|

|

市場調査レポート

商品コード

1469881

デジタル資産管理(DAM)の世界市場:提供サービス別、ビジネス機能別、組織規模別、業界別、地域別 - 予測(~2029年)Digital Asset Management Market by Offering (Solutions and Services), Business Function (Marketing & Advertising, Sales & Distribution, Finance & Accounting), Organization Size, Vertical and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| デジタル資産管理(DAM)の世界市場:提供サービス別、ビジネス機能別、組織規模別、業界別、地域別 - 予測(~2029年) |

|

出版日: 2024年04月22日

発行: MarketsandMarkets

ページ情報: 英文 266 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のデジタル資産管理(DAM)の市場規模は、2024年に53億米ドル、2029年までに103億米ドルに達し、予測期間にCAGRで14.0%の成長が見込まれます。

企業はますます地理的に分散しており、チームはしばしば遠隔地で共同作業を行います。DAMシステムは、デジタル資産への集中アクセスを提供することでシームレスな連携を促進し、チームの効率的な共同作業を可能にし、DAMソリューションの採用を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 提供別、ビジネス機能別、組織規模別、業界別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「ソリューション別では、クラウドベースソリューションセグメントが予測期間に高いCAGRで成長する見込みです。」

クラウドベースDAMソリューションは、画像、動画、文書、クリエイティブファイルなどのデジタル資産をインターネット上で安全に保存、管理、整理、配布するための集中型プラットフォームを組織に提供します。これらのソリューションは、クラウドコンピューティングインフラを活用することで、ユーザーはインターネット接続があれば、いつでも、どこからでも、どのデバイスからでも資産にアクセスすることができます。クラウドベースのDAMシステムは、メタデータのタグ付け、バージョン管理、権限管理、先進の検索機能などの機能を提供し、資産の効率的な検索とチームの連携を促進します。拡張可能なストレージオプションと自動バックアップにより、クラウドベースDAMソリューションは、コストのかかるオンプレミスインフラの必要性を排除し、デジタル資産ライブラリの増加に対応する柔軟性を提供します。さらに、多くの場合、その他のクラウドベースのツールやアプリケーションとシームレスに統合されるため、ワークフローの効率が向上し、シームレスなコンテンツ作成とさまざまなチャネルへの配信が可能になります。

「組織規模別では、大企業が最大の市場シェアを占める見込みです。」

大企業は、デジタル資産の膨大なコレクションを効率的に管理しワークフローを合理化するために、DAMソリューションを採用する傾向が強まっています。例えば、Coca-Colaのような多国籍企業は、マーケティング資料、製品画像、ブランド資産の膨大なリポジトリを管理するためにDAMプラットフォームを統合しています。Coca-ColaがDAMを導入したことで、資産の検索にかかる時間が30%削減され、生産性が40%向上したと報告されており、効率の顕著な向上につながっています。同様に、世界の消費財メーカーであるProcter & Gambleは、多様な製品ポートフォリオ全体でブランドの一貫性を確保するためにDAMを導入しました。この取り組みにより、ブランドの一貫性が25%向上し、コンプライアンス関連の問題が20%減少しました。Nikeのような複雑な経営構造を持つ大企業も、DAMソリューションを活用して、世界に分散したチームの連携を強化し、ワークフローを合理化しています。Nikeは、DAMの採用後、連携効率が25%改善し、新製品の市場投入までの時間が15%短縮したと報告しています。

当レポートでは、世界のデジタル資産管理(DAM)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- デジタル資産管理(DAM)市場の概要

- デジタル資産管理(DAM)市場:サービス別(2024年・2029年)

- デジタル資産管理(DAM)市場:ビジネス機能別(2024年・2029年)

- デジタル資産管理(DAM)市場:組織規模別(2024年・2029年)

- デジタル資産管理(DAM)市場:業界別(2024年・2029年)

- デジタル資産管理(DAM)市場:地域別シナリオ(2024年~2029年)

第5章 市場の概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- サプライチェーン分析

- エコシステム分析

- 技術

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制:地域別

- 顧客のビジネスに影響を与える動向と混乱

- 主なステークホルダーと購入基準

- ビジネスモデル分析

- サブスクリプションベースモデル

- ライセンスベースモデル

- フリーミアムモデル

- 主な会議とイベント(2024年~2025年)

- 投資と資金調達のシナリオ

- デジタル資産管理(DAM)市場:企業デジタル資産の種類

- 文書

- 画像

- 動画

- 音声ファイル

- ソフトウェア

- データセット

- プレゼンテーション

- デザインファイル

- コードリポジトリ

- テンプレート

第6章 デジタル資産管理(DAM)市場:提供別

- イントロダクション

- ソリューション

- サービス

第7章 デジタル資産管理(DAM)市場:ビジネス機能別

- イントロダクション

- マーケティング・広告

- 財務・会計

- 販売・流通

- IT・経営

- HR

- その他のビジネス機能

第8章 デジタル資産管理(DAM)市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 デジタル資産管理(DAM)市場:業界別

- イントロダクション

- 小売・eコマース

- BFSI

- 製造

- IT & 通信

- メディア・エンターテインメント

- 政府・公共部門

- 旅行・ホスピタリティ

- 医療

- その他の業界

第10章 デジタル資産管理(DAM)市場:地域別

- イントロダクション

- 北米

- 北米のデジタル資産管理(DAM)市場の促進要因

- 北米に対する不況の影響

- 米国

- カナダ

- 欧州

- 欧州のデジタル資産管理(DAM)市場の促進要因

- 欧州に対する不況の影響

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のデジタル資産管理(DAM)市場の促進要因

- アジア太平洋に対する不況の影響

- 中国

- 日本

- インド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのデジタル資産管理(DAM)市場の促進要因

- 中東・アフリカに対する不況の影響

- 湾岸協力会議(GCC)

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのデジタル資産管理(DAM)市場の促進要因

- ラテンアメリカに対する不況の影響

- ブラジル

- メキシコ

- その他のラテンアメリカ

第11章 競合情勢

- 概要

- 主な企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- 主な市場動向

第12章 企業プロファイル

- イントロダクション

- 主要企業

- ADOBE

- OPENTEXT

- COGNIZANT

- APRIMO

- CLOUDINARY

- BYNDER

- HYLAND

- ACQUIA

- FRONTIFY

- VEEVA SYSTEMS

- SITECORE

- ESKO

- CELUM

- PHOTOSHELTER

- WEDIA

- EXTENSIS

- ORANGE LOGIC

- INTELLIGENCE BANK

- MARCOMCENTRAL

- スタートアップ/中小企業

- FILECAMP

- PIMCORE

- BRANDFOLDER

- PICKIT

- MEDIAVALET

- STORYTEQ

第13章 隣接市場

- イントロダクション

- エンタープライズコンテンツ管理市場

第14章 付録

The DAM market is expected to grow from USD 5.3 billion in 2024 to USD 10.3 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period. Businesses are increasingly distributed geographically, and teams often collaborate remotely. DAM systems facilitate seamless collaboration by providing centralized access to digital assets, enabling teams to work together efficiently and boosting the adoption of DAM solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | By Offering, Business Function, Organization Size, and Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"As per solutions, the cloud-based solutions segment is expected to grow at a higher CAGR during the forecast period. "

Cloud-based DAM solutions offer a centralized platform for organizations to securely store, manage, organize, and distribute digital assets such as images, videos, documents, and creative files over the internet. These solutions leverage cloud computing infrastructure, enabling users to access their assets anytime, anywhere, and from any device with an internet connection. Cloud-based DAM systems provide features like metadata tagging, version control, permissions management, and advanced search functionalities, facilitating efficient asset retrieval and collaboration among teams. With scalable storage options and automatic backups, cloud-based DAM solutions eliminate the need for costly on-premises infrastructure and provide flexibility to accommodate growing digital asset libraries. Additionally, they often integrate seamlessly with other cloud-based tools and applications, enhancing workflow efficiency and enabling seamless content creation and distribution across various channels.

"As per organization size, large enterprises will hold the largest market share. "

Large enterprises are increasingly embracing DAM solutions to effectively manage their extensive collections of digital assets and streamline their workflows. For instance, multinational corporations like Coca-Cola have integrated DAM platforms to manage their vast repositories of marketing materials, product images, and brand assets. Coca-Cola's implementation of DAM led to a notable improvement in efficiency, with a reported 30% reduction in time spent searching for assets and a 40% increase in productivity. Similarly, Procter & Gamble, a global consumer goods company, implemented DAM to ensure brand consistency across its diverse portfolio of products. This initiative resulted in a 25% improvement in brand consistency and a 20% reduction in compliance-related issues. Large enterprises with complex operational structures, like Nike, have also leveraged DAM solutions to enhance collaboration and streamline workflows across globally distributed teams. Nike reported a 25% improvement in collaboration efficiency and a 15% reduction in time-to-market for new product launches following the adoption of DAM.

"As per region, Europe will witness the second-largest market share during the forecast period."

Europeans are consuming digital content at unprecedented rates across various platforms. From social media platforms and streaming services to e-commerce websites and news portals, the volume and diversity of digital content continue to expand rapidly. Europe accounts for a significant share of global digital content consumption, with countries like the UK, Germany, and France leading the way. This growth is further fueled by new content formats such as podcasts, live streaming, and virtual reality experiences, which cater to evolving consumer tastes and preferences. With the European Union boasting one of the highest internet penetration rates globally, consumers increasingly turn to digital platforms for entertainment, information, and commerce. For instance, a study by Eurostat revealed that over 85% of households in the EU had access to the internet in 2021. This growing demand for digital experiences has led to a staggering increase in the volume and variety of digital content produced by businesses across industries. Moreover, various small and large European players, including MediaValet and Censhare, are another critical factor for adopting DAM solutions across Europe. As the demand for digital content continues to grow, the adoption of DAM solutions in Europe will increase during the forecast period.

The breakup of the profiles of the primary participants is below:

- By Company: Tier I: 30%, Tier II: 45%, and Tier III: 25%

- By Designation: C-Level Executives: 30%, Director Level: 25%, and Others: 45%

- By Region: North America: 40%, Europe: 30%, Asia Pacific: 25%, Rest of World: 5%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Some of the significant vendors offering DAM solutions and services across the globe include Adobe (US), OpenText (Canada), Cognizant (US), Aprimo (US), Cloudinary (US), Bynder (Netherlands), Hyland (US), Acquia (US), Frontify (Switzerland), Veeva Systems (US), Sitecore (US), Esko (Belgium), Celum (Austria), Photoshelter (US), Wedia (France), Extensis (US), Orange Logic (US), Intelligence Bank (Australia), MarcomCentral, Filecamp, Brandfolder (US), Pickit (Sweden), MediaValet (Canada), and Storyteq (Netherlands).

Research coverage:

The market study covers the DAM market across segments. It aims to estimate the market size and the growth potential of this market across different market segments, such as offering, business function, organization size, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall DAM market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (increase in digitalization of content and need for effective collaboration of corporate assets, emergence of cloud-based delivery options, growth in need for controlled access and better security of digital assets to avoid copyright issues, growing focus on digital marketing and focus on enhancing digital experiences of customers), restraints (high cost of implementation of DAM solutions), opportunities (emergence of AI to automate business processes, demand for high-quality digital assets in e-commerce, and infusion of advanced encryption technologies to streamline digital trading), and challenges (need for ensuring security and access control and fulfilling metadata requirements to enable quick access to digital assets) influencing the growth of the DAM market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the DAM market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the DAM market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the DAM market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and Adobe (US), OpenText (Canada), Cognizant (US), Aprimo (US), Cloudinary (US), Bynder (Netherlands), Hyland (US), Acquia (US), Frontify (Switzerland), among others in the DAM market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 DIGITAL ASSET MANAGEMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary interviews

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 DIGITAL ASSET MANAGEMENT MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 DIGITAL ASSET MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 DIGITAL ASSET MANAGEMENT MARKET: RESEARCH FLOW

- 2.3.3 MARKET ESTIMATION APPROACHES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 BOTTOM-UP APPROACH FROM SUPPLY SIDE: COLLECTIVE REVENUE OF VENDORS

- FIGURE 10 DEMAND-SIDE APPROACH: DIGITAL ASSET MANAGEMENT MARKET

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

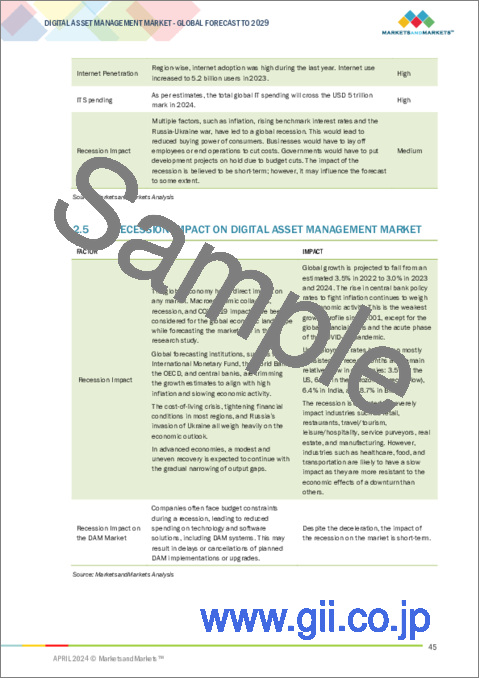

- 2.5 RECESSION IMPACT ON DIGITAL ASSET MANAGEMENT MARKET

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 DIGITAL ASSET MANAGEMENT MARKET SIZE AND GROWTH, 2019-2023 (USD MILLION, Y-O-Y %)

- TABLE 4 DIGITAL ASSET MANAGEMENT MARKET SIZE AND GROWTH, 2024-2029 (USD MILLION, Y-O-Y %)

- FIGURE 11 GLOBAL DIGITAL ASSET MANAGEMENT MARKET TO WITNESS SIGNIFICANT GROWTH

- 3.1 OVERVIEW OF RECESSION IMPACT

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 FASTEST-GROWING SEGMENTS OF DIGITAL ASSET MANAGEMENT MARKET

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF DIGITAL ASSET MANAGEMENT MARKET

- FIGURE 14 GROWING EMPHASIS ON ENHANCING CRITICAL BUSINESS FUNCTIONS RELATED TO TEAM COLLABORATION TO MAXIMIZE VALUE OF DIGITAL ASSETS

- 4.2 DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024 VS. 2029

- FIGURE 15 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024 VS. 2029

- FIGURE 16 MARKETING & ADVERTISING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024 VS. 2029

- FIGURE 17 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.5 DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2024 VS. 2029

- FIGURE 18 MEDIA & ENTERTAINMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 DIGITAL ASSET MANAGEMENT MARKET: REGIONAL SCENARIO, 2024-2029

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL ASSET MANAGEMENT MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in digitalization of content and need for effective collaboration of corporate assets

- FIGURE 21 TIME SPENT ON ASSET SEARCHING USING DAM SOLUTIONS

- 5.2.1.2 Emergence of cloud-based delivery options

- FIGURE 22 TYPES OF STORAGE LOCATIONS FOR DIGITAL ASSETS

- 5.2.1.3 Growth in need for controlled access and better security of digital assets to avoid copyright issues

- 5.2.1.4 Growing focus on digital marketing

- 5.2.1.5 Focus on enhancing digital experiences of customers

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of implementation of DAM solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of AI to automate business processes

- FIGURE 23 IMPORTANCE OF AI SOLUTIONS FOR OVERALL BUSINESS SUCCESS

- 5.2.3.2 Demand for high-quality digital assets in e-commerce

- 5.2.3.3 Infusion of advanced encryption technologies to streamline digital trading

- 5.2.4 CHALLENGES

- 5.2.4.1 Need for ensuring security and managing access control

- 5.2.4.2 Fulfilling metadata requirements to enable quick access to digital assets

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 COMPILED AND DELIVERED CONFERENCE RESOURCES TO PARTICIPANTS

- 5.3.2 SIMPLIFIED DIGITAL ASSET UPDATES AND APPROVAL TO ACHIEVE CONTROLLED BRANDING ACROSS CHANNELS

- 5.3.3 ACHIEVED ASSET CENTRALIZATION AND CONSISTENT BRAND COMPLIANCE ACROSS REGIONS TO IMPROVE MARKETING PERFORMANCE

- 5.3.4 ACCELERATED ACCESS TO MULTIMEDIA USING DIGITAL ASSET MANAGEMENT FOR SAP SOLUTIONS FOR HIGH-VOLUME VIDEO PRODUCTION

- 5.3.5 BREAKING DOWN SILOS AND INCREASING PRODUCTIVITY

- 5.3.6 SPEEDING UP CONTENT MANAGEMENT WITH PERSONALIZATION AT SCALE

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 24 DIGITAL ASSET MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 25 DIGITAL ASSET MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- TABLE 5 DIGITAL ASSET MANAGEMENT MARKET: ECOSYSTEM

- 5.6 TECHNOLOGIES

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Cloud

- 5.6.1.2 AI/ML

- 5.6.1.3 Metadata Management

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Blockchain

- 5.6.2.2 AR/VR

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Big Data and Data Management Platforms

- 5.6.3.2 IoT

- 5.6.3.3 Data Analytics and Business Intelligence

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY ORGANIZATION SIZE

- FIGURE 26 AVERAGE SELLING PRICE TREND, BY ORGANIZATION SIZE

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY SOLUTION

- 5.8 PATENT ANALYSIS

- FIGURE 27 NUMBER OF PATENTS PUBLISHED, 2013-2023

- FIGURE 28 TOP 5 PATENT OWNERS (GLOBAL)

- TABLE 7 TOP 10 PATENT APPLICANTS (US)

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 DIGITAL ASSET MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 DIGITAL ASSET MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS, BY REGION

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 DIGITAL ASSET MANAGEMENT MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VERTICALS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP BUSINESS FUNCTIONS

- 5.12.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE BUSINESS FUNCTIONS

- 5.13 BUSINESS MODEL ANALYSIS

- 5.13.1 SUBSCRIPTION-BASED MODEL

- 5.13.2 LICENSE-BASED MODEL

- 5.13.3 FREEMIUM MODEL

- 5.14 KEY CONFERENCES AND EVENTS (2024-2025)

- TABLE 15 DIGITAL ASSET MANAGEMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO OF MAJOR DIGITAL ASSET MANAGEMENT COMPANIES

- 5.16 DIGITAL ASSET MANAGEMENT MARKET: TYPES OF ENTERPRISE DIGITAL ASSETS

- 5.16.1 DOCUMENTS

- 5.16.1.1 Text Documents

- 5.16.1.2 Spreadsheets

- 5.16.1.3 Presentations

- 5.16.2 IMAGES

- 5.16.2.1 Logos

- 5.16.2.2 Product Images

- 5.16.2.3 Marketing Materials

- 5.16.3 VIDEOS

- 5.16.3.1 Training Videos

- 5.16.3.2 Promotional Videos

- 5.16.3.3 Event Coverage

- 5.16.4 AUDIO FILES

- 5.16.4.1 Podcasts

- 5.16.4.2 Voicemails

- 5.16.4.3 Music

- 5.16.5 SOFTWARE

- 5.16.5.1 Applications

- 5.16.5.2 Tools

- 5.16.5.3 Plugins

- 5.16.6 DATA SETS

- 5.16.6.1 Structured Data

- 5.16.6.2 Unstructured Data

- 5.16.7 PRESENTATIONS

- 5.16.7.1 Business Presentations

- 5.16.7.2 Educational Presentations

- 5.16.7.3 Internal Reports

- 5.16.8 DESIGN FILES

- 5.16.8.1 Graphic Designs

- 5.16.8.2 Product Designs

- 5.16.8.3 Marketing Designs

- 5.16.9 CODE REPOSITORIES

- 5.16.9.1 Frontend Code

- 5.16.9.2 Backend Code

- 5.16.9.3 Version Control

- 5.16.10 TEMPLATES

- 5.16.10.1 Document Templates

- 5.16.10.2 Presentation Templates

- 5.16.10.3 Email Templates

- 5.16.1 DOCUMENTS

6 DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 34 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- 6.1.1 OFFERING: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- TABLE 16 DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 17 DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- FIGURE 35 CLOUD-BASED SOLUTIONS TO RECORD HIGHER CAGR

- 6.2 SOLUTIONS

- 6.2.1 NEED TO MANAGE GROWING NUMBER OF DIGITAL ASSETS TO DRIVE DEMAND FOR SOLUTIONS

- TABLE 18 DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 19 DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- 6.2.2 ON-PREMISE SOLUTIONS

- TABLE 20 ON-PREMISE SOLUTIONS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 21 ON-PREMISE SOLUTIONS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.3 CLOUD-BASED SOLUTIONS

- TABLE 22 CLOUD-BASED SOLUTIONS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 23 CLOUD-BASED SOLUTIONS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 NEED FOR CONTINUOUS BUSINESS IMPROVEMENT TO DRIVE DEMAND FOR SERVICES

- TABLE 24 SERVICES: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 25 SERVICES: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2 CONSULTING

- 6.3.2.1 Strategic Consulting

- 6.3.2.2 Governance Advisory

- 6.3.2.3 Workflow Optimization

- 6.3.3 INTEGRATION & IMPLEMENTATION

- 6.3.3.1 Setup & Configuration Assistance

- 6.3.3.2 Custom Integration Development

- 6.3.3.3 Connector Development

- 6.3.3.4 Data Migration Services

- 6.3.4 TRAINING, SUPPORT & MAINTENANCE

- 6.3.4.1 User Training Sessions

- 6.3.4.2 Onboarding Support

- 6.3.4.3 Regular Software Updates

- 6.3.4.4 Patch Management

- 6.3.4.5 Knowledge Base Access

7 DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION

- 7.1 INTRODUCTION

- 7.1.1 BUSINESS FUNCTION: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- TABLE 26 DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 27 DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- 7.2 MARKETING & ADVERTISING

- 7.2.1 GROWTH IN DIGITAL MARKETING TO DRIVE DEMAND FOR DAM SOLUTIONS

- TABLE 28 MARKETING & ADVERTISING: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 29 MARKETING & ADVERTISING: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.2.2 BRAND ASSET MANAGEMENT

- 7.2.3 CAMPAIGN MANAGEMENT

- 7.2.4 CONTENT MARKETING

- 7.2.5 SOCIAL MEDIA MANAGEMENT

- 7.2.6 DIGITAL ADVERTISING

- 7.3 FINANCE & ACCOUNTING

- 7.3.1 NEED FOR ADVANCED SEARCH CAPABILITIES TO DRIVE DEMAND FOR DAM IN FINANCE & ACCOUNTING

- TABLE 30 FINANCE & ACCOUNTING: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 31 FINANCE & ACCOUNTING: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3.2 FINANCIAL REPORTS

- 7.3.3 ACCOUNTING DOCUMENTS

- 7.3.4 BUDGETING & FORECASTING MATERIALS

- 7.3.5 REGULATORY COMPLIANCE DOCUMENTS

- 7.4 SALES & DISTRIBUTION

- 7.4.1 NEED FOR SCALABLE AND FLEXIBLE SOLUTIONS TO MANAGE SALES COLLATERAL

- TABLE 32 SALES & DISTRIBUTION: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 33 SALES & DISTRIBUTION: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.2 SALES COLLATERAL MANAGEMENT

- 7.4.3 SALES PRESENTATION ASSETS

- 7.4.4 PRODUCT DEMO MATERIALS

- 7.4.5 SALES TRAINING RESOURCES

- 7.5 IT & OPERATIONS

- 7.5.1 NEED FOR ASSET LIFECYCLE MANAGEMENT TO DRIVE DEMAND FOR DAM IN IT & OPERATIONS

- TABLE 34 IT & OPERATIONS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 35 IT & OPERATIONS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.5.2 TECHNICAL DOCUMENTATION

- 7.5.3 SOFTWARE LICENSE MANAGEMENT

- 7.5.4 SYSTEM MANUALS

- 7.5.5 INCIDENT RESPONSE ASSETS

- 7.6 HUMAN RESOURCES

- 7.6.1 NEED TO IMPROVE EMPLOYEE EXPERIENCE TO DRIVE DEMAND FOR DAM

- TABLE 36 HUMAN RESOURCES: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 37 HUMAN RESOURCES: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.6.2 EMPLOYEE ONBOARDING MATERIALS

- 7.6.3 TRAINING & DEVELOPMENT RESOURCES

- 7.6.4 HR POLICY DOCUMENTS

- 7.6.5 COMPLIANCE DOCUMENTS

- 7.7 OTHER BUSINESS FUNCTIONS

- TABLE 38 OTHER BUSINESS FUNCTIONS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 39 OTHER BUSINESS FUNCTIONS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

8 DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- TABLE 40 DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 41 DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 NEED FOR MANAGING LARGE NUMBER OF DIGITAL ASSETS ACROSS DEPARTMENTS TO DRIVE MARKET

- TABLE 42 LARGE ENTERPRISES: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 43 LARGE ENTERPRISES: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 SMES

- 8.3.1 NEED FOR LOW-COST DAM SOFTWARE TO DRIVE MARKET

- TABLE 44 SMES: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 45 SMES: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

9 DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- FIGURE 38 RETAIL & E-COMMERCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 46 DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 47 DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 9.2 RETAIL & E-COMMERCE

- 9.2.1 GROWING EMPHASIS ON ENHANCING CUSTOMER EXPERIENCE TO DRIVE DEMAND IN THIS VERTICAL

- 9.2.2 FASHION & APPAREL

- 9.2.3 CONSUMER ELECTRONICS & APPLIANCES

- 9.2.4 BEAUTY & PERSONAL CARE

- 9.2.5 GROCERY & FOOD RETAIL

- TABLE 48 RETAIL & E-COMMERCE: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 49 RETAIL & E-COMMERCE: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 9.3.1 NEED TO STREAMLINE MARKETING OPERATIONS IN BFSI VERTICAL TO DRIVE DEMAND FOR DAM

- 9.3.2 INSURANCE COMPANIES

- 9.3.3 RETAIL BANKING

- 9.3.4 WEALTH MANAGEMENT & INVESTMENT BANKING

- 9.3.5 DIGITAL BANKING

- TABLE 50 BFSI: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 51 BFSI: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 MANUFACTURING

- 9.4.1 NEED FOR NEW PRODUCT DEMONSTRATION WITH INTERACTIVE CONTENT TO DRIVE DEMAND

- 9.4.2 CONSUMER GOODS MANUFACTURING

- 9.4.3 INDUSTRIAL MACHINERY & EQUIPMENT

- 9.4.4 PROCESS MANUFACTURING

- 9.4.5 DISCRETE MANUFACTURING

- TABLE 52 MANUFACTURING: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 53 MANUFACTURING: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5 IT & TELECOM

- 9.5.1 NEED TO ENHANCE CUSTOMER ENGAGEMENT IN IT & TELECOM TO DRIVE GROWTH OF DAM SOLUTIONS & SERVICES

- 9.5.2 SOFTWARE & TECHNOLOGY COMPANIES

- 9.5.3 TELECOM INFRASTRUCTURE PROVIDERS

- 9.5.4 TELECOM EQUIPMENT MANUFACTURERS

- TABLE 54 IT & TELECOM: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 55 IT & TELECOM: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.6 MEDIA & ENTERTAINMENT

- 9.6.1 EXPONENTIAL GROWTH IN DIGITAL CONTENT TO DRIVE DEMAND FOR DAM IN MEDIA & ENTERTAINMENT VERTICAL

- 9.6.2 BROADCASTING & STREAMING SERVICES

- 9.6.3 ADVERTISING & MARKETING AGENCIES

- 9.6.4 PUBLISHING & PRINT MEDIA

- 9.6.5 FILM & TELEVISION PRODUCTION

- TABLE 56 MEDIA & ENTERTAINMENT: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 57 MEDIA & ENTERTAINMENT: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.7 GOVERNMENT & PUBLIC SECTOR

- 9.7.1 NEED FOR DIGITALIZING HISTORICAL CONTENT TO FUEL MARKET GROWTH

- 9.7.2 GOVERNMENT AGENCIES

- 9.7.3 PUBLIC SERVICES

- 9.7.4 LAW ENFORCEMENT & PUBLIC SAFETY

- TABLE 58 GOVERNMENT & PUBLIC SECTOR: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 59 GOVERNMENT & PUBLIC SECTOR: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.8 TRAVEL & HOSPITALITY

- 9.8.1 NEED FOR MANAGING AND UPDATING MEDIA ASSETS IN TRAVEL & HOSPITALITY VERTICAL TO HELP FUEL MARKET GROWTH

- 9.8.2 TRAVEL AGENCIES & TOUR OPERATORS

- 9.8.3 HOTELS & RESORTS

- 9.8.4 AIRLINES & AVIATION

- TABLE 60 TRAVEL & HOSPITALITY: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 TRAVEL & HOSPITALITY: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.9 HEALTHCARE

- 9.9.1 NEED TO COMPLY WITH DATA PROTECTION REGULATIONS IN HEALTHCARE VERTICAL TO DRIVE DEMAND FOR DAM SERVICES & SOLUTIONS

- 9.9.2 HOSPITALS & CLINICS

- 9.9.3 HEALTHCARE RESEARCH & ACADEMIC INSTITUTIONS

- 9.9.4 PHARMACEUTICALS & BIOTECH COMPANIES

- TABLE 62 HEALTHCARE: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 63 HEALTHCARE: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.10 OTHER VERTICALS

- TABLE 64 OTHER VERTICALS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 65 OTHER VERTICALS: DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

10 DIGITAL ASSET MANAGEMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 NORTH AMERICA TO HOLD LARGEST SHARE IN DIGITAL ASSET MANAGEMENT MARKET

- TABLE 66 DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 67 DIGITAL ASSET MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 68 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 70 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 71 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 72 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION

- TABLE 73 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Increasing investments in advanced technologies to drive demand for DAM in US

- TABLE 80 US: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 81 US: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 82 US: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 83 US: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Growing investments in cloud services to fuel market growth for DAM in Canada

- TABLE 84 CANADA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 85 CANADA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 86 CANADA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 87 CANADA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 88 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 89 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 90 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 91 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 92 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION

- TABLE 93 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 94 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 95 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 96 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 97 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 98 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 99 EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Growing investments in marketing & digitalization to drive demand for DAM in UK

- TABLE 100 UK: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 101 UK: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 102 UK: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 103 UK: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Growing adoption of DAM across verticals to drive market growth

- TABLE 104 GERMANY: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 105 GERMANY: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 106 GERMANY: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 107 GERMANY: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Government initiatives to promote digitalization will drive market for DAM

- TABLE 108 FRANCE: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 109 FRANCE: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 110 FRANCE: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 111 FRANCE: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3.6 ITALY

- 10.3.6.1 Growing adoption among manufacturing industries to drive market growth

- TABLE 112 ITALY: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 113 ITALY: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 114 ITALY: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 115 ITALY: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 116 REST OF EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 117 REST OF EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 118 REST OF EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 119 REST OF EUROPE: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 120 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 121 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 122 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Growing investments in technological advancements and government support to fuel DAM market growth

- TABLE 132 CHINA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 133 CHINA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 134 CHINA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 135 CHINA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Well-developed technological and economic landscape in Japan to fuel demand for DAM solutions & services

- TABLE 136 JAPAN: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 137 JAPAN: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 138 JAPAN: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 139 JAPAN: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Rise in technological innovations in India to present opportunities for DAM market growth

- TABLE 140 INDIA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 141 INDIA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 142 INDIA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 143 INDIA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 144 REST OF ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 148 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION

- TABLE 153 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.5.3 GULF COOPERATION COUNCIL (GCC)

- TABLE 160 GCC: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 161 GCC: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 162 GCC: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 163 GCC: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.5.3.1 UAE

- 10.5.3.1.1 Growing opportunities for adoption of DAM solutions to fuel market growth

- 10.5.3.2 Saudi Arabia

- 10.5.3.2.1 Growing investments in AI to fuel demand for DAM solutions & services

- 10.5.3.3 Rest of GCC Countries

- 10.5.3.1 UAE

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 Need for controlling traffic and crime rates to fuel demand for DAM

- TABLE 164 SOUTH AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 165 SOUTH AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 166 SOUTH AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 167 SOUTH AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 168 REST OF MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 172 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 173 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 174 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 175 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 176 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION

- TABLE 177 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 178 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 179 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 180 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 181 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 182 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 183 LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Digital transformation to boost market growth in Brazil

- TABLE 184 BRAZIL: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 185 BRAZIL: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 186 BRAZIL: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 187 BRAZIL: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Growing focus on digitalization and cloud computing in Mexico to accelerate demand for DAM

- TABLE 188 MEXICO: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 189 MEXICO: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 190 MEXICO: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 191 MEXICO: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.6.5 REST OF LATIN AMERICA

- TABLE 192 REST OF LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 194 REST OF LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 195 REST OF LATIN AMERICA: DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 196 OVERVIEW OF STRATEGIES BY KEY DIGITAL ASSET MANAGEMENT VENDORS

- 11.3 REVENUE ANALYSIS

- FIGURE 42 REVENUE ANALYSIS OF KEY DAM MARKET PLAYERS

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 43 MARKET SHARE ANALYSIS, 2023

- TABLE 197 DIGITAL ASSET MANAGEMENT MARKET: DEGREE OF COMPETITION

- 11.5 BRAND/PRODUCT COMPARISON

- FIGURE 44 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 45 DIGITAL ASSET MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- FIGURE 46 DIGITAL ASSET MANAGEMENT MARKET: COMPANY FOOTPRINT

- TABLE 198 DIGITAL ASSET MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 199 DIGITAL ASSET MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 200 DIGITAL ASSET MANAGEMENT MARKET: ORGANIZATION SIZE FOOTPRINT

- TABLE 201 DIGITAL ASSET MANAGEMENT MARKET: VERTICAL FOOTPRINT

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 47 DIGITAL ASSET MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- TABLE 202 DIGITAL ASSET MANAGEMENT MARKET: KEY STARTUPS/SMES

- TABLE 203 DIGITAL ASSET MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 48 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 KEY MARKET DEVELOPMENTS

- 11.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 204 DIGITAL ASSET MANAGEMENT MARKET: PRODUCT LAUNCHES, OCTOBER 2021-JANUARY 2024

- 11.9.2 DEALS

- TABLE 205 DIGITAL ASSET MANAGEMENT MARKET: DEALS, MARCH 2021-MARCH 2024

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.2.1 ADOBE

- TABLE 206 ADOBE: COMPANY OVERVIEW

- FIGURE 49 ADOBE: COMPANY SNAPSHOT

- TABLE 207 ADOBE: PRODUCTS OFFERED

- TABLE 208 ADOBE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 209 ADOBE: DEALS

- 12.2.2 OPENTEXT

- TABLE 210 OPENTEXT: COMPANY OVERVIEW

- FIGURE 50 OPENTEXT: COMPANY SNAPSHOT

- TABLE 211 OPENTEXT: PRODUCTS OFFERED

- TABLE 212 OPENTEXT: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 213 OPENTEXT: DEALS

- 12.2.3 COGNIZANT

- TABLE 214 COGNIZANT: COMPANY OVERVIEW

- FIGURE 51 COGNIZANT: COMPANY SNAPSHOT

- TABLE 215 COGNIZANT: PRODUCTS OFFERED

- TABLE 216 COGNIZANT: DEALS

- 12.2.4 APRIMO

- TABLE 217 APRIMO: COMPANY OVERVIEW

- TABLE 218 APRIMO: PRODUCTS OFFERED

- TABLE 219 APRIMO: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 220 APRIMO: DEALS

- 12.2.5 CLOUDINARY

- TABLE 221 CLOUDINARY: COMPANY OVERVIEW

- TABLE 222 CLOUDINARY: PRODUCTS OFFERED

- TABLE 223 CLOUDINARY: PRODUCT LAUNCHES/ENHANCEMENTS

- 12.2.6 BYNDER

- TABLE 224 BYNDER: COMPANY OVERVIEW

- TABLE 225 BYNDER: PRODUCTS OFFERED

- TABLE 226 BYNDER: DEALS

- 12.2.7 HYLAND

- TABLE 227 HYLAND: COMPANY OVERVIEW

- TABLE 228 HYLAND: PRODUCTS OFFERED

- TABLE 229 HYLAND PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 230 HYLAND: DEALS

- 12.2.8 ACQUIA

- TABLE 231 ACQUIA: COMPANY OVERVIEW

- TABLE 232 ACQUIA: PRODUCTS OFFERED

- TABLE 233 ACQUIA: PRODUCT LAUNCHES/ENHANCEMENTS

- 12.2.9 FRONTIFY

- TABLE 234 FRONTIFY: COMPANY OVERVIEW

- TABLE 235 FRONTIFY: PRODUCTS OFFERED

- TABLE 236 FRONTIFY: DEALS

- 12.2.10 VEEVA SYSTEMS

- TABLE 237 VEEVA SYSTEMS: COMPANY OVERVIEW

- FIGURE 52 VEEVA SYSTEMS: COMPANY SNAPSHOT

- TABLE 238 VEEVA SYSTEMS: PRODUCTS OFFERED

- TABLE 239 VEEVA SYSTEMS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 240 VEEVA SYSTEMS: DEALS

- 12.2.11 SITECORE

- 12.2.12 ESKO

- 12.2.13 CELUM

- 12.2.14 PHOTOSHELTER

- 12.2.15 WEDIA

- 12.2.16 EXTENSIS

- 12.2.17 ORANGE LOGIC

- 12.2.18 INTELLIGENCE BANK

- 12.2.19 MARCOMCENTRAL

- 12.3 STARTUPS/SMES

- 12.3.1 FILECAMP

- 12.3.2 PIMCORE

- 12.3.3 BRANDFOLDER

- 12.3.4 PICKIT

- 12.3.5 MEDIAVALET

- 12.3.6 STORYTEQ

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT MARKET

- 13.1 INTRODUCTION

- 13.1.1 RELATED MARKET

- 13.2 ENTERPRISE CONTENT MANAGEMENT MARKET

- TABLE 241 ENTERPRISE CONTENT MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2016-2020 (USD MILLION)

- TABLE 242 ENTERPRISE CONTENT MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2021-2026 (USD MILLION)

- TABLE 243 ENTERPRISE CONTENT MANAGEMENT MARKET, BY COMPONENT, 2016-2020 (USD MILLION)

- TABLE 244 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 245 ENTERPRISE CONTENT MANAGEMENT MARKET, BY SOLUTION, 2016-2020 (USD MILLION)

- TABLE 246 ENTERPRISE CONTENT MANAGEMENT MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 247 ENTERPRISE CONTENT MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2016-2020 (USD MILLION)

- TABLE 248 ENTERPRISE CONTENT MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2021-2026 (USD MILLION)

- TABLE 249 ENTERPRISE CONTENT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 250 ENTERPRISE CONTENT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- TABLE 251 ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016-2020 (USD MILLION)

- TABLE 252 ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2021-2026 (USD MILLION)

- TABLE 253 ENTERPRISE CONTENT MANAGEMENT MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 254 ENTERPRISE CONTENT MANAGEMENT MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS