|

|

市場調査レポート

商品コード

1732205

ラボ情報管理システムの世界市場:コンポーネント別、タイプ別、展開モデル別、企業規模別、業界別、地域別 - 2030年までの予測Laboratory Information Management System Market by Type, Component, Deployment (On-premise, Cloud ), Company Size, Industry, & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ラボ情報管理システムの世界市場:コンポーネント別、タイプ別、展開モデル別、企業規模別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月16日

発行: MarketsandMarkets

ページ情報: 英文 344 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のラボ情報管理システムの市場規模は、予測期間中に12.5%のCAGRで拡大し、2025年の28億8,000万米ドルから2030年には51億9,000万米ドルに達すると予測されています。

ラボ情報管理システム(LIMS)市場は、スケーラブルで費用対効果の高い展開オプションを提供するクラウドの採用拡大により急速に拡大しています。ヘルスケアやライフサイエンスなどの分野で規制要件が増加していることも、安全でコンプライアンスに準拠したデータ管理システムの需要を押し上げています。さらに、正確性を高め、手作業を減らし、効率を向上させるためにラボの自動化を推進する動きが、業界全体でLIMSの採用をさらに加速させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | コンポーネント別、タイプ別、展開モデル別、企業規模別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東&アフリカ |

2024年には、オンプレミスセグメントがLIMS市場で最も高いシェアを占めています。オンプレミスセグメントの成長は、特定の業界や組織がLIMSインフラを社内に維持することを好むなど、いくつかの要因によるものです。オンプレミス・ソリューションは、より高度な制御、カスタマイズ、セキュリティを提供し、これは厳格なデータ管理と規制遵守を要件とする企業にとって不可欠です。さらに、オンプレミスの展開モデルは、特に機密データや高度に規制されたデータを扱う組織にとって、データ主権の感覚を提供します。また、データ管理をローカライズして管理できるため、さまざまな業界特有のニーズや嗜好を満たすカスタマイズ性が向上することも、成長の原動力となっています。その結果、オンプレミス型LIMSの需要は増加の一途をたどり、安全でカスタマイズ可能、かつコンプライアンスに準拠した検査室情報管理ソリューションを求める企業のニーズに応えています。

クラウドコンピューティング市場では、スケーラブルでコスト効率に優れ、柔軟性の高いITインフラに対する需要の高まりを受けて、サービスとしてのインフラ(IaaS)が急成長しています。各業界の組織は、設備投資の削減、ビジネスの俊敏性の向上、遠隔操作のサポートなどを目的に、従来のオンプレミス型システムからIaaSへの移行を進めています。ビッグデータ、人工知能、デジタルトランスフォーメーションへの取り組みの高まりは、コンピューティングリソース、ストレージ、ネットワーキングをオンデマンドで迅速にプロビジョニングできるIaaSの採用をさらに後押ししています。企業がIT戦略において俊敏性と回復力を優先する中、この動向は今後も続くと予想されます。

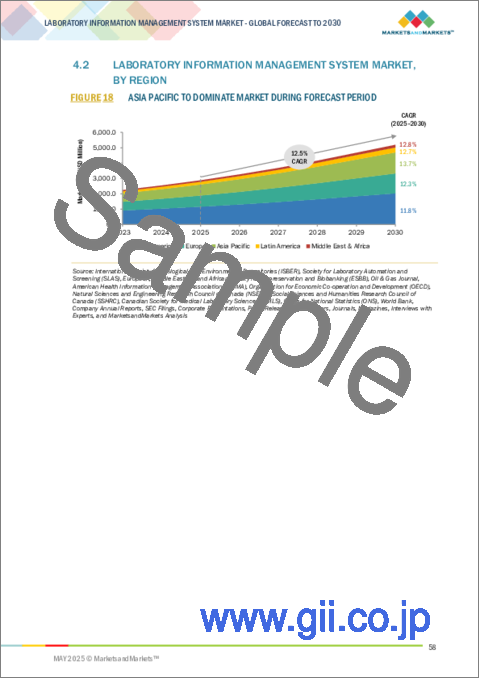

アジア市場は、予測期間中に最も高いCAGRを記録すると予想されます。この成長の原動力は、モノのインターネット(IoT)、ブロックチェーン、人工知能(AI)、機械学習の普及など、先端技術に対する需要の高まりであり、これらが地域全体でラボ情報管理システム(LIMS)の導入を加速させています。政府の政策とイニシアチブがこの勢いをさらに加速させています。さらに、相互運用性標準の改善により、LIMSソリューションの統合と展開が容易になっています。医療ツーリズムの拡大と研究所のインフラ開発もこの動向に寄与しており、組織はLIMSを十分に活用して業務効率を高め、データ精度を向上させ、患者ケアを強化することができます。

当レポートでは、世界のラボ情報管理システム市場について調査し、コンポーネント別、タイプ別、展開モデル別、企業規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- エンドユーザー分析

- ビジネスモデル

- 2025年の米国関税の影響

第6章 ラボ情報管理システム市場(コンポーネント別)

- イントロダクション

- ソフトウェア

- サービス

- サポート

第7章 ラボ情報管理システム市場(タイプ別)

- イントロダクション

- 広範囲のLIMS

- 業界固有のLIMS

第8章 ラボ情報管理システム市場(展開モデル別)

- イントロダクション

- オンプレミスのLIMS

- クラウドベースのLIMS

- リモートホストLIMS

第9章 ラボ情報管理システム市場(企業規模別)

- イントロダクション

- 大規模企業

- 中規模企業

- 小規模企業

第10章 ラボ情報管理システム市場(業界別)

- イントロダクション

- ライフサイエンス

- 飲食品・農業

- 石油化学製品および石油・ガス

- 化学薬品

- 環境試験

- 法医学

- その他

第11章 ラボ情報管理システム市場(地域別)

- イントロダクション

- 北米

- 北米における景気後退の影響

- 米国

- カナダ

- 欧州

- 欧州への景気後退の影響

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋への景気後退の影響

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- ラテンアメリカへの景気後退の影響

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカへの景気後退の影響

- GCC諸国

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- LABWARE

- LABVANTAGE SOLUTIONS, INC.

- THERMO FISHER SCIENTIFIC INC.

- STARLIMS CORPORATION

- AGILENT TECHNOLOGIES, INC.

- LABLYNX, INC.

- CLINISYS, INC.

- AUTOSCRIBE INFORMATICS (XYBION CORPORATION)

- LABWORKS

- DASSAULT SYSTEMES

- CONFIENCE

- CLOUDLIMS

- BIODATA INC.

- SIEMENS

- NOVATEK INTERNATIONAL

- OVATION

- ILLUMINA, INC.

- EUSOFT LTD.

- CALIBER TECHNOLOGIES

- LABTRACK

- その他の企業

- AGILAB

- AGARAM TECHNOLOGIES

- ASSAYNET INC.

- BLAZE SYSTEMS CORPORATION

- THIRD WAVE ANALYTICS, INC.

第14章 付録

List of Tables

- TABLE 1 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD, 2020-2024

- TABLE 3 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: RISK ASSESSMENT

- TABLE 4 GLOBAL INFLATION RATE PROJECTIONS, 2021-2028 (% GROWTH)

- TABLE 5 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 6 VENDORS OFFERING ADVANCED ANALYTICS AND ARTIFICIAL INTELLIGENCE WITH LIMS

- TABLE 7 COST ANALYSIS OF SOLUTIONS, BY PLATFORM

- TABLE 8 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: PRICING ANALYSIS, BY TYPE OF LICENSE

- TABLE 9 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: AVERAGE SELLING PRICE OF KEY SOLUTIONS, BY KEY PLAYER, 2024

- TABLE 10 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: PRICING MODEL, 2024

- TABLE 11 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 TOP APPLICANT COUNTRIES FOR LABORATORY INFORMATION MANAGEMENT SYSTEM PATENTS, JANUARY 2015-MAY 2025

- TABLE 13 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021-2023

- TABLE 14 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: PORTER'S FIVE FORCES

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 23 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: UNMET NEEDS

- TABLE 24 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: END-USER EXPECTATIONS

- TABLE 25 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 27 LABORATORY INFORMATION SYSTEM (LIMS) SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 LABORATORY INFORMATION SYSTEM (LIMS) SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 LABORATORY INFORMATION SYSTEM (LIMS) SUPPORT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

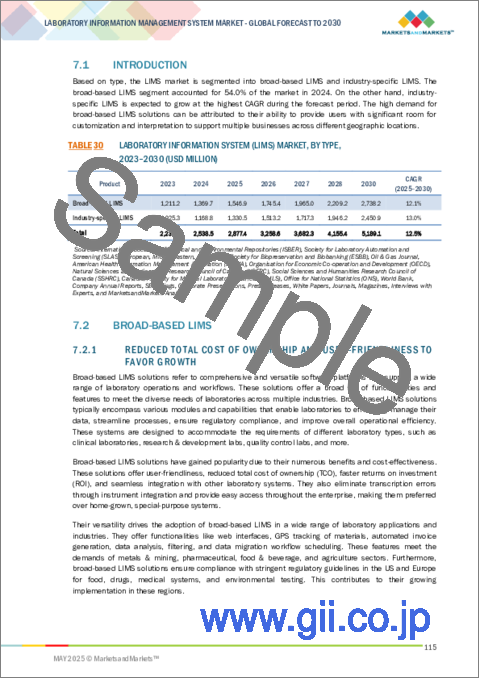

- TABLE 30 LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 31 BROAD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 INDUSTRY-SPECIFIC LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 34 ON-PREMISE LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 36 SAAS LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 IAAS LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 PAAS LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 REMOTELY HOSTED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 41 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LARGE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR MEDIUM-SIZED COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR SMALL COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 45 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 46 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR CONTRACT SERVICE ORGANIZATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR BIOBANKS & BIOREPOSITORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR ACADEMIC RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR NGS LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR TOXICOLOGY LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR FOOD & BEVERAGE AND AGRICULTURE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR PETROCHEMICALS AND OIL & GAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR CHEMICALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR ENVIRONMENTAL TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR FORENSICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 69 US: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 70 US: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 71 US: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 72 US: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 US: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 74 US: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 75 US: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 77 CANADA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 82 CANADA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 94 GERMANY: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 GERMANY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 96 GERMANY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 UK: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 99 UK: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 UK: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 101 UK: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 UK: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 103 UK: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 104 UK: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 108 FRANCE: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 FRANCE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 110 FRANCE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 111 FRANCE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 113 ITALY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 ITALY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 115 ITALY: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 ITALY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 117 ITALY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 118 ITALY: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 SPAIN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 120 SPAIN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 SPAIN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 122 SPAIN: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 SPAIN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 124 SPAIN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 125 SPAIN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 127 REST OF EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 129 REST OF EUROPE: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 REST OF EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 132 REST OF EUROPE: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 JAPAN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 142 JAPAN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 JAPAN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 144 JAPAN: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 JAPAN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 146 JAPAN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 147 JAPAN: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 CHINA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 149 CHINA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 CHINA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 151 CHINA: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 CHINA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 153 CHINA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 154 CHINA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 INDIA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 156 INDIA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 INDIA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 158 INDIA: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 INDIA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 160 INDIA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 161 INDIA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 176 LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 BRAZIL: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 178 BRAZIL: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 BRAZIL: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 180 BRAZIL: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 BRAZIL: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 182 BRAZIL: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 183 BRAZIL: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 MEXICO: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 185 MEXICO: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 MEXICO: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 187 MEXICO: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 MEXICO: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 189 MEXICO: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 190 MEXICO: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 194 REST OF LATIN AMERICA: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 REST OF LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 196 REST OF LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 GCC COUNTRIES: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 207 GCC COUNTRIES: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 GCC COUNTRIES: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 209 GCC COUNTRIES: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 GCC COUNTRIES: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 211 GCC COUNTRIES: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 212 GCC COUNTRIES: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: CLOUD-BASED LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY COMPANY SIZE, 2023-2030 (USD MILLION)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS, JANUARY 2022-APRIL 2025

- TABLE 221 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: DEGREE OF COMPETITION

- TABLE 222 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: REGION FOOTPRINT

- TABLE 223 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: COMPONENT FOOTPRINT

- TABLE 224 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: TYPE FOOTPRINT

- TABLE 225 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: INDUSTRY FOOTPRINT

- TABLE 226 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 227 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 228 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 229 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: DEALS, JANUARY 2022-APRIL 2025

- TABLE 230 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 231 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 232 LABWARE: COMPANY OVERVIEW

- TABLE 233 LABWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 LABWARE: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 235 LABWARE: DEALS, JANUARY 2022-APRIL 2025

- TABLE 236 LABWARE: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 237 LABWARE: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 238 LABVANTAGE SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 239 LABVANTAGE SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 LABVANTAGE SOLUTIONS, INC.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 241 LABVANTAGE SOLUTIONS, INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 242 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 243 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 245 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 246 THERMO FISHER SCIENTIFIC INC.: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 247 THERMO FISHER SCIENTIFIC INC.: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 248 STARLIMS CORPORATION: COMPANY OVERVIEW

- TABLE 249 STARLIMS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 STARLIMS CORPORATION: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 251 STARLIMS CORPORATION: DEALS, JANUARY 2022-APRIL 2025

- TABLE 252 STARLIMS CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 253 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 254 AGILENT TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 AGILENT TECHNOLOGIES, INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 256 LABLYNX, INC.: COMPANY OVERVIEW

- TABLE 257 LABLYNX, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 LABLYNX, INC.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 259 CLINISYS, INC.: COMPANY OVERVIEW

- TABLE 260 CLINISYS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 CLINISYS, INC.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 262 CLINISYS, INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 263 CLINISYS, INC.: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 264 AUTOSCRIBE INFORMATICS: COMPANY OVERVIEW

- TABLE 265 AUTOSCRIBE INFORMATICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 AUTOSCRIBE INFORMATICS: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 267 AUTOSCRIBE INFORMATICS: DEALS, JANUARY 2022-APRIL 2025

- TABLE 268 AUTOSCRIBE INFORMATICS: EXPANSIONS, JANUARY 2022-APRIL 2025

- TABLE 269 AUTOSCRIBE INFORMATICS: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 270 LABWORKS: COMPANY OVERVIEW

- TABLE 271 LABWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 LABWORKS: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 273 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 274 DASSAULT SYSTEMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 CONFIENCE: COMPANY OVERVIEW

- TABLE 276 CONFIENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 CONFIENCE: DEALS, JANUARY 2022-APRIL 2025

- TABLE 278 CONFIENCE: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 279 CLOUDLIMS: COMPANY OVERVIEW

- TABLE 280 CLOUDLIMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 CLOUDLIMS: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 282 CLOUDLIMS: DEALS, JANUARY 2022-APRIL 2025

- TABLE 283 BIODATA INC.: COMPANY OVERVIEW

- TABLE 284 BIODATA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 BIODATA INC.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 286 BIODATA INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 287 SIEMENS: COMPANY OVERVIEW

- TABLE 288 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 NOVATEK INTERNATIONAL: COMPANY OVERVIEW

- TABLE 290 NOVATEK INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 NOVATEK INTERNATIONAL: OTHER DEVELOPMENTS, JANUARY 2022-APRIL 2025

- TABLE 292 OVATION: COMPANY OVERVIEW

- TABLE 293 OVATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 OVATION: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 295 OVATION: DEALS, JANUARY 2022-APRIL 2025

- TABLE 296 ILLUMINA, INC.: COMPANY OVERVIEW

- TABLE 297 ILLUMINA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 ILLUMINA, INC.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 299 ILLUMINA, INC.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 300 EUSOFT LTD.: COMPANY OVERVIEW

- TABLE 301 EUSOFT LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 EUSOFT LTD.: PRODUCT LAUNCHES AND UPGRADES, JANUARY 2022-APRIL 2025

- TABLE 303 EUSOFT LTD.: DEALS, JANUARY 2022-APRIL 2025

- TABLE 304 CALIBER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 305 CALIBER TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 LABTRACK: COMPANY OVERVIEW

- TABLE 307 LABTRACK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 AGILAB: COMPANY OVERVIEW

- TABLE 309 AGARAM TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 310 ASSAYNET INC.: COMPANY OVERVIEW

- TABLE 311 BLAZE SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 312 THIRD WAVE ANALYTICS, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET SEGMENTATION AND REGIONS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY INDUSTRY AND REGION

- FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 BOTTOM-UP APPROACH: END-USER SPENDING ON MARKET

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DYNAMICS, 2025-2030

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DEPLOYMENT MODEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPANY SIZE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: REGIONAL SNAPSHOT

- FIGURE 17 GROWING FOCUS ON AUTOMATION AND NEED TO COMPLY WITH REGULATORY REQUIREMENTS TO DRIVE MARKET

- FIGURE 18 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 INDIA TO REGISTER HIGHEST GROWTH FROM 2025 TO 2030

- FIGURE 20 LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 REVENUE SHIFT IN LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET

- FIGURE 22 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: COMPONENT PRICING

- FIGURE 23 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO

- FIGURE 26 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: PATENT ANALYSIS, 2015-2025

- FIGURE 27 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 30 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: MAJOR PAIN POINTS

- FIGURE 31 NORTH AMERICA: LABORATORY INFORMATION SYSTEM (LIMS) MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM (LIMS) MARKET SNAPSHOT

- FIGURE 33 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 34 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET SHARE ANALYSIS, 2024

- FIGURE 35 EV/EBITDA OF KEY VENDORS

- FIGURE 36 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF VENDORS

- FIGURE 37 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 38 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 39 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: COMPANY FOOTPRINT

- FIGURE 40 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS) MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 41 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 42 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 43 DASSAULT SYSTEMES: COMPANY SNAPSHOT (2024)

- FIGURE 44 SIEMENS: COMPANY SNAPSHOT (2024)

- FIGURE 45 ILLUMINA, INC.: COMPANY SNAPSHOT (2024)

The global laboratory information management system market is projected to reach USD 5.19 billion by 2030 from USD 2.88 billion in 2025, at a CAGR of 12.5% during the forecast period. The Laboratory Information Management System (LIMS) market is expanding rapidly due to growing cloud adoption, which offers scalable and cost-effective deployment options. Increasing regulatory requirements across sectors like healthcare and life sciences are also pushing demand for secure and compliant data management systems. Additionally, the drive toward laboratory automation to enhance accuracy, reduce manual tasks, and improve efficiency is further accelerating LIMS adoption across industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Component, Deployment Mode, Company Size, and Industry |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

The on-premise subsegment, under the Laboratory Information Management Systems (LIMS) market, is expected to register significant growth during the forecast period.

In 2024, the on-premises segment accounted for the highest share of the LIMS market. The growth of the on-premise segment is attributed to several factors, including the preference of certain industries or organizations to keep their LIMS infrastructure in-house. On-premise solutions offer a higher degree of control, customization, and security, which is essential for businesses with strict data management and regulatory compliance requirements. Additionally, the on-premise deployment model provides a sense of data sovereignty, particularly for organizations that handle sensitive or highly regulated data. The growth is also driven by the ability to have localized control over data management, ensuring better customization to meet the unique needs and preferences of various industries. As a result, the demand for on-premise LIMS continues to rise, catering to businesses seeking secure, customizable, and compliant laboratory information management solutions.

Infrastructure as a service is projected to dominate the Laboratory Information Management Systems (LIMS) market, by industry, during the forecast period.

Infrastructure as a Service (IaaS) is emerging as the fastest-growing segment in the cloud computing market, driven by the increasing demand for scalable, cost-effective, and flexible IT infrastructure. Organizations across industries are shifting from traditional on-premise systems to IaaS to reduce capital expenditures, improve business agility, and support remote operations. The rise in big data, artificial intelligence, and digital transformation initiatives further fuels the adoption of IaaS, as it enables rapid provisioning of computing resources, storage, and networking on demand. This trend is expected to continue as businesses prioritize agility and resilience in their IT strategies.

Asia Pacific is expected to register highest market growth during the forecast period.

The Asian market is expected to register the highest compound annual growth rate (CAGR) during the forecast period. This growth is driven by the rising demand for advanced technologies, including the widespread adoption of Internet of Things (IoT), blockchain, artificial intelligence (AI), and machine learning, which are accelerating the implementation of Laboratory Information Management Systems (LIMS) across the region. Government policies and initiatives are further fuelling this momentum. Additionally, improvements in interoperability standards are making it easier to integrate and deploy LIMS solutions. The expansion of medical tourism and the development of infrastructure in research laboratories are also contributing to this trend, enabling organizations to fully leverage LIMS to boost operational efficiency, improve data accuracy, and enhance patient care.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 38%, Tier 2: 45%, and Tier 3: 17%

- By Designation - C-level: 29%, Director-level: 44%, and Others: 27%

- By Region - North America: 42%, Asia Pacific: 21%, Europe: 28%, Latin America: 5%, and Middle East & Africa: 4%

List of Companies Profiled in the Report

- LabWare (US)

- LabVantage (US)

- Thermo Fisher Scientific Inc. (US)

- Agilent Technologies (US)

- LabLynx, Inc. (US)

- Dassault Systemes (France)

- Labworks LLC (US)

- Autoscribe Informatics (US)

- Accelerated Technology Laboratories (ATL)

- Starlims corporation (US)

- CloudLIMS (US)

- Computing Solutions, Inc. (US)

- GenoLogics Inc. (an Illumina Company) (Canada)

- Siemens (Germany)

- Novatek International (Canada)

- Ovation (US)

- Clinsys (US)

- Labworks (US)

- Illumina (US)

- Eusoft Ltd (UK)

- Labtrack (US)

- Caliber Technologies (US)

Research Coverage:

The report analyzes the Laboratory Information Management Systems (LIMS) market and aims to estimate the market size and future growth potential of various market segments, based on type, component, company size, deployment model, industry, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a higher share of the market. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their positions in the market.

This report provides insights on:

- An analysis of the key drivers highlights a rise in LIMS adoption to comply with stringent regulatory standards, an increased focus on improving laboratory efficiency, technological innovations providing advanced LIMS solutions, a growing shift toward cloud-based LIMS, and rising investments in R&D within the pharmaceutical and biotechnology industries. On the other hand, challenges include high maintenance and service costs, lack of standardized LIMS integration, interoperability issues, and limited adoption by small and medium-sized enterprises. Opportunities exist in applying LIMS to the cannabis industry, as well as the growing demand for cloud-based solutions and significant growth potential in emerging markets. However, there are hurdles such as a shortage of skilled professionals and integration issues with informatics software.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Laboratory Information Management Systems (LIMS) market.

- Market Development: Comprehensive information on the lucrative emerging markets, type of solution, component, deployment model, industry, and region.

- Market Diversification: Exhaustive information about the software portfolios, growing geographies, recent developments, and investments in the life science analytics market

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, product offerings, and capabilities of the leading players in the Laboratory Information Management Systems (LIMS) market such as LabWare (US), LabVantage(US), Thermo Fisher Scientific Inc. (US), Agilent Technologies (US), LabLynx, Inc. (US), Dassault Systemes (France), and Labworks LLC (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOTAL MARKET SIZE

- 2.2.2 GROWTH FORECAST

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.5.2 MARKET ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

- 2.8 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET OVERVIEW

- 4.2 LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET, BY REGION

- 4.3 LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of LIMS to comply with stringent regulatory requirements

- 5.2.1.2 Rising requirement for customizable solutions

- 5.2.1.3 Increasing adoption of cloud-based and integrated LIMS

- 5.2.1.4 Growing R&D expenditure in pharmaceutical and biotechnology companies

- 5.2.1.5 Demand for real-time data access in food & beverage industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance and service costs

- 5.2.2.2 Lack of integration standards for LIMS

- 5.2.2.3 Interoperability challenges

- 5.2.2.4 Limited adoption of LIMS in small and medium-sized companies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of LIMS in cannabis industry

- 5.2.3.2 Significant growth potential in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Dearth of trained professionals

- 5.2.4.2 Interfacing challenges with informatics software

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 CLOUD-BASED SOLUTIONS

- 5.3.2 ADVANCED DATA MANAGEMENT SYSTEMS

- 5.3.3 MOBILE APPLICATIONS

- 5.3.4 AUGMENTED REALITY AND MIXED REALITY

- 5.3.5 ADVANCED ANALYTICS AND AI

- 5.3.6 FUTURE OF LABORATORIES

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Artificial intelligence and machine learning

- 5.9.1.2 Cloud computing

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Internet of things

- 5.9.2.2 Data analytics

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Blockchain

- 5.9.3.2 Electronic lab notebooks

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CASE STUDY 1: STARLIMS QUALITY MANUFACTURING LABORATORY INFORMATICS MANAGEMENT SYSTEM FOR DATA INTEGRITY AND SECURITY

- 5.12.2 CASE STUDY 2: MATRIX GEMINI LIMS FOR QUALITY FORENSIC TOXICOLOGY

- 5.12.3 CASE STUDY 3: CLOUDLIMS TO DRIVE AUTOMATED WORKFLOWS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.1.1 NORTH AMERICA

- 5.13.1.1.1 US

- 5.13.1.1.1.1 Health Insurance Portability and Accountability Act (HIPAA)

- 5.13.1.1.1.2 Security in a Cloud Computing Environment

- 5.13.1.1.1.3 Federal Information Security and Management Act (FISMA)

- 5.13.1.1.1.4 Control Objectives for Information and Related Technology (COBIT)

- 5.13.1.1.2 Canada

- 5.13.1.1.1 US

- 5.13.1.2 Europe

- 5.13.1.2.1 EU Cybersecurity Act

- 5.13.1.2.2 General Data Protection Regulation (GDPR), European Union (EU)

- 5.13.1.2.3 EU Clinical Trial Regulation (CTR)

- 5.13.1.3 Asia Pacific

- 5.13.1.3.1 China

- 5.13.1.3.1.1 China's Cyber Security Law (CSL)

- 5.13.1.3.1.2 Multi-Level Protection Scheme (MLPS) 2.0, China

- 5.13.1.3.2 Japan

- 5.13.1.3.2.1 Japan Act on the Protection of Personal Information

- 5.13.1.3.3 Singapore

- 5.13.1.3.3.1 Multi-Tier Cloud Security (MTCS)

- 5.13.1.3.1 China

- 5.13.1.4 Latin America

- 5.13.1.4.1 Brazil

- 5.13.1.4.1.1 Lei Geral de Protecao de Dados General Data Protection Law

- 5.13.1.4.1 Brazil

- 5.13.1.5 Middle East & Africa

- 5.13.1.5.1 South Africa

- 5.13.1.5.1.1 Protection of Personal Information (POPI) Act

- 5.13.1.5.2 Saudi Arabia

- 5.13.1.5.2.1 Private Cloud Computing Regulatory Framework

- 5.13.1.5.1 South Africa

- 5.13.1.1 NORTH AMERICA

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1 REGULATORY ANALYSIS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 END-USER ANALYSIS

- 5.16.1 UNMET NEEDS

- 5.16.2 END-USER EXPECTATIONS

- 5.17 BUSINESS MODELS

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 SOFTWARE

- 6.2.1 RISING NEED FOR BETTER DATA MANAGEMENT TO SUPPORT GROWTH

- 6.3 SERVICES

- 6.3.1 GROWING ADOPTION OF CLOUD-BASED LIMS AND RISING NEED FOR SOFTWARE UPGRADES AND MAINTENANCE TO DRIVE MARKET

- 6.4 SUPPORT

- 6.4.1 NEED FOR TECHNICAL ASSISTANCE, UPDATES, AND EDUCATION TO AID GROWTH

7 LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 BROAD-BASED LIMS

- 7.2.1 REDUCED TOTAL COST OF OWNERSHIP AND USER-FRIENDLINESS TO FAVOR GROWTH

- 7.3 INDUSTRY-SPECIFIC LIMS

- 7.3.1 NEED FOR IN-HOUSE CUSTOMIZED SOLUTIONS TO CONTRIBUTE TO GROWTH

8 LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT MODEL

- 8.1 INTRODUCTION

- 8.2 ON-PREMISE LIMS

- 8.2.1 INCREASING COMPLIANCE WITH INDUSTRY-SPECIFIC REGULATIONS TO SUSTAIN GROWTH

- 8.3 CLOUD-BASED LIMS

- 8.3.1 SOFTWARE-AS-A-SERVICE

- 8.3.1.1 Limited hardware cost and seamless upgrades to stimulate growth

- 8.3.2 INFRASTRUCTURE-AS-A-SERVICE

- 8.3.2.1 On-demand services and pay-as-you-go subscription model to expedite growth

- 8.3.3 PLATFORM-AS-A-SERVICE

- 8.3.3.1 Need for rapid application development to facilitate growth

- 8.3.1 SOFTWARE-AS-A-SERVICE

- 8.4 REMOTELY HOSTED LIMS

- 8.4.1 LOW COST OF OWNERSHIP AND HIGH RETURN ON INVESTMENT TO PROMOTE GROWTH

9 LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET, BY COMPANY SIZE

- 9.1 INTRODUCTION

- 9.2 LARGE COMPANIES

- 9.2.1 NEED FOR STANDARDIZED GLOBAL OPERATIONS AND ADVANCED ANALYTICS TO ACCELERATE GROWTH

- 9.3 MEDIUM-SIZED COMPANIES

- 9.3.1 NEED FOR IMPROVED OPERATIONAL EFFICIENCY AND REDUCED ERRORS TO STIMULATE GROWTH

- 9.4 SMALL COMPANIES

- 9.4.1 GROWING ADOPTION OF CLOUD-BASED LIMS TO FUEL MARKET

10 LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- 10.2 LIFE SCIENCES

- 10.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.2.1.1 Automated laboratory workflows and efficient operations to encourage growth

- 10.2.2 CONTRACT SERVICE ORGANIZATIONS

- 10.2.2.1 Increasing outsourcing of research activities to speed up growth

- 10.2.3 BIOBANKS & BIOREPOSITORIES

- 10.2.3.1 Demand for high-quality specimens to amplify growth

- 10.2.4 CLINICAL RESEARCH LABORATORIES

- 10.2.4.1 Growing use of LIMS in clinical research for improved quality and enhanced productivity to boost market

- 10.2.5 ACADEMIC RESEARCH INSTITUTES

- 10.2.5.1 Increasing advancements in cancer, genomics, and proteomics research to assist growth

- 10.2.6 NGS LABORATORIES

- 10.2.6.1 Need for managing and interpreting sequencing data to intensify growth

- 10.2.7 TOXICOLOGY LABORATORIES

- 10.2.7.1 Need to eliminate human errors and ensure easy information accessibility to spur growth

- 10.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.3 FOOD & BEVERAGE AND AGRICULTURE

- 10.3.1 GROWING FOCUS ON FOOD SAFETY, QUALITY, AND SUPPLY CHAIN TO FUEL MARKET

- 10.4 PETROCHEMICALS AND OIL & GAS

- 10.4.1 RISING FOCUS ON IMPROVED OPERATIONAL EFFICIENCY & REGULATORY COMPLIANCE TO BOLSTER GROWTH

- 10.5 CHEMICALS

- 10.5.1 NEED FOR CHEMICAL COMPANIES TO ABIDE BY STRINGENT REGULATORY GUIDELINES TO ADVANCE GROWTH

- 10.6 ENVIRONMENTAL TESTING

- 10.6.1 INCREASING REGULATORY REQUIREMENTS IN ENVIRONMENTAL AND WATER TESTING LABORATORIES TO AID GROWTH

- 10.7 FORENSICS

- 10.7.1 NEED TO HANDLE LARGE VOLUMES OF DATA TO ACCELERATE GROWTH

- 10.8 OTHER INDUSTRIES

11 LABORATORY INFORMATION MANAGEMENT SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT ON NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Booming environmental testing sector and food & beverage industry to favor growth

- 11.2.3 CANADA

- 11.2.3.1 Rising awareness of lab automation to accelerate growth

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT ON EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Presence of leading medical biotech countries to expedite growth

- 11.3.3 UK

- 11.3.3.1 Increased focus on life science research to encourage growth

- 11.3.4 FRANCE

- 11.3.4.1 Strong focus on adopting advanced technologies to spur growth

- 11.3.5 ITALY

- 11.3.5.1 Increasing focus on digital transformation and automation to bolster growth

- 11.3.6 SPAIN

- 11.3.6.1 Growing food & beverage production to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 RECESSION IMPACT ON ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Large geriatric population to facilitate growth

- 11.4.3 CHINA

- 11.4.3.1 Favorable healthcare reforms by government to amplify growth

- 11.4.4 INDIA

- 11.4.4.1 Booming pharmaceutical industry to augment growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 RECESSION IMPACT ON LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Increasing laboratory investments to support growth

- 11.5.3 MEXICO

- 11.5.3.1 Growing focus on modernizing healthcare facilities to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Increasing demand for advanced laboratory management solutions to spur growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Component footprint

- 12.7.5.4 Type footprint

- 12.7.5.5 Industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND UPGRADES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILE

- 13.1 KEY PLAYERS

- 13.1.1 LABWARE

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches and upgrades

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.3.4 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 LABVANTAGE SOLUTIONS, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches and upgrades

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 THERMO FISHER SCIENTIFIC INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches and upgrades

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.3.4 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 STARLIMS CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches and upgrades

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 AGILENT TECHNOLOGIES, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 LABLYNX, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches and upgrades

- 13.1.7 CLINISYS, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches and upgrades

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Expansions

- 13.1.8 AUTOSCRIBE INFORMATICS (XYBION CORPORATION)

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches and upgrades

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Expansions

- 13.1.8.3.4 Other developments

- 13.1.9 LABWORKS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches and upgrades

- 13.1.10 DASSAULT SYSTEMES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 CONFIENCE

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Other developments

- 13.1.12 CLOUDLIMS

- 13.1.12.1 Business overview

- 13.1.12.2 Products/solutions/services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches and upgrades

- 13.1.12.3.2 Deals

- 13.1.13 BIODATA INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches and upgrades

- 13.1.13.3.2 Deals

- 13.1.14 SIEMENS

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.15 NOVATEK INTERNATIONAL

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Other developments

- 13.1.16 OVATION

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches and upgrades

- 13.1.16.3.2 Deals

- 13.1.17 ILLUMINA, INC.

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Product launches and upgrades

- 13.1.17.3.2 Deals

- 13.1.18 EUSOFT LTD.

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Product launches and upgrades

- 13.1.18.3.2 Deals

- 13.1.19 CALIBER TECHNOLOGIES

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.20 LABTRACK

- 13.1.20.1 Business overview

- 13.1.20.2 Products/Solutions/Services offered

- 13.1.1 LABWARE

- 13.2 OTHER PLAYERS

- 13.2.1 AGILAB

- 13.2.2 AGARAM TECHNOLOGIES

- 13.2.3 ASSAYNET INC.

- 13.2.4 BLAZE SYSTEMS CORPORATION

- 13.2.5 THIRD WAVE ANALYTICS, INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS