|

|

市場調査レポート

商品コード

1829980

セラミックス基複合材料の世界市場:繊維タイプ別、繊維材料別、マトリックスタイプ別、最終用途産業別、地域別 - 予測(~2030年)Ceramic Matrix Composites Market by Fiber Type, Fiber Material, Matrix Type, End-use Industry, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| セラミックス基複合材料の世界市場:繊維タイプ別、繊維材料別、マトリックスタイプ別、最終用途産業別、地域別 - 予測(~2030年) |

|

出版日: 2025年09月15日

発行: MarketsandMarkets

ページ情報: 英文 262 Pages

納期: 即納可能

|

概要

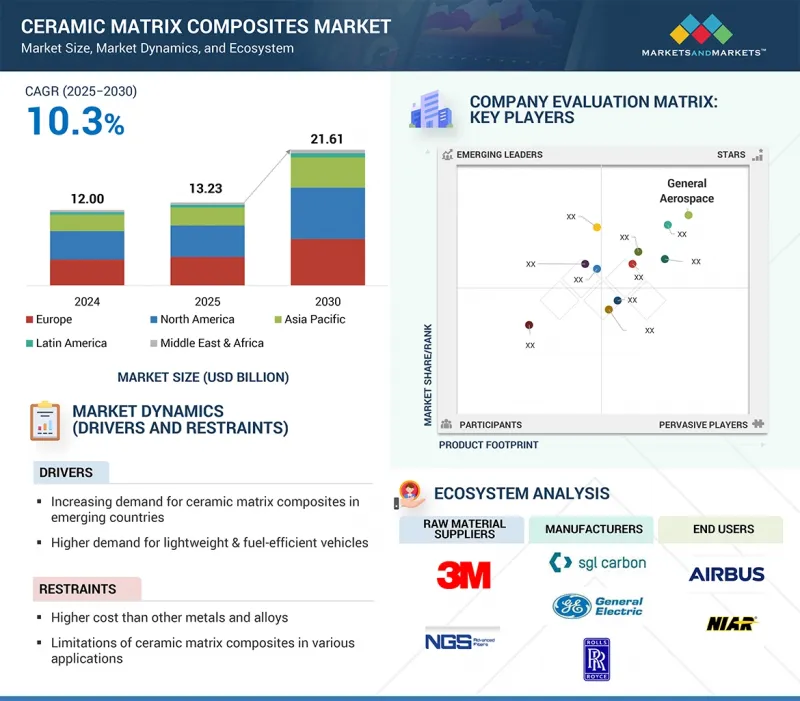

世界のセラミックス基複合材料の市場規模は、2024年の120億米ドルから2030年までに216億1,000万米ドルに達すると予測され、予測期間に金額ベースのCAGRで10.3%の成長が見込まれます。

これはC/SiCマトリックスタイプの軽量化の利点や、卓越した耐熱性、機械的強度により、最高温度を必要とする用途で使用されています。C/SiC複合材料は、航空宇宙、防衛、ハイテク自動車産業において、極端な熱的・機械的負荷に対する耐性が非常に重要となる航空機のブレーキシステム、ロケットノズル、熱保護システム、スポーツカーのブレーキディスクなどの部品に使用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル、キロトン |

| セグメント | 繊維タイプ、繊維材料、マトリックスタイプ、最終用途産業、地域 |

| 対象地域 | 欧州、北米、アジア太平洋、ラテンアメリカ、中東・アフリカ |

新世代航空機や将来の自動車システムにおいて、燃費効率、低排出ガス、運転中の信頼性に対する要求が高まっていることが、C/SiC複合材料の需要をさらに押し上げています。また、化学気相含浸法(CVI)やポリマー含浸・熱分解法(PIP)などの新しい製造プロセスの開発と、より低い生産コストでの製品性能の向上により、C/SiC複合材料は好まれる材料となっています。進行中の研究開発活動は、C/SiCセラミックス基複合材料の特性を向上させ、応用範囲を拡大し続けています。これらの卓越した特性により、C/SiCセラミックス基複合材料は航空宇宙、自動車、エネルギー・電力、工業などの最終用途産業にとって非常に望ましいものとなっています。

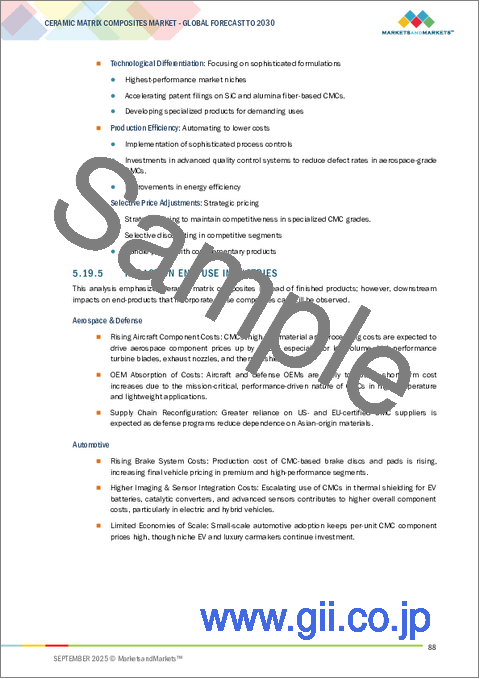

「金額ベースでは、自動車最終用途産業が2024年のセラミックス基複合材料市場全体で2番目に大きなシェアを占めました。」

自動車最終用途セグメントは、効率性、安全性、耐久性の向上により、高性能自動車や高級自動車にCMCが使用されているため、金額ベースで世界のセラミックス基複合材料市場で2番目に大きな市場シェアを占めました。C/SiC基複合材料は、耐摩耗性、軽量性、性能特性を損なうことなく高熱に耐えるといった優れた特性により、自動車のブレーキディスク、クラッチ、その他の高応力条件にさらされる部品に広く利用されています。航続距離、加速度、制動能力を向上させるために洗練された材料を必要とする電気自動車やスポーツカーの需要が増加しているため、産業界におけるセラミックス基複合材料の範囲が拡大しています。自動車の軽量化は、自動車産業が厳しい排ガス規制を遵守し、燃費を向上させるための政策に起因しており、このこともセラミックス基複合材料のような先進の軽量材料の使用が急増する一因となっています。これらの要素により、自動車産業はセラミックス基複合材料の最終用途産業として第2位の市場となっています。

「連続繊維タイプセグメントが予測期間に金額ベースで2番目に高いCAGRを記録すると予測されます。」

繊維タイプに別では、その構造が短繊維タイプやチョップドファイバータイプよりも優れた強度、耐久性、耐熱性を提供することから、連続繊維タイプセグメントがセラミックス基複合材料市場で予測期間に2番目に高いCAGRを記録する見込みです。連続繊維は材料の全長にわたって連続しているため、荷重の迅速な伝達、高い破壊靭性、過酷な熱的・機械的条件下での亀裂に対する堅牢性が得られます。これらの利点により、連続繊維は、軽量さと高温用途がもっとも重要である航空機のエンジン、ガスタービン部品、宇宙船のヒートシールド、ブレーキシステムなどの高性能用途に非常に適しています。さらに、産業界は燃費の向上、排出ガスの削減、部品の長寿命化を実現する材料へと移行しており、これらはすべて連続繊維セラミックス基複合材料のタイムフレームに収まっています。それゆえ、その良好な成長見通しは、航空宇宙、防衛、エネルギー、先進自動車用途での使用の拡大が見込まれることに起因しています。

「欧州のセラミックス基複合材料市場が予測期間に第2位の市場シェアを記録する見込みです。」

2024年に北米が最大の市場シェアを占めたのに対し、欧州は第2位の市場シェアを占めました。市場シェア第3位はアジア太平洋です。欧州は、強固な産業基盤、多数の製造施設に恵まれており、産業の主要企業が集中しているため、予測期間にセラミックス基複合材料で第2位のシェアを占める見込みです。ドイツ、フランス、英国はセラミックス基複合材料を製造している主要国で、複数の研究センターを有しています。CeramTec(ドイツ)やSAFRAN Ceramics(フランス)などの企業は、航空宇宙、自動車、エネルギー産業で高性能セラミックス基複合材料部品の製造に従事しています。

当レポートでは、世界のセラミックス基複合材料市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- セラミックス基複合材料市場における魅力的な機会

- セラミックス基複合材料市場:最終用途産業別、地域別(2024年)

- セラミックス基複合材料市場:繊維タイプ別

- セラミックス基複合材料市場:マトリックスタイプ別

- セラミックス基複合材料市場:最終用途産業別

- セラミックス基複合材料市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 原材料

- 製品メーカー

- エンドユーザー

- バリューチェーン分析

- エコシステム分析

- 価格設定の分析

- 主要企業が提供するセラミックス基複合材料の平均販売量

- 平均販売価格の動向:地域別

- 平均販売価格の動向:地域別(2022年~2024年)

- マクロ経済の見通し

- イントロダクション

- GDPの動向と予測

- セラミックス基複合材料の市場動向

- 技術分析

- 主要技術

- 補完技術

- 主なステークホルダーと購入基準

- 貿易データアナリティクス

- 輸入シナリオ(HSコード681511)

- 輸出シナリオ(HSコード681511)

- 特許分析

- イントロダクション

- 調査手法

- 文献タイプ

- 考察

- 特許の法的地位

- 管轄分析

- 主な出願者

- 規制情勢

- セラミックス基複合材料市場における規制

- 規制機関、政府機関、その他の組織

- 主な会議とイベント(2025年~2026年)

- ケーススタディ分析

- カスタマービジネスに影響を与える動向と混乱

- AI/生成AIの影響

- 投資と資金調達のシナリオ

- セラミックス基複合材料市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第6章 セラミックス基複合材料市場:マトリックスタイプ別

- イントロダクション

- 酸化物/酸化物セラミックス基複合材料

- C/SiCセラミックス基複合材料

- C/Cセラミックス基複合材料

- SiC/SiCセラミックス基複合材料

第7章 セラミックス基複合材料市場:繊維タイプ別

- イントロダクション

- 連続

- 織物

- その他の繊維タイプ

- フェルト/マット

- チョップド

- ツイル

- 組物

- ロープ・ベルト

第8章 セラミックス基複合材料市場:繊維材料別

- イントロダクション

- アルミナ

- SiC

- 炭素

- その他の繊維材料

第9章 セラミックス基複合材料市場:最終用途産業別

- イントロダクション

- 航空宇宙・防衛

- 自動車

- エネルギー・電力

- 工業

- その他の最終用途産業

第10章 セラミックス基複合材料市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- フランス

- ドイツ

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- GCC諸国

- イスラエル

- 南アフリカ

- その他の中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- ブランド/製品の比較分析

- 企業の評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- セラミックス基複合材料メーカーの評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- GE AEROSPACE

- ROLLS-ROYCE PLC

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SGL CARBON

- COORSTEK INC.

- LANCER SYSTEMS

- AXIOM MATERIALS

- ULTRAMET

- CFC CARBON CO., LTD.

- SPIRIT AEROSYSTEMS, INC.

- COIC

- APPLIED THIN FILMS, INC.

- その他の企業

- PRECISION CASTPARTS CORP.

- STAR FIRE SYSTEMS INC.

- PYROMERAL SYSTEMS

- ZIRCAR ZIRCONIA, INC.

- UNITED COMPOSITES B.V.

- TOUCHSTONE ADVANCED COMPOSITES

- BJS CERAMICS GMBH

- WPX FASERKERAMIK GMBH

- KERAMIKBLECH

- MORGAN ADVANCED MATERIALS

- KYOCERA CORPORATION

- UBE CORPORATION

- SCHUNK GROUP