

- 6.2.3 ASIA PACIFIC

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Thailand

- 6.2.1 NORTH AMERICA

- 6.3 PATENT ANALYSIS

- FIGURE 20 NUMBER OF PATENTS APPROVED FOR FOOD-GRADE GASES IN GLOBAL MARKET, 2020-2022

- FIGURE 21 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR FOOD-GRADE GASES, 2020-2022

- TABLE 7 LIST OF MAJOR PATENTS PERTAINING TO FOOD-GRADE GASES, 2020-2022

- 6.4 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN OF FOOD-GRADE GASES MARKET

- 6.4.1 INPUT

- 6.4.2 MANUFACTURING

- 6.4.3 STORAGE

- 6.4.4 DISTRIBUTION

- 6.4.5 MARKETING & SALES

- 6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS IN FOOD-GRADE GASES MARKET

- FIGURE 23 ECO-FRIENDLY PRODUCTS AND GAS SENSORS TO ENHANCE FUTURE REVENUE MIX

- 6.6 ECOSYSTEM ANALYSIS

- TABLE 8 FOOD-GRADE GASES: ECOSYSTEM VIEW

- FIGURE 24 FOOD-GRADE GASES MARKET MAP

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 CHEMI-RESISTIVE GAS SENSORS

- 6.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 PORTER'S FIVE FORCES ANALYSIS

- 6.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.8.2 BARGAINING POWER OF SUPPLIERS

- 6.8.3 BARGAINING POWER OF BUYERS

- 6.8.4 THREAT FROM NEW ENTRANTS

- 6.8.5 THREAT FROM SUBSTITUTES

7 FOOD-GRADE GASES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 25 CARBON DIOXIDE SEGMENT TO DOMINATE FOOD-GRADE GASES MARKET DURING FORECAST PERIOD

- TABLE 10 FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 11 FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 CARBON DIOXIDE

- 7.2.1 GROWING DEMAND FOR AERATED DRINKS TO DRIVE MARKET

- TABLE 12 CARBON DIOXIDE: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 13 CARBON DIOXIDE: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 NITROGEN

- 7.3.1 RISING DEMAND FOR NITROGEN IN MODIFIED-ATMOSPHERE PACKAGING APPLICATIONS TO SUPPORT GROWTH

- TABLE 14 NITROGEN: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 15 NITROGEN: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 OXYGEN

- 7.4.1 GROWING USE OF OXYGEN TO INHIBIT MICROBIAL GROWTH IN FOOD PACKAGES TO PROPEL MARKET

- TABLE 16 OXYGEN: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 17 OXYGEN: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 OTHER GASES

- TABLE 18 OTHER GASES: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 19 OTHER GASES: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

8 FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY

- 8.1 INTRODUCTION

- FIGURE 26 BULK SUPPLY OF FOOD-GRADE GASES TO ACCOUNT FOR LARGER MARKET SHARE

- TABLE 20 FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2017-2021 (USD MILLION)

- TABLE 21 FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2022-2027 (USD MILLION)

- 8.2 BULK

- 8.2.1 EASE OF STORAGE AND TRANSPORTATION OF GASES IN BULK TO DRIVE DEMAND

- TABLE 22 BULK: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 23 BULK: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 CYLINDER

- 8.3.1 HIGH DEMAND FOR FOOD-GRADE GASES FROM SMALL-SCALE FOOD & BEVERAGE MANUFACTURERS TO SUPPORT MARKET

- TABLE 24 CYLINDER: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 25 CYLINDER: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

9 FOOD-GRADE GASES MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 27 BEVERAGE INDUSTRY TO HOLD LARGEST SHARE OF FOOD-GRADE GASES MARKET DURING FORECAST PERIOD

- TABLE 26 FOOD-GRADE GASES MARKET, BY INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 27 FOOD-GRADE GASES MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 9.2 BEVERAGE INDUSTRY

- 9.2.1 GROWING NUMBER OF MICROBREWERIES TO DRIVE MARKET

- TABLE 28 BEVERAGE INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 29 BEVERAGE INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 MEAT, POULTRY, AND SEAFOOD INDUSTRY

- 9.3.1 WIDE APPLICATION OF FREEZING AND PACKAGING IN MEAT, POULTRY, AND SEAFOOD PRODUCTS TO SUPPORT GROWTH

- TABLE 30 MEAT, POULTRY, AND SEAFOOD INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 31 MEAT, POULTRY, AND SEAFOOD INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 DAIRY & FROZEN PRODUCTS INDUSTRY

- 9.4.1 CONVENIENCE OF FROZEN FOOD PRODUCTS TO DRIVE MARKET DEMAND

- TABLE 32 DAIRY & FROZEN PRODUCTS INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 33 DAIRY & FROZEN PRODUCTS INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 FRUITS & VEGETABLES INDUSTRY

- 9.5.1 DEMAND FOR PROLONGED SHELF-LIFE OF FRUITS & VEGETABLES TO SUPPORT ADOPTION

- TABLE 34 FRUITS & VEGETABLES INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 35 FRUITS & VEGETABLES INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 CONVENIENCE FOOD INDUSTRY

- 9.6.1 GROWING CONSUMPTION OF READY-TO-EAT MEALS TO DRIVE MARKET

- TABLE 36 CONVENIENCE FOOD INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 37 CONVENIENCE FOOD INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 BAKERY & CONFECTIONERY PRODUCTS INDUSTRY

- 9.7.1 GROWING PACKAGING APPLICATIONS TO AVOID RANCIDITY IN BAKERY PRODUCTS TO FUEL MARKET

- TABLE 38 BAKERY & CONFECTIONERY PRODUCTS INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 39 BAKERY & CONFECTIONERY PRODUCTS INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.8 OTHER INDUSTRIES

- TABLE 40 OTHER INDUSTRIES: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 41 OTHER INDUSTRIES: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

10 FOOD-GRADE GASES MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 28 FREEZING & CHILLING APPLICATIONS TO DOMINATE FOOD-GRADE GASES MARKET IN 2027

- TABLE 42 FOOD-GRADE GASES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 43 FOOD-GRADE GASES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2 FREEZING & CHILLING

- 10.2.1 GROWING DEMAND FOR READY-TO-EAT MEALS TO DRIVE GROWTH

- TABLE 44 FREEZING & CHILLING APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 45 FREEZING & CHILLING APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 PACKAGING

- 10.3.1 INCREASING DEMAND FOR PACKAGED AND CONVENIENCE FOOD TO FUEL GROWTH

- TABLE 46 PACKAGING APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 47 PACKAGING APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 CARBONATION

- 10.4.1 POPULARITY OF CARBONATED DRINKS TO AID MARKET GROWTH

- TABLE 48 CARBONATION APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 49 CARBONATION APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 OTHER APPLICATIONS

- TABLE 50 OTHER APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 51 OTHER APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

11 FOOD-GRADE GASES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 29 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 52 FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 53 FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 30 NORTH AMERICA: FOOD-GRADE GASES MARKET SNAPSHOT

- TABLE 54 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 55 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 57 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2017-2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2022-2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 High demand for gases for refrigeration and carbonation applications to fuel market

- TABLE 64 US: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 65 US: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Demand for ready-to-eat foods and fizzy beverages to drive market

- TABLE 66 CANADA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 67 CANADA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 High production and consumption of meat and meat products to propel demand for food-grade gases

- FIGURE 31 PORK PRODUCTION IN MEXICO, 2017-2021

- FIGURE 32 BEEF & VEAL PRODUCTION IN MEXICO, 2017-2022

- TABLE 68 MEXICO: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 69 MEXICO: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- TABLE 70 EUROPE: FOOD-GRADE GASES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 71 EUROPE: FOOD-GRADE GASES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 72 EUROPE: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 73 EUROPE: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 74 EUROPE: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2017-2021 (USD MILLION)

- TABLE 75 EUROPE: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2022-2027 (USD MILLION)

- TABLE 76 EUROPE: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 77 EUROPE: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 78 EUROPE: FOOD-GRADE GASES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 79 EUROPE: FOOD-GRADE GASES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 High demand for alcoholic beverages to boost market

- TABLE 80 GERMANY: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 81 GERMANY: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.2 FRANCE

- 11.3.2.1 Large production and export of beef to create demand for food-grade gases

- TABLE 82 FRANCE: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 83 FRANCE: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Growing consumer demand for frozen food products to drive market

- TABLE 84 UK: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 85 UK: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Growing demand for functional food & beverages to propel market

- TABLE 86 ITALY: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 87 ITALY: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Meat & meat products to create demand for food-grade gases for freezing & chilling applications

- TABLE 88 SPAIN: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 89 SPAIN: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.6 NETHERLANDS

- 11.3.6.1 Presence of large number of food & beverage manufacturers to create opportunities for market

- TABLE 90 NETHERLANDS: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 91 NETHERLANDS: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 92 REST OF EUROPE: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 93 REST OF EUROPE: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: FOOD-GRADE GASES MARKET SNAPSHOT

- TABLE 94 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 95 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 96 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 97 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 98 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 99 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 100 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2017-2021(USD MILLION)

- TABLE 101 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2022-2027 (USD MILLION)

- TABLE 102 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 103 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Rapid growth of microbreweries to create demand for food-grade gases

- TABLE 104 CHINA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 105 CHINA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.2 INDIA

- 11.4.2.1 Expanding cold chain industry to drive market

- TABLE 106 INDIA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 107 INDIA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Innovations in sustainable food packaging to support growth

- TABLE 108 JAPAN: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 109 JAPAN: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.4 AUSTRALIA

- 11.4.4.1 Organized retail chain and growing demand for frozen products to create opportunities

- TABLE 110 AUSTRALIA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 111 AUSTRALIA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.5 NEW ZEALAND

- 11.4.5.1 High exports of fruits and meat products to create demand

- TABLE 112 NEW ZEALAND: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 113 NEW ZEALAND: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 114 REST OF ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5 SOUTH AMERICA

- TABLE 116 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 117 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 118 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 119 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 120 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2017-2021 (USD MILLION)

- TABLE 121 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2022-2027 (USD MILLION)

- TABLE 122 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 123 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 124 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 125 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Large-scale beef and veal production to drive demand for meat packaging and preservation

- TABLE 126 BRAZIL: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 127 BRAZIL: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5.2 ARGENTINA

- 11.5.2.1 Growing demand for packaged meat products to fuel growth

- TABLE 128 ARGENTINA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 129 ARGENTINA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5.3 REST OF SOUTH AMERICA

- TABLE 130 REST OF SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 131 REST OF SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.6 REST OF THE WORLD

- TABLE 132 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 133 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 134 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 135 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 136 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2017-2021 (USD MILLION)

- TABLE 137 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2022-2027 (USD MILLION)

- TABLE 138 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 139 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 140 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 141 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.6.1 AFRICA

- 11.6.1.1 Growing demand for on-the-go snacks to support growth

- TABLE 142 AFRICA: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 143 AFRICA: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Growing use of food-grade gases for freezing & chilling applications to create opportunities

- TABLE 144 MIDDLE EAST: FOOD-GRADE GASES MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 145 MIDDLE EAST: FOOD-GRADE GASES MARKET, BY TYPE, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 34 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD BILLION)

- 12.3 MARKET SHARE ANALYSIS

- TABLE 146 FOOD-GRADE GASES MARKET: DEGREE OF COMPETITION, 2021

- 12.4 STRATEGIES OF KEY PLAYERS

- 12.5 COMPETITIVE LEADERSHIP MAPPING (KEY PLAYERS)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 35 FOOD-GRADE GASES MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 12.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 36 FOOD-GRADE GASES MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UPS/SMES)

- 12.7 COMPANY FOOTPRINT

- TABLE 147 COMPANY FOOTPRINT, BY TYPE

- TABLE 148 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 149 COMPANY FOOTPRINT, BY REGION

- TABLE 150 OVERALL COMPANY FOOTPRINT

- TABLE 151 FOOD-GRADE GASES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 152 FOOD-GRADE GASES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.8 COMPETITIVE LANDSCAPE

- 12.8.1 DEALS

- TABLE 153 DEALS, 2017-2022

- 12.8.2 OTHER DEVELOPMENTS

- TABLE 154 OTHER DEVELOPMENTS, 2017-2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View)**

- 13.1.1 LINDE PLC

- TABLE 155 LINDE PLC: BUSINESS OVERVIEW

- FIGURE 37 LINDE PLC: COMPANY SNAPSHOT (2021)

- TABLE 156 LINDE PLC: DEALS

- TABLE 157 LINDE PLC: OTHER DEVELOPMENTS

- 13.1.2 AIR PRODUCTS & CHEMICALS, INC.

- TABLE 158 AIR PRODUCTS & CHEMICALS, INC.: BUSINESS OVERVIEW

- FIGURE 38 AIR PRODUCTS & CHEMICALS, INC.: COMPANY SNAPSHOT (2021)

- TABLE 159 AIR PRODUCTS & CHEMICALS, INC.: OTHER DEVELOPMENTS

- 13.1.3 AIR LIQUIDE

- TABLE 160 AIR LIQUIDE: BUSINESS OVERVIEW

- FIGURE 39 AIR LIQUIDE: COMPANY SNAPSHOT (2021)

- 13.1.4 THE MESSER GROUP GMBH

- TABLE 161 THE MESSER GROUP GMBH: BUSINESS OVERVIEW

- FIGURE 40 THE MESSER GROUP GMBH: COMPANY SNAPSHOT (2021)

- TABLE 162 THE MESSER GROUP GMBH: OTHER DEVELOPMENTS

- 13.1.5 TAIYO NIPPON SANSO CORPORATION

- TABLE 163 TAIYO NIPPON SANSO CORPORATION: BUSINESS OVERVIEW

- FIGURE 41 TAIYO NIPPON SANSO CORPORATION: COMPANY SNAPSHOT (2021)

- TABLE 164 TAIYO NIPPON SANSO CORPORATION: DEALS

- 13.1.6 WESFARMERS LIMITED

- TABLE 165 WESFARMERS LIMITED: BUSINESS OVERVIEW

- FIGURE 42 WESFARMERS LIMITED: COMPANY SNAPSHOT (2021)

- 13.1.7 PT ANEKA GAS INDUSTRI TBK

- TABLE 166 PT ANEKA GAS INDUSTRI TBK: BUSINESS OVERVIEW

- FIGURE 43 PT ANEKA GAS INDUSTRI TBK: COMPANY SNAPSHOT (2021)

- 13.1.8 MASSY GROUP, INC.

- TABLE 167 MASSY GROUP, INC.: BUSINESS OVERVIEW

- FIGURE 44 MASSY GROUP, INC.: COMPANY SNAPSHOT (2021)

- 13.1.9 AIR WATER, INC.

- TABLE 168 AIR WATER, INC.: BUSINESS OVERVIEW

- FIGURE 45 AIR WATER, INC.: COMPANY SNAPSHOT (2021)

- 13.1.10 LES GAZ INDUSTRIELS LTD.

- TABLE 169 LES GAZ INDUSTRIELS LTD.: BUSINESS OVERVIEW

- FIGURE 46 LES GAZ INDUSTRIELS LTD.: COMPANY SNAPSHOT (2021)

- 13.1.11 SOL GROUP

- TABLE 170 SOL GROUP: BUSINESS OVERVIEW

- FIGURE 47 SOL GROUP: COMPANY SNAPSHOT (2021)

- 13.1.12 GULF CRYO

- TABLE 171 GULF CRYO: BUSINESS OVERVIEW

- 13.1.13 NATIONAL GASES LTD.

- TABLE 172 NATIONAL GASES LTD.: BUSINESS OVERVIEW

- 13.1.14 GRUPPO SIAD

- TABLE 173 GRUPPO SIAD: BUSINESS OVERVIEW

- TABLE 174 GRUPPO SIAD: OTHER DEVELOPMENTS

- 13.1.15 CRYOGENIC GASES

- TABLE 175 CRYOGENIC GASES: BUSINESS OVERVIEW

- 13.2 OTHER PLAYERS

- 13.2.1 ADITYA AIR PRODUCTS

- TABLE 176 ADITYA AIR PRODUCTS: BUSINESS OVERVIEW

- 13.2.2 SIDEWINDER DRY ICE & GAS

- TABLE 177 SIDEWINDER DRY ICE & GAS: BUSINESS OVERVIEW

- 13.2.3 AXCEL GASES

- TABLE 178 AXCEL GASES: BUSINESS OVERVIEW

- 13.2.4 CHENGDU TAIYU INDUSTRIAL GASES CO., LTD.

- TABLE 179 CHENGDU TAIYU INDUSTRIAL GASES CO., LTD.: BUSINESS OVERVIEW

- 13.2.5 YINGDE GAS GROUP SHANGHAI

- TABLE 180 YINGDE GAS GROUP SHANGHAI: BUSINESS OVERVIEW

- 13.2.6 SIDDHI VINAYAKA INDUSTRIAL GASES PVT. LTD.

- 13.2.7 AMERICAN WELDING & GAS

- 13.2.8 IJSFABRIEK STROMBEEK N.V.

- 13.2.9 AIR SOURCE INDUSTRIES

- 13.2.10 PURITY CYLINDRICAL GASES

- * Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 FOOD PACKAGING TECHNOLOGY AND EQUIPMENT MARKET

- 14.2.1 LIMITATIONS

- 14.2.2 MARKET DEFINITION

- 14.2.3 MARKET OVERVIEW

- 14.2.4 FOOD PACKAGING TECHNOLOGY AND EQUIPMENT MARKET, BY TYPE

- TABLE 181 FOOD PACKAGING TECHNOLOGY MARKET, BY TYPE, 2016-2023 (USD MILLION)

- 14.2.5 FOOD PACKAGING TECHNOLOGY AND EQUIPMENT MARKET, BY REGION

- TABLE 182 FOOD PACKAGING TECHNOLOGY MARKET, BY REGION, 2016-2023 (USD MILLION)

- 14.3 COLD CHAIN MARKET

- 14.3.1 LIMITATIONS

- 14.3.2 MARKET DEFINITION

- 14.3.3 MARKET OVERVIEW

- 14.3.4 COLD CHAIN MARKET, BY TEMPERATURE TYPE

- TABLE 183 COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2017-2019 (USD MILLION)

- TABLE 184 COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2020-2025 (USD MILLION)

- 14.3.5 COLD CHAIN MARKET, BY REGION

- TABLE 185 COLD CHAIN MARKET, BY REGION, 2017-2019 (USD MILLION)

- TABLE 186 COLD CHAIN MARKET, BY REGION, 2020-2025 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS