|

|

市場調査レポート

商品コード

1309734

ラボ情報管理システムの世界市場:製品別・コンポーネント別・展開方式別・エンドユーザー別・地域別の将来予測 (2028年まで)Laboratory Information System Market by Product, Component, Delivery Mode, End User and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ラボ情報管理システムの世界市場:製品別・コンポーネント別・展開方式別・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月10日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のラボ情報管理システム (LIS) の市場規模は、2023年の24億米ドルから2028年には40億米ドルに達し、予測期間中に10.8%のCAGRで成長すると予測されています。

同市場は、統合型LIS市場の発展により有望な成長が見込まれています。統合型LISソリューションは、検査室のワークフローを容易にし、標準化された質の高い診断を提供し、ソリューションの展開を簡素化し、新しいLISシステムや独立系LISシステムの導入に関連するコストを削減するのに役立ちます。加えて、エンドユーザーへのメンテナンスコストの低減も市場成長に寄与します。しかし、データストレージの課題は、この市場の成長をある程度制限すると予想されます。

"独立系検査室向けLIS:エンドユーザー別で最も急成長するセグメント"

エンドユーザー別に見ると、独立系検査室セグメントは予測期間中に最も急成長が見込まれています。これは、ワークフローの管理、請求プロセスの強化、出動時間の改善を目的とした独立系検査室におけるLISの需要が高まっているためです。PAMA法 (2014年メディケアへのアクセス保護法) およびバンドルペイメントイニシアチブの下での検査室診断に対する有利な償還政策も、独立検査室におけるLISの採用を促進しています。

"サービスセグメントが予測期間中、コンポーネント別で最大の市場になる"

サービスセグメントはLIS市場で最大のシェアを占めています。LISサービスには、コンサルティング、導入と継続的なITサポート、トレーニングと教育、整備サービスなどが含まれます。サービス分野の大きなシェアは、その不可欠な性質と反復的な要件に加え、コンサルティング、ストレージ、ソリューションの実装、訓練、整備、定期的更新など、エンドユーザーがサービスプロバイダーに大きく依存していることに起因しています。

"欧州が予測期間中、地域別で第2位のシェアを占める"

予測期間中、欧州はラボ情報管理システム市場で第2位のシェアを占めました。欧州のLIS市場を牽引する主な要因としては、慢性疾患の有病率の上昇、老人人口の増加、HCITを推進する政府の取り組みなどが挙げられます。ドイツ、英国、フランスは欧州のLIS市場の成長に大きく貢献しています。現在、欧州では (厳しい経済環境のため) あらゆる産業で検査専門家が不足しており、検査担当者の他部門や他国への移動が増加しています。このような要因により、同地域の検査室は自動化への移行を余儀なくされています。その結果、検査室のワークフロープロセスの自動化に不可欠なコンポーネントとして機能するLISソリューションの採用が拡大しています。一方、データセキュリティに対する懸念の高まりや不透明な経済状況といった要因が、欧州のLIS市場の成長を妨げると予想されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界考察

- イントロダクション

- 主要な業界動向の概要

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 規制分析

- エコシステム分析

- バリューチェーン分析

- ケーススタディ分析

- 特許分析

- 主要な会議とイベント (2023年第1四半期~2024年第2四半期)

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

第7章 ラボ情報管理システム市場:製品別

- イントロダクション

- スタンドアロン型LIS

- 統合型LIS

第8章 ラボ情報管理システム市場:コンポーネント別

- イントロダクション

- サービス

- ソフトウェア

第9章 ラボ情報管理システム市場:提供方式別

- イントロダクション

- オンプレミスLIS

- クラウドベースLIS

第10章 ラボ情報管理システム市場:エンドユーザー別

- イントロダクション

- 病院検査室

- 独立系検査室

- 開業医

- その他のエンドユーザー

第11章 ラボ情報管理システム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要企業が採用した戦略

- 上位企業の収益シェア分析 (2022年)

- 市場シェア分析

- 主要企業の企業評価クアドラント

- スタートアップ/中小企業の企業評価クアドラント

- ラボ情報管理システム市場:企業のフットプリント

- 競争シナリオと動向

第13章 企業プロファイル

- 主要企業

- ORCHARD SOFTWARE CORPORATION

- CLINISYS

- ORACLE CORPORATION

- COMPUTER PROGRAMS AND SYSTEMS, INC.

- COMPUGROUP MEDICAL

- SOFT COMPUTER CONSULTANTS, INC. (SCC SOFT COMPUTER)

- AMERICAN SOFT SOLUTIONS CORP.

- EPIC SYSTEMS CORPORATION

- ALTERA DIGITAL HEALTH

- ASPYRA

- COMP PRO MED INC.

- COMPUTER SERVICE & SUPPORT, INC.

- CLINICAL SOFTWARE SOLUTIONS

- GPI S.P.A.

- LIGOLAB INFORMATION SYSTEM

- LABWARE

- LABVANTAGE SOLUTIONS, INC.

- XIFIN, INC.

- SEACOAST LABORATORY DATA SYSTEMS

- VERADIGM LLC

- その他の企業

- WEBPATHLAB

- APEX HEALTHWARE

- TECHNIDATA

- PATHAGILITY

- HEX LABORATORY SYSTEMS

- CLINSIS

- ALPHASOFT

- DENDI, INC.

第14章 付録

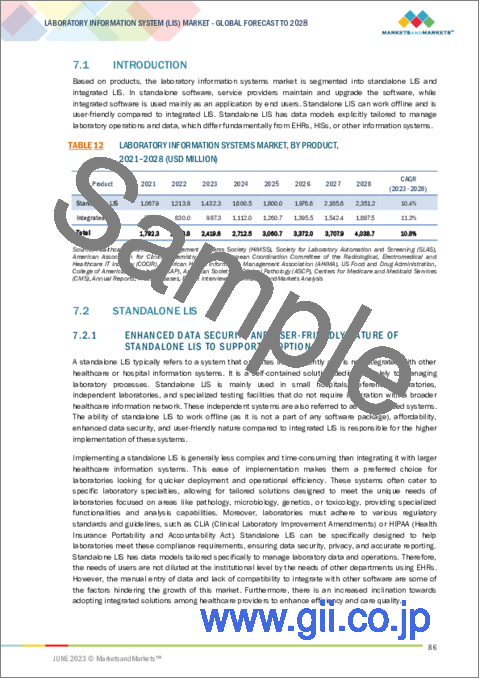

The laboratory information systems market is anticipated to grow from an estimated USD 2.4 billion in 2023 to USD 4.0 billion in 2028, at a CAGR of 10.8% during the forecast period. The market has a promising growth potential due to the development of integrated LIS. Integrated LIS solutions help ease lab workflow, provide standardized and quality diagnosis, enable simplified solution deployment, and help in reducing the cost associated with installing new and independent LIS systems. In addition, offering lower maintenance costs to the end users would help improve the market growth. However, data storage challenges are expected to limit the growth of this market to a certain extent.

"Independent Laboratories: The fastest-growing segment of the laboratory information systems market, by end-user"

Based on the end user, the LIS market is broadly segmented into hospital laboratories, independent laboratories, physician office laboratories (POLs), and other end users (blood banks, retail clinics, public health labs, and nursing homes). The independent laboratories segment is expected to witness the fastest growth in the laboratory information systems market during the forecast. This is owing to the rising demand for LIS among independent laboratories for managing workflows, enhancing billing processes, and improving turnout times. Favorable reimbursement policies for laboratory diagnosis under the Protecting Access to Medicare Act of 2014 (PAMA) and the Bundled Payments initiative are also driving the adoption of LIS in independent laboratories.

"The services segment is anticipated to be the largest laboratory information systems market, by component, during the forecast period."

Based on components, the market is segmented into services and software. The services segment accounted for the largest share of the laboratory information systems market. LIS services include consulting, implementation and ongoing IT support, training and education, and maintenance services. The large share of the services segment can be majorly attributed to their indispensable nature and repetitive requirement, as well as the heavy dependency of end users on service providers for consulting, storage, implementation of solutions, training, maintenance, and regular upgrades.

"Europe accounted for the second-largest share in the laboratory information systems market during the forecast period"

Europe accounted for the second-largest share of the laboratory information systems market during the forecast period. The major factors driving the LIS market in Europe include the rising prevalence of chronic diseases, the growing geriatric population, and government initiatives to promote HCIT. Germany, the UK, and France are the major contributors to the growth of the LIS market in Europe. Currently, Europe is witnessing a shortage of lab professionals across all industries (due to the challenging economic environment) and increased migration of lab personnel to other sectors or countries. This factor is compelling laboratories in the region to move towards automation. This has resulted in the growing adoption of LIS solutions, as they act as an integral component in automating laboratory workflow processes. On the other hand, factors such as growing concerns over data security and uncertain economic conditions are expected to hamper the growth of the LIS market in Europe.

Break of primary participants was as mentioned below:

- By Company Type - Tier 1-40%, Tier 2-35%, and Tier 3-25%

- By Designation - C-level-35%, Director-level-25%, Others-40%

- By Region - North America-45%, Europe-30%, Asia Pacific-20%, Middle East & Africa-3%, and Latin America-2%

Key Players in the Laboratory information systems Market

The key players operating in the laboratory information systems market include Orchard Software Corporation (US), Clinisys (US), Oracle Corporation (US), Computer Programs and Systems, Inc. (US), CompuGroup Medical (Germany), Soft Computer Consultants, Inc. (US), American Soft. Solutions Corp. (US), Epic Systems Corporation (US), Altera Digital Health (US), Aspyra (US), Comp Pro Med Inc. (US), Computer Service & Support, Inc. (US), Clinical Software Solutions (US), GPI S.p.A. (Italy), LigoLab Information Systems (US), LabWare (US), LabVantage Solutions, Inc. (US), XiFin, Inc. (US), Seacoast Laboratory Data Systems (US), Veradigm LLC (US), WebPathLab (US), Apex Healthware (US), TECHNIDATA (France), Pathagility (US), HEX Laboratory Systems (US), Clinsis (Nicaragua), Alphasoft (Germany), and Dendi, Inc. (US).

Research Coverage:

The report analyzes the laboratory information systems market and aims to estimate the market size and future growth potential of this market based on various segments such as product, delivery mode, component, end user, and region. The report also includes a product portfolio matrix of various laboratory information systems products & services available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global laboratory information systems market. The report analyzes this market by product, delivery mode, component, and end user.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global laboratory information systems market

- Market Development: Comprehensive information on the lucrative emerging markets by type, deployment, and end-user

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global laboratory information systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the global laboratory information systems market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKET SEGMENTATION

- FIGURE 1 LABORATORY INFORMATION SYSTEMS MARKET: MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 APPROACH FOR ASSESSING SUPPLY OF LABORATORY INFORMATION SYSTEMS SOLUTIONS

- FIGURE 7 REVENUES GENERATED BY COMPANIES FROM SALES OF LABORATORY INFORMATION SYSTEMS SOLUTIONS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 9 BOTTOM-UP APPROACH

- FIGURE 10 TOP-DOWN APPROACH

- TABLE 2 FACTOR ANALYSIS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- TABLE 3 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 IMPACT OF RECESSION

- 2.6 RISK ASSESSMENT

- TABLE 4 LIMITATIONS AND ASSOCIATED RISKS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 12 LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 LABORATORY INFORMATION SYSTEMS MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 LABORATORY INFORMATION SYSTEMS MARKET OVERVIEW

- FIGURE 17 DEVELOPMENT OF INTEGRATED LIS TO DRIVE MARKET GROWTH

- 4.2 LABORATORY INFORMATION SYSTEMS MARKET, BY REGION

- FIGURE 18 NORTH AMERICA TO DOMINATE LABORATORY INFORMATION SYSTEMS MARKET DURING FORECAST PERIOD

- 4.3 LABORATORY INFORMATION SYSTEMS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 19 INDIA TO REGISTER HIGHEST REVENUE GROWTH FROM 2023 TO 2028

- 4.4 NORTH AMERICAN LABORATORY INFORMATION SYSTEMS MARKET, BY END USER AND COUNTRY, 2022

- FIGURE 20 HOSPITAL LABORATORIES AND US DOMINATED MARKET IN NORTH AMERICA IN 2022

- 4.5 LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT

- FIGURE 21 STANDALONE LIS SEGMENT HELD LARGER MARKET SHARE IN 2022

- 4.6 LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT

- FIGURE 22 SERVICES SEGMENT TO DOMINATE MARKET IN 2028

- 4.7 LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE

- FIGURE 23 CLOUD-BASED LIS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- 4.8 LABORATORY INFORMATION SYSTEMS MARKET, BY END USER

- FIGURE 24 HOSPITAL LABORATORIES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 LABORATORY INFORMATION SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Need for laboratory automation

- 5.2.1.2 Development of integrated LIS

- 5.2.1.3 Rising prevalence of chronic diseases

- 5.2.1.4 Growing demand for LIS in biobanks/biorepositories

- 5.2.1.5 Need to comply with regulatory requirements

- 5.2.1.6 Increasing adoption of LIS to enhance lab efficiency

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance and service costs

- 5.2.2.2 Lack of integration standards for LIS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing popularity of cloud-based LIS

- 5.2.3.2 Growth potential of emerging countries

- 5.2.3.3 Rising demand for personalized medicine

- 5.2.4 CHALLENGES

- 5.2.4.1 Interfacing with diverse laboratory instruments

- 5.2.4.2 Requirement of specialized LIS solutions

- 5.2.4.3 Data storage challenges

- 5.2.4.4 Dearth of trained laboratory professionals

6 INDUSTRY INSIGHTS

- 6.1 INTRODUCTION

- 6.2 OVERVIEW OF KEY INDUSTRY TRENDS

- 6.2.1 SHIFT TO VALUE-BASED AND PATIENT-CENTRIC CARE

- 6.2.2 MOBILE APPLICATIONS AND POINT-OF-CARE TESTING

- 6.2.3 ADVANCED ANALYTICS AND ARTIFICIAL INTELLIGENCE (AI)

- TABLE 5 VENDORS OFFERING ABILITY TO USE ARTIFICIAL INTELLIGENCE WITH LIS

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 LABORATORY INFORMATION SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 LABORATORY INFORMATION SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.4 PRICING ANALYSIS

- TABLE 7 LABORATORY INFORMATION SYSTEMS MARKET: AVERAGE PRICING

- TABLE 8 LABORATORY INFORMATION SYSTEMS MARKET: PRICING ANALYSIS, BY COMPANY TIER

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 MACHINE LEARNING

- 6.5.2 ARTIFICIAL INTELLIGENCE

- 6.5.3 INTERNET OF THINGS

- 6.5.4 BLOCKCHAIN

- 6.5.5 CLOUD COMPUTING

- 6.6 REGULATORY ANALYSIS

- 6.6.1 NORTH AMERICA

- 6.6.2 EUROPE

- 6.6.3 ASIA PACIFIC

- 6.6.4 MIDDLE EAST & AFRICA

- 6.6.5 LATIN AMERICA

- 6.7 ECOSYSTEM ANALYSIS

- FIGURE 27 LABORATORY INFORMATION SYSTEMS MARKET: ECOSYSTEM

- TABLE 9 ROLE OF MARKET PLAYERS IN LABORATORY INFORMATION SYSTEMS ECOSYSTEM

- 6.8 VALUE CHAIN ANALYSIS

- FIGURE 28 LABORATORY INFORMATION SYSTEMS MARKET: VALUE CHAIN

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 CASE STUDY 1

- 6.9.2 CASE STUDY 2

- 6.9.3 CASE STUDY 3

- 6.10 PATENT ANALYSIS

- FIGURE 29 TOP PATENT OWNERS AND APPLICANTS FOR HEALTHCARE IT SOLUTIONS (JANUARY 2011-JUNE 2023)

- FIGURE 30 LABORATORY INFORMATION SYSTEMS MARKET: PATENT ANALYSIS (JANUARY 2011-JUNE 2023)

- 6.11 KEY CONFERENCES & EVENTS (Q1 2023-Q2 2024)

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 31 REVENUE SHIFT IN LABORATORY INFORMATION SYSTEMS MARKET

- 6.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 6.13.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA, BY END USER

- TABLE 11 KEY BUYING CRITERIA, BY END USER (%)

7 LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 12 LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 7.2 STANDALONE LIS

- 7.2.1 ENHANCED DATA SECURITY AND USER-FRIENDLY NATURE OF STANDALONE LIS TO SUPPORT ADOPTION

- TABLE 13 STANDALONE LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 14 NORTH AMERICA: STANDALONE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 15 EUROPE: STANDALONE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 16 ASIA PACIFIC: STANDALONE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 INTEGRATED LIS

- 7.3.1 INCREASING END-USER PREFERENCE FOR SINGLE SOLUTIONS WITH MULTIPLE MODULES TO BOOST DEMAND

- TABLE 17 INTEGRATED LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: INTEGRATED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 19 EUROPE: INTEGRATED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: INTEGRATED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- TABLE 21 LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- 8.2 SERVICES

- 8.2.1 HEAVY DEPENDENCY OF END USERS ON SERVICE PROVIDERS TO DRIVE GROWTH

- TABLE 22 LABORATORY INFORMATION SYSTEM SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: LABORATORY INFORMATION SYSTEM SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 EUROPE: LABORATORY INFORMATION SYSTEM SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 SOFTWARE

- 8.3.1 SOFTWARE SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- TABLE 26 LABORATORY INFORMATION SYSTEM SOFTWARE MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: LABORATORY INFORMATION SYSTEM SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 28 EUROPE: LABORATORY INFORMATION SYSTEM SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: LABORATORY INFORMATION SYSTEM SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

9 LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE

- 9.1 INTRODUCTION

- TABLE 30 LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- 9.2 ON-PREMISE LIS

- 9.2.1 ABILITY TO USE CUSTOMIZED SOLUTIONS TO DRIVE DEMAND FOR ON-PREMISE DELIVERY

- TABLE 31 ON-PREMISE LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: ON-PREMISE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 33 EUROPE: ON-PREMISE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: ON-PREMISE LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 CLOUD-BASED LIS

- 9.3.1 CLOUD-BASED LIS SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- TABLE 35 CLOUD-BASED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: CLOUD-BASED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 37 EUROPE: CLOUD-BASED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: CLOUD-BASED LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

10 LABORATORY INFORMATION SYSTEMS MARKET, BY END USER

- 10.1 INTRODUCTION

- TABLE 39 LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2 HOSPITAL LABORATORIES

- 10.2.1 AFFORDABILITY AND AVAILABILITY OF INTEGRATED LIS SOLUTIONS TO DRIVE DEMAND

- TABLE 40 LABORATORY INFORMATION SYSTEMS MARKET FOR HOSPITAL LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 42 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3 INDEPENDENT LABORATORIES

- 10.3.1 GROWING NEED TO MANAGE WORKFLOWS AND ENHANCE BILLING PROCESSES TO DRIVE ADOPTION

- TABLE 44 LABORATORY INFORMATION SYSTEMS MARKET FOR INDEPENDENT LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET FOR INDEPENDENT LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET FOR INDEPENDENT LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET FOR INDEPENDENT LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4 PHYSICIAN OFFICE LABORATORIES

- 10.4.1 ABILITY TO ASSIST PHYSICIANS IN LABORATORY AND CLINICAL FUNCTIONS TO BOOST MARKET

- TABLE 48 LABORATORY INFORMATION SYSTEMS MARKET FOR PHYSICIAN OFFICE LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET FOR PHYSICIAN OFFICE LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET FOR PHYSICIAN OFFICE LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET FOR PHYSICIAN OFFICE LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.5 OTHER END USERS

- TABLE 52 LABORATORY INFORMATION SYSTEMS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

11 LABORATORY INFORMATION SYSTEMS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 34 INDIA TO EMERGE AS NEW HOTSPOT DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA HELD LARGEST SHARE OF LABORATORY INFORMATION SYSTEMS MARKET IN 2022

- TABLE 56 LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 36 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET SNAPSHOT

- TABLE 57 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Favorable regulatory and reimbursement scenario to drive use of LIS

- TABLE 62 US: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 63 US: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 64 US: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 65 US: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Rising awareness of lab automation to drive market growth

- TABLE 66 CANADA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 67 CANADA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 68 CANADA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 69 CANADA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: RECESSION IMPACT

- TABLE 70 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 71 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 73 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Germany to dominate LIS market in Europe

- TABLE 75 GERMANY: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 76 GERMANY: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 77 GERMANY: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 78 GERMANY: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Government initiatives to propel adoption of LIS

- TABLE 79 UK: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 80 UK: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 81 UK: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 82 UK: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Strong focus on adoption of advanced technologies to favor market growth

- TABLE 83 FRANCE: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 84 FRANCE: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 85 FRANCE: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 86 FRANCE: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Need to automate workflows and effectively manage samples to boost market growth

- TABLE 87 ITALY: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 88 ITALY: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 89 ITALY: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 90 ITALY: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.6 SPAIN

- 11.3.6.1 Growing focus on improving laboratory workflows to support adoption of LIS

- TABLE 91 SPAIN: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 92 SPAIN: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 93 SPAIN: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 94 SPAIN: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 95 REST OF EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 96 REST OF EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 97 REST OF EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 98 REST OF EUROPE: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 37 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET SNAPSHOT

- TABLE 99 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 High prevalence of chronic diseases to drive implementation of LIS

- TABLE 104 CHINA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 105 CHINA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 106 CHINA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 107 CHINA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Growing geriatric population to increase market demand

- TABLE 108 JAPAN: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 109 JAPAN: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 110 JAPAN: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 111 JAPAN: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.4 INDIA

- 11.4.4.1 Rapid growth in healthcare industry to drive demand for laboratory information systems

- TABLE 112 INDIA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 113 INDIA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 114 INDIA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 115 INDIA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Increasing investments in research to provide opportunities for growth

- TABLE 116 AUSTRALIA & NEW ZEALAND: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 117 AUSTRALIA & NEW ZEALAND: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 118 AUSTRALIA & NEW ZEALAND: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 119 AUSTRALIA & NEW ZEALAND: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 120 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5 LATIN AMERICA

- 11.5.1 RISING AWARENESS OF HCIT SOLUTIONS TO SUPPORT MARKET GROWTH

- 11.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 124 LATIN AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 126 LATIN AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND FOCUS ON SAFETY MEASURES TO BOOST GROWTH

- 11.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 128 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEMS MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEMS MARKET, BY DELIVERY MODE, 2021-2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: LABORATORY INFORMATION SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 132 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN LABORATORY INFORMATION SYSTEMS MARKET, JANUARY 2021-MAY 2023

- 12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS, 2022

- FIGURE 38 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS, 2022

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 39 LABORATORY INFORMATION SYSTEMS MARKET: MARKET SHARE ANALYSIS, 2022

- 12.5 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 40 LABORATORY INFORMATION SYSTEMS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 12.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 DYNAMIC COMPANIES

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 41 LABORATORY INFORMATION SYSTEMS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022

- 12.6.5 LABORATORY INFORMATION SYSTEMS MARKET: COMPETITIVE BENCHMARKING

- TABLE 133 LABORATORY INFORMATION SYSTEMS MARKET: DETAILED LIST OF KEY SMES/START-UPS

- TABLE 134 LABORATORY INFORMATION SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY SMES SMES/START-UPS

- 12.7 LABORATORY INFORMATION SYSTEMS MARKET: COMPANY FOOTPRINT

- TABLE 135 BY DELIVERY MODE: COMPANY FOOTPRINT

- TABLE 136 BY END USER: COMPANY FOOTPRINT

- TABLE 137 BY REGION: COMPANY FOOTPRINT

- TABLE 138 COMPANY FOOTPRINT

- 12.8 COMPETITIVE SCENARIOS AND TRENDS

- 12.8.1 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 139 LABORATORY INFORMATION SYSTEMS MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2021-2023

- 12.8.2 DEALS

- TABLE 140 LABORATORY INFORMATION SYSTEMS MARKET: DEALS, 2021-2023

- 12.8.3 OTHER DEVELOPMENTS

- TABLE 141 LABORATORY INFORMATION SYSTEMS MARKET: OTHER DEVELOPMENTS, 2021-2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1.1 ORCHARD SOFTWARE CORPORATION

- TABLE 142 ORCHARD SOFTWARE CORPORATION: COMPANY OVERVIEW

- 13.1.2 CLINISYS

- TABLE 143 CLINISYS: COMPANY OVERVIEW

- 13.1.3 ORACLE CORPORATION

- TABLE 144 ORACLE CORPORATION: COMPANY OVERVIEW

- FIGURE 42 ORACLE CORPORATION: COMPANY SNAPSHOT (2022)

- 13.1.4 COMPUTER PROGRAMS AND SYSTEMS, INC.

- TABLE 145 COMPUTER PROGRAMS AND SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 43 COMPUTER PROGRAMS AND SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- 13.1.5 COMPUGROUP MEDICAL

- TABLE 146 COMPUGROUP MEDICAL: COMPANY OVERVIEW

- FIGURE 44 COMPUGROUP MEDICAL: COMPANY SNAPSHOT (2022)

- 13.1.6 SOFT COMPUTER CONSULTANTS, INC. (SCC SOFT COMPUTER)

- TABLE 147 SOFT COMPUTER CONSULTANTS, INC.: COMPANY OVERVIEW

- 13.1.7 AMERICAN SOFT SOLUTIONS CORP.

- TABLE 148 AMERICAN SOFT SOLUTIONS CORP.: COMPANY OVERVIEW

- 13.1.8 EPIC SYSTEMS CORPORATION

- TABLE 149 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- 13.1.9 ALTERA DIGITAL HEALTH

- TABLE 150 ALTERA DIGITAL HEALTH: COMPANY OVERVIEW

- 13.1.10 ASPYRA

- TABLE 151 ASPYRA: COMPANY OVERVIEW

- 13.1.11 COMP PRO MED INC.

- TABLE 152 COMP PRO MED INC.: COMPANY OVERVIEW

- 13.1.12 COMPUTER SERVICE & SUPPORT, INC.

- TABLE 153 COMPUTER SERVICE & SUPPORT, INC.: COMPANY OVERVIEW

- 13.1.13 CLINICAL SOFTWARE SOLUTIONS

- TABLE 154 CLINICAL SOFTWARE SOLUTIONS: COMPANY OVERVIEW

- 13.1.14 GPI S.P.A.

- TABLE 155 GPI S.P.A.: COMPANY OVERVIEW

- FIGURE 45 GPI S.P.A.: COMPANY SNAPSHOT (2022)

- 13.1.15 LIGOLAB INFORMATION SYSTEM

- TABLE 156 LIGOLAB INFORMATION SYSTEM: COMPANY OVERVIEW

- 13.1.16 LABWARE

- TABLE 157 LABWARE: COMPANY OVERVIEW

- 13.1.17 LABVANTAGE SOLUTIONS, INC.

- TABLE 158 LABVANTAGE SOLUTIONS, INC.: COMPANY OVERVIEW

- 13.1.18 XIFIN, INC.

- TABLE 159 XIFIN, INC.: COMPANY OVERVIEW

- 13.1.19 SEACOAST LABORATORY DATA SYSTEMS

- TABLE 160 SEACOAST LABORATORY DATA SYSTEMS: COMPANY OVERVIEW

- 13.1.20 VERADIGM LLC

- TABLE 161 VERADIGM LLC: COMPANY OVERVIEW

- FIGURE 46 VERADIGM LLC: COMPANY SNAPSHOT (2021)

- 13.2 OTHER PLAYERS

- 13.2.1 WEBPATHLAB

- 13.2.2 APEX HEALTHWARE

- 13.2.3 TECHNIDATA

- 13.2.4 PATHAGILITY

- 13.2.5 HEX LABORATORY SYSTEMS

- 13.2.6 CLINSIS

- 13.2.7 ALPHASOFT

- 13.2.8 DENDI, INC.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS