|

|

市場調査レポート

商品コード

1151635

化合物半導体の世界市場:タイプ別(GaN、GaAs、SiC、InP)、製品別(LED、オプトエレクトロニクス、RFデバイス、パワーエレクトロニクス)、用途別、地域別 - 2027年までの予測Compound Semiconductor Market by Type (GaN, GaAs, SiC, InP), Product (LED, Optoelectronics, RF Devices, Power Electronics), Application (Telecommunication, General Lighting, Automotive, Consumer Devices, Power Supply) & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 化合物半導体の世界市場:タイプ別(GaN、GaAs、SiC、InP)、製品別(LED、オプトエレクトロニクス、RFデバイス、パワーエレクトロニクス)、用途別、地域別 - 2027年までの予測 |

|

出版日: 2022年11月02日

発行: MarketsandMarkets

ページ情報: 英文 234 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の化合物半導体の市場規模は、2022年に405億米ドルと推定され、2027年までに558億米ドルに達し、予測期間中のCAGRで6.6%の成長が予測されています。

この市場は、半導体産業におけるGaNやSiCの需要の高まりや導入など、いくつかの要因によって有望な成長ポテンシャルを秘めています。

化合物半導体とは、2つ以上の異なる周期表グループから2つ以上の元素を使用した半導体のことです。例えば、ヒ化ガリウム(GaAs)、リン化インジウム(InP)、窒化ガリウム(GaN)など、周期表の第III列と第V列の元素を1つずつ用いたものをIII-V族化合物半導体と呼びます。化合物半導体の電子は、シリコンの電子よりも動きが速く、高速処理や低電圧での動作が可能です。

"SiC:化合物半導体市場のタイプ別の急成長セグメント"

SiCは、MOSFET、JFET、SBDなどのパワーディスクリート部品やデバイスに広く使用されているため、大幅な成長を遂げています。SiCは他の化合物半導体と比較して、バンドギャップが広く、高温・高電圧(最大1,200V)で動作することが可能です。そのため、SiCはハイパワー用途での利用が期待されています。SiCは、電気自動車、ワイヤレス充電、電源などに使用されています。

"通信:化合物半導体市場の用途別の最大セグメント"

通信は、GaAs、GaN、InP、SiGeなどの化合物半導体の使用増加により、化合物半導体市場の主要な用途セグメントとなっています。通信用途は、予測期間中に最も大きなシェアを占めると予想されます。5Gは、通信用途の化合物半導体に大きなチャンスをもたらしています。通信用途の成長は、RFデバイスの需要増に牽引されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 化合物半導体バリューチェーン

- シリコン技術に対するGaNの動向

- シリコンに対するGaNの最近の発展

第6章 化合物半導体の成膜技術

- イントロダクション

- 化学蒸着(CVD)

- 分子線エピタキシー

- ハイドライド気相成長(HVPE)

- アモノサーマル

- 液相エピタキシー

- 原子層堆積(ALD)

- その他

第7章 化合物半導体市場:タイプ別

- イントロダクション

- GaN

- GaAs

- SiC

- InP

- SiGe

- GaP

- その他

第8章 化合物半導体市場:製品別

- イントロダクション

- LED

- オプトエレクトロニクス

- RFデバイス

- パワーエレクトロニクス

第9章 化合物半導体市場:用途別

- イントロダクション

- 一般照明

- 通信

- 軍事・防衛・航空宇宙

- 自動車

- 電源

- データ通信

- コンシューマー向けディスプレイ

- 商業

- コンシューマー向けデバイス

- その他

第10章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋地域

- 中国

- 日本

- 韓国

- その他

- その他の地域

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 市場企業のランキング分析

- 競合リーダーシップマッピング

- 製品ポートフォリオの強み(25社)

- 事業戦略の優秀性(25社)

- 競合状況・動向

第12章 企業プロファイル

- 主要企業

- NICHIA CORPORATION

- SAMSUNG ELECTRONICS CO., LTD.

- AMS OSRAM AG

- QORVO, INC.

- SKYWORKS SOLUTIONS, INC.

- WOLFSPEED, INC.

- GAN SYSTEMS

- INFINEON TECHNOLOGIES AG

- MITSUBISHI ELECTRIC CORPORATION

- NXP SEMICONDUCTORS N.V.

- その他の企業

- ON SEMICONDUCTOR CORPORATION

- ANALOG DEVICES, INC.

- BROADCOM INC.

- EFFICIENT POWER CONVERSION CORPORATION

- LUMENTUM HOLDINGS INC.

- MACOM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

- MICROCHIP TECHNOLOGY INC.

- QUALCOMM TECHNOLOGIES, INC.

- RENESAS ELECTRONICS CORPORATION

- ROHM CO., LTD.

- SAN'AN OPTOELECTRONICS CO., LTD.

- II-VI INCORPORATED

- STMICROELECTRONICS N.V.

- TRANSPHORM INC.

- VISIC TECHNOLOGIES LTD.

第13章 付録

The global compound semiconductor market size is estimated to be USD 40.5 billion in 2022 and is projected to reach 55.8 billion by 2027, at a CAGR of 6.6% during the forecast period. The market has a promising growth potential due to several factors, such as rise in demand and implementation of GaN and SiC in semiconductor industry.

A compound semiconductor is a semiconductor made from two or more elements from two or more different periodic table groups. For example, one element from column III and one from column V of the periodic table are called compound III-V semiconductors, such as Gallium Arsenide (GaAs), Indium Phosphide (InP), and Gallium Nitride (GaN). Electrons in compound semiconductors move faster than electrons in silicon, which enables high-speed processing and operations at lower voltages.

"SiC: The fastest-growing segment of the compound semiconductor market, by type"

SiC has been experiencing significant growth owing to its wide use in power discrete components and devices, such as MOSFETs, junction field effect transistor (JFETs), and Schottky barrier diode (SBDs). Compared with other compound semiconductors, SiC has a wider bandgap and can operate at higher temperatures and voltages (up to 1,200 V). Therefore, SiC is expected to be used in high-power applications. SiC is used in electric vehicles, wireless charging, and power supplies.

"Telecommunications: The largest segment of the compound semiconductor market, by application"

Telecommunication is a leading application segment of the compound semiconductor market owing to the increased use of compound semiconductors such as GaAs, GaN, InP, and SiGe. The market for telecommunication application is expected to cater to the largest share during the forecast period. 5G is providing a huge opportunity for compound semiconductors for telecom applications. The growth of telecommunication application is driven by increasing demand for RF devices.

The compound semiconductor market is dominated by a few globally established players such as Nichia Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), ams OSRAM AG (Austria), Qorvo, Inc. (US), Skyworks Solutions, Inc. (US), Wolfspeed, Inc. (US), GaN Systems (Japan), Canon Inc. (Canada), Infineon Technologies AG (Germany), Mitsubishi Electric Corporation (Japan).

The study includes an in-depth competitive analysis of these key players in the compound semiconductor market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the compound semiconductor market and forecasts its size, by volume and value, based on region (Asia Pacific, Europe, North America, and Rest of the World), type (Gallium Nitride (GaN), Gallium Arsenide (GaAS), Silicon Carbide (SiC), Indium Phosphide (InP), Silicon Germanium (SiGe), and Gallium Phosphide (GaP)), product (Light-Emitting Diode (LED), Optoelectronics, Radio Frequency (RF) Devices (RF Power, RF Switching, Other RF Devices), and Power Electronics), application (General Lighting, Consumer Displays, Consumer Devices, Commercial, Telecommunications, Automotive, Power Supply, Datacom, and Others).

The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the compound semiconductor market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the compound semiconductor market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 GEOGRAPHIC SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 COMPOUND SEMICONDUCTOR MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to capture market size using bottom-up analysis (demand-side)

- FIGURE 3 COMPOUND SEMICONDUCTOR MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to capture market size using top-down analysis (supply-side)

- FIGURE 4 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY

- FIGURE 7 GAN SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 POWER ELECTRONICS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 TELECOMMUNICATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMPOUND SEMICONDUCTOR MARKET

- FIGURE 11 INCREASING APPLICATION OF COMPOUND SEMICONDUCTORS IN LEDS TO BOOST MARKET GROWTH

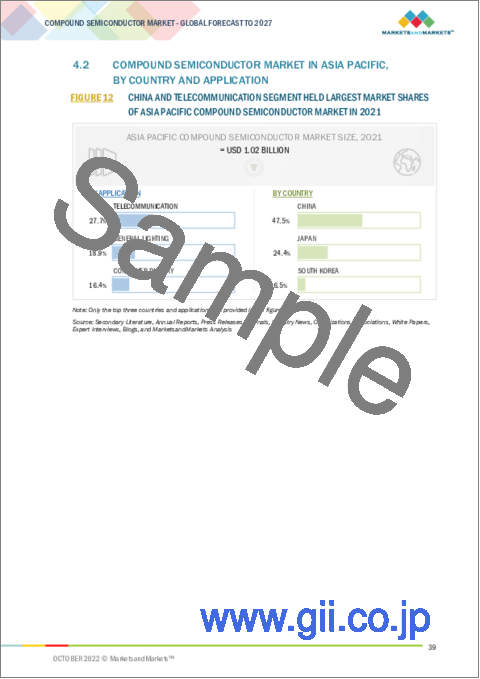

- 4.2 COMPOUND SEMICONDUCTOR MARKET IN ASIA PACIFIC, BY COUNTRY AND APPLICATION

- FIGURE 12 CHINA AND TELECOMMUNICATION SEGMENT HELD LARGEST MARKET SHARES OF ASIA PACIFIC COMPOUND SEMICONDUCTOR MARKET IN 2021

- 4.3 COUNTRY-WISE COMPOUND SEMICONDUCTOR MARKET GROWTH RATE

- FIGURE 13 CHINA TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: COMPOUND SEMICONDUCTOR MARKET

- FIGURE 15 COMPOUND SEMICONDUCTOR MARKET DRIVERS IMPACT ANALYSIS

- FIGURE 16 COMPOUND SEMICONDUCTOR MARKET OPPORTUNITIES IMPACT ANALYSIS

- FIGURE 17 COMPOUND SEMICONDUCTOR MARKET RESTRAINTS AND CHALLENGES IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Continuous emergence of technologies in GaN ecosystem

- 5.2.1.2 Rise in demand and implementation of GaN and SiC in semiconductor industry

- 5.2.1.3 Growing demand for SiC devices in power electronics

- 5.2.2 RESTRAINTS

- 5.2.2.1 High material and fabrication costs associated with compound semiconductors

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Applications in electric and hybrid electric vehicles

- 5.2.3.2 Potential use of GaN in 5G infrastructure development

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexity in design of compound semiconductors

- 5.3 COMPOUND SEMICONDUCTOR VALUE CHAIN

- FIGURE 18 COMPOUND SEMICONDUCTOR VALUE CHAIN ANALYSIS

- 5.4 TRENDS OF GAN ON SILICON TECHNOLOGY

- FIGURE 19 VALUE CHAIN ANALYSIS FOR GAN ON SILICON TECHNOLOGY

- 5.5 RECENT DEVELOPMENTS FOR GAN ON SILICON

6 COMPOUND SEMICONDUCTOR DEPOSITION TECHNOLOGIES

- 6.1 INTRODUCTION

- 6.2 CHEMICAL VAPOR DEPOSITION

- 6.3 MOLECULAR BEAM EPITAXY

- 6.4 HYDRIDE VAPOR PHASE EPITAXY

- 6.5 AMMONOTHERMAL

- 6.6 LIQUID PHASE EPITAXY

- 6.7 ATOMIC LAYER DEPOSITION

- 6.8 OTHER DEPOSITION TECHNOLOGIES

7 COMPOUND SEMICONDUCTOR MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 20 COMPOUND SEMICONDUCTOR MARKET, BY TYPE

- FIGURE 21 GAN TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- TABLE 1 COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 2 COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 GALLIUM NITRIDE

- 7.2.1 INCREASING USE OF GAN IN GENERAL LIGHTING, SIGNAGE, AND AUTOMOTIVE APPLICATIONS TO DRIVE GAN LED MARKET

- 7.2.2 ALUMINUM GALLIUM NITRIDE

- 7.2.3 INDIUM GALLIUM NITRIDE

- TABLE 3 GAN: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- FIGURE 22 LED PRODUCT SEGMENT TO HOLD LARGEST SHARE OF GAN SEGMENT DURING FORECAST PERIOD

- TABLE 4 GAN: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 5 GAN: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- FIGURE 23 GENERAL LIGHTING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 6 GAN: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.3 GALLIUM ARSENIDE

- 7.3.1 HIGH ELECTRON MOBILITY IN GAAS PROVIDES OPPORTUNITY FOR HIGH-SPEED DEVICES

- 7.3.2 ALUMINUM GALLIUM ARSENIDE

- TABLE 7 GAAS: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- FIGURE 24 RF DEVICES SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 8 GAAS: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 9 GAAS: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- FIGURE 25 TELECOMMUNICATION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 10 GAAS: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.4 SILICON CARBIDE

- 7.4.1 INCREASING ADOPTION OF ELECTRIC VEHICLES TO PROVIDE OPPORTUNITIES FOR PLAYERS IN SIC POWER ELECTRONICS MARKET

- TABLE 11 SIC: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 12 SIC: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 7.5 INDIUM PHOSPHIDE

- 7.5.1 HIGHER ELECTRON VELOCITY TO DRIVE INP DEVICE MARKET GROWTH FOR TELECOM AND DATACOM APPLICATIONS

- TABLE 13 INP: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 14 INP: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 15 INP: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 16 INP: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.6 SILICON GERMANIUM

- 7.6.1 OPTOELECTRONICS AND RF TO SUPPORT SILICON GERMANIUM MARKET GROWTH

- TABLE 17 SIGE: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 18 SIGE: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 19 SIGE: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 20 SIGE: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.7 GALLIUM PHOSPHIDE

- 7.7.1 LOW-POWER LEDS TO BE KEY APPLICATION OF GAP

- 7.7.2 ALUMINUM GALLIUM PHOSPHIDE

- TABLE 21 GAP: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 22 GAP: COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 7.8 OTHER TYPES

- 7.8.1 INDIUM ANTIMONIDE

- 7.8.2 CADMIUM SELENIDE

- 7.8.3 CADMIUM TELLURIDE

- 7.8.4 ZINC SELENIDE

- 7.8.5 ALUMINUM INDIUM ARSENIDE

- 7.8.6 CADMIUM ZINC TELLURIDE

- 7.8.7 MERCURY CADMIUM TELLURIDE

8 COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT

- 8.1 INTRODUCTION

- FIGURE 26 COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT

- TABLE 23 COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- FIGURE 27 LED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 24 COMPOUND SEMICONDUCTOR MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.2 LED

- 8.2.1 DECREASING PRICES OF LED AND FAVORABLE GOVERNMENT INITIATIVES TO DRIVE GROWTH

- TABLE 25 LED: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- FIGURE 28 GAN TO HOLD LARGEST SHARE OF LED MARKET DURING FORECAST PERIOD

- TABLE 26 LED: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 27 LED: COMPOUND SEMICONDUCTOR MARKET FOR GAN, BY APPLICATION, 2018-2021 (USD MILLION)

- FIGURE 29 GENERAL LIGHTING SEGMENT TO HOLD LARGEST SHARE OF GAN LED MARKET

- TABLE 28 LED: COMPOUND SEMICONDUCTOR MARKET FOR GAN, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 29 LED: COMPOUND SEMICONDUCTOR MARKET FOR GAAS, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 30 LED: COMPOUND SEMICONDUCTOR MARKET FOR GAAS, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 31 LED: COMPOUND SEMICONDUCTOR MARKET FOR GAP, BY APPLICATION, 2018-2021 (USD MILLION)

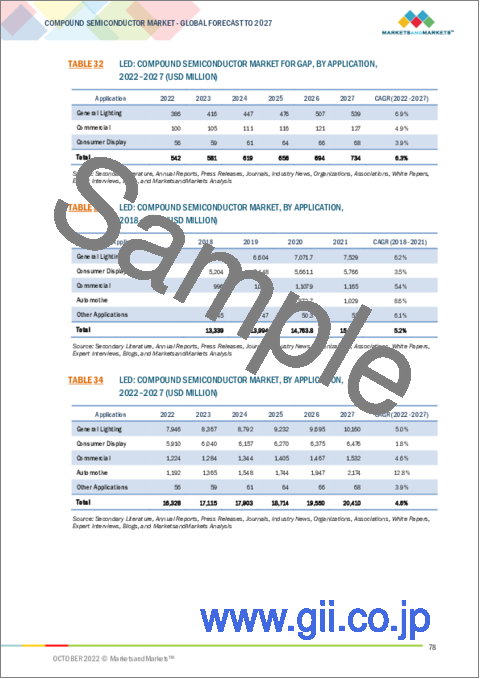

- TABLE 32 LED: COMPOUND SEMICONDUCTOR MARKET FOR GAP, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 33 LED: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 34 LED: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3 OPTOELECTRONICS

- 8.3.1 INCREASING DEMAND FOR HIGH-SPEED DATA TRANSFER DEVICES TO CREATE OPPORTUNITY FOR PLAYERS IN OPTOELECTRONICS MARKET

- TABLE 35 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 36 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 37 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR GAN, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 38 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR GAN, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 39 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR GAAS, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 40 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR GAAS, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 41 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR INP, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 42 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR INP, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 43 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR SIGE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 44 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR SIGE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 45 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 46 OPTOELECTRONICS: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.4 RF DEVICES

- 8.4.1 RF POWER

- 8.4.1.1 Increasing adoption of LTE and 5G to provide opportunities for players RF power market

- 8.4.1.2 Monolithic microwave integrated circuit

- 8.4.2 RF SWITCHING

- 8.4.2.1 Telecommunication and military, defense, and aerospace to be important applications of RF switching market

- 8.4.3 OTHER RF DEVICES

- 8.4.3.1 Other RF devices include LNAs, mixers, and multipliers

- TABLE 47 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 48 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 49 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET FOR GAN, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 50 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET FOR GAN, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 51 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET FOR GAAS, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 52 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET FOR GAAS, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 53 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET FOR INP, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 54 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET FOR INP, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 55 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET FOR SIGE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 56 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET FOR SIGE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 57 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 58 RF DEVICES: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.4.1 RF POWER

- 8.5 POWER ELECTRONICS

- 8.5.1 DISCRETE

- 8.5.1.1 Transistor

- 8.5.1.1.1 Metal oxide field-effect transistor

- 8.5.1.1.1.1 Growing market for electric vehicles to spur demand for MOSFETs

- 8.5.1.1.2 High electron mobility transistor

- 8.5.1.1.2.1 HEMTs to find applications in power supply, charging, and motor drives

- 8.5.1.1.1 Metal oxide field-effect transistor

- 8.5.1.2 Diode

- 8.5.1.2.1 Schottky diode

- 8.5.1.2.1.1 Schottky diodes used in power supply applications

- 8.5.1.2.2 PIN diode

- 8.5.1.2.2.1 PIN diodes used for voltage multiplier applications

- 8.5.1.2.1 Schottky diode

- 8.5.1.1 Transistor

- 8.5.2 BARE DIE

- 8.5.2.1 Bare die to be embedded with required functional circuit

- 8.5.3 MODULE

- 8.5.3.1 Electric vehicles to provide attractive opportunities

- TABLE 59 POWER ELECTRONICS: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- FIGURE 30 SIC TO HOLD LARGER SHARE OF MARKET FOR POWER ELECTRONICS

- TABLE 60 POWER ELECTRONICS: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 61 POWER ELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR GAN, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 62 POWER ELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR GAN, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 63 POWER ELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR SIC, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 64 POWER ELECTRONICS: COMPOUND SEMICONDUCTOR MARKET FOR SIC, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 65 POWER ELECTRONICS: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 66 POWER ELECTRONICS: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.5.1 DISCRETE

9 COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 67 COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- FIGURE 31 TELECOMMUNICATION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 68 COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 GENERAL LIGHTING

- 9.2.1 INCREASING PENETRATION OF LEDS IN GENERAL LIGHTING APPLICATIONS TO DRIVE GAN AND GAN-ON-SILICON LED MARKET

- TABLE 69 GENERAL LIGHTING: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 70 GENERAL LIGHTING: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 71 GENERAL LIGHTING: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 GENERAL LIGHTING: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 TELECOMMUNICATION

- 9.3.1 INCREASING ADOPTION OF COMPOUND SEMICONDUCTORS FOR TELECOM INFRASTRUCTURE AND COMMUNICATION DEVICES TO DRIVE MARKET

- TABLE 73 TELECOMMUNICATION: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- FIGURE 32 GAN SEGMENT TO GROW AT HIGHEST CAGR IN TELECOMMUNICATION MARKET DURING FORECAST PERIOD

- TABLE 74 TELECOMMUNICATION: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 75 TELECOMMUNICATION: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- FIGURE 33 ASIA PACIFIC TO HOLD LARGEST SHARE OF TELECOMMUNICATION MARKET DURING FORECAST PERIOD

- TABLE 76 TELECOMMUNICATION: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 MILITARY, DEFENSE, AND AEROSPACE

- 9.4.1 HIGH POWER CAPABILITY OF GAN INCREASES ITS ADOPTION IN MILITARY & DEFENSE APPLICATIONS

- 9.4.2 RADAR

- 9.4.3 ELECTRONIC WARFARE

- TABLE 77 MILITARY, DEFENSE, AND AEROSPACE: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 78 MILITARY, DEFENSE, AND AEROSPACE: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 79 MILITARY, DEFENSE, AND AEROSPACE: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 MILITARY, DEFENSE, AND AEROSPACE: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 AUTOMOTIVE

- 9.5.1 INCREASING IMPORTANCE OF ADVANCED POWER SEMICONDUCTOR DEVICES IN AUTOMOTIVE APPLICATION TO DRIVE SIC AND GAN POWER ELECTRONICS MARKET

- 9.5.2 ELECTRIC VEHICLES & CHARGING INFRASTRUCTURE

- TABLE 81 AUTOMOTIVE: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 82 AUTOMOTIVE: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 83 AUTOMOTIVE: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 84 AUTOMOTIVE: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 POWER SUPPLY

- 9.6.1 WIRELESS CHARGING TO PROVIDE OPPORTUNITIES IN FOR GAN AND SIC DEVICES MARKET

- TABLE 85 POWER SUPPLY: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- FIGURE 34 GAN TO GROW AT HIGHEST CAGR IN POWER SUPPLY APPLICATION MARKET DURING FORECAST PERIOD

- TABLE 86 POWER SUPPLY: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 87 POWER SUPPLY: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 POWER SUPPLY: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 DATACOM

- 9.7.1 INCREASING DEMAND FOR HIGH-SPEED TRANSCEIVERS IN DATA CENTERS TO DRIVE COMPOUND SEMICONDUCTOR MARKET

- TABLE 89 DATACOM: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 90 DATACOM: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 91 DATACOM: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 92 DATACOM: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.8 CONSUMER DISPLAY

- 9.8.1 DEMAND FOR GAN LEDS FOR BACKLIGHTING TO PLAY AN IMPORTANT ROLE IN CONSUMER DISPLAY APPLICATION

- TABLE 93 CONSUMER DISPLAY: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 94 CONSUMER DISPLAY: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 95 CONSUMER DISPLAY: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 96 CONSUMER DISPLAY: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.9 COMMERCIAL

- 9.9.1 INCREASING IMPORTANCE OF DIGITAL SIGNAGE TO DRIVE COMPOUND SEMICONDUCTOR-BASED LED MARKET

- TABLE 97 COMMERCIAL: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 98 COMMERCIAL: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 99 COMMERCIAL: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 100 COMMERCIAL: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.10 CONSUMER DEVICES

- 9.10.1 INCREASING APPLICATIONS OF 3D SENSING TO CREATE GROWTH OPPORTUNITIES FOR CONSUMER DEVICES MARKET

- TABLE 101 CONSUMER DEVICES: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 102 CONSUMER DEVICES: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 103 CONSUMER DEVICES: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 104 CONSUMER DEVICES: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.11 OTHER APPLICATIONS

- 9.11.1 PHOTOVOLTAICS

- 9.11.1.1 Increasing initiatives by governments to produce clean energy

- 9.11.2 WIND TURBINE

- 9.11.2.1 Electricity generation using wind turbines to increase demand for compound semiconductors

- TABLE 105 OTHER APPLICATIONS: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 106 OTHER APPLICATIONS: COMPOUND SEMICONDUCTOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 107 OTHER APPLICATIONS: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 108 OTHER APPLICATIONS: COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.11.1 PHOTOVOLTAICS

10 GEOGRAPHIC ANALYSIS

- 10.1 INTRODUCTION

- TABLE 109 COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- FIGURE 35 ASIA PACIFIC TO HOLD LARGEST SHARE IN MARKET DURING FORECAST PERIOD

- TABLE 110 COMPOUND SEMICONDUCTOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 36 COMPOUND SEMICONDUCTOR MARKET SNAPSHOT IN NORTH AMERICA

- TABLE 111 NORTH AMERICA: COMPOUND SEMICONDUCTOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: COMPOUND SEMICONDUCTOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 113 NORTH AMERICA: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Growing adoption of compound semiconductors in military and defense industry

- 10.2.2 CANADA

- 10.2.2.1 Rising trend of electric vehicles and solar energy to boost market

- 10.2.3 MEXICO

- 10.2.3.1 Increasing government initiatives in 5G and renewable energy sources

- 10.3 EUROPE

- FIGURE 37 COMPOUND SEMICONDUCTOR MARKET SNAPSHOT IN EUROPE

- TABLE 115 EUROPE: COMPOUND SEMICONDUCTOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 116 EUROPE: COMPOUND SEMICONDUCTOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 117 EUROPE: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 118 EUROPE: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Expanding automotive industry and growing need for electric vehicles to dominate European compound semiconductor market

- 10.3.2 UK

- 10.3.2.1 Increasing initiatives from UK government and private players to boost market growth

- 10.3.3 FRANCE

- 10.3.3.1 Telecom and automotive industries to provide opportunities for market growth

- 10.3.4 ITALY

- 10.3.4.1 Growing automotive industry to provide opportunities for LED and power electronics segments

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 38 COMPOUND SEMICONDUCTOR MARKET SNAPSHOT IN ASIA PACIFIC

- TABLE 119 ASIA PACIFIC: COMPOUND SEMICONDUCTOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 120 ASIA PACIFIC: COMPOUND SEMICONDUCTOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 121 ASIA PACIFIC: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 122 ASIA PACIFIC: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Increasing trend of 5G and EV to drive market in China

- 10.4.2 JAPAN

- 10.4.2.1 Growing adoption of compound semiconductor devices in telecommunication, lighting, and automobile applications

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Compound semiconductor market growth to be driven by telecommunication application

- 10.4.4 REST OF ASIA PACIFIC

- 10.5 ROW

- FIGURE 39 SOUTH AMERICA TO HOLD LARGER MARKET SHARE IN ROW DURING FORECAST PERIOD

- TABLE 123 ROW: COMPOUND SEMICONDUCTOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 124 ROW: COMPOUND SEMICONDUCTOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 125 ROW: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 126 ROW: COMPOUND SEMICONDUCTOR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 GaN and GaAs markets to grow significantly

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Telecommunication application to provide growth for market

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- FIGURE 40 PLAYERS IN MARKET ADOPTED PRODUCT LAUNCH AS KEY STRATEGY FOR BUSINESS EXPANSION FROM 2018 TO 2022

- 11.2 RANKING ANALYSIS OF MARKET PLAYERS

- FIGURE 41 RANKING ANALYSIS OF MARKET PLAYERS, 2021

- 11.3 COMPETITIVE LEADERSHIP MAPPING

- 11.3.1 STARS

- 11.3.2 PERVASIVE PLAYERS

- 11.3.3 EMERGING LEADERS

- 11.3.4 PARTICIPANTS

- FIGURE 42 COMPOUND SEMICONDUCTOR MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.4 STRENGTH OF PRODUCT PORTFOLIO (25 PLAYERS)

- FIGURE 43 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

- 11.5 BUSINESS STRATEGY EXCELLENCE (25 PLAYERS)

- FIGURE 44 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

- 11.6 COMPETITIVE SITUATIONS AND TRENDS

- 11.6.1 PRODUCT LAUNCHES

- TABLE 127 PRODUCT LAUNCHES, 2021-2022

- 11.6.2 AGREEMENTS, COLLABORATIONS, PARTNERSHIPS, AND CONTRACTS

- TABLE 128 AGREEMENTS, COLLABORATIONS, PARTNERSHIPS, AND CONTRACTS, 2021-2022

- 11.6.3 ACQUISITIONS

- TABLE 129 ACQUISITIONS, 2021-2022

- 11.6.4 EXPANSIONS

- TABLE 130 EXPANSIONS, 2021-2022

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 KEY PLAYERS

- 12.1.1 NICHIA CORPORATION

- TABLE 131 NICHIA CORPORATION: BUSINESS OVERVIEW

- TABLE 132 NICHIA CORPORATION: PRODUCTS OFFERED

- TABLE 133 NICHIA CORPORATION: PRODUCT LAUNCHES

- TABLE 134 NICHIA CORPORATION: DEALS

- 12.1.2 SAMSUNG ELECTRONICS CO., LTD.

- TABLE 135 SAMSUNG ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

- FIGURE 45 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

- TABLE 136 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 137 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

- 12.1.3 AMS OSRAM AG

- TABLE 138 AMS OSRAM AG: BUSINESS OVERVIEW

- FIGURE 46 AMS OSRAM AG: COMPANY SNAPSHOT

- TABLE 139 AMS OSRAM AG: PRODUCTS OFFERED

- TABLE 140 AMS OSRAM AG: PRODUCT LAUNCHES

- TABLE 141 AMS OSRAM AG: DEALS

- 12.1.4 QORVO, INC.

- TABLE 142 QORVO, INC.: BUSINESS OVERVIEW

- FIGURE 47 QORVO, INC.: COMPANY SNAPSHOT

- TABLE 143 QORVO, INC.: PRODUCTS OFFERED

- TABLE 144 QORVO, INC.: PRODUCT LAUNCHES

- TABLE 145 QORVO, INC.: DEALS

- 12.1.5 SKYWORKS SOLUTIONS, INC.

- TABLE 146 SKYWORKS SOLUTIONS, INC.: BUSINESS OVERVIEW

- FIGURE 48 SKYWORKS SOLUTIONS, INC.: COMPANY SNAPSHOT

- TABLE 147 SKYWORKS SOLUTIONS, INC.: PRODUCTS OFFERED

- TABLE 148 SKYWORKS SOLUTIONS, INC.: PRODUCT LAUNCHES

- TABLE 149 SKYWORKS SOLUTIONS, INC.: DEALS

- 12.1.6 WOLFSPEED, INC.

- TABLE 150 WOLFSPEED, INC.: BUSINESS OVERVIEW

- FIGURE 49 WOLFSPEED, INC.: COMPANY SNAPSHOT

- TABLE 151 WOLFSPEED, INC.: PRODUCTS OFFERED

- TABLE 152 WOLFSPEED, INC.: PRODUCT LAUNCHES

- TABLE 153 WOLFSPEED, INC.: DEALS

- 12.1.7 GAN SYSTEMS

- TABLE 154 GAN SYSTEMS: BUSINESS OVERVIEW

- TABLE 155 GAN SYSTEMS: PRODUCTS OFFERED

- TABLE 156 GAN SYSTEMS: PRODUCT LAUNCHES

- TABLE 157 GAN SYSTEMS: DEALS

- 12.1.8 INFINEON TECHNOLOGIES AG

- TABLE 158 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

- FIGURE 50 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 159 INFINEON TECHNOLOGIES AG: PRODUCTS OFFERED

- TABLE 160 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 161 INFINEON TECHNOLOGIES AG: DEALS

- 12.1.9 MITSUBISHI ELECTRIC CORPORATION

- TABLE 162 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 163 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 164 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- 12.1.10 NXP SEMICONDUCTORS N.V.

- TABLE 165 NXP SEMICONDUCTORS N.V.: BUSINESS OVERVIEW

- FIGURE 52 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

- TABLE 166 NXP SEMICONDUCTORS N.V.: PRODUCTS OFFERED

- TABLE 167 NXP SEMICONDUCTORS N.V.: PRODUCT LAUNCHES

- TABLE 168 NXP SEMICONDUCTORS N.V.: DEALS

- 12.2 OTHER PLAYERS

- 12.2.1 ON SEMICONDUCTOR CORPORATION

- 12.2.2 ANALOG DEVICES, INC.

- 12.2.3 BROADCOM INC.

- 12.2.4 EFFICIENT POWER CONVERSION CORPORATION

- 12.2.5 LUMENTUM HOLDINGS INC.

- 12.2.6 MACOM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

- 12.2.7 MICROCHIP TECHNOLOGY INC.

- 12.2.8 QUALCOMM TECHNOLOGIES, INC.

- 12.2.9 RENESAS ELECTRONICS CORPORATION

- 12.2.10 ROHM CO., LTD.

- 12.2.11 SAN'AN OPTOELECTRONICS CO., LTD.

- 12.2.12 II-VI INCORPORATED

- 12.2.13 STMICROELECTRONICS N.V.

- 12.2.14 TRANSPHORM INC.

- 12.2.15 VISIC TECHNOLOGIES LTD.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS