|

|

市場調査レポート

商品コード

1493850

ハース(炉床)の世界市場:燃料タイプ別、製品別、設置場所別、デザイン別、点火タイプ別、換気口の有無別、暖炉タイプ別、用途別、材料別、地域別 - 予測(~2029年)Hearth Market by Fuel Type (Electricity, Gas, Wood, Pellet), Product (Fireplaces, Stoves, Inserts), Ignition Type (Electronic Ignition, Standing Pilot Ignition), Placement, Design Vent Availability, Application and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ハース(炉床)の世界市場:燃料タイプ別、製品別、設置場所別、デザイン別、点火タイプ別、換気口の有無別、暖炉タイプ別、用途別、材料別、地域別 - 予測(~2029年) |

|

出版日: 2024年06月05日

発行: MarketsandMarkets

ページ情報: 英文 218 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

ハース(炉床)の市場規模は、2024年の109億米ドルから2029年には134億米ドルに達すると予測され、2024年から2029年までのCAGRは4.2%になるとみられています。

ハース(炉床)市場の成長を促進する主な要因としては、ホームオートメーション需要の高まり、見た目に美しい暖炉への関心の高まり、寒さ対策として住宅内やその周辺でのハース(炉床)利用の増加、ハース(炉床)デザインのカスタマイズによる豊富なオプションの提供、気候変動や環境の持続可能性に対する意識の高まりなどが挙げられます。さらに、ハース(炉床)製品の継続的な技術進歩や、住宅、商業、ホスピタリティ産業におけるハース(炉床)の展開の拡大は、ハース(炉床)市場の市場参入企業にいくつかの成長機会を提供すると期待されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 製品タイプ別、燃料タイプ別、設置場所別、デザイン別、点火タイプ別、換気口の有無別、用途別、暖炉タイプ別、材料別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

屋外ハース(炉床)の動向は、屋外リビングスペースの人気上昇、裏庭エンターテイメントへの傾向、美的で機能的な屋外暖房ソリューションへの要望など、いくつかの要因に起因しています。ハース(炉床)市場は屋内用ハース(炉床)が最大のシェアを占めており、予測期間中も継続するとみられます。ポータブルハース(炉床)は、屋内および屋外ハース(炉床)に比べて市場シェアは小さいですがが、顧客に好まれるようになってきています。この変化は、汎用性と利便性、設置や移動の容易さ、屋内外での使用に適していることによるもので、暖房ソリューションに柔軟性を求める消費者にとって魅力的な選択肢となっています。

消費者は、その利便性と高度な機能により、近代的なハース(炉床)を採用するようになってきています。近代的なハース(炉床)は機能性と効率性を優先し、多くの場合、簡単な制御と強化された安全性のための高度な技術が組み込まれています。近代的なハース(炉床)への嗜好の高まりは、その視覚的な魅力、最新技術の組み込み、低排出率に起因しています。さらに、最新のハース(炉床)は、規制機関が発行するガイドラインを満たすための設備が充実しており、消費者にとってより持続可能でコンプライアンスに適合した選択肢となっています。伝統的なハース(炉床)が最大の市場シェアを占めているにもかかわらず、伝統的なハース(炉床)の採用率は、薪燃焼による排出が環境問題の一因となり、政府による課税や規制、メンテナンスの問題につながっているため、低下しています。

当レポートでは、世界のハース(炉床)市場について調査し、製品タイプ別、燃料タイプ別、設置場所別、デザイン別、点火タイプ別、換気口の有無別、用途別、暖炉タイプ別、材料別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客のビジネスに影響を与える動向と混乱

- 技術分析

- 価格分析

- 主な利害関係者と購入基準

- ポーターのファイブフォース分析

- ケーススタディ分析

- 貿易分析

- 特許分析

- 規制状況

- 2024年~2025年の主な会議とイベント

第6章 ハース(炉床)市場、製品別

- イントロダクション

- 暖炉

- ストーブ

- インサート

第7章 ハース(炉床)場、燃料タイプ別

- イントロダクション

- 電気

- ガス

- 木材

- ペレット

第8章 ハース(炉床)場、設置場所別

- イントロダクション

- 屋内

- 屋外

第9章 ハース(炉床)場、デザイン別

- イントロダクション

- 従来型

- 近代型

第10章 ハース(炉床)場、点火タイプ別

- イントロダクション

- 電子

- スタンディングパイロット

第11章 ハース(炉床)場、換気口の有無別

- イントロダクション

- 換気口有

- 換気口無

第12章 ハース(炉床)場、用途別

- イントロダクション

- 住宅

- 商用

- ホスピタリティ

第13章 ハース(炉床)場、暖炉タイプ別

- イントロダクション

- 片面型

- 多面型

第14章 ハース(炉床)場、材料別

- イントロダクション

- レンガ

- 花崗岩

- 大理石

- 石

- コンクリート

- スレート

- 採石場タイル

第15章 ハース(炉床)場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2023年

- 収益分析、2019年~2023年

- 企業価値評価と財務指標

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- ブランド/製品比較

- 競合シナリオと動向

第17章 企業プロファイル

- 主要参入企業

- HNI CORP.

- GLEN DIMPLEX

- NAPOLEON

- TRAVIS INDUSTRIES INC.

- HPC FIRE INSPIRED

- JOTUL

- MONTIGO

- STOVE BUILDER INTERNATIONAL

- INNOVATIVE HEARTH PRODUCTS

- EMPIRE COMFORT SYSTEMS

- その他の企業

- GHP GROUP INC.

- HEARTHSTONE QUALITY HOME HEATING PRODUCTS INC.

- RH PETERSON CO.

- BFM EUROPE LTD

- WILKENING FIREPLACE

- NORDPEIS

- BOLEY

- EUROPEAN HOME

- BARBAS BELLFIRES

- MENDOTA

- PACIFIC ENERGY

- STELLAR BY HEAT & GLO

- FPI FIREPLACE PRODUCTS INTERNATIONAL LTD.

- RASMUSSEN GAS LOGS

- MELROY PLUMBING & HEATING, INC.

第18章 付録

The hearth market is projected to reach USD 13.4 billion by 2029 from USD 10.9 billion in 2024, at a CAGR of 4.2% from 2024 to 2029. The major factors driving the market growth of the hearth market include the rising demand for home automation, growing interest in visually pleasing fireplaces, increasing use of hearths in and around houses to combat cold weather, customizing hearth designs offers an abundance of options, and increasing awareness of climate change and environment sustainability. Moreover, continuous technological advancement in hearth products and growing deployment of hearths in residential, commercial and hospitality industry is expected to provide several growth opportunities for market players in the hearth market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Fuel Type, Product, Ignition Type, Placement, Design Vent Availability, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Outdoor hearths expected to grow at the highest CAGR of the hearth market during the forecast period.

The growing trend for outdoor hearths is attributed to several factors such as the rising popularity of outdoor living spaces, the trend towards backyard entertainment, and the desire for aesthetically pleasing and functional outdoor heating solutions. Indoor hearths hold the largest hearth market share and are likely expected to continue during the forecast period. Portable hearths, having a smaller market share compared to indoor and outdoor hearths, are becoming increasingly preferred by customers. This shift is due to their versatility and convenience, the ease of installation and mobility, and their suitability for both indoor and outdoor use, making them an attractive option for consumers seeking flexibility in their heating solutions.

Traditional hearths designs are projected to register the largest market share in the hearth market during the forecast period.

Consumers are increasingly adopting modern hearths due to their convenience and advanced features. Modern hearths prioritize functionality and efficiency, often incorporating advanced technology for easy control and enhanced safety. The increasing preference for modern hearths can be attributed to their visual appeal, incorporation of the latest technologies, and low emission rates. Furthermore, modern hearths are better equipped to meet guidelines issued by regulatory bodies, making them a more sustainable and compliant choice for consumers. Despite traditional hearths holding the largest market share, the adoption rate of traditional hearths is decreasing due to emissions from wood-burning contribute to environmental concerns, leading to government-imposed taxes and regulations and maintenance issues.

North America is expected to account for the largest market share during the forecast period

The growing market for electric-based fireplaces and stoves, outdoor hearths and modern hearths significantly contributes to the market growth of the region. Energy-efficient hearth products with advanced technologies have further propelled the market, offering innovative and efficient heating devices that cater to modern consumer needs. Key players in the hearth market in North America include Napoleon (Canada), HNI Corp. (US), Innovative Hearth Products (US), Empire Comfort Systems (US) and Montigo (Canada).

The break-up of profile of primary participants in the hearth market-

- By Company Type: Tier 1 - 10%, Tier 2 - 20%, Tier 3 - 70%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: North America - 40%, Europe - 35%, Asia Pacific - 15%, Rest of the World (RoW) - 10%

The major players of hearth market are HNI Corp. (US), Glen Dimplex (Ireland), Napoleon (Canada), Travis Industries, Inc. (US), and HPC Fire Inspired (US) among others.

Research Coverage

The report segments the hearth market and forecasts its size based on type, fuel type, placement, design, ignition type, vent availability, application, fireplace type, material, and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall hearth market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for home automation, growing interest in visually pleasing fireplaces, increasing use of hearths in and around houses to combat cold weather, customizing hearth designs offers an abundance of options, and increasing awareness of climate change and environment sustainability), restraints (hurdles associated with installation and maintenance costs of hearths, and limited access to renewable fuels), opportunities (rising interest in hearth products within the hospitality sector, updating outdates space heating systems, and technological advancements), and challenges (rigorous government regulations for environment protection, and competition from alternative heating solutions) influencing the growth of the hearth market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the hearth market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the hearth market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the hearth market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like HNI Corp. (US), Glen Dimplex (Ireland), Napoleon (Canada), Travis Industries, Inc. (US), and HPC Fire Inspired (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 HEARTH MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RECESSION IMPACT ANALYSIS

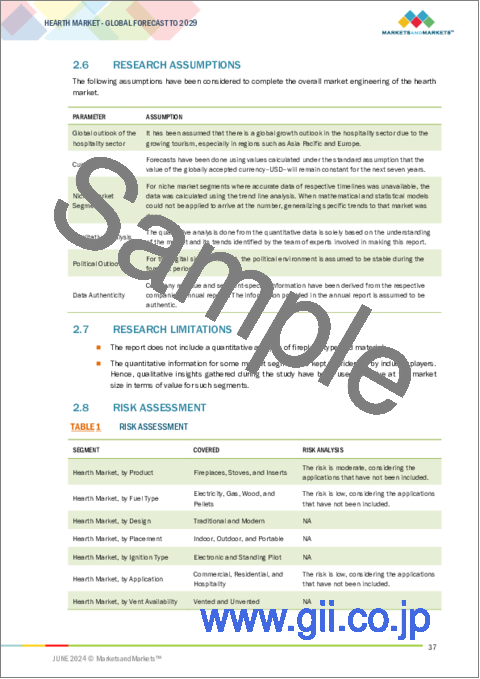

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 GLOBAL HEARTH MARKET SNAPSHOT

- FIGURE 9 HEARTH MARKET, BY PRODUCT, 2024-2029

- FIGURE 10 HEARTH MARKET, BY FUEL TYPE, 2024-2029

- FIGURE 11 HEARTH MARKET, BY DESIGN, 2024-2029

- FIGURE 12 HEARTH MARKET, BY VENT AVAILABILITY, 2024-2029

- FIGURE 13 HEARTH MARKET, BY APPLICATION, 2024-2029

- FIGURE 14 HEARTH MARKET, BY IGNITION TYPE, 2024-2029

- FIGURE 15 HEARTH MARKET, BY REGION, 2024-2029

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HEARTH MARKET

- FIGURE 16 RISING INTEREST IN CUSTOMIZED HEARTH DESIGNS TO DRIVE MARKET

- 4.2 HEARTH MARKET, BY PRODUCT

- FIGURE 17 INSERTS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.3 HEARTH MARKET, BY FUEL TYPE

- FIGURE 18 ELECTRICITY TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- 4.4 HEARTH MARKET, BY PLACEMENT

- FIGURE 19 INDOOR SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- 4.5 HEARTH MARKET, BY DESIGN

- FIGURE 20 TRADITIONAL/CONVENTIONAL SEGMENT TO BE LARGER THAN MODERN SEGMENT DURING FORECAST PERIOD

- 4.6 HEARTH MARKET, BY IGNITION TYPE

- FIGURE 21 ELECTRONIC SEGMENT TO ACCOUNT FOR HIGHER SHARE DURING FORECAST PERIOD

- 4.7 HEARTH MARKET, BY APPLICATION

- FIGURE 22 RESIDENTIAL TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- 4.8 HEARTH MARKET, BY REGION

- FIGURE 23 NORTH AMERICA TO BE LARGEST MARKET FOR HEARTHS DURING FORECAST PERIOD

- 4.9 HEARTH MARKET, BY COUNTRY

- FIGURE 24 CHINA TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 HEARTH MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for home automation

- 5.2.1.2 Growing consumer interest in visually appealing fireplaces

- 5.2.1.3 Increasing deployment of hearths to combat cold weather

- 5.2.1.4 Availability of diverse hearth designs

- 5.2.1.5 Rising awareness of climate change and environmental sustainability

- FIGURE 26 IMPACT ANALYSIS OF DRIVERS ON HEARTH MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and maintenance costs of hearths

- 5.2.2.2 Limited access to renewable fuels

- FIGURE 27 IMPACT ANALYSIS OF RESTRAINTS ON HEARTH MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for hearth products from hospitality sector

- 5.2.3.2 Upgrade of outdated space heating systems

- 5.2.3.3 Rapid innovations in technology

- FIGURE 28 IMPACT ANALYSIS OF OPPORTUNITIES ON HEARTH MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent government regulations for environmental protection

- 5.2.4.2 Availability of alternative heating solutions

- FIGURE 29 IMPACT ANALYSIS OF CHALLENGES ON HEARTH MARKET

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 31 ECOSYSTEM ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN ECOSYSTEM

- 5.5 INVESTMENT AND FUNDING SCENARIO

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2018-2024

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGY

- 5.7.1.1 Intermittent pilot ignition

- 5.7.2 COMPLEMENTARY TECHNOLOGY

- 5.7.2.1 Direct-vent

- 5.7.2.2 Natural vent

- 5.7.2.3 Vent-free

- 5.7.3 ADJACENT TECHNOLOGY

- 5.7.3.1 Zone heating

- 5.7.1 KEY TECHNOLOGY

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS

- FIGURE 34 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, 2023 (USD)

- TABLE 3 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY NAPOLEAN, 2019-2023 (USD)

- TABLE 4 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY INNOVATIVE HEARTH PRODUCTS, 2019-2023 (USD)

- TABLE 5 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY STOVE BUILDER INTERNATIONAL, 2019-2023 (USD)

- 5.8.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 35 AVERAGE SELLING PRICE OF FIREPLACES, BY REGION, 2019-2023 (USD)

- FIGURE 36 AVERAGE SELLING PRICE OF STOVES, BY REGION, 2019-2023 (USD)

- FIGURE 37 AVERAGE SELLING PRICE OF INSERTS, BY REGION, 2019-2023 (USD)

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 39 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 7 KEY BUYING CRITERIA, BY APPLICATION

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 IMPACT OF PORTER'S FIVE FORCES

- FIGURE 41 IMPACT OF PORTER'S FIVE FORCES

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 STOVE INDUSTRY ALLIANCE TRANSFORMED DISUSED PUBLIC TOILET INTO ECO-FRIENDLY HOLIDAY HOME WITH NORDPEIS S-31A WOOD BURNER

- 5.11.2 MICORP BUILDERS ENHANCED HOME ENTRANCES WITH ECOSMART FIRE

- 5.11.3 VGF, MCLEOD BOVELL DESIGN, AND WOODROSE HOMES COLLABORATED TO DEVELOP CUSTOM FIRE FEATURES

- 5.12 TRADE ANALYSIS

- TABLE 9 IMPORT DATA FOR HS CODE 732181, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 42 IMPORT DATA FOR HS CODE 732181, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 732181, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 43 EXPORT DATA FOR HS CODE 732181, BY COUNTRY, 2019-2023 (USD MILLION)

- 5.13 PATENT ANALYSIS

- FIGURE 44 PATENTS ANALYSIS

- TABLE 11 PATENT ANALYSIS

- 5.14 REGULATORY LANDSCAPE

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 KEY CONFERENCES AND EVENTS, 2024-2025

6 HEARTH MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- FIGURE 45 HEARTH MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 17 HEARTH MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 18 HEARTH MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- 6.2 FIREPLACES

- 6.2.1 NEED TO COMBAT COLD WEATHER TO DRIVE MARKET

- FIGURE 46 NORTH AMERICA TO BE LARGEST MARKET FOR FIREPLACES DURING FORECAST PERIOD

- TABLE 19 FIREPLACES: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 20 FIREPLACES: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 STOVES

- 6.3.1 RISING ENERGY COSTS AND ENVIRONMENTAL AWARENESS TO DRIVE MARKET

- FIGURE 47 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR STOVES DURING FORECAST PERIOD

- TABLE 21 STOVES: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 22 STOVES: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4 INSERTS

- 6.4.1 INCREASING DEMAND FOR MODERNIZING EXISTING FIREPLACES TO DRIVE MARKET

- FIGURE 48 NORTH AMERICA TO BE LARGEST MARKET FOR INSERTS DURING FORECAST PERIOD

- TABLE 23 INSERTS: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 INSERTS: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

7 HEARTH MARKET, BY FUEL TYPE

- 7.1 INTRODUCTION

- FIGURE 49 HEARTH MARKET, BY FUEL TYPE, 2024-2029 (USD MILLION)

- TABLE 25 HEARTH MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 26 HEARTH MARKET, BY FUEL TYPE, 2024-2029 (USD MILLION)

- 7.2 ELECTRICITY

- 7.2.1 GROWING POPULARITY OF ELECTRIC FIREPLACES AND STOVES TO DRIVE MARKET

- FIGURE 50 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN ELECTRICITY SEGMENT DURING FORECAST PERIOD

- TABLE 27 ELECTRICITY: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 ELECTRICITY: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 GAS

- 7.3.1 SMOKE-FREE OPERATION OF MODERN GAS HEARTHS TO DRIVE MARKET

- FIGURE 51 NORTH AMERICA TO BE DOMINANT IN GAS SEGMENT DURING FORECAST PERIOD

- TABLE 29 GAS: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 GAS: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4 WOOD

- 7.4.1 RISING ENVIRONMENTAL CONCERNS TO IMPEDE MARKET

- FIGURE 52 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN WOOD SEGMENT DURING FORECAST PERIOD

- TABLE 31 WOOD: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 32 WOOD: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.5 PELLET

- 7.5.1 LOWER HEATING COSTS THAN OTHER FUEL TYPES TO DRIVE MARKET

- FIGURE 53 ASIA PACIFIC TO EXHIBIT FASTEST GROWTH IN PELLET SEGMENT DURING FORECAST PERIOD

- TABLE 33 PELLET: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 34 PELLET: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

8 HEARTH MARKET, BY PLACEMENT

- 8.1 INTRODUCTION

- FIGURE 54 HEARTH MARKET, BY PLACEMENT, 2024-2029 (USD MILLION)

- TABLE 35 HEARTH MARKET, BY PLACEMENT, 2020-2023 (USD MILLION)

- TABLE 36 HEARTH MARKET, BY PLACEMENT, 2024-2029 (USD MILLION)

- 8.2 INDOOR

- 8.2.1 INTEGRATION OF SMART HOME TECHNOLOGIES TO DRIVE MARKET

- FIGURE 55 INDOOR HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 INDOOR: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 INDOOR: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 OUTDOOR

- 8.3.1 RISING DEMAND FOR OUTDOOR HEATING SOLUTIONS TO DRIVE MARKET

- FIGURE 56 OUTDOOR HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 OUTDOOR: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 OUTDOOR: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4 PORTABLE 104 8.4.1 VERSATILITY AND EASE OF INSTALLATION TO DRIVE MARKET

- FIGURE 57 PORTABLE HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 PORTABLE: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 PORTABLE: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

9 HEARTH MARKET, BY DESIGN

- 9.1 INTRODUCTION

- FIGURE 58 HEARTH MARKET, BY DESIGN, 2024-2029 (USD MILLION)

- TABLE 43 HEARTH MARKET, BY DESIGN, 2020-2023 (USD MILLION)

- TABLE 44 HEARTH MARKET, BY DESIGN, 2024-2029 (USD MILLION)

- 9.2 TRADITIONAL/CONVENTIONAL

- 9.2.1 GOVERNMENT-IMPOSED TAXES AND REGULATIONS TO IMPEDE MARKET

- FIGURE 59 TRADITIONAL/CONVENTIONAL HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 TRADITIONAL/CONVENTIONAL: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 TRADITIONAL/CONVENTIONAL: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 MODERN

- 9.3.1 INTEGRATION OF ADVANCED FEATURES TO DRIVE MARKET

- FIGURE 60 MODERN HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 MODERN: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 MODERN: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

10 HEARTH MARKET, BY IGNITION TYPE

- 10.1 INTRODUCTION

- FIGURE 61 HEARTH MARKET, BY IGNITION TYPE, 2024-2029 (USD MILLION)

- TABLE 49 HEARTH MARKET, BY IGNITION TYPE, 2020-2023 (USD MILLION)

- TABLE 50 HEARTH MARKET, BY IGNITION TYPE, 2024-2029 (USD MILLION)

- 10.2 ELECTRONIC

- 10.2.1 IMPROVED ENERGY EFFICIENCY DUE TO LOW FUEL CONSUMPTION TO DRIVE MARKET

- 10.3 STANDING PILOT

- 10.3.1 HIGH OPERATIONAL COSTS AND ENVIRONMENTAL RISKS TO IMPEDE MARKET

11 HEARTH MARKET, BY VENT AVAILABILITY

- 11.1 INTRODUCTION

- FIGURE 62 HEARTH MARKET, BY VENT AVAILABILITY, 2024-2029 (USD MILLION)

- TABLE 51 HEARTH MARKET, BY VENT AVAILABILITY, 2020-2023 (USD MILLION)

- TABLE 52 HEARTH MARKET, BY VENT AVAILABILITY, 2024-2029 (USD MILLION)

- 11.2 VENTED

- 11.2.1 INCREASING DEMAND FOR MODERN GAS AND WOOD FIREPLACES TO DRIVE MARKET

- 11.3 UNVENTED

- 11.3.1 FOCUS ON REDUCING HARMFUL GAS PRODUCTION TO DRIVE MARKET

12 HEARTH MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- FIGURE 63 HEARTH MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 53 HEARTH MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 54 HEARTH MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.2 RESIDENTIAL

- 12.2.1 CHANGING CONSUMER PREFERENCES TO DRIVE MARKET

- FIGURE 64 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN RESIDENTIAL SEGMENT DURING FORECAST PERIOD

- TABLE 55 RESIDENTIAL: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 RESIDENTIAL: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.3 COMMERCIAL

- 12.3.1 NEED FOR AESTHETICALLY PLEASING BUSINESS SETTINGS TO DRIVE MARKET

- FIGURE 65 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN COMMERCIAL SEGMENT DURING FORECAST PERIOD

- TABLE 57 COMMERCIAL: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 COMMERCIAL: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.4 HOSPITALITY

- 12.4.1 EMPHASIS ON VISUAL AND FUNCTIONAL BENEFITS TO DRIVE MARKET

- FIGURE 66 NORTH AMERICA TO BE DOMINANT IN HOSPITALITY SEGMENT DURING FORECAST PERIOD

- TABLE 59 HOSPITALITY: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 HOSPITALITY: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

13 HEARTH MARKET, BY FIREPLACE TYPE

- 13.1 INTRODUCTION

- 13.2 SINGLE-SIDED

- 13.3 MULTI-SIDED

14 HEARTH MARKET, BY MATERIAL

- 14.1 INTRODUCTION

- 14.2 BRICK

- 14.3 GRANITE

- 14.4 MARBLE

- 14.5 STONE

- 14.6 CONCRETE

- 14.7 SLATE

- 14.8 QUARRY TILE

15 HEARTH MARKET, BY REGION

- 15.1 INTRODUCTION

- FIGURE 67 HEARTH MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 61 HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 15.2 NORTH AMERICA

- FIGURE 68 NORTH AMERICA: HEARTH MARKET SNAPSHOT

- TABLE 63 NORTH AMERICA: HEARTH MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: HEARTH MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: HEARTH MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: HEARTH MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 67 NORTH AMERICA: HEARTH MARKET, BY DESIGN, 2020-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: HEARTH MARKET, BY DESIGN, 2024-2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: HEARTH MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA: HEARTH MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 71 NORTH AMERICA: HEARTH MARKET, BY PLACEMENT, 2020-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA: HEARTH MARKET, BY PLACEMENT, 2024-2029 (USD MILLION)

- TABLE 73 NORTH AMERICA: HEARTH MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 74 NORTH AMERICA: HEARTH MARKET, BY FUEL TYPE, 2024-2029 (USD MILLION)

- TABLE 75 NORTH AMERICA: HEARTH MARKET, BY FUEL TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 76 NORTH AMERICA: HEARTH MARKET, BY FUEL TYPE, 2024-2029 (THOUSAND UNITS)

- 15.2.1 RECESSION IMPACT ANALYSIS

- 15.2.2 US

- 15.2.2.1 Significant presence of hearth manufacturers to drive market

- 15.2.3 CANADA

- 15.2.3.1 Extreme climatic conditions to drive market

- 15.2.4 MEXICO

- 15.2.4.1 Inclination toward aesthetic appeal of hearths to drive market

- 15.3 EUROPE

- FIGURE 69 EUROPE: HEARTH MARKET SNAPSHOT

- TABLE 77 EUROPE: HEARTH MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 EUROPE: HEARTH MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 79 EUROPE: HEARTH MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 80 EUROPE: HEARTH MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 81 EUROPE: HEARTH MARKET, BY DESIGN, 2020-2023 (USD MILLION)

- TABLE 82 EUROPE: HEARTH MARKET, BY DESIGN, 2024-2029 (USD MILLION)

- TABLE 83 EUROPE: HEARTH MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 84 EUROPE: HEARTH MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 85 EUROPE: HEARTH MARKET, BY PLACEMENT, 2020-2023 (USD MILLION)

- TABLE 86 EUROPE: HEARTH MARKET, BY PLACEMENT, 2024-2029 (USD MILLION)

- TABLE 87 EUROPE: HEARTH MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: HEARTH MARKET, BY FUEL TYPE, 2024-2029 (USD MILLION)

- TABLE 89 EUROPE: HEARTH MARKET, BY FUEL TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 90 EUROPE: HEARTH MARKET, BY FUEL TYPE, 2024-2029 (THOUSAND UNITS)

- 15.3.1 RECESSION IMPACT ANALYSIS

- 15.3.2 WESTERN EUROPE

- 15.3.2.1 Unique cultural preferences and architectural styles to drive market

- 15.3.3 RUSSIA

- 15.3.3.1 Growing demand for traditional heating methods to drive market

- 15.3.4 EASTERN EUROPE

- 15.3.4.1 Urbanization and rising disposable incomes to drive market

- 15.3.5 REST OF EUROPE

- 15.4 ASIA PACIFIC

- FIGURE 70 ASIA PACIFIC: HEARTH MARKET SNAPSHOT

- TABLE 91 ASIA PACIFIC: HEARTH MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: HEARTH MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: HEARTH MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: HEARTH MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HEARTH MARKET, BY DESIGN, 2020-2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: HEARTH MARKET, BY DESIGN, 2024-2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: HEARTH MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: HEARTH MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: HEARTH MARKET, BY PLACEMENT, 2020-2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: HEARTH MARKET, BY PLACEMENT, 2024-2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: HEARTH MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: HEARTH MARKET, BY FUEL TYPE, 2024-2029 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HEARTH MARKET, BY FUEL TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 104 ASIA PACIFIC: HEARTH MARKET, BY FUEL TYPE, 2024-2029 (THOUSAND UNITS)

- 15.4.1 RECESSION IMPACT ANALYSIS

- 15.4.2 CHINA

- 15.4.2.1 Increasing demand for modern heating solutions to drive market

- 15.4.3 JAPAN

- 15.4.3.1 High demand for energy-efficient and technologically advanced hearths to drive market

- 15.4.4 SOUTHEAST ASIA

- 15.4.4.1 Shift toward luxury consumption patterns to drive market

- 15.4.5 REST OF ASIA PACIFIC

- 15.5 REST OF THE WORLD

- TABLE 105 REST OF THE WORLD: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 106 REST OF THE WORLD: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 107 REST OF THE WORLD: HEARTH MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 108 REST OF THE WORLD: HEARTH MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 109 REST OF THE WORLD: HEARTH MARKET, BY DESIGN, 2020-2023 (USD MILLION)

- TABLE 110 REST OF THE WORLD: HEARTH MARKET, BY DESIGN, 2024-2029 (USD MILLION)

- TABLE 111 REST OF THE WORLD: HEARTH MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 112 REST OF THE WORLD: HEARTH MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 REST OF THE WORLD: HEARTH MARKET, BY PLACEMENT, 2020-2023 (USD MILLION)

- TABLE 114 REST OF THE WORLD: HEARTH MARKET, BY PLACEMENT, 2024-2029 (USD MILLION)

- TABLE 115 REST OF THE WORLD: HEARTH MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 116 REST OF THE WORLD: HEARTH MARKET, BY FUEL TYPE, 2024-2029 (USD MILLION)

- TABLE 117 REST OF THE WORLD: HEARTH MARKET, BY FUEL TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 118 REST OF THE WORLD: HEARTH MARKET, BY FUEL TYPE, 2024-2029 (THOUSAND UNITS)

- 15.5.1 RECESSION IMPACT ANALYSIS

- 15.5.2 MIDDLE EAST & AFRICA

- 15.5.2.1 Slow adoption of hearth products due to constrained usability to impede market

- TABLE 119 MIDDLE EAST & AFRICA: HEARTH MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: HEARTH MARKET, BY REGION, 2024-2029 (USD MILLION)

- 15.5.2.1.1 Gulf Cooperation Council (GCC)

- 15.5.2.1.2 Rest of Middle East & Africa

- 15.5.3 SOUTH AMERICA

- 15.5.3.1 Limited availability of hearth models to impede market

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 121 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 16.3 MARKET SHARE ANALYSIS, 2023

- TABLE 122 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 71 HEARTH MARKET: MARKET SHARE ANALYSIS, 2023

- 16.4 REVENUE ANALYSIS, 2019-2023

- FIGURE 72 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD MILLION)

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 73 COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 74 FINANCIAL METRICS, 2024 (USD BILLION)

- 16.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- FIGURE 75 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 16.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 16.6.5.1 Company footprint

- FIGURE 76 COMPANY FOOTPRINT

- 16.6.5.2 Region footprint

- TABLE 123 REGION FOOTPRINT

- 16.6.5.3 Product footprint

- TABLE 124 PRODUCT FOOTPRINT

- 16.6.5.4 Fuel type footprint

- TABLE 125 FUEL TYPE FOOTPRINT

- 16.6.5.5 Placement footprint

- TABLE 126 PLACEMENT FOOTPRINT

- 16.6.5.6 Design footprint

- TABLE 127 DESIGN FOOTPRINT

- 16.6.5.7 Ignition type footprint

- TABLE 128 IGNITION TYPE FOOTPRINT

- 16.6.5.8 Vent availability footprint

- TABLE 129 VENT AVAILABILITY FOOTPRINT

- 16.6.5.9 Application footprint

- TABLE 130 APPLICATION FOOTPRINT

- 16.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 16.7.1 PROGRESSIVE COMPANIES

- 16.7.2 RESPONSIVE COMPANIES

- 16.7.3 DYNAMIC COMPANIES

- 16.7.4 STARTING BLOCKS

- FIGURE 77 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- 16.7.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 16.7.5.1 List of start-ups/SMEs

- TABLE 131 LIST OF START-UPS/SMES

- 16.7.5.2 Competitive benchmarking of start-ups/SMEs

- TABLE 132 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 16.8 BRAND/PRODUCT COMPARISON

- FIGURE 78 BRAND/PRODUCT COMPARISON

- 16.9 COMPETITIVE SCENARIO AND TRENDS

- 16.9.1 PRODUCT LAUNCHES

- TABLE 133 HEARTH MARKET: PRODUCT LAUNCHES, 2020-2024

- 16.9.2 DEALS

- TABLE 134 HEARTH MARKET: DEALS, 2020-2024

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices, and Weaknesses and Competitive threats)**

- 17.1.1 HNI CORP.

- TABLE 135 HNI CORP.: COMPANY OVERVIEW

- FIGURE 79 HNI CORP.: COMPANY SNAPSHOT

- TABLE 136 HNI CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 HNI CORP.: DEALS

- 17.1.2 GLEN DIMPLEX

- TABLE 138 GLEN DIMPLEX: COMPANY OVERVIEW

- TABLE 139 GLEN DIMPLEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 GLEN DIMPLEX: PRODUCT LAUNCHES

- TABLE 141 GLEN DIMPLEX: DEALS

- 17.1.3 NAPOLEON

- TABLE 142 NAPOLEON: COMPANY OVERVIEW

- TABLE 143 NAPOLEON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 NAPOLEON: PRODUCT LAUNCHES

- 17.1.4 TRAVIS INDUSTRIES INC.

- TABLE 145 TRAVIS INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 146 TRAVIS INDUSTRIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 17.1.5 HPC FIRE INSPIRED

- TABLE 147 HPC FIRE INSPIRED: COMPANY OVERVIEW

- TABLE 148 HPC FIRE INSPIRED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 HPC FIRE INSPIRED: PRODUCT LAUNCHES

- TABLE 150 HPC FIRE INSPIRED: DEALS

- 17.1.6 JOTUL

- TABLE 151 JOTUL: COMPANY OVERVIEW

- FIGURE 80 JOTUL: COMPANY SNAPSHOT

- TABLE 152 JOTUL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 JOTUL: DEALS

- 17.1.7 MONTIGO

- TABLE 154 MONTIGO: COMPANY OVERVIEW

- TABLE 155 MONTIGO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 MONTIGO: PRODUCT LAUNCHES

- 17.1.8 STOVE BUILDER INTERNATIONAL

- TABLE 157 STOVE BUILDER INTERNATIONAL: COMPANY OVERVIEW

- TABLE 158 STOVE BUILDER INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 STOVE BUILDER INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 160 STOVE BUILDER INTERNATIONAL: DEALS

- 17.1.9 INNOVATIVE HEARTH PRODUCTS

- TABLE 161 INNOVATIVE HEARTH PRODUCTS: COMPANY OVERVIEW

- TABLE 162 INNOVATIVE HEARTH PRODUCTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 17.1.10 EMPIRE COMFORT SYSTEMS

- TABLE 163 EMPIRE COMFORT SYSTEMS: COMPANY OVERVIEW

- TABLE 164 EMPIRE COMFORT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 17.2 OTHER PLAYERS

- 17.2.1 GHP GROUP INC.

- TABLE 165 GHP GROUP INC.: COMPANY OVERVIEW

- 17.2.2 HEARTHSTONE QUALITY HOME HEATING PRODUCTS INC.

- TABLE 166 HEARTHSTONE QUALITY HOME HEATING PRODUCTS INC.: COMPANY OVERVIEW

- 17.2.3 RH PETERSON CO.

- TABLE 167 RH PETERSON CO.: COMPANY OVERVIEW

- 17.2.4 BFM EUROPE LTD

- TABLE 168 BFM EUROPE LTD: COMPANY OVERVIEW

- 17.2.5 WILKENING FIREPLACE

- TABLE 169 WILKENING FIREPLACE: COMPANY OVERVIEW

- 17.2.6 NORDPEIS

- TABLE 170 NORDPEIS: COMPANY OVERVIEW

- 17.2.7 BOLEY

- TABLE 171 BOLEY: COMPANY OVERVIEW

- 17.2.8 EUROPEAN HOME

- TABLE 172 EUROPEAN HOME: COMPANY OVERVIEW

- 17.2.9 BARBAS BELLFIRES

- TABLE 173 BARBAS BELLFIRES: COMPANY OVERVIEW

- 17.2.10 MENDOTA

- TABLE 174 MENDOTA: COMPANY OVERVIEW

- 17.2.11 PACIFIC ENERGY

- TABLE 175 PACIFIC ENERGY: COMPANY OVERVIEW

- 17.2.12 STELLAR BY HEAT & GLO

- TABLE 176 STELLAR BY HEAT & GLO: COMPANY OVERVIEW

- 17.2.13 FPI FIREPLACE PRODUCTS INTERNATIONAL LTD.

- TABLE 177 FPI FIREPLACE PRODUCTS INTERNATIONAL LTD.: COMPANY OVERVIEW

- 17.2.14 RASMUSSEN GAS LOGS

- TABLE 178 RASMUSSEN GAS LOGS: COMPANY OVERVIEW

- 17.2.15 MELROY PLUMBING & HEATING, INC.

- TABLE 179 MELROY PLUMBING & HEATING, INC.: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS