|

|

市場調査レポート

商品コード

1562743

プロジェクトポートフォリオ管理 (PPM) の世界市場:用途 (プロジェクト計画&管理・戦略的ポートフォリオ管理・予算&財務管理・リソース&キャパシティ最適化・レポーティング&アナリティクス) 別 - 予測(~2029年)Project Portfolio Management (PPM) Market by Application (Project Planning & Management, Strategic Portfolio Management, Budget & Financial Management, Resource & Capacity Optimization, Reporting & Analytics) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| プロジェクトポートフォリオ管理 (PPM) の世界市場:用途 (プロジェクト計画&管理・戦略的ポートフォリオ管理・予算&財務管理・リソース&キャパシティ最適化・レポーティング&アナリティクス) 別 - 予測(~2029年) |

|

出版日: 2024年09月23日

発行: MarketsandMarkets

ページ情報: 英文 341 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

プロジェクトポートフォリオ管理 (PPM) の市場規模は、2024年の78億米ドルから、予測期間中は11.9%のCAGRで推移し、2029年には137億米ドルの規模に成長すると予測されています。

PPMプラットフォームへのAIと機械学習の統合が進むことで、プロセスの円滑化における大幅な効率化が実現します。AI主導のツールは、プロジェクトの優先順位付け、リソース配分、実績追跡を自動化し、PPMに必要な時間と労力を削減します。機械学習アルゴリズムは、プロジェクトの洞察における精度と関連性を微調整することで、十分な情報に基づいた意思決定を行い、プロジェクトの成果を最適化するためのデータを組織に提供します。また、このアルゴリズムは、より効率的な方法でプロジェクト運営を自動化し、戦略的目標に合致させ、より質の高い結果を生み出し、ポートフォリオ全体の成功を確実なものにします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | 提供区分・用途・ビジネス機能・展開モード・組織規模・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

”提供区分別では、サービス部門が予測期間中にもっとも高いCAGRで成長します”

プロフェッショナルサービス、マネージドサービスを含むサービス部門は、PPMソリューションを効率的かつ効果的なものにするのに役立っています。プロフェッショナルサービスには、コンサルティングやアドバイザリー、導入、トレーニング、サポートが含まれ、適切なPPMツールの選択、展開、最適化を促進します。このようなサービスは、ベストプラクティスに関する専門家のアドバイスを提供し、新しいシステムへのシームレスな移行を保証します。一方で、マネージドサービスは、アップデート、モニタリング、問題解決など、PPMシステムの導入後の継続的な管理とメンテナンスに関するサービスを提供します。マネージドサービスを通じて、組織はPPMシステムの管理をアウトソーシングし、安定したパフォーマンスを得ることができます。カスタマイズされた効率的なPPMソリューションへの需要が高まっていることから、予測期間中はサービス部門が最大のCAGRを示すと予測されています。

”組織規模別では、小規模企業が予測期間中にもっとも高いCAGRで成長する見通しです”

従業員250人未満の小規模企業は、一般的に、手頃な価格で拡張性があり、導入が容易なPPMソリューションを求めています。こうした企業は、複雑なITサポートやセットアップを必要とせず、プロジェクト追跡、リソース割り当て、タスク管理を容易にするツールを使用しています。クラウドベースまたはモジュール式のPPMソリューションは、その柔軟性、費用対効果、迅速な展開能力により、頻繁に選ばれています。中小企業はPPMを利用してプロジェクトの可視性を高め、コラボレーションを強化し、限られたリソースを効率的に管理するビジネス目標に沿うように努めています。さらに、PPMソリューションは、戦略的プランニングと意思決定に不可欠な情報を提供し、小規模な組織がプロジェクトの成果を高め、成長を促すことを可能にします。たとえ小規模であっても、組織化されたプロジェクト管理から得られるものは大きく、リソースを効果的に活用し、事業拡大に伴う成長を容易にします。

当レポートでは、世界のプロジェクトポートフォリオ管理 (PPM) の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- エコシステム分析

- サプライチェーン分析

- 技術分析

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 規制状況

- 顧客のビジネスに影響を与える動向とディスラプション

- 主なステークホルダーと購入基準

- ビジネスモデル分析

- 主な会議とイベント

- 投資と資金調達のシナリオ

- AI/生成AIがプロジェクトポートフォリオ管理市場に与える影響

第6章 プロジェクトポートフォリオ管理 (PPM) 市場:提供区分別

- ソリューション

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 プロジェクトポートフォリオ管理 (PPM) 市場:用途別

- プロジェクト計画・管理

- プロジェクトスケジュール

- タスク管理

- プロジェクトリスク管理

- プロジェクト文書

- リソース&キャパシティ最適化

- リソース管理

- キャパシティ計画

- 時間追跡

- ワークロードバランス

- 予算・財務管理

- 財務計画・予測

- 予算追跡

- 経費管理

- 利益の実現

- レポート&アナリティクス

- ダッシュボード・視覚化

- KPIトラッキング

- データ分析・洞察

- カスタムレポート

- 戦略的ポートフォリオ管理

- ポートフォリオの優先順位付け

- ポートフォリオの最適化

- 戦略的連携

- ガバナンス&コンプライアンス

- アイデア&需要管理

- アイデアの収集・管理

- 需要の取り込み・優先順位付け

- イノベーションマネジメント

- 実現可能性評価

- チームデリバリー&コラボレーション

- コミュニケーション&コラボレーション

- アジャイルチームデリバリー

- ワークフロー管理

- アジャイル統合

第8章 プロジェクトポートフォリオ管理 (PPM) 市場:ビジネス機能別

- IT・ソフトウェア開発

- 経営

- マーケティング&セールス

- 人事

- 財務・会計

- 研究開発

第9章 プロジェクトポートフォリオ管理 (PPM)展開モード別

- オンプレミス

- クラウド

第10章 プロジェクトポートフォリオ管理 (PPM) 市場:組織規模別

- 小規模企業

- 中規模企業

- 大規模企業

第11章 プロジェクトポートフォリオ管理 (PPM) 市場:産業別

- IT&通信

- BFSI

- 政府・防衛

- 製造

- ヘルスケア&ライフサイエンス

- エネルギー・ユーティリティ

- 小売・消費財

- 輸送・物流

- 建設・重工業

- 自動車

- その他

第12章 プロジェクトポートフォリオ管理 (PPM) 市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第13章 競合情勢

- 主要企業の戦略/有力企業

- 市場シェア分析

- ベンダー製品/ブランドの比較

- 収益分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 主要ベンダーの企業評価と財務指標

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- ORACLE

- SMARTSHEET

- MICROSOFT

- ASANA

- SERVICENOW

- PLANVIEW

- SAP

- ATLASSIAN

- ADOBE

- WORKDAY

- GFT TECHNOLOGIES

- WRIKE

- MONDAY.COM

- OPENTEXT

- HEXAGON

- BROADCOM

- UPLAND SOFTWARE

- SOPHEON

- PLANISWARE

- PLANFORGE

- BESTOUTCOME

- CELOXIS

- CERRI

- SCIFORMA

- PROJECT OBJECTS

- WORKOTTER

- IVANTI

- CORPORATER

- CORA SYSTEMS

- TEAMWORK

- その他の企業

- KEYEDIN PROJECTS

- MEISTERPLAN

- ITM PLATFORM

- ACUITY PPM

- PROJECTMANAGER

- UNIPHI

- PROGGIO

- ASSESSTEAM

- TRISKELL SOFTWARE

- PRIMETRIC

- CPLACE

- APPTIVO

第15章 隣接市場と関連市場

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2018-2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 INDICATIVE PRICING ANALYSIS, BY SOLUTION

- TABLE 4 TOP 10 PATENT APPLICANTS (US), 2013-2023

- TABLE 5 PROJECT PORTFOLIO MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE BUSINESS FUNCTIONS

- TABLE 12 PROJECT PORTFOLIO MANAGEMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 13 PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 14 PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 15 SOLUTIONS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 16 SOLUTIONS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 17 PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 18 PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 19 PROFESSIONAL SERVICES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 20 PROFESSIONAL SERVICES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 21 MANAGED SERVICES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 22 MANAGED SERVICES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 23 PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 24 PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 25 PROJECT PLANNING & MANAGEMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 PROJECT PLANNING & MANAGEMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 RESOURCE & CAPACITY OPTIMIZATION: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 28 RESOURCE & CAPACITY OPTIMIZATION: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 BUDGET & FINANCIAL MANAGEMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 BUDGET & FINANCIAL MANAGEMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 REPORTING & ANALYTICS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 REPORTING & ANALYTICS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 STRATEGIC PORTFOLIO MANAGEMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 STRATEGIC PORTFOLIO MANAGEMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 IDEA & DEMAND MANAGEMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 36 IDEA & DEMAND MANAGEMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 TEAM DELIVERY & COLLABORATION: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 TEAM DELIVERY & COLLABORATION: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 40 PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 41 IT & SOFTWARE DEVELOPMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 IT & SOFTWARE DEVELOPMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 OPERATIONS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 44 OPERATIONS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 MARKETING & SALES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 MARKETING & SALES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 HUMAN RESOURCES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 HUMAN RESOURCES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 FINANCE & ACCOUNTING: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 FINANCE & ACCOUNTING: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 RESEARCH & DEVELOPMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 52 RESEARCH & DEVELOPMENT: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 53 PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 54 PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 55 ON-PREMISES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 ON-PREMISES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 CLOUD: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 CLOUD: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 60 PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 61 SMALL ENTERPRISES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 62 SMALL ENTERPRISES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 MEDIUM ENTERPRISES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 64 MEDIUM ENTERPRISES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 LARGE ENTERPRISES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 LARGE ENTERPRISES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 68 PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 69 IT & TELECOM: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 IT & TELECOM: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 71 BFSI: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 BFSI: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 GOVERNMENT & DEFENSE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 GOVERNMENT & DEFENSE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 MANUFACTURING: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 76 MANUFACTURING: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 HEALTHCARE & LIFE SCIENCES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 HEALTHCARE & LIFE SCIENCES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 ENERGY & UTILITIES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 80 ENERGY & UTILITIES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 RETAIL & CONSUMER GOODS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 RETAIL & CONSUMER GOODS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 TRANSPORTATION & LOGISTICS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 84 TRANSPORTATION & LOGISTICS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 85 CONSTRUCTION & HEAVY INDUSTRIES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 CONSTRUCTION & HEAVY INDUSTRIES: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 87 AUTOMOTIVE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 88 AUTOMOTIVE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 89 OTHER VERTICALS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 OTHER VERTICALS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 91 PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 92 PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 98 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 99 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 100 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 101 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 102 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 103 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 104 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 105 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 106 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 107 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 108 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 109 US: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 110 US: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 111 US: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 112 US: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 113 CANADA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 114 CANADA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 115 CANADA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 116 CANADA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 117 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 118 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 119 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 120 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 121 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 122 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 123 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 124 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 125 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 126 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 128 EUROPE: TRAINING, PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 129 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 130 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 131 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 132 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 133 UK: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 134 UK: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 135 UK: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 136 UK: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 137 GERMANY: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 138 GERMANY: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 139 GERMANY: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 140 GERMANY: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 141 FRANCE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 142 FRANCE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 143 FRANCE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 144 FRANCE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 145 ITALY: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 146 ITALY: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 147 ITALY: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 148 ITALY: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 149 SWITZERLAND: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 150 SWITZERLAND: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 151 SWITZERLAND: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 152 SWITZERLAND: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 153 SPAIN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 154 SPAIN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 155 SPAIN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 156 SPAIN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 157 NETHERLANDS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 158 NETHERLANDS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 159 NETHERLANDS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 160 NETHERLANDS: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 161 POLAND: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 162 POLAND: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 163 POLAND: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 164 POLAND: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 165 BELGIUM: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 166 BELGIUM: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 167 BELGIUM: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 168 BELGIUM: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 169 REST OF EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 170 REST OF EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 171 REST OF EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 172 REST OF EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 173 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 174 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 175 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 176 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 177 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 178 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 179 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 180 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 181 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 182 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 183 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 184 ASIA PACIFIC: TRAINING, PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 185 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 186 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 187 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 188 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 189 CHINA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 190 CHINA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 191 CHINA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 192 CHINA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 193 INDIA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 194 INDIA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 195 INDIA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 196 INDIA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 197 JAPAN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 198 JAPAN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 199 JAPAN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 200 JAPAN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 201 SINGAPORE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 202 SINGAPORE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 203 SINGAPORE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 204 SINGAPORE: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 205 AUSTRALIA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 206 AUSTRALIA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 207 AUSTRALIA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 208 AUSTRALIA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 209 SOUTH KOREA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 210 SOUTH KOREA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 211 SOUTH KOREA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 212 SOUTH KOREA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 233 GCC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 234 GCC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 235 GCC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 236 GCC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 237 REST OF GCC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 238 REST OF GCC: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 239 SOUTH AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 240 SOUTH AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 241 SOUTH AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 242 SOUTH AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 243 REST OF MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 247 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 248 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 249 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 250 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 251 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 252 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 253 LATIN: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 254 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024-2029 (USD MILLION)

- TABLE 255 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 256 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 257 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 258 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 259 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 260 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 261 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 262 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 263 BRAZIL: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 264 BRAZIL: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 265 BRAZIL: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 266 BRAZIL: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 267 MEXICO: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 268 MEXICO: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 269 MEXICO: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 270 MEXICO: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 272 REST OF LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 273 REST OF LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 275 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 276 MARKET SHARE OF KEY VENDORS, 2023

- TABLE 277 PROJECT PORTFOLIO MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 278 PROJECT PORTFOLIO MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 279 PROJECT PORTFOLIO MANAGEMENT MARKET: VERTICAL FOOTPRINT

- TABLE 280 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 281 PROJECT PORTFOLIO MANAGEMENT MARKET: KEY STARTUPS/SMES

- TABLE 282 PROJECT PORTFOLIO MANAGEMENT MARKET: PRODUCT LAUNCHES, FEBRUARY 2023-AUGUST 2024

- TABLE 283 PROJECT PORTFOLIO MANAGEMENT MARKET: DEALS, FEBRUARY 2021-OCTOBER 2023

- TABLE 284 ORACLE: COMPANY OVERVIEW

- TABLE 285 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 287 ORACLE: DEALS

- TABLE 288 SMARTSHEET: COMPANY OVERVIEW

- TABLE 289 SMARTSHEET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 SMARTSHEET: PRODUCT LAUNCHES

- TABLE 291 MICROSOFT: COMPANY OVERVIEW

- TABLE 292 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 MICROSOFT: PRODUCT LAUNCHES

- TABLE 294 MICROSOFT: DEALS

- TABLE 295 ASANA: COMPANY OVERVIEW

- TABLE 296 ASANA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 ASANA: PRODUCT LAUNCHES

- TABLE 298 ASANA: EXPANSIONS

- TABLE 299 SERVICENOW: COMPANY OVERVIEW

- TABLE 300 SERVICENOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 SERVICENOW: PRODUCT LAUNCHES

- TABLE 302 SERVICENOW: DEALS

- TABLE 303 PLANVIEW: COMPANY OVERVIEW

- TABLE 304 PLANVIEW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 PLANVIEW: PRODUCT LAUNCHES

- TABLE 306 PLANVIEW: DEALS

- TABLE 307 SAP: COMPANY OVERVIEW

- TABLE 308 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 310 SAP: DEALS

- TABLE 311 ATLASSIAN: COMPANY OVERVIEW

- TABLE 312 ATLASSIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 ATLASSIAN: PRODUCT LAUNCHES

- TABLE 314 ATLASSIAN: DEALS

- TABLE 315 ADOBE: COMPANY OVERVIEW

- TABLE 316 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 318 WORKDAY: COMPANY OVERVIEW

- TABLE 319 WORKDAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 WORKDAY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 321 WORKDAY: DEALS

- TABLE 322 GFT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 323 GFT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 GFT TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 325 GFT TECHNOLOGIES: DEALS

- TABLE 326 GFT TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 327 WRIKE: COMPANY OVERVIEW

- TABLE 328 WRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 WRIKE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 330 WRIKE: DEALS

- TABLE 331 MONDAY.COM: COMPANY OVERVIEW

- TABLE 332 MONDAY.COM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 MONDAY.COM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 334 OPENTEXT: COMPANY OVERVIEW

- TABLE 335 OPENTEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 OPENTEXT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 337 AI IN PROJECT MANAGEMENT MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 338 AI IN PROJECT MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 339 AI IN PROJECT MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 340 AI IN PROJECT MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 341 AI IN PROJECT MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 342 AI IN PROJECT MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 343 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 344 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 345 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 346 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 347 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 348 ENTERPRISE PERFORMANCE MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 PROJECT PORTFOLIO MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 PROJECT PORTFOLIO MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF PPM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM OFFERINGS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): PROJECT PORTFOLIO MANAGEMENT MARKET

- FIGURE 9 PROJECT PORTFOLIO MANAGEMENT MARKET SNAPSHOT, 2021-2029

- FIGURE 10 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 12 RISING DEMAND FOR EFFICIENT PROJECT EXECUTION AND INCREASING ADOPTION OF STRATEGIC PORTFOLIO MANAGEMENT TO DRIVE MARKET GLOBALLY

- FIGURE 13 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 14 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 15 PROJECT PLANNING & MANAGEMENT TO ACCOUNT FOR LARGEST SHARE IN 2024

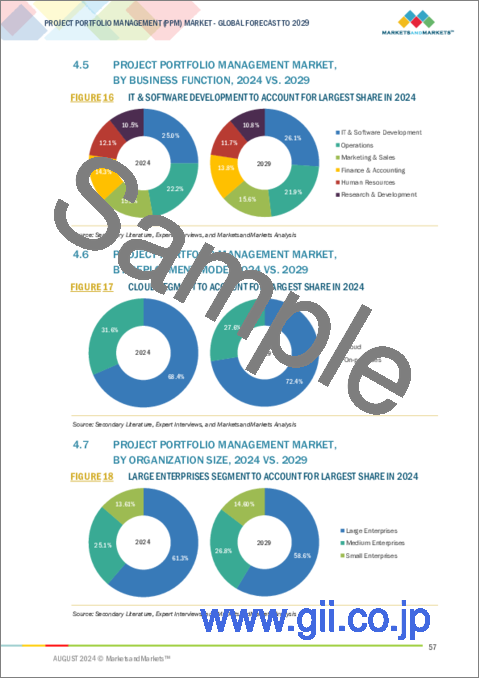

- FIGURE 16 IT & SOFTWARE DEVELOPMENT TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 17 CLOUD SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 18 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 19 IT & TELECOM SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 20 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 21 PROJECT PORTFOLIO MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 PROJECT PORTFOLIO MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 PROJECT PORTFOLIO MANAGEMENT MARKET: SUPPLY CHAIN

- FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2013-2023

- FIGURE 25 TOP FIVE PATENT OWNERS (GLOBAL), 2013-2023

- FIGURE 26 PROJECT PORTFOLIO MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 PROJECT PORTFOLIO MANAGEMENT MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO OF MAJOR PROJECT PORTFOLIO MANAGEMENT COMPANIES

- FIGURE 31 IMPACT OF GEN AI ON PROJECT PORTFOLIO MANAGEMENT MARKET, 2024

- FIGURE 32 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 MANAGED SERVICES TO GROW AT HIGHER RATE DURING FORECAST PERIOD

- FIGURE 34 PROJECT PLANNING & MANAGEMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 35 IT & SOFTWARE DEVELOPMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 SMALL ENTERPRISES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 IT & TELECOM TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET BY 2029

- FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 42 PROJECT PORTFOLIO MANAGEMENT MARKET: MARKET SHARE ANALYSIS

- FIGURE 43 VENDOR PRODUCTS/BRANDS COMPARISON

- FIGURE 44 HISTORICAL REVENUE ANALYSIS, 2019-2023 (USD MILLION)

- FIGURE 45 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 46 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- FIGURE 47 PROJECT PORTFOLIO MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 48 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 49 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- FIGURE 50 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 52 ORACLE: COMPANY SNAPSHOT

- FIGURE 53 SMARTSHEET: COMPANY SNAPSHOT

- FIGURE 54 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 55 ASANA: COMPANY SNAPSHOT

- FIGURE 56 SERVICENOW: COMPANY SNAPSHOT

- FIGURE 57 SAP: COMPANY SNAPSHOT

- FIGURE 58 ATLASSIAN: COMPANY SNAPSHOT

- FIGURE 59 ADOBE: COMPANY SNAPSHOT

- FIGURE 60 WORKDAY: COMPANY SNAPSHOT

- FIGURE 61 GFT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 62 MONDAY.COM: COMPANY SNAPSHOT

- FIGURE 63 OPENTEXT: COMPANY SNAPSHOT

The project portfolio management market is expected to grow from USD 7.8 billion in 2024 to USD 13.7 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 11.9% during the forecast period. The increased AI and machine learning integration into PPM platforms opens up vast efficiency gains in process smoothing. AI-driven tools prioritize, resource, and performance-track projects, automating them to reduce the time and effort required to manage project portfolios. Machine learning algorithms fine-tune accuracy and relevance in project insight, thus providing organizations with data to make informed decisions and optimize project outcomes. It automates a more efficient way of running projects, aligns more effectively with strategic goals, and produces higher-quality results to ensure success across the entire portfolio.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Offering, Application, Business Function, Deployment Mode, Organization Size, Vertical and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"As per offering, services will grow at the highest CAGR during the forecast period."

Services ranging from professional to managed services are instrumental in making the PPM solutions efficient and effective. Professional services entail consulting and advisory, implementation, training, and support for facilitating an organization's selection, deployment, and optimization of the right PPM tools. Such services will give expert advice on best practices and ensure seamless transitions into new systems. Managed services, however, are associated with the post-implementation ongoing management and maintenance of PPM systems, including updates, monitoring, and problem resolution. Through managed services, an organization can outsource the management of a PPM system to get consistent performance, freeing the internal team's capacity for core business activities. Given the growing demand for customized and efficient PPM solutions, services are expected to register the highest CAGR over the forecast period.

"As per services, professional services will hold the largest share during the forecast period."

Professional services bridge the gap between an organization's vision and attaining PPM capabilities through consulting and advisory, integration and implementation, and support and maintenance. Consulting and advisory services help improve PPM processes within organizations and align projects with strategic business objectives. Integration and implementation ensure the smooth rollout of PPM solutions, integrated cohesively with current systems and workflows. This also goes for system performance maintenance, troubleshooting services, and assurance of continued efficiency of PPM tools. Such professional services are there to enhance organizational project management abilities for better decision-making and improved project results. This shall enable an organization to ensure that applied PPM tools are helping drive overall business success and strategic objectives.

"As per organization size, the small enterprises will grow with the highest CAGR during the forecast period."

Smaller businesses with less than 250 workers generally seek affordable, scalable, and easy-to-deploy Project Portfolio Management (PPM) solutions. These companies use tools that make project tracking, resource allocation, and task management easier without the need for complicated IT support or setups. Cloud-based or modular PPM solutions are frequently chosen due to their flexibility, cost-effectiveness, and quick deployment abilities. Small businesses strive to use PPM to boost project visibility, enhance collaboration, and align with business objectives to manage their restricted resources efficiently. Furthermore, PPM solutions offer essential information for strategic planning and decision-making, enabling small organizations to enhance project results and stimulate growth. Even though they are small, these businesses gain a lot from organized project management, which helps them use resources effectively and makes it easier to grow as they expand.

The breakup of the profiles of the primary participants is below:

- By Company: Tier I: 38%, Tier II: 42%, and Tier III: 20%

- By Designation: C-Level Executives: 40%, Director Level: 35%, and Others: 25%

- By Region: North America: 35%, Europe: 45%, Asia Pacific: 15%, Rest of World: 5%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Key vendors providing project portfolio management solutions and services include Oracle (US), Smartsheet (US), Microsoft (US), Asana (US), ServiceNow (US), Planview (US), SAP (Germany), Atlassian (Australia), Wrike (US), Monday.com (Israel), GFT Technologies (Germany), Adobe (US), Workday (US), OpenText (Canda).

Research coverage:

In this study, an in-depth analysis of the Project Portfolio Management market is done based on market trends, potential growth during 2019, and a forecast up to 2024-2029. Further, it gives detailed market trends, a competitive landscape, market size, forecasts, and key players' analysis of the Project Portfolio Management market. This market study analyzes the growth rate and penetration of project portfolio management across all the major regions.

Reasons to buy this report:

The report will aid the market leaders/new entrants in the following: Details regarding the closest approximations of the revenue numbers for the overall project portfolio management market and its subsegments. This study will aid the stakeholders in understanding the competitive landscape; it gives more insights to position their businesses better and plan suitable go-to-market strategies. It also helps the stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (need for enhanced ROI, rapidly increasing BYOD trend among organizations, need for efficient workflow and transparency, growing demand for advanced PPM tools due to increasing project complexities), restraints (high implementation costs, resistance to change within organizations, data security, and privacy concerns), opportunities (adoption of cloud-based solutions, rising demand for digital transformation, the advent of digitalization to open new avenues for business, adoption of AI-driven tools, increasing emphasis on sustainability and environmental, social, and governance (ESG) goals), and challenges (ensuring practical user training and adoption, customization and integration complexities, navigating diverse methodologies and practices) influencing the growth of the project portfolio management market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the project portfolio management market.

- Market Development: In-depth understanding of upcoming technologies, research & development efforts, and new product & service releases in the project portfolio management market.

- Market Diversification: Comprehensive details on the latest products & services, unexplored regions, recent advancements, and investments in the project portfolio management market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and Oracle (US), Smartsheet (US), Microsoft (US), Asana (US), ServiceNow (US), Planview (US), SAP (Germany), Atlassian (Australia), Wrike (US), Monday.com (Israel), GFT Technologies (Germany), Adobe (US), Workday (US), OpenText (Canda) among others in the project portfolio management market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN PROJECT PORTFOLIO MANAGEMENT MARKET

- 4.2 PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING, 2024 VS. 2029

- 4.3 PROJECT PORTFOLIO MANAGEMENT MARKET, BY SERVICE, 2024 VS. 2029

- 4.4 PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION, 2024 VS. 2029

- 4.5 PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2024 VS. 2029

- 4.6 PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024 VS. 2029

- 4.7 PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024 VS. 2029

- 4.8 PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL, 2024 VS. 2029

- 4.9 PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION, 2024 VS. 2029

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for advanced PPM tools due to growing project complexities

- 5.2.1.2 Need for enhanced return on investment (ROI)

- 5.2.1.3 Increasing demand for holistic view of resource management and project operations

- 5.2.1.4 Rapidly increasing BYOD trend among organizations

- 5.2.1.5 Need for efficient workflow and transparency

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs

- 5.2.2.2 Resistance to change within organizations

- 5.2.2.3 Data security and privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of cloud-based solutions

- 5.2.3.2 Rising demand for digital transformation

- 5.2.3.3 Adoption of AI-driven tools

- 5.2.3.4 Increasing emphasis on sustainability and environmental, social, and governance (ESG) goals

- 5.2.4 CHALLENGES

- 5.2.4.1 Ensuring practical user training and adoption

- 5.2.4.2 Customization and integration complexities

- 5.2.4.3 Navigating diverse methodologies and practices

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 AVEC STREAMLINED TIMESHEET USING PROJECT PORTFOLIO OFFICE'S SOLUTION

- 5.3.2 LENDLEASE CENTRALIZED DATA USING ORACLE SOLUTIONS

- 5.3.3 PLANVIEW'S CLOUD-NATIVE PLATFORM HELPED COGNIZANT OVERCOME SECURITY BREACH CHALLENGES

- 5.3.4 SAP EPPM HELPED STIHL STREAMLINE QUALITY MANAGEMENT PROCESSES AND IMPROVE PRODUCT QUALITY

- 5.3.5 GEORGIA STATE UNIVERSITY'S PROJECT MANAGEMENT TRANSFORMATION WITH ECLIPSE PPM

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Cloud computing

- 5.6.1.2 AI/ML

- 5.6.1.3 Big data analytics

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Collaboration and communication tools

- 5.6.2.2 Reporting and visualization tools

- 5.6.2.3 Risk and financial tools

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Internet of Things

- 5.6.3.2 Blockchain

- 5.6.3.3 AR/VR

- 5.6.3.4 Process automation

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE, BY SOLUTION

- 5.8 PATENT ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 PROJECT PORTFOLIO MANAGEMENT MARKET: REGULATIONS, BY REGION

- 5.10.2.1 North America

- 5.10.2.2 Europe

- 5.10.2.3 Asia Pacific

- 5.10.2.4 Middle East & South Africa

- 5.10.2.5 Latin America

- 5.10.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.10.3.1 General Data Protection Regulation

- 5.10.3.2 SEC Rule 17a-4

- 5.10.3.3 ISO/IEC 27001

- 5.10.3.4 System and Organization Controls 2 Type II Compliance

- 5.10.3.5 Financial Industry Regulatory Authority

- 5.10.3.6 Freedom of Information Act

- 5.10.3.7 Health Insurance Portability and Accountability Act

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 BUSINESS MODEL ANALYSIS

- 5.13.1 SUBSCRIPTION-BASED MODEL

- 5.13.2 LICENSE-BASED MODEL

- 5.13.3 FREEMIUM MODEL

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON PROJECT PORTFOLIO MANAGEMENT MARKET

- 5.16.1 INDUSTRY TRENDS: USE CASES

- 5.16.1.1 IT & ITeS industry

- 5.16.1.2 Energy & utilities industry

- 5.16.2 VENDOR INITIATIVES

- 5.16.2.1 Broadcom

- 5.16.2.2 Planview

- 5.16.1 INDUSTRY TRENDS: USE CASES

6 PROJECT PORTFOLIO MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Consulting & advisory

- 6.3.1.2 Integration & implementation

- 6.3.1.3 Support & maintenance

- 6.3.1 PROFESSIONAL SERVICES

- 6.4 MANAGED SERVICES

7 PROJECT PORTFOLIO MANAGEMENT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 7.2 PROJECT PLANNING & MANAGEMENT

- 7.2.1 PROJECT SCHEDULING

- 7.2.2 TASK MANAGEMENT

- 7.2.3 PROJECT RISK MANAGEMENT

- 7.2.4 PROJECT DOCUMENTATION

- 7.3 RESOURCE & CAPACITY OPTIMIZATION

- 7.3.1 RESOURCE MANAGEMENT

- 7.3.2 CAPACITY PLANNING

- 7.3.3 TIME TRACKING

- 7.3.4 WORKLOAD BALANCING

- 7.4 BUDGET & FINANCIAL MANAGEMENT

- 7.4.1 FINANCIAL PLANNING & FORECASTING

- 7.4.2 BUDGET TRACKING

- 7.4.3 EXPENSE MANAGEMENT

- 7.4.4 BENEFIT REALIZATION

- 7.5 REPORTING & ANALYTICS

- 7.5.1 DASHBOARDS & VISUALIZATIONS

- 7.5.2 KPI TRACKING

- 7.5.3 DATA ANALYTICS & INSIGHTS

- 7.5.4 CUSTOM REPORTING

- 7.6 STRATEGIC PORTFOLIO MANAGEMENT

- 7.6.1 PORTFOLIO PRIORITIZATION

- 7.6.2 PORTFOLIO OPTIMIZATION

- 7.6.3 STRATEGIC ALIGNMENT

- 7.6.4 GOVERNANCE & COMPLIANCE

- 7.7 IDEA & DEMAND MANAGEMENT

- 7.7.1 IDEA CAPTURE & MANAGEMENT

- 7.7.2 DEMAND INTAKE & PRIORITIZATION

- 7.7.3 INNOVATION MANAGEMENT

- 7.7.4 FEASIBILITY ASSESSMENT

- 7.8 TEAM DELIVERY & COLLABORATION

- 7.8.1 COMMUNICATION & COLLABORATION

- 7.8.2 AGILE TEAM DELIVERY

- 7.8.3 WORKFLOW MANAGEMENT

- 7.8.4 AGILE INTEGRATION

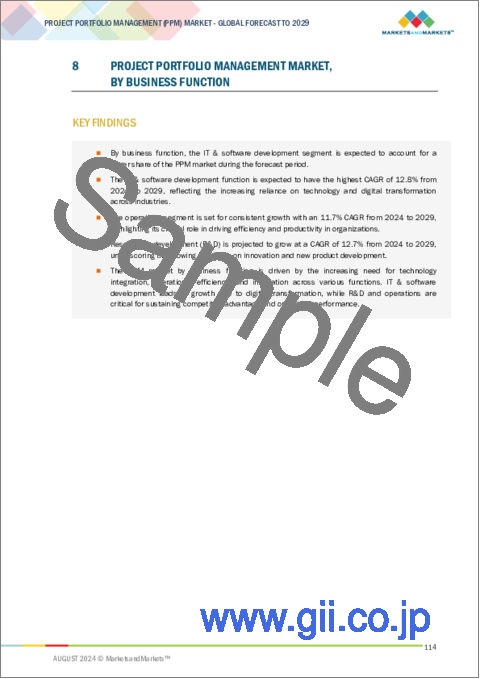

8 PROJECT PORTFOLIO MANAGEMENT MARKET, BY BUSINESS FUNCTION

- 8.1 INTRODUCTION

- 8.1.1 BUSINESS FUNCTION: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 8.2 IT & SOFTWARE DEVELOPMENT

- 8.3 OPERATIONS

- 8.4 MARKETING & SALES

- 8.5 HUMAN RESOURCES

- 8.6 FINANCE & ACCOUNTING

- 8.7 RESEARCH & DEVELOPMENT

9 PROJECT PORTFOLIO MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODE: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 9.2 ON-PREMISES

- 9.3 CLOUD

10 PROJECT PORTFOLIO MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.1.1 ORGANIZATION SIZE: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 10.2 SMALL ENTERPRISES

- 10.3 MEDIUM ENTERPRISES

- 10.4 LARGE ENTERPRISES

11 PROJECT PORTFOLIO MANAGEMENT MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICAL: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 11.2 IT & TELECOM

- 11.2.1 IT & TELECOM: USE CASES

- 11.2.1.1 Software development & delivery

- 11.2.1.2 Telcom projects

- 11.2.1.3 IT service management

- 11.2.1 IT & TELECOM: USE CASES

- 11.3 BFSI

- 11.3.1 BFSI: USE CASES

- 11.3.1.1 Regulatory compliance projects

- 11.3.1.2 Core systems upgrade

- 11.3.1.3 Risk management

- 11.3.1 BFSI: USE CASES

- 11.4 GOVERNMENT & DEFENSE

- 11.4.1 GOVERNMENT & DEFENSE: USE CASES

- 11.4.1.1 Public infrastructure projects

- 11.4.1.2 Defense procurement

- 11.4.1.3 Infrastructure modernization

- 11.4.1.4 Military weapons and equipment development

- 11.4.1.5 Military training

- 11.4.1 GOVERNMENT & DEFENSE: USE CASES

- 11.5 MANUFACTURING

- 11.5.1 MANUFACTURING: USE CASES

- 11.5.1.1 Supply chain management

- 11.5.1.2 Product development

- 11.5.1.3 Product line optimization

- 11.5.1 MANUFACTURING: USE CASES

- 11.6 HEALTHCARE & LIFE SCIENCES

- 11.6.1 HEALTHCARE & LIFE SCIENCES: USE CASES

- 11.6.1.1 Clinical trials

- 11.6.1.2 Facility construction & renovation

- 11.6.1.3 Health IT projects

- 11.6.1 HEALTHCARE & LIFE SCIENCES: USE CASES

- 11.7 ENERGY & UTILITIES

- 11.7.1 ENERGY & UTILITIES: USE CASES

- 11.7.1.1 Renewable energy projects

- 11.7.1.2 Energy infrastructure projects

- 11.7.1.3 Maintenance & operations

- 11.7.1 ENERGY & UTILITIES: USE CASES

- 11.8 RETAIL & CONSUMER GOODS

- 11.8.1 RETAIL & CONSUMER GOODS: USE CASES

- 11.8.1.1 Product development & innovation

- 11.8.1.2 Store operations

- 11.8.1.3 Customer experience enhancement

- 11.8.1 RETAIL & CONSUMER GOODS: USE CASES

- 11.9 TRANSPORTATION & LOGISTICS

- 11.9.1 TRANSPORTATION &LOGISTICS: USE CASES

- 11.9.1.1 Fleet management

- 11.9.1.2 Logistics optimization

- 11.9.1.3 Technology integration projects

- 11.9.1 TRANSPORTATION &LOGISTICS: USE CASES

- 11.10 CONSTRUCTION & HEAVY INDUSTRIES

- 11.10.1 CONSTRUCTION & HEAVY INDUSTRIES: USE CASES

- 11.10.1.1 Design & engineering

- 11.10.1.2 Equipment & machinery procurement

- 11.10.1.3 Quality & compliance

- 11.10.1 CONSTRUCTION & HEAVY INDUSTRIES: USE CASES

- 11.11 AUTOMOTIVE

- 11.11.1 AUTOMOTIVE: USE CASES

- 11.11.1.1 Product development & innovation

- 11.11.1.2 Production optimization

- 11.11.1.3 Technology & IT integration

- 11.11.1 AUTOMOTIVE: USE CASES

- 11.12 OTHER VERTICALS

12 PROJECT PORTFOLIO MANAGEMENT MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 12.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.3 US

- 12.2.3.1 Increasing need for improved resource management and aligning projects with organizational objectives to drive market

- 12.2.4 CANADA

- 12.2.4.1 Focus on implementing innovative cloud-based solutions and AI-powered analytics to boost market

- 12.3 EUROPE

- 12.3.1 EUROPE: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 12.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.3 UK

- 12.3.3.1 Changes in regulations post-Brexit to impact market growth

- 12.3.4 GERMANY

- 12.3.4.1 Increasing demand for advanced project portfolio management solutions that can handle complex data projects to foster market growth

- 12.3.5 FRANCE

- 12.3.5.1 Rising need for simplification of intricate project processes and improvement of resource distribution to drive market

- 12.3.6 ITALY

- 12.3.6.1 Local economic conditions and regulatory frameworks that encourage implementation to bolster market growth

- 12.3.7 SWITZERLAND

- 12.3.7.1 Strong industry adoption and advanced data security practices to foster market growth

- 12.3.8 SPAIN

- 12.3.8.1 Surging demand for leveraging PPM solutions and commitment to digital transformation to drive market

- 12.3.9 NETHERLANDS

- 12.3.9.1 Steady economy and supportive government policies to support market growth

- 12.3.10 POLAND

- 12.3.10.1 Progressive economy and substantial digital infrastructure investments to expand market

- 12.3.11 BELGIUM

- 12.3.11.1 Economic stability to create favorable environment for adoption of project portfolio management solutions

- 12.3.12 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 12.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.3 CHINA

- 12.4.3.1 Digital transformation initiatives in various industries to boost market

- 12.4.4 INDIA

- 12.4.4.1 Rising popularity of cloud-based platforms and thriving IT services sector to propel market growth

- 12.4.5 JAPAN

- 12.4.5.1 Fusion of IoT and automation in project portfolio management procedures to support market's growth trajectory

- 12.4.6 SINGAPORE

- 12.4.6.1 Surging demand for improved project productivity and alignment with strategic goals to fuel market growth

- 12.4.7 AUSTRALIA

- 12.4.7.1 Sophisticated digital infrastructure and regulatory frameworks promoting innovation to enhance market growth

- 12.4.8 SOUTH KOREA

- 12.4.8.1 Promotion of smart city projects and enhancement of digital infrastructure to boost market

- 12.4.9 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 12.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.5.3 GULF COOPERATION COUNCIL (GCC)

- 12.5.3.1 Saudi Arabia

- 12.5.3.1.1 Significant investments in infrastructure and digital innovation to boost market

- 12.5.3.2 UAE

- 12.5.3.2.1 Government initiatives toward enhancing project management efficiency and productivity to accelerate market growth

- 12.5.3.3 REST OF GCC COUNTRIES

- 12.5.3.1 Saudi Arabia

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Local economic conditions and emerging regulatory frameworks to drive market

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: PROJECT PORTFOLIO MANAGEMENT MARKET DRIVERS

- 12.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.6.3 BRAZIL

- 12.6.3.1 High adoption of cloud services by startups to drive market growth

- 12.6.4 MEXICO

- 12.6.4.1 Rise in digital transformation efforts and incorporation of artificial intelligence into project management software to foster market growth

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.4 PROJECT PORTFOLIO MANAGEMENT MARKET: VENDOR PRODUCTS/BRANDS COMPARISON

- 13.5 REVENUE ANALYSIS

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2023

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 MAJOR PLAYERS

- 14.2.1 ORACLE

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 SMARTSHEET

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.4 MnM view

- 14.2.2.4.1 Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 MICROSOFT

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 ASANA

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Other developments

- 14.2.4.4 MnM view

- 14.2.4.4.1 Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 SERVICENOW

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weakness and competitive threats

- 14.2.6 PLANVIEW

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches

- 14.2.6.3.2 Deals

- 14.2.6.4 MnM view

- 14.2.6.4.1 Right to win

- 14.2.6.4.2 Strategic choices

- 14.2.6.4.3 Weaknesses and competitive threats

- 14.2.7 SAP

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Product launches

- 14.2.7.3.2 Deals

- 14.2.8 ATLASSIAN

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Product launches

- 14.2.8.3.2 Deals

- 14.2.8.4 MnM view

- 14.2.8.4.1 Right to win

- 14.2.8.4.2 Strategic choices

- 14.2.8.4.3 Weaknesses and competitive threats

- 14.2.9 ADOBE

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product launches

- 14.2.10 WORKDAY

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product launches

- 14.2.10.3.2 Deals

- 14.2.11 GFT TECHNOLOGIES

- 14.2.11.1 Business overview

- 14.2.11.2 Products/Solutions/Services offered

- 14.2.11.3 Recent developments

- 14.2.11.3.1 Product launches

- 14.2.11.3.2 Deals

- 14.2.11.3.3 Other developments

- 14.2.12 WRIKE

- 14.2.12.1 Business overview

- 14.2.12.2 Products/Solutions/Services offered

- 14.2.12.3 Recent developments

- 14.2.12.3.1 Product launches

- 14.2.12.3.2 Deals

- 14.2.13 MONDAY.COM

- 14.2.13.1 Business overview

- 14.2.13.2 Products/Solutions/Services offered

- 14.2.13.3 Recent developments

- 14.2.13.3.1 Product launches

- 14.2.14 OPENTEXT

- 14.2.14.1 Business overview

- 14.2.14.2 Products/Solutions/Services offered

- 14.2.14.3 Recent developments

- 14.2.14.3.1 Product launches

- 14.2.15 HEXAGON

- 14.2.16 BROADCOM

- 14.2.17 UPLAND SOFTWARE

- 14.2.18 SOPHEON

- 14.2.19 PLANISWARE

- 14.2.20 PLANFORGE

- 14.2.21 BESTOUTCOME

- 14.2.22 CELOXIS

- 14.2.23 CERRI

- 14.2.24 SCIFORMA

- 14.2.25 PROJECT OBJECTS

- 14.2.26 WORKOTTER

- 14.2.27 IVANTI

- 14.2.28 CORPORATER

- 14.2.29 CORA SYSTEMS

- 14.2.30 TEAMWORK

- 14.2.1 ORACLE

- 14.3 OTHER PLAYERS

- 14.3.1 KEYEDIN PROJECTS

- 14.3.2 MEISTERPLAN

- 14.3.3 ITM PLATFORM

- 14.3.4 ACUITY PPM

- 14.3.5 PROJECTMANAGER

- 14.3.6 UNIPHI

- 14.3.7 PROGGIO

- 14.3.8 ASSESSTEAM

- 14.3.9 TRISKELL SOFTWARE

- 14.3.10 PRIMETRIC

- 14.3.11 CPLACE

- 14.3.12 APPTIVO

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 RELATED MARKETS

- 15.2.1 AI IN PROJECT MANAGEMENT MARKET

- 15.2.2 ENTERPRISE PERFORMANCE MANAGEMENT MARKET

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS