|

|

市場調査レポート

商品コード

1591568

非臨床情報システム市場- 世界の産業規模、シェア、動向、機会、予測、セグメント別、用途別、コンポーネント別、展開別、地域別、競合、2019年~2029年Non-Clinical Information System Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented, By Applications, By Components, and By Deployment, By Region, By Competition, 2019-2029F |

||||||

カスタマイズ可能

|

|||||||

| 非臨床情報システム市場- 世界の産業規模、シェア、動向、機会、予測、セグメント別、用途別、コンポーネント別、展開別、地域別、競合、2019年~2029年 |

|

出版日: 2024年11月15日

発行: TechSci Research

ページ情報: 英文 182 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

非臨床情報システムの世界市場規模は2023年に405億6,000万米ドルで、予測期間中のCAGRは12.45%で2029年には827億5,000万米ドルに達すると予測されています。

非臨床情報システム(NCIS)市場とは、ヘルスケア情報技術(IT)分野の一分野であり、ヘルスケア環境における非臨床データおよび業務の管理、処理、保存を目的としたソフトウェアおよび技術ソリューションに焦点を当てています。これらのシステムは、財務管理、人事、サプライチェーン管理、患者スケジューリング、請求、保険請求処理、その他ヘルスケア業務の非医療的側面を含む、幅広い管理・運営機能をサポートします。患者の健康記録、診断、治療計画を扱う臨床情報システムとは異なり、非臨床システムは、ヘルスケア組織が効率的に、規制要件に準拠して運営できるようにするインフラに重点を置いています。この市場には、企業資源計画(ERP)、病院情報システム(HIS)、顧客関係管理(CRM)プラットフォームなど、医療提供者、支払者、供給者に合わせたさまざまなソリューションが含まれます。医療業界では、業務効率化、コスト削減、法規制遵守が重視されるようになっており、NCISソリューションの需要が高まっています。病院、診療所、長期介護施設、保険業者は、大量のデータを管理し、非臨床部門全体のワークフローを合理化するために、これらのシステムを必要としています。この市場をさらに支えているのは、クラウドコンピューティング、人工知能、データ分析などの技術的進歩であり、これらは非臨床システムの機能を強化し、より効果的な意思決定、資源配分、患者管理を可能にしています。さらに、ヘルスケア組織が管理コストの上昇と業務効率の改善というプレッシャーに直面する中、NCISソリューションはルーチン作業の自動化、ヒューマンエラーの削減、各部門の生産性向上に不可欠なものとなっています。さらに、非臨床情報システムと臨床システムとの統合が優先事項となりつつあり、質の高い患者中心の医療を提供するために不可欠な、臨床と管理部門間のより良い連携が可能となっています。NCIS市場の成長は、ヘルスケア部門におけるデジタルトランスフォーメーション・イニシアチブの採用増加や、患者の転帰改善と医療費削減を重視するバリューベースのケアモデルの台頭も後押ししています。非臨床システムは、財務トランザクションの管理、リソース利用の最適化、全体的なオペレーションの透明性の向上において重要な役割を果たしています。

| 市場概要 | |

|---|---|

| 予測期間 | 2025-2029 |

| 市場規模:2023年 | 405億6,000万米ドル |

| 市場規模:2029年 | 827億5,000万米ドル |

| CAGR:2024年~2029年 | 12.45% |

| 急成長セグメント | ラボラトリーズ |

| 最大市場 | 北米 |

市場促進要因

ヘルスケアのデジタル化とデータ管理ニーズの高まり

業務効率化とコスト削減の重視

規制遵守と報告要件

主な市場課題

統合と相互運用性の課題

データセキュリティとプライバシーへの懸念

主な市場動向

クラウドの採用と拡張性

データ・セキュリティとコンプライアンス

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の非臨床情報システム市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 用途別(病院、診療所、研究所、外来診療ソリューション)

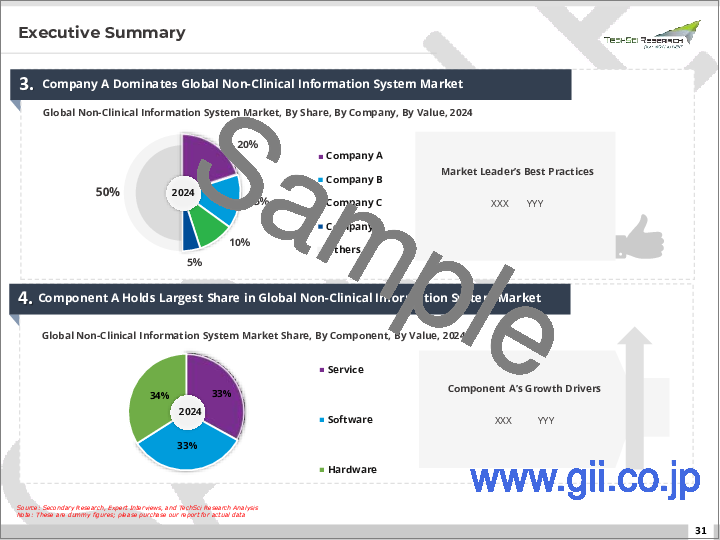

- コンポーネント別(サービス、ソフトウェア、ハードウェア)

- 展開別(Webベース、クラウドベース、オンプレミス)

- 地域別

- 企業別(2023)

- 市場マップ

第6章 北米の非臨床情報システム市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 用途別

- コンポーネント別

- 展開別

- 国別

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 欧州の非臨床情報システム市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 用途別

- コンポーネント別

- 展開別

- 国別

- 欧州:国別分析

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

第8章 アジア太平洋地域の非臨床情報システム市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 用途別

- コンポーネント別

- 展開別

- 国別

- アジア太平洋地域:国別分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

第9章 南米の非臨床情報システム市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 用途別

- コンポーネント別

- 展開別

- 国別

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第10章 中東・アフリカの非臨床情報システム市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 用途別

- コンポーネント別

- 展開別

- 国別

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

- トルコ

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

第13章 企業プロファイル

- Veradigm LLC

- SSI Group, LLC

- Quest Diagnostics

- CareCloud, Inc.

- McKesson Corporation

- Oracle Corporation

- Tebra Technologies, Inc.

- athenahealth, Inc.

- eClinicalWorks, LLC

第14章 戦略的提言

第15章 調査会社について・免責事項

Global Non-Clinical Information System Market was valued at USD 40.56 billion in 2023 and is expected to reach USD 82.75 billion by 2029 with a CAGR of 12.45% during the forecast period. The Non-Clinical Information System (NCIS) market refers to a segment of the healthcare information technology (IT) sector focused on software and technology solutions designed to manage, process, and store non-clinical data and operations within healthcare settings. These systems support a wide range of administrative and operational functions, including financial management, human resources, supply chain management, patient scheduling, billing, insurance claims processing, and other non-medical aspects of healthcare operations. Unlike clinical information systems, which deal with patient health records, diagnostics, and treatment plans, non-clinical systems focus on the infrastructure that enables healthcare organizations to operate efficiently and in compliance with regulatory requirements. The market encompasses a variety of solutions such as Enterprise Resource Planning (ERP), Hospital Information Systems (HIS), and Customer Relationship Management (CRM) platforms, all tailored to healthcare providers, payers, and suppliers. The increasing emphasis on operational efficiency, cost reduction, and regulatory compliance within the healthcare industry drives the demand for NCIS solutions. Hospitals, clinics, long-term care facilities, and insurance providers require these systems to manage large volumes of data and streamline workflows across their non-clinical departments. The market is further supported by technological advancements such as cloud computing, artificial intelligence, and data analytics, which enhance the capabilities of non-clinical systems, allowing for more effective decision-making, resource allocation, and patient management. Additionally, as healthcare organizations face rising administrative costs and the pressure to improve operational efficiency, NCIS solutions have become essential in automating routine tasks, reducing human error, and improving productivity across various departments. Furthermore, the integration of non-clinical information systems with clinical systems is becoming a priority, enabling better coordination between clinical and administrative functions, which is critical for delivering high-quality, patient-centered care. The growth of the NCIS market is also driven by the increasing adoption of digital transformation initiatives within the healthcare sector, as well as the rise of value-based care models, which emphasize improved patient outcomes and reduced healthcare costs. Non-clinical systems play a crucial role in managing financial transactions, optimizing resource utilization, and enhancing overall operational transparency.

| Market Overview | |

|---|---|

| Forecast Period | 2025-2029 |

| Market Size 2023 | USD 40.56 Billion |

| Market Size 2029 | USD 82.75 Billion |

| CAGR 2024-2029 | 12.45% |

| Fastest Growing Segment | Laboratories |

| Largest Market | North America |

Key Market Drivers

Increasing Healthcare Digitalization and Data Management Needs

The ongoing digital transformation within the healthcare industry is a significant driver for the growth of the Non-Clinical Information System market. As healthcare organizations continue to adopt electronic health records (EHRs), digital billing systems, and other software solutions, there is a growing need to manage large volumes of non-clinical data efficiently. Non-clinical information systems, including administrative, financial, and operational management tools, help streamline processes such as patient scheduling, billing, supply chain management, and human resources. These systems enable healthcare providers to store, access, and analyze patient information, medical inventories, and administrative tasks in a secure and efficient manner. With the push toward interoperability in healthcare, data integration between clinical and non-clinical systems has become a priority to ensure smooth information flow across various departments. Non-clinical information systems play a critical role in improving the accuracy and speed of data exchange, reducing operational costs, and improving overall patient care delivery. The need for better data management is further fueled by regulatory requirements such as HIPAA, which mandate secure handling and storage of patient data. Additionally, the advent of cloud computing has made it easier for healthcare organizations of all sizes to adopt scalable non-clinical systems that can handle increasing volumes of data while reducing IT infrastructure costs. As more healthcare organizations transition to fully integrated digital systems, the demand for robust, scalable, and secure NCIS solutions will continue to rise.

Focus on Operational Efficiency and Cost Reduction

Cost control and operational efficiency are central objectives for healthcare organizations, driving the adoption of non-clinical information systems. With rising healthcare costs and the need to allocate resources effectively, hospitals and other healthcare providers are leveraging NCIS to improve various administrative functions, from payroll processing to inventory management. Non-clinical systems, such as enterprise resource planning (ERP) and human resource management systems (HRMS), help streamline operations by automating routine administrative tasks, reducing the need for manual intervention, and minimizing the chances of errors. Automation of functions such as billing, payment processing, and supply chain management allows healthcare organizations to minimize operational bottlenecks, optimize workflows, and reduce costs. Moreover, the integration of non-clinical systems with other technology solutions, such as analytics platforms, enables healthcare providers to gain valuable insights into performance metrics, resource utilization, and financial trends, empowering them to make data-driven decisions that enhance operational efficiency. These improvements in productivity not only result in direct cost savings but also enhance patient satisfaction by reducing wait times and administrative delays. Furthermore, the rise of value-based care models, which emphasize patient outcomes over the volume of services provided, necessitates better tracking of operational costs and resource usage, making non-clinical information systems an essential tool for healthcare providers. In an increasingly competitive healthcare environment, organizations are looking to leverage non-clinical systems to remain financially viable while delivering high-quality care.

Regulatory Compliance and Reporting Requirements

The growing emphasis on regulatory compliance in the healthcare sector is a significant driver for the expansion of the Non-Clinical Information System market. Healthcare organizations are required to comply with an array of complex regulations, such as HIPAA (Health Insurance Portability and Accountability Act), GDPR (General Data Protection Regulation), and financial reporting standards, which necessitate secure and accurate record-keeping and reporting. Non-clinical systems support these requirements by providing robust data tracking, auditing, and reporting capabilities. These systems help healthcare organizations maintain compliance by automating the process of generating regulatory reports, ensuring that data is stored securely, and offering transparency for auditing purposes. Non-clinical systems also facilitate real-time monitoring of compliance-related activities, enabling organizations to identify potential risks and take corrective action before violations occur. As healthcare regulations become more stringent, the ability to efficiently manage and report non-clinical data is crucial for avoiding legal issues and financial penalties. Additionally, with the growing trend of digital health technologies and cross-border patient data exchanges, compliance with international standards and laws has become even more complex. Non-clinical information systems provide the necessary infrastructure to ensure that healthcare organizations can meet these increasingly stringent regulatory demands, supporting both operational efficiency and legal compliance. As healthcare organizations continue to face pressure from regulators and stakeholders to uphold data security and privacy standards, the demand for comprehensive non-clinical information systems will continue to grow.

Key Market Challenges

Integration and Interoperability Challenges

One of the primary challenges facing the Non-Clinical Information Systems market is the complexity of integration and interoperability across diverse healthcare systems. As healthcare organizations increasingly adopt digital solutions to streamline operations, the need for seamless integration between non-clinical information systems (such as administrative, billing, supply chain management, and HR systems) and clinical systems (such as Electronic Health Records (EHR) and laboratory management systems) becomes more critical. However, achieving interoperability remains a significant hurdle due to the variety of legacy systems, differing software platforms, and proprietary technologies used across healthcare providers, payers, and vendors. Many non-clinical information systems are designed in silos, making data sharing and real-time updates difficult. This fragmentation creates inefficiencies, increases the risk of data inconsistencies, and complicates decision-making processes, potentially leading to errors, delays, and added costs. For example, mismatched data between clinical and non-clinical systems may affect billing processes or create discrepancies in patient records. Furthermore, healthcare organizations face the challenge of complying with strict regulatory standards such as HIPAA (Health Insurance Portability and Accountability Act), which adds an additional layer of complexity when integrating systems while maintaining data privacy and security. The integration process is also often resource-intensive, requiring skilled personnel, time, and substantial financial investment. Smaller healthcare facilities may struggle to afford these integration costs, resulting in suboptimal utilization of non-clinical information systems. Additionally, advancements in cloud computing and data-sharing protocols such as APIs (Application Programming Interfaces) can help, but the adoption rate is often slow, further delaying the potential benefits of integrated systems. Overcoming these integration challenges requires ongoing efforts to standardize protocols, develop flexible and scalable integration frameworks, and ensure all stakeholders are aligned on interoperability goals.

Data Security and Privacy Concerns

Another significant challenge in the Non-Clinical Information System market is ensuring robust data security and privacy protection. As healthcare organizations increasingly rely on digital systems for administrative, financial, and operational functions, the volume of sensitive data stored and processed within non-clinical information systems has surged. These systems often handle personal, financial, and insurance information, making them prime targets for cyberattacks, data breaches, and identity theft. As regulations like HIPAA continue to evolve, healthcare providers and technology vendors must ensure that non-clinical systems meet stringent security standards to protect both patient data and organizational integrity. The challenge lies in implementing comprehensive security measures across diverse systems, as each non-clinical application may have different levels of security features, access controls, and encryption methods. Many healthcare organizations still rely on legacy systems that may not have been designed with modern cybersecurity threats in mind, creating vulnerabilities that hackers can exploit. Furthermore, the increasing use of cloud-based platforms for data storage and management, while offering scalability and flexibility, introduces new risks, particularly if cloud services are not adequately secured. The decentralization of data across multiple cloud environments and third-party vendors raises concerns over data ownership, access control, and potential security loopholes. Additionally, with the growing trend toward remote work and digital collaboration tools, healthcare staff accessing sensitive data outside traditional office settings creates additional entry points for cyber threats. Non-clinical information systems also face the challenge of managing third-party vendors and partners who may have access to confidential data, raising concerns about data leakage or improper handling. To mitigate these risks, healthcare organizations need to implement end-to-end encryption, multi-factor authentication, regular system audits, and comprehensive employee training programs. However, balancing stringent security measures with operational efficiency and user accessibility remains a delicate challenge. As cyber threats continue to evolve, non-clinical information system providers must remain agile and proactive in their approach to cybersecurity, ensuring that both patient and organizational data are safeguarded against emerging risks.

Key Market Trends

Cloud Adoption and Scalability

The increasing shift towards cloud-based solutions is a prominent trend in the non-clinical information systems market. Cloud computing enables healthcare and other industries to scale their IT infrastructures with ease, providing access to a wide range of services without the need for costly on-premise hardware. This scalability and flexibility make cloud solutions an attractive option for businesses looking to optimize operations while maintaining cost-efficiency. Cloud-based NCIS platforms allow for seamless updates, real-time collaboration, and enhanced data sharing across departments and even with external partners. In healthcare, this translates to improved management of administrative tasks such as billing, scheduling, and HR operations, with systems capable of adapting to the dynamic needs of the organization. Additionally, the cloud facilitates better integration between non-clinical and clinical data systems, enabling organizations to optimize workflows across the entire healthcare continuum. The ability to leverage cloud technology also supports disaster recovery, as critical data can be backed up securely and accessed remotely, ensuring business continuity. Security remains a key concern with cloud adoption, prompting a rise in solutions offering enhanced encryption, compliance with regulations such as HIPAA, and multi-factor authentication. Despite these concerns, cloud-based solutions are becoming increasingly popular due to their cost-effectiveness, scalability, and ease of integration with other digital tools. The shift to the cloud is particularly noticeable among small to medium-sized organizations, which benefit from the affordability and reduced complexity of cloud services compared to traditional on-premises solutions. As more businesses realize the advantages of cloud solutions, the non-clinical information systems market is expected to see accelerated growth, driven by the demand for more agile, cost-effective, and scalable technology platforms.

Data Security and Compliance Focus

In an era of increasing cyber threats and regulatory scrutiny, data security and compliance have become critical priorities in the non-clinical information systems market. With sensitive business data being exchanged across various platforms, including financial records, HR data, and administrative functions, ensuring the protection of this information is paramount. Non-clinical information systems are increasingly incorporating sophisticated security measures, such as end-to-end encryption, multi-factor authentication, and advanced threat detection systems, to safeguard data from unauthorized access and potential breaches. As a result, organizations are turning to systems that provide robust security features, ensuring compliance with global standards and regulations such as GDPR, HIPAA, and other data protection laws. For example, in healthcare, NCIS platforms managing billing and claims must comply with stringent regulations regarding patient data protection and privacy. The growing regulatory landscape is compelling organizations to adopt more comprehensive data governance strategies, driving demand for NCIS solutions that offer built-in compliance tools and reporting capabilities. Furthermore, the rise in remote work and digital collaboration is intensifying the need for secure access controls and real-time monitoring of user activity. As cyberattacks become more sophisticated, data protection is no longer an afterthought but a central component of non-clinical information system design. The market is thus witnessing increased investment in cybersecurity features that ensure both data integrity and regulatory compliance. This trend is expected to continue, with organizations demanding more advanced NCIS platforms capable of maintaining security standards while supporting seamless data exchange across various systems and stakeholders. As such, data security and compliance remain a primary focus, driving the evolution of non-clinical information systems to be more secure and regulatory-compliant than ever before.

Segmental Insights

Applications Insights

The Ambulatory Care Solutions segment held the largest Market share in 2023. The non-clinical information system market, particularly within the Ambulatory Care Solutions segment, is experiencing robust growth due to several key drivers shaping the healthcare industry. One of the primary drivers is the increasing demand for efficient management of administrative and operational functions in ambulatory care settings. These systems help streamline patient scheduling, billing, and insurance verification processes, significantly improving operational efficiency and reducing administrative burdens. As the healthcare sector moves towards value-based care, there is a growing need for systems that enhance patient management, enable data interoperability, and support the transition from traditional fee-for-service models to outcome-focused models. Non-clinical information systems also enable improved patient experience by providing easier access to appointment schedules, billing information, and communication with care teams, thus promoting patient engagement and satisfaction. Furthermore, the shift toward ambulatory care is accelerating as healthcare providers increasingly adopt outpatient services to reduce costs and improve accessibility. This trend is driving the demand for specialized software solutions that support the unique needs of ambulatory care facilities, including multi-location clinics, outpatient surgical centers, and rehabilitation centers. Another key factor propelling growth in this segment is the adoption of electronic health records (EHR) and health information exchanges (HIE), which require integrated non-clinical information systems to manage the vast amounts of patient data generated outside the hospital setting.

These systems play a crucial role in ensuring compliance with regulatory requirements such as HIPAA, helping healthcare providers maintain data security and privacy while ensuring seamless data flow across various departments and third-party entities. Technological advancements in cloud computing and data analytics are also contributing to the market's expansion. Cloud-based non-clinical information systems provide ambulatory care centers with scalable, cost-effective solutions that can be accessed from anywhere, facilitating real-time updates and remote management of patient information. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into these systems is enabling smarter decision-making and predictive analytics, further enhancing operational efficiency. The growing emphasis on improving healthcare quality, optimizing resource allocation, and reducing costs is another driver for the adoption of non-clinical information systems in ambulatory care. These systems enable healthcare providers to manage financial operations, track performance metrics, and ensure regulatory compliance, all of which contribute to cost reductions and improved care delivery. As healthcare reforms, such as the Affordable Care Act (ACA) in the U.S., continue to push for improved healthcare delivery, the demand for robust, integrated solutions to manage non-clinical operations is expected to remain strong. Additionally, the COVID-19 pandemic has accelerated the shift toward remote and virtual care, which has led to a surge in demand for digital tools that enable telemedicine, remote patient monitoring, and virtual consultations. As a result, ambulatory care solutions are increasingly leveraging non-clinical information systems to manage these new care models effectively. Overall, the non-clinical information system market in the Ambulatory Care Solutions segment is poised for sustained growth, driven by the need for operational efficiency, regulatory compliance, and enhanced patient care in a rapidly evolving healthcare landscape.

Regional Insights

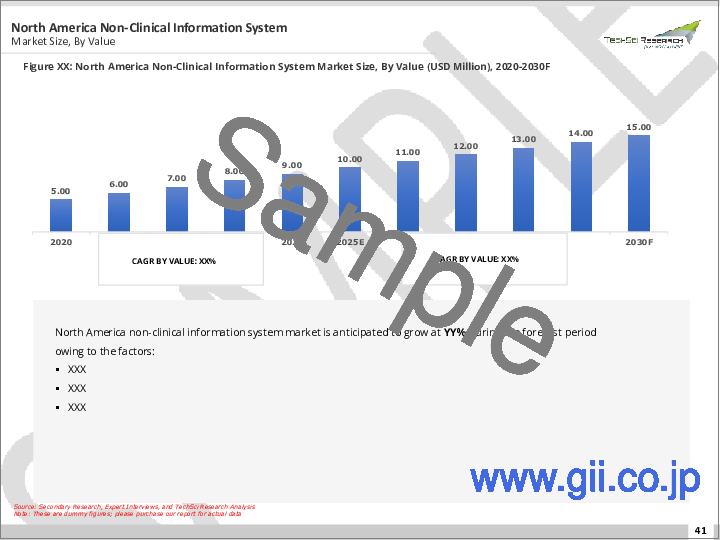

North America region held the largest market share in 2023. The Non-Clinical Information System (NCIS) market in North America is experiencing significant growth, driven by the increasing demand for efficient management of healthcare operations, rising operational costs, and a growing emphasis on improving patient care quality. As healthcare organizations focus on enhancing administrative workflows and reducing costs, NCIS solutions offer a critical advantage by automating tasks such as billing, scheduling, inventory management, and human resources. The region's healthcare industry is also undergoing a digital transformation, with many organizations adopting cloud-based solutions for their scalability, flexibility, and cost-effectiveness. This shift is further supported by the adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and data analytics, which are integrated into NCIS to streamline operations and provide actionable insights for decision-making. Additionally, the growing need for data-driven solutions and improved reporting capabilities to meet regulatory requirements, particularly in light of evolving healthcare regulations like the Health Insurance Portability and Accountability Act (HIPAA), is fueling the demand for NCIS. The ongoing efforts to improve healthcare interoperability across systems are also acting as a driver, as NCIS solutions allow for better data exchange and integration across various clinical and non-clinical systems, leading to more seamless operations.

North America's aging population is increasing healthcare service demand, which is driving hospitals, healthcare providers, and clinics to adopt NCIS solutions to better manage patient services, optimize resource allocation, and reduce administrative burdens. The push for enhanced patient satisfaction and quality of care is another factor driving the market, as NCIS solutions can optimize workflows and support healthcare providers in delivering more efficient and timely services. Moreover, the North American government's initiatives to promote healthcare digitalization, such as incentives for electronic health record (EHR) adoption, are spurring the growth of NCIS solutions across the region. The robust healthcare infrastructure and increasing investment in health IT solutions also create a favorable environment for the expansion of the NCIS market. With healthcare systems and providers striving to stay competitive in an increasingly complex healthcare landscape, there is a clear trend toward adopting integrated, non-clinical information systems to enhance operational efficiency, reduce administrative overhead, and ultimately improve patient outcomes. The convergence of these factors, along with a strong push toward value-based care models, is creating a significant demand for non-clinical information systems that address not only operational needs but also the overarching goals of healthcare organizations to optimize patient care delivery and resource management. As the healthcare sector continues to evolve, the non-clinical information system market in North America is expected to expand, driven by these transformative shifts and technological advancements aimed at improving the overall healthcare ecosystem.

Key Market Players

- Veradigm LLC

- SSI Group, LLC

- Quest Diagnostics

- CareCloud, Inc.

- McKesson Corporation

- Oracle Corporation

- Tebra Technologies, Inc.

- athenahealth, Inc.

- eClinicalWorks, LLC

Report Scope:

In this report, the Global Non-Clinical Information System Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Non-Clinical Information System Market, By Applications:

- Hospitals

- Clinics

- Laboratories

- Ambulatory Care Solutions

Non-Clinical Information System Market, By Components:

- Service

- Software

- Hardware

Non-Clinical Information System Market, By Deployment:

- Web-based

- Cloud-based

- On-premises

Non-Clinical Information System Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Non-Clinical Information System Market.

Available Customizations:

Global Non-Clinical Information System Market report with the given Market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional Market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Formulation of the Scope

- 2.4. Assumptions and Limitations

- 2.5. Sources of Research

- 2.5.1. Secondary Research

- 2.5.2. Primary Research

- 2.6. Approach for the Market Study

- 2.6.1. The Bottom-Up Approach

- 2.6.2. The Top-Down Approach

- 2.7. Methodology Followed for Calculation of Market Size & Market Shares

- 2.8. Forecasting Methodology

- 2.8.1. Data Triangulation & Validation

3. Executive Summary

4. Voice of Customer

5. Global Non-Clinical Information System Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Applications (Hospitals, Clinics, Laboratories and Ambulatory Care Solutions)

- 5.2.2. By Components (Service, Software, Hardware)

- 5.2.3. By Deployment (Web-based, Cloud-based, On-premises)

- 5.2.4. By Region

- 5.3. By Company (2023)

- 5.4. Market Map

6. North America Non-Clinical Information System Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Applications

- 6.2.2. By Components

- 6.2.3. By Deployment

- 6.2.4. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Non-Clinical Information System Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Applications

- 6.3.1.2.2. By Components

- 6.3.1.2.3. By Deployment

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Non-Clinical Information System Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Applications

- 6.3.2.2.2. By Components

- 6.3.2.2.3. By Deployment

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Non-Clinical Information System Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Applications

- 6.3.3.2.2. By Components

- 6.3.3.2.3. By Deployment

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Non-Clinical Information System Market Outlook

7. Europe Non-Clinical Information System Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Applications

- 7.2.2. By Components

- 7.2.3. By Deployment

- 7.2.4. By Country

- 7.3. Europe: Country Analysis

- 7.3.1. Germany Non-Clinical Information System Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Applications

- 7.3.1.2.2. By Components

- 7.3.1.2.3. By Deployment

- 7.3.1.1. Market Size & Forecast

- 7.3.2. United Kingdom Non-Clinical Information System Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Applications

- 7.3.2.2.2. By Components

- 7.3.2.2.3. By Deployment

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Italy Non-Clinical Information System Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Applications

- 7.3.3.2.2. By Components

- 7.3.3.2.3. By Deployment

- 7.3.3.1. Market Size & Forecast

- 7.3.4. France Non-Clinical Information System Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Applications

- 7.3.4.2.2. By Components

- 7.3.4.2.3. By Deployment

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Spain Non-Clinical Information System Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Applications

- 7.3.5.2.2. By Components

- 7.3.5.2.3. By Deployment

- 7.3.5.1. Market Size & Forecast

- 7.3.1. Germany Non-Clinical Information System Market Outlook

8. Asia-Pacific Non-Clinical Information System Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Applications

- 8.2.2. By Components

- 8.2.3. By Deployment

- 8.2.4. By Country

- 8.3. Asia-Pacific: Country Analysis

- 8.3.1. China Non-Clinical Information System Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Applications

- 8.3.1.2.2. By Components

- 8.3.1.2.3. By Deployment

- 8.3.1.1. Market Size & Forecast

- 8.3.2. India Non-Clinical Information System Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Applications

- 8.3.2.2.2. By Components

- 8.3.2.2.3. By Deployment

- 8.3.2.1. Market Size & Forecast

- 8.3.3. Japan Non-Clinical Information System Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Applications

- 8.3.3.2.2. By Components

- 8.3.3.2.3. By Deployment

- 8.3.3.1. Market Size & Forecast

- 8.3.4. South Korea Non-Clinical Information System Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Applications

- 8.3.4.2.2. By Components

- 8.3.4.2.3. By Deployment

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Australia Non-Clinical Information System Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Applications

- 8.3.5.2.2. By Components

- 8.3.5.2.3. By Deployment

- 8.3.5.1. Market Size & Forecast

- 8.3.1. China Non-Clinical Information System Market Outlook

9. South America Non-Clinical Information System Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Applications

- 9.2.2. By Components

- 9.2.3. By Deployment

- 9.2.4. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Non-Clinical Information System Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Applications

- 9.3.1.2.2. By Components

- 9.3.1.2.3. By Deployment

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Non-Clinical Information System Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Applications

- 9.3.2.2.2. By Components

- 9.3.2.2.3. By Deployment

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Colombia Non-Clinical Information System Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Applications

- 9.3.3.2.2. By Components

- 9.3.3.2.3. By Deployment

- 9.3.3.1. Market Size & Forecast

- 9.3.1. Brazil Non-Clinical Information System Market Outlook

10. Middle East and Africa Non-Clinical Information System Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Applications

- 10.2.2. By Components

- 10.2.3. By Deployment

- 10.2.4. By Country

- 10.3. Middle East and Africa: Country Analysis

- 10.3.1. South Africa Non-Clinical Information System Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Applications

- 10.3.1.2.2. By Components

- 10.3.1.2.3. By Deployment

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Saudi Arabia Non-Clinical Information System Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Applications

- 10.3.2.2.2. By Components

- 10.3.2.2.3. By Deployment

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE Non-Clinical Information System Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Applications

- 10.3.3.2.2. By Components

- 10.3.3.2.3. By Deployment

- 10.3.3.1. Market Size & Forecast

- 10.3.4. Kuwait Non-Clinical Information System Market Outlook

- 10.3.4.1. Market Size & Forecast

- 10.3.4.1.1. By Value

- 10.3.4.2. Market Share & Forecast

- 10.3.4.2.1. By Applications

- 10.3.4.2.2. By Components

- 10.3.4.2.3. By Deployment

- 10.3.4.1. Market Size & Forecast

- 10.3.5. Turkey Non-Clinical Information System Market Outlook

- 10.3.5.1. Market Size & Forecast

- 10.3.5.1.1. By Value

- 10.3.5.2. Market Share & Forecast

- 10.3.5.2.1. By Applications

- 10.3.5.2.2. By Components

- 10.3.5.2.3. By Deployment

- 10.3.5.1. Market Size & Forecast

- 10.3.1. South Africa Non-Clinical Information System Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Market Trends & Developments

13. Company Profiles

- 13.1. Veradigm LLC

- 13.1.1. Business Overview

- 13.1.2. Key Revenue and Financials

- 13.1.3. Recent Developments

- 13.1.4. Key Personnel/Key Contact Person

- 13.1.5. Key Product/Services Offered

- 13.2. SSI Group, LLC

- 13.2.1. Business Overview

- 13.2.2. Key Revenue and Financials

- 13.2.3. Recent Developments

- 13.2.4. Key Personnel/Key Contact Person

- 13.2.5. Key Product/Services Offered

- 13.3. Quest Diagnostics

- 13.3.1. Business Overview

- 13.3.2. Key Revenue and Financials

- 13.3.3. Recent Developments

- 13.3.4. Key Personnel/Key Contact Person

- 13.3.5. Key Product/Services Offered

- 13.4. CareCloud, Inc.

- 13.4.1. Business Overview

- 13.4.2. Key Revenue and Financials

- 13.4.3. Recent Developments

- 13.4.4. Key Personnel/Key Contact Person

- 13.4.5. Key Product/Services Offered

- 13.5. McKesson Corporation

- 13.5.1. Business Overview

- 13.5.2. Key Revenue and Financials

- 13.5.3. Recent Developments

- 13.5.4. Key Personnel/Key Contact Person

- 13.5.5. Key Product/Services Offered

- 13.6. Oracle Corporation

- 13.6.1. Business Overview

- 13.6.2. Key Revenue and Financials

- 13.6.3. Recent Developments

- 13.6.4. Key Personnel/Key Contact Person

- 13.6.5. Key Product/Services Offered

- 13.7. Tebra Technologies, Inc.

- 13.7.1. Business Overview

- 13.7.2. Key Revenue and Financials

- 13.7.3. Recent Developments

- 13.7.4. Key Personnel/Key Contact Person

- 13.7.5. Key Product/Services Offered

- 13.8. athenahealth, Inc.

- 13.8.1. Business Overview

- 13.8.2. Key Revenue and Financials

- 13.8.3. Recent Developments

- 13.8.4. Key Personnel/Key Contact Person

- 13.8.5. Key Product/Services Offered

- 13.9. eClinicalWorks, LLC

- 13.9.1. Business Overview

- 13.9.2. Key Revenue and Financials

- 13.9.3. Recent Developments

- 13.9.4. Key Personnel/Key Contact Person

- 13.9.5. Key Product/Services Offered